November 21, 2022

Gold: There Is No (Crypto) Substitute

Author - Ben McGregor

Gold edges down as crypto market flattens in wake of FTX crash

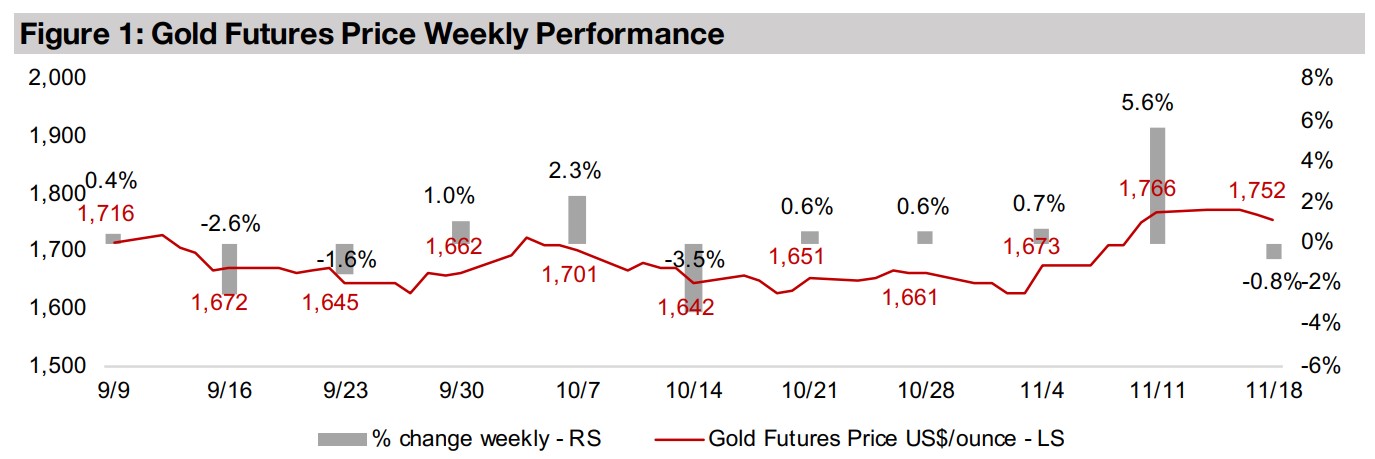

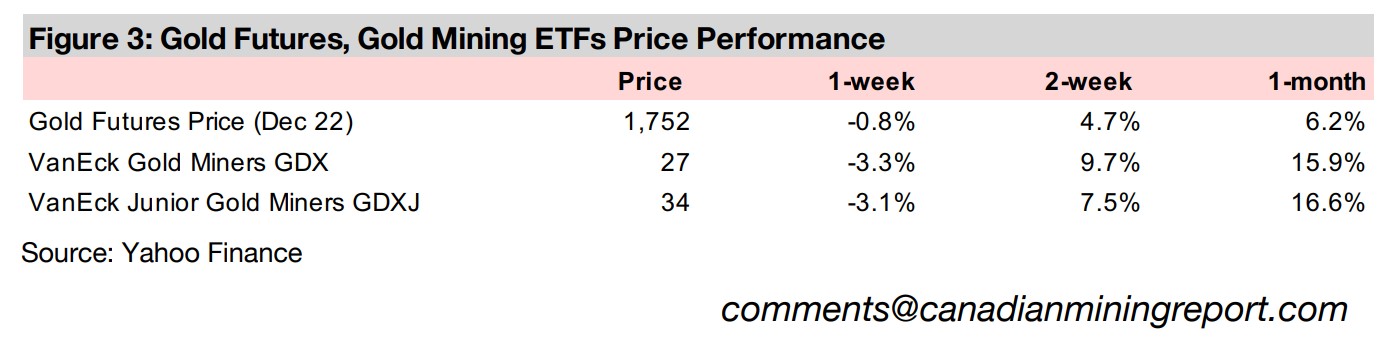

Gold edged down 0.8% this week to US$1,752/oz as the crypto market flattened after the crash driven by the FTX Exchange collapse, with crypto being exposed this year as being no safe substitute for gold as had been touted in 2020 and 2021.

Differences between the 2010s and 2022 gold stock bear markets

This week we look at the very big differences between the gold stock bear markets of the 2010s and 2022, including a resilient gold price, high inflation and interest rates and a strong US$, a move away from risks assets and strongly cashed up majors.

Gold: There Is No (Crypto) Substitute

Gold eased -0.8 to US$1,752/oz, after its historically huge gains of 5.6% last week, which had been driven by a moderate decline in US inflation, leading to expectations of a rate hike pullback from the Fed that was likely a bit overblown. Another big move developed in the crypto markets over the past three weeks, but in the other direction, with the asset class declining on the news that one of its major exchanges, FTX had collapsed. This meant that many holders of crypto lost the entirety of their investment and has raised concerns that similar issues could arise at other crypto exchanges.

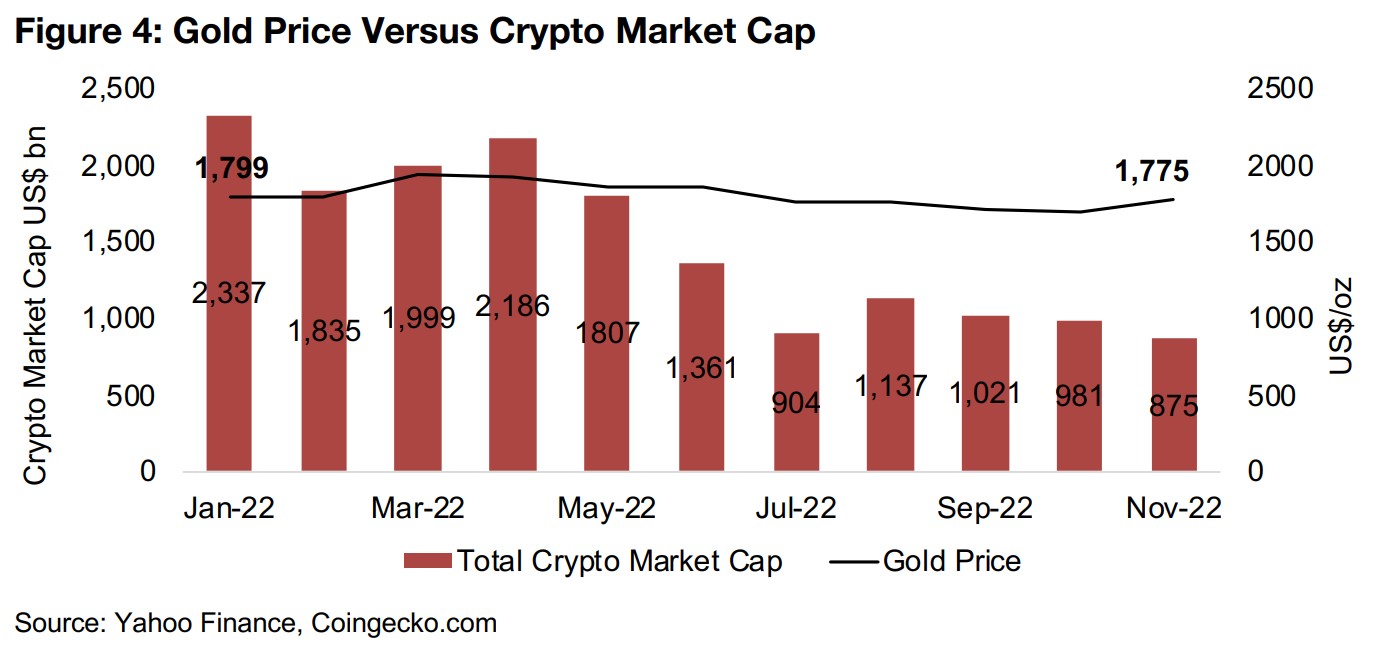

FTX shifts crypto risk from individual coins to systemic

This has highlighted a new systemic problem for crypto this year. While the space had been reeling since May 2022 after a 59% crash in market cap from US$2.2bn in April 2022 to US$0.9bn by July 2022, this had been driven by a decline in the value of specific crypto assets. However, this drop was perhaps less of a surprise than the FTX-driven one, as many crypto coins are new and untested, with long-term adoption to the level of industry stalwarts like Bitcoin or Ethereum often suspect. While the May 2022 decline was one of the first instances of a coin with such a huge market cap evaporating, the idea that coins could collapse was not a new one (Figure 4).

The FTX problem was really a much different and wider one, as it was not about a

specific coin, which most would accept was a 'buyer beware' situation. This was

about an exchange where many different assets were held, like a crypto bank, which

was a huge and well recognized brand and a trusted name for crypto storage. This

raised far larger issues that the risks of the crypto market could be well beyond a few

weak coins and could even spill over into other markets.

It exposed a total lack of adequate governance for such a large company in industry,

compounded by FTX being run from the Bahamas, a jurisdiction with very relaxed

financial regulation compared to the US. All of this has raised the issue for the

potential need for regulation of the industry, especially in the US, given that FTX

management was mainly US citizens. Details continue to come in on the case and

while the crypto market has calmed down over the past week, there is still increased

caution, as there is still the chance for the 'crypto contagion' to spread.

The benefits of gold's tangibility highlighted by the FTX crisis

These events do bring light the very extreme differences between the gold and crypto

markets, especially after crypto had been touted widely as a replacement for gold

during the peak of the crypto boom in 2020 and 2021. The emergence of the crypto

as a market large enough to really draw fund flows away from a huge market like gold

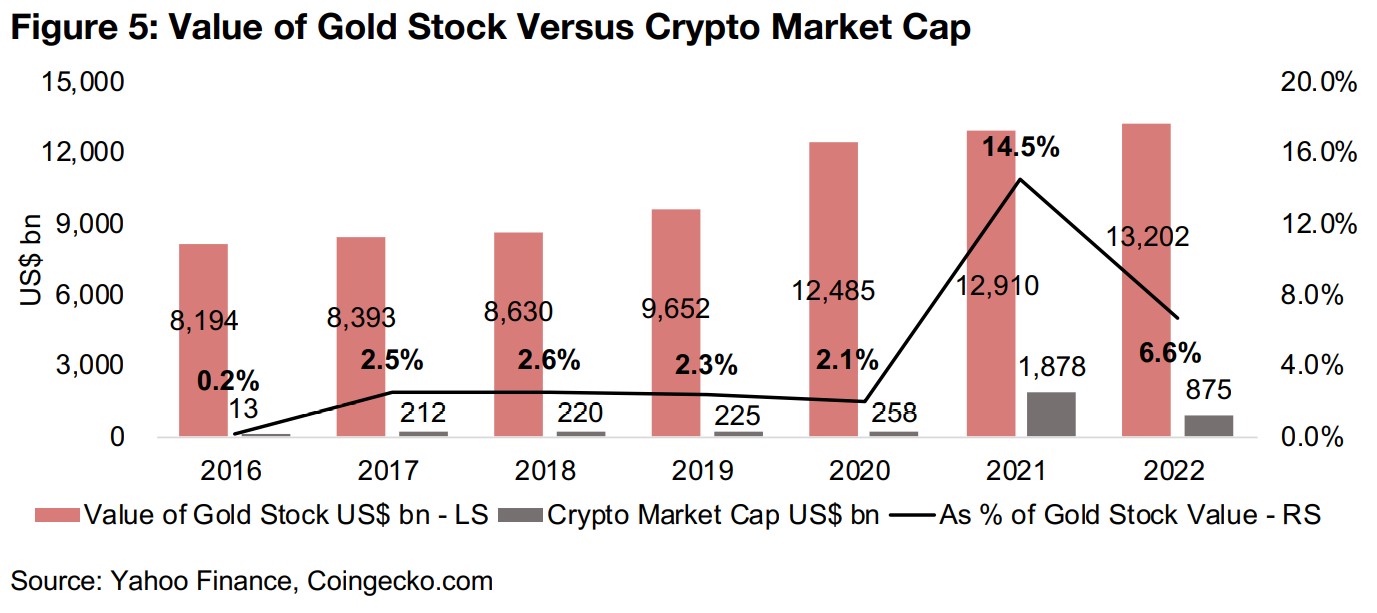

really only occurred in 2021. The total crypto market cap was just 0.2% of the value

of all above ground gold stocks in 2016 and had risen to just 2.1% by 2020 before

jumping to 14.5% at its peak in 2021, and is still at 6.6% after the decline in 2022.

We had outlined in a weekly report earlier this year, when crypto was being vaunted

as a replacement for gold, that one of gold's key strengths was its tangibility, in

contrast to crypto, the value of which can literally disappear without a trace quite

quickly, as demonstrated in 2022. It would have proved difficult to move the

equivalent value of the physical gold that was lost in the crypto market this year to

collapsing coins and exchanges without some security staff at storage vaults noticing.

So while with the boom in digital assets last year, such a quality as tangibility,

especially for an asset that is expected to store value long-term, may have been

overlooked temporarily, this is not likely the case as much now.

Crypto less likely to be stealing gold's thunder

There has been some speculation over the past couple of years that part of the reason

we had not seen the gold price rise further given the massive monetary expansion

was because some of the fund flows were instead going into crypto. Given the

massive surge in crypto's value 2021, this certainly made sense in terms of short-term trading, with even gold's gains in its 2019-2020 bull market moderate by

comparison. However, the market has shifted to much more caution regarding crypto

after the events of 2022, with both the safety of individual coins and the crypto system

overall brought into question. If the crypto had been holding down gold, perhaps

investors shying away from an only decade-old crypto market and looking for a true

store of value, proven over 3,000 years, may become a driver for gold.

While we do believe that crypto will continue to be an important new asset class, it

has been shown this year, and in its previous huge cyclical swings over the past

decade, to be clearly a very risky asset, not at all a safe haven like gold. While certain

coins or crypto overall may prove to be safe havens as the market moves from

nascent to more developed, this will likely take decades, and for now the sector still

remains effectively the wild west.

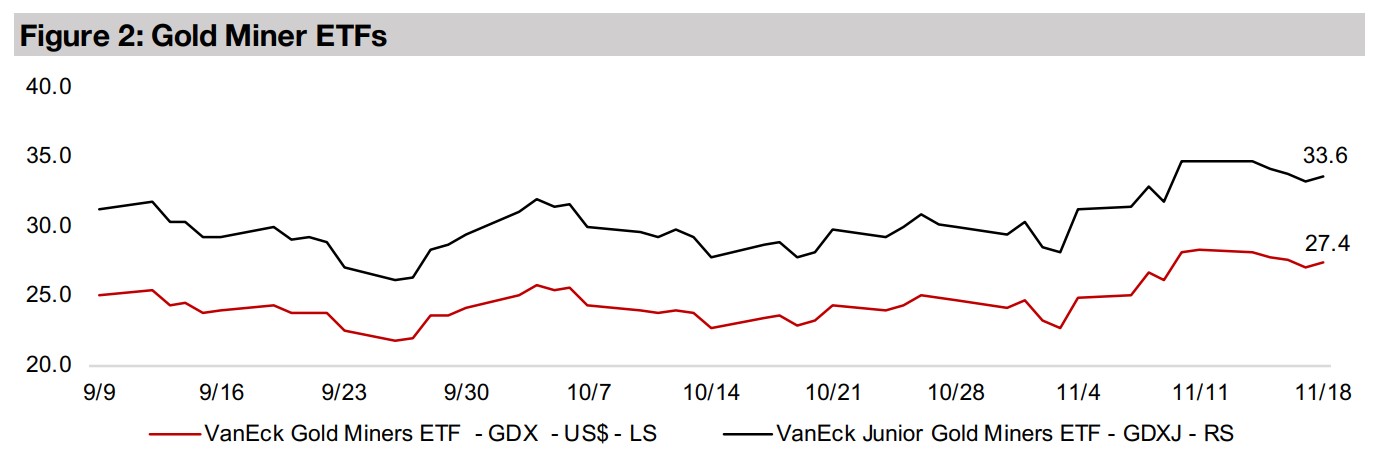

How the 2020-2022 gold stock bear market differs from 2012-2018

Gold stocks have been in a bear market for much of this year, with the GDX ETF of producing miners and GDXJ ETF of junior miners down over -30% from their most recent peaks in April 2022. This could be raising some concern that the situation devolves similarly to the extended weakness in the sector from 2012 to 2018. However, this week we show that there were some very specific and rare circumstances during the mid-2010s that caused this long gold stock bear market that are not present currently. This leads us to anticipate that the bottom could well be in for the sector as early as 2023 and that it is much less likely to remain there as it had in the extended trough at the bottom of the last cycle.

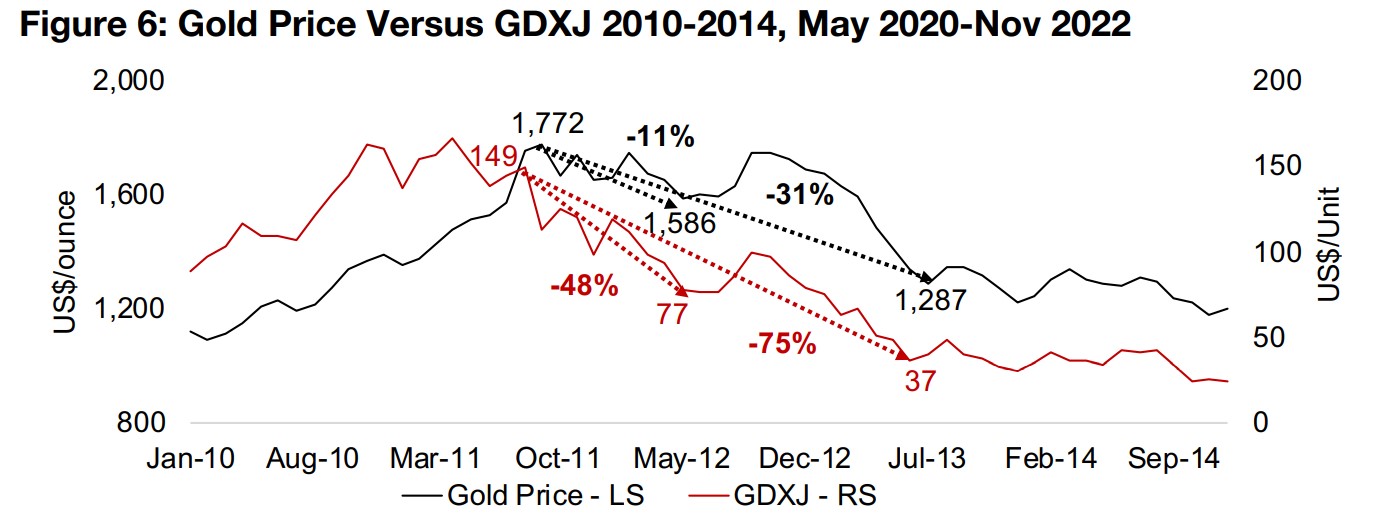

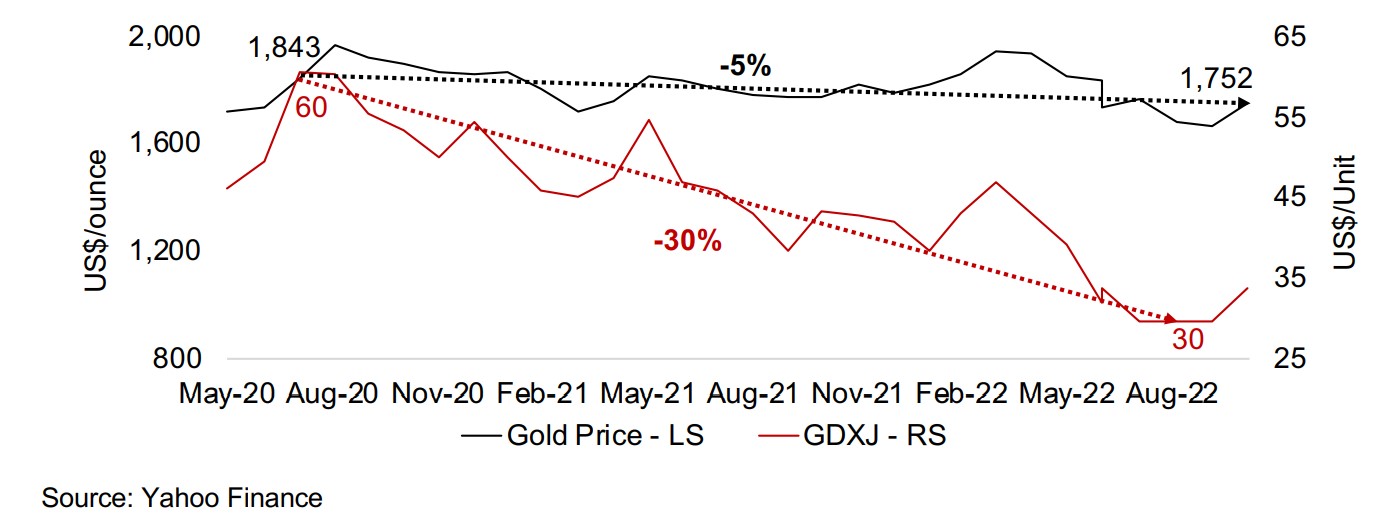

Difference #1: Gold Has Been Holding Up Well

One of the first major differences is that gold price has actually been holding up reasonably well in the current bear market, while the mid-2010s decline was largely driven by a severe drop in gold. Tracking the decline from the August 2011 GDXJ price of $149/unit and September 2011 peak in gold at $1,772/oz, by May 2012, gold had declined -11% and the GDXJ was down -48% (Figure 6). Within roughly another year by mid-2013, as the market started its long bottom, gold was down -31% and the GDXJ down -75%. With the current gold stock bear market starting around mid-2020, we are about two years into the decline, but in distinct contrast, gold has declined just -5%, and the GDXJ is down just -30%. This bear market is therefore clearly not a 'gold-price-led' one as we saw in the mid-2010s and is more driven by by the broader decline in the equity market, than specific issues in the gold sector.

Difference #2: Inflation is Surging and Rates Are Rising

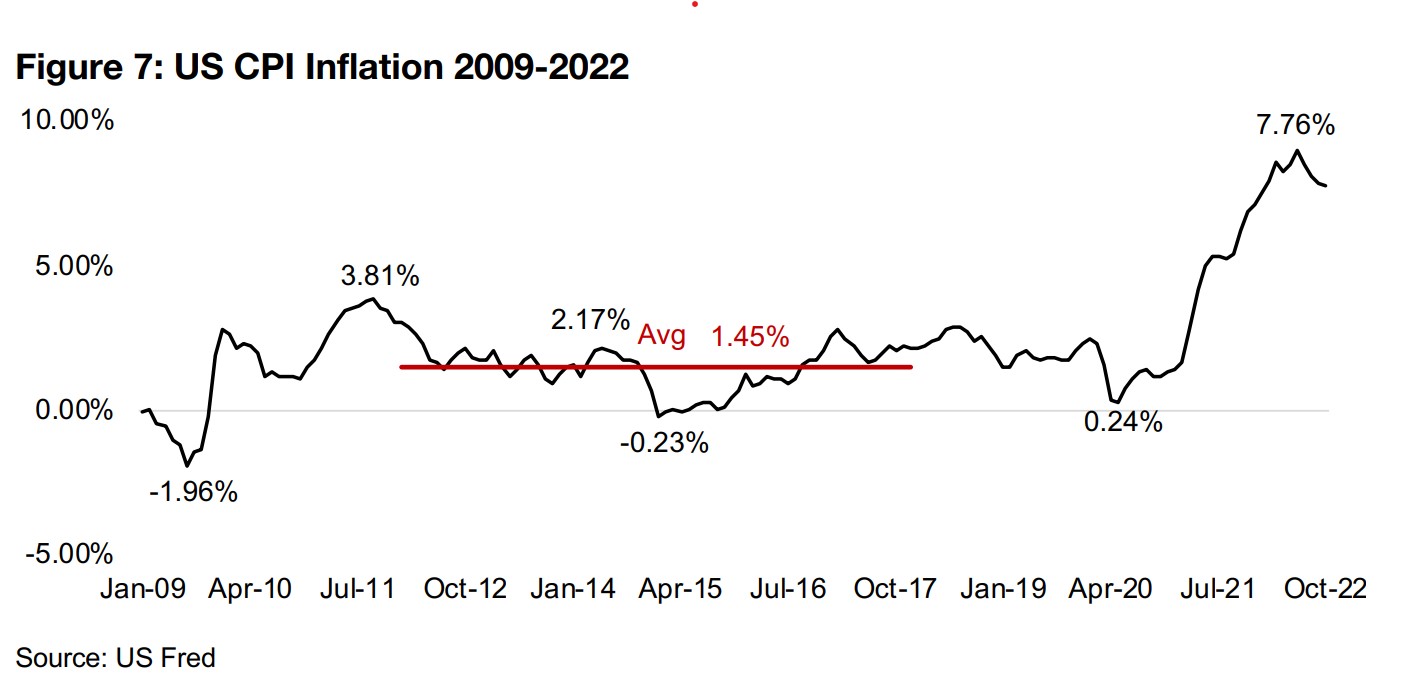

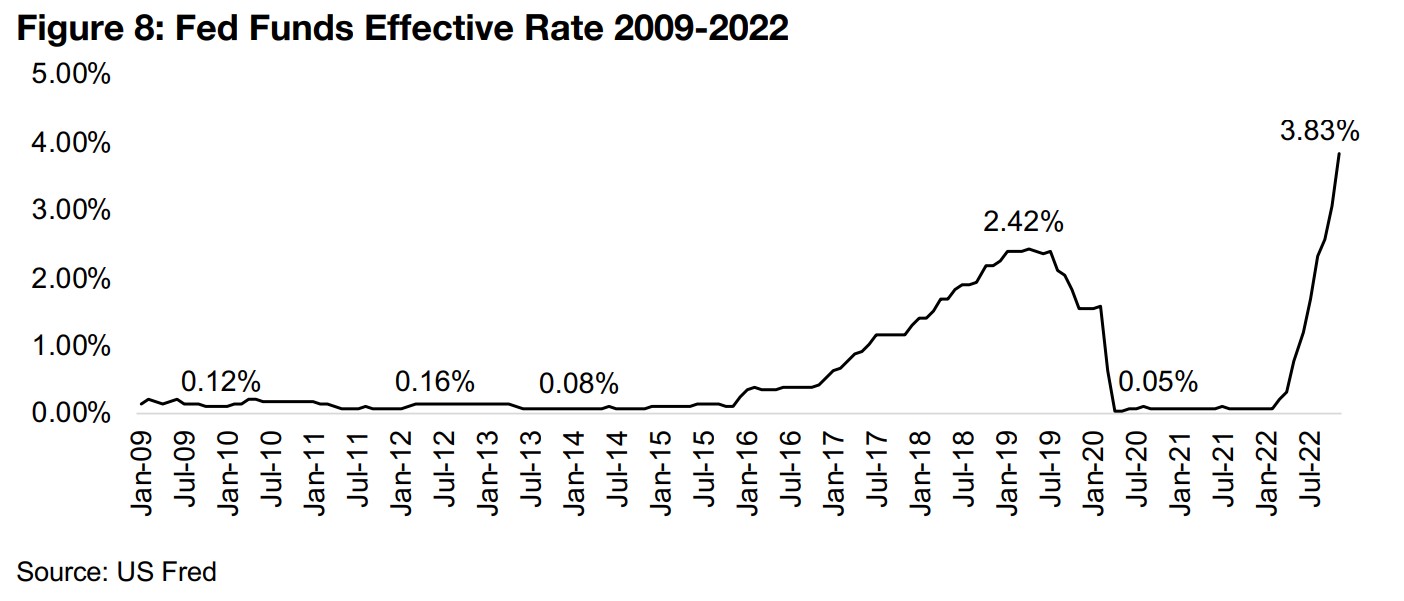

Another major difference is that inflation is high, with US CPI Inflation up 7.76% yoy as of the most recently reported October 2022 data. In contrast, inflation been declining as the 2010s gold stock bear market started, and stayed exceptionally low throughout it, averaging just 1.45%. With gold often considered an inflation hedge, this was clearly a negative factor for it through the mid-2010s (Figure 7). Another major difference is that interest rates have been rising in 2022, with the Fed Funds Effective Rate having jumped to 3.83% in 2022 from near zero at the start of the year (Figure 8). In contrast, rates had been near zero through the mid-2010s gold stock bear market.

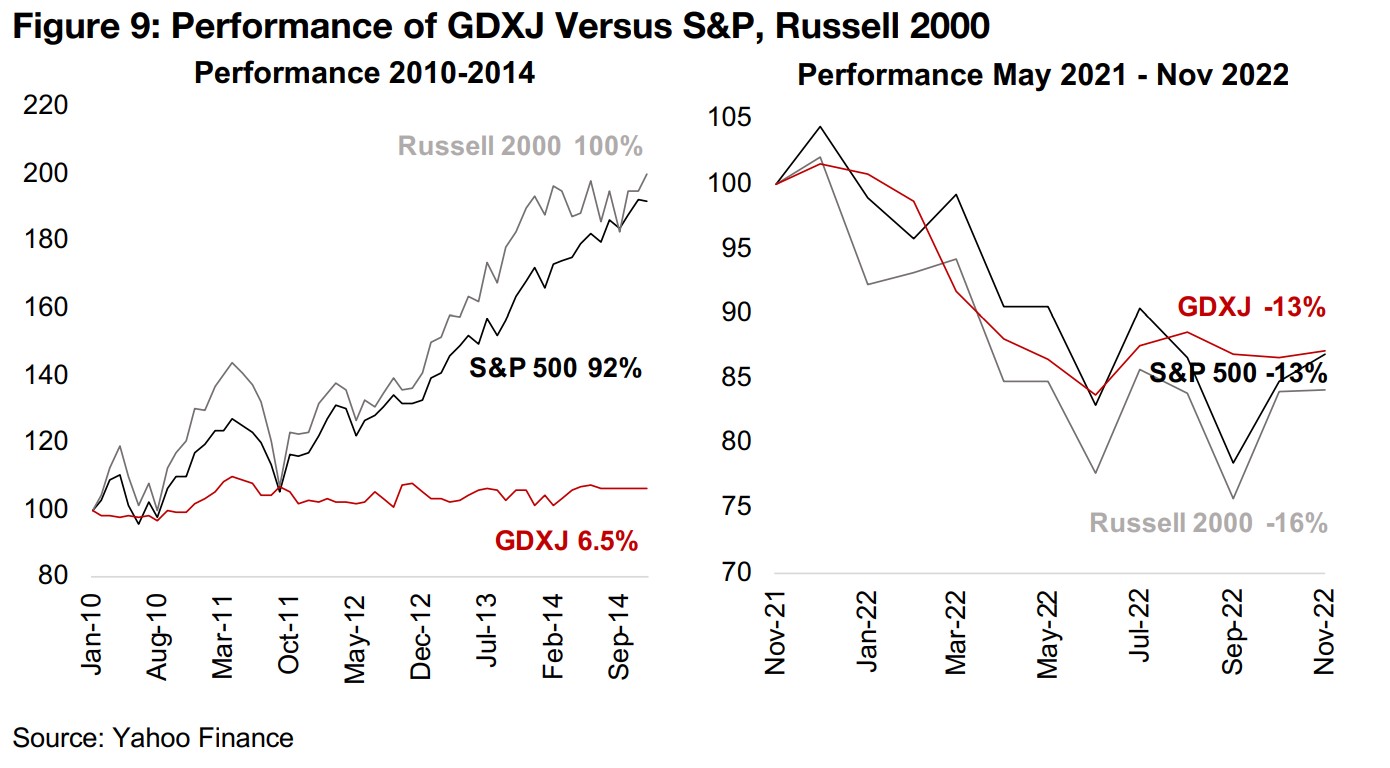

Difference #3: Risk Assets are Declining

These low interest rates were the driver of another major difference, which was that risk assets were surging through the 2010s, with the S&P 500 up 92% from 2010 to 2014 and the Russell 2000 Index of small cap US stocks up 100% (Figure 9). This huge gain for small caps was of little help to the juniors, in contrast, which rose just 6.5% over the period, given the downward pressure from the low gold price. The recent bear market has been a very different story, with risk assets declining substantially, with pressure especially on small caps, but the junior miners actually outperforming. The GDXJ is down just -13% since the broader stock market decline started around November 2021, equal to the performance of the S&P 500, down - 13%, and ahead of the -16% decline of the small caps overall.

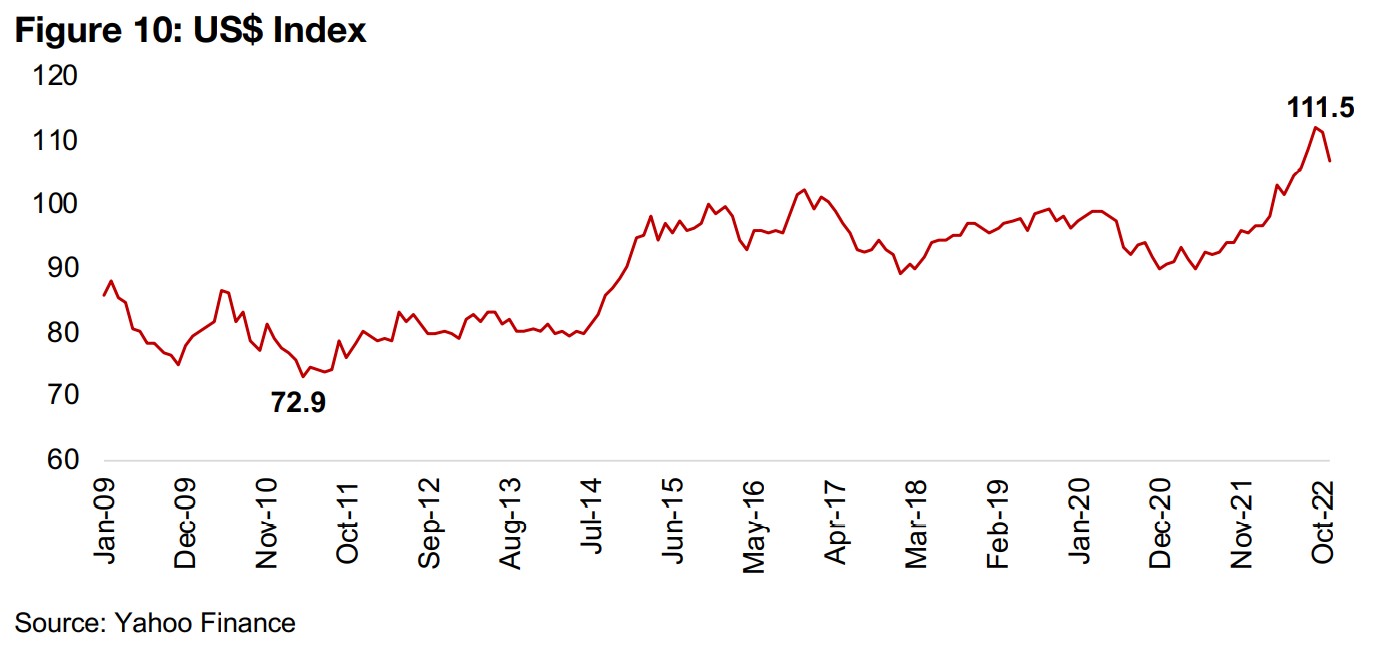

Difference #4: The US Dollar is Very Strong

The US$ has been extremely strong over the past two years, with US rate hikes outpacing other major regions, and this rate differential drawing in fund flows to the currency, with the dollar index peaking recently as high as 111.5 (Figure 10). Given that the US$ tends to move inversely to gold, this has likely suppressed the gold price, although this could shift over the next year as other major regions are starting to hike rates, likely drawing back fund flows into their currencies. In contrast, the US$ was very low in mid-2010s gold bear market, although it failed to give much support to the gold price given the other more than offsetting factors holding it down.

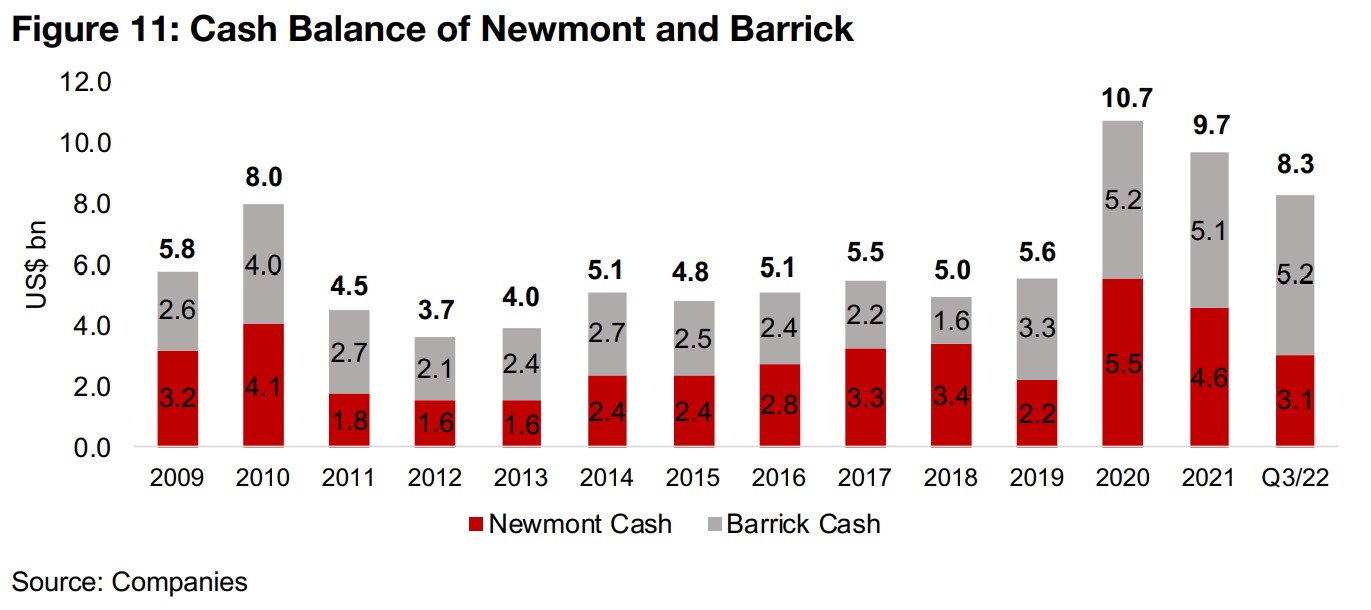

Difference #5: Majors Are Cashed-Up

Another major difference is that the major gold producers have very high cash balances, with the combined cash of the two global market leaders Newmont and Barrick at US$8.3bn as of Q3/22. This is important for many juniors as they are often still exploring, have no cash flow and need to raise capital, and larger producers which are perpetually on the hunt for new reserves can therefore be a key source of cash especially with weakening capital markets seeing funding from outside the industry declining. The larger producers had about just half the cash levels that they do currently from 2011 to 2013, and the low gold price was discouraging them from investment. We expect to see this cash deployed in the sector, not conserved as it might have been in the mid-2010s, and the junior gold mining sector could benefit.

Still a bear market, but less likely to be as long or brutal

Overall, while we are still in a bear market for gold stocks, we do not expect it to be anywhere near as long or brutal as that of the mid-2010s. The gold price has been holding up well, and we expect to see it supported by continued high inflation, even if it pulls back somewhat, whereas there was virtually no inflation in the mid-2010s. Risk assets more broadly have been on the decline, especially small caps, and are likely the major cause of decline in junior gold mining stocks, as opposed to any fundamental issues in the gold sector. In the mid-2010s, risk assets were all the rage, and safe havens like gold were of little interest. The US$ has been exceptionally strong, which has likely weighed on the gold price, but this could reverse heading into next year, while in the mid-2010s, the gold sector saw no relief even from a very low US$. Finally, the largest gold producers have abundant cash that they will be looking to deploy, which could flow through to the stronger junior gold mining stories. In total, these factors we see this factors as pointing to the potential for a bottoming in the sector as early as next year.

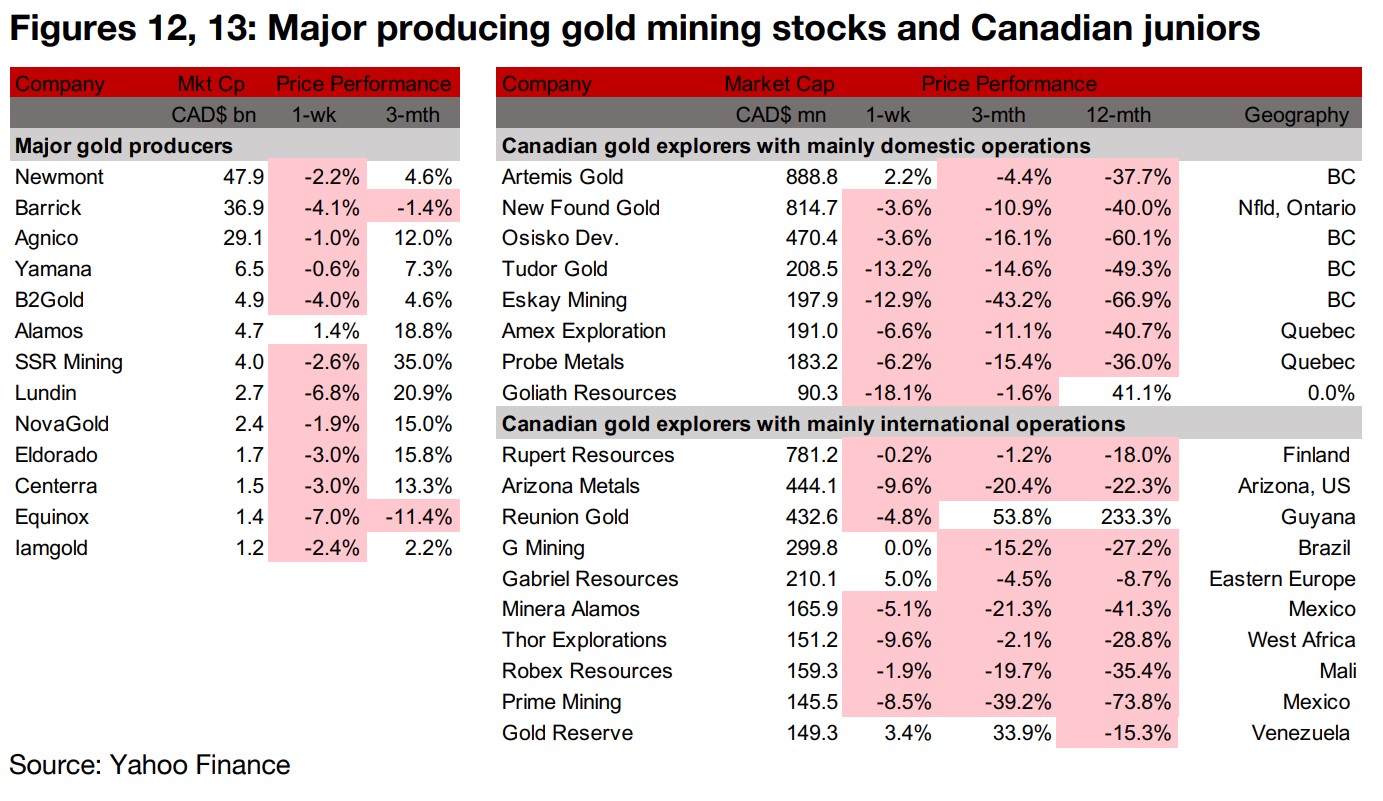

Producers nearly all down after historic market rip

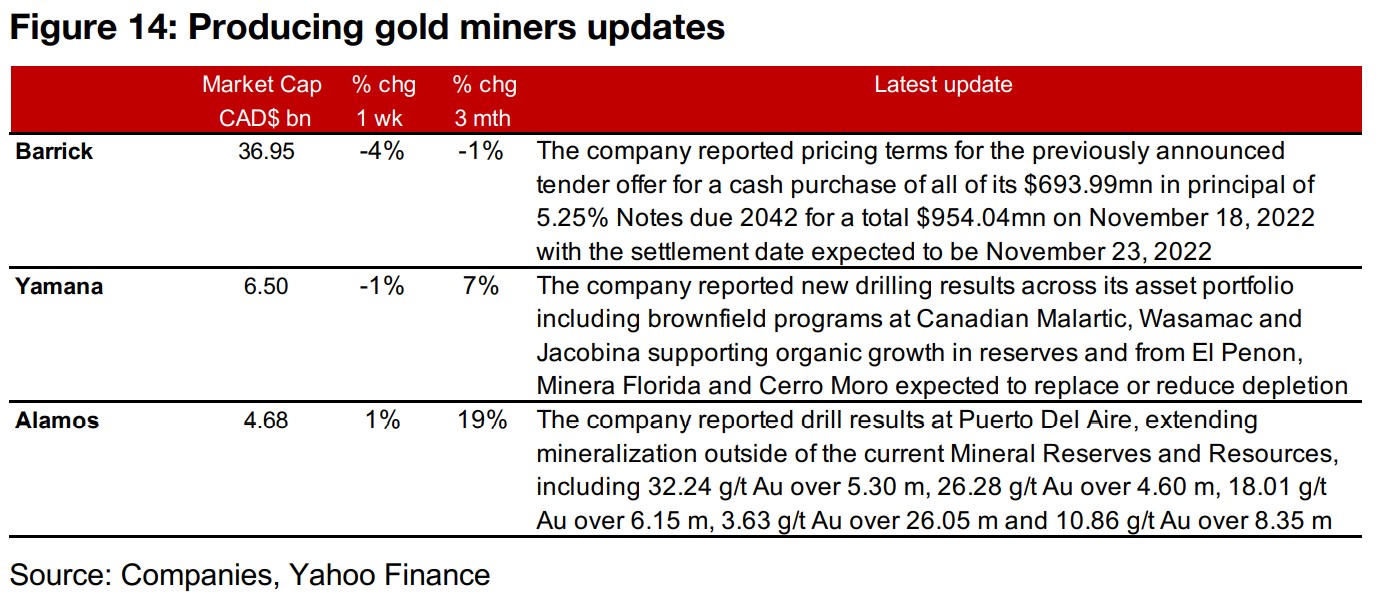

The producing gold miners were nearly all down on profit taking after the previous week's historic rip in both gold and equity markets (Figure 12). Barrick reported the pricing terms for its previously announced tender offer to purchase all of its outstanding Notes due 2042, Yamana reported new drilling results from many mines across its portfolio and Alamos reported drill results from Puerto Del Aire (Figure 14).

TSXV larger cap juniors decline after previous week's surge

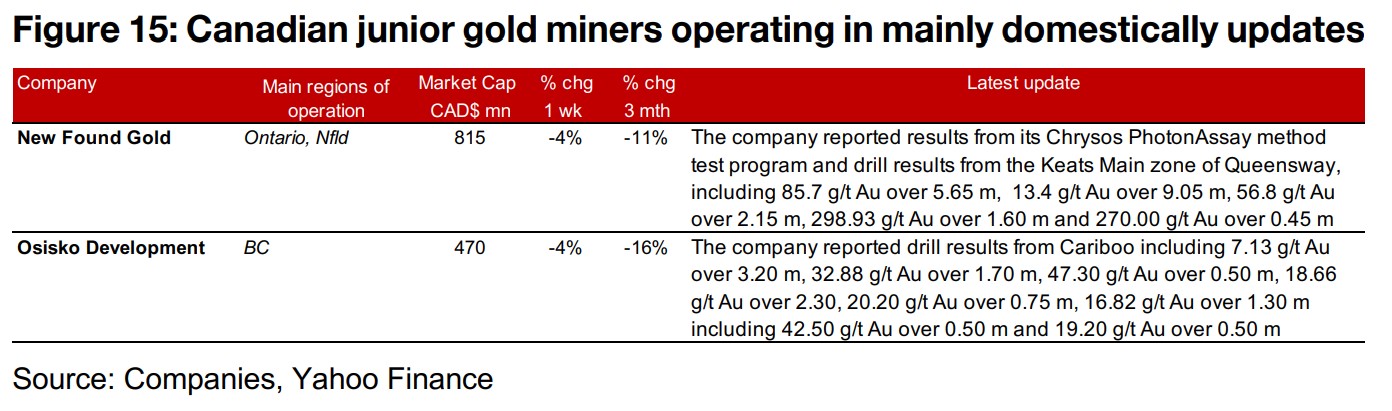

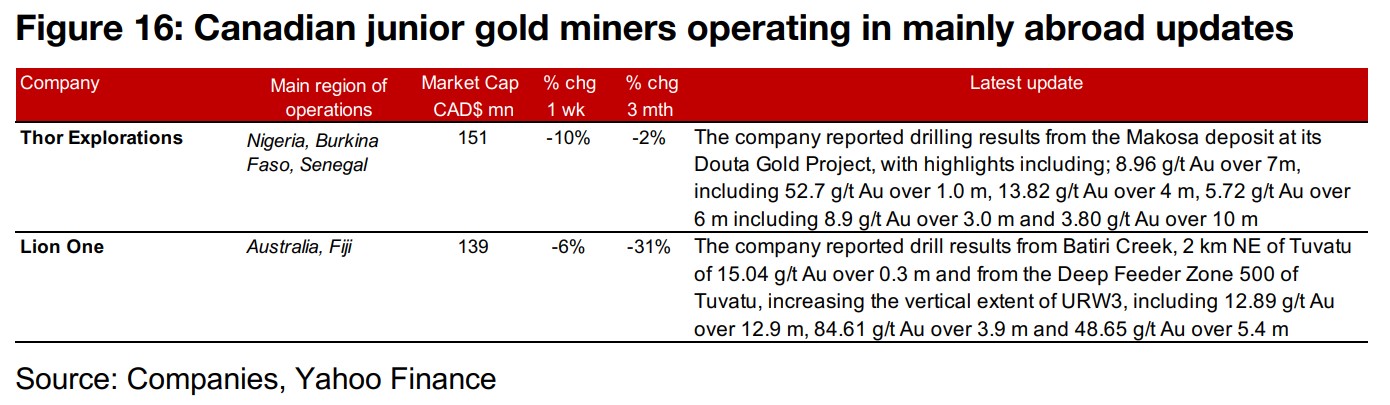

The larger cap TSXV gold stocks mostly slid after gold and stocks eased off of last week's surge (Figure 13). For the Canadian juniors operating mainly domestically, New Found Gold reported results from its Chrysos PhotonAssay method test program and drill results from the Keats Main Zone of Queensway and Osisko Development reported drill results from the Cariboo project (Figure 15). For the Canadian juniors operating mainly internationally, Thor Explorations reported drill results from the Makosa deposit at the Douta Gold Project and Lion One reported drill results from Batiri Creek, 2 km northeast of Tuvatu, and drill results from the Deep Feeder Zone 500 at Tuvatu (Figure 16).

Disclaimer: This report is for informational use only and should not be used an alternative to the financial and legal advice of a qualified professional in business planning and investment. We do not represent that forecasts in this report will lead to a specific outcome or result, and are not liable in the event of any business action taken in whole or in part as a result of the contents of this report.