April 01, 2022

Gold Maintains Geopolitics Premium

Author - Ben McGregor

Gold prices near flat for the week

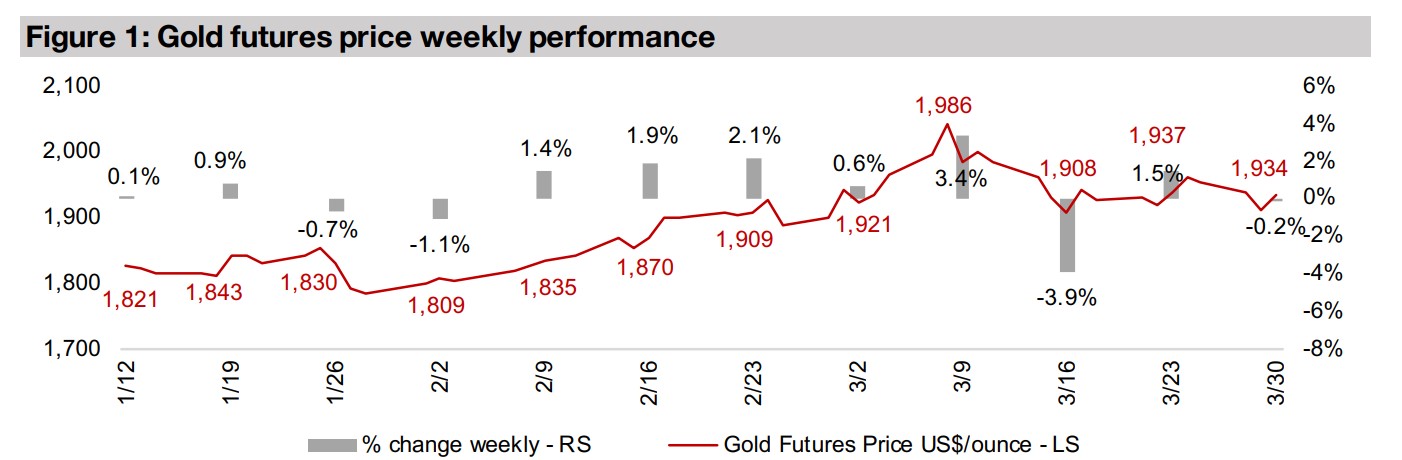

Gold was near flat for the week, down just -0.2% to US$1,934/oz, as there was no new major news flow driving it to the upside or the downside, with a continued status quo of high inflation and heightened geopolitical risks supporting the price.

Prime Mining and Reunion Gold In Focus

This week two South American explorers are In Focus, both with strong drill results over the past year, Prime Mining, which operates Los Reyes, a large gold-silver project in Mexico, and Reunion Gold, exploring for gold in Guyana.

Producers near flat, juniors decline on continued risk aversion

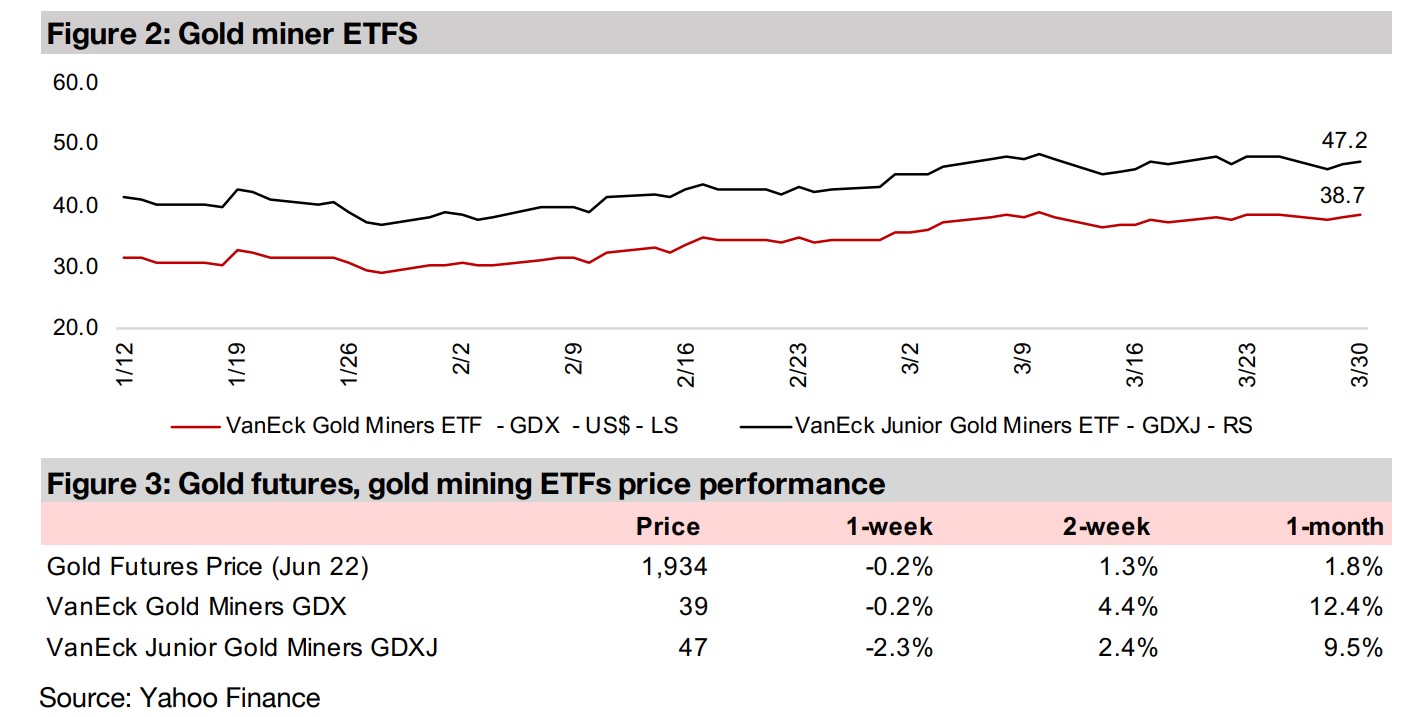

The producing miners were near flat, with the GDX down -0.2% but the juniors took a hit, with the GDXJ declining -2.3% and the larger TSXV Canadian juniors down as equity markets remain jittery and are still pulling back from smaller, riskier companies.

Gold Maintains Geopolitics Premium

Gold was near flat this week, edging down just -0.2% to US$1,934/oz, and continues to hold up in a new trading range from US$1,886/oz to US$2,040.1/oz and averaging US$1,943/oz that has held since the Russian invasion of Ukraine in the last week of February 2022. With gold trading at an average US$1,848/oz in the first three weeks of February 2022, and market having already priced in the other major drivers of gold at that point, including high inflation and negative real yields, this implies about a US$95/oz premium for has been baked into gold because of heightened geopolitical risk. It also does not appear that there will be a solution to this anytime soon, and geopolitical risks seem more likely to become even more aggravated than subside. We would therefore expect the premium for geopolitical risk to at least remain at the current levels this year and that it could even widen. Meanwhile, there are few signs that high inflation will soon be brought under control, even as the Fed has continued to talk more aggressively on this issue, and started a rate hike cycle, as it is still playing catch up with rising prices. Meanwhile, economic growth looks like it is starting to ease, which could mean stagflation, and combined with the political tensions with Russia, could mean we are entering a period similar to the 1970s economically and politically, which was certainly a very strong time for the gold price.

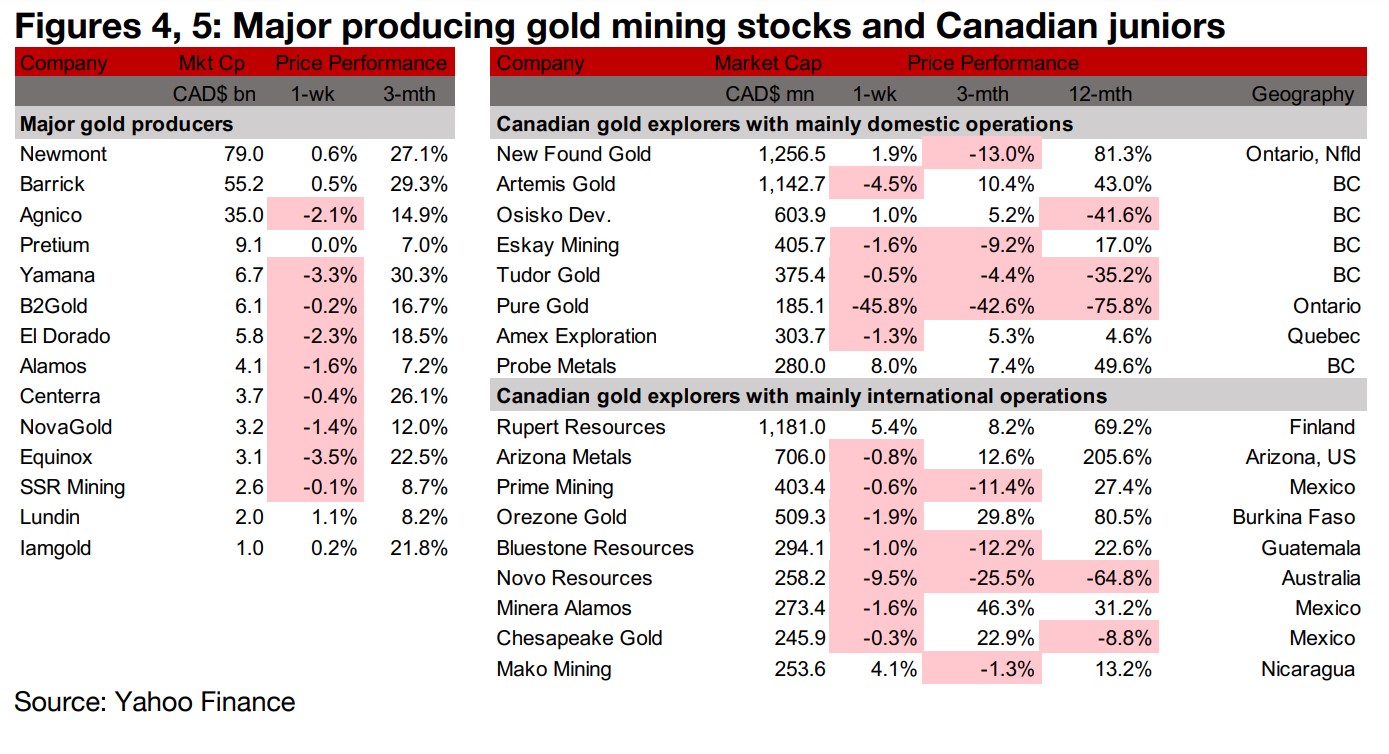

Producers mainly down with gold price near flat

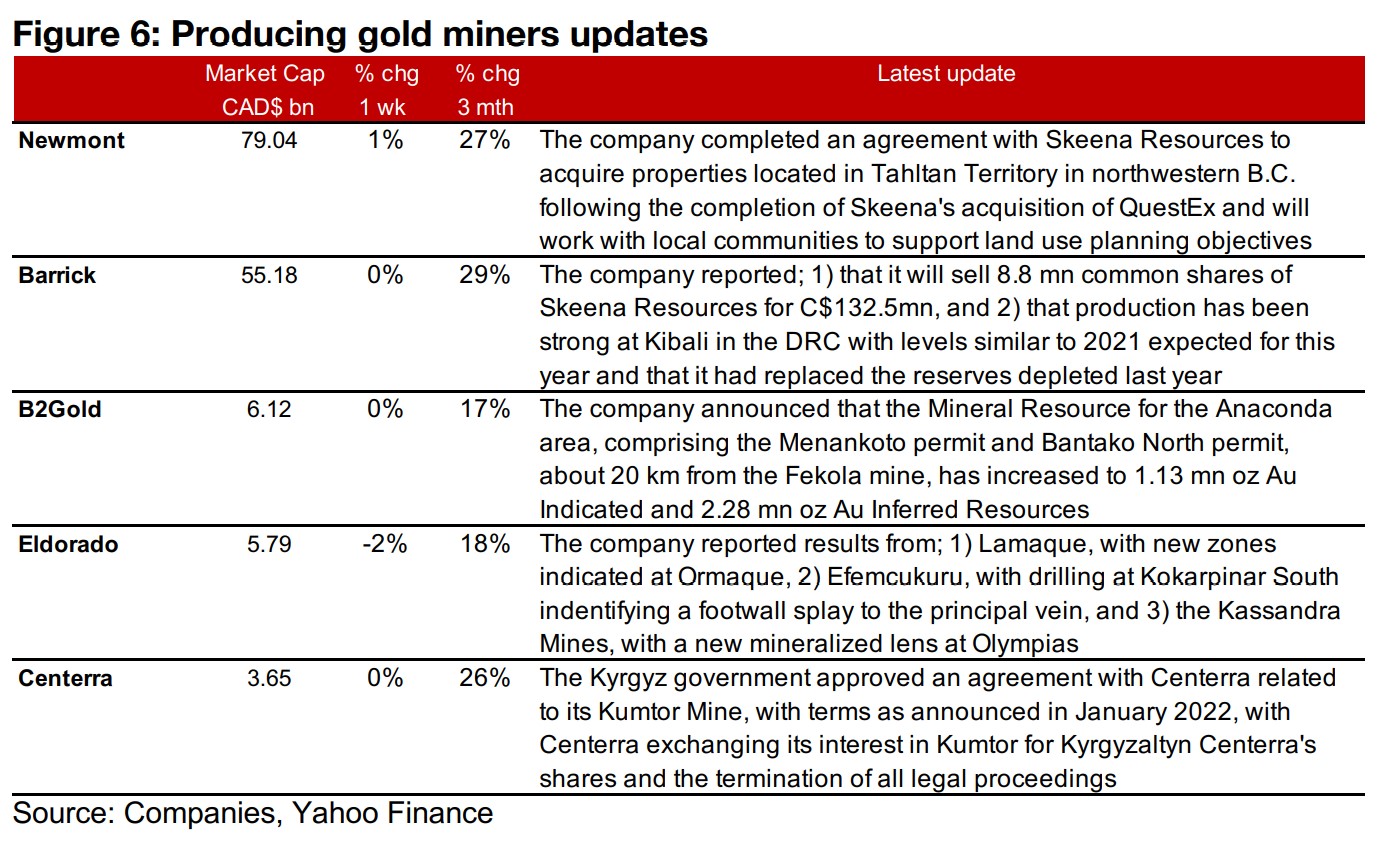

The producing gold miners were mainly down even as the gold price remained near flat for the week (Figure 4). Newmont completed an agreement with Skeena Resources to acquire properties in Tahltan Territory in northwestern B.C. following its acquisition of QuestEx. Barrick reported it would sell shares of Skeena Resources, and that production was strong at Kibali in the DRC. B2Gold announced an increase in its Mineral Resource for the Anaconda area, El Dorado reported exploration results from Lamaque, Efemcukuru and Kassandra mines, and the Kyrgyz government approved an agreement with Centerra related to the Kumor Mine with terms similar to those announced in January 2022 (Figure 6).

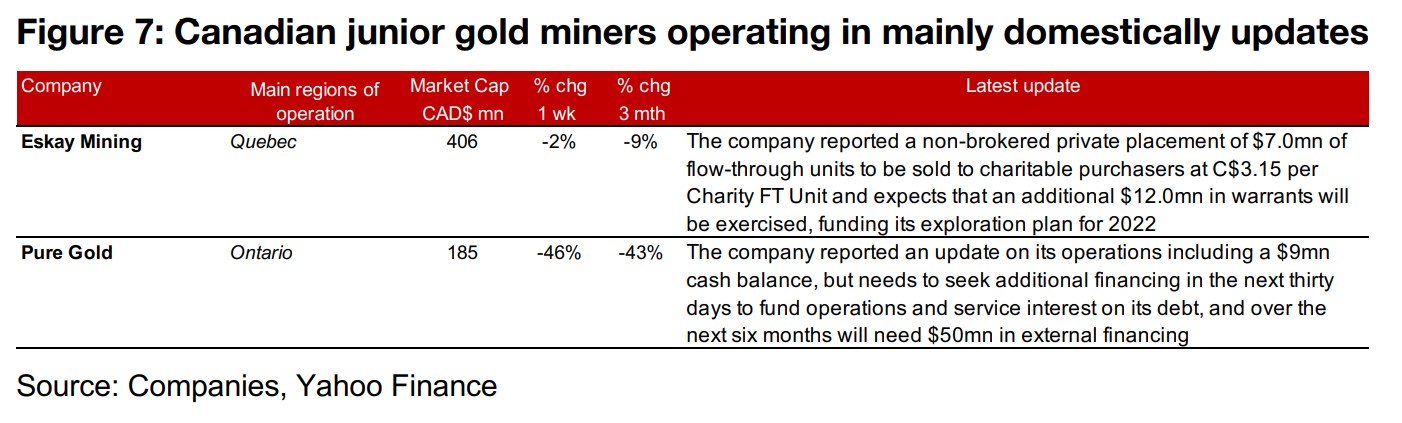

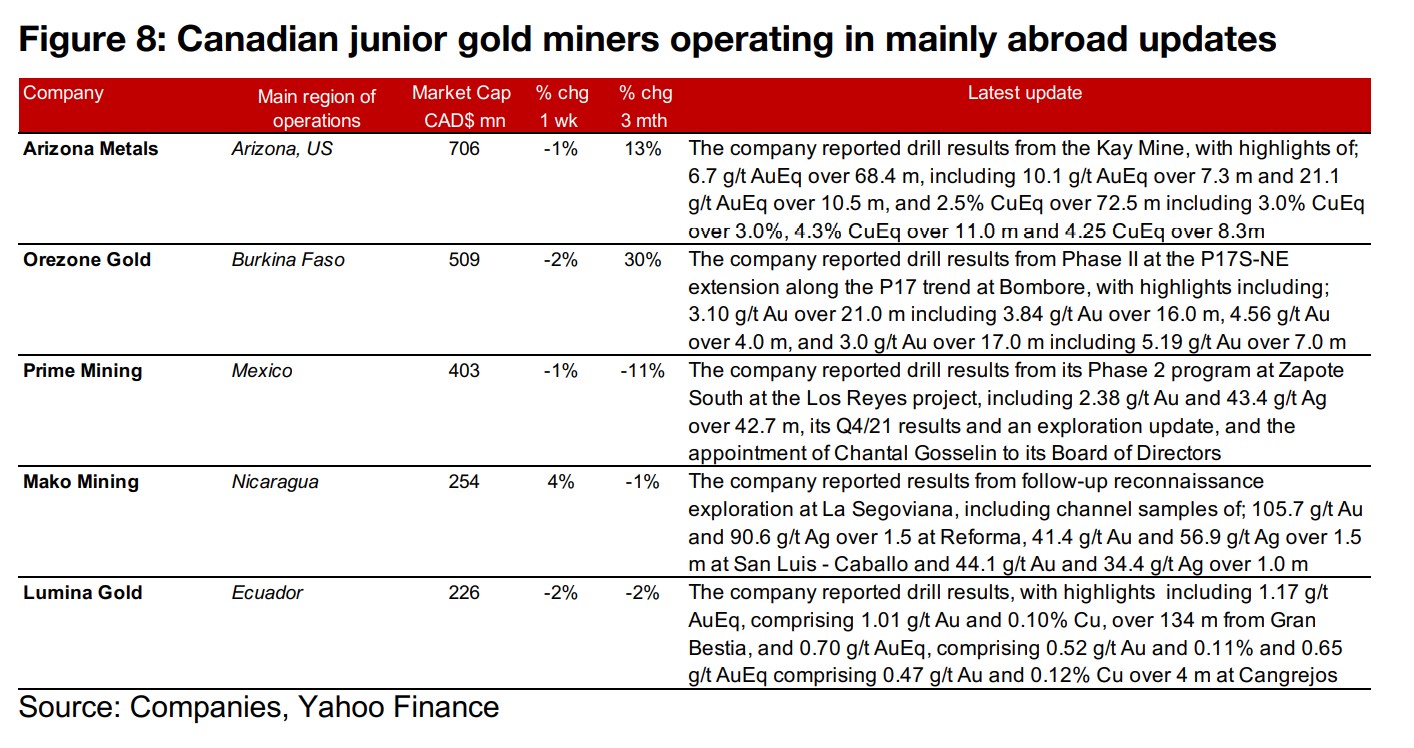

Canadian juniors decline, Pure Gold down on debt service issues

The Canadian juniors were mainly down as equity markets remained jittery and continued to sell off smaller riskier companies (Figure 5). For the Canadian juniors operating mainly domestically, Eskay reported a private placement of $7.0mn to charities and expects $12.0mn of warrants to be exercised soon, and Pure Gold reported an update on its operations, including additional financing needed in the next thirty days for debt service and $50mn in external financing over the next six months, which drove a -46% decline in its share price in the past week (Figure 7). For the Canadian juniors operating mainly internationally, Arizona, Orezone, Prime and Lumina all reported drilling results, and Mako reported results from follow-up reconnaissance exploration at La Segoviana (Figure 8).

In Focus: Reunion Gold (RGD.V)

Exploring for gold in the Guiana Shield

Reunion Gold operates the Oko West project in Guyana, which is in the Guiana Shield, a prolific gold belt that runs from the east of Venezuela through Guyana, Suriname and French Guiana and into northern Brazil, which has seen fourteen sizeable gold mines, ranging from 1.5mn oz to 17.0 mn oz. The company has been exploring in this region for several years, with a focus from 2017 to 2020 on the Dorlin and Boulanger projects in French Guiana. The company initially optioned the claims for Oko West in 2019 and that year did an airborne magnetic survey that identified shear zones along greenstone/granitoid contact. In 2020 soil geochemical surveys identified a 6 km long gold anomaly and follow up trenching in the Kairuni zone confirmed gold mineralization in saprolite.

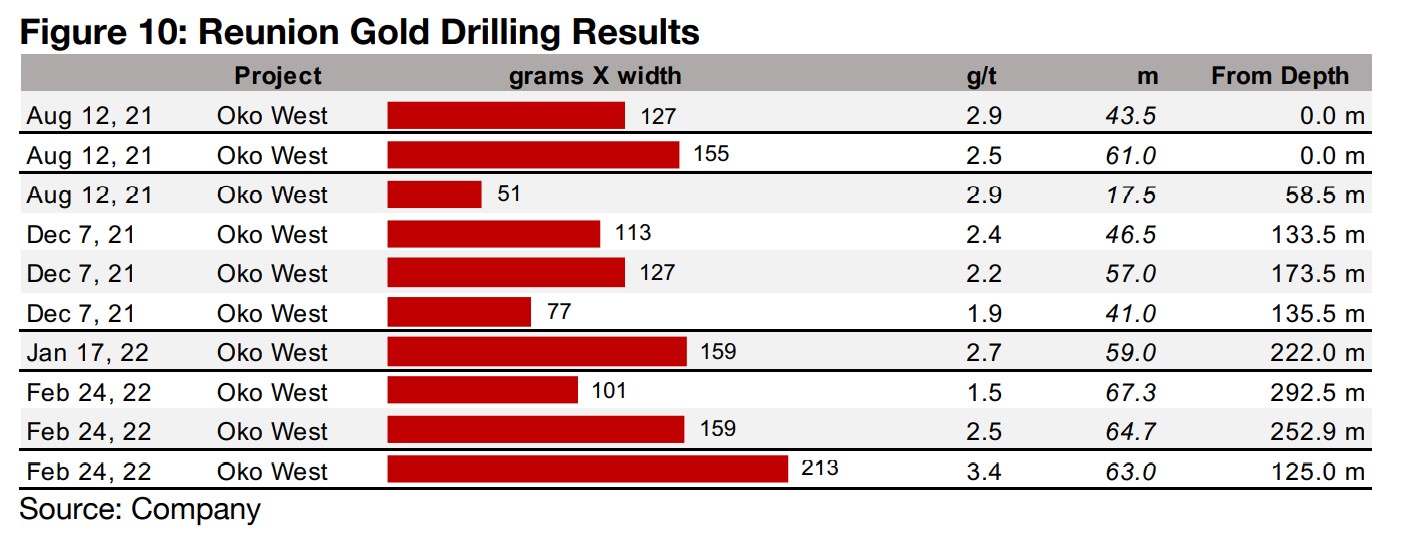

Strong drilling results from Oko West over past year

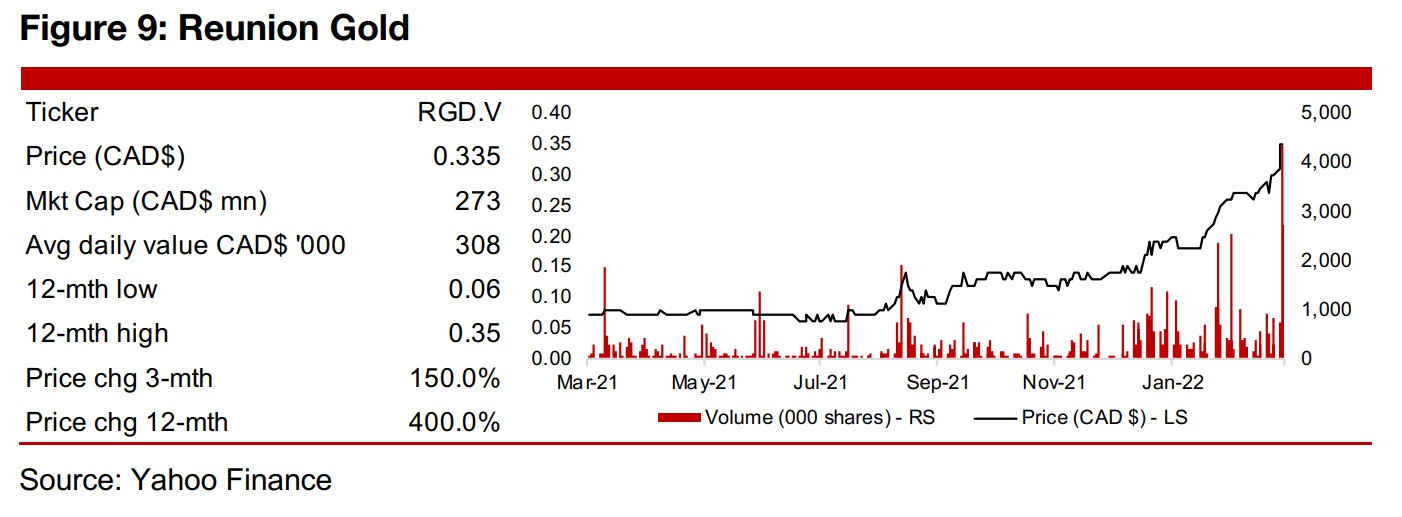

The company then did an initial 1,000 m drill program in the first quarter of 2021 which confirmed gold mineralization in saprolite, and in third quarter 2021, began its first major drill program at the project, with a total 17,500 m in 64 diamond drill holes and 104 reverse circulation holes completed as of February 2022. The drilling shows continuous gold mineralization on the Kairuni zone over a 2.5 km strike length. The highlights from the drill program are shown in Figure 10, with the two most outstanding holes in terms of grams X thickness on January 17, 2022, at 169, comprising 2.7 g/t Au over 59.0 m, and on February 24, 2022, at 213 grams X thickness comprising 3.4 g/t Au over 63.0 m. The company also saw strong drilling results earlier, in August 2021, at 155 grams X thickness, comprising 2.5 g/t Au over 43.5 m. These strong drill results have been the main drivers of the 400% rise in the share price over the past year, with major gains in August 2021 on the drill results, with the stock doubling, then gradually doubling again over the rest of the second half of 2021, and then up 150.0% over the past three months again on strong drill results. The company expects to complete its 15,000 m Phase 4 drill program by the end of Q2/22 and targets a maiden Mineral Resource estimate by H2/22.

Company well-funded with strong institutional shareholding

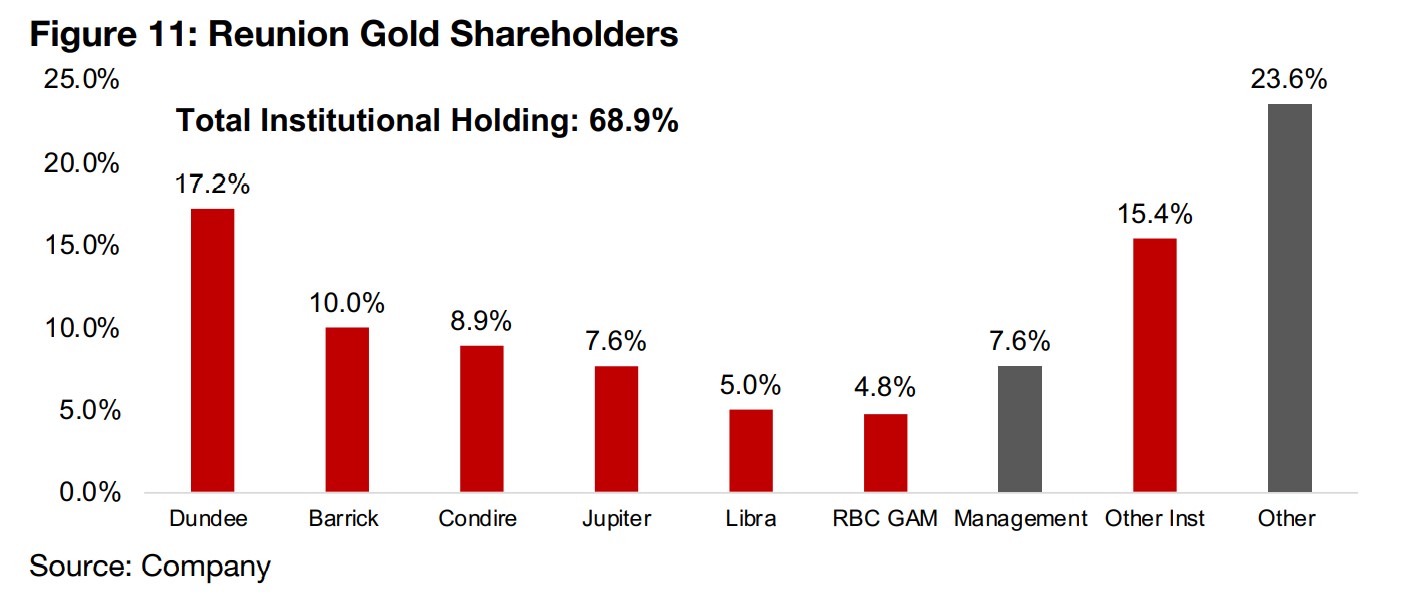

The company closed a CAD$10.5mn placement in May 2021 and a CAD$11.5mn bought deal private placement in February 2021, with its cash as of the most recently released September 2021 results at CAD$8.2mn, with the placement last month likely boosting its cash to nearly CAD$20.0mn. This would fund about two years of exploration at a similar level to the third quarter exploration and management expenses of around CAD$2.5mn. The company also has strong large shareholder support, with institutions holding a total 68.9% of Reunion shares, including the mining companies Dundee Resources, with 17.2%, and Barrick, with 10.0%, with Reunion Gold announcing a strategic alliance with Barrick for operations in the Guiana Shield in 2019, with several asset managers also holding material stakes (Figure 11).

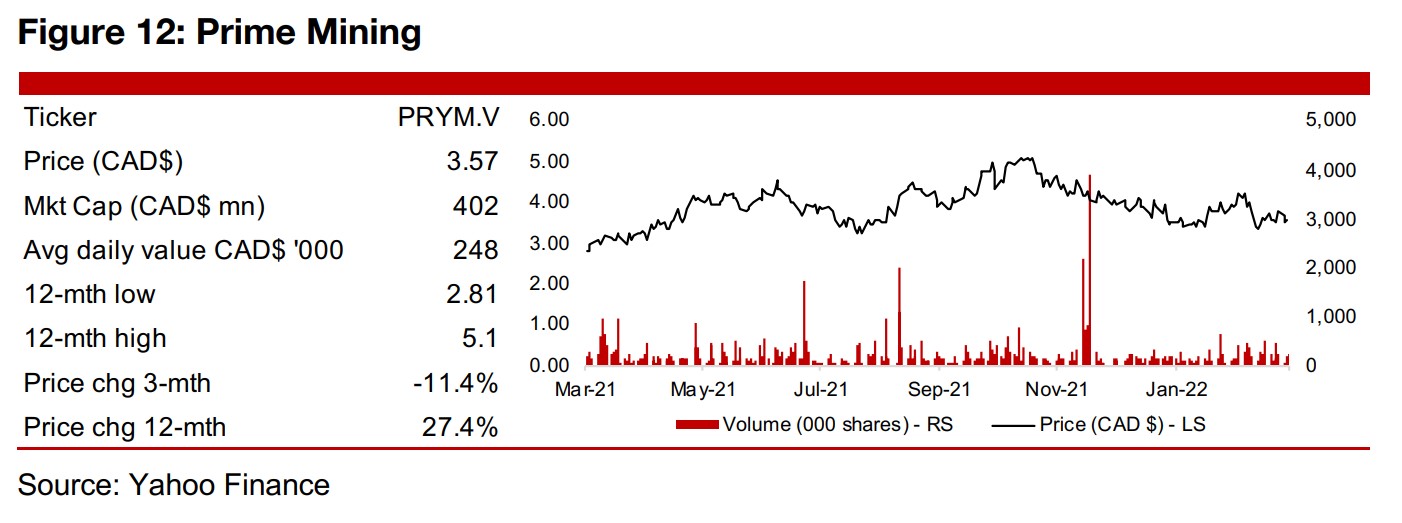

In Focus: Prime Mining (PRYM.V)

Prime Mining formed to explore Los Reyes project in Mexico

Prime Mining was previously ePower Metals, and was formed in 2019 to explore the Los Reyes project, which it acquired from Minera Alamos. The project is close to other major mining operations at 43 km from Cosala in the historic mining region of Sinaloa, giving access to infrastructure including road, power, water and skilled labour. Prime Mining signed a letter of intent for the deal in June 2019 and raised $8.7mn by August 2019 to acquire the rights to Los Reyes, with Minera Alamos taking a 16% stake in Prime in the same month. The company began exploration at Los Reyes by September 2019 and released its first drill results from the project in December 2019, and then reported drill results throughout 2020, and then a Resource Estimate in April 2020 of 833k oz AuEq for the project.

Drilling results from multiple zones of Los Reyes over the past year

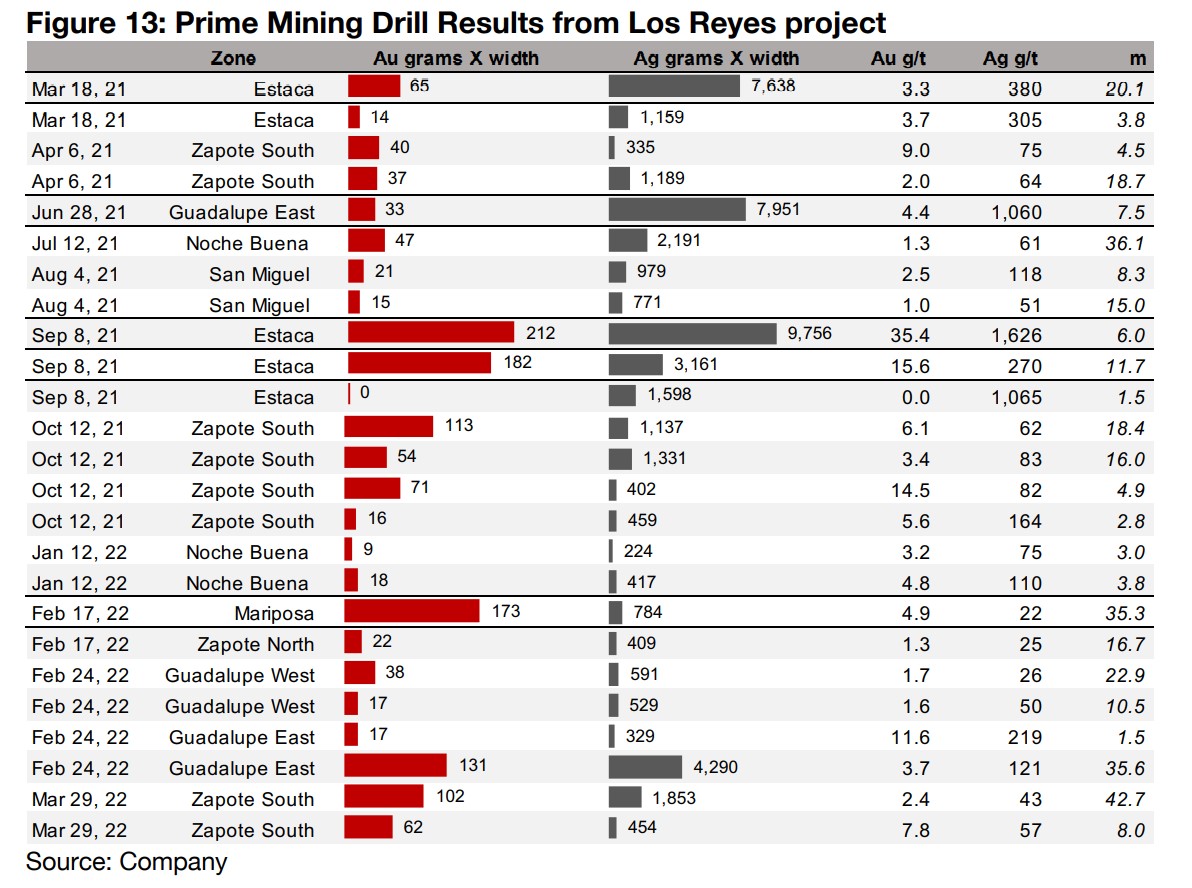

The company continued to expand its drill program, adding a fifth drill in February

2021, and then doubled its land holding at the project to 13,800 hectares in March

2021, and continued to report drilling results through the rest of 2021 with the most

recent drill results reported in March 2022. Prime has completed 25,640 metres of

drilling in its Phase 1 and 20,925 in Phase 2, with new drilling continuing on its Phase

1 discoveries with 50,000 metres planned over 250 drill holes, with eight drill rigs

currently operating. Prime Mining has multiple zones at the Los Reyes project,

including Estaca, Zapote North and South, Guadalupe East and West, Noche Buena,

San Miguel, and Mariposa, and has reported drill results from all of these zones over

the past year (Figure 13). The company reported strong results in March 2021, with a

grams X thickness of 64 for gold, at 3.3 g/t and 7,638 for silver, at 380 g/t, over 20.1

m, and then in June 2021, with a grams X thickness of 33 for gold, at 4.4 g/t Au and

7,951 for silver, at 1,060.1 g/t Ag over 7.5 m, which helped drive up the shares through

H1/21

While the shares eased through July and August 2021, another series of strong results

in September 2021 drove another rise in the share price, with 212 grams X thickness

for gold, at 35.4 g/t Au and 9,756 for silver, at 1,626 g/t Ag, over 6.0 m, and there

were also reasonably strong results in October 2021. There were no drilling results

released for the rest of Q4/21, resulting in a share price decline, but there was a brief

lift to the share price from results in February 2022, with 173 grams X thickness for

gold, at 4.9 g/t Au and 784 for silver, at 22 g/t Ag, over 35.3 m, and then 131 grams

X thickness for gold, at 3.7 g/t Au and 4,290 for silver, at 121 g/t Ag over 35.6 m.

Company funded for over a year of exploration at 2021 rate

The company has cash of CAD$27.4mn as of its most recent December 2021 results, after a bought deal private placement of CAD$25.0mn in April 2021 and a warrant exercise for CAD$31.0m in August 2021. With exploration costs for the last eight months of 2021 at CAD$14.4mn, or CAD$21.8 annualized, the company would be funded for over a year at the current rate of expenditure.

Disclaimer: This report is for informational use only and should not be used an alternative to the financial and legal advice of a qualified professional in business planning and investment. We do not represent that forecasts in this report will lead to a specific outcome or result, and are not liable in the event of any business action taken in whole or in part as a result of the contents of this report.