February 11, 2022

Gold Up as Inflation Rages

Author - Ben McGregor

Gold rises as US CPI inflation continues to surprise to the upside

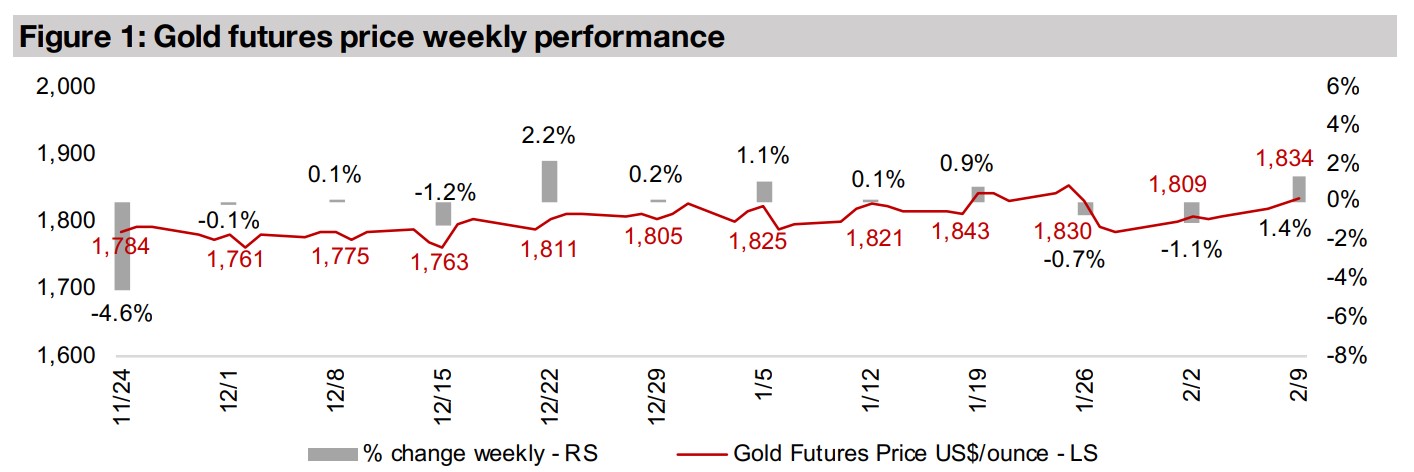

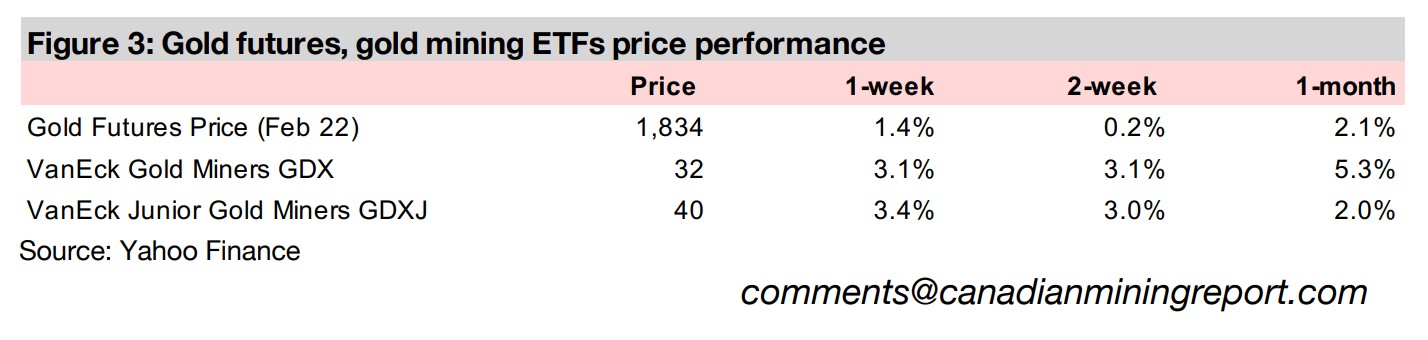

The gold price rose 1.4% to US$1,834/oz this week as the January 2022 US CPI inflation numbers again surprised to the upside driving concerns that real bond yields will remain heavily negative even given expected Fed rate hikes by March.

TSXV large silver and base metals companies mostly weak YTD

This week we look at the performance of the large TSXV-listed silver and base metals companies in 2022, with the group quite weak overall, although some standouts are holding up against the pressure in equity markets especially for riskier small caps.

Gold Up as Inflation Rages

Gold rose 1.4% to US$1,834/oz this week, as US CPI inflation surprised to the upside,

which lead to market concerns about an increasingly aggressive appearing US

Federal Reserve which is already looking to move forward rate hikes from an originally

planned 2023 to as early as March 2022. However, even with a series of rate hikes

this year, the Fed may still not bring real bond yields positive if inflation continues to

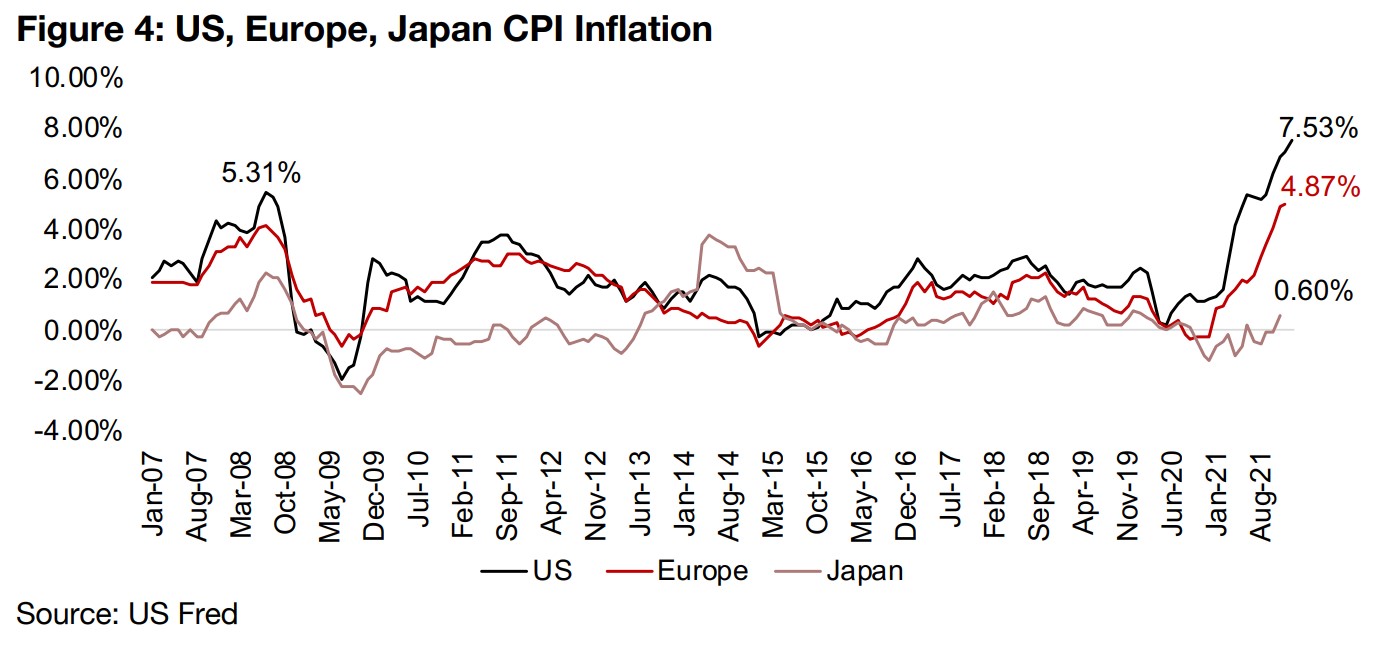

rage, as it has over the past six months. US CPI Inflation hit 7.53% year-on-year in

January 2022, up from lows of just 0.24% in May 2020, while European CPI inflation

also continued to jump, to 4.87% in December 2021, up from lows of -0.31% in

September 2020. Even Japan, which has remained deflationary for much of the last

thirty years, is seeing inflation rise, to 0.60% as of the latest November 2021 data,

just above the average 0.53% monthly CPI inflation since November 2011 (Figure 4).

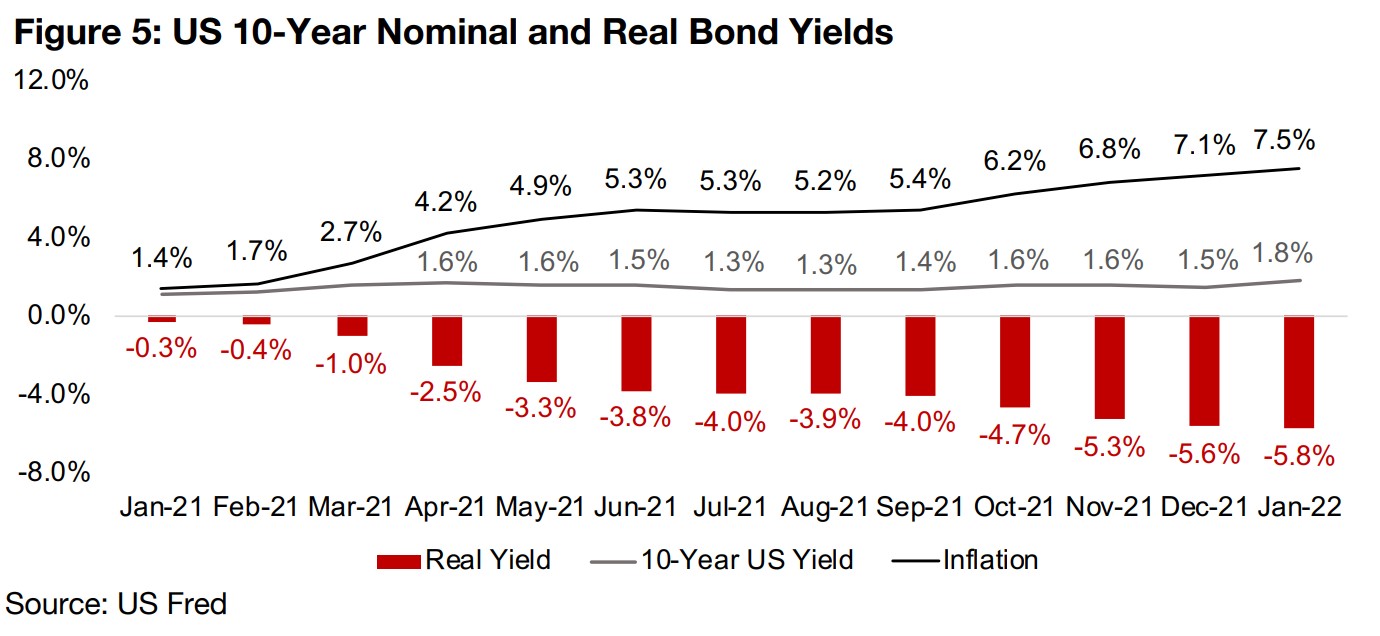

The 10-year US bond yield rose to over 2.0% on the news, as the market starts to

price in a series of Fed rate hikes. We might expect higher yields to put pressure on

gold, driving investors into bonds and away from yieldless gold. However, real rates,

taking the nominal yield and subtracting inflation, have become increasingly negative

over the past year, as the rise in inflation strongly outpaced the increase in nominal

yields. US real yields, based on the 10-year government bond, were already slightly

negative at the start of 2021, at -0.28%, with inflation at 1.36% and the nominal yield

at just 1.08% (Figure 5). As of January 2022, inflation has surged to 7.53%, but the

nominal yield has risen only to 1.76%, for a negative real yield of -5.77%. While the

nominal yield could average over 2.0% for February 2022, we expect that the rise in

inflation is still far from over, so real yields could remain flat at best, or even decline

further. This would continue to support gold, with the real return on holding bonds

heavily negative, and even with a 1.0%-2.0% carrying cost of storing physical gold

or fees for a gold ETF, holding gold would continue to look attractive.

Also important is that the Fed is now playing catch up with inflation, but it can't raise interest rates too quickly, or it risks an economic and stock market crash, with the current recovery tenuous and equity market valuations still very high. If we were to see the Fed boost rates 0.25% each quarter for the next two years, the base rate would only just be heading for 2.50% by the end of 2023, hardly the 19.0% level that the Fed needed to crush similarly high levels of inflation in the early 1980s. Anything considerably more aggressive than this is surely to lead to a pullback in investment, hitting the economy, and drive investors to sell off equity, hitting the stock market. Given this, we expect that there is a high probability that inflation will continue to remain elevated and surprise to the upside, keeping real yields negative, and supporting gold, likely through much of 2022.

A look at the larger TSXV silver and base metals miners so far in 2022

Following on from last week when we looked at the performance of the large TSXV-listed gold juniors so far in 2022, this week look at the performance of the largest

TSXV-listed base metals junior miners. Similar to the large gold juniors, the silver and

base metals juniors have mostly declined so far this year, although there are still some

standouts that have seen gains. The downward pressure on the group has mainly

come from the overall decline in the equity markets driven by increasing concerns

over potentially more aggressive than expected Fed rate hikes, which would increase

the discount rates for all stocks, pulling down equity valuations across the board.

There has actually not been that much pressure from declines in the underlying

metals themselves for these stocks, with the copper and silver prices holding up well

so far this year, tin and zinc continuing to rise and cobalt flat. However, as we expect

that there is a chance that the global economy could slow this year, we see scope for

these metals prices to potentially ease this year, further exacerbating the pressure

many in the group are already facing from the general equity market sell-off.

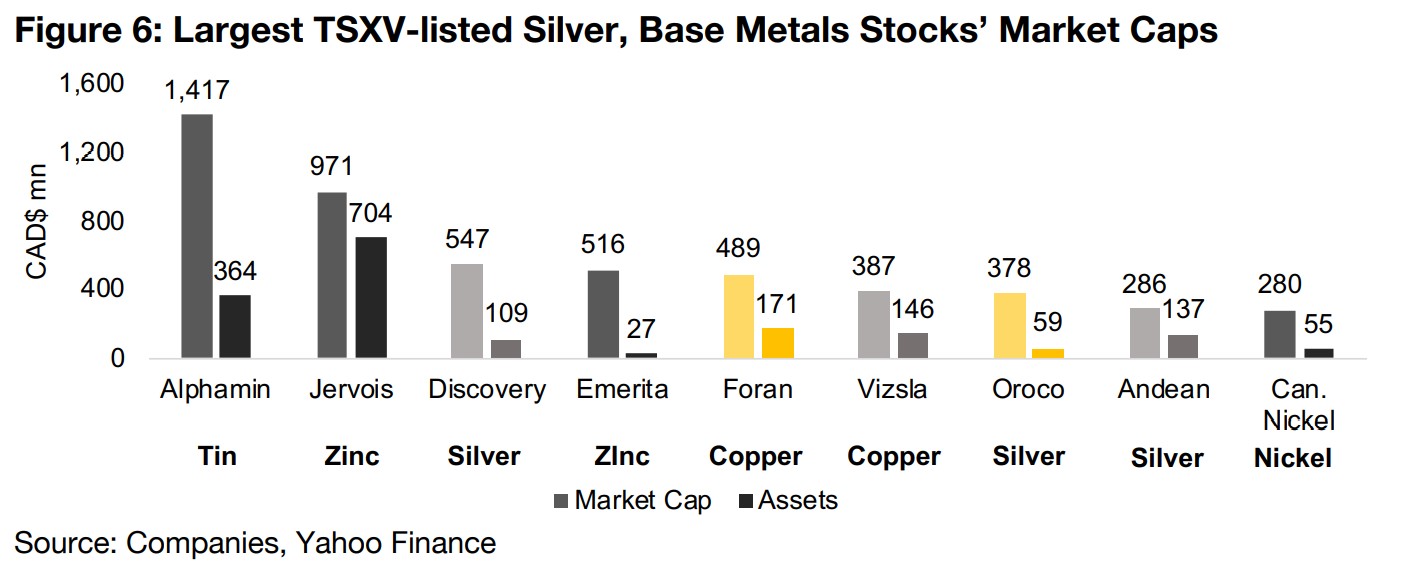

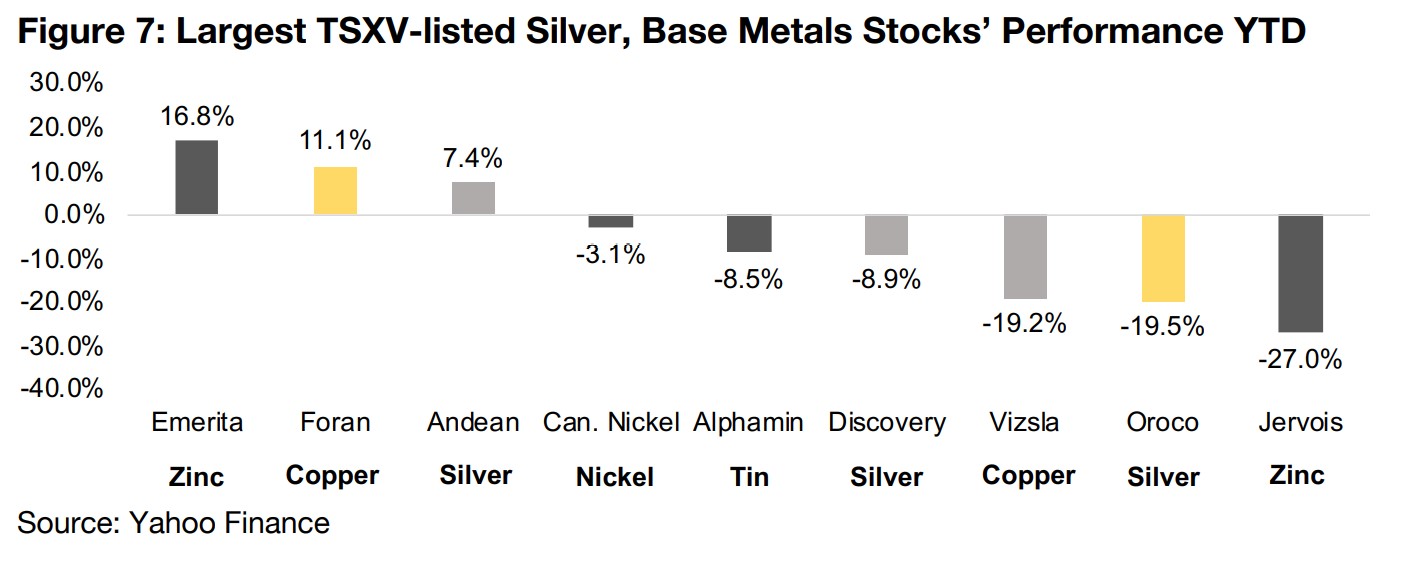

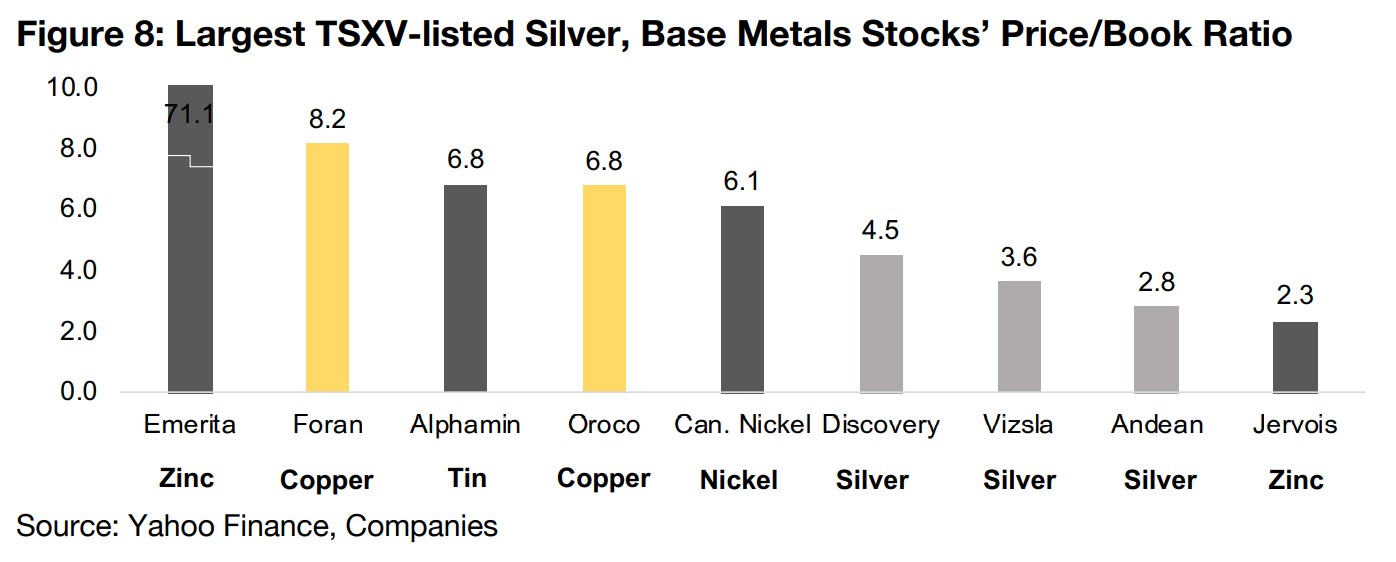

Emerita Resources gains on continued strong progress at Iberian West

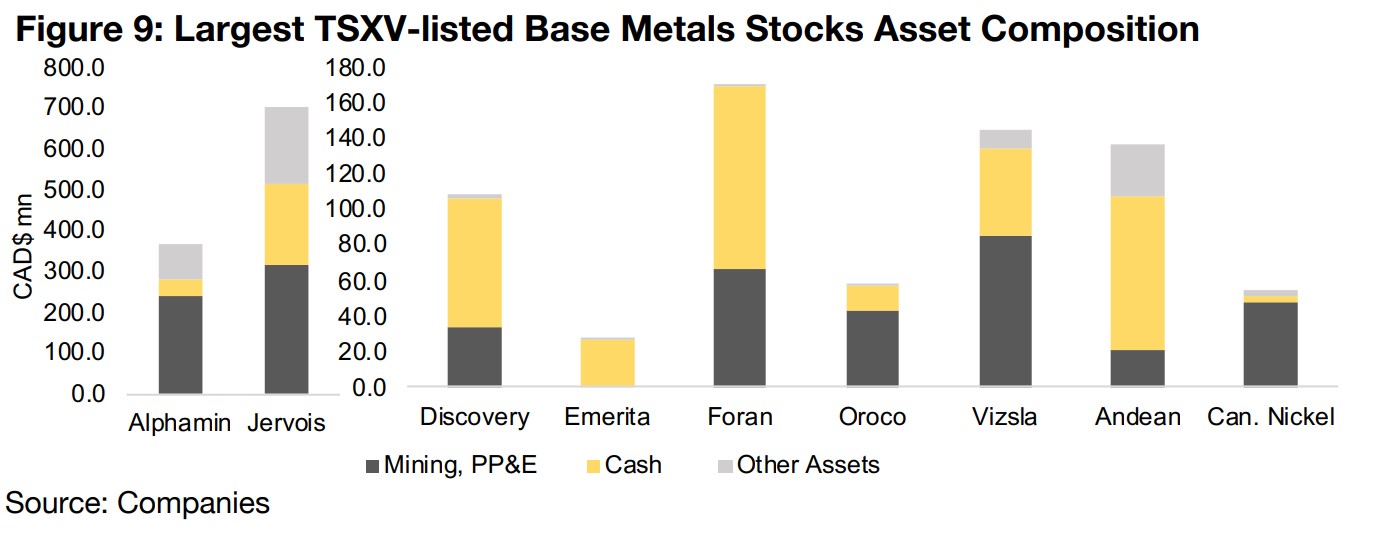

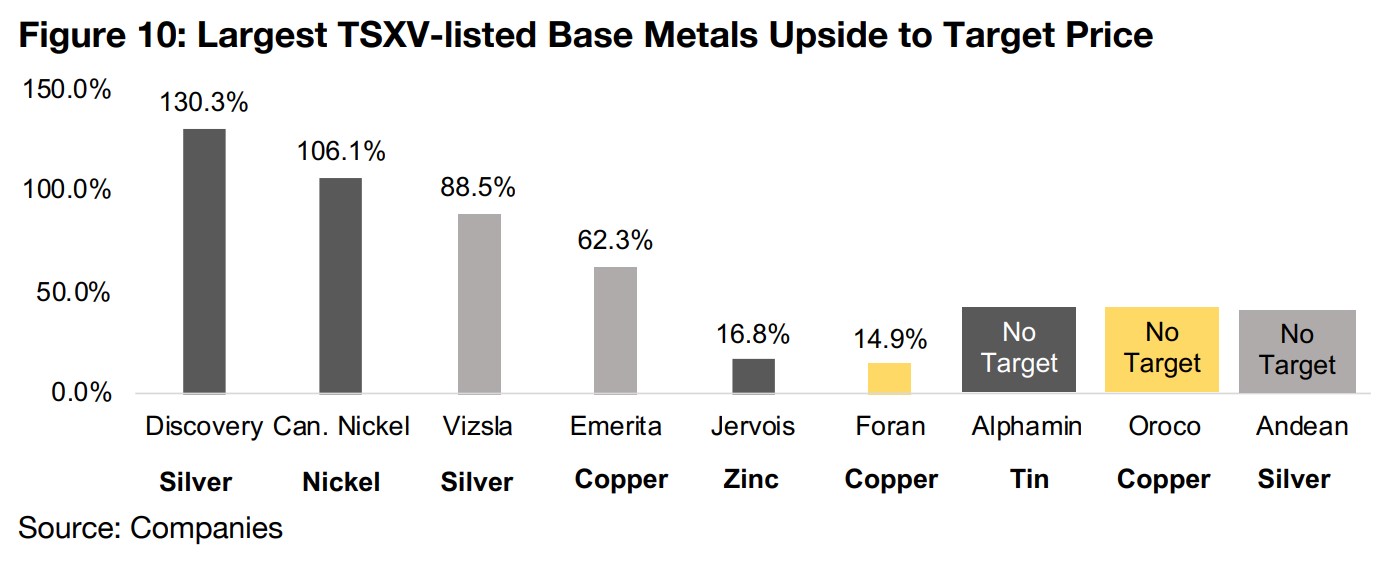

The strongest performer of the group so far has been Emerita Resources, the fourth largest in terms of market cap, at $516mn (Figure 6), up 16.8% year to date in 2022 (Figure 7). The company operates zinc-copper projects in Spain, with drill results for the past year focusing on the La Infanta deposit at its Iberian West Belt project, coupled with the strong gains in the zinc price, driving substantial gains in the share price. The most recent news flow was in November 2021, with the company mobilizing three drills at the Iberian West Project, bringing the total to five, and then the exercise of warrants by Eric Sprott. The company's price to book valuation is literally 'off the chart' at 71.1x, by far the highest of the group, but not because of market overexuberance but rather because the ratio is distorted by Emerita's very low equity (Figure 8). Its asset base is also low versus the rest of the group, mostly consisting of cash which should fund exploration for over two years, with the rest of the group seeing a higher proportion of mining assets or capitalized mining expenses (Figure 9). The market sees 62.3% upside for the stock based on its consensus target, which is reasonably high versus the group (Figure 10).

Foran up on strong results from McIlvenna

Foran Mining is the fifth largest of the group, at a $516mn market cap, and the second strongest performer, up 11.1% in 2022. The company's drilling program at the McIlvenna Bay project copper and zinc project generated one of the company's widest copper intervals to date in June 2021, and it increased its Indicated Resources by 70% in October 2021. Recent news flow includes drill results from Bigstone, a new deposit 25 km southwest of McIlvenna and management appointments including a new COO and VP of Environmental, Social and Governance. While the company is also very well-funded, with the highest cash balance of the group, at $103mn, with a price to book of 8.2x, the highest of the group excluding the distorted Emerita figure, the market sees it as near fully valued, with only 14.9% upside to its target consensus.

Andean's San Bartolome silver and tin project up on underlying metals' rise

Andean Precious Metals, with a relatively small market cap of $286mn, is up 7.4%, the third highest of the group. The company operates the San Bartolome silver-tin project, which has been operating for 12 years and is the only commercial oxide plant in Bolivia. The company will have therefore been boosted by strength in the tin and silver prices this year, and recent news flows has included a significant increase in the resource at San Bartolome in February 2022. The company has also been drilling at its San Pablo and Rio Blanco exploration projects, including the start of a Phase 2 drilling program at San Pablo in February 2022. The company has the second strongest cash balance of the group, as it is already producing, providing ongoing funding for its exploration activities. The company trades at a relatively low P/B versus the group of 2.8x, and currently has no target consensus price.

Canada Nickel, targeting Crawford Feasibility Study for 2022, edges down

Canada Nickel, with the smallest of the group, with a market cap of $280mn, has seen a slight -3.1% decline so far this year, with the company operating the Crawford nickel-sulphide project in Ontario, with a PEA completed in May 2021 and a Feasibility Study targeted for 2022. Recent news flow has included the demonstration of improvements in metallurgical performance at Crawford, a US$10mn loan facility announced in December 2021 and drill results from its recently acquired Deloro target in January 2022. The company trades at a price to book of 6.1x, near the middle of the group, and has 106.1% upside to its target, the second highest of the group.

Alphamin declines after major 2021 gains from rise in tin price

Alphamin, with a market cap of $1,417bn, the largest of the group, is down -8.5% year to date. The company produces over 4% of the world's tin at its Bisie mine in the DRC, and has likely seen some pressure with the tin price easing off its highs so far this year, and with the company already rising 152% in 2021 on the surging tin price last year. The company also trades at a reasonably high price to book versus the group of 6.8x, and it has no target consensus price.

Discovery Silver slides even as silver price remains strong

Discovery Silver, with a market cap of $547mn, is down -8.9% this year, even though it operates the Cordero project in Mexico, one of the largest undeveloped silver resources globally, and the silver price has been reasonably strong so far this year. Recent news flow included an updated mineral resource for Cordero released in October 2021, an updated PEA in November 2021 and drill results from Cordero in February 2022. The company's price to book of 4.5x is slightly below the group average (excluding Emerita), and it has the highest upside to its target of the group at 130.3%, given the relatively low multiple and the large potential size of the project.

Vizsla Silver down from January 2022 highs on Panuco drilling results

Vizsla Silver, with a market cap of $387mn, has been relatively weak, down -19.2% so far this year. The company operates the Panuco project in Mexico, with strong drilling results over the past year, with ten drills continuing to operate, and a high cash balance of $76.0mn, which could fund drilling at current levels for several years. Recent news flow includes drill results from Panuco on January 19, 2022, which initially pushed the stock up to highs for the year, but it has declined since. Its price to book is relatively low versus the group at 3.6x, and the market sees a reasonably strong 88.5% upside to its target price.

Oroco Resources down even with strong drill results from Santo Tomas

Oroco Resources, with a market cap of $378mn, is down -19.5% in 2022, with the company operating the Santo Tomas copper porphyry project in Mexico, where a diamond drilling program began over H2/21. The first results from the drilling program were released in December 2021, and drill results released on January 13, 2022 sent the shares to the highs of the year, but the shares pulled back after with the broader equity market sell off. The company trades at a relatively high price to book versus the group of 6.8x and has no consensus target price.

Jervois sees large losses on broad battery metals miners sell off

Jervois Global, with a market cap of $704mn, has seen the largest losses of the group, declining -27.0%. The company is a battery metals company focusing on cobalt, which runs the Idaho Cobalt Operations in the US, a fully permitted mine in construction, the Miguel Paulista nickel and cobalt refinery in Brazil and the recently acquired Jervois Finland, with cobalt refining and downstream assets. Jervois has not had any press releases since late-October 2021, and its decline seems to have been part of a broader decline in battery metals companies so far this year. The sector had seen a boom in 2021, but was sold off aggressively in equity market decline so far this year, as investors cut their holdings of higher growth, high valuation and momentum sectors. The company now trades at the lowest price to book of the group at 2.3x, with a relatively moderate upside of 16.8% to its consensus target price.

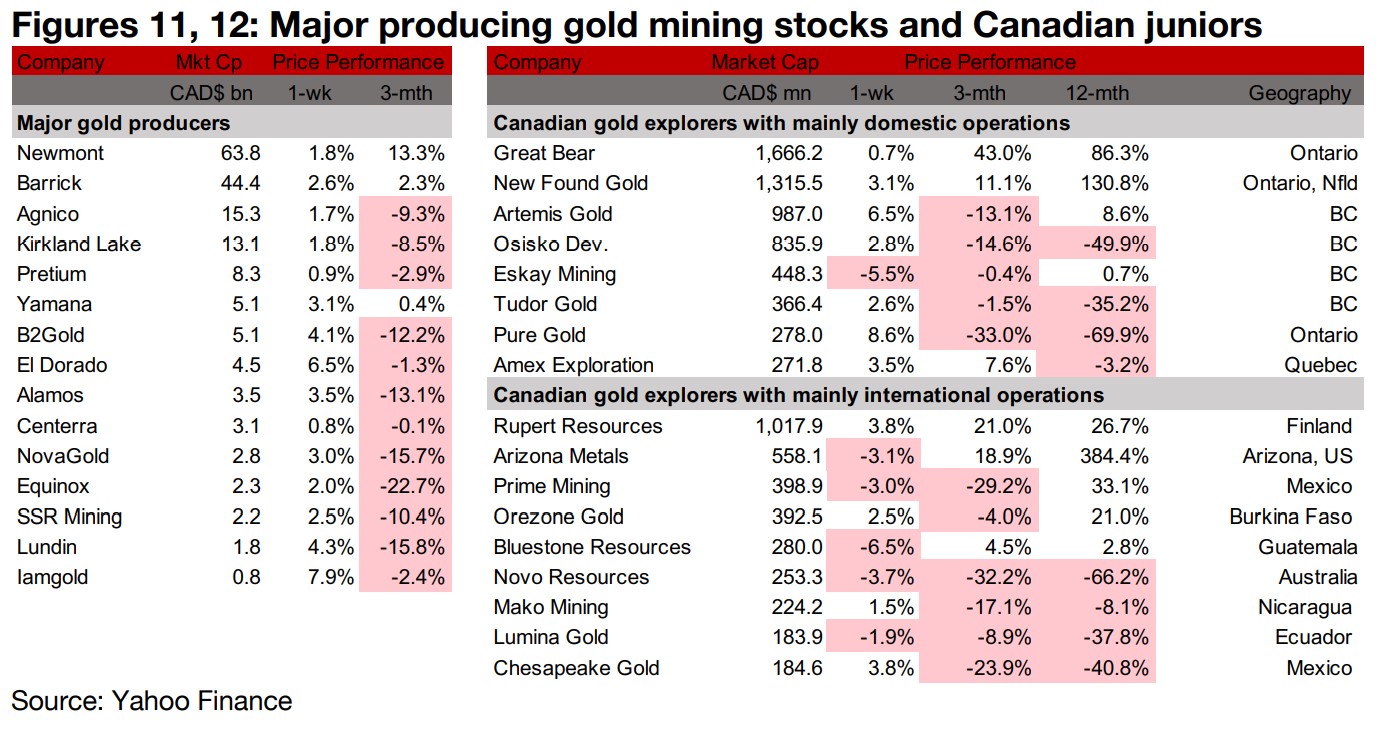

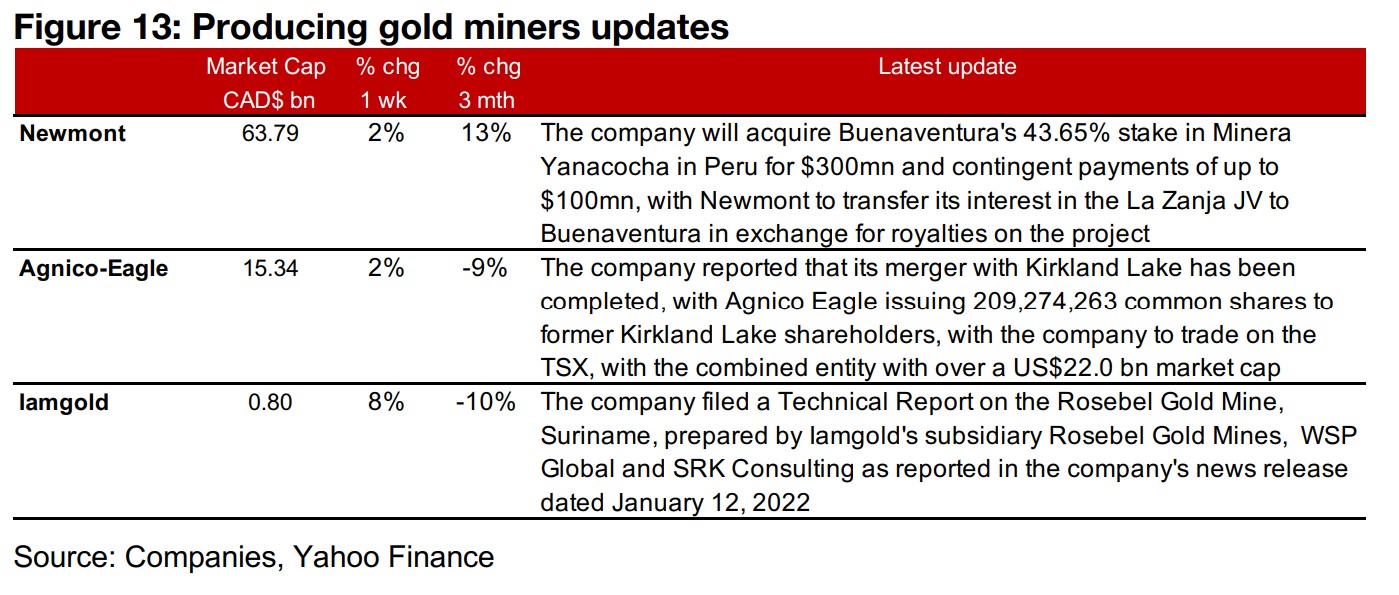

Producers all up as gold jumps on US inflation surge

The producing gold miners were all up as US CPI inflation data continued to surprise to the upside (Figure 11). The news flow from these producers was limited as most companies are to release their Q4/21 results over the next few weeks. Newmont reported that it would acquire Buenaventura's 43.65% stake in Minera Yanacocha in Peru for $300mn and contingent payments of up to $100mn, with Newmont to transfer its interest in the La Zanja project to Buenaventura in exchange for royalties on the project. Agnico Eagle announced that its merger with Kirkland Lake had been completed, with the company to continue trading as Agnico Eagle with a new merged market cap over US$22.0bn and Iamgold filed a technical report on the Rosebel Gold mine (Figure 13).

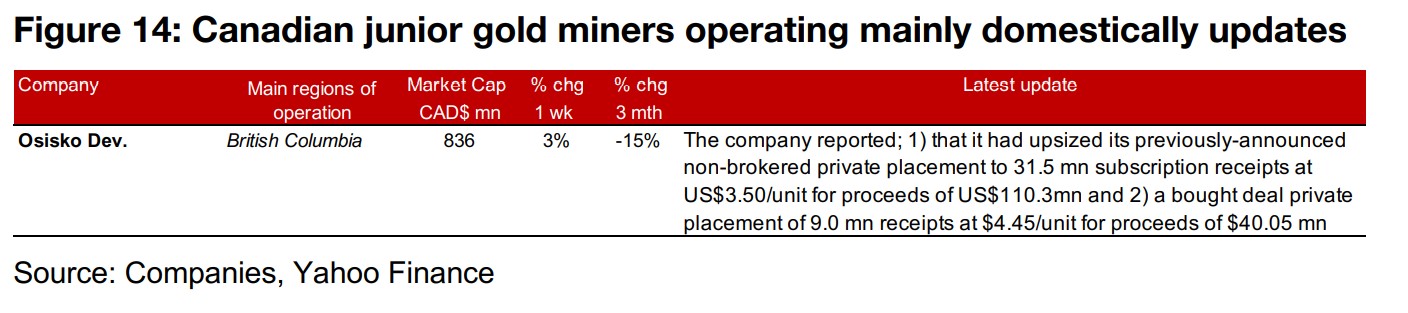

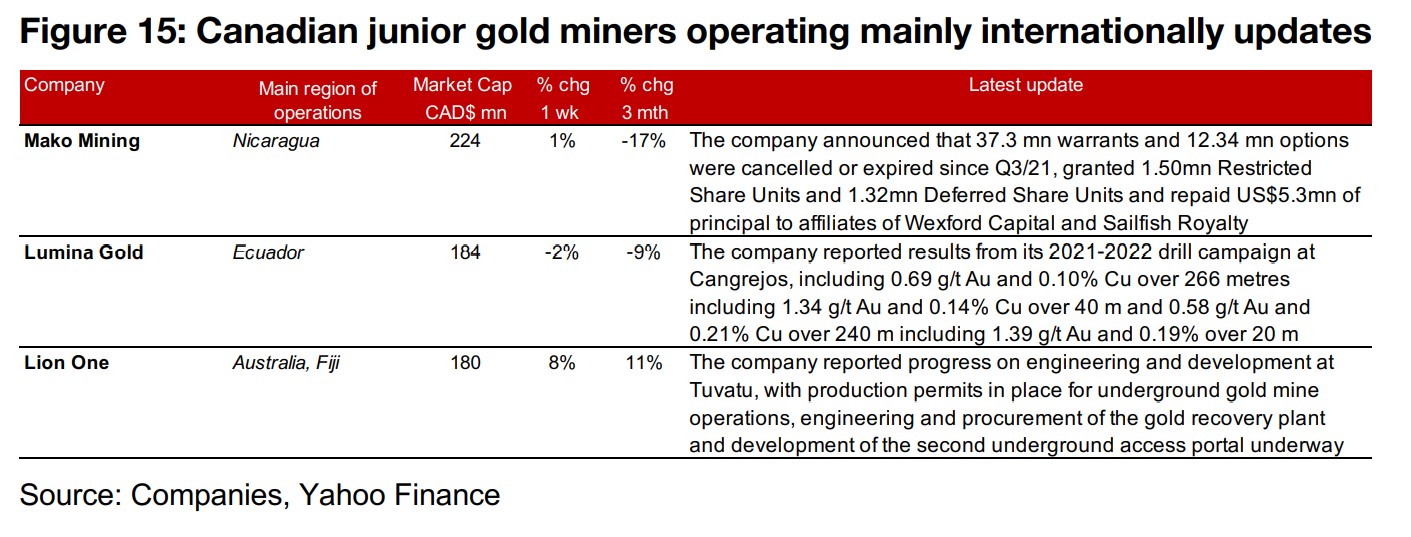

Canadian juniors mixed even with gold up

The Canadian juniors were mixed this week, even as gold jumped, with the market appearing to remain cautious on riskier stock market sectors, including the junior miners (Figure 12). For the Canadian juniors operating mainly domestically, Osisko Development reported an upsizing of its previously announced non-brokered private placement to US$110.3mn and a bought deal private placement of $40.05mn (Figure 14). For the Canadian juniors operating mainly internationally, Mako Mining announced an update on its capital structure, Lumina reported results from the first holes from the 2021-2022 drill campaign and Lion One provided an update on the progress on engineering and development at the Tuvatu project (Figure 15).

Disclaimer: This report is for informational use only and should not be used an alternative to the financial and legal advice of a qualified professional in business planning and investment. We do not represent that forecasts in this report will lead to a specific outcome or result, and are not liable in the event of any business action taken in whole or in part as a result of the contents of this report.