April 23, 2021

Gold starting to come back as yields ease

Author - Ben McGregor

Gold price continues to rise as 10-year US yield slides

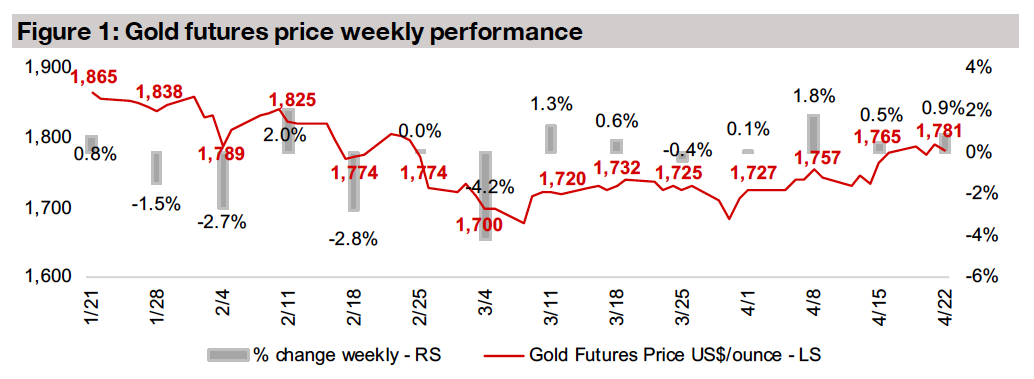

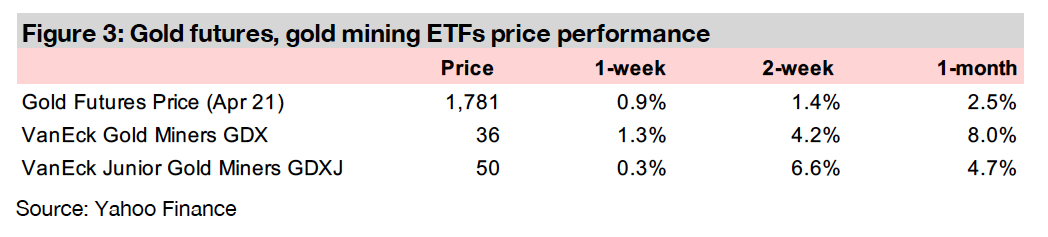

The gold price rose 0.9% this week to US$1,781/oz, its highest level in two months, as U.S. bond yields continued to ease even as inflation has jumped, and we expect that gold will continue to be driven by inflation, regardless of movement in yields.

A look at mining ETFs shows relatively limited choices

This week we look at the range of mining ETFs, with gold having the widest variety, silver with a few and other metals with only one or as part of an aggregate ETF, with investing directly in miners required to get specific exposure to many segments.

Canadian juniors having mixed reactions to gold year-to-date

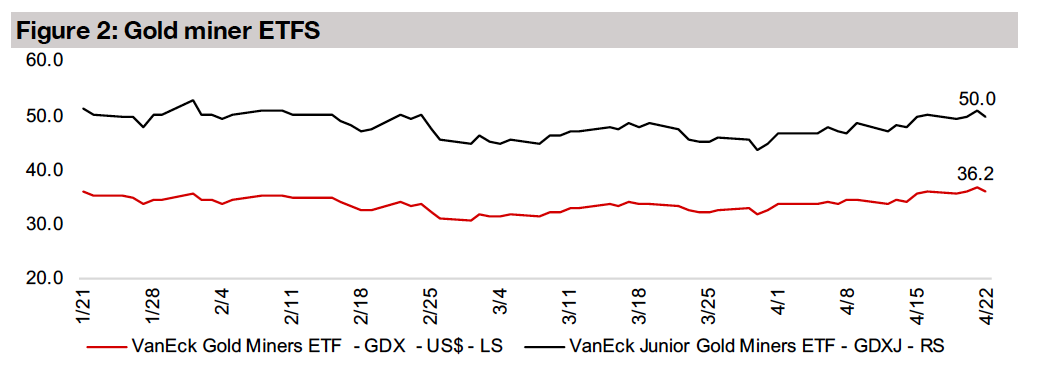

The gold producers rose 1.3%, juniors edged up 0.3% and Canadian juniors were mixed. The major Canadian gold juniors have had a mixed reaction to the gold price decline to early March 2021 and subsequent recovery, which we highlight this week.

1) Gold price heading back up on declining yields

Bond yields continued to move the gold price this week, with an easing in the U.S.

10-year yield to just 1.554%, after peaking at 1.75% on March 31, 2021, driving gold

up to a peak of US$1,792/oz, and it closed the week at US$1,781/oz, its highest

levels in two months. We have addressed the relationship between the gold price and

bond yields at length in our recent weeklies, and shown there is little proof of a

historical relationship between U.S. bond yields and the gold price. Nonetheless, this

is the driver the market is focusing on now, for better or worse, and therefore it is not

be ignored, and any further easing will likely continue to be good for the gold price.

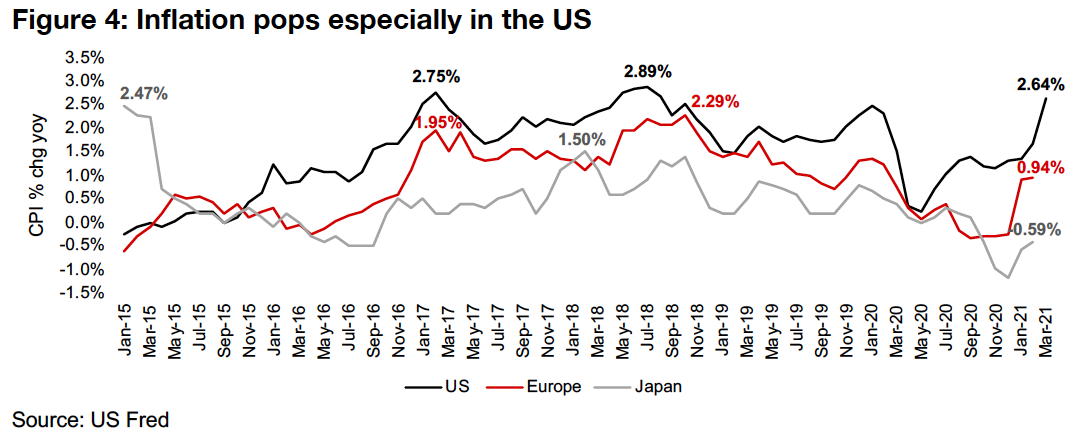

However, we are seeing some recent disconnection between this story, which had

yields rising on a jump in inflation expectations, and the current data, with U.S.

inflation spiking to near pre-crisis levels of 2.64% (Figure 4), but yields falling in recent

weeks. And while Europe and Japan have not seen spikes in inflation to over a fouryear

peaks as in the U.S., inflation has picked up significantly from trough levels

reached during the 2020 crisis, and the data is only available to February 2020. Surely

such a spike in inflation should be driving up yields further, if market behavior was

consistent with the inflation-driving-yields story. Our research shows the same lack

of clear connection between these drivers over the medium and long-term also.

However, taking out the middle-man of bond yields in this argument, we can consider

the direct relationship between rising inflation and gold, with gold indeed historically

a strong inflation hedge. The rise in gold thus makes more sense, as it would be

driven directly by inflation, regardless of yields. Behind this rise in inflation has been

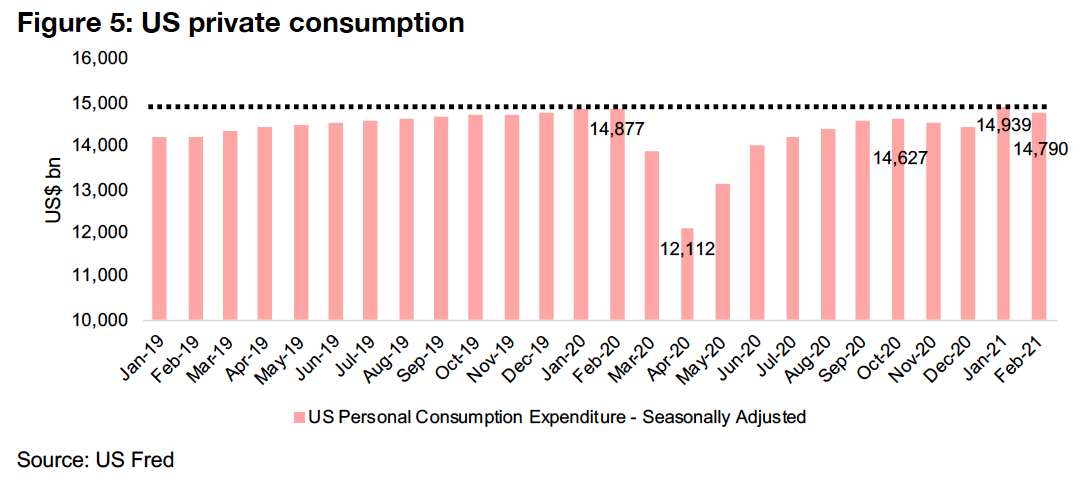

a rebound in personal consumption spending in the U.S. to back near pre-crisis levels,

reaching $14.9trn in January 2021 and down slightly to $14.8trn in February 2021,

compared to $12.1bn at the depths of the crisis in April 2020, and $14.9trn in

February 2020 just prior to the crisis (Figure 5). This in turn has been driven by the

U.S. government's epic monetary and fiscal pump, which have clearly brought back

demand, however artificially stimulated it may be. If this monetary expansionpropelled

rebound continues we could be seeing just the start of a major inflation

surge, which should drive gold substantially. Importantly, the collapse in gold from

2012-2018 was driven by growth without inflation, which is historically very rare.

What is really affecting bond yields in our opinion is not so much a bullish 'inflation is

picking-up because demand is recovering' bullish story, but rather a more bearish

supply-side story, with more bonds issued than the market is demanding, driving

down prices, and up yields. It is hardly a case where an underlying fundamental pickup

in demand is making money relative scarce and driving up rates, and in fact is

likely entirely due to monetary shenanigans, which tend to eventually culminate in

inflation, and often hyperinflation. Such scenarios would certainly be bullish for gold.

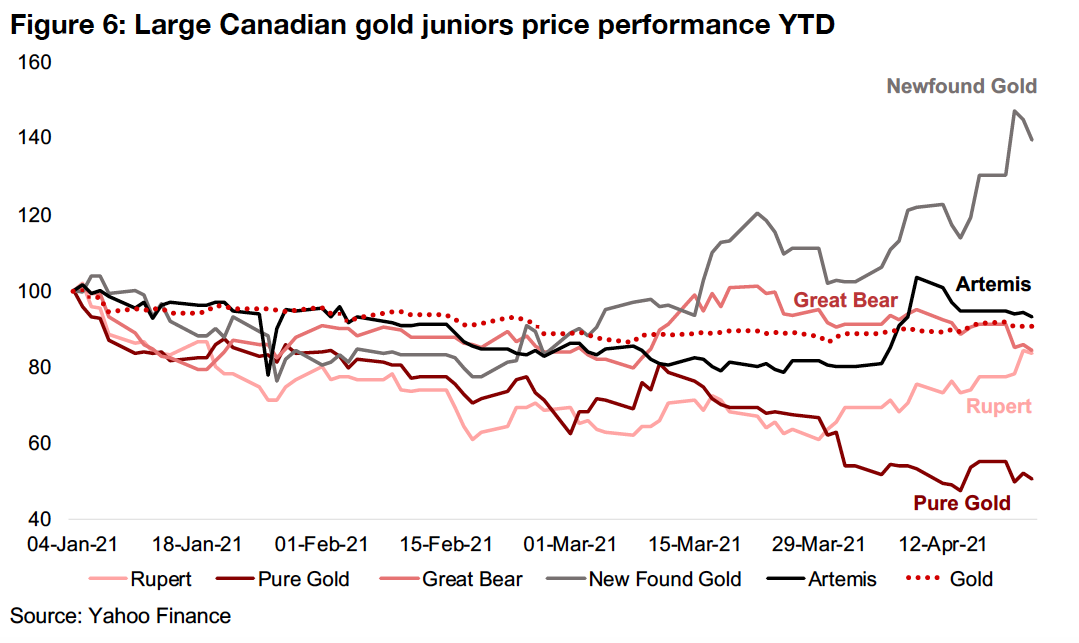

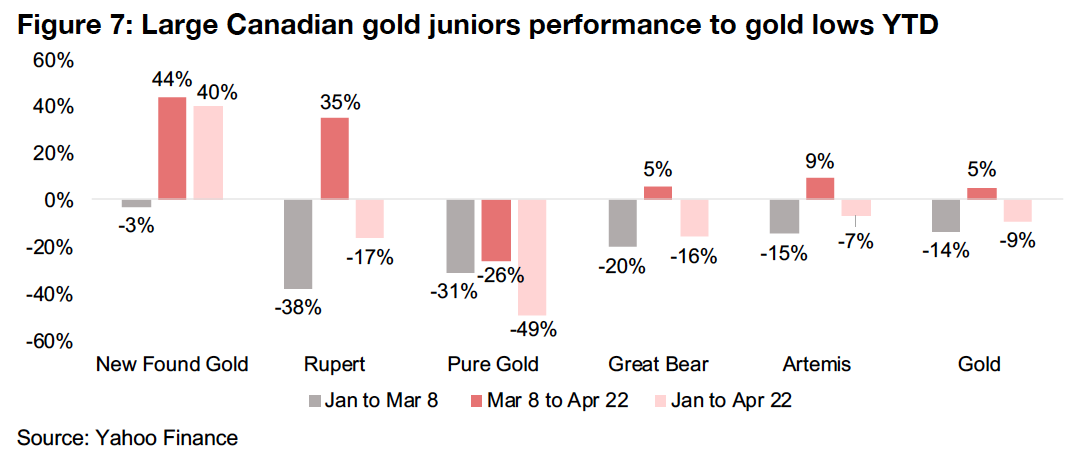

2) Junior gold performance on gold dip and recovery

The performance of gold juniors as gold dips and recovers With the gold price dipping in 2021 until early March, and then recovering since, this gives an opportunity to see how the larger Canadian gold juniors are leveraged to the gold price on both down and upside and how much company specific factors may be overriding the effect of just the gold price. We look at the performance of the five largest gold juniors listed on the TSXV, Rupert Resources, Pure Gold Mining, Great Bear Resources, Artemis Gold and New Found Gold versus the gold price in Figures 6 and 7. Gold has declined -9% YTD, falling -14% to lows of US$1,678/oz on March 8, 2021, and then recovering 5% from that date to April 22, 2021. We measure the performance of companies from these dates to see how they moved in relation to the gold price fall and rebound, with only Newfound Gold actually seeing gains year-todate, and all the others falling by varying levels.

Newfound Gold shrugs off gold with strong drilling results: Clearly New Found

Gold has had company specific drivers far outshadowing the effects of the gold price,

declining only -3% to March 8, and then surging 52% since then, as it has continued

to report an impressive series of drilling results from the Keats Zone of its Queensland

project in Newfoundland. We saw a similar ramp up last year in several names in the

group, including Rupert Resources, up 657%, Pure Gold, up 219% and Great Bear

up 93%. However these are all down -17%, -49% and -16% YTD in 2021, showing

that eventually gains from strong drill results do reach a point of diminishing returns.

Nonetheless, Newfound Gold may still have to room to gain from its current program.

Rupert Resources seeing particularly strong leverage to gold: While Rupert was

the star outperformer of this group in 2020, shooting up 657%, it has proven quite

leveraged to gold price moves this year, plunging -38% to March 8, but then shooting

back up 35% for an overall drop YTD of -17%. This suggests that the very strong

drilling results over the past year from the Ikkari zone of its Pahtavaara project in

Finland, which have continued into 2021, may have been largely priced in by the

market, leaving gold as the likely main driver.

Pure Gold sees a dip in the transition to junior producer: Pure Gold, which is the

only one of this group that has shifted to the early stages of production, with first gold

poured at the very end of 2020, is down the most, by -49%, as it fell -31% to March

8, but continued to decline another -26% to the present even with gold rebound. This

will partly be because while the company is on track to production, there has been

limited recent exploration news suggesting any further major expansion of the project

from the current resource. This type of decline can happen with junior explorers in

the shift to production, as the hope built into the share price that a project still under

exploration could still surprise to the upside gives way to the reality of what is going

to actually be developed as production looms. On other hand, however, there is a lot

to be said for downside protection from a company nearing production with imminent

cash flow, in contrast to juniors full of promise but with limited cash. There is plenty

of room now for Pure Gold to gain on a rise in the gold price as it transitions to junior

producer, and with much less risk than a junior still in the earlier exploration phases.

Great Bear sees moderate dip and recovery: Like Rupert, Great Bear is another

explorer which saw particularly stand-out drill results over 2020 and which has carried

over into 2021, but has seen a relatively weak share price this year, even after gaining

93% in 2020. Compared to Rupert, however, its decline and rebound have been

relatively muted, with it dipping -20% to March 8, and then rebounding 5% to April

22 for a total decline -16% year-to-date. Great Bear has shown strong continuity and

decent grades at its project, but has still not released a mineral resource estimate as

it looks to expand the project as much as possible before 'locking-in' the value with

such an announcement, which the market tends to fix as a benchmark for project.

Artemis Gold moderately surpasses gold YTD: Artemis Gold, which operates the

Blackwater Project in British Columbia has surpassed gold this year, declining -15%

to March 8, but then rebounding 7% since, to leave it down -7% for the year,

compared to -9% for gold. It has held up reasonably well given the very advanced

stage of Blackwater, with the most recent announcement that the company had

secured a $360mn to finance the project. Debt financing shows market confidence in

the company, as it suggests that lenders are expecting to see the return of their

underlying capital, implying that the company will operate for many years to come.

This contrasts with the entirely equity financing usual in early stages, where investors

are aware that their capital may not be returned if exploration is unsuccessful.

3) A look at the mining ETFs

A range of ETFs, but limited ability for concentrated exposure

This week we look at most of the major mining ETFs, as these are an option for

investors who would like some wider exposure to the sector, but may not want to dig

around for individual junior mining stocks. There is a decent range of ETFs available

for the sector, but there are significant limits compared to the flexibility of investing in

individual miners, where investors can choose the specific exposure they want to a

metal or a combination of metals, in the country or mining district they prefer, and at

the stage of development they prefer, from early exploration to a mine on the verge

of production. The ETFs, in contrast, being always a mix of holdings, provide only a

moderate level of choice and specification.

Gold has widest range, silver some, and other metals limited ETFs

The biggest range of mining ETFs is focused on gold, with six major ETFs, three each

for seniors and junior, while silver has three, two for senior miners and one for juniors,

and only a few other metals have a specific mining ETF, including copper, lithium and

uranium. Rare earth metals have a single mining ETF and other important metals have

no individual ETFs. However, for all of these metals, there are individual mining

companies who concentrate on them specifically, so direct exposure is available

outside of the diversifying effects of ETFs, which can certainly reduce risk, but also

curb potential returns for risk takers. While most of these metals do have ETFs that

track the price of the metal directly, they are not comprised of mining companies.

Therefore they do not provide the high leverage miners have to metal prices, with

companies seeing almost entirely profit past a high fixed cost/unit hurdle, with

variable costs very low. Of course, this also works to the downside, with profitability

eroded significantly as metals prices fall below this cost/unit.

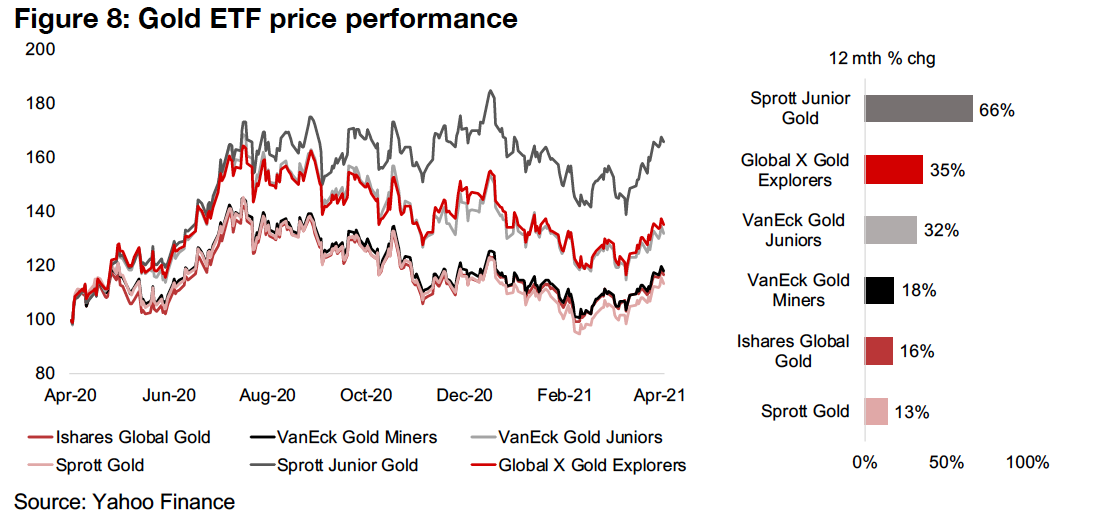

Gold has the widest selection for mining ETFs

For the mining ETFs, gold has the widest variety of choice, with a range of both senior

and junior gold ETFs. The best performing have been the junior gold mining ETFs

over the past year, given the strong leverage these stocks have to the gold price,

many of which are undervalued and therefore have more room to jump as gold rises

compared to seniors and their less risky profiles. Sprott's junior gold has done the

best, up 66%, and with its weighting towards a relatively small group of earlier stage

juniors. Global X Gold explorers, up 35%, and VanEck Gold Juniors ETFs , up 32%,

have performed roughly inline with each other, as these both comprise large junior

producers and explorers (Figure 8). The other three ETFs shown in Figure 4 are senior

gold mining ETFs, with VanEck's Gold Miners ETF, up 18%, and Ishares Global Gold,

up 16%, having similar returns, given a similar composition of mining stocks

underlying them, while Sprott Gold ETF, up 13%, has the lowest gain of the group.

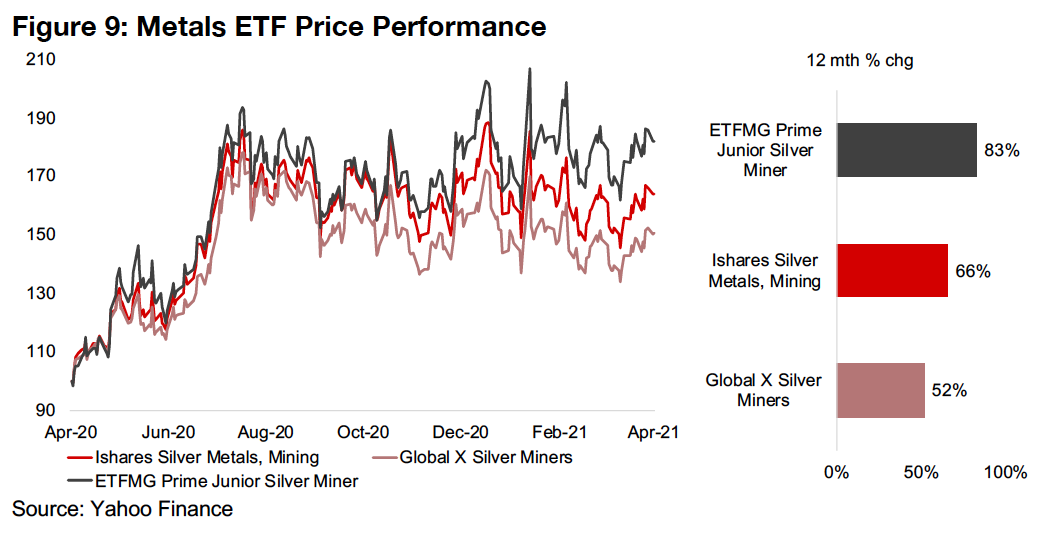

Silver mining has three ETFs, other segments only one (or none)

There are three main larger silver mining ETFs, two for senior miners globally and one for junior miners. The silver mining ETFs as a group have clearly outperformed the gold ETFs, with only the Sprott Junior Gold ETF, which is weighted to quite risky companies, and therefore has seen a high return, seeing gains as high as the silver ETFs. The ETFMG Prime Junior Silver Miner has been the stand-out, which like Sprott junior gold has a high risk-high reward holding, up 83%, with the Ishares Silver Metals and Mining ETF gaining 66% and Global X Silver Miners up 52%, as the silver price has surged over the past year (Figure 9).

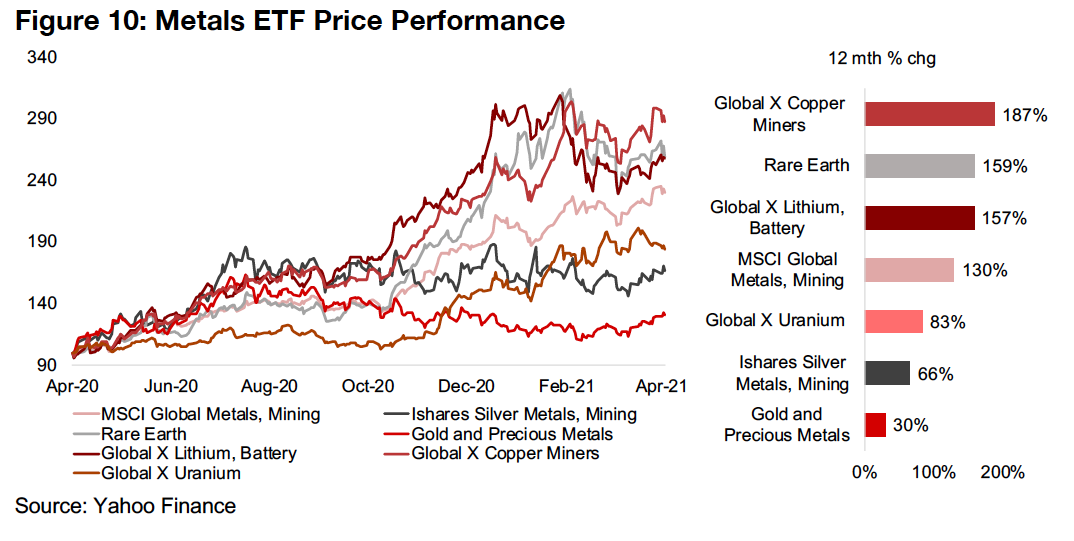

The more base, the better

While gold ETFs on the whole have done well over the past year, and silver ETFs have done great, the base and industrial metals mining ETFs have them both beat with outstanding gains. Most of the group is up over 100%, with the Global X Copper ETF up 187%, VanEck's Rare Earth ETF up 159% and the Global X Lithium and Battery ETF up 157% (Figure 10). If we take the MSCI Global Metals and Mining ETF, up 130% over the past year, as the benchmark for the global mining ETFs, base, industrial and rare metals have outperformed while silver and gold have lagged, despite seeing decent performances in absolute terms. Another 'laggard' versus the benchmark has been Uranium, which not necessarily heavily correlated with the overall economic and industrial cycle as other base and industrial metals, driven mainly by its use in nuclear power. The Global X Uranium Miners ETF has had an excellent absolute performance, up 83%, but it is relatively weak compared to the surge in base and industrial metals mining ETFs.

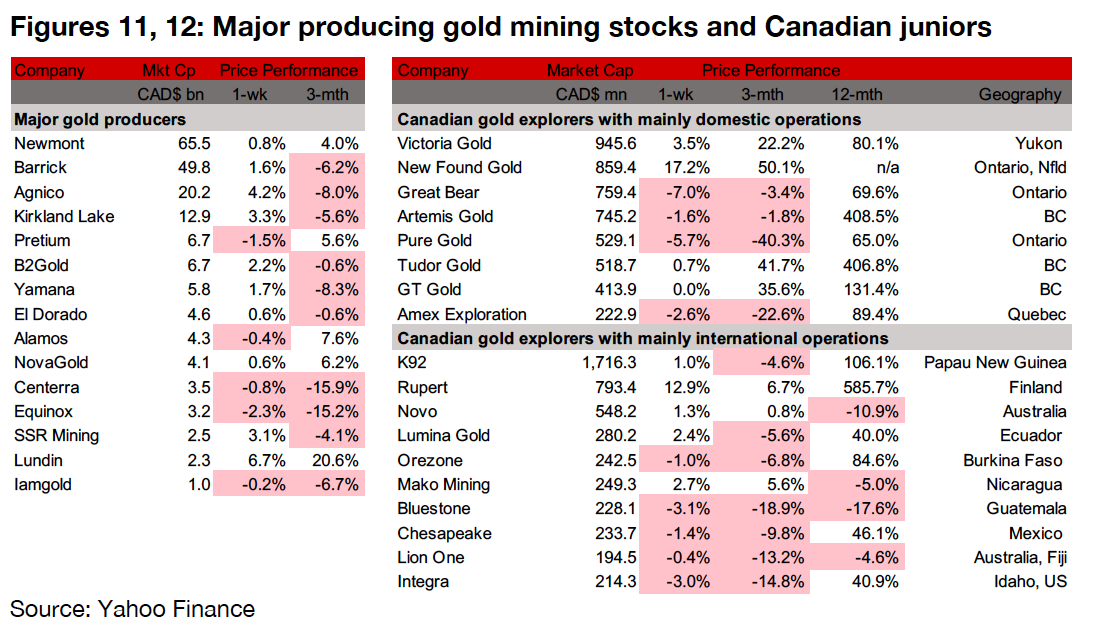

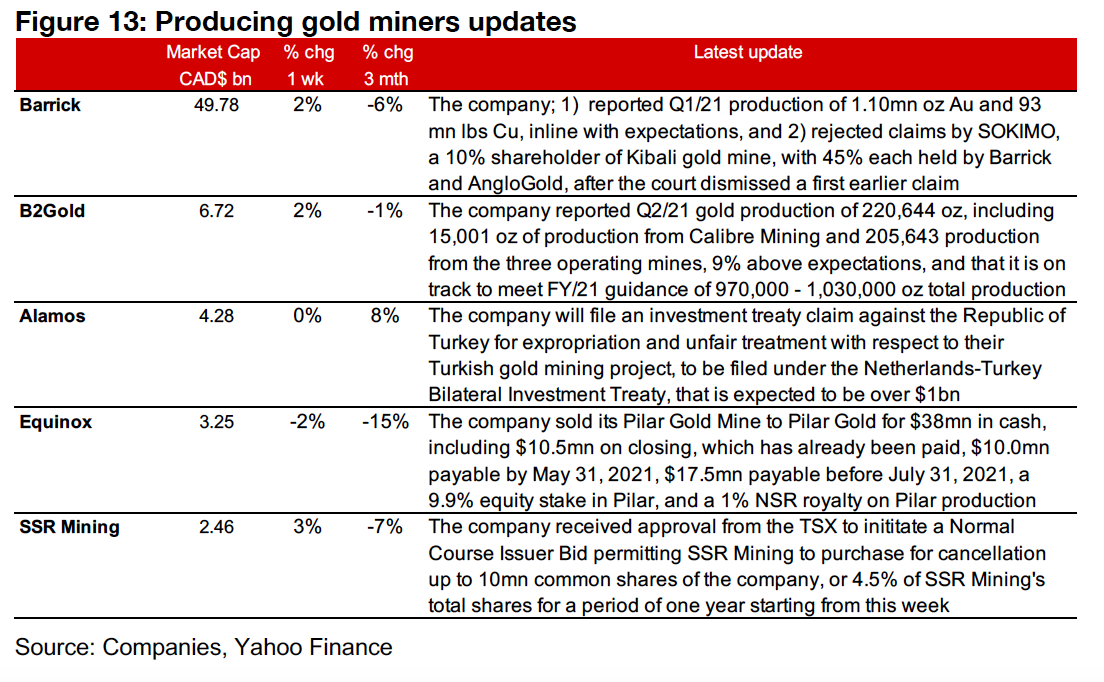

Producing miners mainly up on continued gold rise

Most of the gold producers were up this week as the gold price continued to gain (Figure 11). Barrick reported its Q1/21 production and rejected a court claim by stateowned company SOKIMO, its partner and 10% shareholder in the Kibali mine in the Democratic Republic of Congo, the second such claim after the first was dismissed (Figure 13). B2Gold also reported its Q1/21 gold production, Alamos filed an investment treaty claim against the Republic of Turkey for issues related to their Turkish gold mining project, and Equinox sold its Pilar Gold Mine to Pilar Gold for $38mn in cash, a 9.9% equity stake in Pilar and 1% NSR royalty on Pilar production.

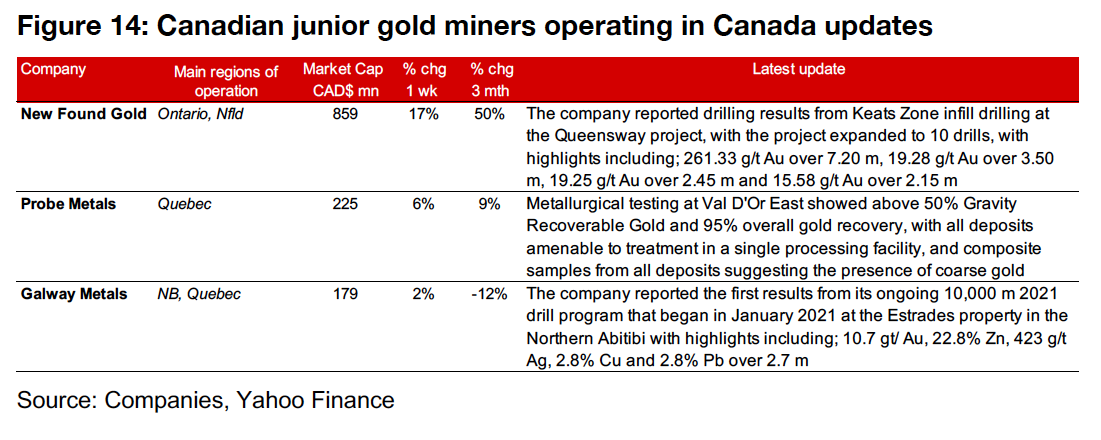

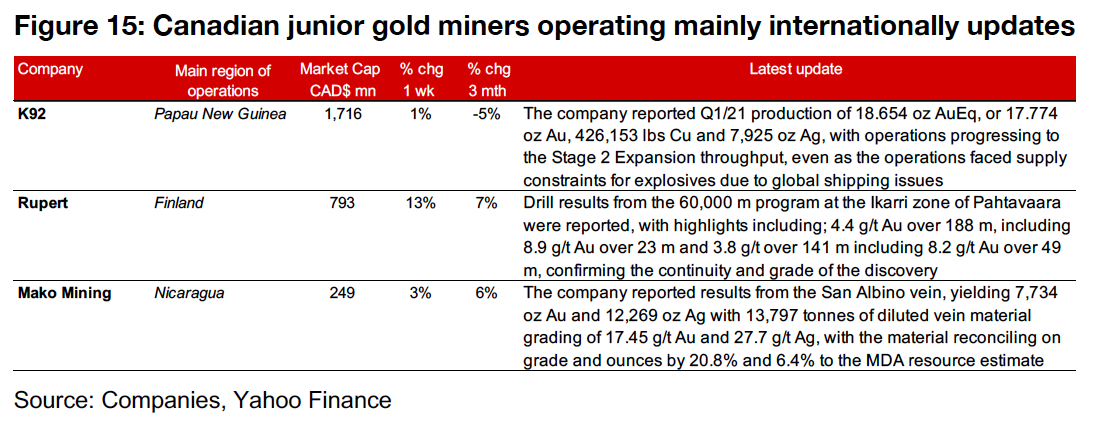

Canadian juniors mixed on company specific drivers

The Canadian juniors were mixed this week, partly on company drivers even as the gold price rose (Figure 12). For the Canadian juniors operating mainly domestically, New Found Gold reported drilling results from the Keats Zone at the Queensway project, Probe Metals reported metallurgical testing showing gold recoveries above 95% at the Val d'Or East Project, and Galway reported the first results from its 2021 ongoing 10,000 m drill program (Figure 14). For the Canadian juniors operating internationally, K92 Mining reported Q1/21 production, with operations progressing to the Stage Expansion, Rupert reported drill results from the 60,000 m ongoing program at the Ikkari zone of Pahtavaara and Mako Mining reported results from the San Albino vein (Figure 15).

Disclaimer: This report is for informational use only and should not be used an alternative to the financial and legal advice of a qualified professional in business planning and investment. We do not represent that forecasts in this report will lead to a specific outcome or result, and are not liable in the event of any business action taken in whole or in part as a result of the contents of this report.