November 20, 2020

Gold remains near flat after some volatile weeks

Author - Ben McGregor

Gold near flat on lack of major drivers as recent volatility cools

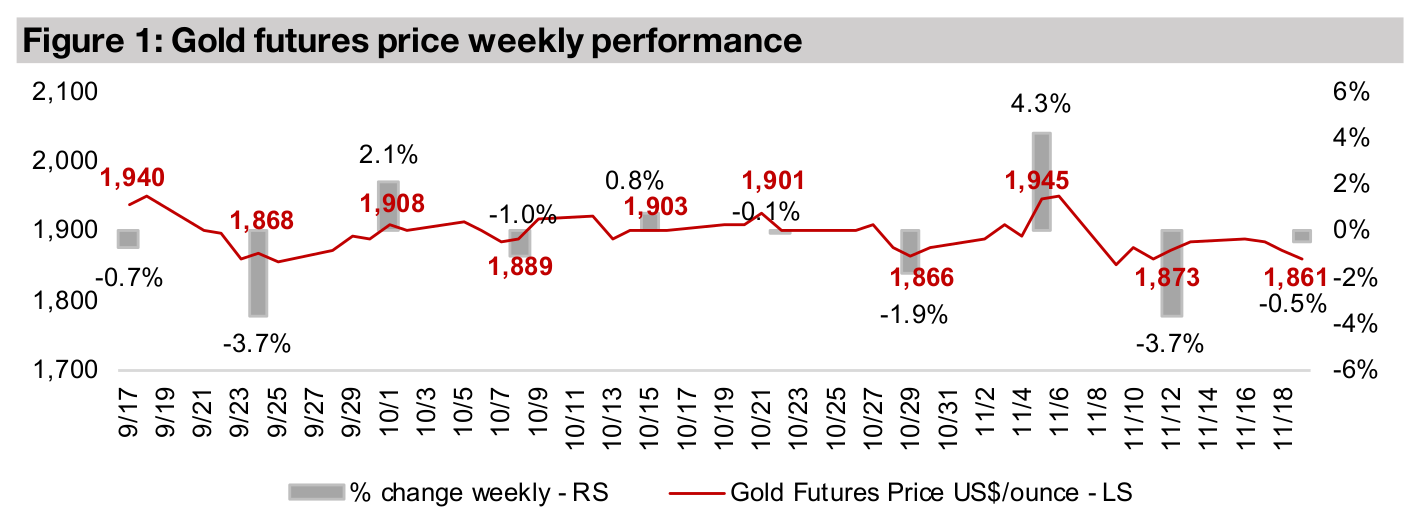

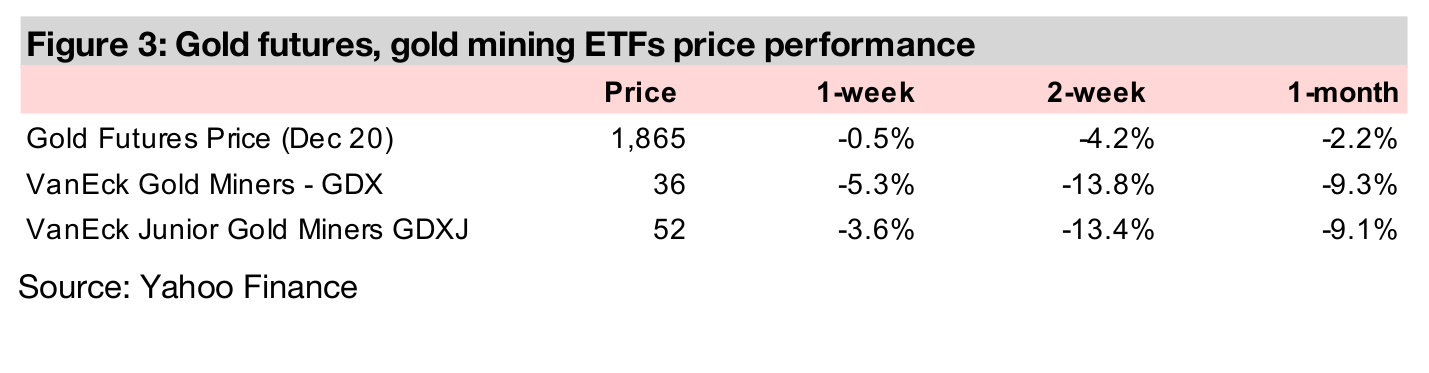

Gold was near flat this week, down -0.5% to US$1,861/oz, with a lack of major drivers, with the US$ and stock markets subdued, the health crisis balanced on vaccine news versus rising cases and big moves related to the election having subsided.

Producers and juniors pull back on flat gold and limited news

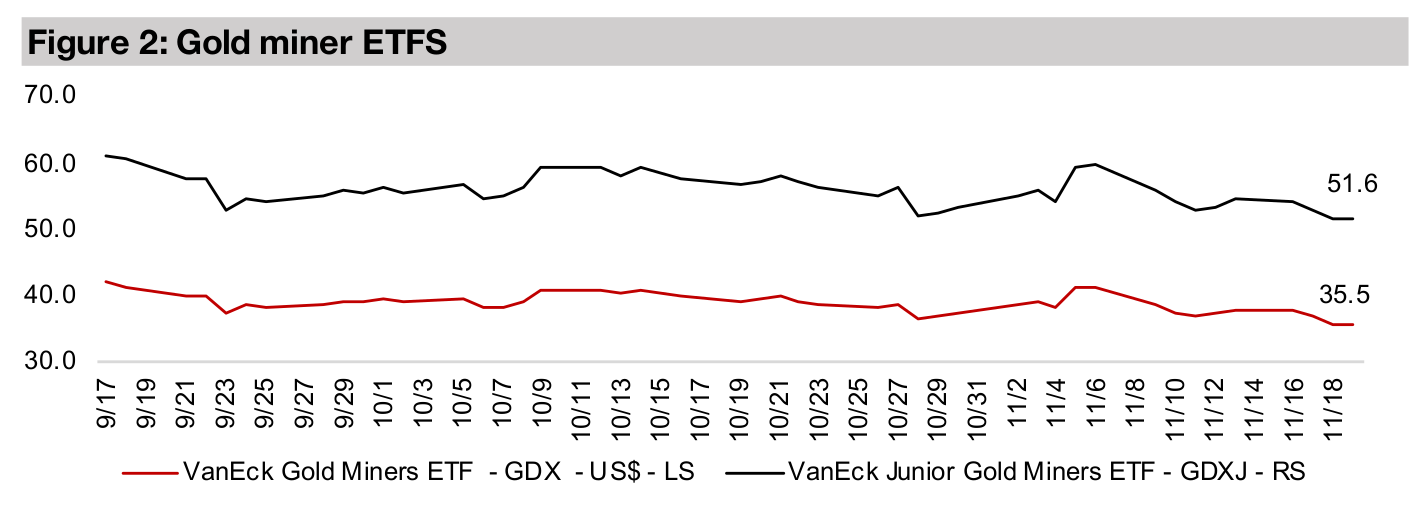

The producing and junior miners all fell this week, with the GDX down -5.6%, and the GDXJ dropping -3.6% on a lack of clear movement for gold and some overall consolidation following a wave of strong Q3/20 results for the producers.

Canadian juniors' capital raising and valuations, VGCX.TO In Focus

This week we look at capital raising for the larger Canadian junior miners in recent years, and some valuation metrics for the sector, while Victoria Gold (VCGX.TO) is In Focus, after a considerable decline after Q3/20 results disappointed the market.

A relatively uneventful week for gold as recent drivers cool

Gold edged down -0.5% this week to US$1,861/oz, in a relatively unexciting week for its underlying core drivers. In the weeks around the US election, there had been big moves in several major drivers, including the US$ Index and key alternative assets including treasuries and global equity markets, as well as shifts in broader risk premiums as news of a vaccine competed with news that health crisis cases were again rising. News flow on these factors has been more subdued this week compared to the last several weeks, likely leading to the much lower volatility in the gold price.

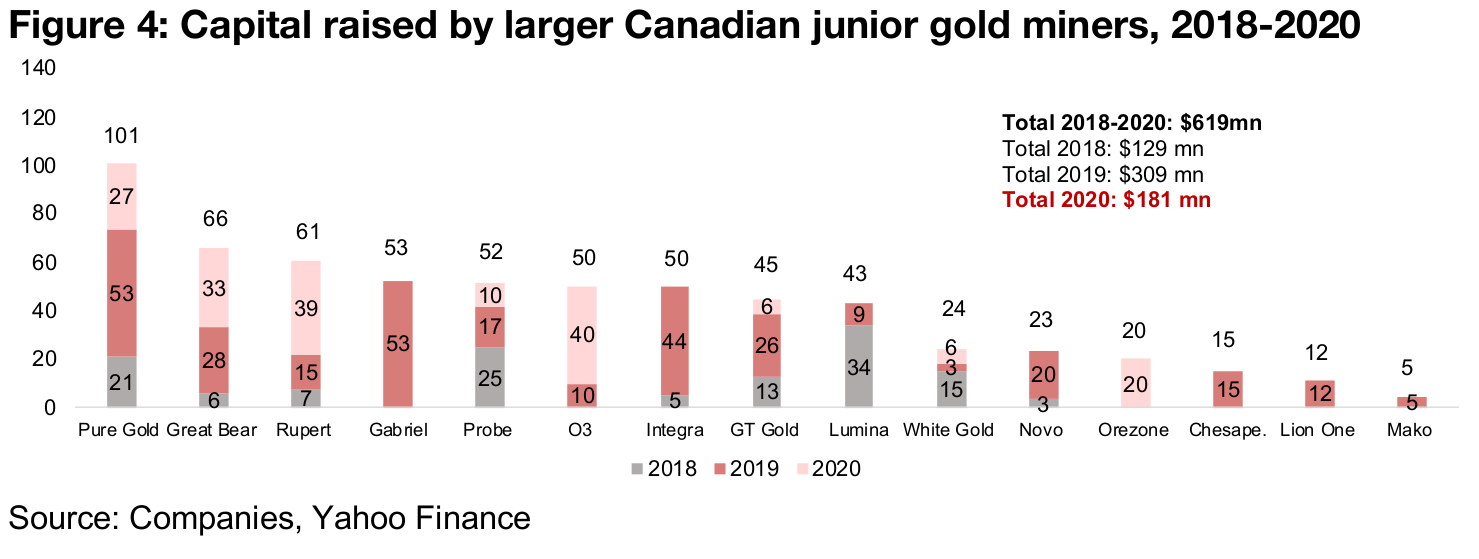

A look at capital raising by major Canadian junior gold miners

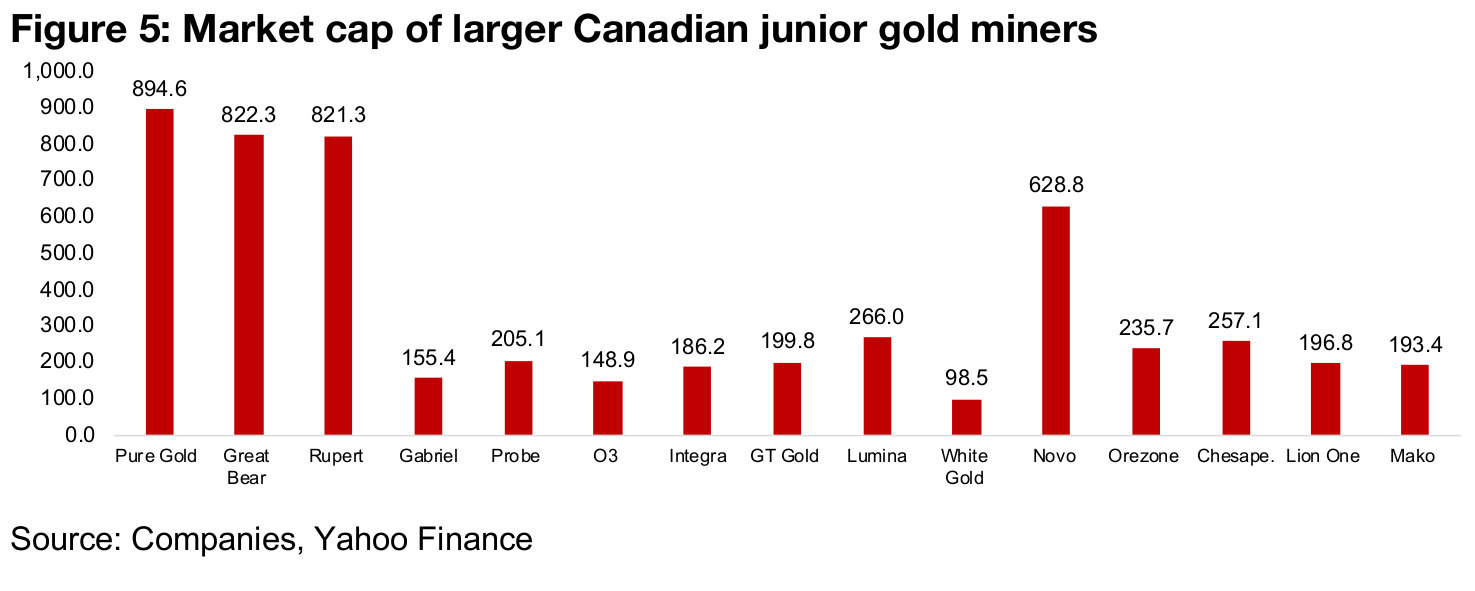

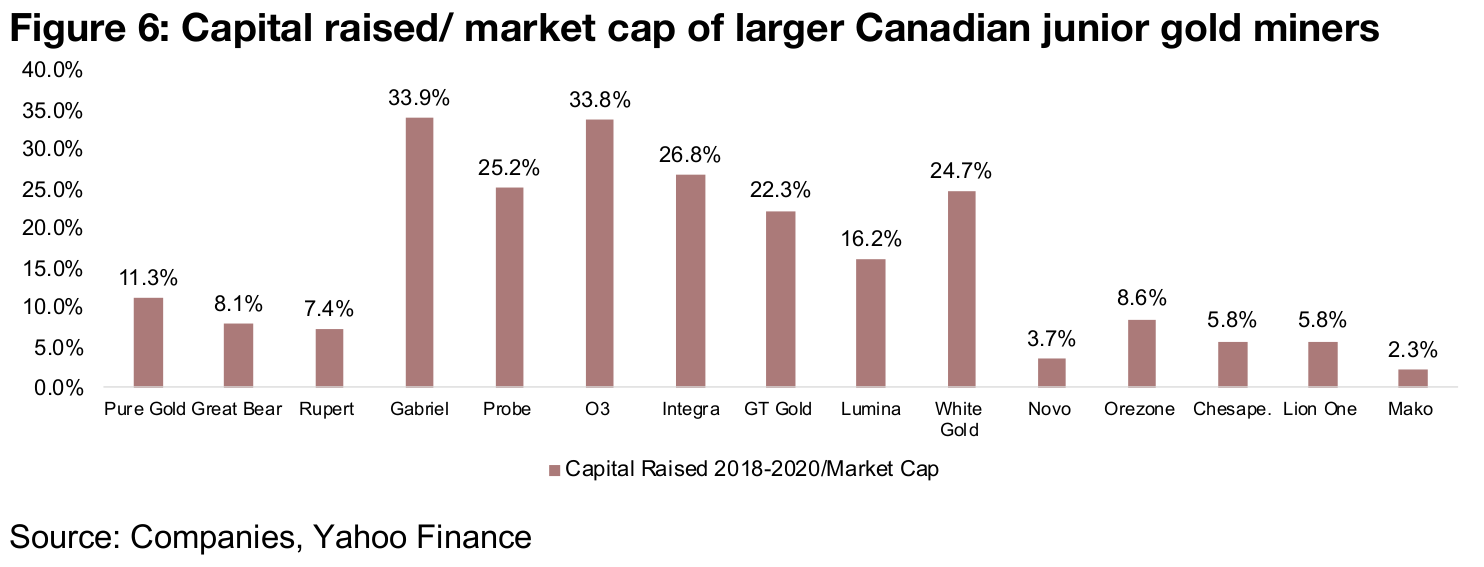

This week we look at capital raising by the larger Canadian junior gold miners over the past three years, and valuation metrics including price to book and market cap per share. The top fifteen by market cap have raised a total $619mn over the past three years, and although 2020 has been a relatively strong year, with $181mn raised so far, 2019 was even stronger, with $309mn (Figure 4). Three stocks, Pure Gold Mining, Great Bear Resources and Rupert Resources, which also have the largest market caps of group (Figure 5) have seen the largest amount of capital raised, with $228mn since 2018, or 37% of the total, with much of this concentrated in 2020 (only O3 Mining has seen similar levels of capital raised in 2020).

The capital raising for the top three has been a relatively low percentage of these stock's market caps, ranging from just 7.4% to 11.3%, however, as encouraging operating results have been the main factor driving up these company’s market values (Figure 6). Beyond the top three, the next seven raised between US$43- US$53mn each, and with operational success, and in turn market cap gains, not at the level of the top three, the capital raised to market cap has been substantially higher, at between 16.2% to 33.9%. The remaining group has seen a low absolute level of capital raised, for various company specific reasons, but generally showing less impressive operational progress compared to the rest of the group.

P/B and market cap/share for larger Canadian junior gold miners

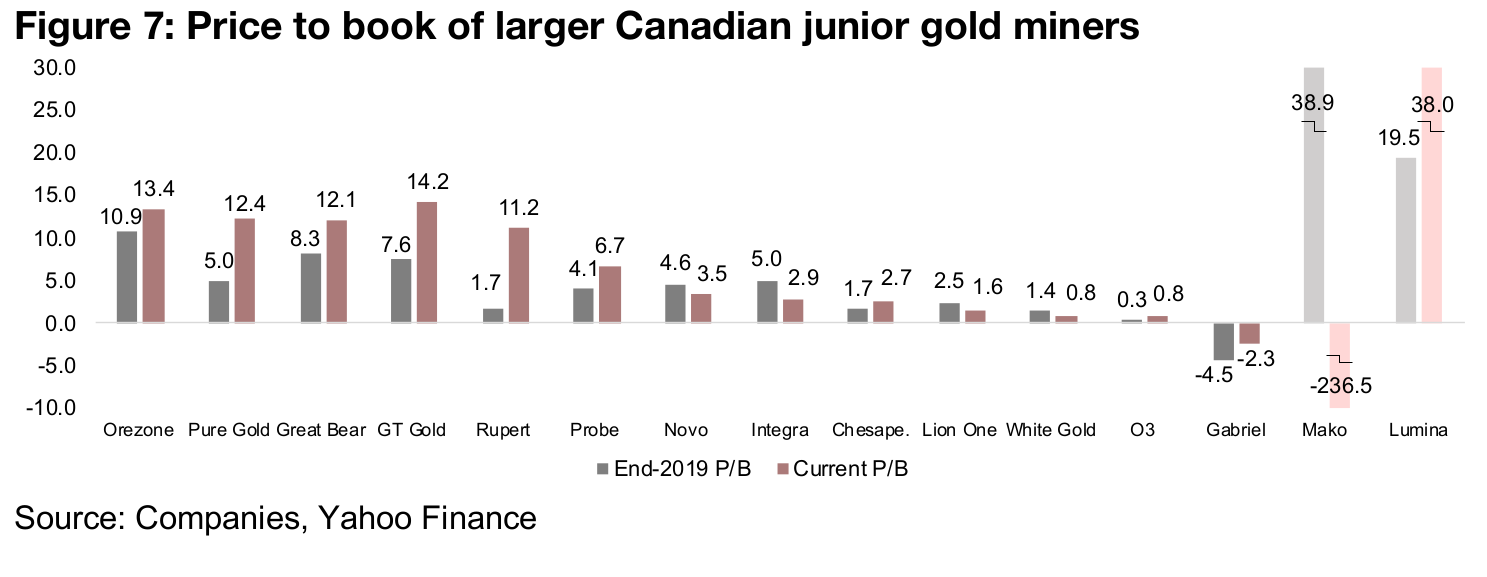

We have seen some substantial moves in valuation this year for the group. Looking at price to book (P/B) currently versus the end of the 2019, we have generally seen a major upward re-rating (Figure 7). The top three for capital raising stand out here, with a significant increase in their P/B multiples in 2020. Orezone has also seen a high and rising multiple; although it is a relatively small in terms of market cap, in 2020 it has raised the largest amount of capital beyond the top three and O3 Mining (Figure 4), and has made substantial operational progress.

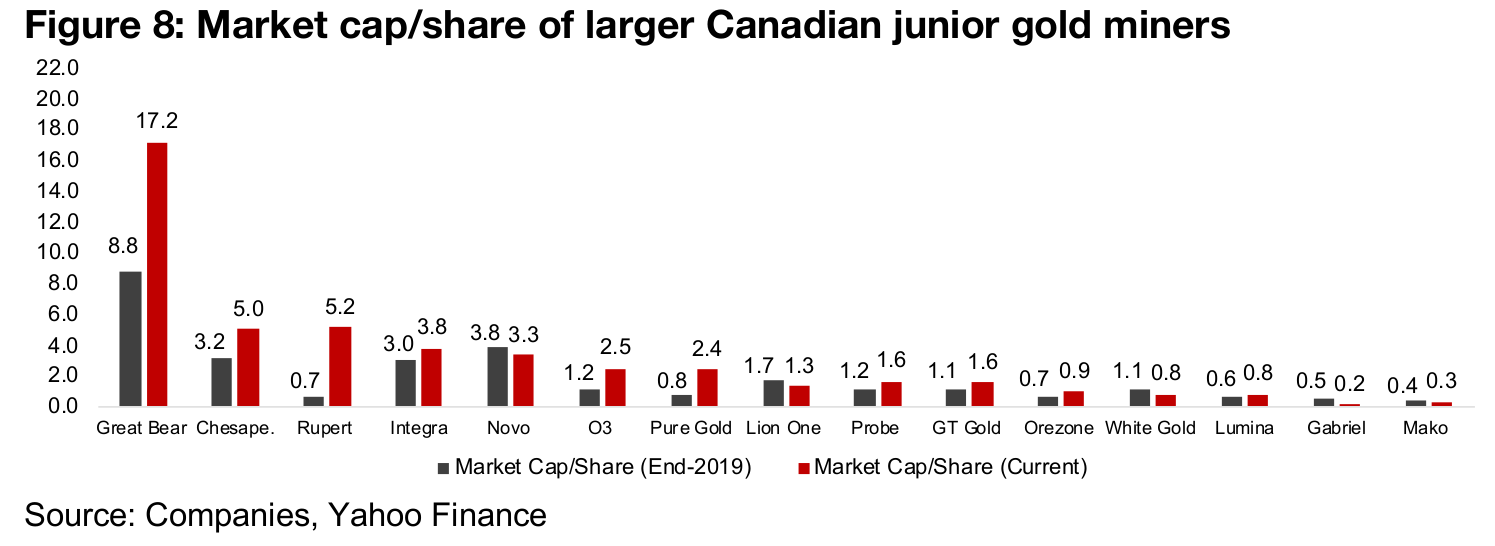

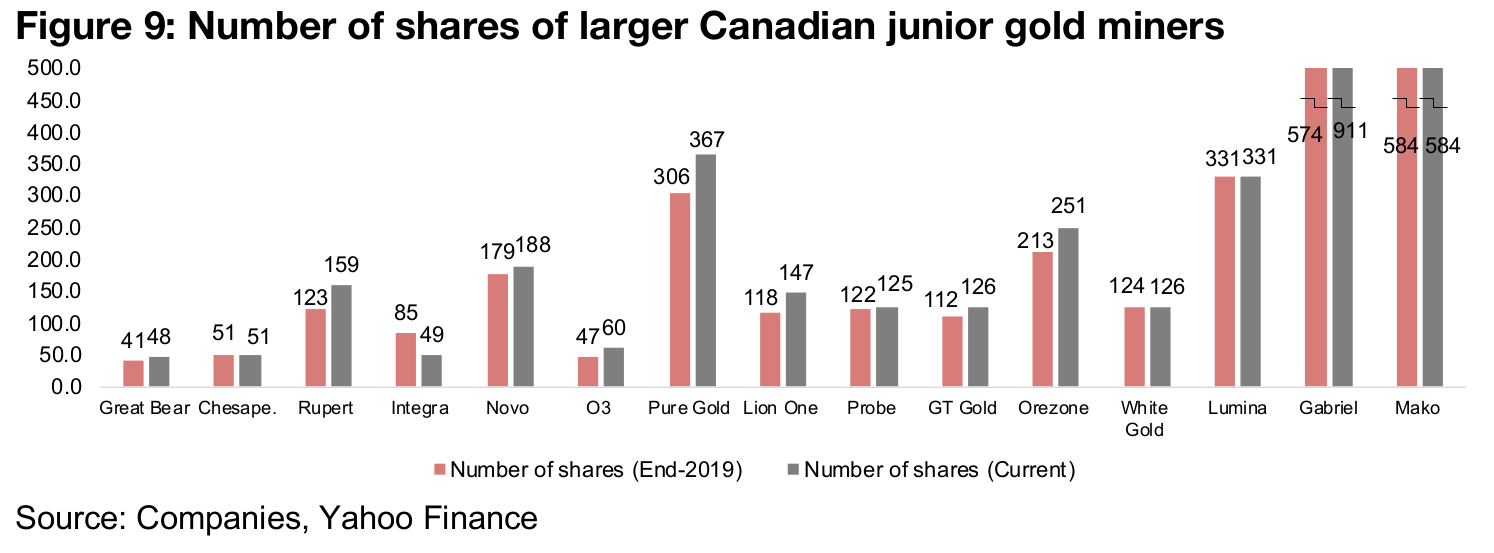

Another valuation metric to consider is market cap/share, which can indicate situations were there have been considerable dilution through new share issuance. Overall we see a considerable rise in market cap/share for the sector since the end of 2019, as we are generally seeing market cap gains across the sector, but few instances of strongly dilutive share issuance. The clear stand out on this measure is Great Bear, with a very high market cap/share versus the peer group (Figure 8). This is of because of its very low absolute number of shares versus the peer group, even as its market value has surged this year on a continued series of strong exploration results (Figure 9). The other two capital raising leaders have also seen major increases in their market cap/share, but while Rupert Resources has the third highest market cap/share of the group, Pure Gold Mining is more to the middle of the pack on this metric, given a relatively high number of shares compared to the group. Overall the top three have only seen moderate increases in their share count, and only one stock of the group, Gabriel Resources, has seen a major percentage increase in its shares outstanding this year.

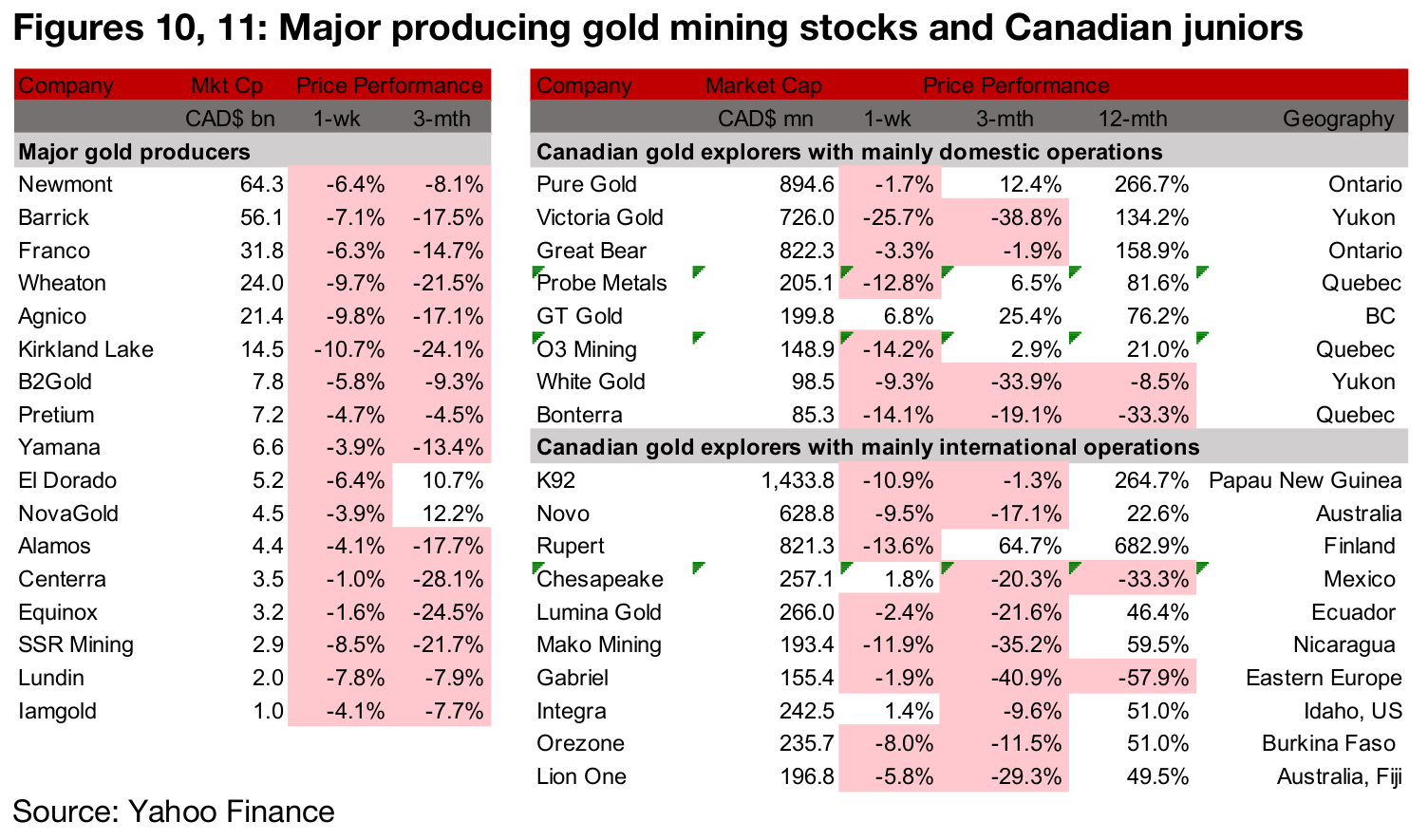

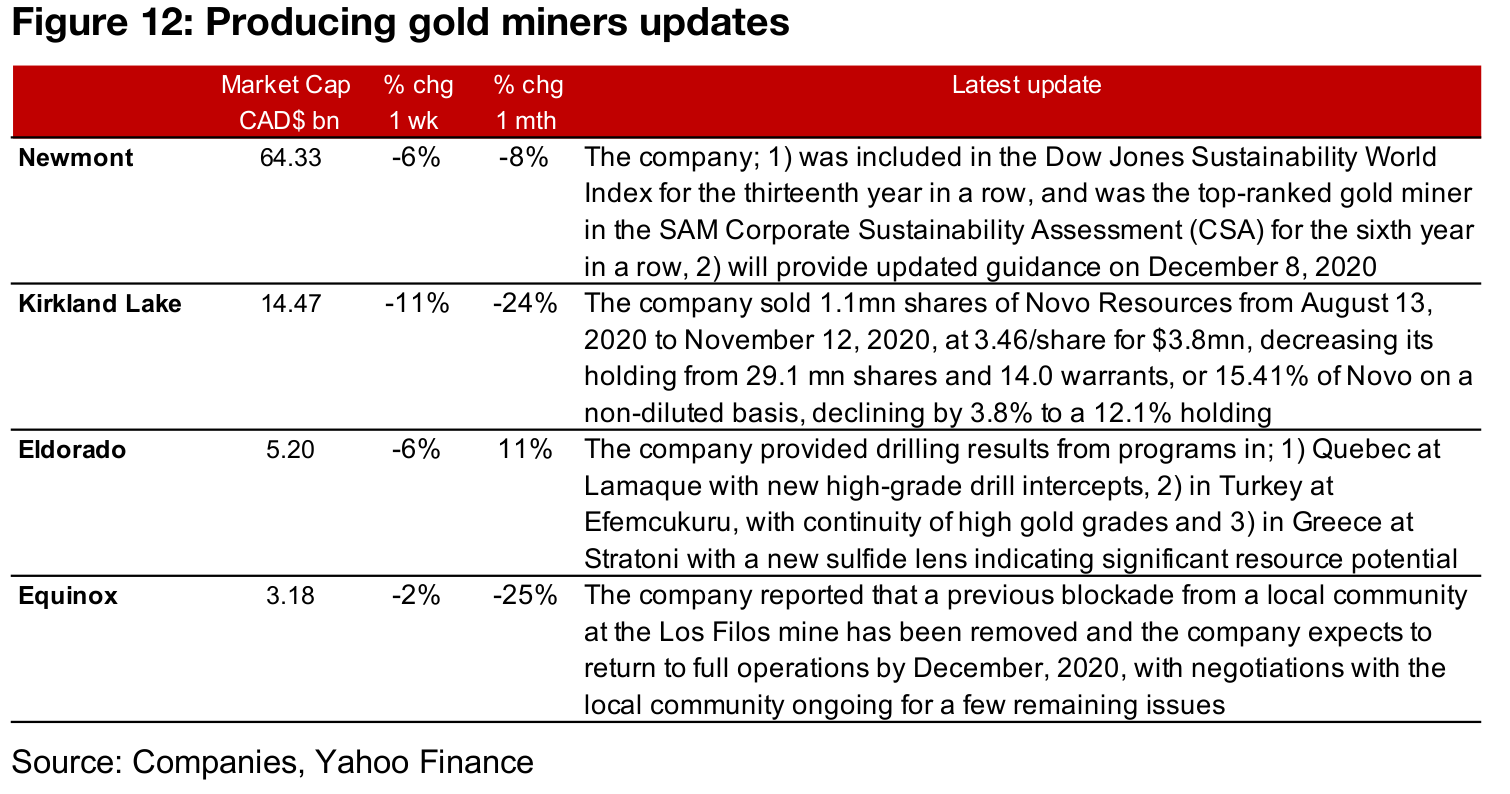

Producers down on gold decline as key drivers cool

The producing miners were all down this week as the volatility over the past few weeks in the major underlying drivers for gold price cooled substantially (Figure 10). New flow was limited especially in the context of the major wave of news flow over the past three weeks related to Q3/20 results. Newmont reported its inclusion in the Dow Jones Sustainability World Index and a top ranking in the SAM Corporate Sustainability Assessment and Kirkland Lake announced the sale of some of its holding of Novo Resources. Eldorado announced drilling results from three of its projects and Equinox reported that a blockade at its Los Filos Mine had ended.

Canadian gold juniors mainly down

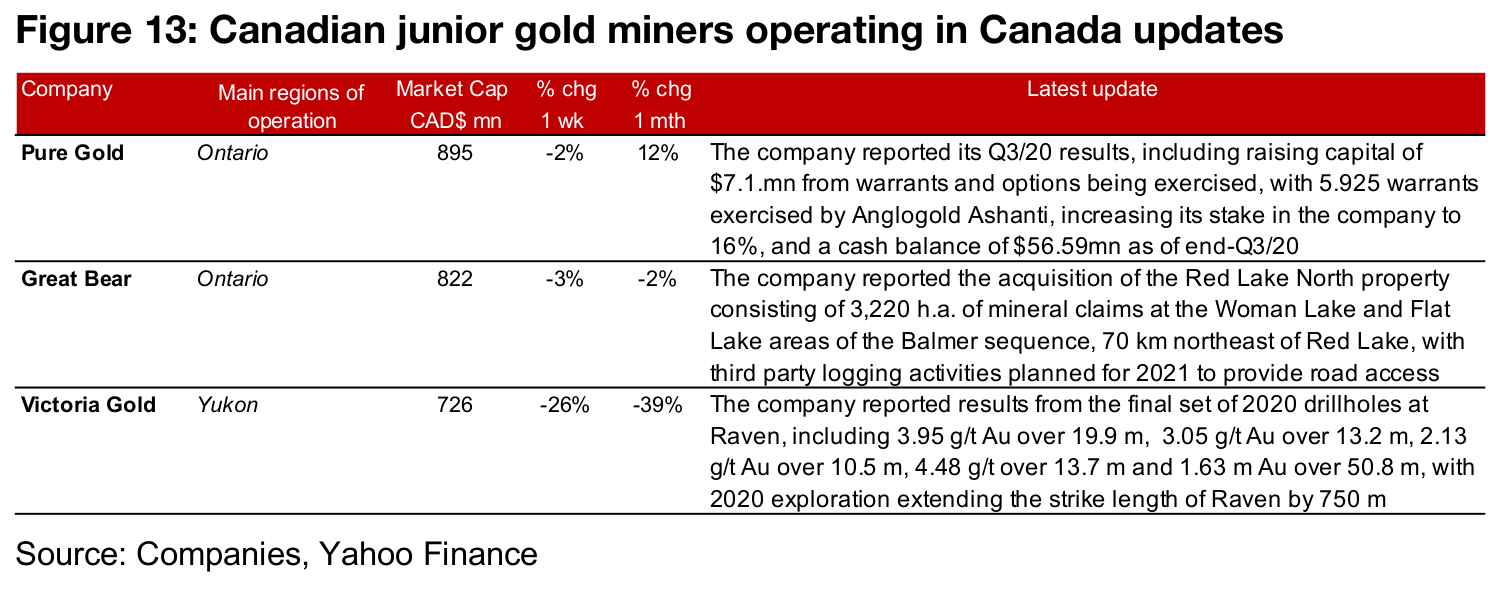

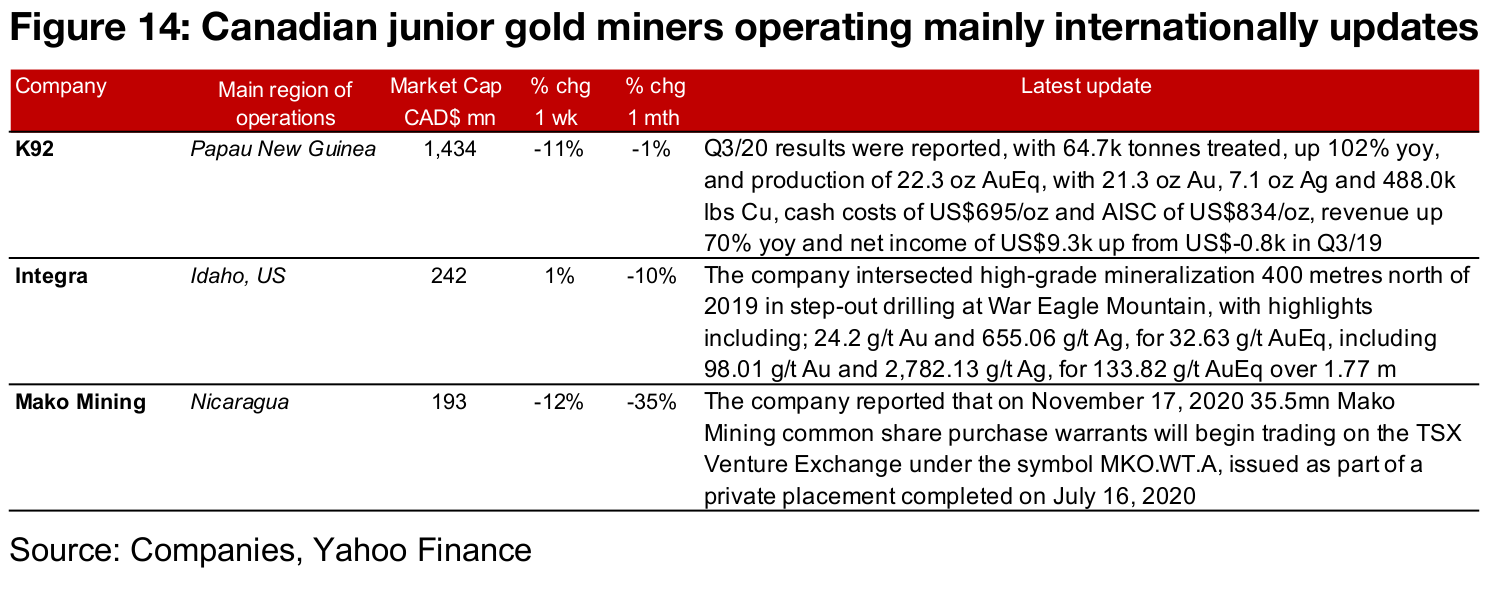

The Canadian juniors were mainly down this week as the sector saw some consolidation after the volatility of recent weeks (Figure 11). For the Canadian junior gold miners operating domestically, Pure Gold reported their Q3/20 results, Great Bear announced the acquisition of another property north of Red Lake, and Victoria Gold reported results from the final set of 2020 drillholes at its Raven project, extending the strike length by 750 m (Figure 13). For the internationally operating juniors, K92 reported Q3/20 results, Integra Resources reported drilling results from War Eagle Mountain, and Mako Mining announced the start of trading on the TSX of warrants issued as part of its private placement completed in July 2020 (Figure 14).

In Focus: Victoria Gold (VGCX.TO)

Q3/20 results disappoint the market

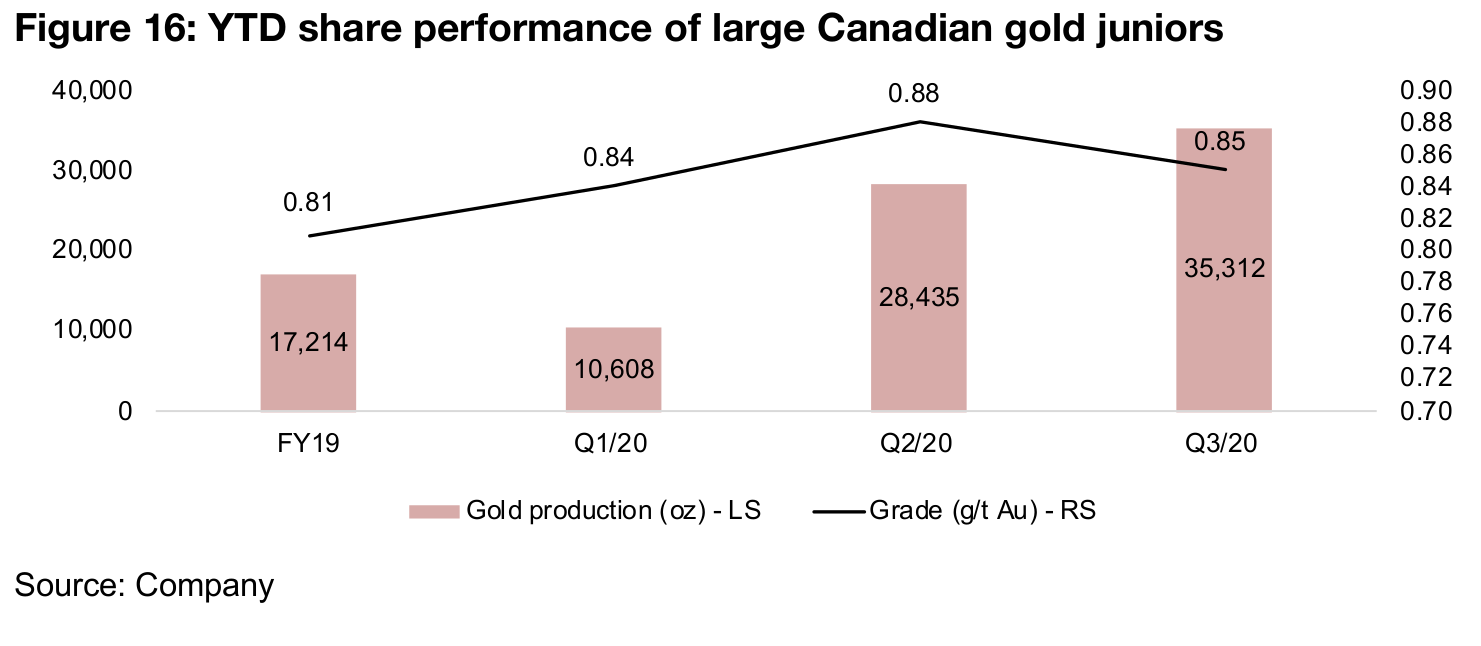

Victoria Gold saw the weakest performance of the larger Canadian junior gold miners this week, falling -25.6%, which is a steep decline even in the context of the volatile price movements of the past few weeks. The major reason for the decline was Q3/20 production at the Eagle Mine of 35,312 oz, which suggested that the company would have difficulty even reaching the lower end of their H2/20 production guidance of 85,000-100,000 ounces (Figure 16). The company therefore revised down its guidance to 72,000-77,000 ounces of for Q4/20, implying production of around 37,000 oz to 41,700 oz, or a q-o-q increase in production of between 3.9% to 18.1% next quarter.

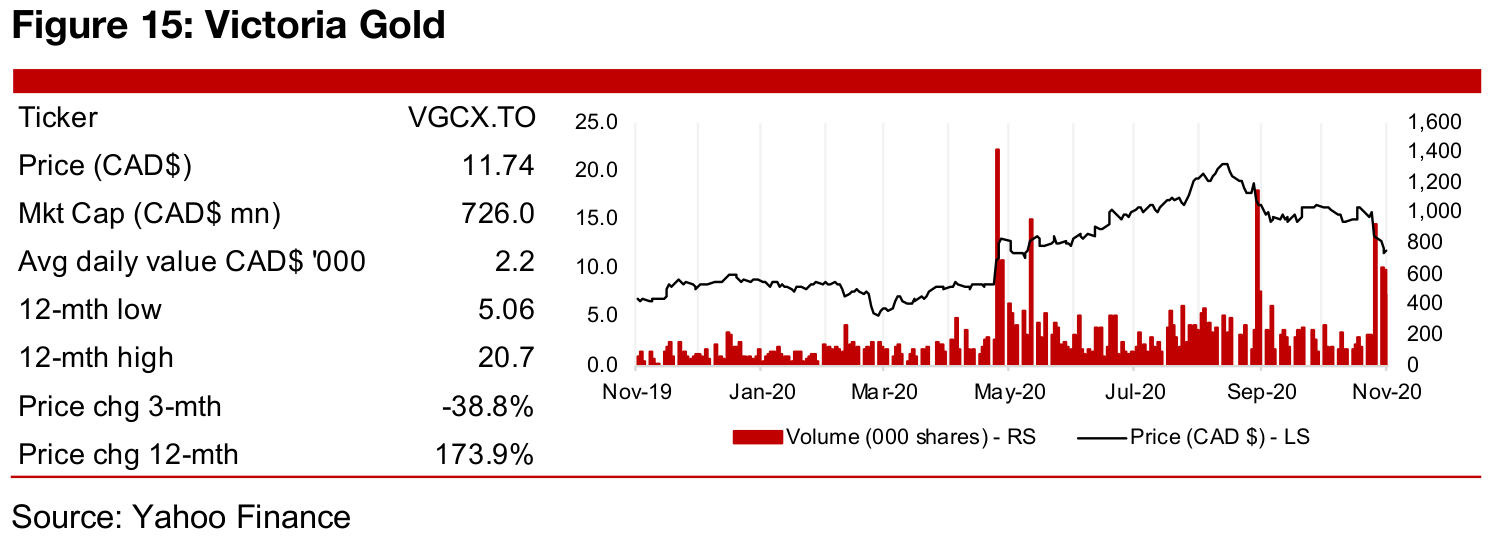

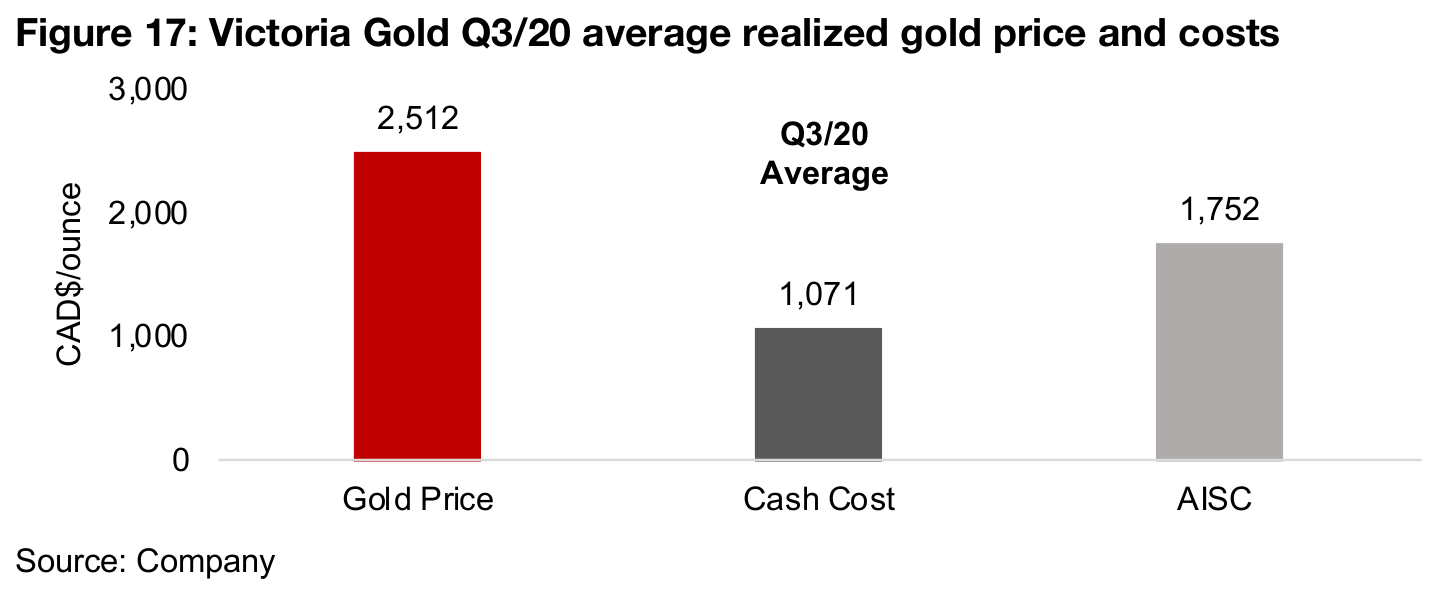

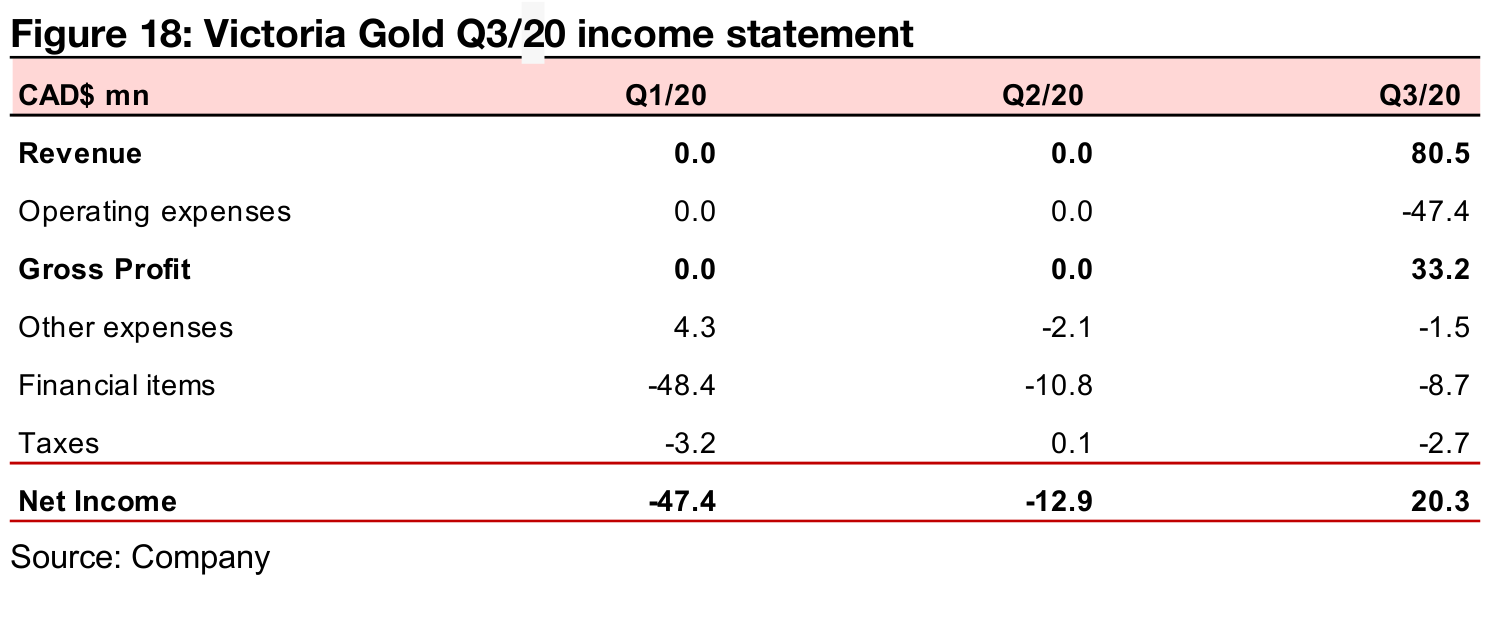

The Eagle Mine reached first gold pour in Q3/19 and reached commercial production only on July 1, 2020, so there was no y-o-y comparison available. However q-o-q, production rose a substantial 24.2%, from 28,432 oz in Q2/20 and is up 168% from just 10,680 oz in Q1/20. The company was profitable in Q3/20, with a CAD$2,512/oz gold price well ahead of cash costs of CAD$1,071/oz and AISC of CAD$1,752/oz (Figure 17). The company generated its first quarter of revenue as commercial production began, with revenue of CAD$80.5mn, expenses of CAD$47.4mn, gross profit of CAD$33.2mn and net income of US$20.3mn (Figure 18). The company's share price has seen pressure since September 2020, as it started to fade from its August 31, 2020 peak at CAD$20.1/share, and is now down 42% off the highs, with about half of that loss occurring in just the past week since the results.

Disclaimer: This report is for informational use only and should not be used an alternative to the financial and legal advice of a qualified professional in business planning and investment. We do not represent that forecasts in this report will lead to a specific outcome or result, and are not liable in the event of any business action taken in whole or in part as a result of the contents of this report.