August 20, 2021

Gold up but gold stocks still slide

Author - Ben McGregor

Gold continues to pick up for second week

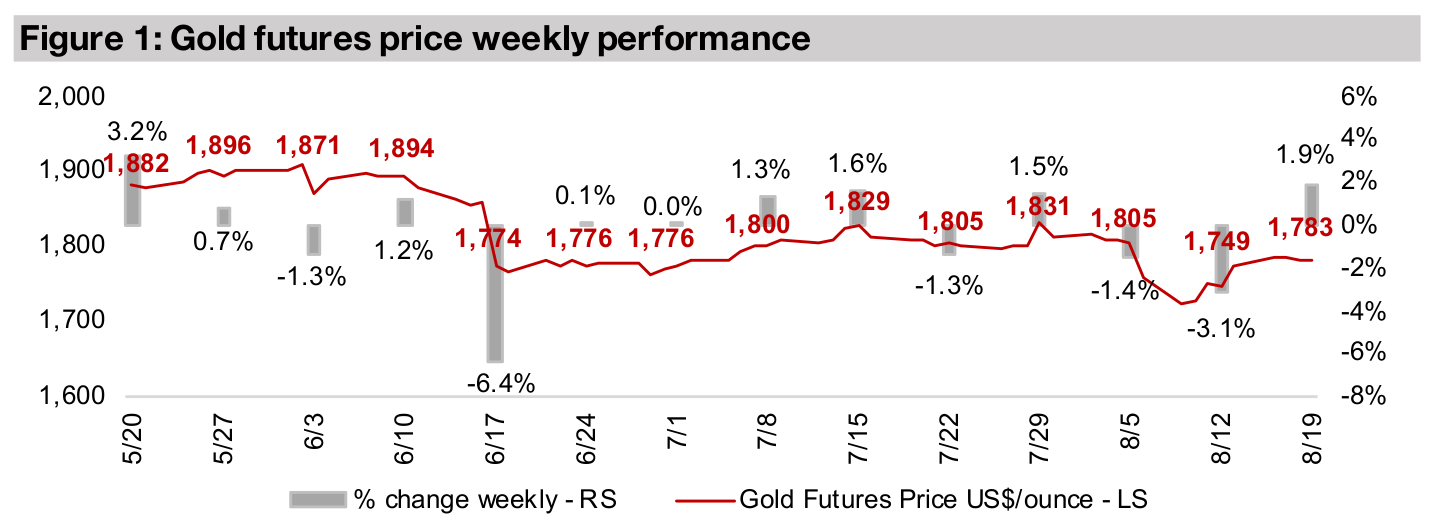

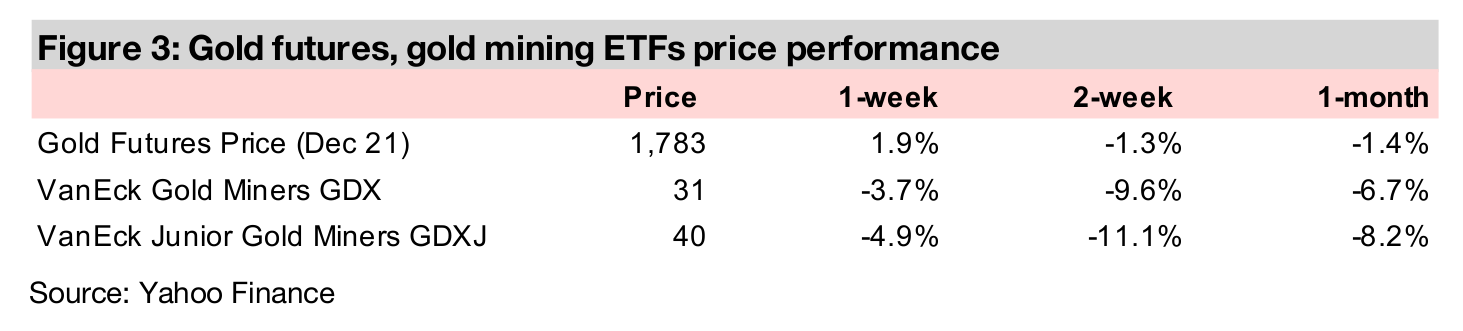

The gold price rose 1.9% this week to US$1,783/oz, recovering 3.5% off lows of US$1,723/oz over the past two weeks, as the market shrugged off another dip as it appears to see fair value for gold as being considerably above US$1,700/oz.

A look at the mid-tier royalty and streaming companies

This week we look at mid-tier TSX and TSXV-listed royalty and streaming companies, which offer diversification and risk reduction through holding many assets, in contrast to the concentrated risk of many junior miners, many with only one or two projects.

1) Gold rebounds again, but early taper a concern

Gold was up 1.9% this week to US$1,783/oz, and is now up 3.5% from a dip as low

as US$1,723/oz over the past two weeks, as there is a bit of a battle between two

views on gold in the market currently. The first view, which drove the dip, is that the

Fed could surprise the market by beginning to taper its stimulus sooner than

expected, and follow this with aggressive rate hikes in an effort to keep rising inflation

under control. This would in turn put pressure on gold as bond yields rose, making

fixed income investments more attractive than yield-less gold. The second view is

that Fed action will either be delayed, or very cautious, and this will let inflation

continue to run at high levels, given the massive monetary expansion of the past year.

This would lead to gold rising as an inflation hedge. In last week's dip, gold was under

pressure likely from those holding the former view, while this week, those holding the

latter view appear to have dominated the trading.

We believe that it will be quite difficult for the Fed to reduce its stimulus or raise rates

aggressively without curbing an economic expansion that is so driven by government

debt, or popping a substantial bubble in the equity markets. To this end, we expect

the Fed to 'disappoint' the gold bears with mild, not aggressive action. The most

recent Fed meeting minutes show that the board members are still mixed on whether

to start to curb the currently monetary stimulus, although there are expectations that

it could begin as early as next month. If this does happen, we should be prepared for

another dip in gold, and gold stocks also, but we believe that any such taper is likely

to be limited and cautious. As we seen with previous dips, the market is not likely to

believe in a truly hawkish Fed, given the potential economic fallout, and that they will

be pricing in high inflation longer-term, which should support gold.

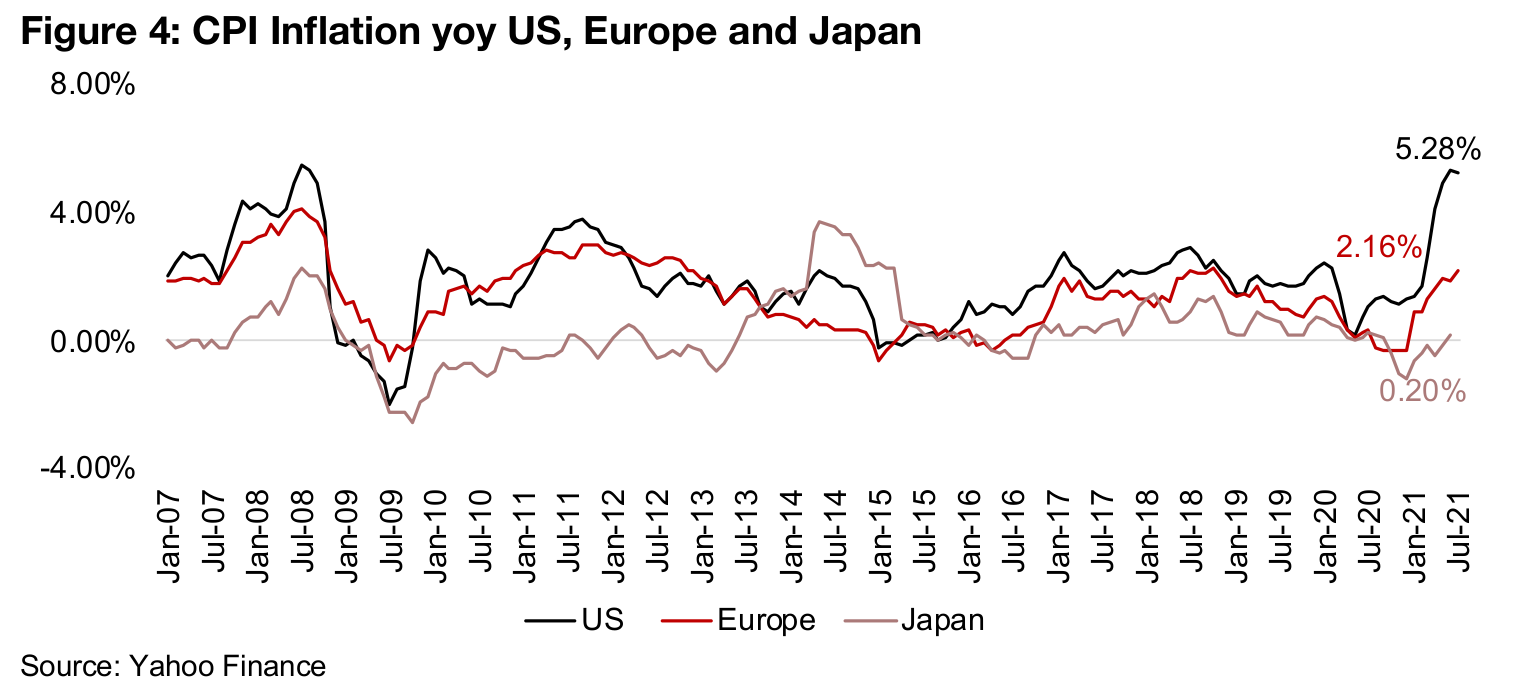

There is also the argument, from the market and the Fed, that inflation may subside

as supply chains return to somewhat normal after the disruptions of the global health

crisis, while the CPI growth is also high because of a low base last year. While we

agree that this will be a factor, we believe that the monetary expansion of the past

year will still be the dominant driver, and inflation could remain persistently high even

as supply chains return to normal. The slight decline in US inflation to 5.28% in July

2021 from 5.32% in June 2021 could possibly be pointed to as supporting the

subsiding inflation theory, after a year of increases (Figure 4). However, we would

note that this is still at an eleven year high, with inflation last this high in August 2008.

Also, we are seeing inflation continue to pickup globally, with Europe heading over

2.0% in July 2021, for the first time in nearly three years. Even Japan saw inflation of

0.20% in June 2020, which in the context of other regions may look very low, but in

the context of this perpetually deflationary country, is actually reasonably high.

Overall, considering the past two months of data, there is really still little support for

the idea that inflation is starting to ease globally.

2) Mid-tier gold royalty and streaming companies

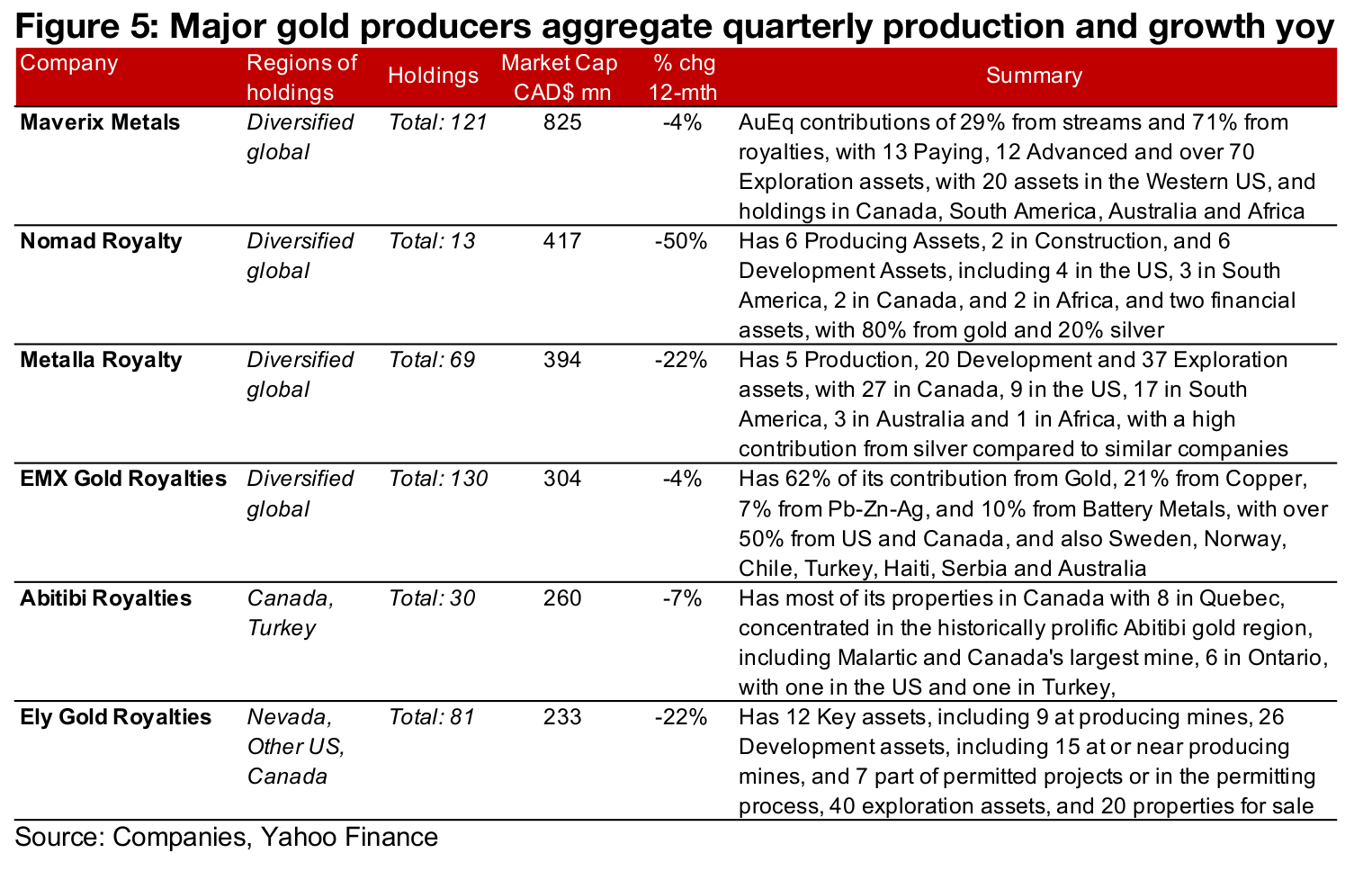

This week we look at the mid-tier gold royalty and streaming sector, comprising two companies listed on the TSX, Maverix Metals and Nomad Royalty, and four listed on the TSXV, Metalla Royalty, EMX Gold Royalties, Abitibi Royalties, and Ely Gold Royalties (Figure 5). Most of the companies have seen continued decent operational gains, but share prices have declined as the gold price remained weak.

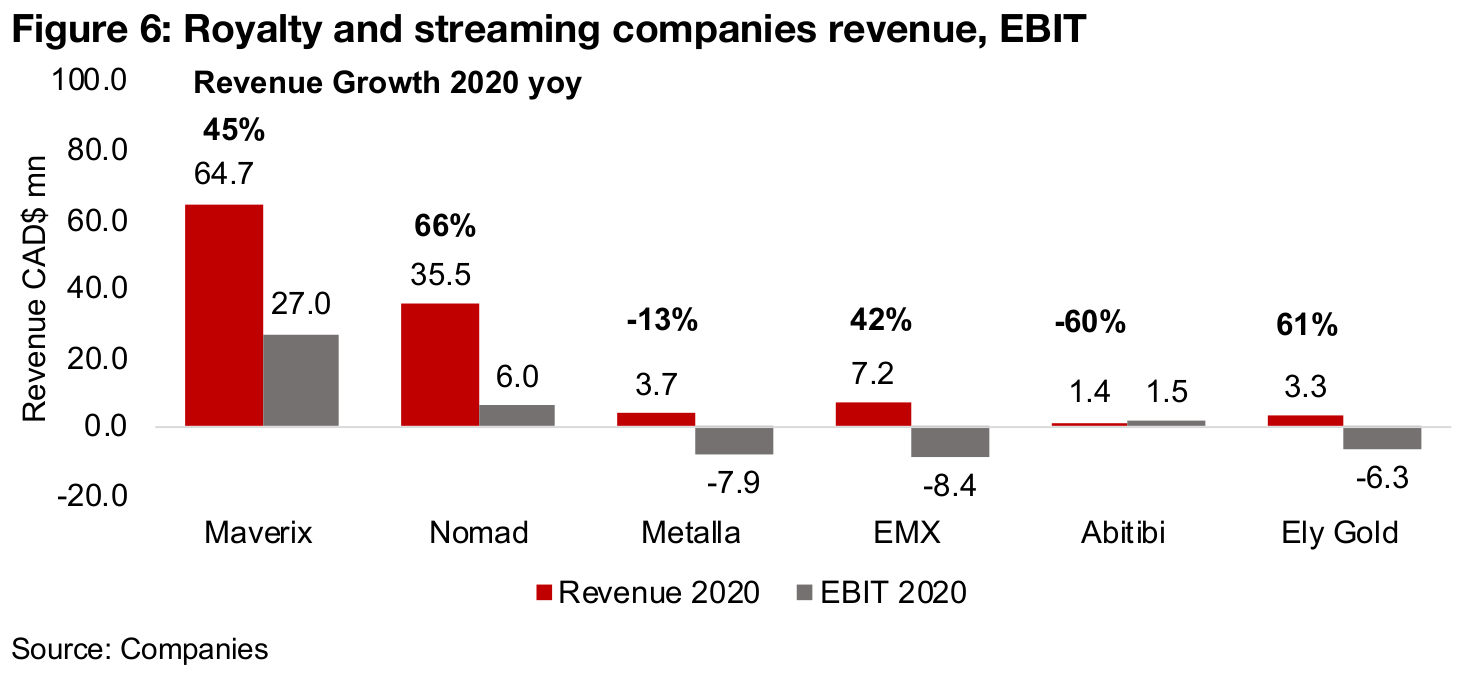

Two companies, Maverix and Nomad, have already built up a substantial base of producing assets, with revenue in 2020 of $64.7mn and $35.5mn, respectively, with the differential reflected in Maverix's larger market cap of $825mn versus $417mn for Nomad (Figure 6). While Metalla Royalty had revenue of just $3.7mn in 2020, its market cap is just below Nomad at $394mn, suggesting that expectations for the prospects for Metalla's assets are strong, and that there value will be similar to Nomad long-term. While EMX's revenue, at $7.2mn in 2020 was actually ahead of Metalla, the market is valuing it significantly below it, at a market cap of US$301mn, suggesting lower expected cash flow generation from its assets over the long-term. Maverix generated earnings before interest and taxes (EBIT) of $27mn and Nomad $6mn, but Metalla and EMX both had negative earnings, of -$7.9mn and -$8.4mn, with the future royalties and streams that the market expects will push them into profitability having yet to flow through to the revenue line in their income statements.

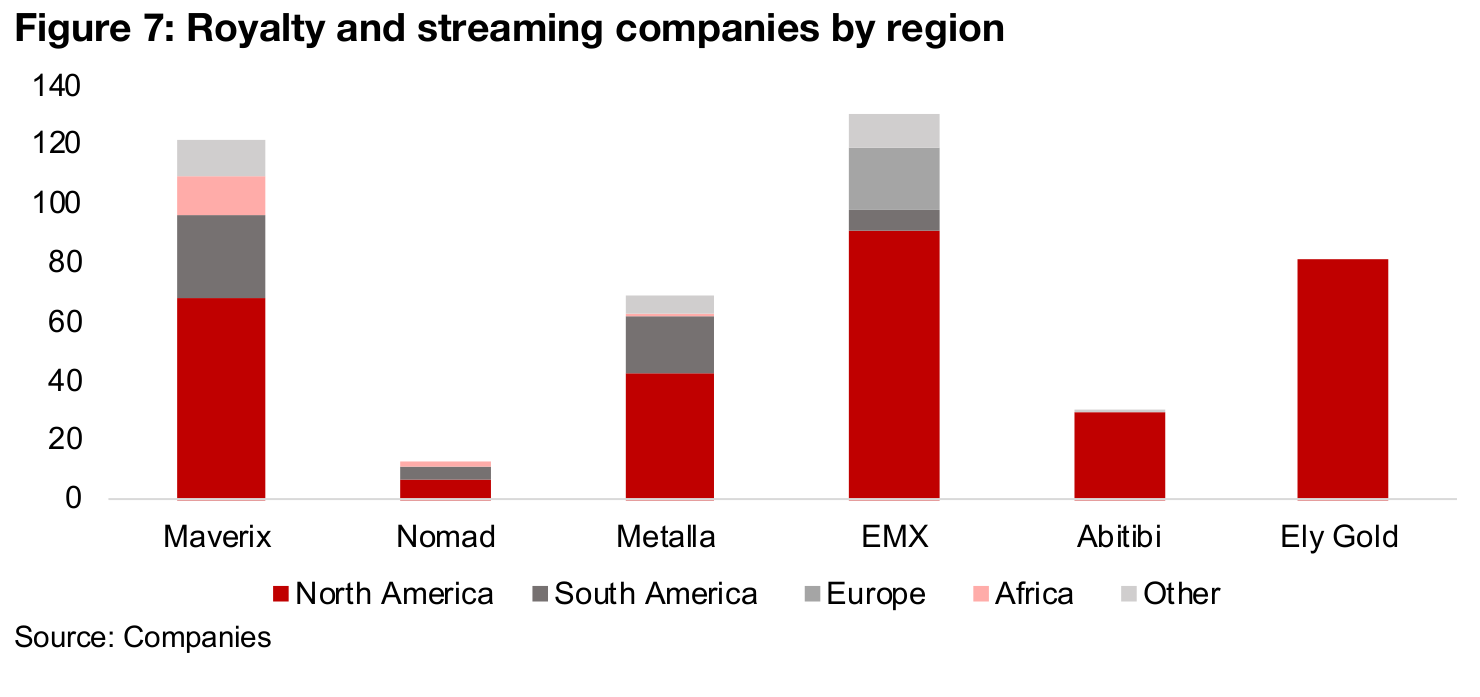

Maverix has a high number of assets, at 121 in total, which are very diversified

globally, while Nomad, in contrast, has a concentrated portfolio of 13 assets,

although they too are well diversified geographically (Figure 7). Both Metalla and EMX

also have assets across several regions, with the former having 69 holdings

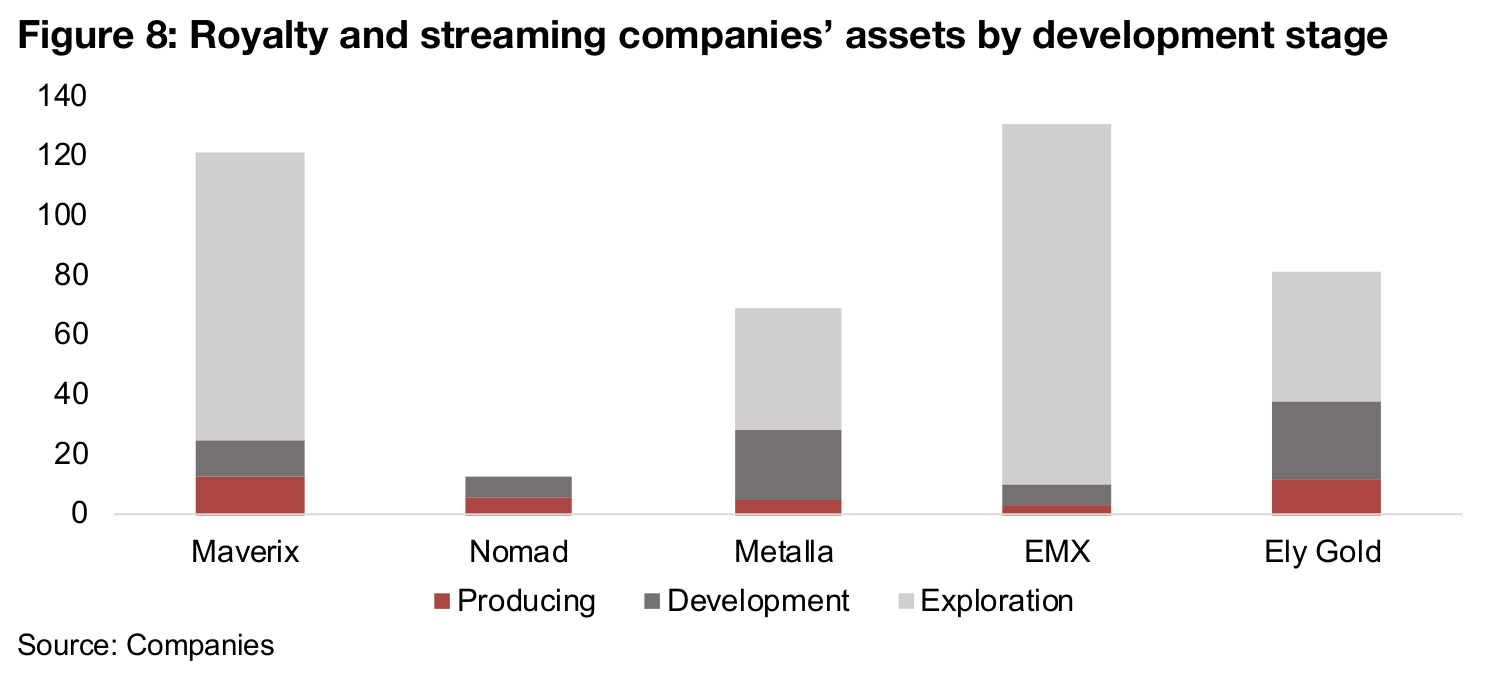

compared to 130 for EMX. The structure of the group in terms of development stage

is that each have a few producing assets actually generating the current revenue and

a handful of development assets nearer to production and revenue contribution. Most

of the holdings are exploration assets, which is necessary to secure long-term

revenue, as many projects in this category may not make it to production. Of the

group, only Nomad has a low number of exploration assets (Figure 8).

Abitibi and Ely Gold are both smaller in terms of revenue, at $1.4bn and $3.3bn in

2020, with Abitibi already generating EBIT in 2020, but Ely still seeing operating losses.

They are also much more geographically concentrated in terms of their assets, with

Abitibi having projects concentrated mainly in Abitibi in Quebec, and Ely mainly

focusing on Nevada in the US.

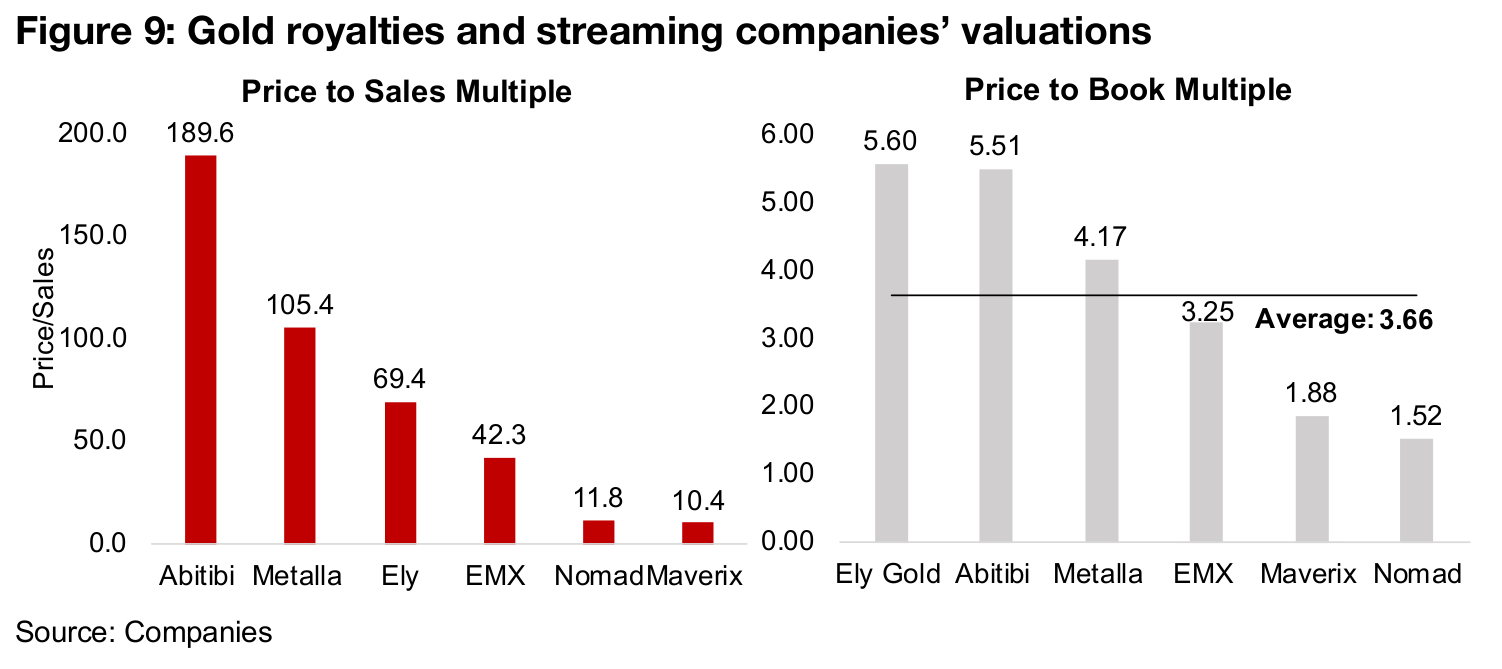

One multiple that is rarely used in valuing junior miners, but can be used for royalty

and streaming companies, is price to sales, as junior miners are often in the

exploration phase and have no revenue. We can see that the price to sales multiples

especially for the four smaller royalty and streaming companies look quite excessive,

with Abitibi at 189.6x and Metalla at 105.4x, soaring above the larger companies, with

Nomad at just 11.8x and Maverix at 10.4x (Figure 9). This is because upcoming

revenue streams for these smaller players is being anticipated by the market. If we

adjusted up the sales in the price/sales multiple for based on the revenue expected

over the next one to two years, the figure would likely decline considerably, to a

reasonable level more in line with the larger established royalty and streaming

companies. We also see a similar situation with the price to book multiples.

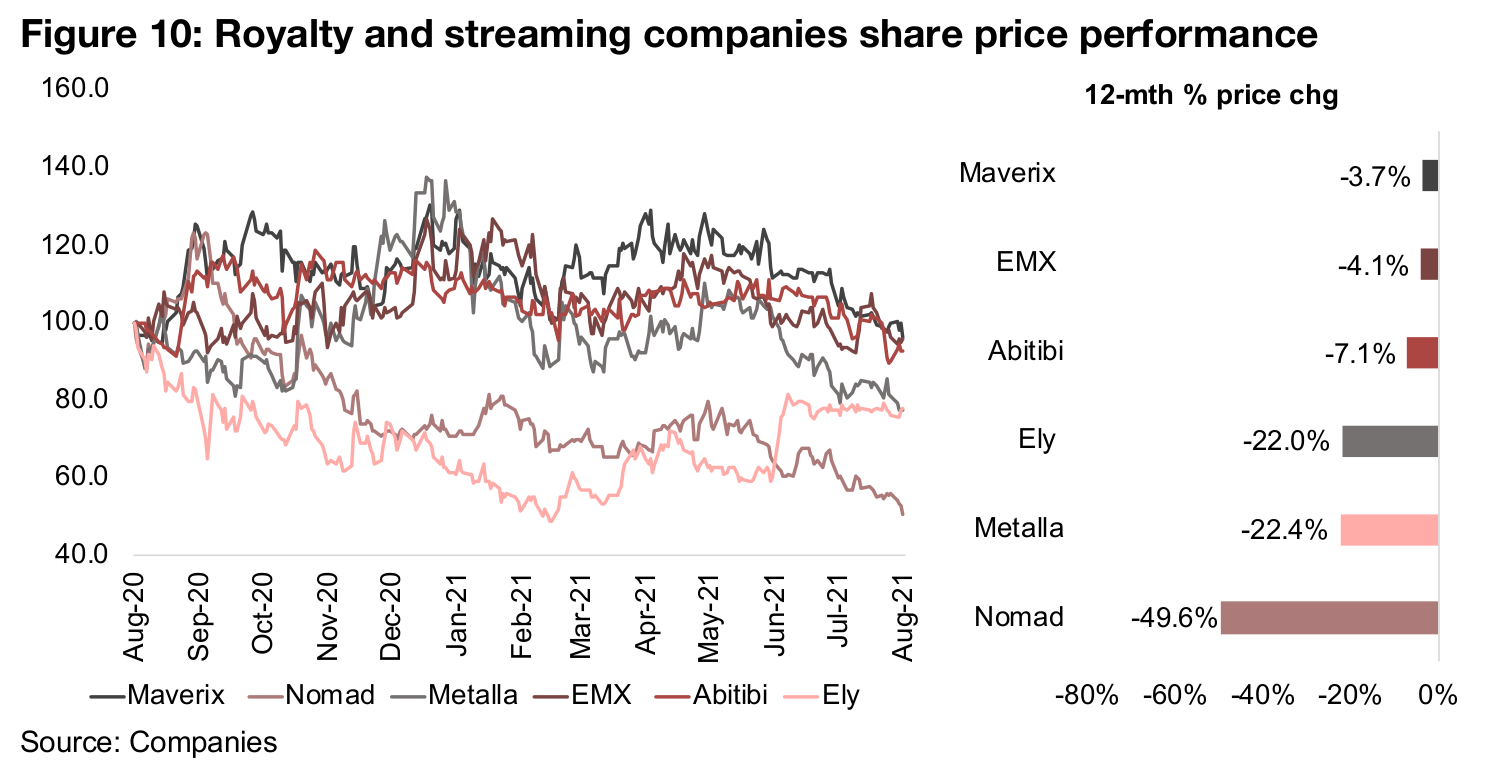

The share prices of all the royalty and streaming companies have declined this year

as gold has been relatively weak, although overall the declines have been moderate

compared to the drop for some junior miners, which, as we have noted above, do not

have the diversification and risk reduction offered by these companies. The largest of

the group, Maverix, has held up the best, down just -3.7% over the past twelve

months, although the second largest, Nomad is down -49.6%, the worst performer

of the group. EMX and Abitibi have seen only moderate declines of -4.1% and -7.1%,

quite decent performances in light of the relatively weak gold price over the past year,

while Ely is down -22.0% and Metalla down -22.4%.

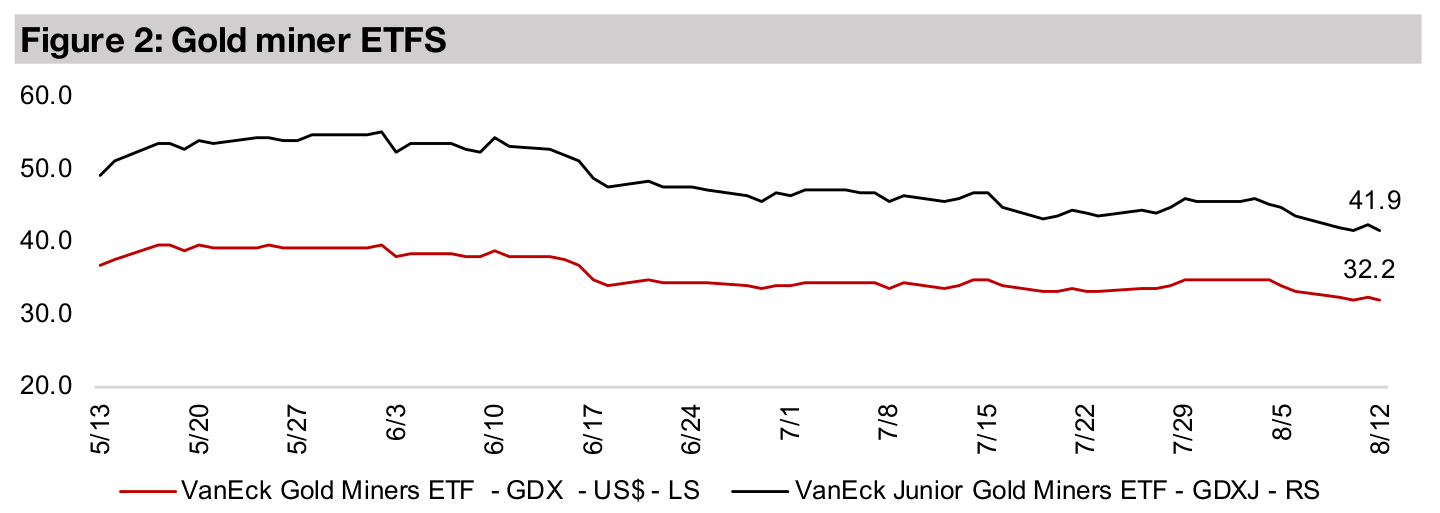

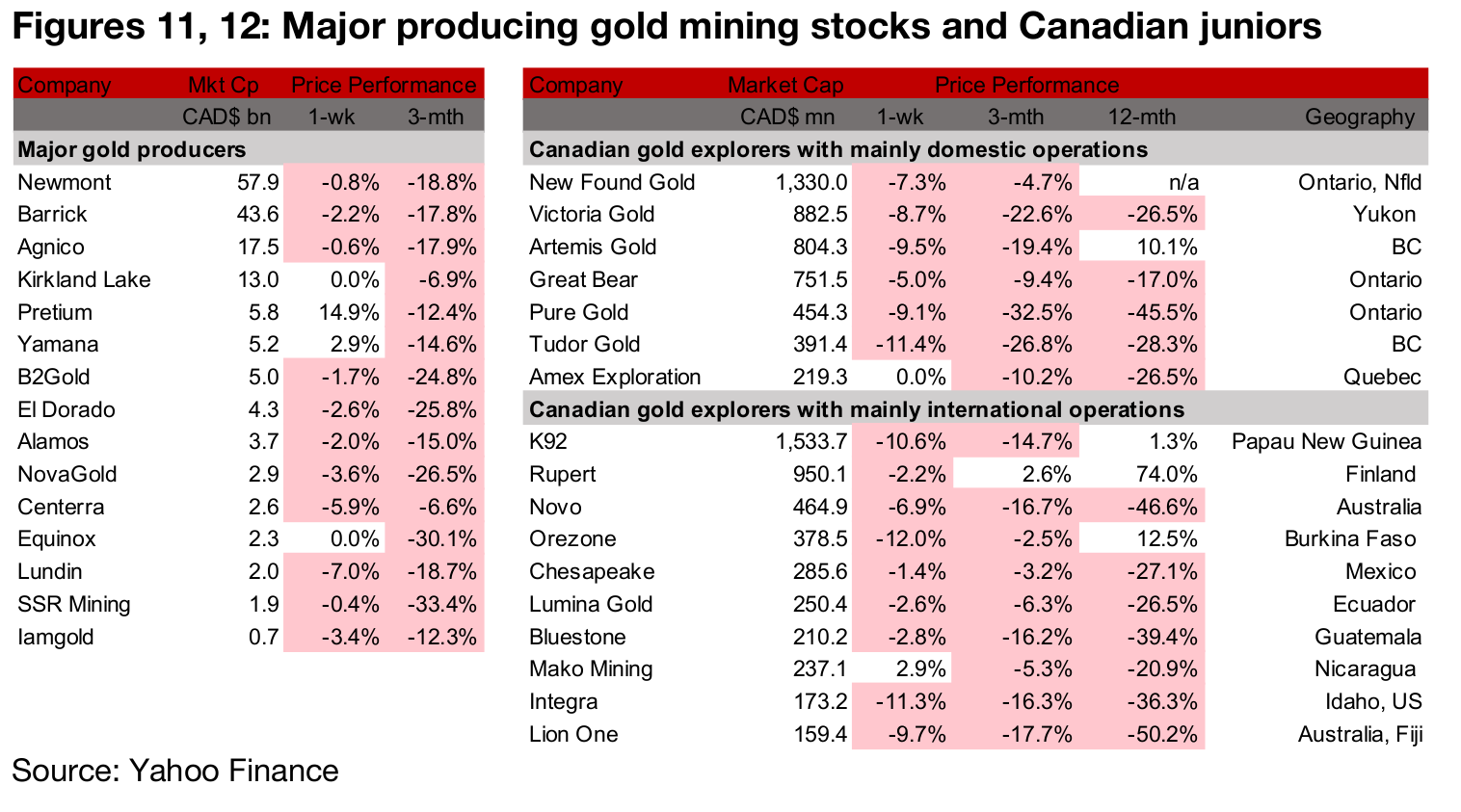

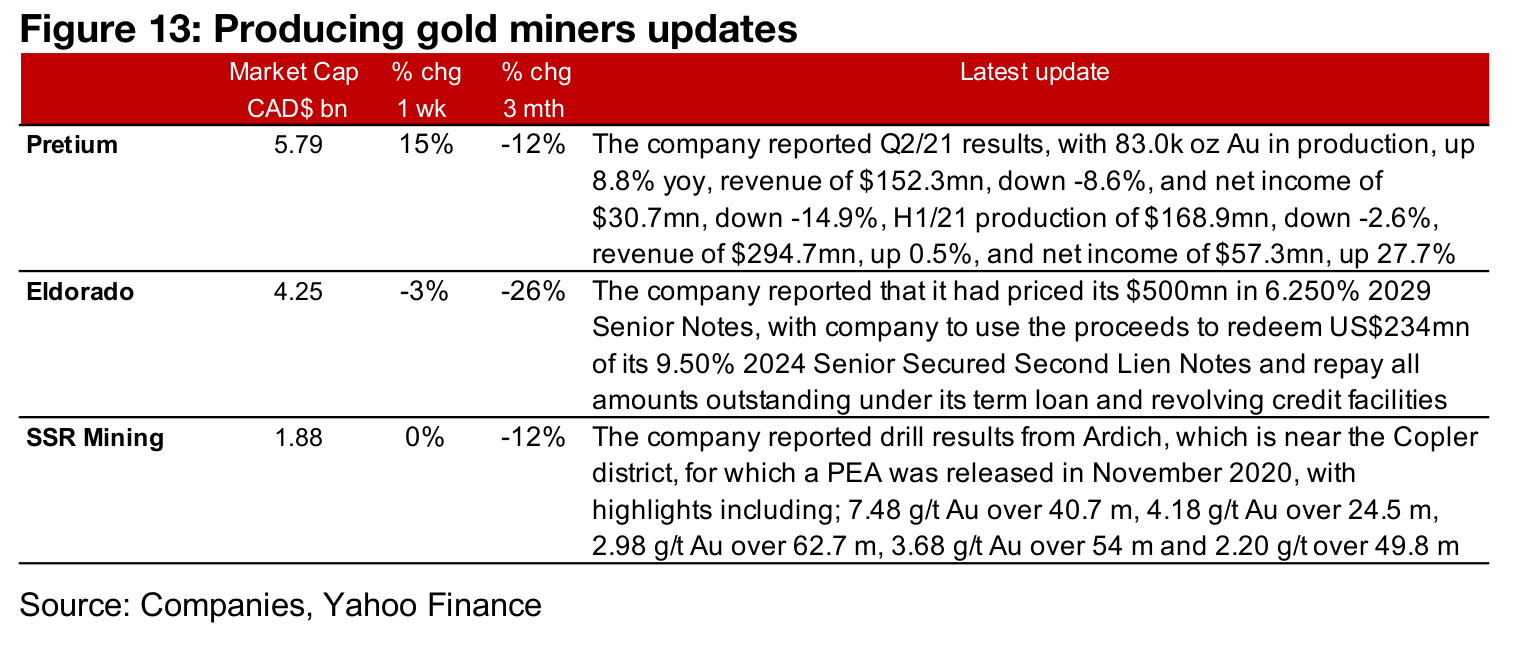

Producers mostly down even as gold picks up

The producing gold miners were mainly down this week as the pickup in gold was offset by pressure on equity markets (Figure 11). Pretium reported its Q2/21 results, Eldorado reported the pricing on its Senior Notes and SSR Mining reported drill results from Ardich (Figure 13).

Canadian juniors nearly all down even on rise in gold

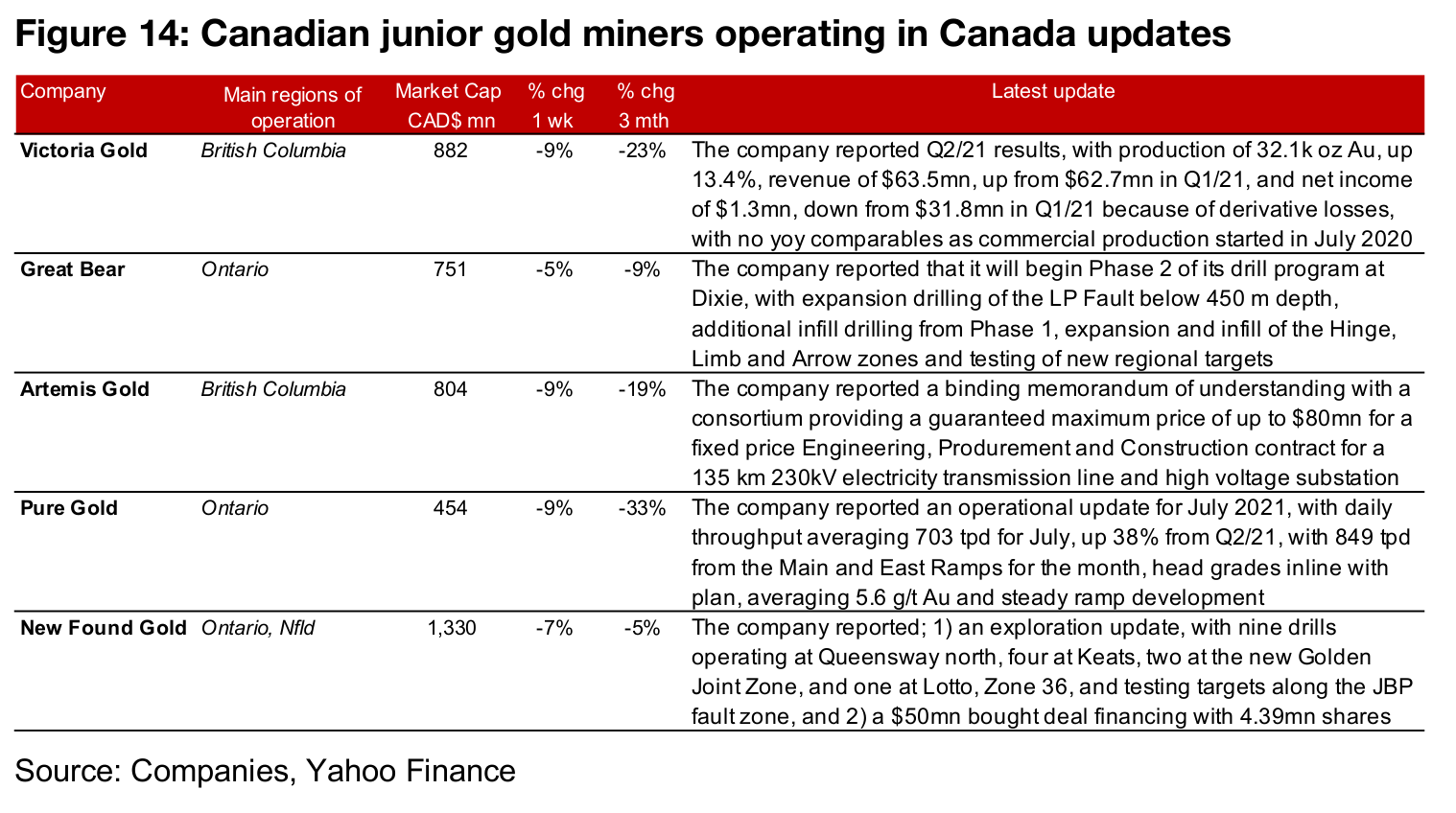

The Canadian juniors were nearly all down as the fall in equity markets offset the rise in gold (Figure 12). For the Canadian juniors operating mainly domestically, Victoria gold reported Q2/21 results, Great Bear reported that it will begin Phase 2 of its drill program and Artemis reported a binding MoU for a guaranteed fixed price with contractors for the construction of an electricity transmission line. Pure Gold reported an operational update for July 2021 and New Found Gold reported an exploration update, with nine drills operating, and a $50mn bought deal financing (Figure 13).

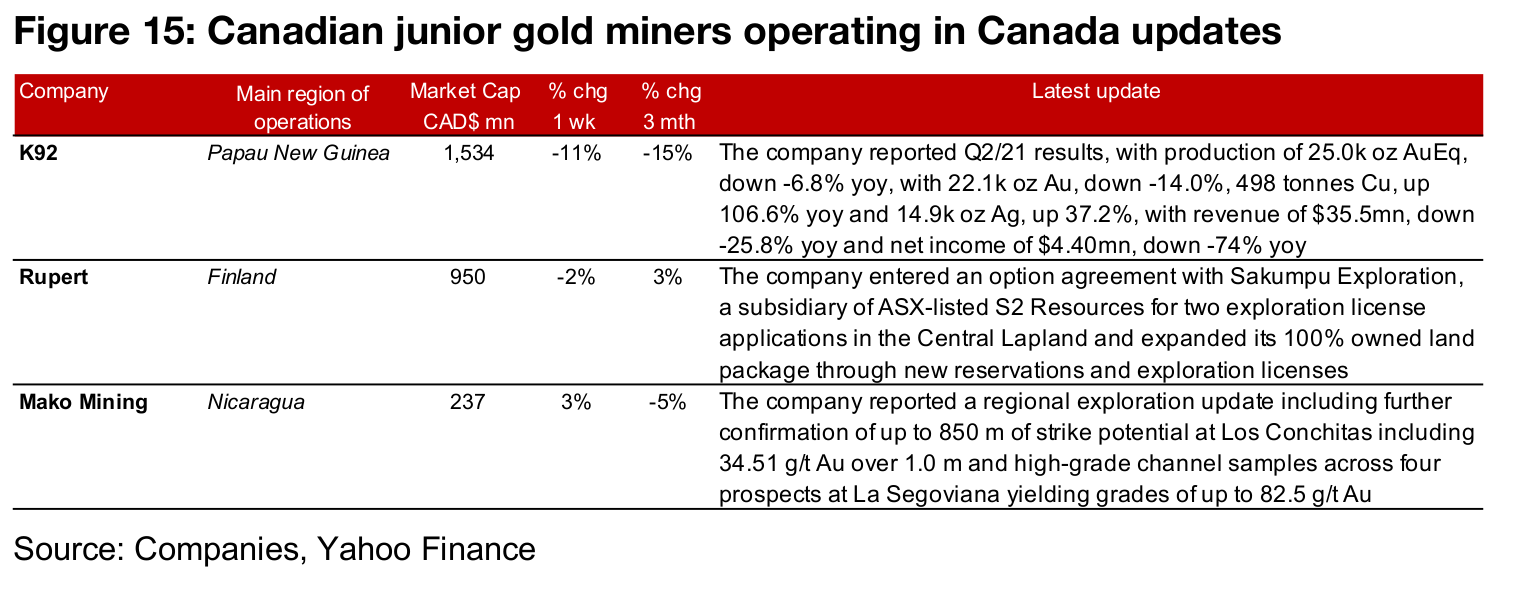

For the Canadian juniors operating mainly internationally, K92 reported Q2/21 results, Rupert reported an option agreement with Sakumpy Exploration for two exploration license applications in Central Lapland and expanded its 100%-owned land package through new reservations and exploration licenses, and Mako Mining reported a regional exploration update. (Figure 14).

Disclaimer: This report is for informational use only and should not be used an alternative to the financial and legal advice of a qualified professional in business planning and investment. We do not represent that forecasts in this report will lead to a specific outcome or result, and are not liable in the event of any business action taken in whole or in part as a result of the contents of this report.