December 09, 2024

Gold Stabilizes

Author - Ben McGregor

Gold market cools even as geopolitical turmoil continues

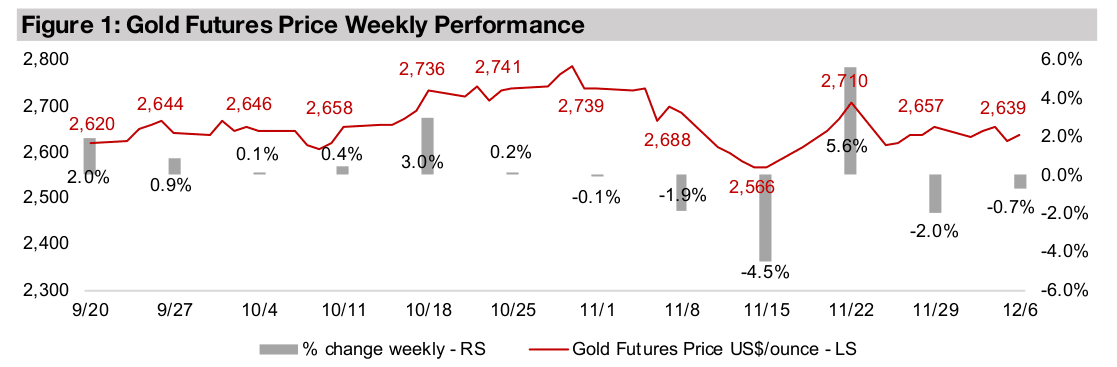

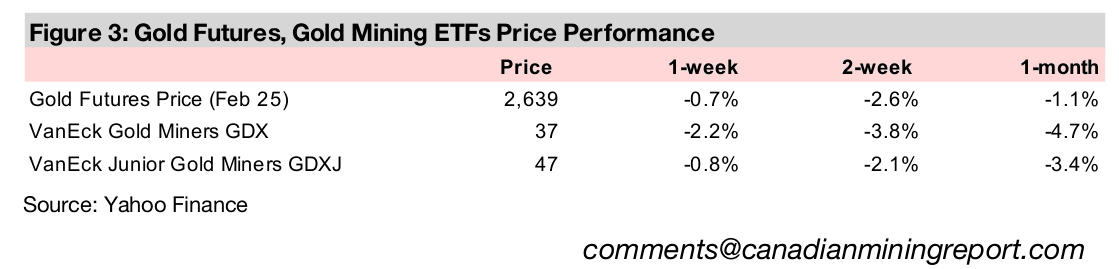

Gold declined -0.7% to US$2,639/oz, a subdued move showing some stabilization compared to the wild geopolitically-driven swings of the past month, even though international shocks continued this week in South Korea and the Middle East.

Gold Stabilizes

Gold declined -0.7% to US$2,639/oz, a quite subdued move and showing some

stabilization after the geopolitically-driven wild swings of the previous four weeks,

even as unprecedented international events continued. The two new shocks this

week were a very brief period of martial law in South Korea, which was followed by

protests and a vote that left the current government still in power, and the escalating

conflict in Syria. Evidently neither of these events were taken by markets to be as

critical for the gold price as the US elections results, Russian-Ukraine escalation or

Israel-Lebanon ceasefire which had driven a month of volatility for the metal price.

The biggest economic news was US jobs data, with nonfarm payrolls rising by 227k

in October 2024, ahead of expectations for 214k, while a 4.2% rise in unemployment

was line with consensus. While a risk-on move into large caps continued, with the

S&P 500 up 0.8% and Nasdaq jumping 3.8%, small caps declined with the Russell

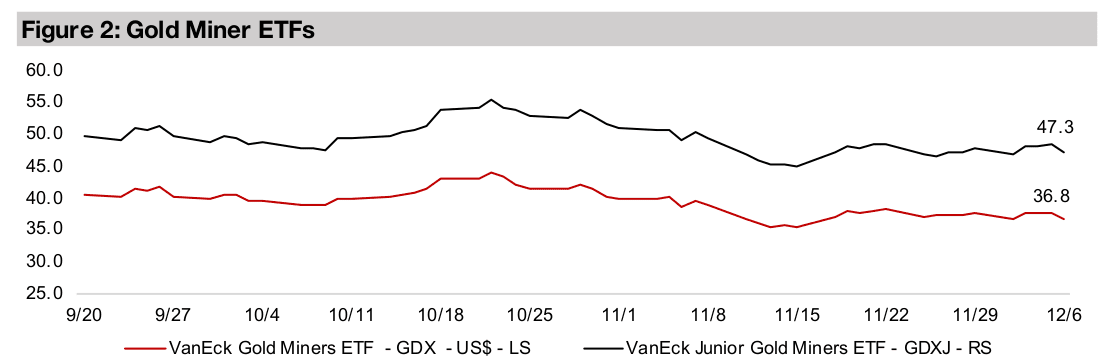

2000 off -1.2%. Large cap gold stocks declined on the pullback in the metal, with the

GDX dropping -2.2%, although junior gold outperformed even given the pressure of

a decline in small caps, with the GDXJ down just -0.8%.

Large TSXV gold valuations outpacing TSX Big Gold

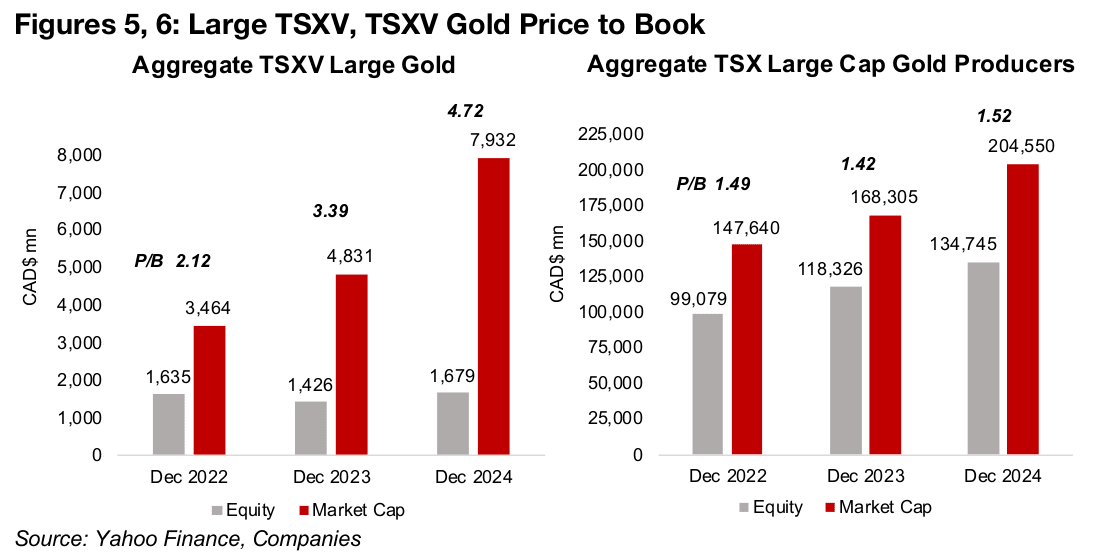

This week we look at the valuations of TSXV large cap gold and TSX Big Gold, with the price to book multiple of the former, rising to 4.72x currently from 3.39x at the end of 2023, significantly outperforming the latter, which is up comparatively moderately to 1.52x from 1.42x (Figures 5, 6). However, these TSXV large gold figures have been skewed up by a few companies, which are also some of the strongest in the sector currently, so they may not necessarily reflect the rest of the TSXV gold sector, where valuation gains may be more subdued.

For junior gold stocks, P/B is one of the only valuation measures that can be easily calculated and compared across companies over time. Measures like price/earnings are often not usable because many juniors have no earnings, and Price/NAV is very subjective to who is calculating it, versus the quite objective Price/Book. We can theoretically split a gain in a stock’s market cap between a rise in the book value, or equity, holding the P/B flat, or a rise in the P/B, holding the equity flat. The rise in the equity comes usually from increased earnings, and a rise in the P/B is an indicator of the market’s confidence in how much the equity can grow long-term. Most market cap moves are a combination of these two factors.

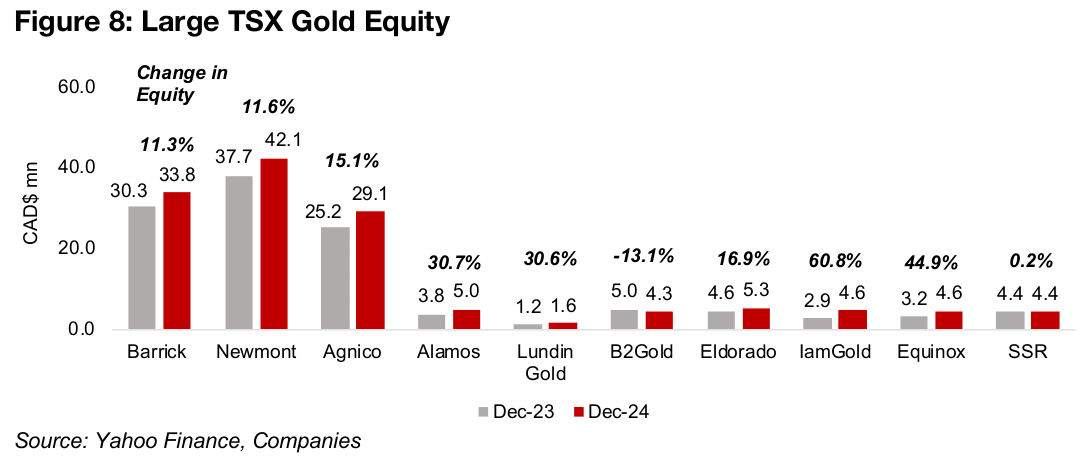

Largest giants weighing on Big Gold valuation gains

TSX Big Gold has seen a strong year operationally, with the equity of all the

companies expect B2Gold rising substantially. While the equity of sector giants

Barrick, Newmont and Agnico Eagle are all up well over 10%, this is only about half

or less the rise for many of the mid-tier Big Gold players. However, it is harder for

these larger companies to grow by high percentages given their much bigger

absolute sizes (Figure 8). The aggregate equity for the group has risen 13.9% to

CAD$137.7bn from CAD$118.3bn at the end of 2023.

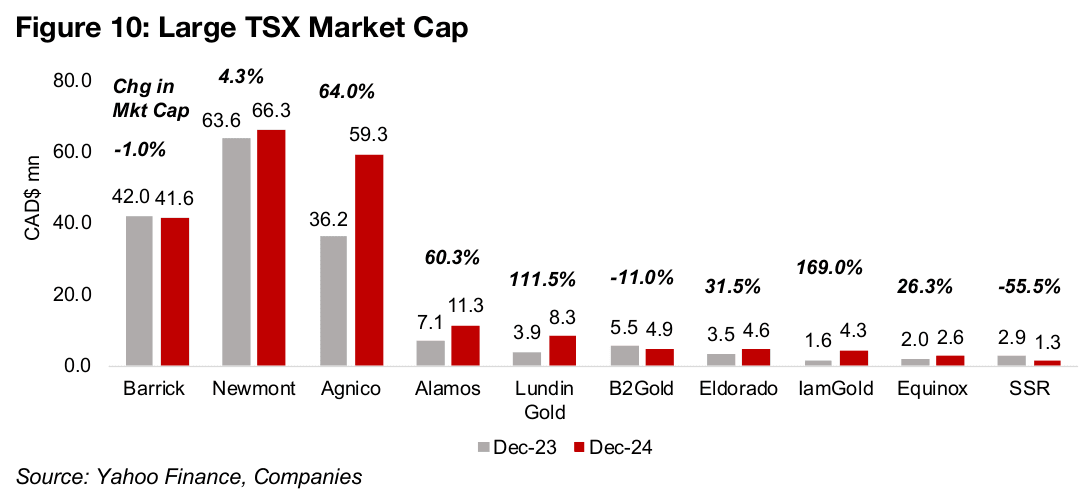

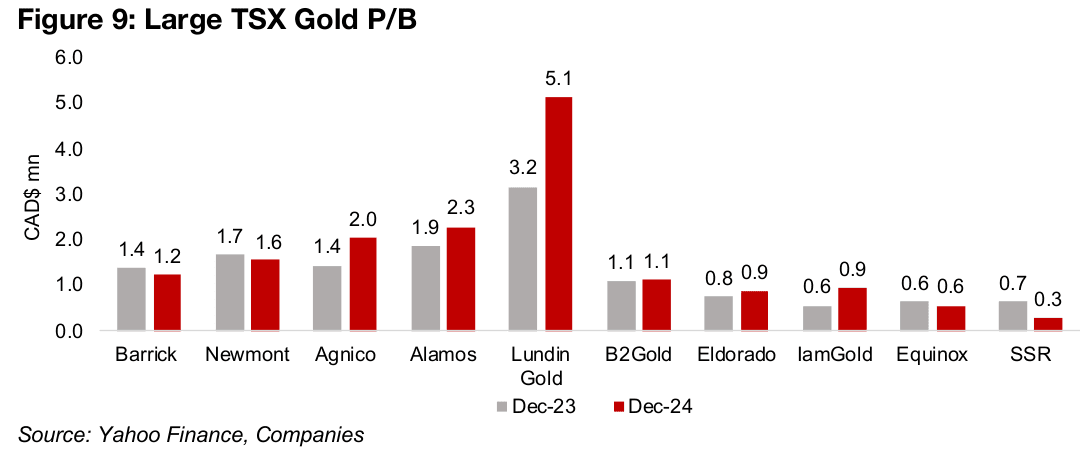

While the strong earnings growth this year has translated into higher price to book

multiples for most of the sector this year, the P/B of both Newmont and Barrick have

actually declined, which has been a drag on the sector aggregate P/B (Figure 9). This

partly seems to be on cost concerns, which was especially shown by a major decline

in Newmont’s share price after its Q3/24 results showed inflation in expenditure even

though earnings growth overall was still very strong. This decline in the P/B multiples

has driven a -1.0% decline in Barrick’s market cap this year and only a 4.3% rise for

Newmont, even in a huge year for the gold price. This contrasts with a surge in the

value of six of the ten TSX Big Gold companies between 26% and 169% (Figure 10).

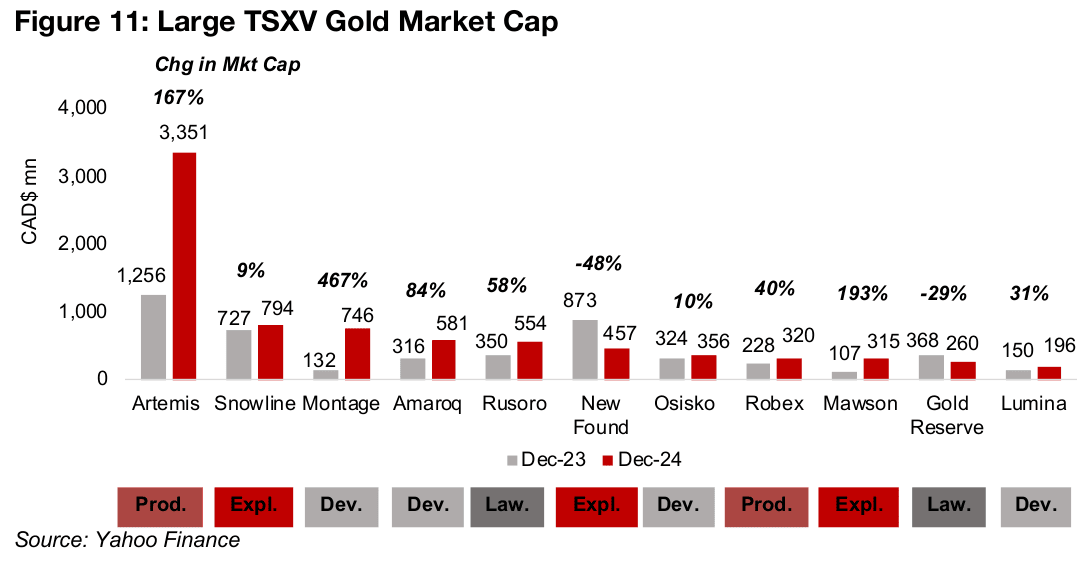

TSXV large gold gains overall, but a mixed story underneath

For TSXV gold, while overall there have been substantial gains in the aggregate

market cap, there is more of a mixed story underneath. First, most of the market cap

gain has been driven by just three stocks. Artemis Gold, which has reached first gold

pour for its huge Blackwater project in British Columbia, is by far the largest stock of

the group at CAD$3.3bn, and therefore its 167% market cap gain has obviously had

the largest effect on the aggregate (Figure 11).

The third largest stock, Montage, which has secured key permits and financing this

year for its Kone Project in Cote D’Ivoire, has also seen a large absolute gain in its

market cap to US$0.75bn, rising 467% this year. Offsetting both of these somewhat

has been New Found Gold, which is still at the exploration phase for its Queensway

project, and has seen a -48% decline in its market cap to CAD$457mn, even as it

targets an initial mineral resource estimate and PEA heading into 2025.

Amaroq, which has reached first gold pour for its Nalunaq project in Greenland, has

also seen a strong 84% gain in its market cap to CAD$581mn, as has Mawson, driven

by strong drill results from its 49% stake in Southern Gold, rising 193% to

CAD$315mn. The ‘lawsuit’ stocks Rusoro and Gold Reserve, which appear to be

coming towards the end of long-term arbitration cases with significant expected

payouts, but very limited ongoing exploration or development activities, have been

mixed this year. Rusoro’s market cap has gained 58% to CAD$554mn but Gold

Reserve’s valuation has declined -29% to CAD$260mn. Snowline, an early-stage

explorer at the Rogue project in the Yukon, and Osisko Development, mainly

advancing the large Cariboo project, but also two other smaller projects, have seen

moderate market cap gains of 9% and 10%, respectively, this year.

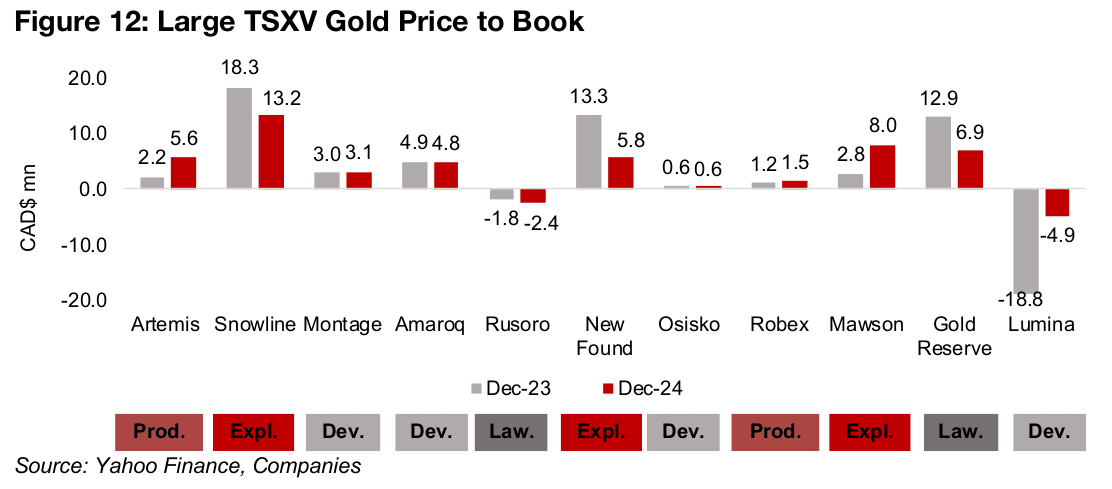

The big movements in price to book for the sector have been for Artemis, more than

doubling to 5.6x from 2.2x, and Mawson, rising to 8.0x from 2.8x (Figure 12). There

have been substantial declines for the two largest exploration stage companies,

Snowline, down to 13.2x from 18.3x, and New Found Gold, declining to 5.8x from

13.3x. This could partly be because the market has been more risk averse this year,

with increased interest in companies further along in the development process. Both

also had very strong gains in recent years based on their strong drill results, but the

markets may be now looking for delivery on their earlier promise through the

announcement of initial mineral resource estimates. Lumina Gold has seen its P/B

become less negative, reaching -4.9x from -18.8x, on market cap gains.

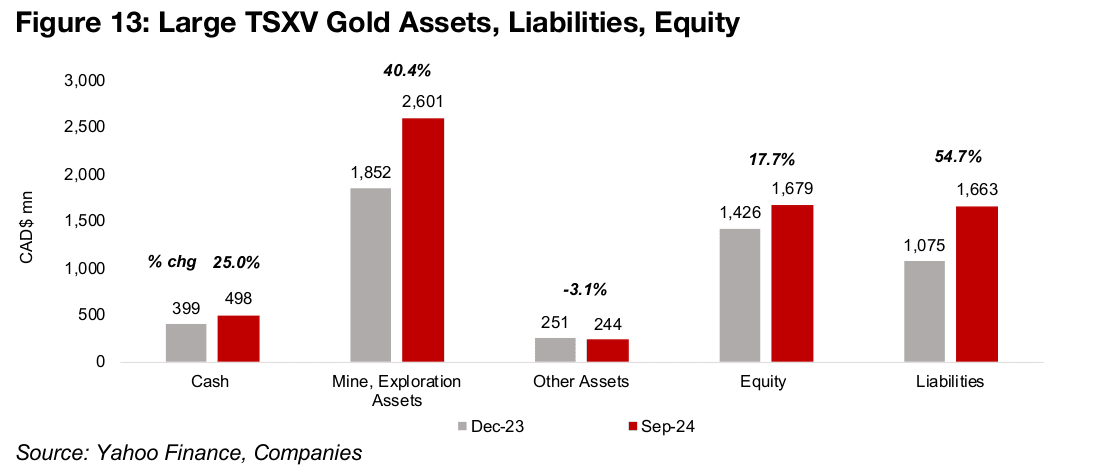

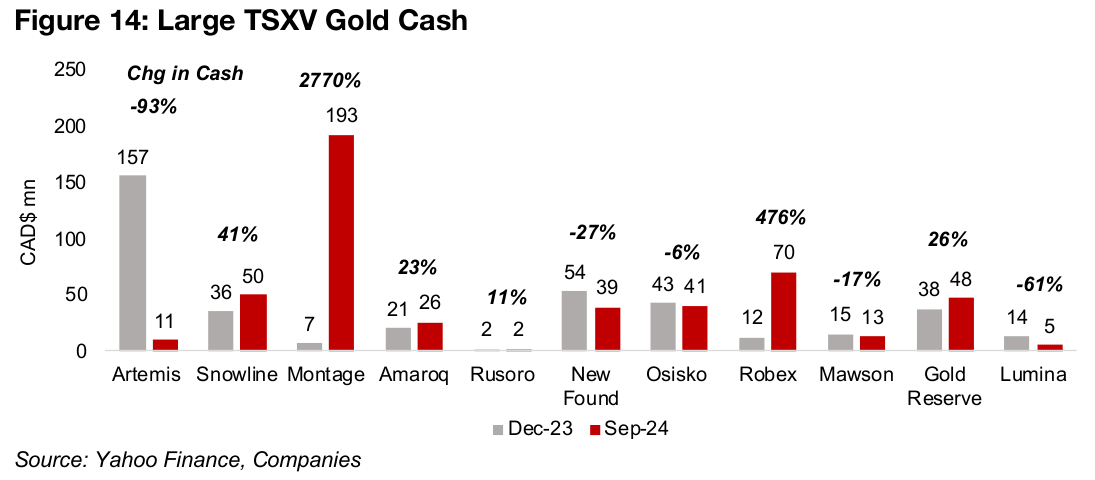

The TSXV gold sector has seen a substantial rise in aggregate cash, up 25.0%, mine and exploration assets, rising 40.4%, equity, up 17.7%, and liabilities, increasing 54.7% (Figure 13). A major decline in cash from Artemis of about CAD$150mn, from expenditure on its mine, was offset by a rise of around CAD$180mn from Montage on its capital raising (Figure 14). The rest of the rise in cash came mainly from Snowline Gold, up CAD$30mn on capital raising, and Robex Resources, increasing about CAD$60mn on cashflow generation from production and capital raising.

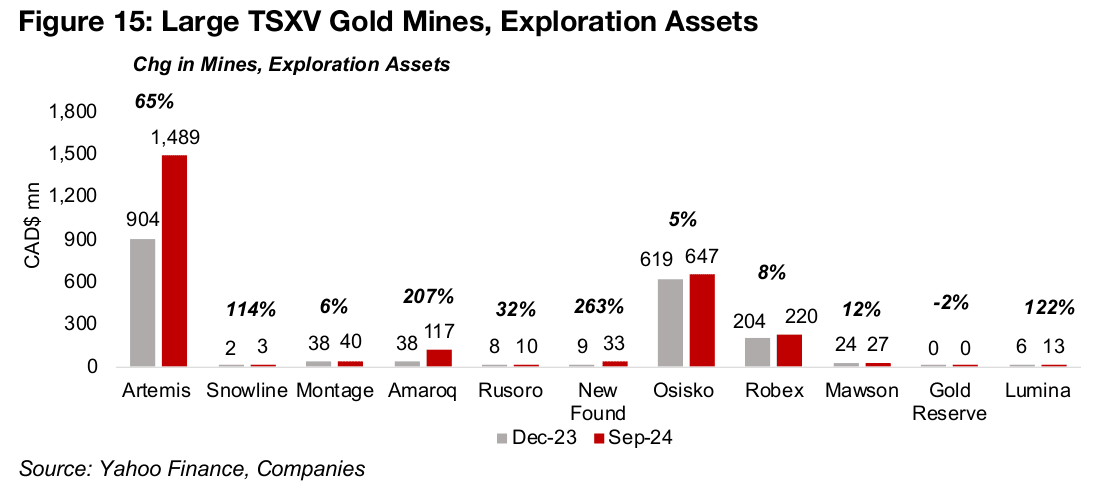

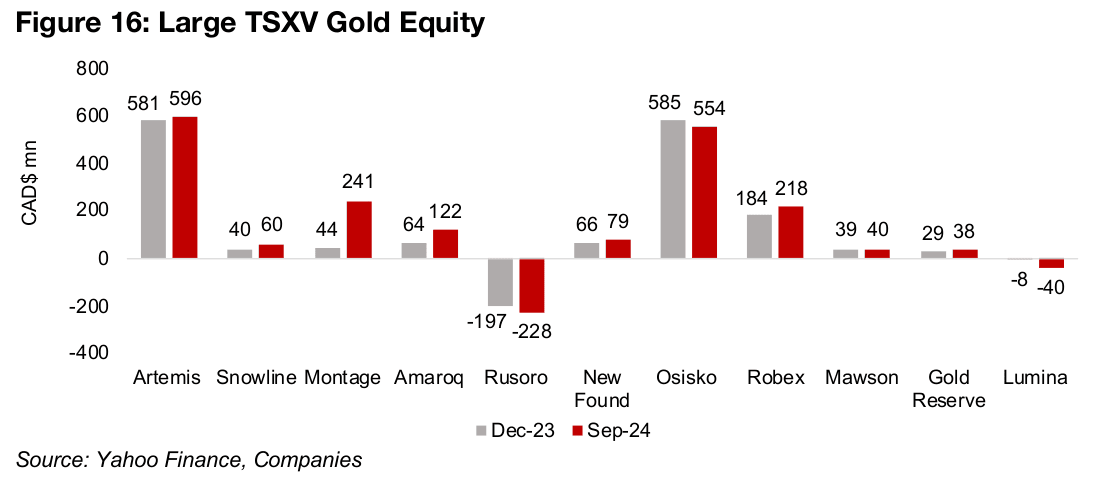

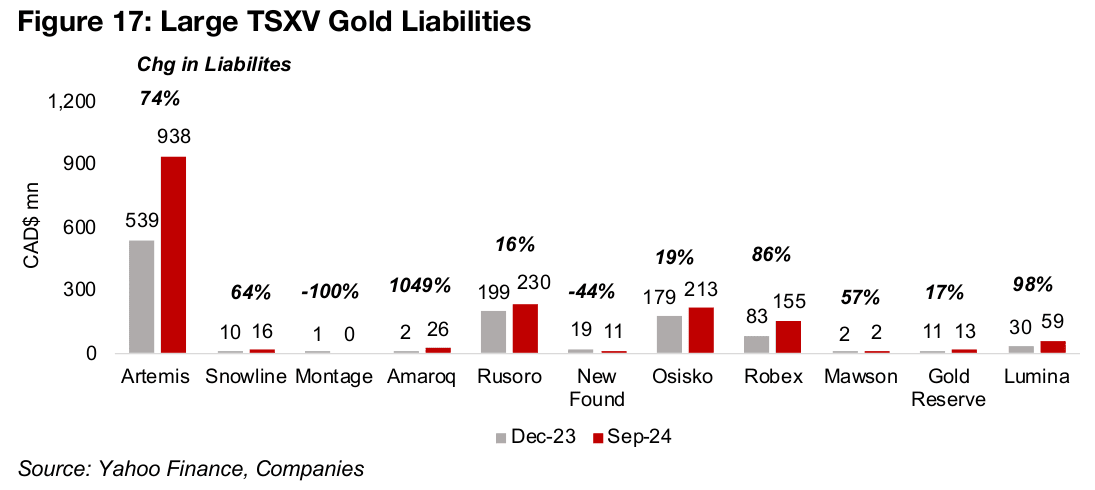

Most of the change in mines and exploration assets for the sector came from Artemis Gold, rising 65% to CAD$1.49bn (Figure 15). The equity for the sector was actually quite flat, with Artemis’ equity only edging up as the large rise in assets was offset by a 74% rise in liabilities to CAD$0.94bn (Figures 16, 17). The only other large contributor to aggregate sector equity was Osisko Development, largely because of the capitalization of exploration expenditure over many years. Many juniors expense exploration expenditure for a given year rather than capitalize it, so it does not accumulate as a large asset on the balance sheet over time.

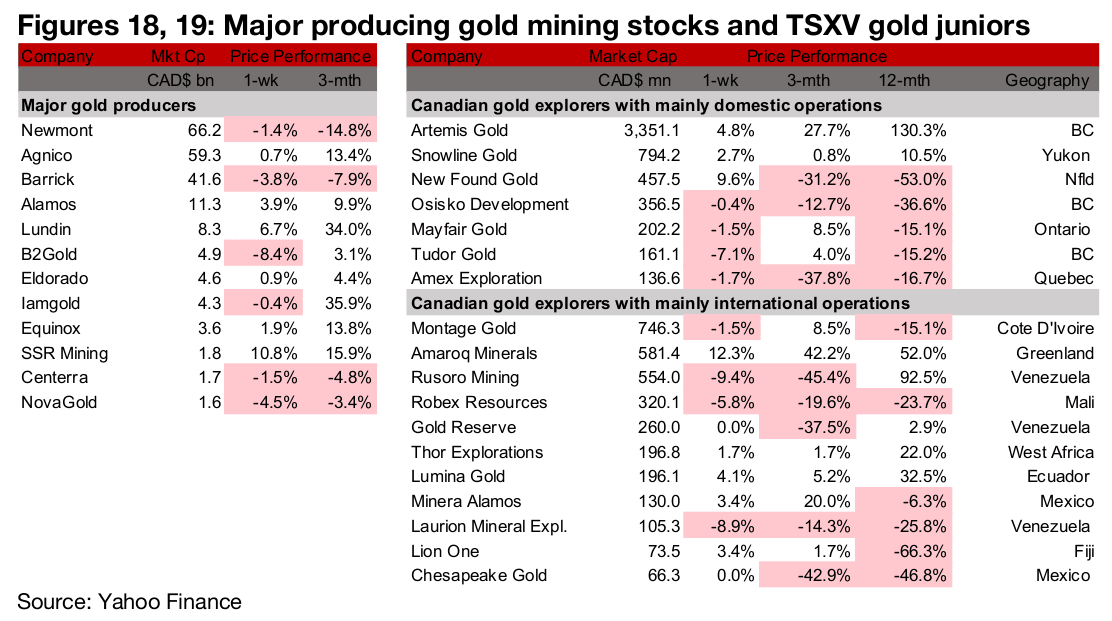

Large producers and TSXV gold mixed

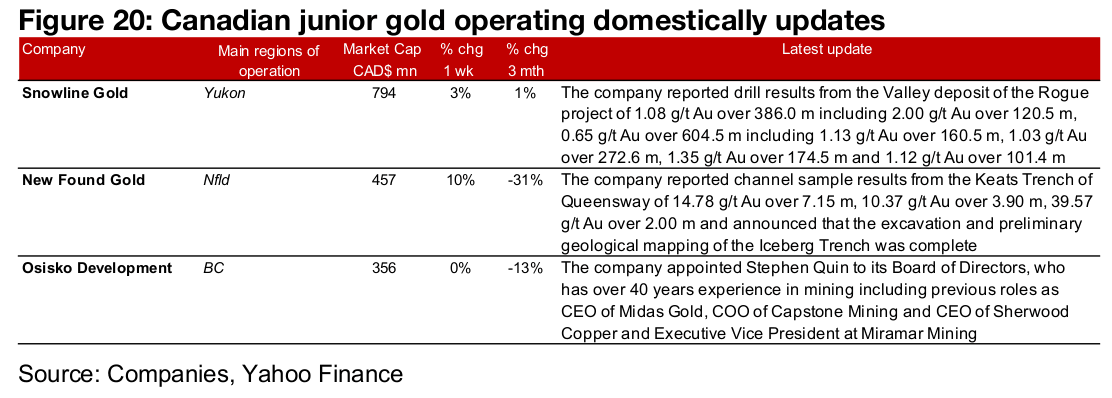

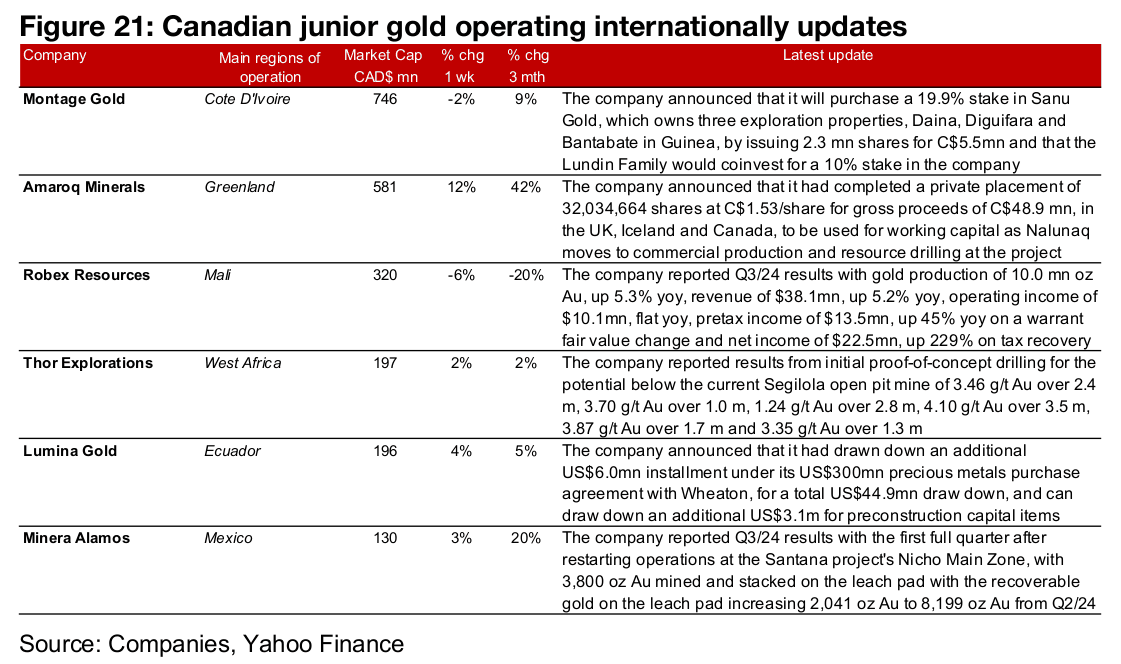

The large gold producers and TSXV gold were mixed as the metal price declined (Figures 18, 19). For the TSXV gold companies operating domestically Snowline reported drill results from Rogue, New Found Gold channel samples from the Keats Trench of Queensway and Osisko Development appointed a new Board member (Figure 20) For the TSXV gold companies operating internationally, Montage announced the purchase of 19.9% stake in Sanu Gold, Amaroq the completion of a private placement and Robex reported Q3/24 results. Thor reported drill results from Segilola, Lumina announced a US$6.0mn draw down from its precious metals purchase agreement and Minera Alamos reported Q3/24 results (Figure 21).

Disclaimer: This report is for informational use only and should not be used an alternative to the financial and legal advice of a qualified professional in business planning and investment. We do not represent that forecasts in this report will lead to a specific outcome or result, and are not liable in the event of any business action taken in whole or in part as a result of the contents of this report.