April 15, 2022

Gold Up as Raging Inflation Continues

Author - Ben McGregor

Gold rises on continued inflation surge

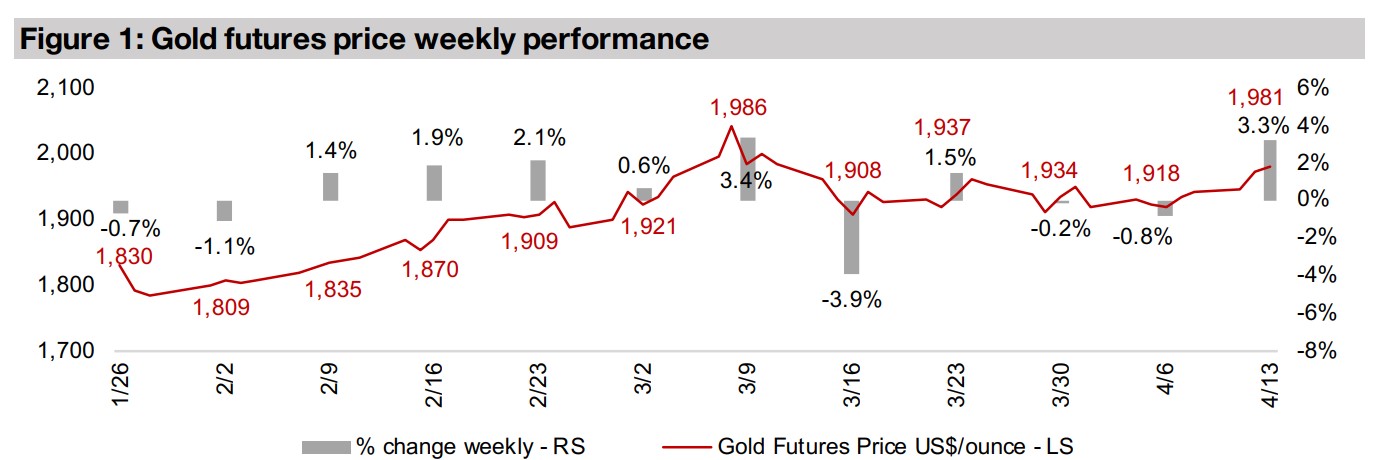

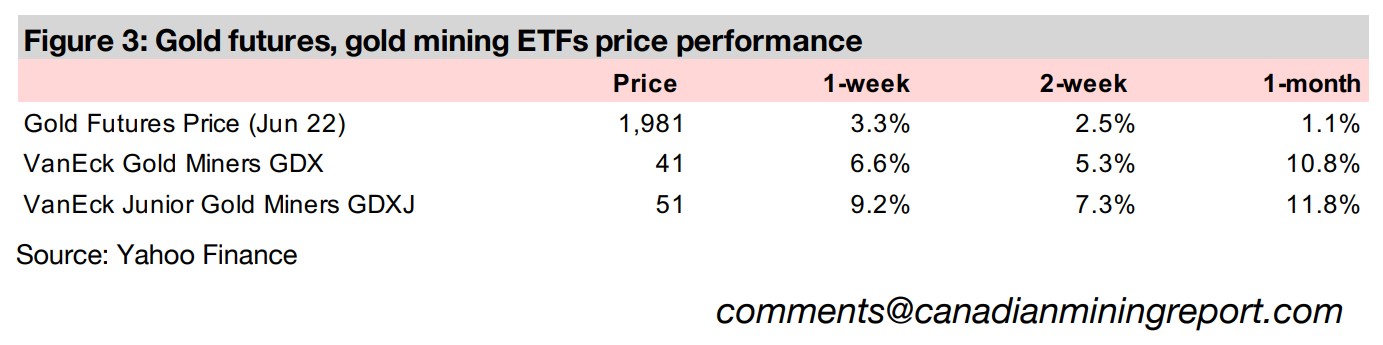

Gold rose 3.3% to US$1,981/oz this week as US inflation continued to surge, outpacing the rise in nominal yields and driving real yields down further into negative territory, reducing the relative cost of holding yieldless gold.

Rio2 Limited, operating the advanced Fenix Gold project, In Focus

This week Rio2 Limited is In Focus, operating the advanced Fenix Gold project in Argentina, which secured financing for mine construction in 2021 and has a PFS indicating a $121mn after-tax project value at a gold price of US$1,300/oz.

Gold Up as Raging Inflation Continues

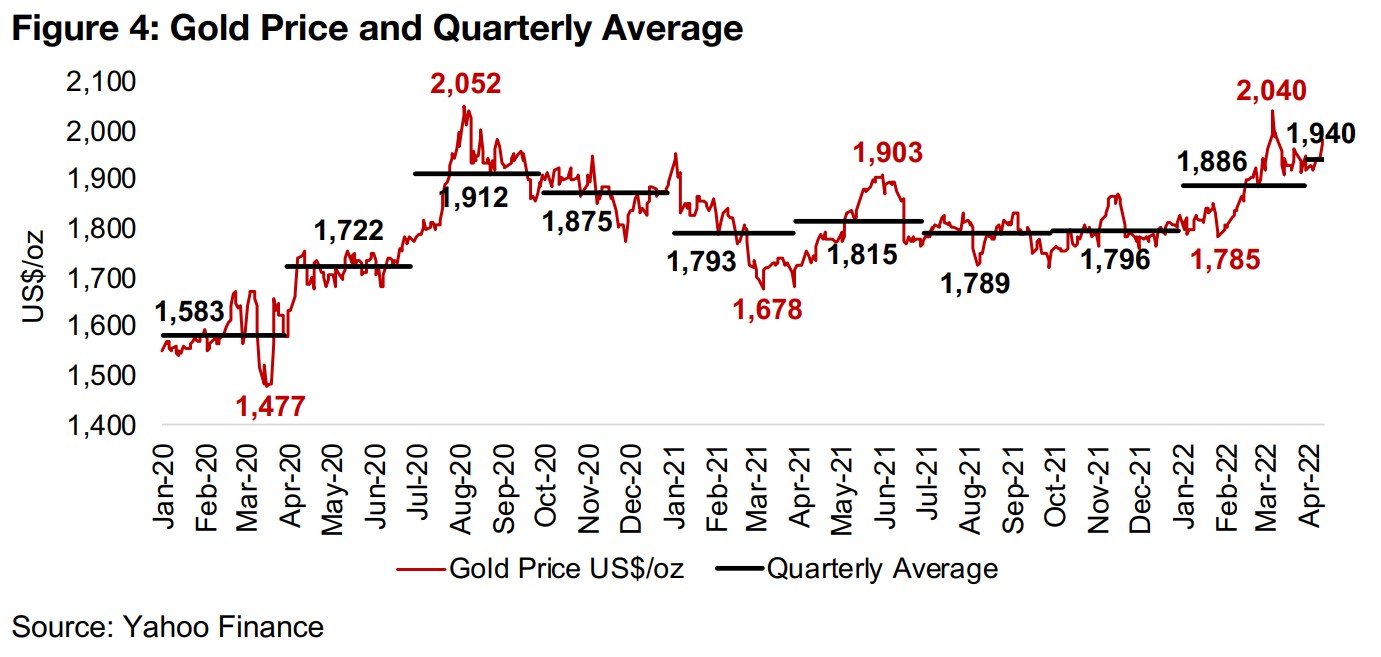

Gold rose 3.3% to US$1,981/oz this week, its highest level in six weeks, nearing the top of a trading range we have seen for gold since late February 2022 around US$1,900/oz to US$1,990/oz. The average price for the first two weeks of this quarter at US$1,940/oz has surpassed the average for all quarters since the gold price really started to pick up in 2020 (Figure 4). This is over US$350/oz higher than the average Q1/20 price of US$1,583/oz, the last quarter before a significant rebasing of the gold price above US$1,700/oz, with the quarterly average not dropped below this level since Q2/20. The average so far this quarter is even above Q3/20, when gold reached highs of US$2,052/oz, but lower prices at the start and end of the quarter pulled down the average to US$1,912/oz, offsetting the mid-quarter surge. We expect that gold will likely at least maintain its current range this year, if not move much higher, with strong drivers including inflation and high geopolitical risks.

Raging Inflation Continues to Drive Real Yields Down

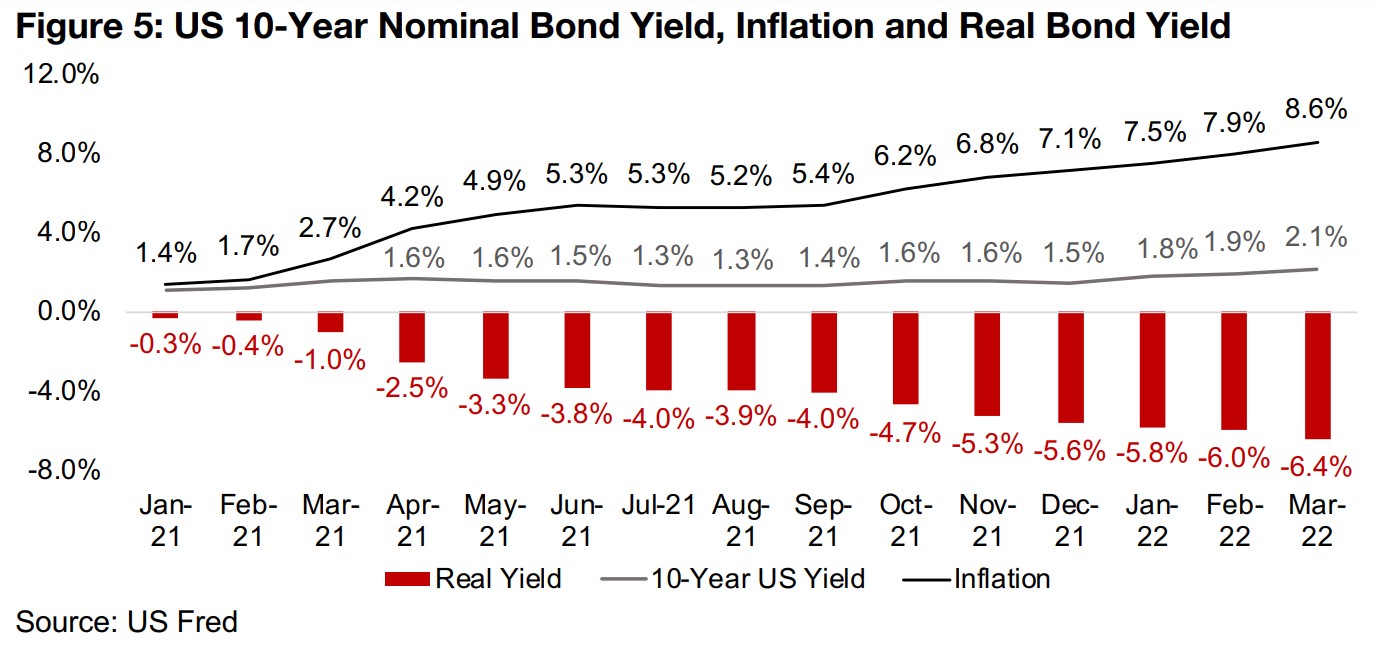

The rise in gold this week was driven mainly by a continued surge in CPI inflation in the US, which rose to 8.6% yoy in March 2022, up from just 1.4% in January 2021. While US 10-year nominal yields have also risen substantially, to 2.1% in March 2022, up from 1.4% in January 2021, the pickup in inflation has been much more rapid, driving down US 10-year real yields from near zero at -0.3% in January 2021 to heavily negative at -6.4% in March 2022. This is a strong driver for gold with bonds a substitute investment which tends to have a positive yield, which can make them more attractive to some investors than yieldless gold, which also incurs storage costs. However, even with a 1.0%-2.0% storage cost for gold, 10-year US bonds are much less attractive, as investors actually lose -6.4% by holding them, making holding gold relatively far more attractive.

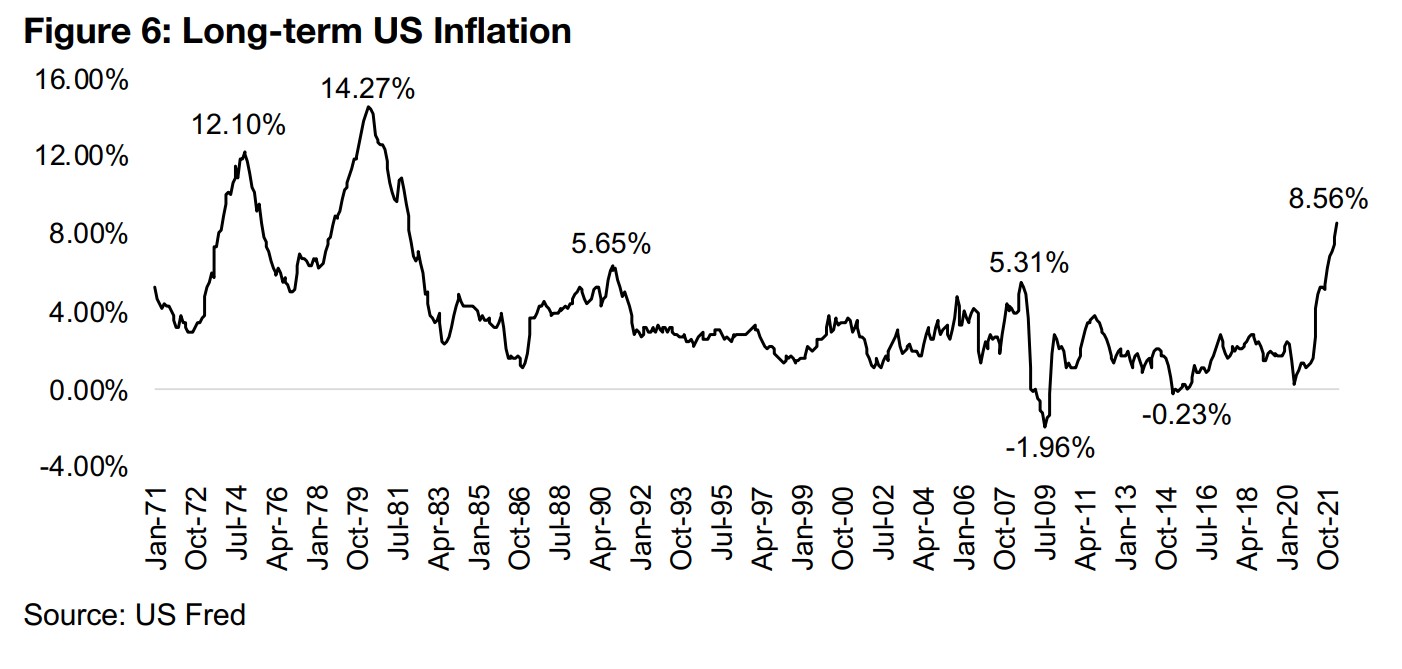

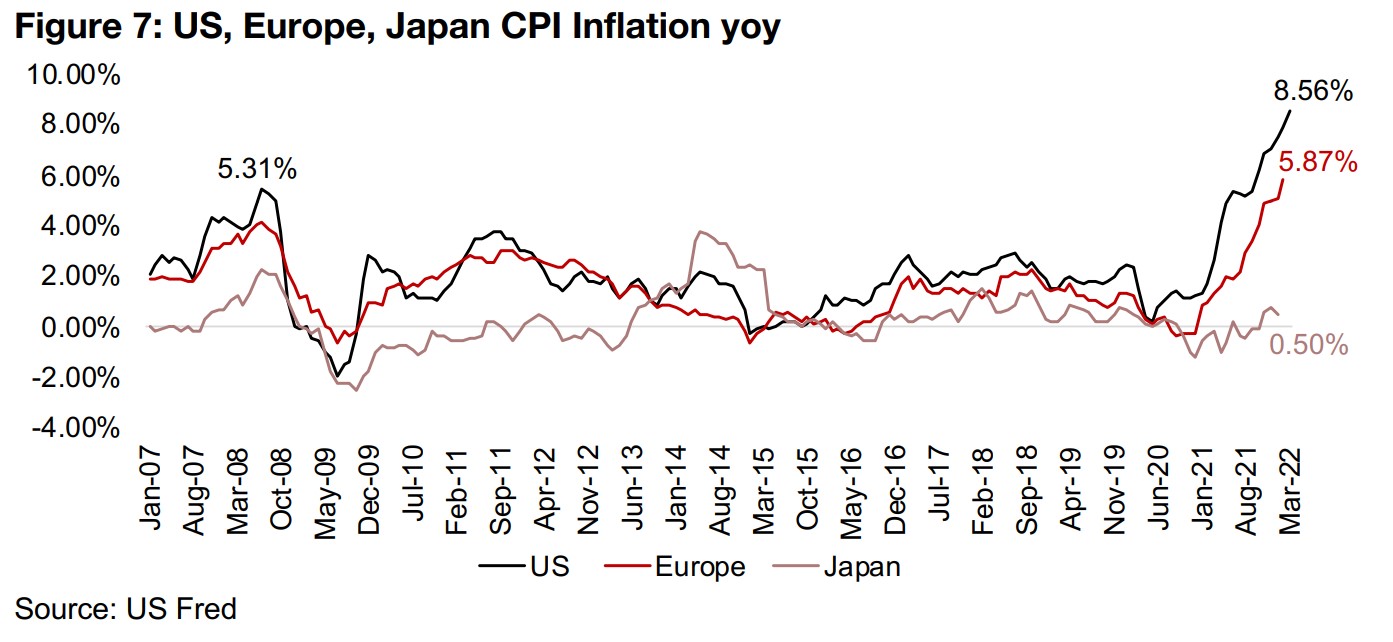

The current inflation rate of 8.56% is very high in historical terms, with nothing like these levels seen for nearly forty years, with the last time prices rose this quickly being the 1970s. Inflation reached above 10.0% twice in that decade, first in 1975, peaking at 12.10%, and again in 1980, peaking at 14.27%, and was only curbed by a severe hike in interest rates in the early 1980s, which crushed inflation, but drove a major recession (Figure 7). The high inflation is also not limited to the US, with European inflation now at 5.87%, well above the levels of the last fifteen years, and even Japan, which has tended towards deflation for over three decades, seeing inflation of 0.50%. While the US Fed has already started to hike rates, and other central banks globally also seem set to start tightening monetary policy, they seem to be well behind the curve so far, and some quite aggressive, and therefore potentially recession-inducing, hikes could be required to really bring inflation under control.

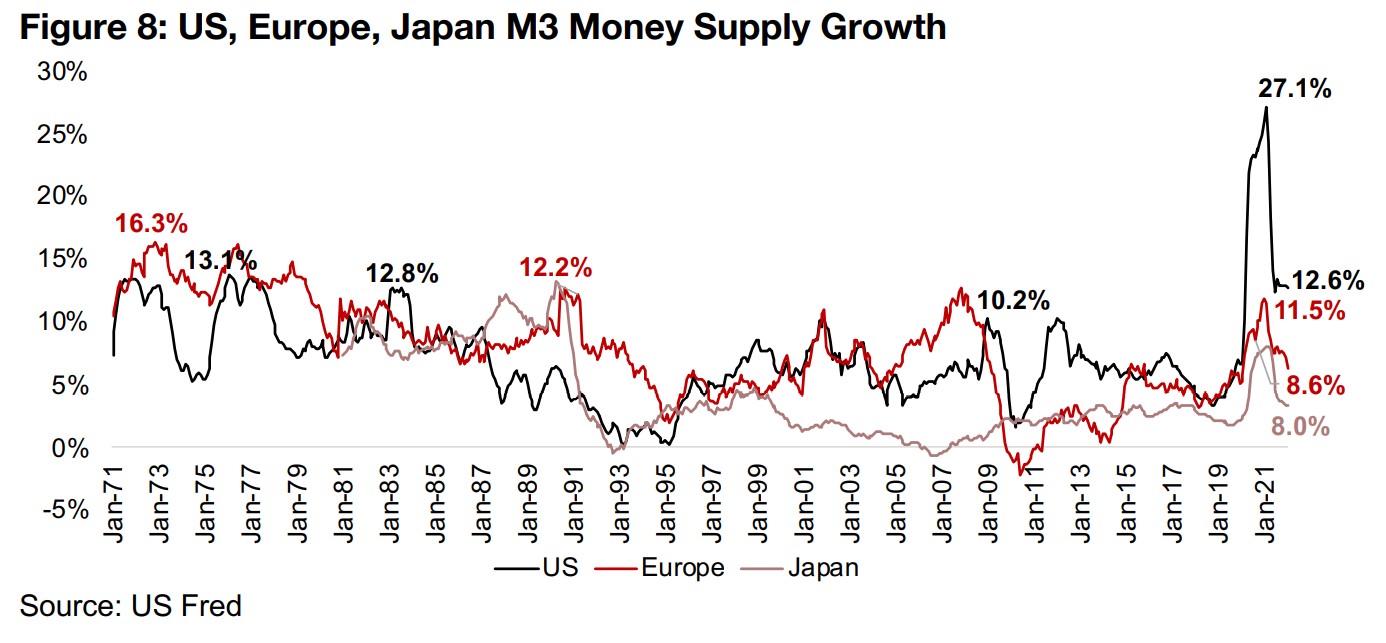

As for predicting what inflation what might do for the rest of the year, we can look at money supply growth, which tends to lead an eventual rise in prices by twelve to eighteen months or more. While M3 money supply growth for the US, Europe and Japan is well off the highs at the peak of the global health crisis, it is still extremely high in recent months versus its longer-term history (Figure 8). With this liquidity still to make its way through the monetary system, inflation could remain very high for another year or even two, with the effects from the Fed's rate hikes on inflation, especially if the hikes are small, potentially not having a significant effect on CPI inflation throughout 2022 and even into 2023. This could mean continued negative bond yields for an extended period, which should continue to support gold.

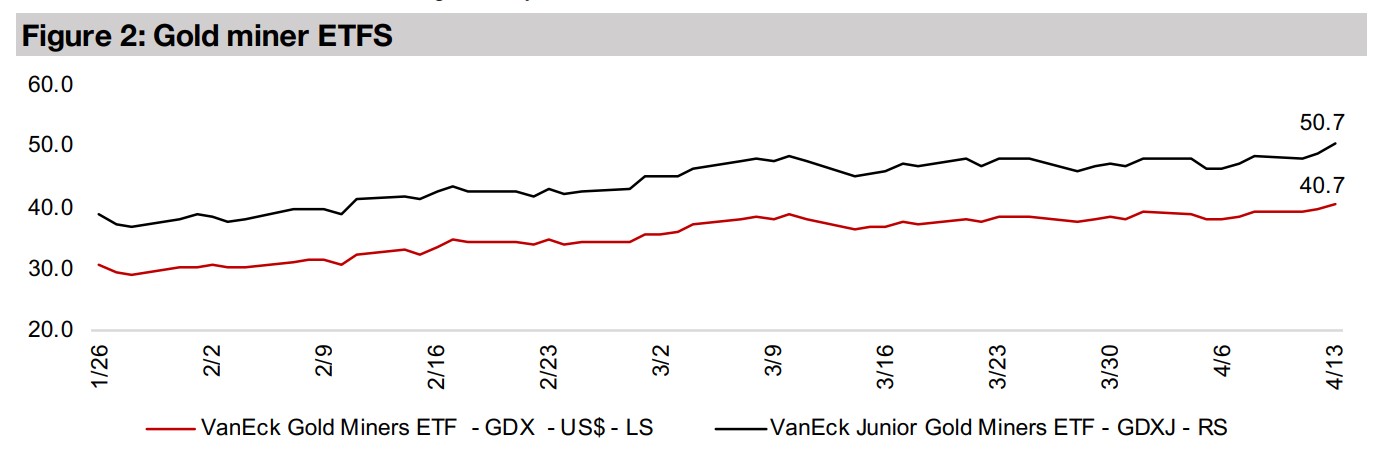

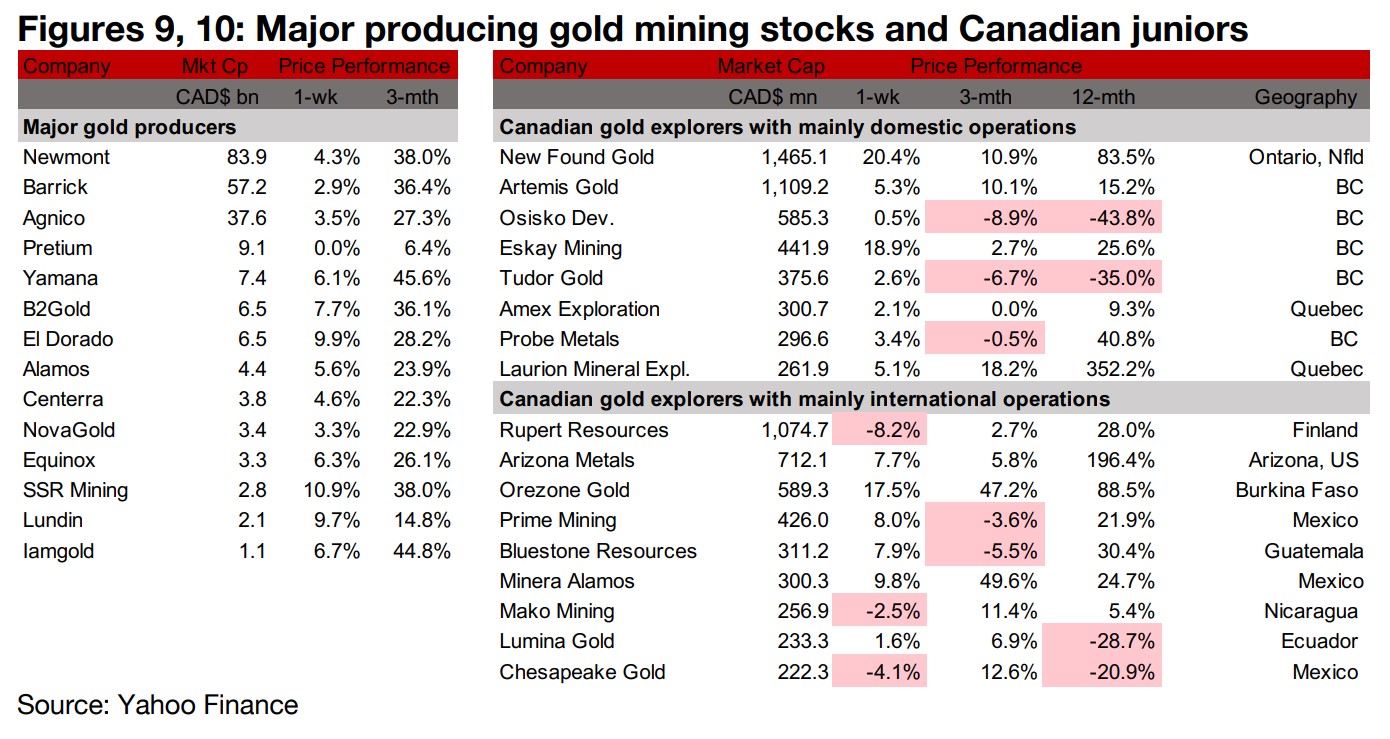

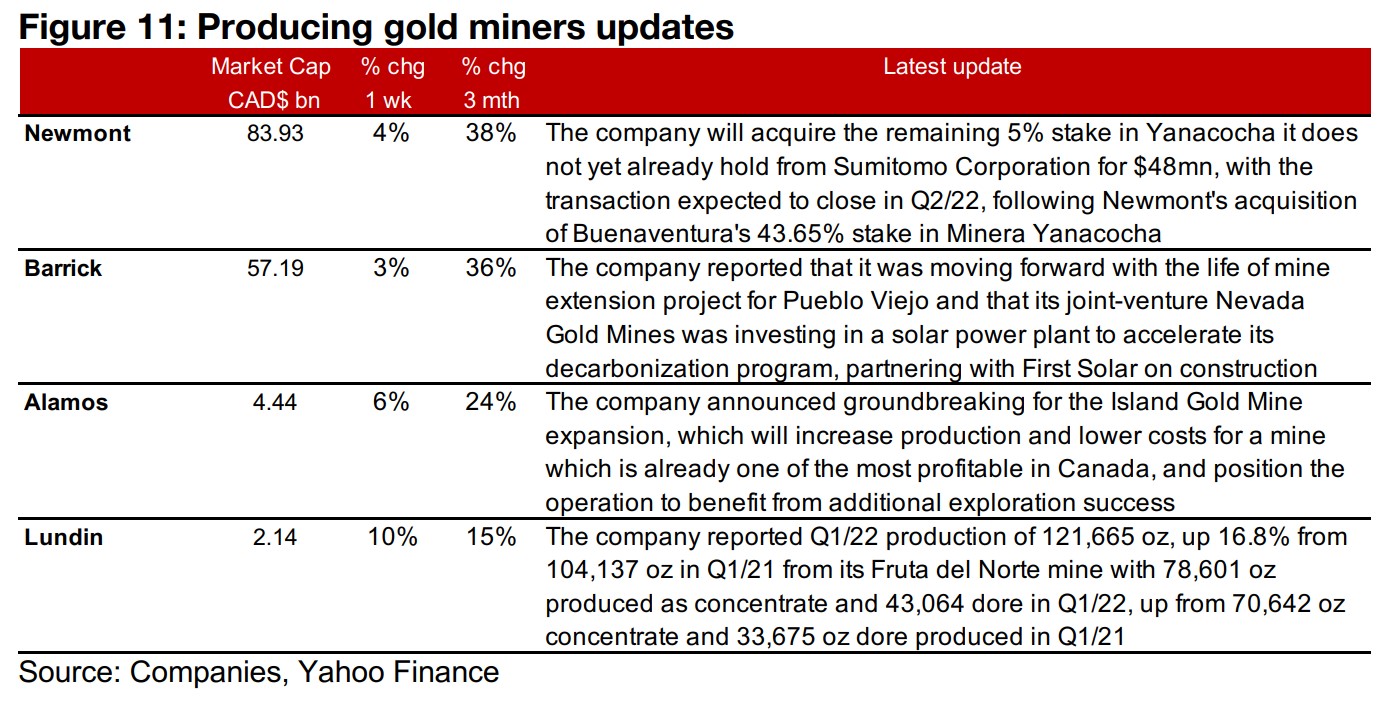

Producers all up as gold jumps on inflation

The producing gold miners were all up as gold jumped on rising inflation (Figure 9). Newmont reported that it would acquire the remaining 5% of Yanacocha that it does not already hold from Sumitomo, while Barrick is moving forward on the life of mine extension project for Pueblo and announced that its joint-venture Nevada Gold Mines was investing in a solar power plant to accelerate its decarbonization program, with First Solar as a partner for construction. Alamos announced groundbreaking for the Island Gold Mine expansion and Lundin reported its Q1/22 production from the Fruta Del Norte mine (Figure 11).

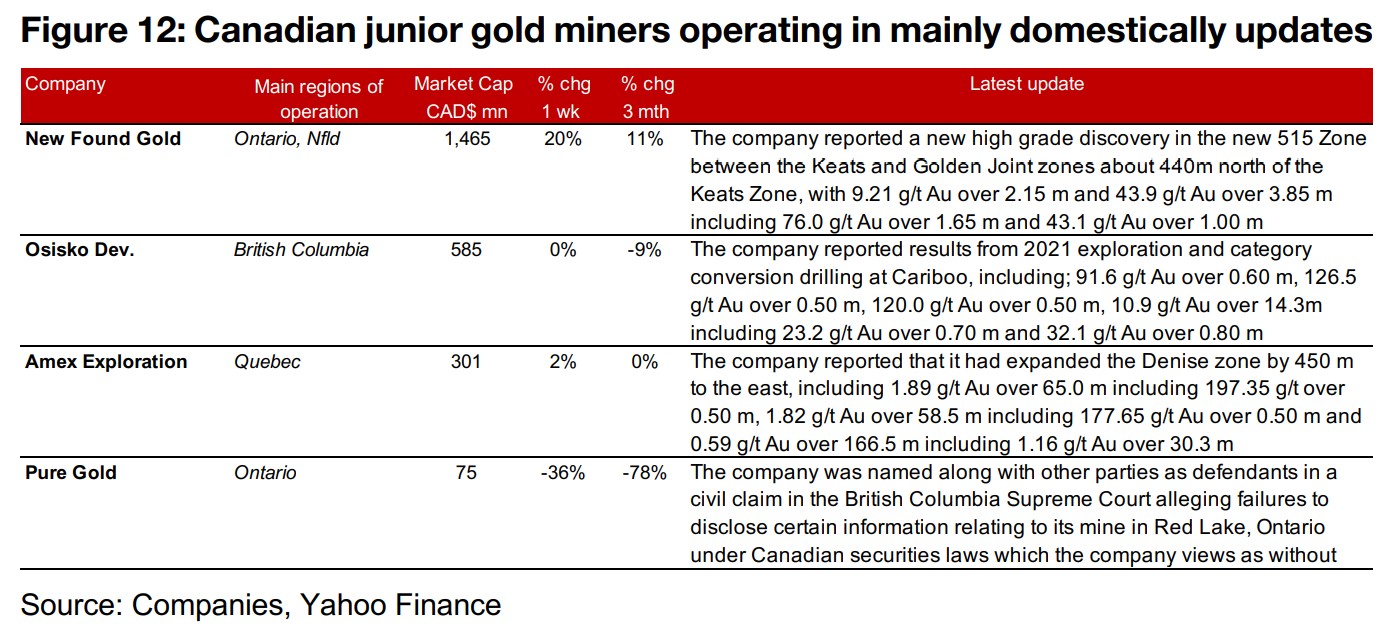

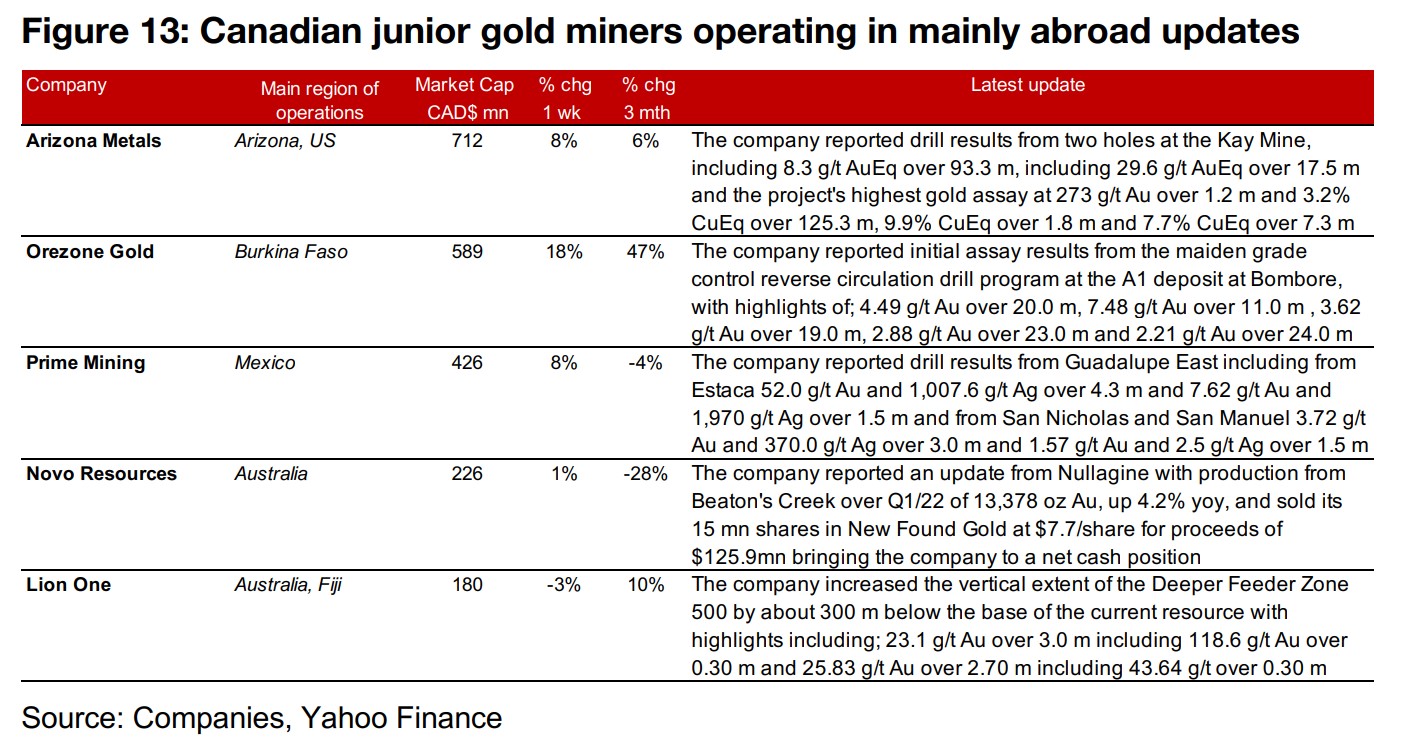

Canadian juniors mostly rise

The Canadian juniors were mostly up on the pickup in the gold price (Figure 10). For the Canadian juniors operating mainly domestically, New Found Gold reported a new discovery at its new 515 Zone at its Queensway project, Osisko Development reported drill results from exploration and category conversion drilling at Cariboo, Amex Exploration reported drill results from an extension of the Denise zone, and Pure Gold reported that it was named in a civil claim alleging failures to disclose certain information relating to its Red Lake mine under Canadian securities laws (Figure 12). For the Canadian juniors operating mainly internationally, Arizona Metals reported drill results from the Kay Mine, Orezone announced initial assay results from the maiden grade control reverse circulation drill program at the A1 deposit of Bombore and Prime Mining reported drill results from Guadalupe East. Novo Resources reported an update from Nullagine including Q1/22 production from Beaton's Creek and Lion One increased the vertical extent of the Deeper Feeder Zone 500 (Figure 13).

In Focus: Rio2 Limited (RIO.V)

Operating the advanced, financed, Fenix Gold project in Argentina

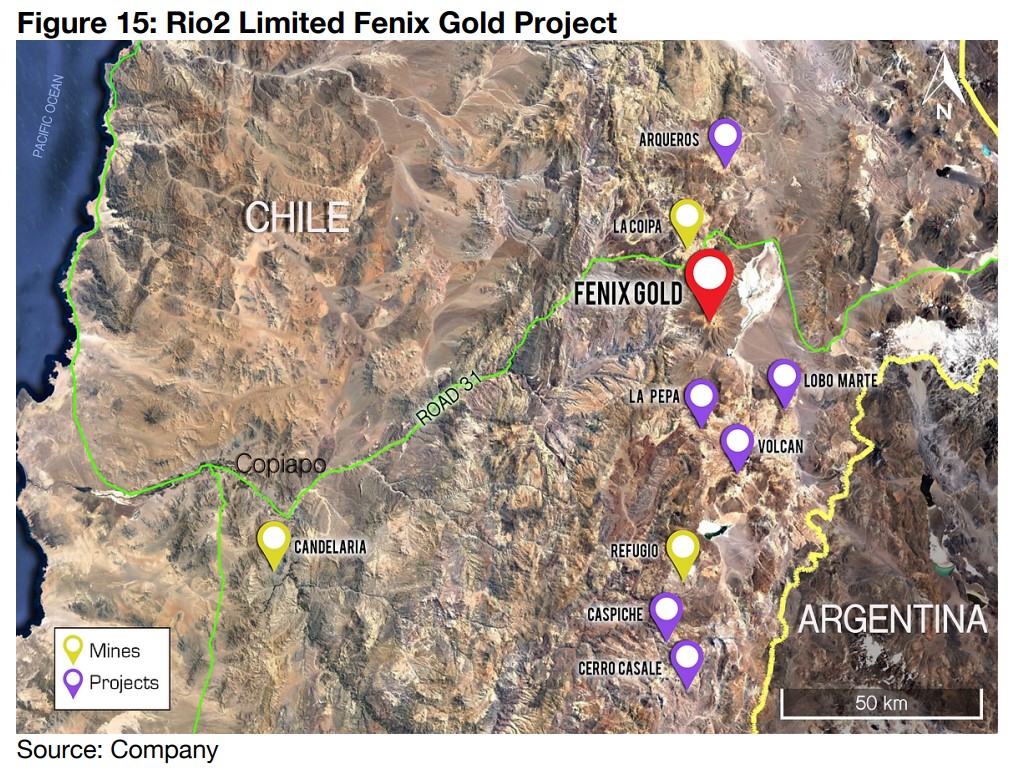

Rio2 Limited operates the Fenix Gold project in Argentina over 16,050 h.a. in the

established Maricunga mining district with three mines established and several more

projects being developed (Figure 15). The project is surrounded by key infrastructure

with a connection to grid power and has existing power agreements and has a water

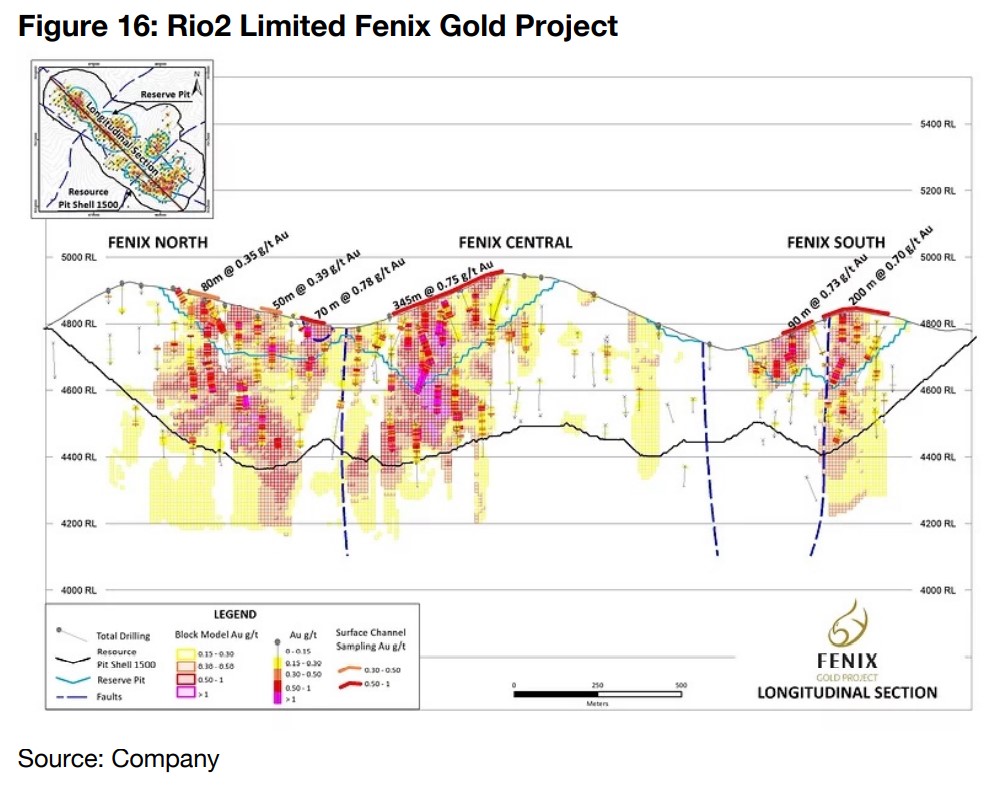

agreement in place. Fenix Gold is a massive outcropping oxide orebody, a bulk,

disseminated deposit and unique in the Maricunga region for no transitional or sulfide

mineralization and is open in all directions (Figure 16).

The project has Proven and Probable Reserves of 1.8 mn oz, Measured and Indicated

Resources of 5.0mn oz and Inferred Resources of 1.4 mn oz. It is an at advanced

stage, with the company acquiring it in July 2018, completing a Pre-feasibility in

August 2019, filing an Environmental Impact Assessment in April 2020 and securing

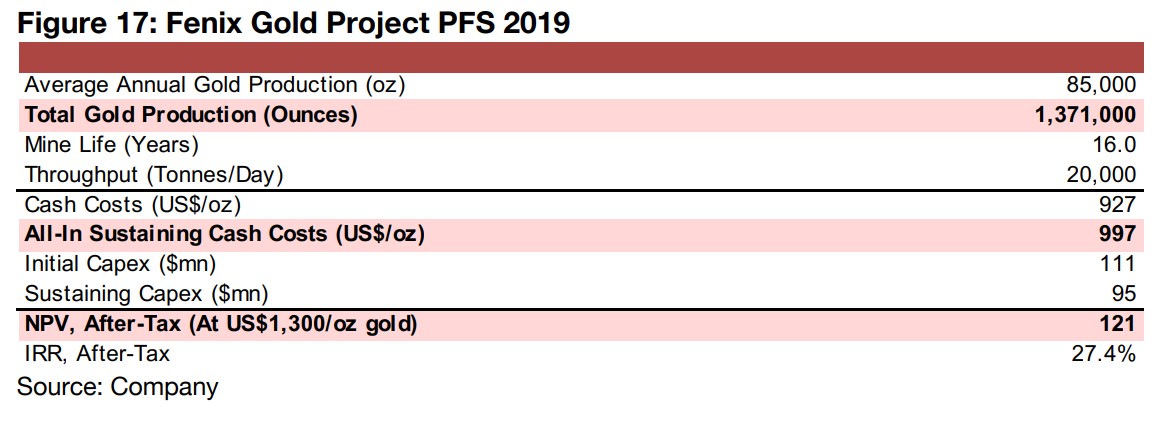

financing for construction of the mine in August of 2021. The Pre-Feasibility Study for

the project outlines total gold production of 1,371k oz over sixteen years, with an

average annual production of 85k oz per year (Figure 17). Initial capex is expected to

be $111mn and sustaining capex $95mn, with cash costs of $927/oz and an AISC of

$997/oz, for an after-tax NPV of $121mn at US$1,300/oz gold for an IRR of 27.4%.

The company has arranged US$125mn-US$135mn in financing for the project,

comprising CAD$35.1mn in equity financing closed in August 2021, a US$50mn gold

stream signed on November 15, 2021 and a Senior Project Debt Facility, with BNP

Paribas the sole bookrunner and lead arranger. The company has a large proportion

of institutional shareholders, with Eric Sprott holding 10%, Van Eck Associates 4%

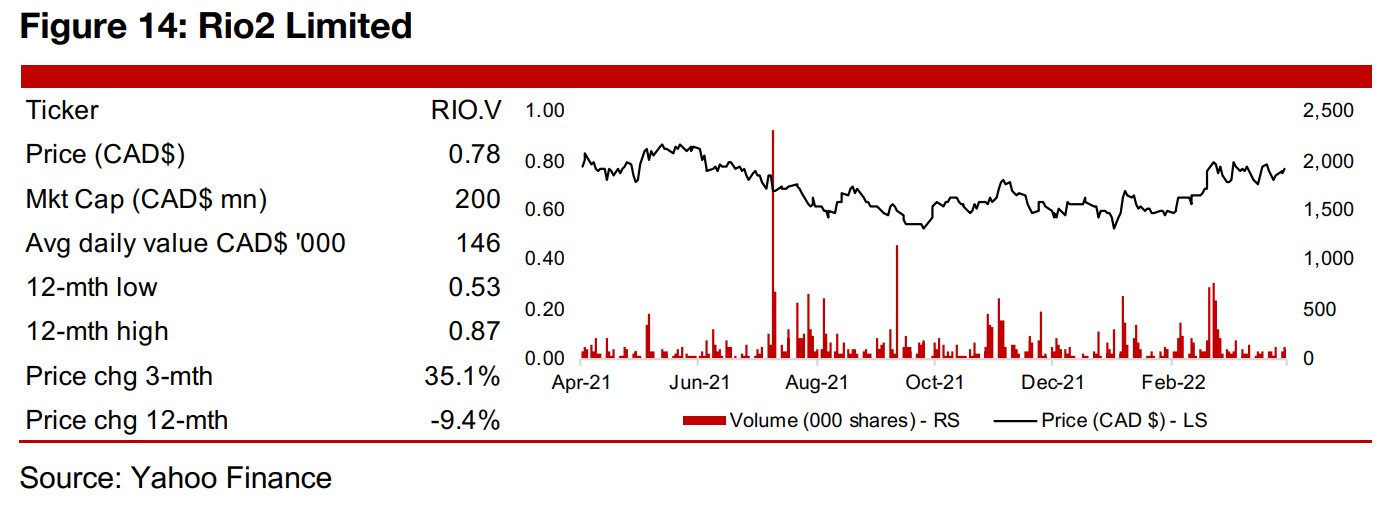

and other funds 17% and management holding 13%. The share price has been

relatively flat over the past year, down -9.4%, as the project moves ahead, but there

has been little in the way of news flow surprises to substantially shift the market's

perception of its value.

Disclaimer: This report is for informational use only and should not be used an alternative to the financial and legal advice of a qualified professional in business planning and investment. We do not represent that forecasts in this report will lead to a specific outcome or result, and are not liable in the event of any business action taken in whole or in part as a result of the contents of this report.