January 07, 2022

Gold Hit By Potentially Hawkish Fed

Author - Ben McGregor

Concerns of potentially hawkish Fed drives down gold

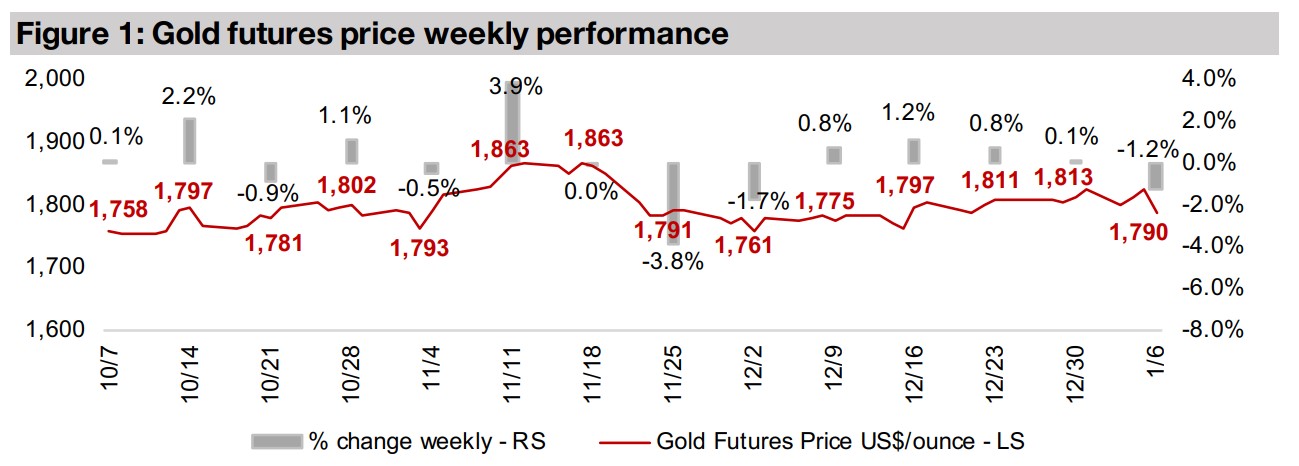

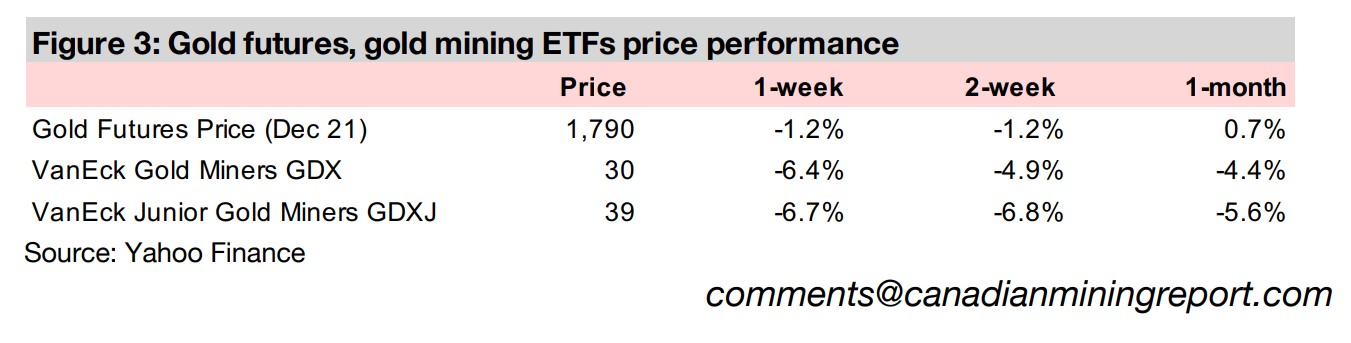

Gold declined -1.2% to US$1,790/oz this week, after Fed meeting minutes this week indicated a potentially more hawkish stance, as they focused on rising inflation and a tightening labour market, suggesting possible earlier than expected rate hikes.

A look at TSXV smaller-cap gold companies

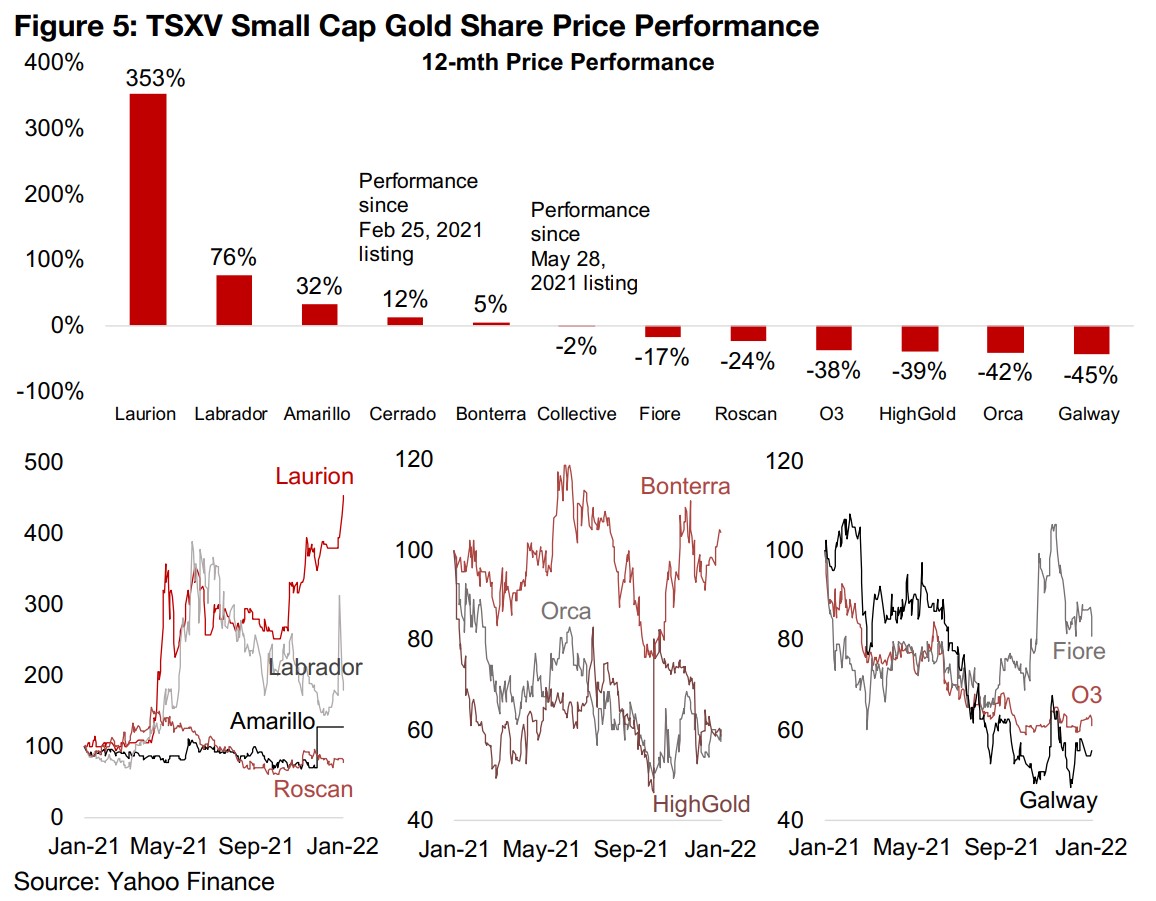

This week we look at TSXV gold juniors with smaller market capitalizations, from just above US$200mn to just below US$100mn, with a few stand-out gainers, including Laurion, Labrador and Amarillo, but most declining over the past year.

Gold Hit By Potentially Hawkish Fed

Gold fell -1.2% to US$1,790/oz in the first week of 2022, as the market took the

minutes from Fed meeting released this week as indicating a potentially more hawkish

stance from the central bank. The minutes highlighted rising inflation and the

tightening labour market and showed the Fed considering rate hikes that would be

earlier than previously expected. This follows from changes in previous minutes

where the word 'transitory' was removed from a discussion of inflation, suggesting

that the Fed is viewing the rise in prices over H2/21 as more persistent than they

originally expected. The US CPI inflation of 6.8% yoy as of the most recent December

2021 numbers is well above the Fed's mandate to keep inflation within a range around

2.0% and may push them towards action to curb rising prices.

So far this has taken the form of tapering its monetary stimulus, which already started

towards the end of 2021, although even this could hardly be considered very hawkish,

as a strong monetary expansion still continues, and had been reduced only in degree.

It will only be when the money supply is actually cut, and no longer increased, that

we can say the Fed has turned truly hawkish. While the Fed is 'talking tough' for now,

we believe that it will be very difficult for them to aggressively cut monetary stimulus.

Economic growth could falter without continued monetary stimulus, with many

distortions caused by the global health crisis still persisting, equity markets are at

excessive valuations in historical terms and another housing boom is currently being

inflated. It might only take moderate rate hikes, not even aggressive ones, to bring all

three of these simultaneously crashing down.

We therefore expect that the Fed will continue to tread lightly on monetary stimulus

reduction and rate hikes, preferring high inflation to wider market crashes. There is

already clear evidence of this in their action over the past six months, where inflation

was already clearly out of the Fed's mandated range of around 2.0%, and yet no

aggressive action has been taken. So far we have only gotten a continuation of the

major monetary expansion of the past two year, only at a somewhat less aggressive

pace. This could hardly be called hawkish. The Fed remains 'data dependent', and

we expect that we may start to see signs of economic growth slowing after the

surging economic recovery of 2021, which could lead to the Fed backing off its more

hawkish tone.

We believe that gold will continue to at least hold up this year, if not increase, as the

Fed's current hawkish tone does not translate to aggressive action, with the economy

slowing more than expected. However, we still see the chance for a decline in equity

markets even without an aggressive cut in the monetary stimulus by the Fed, given

the currently very high valuations, which could hit gold stocks, even as the gold price

itself could remain stable. In general we believe that 2022 is a year to exercise extra

caution in investing in gold stocks, especially the riskier juniors.

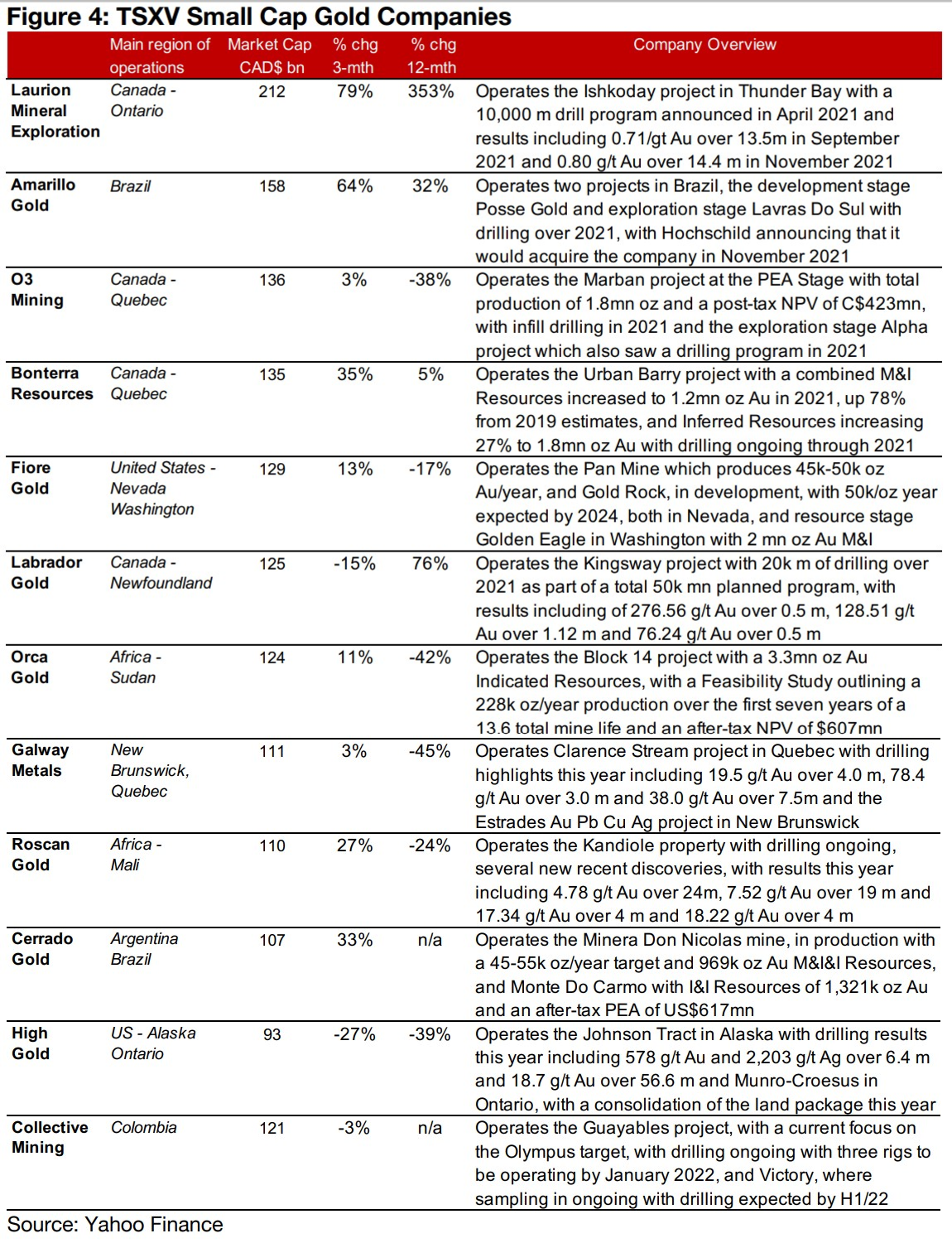

A look at the TSXV small cap gold companies

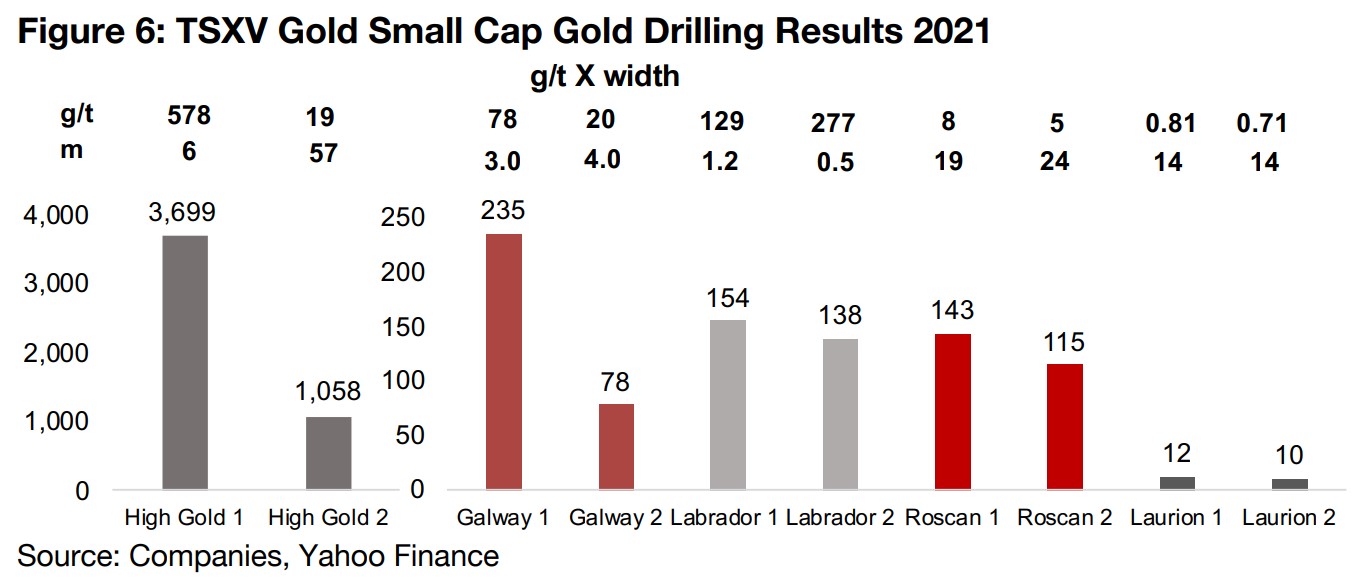

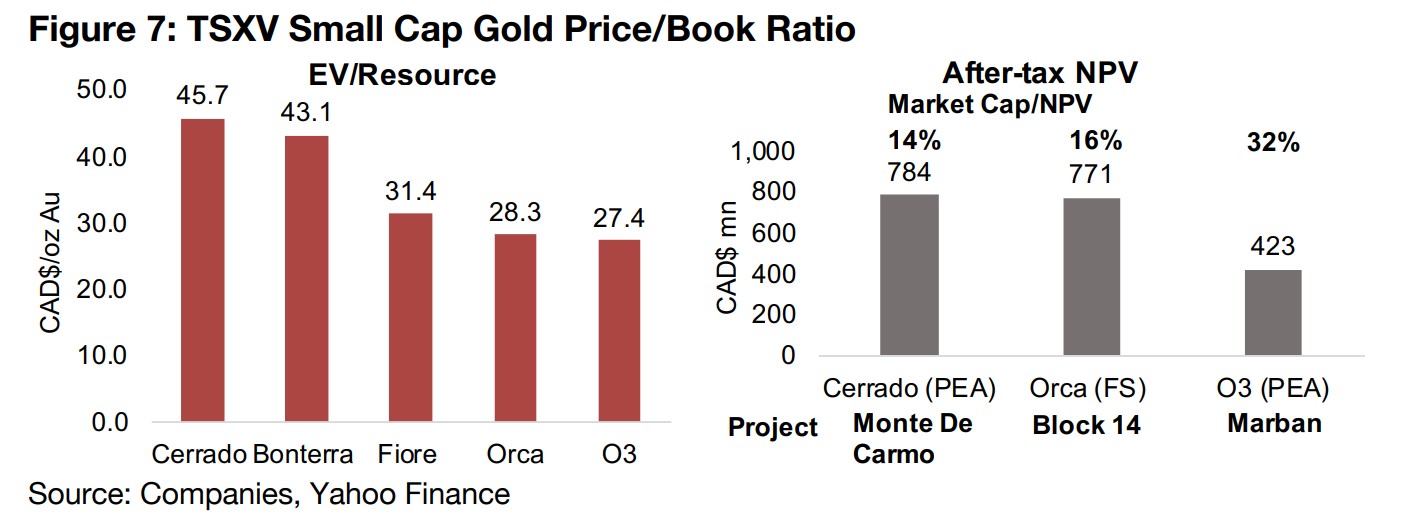

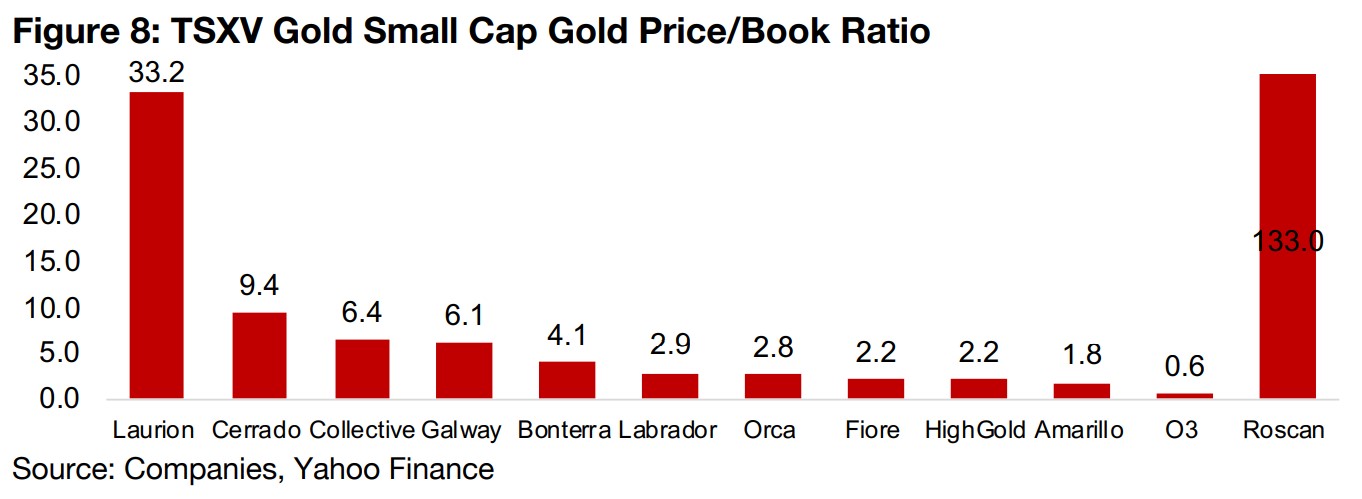

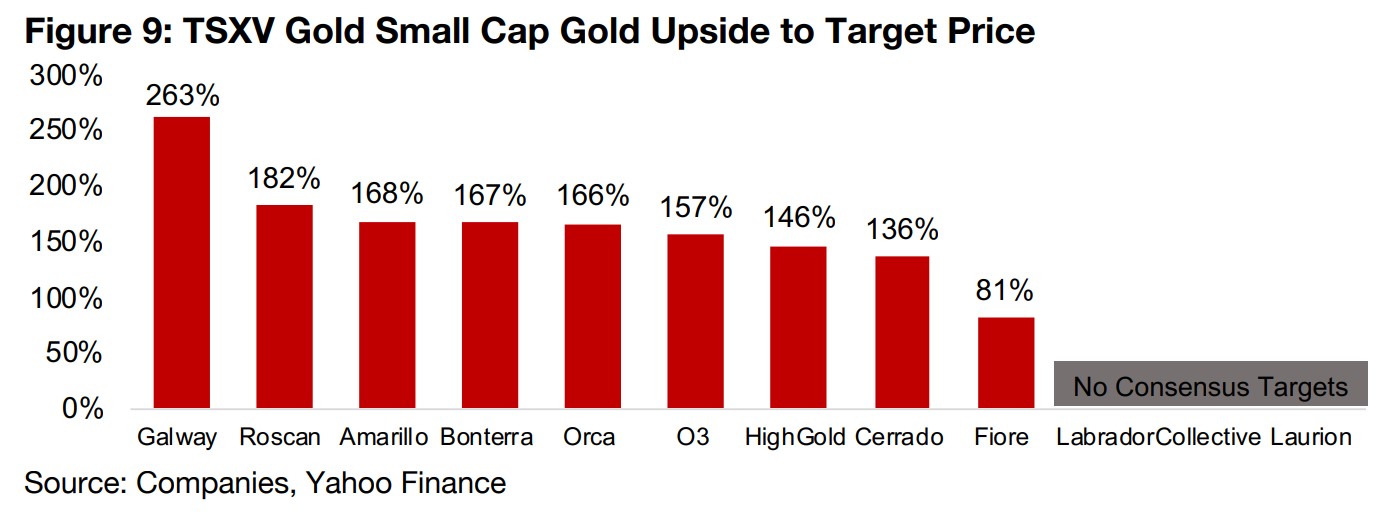

This week we look at the smaller cap TSXV-listed gold companies, which we define as just above US$200mn in market cap to just below US$100mn in market cap (Figure 4). While there are a few standouts, including Laurion, up 353% over the past 12 months, Labrador, up 75% and Amarillo, up 32%, the rest of the group has made either marginal gains or losses (Figure 5). Laurion, operating the Ishkoday project in Thunder Bay, Ontario, saw two main periods of gains over the past year, first following the announcement of a 10,000 m drill program in April 2021, and the second following strong drill results in September and November 2021. The stock trades at by far the high price to book ratio of the group, at 33.2x (Figure 8), and with no consensus target, there is currently no gauge for how much longer its current momentum is expected to continue (Figure 9). The other major gainer, Labrador Gold, which is part of the current surge in gold exploration in Newfoundland, has been driven by strong drilling results over the past year, including 129 g/t over 1.2 m and 277 g/t over 0.5 m (Figure 6). Labrador trades at a 2.9x price to book, a moderate level versus the rest of the group, and has no target price, so as with Laurion, there is no clear outline of upside to its fundamental value by the market.

The rise in Amarillo, which operates two projects in Brazil, development stage Posse Gold and exploration stage Lavras Do Sul, was driven by its acquisition by Hochschild in November 2021. Cerrado Gold, listed in February 2021, has gained 12%, operating the Minera Don Nicolas mine in Argentina, which recently entered production and the Monte Do Carmo mine in Brazil, at the PEA stage. Although Cerrado has the second highest P/B ratio of the group at 9.4x, its market cap is just 14% of the NPV for Monte De Carmo outlined in its PEA (Figure 6), and it has 136% upside to its consensus target. Bonterra Resources gained just 5% for the year, as an increase in its M&I Resources by 78% and Inferred Resources by 27% for its Urban Barry project in 2021 compared to 2019 offset much of the downward pressure on the sector but was not enough to propel the stock forward. The stock trades at an EV/Resource of CAD$43.1/oz Au, towards the higher-end of the small caps with resource estimates (Figure 7), and at a moderate P/B of 4.3x, with 167% upside to its target price. Collective Mining was newly listed on the TSXV in 2021 and is down -2% since its listing in May 2021, with drilling results from exploration of its Guayables project in Colombia enough to just support the stock near its listing price, but not enough to drive gains. It trades at a relatively high 6.4x P/B and has no consensus target price.

Fiore Gold, down -17% for the year, operates the Pan Mine in Nevada, with

production of up to 47k oz Au expected for 2021, and the Gold Rock project, in

development and expected to add 50k oz Au in production by 2024, and trades at an

EV/Resource of CAD$31.4/oz Au. Roscan was down -24%, even with decent drilling

results from its Kandiole project in Mali. Its P/B of 133.0x is distorted by its low equity,

and has 182% upside to its target, the second highest of the group. O3 Mining

declined -38%, operating the Marban project in Quebec, with its market cap at 32%

of the NPV in its PEA. O3 has the lowest P/B of the group, at just 0.6x, and 157%

upside to its target consensus.

While High Gold saw the strongest drilling result of the group over the past year, this

supported its share price only briefly, and it ended up down -39%, trades at a low

P/B of 2.2x and has 146% upside to its target. Orca Gold declined -42%, with its

Block 14 project in Sudan at the Feasibility Study stage, and its market cap at just

16% of the NPV, and it trades on a P/B of 2.8x and has 166% upside to its target.

The weakest performer this year has been Galway, down -45%, even with its drilling

results from its Clarence Stream project in New Brunswick the second strongest of

the group over the past year. The stock trades at a relatively high P/B of 6.1x, and

has the highest upside to its target of the group, at 263%.

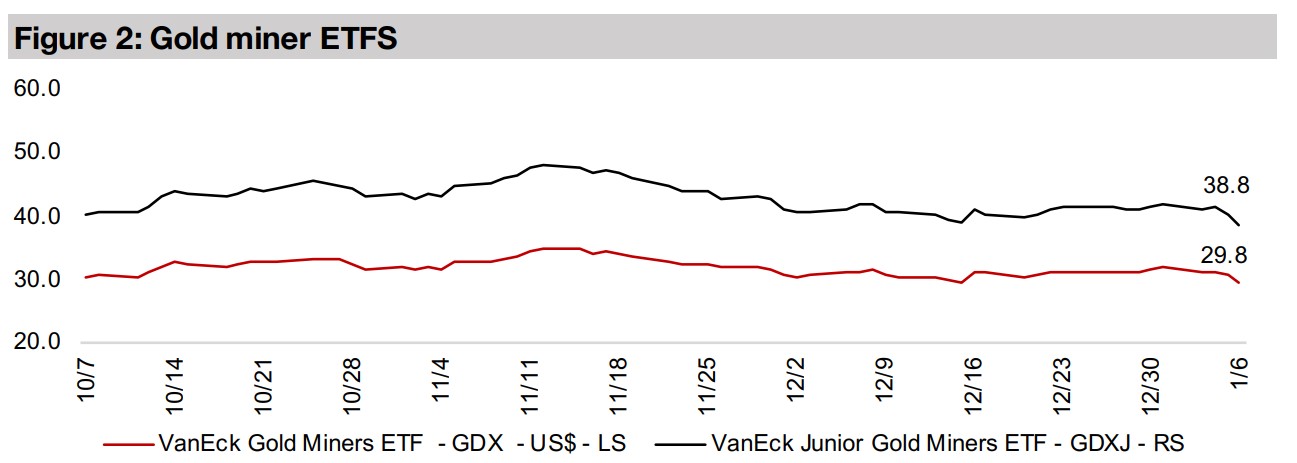

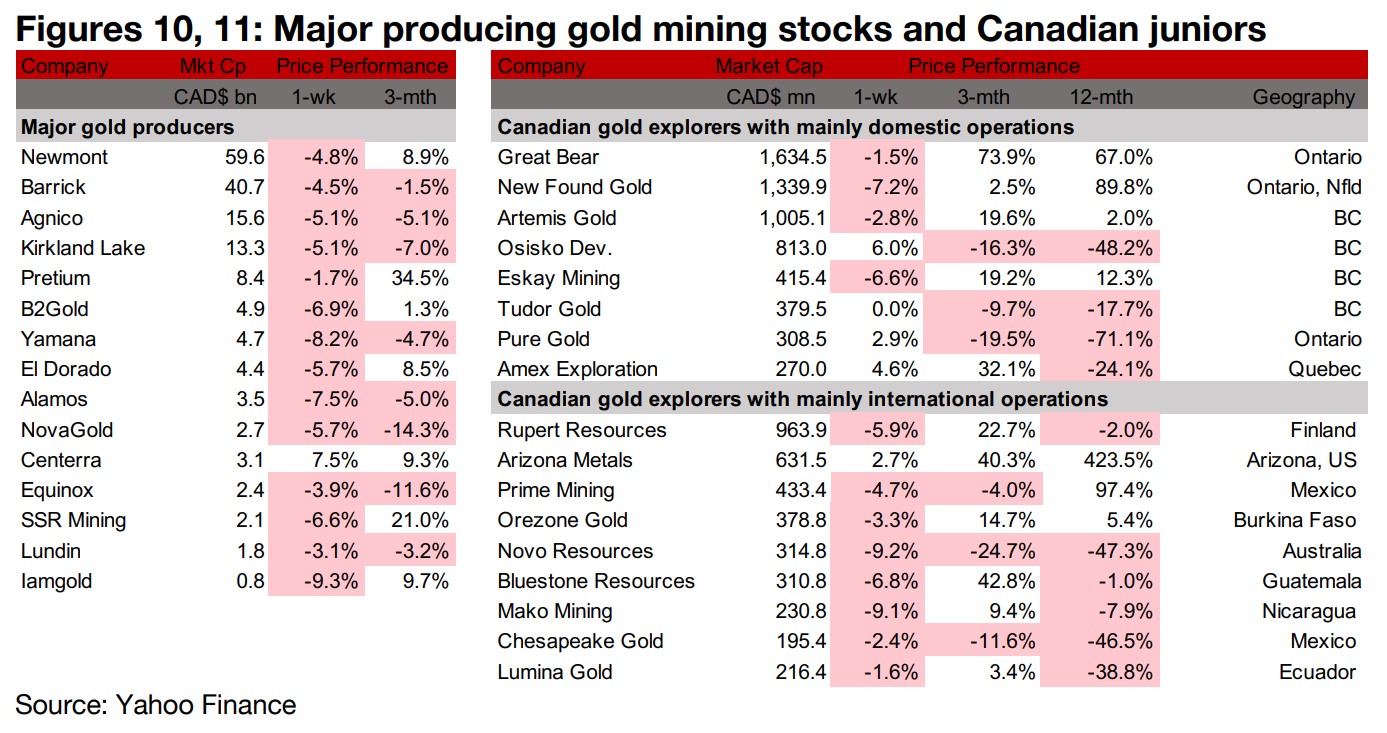

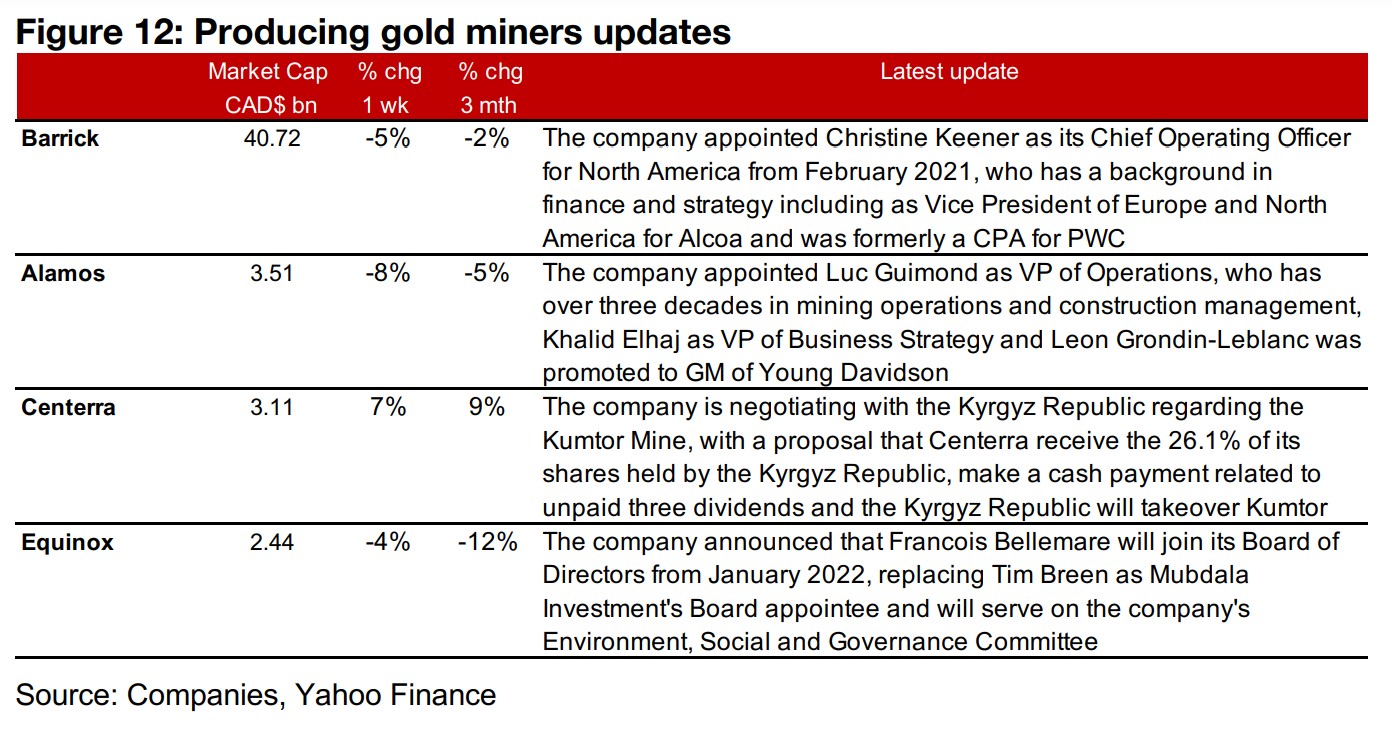

Producers down as gold declines on potentially more hawkish Fed

The producing gold miners were nearly all down with gold declining on the potentially more hawkish Fed (Figure 10). Barrick appointed Christine Keener as its new CFO for North America, and Alamos appointed a new VP of operations, Luc Guimond, and new VP of Business Strategy, Khalid Elhaj, Centerra announced a proposal in its negotiations with the Kyrgyz Republic for the Kumtor Mine, and Equinox announced that Francois Bellemar with join its Board of Directors in January 2022 (Figure 12).

Canadian juniors mostly decline as gold drops

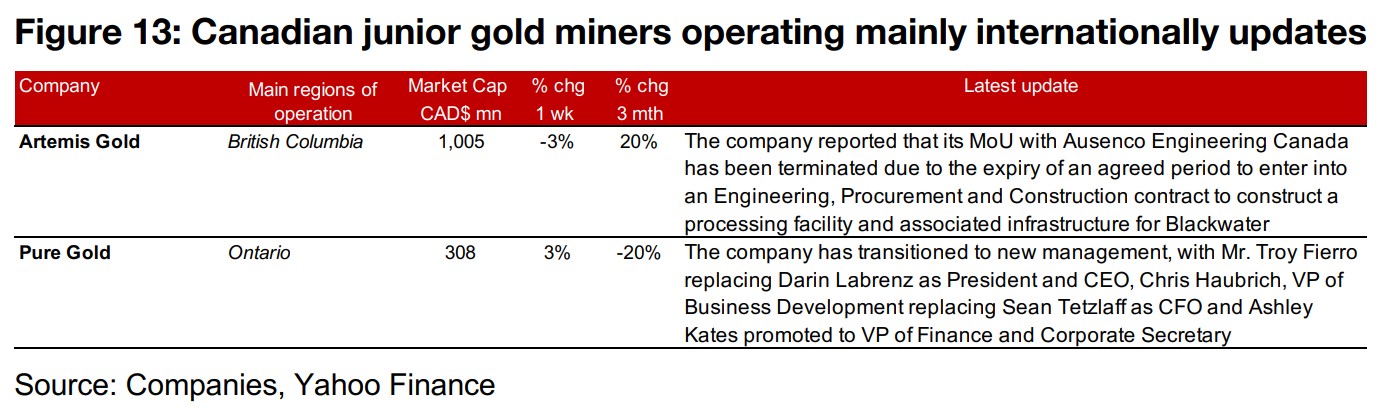

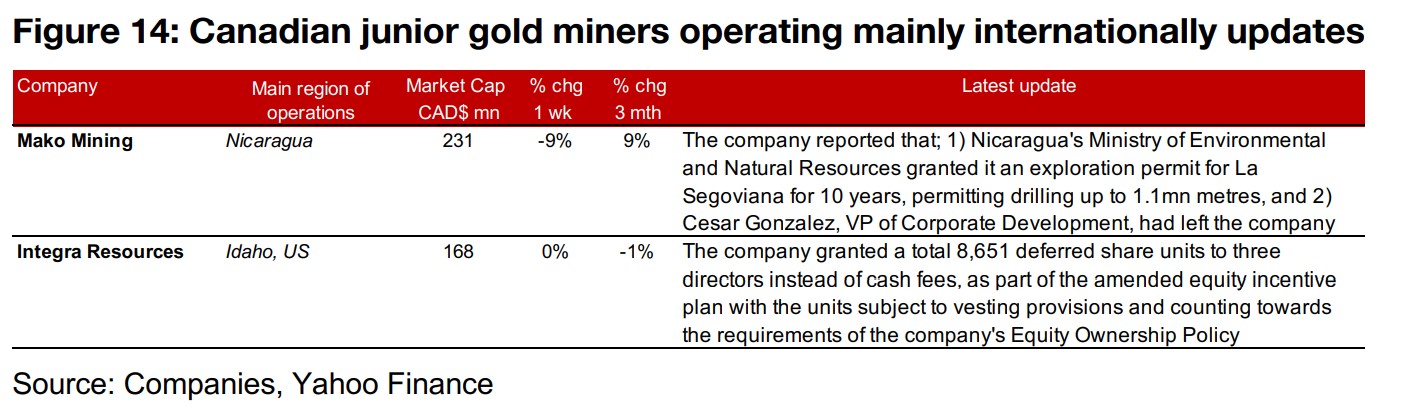

The Canadian juniors mostly declined as gold dropped over concerns that the Fed might cut its monetary stimulus earlier than was previously expected (Figure 11). For the Canadian juniors operating mainly domestically, Artemis reported that its MoU with Ausenco Engineering had been terminated due to the expiry of an agreed period to enter into a contract, and Pure Gold announced that it had transitioned to new management with more experience in mine operations as it has entered production (Figure 13). For the Canadian juniors operating mainly internationally, Mako reported that it received an exploration permit for ten years from Nicaragua's Ministry of Environmental and Natural Resources, and that its VP of Corporate Development had left the company, and Integra granted 8,651 deferred share units to three directors (Figure 14).

Disclaimer: This report is for informational use only and should not be used an alternative to the financial and legal advice of a qualified professional in business planning and investment. We do not represent that forecasts in this report will lead to a specific outcome or result, and are not liable in the event of any business action taken in whole or in part as a result of the contents of this report.