January 29, 2021

Gold ETFs and Royalties Companies

Gold edges down

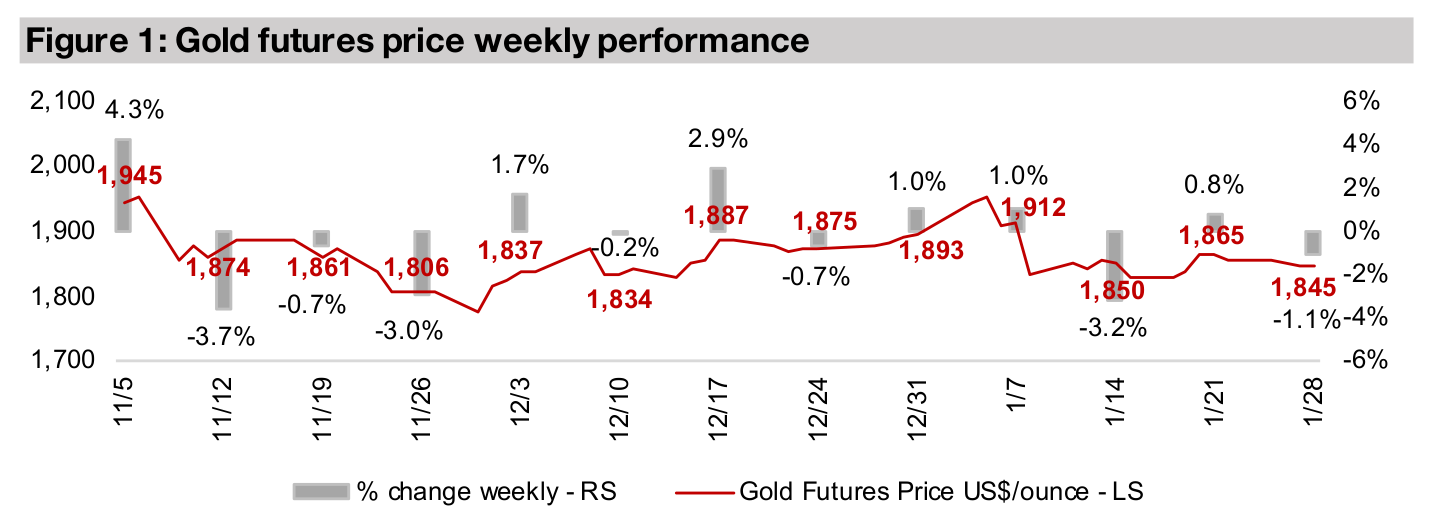

Gold edged down -1.1% to US$1,845/oz this week, as a gain in the US$ was offset somewhat by a decline in bond yields and a drop in equity markets, driven by extreme stock speculation leading to concerns of potential major losses at hedge funds.

Considering Gold ETFs as a benchmark

This week we investigate the underlying composition of the main gold ETFs used as proxies for the industry, the GDX and GDXJ, and show how the S&P/TSXV Metals and Mining Index is a better measure of the Canadian junior miners that we look at.

Equity markets volatile this week on speculators

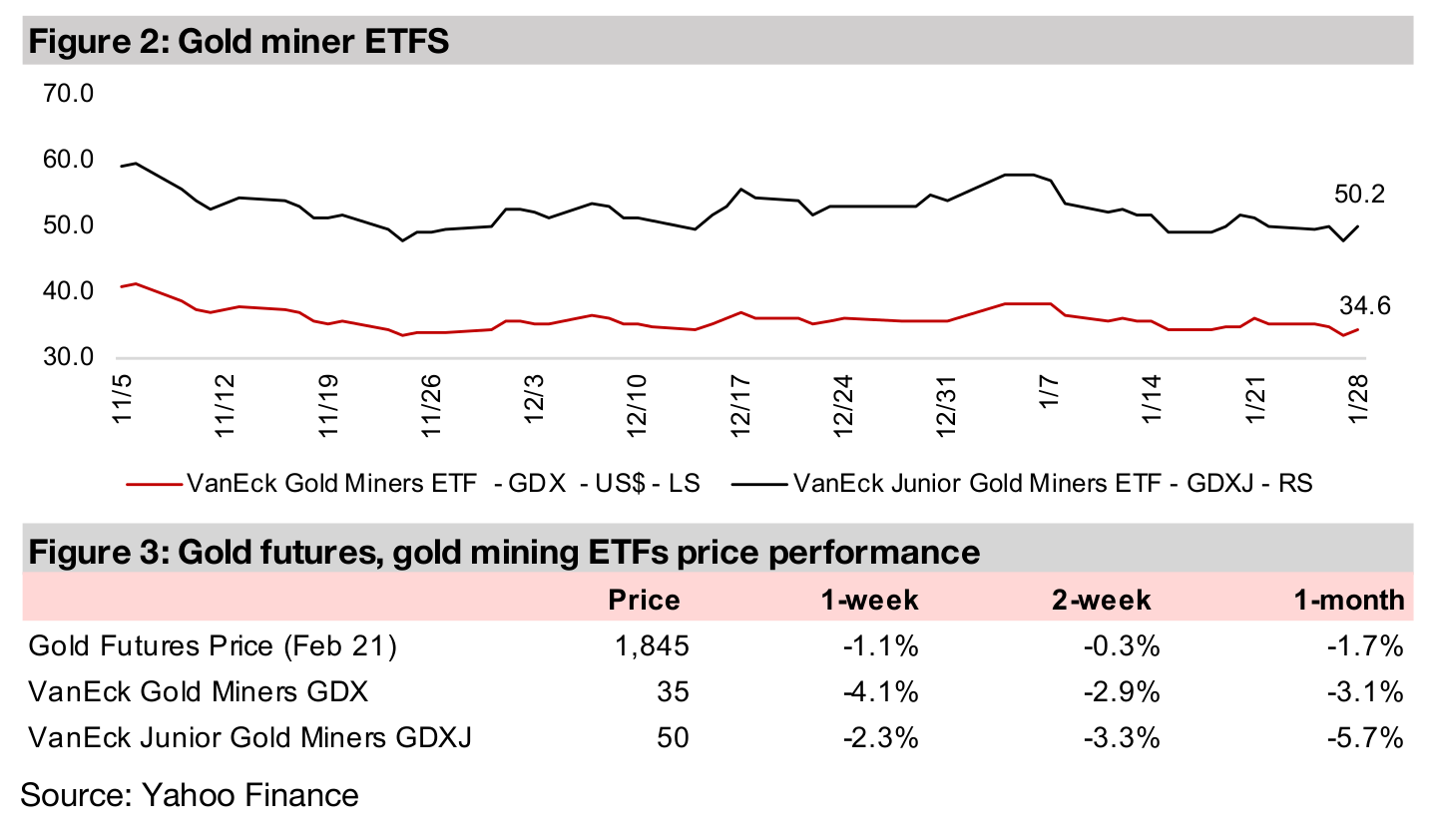

Gold edged down -1.1% this week, as the US$ rose but bond yields dipped, and was a moderate move compared to the big swing in the US equity market. There had been major speculation in some equity names, as retail investors are trying to drive some short-selling hedge funds out of specific holdings, causing some concern that these funds may be sitting on major losses that could spill over into the rest of the market. The market volatility led to a -4.1% decline in the GDX, a proxy for the producing gold miners, but only a -2.3% decline in the GDXJ, comprising junior gold miners. Generally, declines in the GDXJ tend to be larger than the GDX when the gold price falls, because of the higher risk of the juniors. That this did not happen, and only larger names sold off, and given that the gold price only edged down, suggests that the move this week is from a broader fallout in larger caps from the speculation issues, and not really so much about fundamentals in the gold sector.

Unpacking the Gold ETFs versus the S&P/TSXV mining index

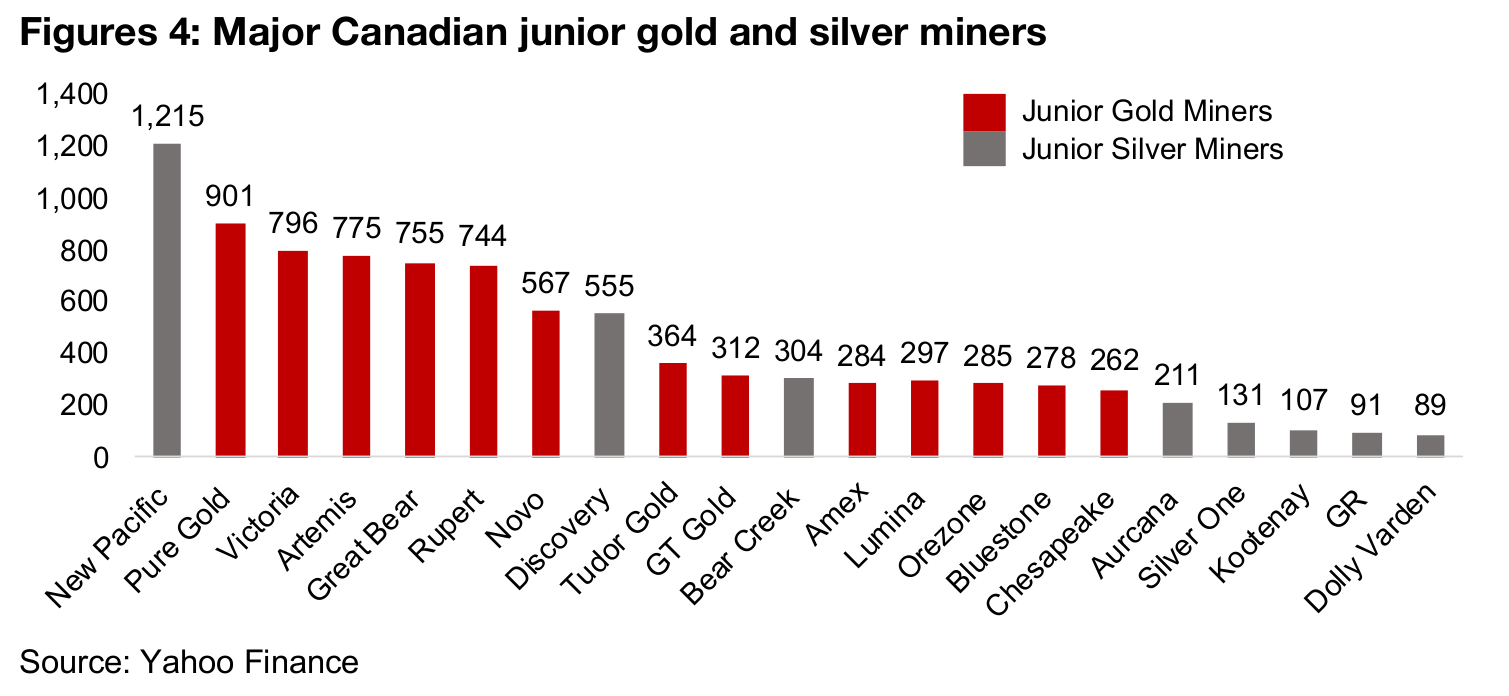

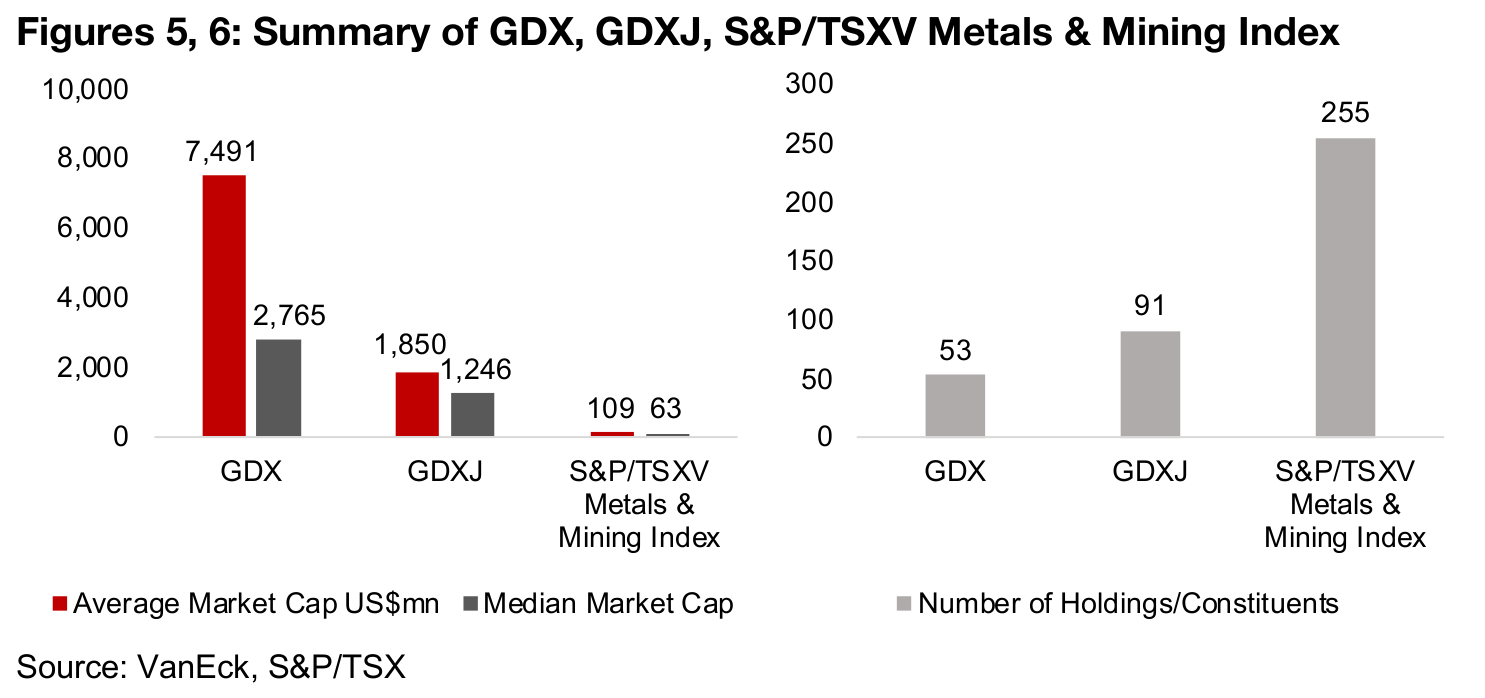

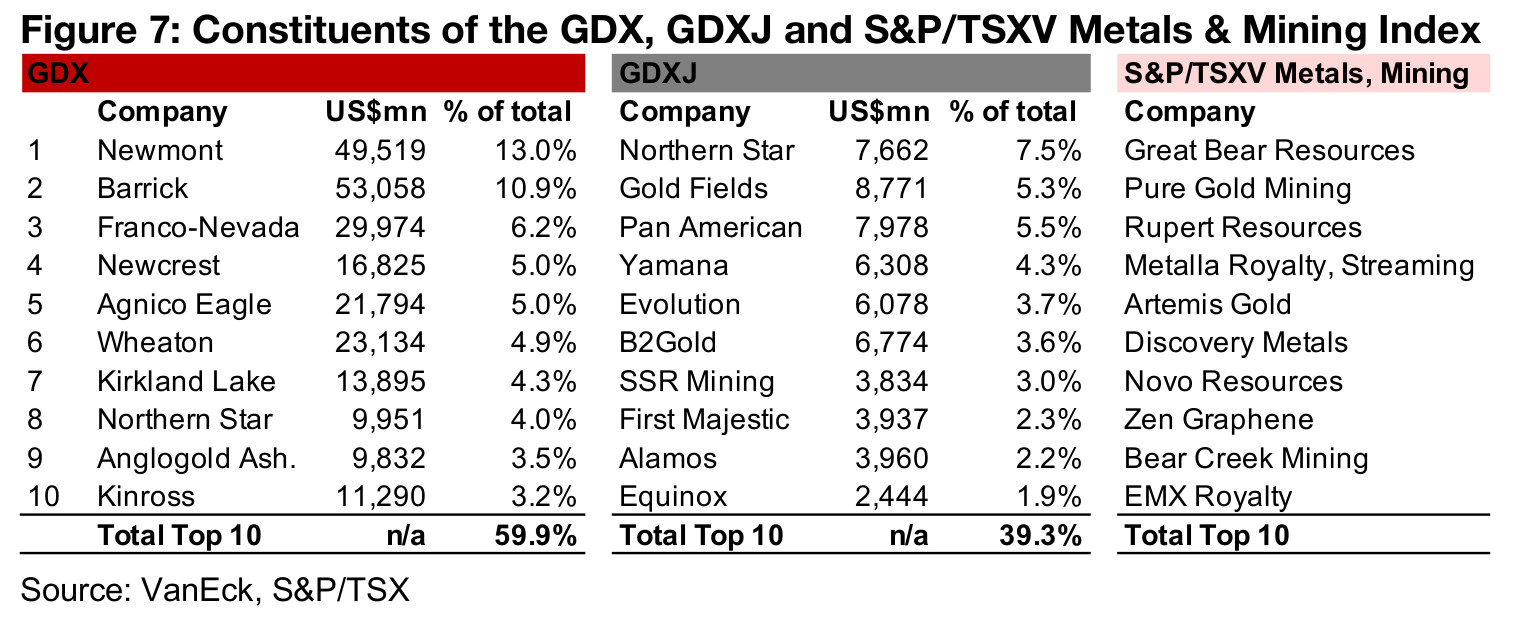

This week we compare the Gold ETFs generally used a proxies for the global gold mining industry, with another proxy that we view as more accurately reflecting the performance of the Canadian junior miners that we regularly track, with their market caps shown in Figure 4. Clearly these companies are quite small in the context of GDX, for example, which holds producing miners with an average market cap of $7,491mn, and the GDXJ, with an average market cap of $2,765mn (Figure 5).

The major holdings of the GDX are shown in Figure 7, with the top ten of 53 holdings around a market cap of $10bn or higher (Figure 6). The Canadian juniors we track have a market cap less than 10% of the size of even the average stock in GDXJ, which is considered a 'junior' miner ETF. While some of the juniors we regularly cover do appear in the GDXJ, for example, K92, Great Bear and Pure Gold, they are well down the list, at the 29th, 59th, and 61st largest holdings, respectively.

Given the composition of these two ETFs, while they are helpful in gauging the overall

global temperature of the industry, they are far from perfect proxies for the Canadian

juniors we focus on. The S&P/TSXV Metals and Mining Index is a much closer proxy,

with the top ten constituent list showing five of the gold stocks we look at included,

Great Bear, Pure Gold, Rupert, Artemis and Novo. While this is not a purely gold index,

like GDX and GDXJ, two of the other names in the top 10 are also Canadian junior

silver stocks we look at, Discovery and Bear Creek. The other three in the top ten are

two gold and silver royalty and streaming companies, and a graphite company.

In general the S&P/TSXV Metals & Mining Index could be considered a much closer

benchmark for the companies that we cover, than the GDX or GDXJ. However,

developments in the GDX and GDXJ remain important to track because there is an

important feed through effect from the companies in these ETFs to the juniors, as

these larger companies are often the ones providing capital and making acquisitions

that are the lifeblood of the juniors.

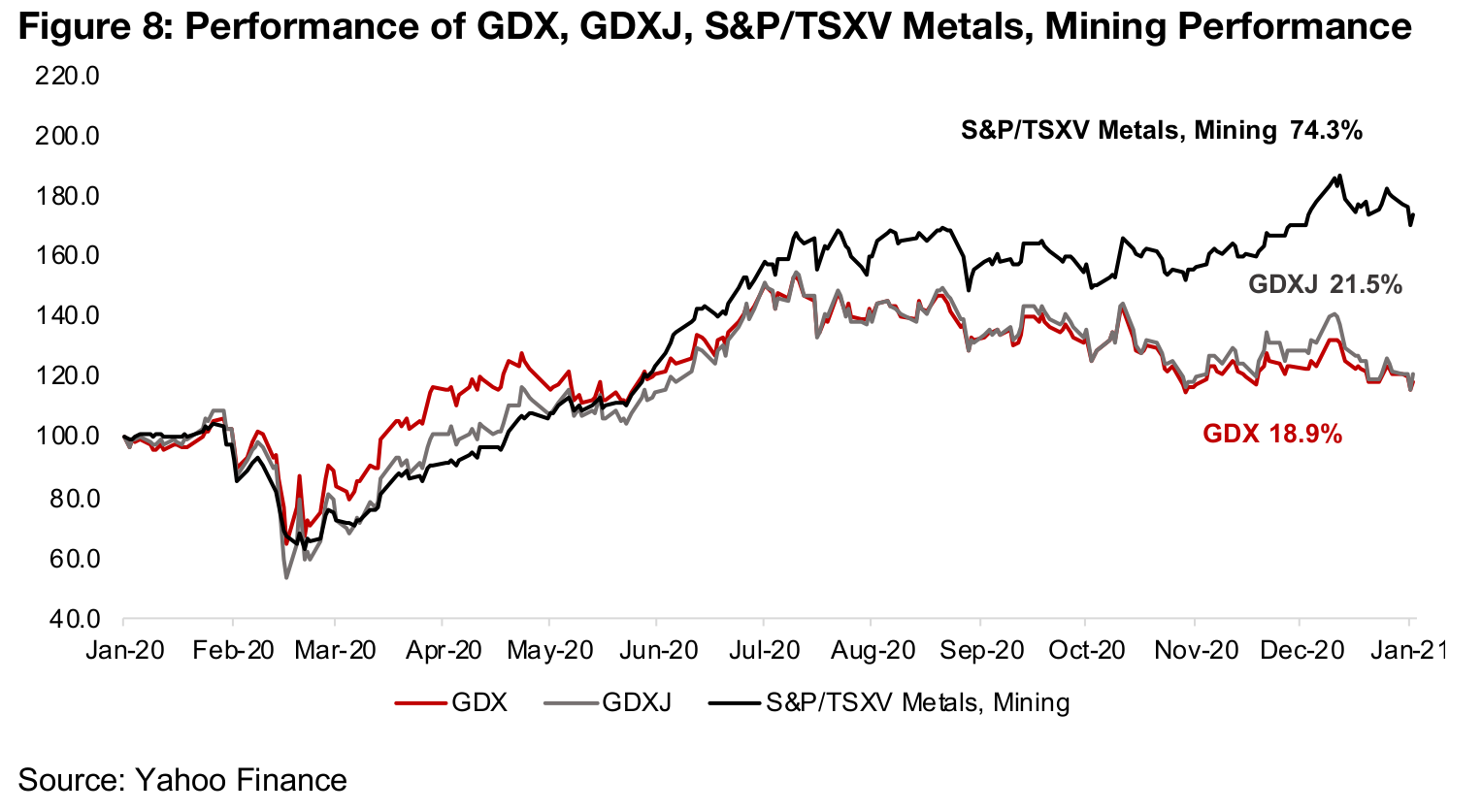

While the GDXJ and the GDX have performed well over the past year, up 21.1% and

21.1%, the S&P/TSXV Metals and Mining index has seen nearly four times the level

of gains as these ETFs, surging 79.9%, as the Canadian junior miners have really had

an epic year. This demonstrates the much higher risk-reward matrix of these junior

miners, many of which are defined as 'microcap' (or stocks with market cap of about

$50mn-$300mn) in an environment of high and rising gold. In a low gold price

environment, investors focus on the fact that juniors often are on the cusp of running

out of capital within a year or two, as they run down cash through exploration.

However, in a strong gold price environment, capital becomes more plentiful and

investors become more focussed on the potential for strong new finds given the

increased cash to expand exploration, and the potential for companies to be acquired.

Under these circumstances, there is the chance for juniors to have much higher

percentage stock price gains than a producing miner, for which such major upside

surprises are limited, with their production and costs known well in advance.

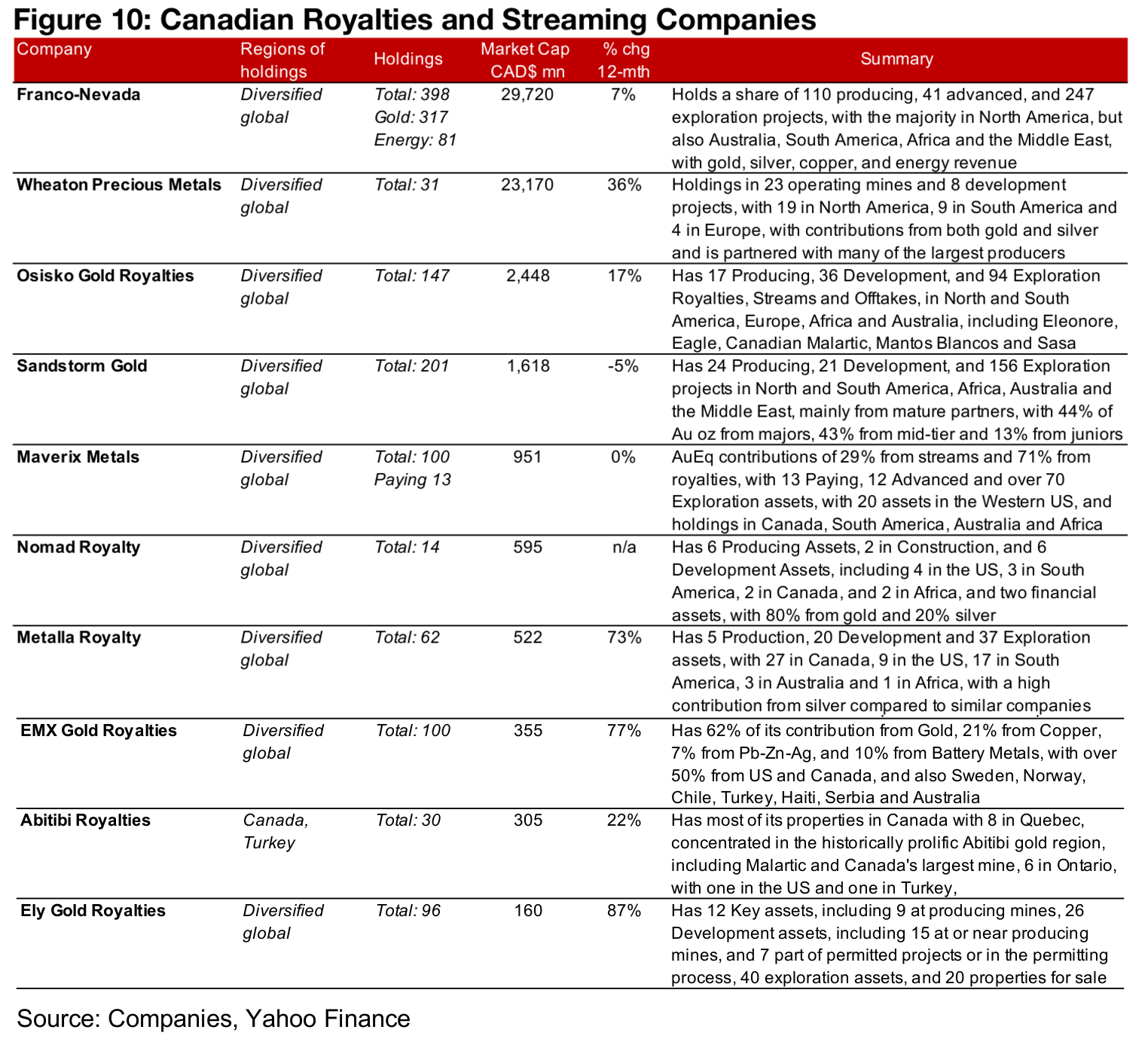

Royalty and Streaming companies are diversified and lower risk

While investing in a junior gold miner with a single project in the early stage of exploration is pretty much as risky as it gets in the gold mining space, Royalty and Streaming companies are probably about as risk-averse as the sector gets. These companies take either revenue or actual gold delivery from many projects, in various types of arrangements, with payment ranging from a large amount upfront to more fluid payments as projects progress. This means that the Royalty and Streaming companies do not incur the major costs and risks of actually developing a mine, while offering diversification across many projects.

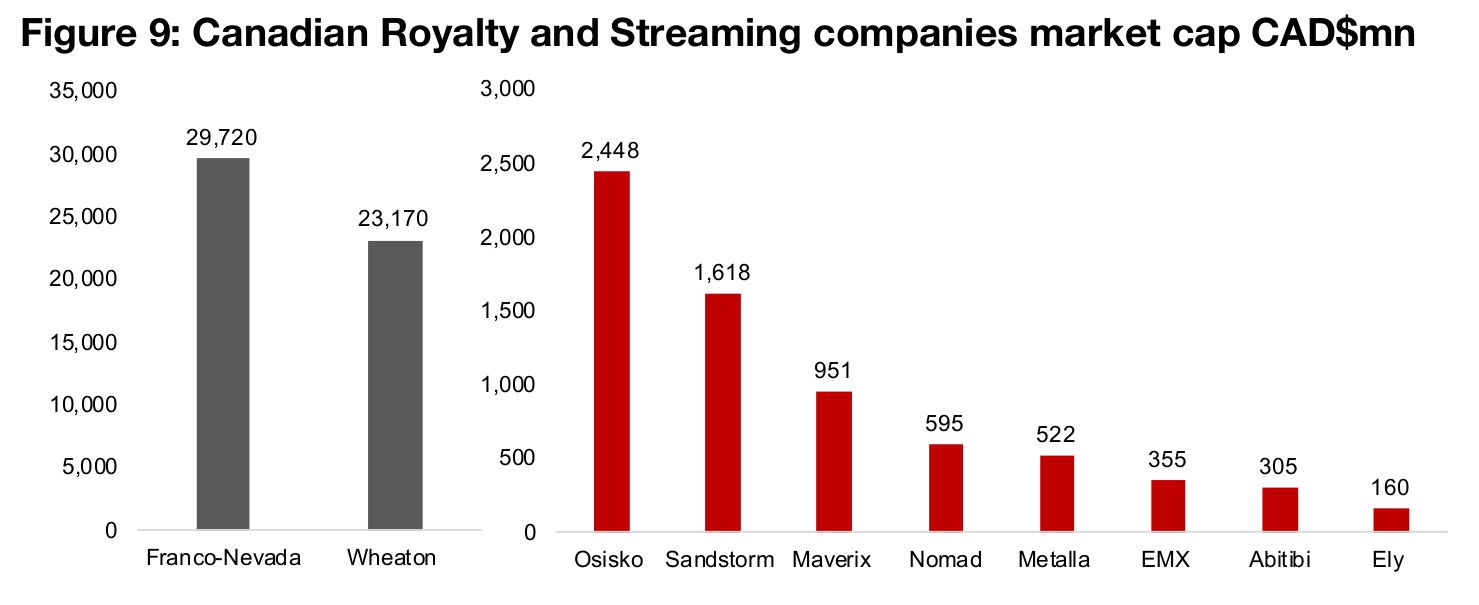

The major Canadian Royalty and Streaming companies are shown in Figures 9 and

10. There are two industry giants that clearly stand-out, Franco-Nevada and Wheaton

Precious Metals, and the next largest, Osisko Gold Royalties, is about a tenth the size.

Most of the companies offer strong diversification not only across multiple projects,

but across multiple countries, with only Abitibi Royalties seeing some geographic

concentration, being mainly focused on Canada, although even this company has

Royalties from multiple provinces. We would expect these companies to do well in a

low gold price environment, where investors want to play on a potential rise in the

gold price, but are too wary of the downside to invest heavily in producers, which are

highly leveraged to the gold price, or the even more risky juniors. However, we would

also expect that these companies would not do as well in a rising gold price

environment, with leverage to the gold price kicking in for the producer and juniors.

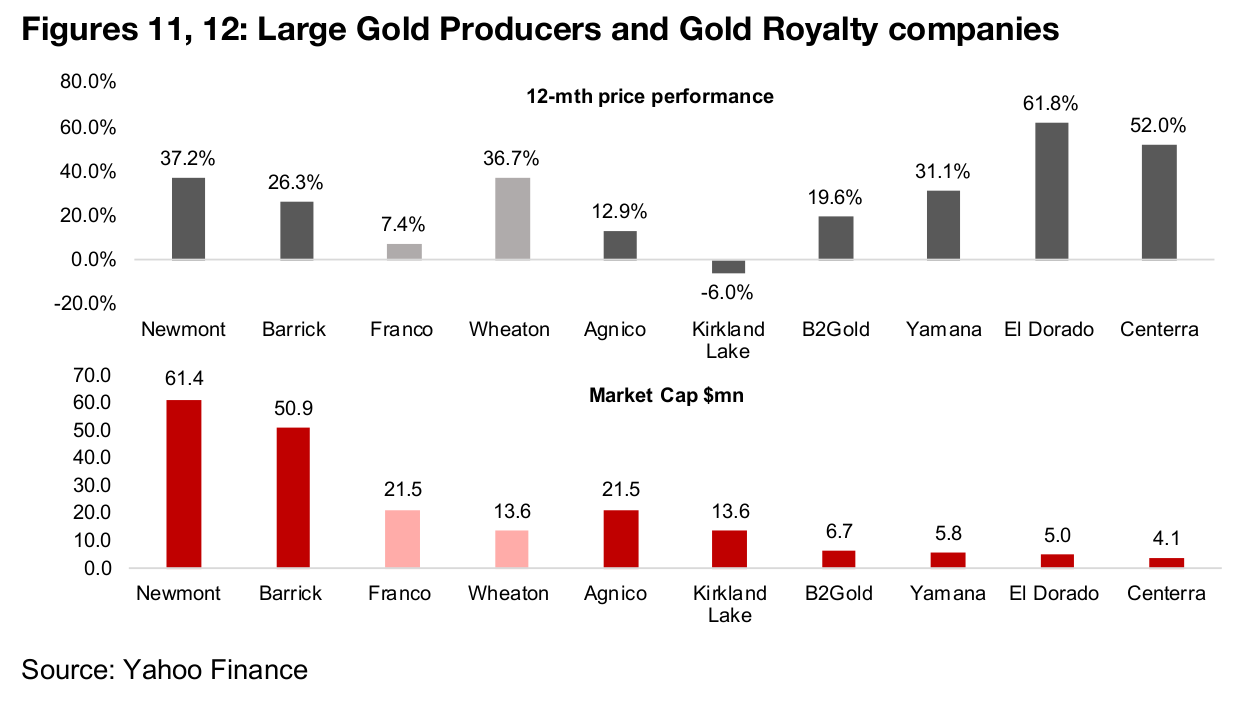

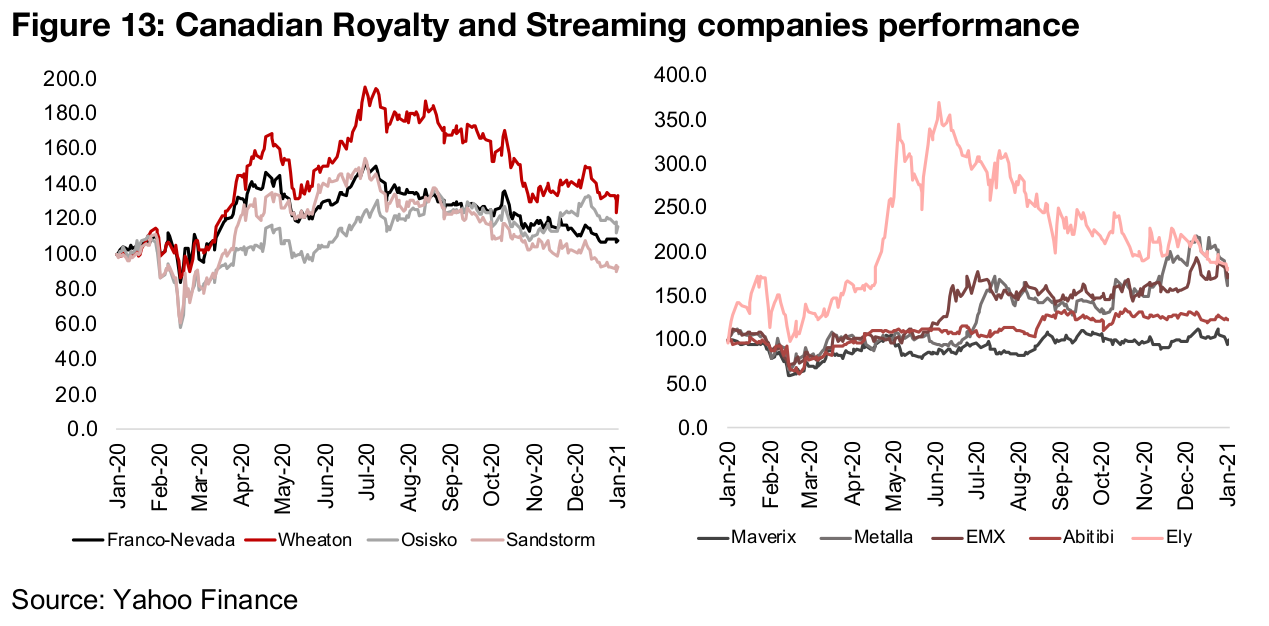

Interestingly, the largest Royalty and Streaming companies, which are also two of the

largest gold companies in the world, Franco-Nevada and Wheaton, have had a mixed

performance over the past year, that does not clearly support what we might

theoretically expect (Figures 11, 12). Franco-Nevada gained only 7.4%, compared to

37.2% for Newmont and 26.3% for Barrick, which might seem to support our thesis

of underperforming Royalties companies when gold is rising. However, Wheaton rose

36.7%, surpassing both Newmont and Barrick. The prices of other Royalties and

Streaming companies are also mixed, and some have even declined (Figure 13). So

in general, the performance of these companies will really depend on what Streams

and Royalties they have, the terms of their deals, and whether the share price has

already incorporated all the upside. What we can bet on, however, is that Royalties

and Streaming companies are very unlikely to provide the several hundred

percentage point gains that can sometimes be achieved by a junior miner in a year.

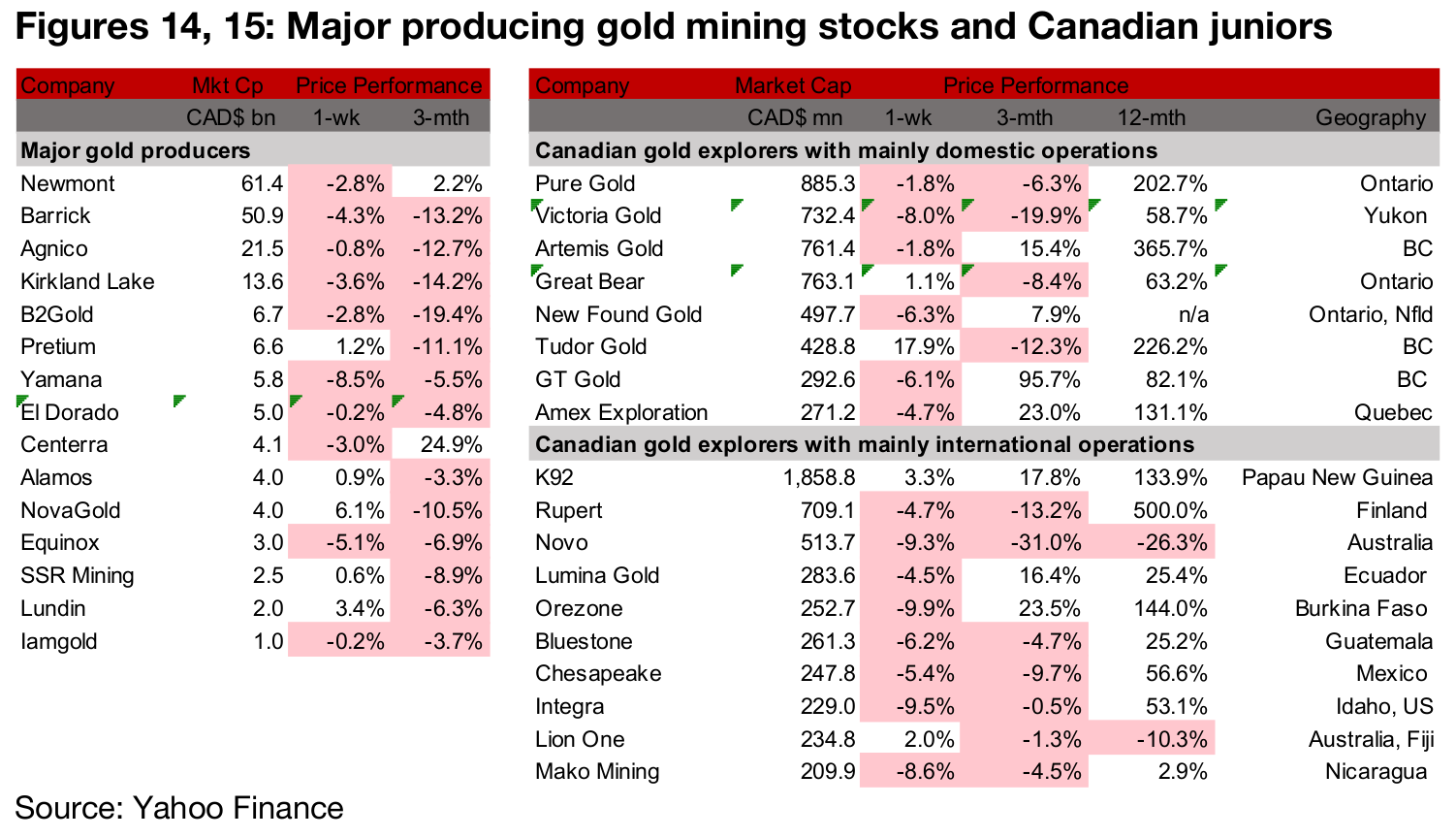

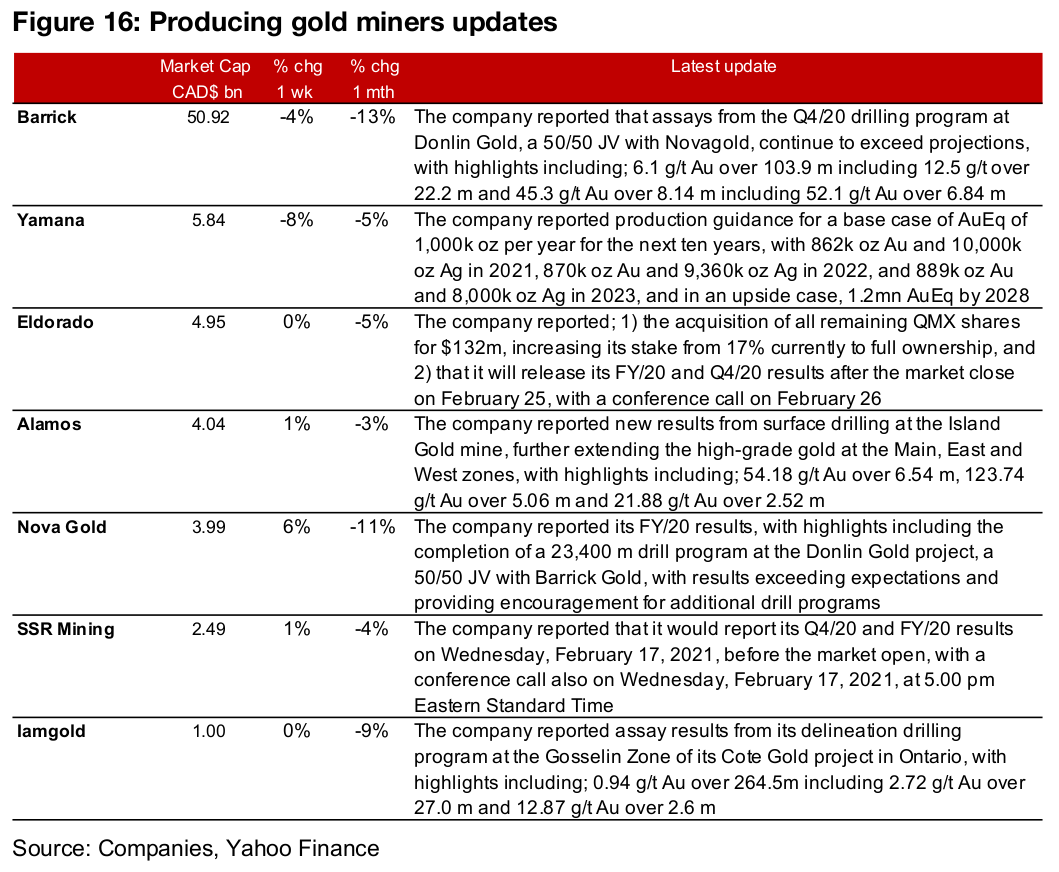

Producers mixed on slight dip in gold

The producing miners were mixed this week on the dip in gold (Figure 14). Barrick and Novagold reported news on their 50/50 joint venture, Donlin Gold, with drilling continuing to exceed expectations, and Novagold reported FY/20 results. Yamana reported production guidance for the next decade, El Dorado increased its holding of QMX to 100%, and announced its FY/20 release date. Alamos reported results from surface drilling at the Island, SSR mining announced its FY/20 results date and Iamgold reported new assay results from the Gosselin Zone of Cote (Figure 16).

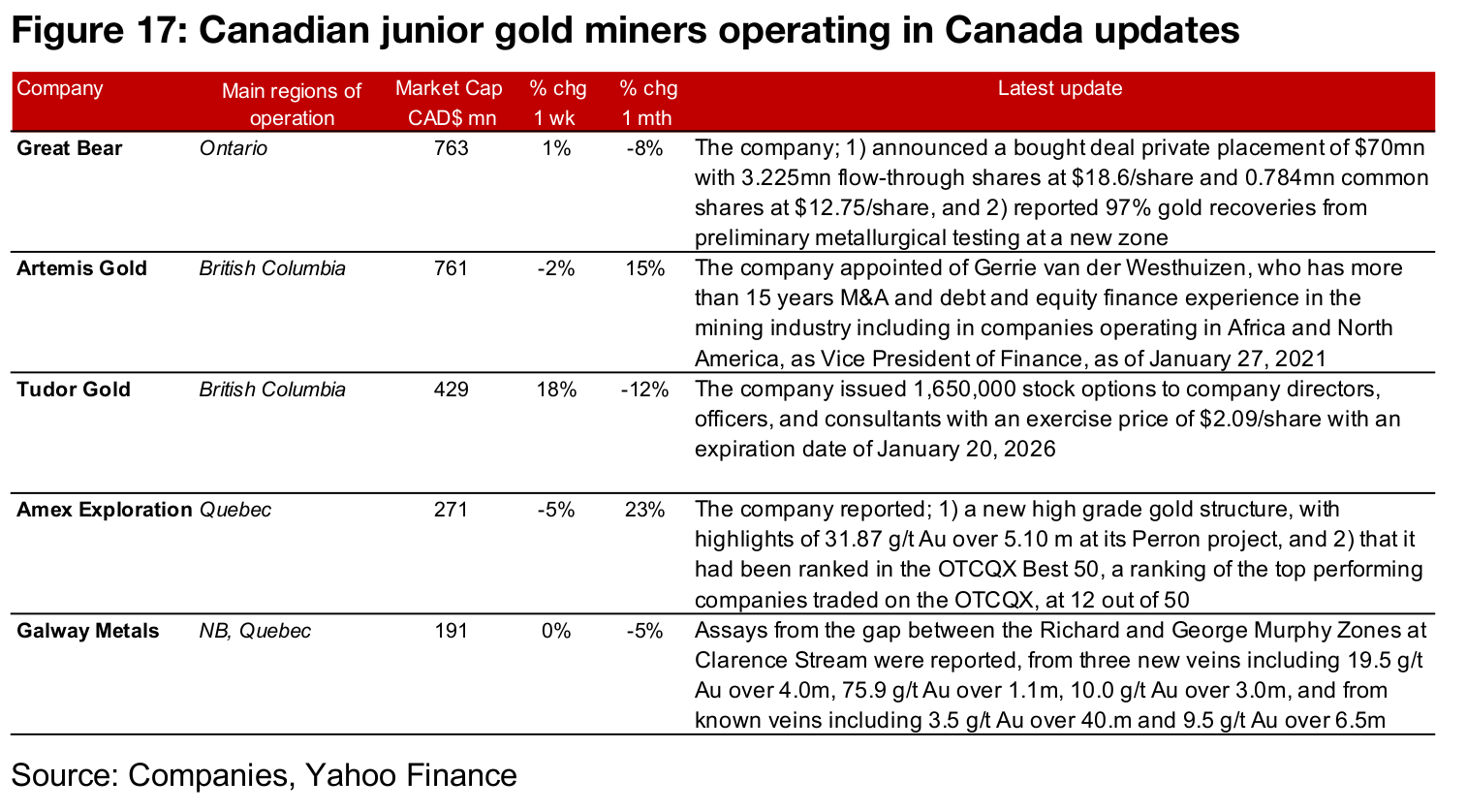

Canadian juniors mostly decline

The Canadian juniors were mainly down this week (Figure 15). News flow from the

Canadian juniors included Great Bear announcing a bought deal private placement

and 97% gold recoveries from preliminary metallurgical testing at a new zone,

Artemis appointing a new Vice President of Finance and Tudor issuing stock options

to company employees. Amex reported a new high-grade gold structure, and that it

had been ranked in the OTCQX Best 50, and Galway reported new assays from a gap

at the Clarence Stream project. (Figure 17).

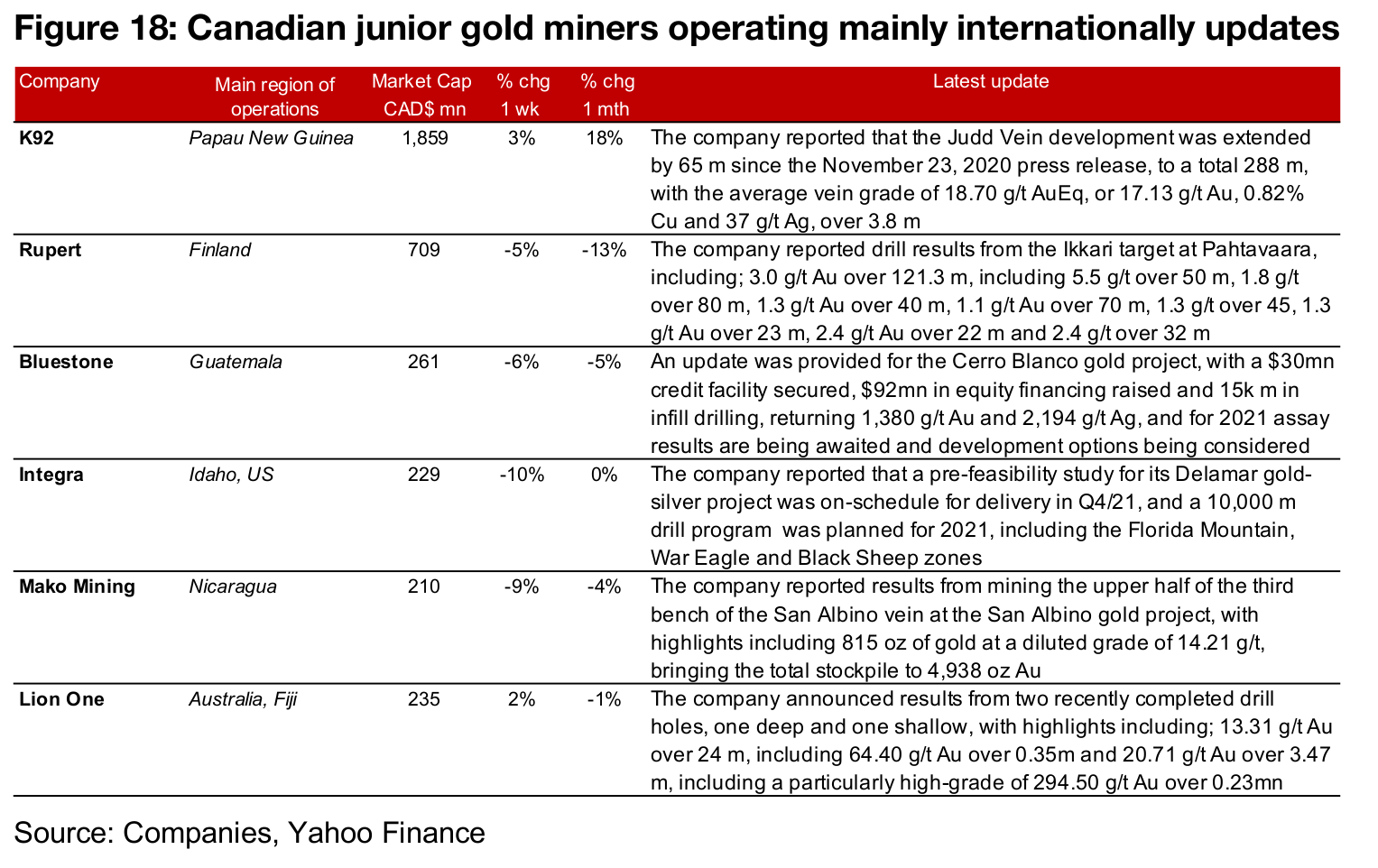

For the Canadian juniors operating internationally, K92 reported an extension to the

Judd Vein, Rupert reported new drill results from the Ikkari target at Pahtavaara and

Bluestone reported a FY/20 update on the Cerro Blanco project, and 2021 plans.

Integra reported that its pre-feasibility study for Delamar was on-schedule for delivery

in Q4/21 and that a 10,000 m drill program was planned for 2021. Mako Mining

reported results from its San Albino gold project and Lion One announced results

from two recently completed drill holes (Figure 18).

Disclaimer: This report is for informational use only and should not be used an alternative to the financial and legal advice of a qualified professional in business planning and investment. We do not represent that forecasts in this report will lead to a specific outcome or result, and are not liable in the event of any business action taken in whole or in part as a result of the contents of this report.