February 27, 2023

Good News is Bad News

Author - Ben McGregor

Gold continues down on robust economic data

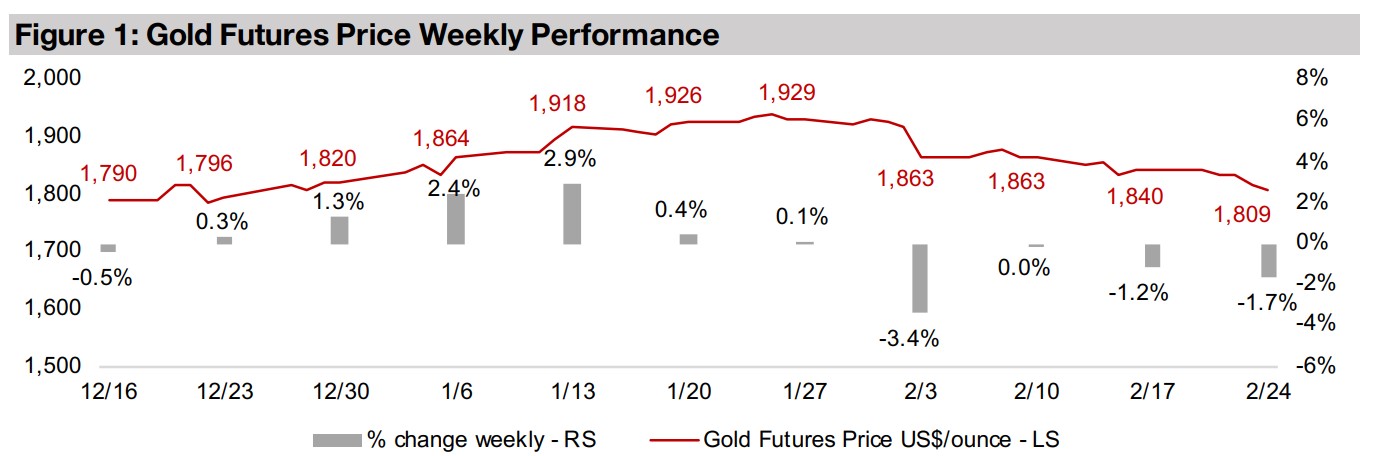

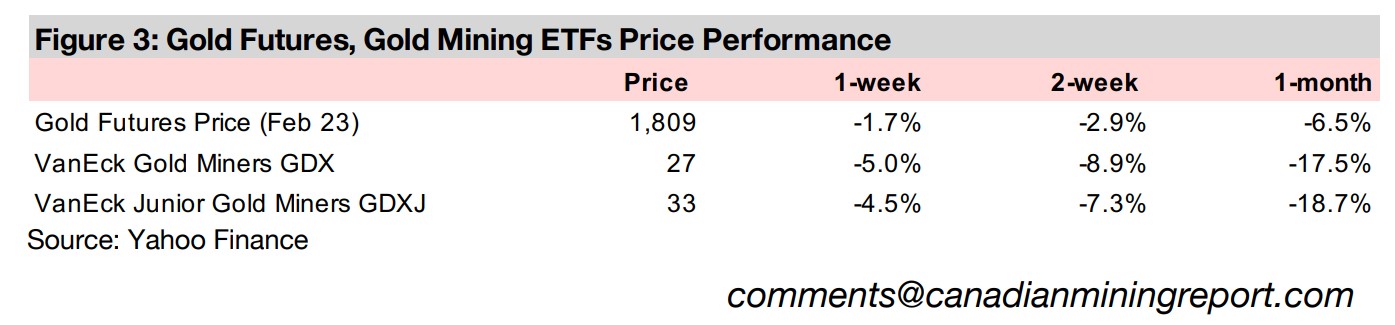

Gold declined -1.7% this week to US$1,809/oz as 'good news was bad news', with economic data, including US PCE and whole price inflation, continuing to surprise to the upside, causing market concerns that rates would remain higher for longer.

Metals price rally eases, three newcomers to TSXV 'big lithium'

This we look at the slowdown in the recent rally for most of the major metals, while In Focus are newcomers to TSXV 'big lithium', Patriot Battery Metals, Arena Minerals and Ionic Lithium after their large share price gains over the past year.

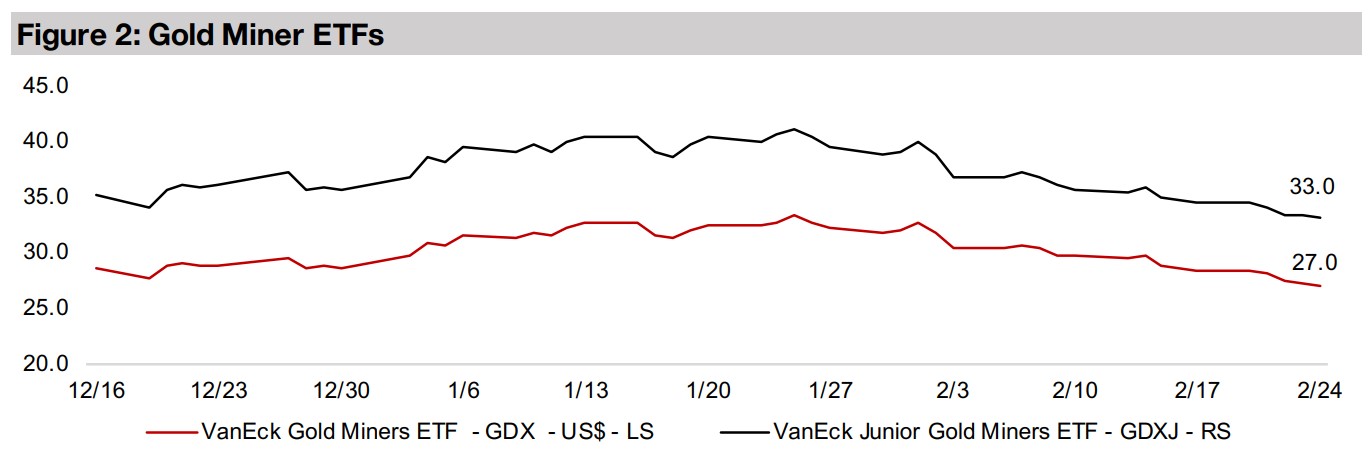

Producing and junior gold stocks hit by falling gold and stocks

The producing and junior gold miners were hit, with the GDX losing -5.0% and GDXJ off -4.5%, while TSXV gold juniors were mixed, as gold and equity markets declined on concerns that strong economic data would delay any pullback in interest rates.

Good News is Bad News

Gold dropped -1.7% to US$1,809/oz, continuing a downtrend from early February

2023, as 'good news was bad news' with the metal and stock markets down as

economic data continued to surprise to the upside, with markets concerned that this

would mean that interest rates would stay higher for longer. The latest data included

January 2023 US core personal consumption expenditure (PCE) price inflation, which

rose 0.6% mom and 4.7% yoy, and US producer prices, up 0.7% mom and 6.0%

yoy. The PCE number is especially critical, as the US Fed views it as a key gauge of

inflationary pressures and can heavily affect its decisions on interest rate changes.

Meanwhile, the OECD this week also indicated a slightly better outlook for the global

economy in 2023, but highlighted continued risks of high inflation.

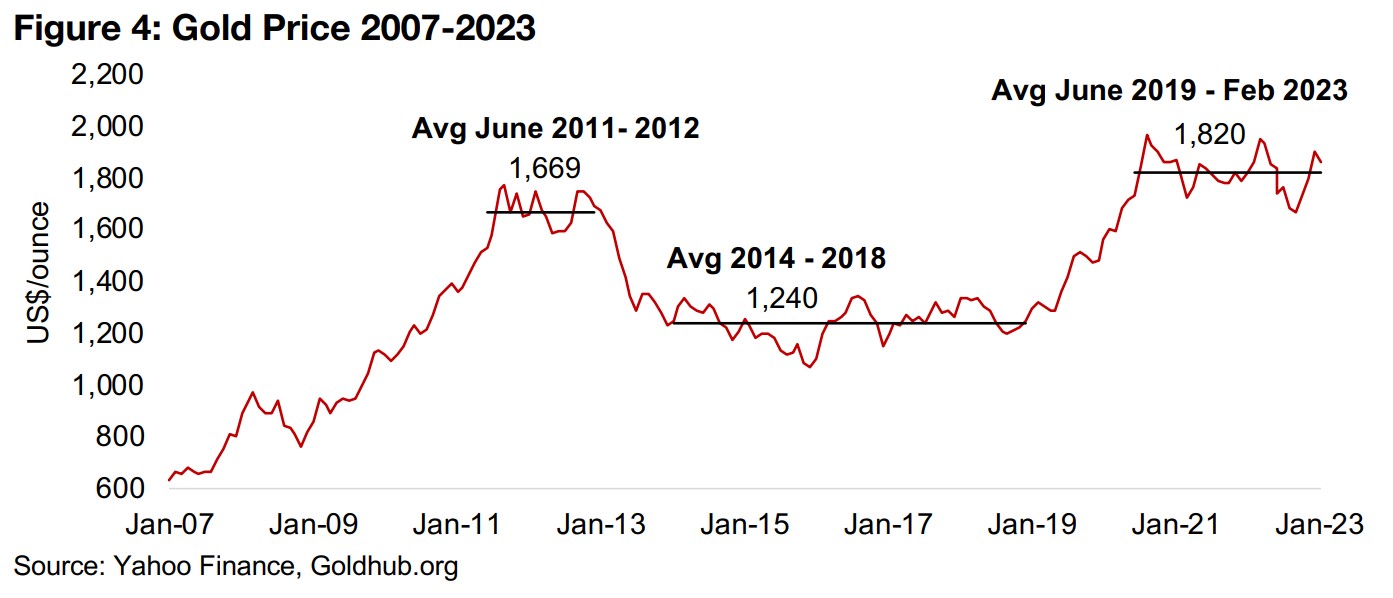

Overall, the recent news seems to have dashed markets' hopes in January 2023 for

an early pullback in global interest rates, driving the decline in February 2023. The

recent decline in gold has seen it revert to near the mean it has held since mid-2019

of US$1,820/oz (Figure 4). The gold price has risen substantially above this level over

the past three years only because of severe exogenous shocks, the first being the

global health crisis in early 2020 and then Russia's invasion of Ukraine in early 2022.

Declines below this average have occurred mainly on evidence of the declining

inflation markets believe could result in a pullback in interest rates, implying monetary

expansion and lower real interest rates, which are both core drivers of the gold price.

The market settled in on this gold valuation of just above US$1,800/oz on average

after a long gold bear market, with an average price of just US$1,240/oz from 2014-

2018, a period with a rare combination of strong economic growth but virtually no

inflation, which is historically rare. While the gold price has been above the previous

peak from 2011-2012, we note that monetary expansion has been extreme since then,

and that gold does not look overvalued versus the current global money supply.

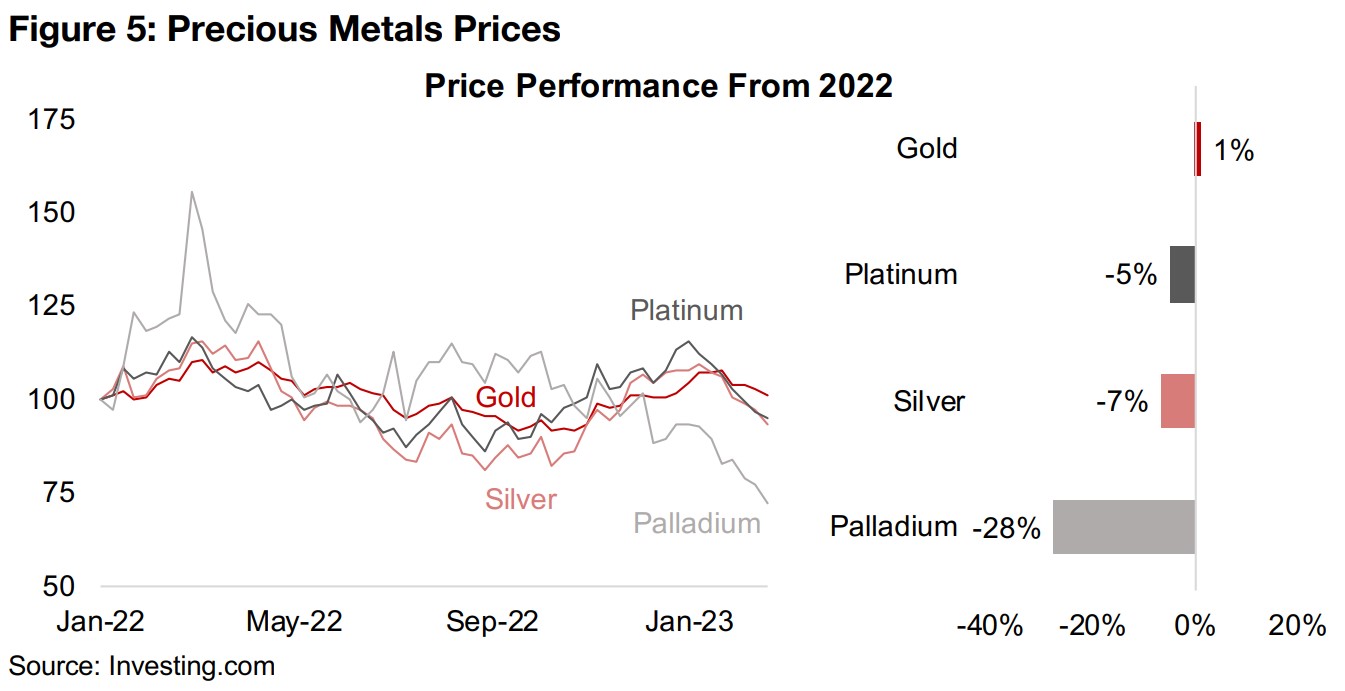

Precious metals slide over past month, palladium sees biggest decline

This reversion to the mean has meant a relatively strong performance for gold, up 1% since 2022, versus other precious metals, which have all declined (Figure 5). While there had been a rebound in platinum and silver from October 2022 through January 2023, much of this has been erased in February 2023, with the metals down -5% and -7% since 2022. This has occurred because of concerns that continued high global interest rates will eventually hit economic growth, the recent strong data notwithstanding, with platinum and silver both driven by a mix of industrial and monetary drivers. Palladium has seen a major collapse over the past few months, and is now down -28%, which was accelerated when the supply deficit forecast for 2023 by Norilsk Nickel, the world's largest palladium producer, was reduced by over half.

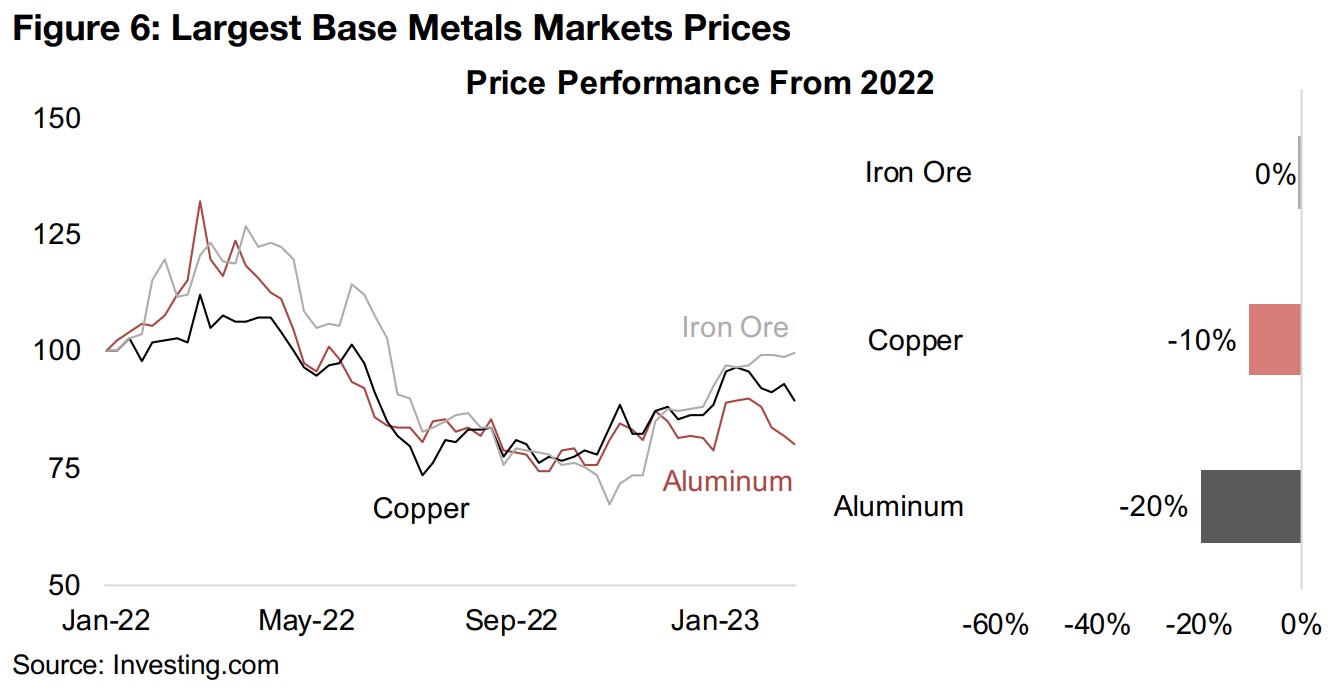

Two of three big base metals pullback, mixed performance for smaller metals

Two of the three big base metals, copper and aluminum, have pulled back in February,

and are down -10% and -20% respectively since 2022 (Figure 6). With copper a

bellwether for developed economies given its heavy use in electronics and machinery,

and aluminum being one of the broadest barometers for the global economic, this

recent price action seems to contradict the OECD's slightly rosy economic outlook.

The third big base metal, iron ore, is flat, and has continued the uptrend started in

October 2022 through January and February 2023. This is because iron ore is an

indicator especially of the performance of China's economy, which remains the

largest source of demand for the metal, and with the lifting of global health crisis-related restrictions in the country, economic activity has begun to rebound. We

suspect that the risk remains to downside for economic growth shocks this year, and

that this could mean further pressure on these three major base metals.

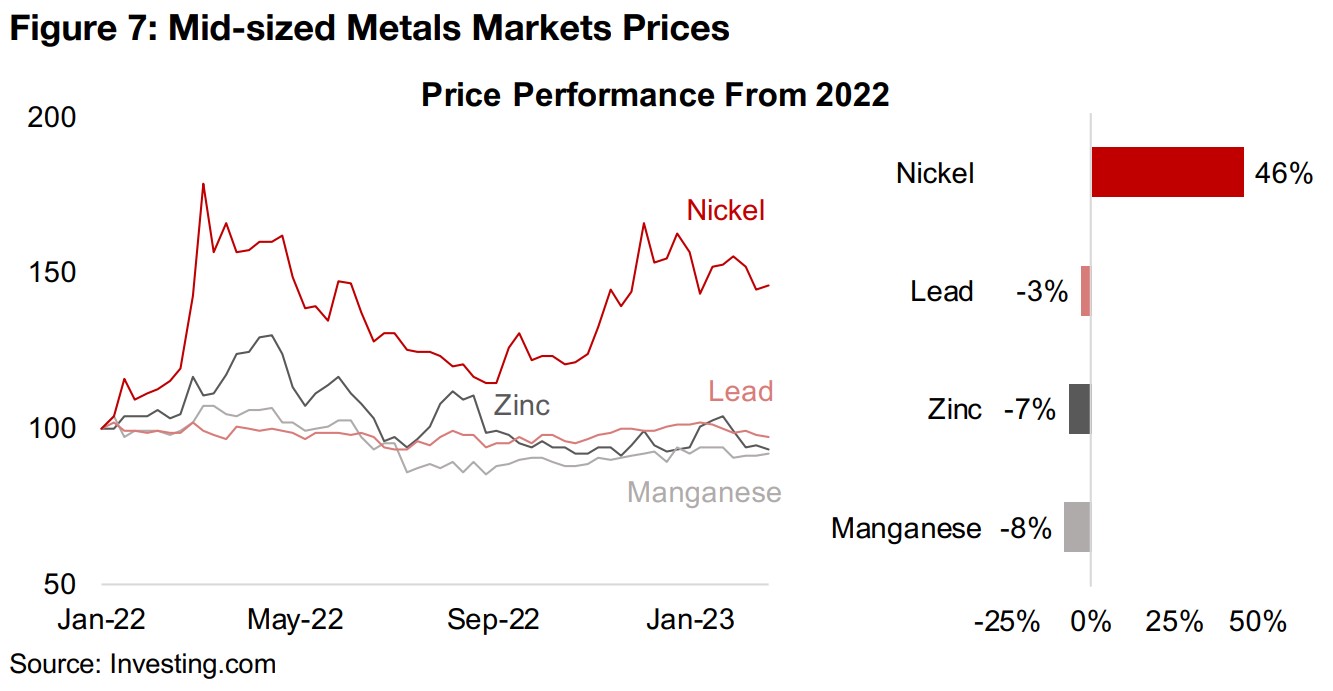

Sustainability of nickel outperformance questioned by analysts

For the mid-sized metals, nickel is the clear stand out, and is still up 46% since the start of 2022, having recovered from a significant dip through the middle of last year (Figure 7). However, some analysts believe that this high price will not be sustained, with nickel market having shifted from deficit to supply over 2022, especially on a surge in production from Indonesia. The price action has been more moderate for the other mid-sized metals markets, with lead seeing very low volatility over the past year, and down -3% since January 2022, Zinc had strong gains early in 2022, but these have now been erased, with it down -7%, while manganese was quite flat through H1/21, dipping mid-year, gradually recovering since, but still down -8%.

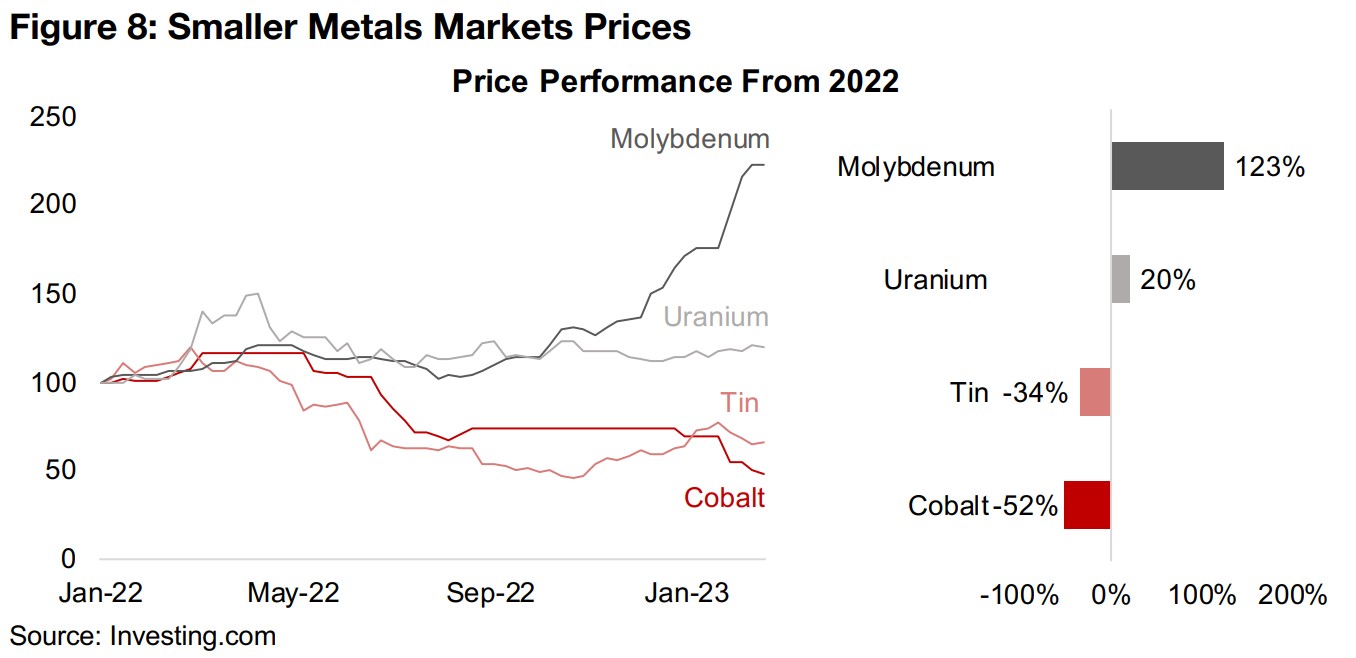

Molybdenum the only outstanding gainer in recent months

Of all the major metals, only molybdenum has seen outstanding gains, surging since December 2022 and up 123% since January 2022 driven by recovering Chinese demand and tight global supply (Figure 8). Uranium has risen 20% since January 2022, with it being reconsidered as part of green energy and restrictions against it especially in Japan and Europe becoming less stringent. Both tin and cobalt have seen substantial declines over the past year, down -34% and -52%, respectively, with cobalt losing market share to lithium for EV batteries, while a rebound in tin since December 2022 crested by late January 2023, with a decline through February 2023.

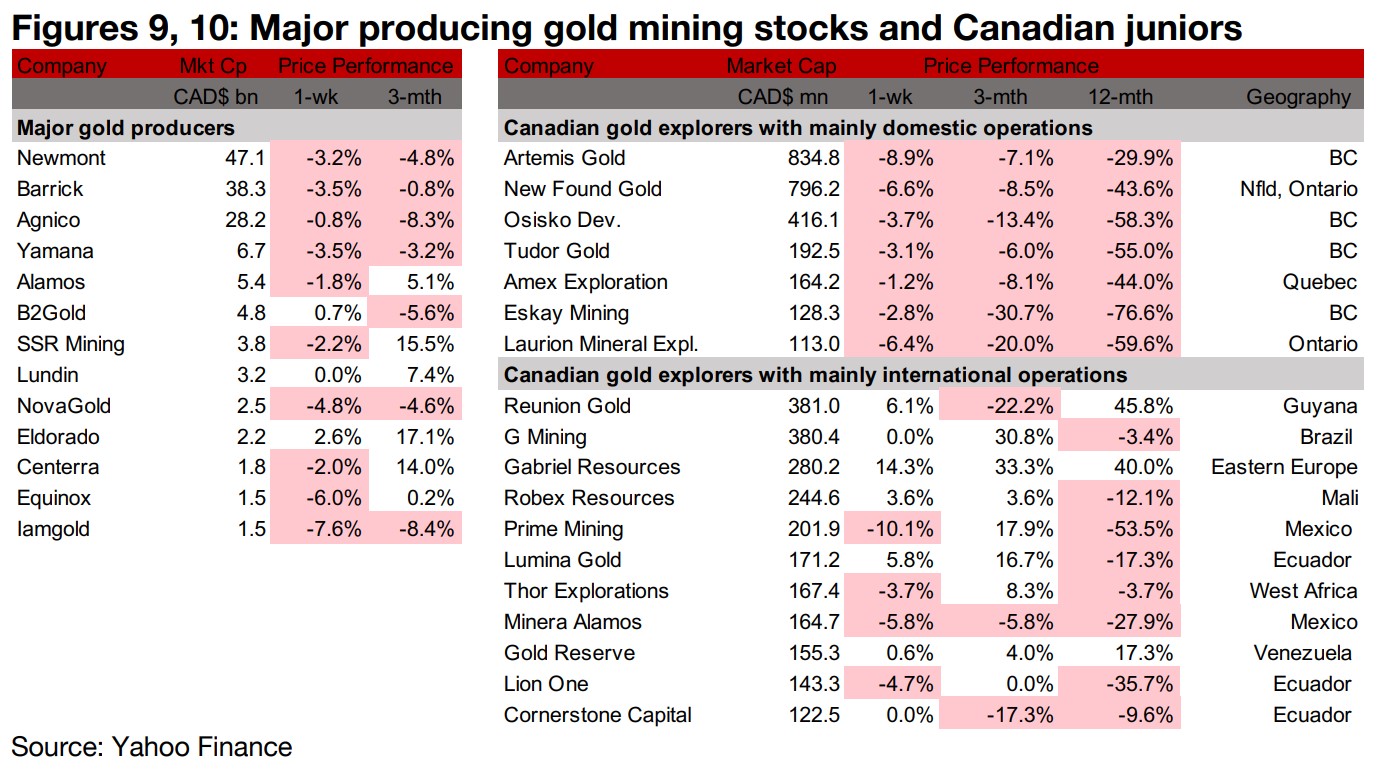

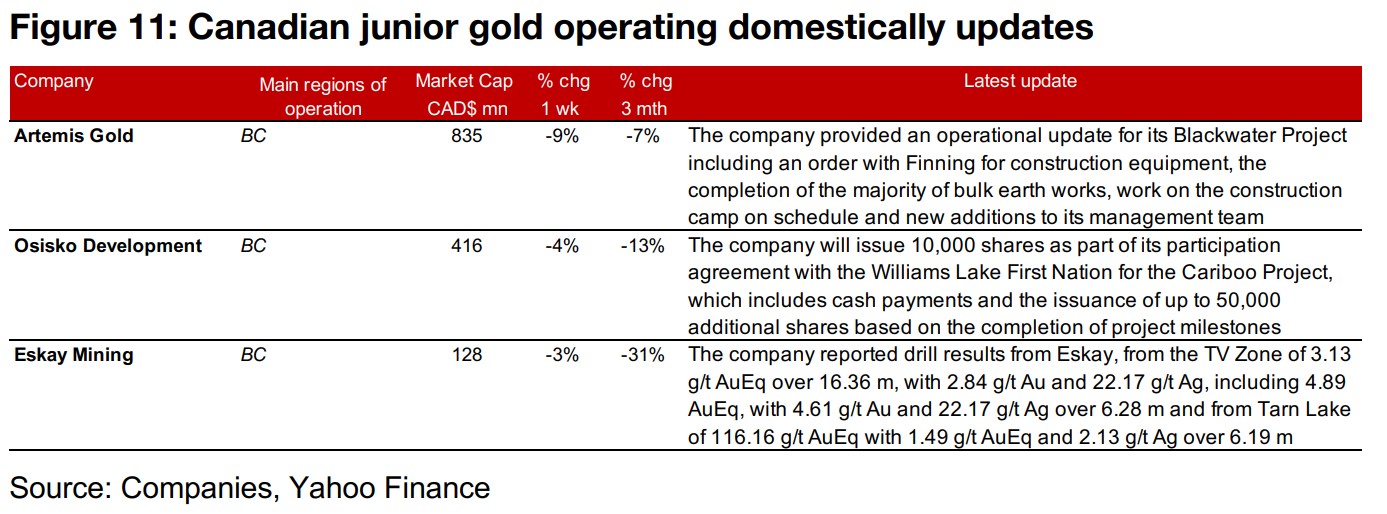

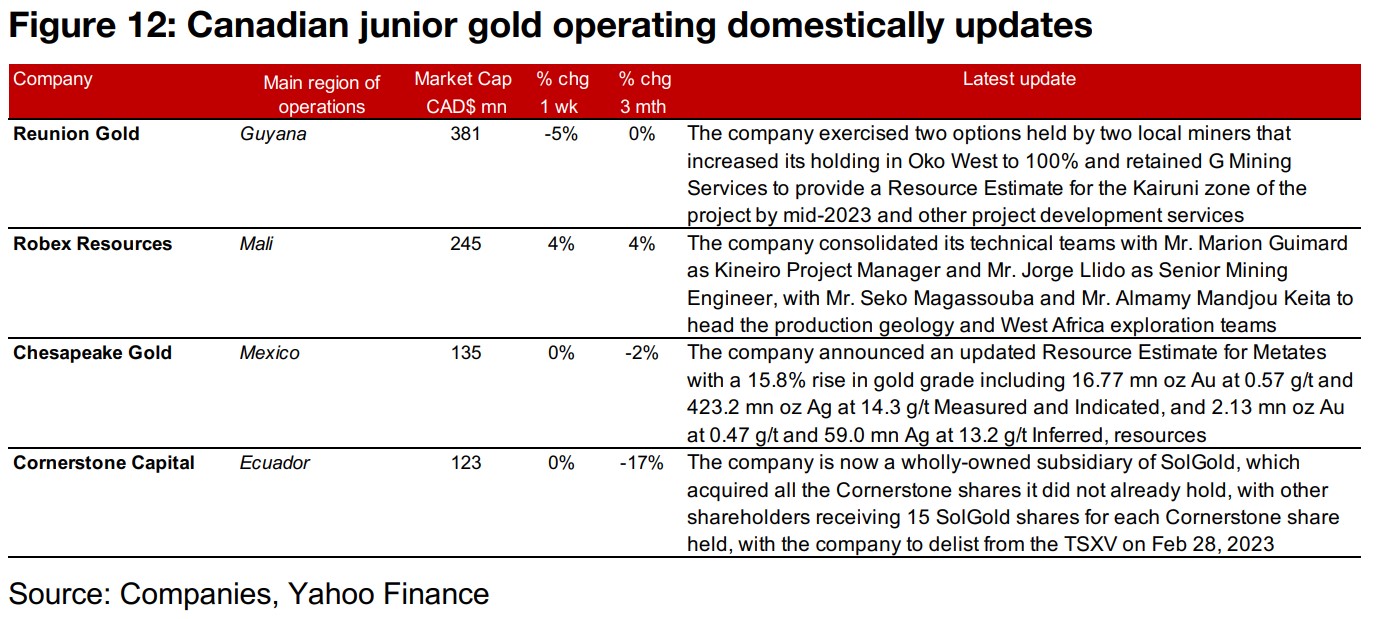

Gold producers mostly down and TSXV gold mixed

The producing gold miners were mostly down and the TSXV junior gold miners were mixed as the gold price and equity markets declined (Figures 9, 10). For the Canadian juniors operating mainly domestically, Artemis Gold provided an operational update for the Blackwater project, Osisko Development issued 10,000 shares as part of its participation agreement with the Williams Lake First Nation for the Cariboo Project and Eskay Mining reported drill results from the Eskay project (Figure 11). For the Canadian juniors operating mainly internationally, Reunion Gold exercised options held by two local miners, increasing its holding of Oko West to 100% and Robex Resources announced appointments in its technical teams. Chesapeake Gold announced an updated Resource Estimate for Metates and Cornerstone reported that it has become a wholly-owned subsidiary of SolGold after the latter's purchase of all the Cornerstone shares it did not already hold (Figure 12).

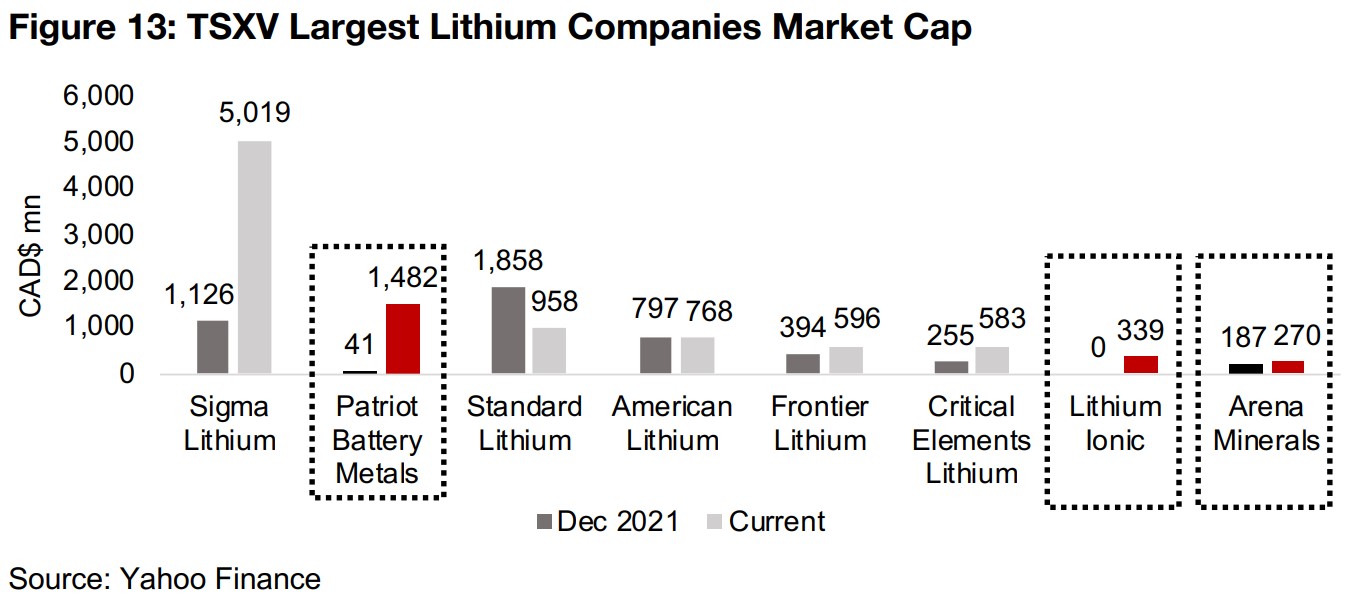

In Focus: Three new TSXV 'Big Lithium' players

Patriot Battery Metals, Arena Minerals, Lithium Ionic now TSXV 'big' lithium This week In Focus are three companies that have relatively recently entered the territory of TSXV 'big lithium', currently roughly defined as those stocks with over CAD$250mn in market cap. The three include Patriot Battery Metals, with CAD$1,482mn market cap, up from just CAD$41mn at the end of 2021 and Lithium Ionic, with a CAD$339mn market cap, up from zero at the start of 2021, as it only listed in May 2022. Arena Minerals has seen less of a gain to a CAD$270mn market cap, as it was already reasonably well established as of end-2021 with a CAD$187mn market cap, and just hovering below the level of TSXV 'big lithium'.

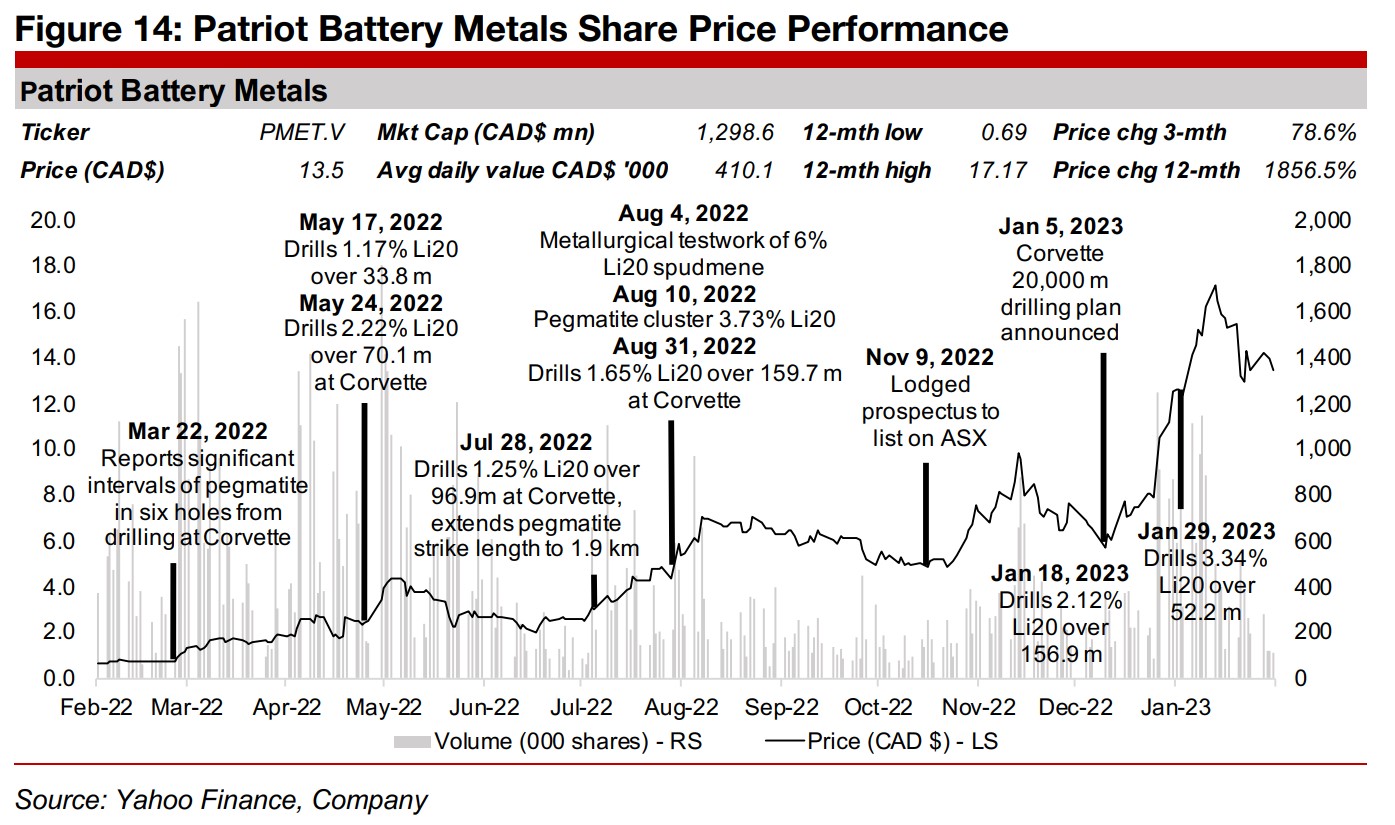

Patriot Battery Metals driven by strong drill results from Corvette property

Patriot Battery Metals has seen an extremely strong twelve months, up nearly 1,900%,

driven by drill results from its Corvette property in the James Bay region of Quebec,

Canada. The first evidence of a strong outlook for the project occurred on March 22,

2022, with the company reporting significant intervals of pegmatite from six holes at

Corvette, and the share price starting its upward trajectory (Figure 14). There was

another lift to the price from strong drill results on May 17, 2022, of 1.17% Li20 over

33.8 m and on May 24, 2022 of 2.22% Li20 over 70.1 mn at the project.

The share price then pulled back before another rise on July 28, 2022 drill results of

1.25% Li20 over 96.9 m, and press releases through August reporting metallurgical

test work showing 6% Li20 spudomene, a pegmatite cluster of 3.73% Li2O, and drill

results of 1.65% Li20 over 159.7 m. The share price again retraced, with a November

9, 2022, announcement of an intention to list on the Australia Stock Exchange

seeming to give the share price a lift.

Another huge surge in the shares have occurred since January 18, 2023, when results

of 2.12% over Li20 over 159.9 m where announced, followed by January 29, 2023

drill results of 3.34% Li20 over 52.2 m. The share price peaked in early February 2023,

and has declined since, with both equity markets and the lithium price having pulled

back.

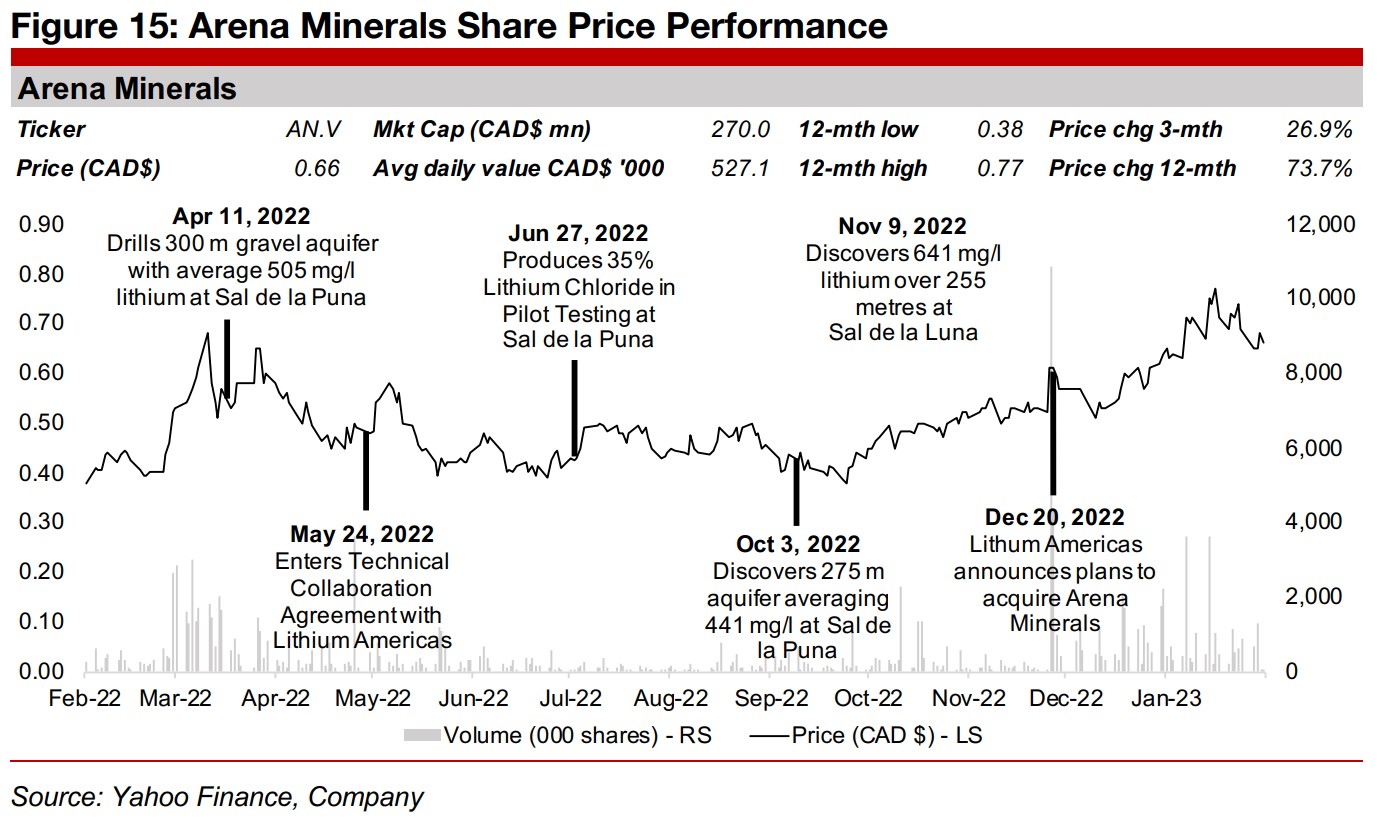

Arena Minerals to be acquired by Lithium Americas

While the Arena Minerals news flow over the past year has focused on Sal de la Puna

it is also developing Antofallo, with both lithium brine projects in Argentina. The share

price actually had limited momentum through most of 2022, with an unsustained lift

in March and April 2022, including from news of a 300 m gravel aquifer with an

average 505 mg/l (Figure 15). Although the share price trended down through most

of May and June 2022, a key development was reported on May 24, 2022, when the

company entered a technical collaboration agreement with Lithium Americas.

The share price mainly stagnated from June to October 2022, with a press release on

June 27, 2022, reporting 35% lithium chloride from pilot testing at Sal de Puna and

on October 3, 2022 reporting the discovery of a 275 m aquifer averaging 441 mg/l

which failed to boost the share price. However, the share price has trended up

following December 20, 2022 announcement that Lithium Americas intended to

acquire Arena, with the deal expected to close by Q3/23.

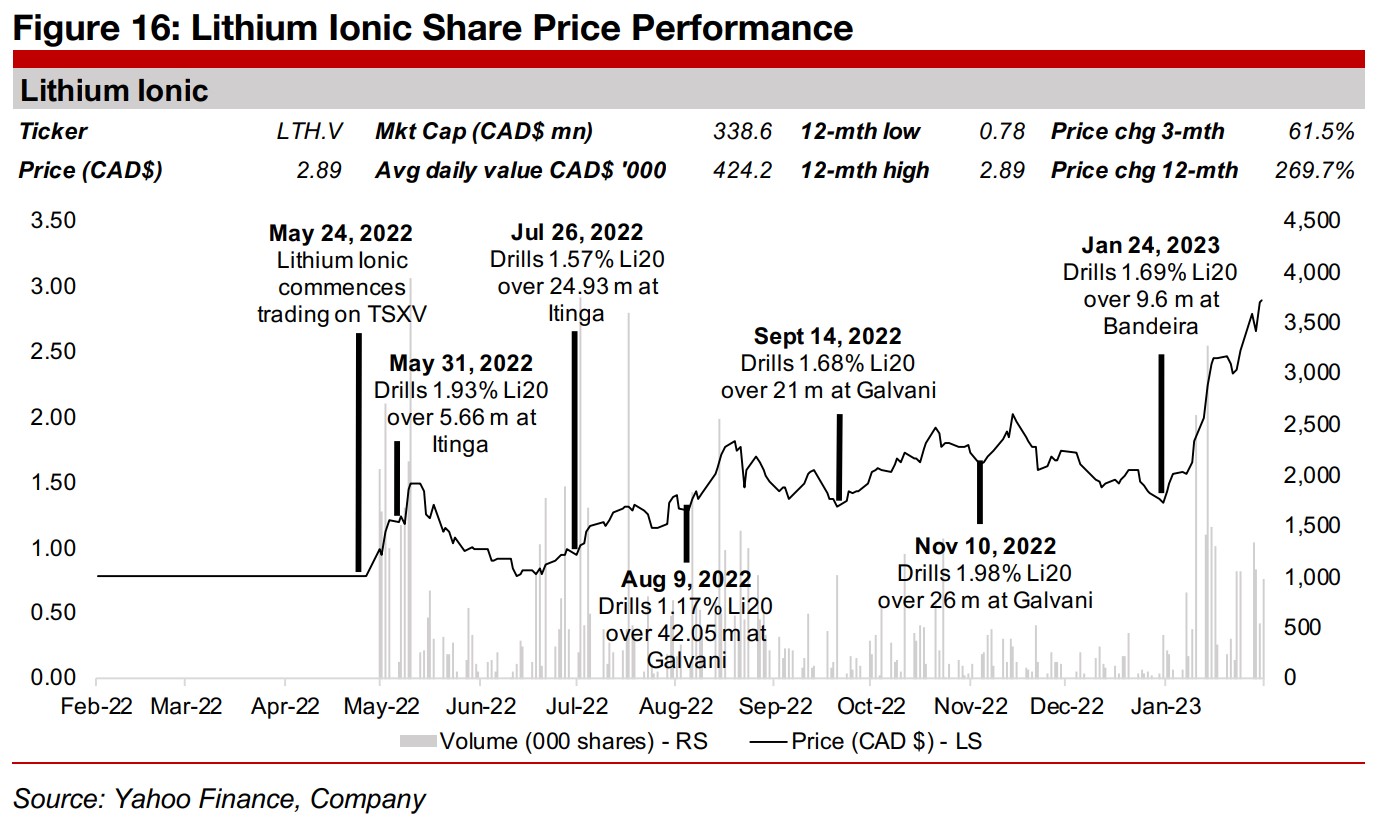

Lithium Ionic lists in May 2022, developing Itinga in Brazil

Lithium Ionic is the newest stock of the three, having just listed on May 24, 2022,

operating the Itinga hard rock lithium project in Brazil, which has two main zones,

Galvani and Bandeira. After seeing some gains following the listing and then from drill

results reported on May 31, 2022 of 1.93% Li20 over 5.66 m, the stock pulled back

through June 2022 (Figure 16). Another uptrend started in July 2022, with drill results

released on July 26, 2022 of 1.57% Li20 over 24.93 m, and then on August 9, 2022

of 1.17% Li20 over 42.05 m.

Results released on September 14, 2022, from the Galvani zone of 1.68% Li20 over

21 m and on November 10, 2022 of 1.98% Li20 over 26 m did not drive a sustained

rise in the share price, which ended last year near its August 2022 levels. However,

drill results from the Bandeira Zone, including on January 24, 2023, 1.69% Li20 over

9.6 m, have been viewed very favourably by the market, with the share price

continuing to hit new highs currently, even as declining equity markets, junior miners

and the lithium price fail to provide a supportive backdrop.

Disclaimer: This report is for informational use only and should not be used an alternative to the financial and legal advice of a qualified professional in business planning and investment. We do not represent that forecasts in this report will lead to a specific outcome or result, and are not liable in the event of any business action taken in whole or in part as a result of the contents of this report.