December 18, 2020

Gold rebounds even with vaccines

Author - Ben McGregor

Gold at highest level in six weeks, even as vaccines come through

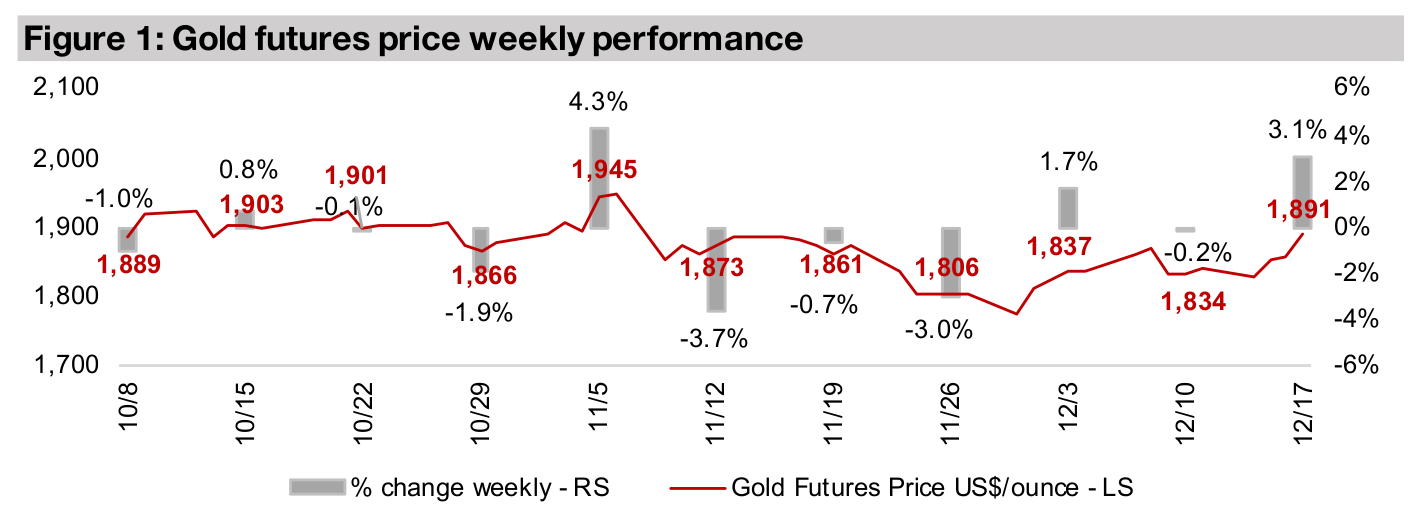

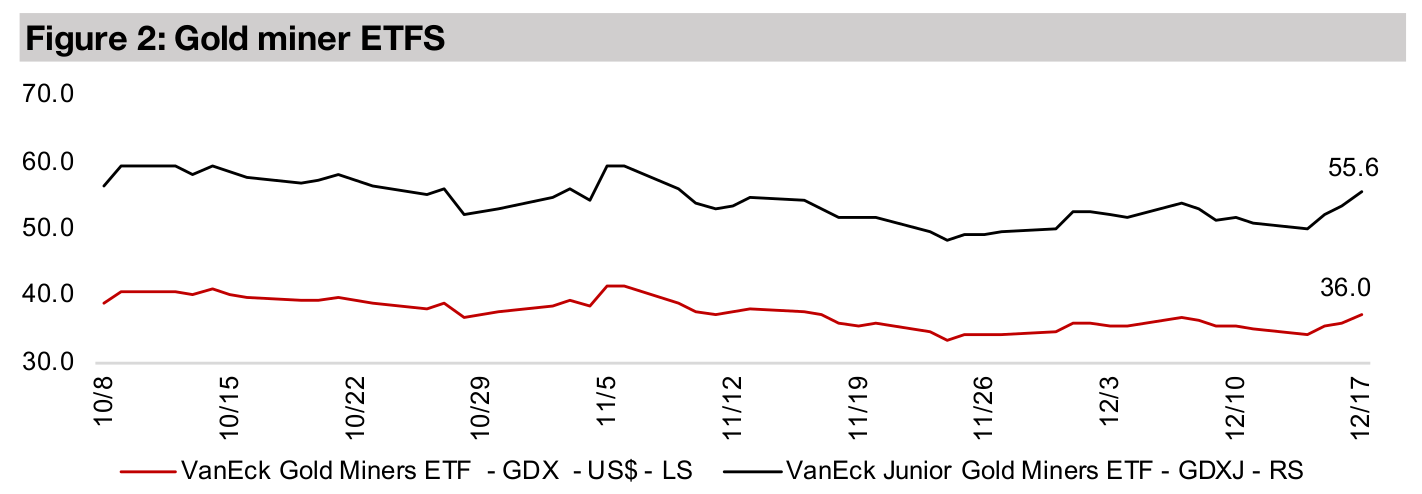

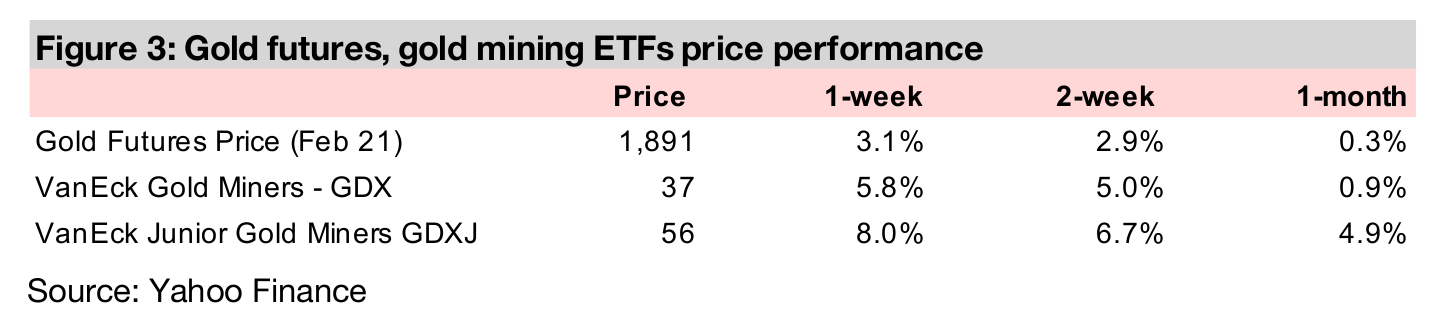

Gold rose 3.1% this week to US$1,891/oz, its highest level in six weeks, even with news of vaccines starting to be administered, suggesting that the global monetary expansion continues to be a driver of gold even as global health crisis concerns fade.

Looking at performance of gold versus other commodities this year

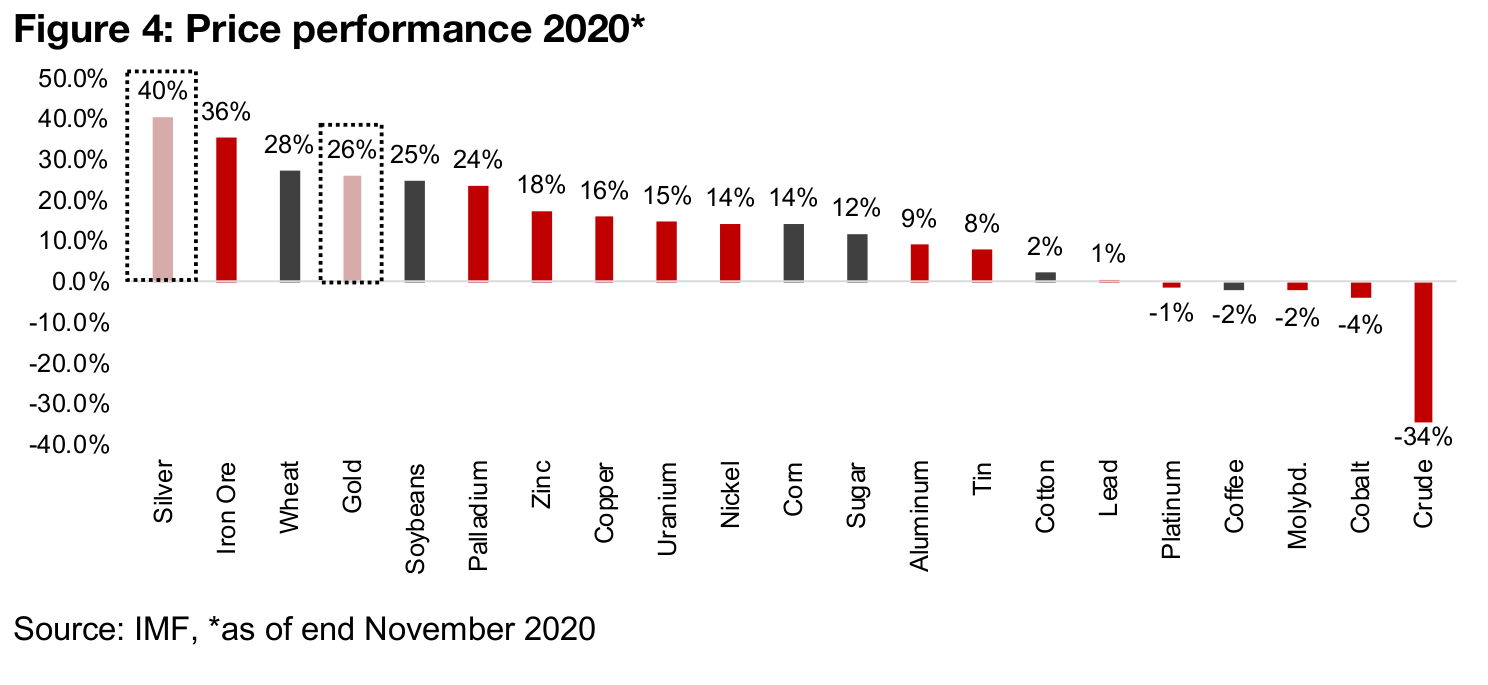

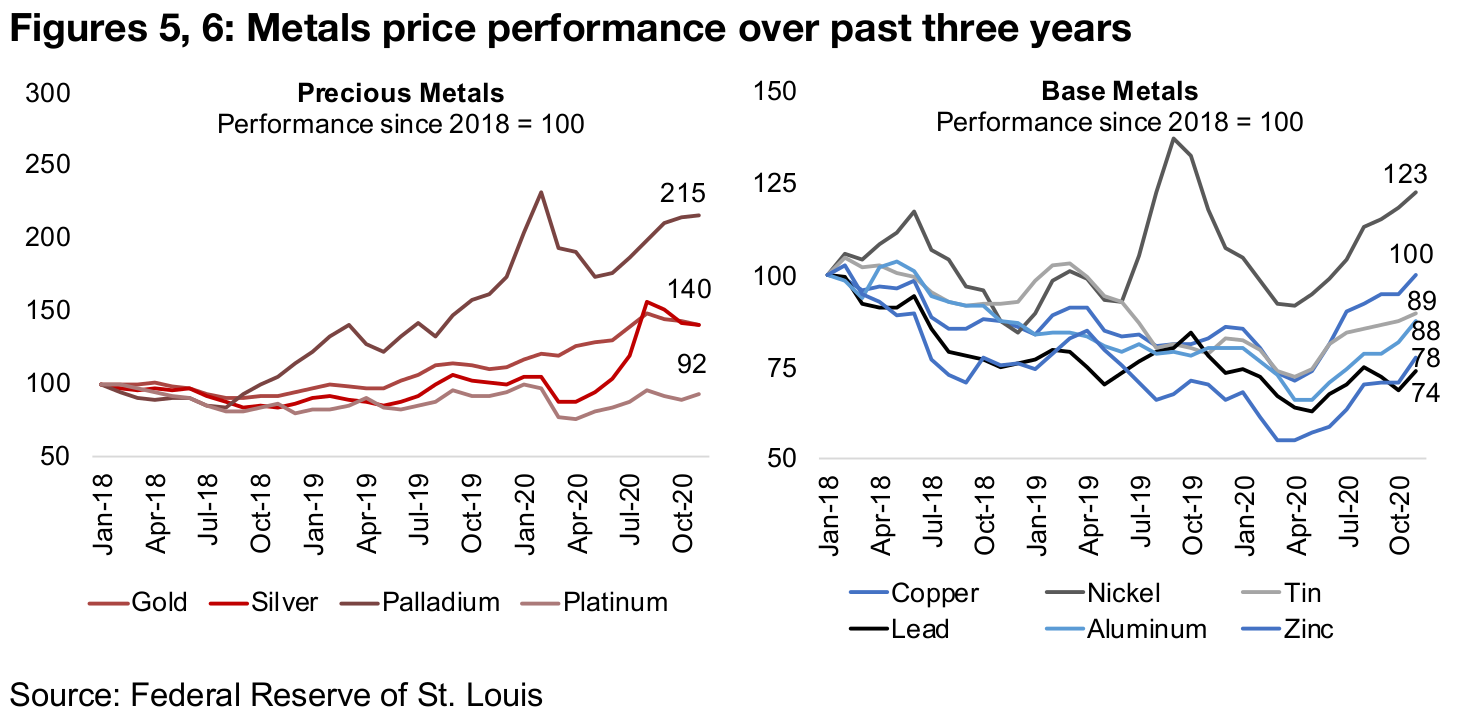

This week we look at the performance of gold versus other major commodities this year, with it coming in fourth after silver, wheat and iron ore, and with gold and other precious metals generally outperforming other metals since 2018.

Gold rebounds even as vaccines start to come through

The gold price rebounded 3.1% this week to US$1,891/oz, even as news that vaccines are starting to be administered came through. This suggests that there are other factors continuing to support the gold price beyond the fears related to the global health crisis. While this week US$ weakness and expectations of a major fiscal stimulus were the immediate drivers, both of these issues really relate to a major underlying driver, that being the major ongoing monetary expansion that will be required to continue to support the global macroeconomy. Even as global health crisis fears fade, we believe that the continued need for monetary expansion, certainly into 2021, and likely much longer, will continue to support gold for an extended period. For more details on this, please see our last three weeklies.

Gold a top performing global commodity in 2020, silver even better

With 2020 coming to close, this week we look at gold in the context of the global commodities market, using IMF monthly pricing data to November 2020. Gold is the fourth best performing of the major commodities, up 26% from December 2019 to November 2020. It was outpaced only by another precious metal, silver, the stand out commodity for 2020, the base metal iron ore, up 36%, and the agricultural commodity wheat, which rose just a bit faster than gold, up 28% this year (Figure 4). It was a good year in general for the metals and agriculture commodities, which ranged from quite strong gains to near flat for the year to November, and of the major sectors, only energy was weak, with Brent Crude oil, down -34% for the year, the clear laggard of the major commodities.

Precious metals beat base metals over past three years

Figures 5 and 6 looks at the performance of the metals commodities over the past three years, showing that the precious metals have been the big outperformers of the sector, especially since H2/19, after most saw a relatively subdued 2018. However, palladium, which is by far the best performer of the space, has risen 115% since 2018 and began to breakout well before the rise in gold and silver, in mid-2018. This was mainly driven by palladium's use in the catalytic converters of petroleum and hybrid vehicles to control emissions, and these vehicles have seen strong rising demand in recent years. Palladium's gain has to some degree been platinum's loss, as it is also used in catalytic convertors, but instead for diesel vehicles, for which demand has been falling, sending platinum down 8% over the past three years.

Gold and silver have been the next two best performers, and interestingly have the same percentage gain over the past three years, with both up 40%. We believe that global monetary expansion will remain the main driver for these two metals over the next few years, and that they likely have more to run, with current price levels not excessive given the support of this very strong underlying factor. Of the base metals, only nickel has seen substantial gains over the past three years, up 23%. Other base metals have been flat to down over the past three years, with copper flat, tin down 11%, aluminum down 12%, zinc down 22% and lead down 26%. Base metals have been declining over the past few years as there has been an easing in overall global economic growth, and they dipped especially after the global health crisis, although their prices have recovered somewhat in H1/20. For 2020, analysts expect that gold and silver will continue rise, especially driven by a continued global monetary expansion, while the global vehicles market will continue to be a major driver of palladium and platinum market. A continued recovery in the base metals will depend on a rebound in the global macroeconomy.

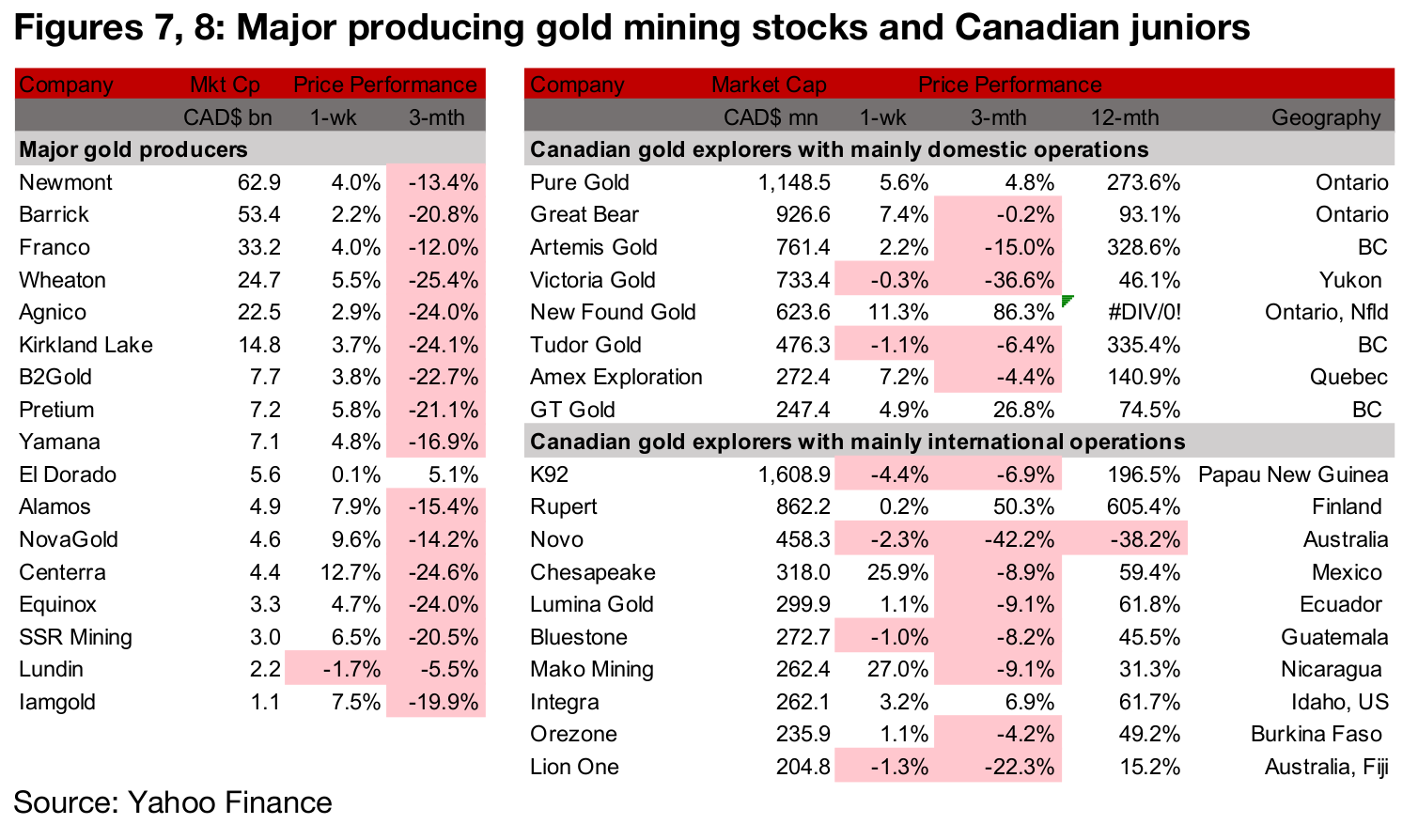

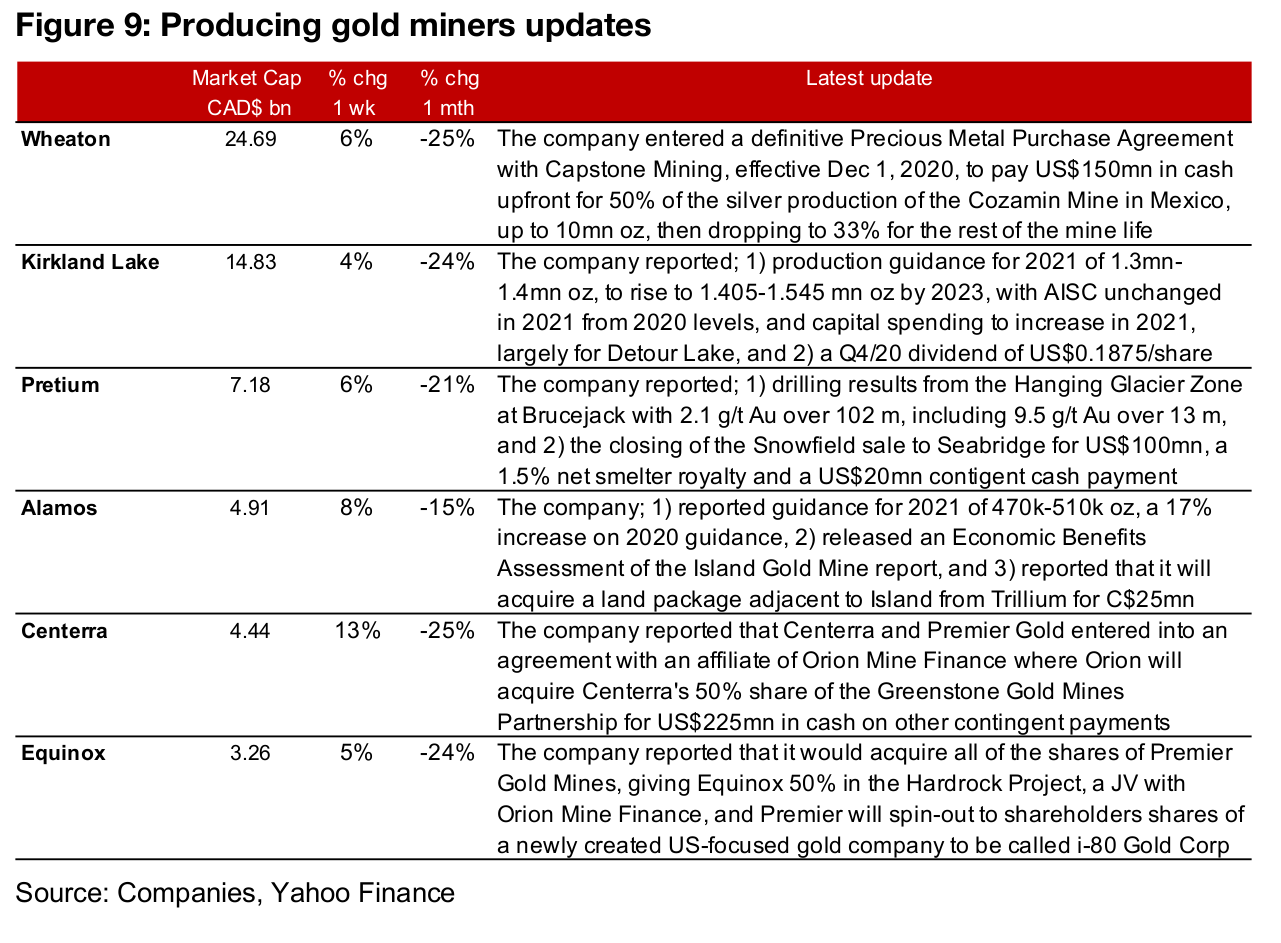

Producers nearly all up on gold price rebound

The producing miners were nearly all up on the rise in the gold price, with Lundin the only exception, which edged down by just 1.7% (Figure 7). Wheaton entered a Precious Metal Purchase Agreement with Capstone, Kirkland announced its 2021 guidance and its Q4/20 dividend, and Pretium reported drilling results from the Hanging Glacier Zone at Brucejack, and announced the closing of its Snowfield sale to Seabridge. Alamos reported its 2021 guidance, released an Economic Benefits Assessment report for Island, and reported the acquisition of a land package adjacent to Island from Trillium. Centerra and Premier Gold entered an agreement under which Orion will acquire Centerra's 50% of the Greenstone Gold Mines Partnership and Equinox reported the acquisition of Premier Gold Mines, giving it a 50% stake in the Hardrock project in a JV with Orion (Figure 9).

Canadian gold juniors mixed

The Canadian juniors were mixed this week even as the gold price gained. (Figure 8).

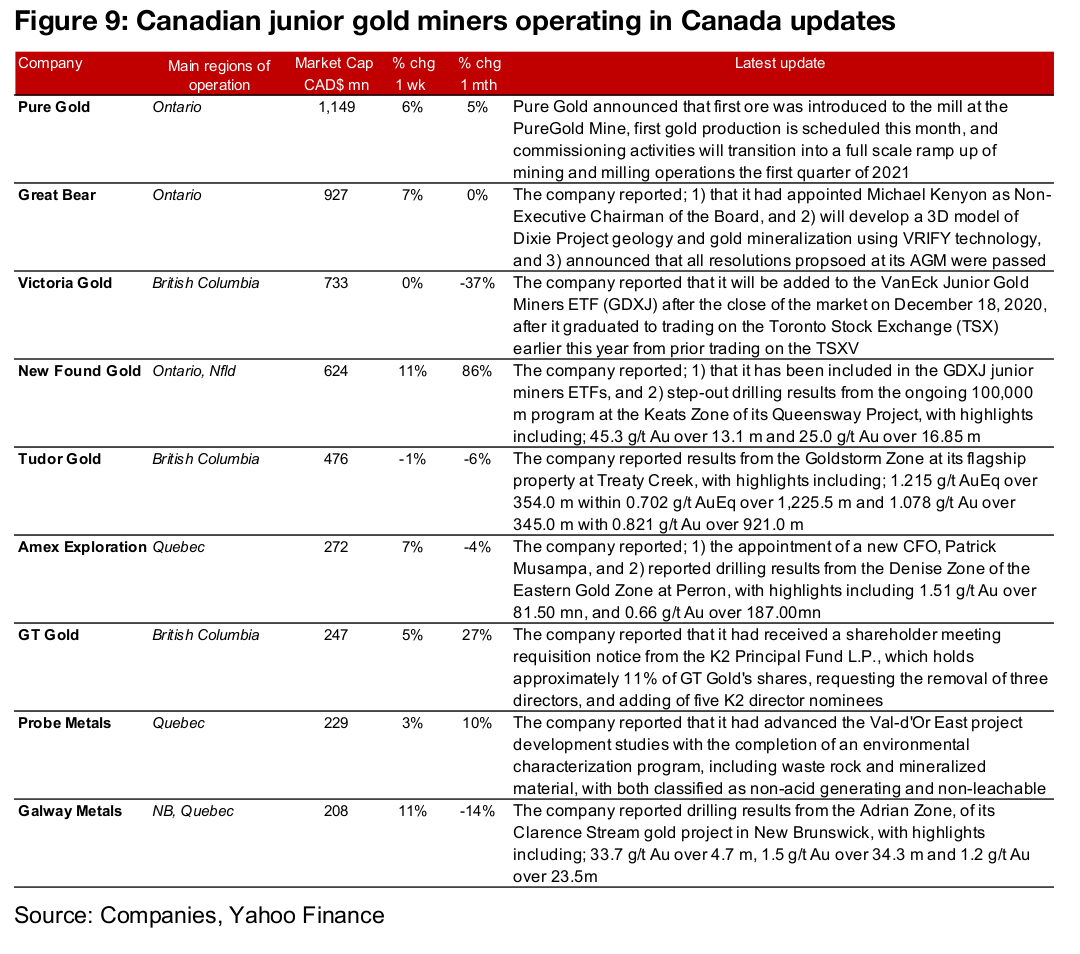

For the domestically focussed companies, Pure Gold introduced its first ore to its

PureGold mine, Great Bear appointed a non-executive Chairman and announced the

development of a 3D model of Dixie using VRFY, and Victoria reported that it would

be added to the GDXJ junior miner ETF. New Found Gold announced that it would

also be added to the GDXJ as well as step-out drilling results from the Keats Zone at

its Queensway project. Amex announced the appointment of a new CFO and drilling

results from the Denise Zone of the Eastern Gold Zone at Perron, and GT Gold

received a requisition notice from a major shareholder, K2, requesting the removal of

three directors and addition of five K2 director nominees. Probe reported progress

on an Environmental Characterization Program, and Galway reported drilling results

from the Adrian Zone of its Clarence Stream project (Figure 9).

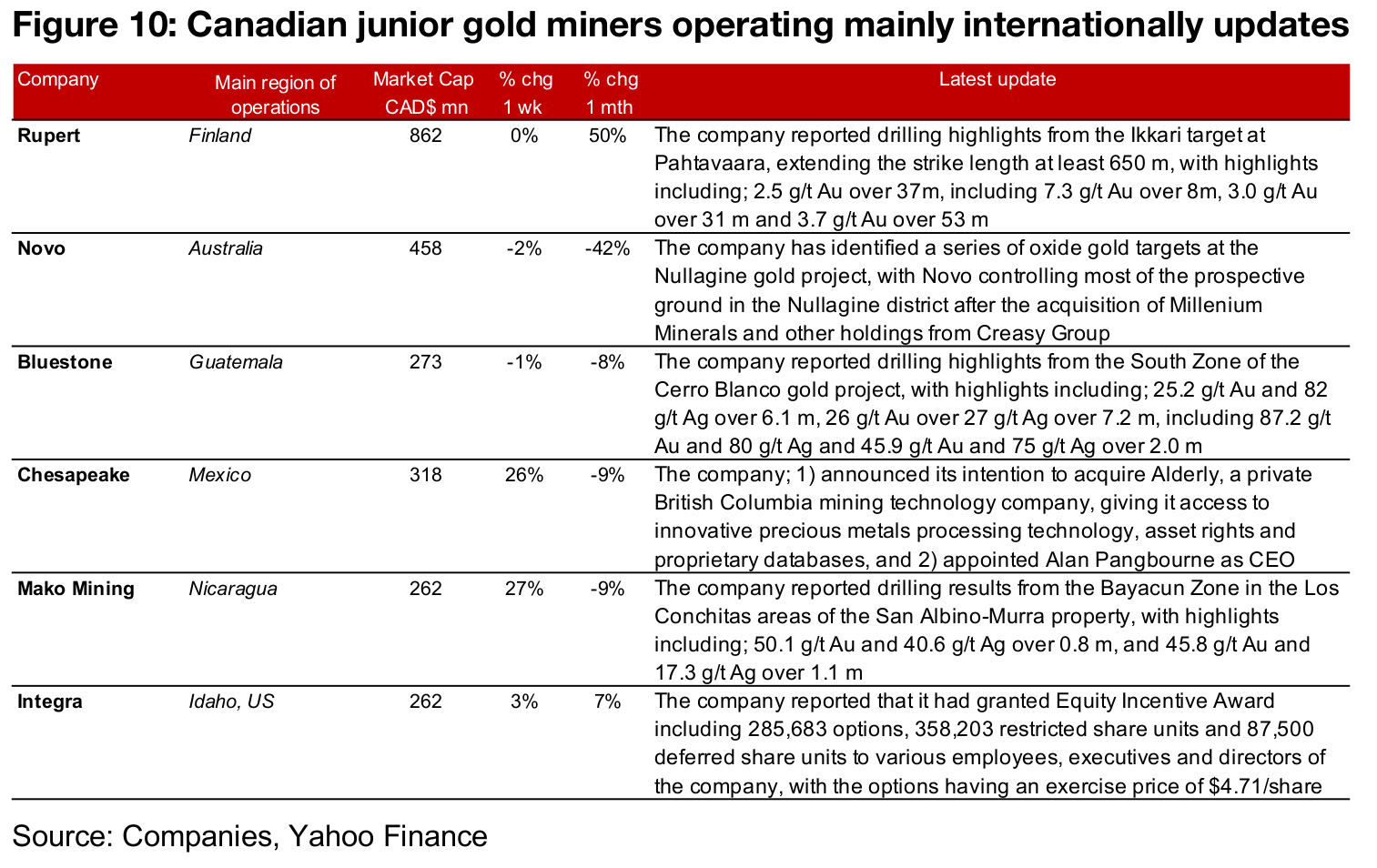

For the internationally operating companies, Rupert reported drilling results from

Ikkari at Pahtavaara, Novo identified a series of oxide gold targets at the Nullagine

project, and Bluestone reported drilling results from the South Zone of the Cerro

Blanco project. Chesapeake announced its intention to acquire Alderly, Mako

reported drilling results from the Bayacun Zone in the Los Conchitas area of the San

Albino-Murra project and appointed a new CEO and Integra provided details on the

Equity Incentive Awards for its management and employees (Figure 10).

In Focus: Artemis Gold (ARTG.V)

Artemis a spin-off from Atlantic Gold, owns Blackwater project

Artemis was formed as spin out from Atlantic Gold, the operator of the Moose River project in Nova Scotia, Canada, before Atlantic was acquired by Australian mining company St. Barbara in July 2019. Artemis's original holding was the GK Property in British Columbia and it raised $32.6mn in August 2019 and began trading the TSX in September 2019. It made a major transition when it announced the acquisition of the Blackwater Project in British Columbia in June 2020 from New Gold which closed in August 2020. The company then announced the issuance of C$175mn in subscription receipts in June 2020, which closed in July 2020. In August the company announced a revised Pre-Feasibility Study for Blackwater, and in September 2020 closed a private placement of $1.352mn, and filed a 43-101 for Blackwater. The company has continued drilling to expand the resource at Blackwater over the past two months, and this is expected to continue through to Q2/20.

Permitting and DFS in focus for 2021

For 2021-2020 Artemis will be focused on achieving full permitting and completing a Definitive Feasibility Study (DFS) for Blackwater, and has already been moving towards both of these targets throughout 2020. The company expects to have most of the preparation for mine construction completed by Q1/21. The company is targeting completion of the permitting process with the British Columbia government by Q3/21, and then with the Canadian Federal Government by Q1/22. Artemis signed Partnership Agreements with local communities in 2019, and ongoing negotiations are expected to be completed by Q1/22. The company also estimates that it will have an Engineering, Procurement and Construction Lump Sum contract in place by Q3/20 and financing for the project secured by Q1/21. Finally, mine construction is expected to begin by Q2/22.

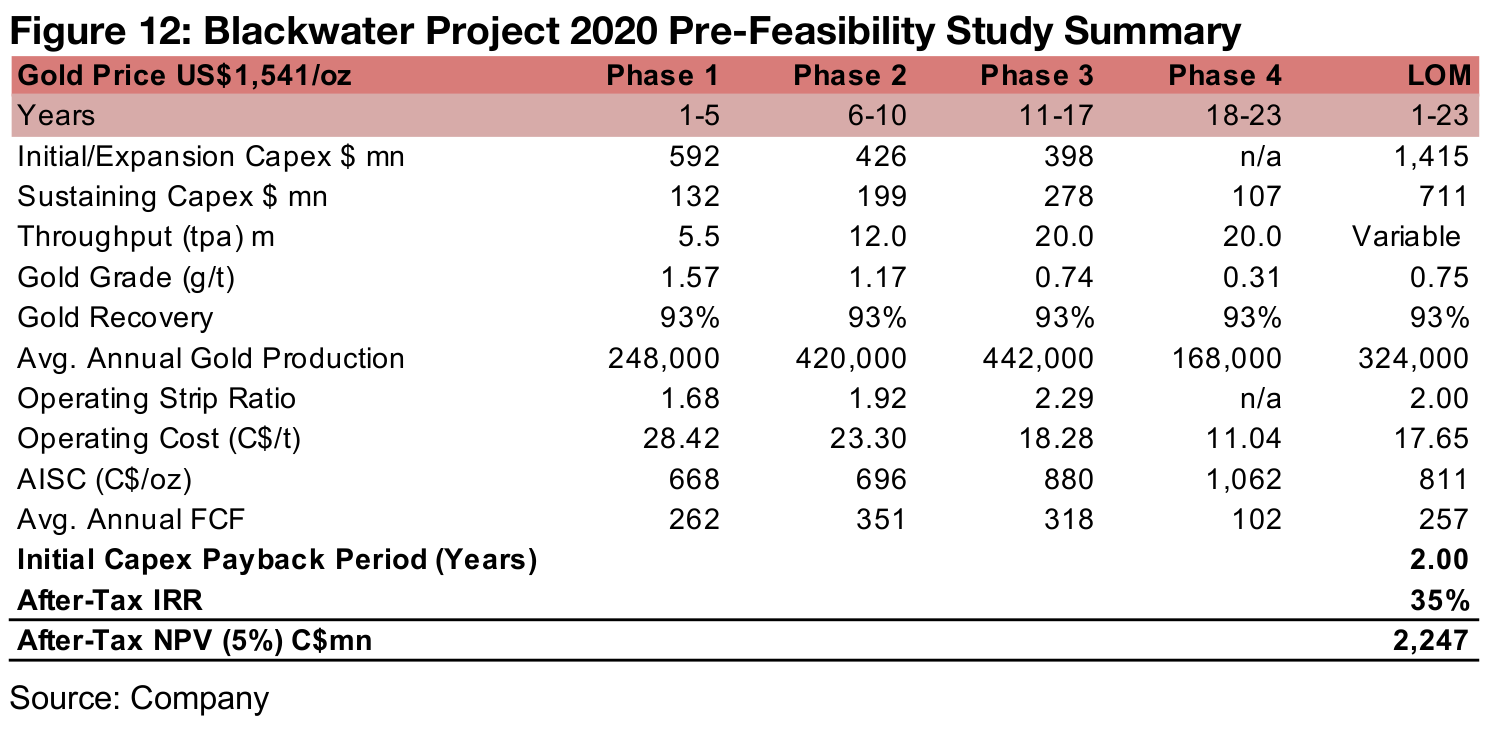

Details of the Blackwater pre-feasibility study

Figure 12 shows the details of the Blackwater Pre-Feasibility Study, with LOM gold production of 324k oz/year with a 23-year mine life, starting at 248k oz/year in years 1-5 and peaking at 442k oz/year in years 11-17. The total LOM capex is expected to be $1,415mn, with a capex of $592mn in Phase 1 and the AISC is estimated at CAD$811/oz over the LOM. The NPV of the project is targeted at CAD$2,247mn, with an after-tax IRR of 35%, using a gold price of US$1,541/oz, which is nearly three times Artemis's market cap of CAD$761.4mn.

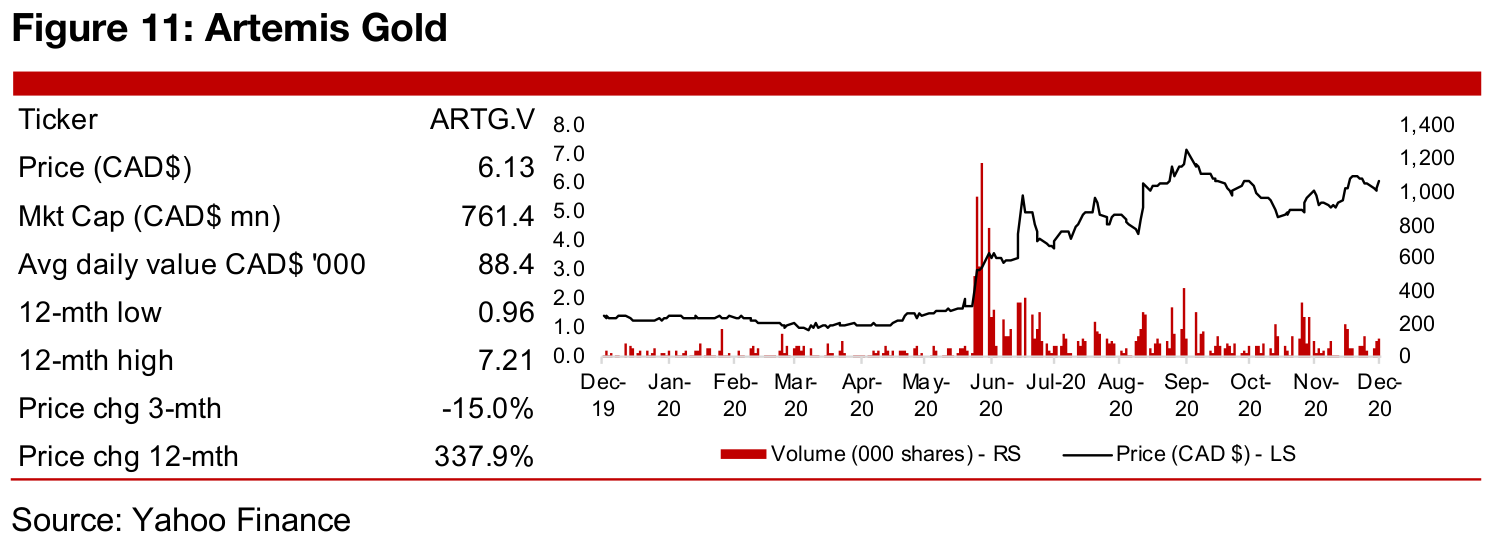

Share price gaining on Blackwater progress and gold price

The company has strong shareholder support, with management holding 42%, institutions holding 38%, including Blackrock, Sentry and Fourth Sail, and retail holding 20%. Blackwater’s share price had traded under CAD$2.0/share prior the Blackwater acquisition in June 2020, which sent the share price up to $5.60/share by July 2020. While the share price cooled off this peak it generally continued to pick up as progress on Blackwater continued, and peaked at $7.21/share in September 2020, driven by the completed PFS and financing and the surge in gold. Since then the share price has eased, along with the pullback in gold, but less than some other names in space, and is still up 337.9% over the past twelve months at the current price of $6.13/share.

Disclaimer: This report is for informational use only and should not be used an alternative to the financial and legal advice of a qualified professional in business planning and investment. We do not represent that forecasts in this report will lead to a specific outcome or result, and are not liable in the event of any business action taken in whole or in part as a result of the contents of this report.