January 13, 2025

Gold’s Strong Start to 2025

Author - Ben McGregor

Gold jumps on strong US jobs data

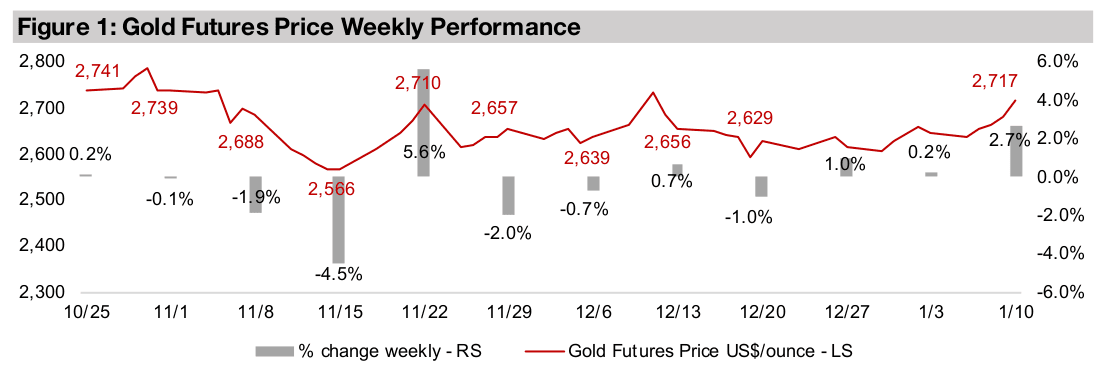

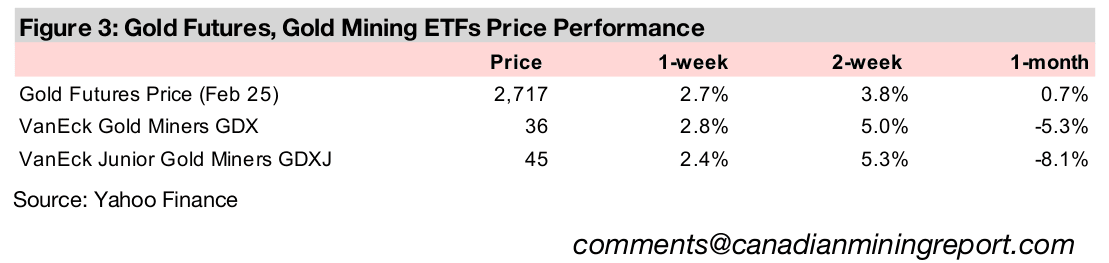

Gold rose 2.7% to US$2,717/oz, continuing a robust start to the year, as strong US jobs data diminished the market’s expectations for further cuts from the Fed especially after its warnings last year that the pace of rate reductions would slow.

Gold’s Strong Start to 2025

Gold rose 2.7% to US$2,717/oz this week and has had a strong start to the year. The

main economic news was US jobs data which came in reasonably strong, implying

inflationary pressure, lowering expectations for further rate cuts by the US Fed

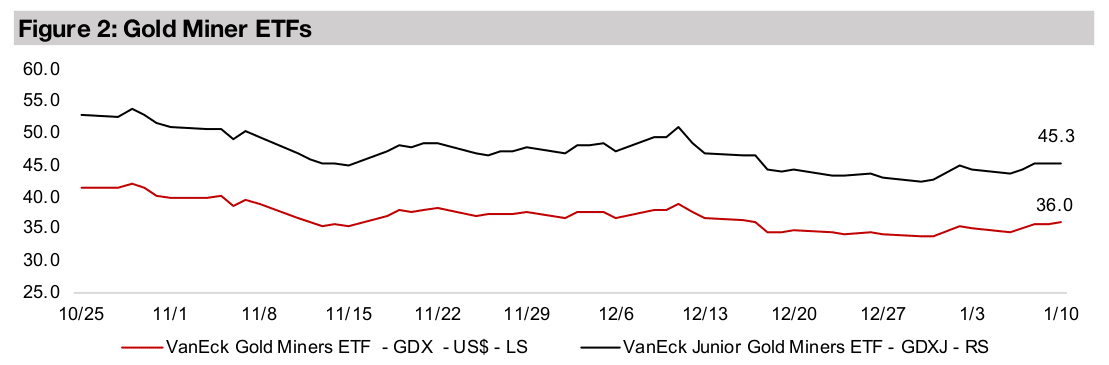

anytime soon and boosting the metal. Gold stocks gained, with the GDX up 2.8%

and rising GDXJ 2.4%, even as the broader equity markets declined, with the S&P

500 down -1.1%, Nasdaq off -1.2% and the Russell 2000 losing -2.3%.

Major underperformance of materials and energy versus tech continues

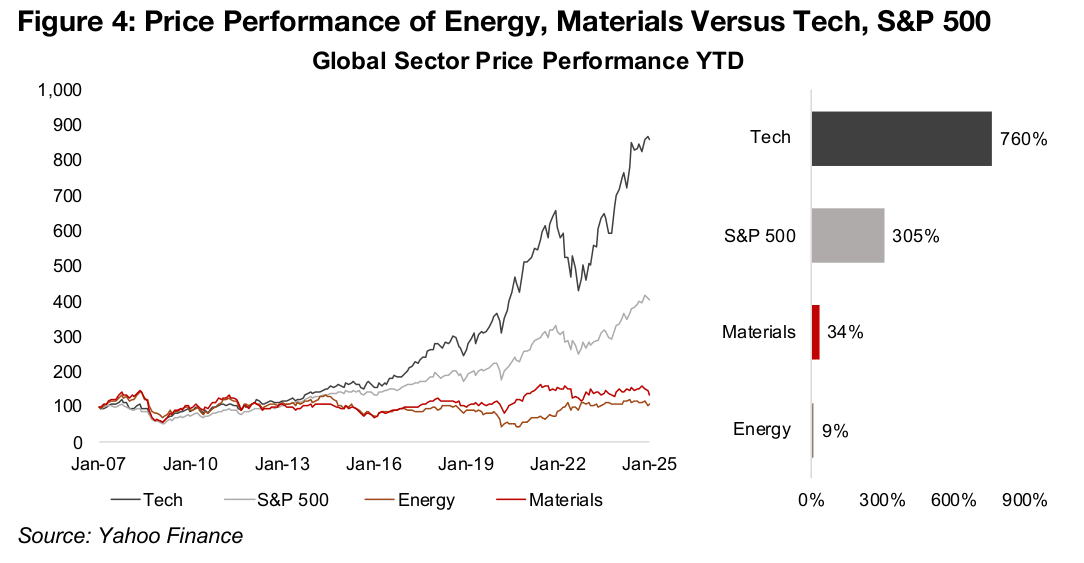

While the gold stocks have done reasonably well in recent years, the performance of

the global resources sector overall has remained subdued. From 2007 through to

2014, the performance of the iShares Global Materials ETF, which includes mining,

and the Global Energy ETF, had not been far out of line with the Global Tech ETF and

S&P 500. However, from around 2015 a large divergence began, with Tech now up

760% and the main factor in the S&P 500’s 305% gain, far outpacing Materials, up

just 34%, while Energy has made almost no gains, rising only 9% (Figure 4).

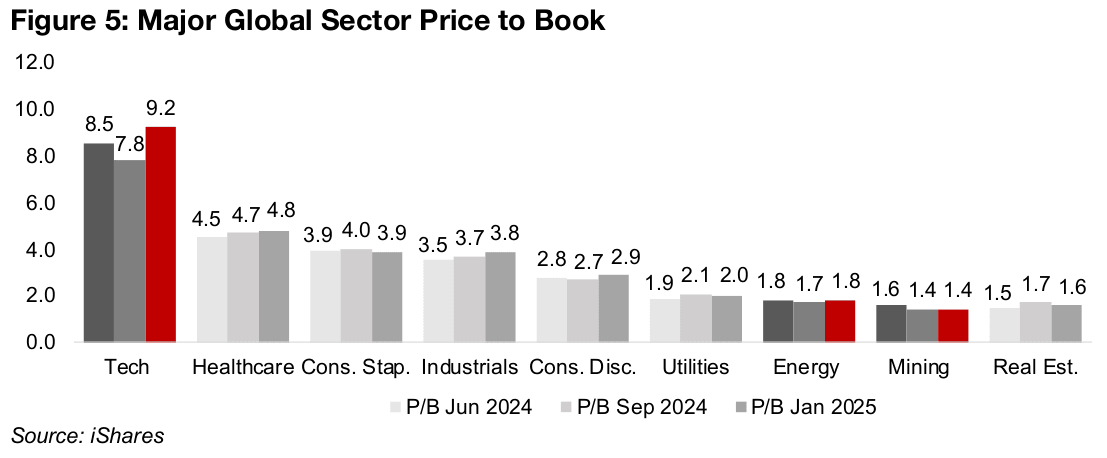

While part of this divergence has come from higher tech earnings versus materials

and energy, this does not fully explain the wide gap. Much of it also comes from a

huge rise in multiples for the tech sector not only compared to materials and energy,

but versus most major sectors. The Global Tech sector price to book (P/B) valuation

is currently at 9.2x, up from 8.5x in June 2024, and is about twice as high as any other

major sector (Figure 5). The Global Energy Sector P/B is just 1.8x, holding flat versus

June 2024, and the Global Materials Sector is just 1.4x, the lowest of all the major

sectors, and has actually declined over the past six months, from 1.6x.

This indicates that the market is pricing in not only the current high growth rates for

tech versus materials and energy, but that it expects this wide spread in earnings

growth to continue for an extremely long period. However, such a split could not

continue indefinitely, as the expansion of tech of course requires the products of the

materials and energy sector to grow. Such huge tech growth assumptions imply high

demand for these commodities, which should in turn correlate with higher multiples

for the companies in these sectors. Therefore, it appears like markets are continuing

to price in overly bullish expectations for tech and overly bearish expectations for

materials and energy and likely many other major sectors.

Another driver for the global resources sector could be an ongoing global political

shift towards more conservative leadership. Over the past decade oil and gas

especially have seen far less attention from governments than green energy sources.

However, new administrations in many countries seem interested in more of a

balance between new and traditional energy sources. Clearly the Trump

administration looks set to expand oil and gas production and exploration in the US,

which could see investment in the sector rise substantially versus recent years. There

are expectations for a similar shift in Canada this year, with a change in leadership

widely expected and investment in the huge oil and gas sector lacking in recent years.

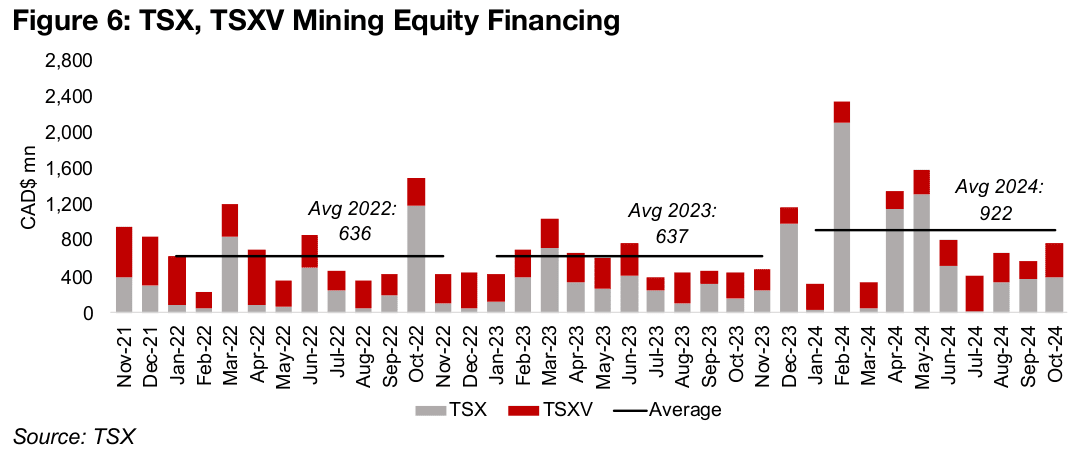

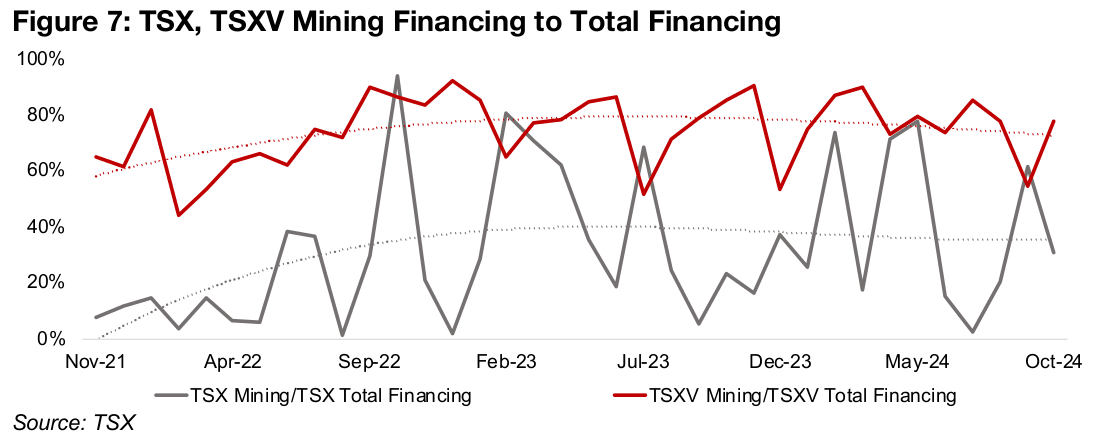

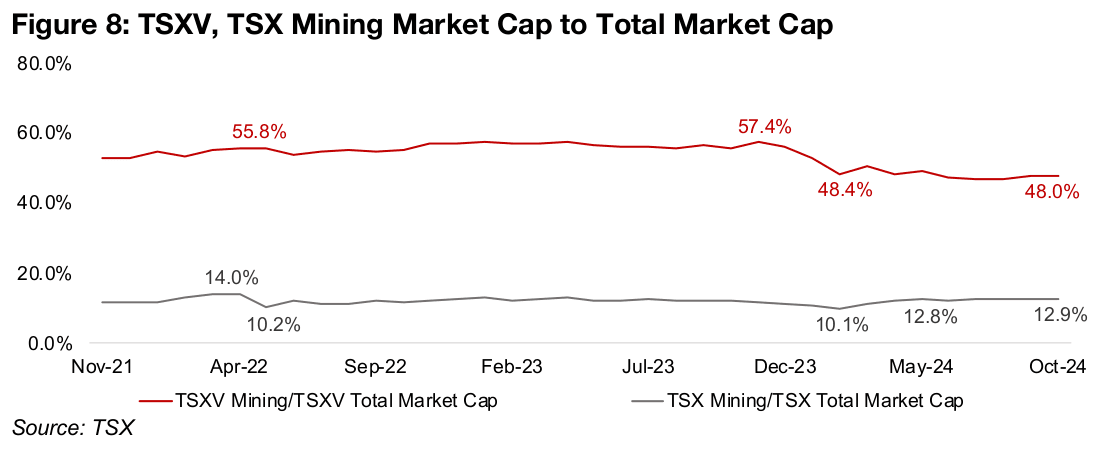

Aggregate TSX/TSXV mining equity financing picks up in 2024

The combined mining equity financing for the TSX and TSXV has picked up in 2024, averaging CAD$922mn per month as of the most recently reported October 2024 data, up from CAD$637mn for 2023 and US$636mn in 2022 (Figure 6). The mining sector remains a much larger proportion of equity financing for the TSXV, around 70% of the total over the past two years, compared to around 30% for the TSX (Figure 7). Mining is also a much larger proportion of the total TSXV market cap, at 48% of the total in October 2024, and has been slightly below 50% for most of 2024. It had a moderately higher share in 2022 and 2023, holding mostly above 55% (Figure 8).

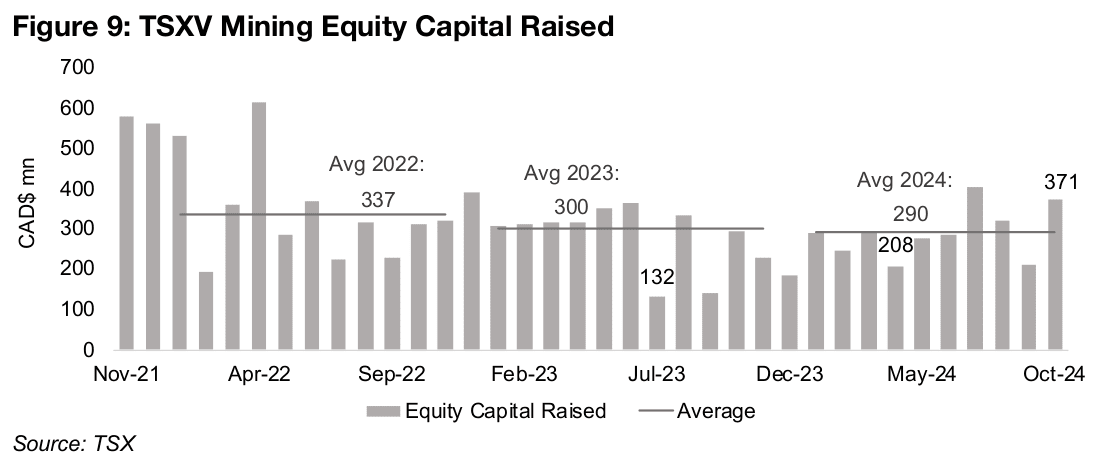

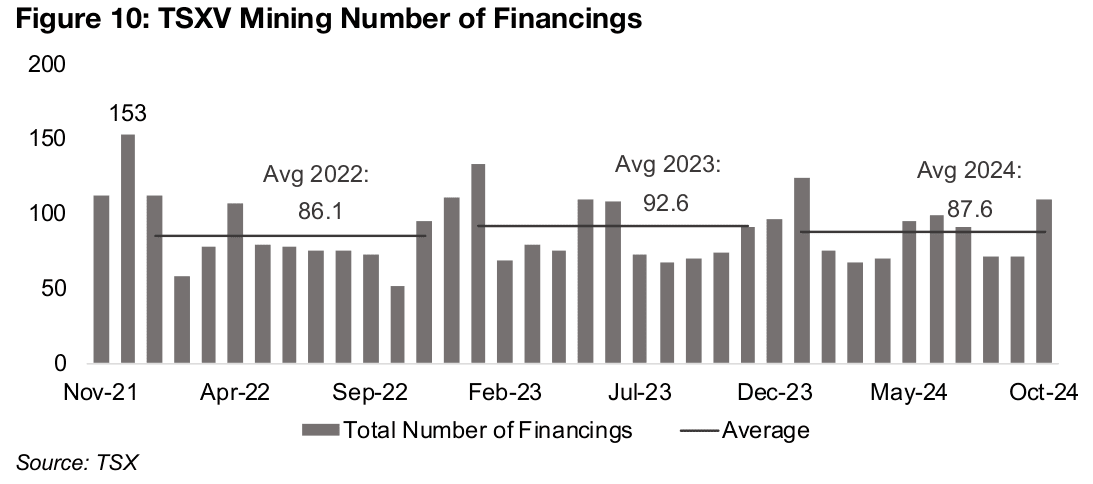

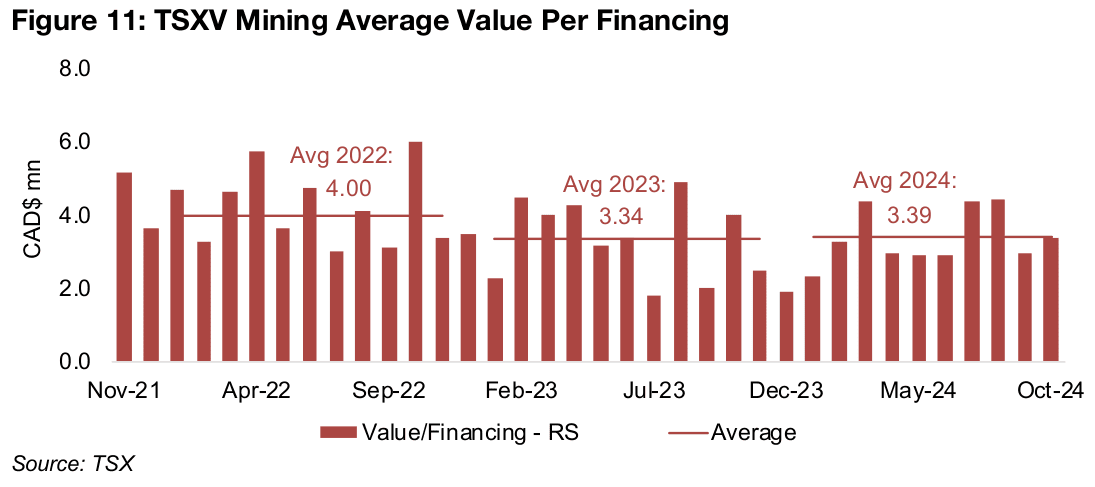

The big driver of the equity financing gains this year has been the TSX, while activity for the TSX has remained roughly flat. Mining equity capital raised on the TSXV averaged CAD$290mn per month over the first ten months of 2024 (10M/24) versus CAD$300/month in 2023, with both down from CAD$337mn in 2022. The number of financings edged down to 87.6 per month for 10M24 from 92.6 per month in 2023, and is up slightly from 86.1 in 2022 (Figure 10). The value per financing has remained nearly the same year on year, at CAD$3.39mn over 10M/24 versus CAD$3.34mn over 2023, and down from CAD$4.00mn in 2022 (Figure 11).

While the TSXV mining equity capital raising has been relatively evenly weighted throughout the year, the two strongest months for 2024 have actually been in the second half, in July and October. The lowest month for TSXV equity raising over 10M/24 was April 2024, with CAD$208mn, which is well above the weakest month in 2023, July 2023, with only CAD$132mn.

Smaller juniors still financed even in more cautious market

The investment environment for global small caps overall has been relatively tough

over the past year as the markets have shifted to a more cautious stance, outside of

a few mega-cap tech stocks. This would seem to be especially the case for extremely

high-risk companies like the many micro-cap junior miners on the TSXV, most of

which have no revenue, and need to constantly raise capital to keep exploring, often

for half a decade or even far longer.

That the average equity capital raised for TSXV mining has remained flat even given

this more risk averse shift by the market could actually be viewed as quite a good

outcome, as it might have been expected that investor interest in the sector could

have waned significantly in 2024. This may have partly been because of the large

proportion of TSXV mining companies exploring for gold, and support could have

come from the huge rise in the metal price over the past year.

Given the more cautious backdrop, we might have expected a scenario where even

if TSXV mining equity capital raised remained flat, that the number of deals may have

fallen while their value rose. This would have indicated that capital was flowing more

to larger companies than in 2023. However, this has also not been the case, with

average number of financings and average value reasonably flat, implying that smaller

TSXV juniors also have had access to a similar level of financing as 2023.

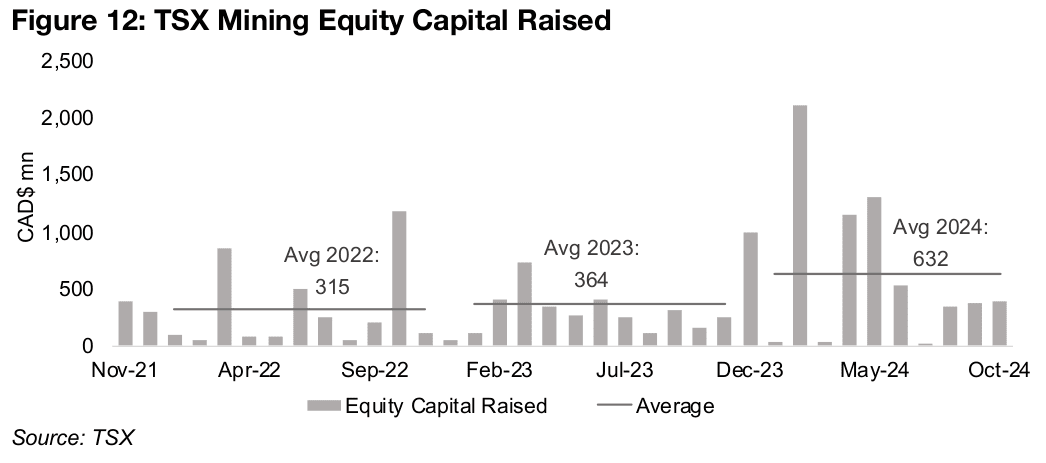

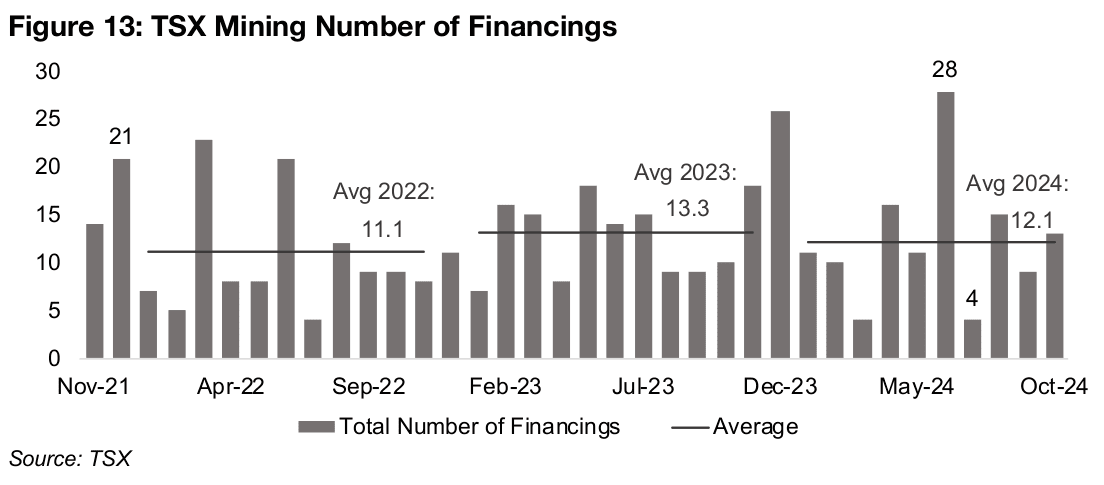

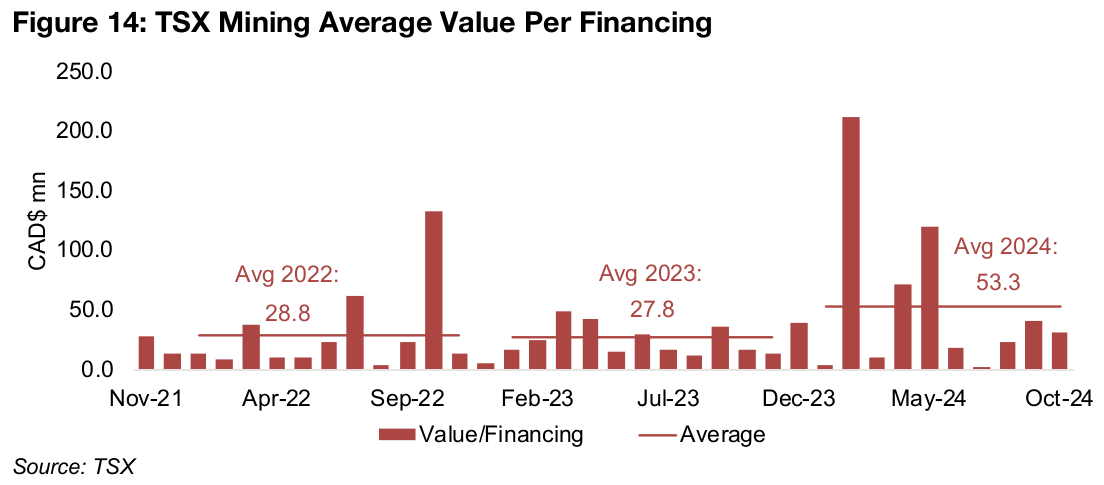

The gains in mining equity financing for the TSX over 10M/24 have been from a particularly strong February 2024 and reasonably highs level in April and May 2024 (Figure 12). The average number of financings dropped slightly to 12.1 over 10M/23 from 13.3 in 2023, but was above the 11.1 of 2022. (Figure 13) The average value per financing was far higher, however, at CAD$53.3mn for 10M/24, with the prior two years at similar levels, CAD$27.8mn for 2023 and CAD$28.8mn in 2022 (Figure 14).

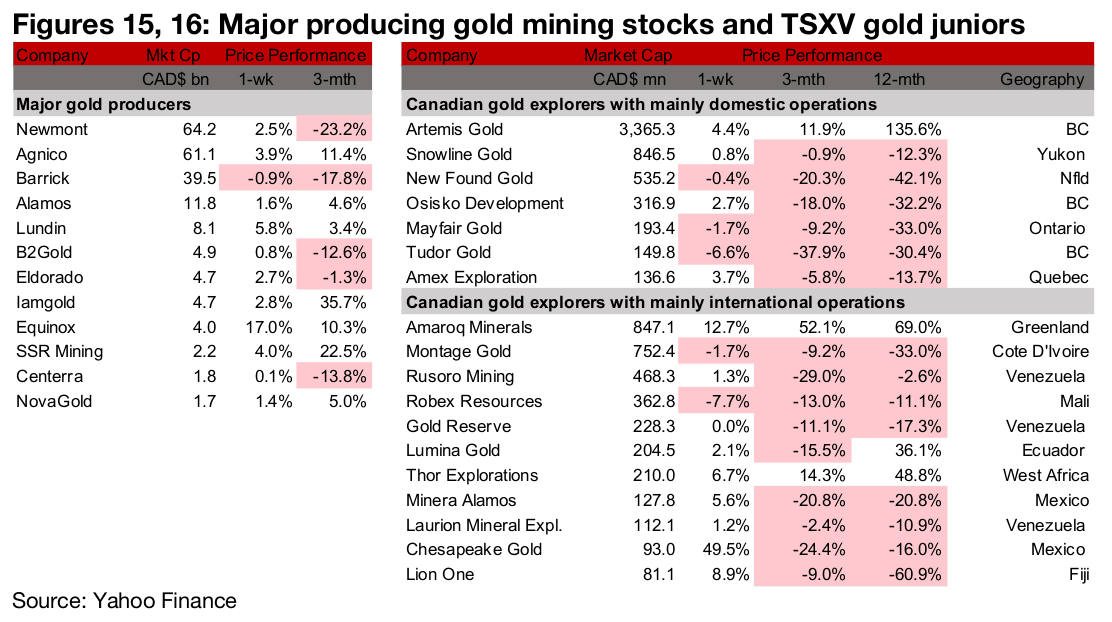

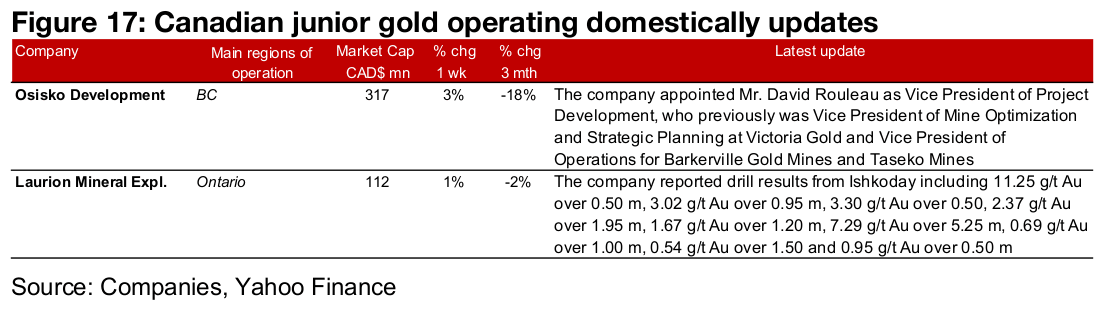

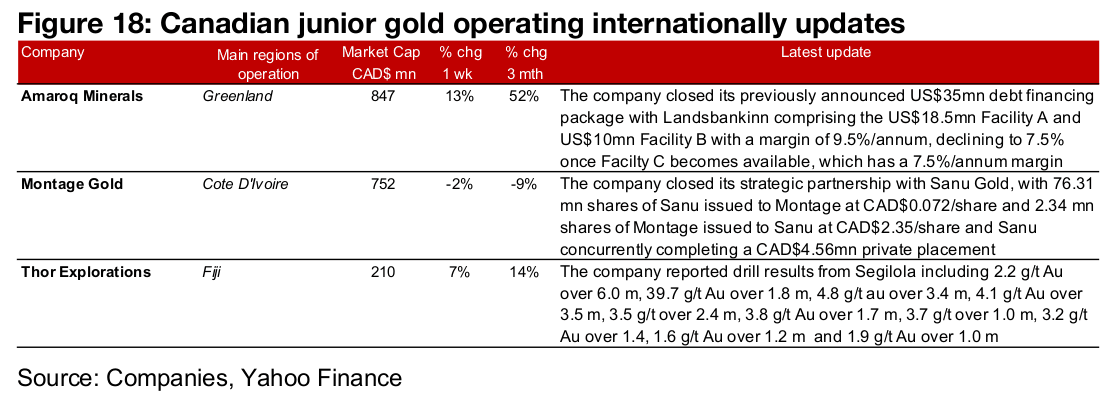

Most large producers and TSXV gold gain

The large gold producers and TSXV gold mostly gained on the rise in the metal price (Figures 15, 16). For the TSXV gold companies operating domestically Osisko Development appointed Mr. David Rouleau at Vice President of Project Development and Laurion Mineral Exploration reported drill results from Ishkoday (Figure 17). For the TSXV gold companies operating internationally Amaroq closed its US$35mn debt financing package with Landsbankinn, Montage Gold closed its strategic partnership with Sanu Gold and Thor Explorations reported drill results from Segilola (Figure 18).

Disclaimer: This report is for informational use only and should not be used an alternative to the financial and legal advice of a qualified professional in business planning and investment. We do not represent that forecasts in this report will lead to a specific outcome or result, and are not liable in the event of any business action taken in whole or in part as a result of the contents of this report.