April 24, 2020

Gold mining stocks have strong week

Author - Ben McGregor

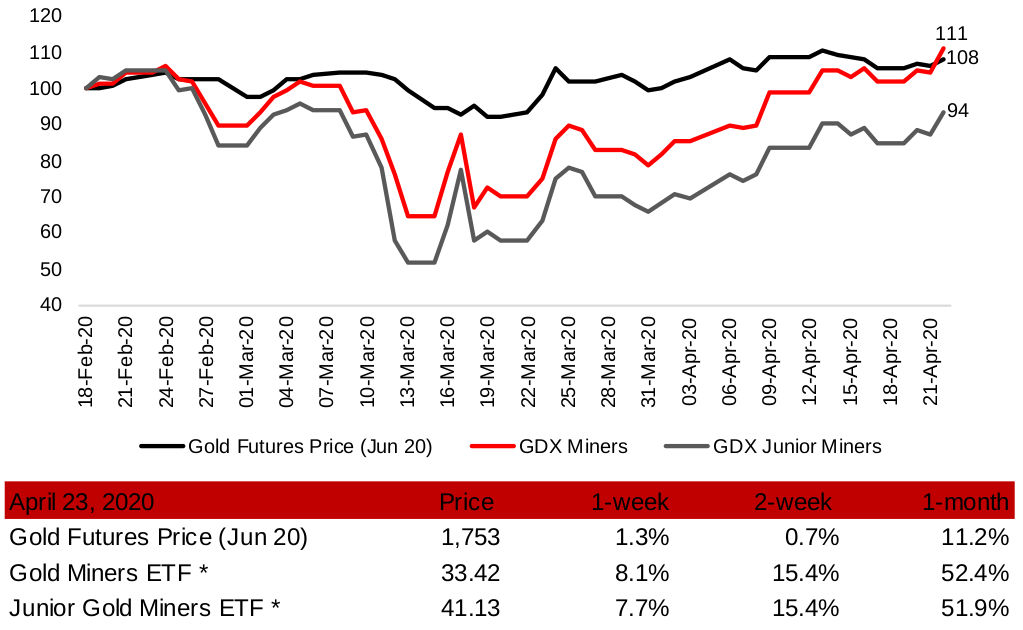

Gold ticks up, but gold mining stocks jump

While the nearest gold futures price ticked up just 1.6% this week, gold mining stocks generally surged, as investors seemed to be considering that gold holding above US$1,600 may not be a blip, but rather the new normal.

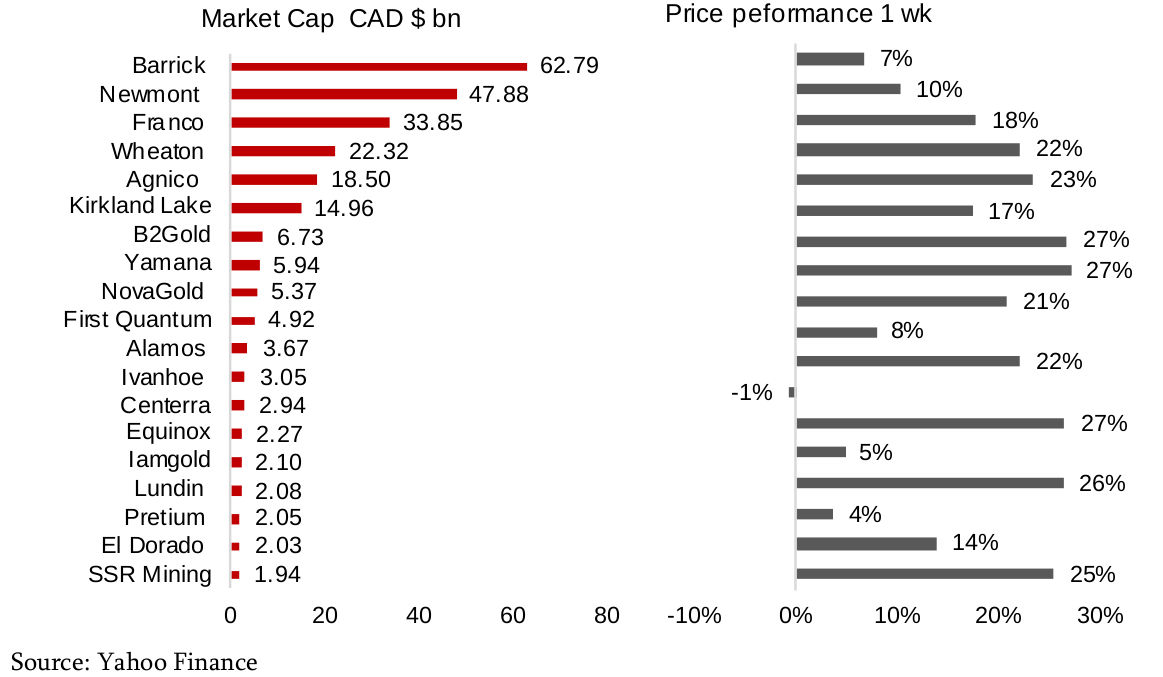

Many producing mines saw over 20% gains this week

Many producing Canadian gold miners saw gains of over 20% this week, as gold continues to hold up, stimulus plans are proceeding, and the initial panic over the global health crisis shifts to a calmer acceptance of a difficult reality.

Gold futures price and gold mining ETFs

Source: Yahoo Finance

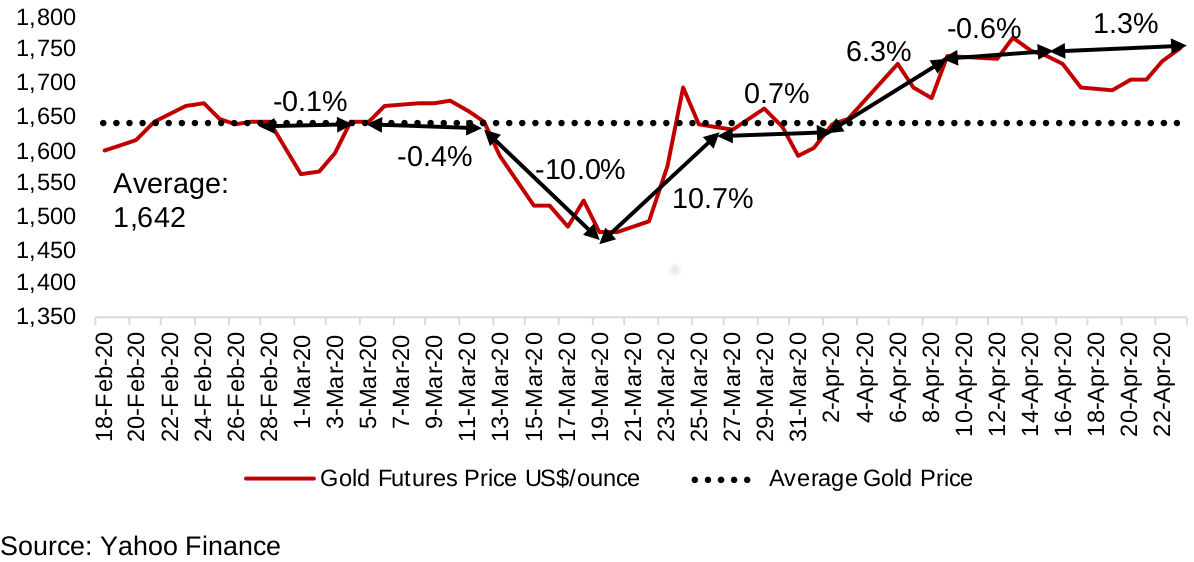

Gold starting to prove that levels above US$1,600 not a blip

The gold price based on the nearest futures contract ended the week of April 23, 2020 up 1.6% at US$1,753/ounce, which was not a significant rise compared to some weeks in the recent crisis (Figure 1). However, it was an important week in that; 1) a dip below US$1,700 was rapidly reversed, and 2) the market seems to be accepting that gold averaging US$1,600 is not just a blip, but may be the new normal. Gold has averaged US$1,642 over the past three months of the crisis, and above US$1,700 so far in April 2020.

Figure 1: Gold futures weekly price change through the crisis

Producing gold miners jump even as this week's gold move muted

Producing miners were strong this week, with VanEck's GDX ETF now up 11% since just prior to the start of the crisis in late February 2020, and moving ahead even of gold, which is up 8% since prior to the crisis. Canadian producing gold miners surged this week, with over half of the group in Figures 2 and 3 up over 20%. The gold price rise alone this week was clearly not enough to drive this. Rather it appears that it was more a combination of; 1) the growing perception that a much higher gold level than was previously expected could in fact hold for an extended period, and 2) the panic previously related to the global health crisis seems to have shifted to a calmer acceptance of the difficult situation, with stimulus efforts clearly large, and proceeding. It is interesting to notice that at lower market cap levels, the gains have been less consistent across firms, as the market seems to be more focused on company specific issues at these levels.

Figures 2, 3: Canadian producing gold miners

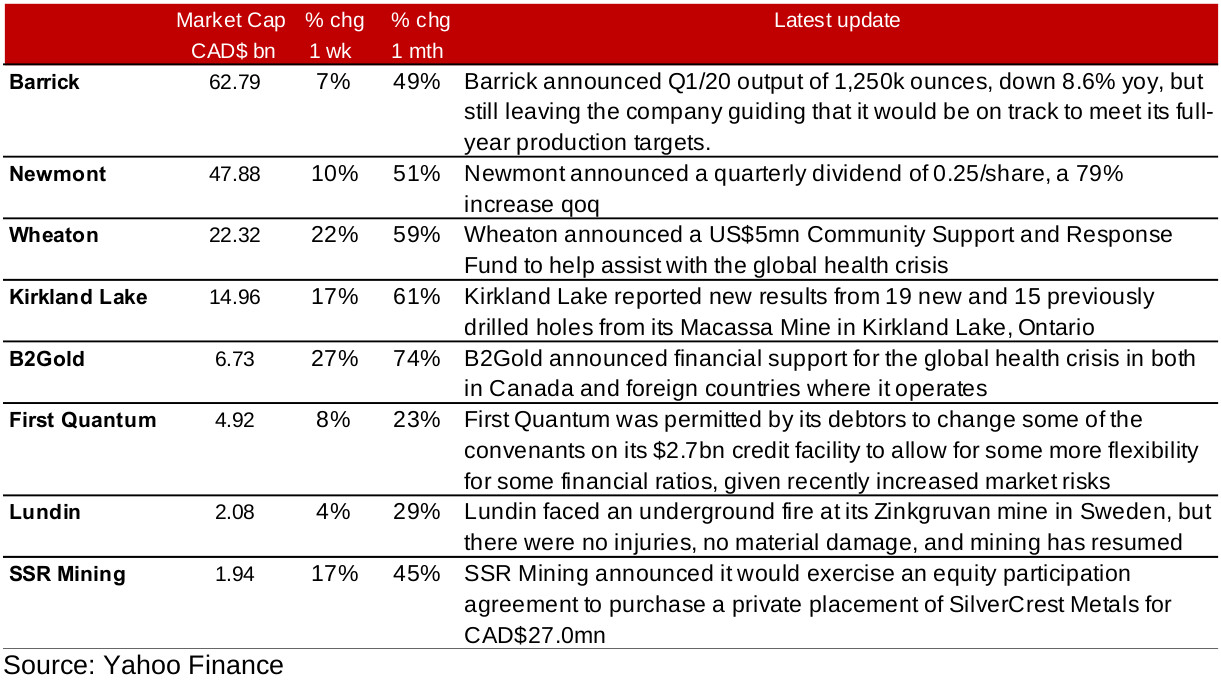

Figure 4: Producing gold miners updates

News flow from the producing miners generally upbeat

News flow from the producing miners was generally upbeat this week (Figure 4), and could have given some incremental boost to share prices in addition to the more macro factors addressed above. Barrick announced its Q1/20 production, which was down 8.6% yoy, but the company's guidance suggested it was still on track to meet its 2020 targets. Newmont increased in dividend 79% qoq and SSR Mining announced that it would take part in a private placement of SilverCrest, showing that some firms are maintaining financial flexibility and expanding even in this difficult environment. First Quantum, however, did announce that it was adjusting some debt convenants to ensure that they were ability to stay within acceptable levels for their creditors, even if problems in the financial markets were to persist. In terms of exploration, Kirkland Lake announced new sampling results, and Lundin announced a fire at one of its mines, but there were no injuries, and operations resumed quickly. Wheaton and B2Gold both announced funds to support the countries where they operate in their efforts in the global health crisis.

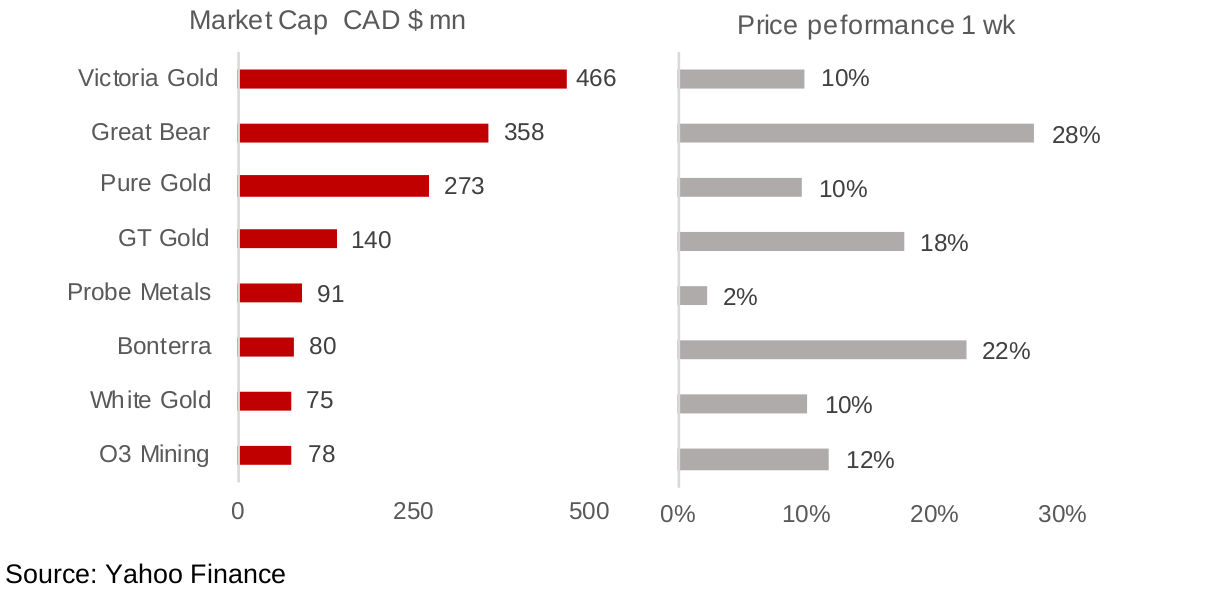

Figures 5, 6: Canadian junior gold miners with operations in Canada

Canadian junior gold miners with domestic operations rise

The larger Canadian junior gold miners with domestic operations all rose this week, but by varying amounts (Figures 5, 6). In earlier weeks of the crisis, we had seen larger cap junior gold stocks perform better than smaller cap junior gold stocks, as the market was particularly concerned about the ability of firms to raise capital and continue operations at the depth of the crisis in March 2020. The performance has become more mixed this week, with no clear trend between larger or smaller cap stocks seeing gains. While a strong gold price will continue to be the overarching driver for the sector, stock specific factors like financial flexibility and ongoing development of core mineral properties will remain key in determining the best junior gold mining stocks in 2020.

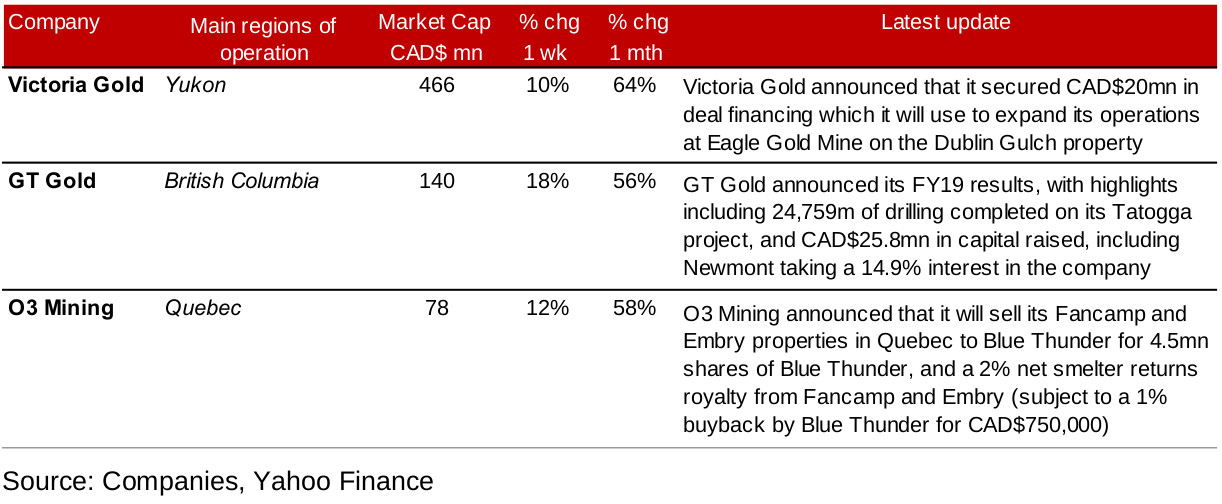

Figure 7: Canadian junior gold miners operating in Canada updates

Victoria secures financing, GT Gold reports FY19, O3 makes a sale

Key news flow for this segment showed that the sector continues to move forward, even given the difficult operating environment. Victoria Gold announced that it had secured CAD$20mn in financing to expand its Eagle Gold Mine on the Dublin Gulch property. GT Gold announced FY19 results, with major progress this year including an extensive drilling program on its Tatogga property, and successful capital raising. O3 Mining announced that it would sell off two properties, Fancamp and Embry. Other big gainers Great Bear and Bonterra did not have major press releases accompanying their moves.

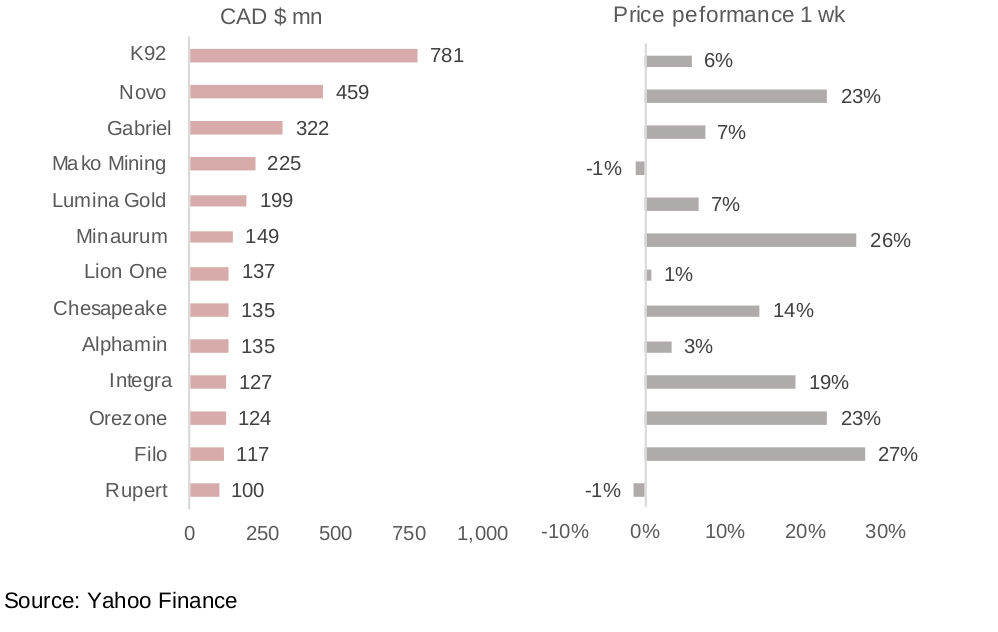

Figures 8, 9: Canadian junior gold miners operating mainly internationally

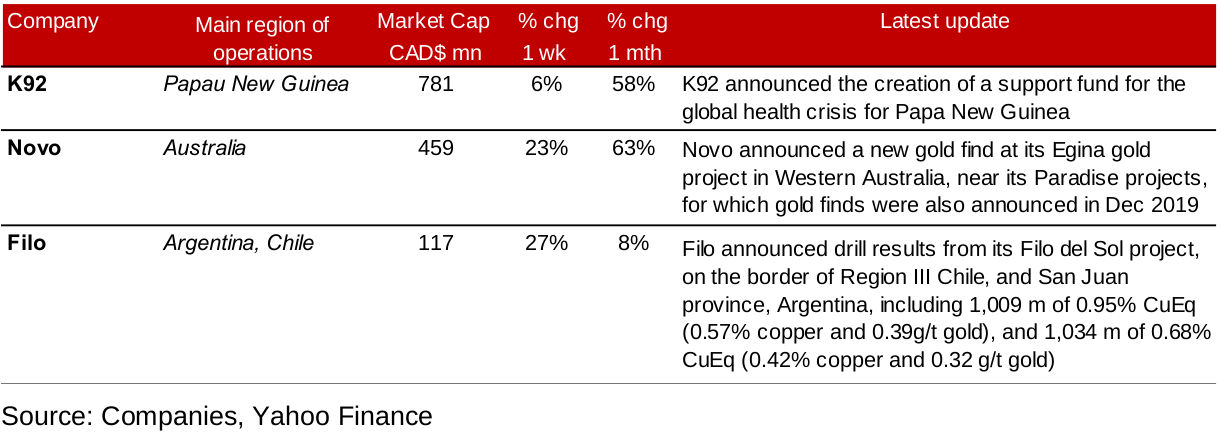

K92 offers health crisis funding, Novo and Filo announce finds

The Canadian junior gold miners operating mainly internationally mostly saw gains, although they varied across company substantially (Figures 8, 9). K92 announced that it would offer funding for the health crisis in Papua New Guinea, where it has its core operations (Figure 10). Both Novo and Filo saw substantial gains on announcements of exploration results. Novo announced new gold finds at its Egina project in Western Australia, which is near its Paradise projects, for which it previously announced gold finds in December 2019. Filo announced results from its gold and copper Filo De Sol project at the border of Chile and Argentina, which seems to have driven its share price this week.

Figure 10: Canadian junior gold miners operating mainly internationally updates

Disclaimer: This report is for informational use only and should not be used an alternative to the financial and legal advice of a qualified professional in business planning and investment. We do not represent that forecasts in this report will lead to a specific outcome or result, and are not liable in the event of any business action taken in whole or in part as a result of the contents of this report.