August 13, 2021

Gold regains ground after strong dip

Gold price recovers some ground after strong dip

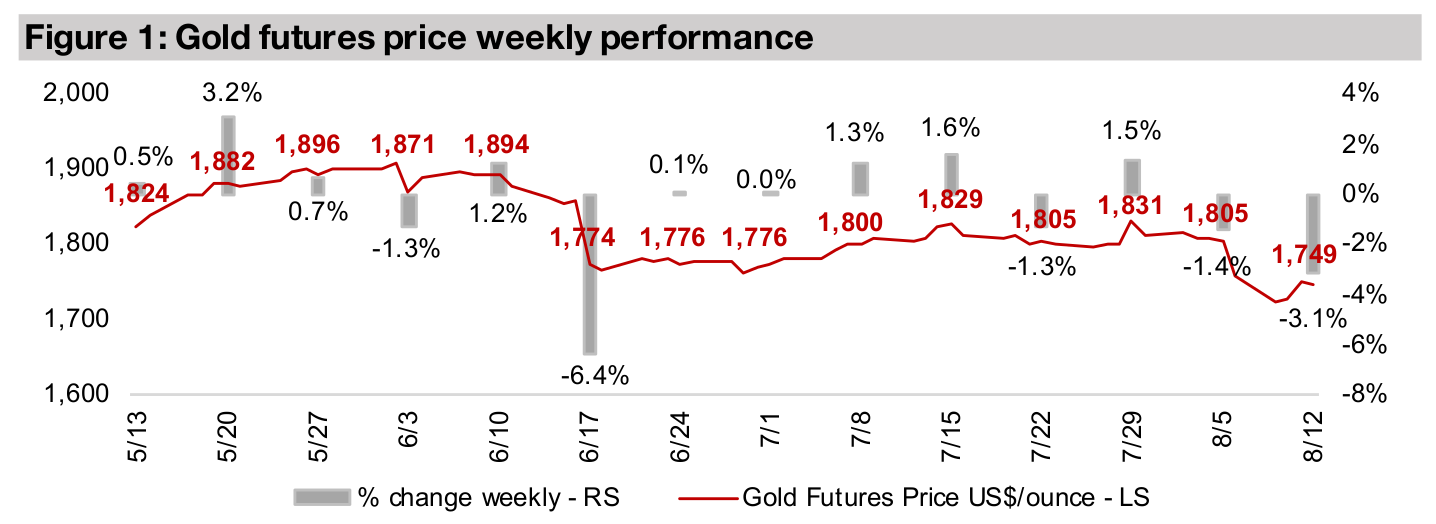

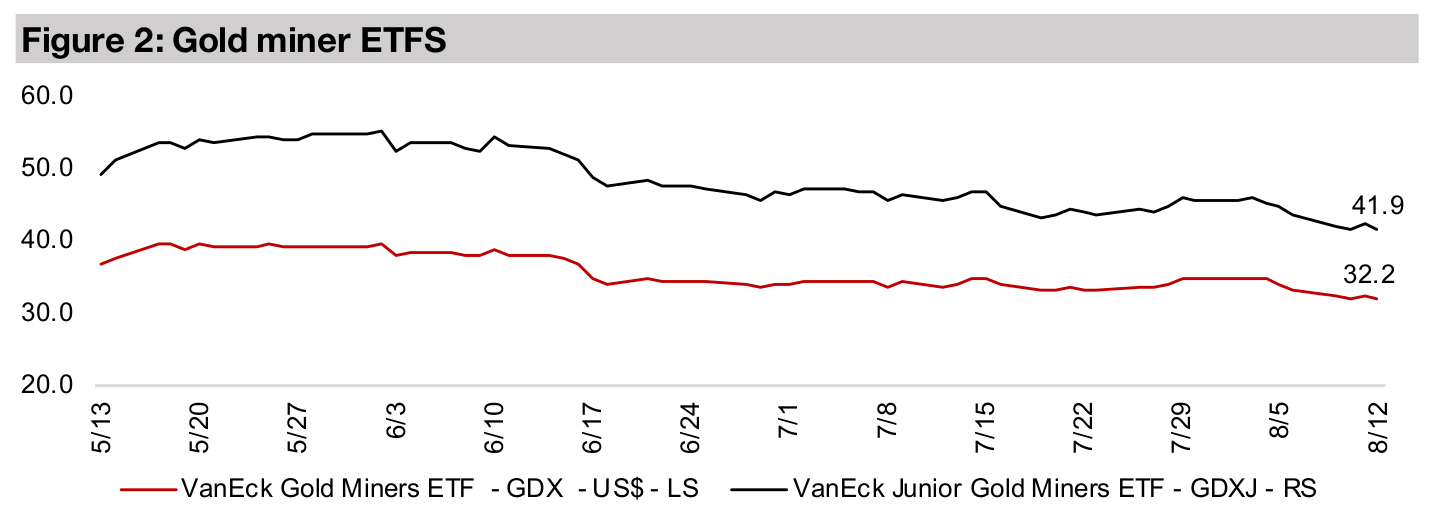

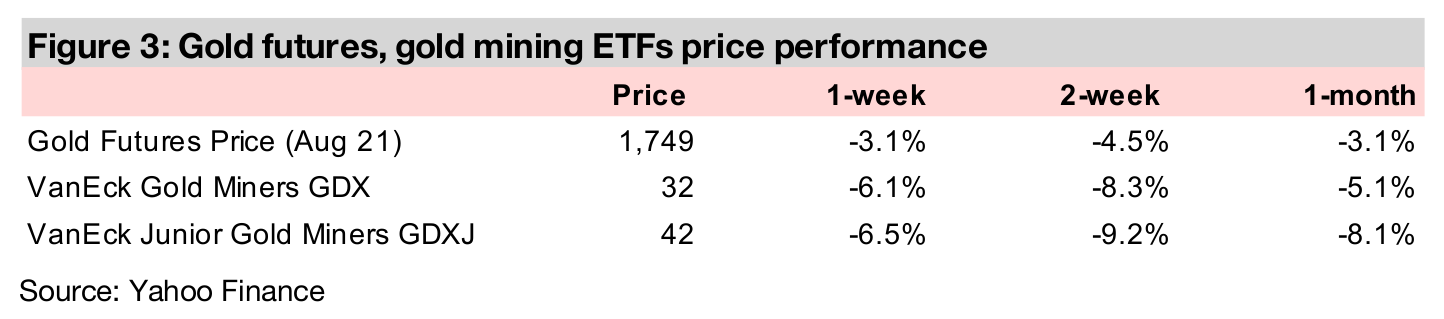

The gold price declined -3.1% this week to US$1,749/oz, having regained some ground after closing as low as US$1,723/oz earlier in the week, with the market weighting more heavily the chances for an earlier than expected taper by the Fed.

Q2/21 results season completed with decent results

The Q2/21 results season was completed this week, with all of the major and mid-tier gold producers having reported, showing overall decent results, but with growth rates having subsided from the particularly strong sector rebound from H2/19 to 2020.

1) Gold regains ground after strong dip

Gold declined -3.1% this week to US$1,749/oz, having regained some ground after

closing as low as US$1,723/oz, as the market was apparently attributing a higher

weighting to a potential early taper by the Fed, while a strong dollar and yields also

put pressure on gold. However, we continue to believe that the expectations for

aggressive moves by the Fed are weighted too highly, given a tenuous economic

recovery and continued slog of attempting to exit the global health crisis. We believe

that without the full throttle monetary expansion of the past year, a quite precarious

economic situation would be exposed and that therefore continued strong stimulus

will be needed for an extended period. Also, stock markets are at unprecedented

levels on a market cap/GDP measure, and any aggressive taper or raise hikes could

drive a collapse in equity. We believe that more stimulus, not less, may become the

order of the day, and inflation will continue to remain high, with gold benefiting.

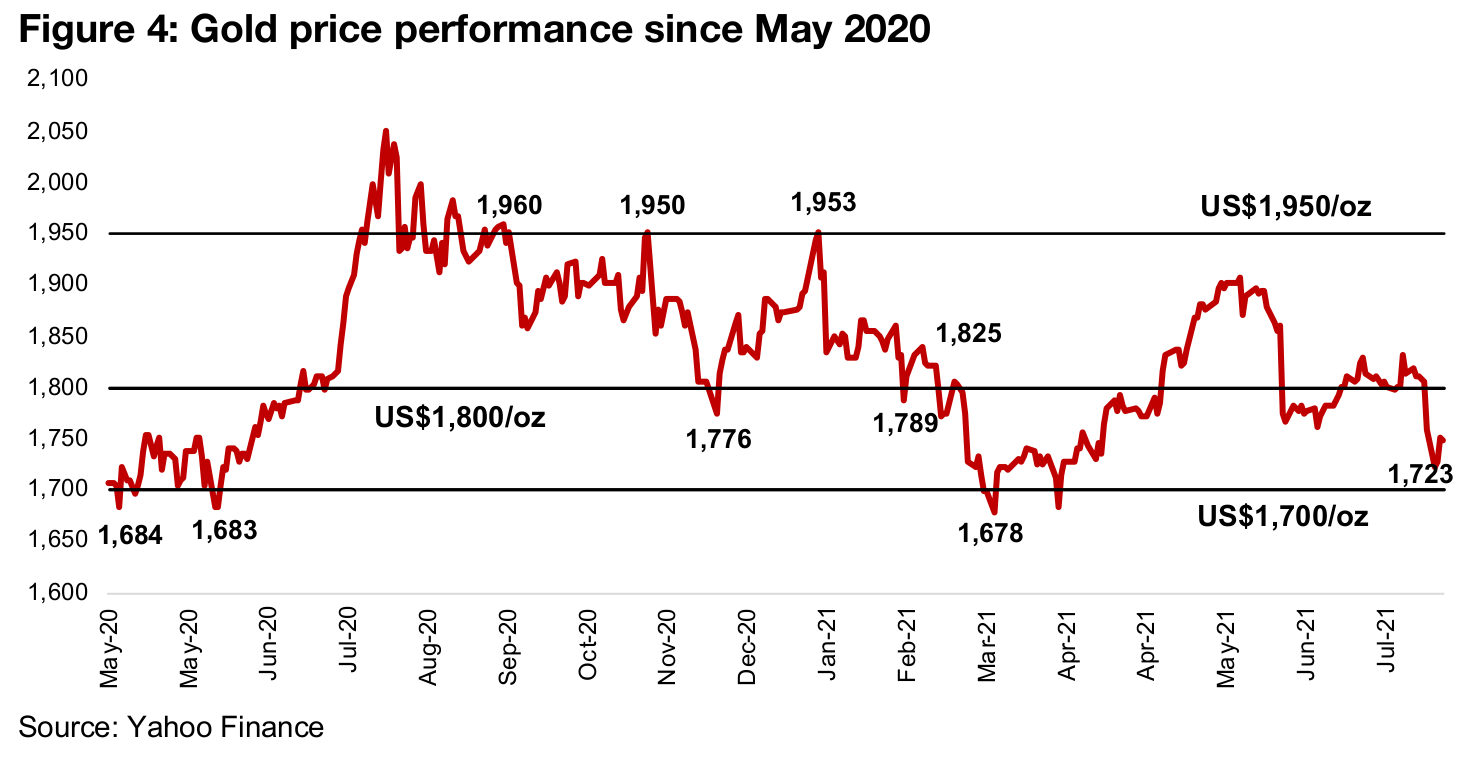

Nonetheless, with the market still selling off gold short-term, it is a good time to pull

back and consider the dip this week in a long-term context. Overall we see gold over

the past year moving between three key levels, with US$1,950/oz appearing to be

the upper bound during the peak of global health crisis fears, but it settling down to

between US$1,700/oz and US$1,800/oz once there was at least some degree of

control over the situation. So the move this week is towards the lower end of a range

that has held for over the past year. Given that, in contrast to the market, we do not

see an easy exit from stimulus for the Fed, and that we expect inflation could continue

to surprise to the upside given the massive monetary expansion of the past year, we

believe that gold may once again rebound from its dip, as we have seen before this

year, with a recovery off March-April 2021 lows.

2) Gold producers see decent Q2/21

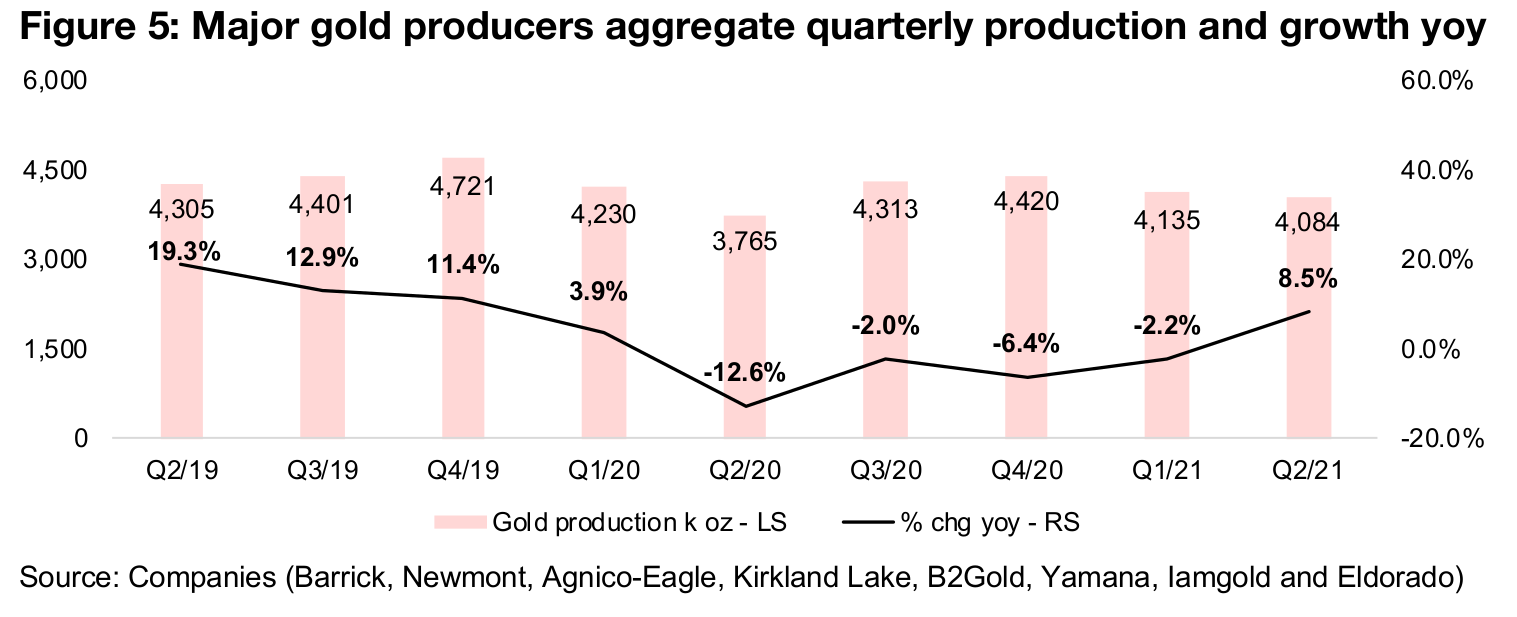

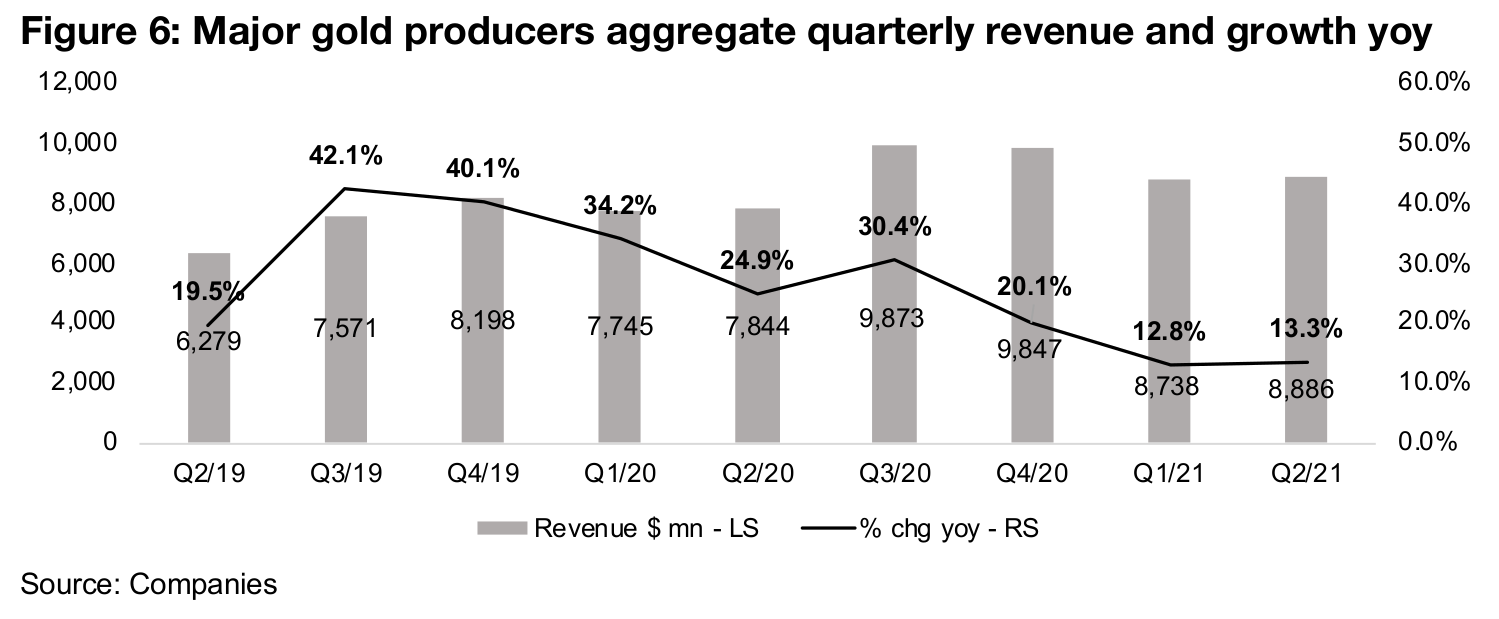

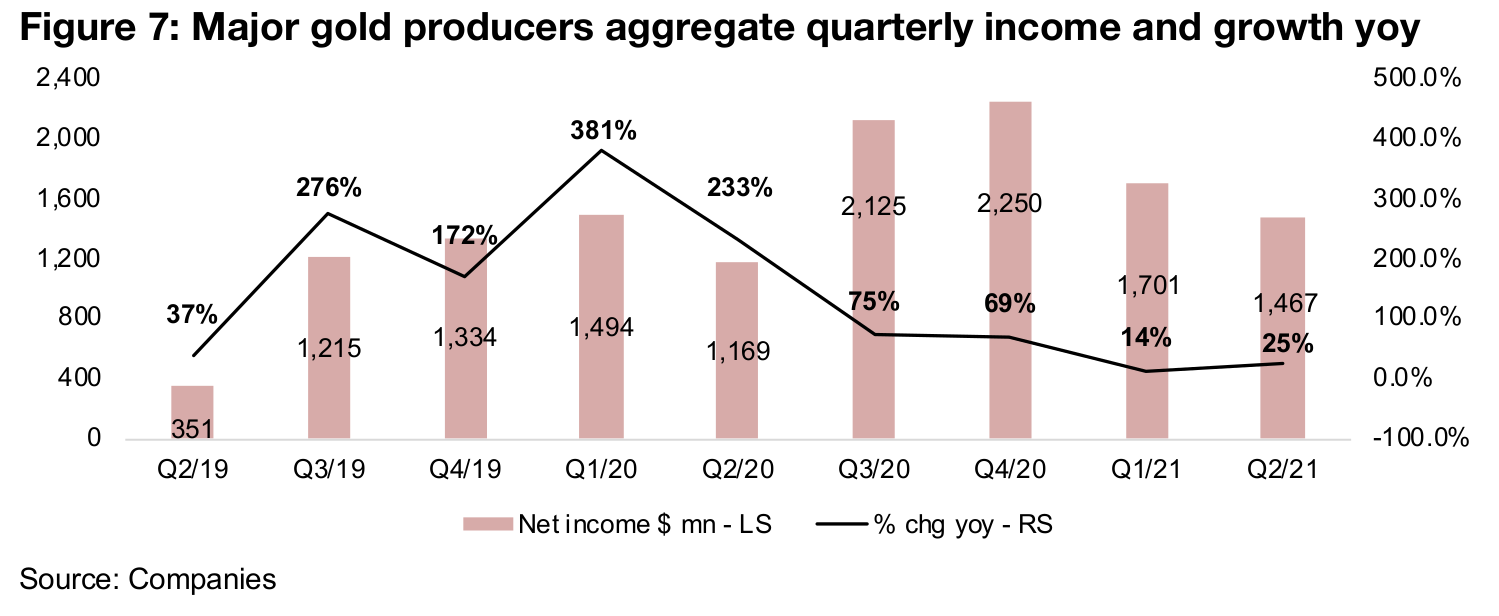

The gold producers saw a decent set of Q2/21 results overall. The aggregate production of the major producers (Barrick, Newmont, Agnico-Eagle, Kirkland Lake, B2Gold, Yamana, Iamgold and Eldorado) rose 8.5% year-on-year, its strongest level since Q4/19, following four straight quarters of contraction (Figure 5). Revenue growth was 13.3%, up from Q1/21, but overall first half growth was moderate compared to the last two years, given weaker yoy gains in the gold price compared to the big rise in H2/19 and 2020 (Figure 6). Net income rose 25% in Q2/21, up from just 14% growth in Q2/21, but again was considerably lower than the growth of H2/19 and 2020, as the net income of the gold producers was very leveraged to the strong gains in the gold price during those periods (Figure 7).

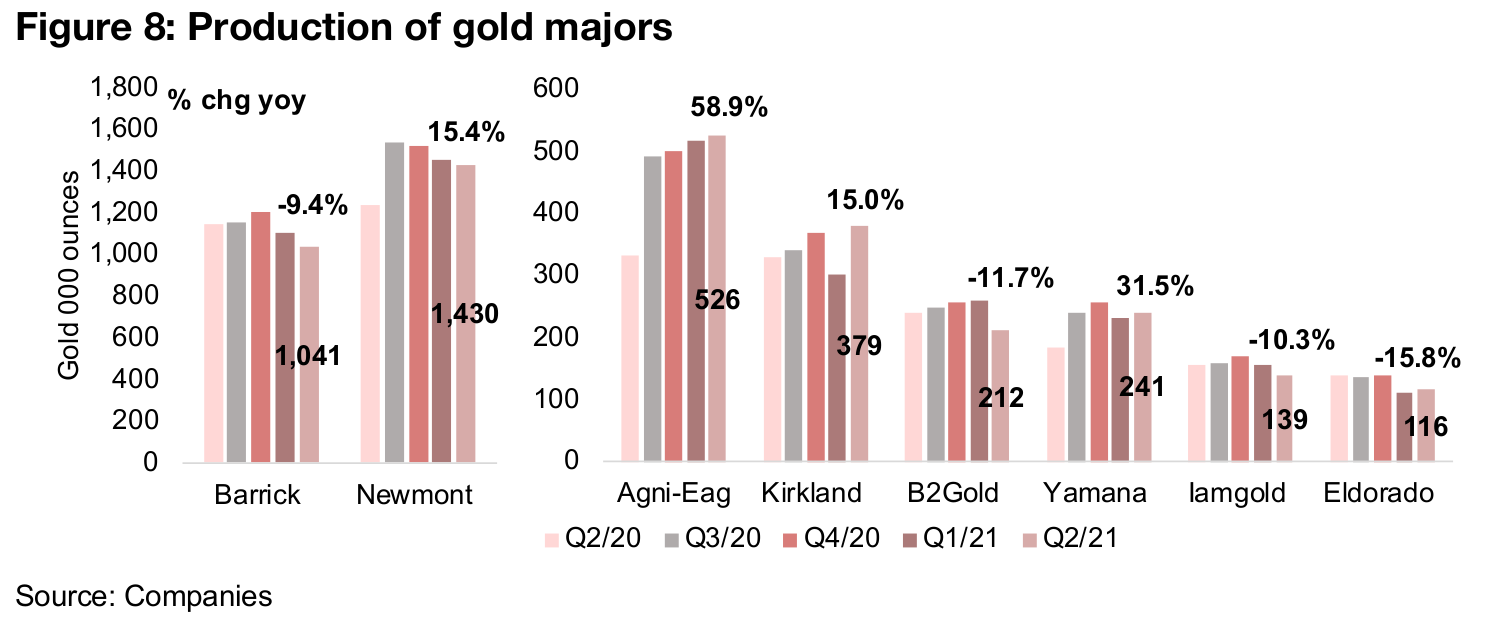

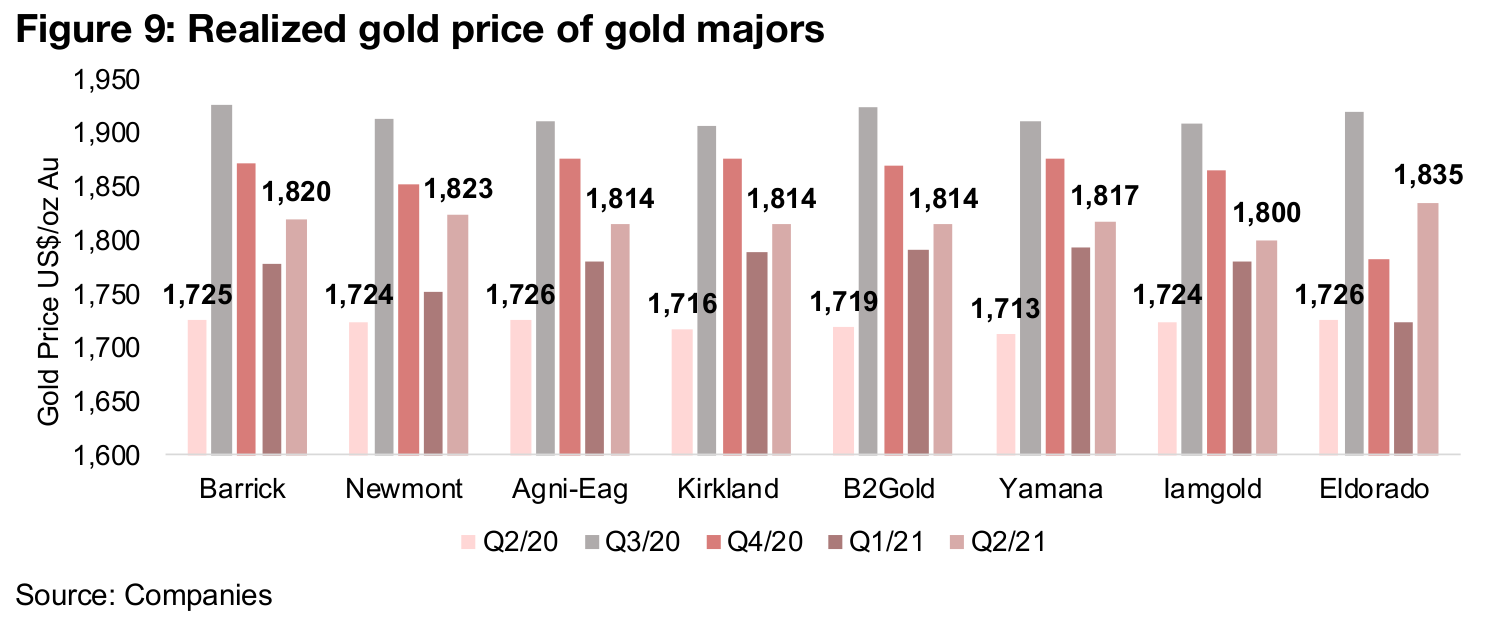

Of the two industry giants, Barrick saw a -9.4% decline in production, but Newmont a 15.4% gain, with the largest growth from Agnico-Eagle, up 58.9% yoy. The mid-tier players saw mixed results, with Kirkland, up 15.0%, and Yamana, up 31.5%, seeing strong growth growth, but B2Gold, Iamgold and Eldorado, all seeing contractions, down -11.7%, -10.3% and -15.8%, respectively (Figure 8). All of these operators saw substantial gains in realized gold prices yoy, by around $US100/oz, from a range of US$1,713/oz-US$1,726/oz to US$1,800/oz-US$1,835/oz (Figure 9).

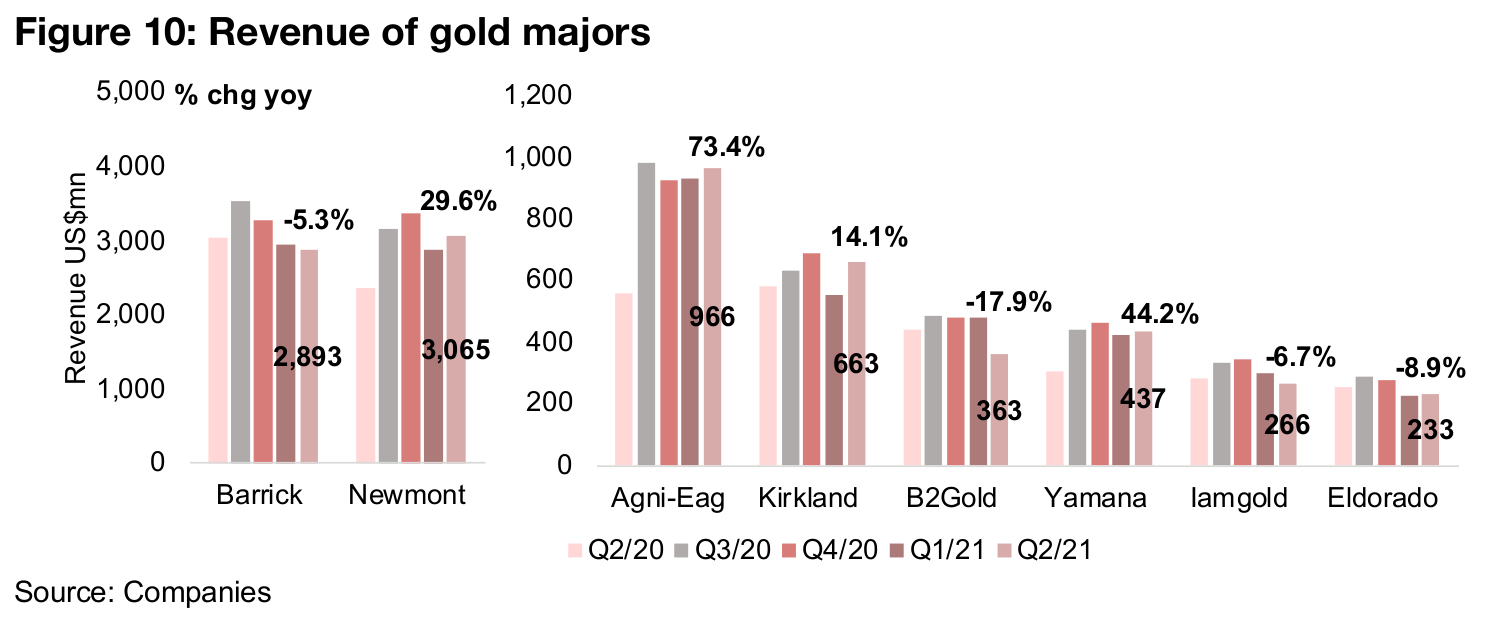

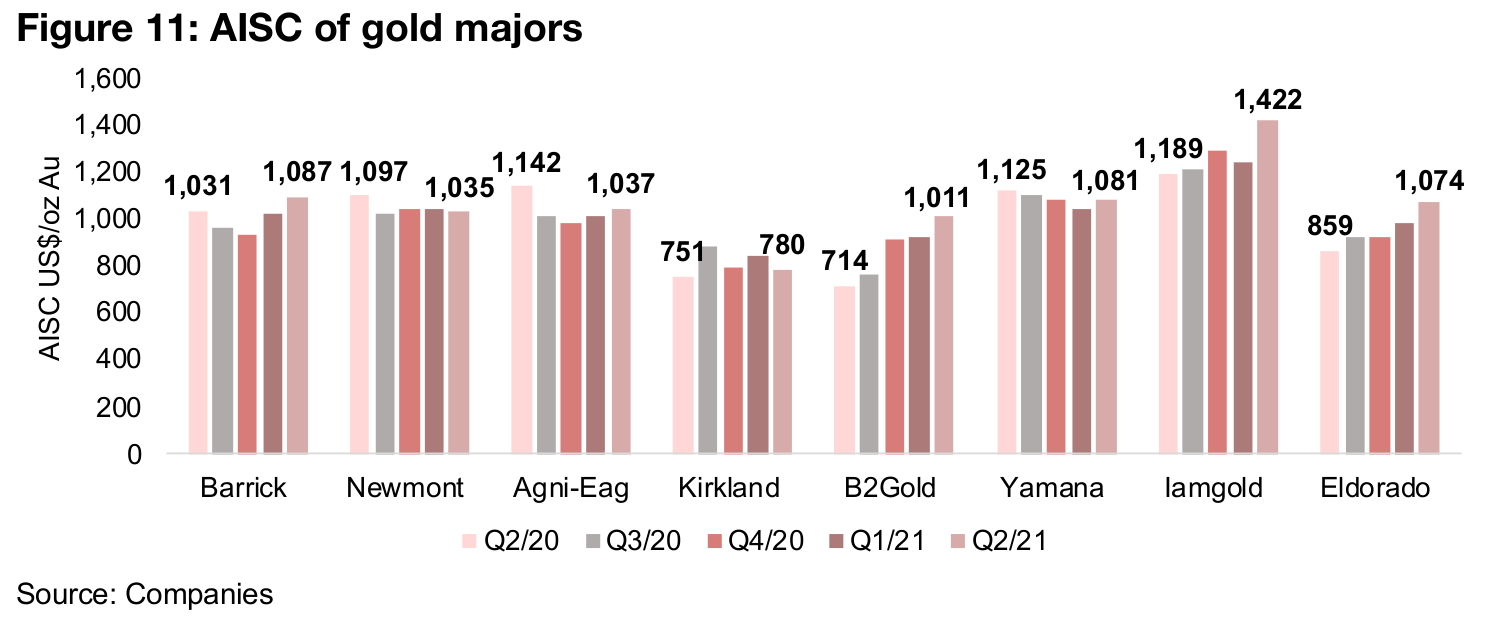

The rising gold price led to strong revenue growth yoy for Newmont, up 29.6%, Agnico-Eagle, up 73.4%, Kirkland, up 14.1% and Yamana, up 44.2%. The other firms saw revenue decline, with Barrick down -5.3%, B2Gold down -17.9%, Iamgold down -6.7% and Eldorado down -8.9% (Figure 10). Five of the eight, Barrick, Kirkland, B2Gold, Iamgold and Eldorado saw AISC costs increase, but costs declined for Newmont, Agnico-Eagle and Yamana (Figure 11).

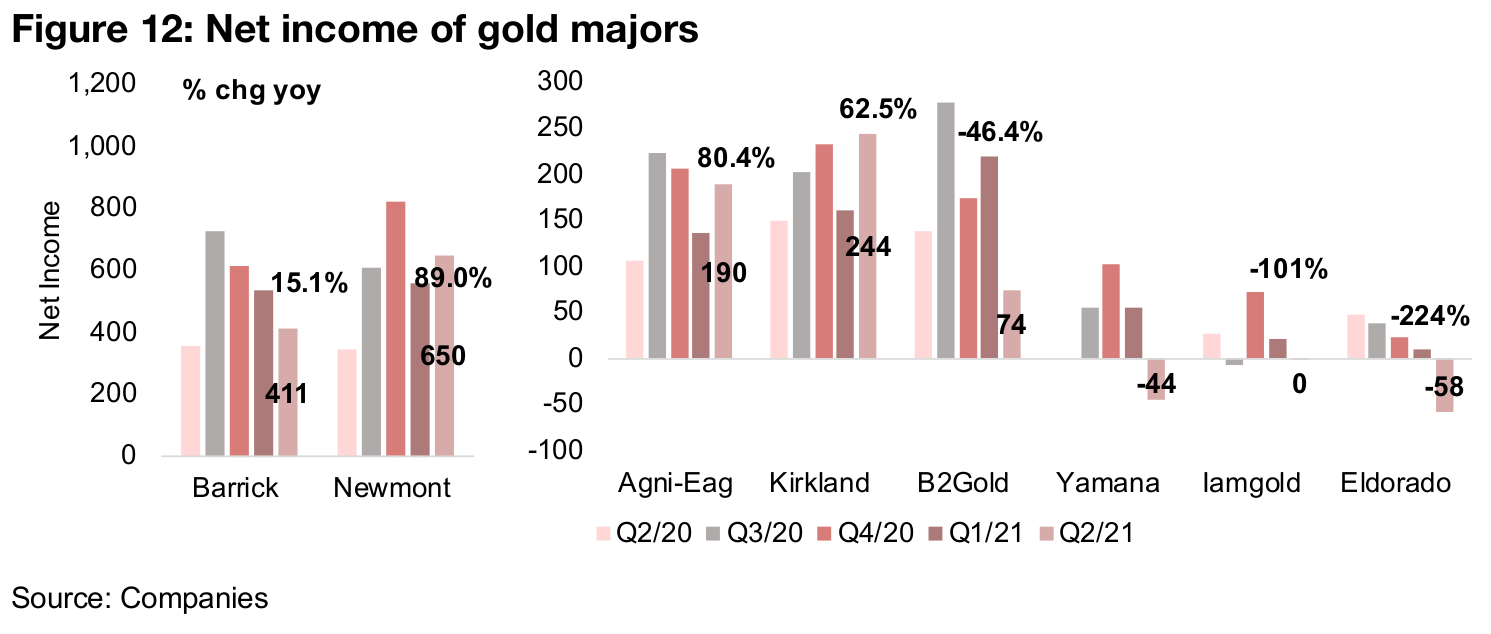

The big jumps in net income came from Newmont, up 89.0%, Agnico-Eagle, up 80.4% and Kirkland, up 62.5%, while Barrick saw moderate gains, up 15.1%. The other firms, including B2gold, Yamana, Iamgold and Eldorado, all saw substantial yoy declines in net income, but this was mainly from non-recurring items.

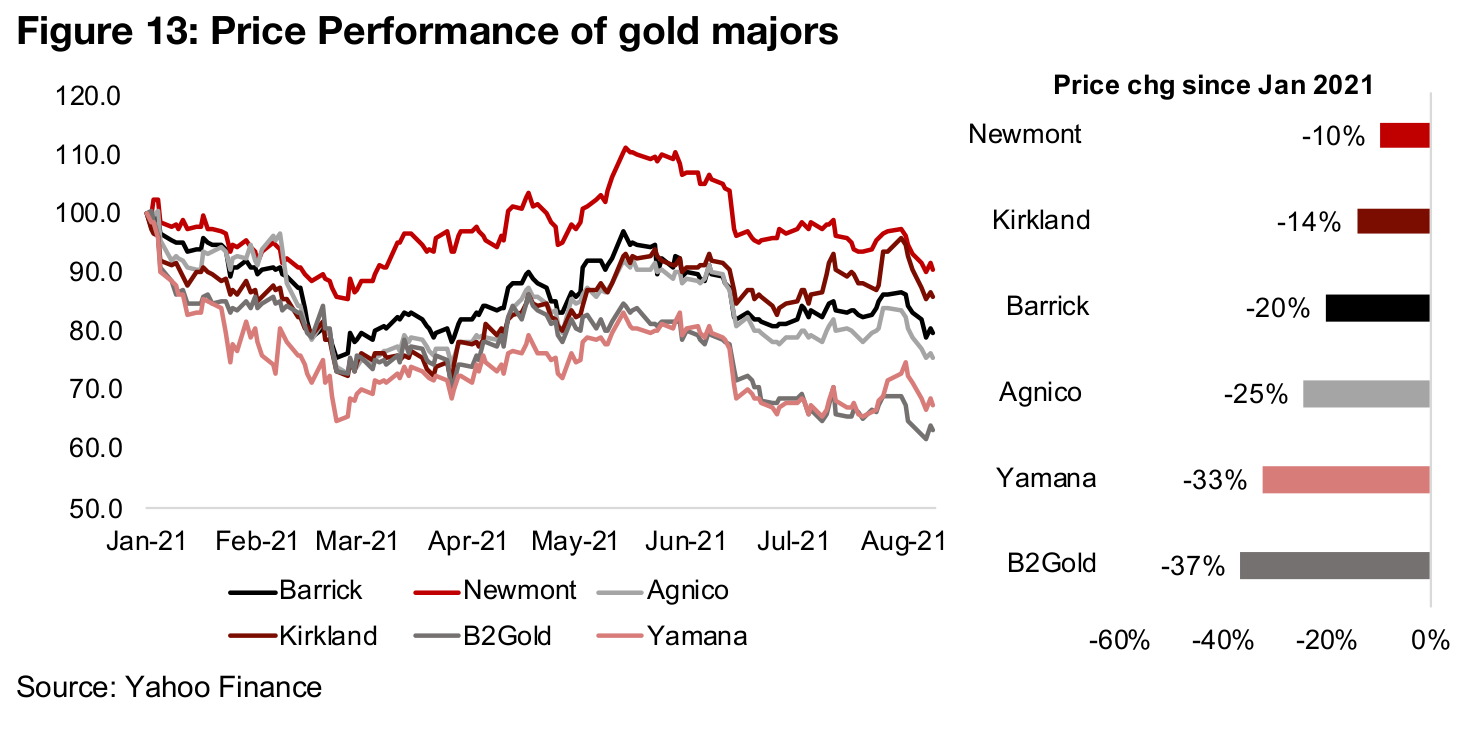

The share prices of the major gold producers have all declined this year. Newmont, Kirkland and Barrick have held up the best, down just -10%, -14%, and -21%, respectively, while Agnico, Yamana and B2Gold have declined -25%, -33% and -38%. This has mainly been driven by a decline in the gold price, on rising bond yields and expectations of eventual rate hikes by the Fed. However, we expect that it will be very difficult for Fed to raise rates aggressively given the tentative recovery and lingering global health crisis, and see strong potential for continued upside inflation surprises and a slower than expected stimulus reduction which should support gold.

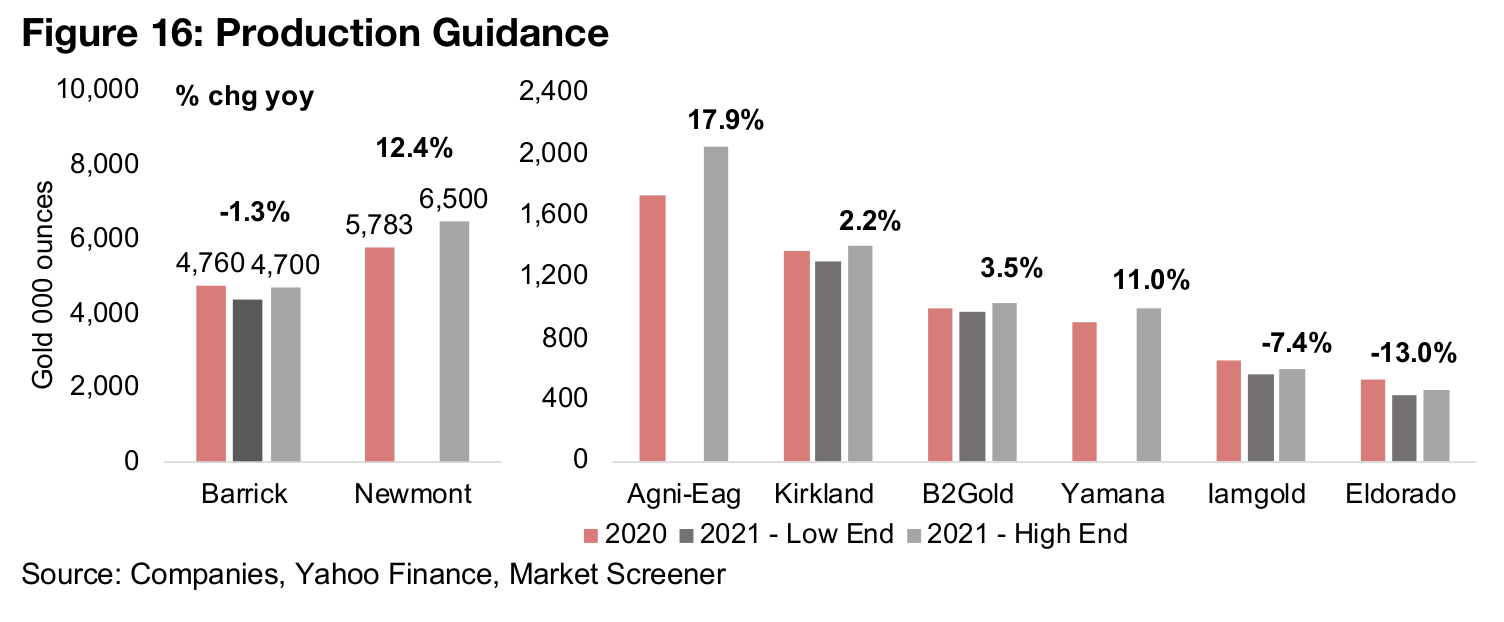

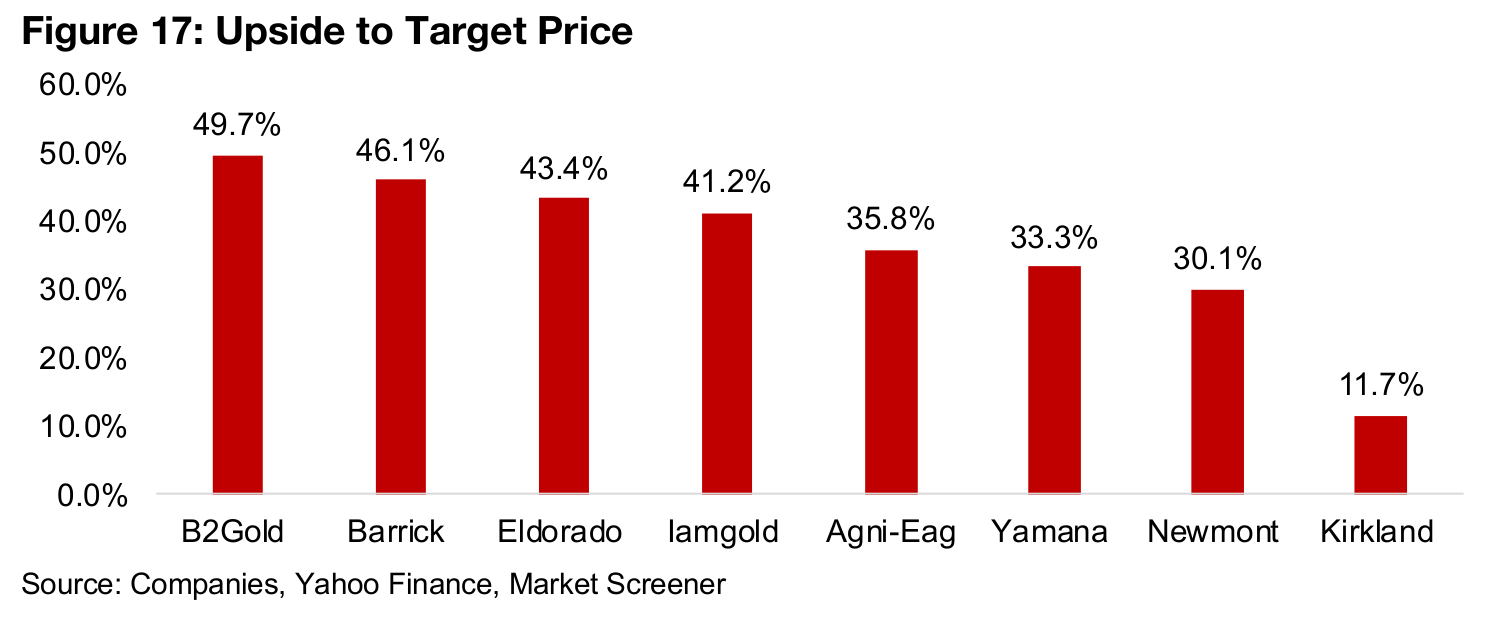

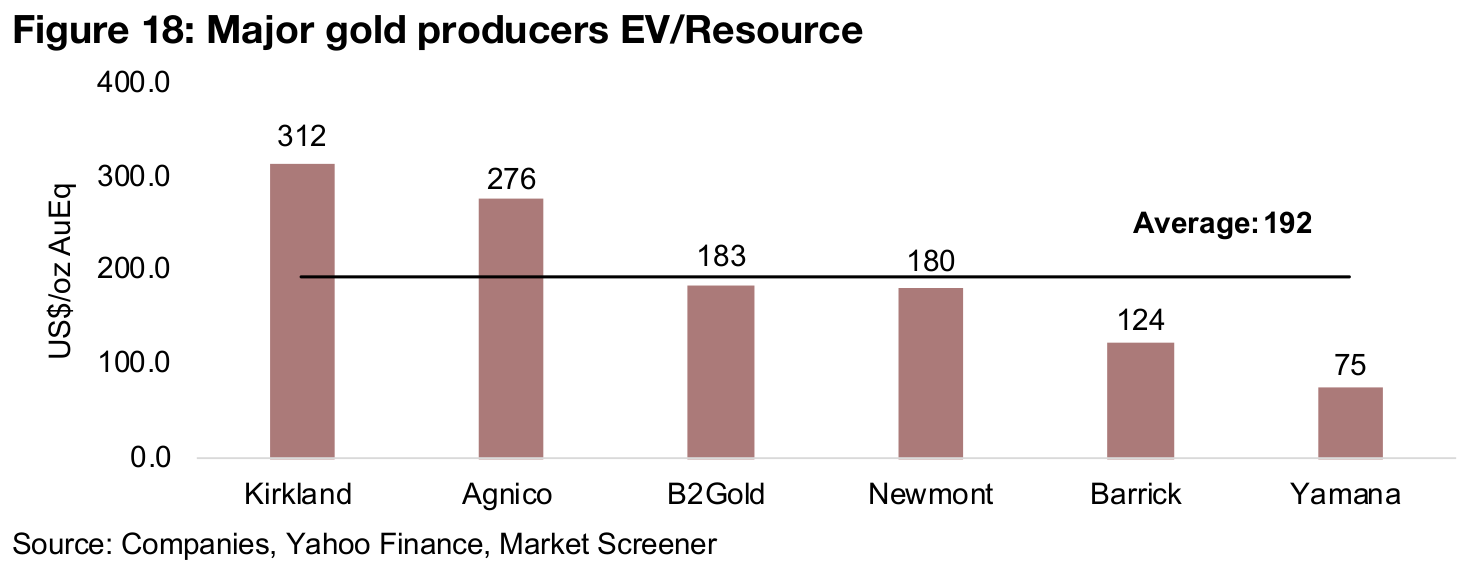

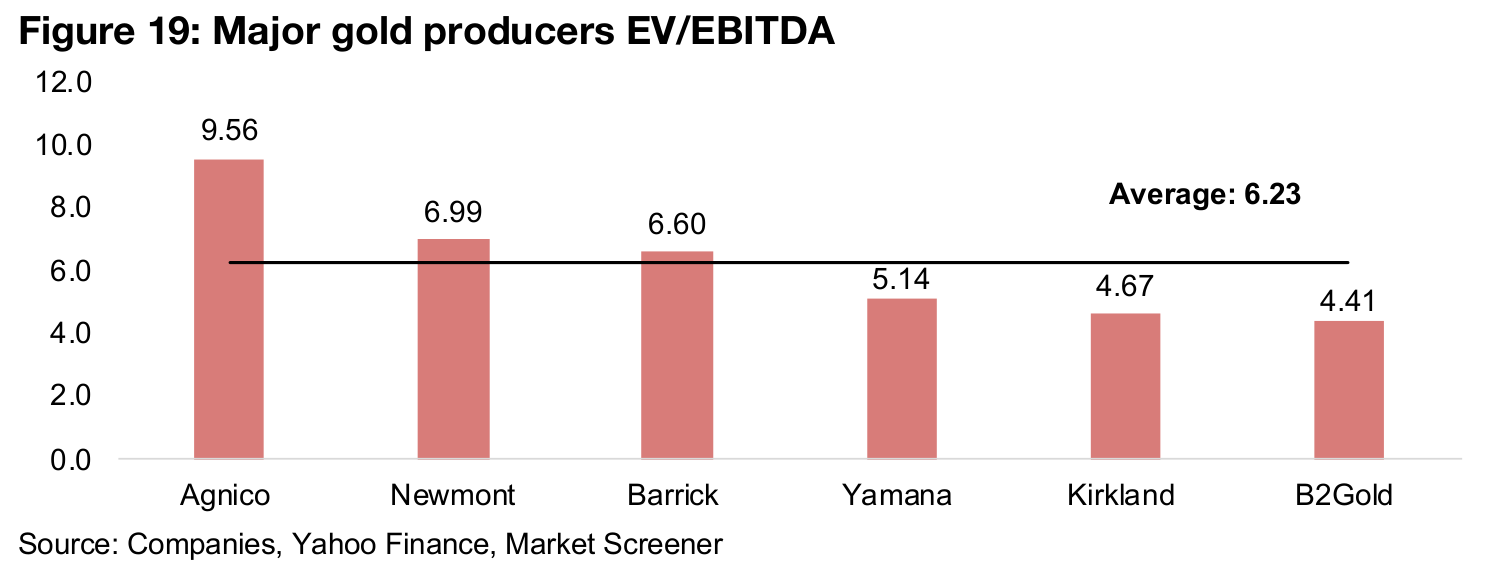

Most of the gold producers are expecting moderate production growth yoy, with Newmont guiding for a marginal -1.3% decline and Iamgold and Eldorado expecting notable contractions (Figure 16). Even with only moderate expected production gains, the market is still forecasting strong upside for the producers’ share prices based on consensus targets, ranging from 27%-47%, except for Kirkland, with only 9% upside. This suggests that the market is baking in a considerable rise in the gold price over the next year (Figure 17). In terms of valuations, the market is putting a premium on Agnico and Kirkland on EV/Resource, likely driven by earnings growth far above the rest of the sector, and a discount for Barrick and Yamana, while B2Gold and Newmont are both near the group average for EV/Resource (Figure 18). On an EV/EBITDA basis, we are seeing Agnico at the top of the group again, with Barrick and Newmont having the second and third highest multiples, and Kirkland coming in fourth, below the group average along with Yamana and B2Gold (Figure 19).

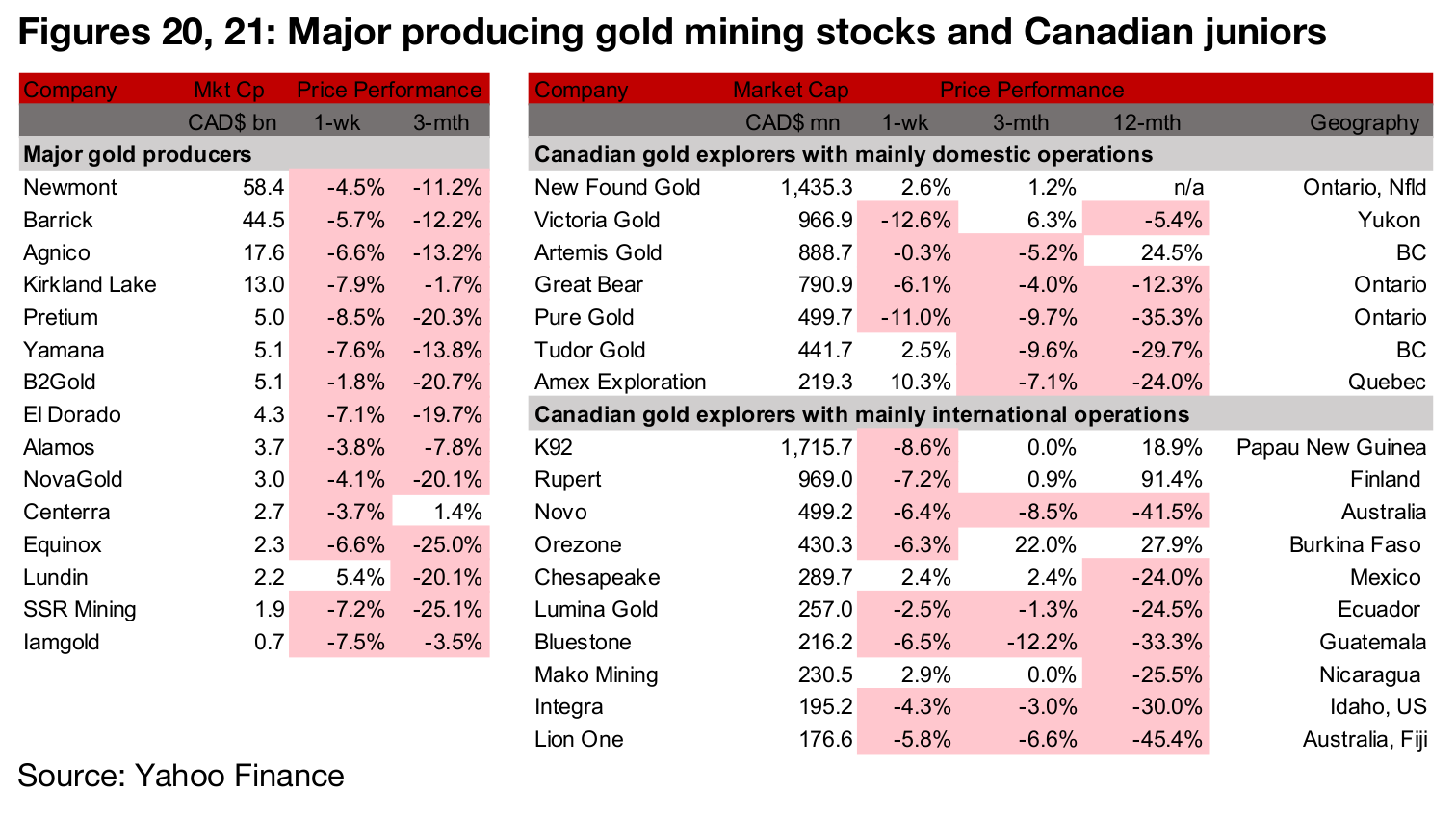

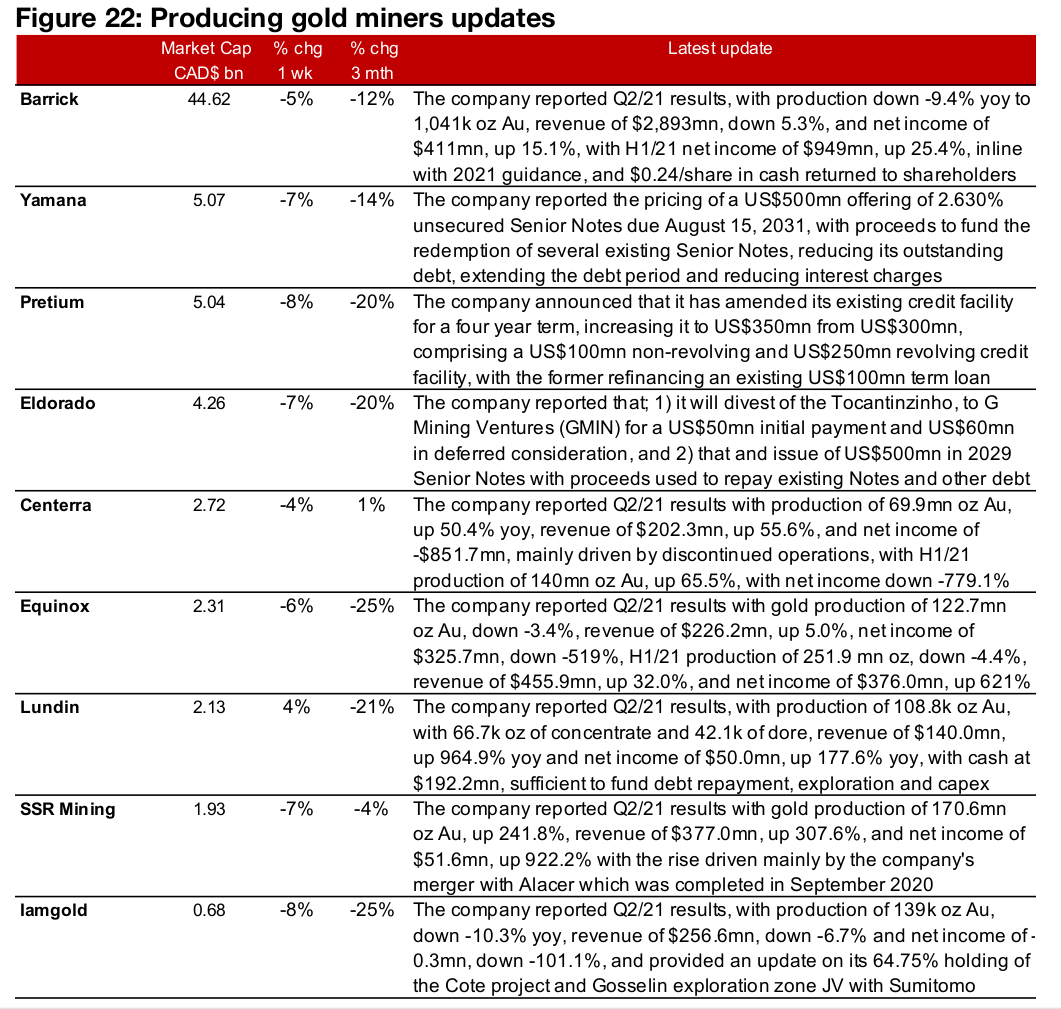

Producers down on gold price drop as results seasons near done

Most of the major gold producers were down this week on the fall in gold, with the Q2/21 results season wrapping up for the large and mid-tier producers, with Barrick, Equinox, Centerra, SSR Mining, Lundin Gold and Iamgold all reporting Q1/21 results (Figure 20). Pretium announced an amendment to its credit facility, Yamana announced the pricing of its US$500mn in unsecured debt and Eldorado announced the planned divestment of Tocantinzinho and the issuance of US$500mn in debt (Figure 22).

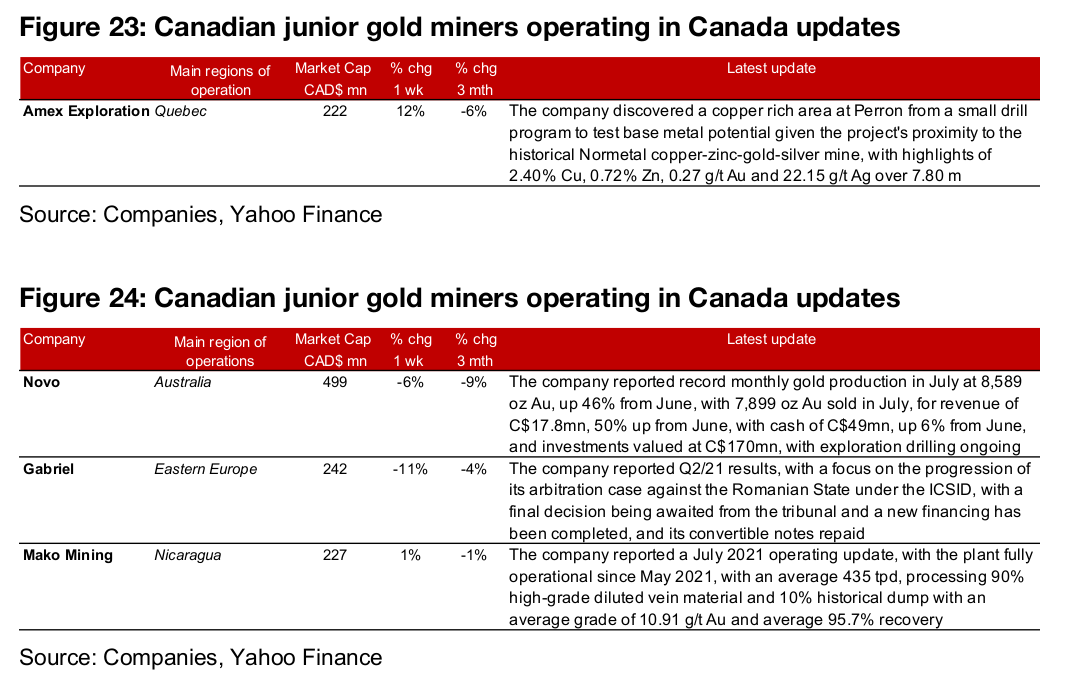

Canadian juniors mostly fall on gold price decline

The Canadian juniors were down on the decline in gold (Figure 21). For the Canadian juniors operating mainly domestically, Amex reported drill results from a copper rich area at Perron (Figure 23). For the Canadian juniors operating mainly internationally, Novo reported record gold production for July 2020, Mako Mining reported a July 2020 operating update and Gabriel reported its Q2/21 results (Figure 24).

Disclaimer: This report is for informational use only and should not be used an alternative to the financial and legal advice of a qualified professional in business planning and investment. We do not represent that forecasts in this report will lead to a specific outcome or result, and are not liable in the event of any business action taken in whole or in part as a result of the contents of this report.