May 14, 2021

Gold holds up in market dip

Author - Ben McGregor

Gold price holds up well as market dips

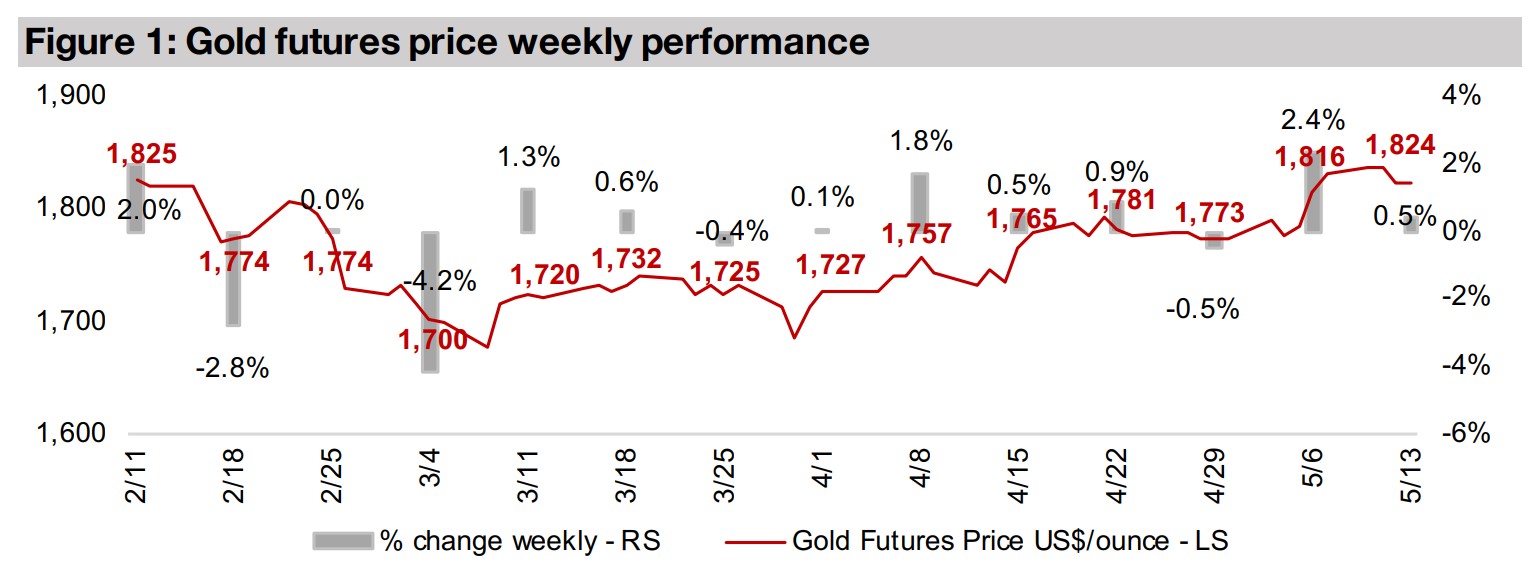

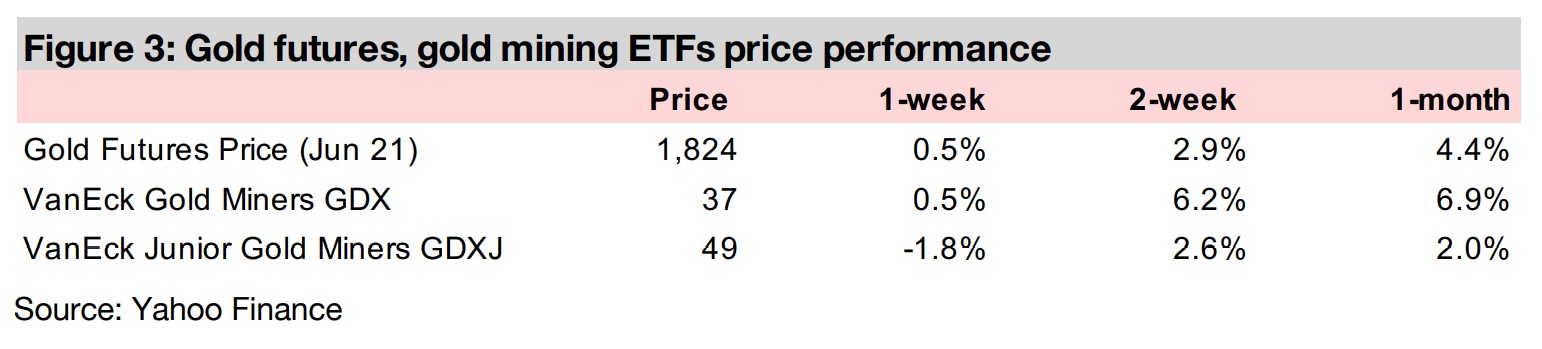

The gold price rose 0.5% this week to US$1,824/oz, reaching another three-month high, even as stock markets dipped considerably as US inflation spiked, suggesting that gold would hold up under the pressure of a sell-off in riskier assets.

Base metals have been soaring, but gold looks safer in our view

The dip in markets also led to a decline in base metals this week, which have been soaring since the start of 2021 on the economic recovery, and we still view gold as safer bet even though it has been underperforming other metals so far this year.

1) A test of our gold thesis versus the market's

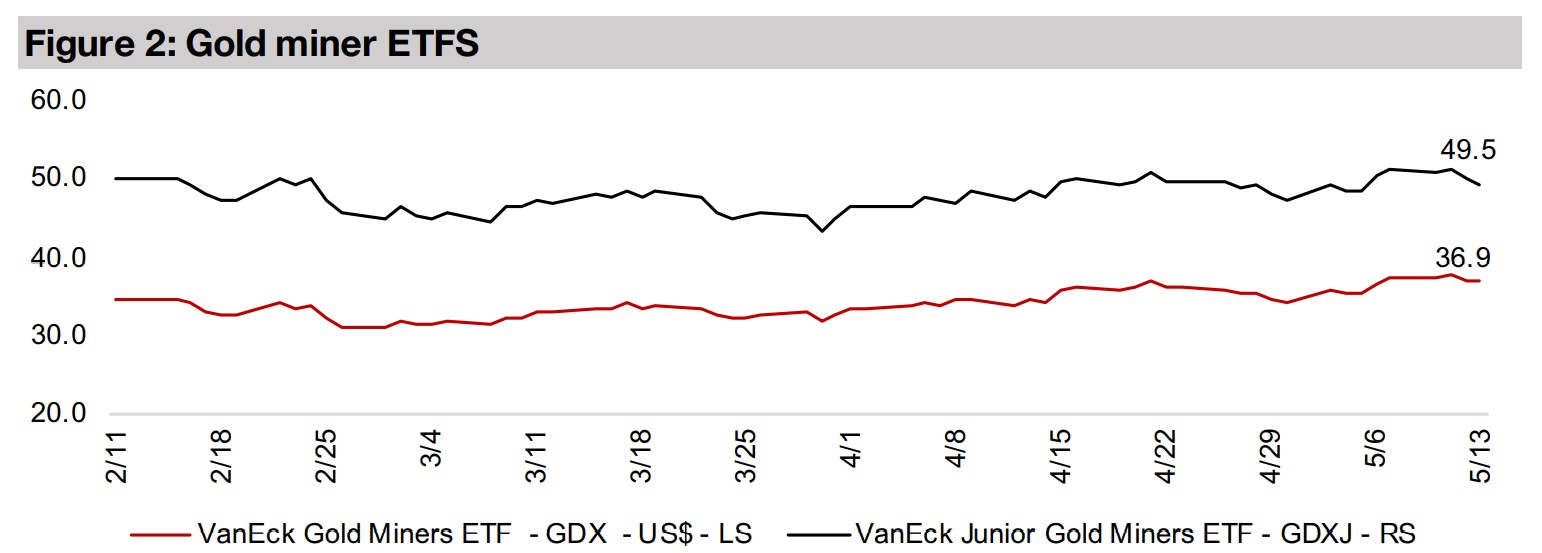

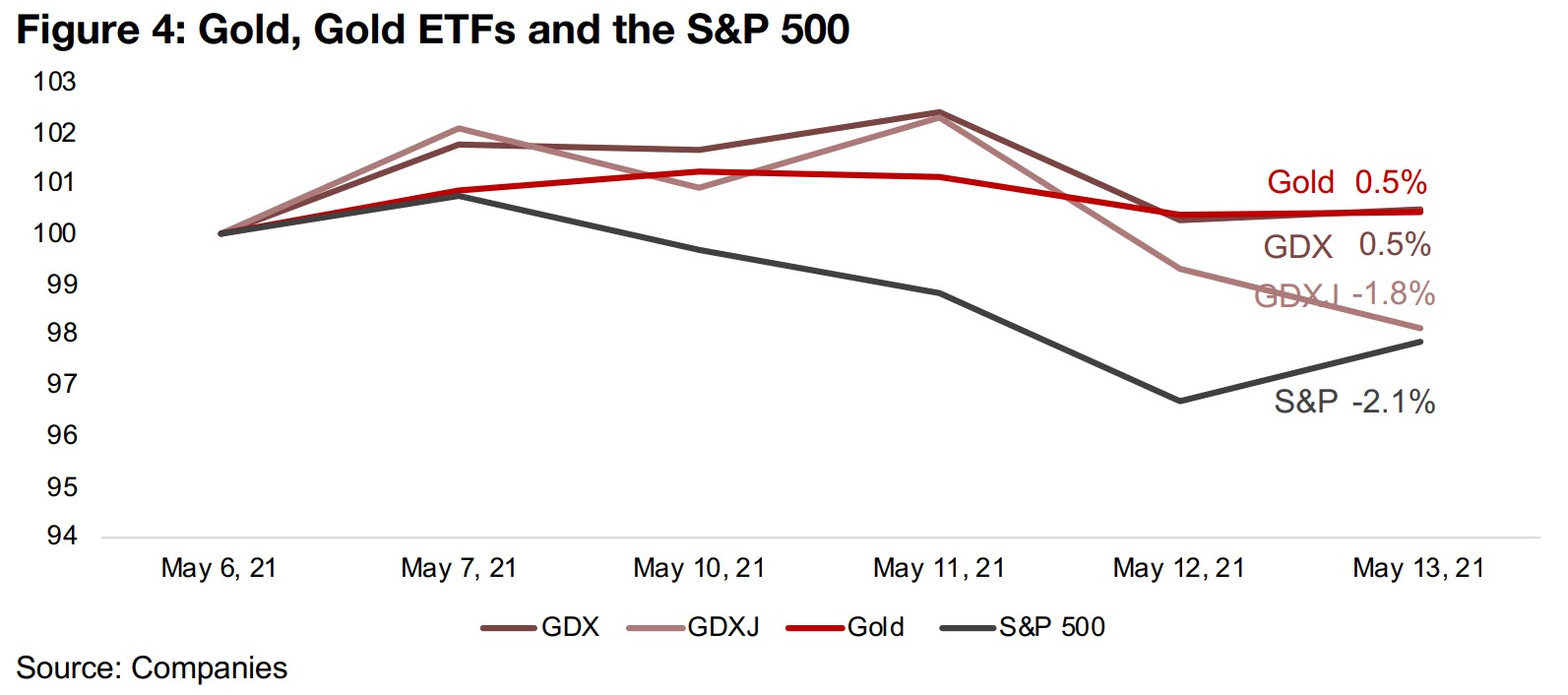

Gold was up 0.5% this week to US$1,824/oz, as it saw one of its biggest tests in a few months, as there was a considerable decline in the equity markets, with the S&P down -2.1% from May 6, 2021, while gold held near flat, dropping just 0.5%, as investors apparently were viewing it as a hedge against the inflation fears that drove the dip in the market (Figure 4). The producing gold stocks also showed resilience, gaining 0.5%, although the juniors declined, with the GDXJ down -1.8%, as could be expected given their higher risk, at a time when the market is selling down riskier assets. However, the dip in the juniors was less that the fall in the S&P 500, showing that even these riskier gold names were offered some support versus the equity markets by the underlying strength of the gold price. In our view, this week offered a test of our thesis for gold versus the market's thesis that had held at least from January 2021 to April 2021 (and probably before that, since around Q4/20), and it seems that our thesis has won out, for this week at least.

The market's thesis on gold, versus our thesis on gold

So what seems to have been the market's thesis on gold from January-April 2021? It

has been that the economy is picking up because of solid underlying fundamental

growth, and this is driving expectations for 'healthy' levels of inflation and these

inflation expectations are in turn driving up yields. The market will therefore be buying

bonds to take advantage of these 'healthy' yields, and selling off 'yield-less' gold.

Conversely, when yields decline, this is implying lower inflation expectations, lower

yields, and a time to buy gold. Our thesis is quite different: We believe the economic

rebound has been artificially propelled by an absolutely epic, hyperflationary-esque

monetary expansion since the March 2020 crisis. This has led to the issuance of so

many bonds that there is not enough demand to absorb them at high prices, and

therefore bond prices have plummeted, and yields have spiked.

Hardly a 'healthy' economic situation, and with high bond issuance likely to continue,

we may continue to see pressure on yields, making it hardly a time to chase yields in

the bond market. Meanwhile, the massive money printing is starting to flow through

to prices everywhere, except for, apparently, gold and silver. We do not expect this

to last long, however, and expect that the inflation will move through to gold and silver

soon, which have historically been a strong inflation hedge, being direct monetary

substitutes, with gold very clearly making up a core component of the monetary base

for almost every major global central bank.

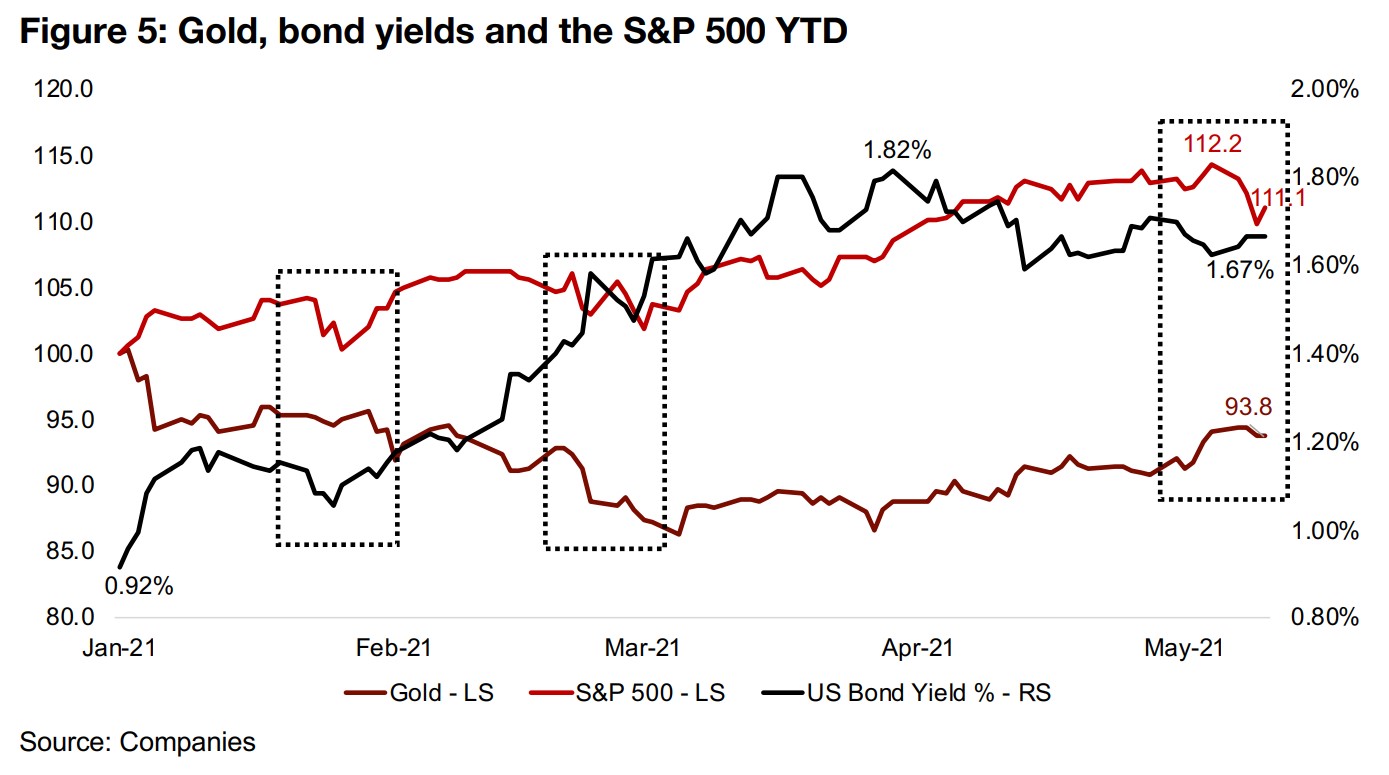

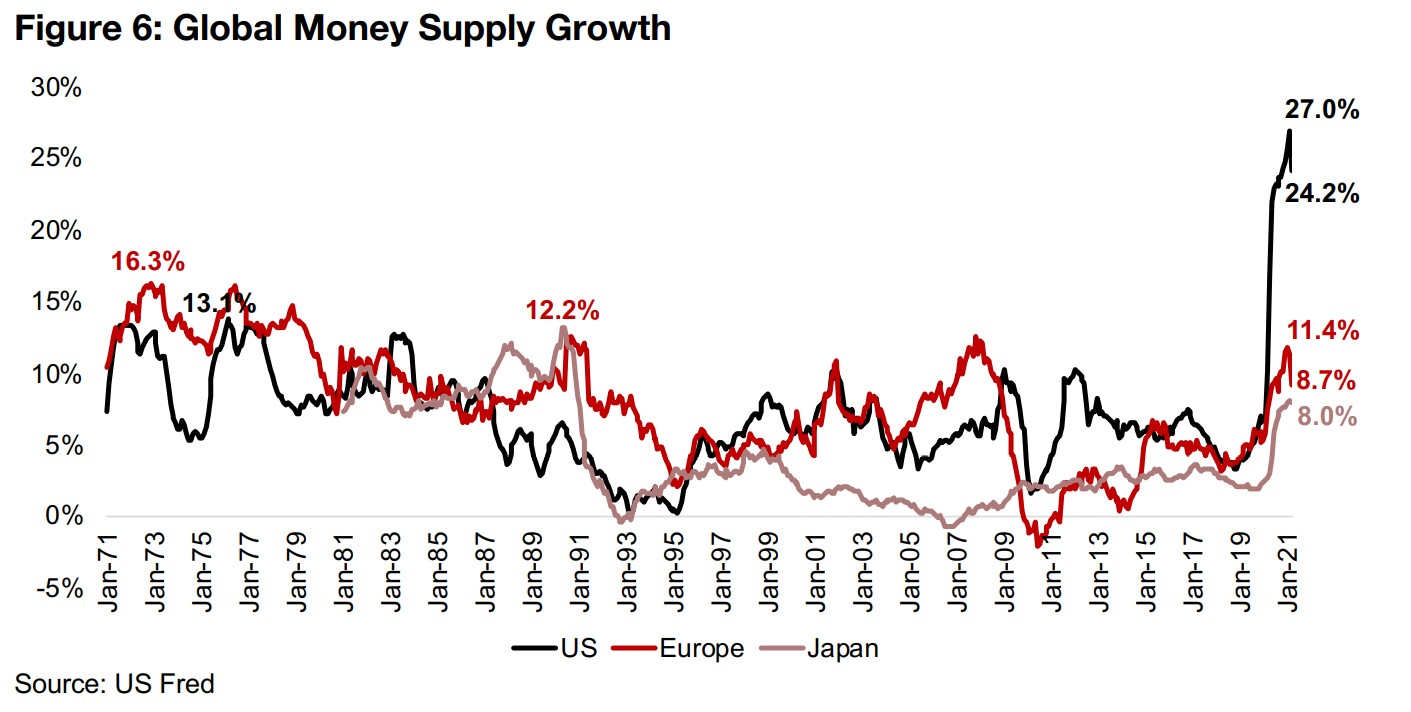

Given these two theses, we can look at the evidence in Figures 4 and 5; we have already discussed Figure 4, the most significant test of these ideas so far this year, with a spike in inflation announced in the US spooking markets, and the stock market declining, but the gold price and producing stocks holding up well. So much for 'healthy' inflation being a sign of a strong economy. Pulling back a bit further to the start of the 2021 in Figure 5, we see about three dips in the stock market, the one this week, one in February and one in March. In February, the S&P 500 and yields dipped, but gold held up, and in March yields rose, the S&P 500 dipped and gold declined, which shows a lack of consistency in the gold price and yield relationship. What we do believe will have consistency over time is this; rising inflation will drive up the gold price. If this is indeed the case, the outlook for gold is extremely rosy. We could consider inflation under the older definition, which is an increase in the money supply, shown in Figure 6. Under this definition, inflation is spiking globally, but especially in the US, where the M3 Money Supply has soared well above historical levels, and was up a hyperinflationary-esque 24.2% as of the most recent March 2021 data.

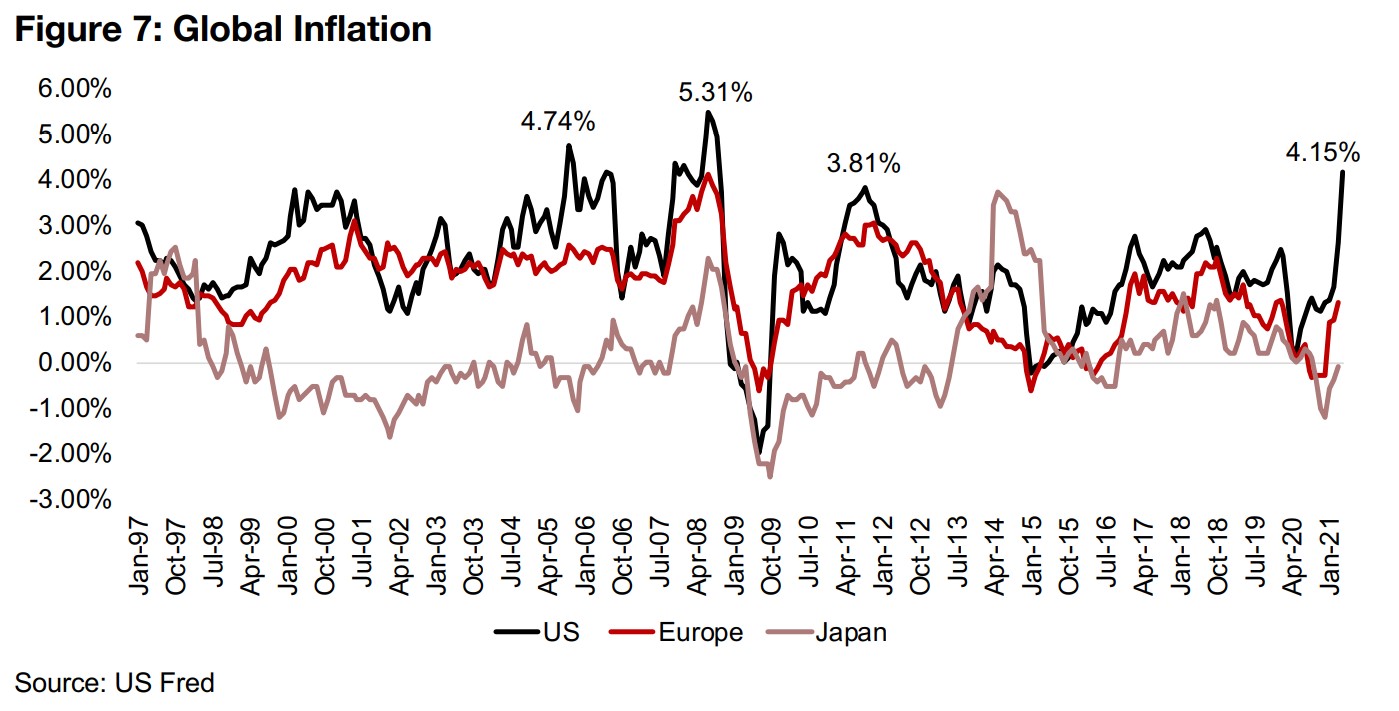

We could also use the more modern definition of inflation, which is a rise in consumer

prices, and under this definition, inflation is also spiking around the world (Figure 7),

with US inflation at 4.15%, having jumped nearly fourfold from just over 1.0% only

two months ago, and is at its highest levels since the economic crisis in 2008. Again,

this hardly looks like the gradual rise in inflation we might expect in a strong economy,

but is starting to look quite dangerous, especially in light of the massive monetary

explosion backing it. The market seems to be starting to lean a lot more towards our

thesis this week, and appears to be beginning to ask; 'is inflation about to spiral out

of control`?

If inflation does take off, gold should soar in our view, and this may hit the markets

hard, as expectations for a major increase in rates to combat inflation follow. While

this could also hit gold stocks temporarily, especially the juniors, as there is an

across-the-board sell off of equity, we expect that as the gold price rises the safety

of both gold and gold stocks will come to be realized, and any dip for gold stocks will

be short-term. While we will need more than a week to keep testing to see if our thesis

or the market's January-April 2021 thesis holds over the next few months, this first

big test is encouraging. When the market dipped, investors moved to gold, as we

believe they should in such an increasingly tumultuous monetary environment.

2) Gold a safer bet, even as base metals blowout

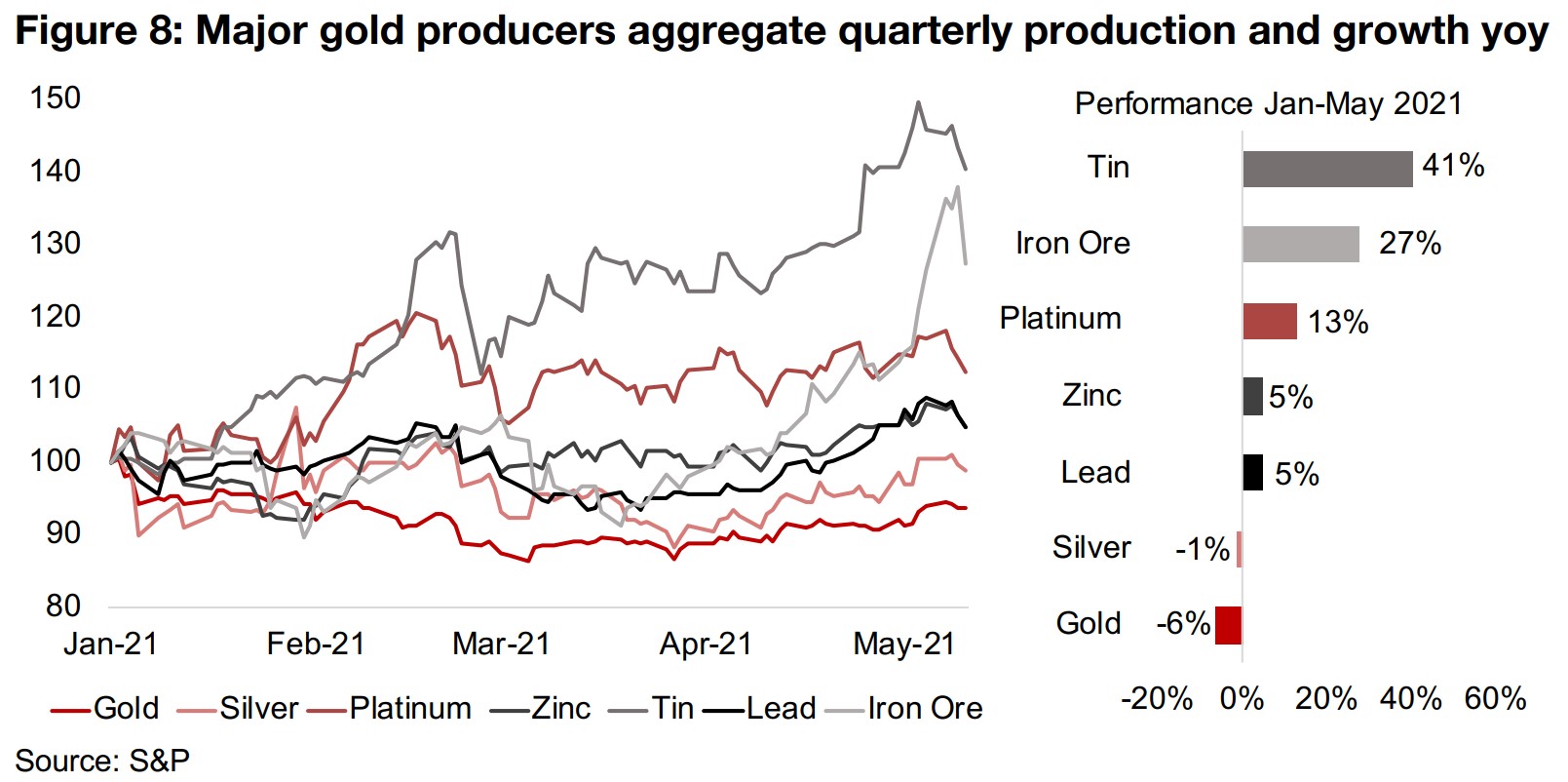

There has been a major blowout in base metals this year as the major economic rebound has led to strong demand pressure even as supply has been constrained by various limits related to the global-health-crisis, with tin spiking 41% and iron ore up 27% (Figure 8). However, with the inflation shock from the US announced this week, there was quite a significant drop in both the tin and iron price prices, on fears that central bank action to curb this would follow. We believe that much of the major spike in these base metals may have already passed and that we may be entering a period of limbo, where these prices stagnate for a while. This will be driven by the monetary expansion still coming through causing pressure to the upside, but the inflation fears providing pressure to the downside, with the net effect that the base metals prices may not really go anywhere from here for a while.

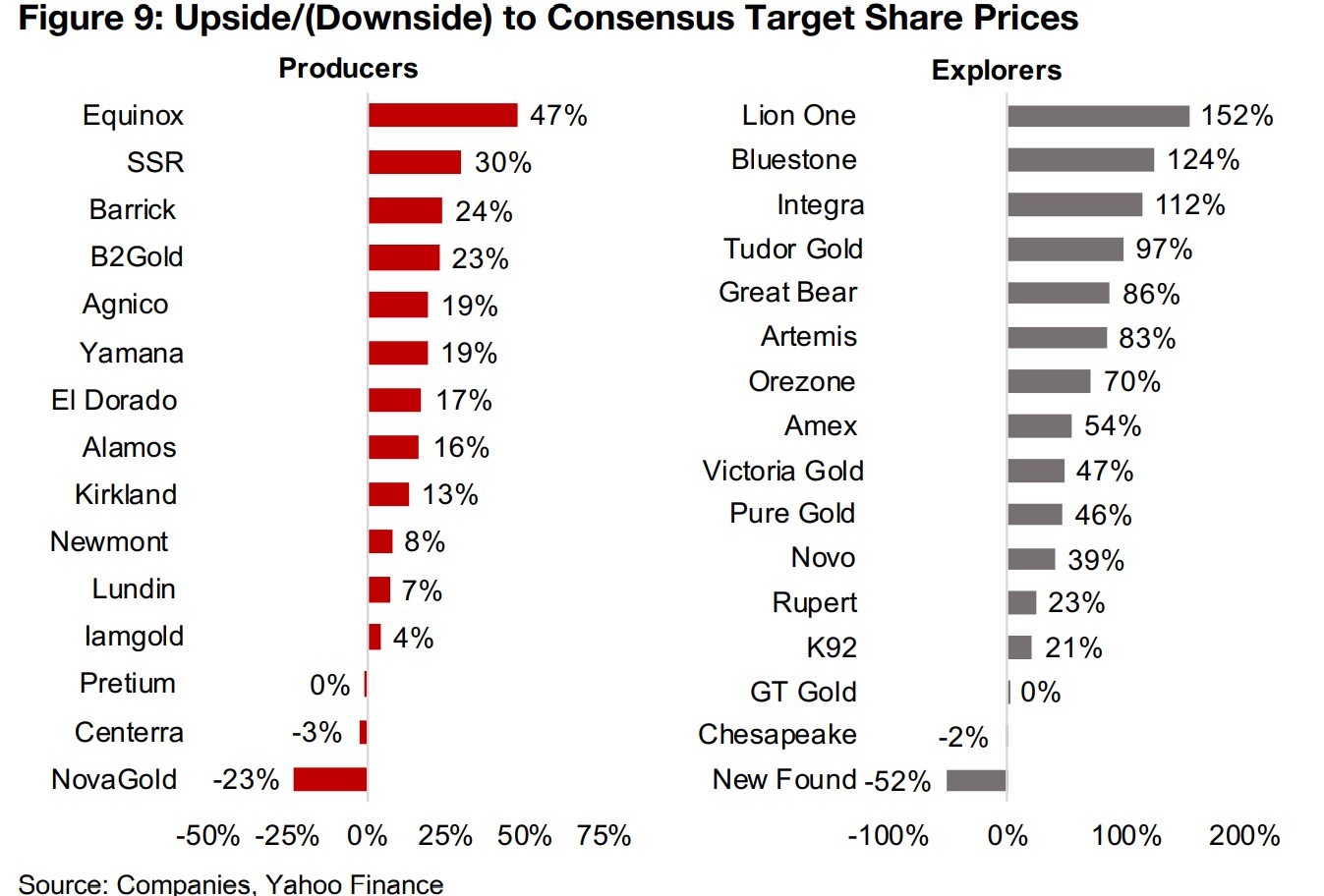

However, gold (and to a lesser degree silver) is a monetary metal, which is not as beholden to the industrial demand as these other metals, and will have the massive monetary expansion instead as its main driver, and the inflation fears that would pressure the base metals, should only propel gold up further. So while gold has been an underperformer this year, declining -6%, we believe that this may not continue for the rest of 2021, and that a reversal may be in the cards, where it is the base metals prices that start to stagnate or even decline, while gold picks up. Analysts for the gold producers and juniors seem to be adopting this idea, as shown by the high expected upside for nearly all of the gold stocks shown in Figure 9. While we always need to take analysts' targets with a grain of salt, as they tend to be biased to the upside, the consensus outlook for the sector is clearly bullish, even adjusting for this effect.

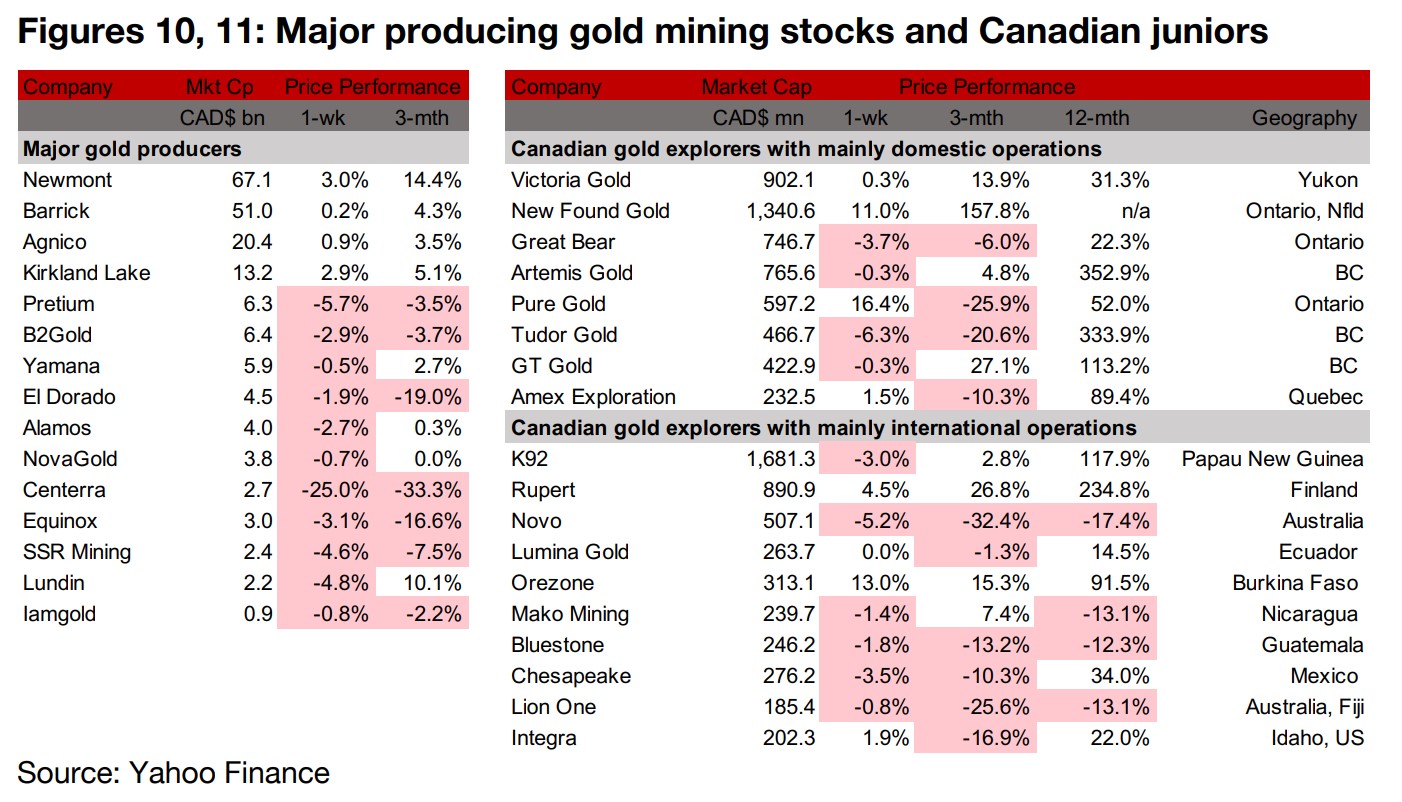

Producers mostly decline on market slide

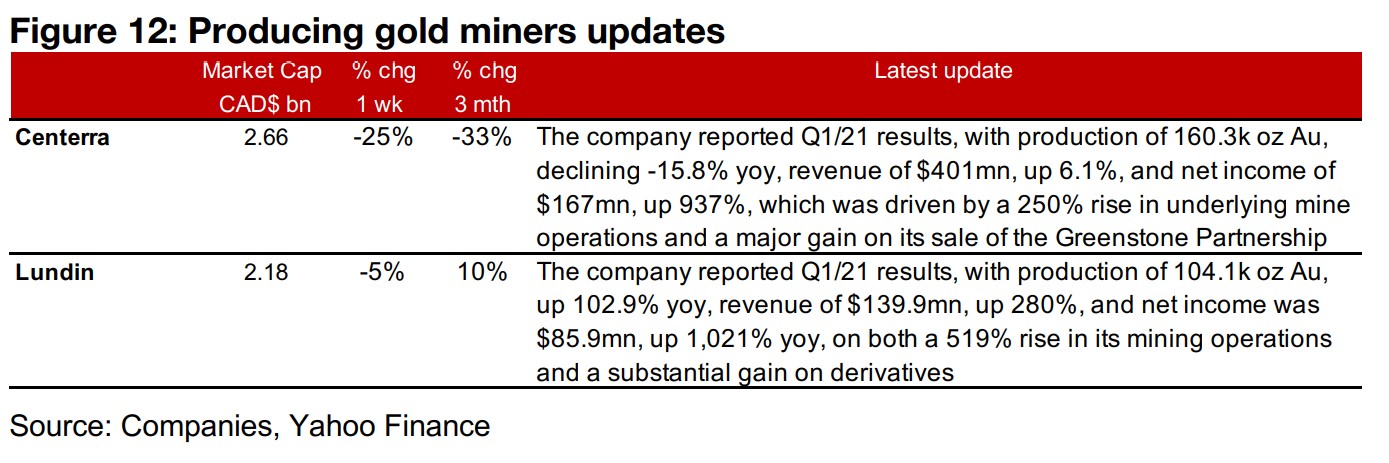

While most of the producers declined this week on the dip in equity markets, the GDX was still up as it is weighted heavily towards the larger cap gold producers, which all saw gains (Figure 10). The News flows this week was the last of the Q1/21 results from the producers, with Centerra and Lundin reporting, with the bulk of the results having already come through last week (Figure 12).

Canadian juniors mainly decline

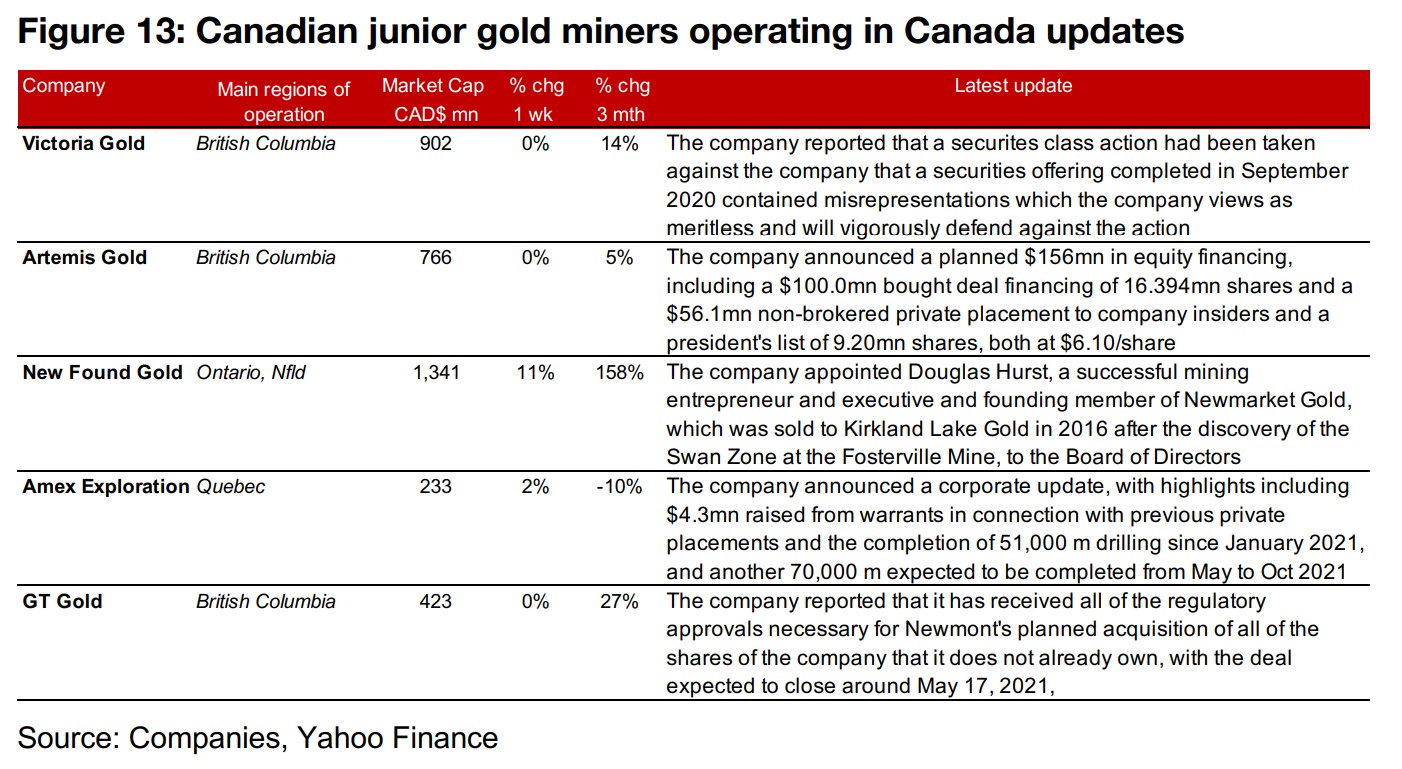

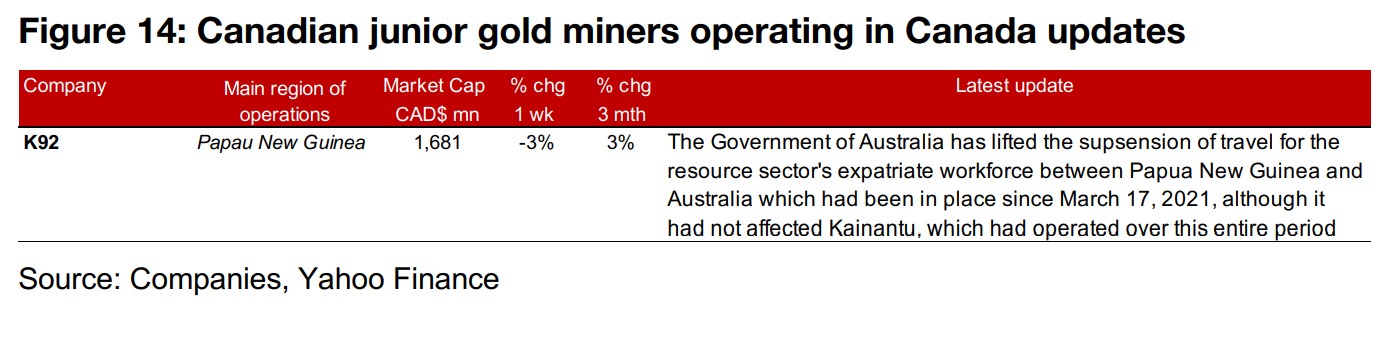

The Canadian juniors mainly declined this week as riskier assets were sold off with the equity market decline (Figure 11). For the Canadian juniors operating mainly domestically, Victoria reported a class action lawsuit against it, Artemis announced a planned $156mn in equity financing, New Found Gold appointed Douglas Hurst to its board of directors, Amex provided a corporate update and GT Gold received all the required approvals for the Newmont acquisition (Figure 13). For the Canadian juniors operating mainly internationally, K92 announced that a travel suspension for expatriates working in the resources sector between Papua New Guinea and Australia had been lifted (Figure 14).

Disclaimer: This report is for informational use only and should not be used an alternative to the financial and legal advice of a qualified professional in business planning and investment. We do not represent that forecasts in this report will lead to a specific outcome or result, and are not liable in the event of any business action taken in whole or in part as a result of the contents of this report.