January 30, 2023

Gold Rally Takes a Pause

Author - Ben McGregor

Gold rally takes a pause even with more signs of falling inflation

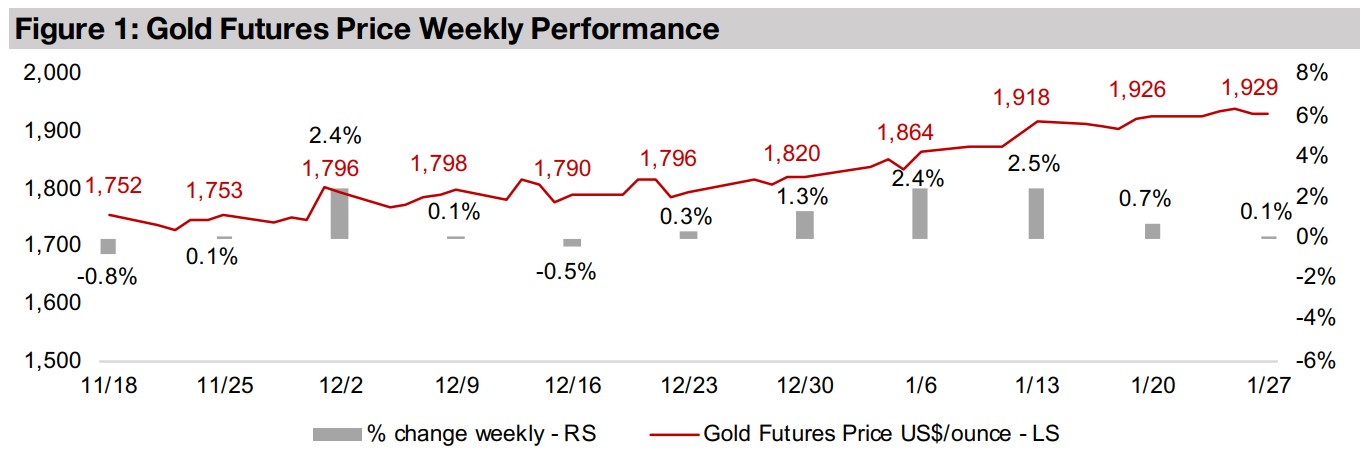

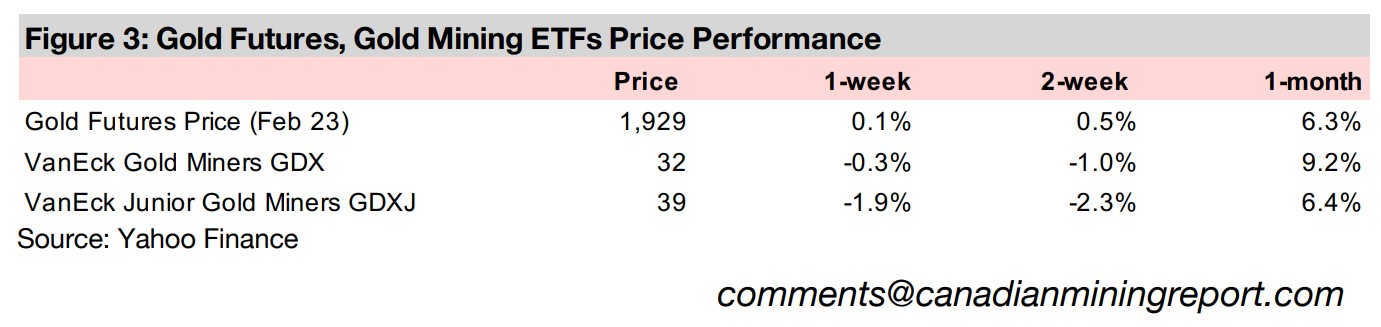

Gold was near flat, up just 0.1% to US$1,929/oz, marking a pause in a five-week rally, even as the US Personal Consumption Price Index, one of the US Fed's preferred inflation gauges, indicated that that inflation continued to slow in December 2022.

Osisko Development In Focus with new FS and Resource Estimate

This week Osisko Development is In Focus, having recently released a Feasibility Study for its flagship Cariboo Project and a Resource Estimate for the Trixie Mine at the recently acquired Tintic Project, with small scale production ongoing.

Gold Rally Takes a Pause

Gold rose just 0.1% to US$1,929/oz this week, marking a pause in a five-week rally

that saw the price jump 7.7% from US$1,790/oz on December 16, 2022. This

occurred even as more data indicated cooling inflation, specifically the December

2022 US Personal Consumption Expenditure Price (PCE) Index, driving up the stock

market, with the S&P 500 up 2.3%, but doing little for gold. In recent weeks, the

'lower-inflation-will-allow-for-a-less-aggressive-Fed-monetary-policy' story tended

to bolster both the stock market and gold in tandem, but this week was an exception,

and we expect that this narrative could be nearly fully priced into markets.

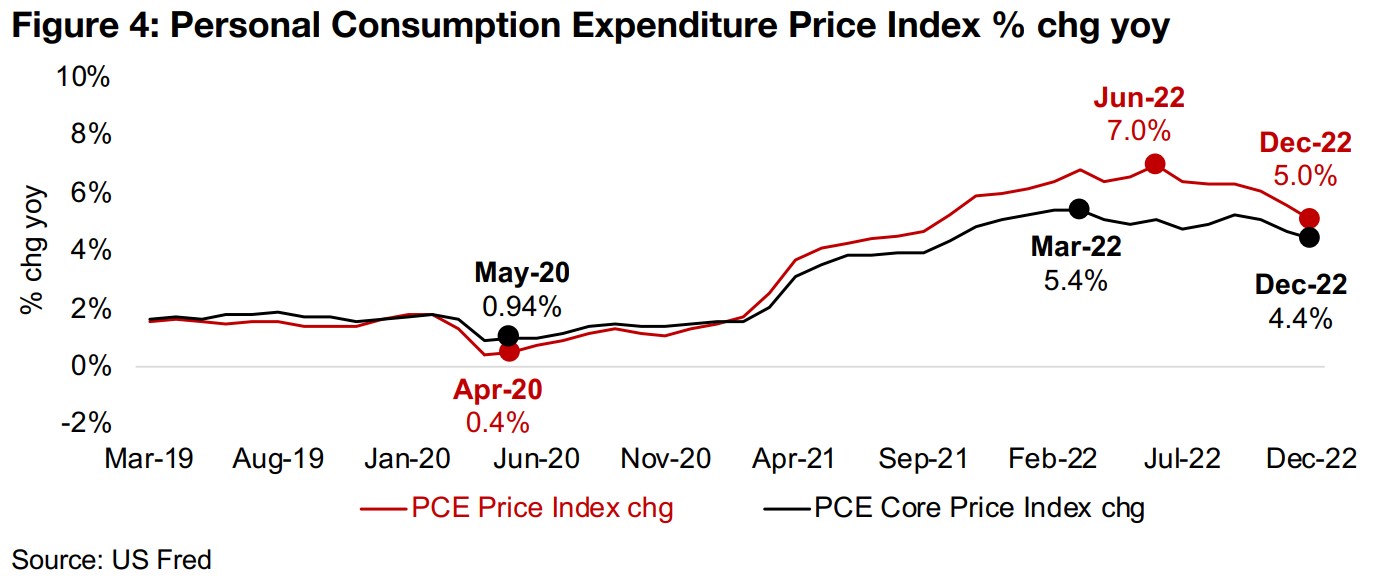

The trend shown by the PCE Price Index was also not really 'new' news, with US CPI

inflation for December 2022 having been reported earlier this month, showing a

decline. However, the market views the PCE Core Price Index, which excludes the

more volatile food and energy components, as having a strong weight in the Fed's

policy decisions as it is known to be one of the central bank's 'preferred' inflation

measures. The Core PCE Price Index dropped to 4.4% for December 2022, having

trended down from a peak of 5.4% in March 2022, which is a considerably less steep

decline than the headline PCE Price Index, which fell to 5.0% in December 2022 from

a June 2022 peak of 7.0% (Figure 4). While peak inflation does increasingly appear

to be behind us, we note that the current readings are still not actually that low, and

that a continued decline in them is likely to come at the expense of a recession.

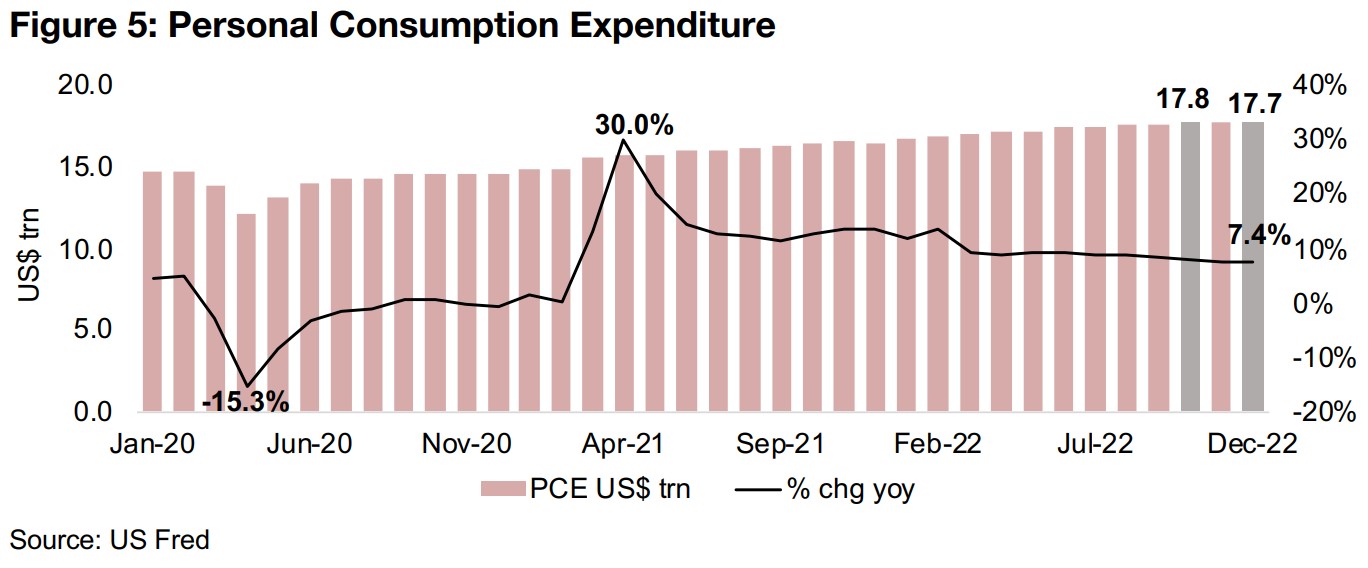

Total US Personal Consumption Expenditure (PCE) overall looked moderately bearish, having declined from a US$17.8trn peak in October 2022 to US$17.7trn in December 2022 (Figure 5). PCE growth was 7.4% yoy, and while the growth rate continues to trend down, and is well off its global health crisis peak of 30%, is still relatively robust and shows the US consumer still only moderately pulling back on purchases in recent months.

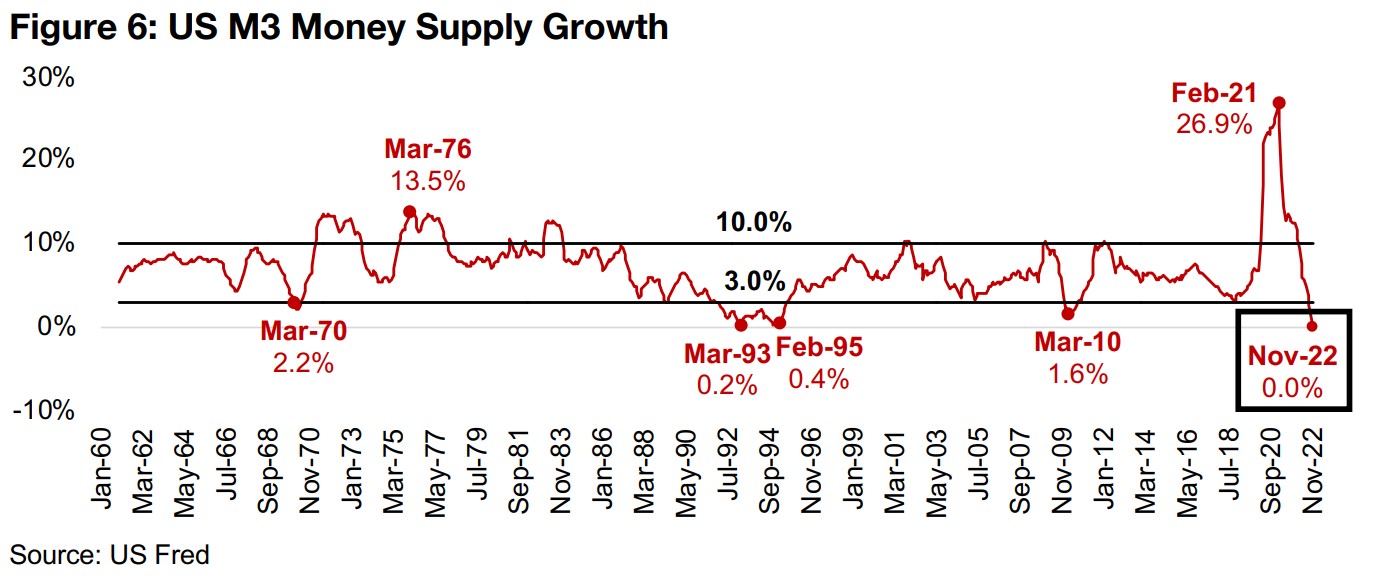

US M3 Money Supply growth yoy at its lowest level ever

We believe that the equity market might be getting ahead of itself with this 'bad economic news is good news for stocks' idea, focusing on the relief to valuations of a potential rate hike pause but not weighing highly enough the negative effect of a recession on company earnings. We harken back to a quote from Business Insider's 'Daily Reckoning' from May 20, 2011, that 'the single most important thing to understand about economics in the age of paper money is that credit growth drives the economy.' In this context, the drop in the US M3 Money Supply, a key indicator of credit growth, to 0.0% yoy in November 2022 - its lowest level ever since the data series started in January 1960 - should certainly be a concern (Figure 6). It highlights that controlling inflation, while good, does have a cost, which equity markets seem to be very much underestimating. Large cap gold stocks (but not the TSXV juniors) have fortunately decoupled from equity markets, dramatically outperforming the S&P on a rising gold price and flight to safety, but it remains to be seen if they can entirely avoid the pressure of a potential recession-driven retreat in the broader stock market.

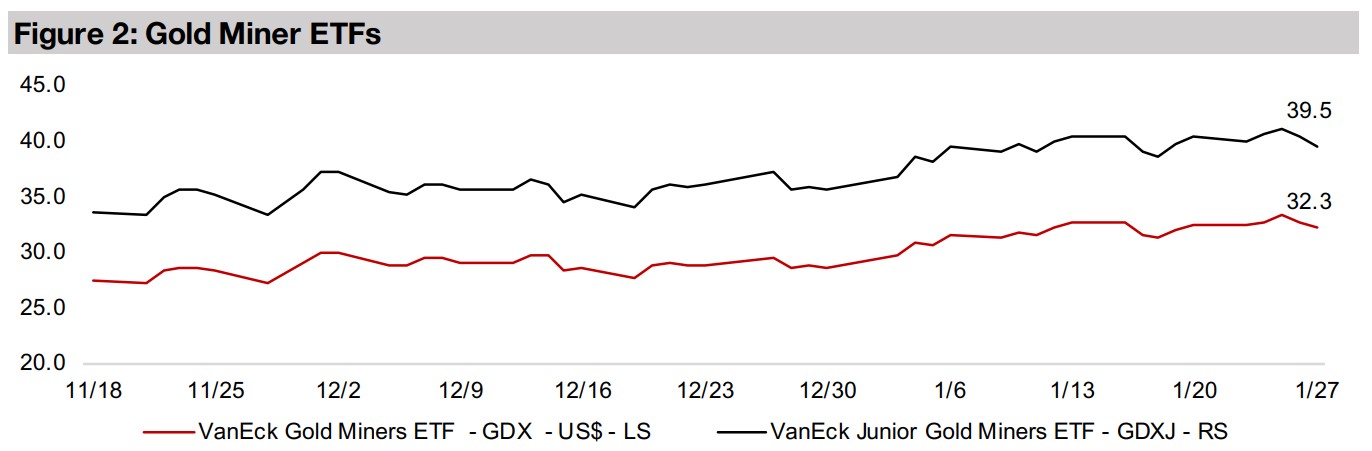

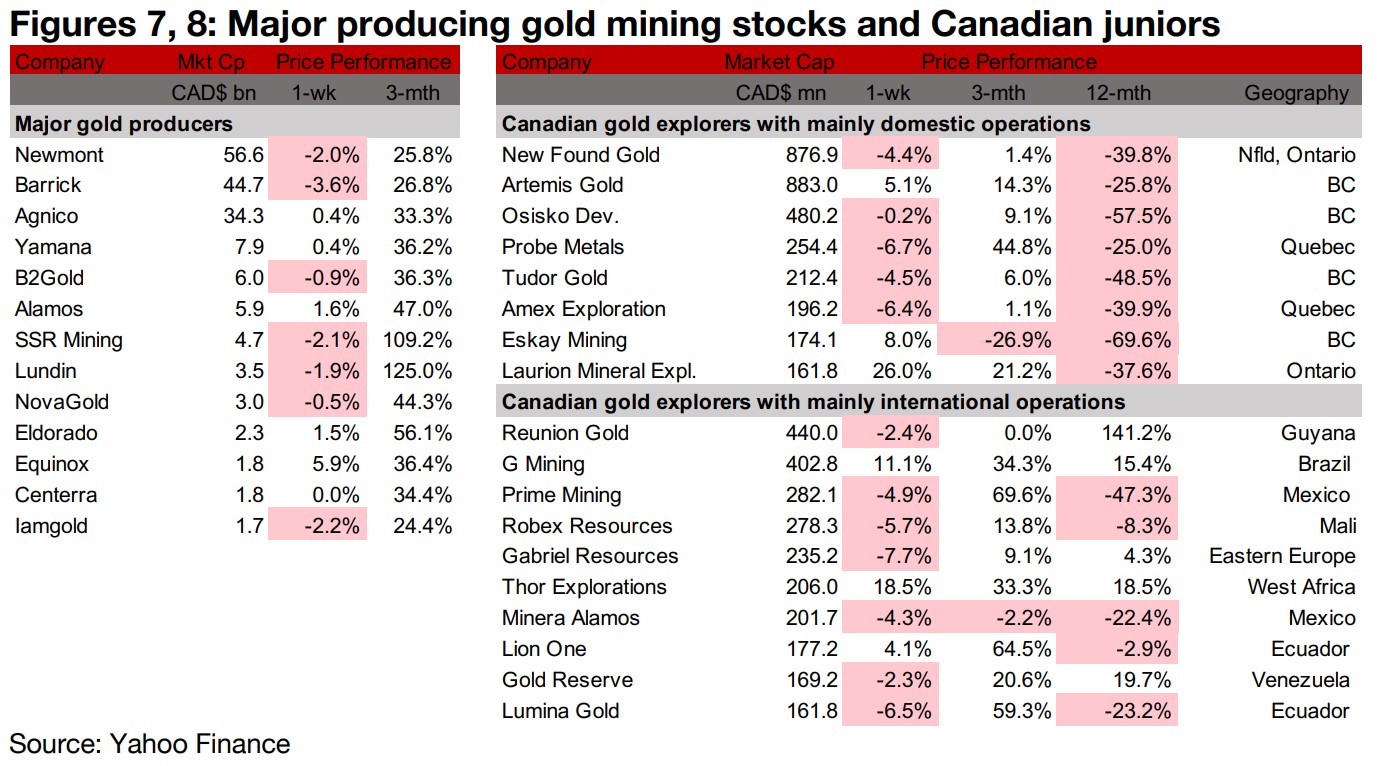

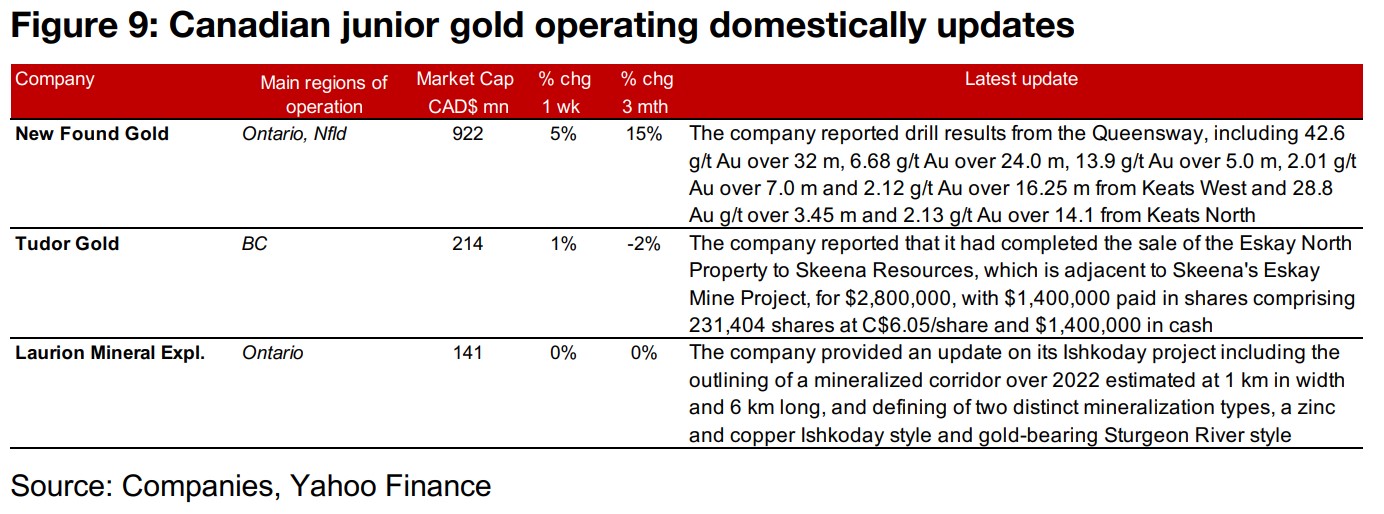

Gold producers mixed while TSXV gold stocks mostly down

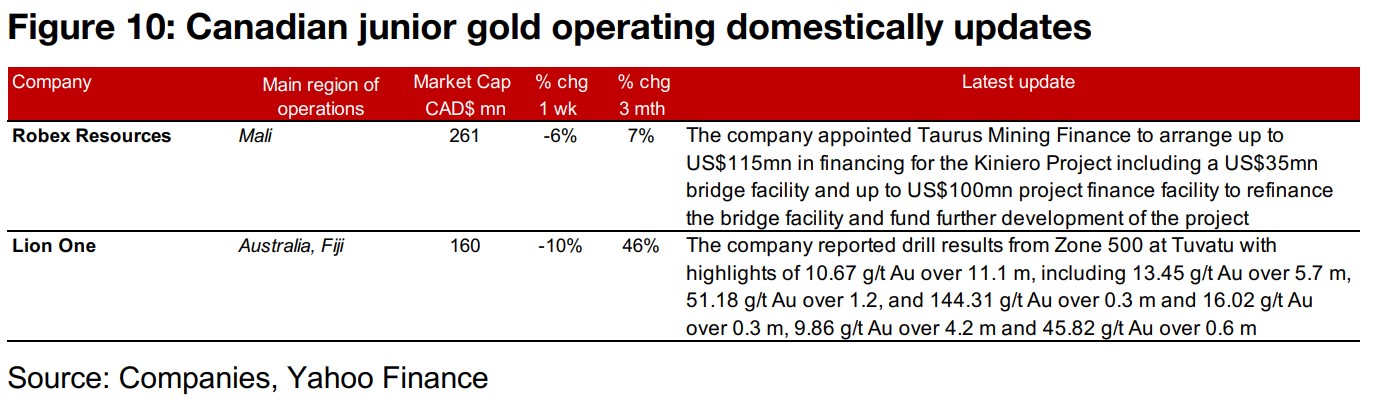

The producing gold miners were mixed and the TSXV junior gold miners mostly down as the gold price was flat but equity markets jumped considerably (Figures 7, 8). For the Canadian juniors operating mainly domestically, New Found Gold reported drill results from the Keats West and Keats North Zone of Queensway, Tudor completed the sale of the Eskay North Property to Skeena, and Laurion Mineral Exploration provided an update on progress at its Ishkoday project over 2022 (Figure 9). For the Canadian juniors operating main internationally, Robex Resources appointed Taurus Mining Finance to arrange up to US$115mn in financing for the Kineiro Project and Lion One reported drill results from Zone 500 at the Tuvatu Project (Figure 10).

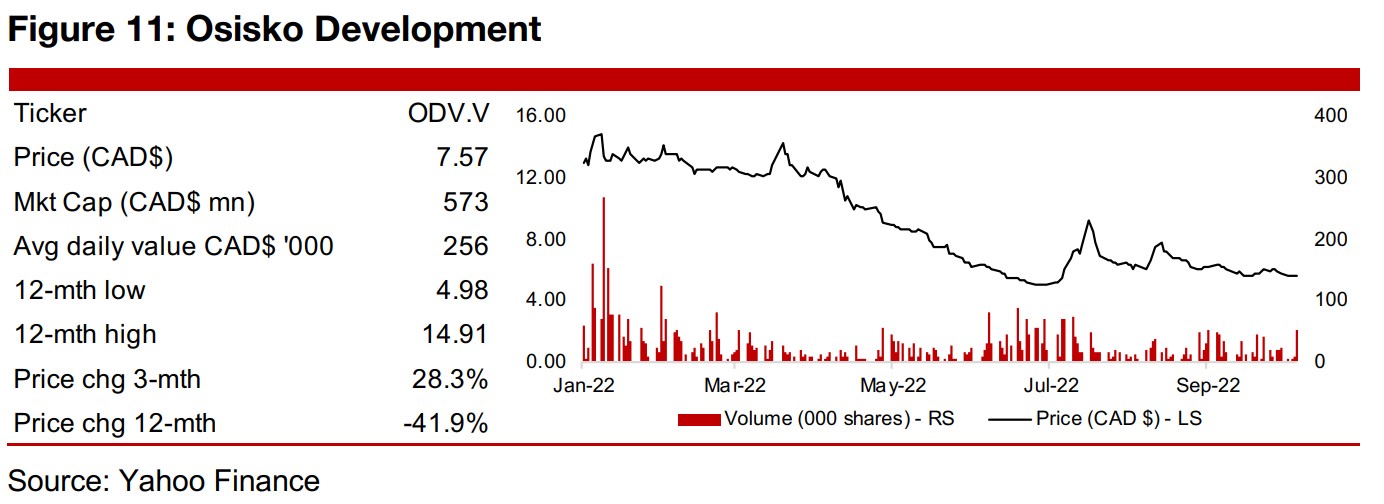

In Focus: Osisko Development (ODV.V)

Feasibility Study for Cariboo and Resource Estimate for Trixie

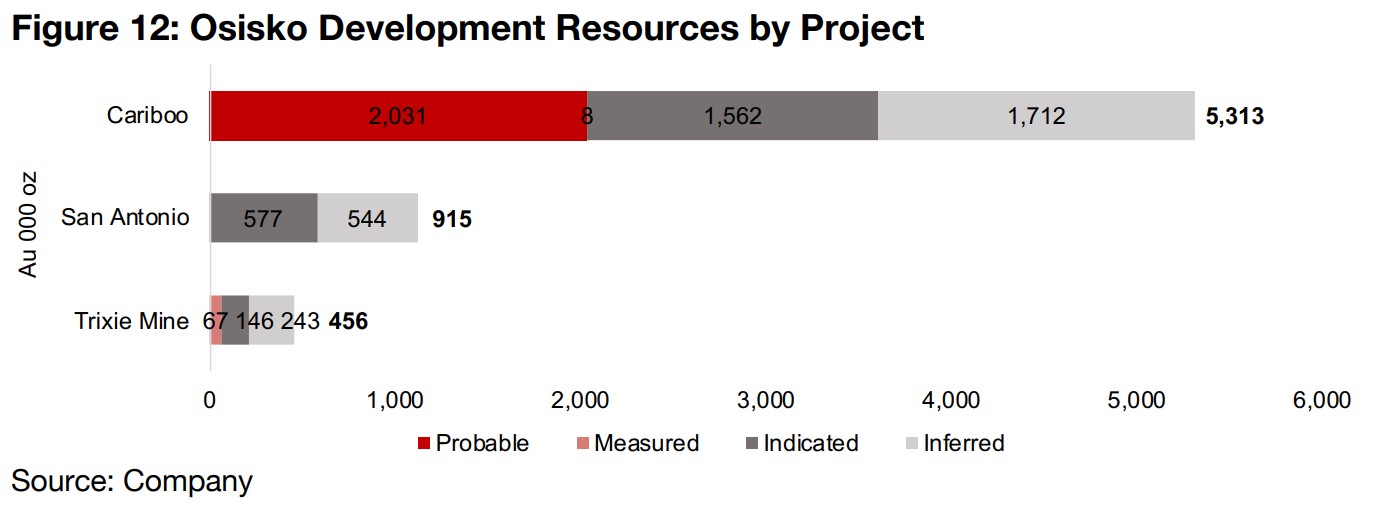

Osisko Development has already reported two major milestones in 2023, with the release of a Feasibility Study for its Cariboo Project on January 3, and a Resource Estimate for the Trixie Mine at its Tintic Project on January 17, which was relatively recently acquired in May of 2022. The advanced Cariboo project in British Columbia is the company's largest project, with a total 5.3 mn oz Au, compared to 0.9mn oz for San Antonio in Mexico and 0.5 mn for the Trixie Mine in Utah (Figure 12).

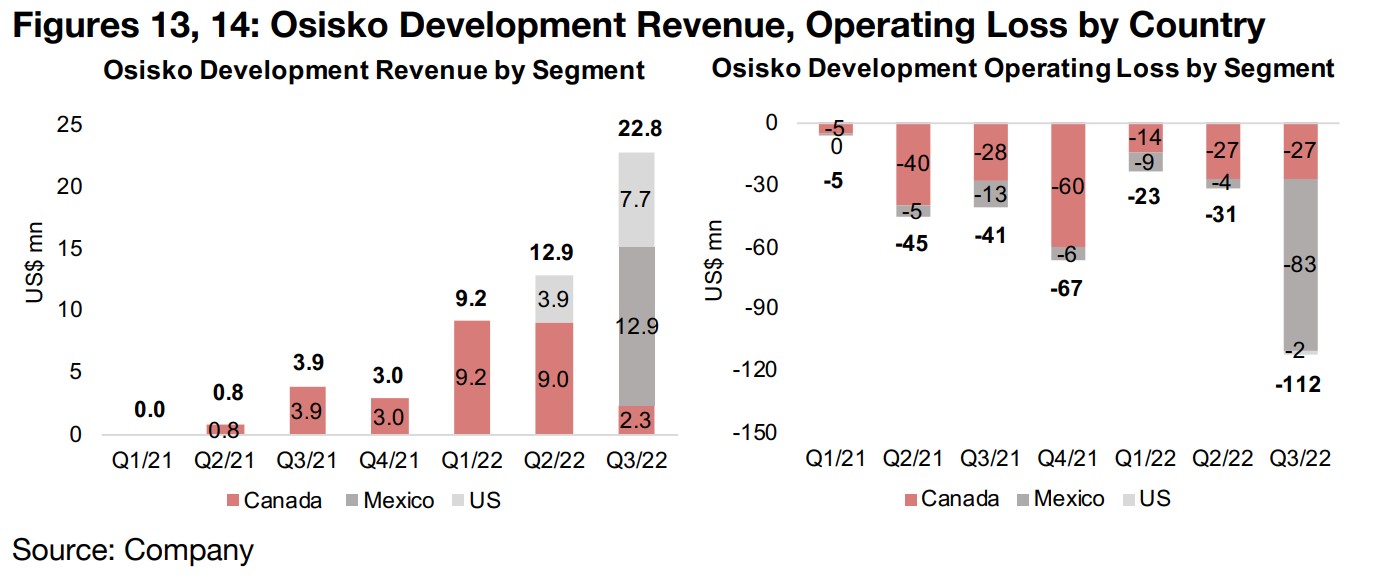

Small scale production from all three projects in recent quarters

The company has actually had small scale production from all of these projects in recent quarters. While there was no revenue as of Q1/21, by Q2/21 the company began production from the Bonanza Ledge deposit at Cariboo, which is shown in the Canada portion of revenue in Figure 13. While revenue from Bonanza Ledge production peaked in Q1/22, with the resource largely depleted by Q3/22, the Trixie mine of the Tintic project had been in production prior to the acquisition by Osisko Development and it started contributing to revenue from mid-Q2/22, with the first full quarter of contribution in Q3/22, under 'US' in Figure 13. In Q3/22 the company also saw revenue from San Antonio in Mexico from a stockpile on the heap leach pad. While this growing revenue has not yet led to operating profit, losses were contracting over H1/22 before a major $81mn writedown of the Sapuchi deposit at San Antonio drove a major loss in Q3/22 (Figure 14).

Cariboo will remain the big value driver

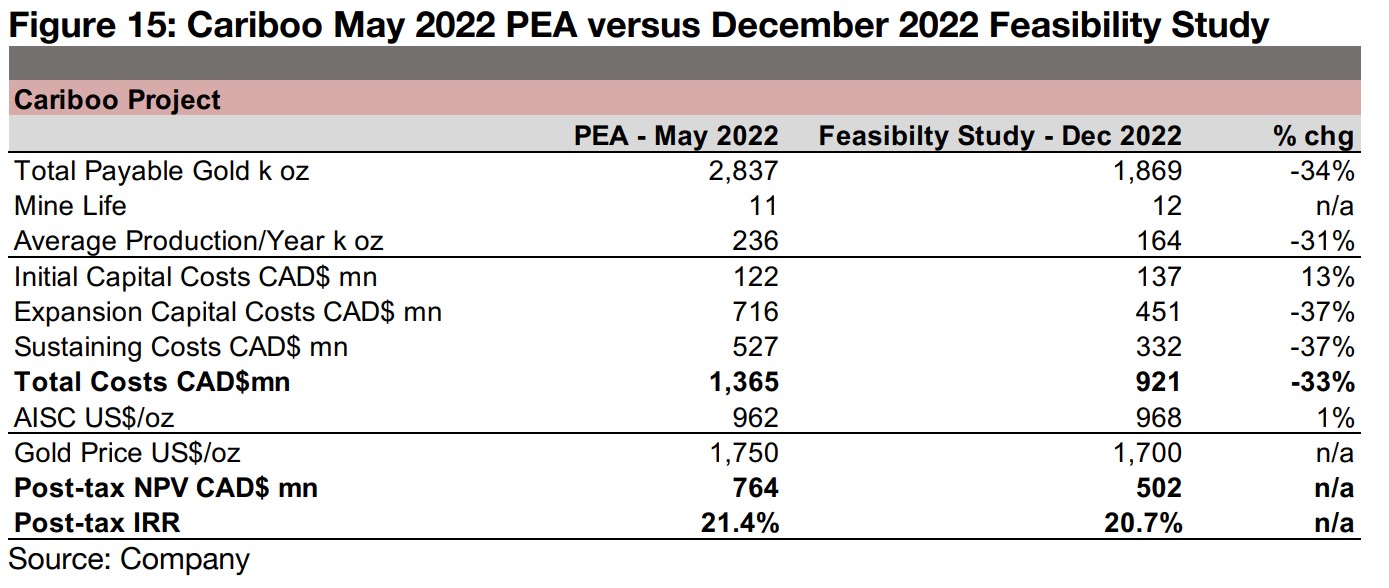

While small scale production from Trixie and San Antonio will provide some cash flow for the company short-term, Cariboo will remain the largest proportion of the company's value, with commercial production targeted by 2024. The Feasibility Study for Cariboo shows some changes to the economics of the project from the May 2022 PEA, with total payable gold production down -34% to 1.85mn oz Au from 2.84mn oz, but this is offset by a -33% decline in total costs to CAD$0.92 bn from CAD$1.37 bn, with the AISC near flat (Figure 15). The post-tax NPV of the PEA and FS, at CAD$764mn and US$502mn, respectively, are not entirely comparable, as they use two different gold prices, US$1,750/oz and US$1,700/oz.

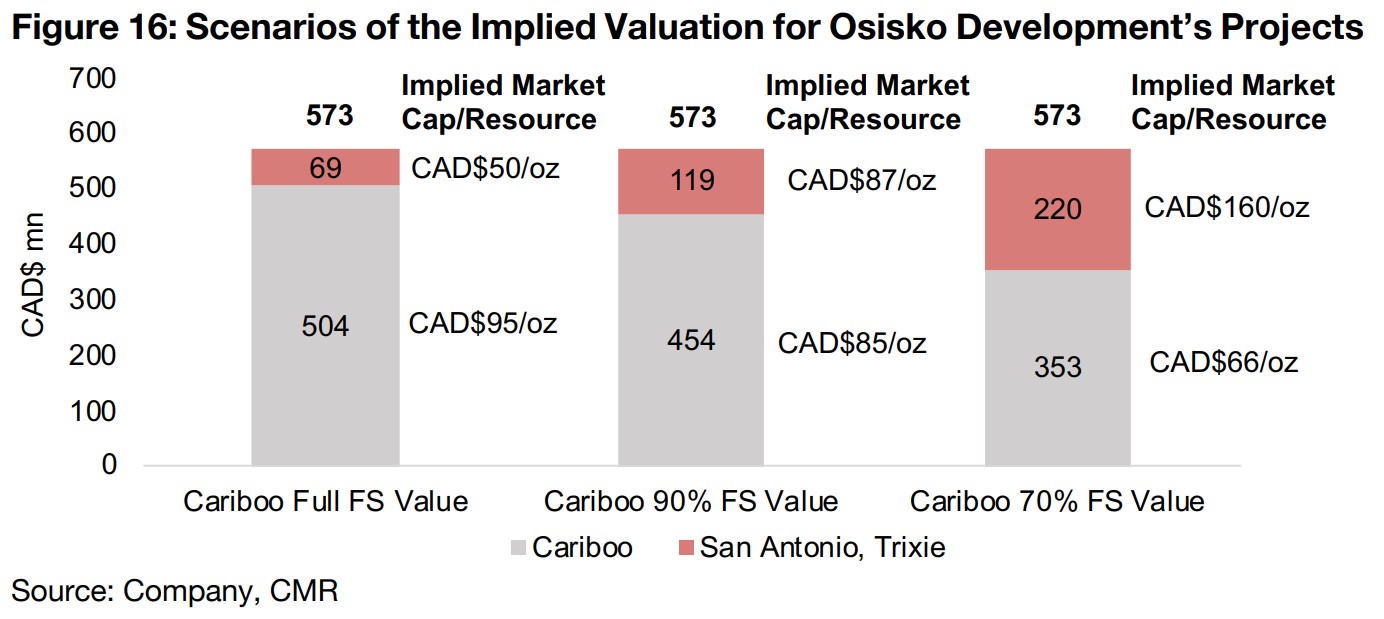

Backing out valuation by project from current market cap

We back out some scenarios on what value the market may be attributing to Cariboo and Osisko Development's other projects, using the current market cap of CAD$573mn as the basis, in Figure 16. In the first scenario, we assume that the market is attributing 100% of the CAD$504mn valuation for Cariboo in the Feasibility Study, implying CAD$69mn remaining for Trixie and San Antonio and an average CAD$50/oz Market Cap/Resource valuation. However, this first scenario seems implausible for a couple of reasons, first being that the market is likely to be valuing Cariboo at least somewhat below the value in the FS to account for risk. The second is that the average Market Cap/Resource for several similar stage TSXV gold companies is around CAD$75/oz, which would suggest that the CAD$50/oz valuation for Trixie and San Antonio might prove somewhat low.

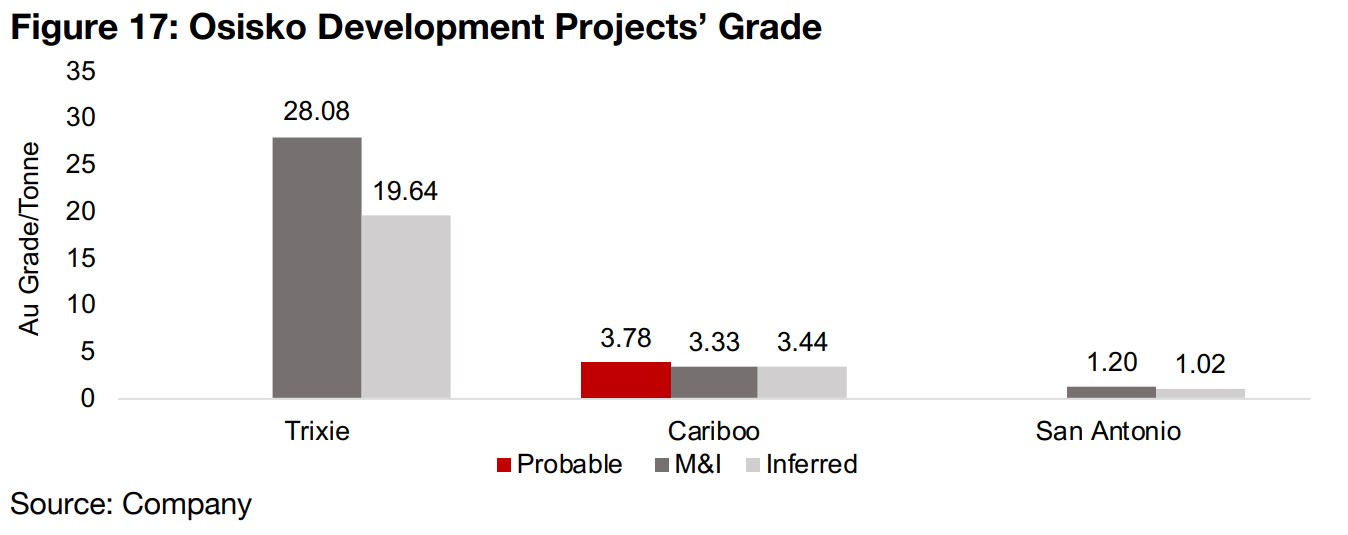

Trixie grade far higher than Cariboo or San Antonio

While we could explain this differential by the advanced stage and large scale of

Cariboo versus Trixie and San Antonio, we also need to consider that the combined

gold grade of these two other projects is far higher than for Cariboo. This is mainly

because of Trixie, which has an outstanding grade of 23.2 g/t Au on average, with

San Antonio much lower, at just 1.1 g/t Au, and the average between the two comes

out to 5.6 g/t Au, about 60% higher than Cariboo's average 3.5 g/t Au grade (Figure

17). This much higher average grade for Trixie and San Antonio combined, and the

fact that both projects have reached production, even if only to a small scale so far,

indicate that the valuation gap in the first scenario may be a little too wide.

The second scenario assumes the market attributes 90% of Cariboo's value in

Feasibility Study, and this nearly balances out the implied Market Value/Resource to

CAD$87/oz for Cariboo and CAD$85/oz for the other two projects combined. This

would indicate that Cariboo's more advanced stage is being offset especially by

Trixie's very high grade. The third scenario attributes just 70% of the value of the

Cariboo PEA, and implies only a CAD$66/oz value for Cariboo, and a CAD$160/oz

value for Trixie and San Antonio combined. This latter number seems excessive

putting them at nearly twice the average Market Cap/Resource for similar projects.

Overall we expect that the market is most likely attributing a valuation somewhere

between the first and second scenario.

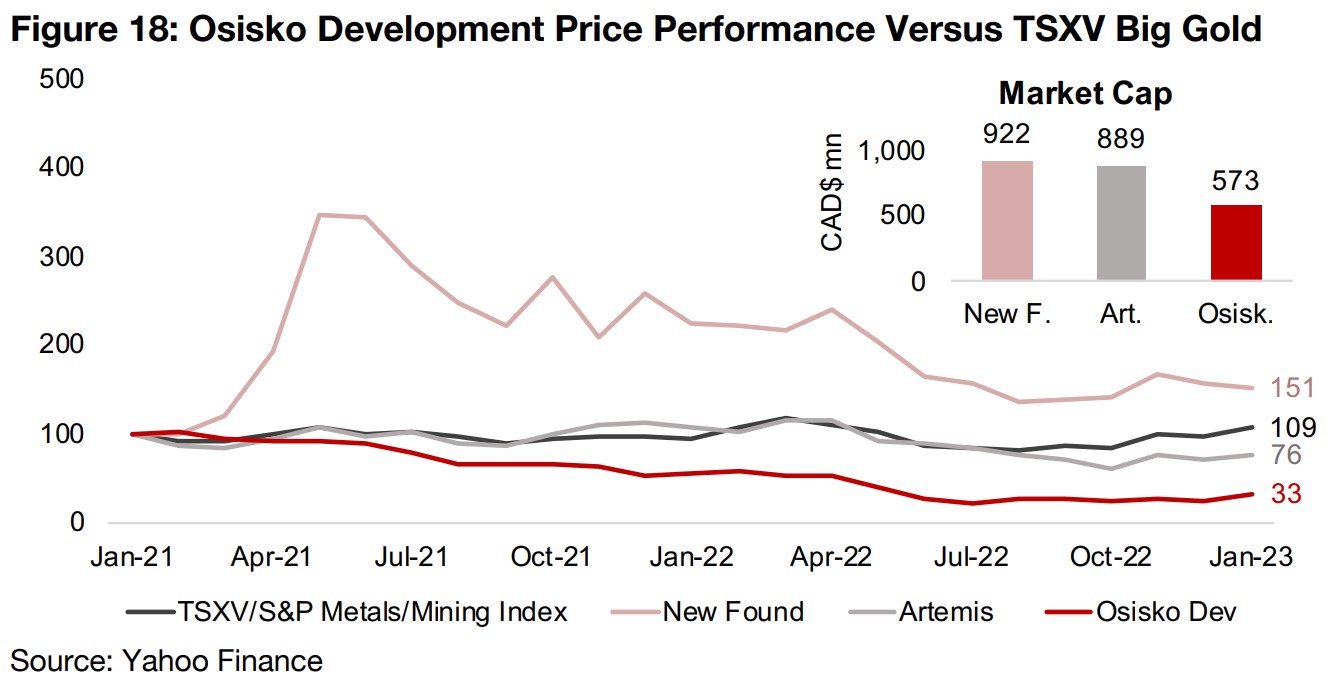

Osisko Development underperforming largest TSXV Gold stocks since 2021

These recent operational developments, combined with the rising gold price, generated a pickup in Osisko Development's share price over the past three months, offering some relief after an extended decline. The shares have lost -67% of their value since the start of 2021, underperforming the S&P/TSXV Metals and Mining Index, which was up 9% over the period, and the two other largest TSXV gold companies by market cap, New Found Gold, up 51%, and Artemis Gold, down -24% (Figure 18). So we are certainly not in a frothy period of irrational overexuberance for Osisko Development, and its valuation does not look particularly excessive, especially given the underlying economics of Cariboo and high grade of Trixie. However, there remains the risk of recession, another drop in equity markets overall and continued risk aversion over the first half of 2023, which could hit especially small caps like the junior miners, dragging down even reasonable looking valuations for companies like Osisko Development, still lower.

Disclaimer: This report is for informational use only and should not be used an alternative to the financial and legal advice of a qualified professional in business planning and investment. We do not represent that forecasts in this report will lead to a specific outcome or result, and are not liable in the event of any business action taken in whole or in part as a result of the contents of this report.