August 15, 2022

Gold Stocks Not Participating in Rally

Gold reaches highest level in seven weeks

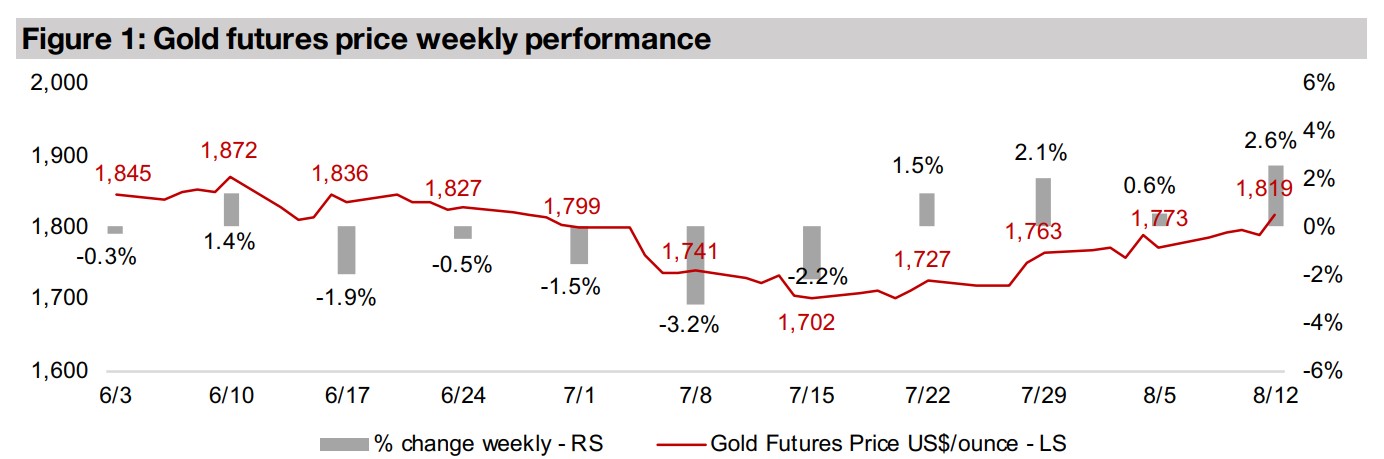

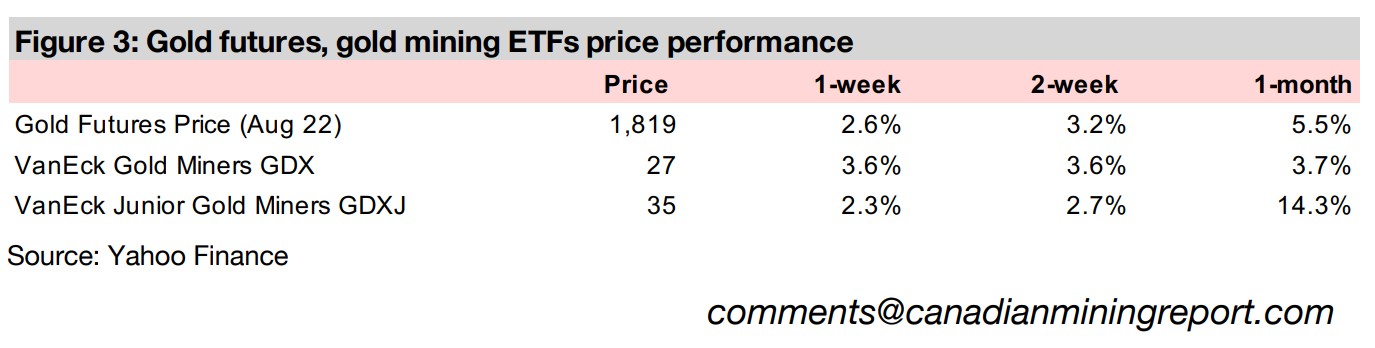

Gold rose 2.6% to US$1,819/oz this week, a seven-week high, as US CPI inflation edged down in July 2022 to 8.5% from 9.0% in June, increasing hope that inflation may be peaking and the Fed could pull back on its aggressive rate hike path.

Gold stocks not participating in two-month rally, Q2/22 results finish

This week we look at the performance of gold stocks in the equity market rally that began in mid-June 2022, and see that they have not really participated, including most of the TSXV large cap juniors, and show aggregate Q2/22 results for Big Gold.

Producers and juniors up on gold and equity market rebound

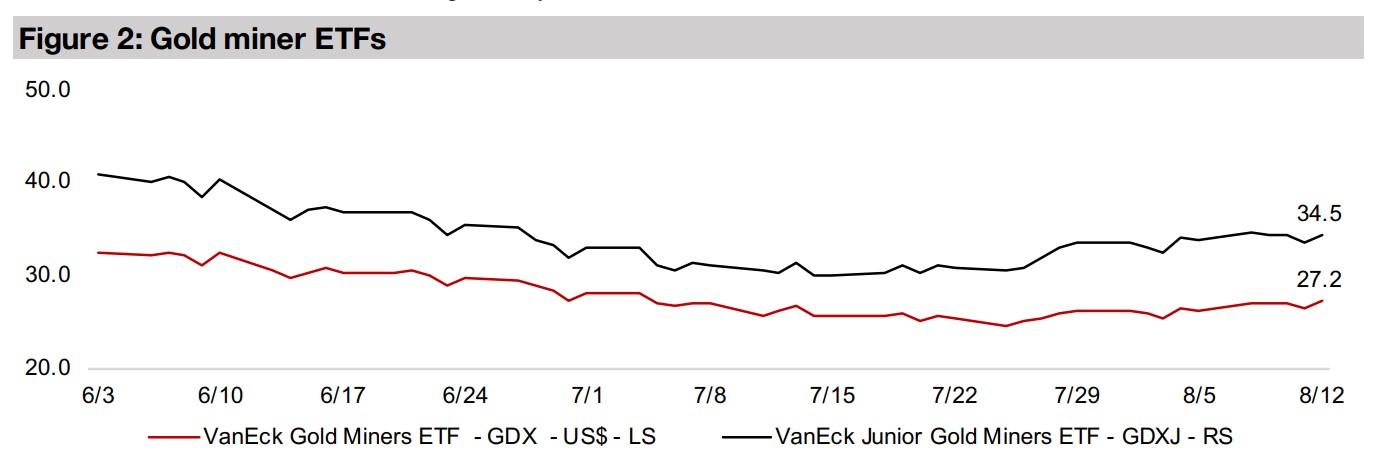

The producers and the juniors were up this week, with the GDX rising 3.6% and GDXJ up 2.3%, and the larger cap TSXV junior gold miners were mostly down even with the continued rebound in both gold and equity markets and small cap outperformance.

Gold Stocks Not Participating in Rally

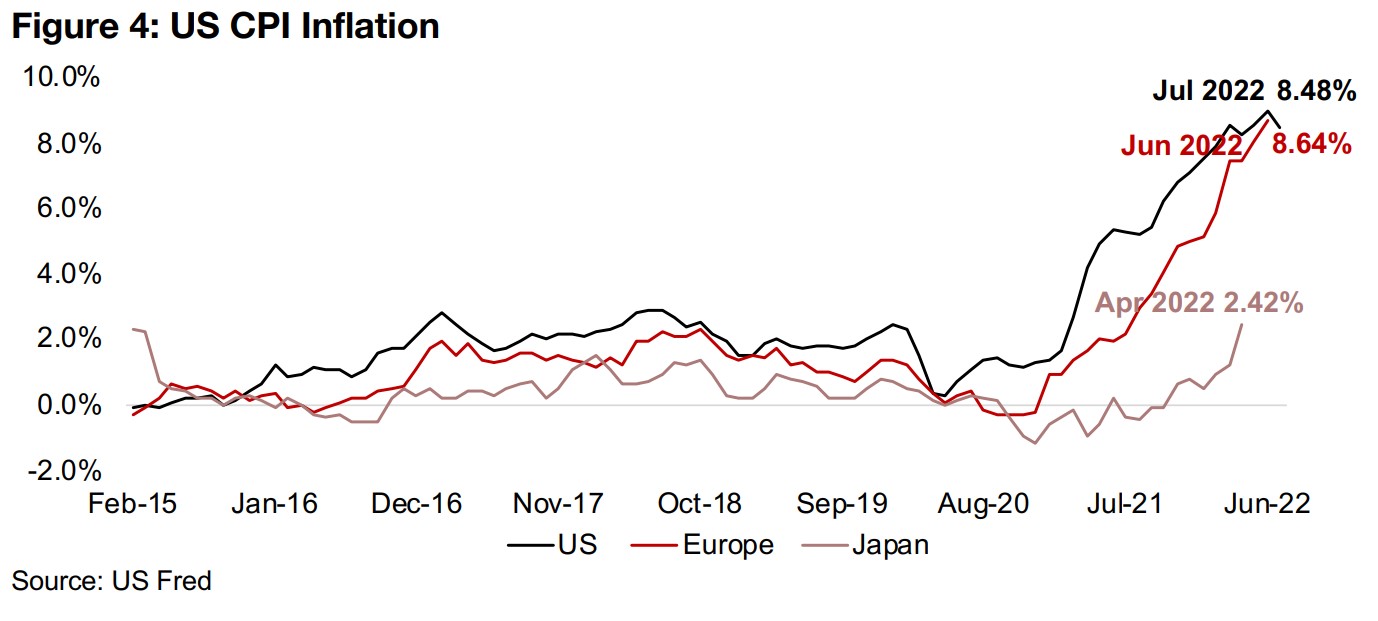

Gold was up 2.6% to US$1,819/oz, a seven-week high, as US CPI inflation came in below the market's expectation in July 2022 at 8.5%, down from 9.0% in June 2022, increasing hope that inflation could be peaking and the Fed might pull back from its current aggressive rate hike path. However, the Fed is hardly out of woods on inflation yet, as it remains at four-decade highs, and could still take substantial rate hikes to reduce, even if it flattens (Figure 4). Historically, the Fed Effective Funds rate has needed to get near or exceed inflation to truly curb it, and with this rate at just 2.50% it implies more than a tripling from current level to drive inflation back down to the Fed's target of around 2.0%, which would very likely drive severe fallout for the economy and markets. Inflation is also continuing to surge globally, with Europe reaching 8.6% in June 2022 and showing no signs of slowing down, and even typically deflationary Japan at 2.4% inflation as of April 2022.

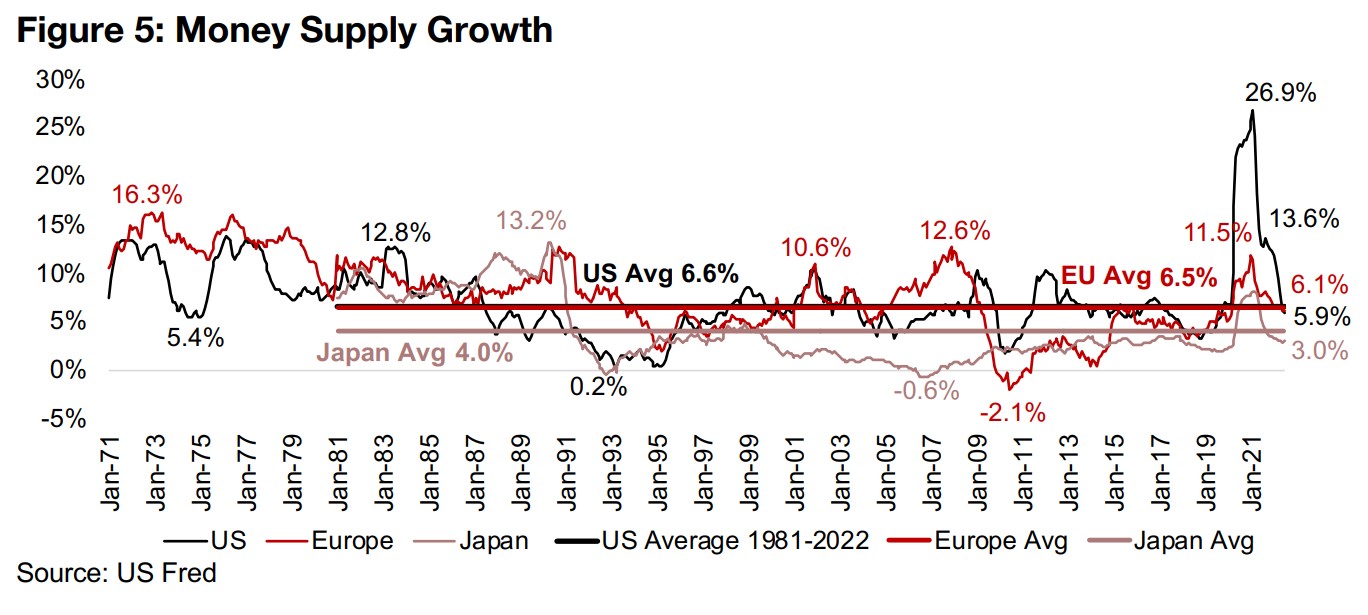

One indicator suggesting that the monetary situation may be getting a bit back under

control after the last two years of historically unprecedented levels of expansion in

the US is M3 money supply growth. US money supply during the global health crisis

peaked year on year in February 2021 at 26.9%, well over double the previous peak

growth of 12.3% nearly forty years ago in July 1983, with the early 1980s the last time

the Fed had to actively bring down extremely high inflation with aggressive monetary

tightening (Figure 5). While US money supply growth remained over 12.0% through

2021, it has come down quickly in 2022, and as of the most recently reported June

2022 data was up just 5.9% yoy, inline with the tightening policy of the Fed.

However, this rate of money supply growth could not be considered that low, with

the average for the US since 1981 at 6.6%, meaning it could still be enough to

propagate continued inflation well above the Fed's target. We might have to see this

money supply growth head towards zero year on year before inflation is truly brought

under control. Even then there is a major lag between money supply growth and it

showing up in inflation figures, as we can see with the expansion in early 2021 not

really beginning to result in out of control inflation until over a year later.

While Europe and Japan had nowhere near the excessive monetary expansion seen

in the US, peak M3 growth was well above historical averages during the crisis.

Europe's money supply growth peaked at 11.5% in February 2021, versus an average

since 1981 of 6.5%, and Japan peaked at 8.1% in the same month, compared to an

average of 4.0%. The M3 growth for Europe, at 6.1% as of June 2022, and for Japan

at 3.0%, have now dipped below these averages, but there is certainly not a major

monetary contraction, only a return to 'normal' levels of monetary expansion. As with

the US, we could need to see this M3 growth contract even further to start seeing a

strong reduction in inflation.

Gold stocks not participating in the equity market rally

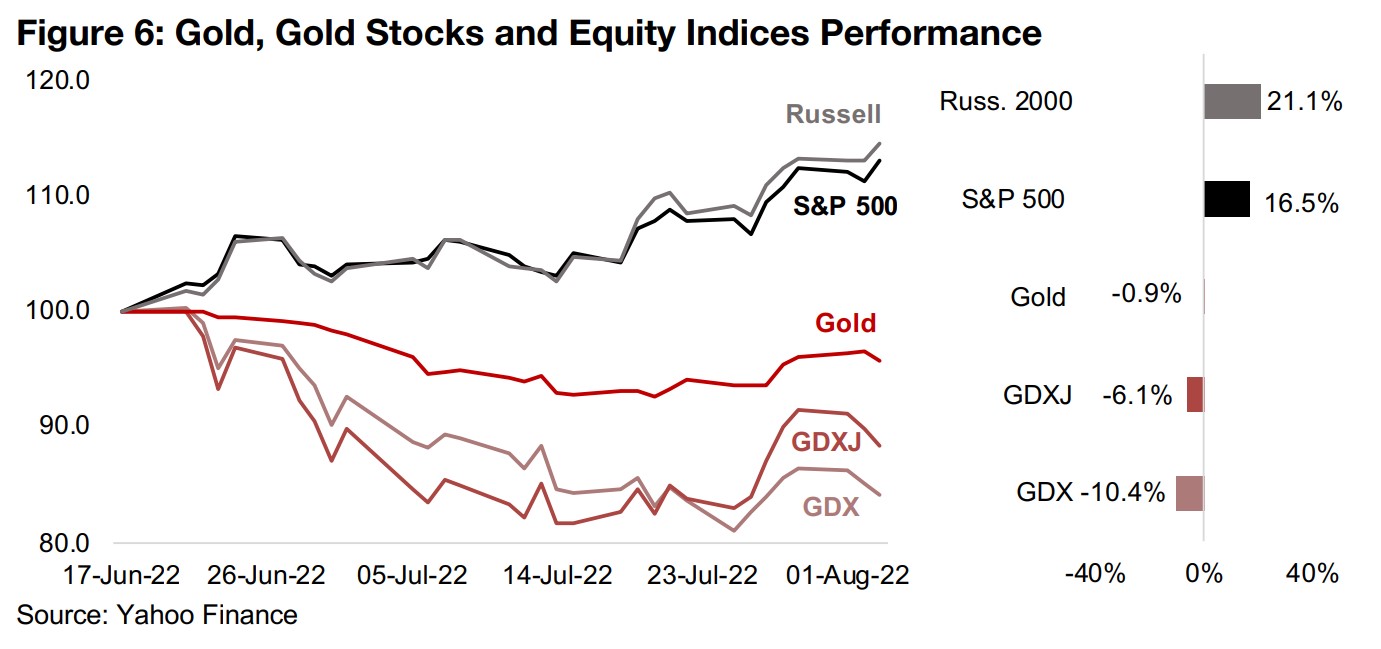

This week we look at the performance of gold stocks in the equity market rally of the

past two months, and see that they have not been participating, with the S&P 500 up

16.5% since June 17, 2022, but the GDX ETF, a proxy for the producing miners, down

-10.4%, even as gold has remained flat (Figure 6). The junior miners have not gained

either, with the sector proxy ETF GDXJ down -6.1% even as small caps significantly

outperformed large caps, with the Russell 2000 up 21.1%. This is occurring even as

gold has remained relatively flat, down just -0.9%, suggesting that the rally is a revival

in risk-on sentiment, with gold and gold stocks viewed more as safe havens, and

therefore seeing limited interest. This could also explain why the junior gold sector is

outperforming the producers, with the market more willing to take on the risk.

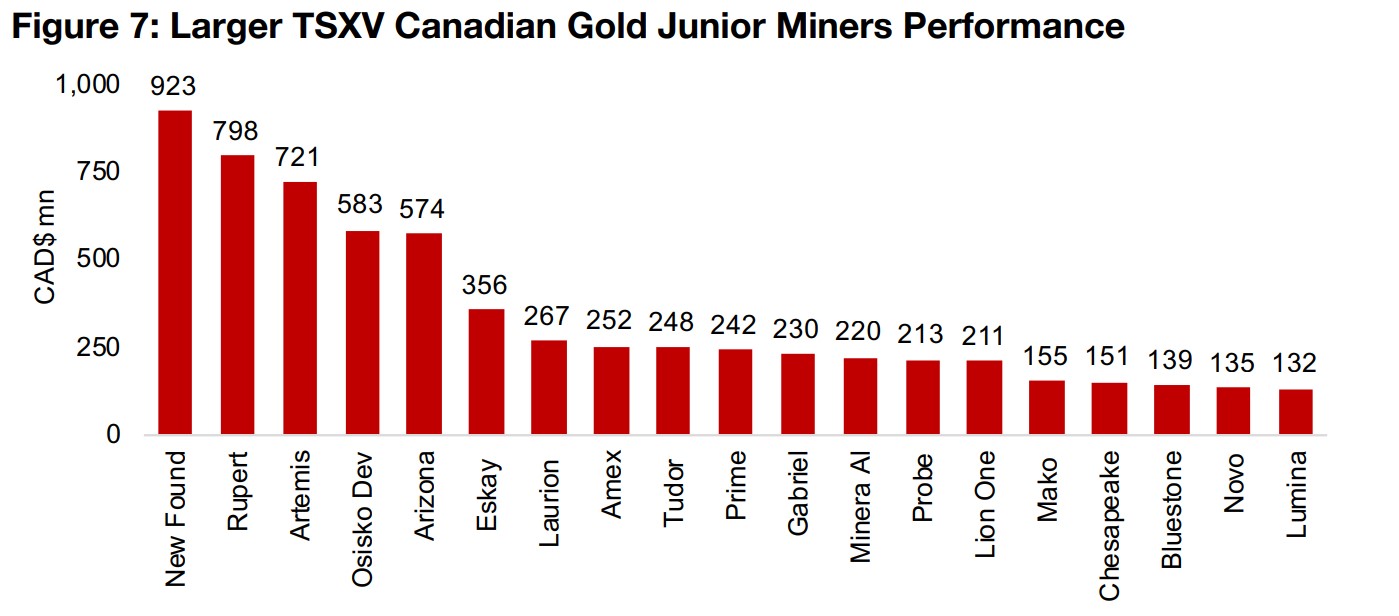

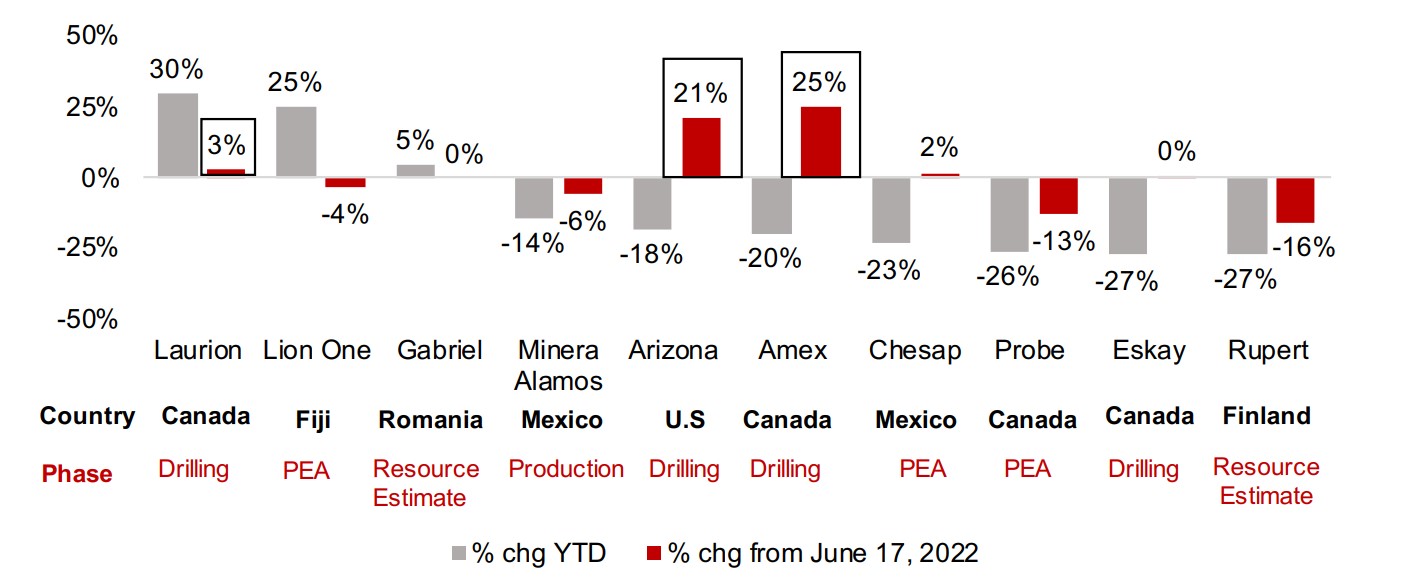

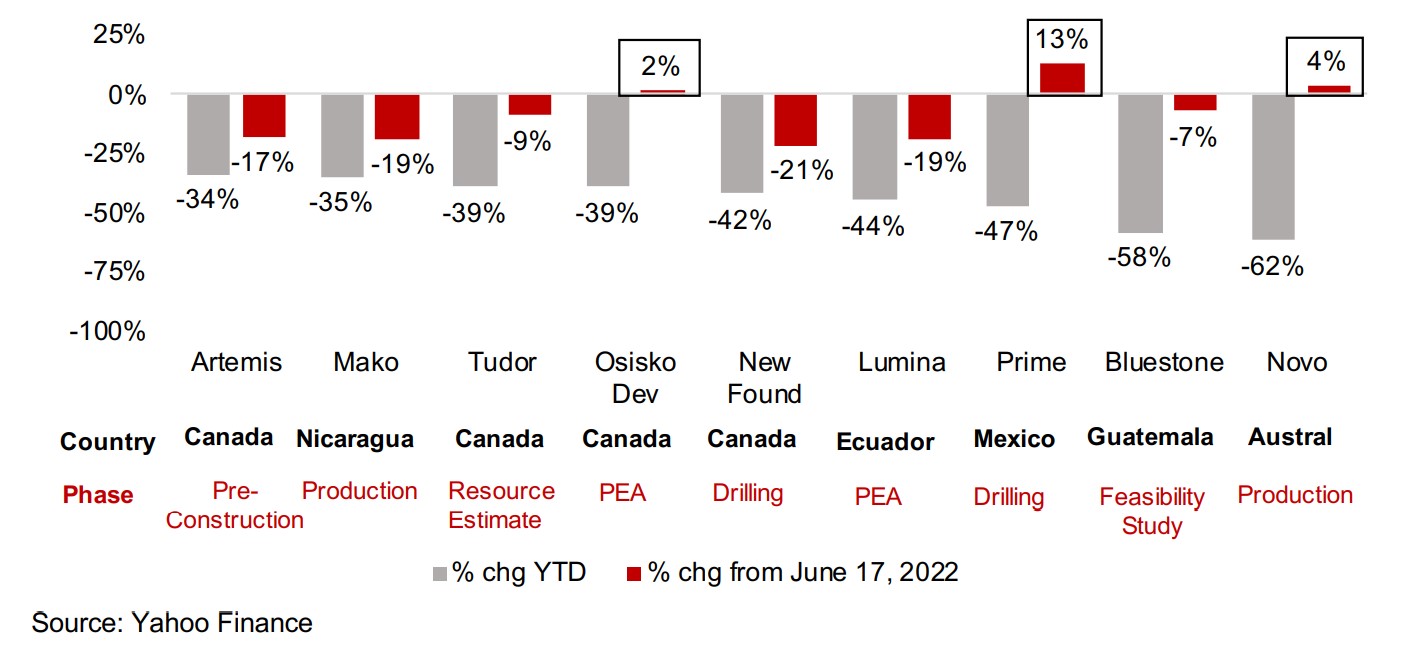

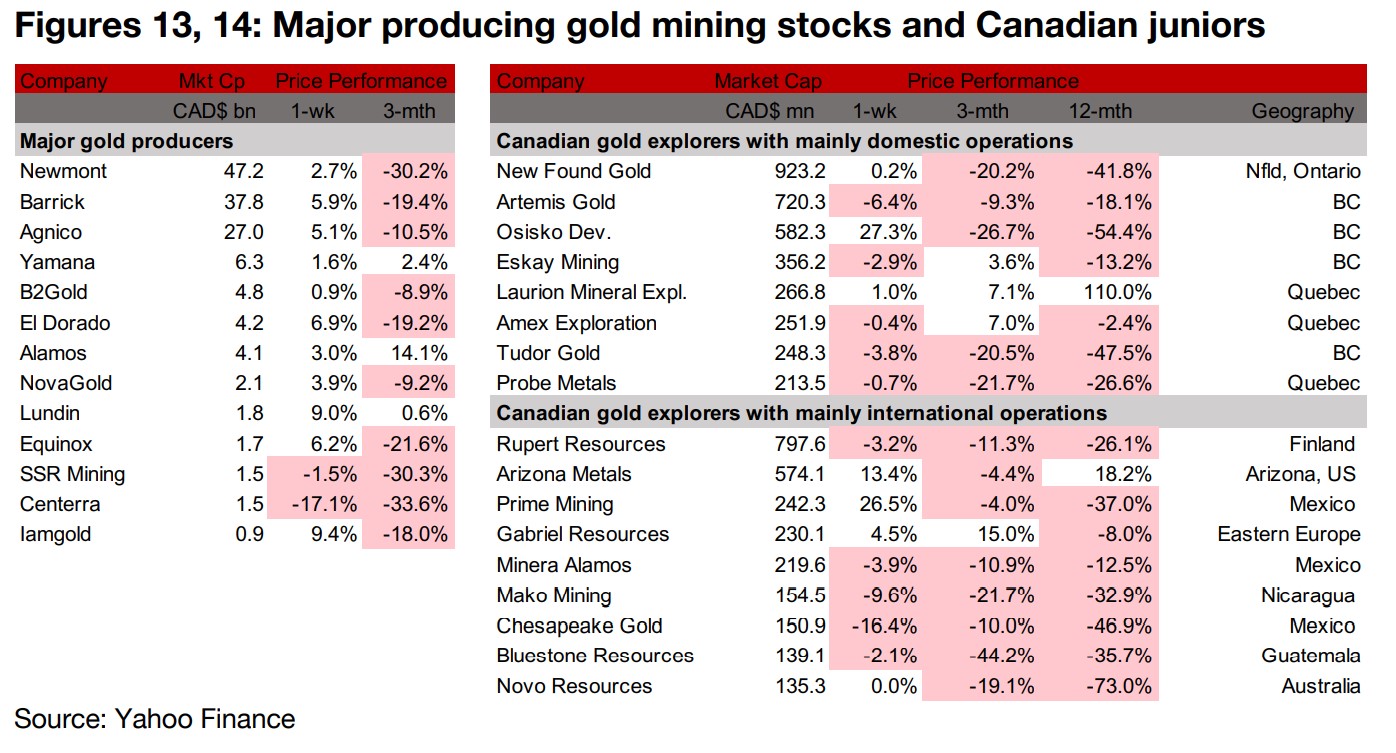

The larger cap TSXV gold junior miners have not been an exception, with only six of

nineteen gaining in the rally, and only three up substantially, Arizona Metals, Amex

Exploration and Prime Mining, all boosted by outstanding drill results (Figure 7). Only

three have gained year to date, with just two, Laurion Mineral Exploration and Lumina

Gold, seeing major rises, up 30% and 25%, respectively, and a third, Gabriel

Resources, up just 5.0%. The rest are down well over 10%, and about half the group

have declined over -30%. We continue to suggest caution in the junior mining space

specifically, but also would warn that the recent rebound in the broader equity

markets could prove to be just another bear market rally.

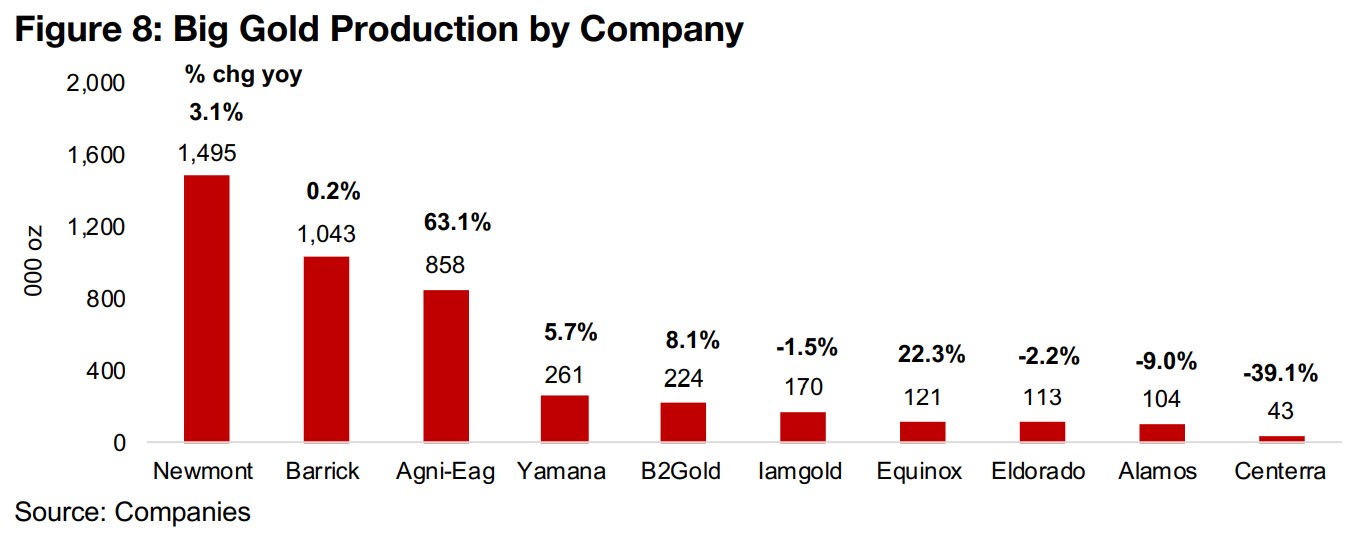

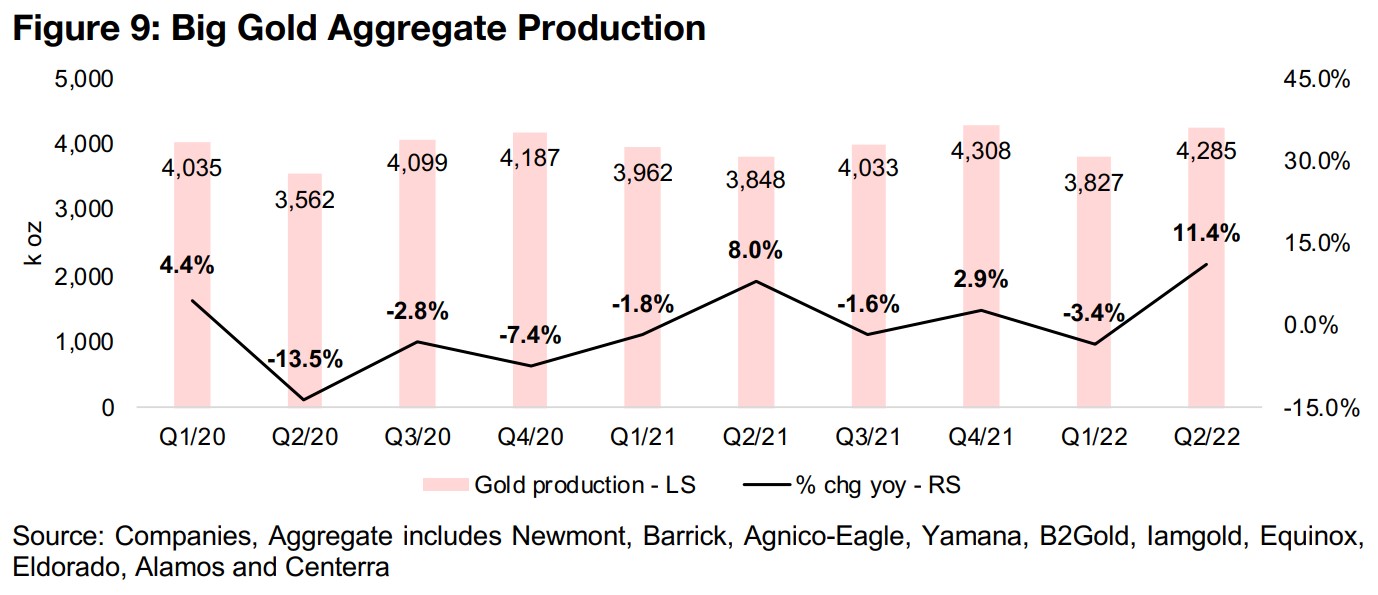

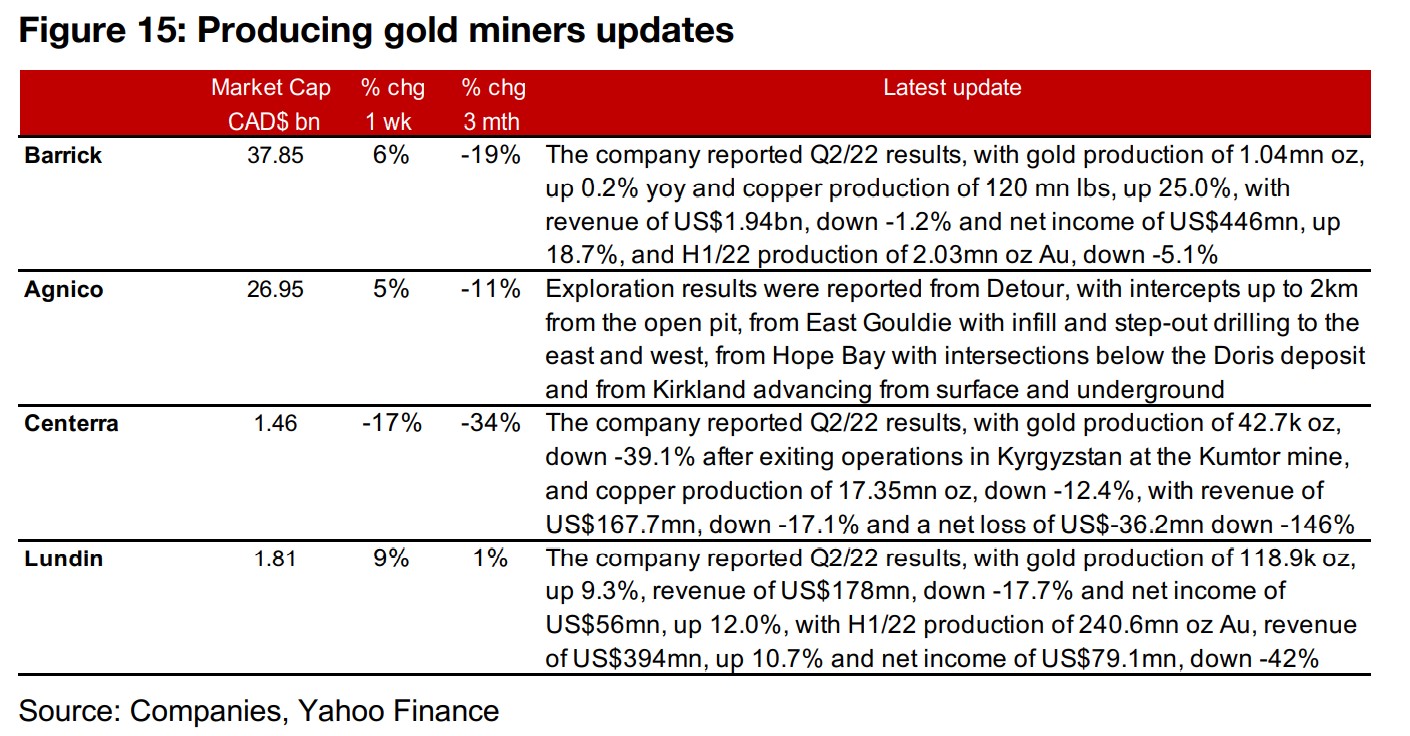

Q2/22 results for Big Gold complete with Barrick, Lundin, Centerra reporting

The Q2/22 results for Big Gold have now completed, with Barrick, the second largest player by gold production, and Centerra, the tenth largest player, as well as Lundin Gold, reporting this week (Figure 8). While aggregate production for these top ten largest gold producers in Q2/22 was up 11.4%, this was driven by a 63.1% yoy rise in the third largest player, Agnico-Eagle, mainly from its merger with Kirkland Lake (Figure 9). The biggest decline in production was from Centerra, down -39.1% yoy, which exited operations in Kyrgyzstan this year, which lead to production from the Kumtor mine no longer being included in their results for Q2/22.

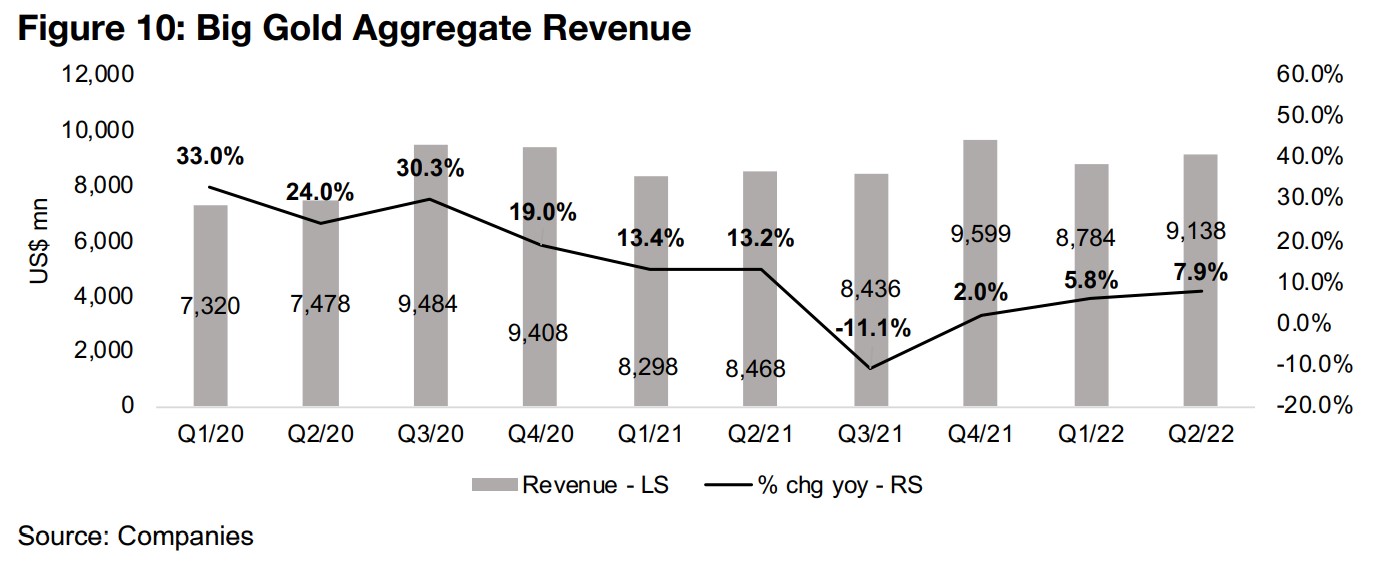

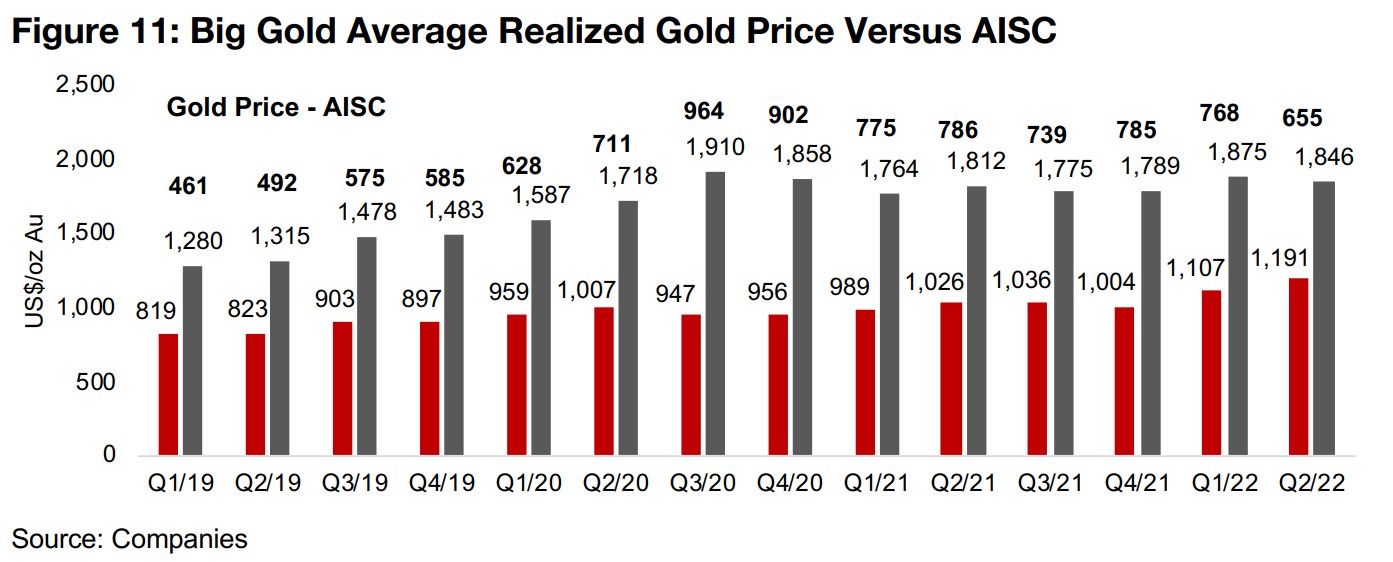

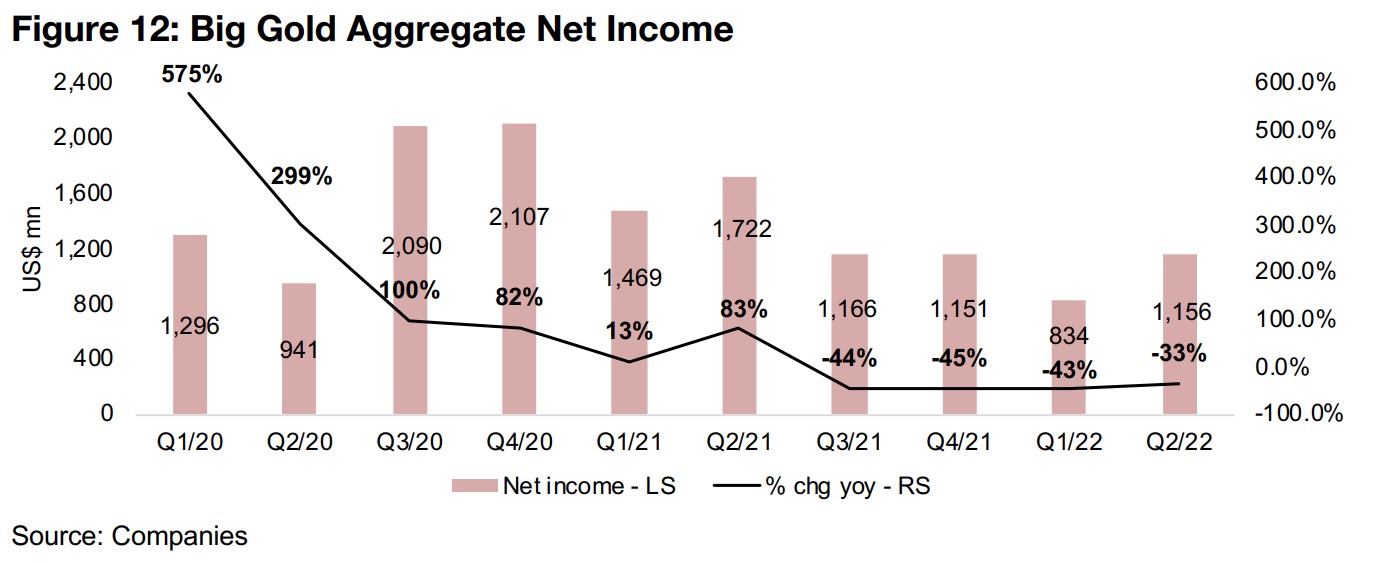

Aggregate revenue rose 7.9% yoy for Q2/22 (Figure 10), on both the rise in production and increase in the realized gold price to US$1,846, up 1.9% from US$1,812 in Q1/22 (Figure 11). While the yoy growth rate has picked up over the past two quarters, much of this is coming from the Agnico-Eagle and Kirkland Lake merger completed in February 2022. While this could therefore continue to support aggregate growth rates over the next two quarters, it is not indicative of the level of organic growth for the group. We are starting to see rising inflation hit the sector, with the average AISC at US$1,191/oz in Q2/22, up US$165/oz or 16.1% from US$1,026 in Q2/21, with the AISC for the sector having remained relatively flat through 2020 and 2021 but started to really pick up in 2022. This has driven the spread between the realized gold price and AISC for the sector to US$655/oz in Q2/22, down US$131/oz or -16.7% from US$786/oz in Q1/21. Net income was down -33% yoy in Q2/22 for the sector, a moderate improvement after three quarters of over -40% contraction, a combination of the very high base from Q3/20 to Q2/21 on a surging gold price and low costs, but also because of a series of exceptional non-operating items affecting different companies over the past few quarters (Figure 12).

Producing miners mainly up on rise in gold

The producing gold miners were mainly up on the rise in gold and the pickup in equity markets. The Q2/22 results for Big Gold completed, with Barrick and Lundin both reporting and seeing decent share price gains. Centerra also reported Q2/22 results, but saw a considerable -17.1% decline after its production dropped yoy after the exit from its Kyrgyzstan operations, which included the Kumtor Mine, with the final agreement to leave the country completed in July 2022 (Figure 13). Agnico Eagle reported exploration updates for Detour, East Gouldie, Hope Bay and Kirkland.

Canadian junior miners mixed even as small caps rise

The Canadian junior miners were mixed even with the rise in gold and overall equity

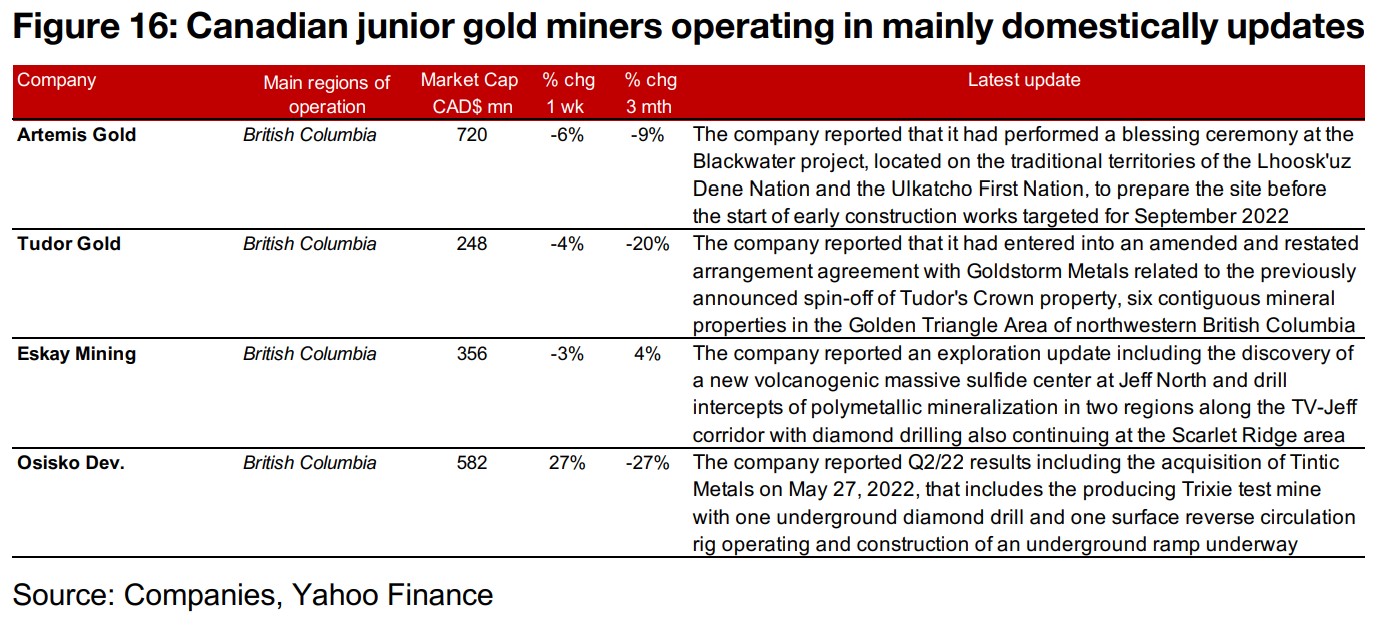

markets (Figure 14). For the Canadian miners operating mainly domestically, Artemis

completed a blessing ceremony at its Blackwater project, located on traditional

territories of the Lhoosk'uz Dene Nation and the Ulkatcho First nation. Tudor Gold

entered into an amended and restated arrangement agreement with Goldstorm

Metals for the Crown Property, Eskay Mining reported on exploration update on the

Eskay project and Osisko Development reported Q2/22 results including its

development of the Trixie mine, part of its acquisition of Tintic Metals. (Figure 16).

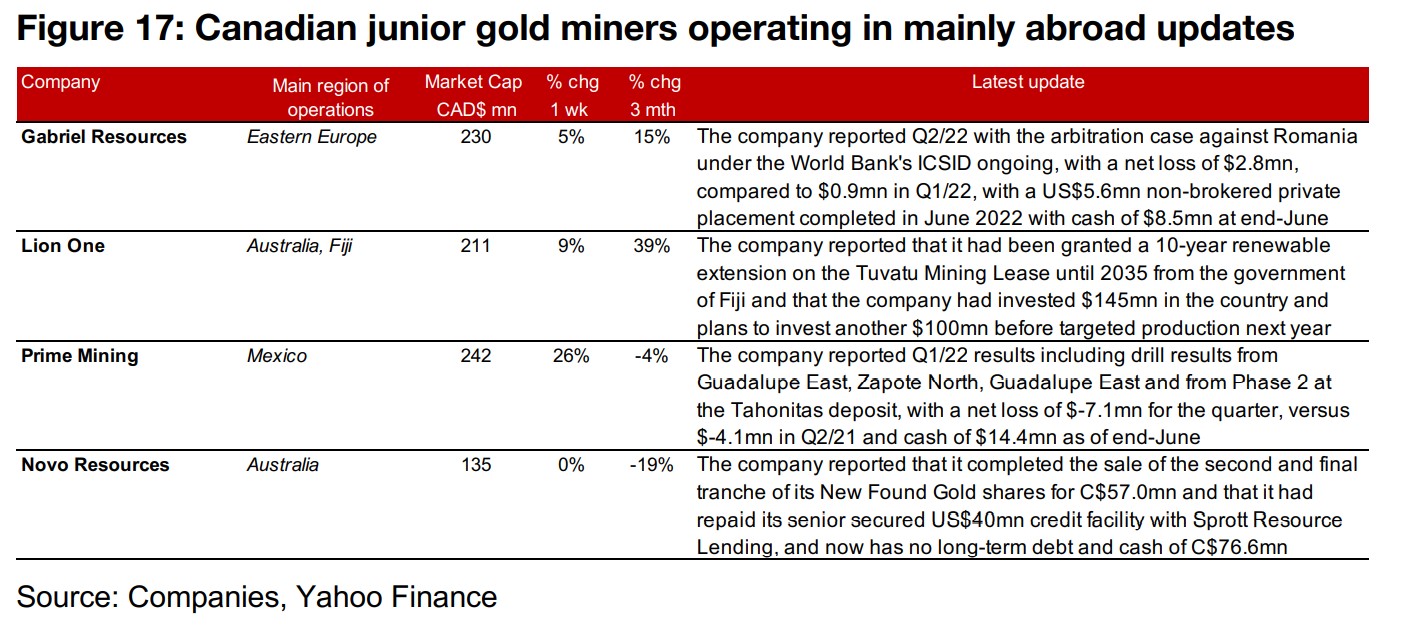

For the Canadian juniors operating mainly internationally, Gabriel Resources reported

Q2/22 results with a focus on its arbitration case in Romania, Lion One was granted

a 10-year extension on the Tuvatu Mining Lease from the government of Fiji, Prime

Mining reported its Q2/22 including a series of drill results and Novo Resources

completed the C$57mn sale of the second and final tranche of its New Found Gold

Shares, and repaid its $40mn credit facility with Sprott Resource Lending (Figure 17).

Disclaimer: This report is for informational use only and should not be used an alternative to the financial and legal advice of a qualified professional in business planning and investment. We do not represent that forecasts in this report will lead to a specific outcome or result, and are not liable in the event of any business action taken in whole or in part as a result of the contents of this report.