January 15, 2024

Gold Holds as Markets Struggle

Author - Ben McGregor

Gold holds up as US inflation sees slight pickup

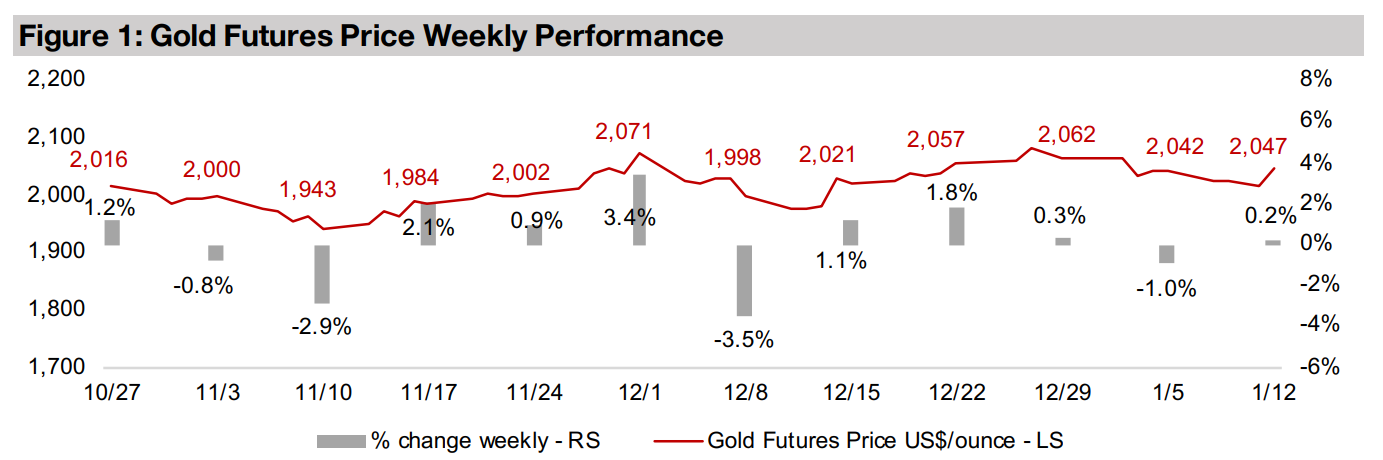

The gold futures were near flat, rising 0.2% to US$2,047/oz, as there was a slight pickup in U.S. December 2023 CPI inflation, with the metal having now spent twenty consecutive trading days above the key US$2,000/oz level, it longest stretch ever.

Hercules Silver’s rollercoaster move into large TSXV silver

This week Hercules Silver is In Focus, which saw a ten-fold price surge and buy-in by Barrick Gold on strong silver, and then copper, drill results from its eponymous project, before a 50% pullback which still left it among the largest TSXV silver stocks.

Gold Holds as Markets Struggle

The gold futures price was near flat this week, up just 0.2% to US$2,047/oz, and has steadied since the start of the year, as it consolidates above the key US$2,000/oz level, having remained there for the last twenty consecutive days, its longest stretch ever. This was not a bad start to the year for gold, especially in contrast to other metals and major equity markets, which have struggled out of the gate. Most of this has come likely because of the aggressiveness of the move up in markets in the last two months of 2023. This pushed forward the pricing-in of some of the gains to come for equities from widely expected Fed rate cuts for this year. Now the Fed will actually need to deliver on these cuts, and the first meeting where this could happen is still far off in March 2024, leaving the markets looking for further drivers until then.

US inflation comes in (a bit) hot

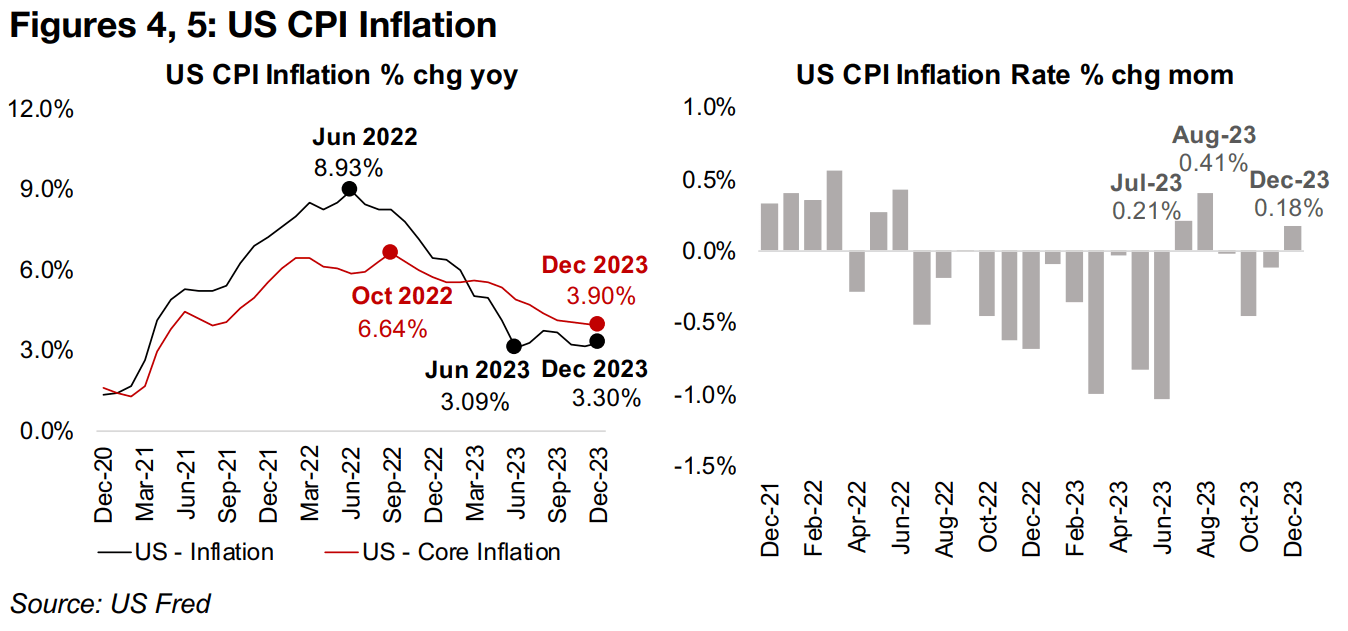

The main economic data release this week was US inflation, a key indicator of how

strongly the Fed can come through with cuts, with falling inflation giving more room

for reduced rates. Stock markets were jittery over ‘hot’ December 2023 headline CPI

inflation ticking up to 3.30% from 3.12% in November 2023 (Figure 4). The month on

month change was also significant at 0.18%, its third highest gain in eighteen months,

after a 0.21% rise in July 2023 and 0.41% in August 2023 (Figure 5).

However, it was hardly a major resurgence of prices, and headline US inflation seems

to have steadied, averaging 3.35% over the past six months. Also, core inflation,

which the Fed tends to focus more on, continued to decline, to 3.90% in December

2023 from 3.99% in November 2023. While these figures are still above the Fed’s

2.00%, there is a lag effect in increasing interest rates, and downward pressure on

prices from the hikes already made may still only fully come through later this year.

So, while battle against inflation may not be over, it seems to be winding down.

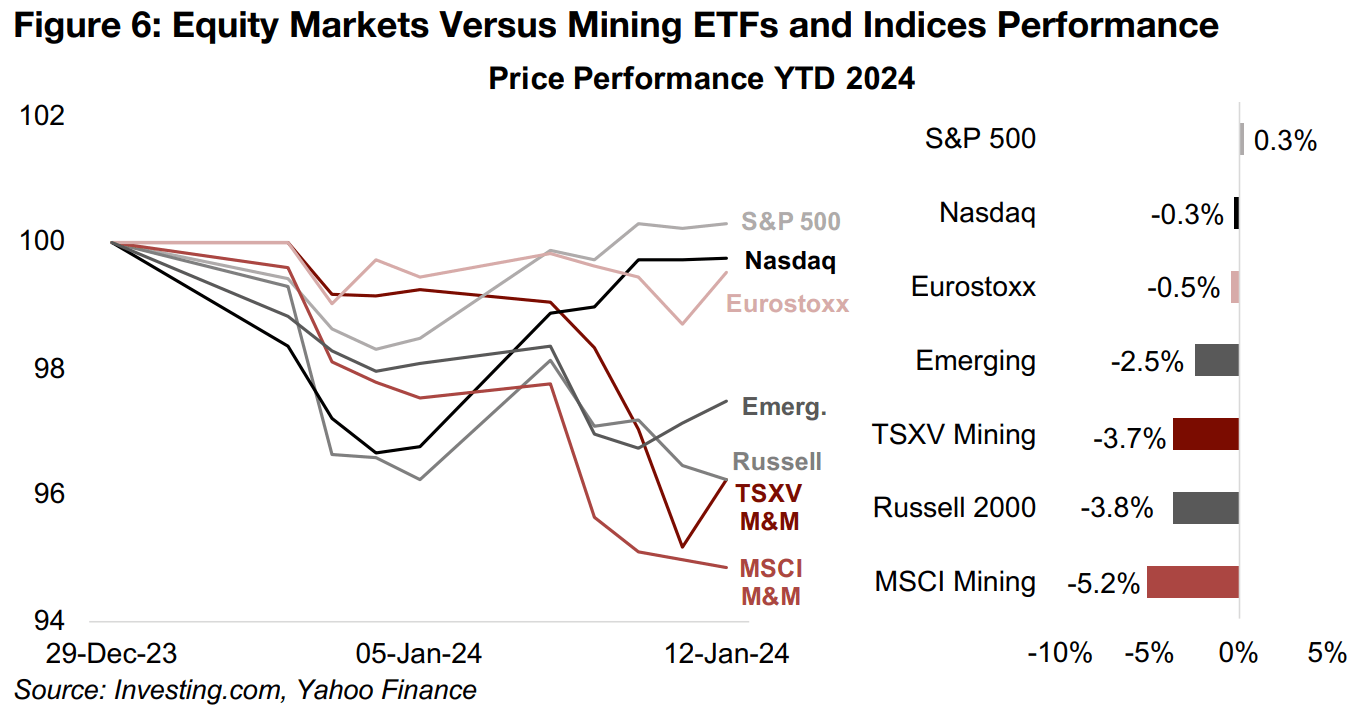

Mining sector continues to underperform global markets

The late-2023 boom for the big U.S. markets has not carried over into January 2024, with the S&P just eking out a 0.3% gain YTD and the Nasdaq down -0.3%, just ahead of a -0.5% drop for European stocks and -2.5% decline for emerging markets (Figure 6). However, the 2023 trend of the mining sector underperforming global markets has continued, with the MSCI Metals and Mining ETF of the largest global producers in the industry down -5.2% to start the year. The S&P/TSXV Metals and Mining index has fared a bit better, down -3.7%, just outperforming the -3.8% drop in the small cap Russell 2000, which is a reasonable major benchmark for the junior miners, as it also has a high weighting of newer, riskier companies.

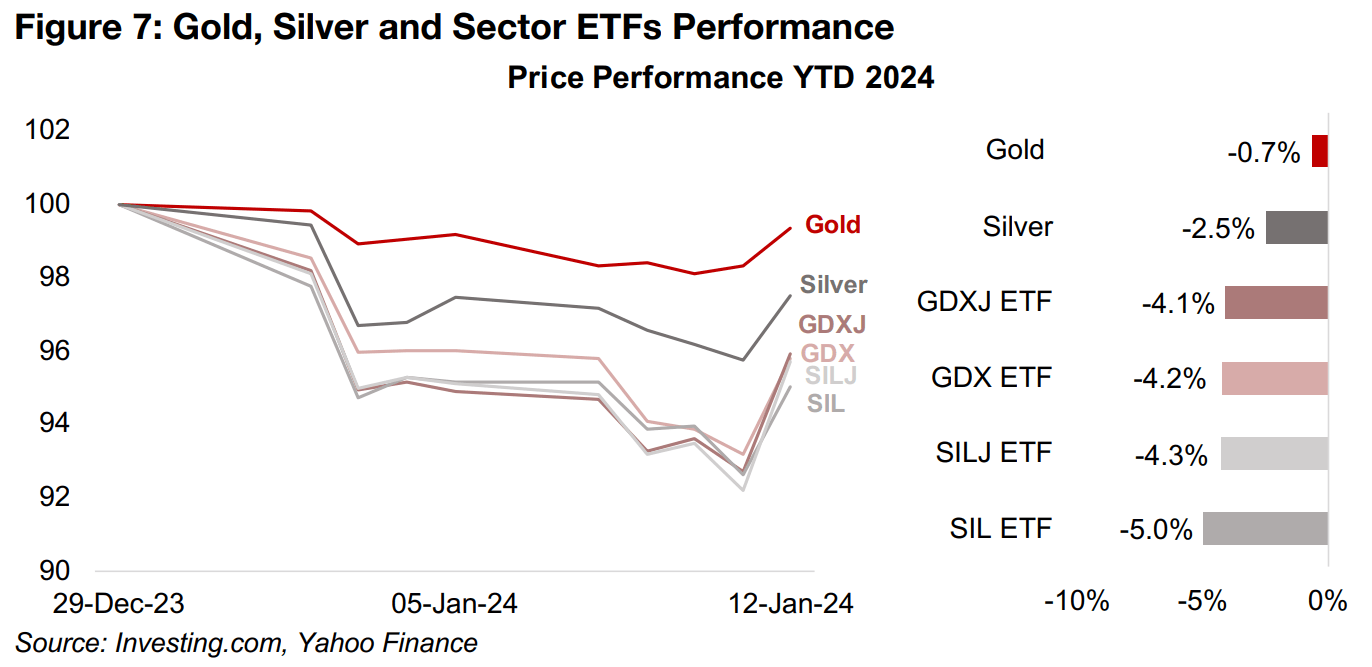

Major metals stock ETFs decline as investors lock in gains

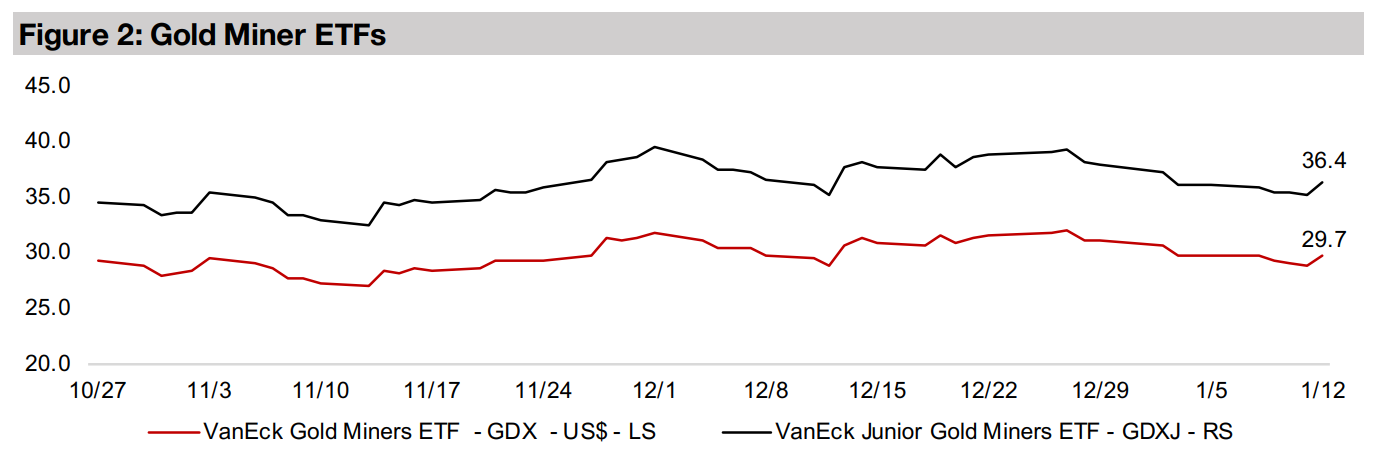

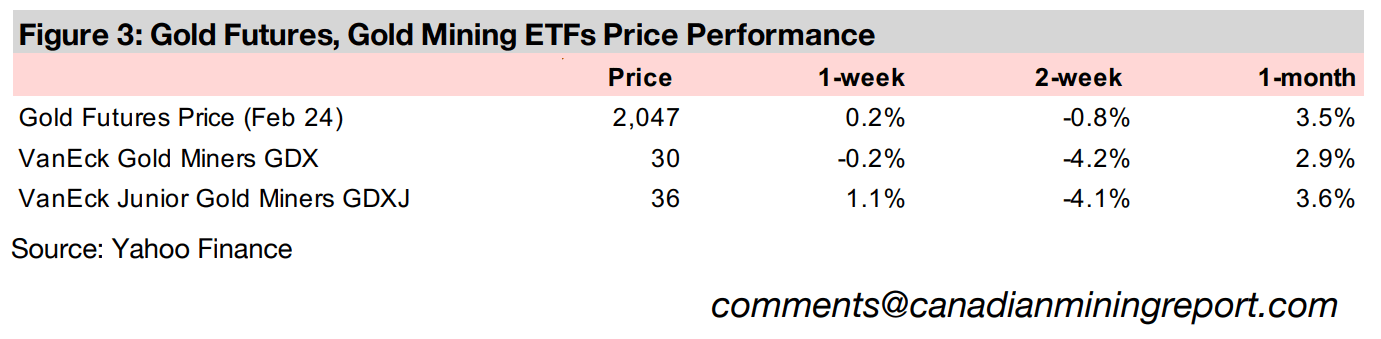

This puts the -0.7% and -2.5% decline in the spot gold and silver prices, respectively,

in a good light, as they have held up relatively well versus the major markets (Figure

7). However, the major ETFs for these two sectors have struggled, with GDXJ ETF of

gold juniors down -4.1%, similar to the -4.2% decline for the GDX ETF of gold

producers. The silver ETFs are only slightly behind this, with the SILJ ETF of silver

juniors losing -4.3% and the SIL ETF of producers declining -5.0%.

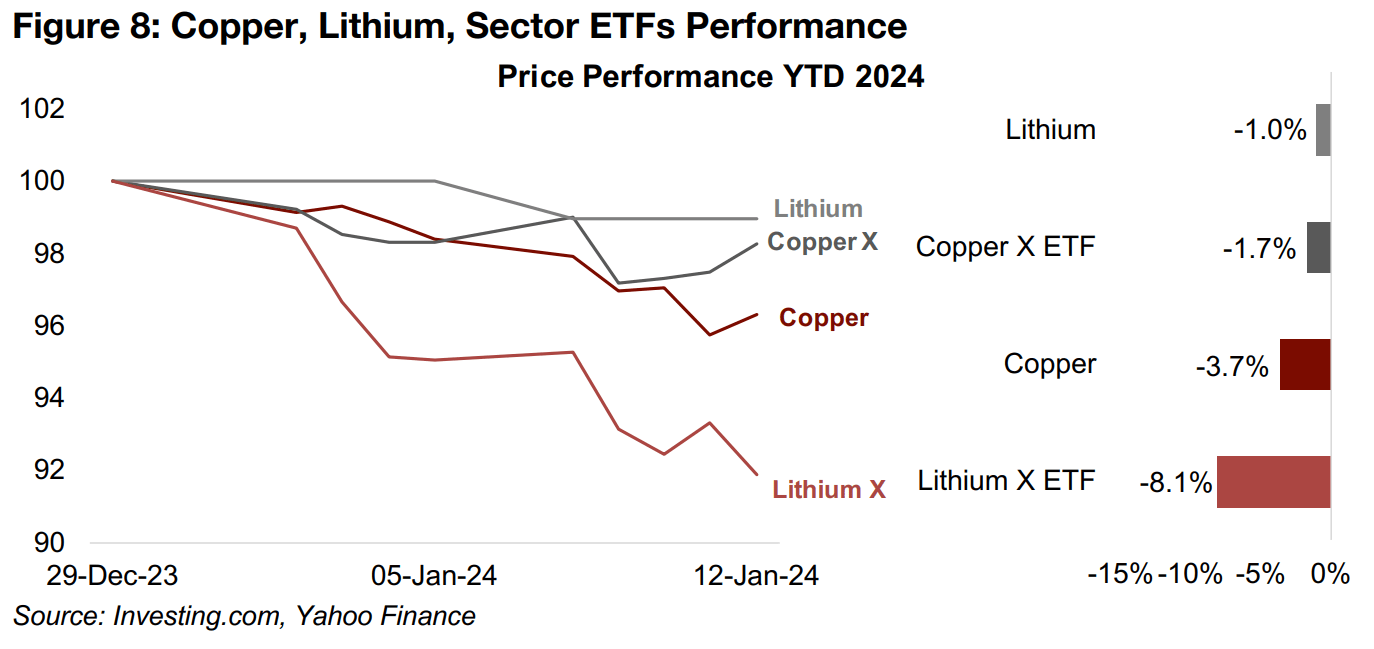

The major slump in lithium from 2023 has eased, with only a -1.0% drop so far in

2024 (Figure 8). The Lithium X ETF has seen the weakest performance of these major

metal stock ETFs, given its significant exposure beyond lithium stocks. The copper

producer ETF COPX, down -1.7%, has outperformed its underlying metal, with

copper off -3.7%. With relatively limited major macro news driving these moves, it

could be investors locking in gains in riskier stocks after a scorching rally in late 2024,

and not seeing many major catalysts until a potential March 2024 Fed rate cut.

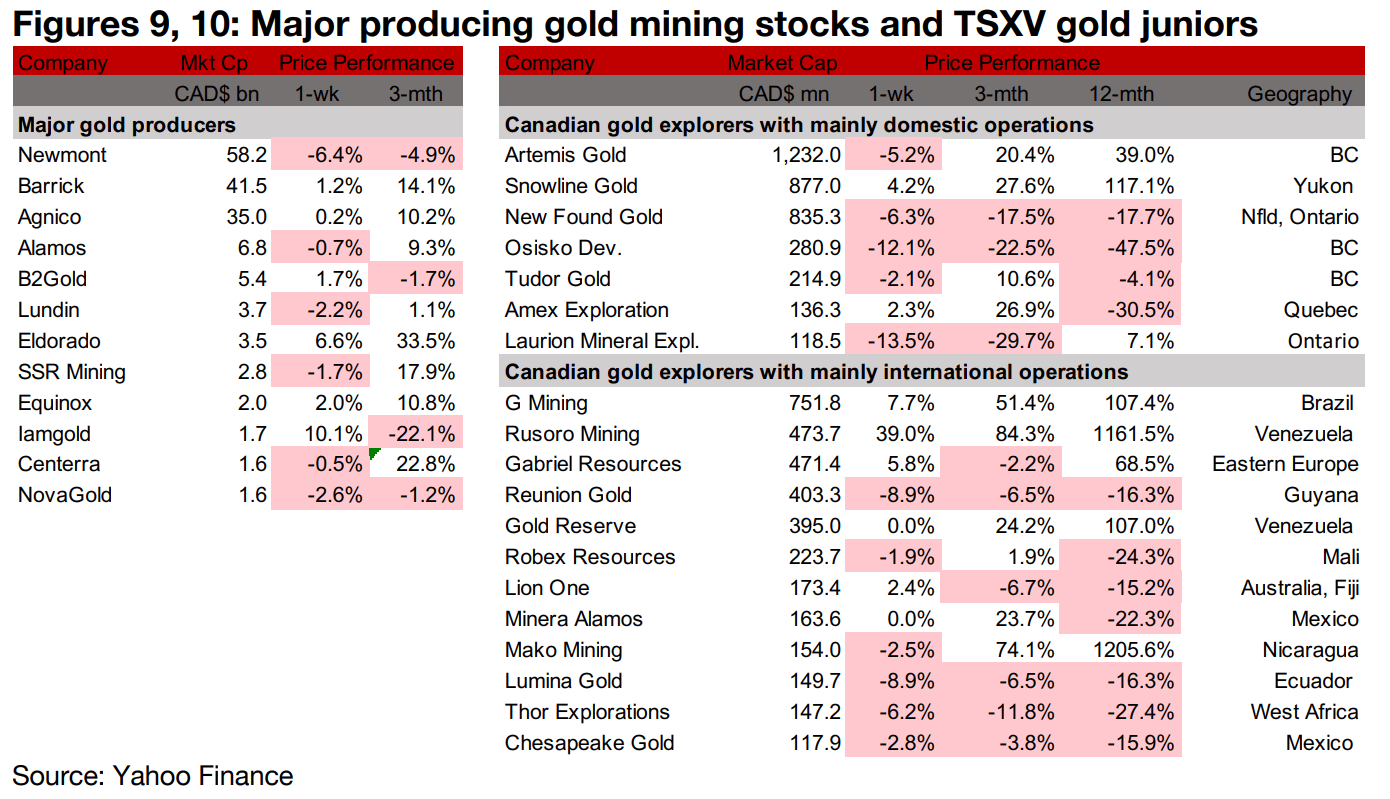

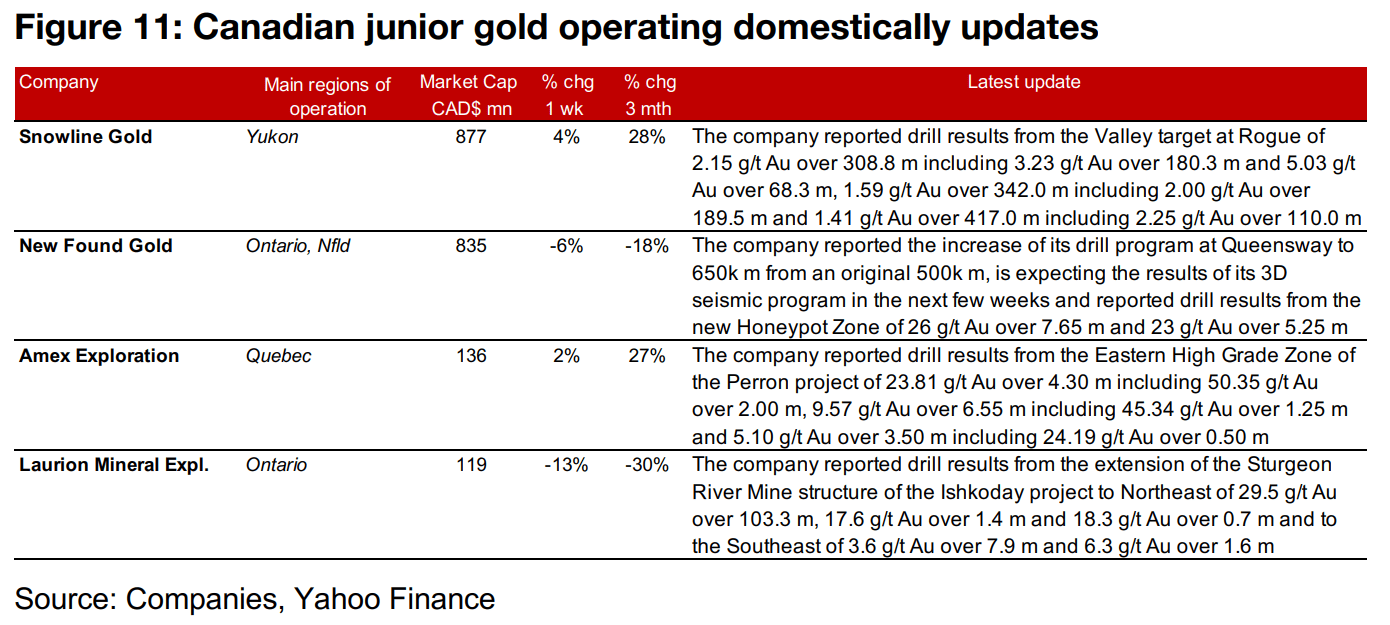

Gold producers and large TSXV gold mixed

The gold producers and large TSXV gold stocks were mixed on flat gold and limited

major economic catalysts (Figures 9, 10). For the TSXV gold companies operating

domestically, Snowline reported drill results from the Valley target of the Rogue

project, New Found Gold increased its drill program to 650k m and reported drill

results from the new Honeypot zone. Amex Exploration announced drill results from

the Eastern High Grade Zone of Perron and Laurion Mineral Exploration reported drill

results from an extension of the Sturgeon River Mine structure at Ishkoday. (Figure

11).

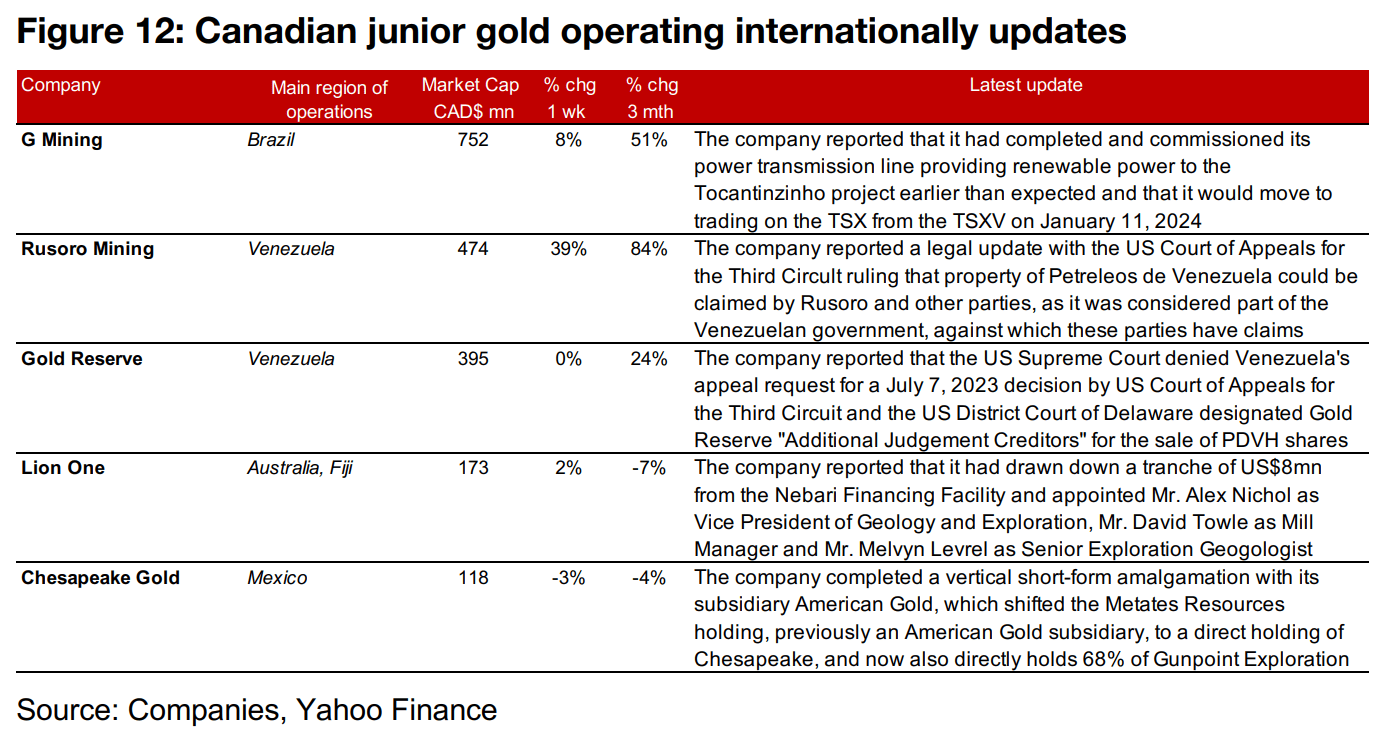

For the TSXV gold companies operating internationally, G Mining completed and

commissioned its power transmission line to Tocantinzinho earlier than expected and

Rusoro Mining and Gold Reserve reported legal updates on their respective ongoing

cases regarding Venezuela. Lion One drew down a US$8mn tranche of its Nebari

financing and made new management appointments and Chesapeake Gold

completed a vertical short-form amalgamation with its subsidiary American Gold,

giving it a direct holding of Metates Resources. (Figure 12).

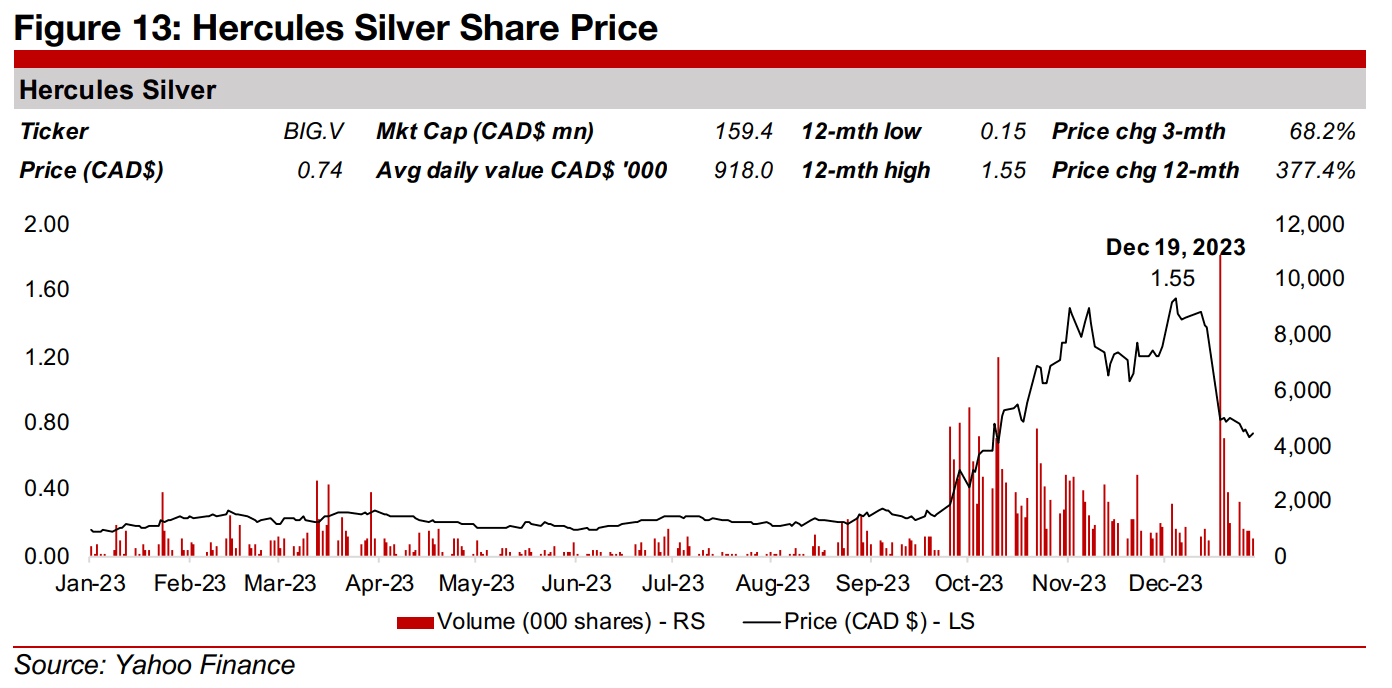

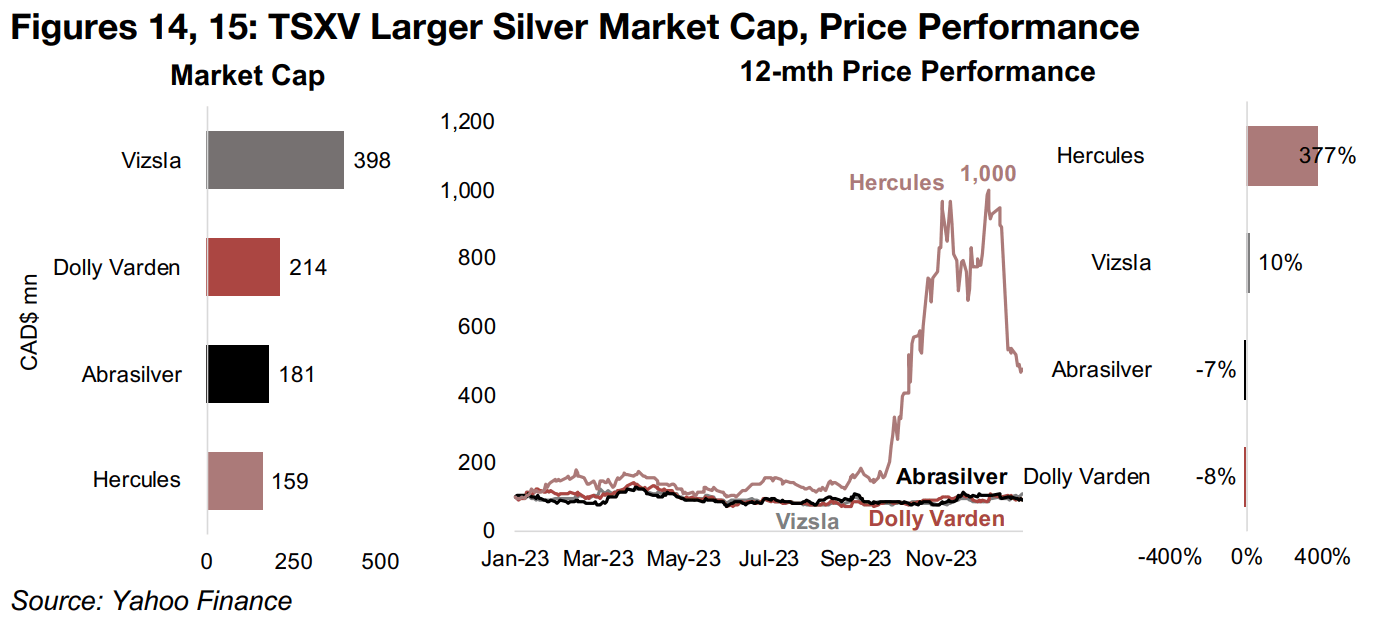

In Focus: Hercules Silver

Hercules Silver surges into large cap TSXV sector over past year

Hercules Silver, operating the Hercules silver and copper project in Idaho, U.S., has seen a huge rise in its share price since October 2023 to CAD$0.74/share, up from just CAD$0.16/share a year ago (Figure 13). However, it has come down significantly off a peak of CAD$1.55/share reached on December 19, 2023. This has seen it rise into the ranks of the larger market cap TSXV silver stocks over the past year, to fourth highest at CAD$159m, after Vizla Silver, Dolly Varden Silver and Abrasilver (Figure 14). Hercules Silver has also strongly outperformed these other companies, which have had only had single digit moves, as they are far more advanced in their development, with all at least at the Initial Resource Estimate stage (Figure 15).

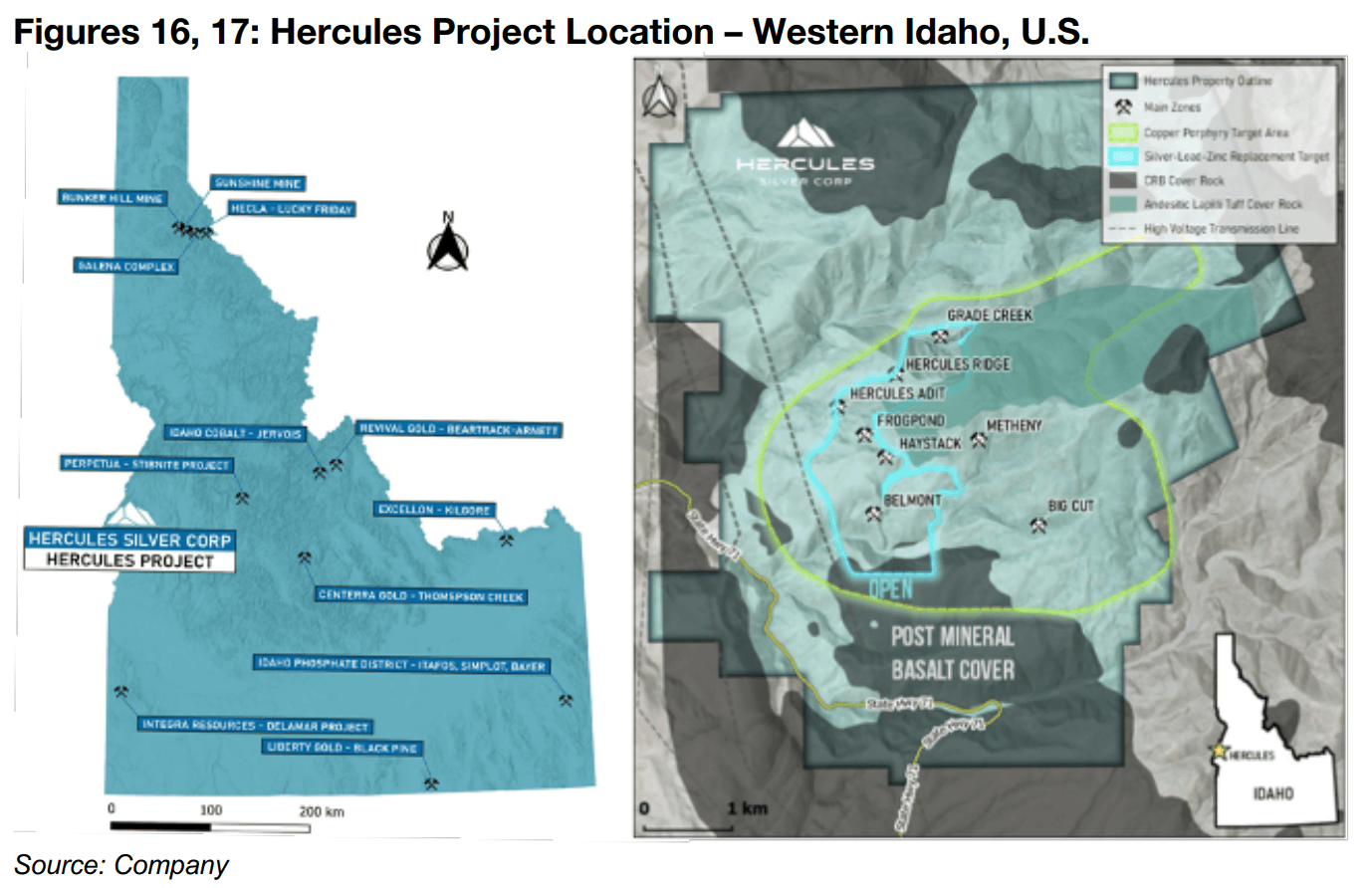

Confirming past silver drilling of Hercules and new copper discovery

The company’s Hercules project is in Western Idaho, U.S., which is ranked as one of the most mining-friend jurisdictions in the world, and already has many projects currently operating (Figure 16). While the company was initially targeting silver exploration at Hercules, the thesis for the property was shifted by a major copper discovery last year, generating a large copper porphyry target (Figure 17).

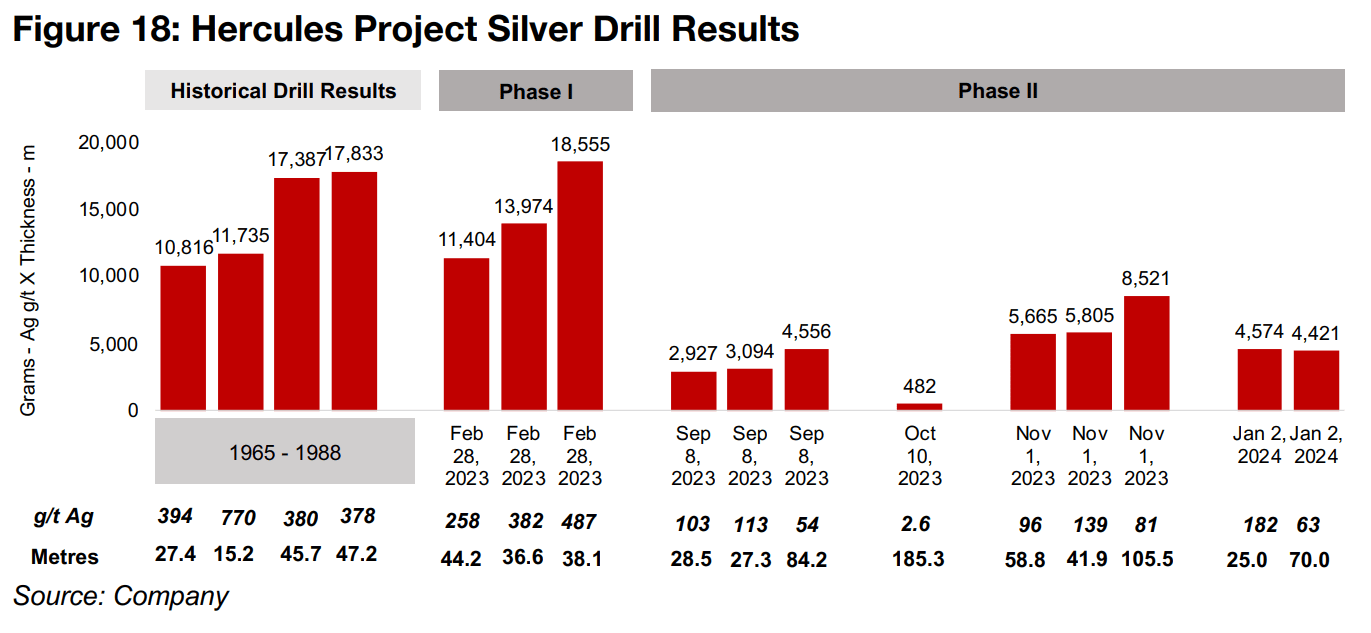

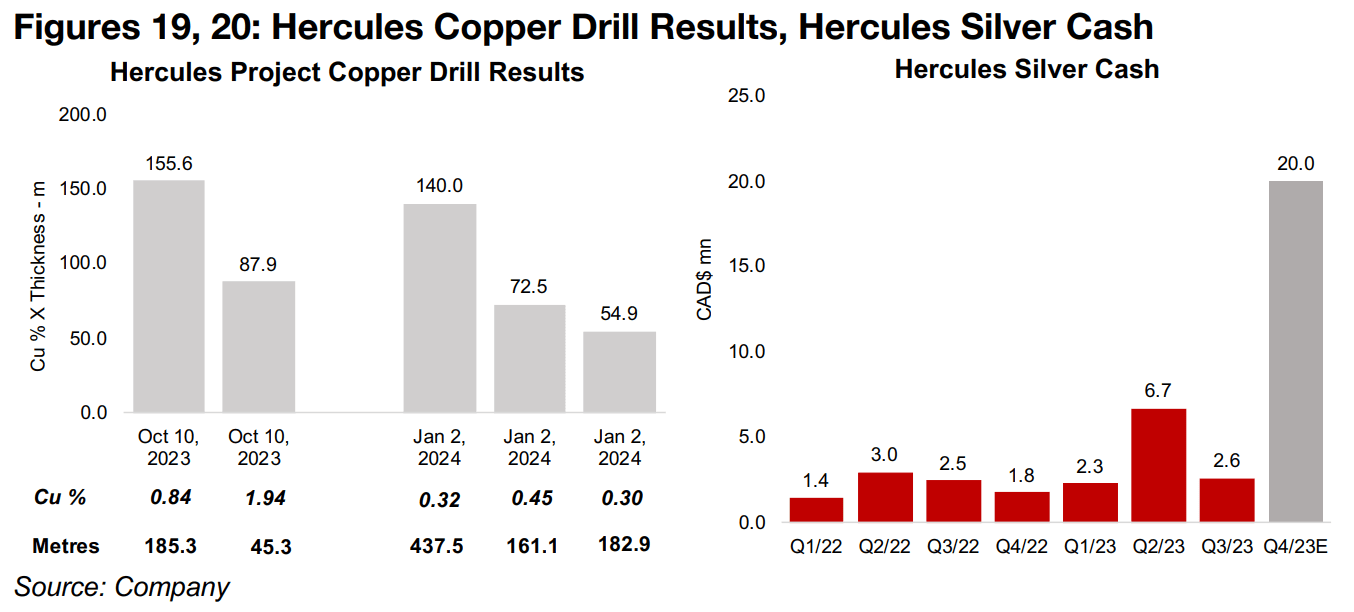

There had been extensive drilling at the project from 1965-1988 by other companies, and Hercules in early 2023 released its Phase I drilling results confirming the high silver grade previously reported (Figure 18). While this had been enough to drive a near doubling of the share price from January 2024 to April 2024, it was only with a major copper discovery in Q4/23 that the share price really took off. The company released drill results on October 10, 2023, with extremely high copper grades of 0.84% over 185.3 m and 1.94% over 45.3 m (Figure 19). However, subsequent results in early January 2024 disappointed the market, driving the share price down -52% from its highs. This was likely because of a much lower copper grade at just 0.32% to 0.45%, but also a lower silver grade well off the peak results of 2023.

Company well cashed up after Barrick buy-in

The company remains well positioned to continue an aggressive exploration campaign at the Hercules project, with Barrick Gold taking a strategic 12.33% stake in the company, which closed in November 2023. This had boosted Hercules Silver’s cash to approximately CAD$20.0mn as of Q4/23, leaving it well funded compared to a cash balance that rarely got above CAD$3.0mn in the previous seven quarters (Figure 20).

Disclaimer: This report is for informational use only and should not be used an alternative to the financial and legal advice of a qualified professional in business planning and investment. We do not represent that forecasts in this report will lead to a specific outcome or result, and are not liable in the event of any business action taken in whole or in part as a result of the contents of this report.