March 20, 2023

Gold Rush

Author - Ben McGregor

Gold surges as economic risk spikes

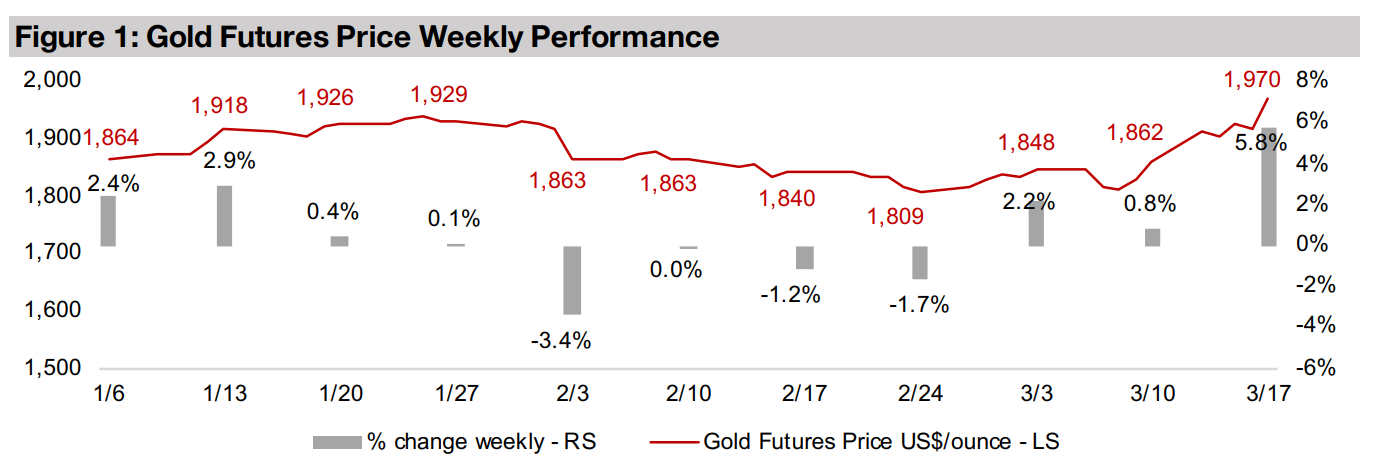

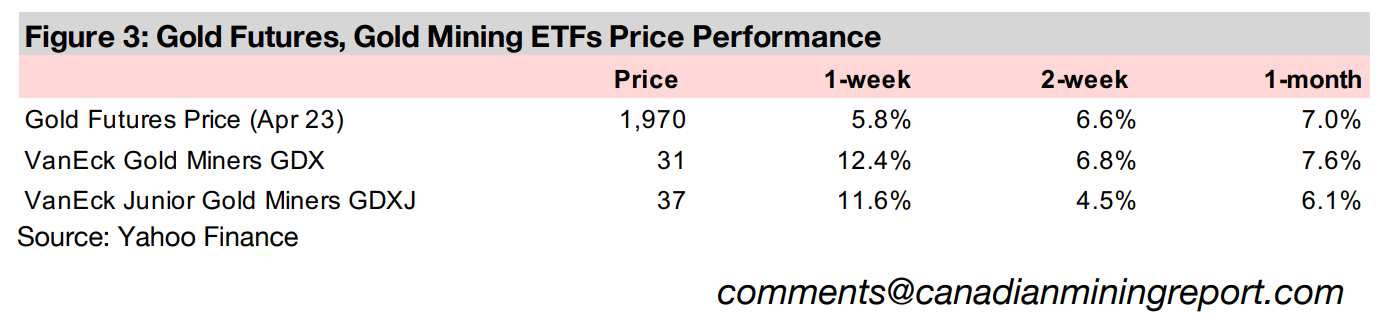

Gold spiked 5.8% this week to US$1,970/oz, its highest level since April 2022, as global economic risk surged with major bank failures continuing across the US and Europe while related bailouts did not entirely curb pressure on financial stocks.

A look at TSXV streaming and royalty companies

This week we look at the large TSXV streaming and royalty companies, which have seen strong revenue growth overall over the past two years and continue to offer a more diversified and less risky way to gain exposure to the junior gold mining sector.

Gold Rush

Gold surged 5.8% this week to US$1,970/oz with the metal delivering on expectations as a safe haven, as global economic risks have spiked, particularly from major fallout in the banking sector. We covered the 'first domino' to fall, Silicon Valley Bank, last week, which was shut by regulators, and the contagion has spread, with mid-tier US banks Signature shut down and First Republic requiring a bailout. There was substantial intervention into the banking system in reaction to this, with the US government guaranteeing deposits for customers of failed banks and announcing a large emergency lending program for the finance sector. The crisis also spread to Europe, with Credit Suisse, a huge systemically important bank in Switzerland with a global presence, on the verge of collapse. While the Swiss National Bank intervened with liquidity mid-week, Credit Suisse could not stand alone and will now be purchased by UBS, its largest Swiss competitor. While interventions lifted the US markets with the S&P up 1.43%, Europe fell, with the Eurostoxx 600 down -3.8%.

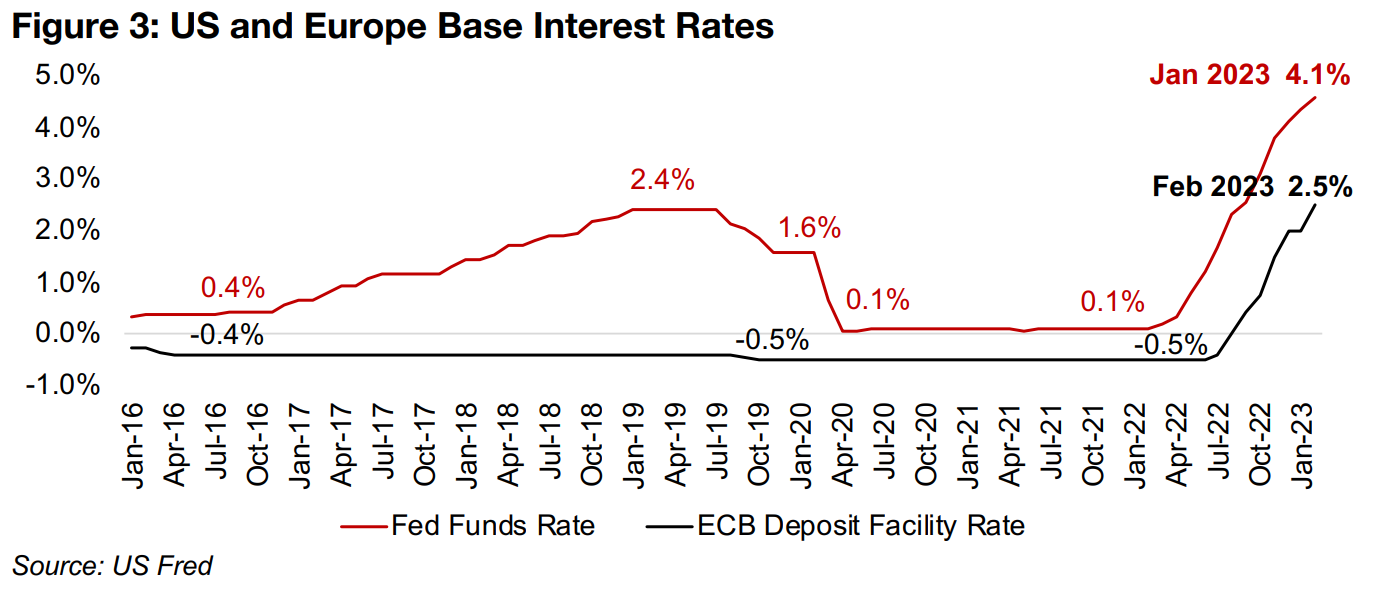

The ECB hiked even under pressure, and the Fed may follow suit

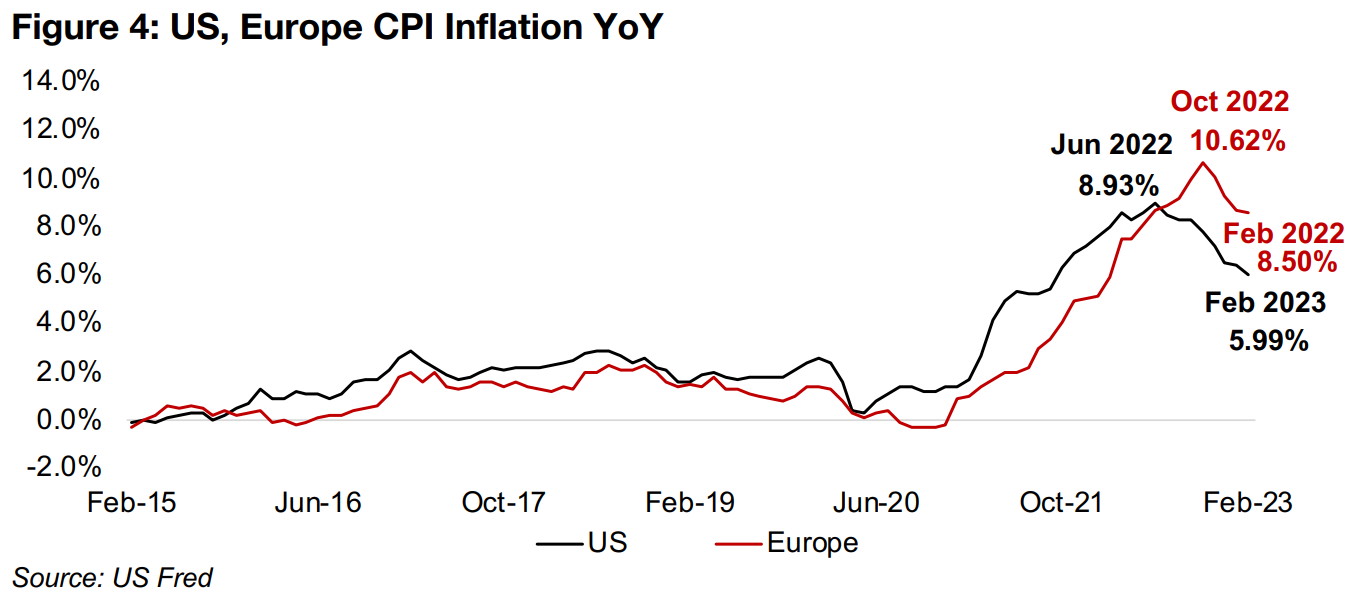

One major move economic this week clearly indicating global central banks'

continued bold stance against inflation was the European Central Bank's hike in its

ECB Deposit Facility Rate, a parallel to the Effective Fed Funds Rate, by 50 bps basis

points to 2.5% (Figure 3). There had been the potential for a pause in rates from the

ECB, given that the massive ongoing banking system fallout has at its root the major

rate hikes of the past year, but the central bank charged ahead. This is because

Europe is still facing extremely high inflation, at 8.50% in February 2023, off a peak

at 10.62% in October 2022 which was well above even the peak inflation in the US

at 8.9% in June 2022 (Figure 4). The strategy in both the US and EU seems to be

continuing to attack inflation directly through rate hikes, and then to deal with any

fallout on a sector-by-sector basis as and when it happens, as we saw with the

financial system bailouts this week.

This would be in contrast to just easing the broader pressure off the global economic

system by cutting rates, or at least not increasing them further. However, the central

banks are well aware this could drive a resurgence in inflation, and preventing this is

obviously their main priority. We expect this to remain the case as long as

employment in both regions remains strong, and it seems that as long as inflation

remains stubbornly high, it will take a substantial surge in unemployment to see these

central banks pull back on rate hikes. Even the full-blown banking crisis erupting has

not seen them waver from their inflation slashing mission.

Fed Chairman Powell likely to continue going full-Volckerian

This leads us the Fed's March 2023 rate decision; if the ECB is anything to go by, we

can expect a 25-basis rate hike in the Effective Fed Funds Rate, to its highest level

since 2007, and well above the 1995-2023 average of just 2.47%. As in Europe,

inflation remains stubbornly high in the US, and even after a continued decline in

February 2023 to 5.99% reported this week, it is still three times the Fed's upper limit

target of 2.00%. Chairman Powell is looking increasingly like Fed Chairman Volcker,

who in the late-1970s to early-1980s crushed inflation at the expense a major

recession, and a hike this week could really lock this in. However, we still see the

potential for at least slightly more dovish language accompanying the release.

Even as the central banks continue to tighten monetary policy 'officially', the question

is now whether the recent bailouts will offset this, bringing a defacto end to monetary

tightening. Even if this is the case, the bailouts, which comprise specific lending to

the banking sector only, would not have the more immediate and wide-ranging effect

that pausing or cutting the base rate would. Bailout funds would need to be taken on

by the banks and then eventually lent out to really drive an increase in liquidity, and

this would take an extended period of time. This is especially the case with bank

managements likely to be much more cautious in expanding lending after the recent

collapses, potentially reducing the stimulating effect of the bailouts.

Recent rush into gold from economic factors; geopolitical ones still loom

While we had expected the surge in interest rates over the past year to have a deleterious effect on the global economy, we thought that it would be more of a H2/23 issue. We anticipated a slower compounding of negative effects, with perhaps some initial blips on the radar of distressed companies, but not an abrupt full blown banking crisis so soon. We had also expected any sudden spike in gold this year, like that of the past two weeks, would be more likely driven by geopolitical factors than economic ones. So far just these economic risk factors alone have sent gold surging back to near US$2,000/oz. Geopolitical risks boosted the gold price by over US$100/oz twice over the last four years, during the peak of the global health crisis and after Russia's invasion of Ukraine. If we were to see gold gain an additional US$50-US$100/oz on continued economic issues, and then add another US$100/oz for a potential further spike in geopolitical risk, it appears possible that gold could solidly break through all-time highs this year.

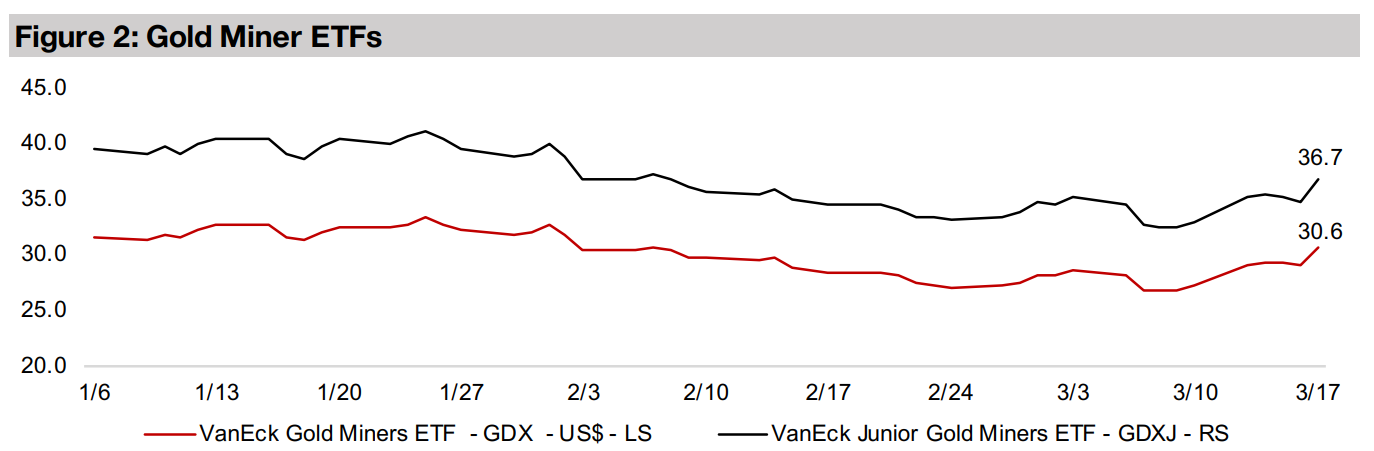

TSXV royalty and streaming companies a lower risk way to play junior mining

The recent rise in risk could understandably be leading investors to reconsider the level of risk in their portfolios, even for the type of risk seekers interested in the particularly volatile junior mining sector. Royalty and streaming companies help reduce the risk inherent in a single junior miner, but also provide exposure to the potential for growth in the exploration and development side of the sector. There are five larger cap stocks in this sector on the TSXV, in order of market cap; Metalla Royalty & Streaming, EMX Royalty, Elemental Altus Royalties, Vox Royalty and Nova Royalty. This contrasts with ETFs like the GDX, providing diversified exposure only to major producing miners, not the juniors. The GDXJ ETF has exposure to junior miners, but they tend be larger, and many have already entered production or are more advanced than the earlier stage companies on the TSXV.

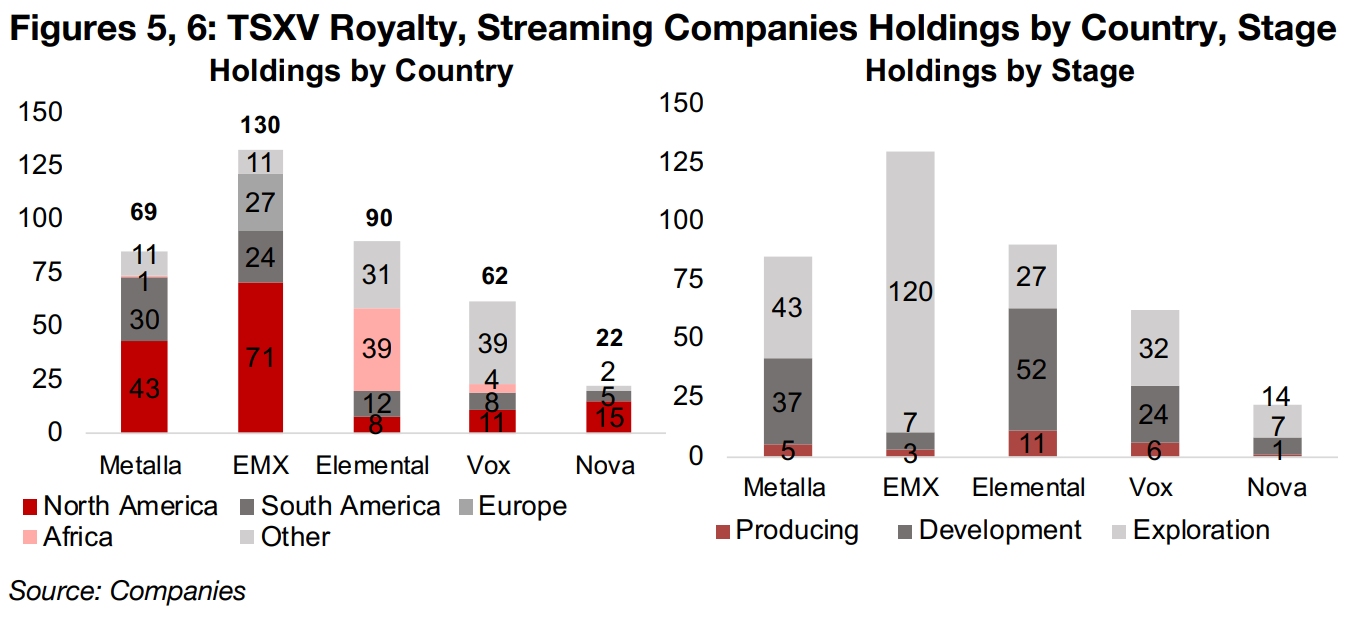

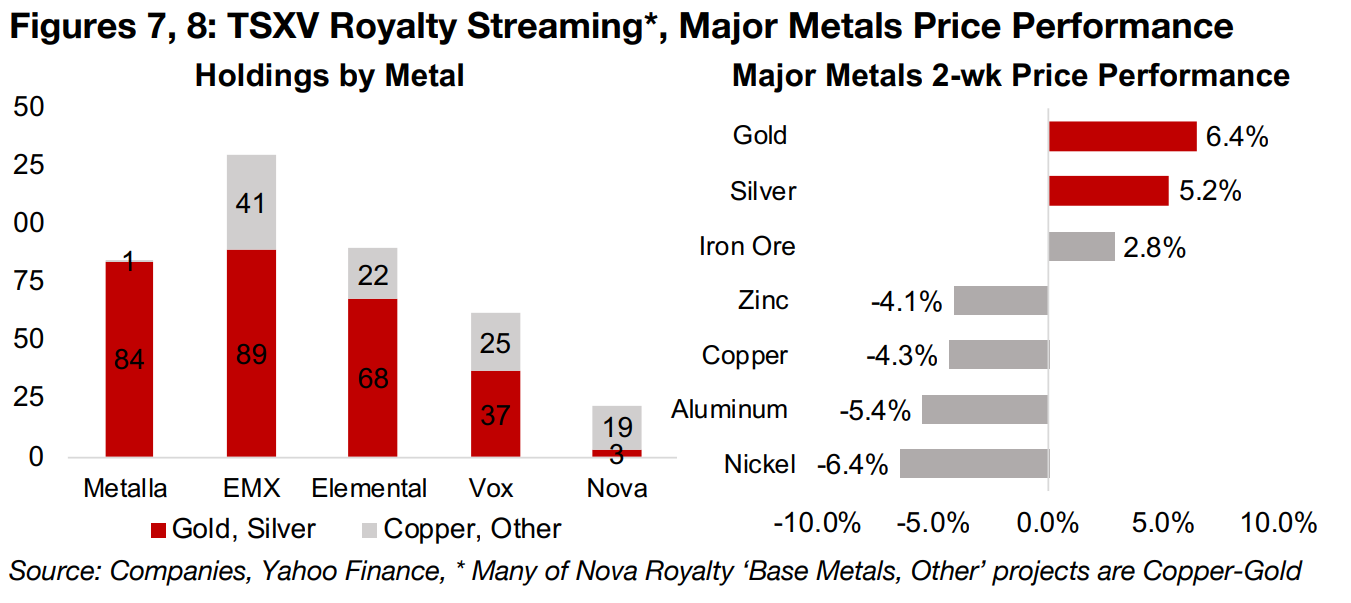

Metalla Royalty has 69 assets focussed mainly on North and South America (Figure

5), with five assets in production, and the rest spread reasonably evenly between

development and production (Figure 6), and almost 100% focussed on gold (Figure

7). EMX has the largest number of assets at 130, with over half in North America, a

high concentration in South America, and is more concentrated on exploration stage

projects, with about 70% of its assets gold-focused and the rest in base and other

metals. Elemental Altus has 90 projects, with the largest number in Africa and Other

regions, and has the largest percentage of development stage projects of the group,

with a focus on gold, but also a significant number of base metals projects.

Vox Royalty has the majority of its 62 projects in Australia, although it also has several

in the Americas and Europe, with six producing assets and a similar proportion of

exploration and development projects, with only moderately more gold than base

metals projects. Nova Royalty has the smallest number of assets, at just 22, with

most in North America, with one in production, about third of the total in development,

and the rest in exploration. While Nova appears to be initially entirely base metals-focussed, many of the projects Figure 7 in 'Base Metals, Other' are copper-gold

projects, so the exposure to gold is actually higher than this chart would indicate.

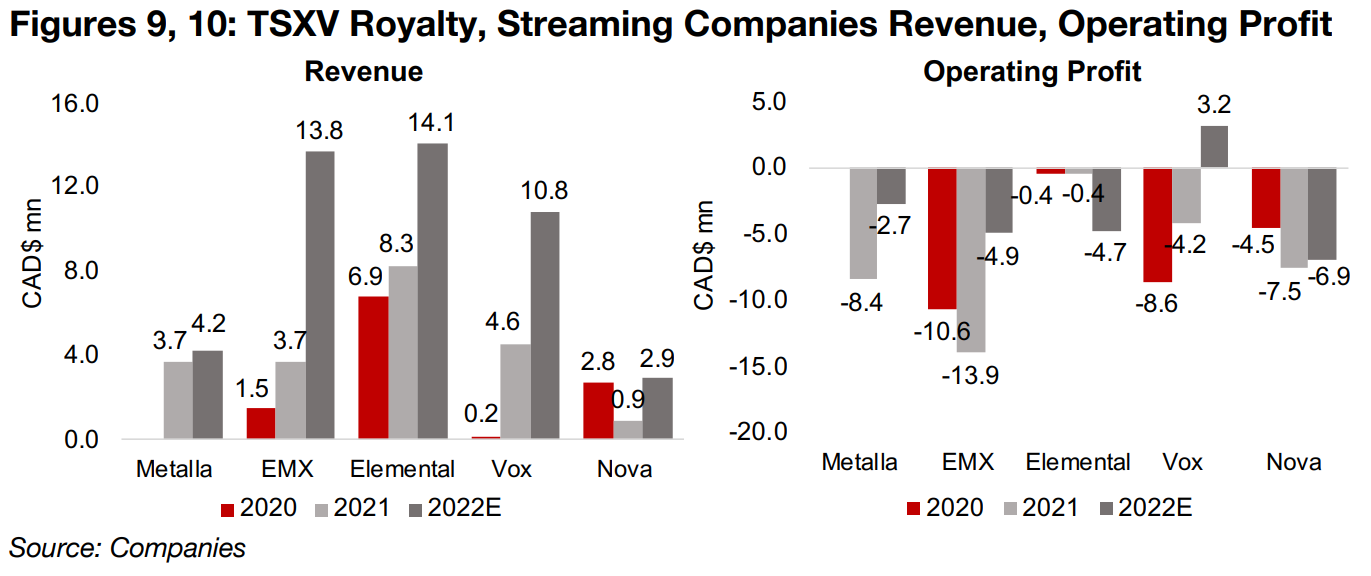

With most of these companies exposed heavily to gold, we expect this metal to be the major driver for the large cap TSXV royalty and streaming companies, and over the past two weeks, the market has turned in favour of safe havens like gold and sold down many major base metals (Figure 8). Revenue growth for the group has generally been strong over the past two years, with Metalla edging up, EMX, Elemental and Vox all seeing substantial gains, and Nova roughly flat between 2020 and 2022, with a major decline in between in 2021 (Figure 9). The group is still struggling to reach operating profitability, as they will need more of their assets to start producing to cover fixed admin costs, but overall losses have been contracting, and it appears that one company, Vox, will turn an operating profit in 2022E (Figure 10).

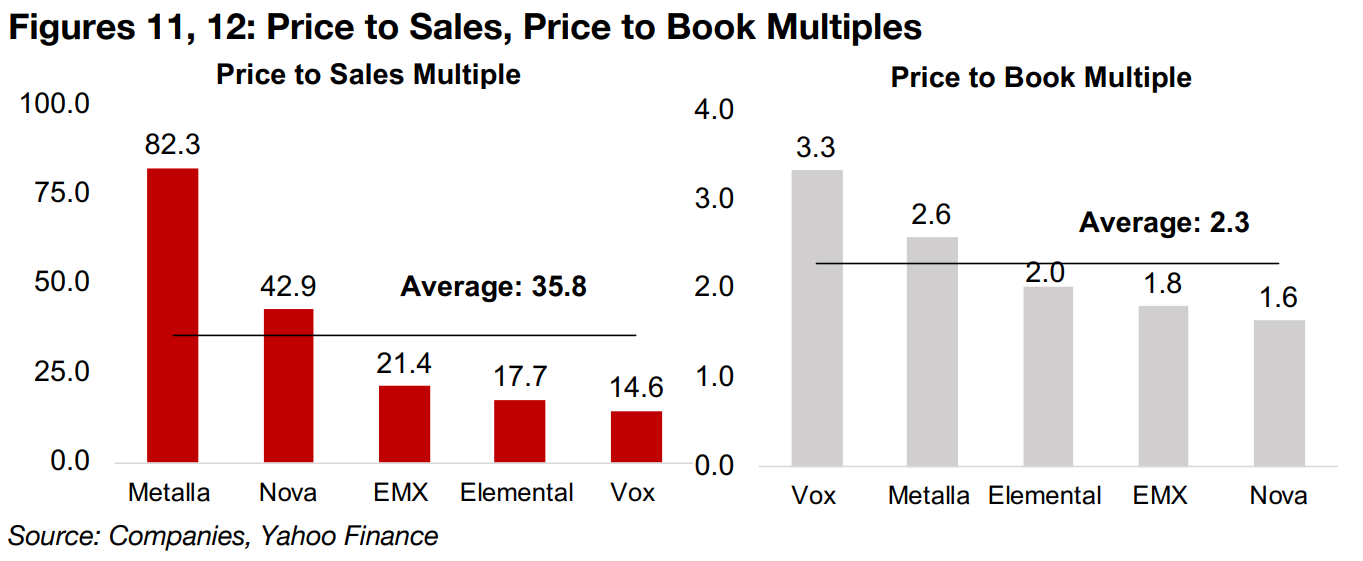

With this lack of earnings for the group, there are no PE multiples, and while price to sales and price to book multiples can be calculated they don't offer a clear conclusion on the market's view for most of the companies, which are not consistently ranked across the two metrics (Figures 11, 12). This excludes Metalla, however, where the market is paying the highest price to sales by far, and the second highest price to book. This seems to be driven by consensus estimates for a substantial profit by 2024E as more streams and royalties come through, and because of its 100% gold exposure in a time where this metal may become increasingly favoured.

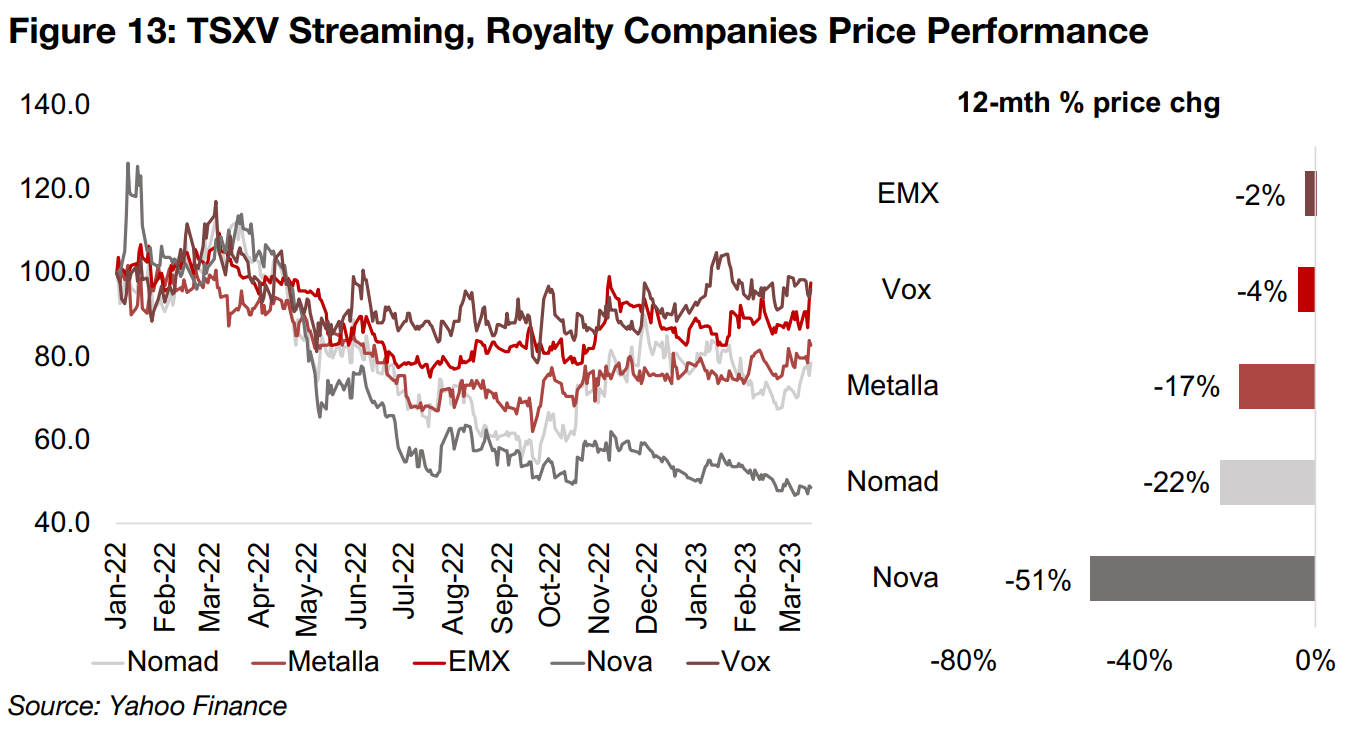

The TSXV streaming and royalty sector has taken a share price hit since 2022 along with the broader market, although the group has fared well versus many large cap TSXV junior miners, down -30% or more, with a -51% decline in Nova Royalty the main outlier (Figure 13). The sector has therefore delivered to some to degree on the expectation to truncate the downside compared to directly investing in junior miners, with EMX and Vox down by low single digits, and both Metalla and Nomad outperforming the 28% decline in the TSXV Metals and Mining Index since 2022.

Could still be a time for risk takers to consider junior gold miners

While we have highlighted here the defensive qualities of the royalty and streaming

companies, this is mainly because the disruptions of the past week may have many

investors heavily reconsidering risk in their portfolio. While this is certainly prudent

given recent events, we see the main risks for the juniors being concentrated more

towards the base metals stocks, which would be exposed heavily to any downturn in

the economic cycle. In contrast, for the gold sector, the outlook seems much more

bright, and the metal's outperformance this week is just what we would expect from

gold in a time of crisis.

While the TSXV junior gold miners still face the risk of being mainly pre-production

and could face the difficulty of raising capital in weakening markets, if the gold price

is strong enough, it will simply offset these other factors. We could even have the

interesting situation where gold spikes so much on economic and political risk that it

becomes the 'go to' sector for the market to allocate capital to, even as other metals

could potentially face a decline in their prices.

In such a case, taking on some risk in the junior gold mining sector directly, with the

individual companies much more leveraged to the gold price than the royalty and

streaming companies, could generate much stronger returns. Overall, the options

remain wide for both the risk averse or risk seeking to continue to play into a potential

continued gold rush, ranging from lower to higher risk. In either case, registered

investment advisors should be consulted for the most appropriate course of action in

relation to a given portfolio's time horizon and risk tolerance.

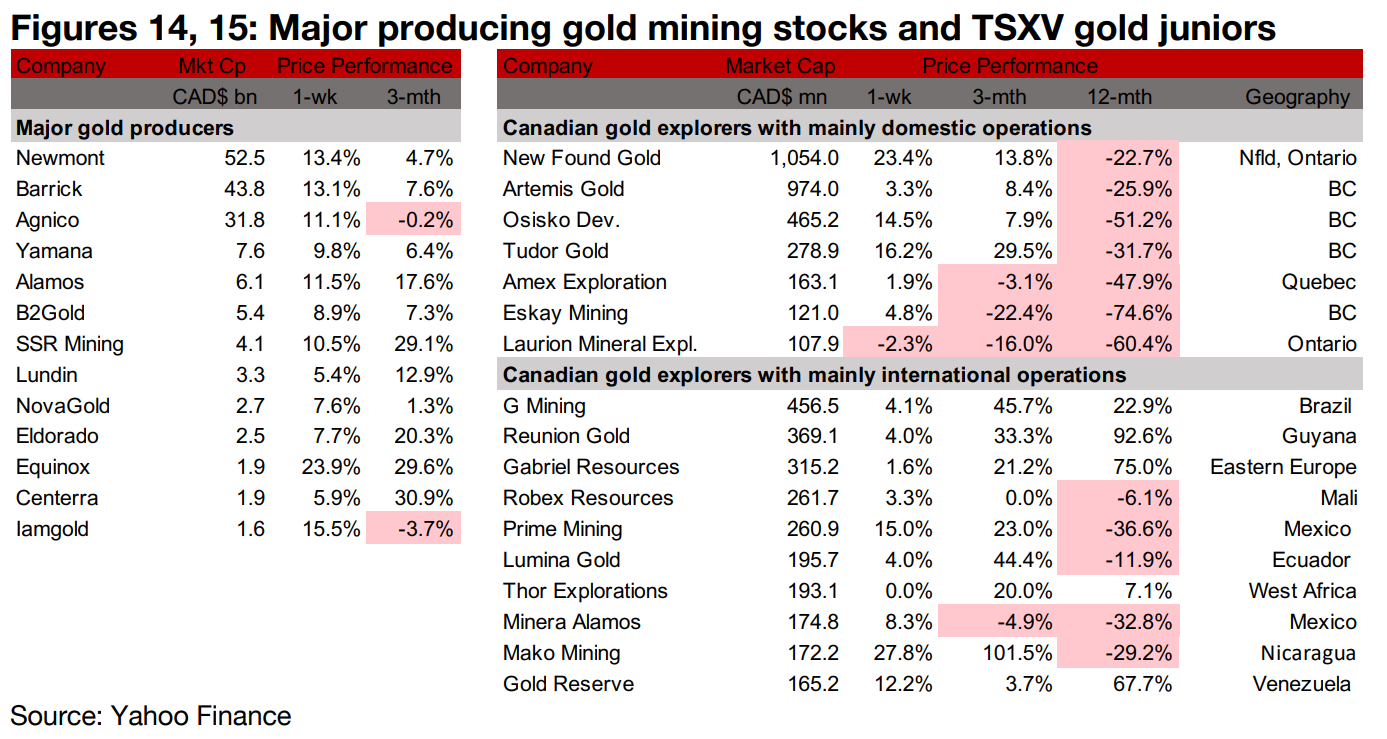

Gold producers and TSXV gold soars with many double digit gains

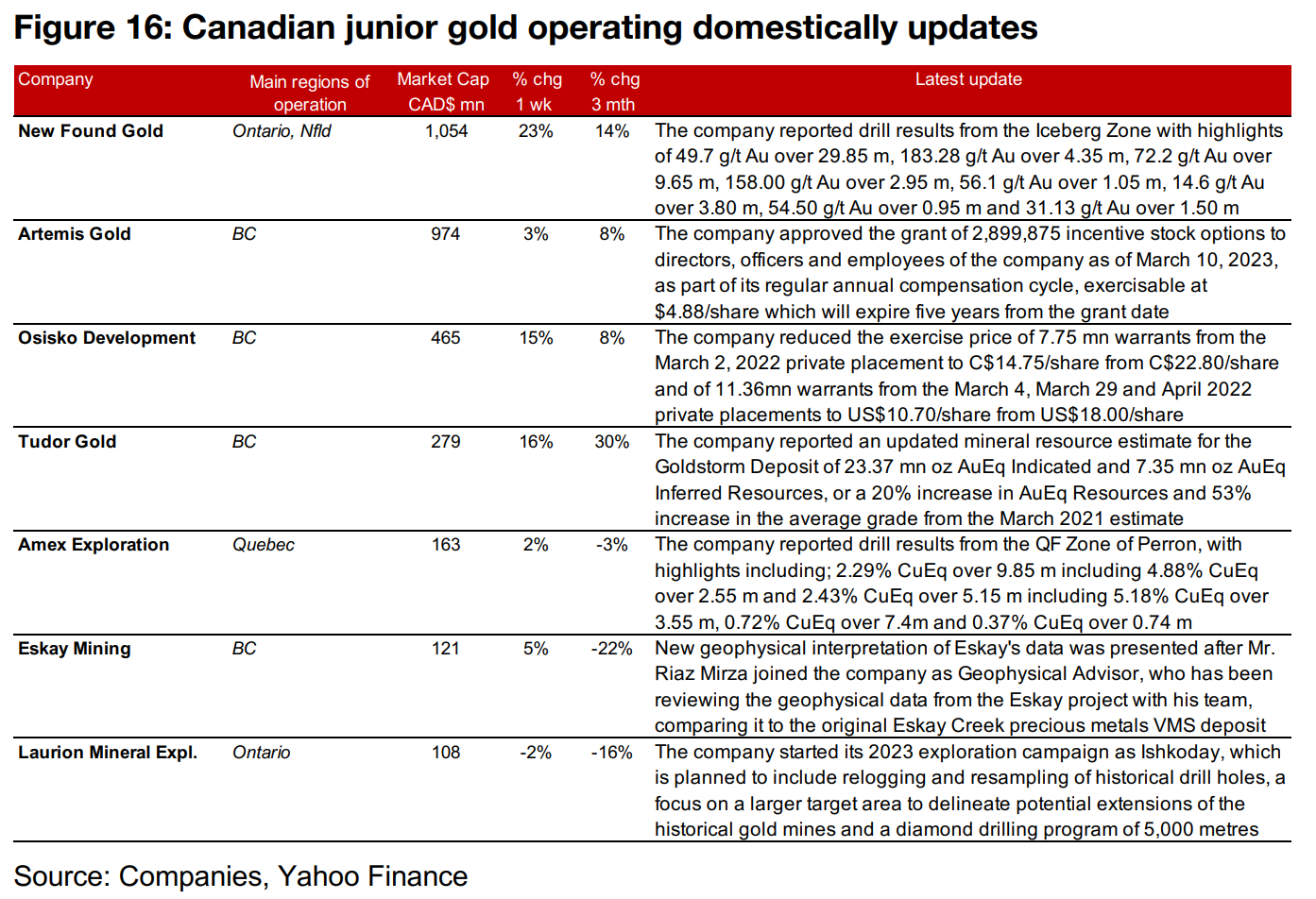

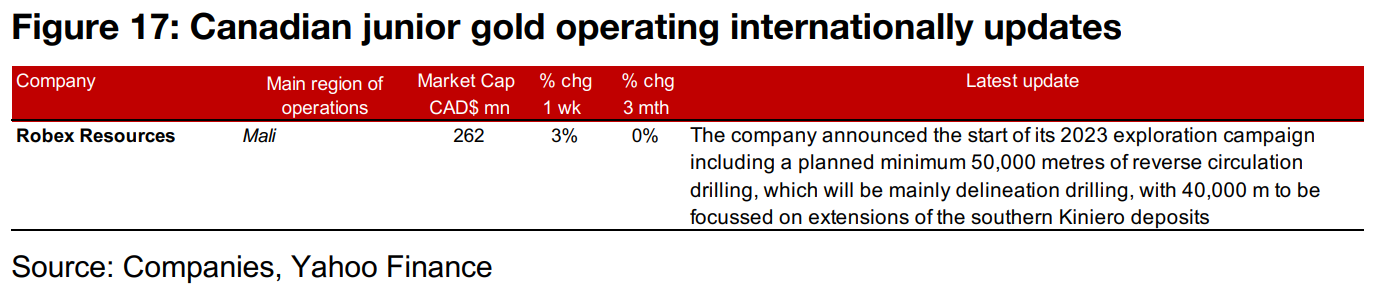

The producing gold miners and the TSXV gold juniors soared, with many up double digits on the jump in the gold price to its highest levels in almost a year (Figures 14, 15). For the Canadian juniors operating mainly domestically, New Found Gold reported drill results from the Iceberg Zone of Queensway, Artemis Gold approved incentive stock options for company staff and Osisko Development reduced the exercise price of warrants issued in some private placement in 2022 (Figure 16). Tudor Gold reported an updated mineral resource for the Goldstorm Deposit, Amex Exploration reported drill results from the QF Zone of Perron, Eskay Mining announced a new geophysical interpretation of its Eskay Project data and Laurion Mineral Exploration started its 2023 exploration campaign at Ishkoday. For the Canadian juniors operating mainly internationally, Robex Resources announced the start of its 2023 exploration campaign (Figure 17).

Disclaimer: This report is for informational use only and should not be used an alternative to the financial and legal advice of a qualified professional in business planning and investment. We do not represent that forecasts in this report will lead to a specific outcome or result, and are not liable in the event of any business action taken in whole or in part as a result of the contents of this report.