October 23, 2023

Gold Rips After Slip

Author - Ben McGregor

Gold gains moderately in 2023 while most metals struggle

This week we look at the performance year to date of the major metals and mining ETFs, with most struggling, ranging from near flat to significantly down, with exceptions being gold with a mid-single digit rise, and a nearly 50% gain in uranium.

Gold Rips After Slip

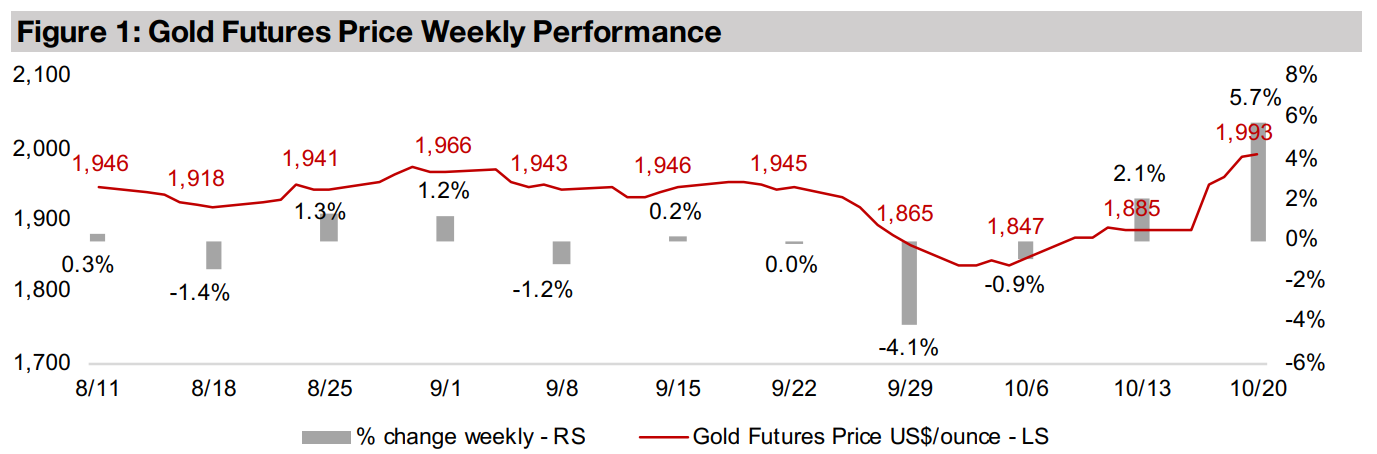

Gold surged 5.7% to US$1,993/oz, and has gained 7.9% in just two weeks, after plunging -5.0% in the previous two weeks. The ongoing rebound has been driven by the spike in geopolitical tensions but also from rising broader macroeconomic concerns. This contrasts with the prior two weeks where the market was finally pricing in a several month surge in both the US$ and US bond yields, both of which tend to put downward pressure on the gold price. The market seemed to have had been holding off on pricing in these factors through mid-2023 on hopes of a dovish Fed, but finally capitulated with the central bank remaining steadfastly hawkish.

Gold drivers of high yields and US$ could still offset surging geopolitical risk

While the high dollar and yields remain strong negative drivers, it is a testament to

the severity of the increase in geopolitical risk that in the space of a couple weeks

gold has totally reversed over a US$100/oz fall and jumped to its highest levels since

May 2023. The gold price at that time was just coming off a jump driven by a US and

European banking crisis that started in March 2023, which was actually quite brief,

being quickly brought under control by regulators. We suspect that the current

geopolitical issues could escalate, and this factor taken alone could be expected to

drive a further move into gold on a flight to safety.

However, with the conflict centered around the Middle East, it has been driving up

the oil price, which has been a main source of a rebound in inflation in the US over

the past three months. This higher inflation could mean a continued hawkish Fed well

into 2024, and Chairman Powell has made it clear that further rate hikes are not off

the table. This in turn could propel a rise in bonds yields and the US$, putting

downward pressure on gold, potentially attenuating the metal’s rise. We have seen a

similar situation over the past four years, with gold’s upside and downside drivers

tending to balance out, and it repeatedly reverting to its average of US$1,840/oz.

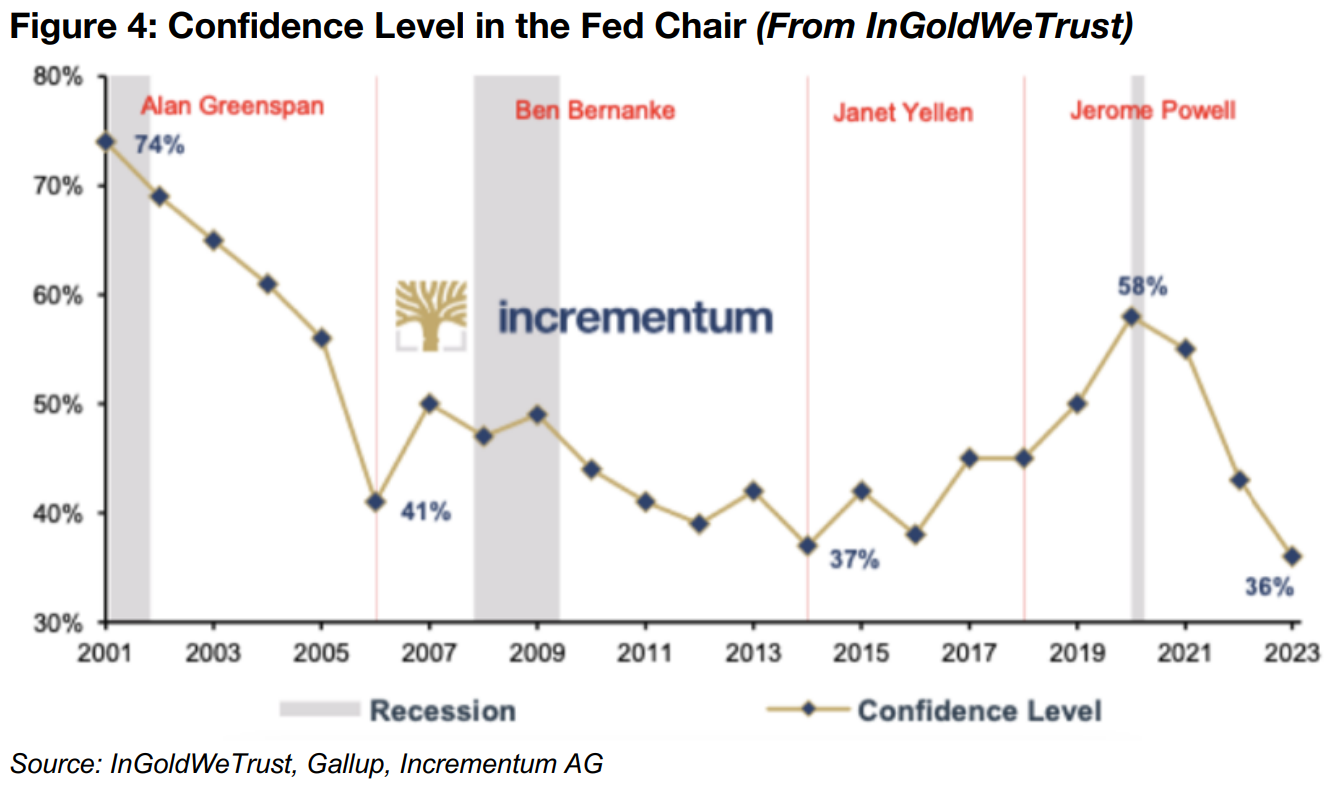

Confidence in Fed reduced by hawkish stance

The Fed's continued tight monetary policy has not done much for market confidence in the institution. A survey tracking the Confidence Level in the Fed Chair, shown in a report from InGoldWeTrust, has dropped to the lowest level since it started, with just 36% reporting they have a ‘great deal’ or ‘fair amount’ of confidence in the Federal Reserve Chairman (Figure 4). Confidence in the current Fed Chairman Jerome Powell peaked in 2020 at 58% at a time when massive liquidity was released into the market during the global health crisis. Of course, this increase in the money supply itself was the main cause of the eventual surge inflation that erupted starting in 2022. This indicates the ironic trade off a Fed Chairman, whose popularity tends to rise when monetary policy is loose, but decline when later tightening is required by the inflation generated from the earlier period of easy money policy.

We see this in the popularity of Fed Chairman Alan Greenspan during early 2000s,

with a cut in interest rates after the dot.com bubble burst driving a high 74%

confidence level. However, with a persistently sluggish economy and markets

through to 2003, and then a gradual increase in interest rates starting from late 2004,

his support reached a low of 41% in 2006. Confidence in Ben Bernanke was also at

its height when his policy was at its most expansionary in 2008 and 2009, and

declined thereafter, and never reached the peaks of either a Powell or Greenspan.

Janet Yellen was the only recent Fed Chair who did not follow this pattern, with her

popularity lowest early on when rates remained low, and higher later on as interest

rates were gradually increased. Overall, the confidence in a Fed Chairman tends to

be higher during periods of easier monetary policy, with survey participants

apparently discounting the future potential inflationary pressures, and responding

rate hikes, that the present expansion policy could generate.

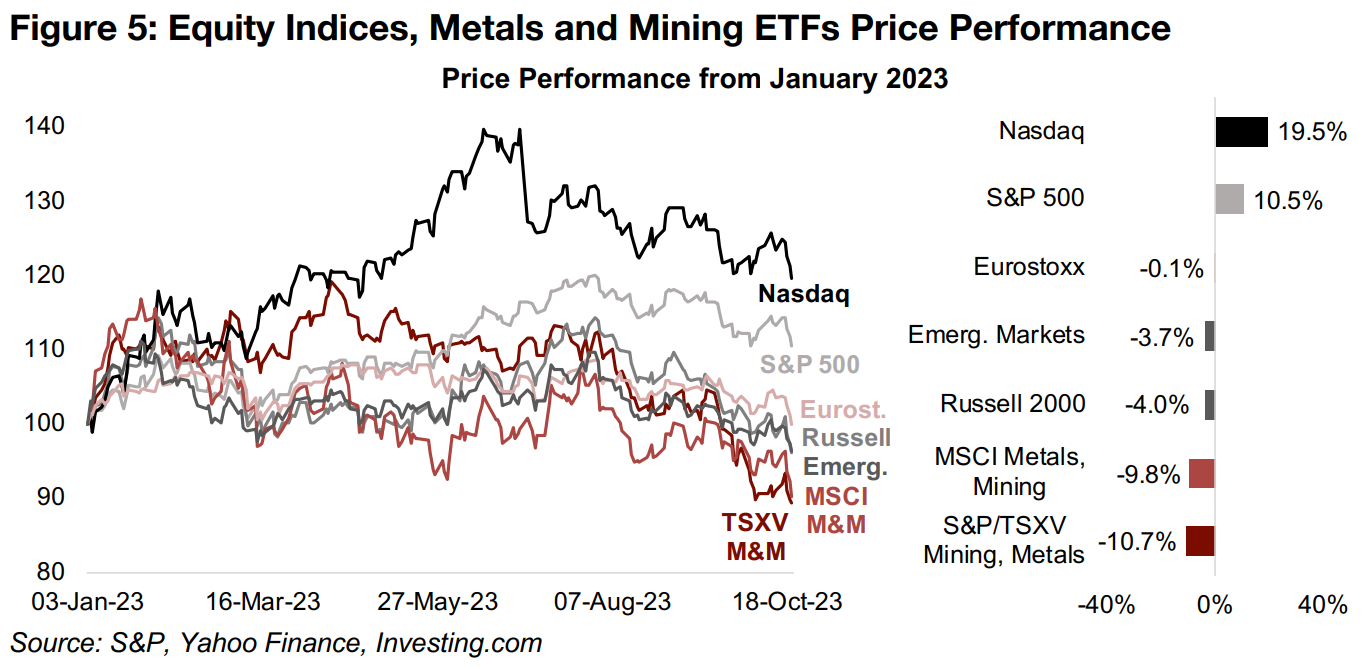

Most major metals and mining ETFs struggle to make gains in 2023

This week we look at performance of the major mining ETFs and metals, which overall have struggled to make gains this year as the industry feels the pressure of over a full year of interest rates near thirty-year highs. This has made investors more cautious across the economy in general, and with mining being cyclical and projects having extremely long lead times, the sector will likely have come under particular scrutiny in recent months. While TSX and TSXV mining equity investment has held up quite well as of the most recently available August 2023 data, the prospects are still there for a pullback in late 2023 and into 2024.

The MSCI Metals and Mining Index, containing the largest cap mining stocks globally,

is down -9.8% this year, around -20.0% below the gain in the S&P 500 and -30.0%

below the Nasdaq, and slightly ahead of the -10.7% drop in the S&P/TSXV Mining

and Metals Index, comprising junior miners (Figure 5). However, the Nasdaq’s

exceptional 19.5% gain has been driven by an AI-led tech boom, the sustainability of

which is questionable, and it is already well off its highs, having been up near 40%

as of mid-year. With much of the gains in the S&P 500 having also bled over from

tech stocks we could view these major US markets as anomalies.

The underlying picture for markets is possibly better reflected by the rest of the world,

with the Eurostoxx 600 down -0.1% and EEM Emerging Market ETF down -3.7%.

Also, outside of the large caps, the US market has declined, with the Russell 2000

down -3.7%. Using these indices as benchmarks, the MSCI Metals & Mining and

S&P/TSXV Mining & Metals have still underperformed, but only moderately compared

to the extremely wide gap using the Nasdaq and S&P 500.

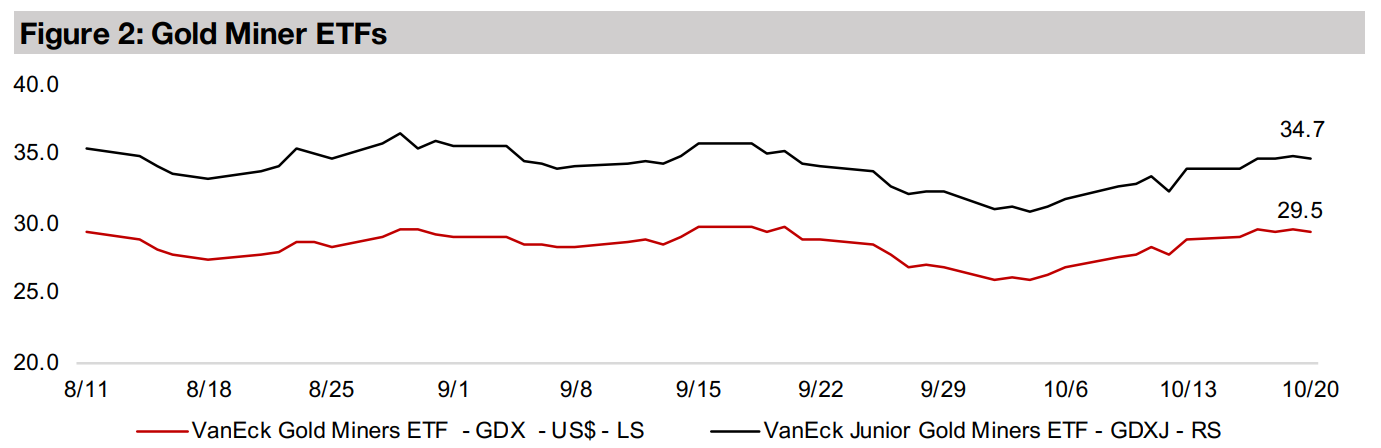

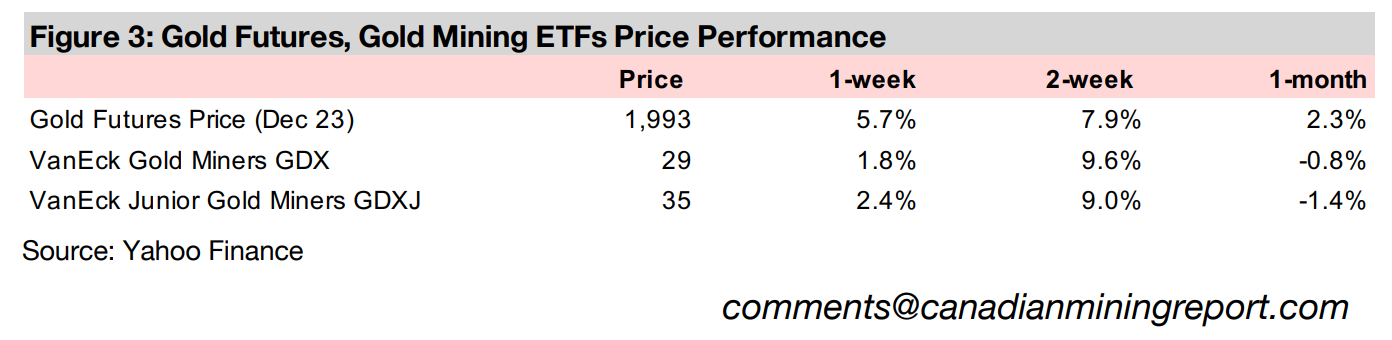

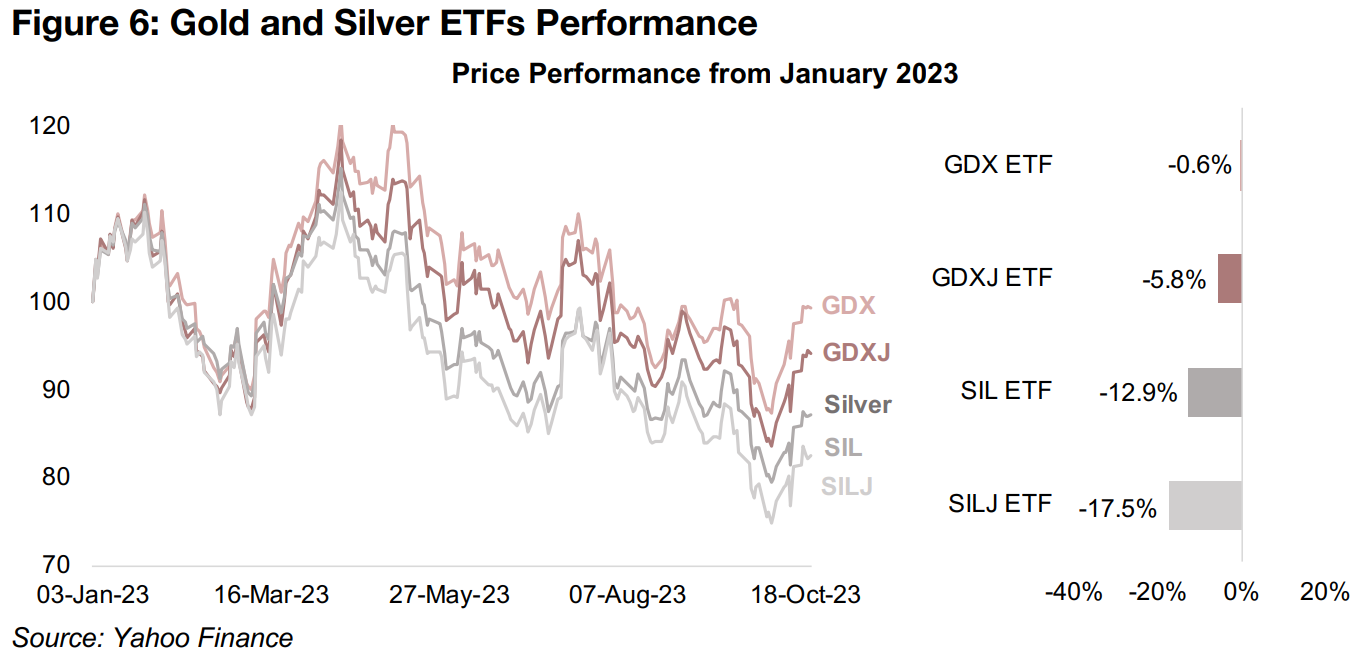

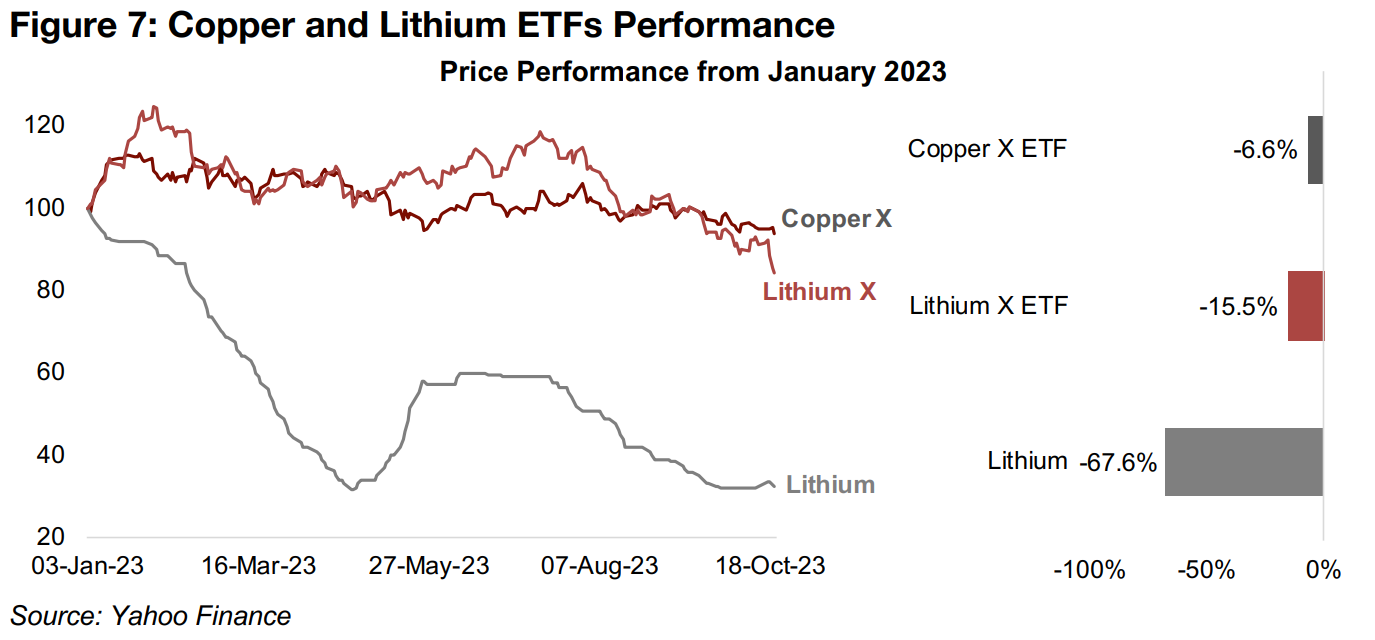

Large cap gold holding up best of major mining ETFs

For the major mining ETFs, even the best performing large cap gold GDX made a slight loss of -0.6%, while the junior miner gold ETF GDXJ is down -5.8%, with the underperformance to be expected given the smaller, riskier names it holds (Figure 6). The silver ETFs have underperformed the gold ETFs as the silver price has lagged gold, with the SIL ETF of larger silver producers down -12.9% and SILJ ETF of silver juniors down -17.5%, again given a higher weighting of smaller riskier stocks. The copper producers ETF Copper X, down -6.6% has been driven by a fall in the copper price, and the -15.5% decline in the lithium producers ETF Lithium X is still considerably above the -67.6% plunge in the lithium price. This is likely because many of the underlying stocks had not fully priced in the surge in the lithium to its peak in August 2022, with assumptions that the spike would be temporary (Figure 7).

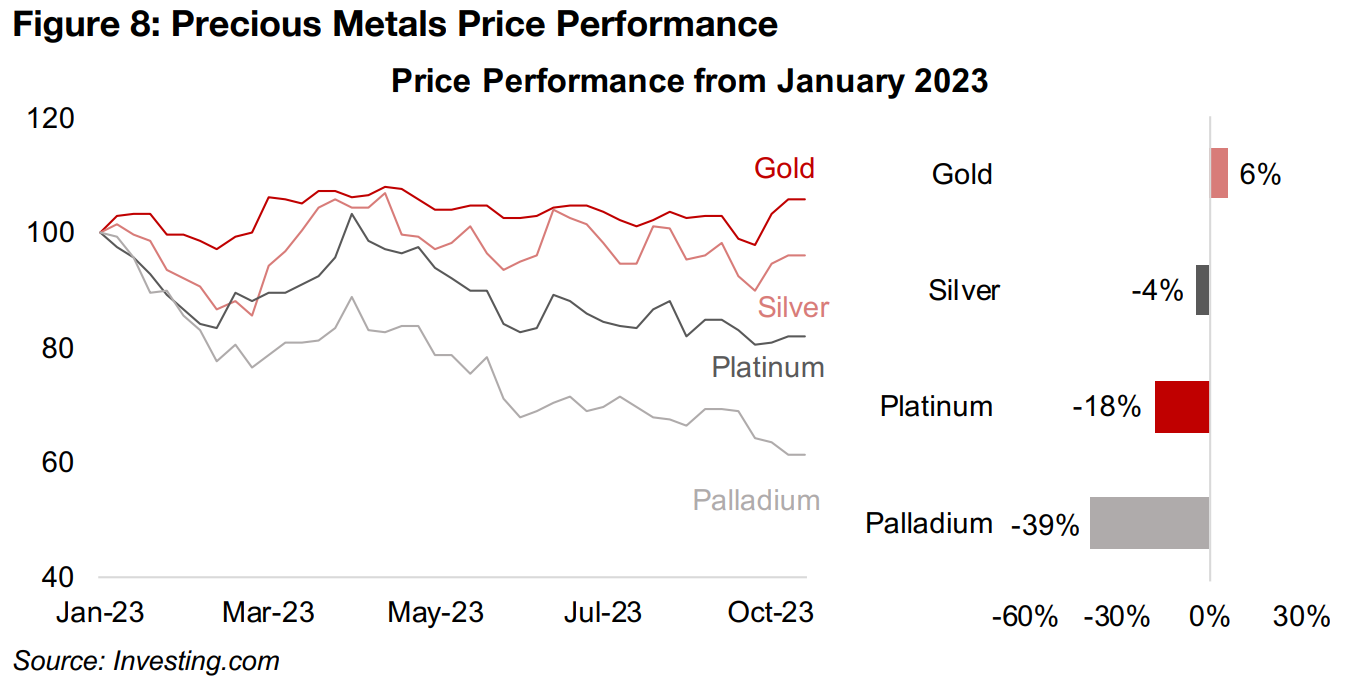

Only gold makes gains this year among precious metals

Of the major metals, only gold has made notable gains in 2023, and even this has been just mid-single digits at 6% after the major boost from rising geopolitical tensions, with it sitting on substantial losses just two weeks ago, pressured by a rise in the US$ and yields. It has also been the only gainer of the precious metals, with silver down -4%, as its significant exposure to the industrial cycle, similar to copper, has offset its safe haven properties, which are similar to gold (Figure 8). Both platinum and palladium are down significantly this year, by -18% and -39% respectively, as their main driver is use in autocatalytic convertors, and the outlook for vehicle sales has weakened on recession fears. Palladium has underperformed as the majority of its demand is from the auto industry, where there is an ongoing substitution towards platinum, and platinum has a much lower proportion of demand from this sector.

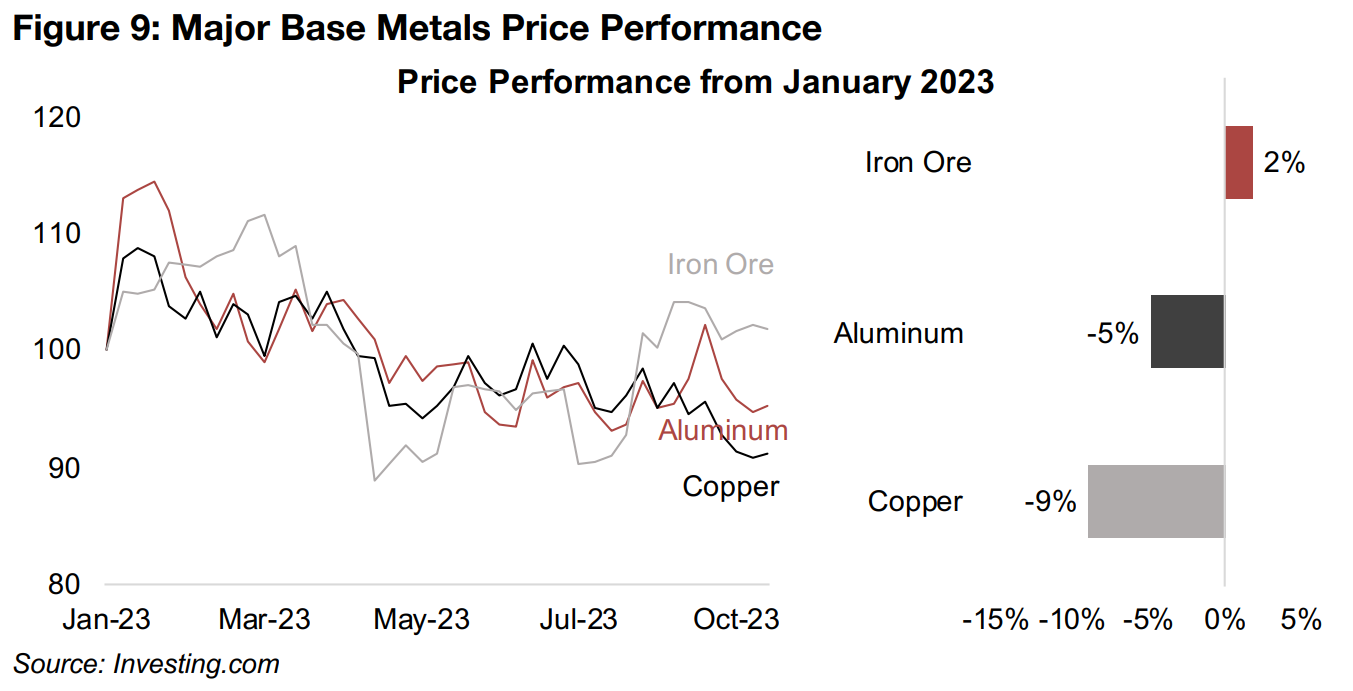

Major base metals suggest weakening economic expectations

The major base metals have been weak overall this year, likely reflecting sliding economic expectations. Even the best performer, iron ore, is nearly flat with a 2.0% gain, and tends to be a reflection of demand in China, which accounts for the majority of global iron ore consumption (Figure 9). The metal may have been given a slight boost by a reduction in interest rates in China, in contrast to the major hikes for most of the rest of the world, improving liquidity to the construction sector, and giving the metal a slight push. The other two major metals, aluminum, often considered one of the broadest indicators of global economic demand, and copper, a proxy for demand in heavily electrified developed economies, are down -5% and -9%, respectively, suggesting rising concerns about broader economic prospects heading into 2024.

Mid-tier and smaller metals all down apart from surging uranium

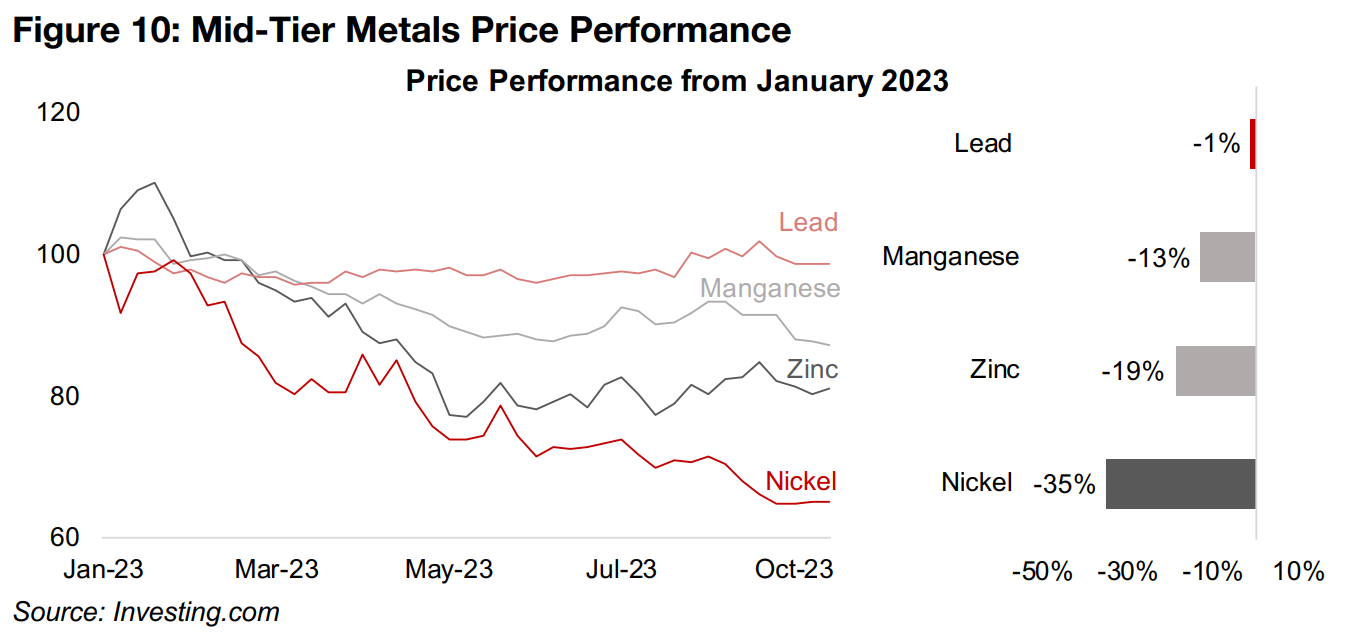

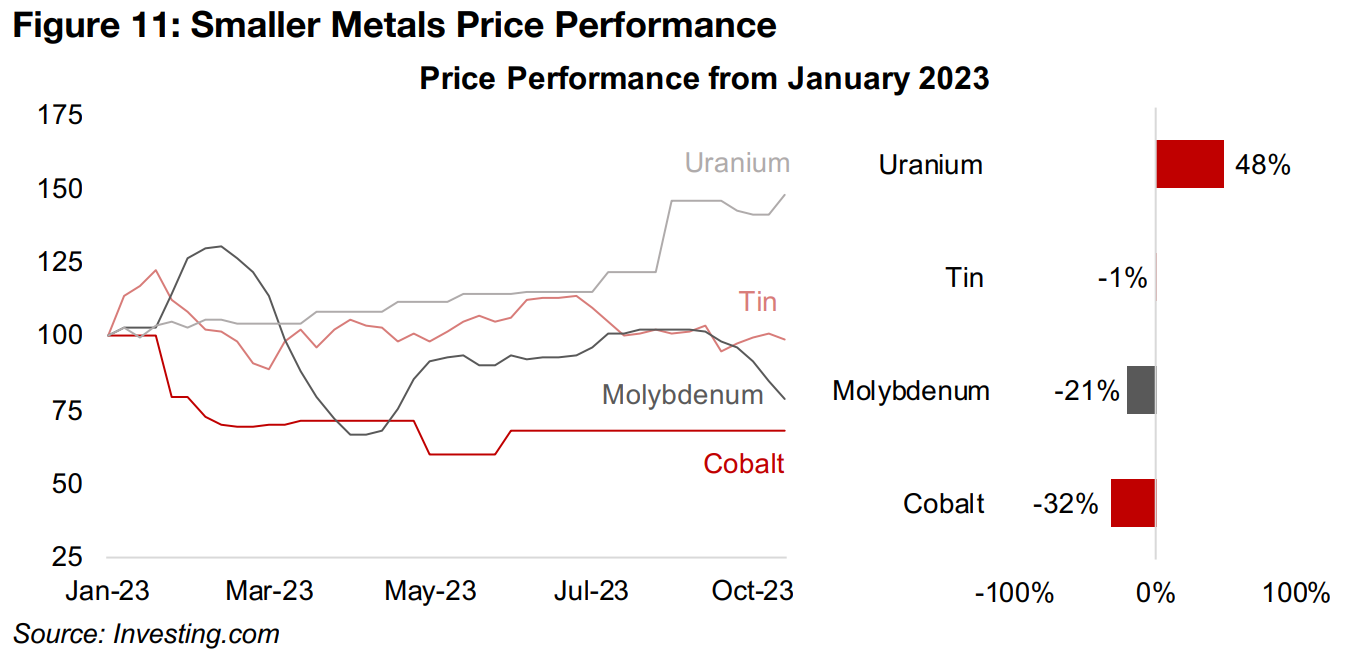

All the mid-tier and smaller metals are down with the exception of a surge in uranium. Lead edged down -1%, and has remained remarkably flat for about two years, manganese has dropped -13%, continuing its gradual slide since 2022, zinc is off - 19% and nickel has contracted -35%, continuing a slide off Russian-invasion induced highs in 2022 (Figure 10). Tin is down -1% and is also cooling from a 2022 post-global health crisis spike, while both molybdenum and cobalt are down -21% and -32%, also declining from supply constraint induced spikes last year (Figure 11). Uranium’s strength is part of a major secular push to use nuclear power as part of the green energy transition, with many governments and political organizations formerly wary of its use easing their stance and shifting towards more supportive policies.

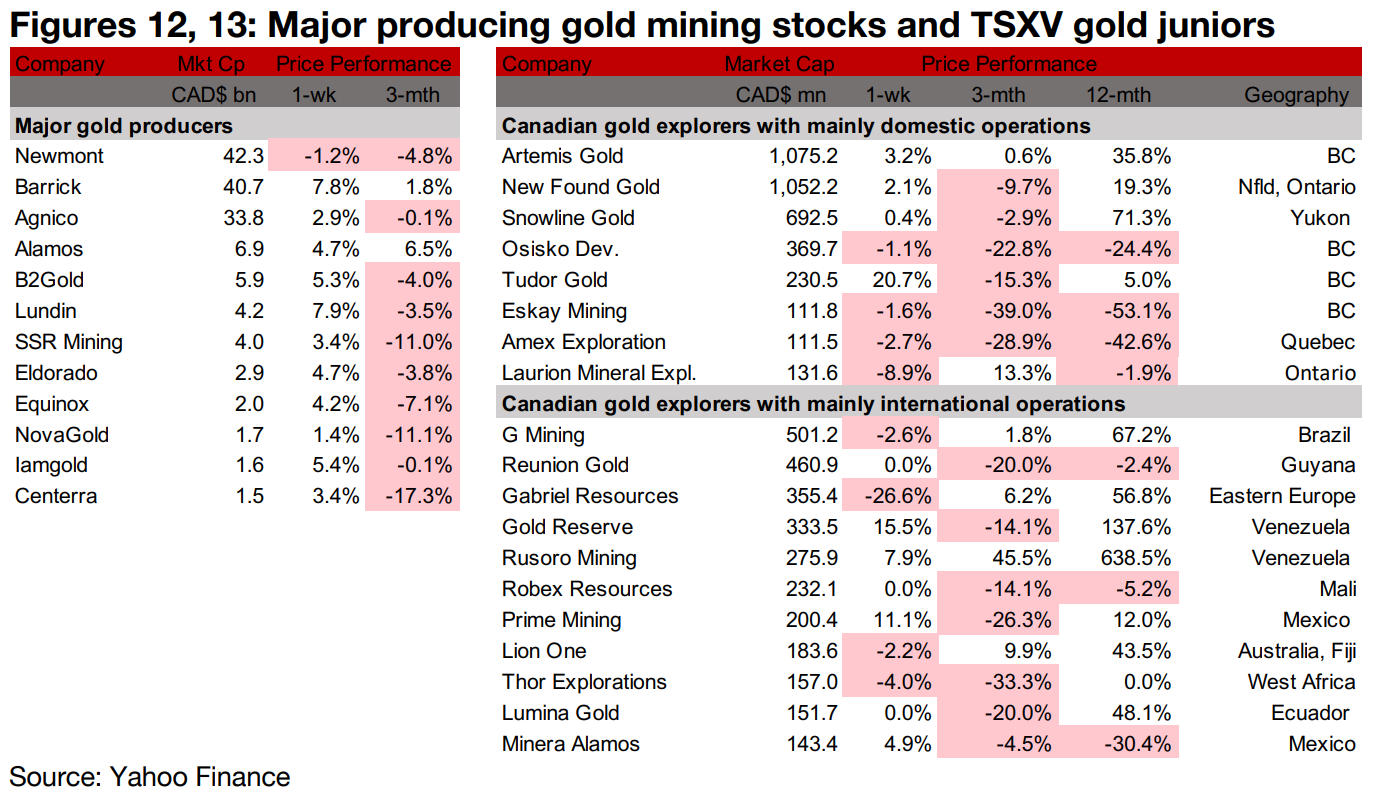

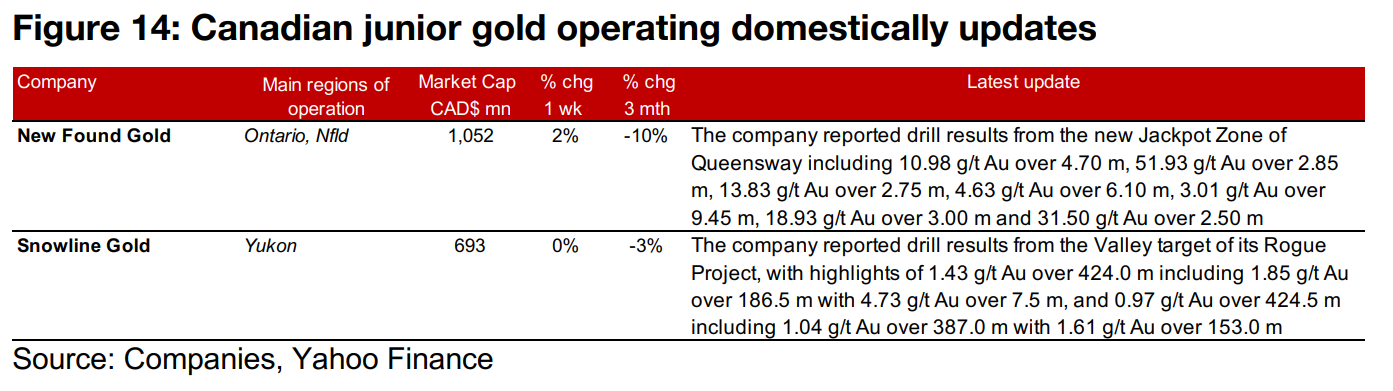

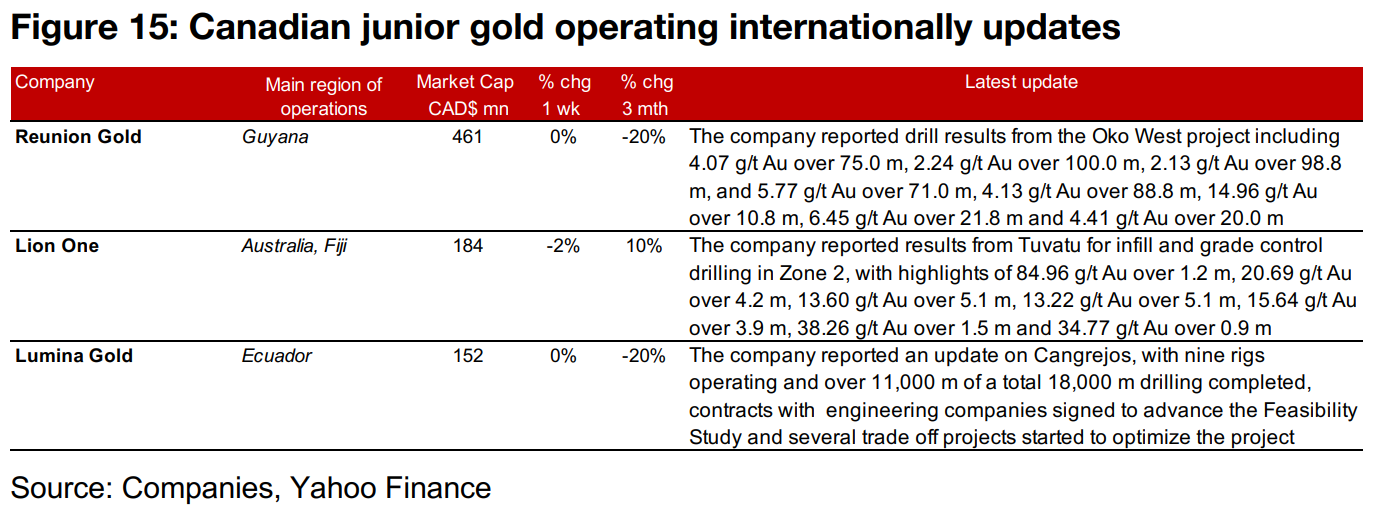

Most gold producers rise and TSXV gold mixed

All the major gold producers except Newmont gained and the large TSXV gold stocks were mixed as gold jumped but equities declined (Figures 12, 13). For the TSXV gold companies operating domestically, New Found Gold announced drill results from the new Jackpot Zone of the Queensway project and Snowline Gold reported drill results from the Valley target of its Rogue project (Figure 14). For the TSXV gold companies operating internationally, Reunion Gold released drill results from Oko West, Lion One reported drill results from Tuvatu and Lumina reported a drilling update from Cangrejos (Figure 15).

Disclaimer: This report is for informational use only and should not be used an alternative to the financial and legal advice of a qualified professional in business planning and investment. We do not represent that forecasts in this report will lead to a specific outcome or result, and are not liable in the event of any business action taken in whole or in part as a result of the contents of this report.