January 20, 2025

Gold Up as Inflation Offsets Geopolitics

Author - Ben McGregor

Gold rises as inflation concerns overshadow geopolitical risk drop

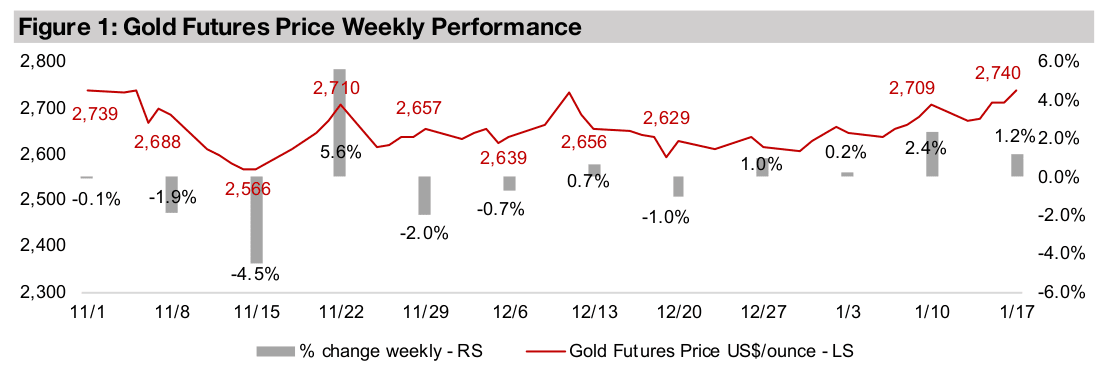

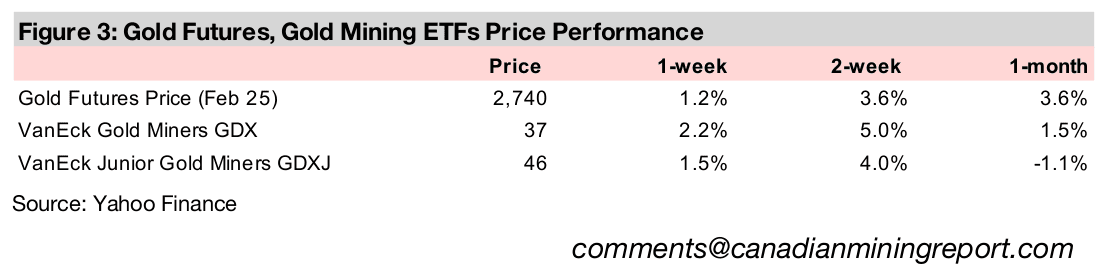

Gold rose 1.2% to US$2,740/oz as the upward driver of inflation concerns, after December 2024 US CPI data came in hotter than expected, overshadowed the downward pressure on the metal from a major decline in geopolitical risk.

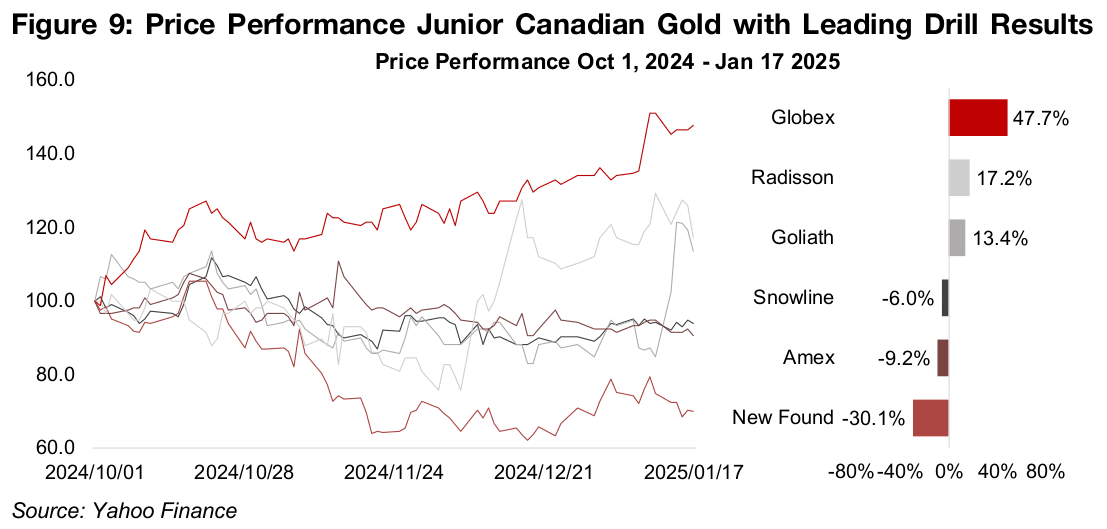

Canadian gold’s major drill results for past three months

This week we look at the top drill results for Canada’s major gold producers and developers and larger juniors over the past few months using data provided by Mining Hub, and the mixed share price performances of these stocks over this period.

Gold Up as Inflation Offsets Geopolitics

Gold rose 1.2% to US$2,740/oz, its highest level in three months and heading again

towards all-time highs. This week was a key test for the two main forces that we

expect to affect gold this year, an ongoing monetary expansion and geopolitics, with

major news for both. The decline in gold that we would have expected from the

ceasefire in Gaza, given that we estimate about a US$200/oz or more premium in the

price from this conflict (with another US$200/oz or more from the Russia-Ukraine war,

with both based on gold’s moves after these situations began), did not occur.

One reason gold may not have dropped on the news is that the market may be

viewing the resolution as still tentative. However, we could assume that the premium

in gold for this conflict did decline to a degree, and that there had to be a major factor

strongly offsetting the drop in geopolitical risk. This was likely from the monetary side,

with US CPI data surprising to the upside and increasing fears of an extended inflation

resurgence this year. US headline CPI inflation rose for the third consecutive month

to 2.86% and core inflation was 3.25%, having roughly flattened for the past six

months but holding stubbornly flat about 1.0% above the Fed’s 2.0% target.

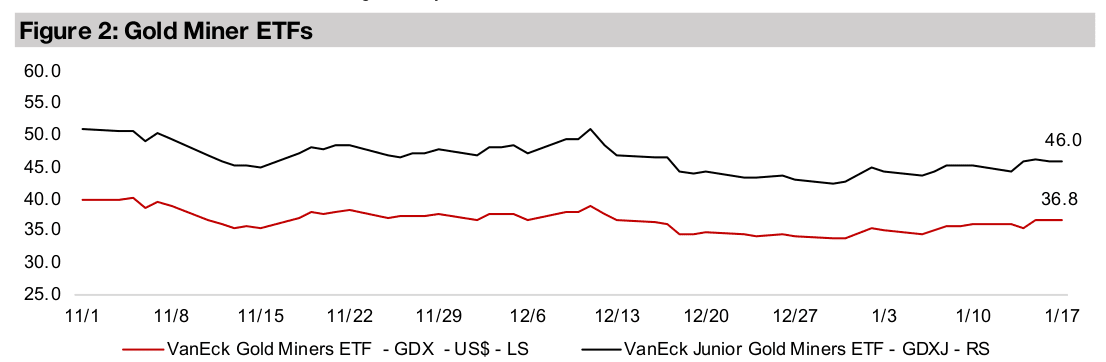

The reaction in equity markets seems to have been the opposite of that for gold, with

the effects of the ceasefire outweighing rising inflation concerns, and the major

indices soaring. The S&P jumped 3.7%, although in contrast to much of last year, this

was not driven mainly by mega-cap tech, with the Nasdaq rising just 1.5%, and small

caps having a much bigger role, with the Russell 2000 up 4.6%. The gold stocks did

reasonably well given the rise in the metal and equities, with the GDX of large

producers up 2.2% and the GDXJ of junior miners rising 1.5%, although the latter

looked a bit weak in the context of the outsized gains for small caps overall.

Top recent drill results from Canadian major gold producers and juniors

This week we look at the top drilling results for the Canadian major gold producers

and mid-sized juniors. This is based on data from Mining Hub, which provides a range

of information on global mining companies including drill results and news which can

be screened using several metrics including market cap, metal, country and region,

date and others. We have focused on the strongest results for Canadian gold

companies since October 2024 ranked by grams-thickness, which is the grams per

tonne of gold (g/t Au) multiplied by the width in metres (m).

While we included only companies with a reasonably sizeable market cap, with nearly

all above CAD$100mn, there are several junior miners with smaller market caps that

have also seen exceptional results over the period. These include Sun Summit

Minerals, Golden Cariboo, Galway Metals, Emperor Metals, Scottie Resources,

Endurance Gold and Cassiar Gold.

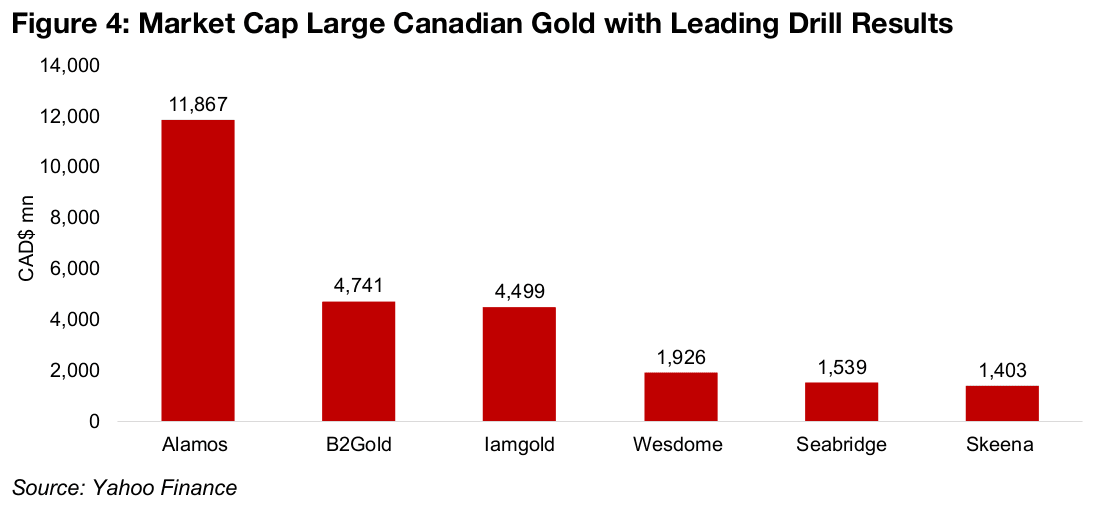

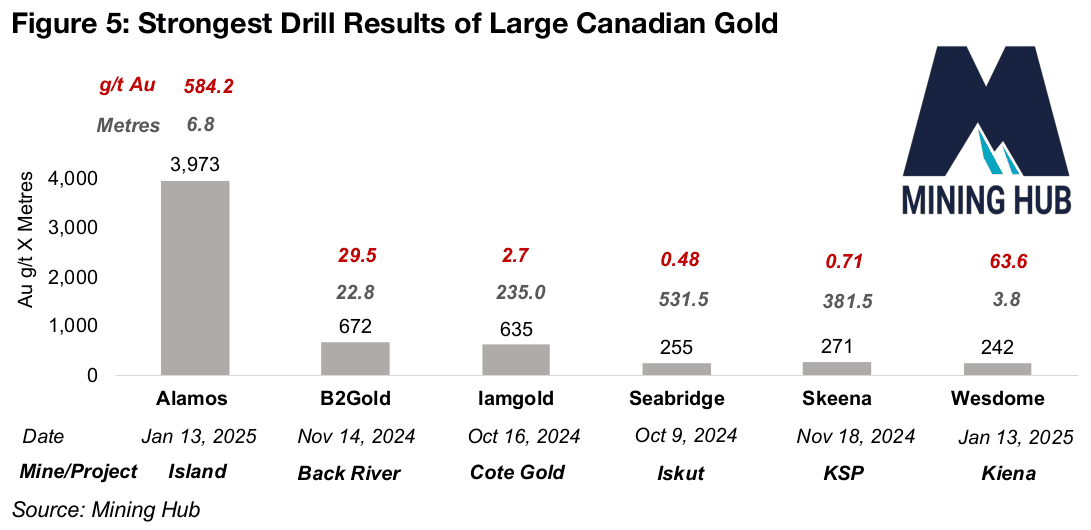

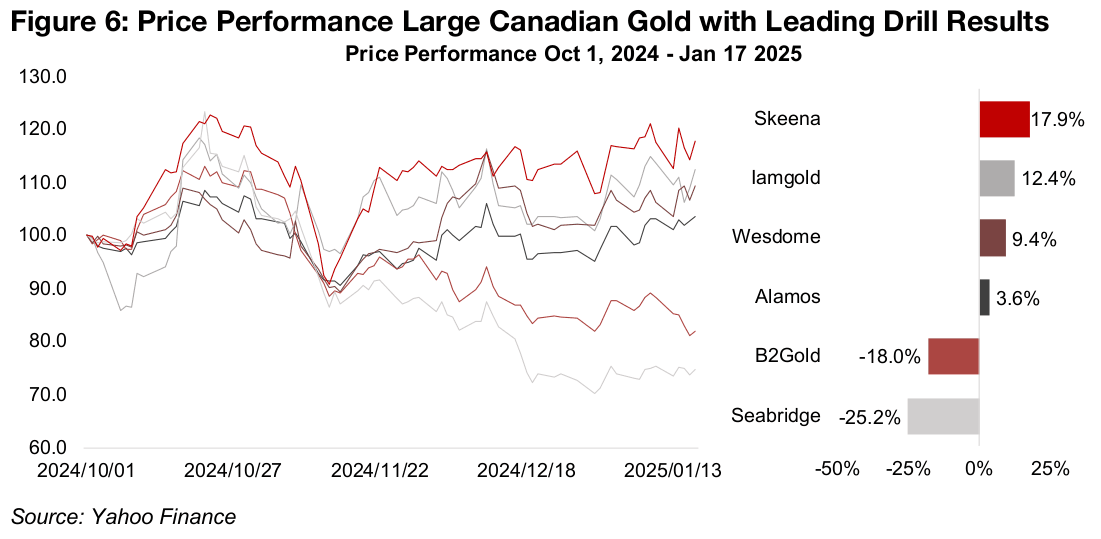

Alamos, B2Gold and Iamgold post strongest recent drill results of Big Gold

Many of the top drill results come from Big Gold’s second tier, a group of large gold companies with market caps just below the big three, Newmont, Barrick and Agnico- Eagle. These include Alamos Gold, with a market cap of CAD$11.9bn (Figure 4), with by far the strongest drill result in terms of grams-thickness for both Canadian and global gold, at 3,973 from its Island Mine (Figure 5). This comprises an extremely high 584.2 g/t Au grade over 6.8 m. The two next best results are also from mid-tier Big Gold, with B2Gold reporting a 672 grams-thickness from its Back River mine, with a 29.5 g/t Au over 22.8 m, and Iamgold with a 635 grams-thickness of 2.7 g/t Au over 235 m from its Cote Gold mine.

As all three of these companies operate several large mines, a single outstanding recent drill result is often not enough to move the share price much, given a potential large range of other significant offsetting drivers. There can also be a situation where a pattern of previous strong results have led the market to expect, and already price in, a continuation of the successful trend. This sets a higher hurdle for reported drill results to substantially drive up share prices. Of these three companies, only Iamgold has seen a strong share price rise since October 2024, up 12.4%, while Alamos rose just 3.6% and B2Gold declined -25.2% over the period (Figure 6).

Wesdome, Seabridge and Skeena report outstanding drill results

There have also been outstanding drill results since October 2024 from Wesdome,

Seabridge and Skeena, which only have one or two major projects each and therefore

smaller market caps than mid-tier Big Gold. Wesdome has two producing mines,

Eagle River, and Kiena, with its strong recent drill result from the latter, a 242 grams-

thickness with 63.6 g/t Au over 3.8 m. While this result from January 13, 2025 may

have partly driven its 9.4% share price gain since October 2024, the rise in the gold

price this year will also have been a factor.

Seabridge has one of the largest gold resources in the world, with two Pre-Feasibility

Stage Projects, KSM and Courageous Lake with 50 mn oz of reserves, while KSM

also has 19.6 bn lbs of M&I copper resources. However, its major drill result has not

come from these two projects, but rather one of its smaller exploration projects, Iskut.

While a 255 gram-thickness was reported, the result was relatively low grade, at 0.48

g/t Au, over a high width of 531.5 m, and seems to have done little to curb Seabridge’s

struggling share price, down -25.2% since October, the worst performer of the group.

Similarly, the strongest drill result from Skeena Resources, a 271 grams-thickness,

with 0.71 g/t Au over 381.5 m, has come from its smaller KSP exploration project, not

its flagship Eskay Creek project, which is at the Feasibility Study stage. The company

has had the strongest performance of the group since October 2024, up 17.9%.

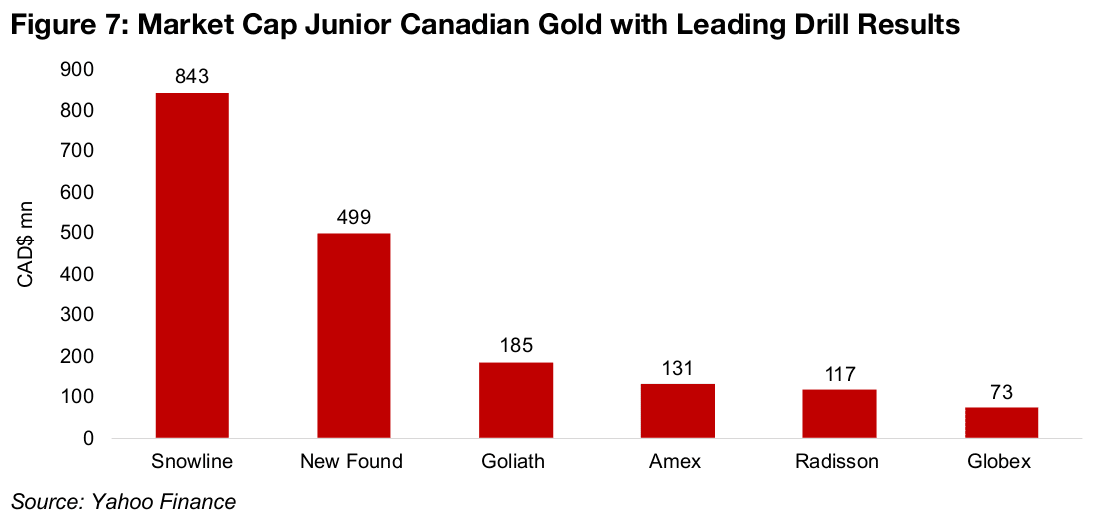

Snowline, New Found and Amex down even as drill results remain robust

Some of the strongest recent drill results for the Canadian juniors have come from

Snowline Gold, New Found Gold and Amex Exploration, which all have a long track

record of consistent high grade results over the past several years. Snowline and New

Found’s strong gold grades have propelled their market caps to CAD$843mn and

CAD$499mn, respectively, even both are still in the earlier stages of exploration

(Figure 7).

Snowline released an initial resource estimate for its Rogue project in mid-2024, with

4.0 mn oz in Indicated Resources at a 1.66 g/t Au grade and 3.3mn oz in Inferred

Resources at a 1.25 g/t Au grade. New Found Gold has still not released an initial

resource estimate for its Queensway project, but targets completion of this by Q2/25.

Amex has a considerably lower market cap than these two of CAD$131mn given a

smaller resource for its Perron project of 0.5mn oz Au M&I and 1.05 mn oz Au Inferred,

although at very high grades of 4.3 g/t Au and 3.8 g/t Au, respectively.

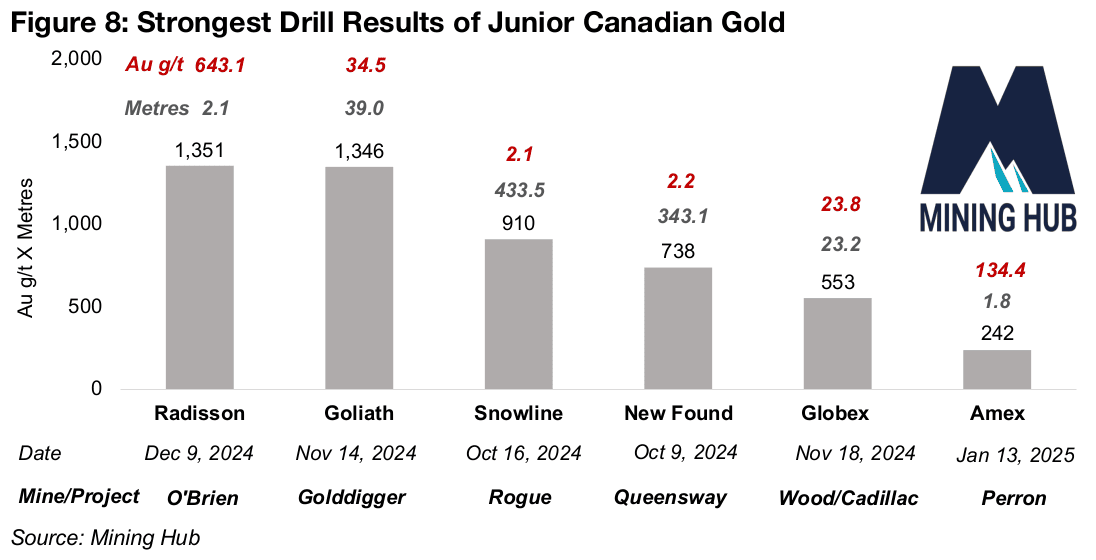

Snowline, New Found’s and Amex’s major drill results are all from their flagship

projects. Snowline reported the strongest result of the three, with a grams-thickness

of 910 with 2.1 g/t Au over 433.5 m, and New Found announced a grams-thickness

of 738 with a similar grade of 2.2 g/t Au over 343.1 m (Figure 8). Amex’s major drill

result had a grams-thickness of 242, with a very high 134.4 g/t Au grade but over only

1.8 m. The strong drill results have not driven an increase in the share prices of these

companies since October 2024, with Snowline, New Found and Amex down -6.0%,

-9.2% and -30.1%, respectively (Figure 9).

All three of these companies are facing an issue typical of junior miners with an extended exploration phase that has been particularly successful. The market will have come to expect continued strong drill results from these companies given the previous track record of the projects, and already priced this into share prices. To boost the market cap further, the companies generally need to show that they advancing into the development phase and give the market more clarity on the expected output and costs of an actual mine. This will partly explain while the share prices will have lagged for these companies even as they continue to release outstanding drill results.

Smaller caps Radisson, Goliath, Globex propelled by strong drill results

The other three Canadian juniors with leading drill results, Radisson, Goliath and

Globex, developing the O’Brien, Golddigger and Wood/Central Cadillac projects,

respectively, are in an earlier phase of exploration for their major projects where these

releases can still have a substantial effect on their share prices. This occurs as strong

drill results for a given project suddenly start to present a more concrete reality to the

market for what was previously mainly only a thesis backed by relatively limited

physical evidence.

This can lead to a major increase in the probability of a significant resource that is

priced in by the market over a relatively short period. This in turn can drive some of

the highest and fastest percentage gains in market cap that a junior is likely to ever

see, often rising four or five times from US$10-US$20mn to US$100mn. The next

potential doubling or tripling again to the US$300mn level or higher often requires

entering the long process of development.

The strongest recent results from Radisson and Goliath and have had a similar grams-

thickness, at 1,351 and 1,346, but the former has a much higher grade of 643.1 g/t

Au over a lower width of 2.1 m and the latter a grade of 34.5 g/t Au over 39.0 m. While

Globex’s drill results gram-thickness has been towards the bottom of the group, at

553 with 23.8 g/t Au over 23.2 m, it has seen the strongest share price gains of the

group, up of 47.7%, as it still in the early phases of the potential move outlined above,

with a market below CAD$100mn.

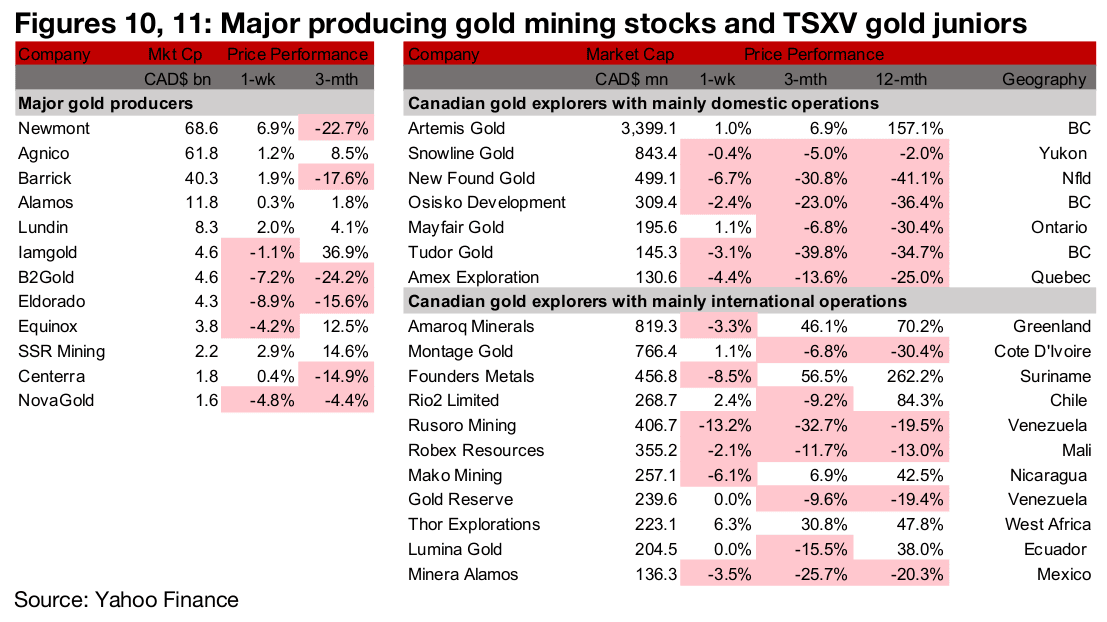

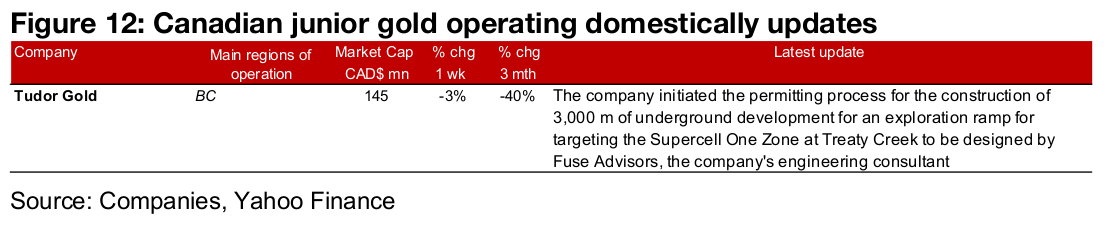

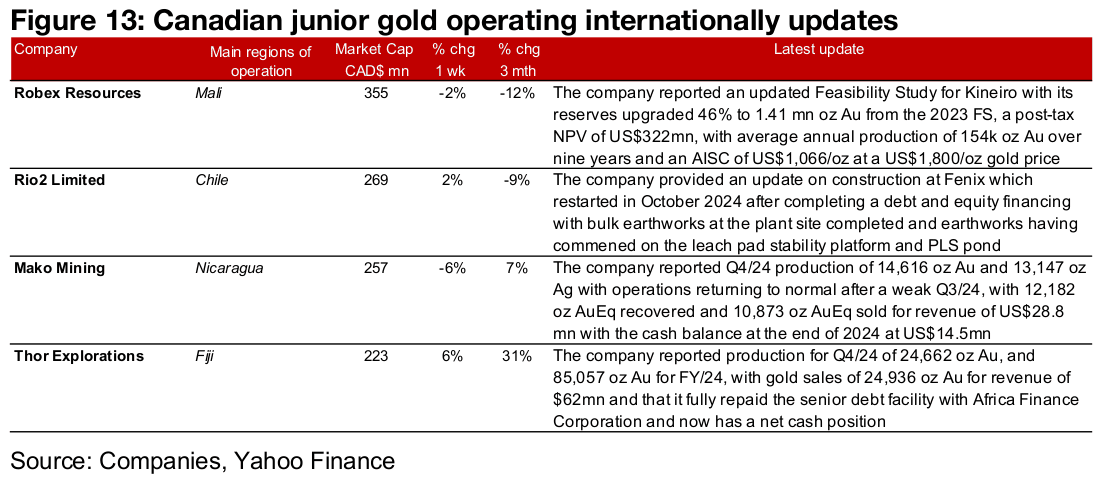

Large producers and TSXV gold mixed

The largest gold producers rose but most mid-tier gold majors declined and TSXV gold was mixed (Figures 10, 11). For the TSXV gold companies operating domestically, Tudor Gold initiated a permitting process for construction of underground development for exploration of Supercell One at Treaty Creek (Figure 12). For the TSXV gold companies operating internationally, Robex Resources reported an updated Feasibility Study for Kineiro, Thor Explorations and Mako Mining reported Q4/24 production and Rio2 Limited provided an update on construction at the Fenix mine (Figure 13).

Disclaimer: This report is for informational use only and should not be used an alternative to the financial and legal advice of a qualified professional in business planning and investment. We do not represent that forecasts in this report will lead to a specific outcome or result, and are not liable in the event of any business action taken in whole or in part as a result of the contents of this report.