November 12, 2021

Gold jumps on continued high inflation

Gold surges as US inflation again comes in above expectaions

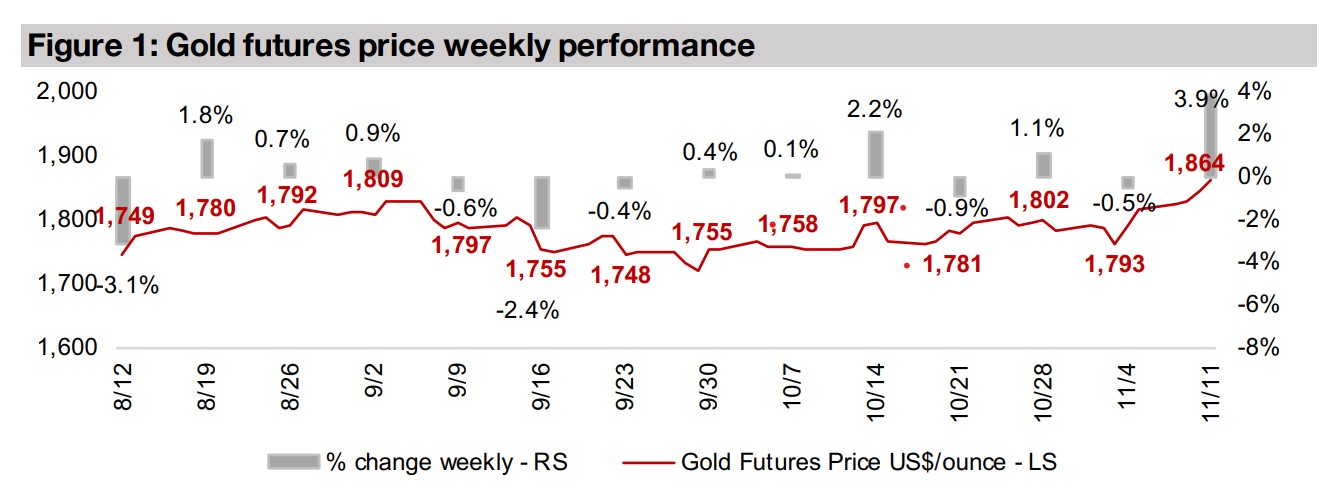

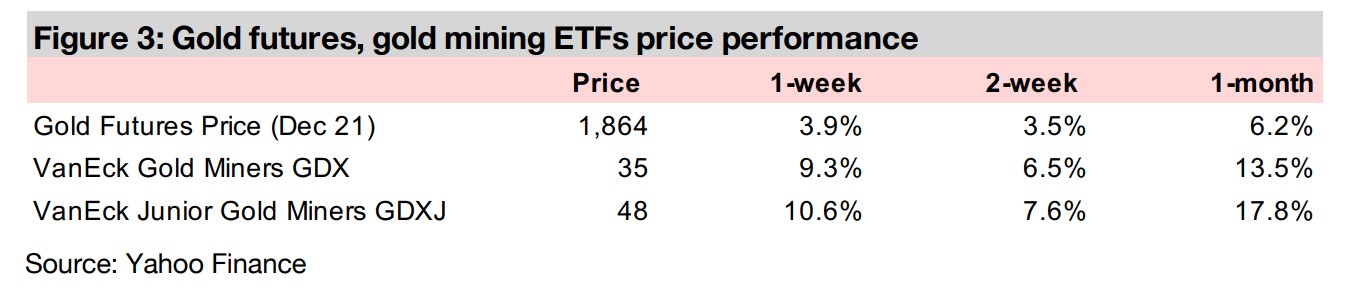

Gold surged 3.9% to US$1,864/oz this week, its strongest weekly gain in just over a year, as US inflation again came in above expectations, with concerns over rising prices offsetting the potential downward pressure from the Fed's upcoming taper.

Producers' Q3/21 results down with year-on-year gold price decline

The Q3/21 results season is now complete and all of the major producers having now reported, with a relatively weak quarter, with production growth edging down yoy, but revenue and net income declining substantially as the gold price declined.

Producers and juniors surge, but New Found Gold drops

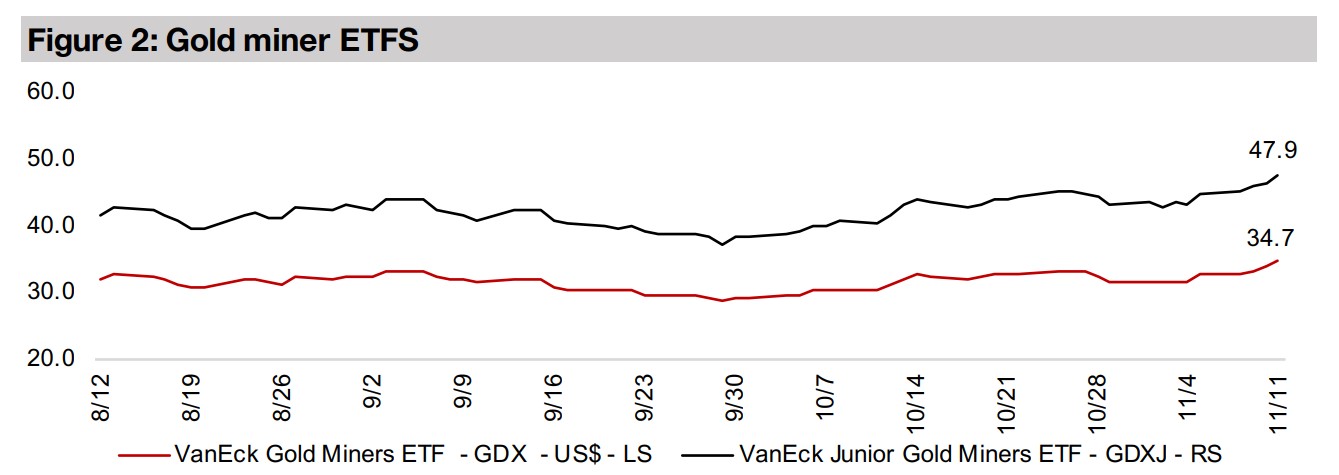

The producing and junior miners surged on the gold price rise, with the GDX up 9.3% and GDXJ up 10.6%, and the Canadian junior miners were nearly all up this week, although New Found Gold dropped significantly on a report of bias in some samples.

Gold jumps on continued high inflation

Gold jumped 3.9% this week to US$1,864/oz, its strongest weekly gain in around a

year, sending gold well above a trading range of between around US$1,750 to just

below US$1,800/oz that had held for several months. The driver for the big rise was

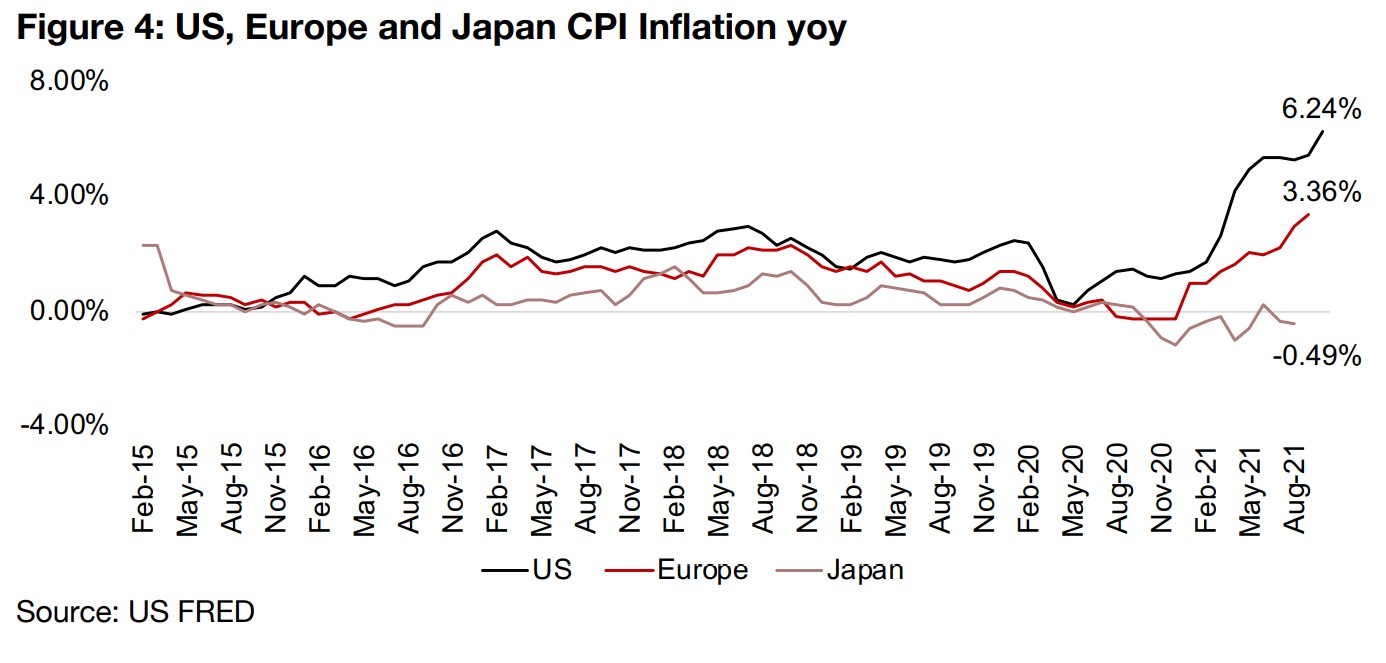

another month of high inflation in the US, with year-on-year growth in consumer

prices up 6.24% for October 2021, above the market's expectations for 5.90%, and

at the highest levels in thirty years (Figure 4). Inflation is not limited to the US, with

consumer prices in Europe also picking up, to 3.36% yoy as of the most recently

reported September 2021 figures. While Japan has actually seen mainly deflation

over the past several months, with its CPI contracting -0.49% yoy as of the most

recently reported August 2021 figures, this is in keeping with the norm of the last

several decades, where prices in the country have been near flat or contracting.

In our previous weeklies, we have gone on at length about how we expect that

inflation will continue to surprise to the upside well into 2022, and that this will tend

to offset downward pressure from the Fed's taper of its stimulus, which is targeted

to begin this month. Some in the market are pointing to continued distortions in

supply chains as the main culprit for inflation, and that consumer price rises will slow

once these are worked out through 2022. While we also believe that supply chains

will get back to normal next year, in contrast, we view inflation as more of a monetary

than a real phenomenon currently. We expect that the huge monetary stimulus over

the past year still has yet to work its way through the system, and will likely to continue

to drive prices. We believe that the Fed's taper, which it has already indicated will be

moderate, will not be enough to stem the huge liquidity that is driving up prices, and

that with rate hikes expected only as late as 2023, inflation will have plenty of room

to run, and gold could continue to benefit.

Q3/21 quite a weak quarter for gold producers

The Q3/21 results season is now nearly complete, with all of the major producers

having now reported and only a few mid-tier producers having still yet to release their

results. Overall, the quarter was quite weak, in the context of the gold boom that ran

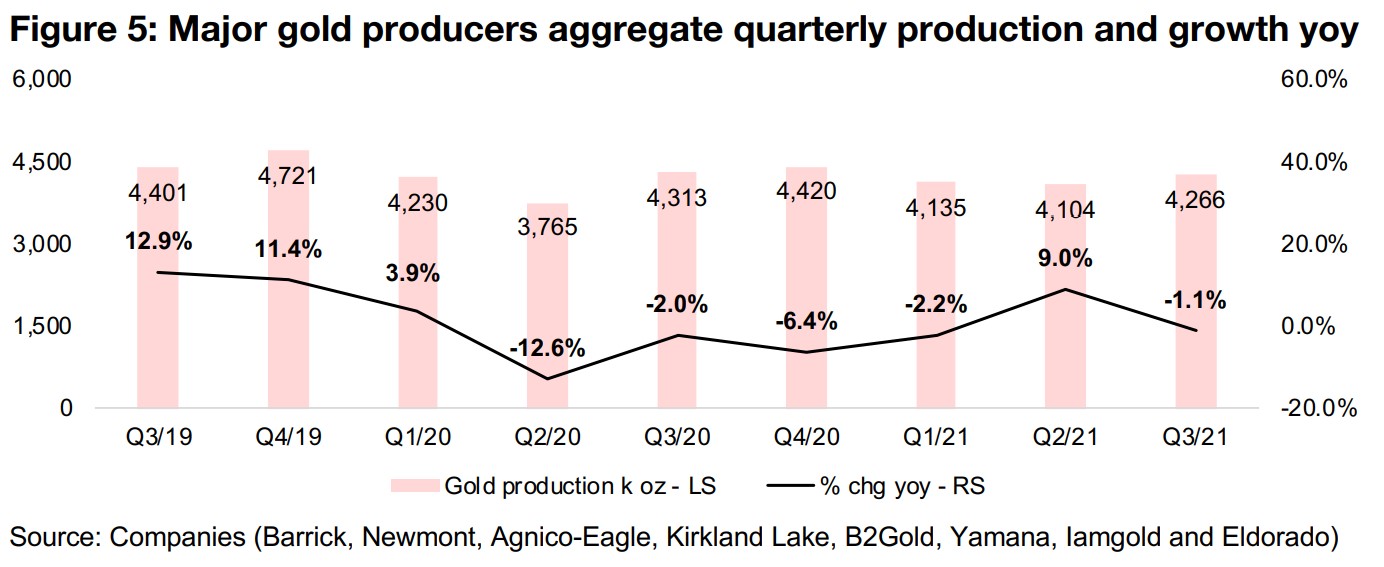

from around Q3/19 to Q2/21. The aggregate production of the major producers

(Barrick, Newmont, Agnico-Eagle, Kirkland Lake, B2Gold, Yamana, Iamgold and

Eldorado) dipped -1.1% year-on-year (Figure 5). This was down off a strong 9.0%

rise in Q2/21 which was inflated by a low base, with Q2/20 seeing the peak of global-health-crisis fears, with major production shutdowns.

Production of the top eight producers has been relatively steady in recent quarters,

averaging 4,291k oz/quarter since Q4/18, apart from Q2/21, at just 3,674k oz Au.

Q4/18 was the last quarter where there was a clear rise in the level of gold production

by the majors, with the average over 9M/18 at 3,715k oz Au. Barrick, Newmont,

Kirkland, and Yamana all saw sustainable boosts to production starting in the last

quarter of the 2018. This lack of another major rise in production since explains the

negative yoy growth that has persisted since Q2/20, excluding the Q2/21 outlier.

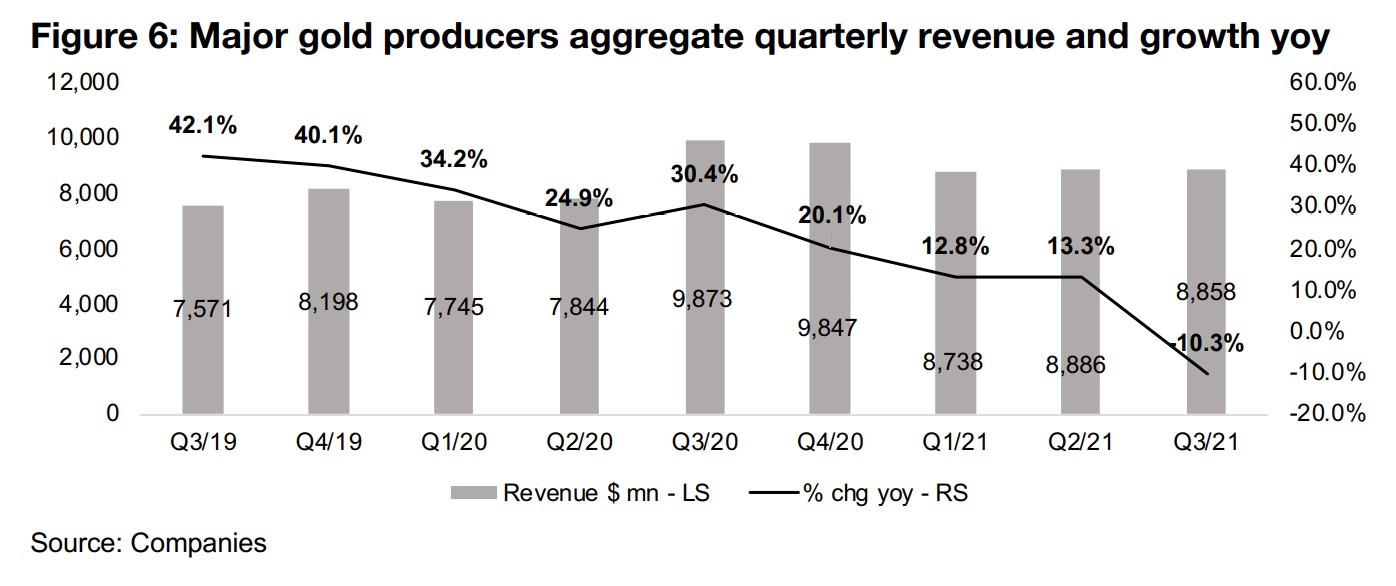

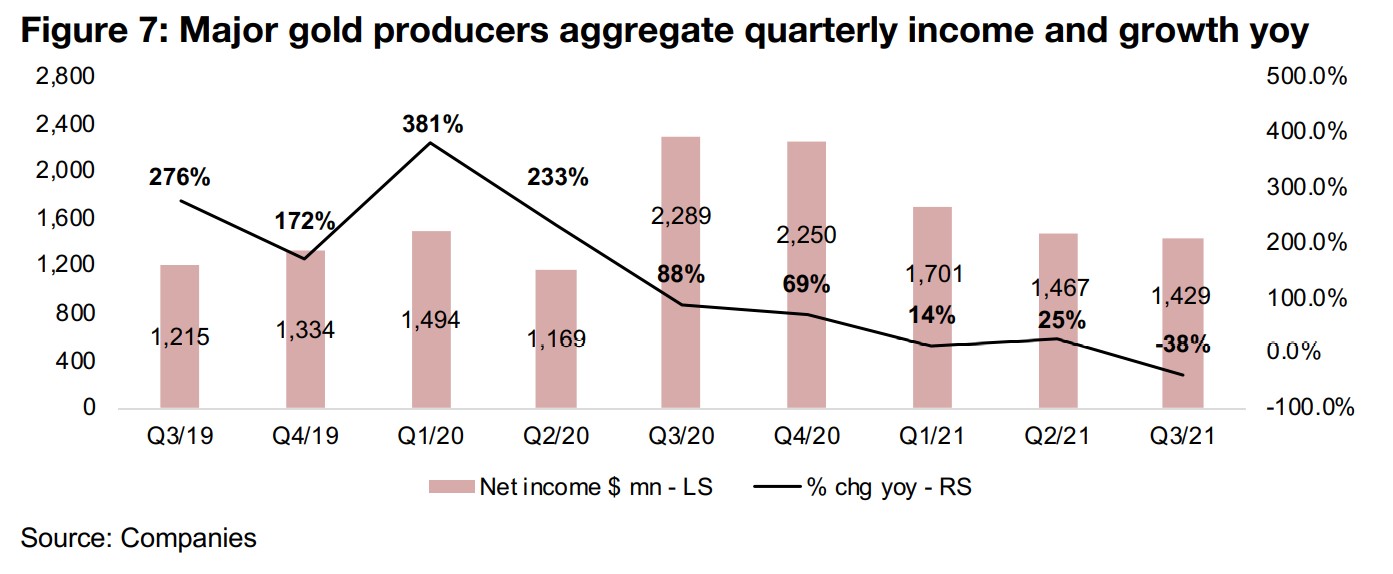

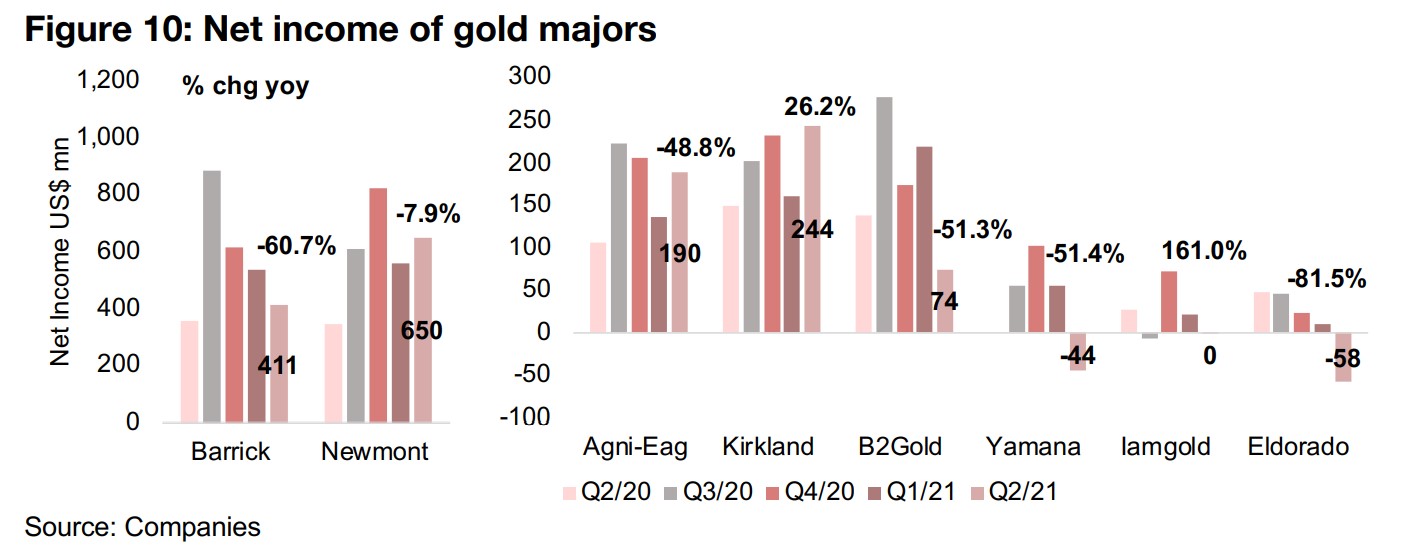

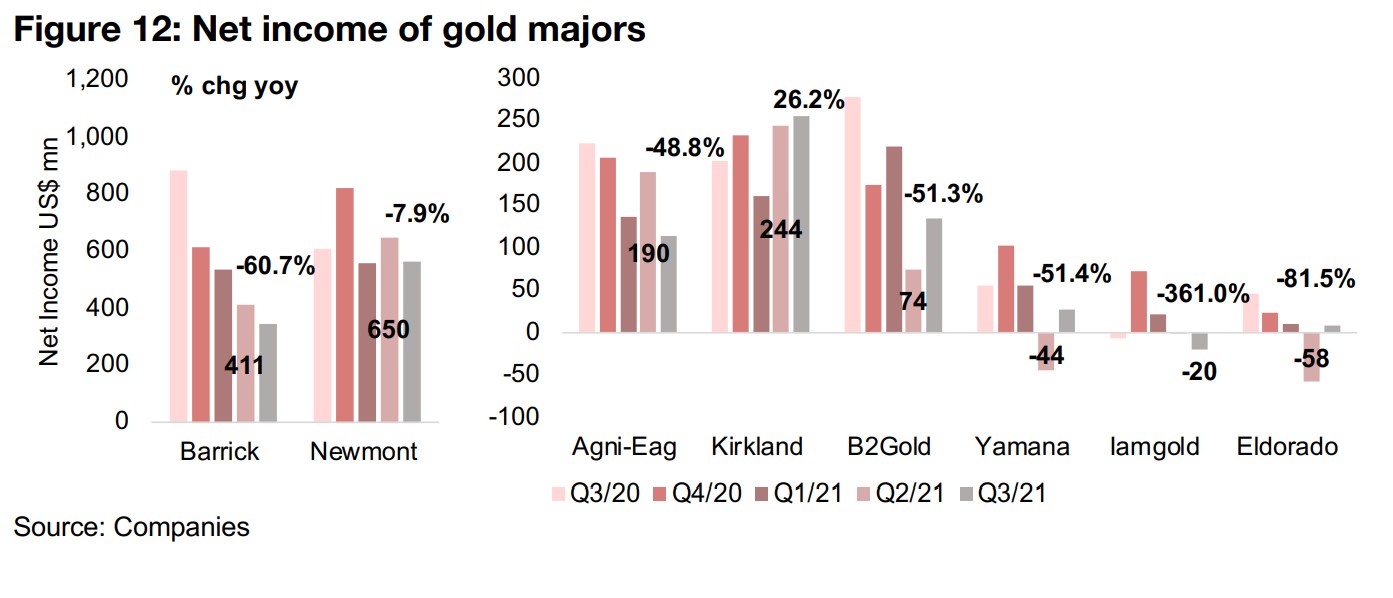

Revenue and net income growth declined to their lowest levels in recent years in Q3/21, mainly on the major yoy decline in gold price, with the industry consistently buoyed by a yoy rise in gold from Q3/19 to Q2/21, but this driver absent in Q3/21, sending revenue down -10.3% yoy (Figure 6). Net income declined even further, falling -38% as the industry's leverage to the gold price went into reverse. (Figure 7).

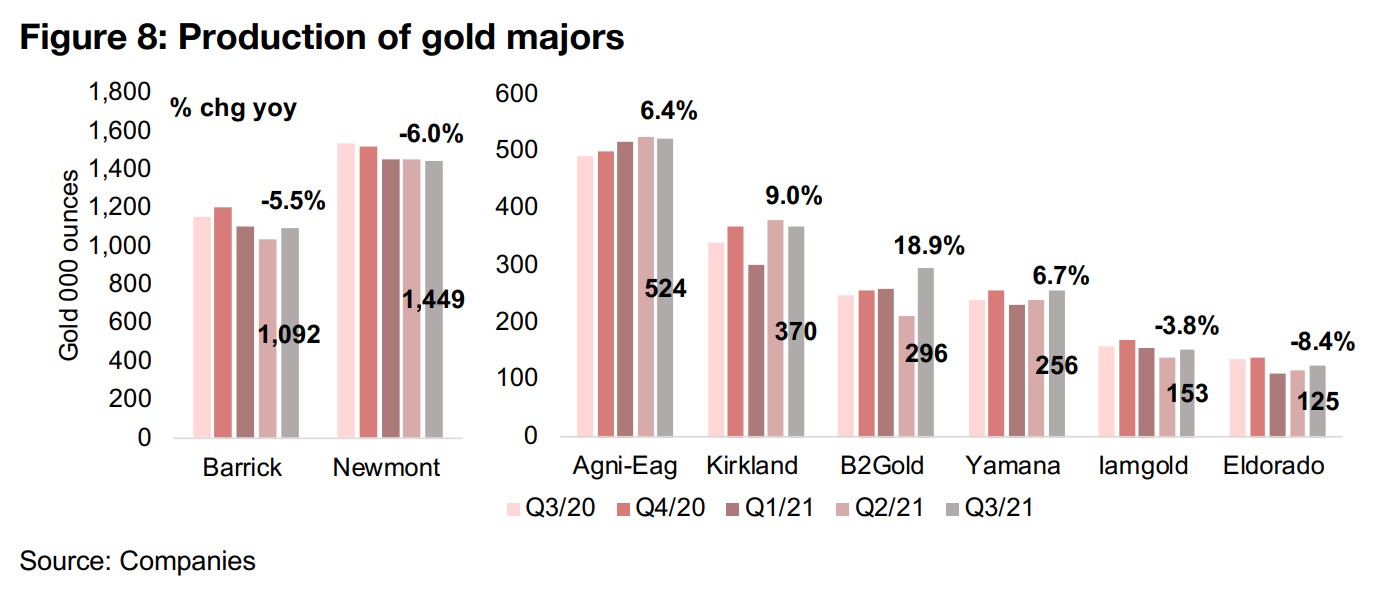

Mid-tier production growth offsets Barrick, Newmont declines

Both of the industry giants, Barrick and Newmont, saw significant declines in production, down -5.5% and -6.0%, respectively, as these majors continue to face the challenge of sourcing projects large and potentially profitable enough to bring into their fold and maintain production long-term (Figure 8). These declines for the majors, however, were offset somewhat by the mid-tier producers, with solid production growth for Agnico-Eagle, Kirkland Lake, B2Gold and Yamana, up 6.4%, 9.0%, 18.9% and 6.7%, respectively. Production declined for both Iamgold, down -3.8%, and Eldorado, down -8.4%.

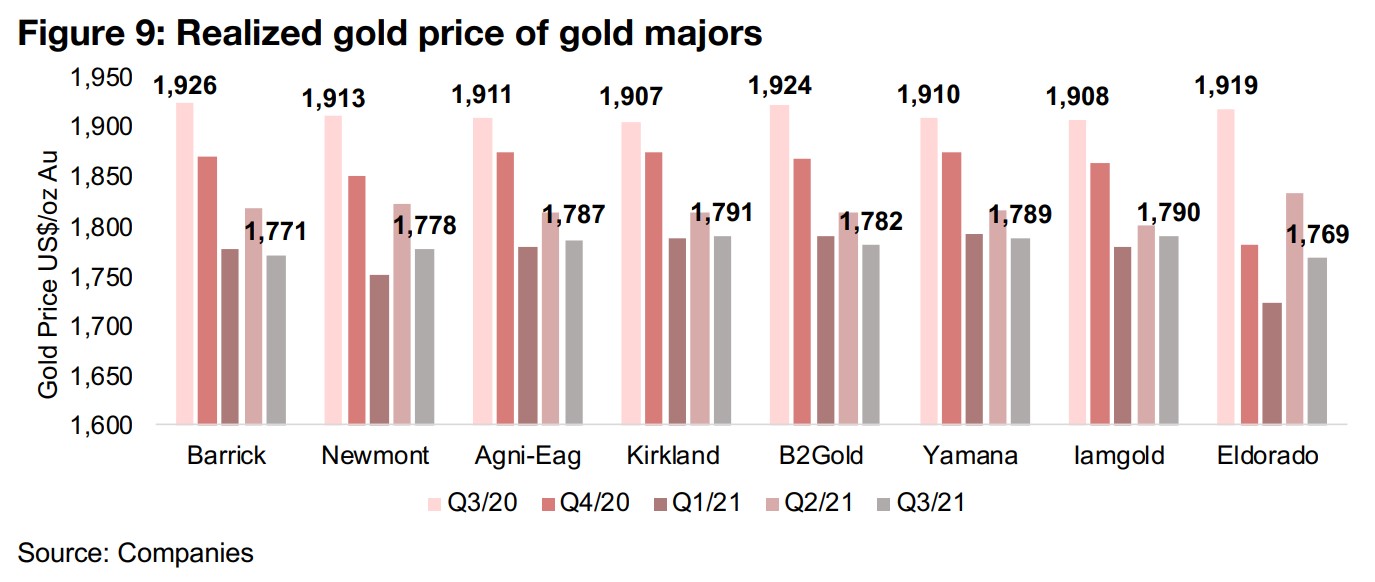

Decline in gold price year on year the big driver in Q3/21

The big issue for the sector this quarter is most evident in Figure 9, showing the realized gold price for the top eight producers, with an average realized gold price of Q3/21 of US$1,780/oz, down -7.1% from an average US$1,916/oz in Q3/20. While the gold price picked up this week, its average so far in Q4/21 is US$1,787/oz, down slightly from US$1,789/oz in Q3/21. This suggests that results quarter on quarter may not be driven up by the gold price for Q4/21, unless we see a further increase in the last six weeks of the year. Also, with an average gold price of US$1,875/oz over Q4/20, the average gold price for Q4/21 may be down yoy, which could hit producers' results again next quarter.

Net income fell for the two market leaders, with Barrick down -60.7% and Newmont declining -7.9% (Figure 10). Most of the mid-tier producers saw declines, with Agnico Eagle's net income down -48.8%, B2Gold down -51.3%, Yamana down -51.4%, and Eldorado down -81.5%, with the big driver being the decline in the gold price. Kirkland Lake was up 26.2% on a yoy decline in extraordinary items, while Iamgold's -361% decline was to a loss of US$-20.1mn in Q3/21 from US$-7.7mn in Q3/20.

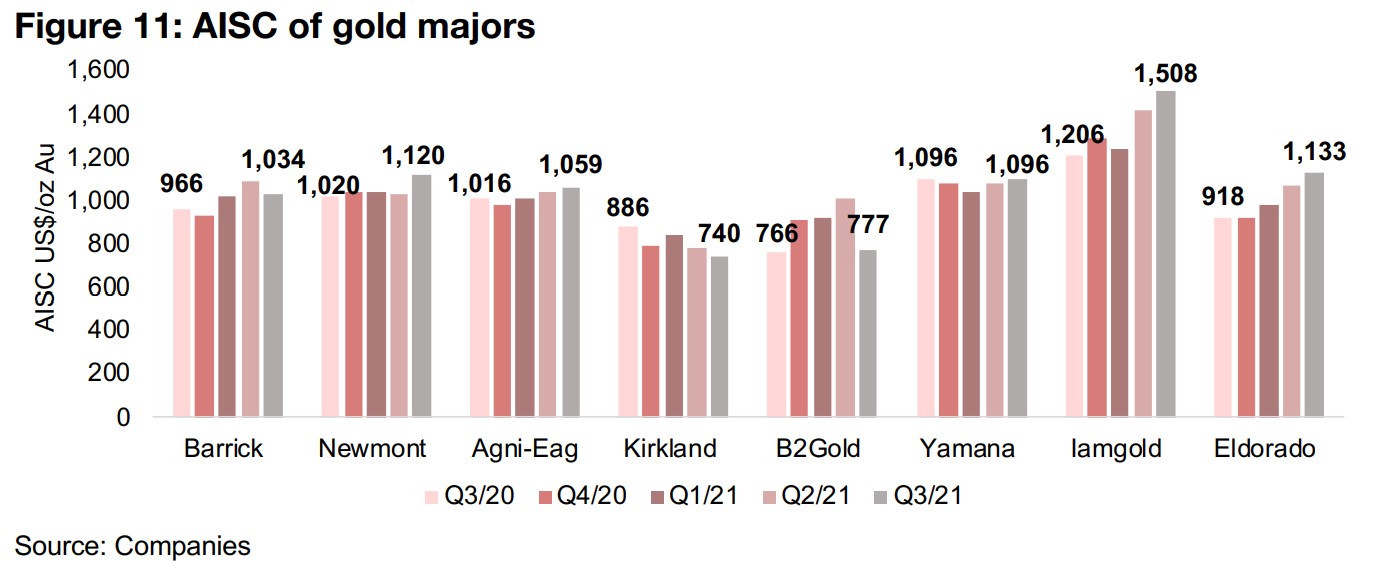

Costs in focus as inflation rises

While cost inflation for the miners had not been at the forefront of the issues for the past several years, it has become an increasing concern especially over the past two quarters. We are starting to see a rise in all-in-sustaining-costs (AISC) for most of the major producers, with only Kirkland seeing a decline in AISC yoy, while Yamana’s AISC has been flat yoy (Figure 11). With inflation remaining high, and especially fuel costs elevated, we may see further increases in AISC at least into Q4/21, and likely well into 2022. This is because severe global supply chain distortions are persisting, and even in a best case where these prove to be the main cause of inflation, supply chains are unlikely to return to normal until the middle of next year. We suspect, however, that it is as much, or more, monetary expansion driving the inflation as it is supply chain interruptions, and this could mean that inflation persists even for years.

Rough year for gold producers' share prices

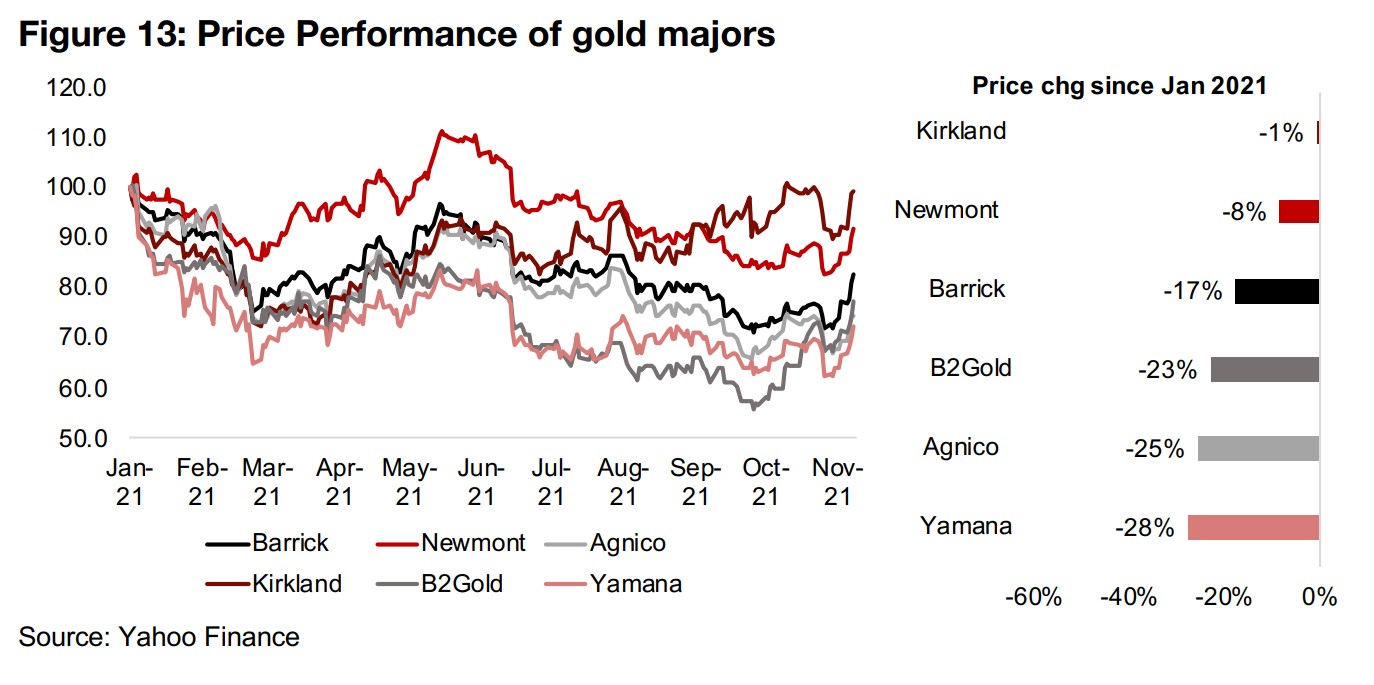

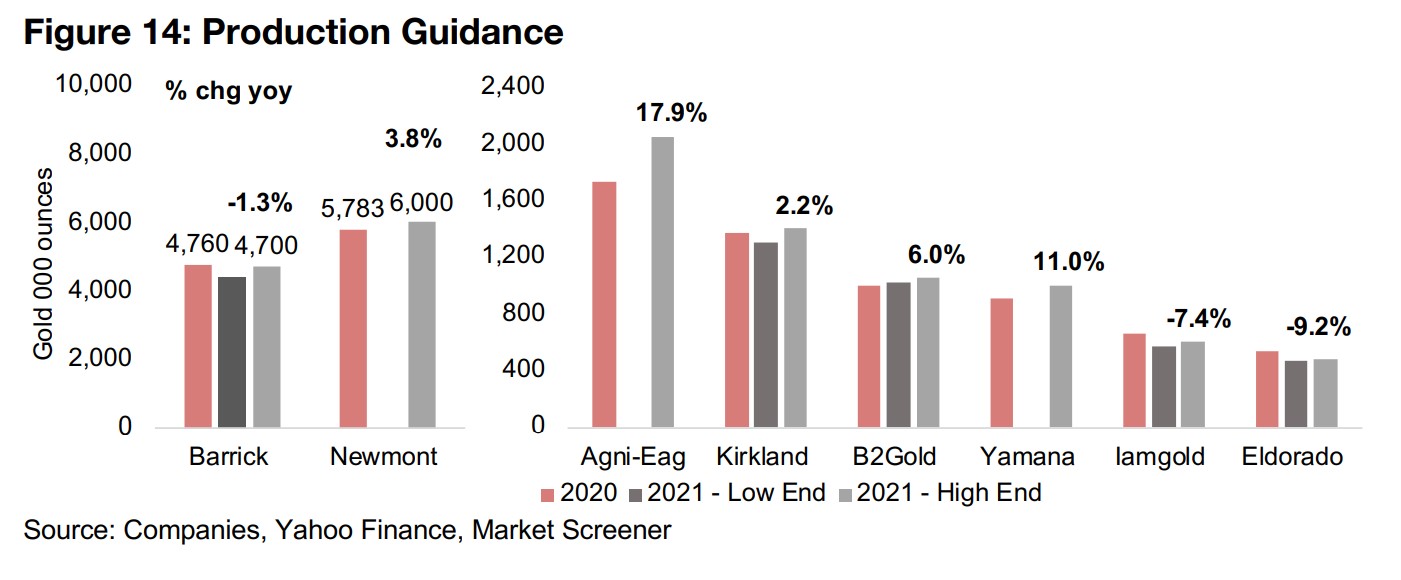

While in absolute terms, the gold producers have actually had quite a good year, with revenue and profits highs, especially in contrast to the gold bear market of 2013-2018, this year has been quite weak compared to the blowout income growth and share price gains from late 2019 through to mid-2020. The share prices of all the majors are down considerably this year, with Kirkland Lake the only stock near flat, mainly on gains from its combination with Agnico-Eagle. While industry giant Newmont has held up relatively well, even it is down -8% for the year, with the rest of the group declining between -17% to -28% (Figure 13). Figure 14 shows the companies' production outlooks for 2021, with Newmont reducing its guidance -7.7% compared to Q2/21, B2Gold and Eldorado increasing their guidance by 2.4% and 4.3%, respectively, and the others maintaining their guidance. The market's 2021 EBITDA estimates for the majors have all been reduced since Q2/21, likely on lower gold price expectations.

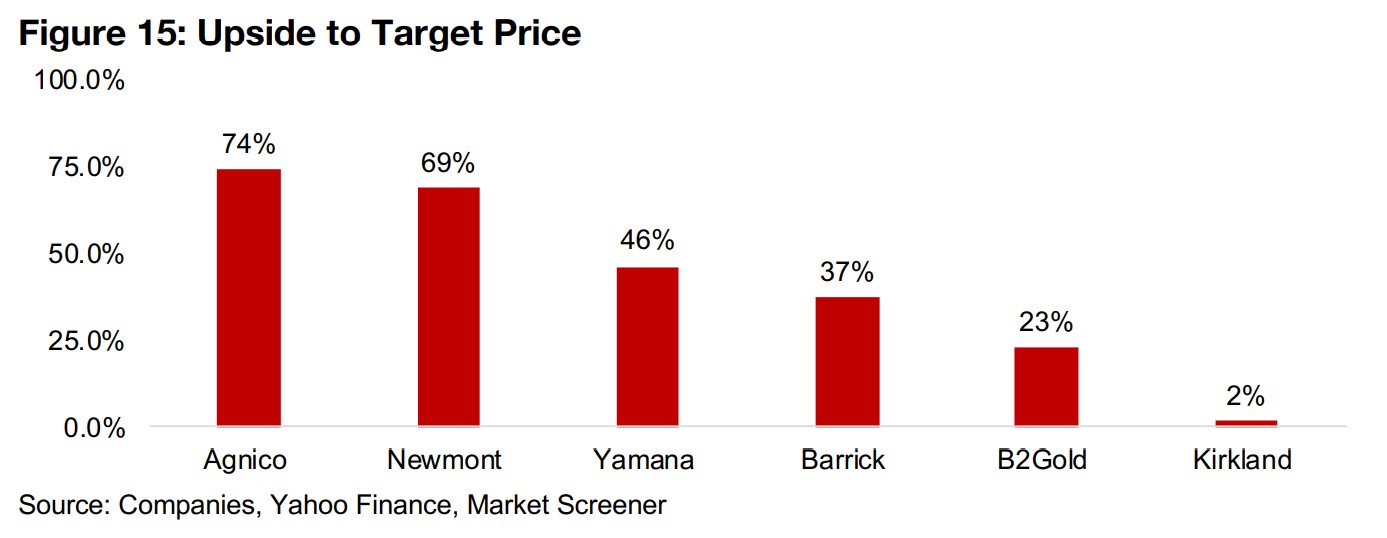

Market still bullish on gold producers

The market remains upbeat on the sector overall, with considerable upside to the target prices of all the majors. With strong visibility on the production and cost outlook, the main variable driving the upside would likely be a pickup in the gold price. We believe that a rise in the gold price towards US$2,000/oz is certainly feasible in 2022, as inflation could continue to surprise to the upside as much as growth could surprise to the downside, with such a stagflation scenario likely to be supportive of gold. Of the producers, the market is most bullish on Agnico and Newmont, with 74% and 69% upside to their target prices, respectively, with more moderate upside for Yamana, at 46%, Barrick, at 37%, B2Gold, at 23%, and Kirkland, at just 2% (Figure 15).

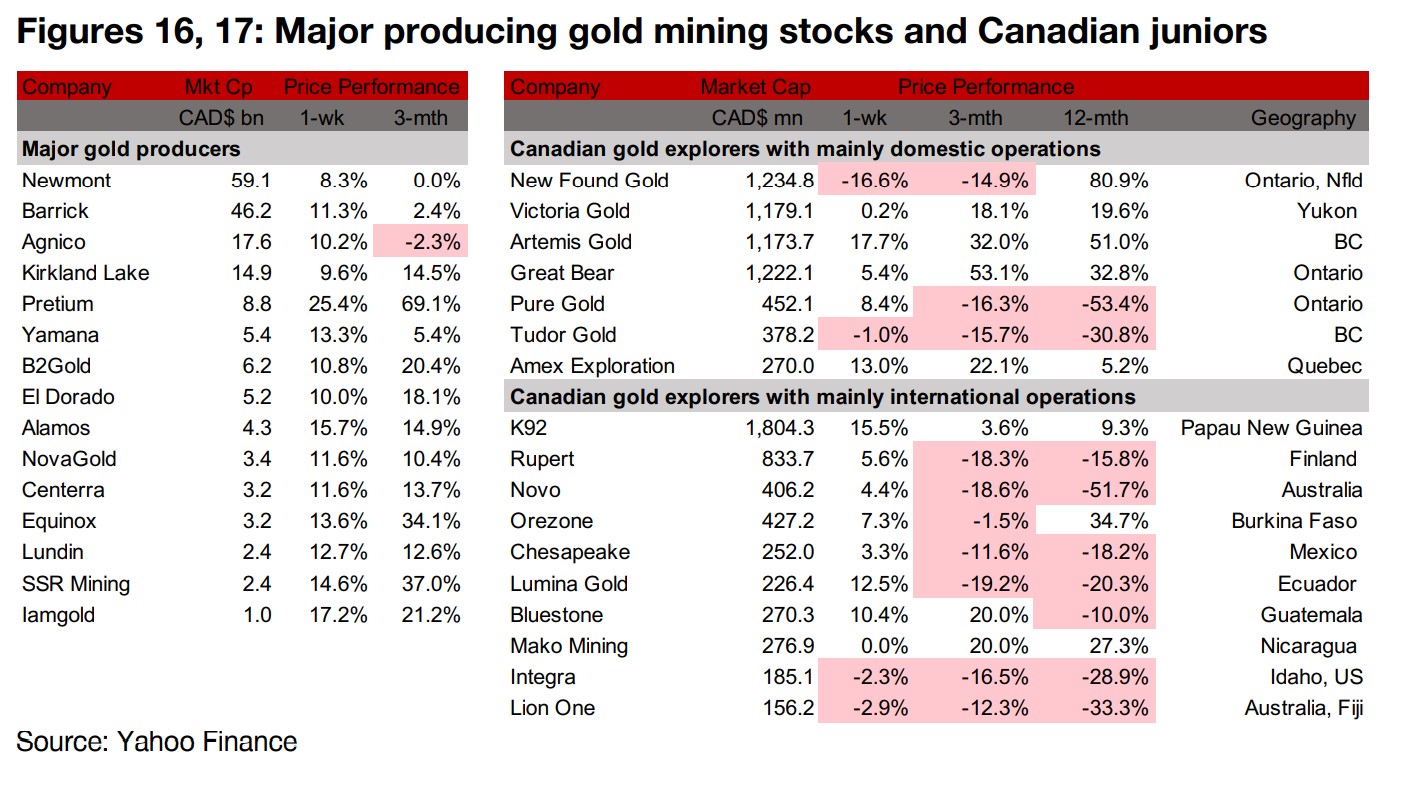

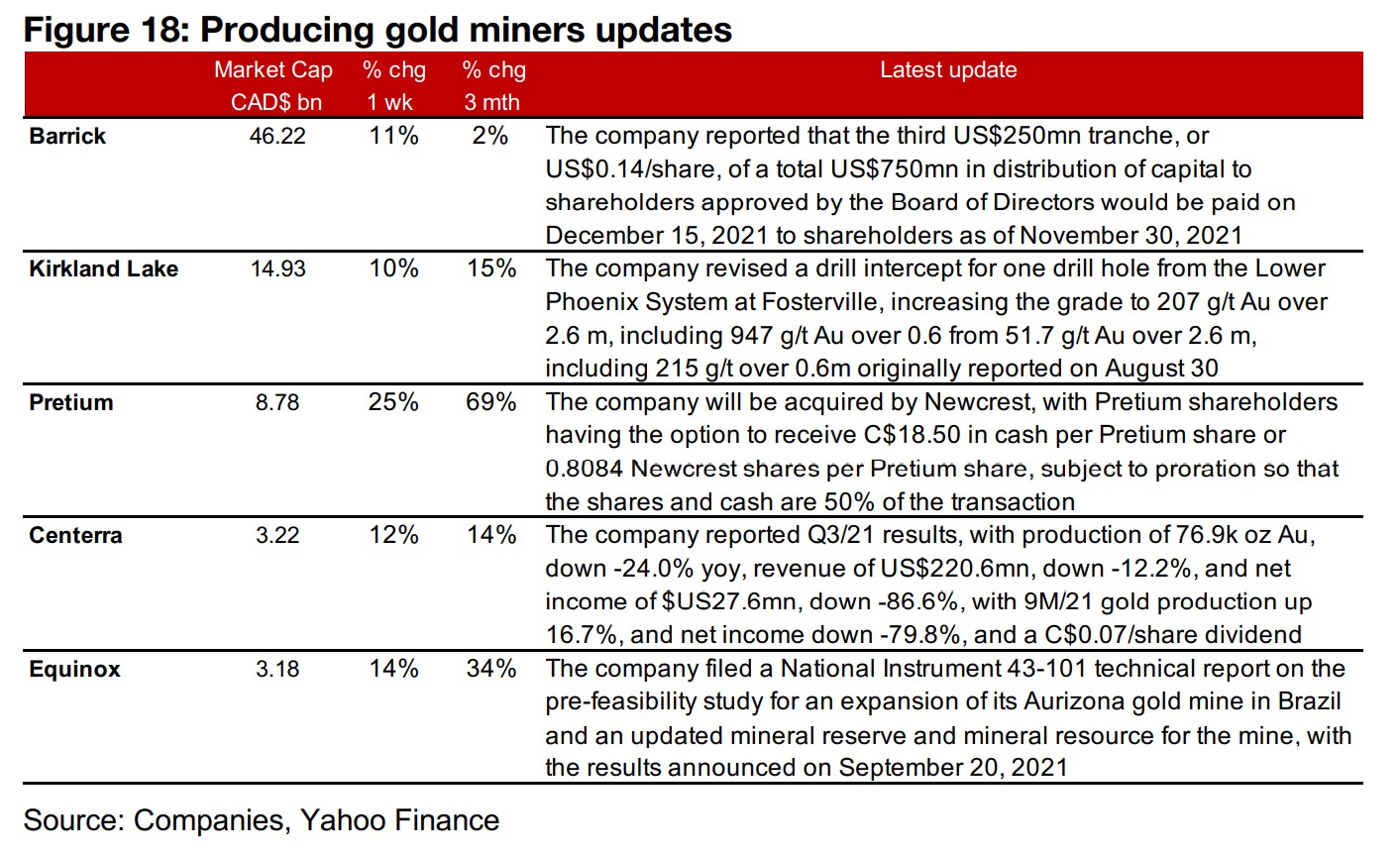

Producers all up on surging gold price

The producing gold miners all saw major gains this week on the jump in gold (Figure 16). The biggest news this week from the producers was Pretium's announcement that it would be acquired by Newcrest, and combined with the strong rise in gold, the stock rose 25%. Barrick reported that it would distribute the third US$250mn tranche of a total US$750mn distribution of capital to shareholders and Kirkland Lake reported a revised intercept from one drill hole at the Lower Phoenix System at Fosterville. Centerra released Q3/21 results, and Equinox filed a National Instrument 43-101 technical report on the pre-feasibility study for an expansion of its Aurizona gold in Brazil and an updated mineral reserve and resource for the mine (Figure 18).

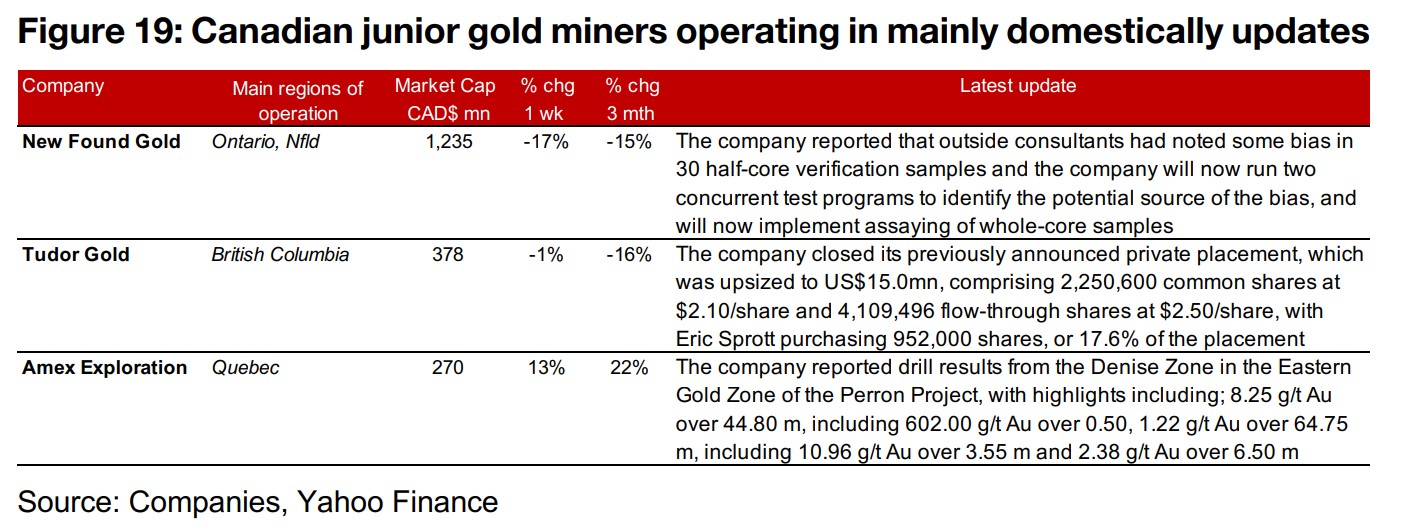

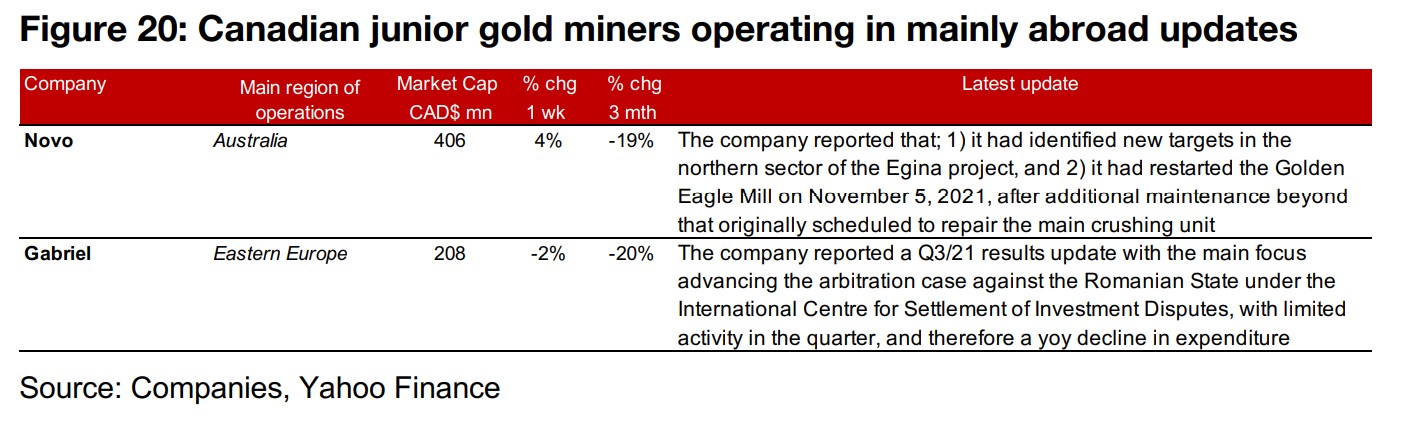

Canadian juniors nearly all up, with New Found Gold an exception

The Canadian juniors were nearly all up, although New Found Gold slumped -16.6% (Figure 17). This followed an announcement on November 4, 2021, that independent consultants had identified bias in 30 half-core samples, and that the company would run two concurrent programs to undercover the source and will now implement whole-core assaying. For the other Canadian juniors operating mainly domestically, Tudor Gold closed a previously announced private placement and Amex Exploration reported drill results from the Denise Zone in the Eastern Gold Zone of the Perron project (Figure 19). For the Canadian juniors operating mainly internationally, Novo Resources reported that it had identified new targets at the Egina project, and restarted the Golden Eagle Mill, and Gabriel Resources reported a Q3/21 operating update, with its arbitration against Romania continuing (Figure 20).

Disclaimer: This report is for informational use only and should not be used an alternative to the financial and legal advice of a qualified professional in business planning and investment. We do not represent that forecasts in this report will lead to a specific outcome or result, and are not liable in the event of any business action taken in whole or in part as a result of the contents of this report.