November 18, 2024

Gold Down on Geopolitical Risk Drop

Author - Ben McGregor

Crypto stealing some of gold’s thunder

Crypto has surged since Trump’s win, and the launch of major ETFs for the sector this year has likely stolen some of gold’s thunder, given that it is also an ‘unprintable’ asset, with the IBIT Bitcoin ETF value surging to near 60% of the GLD gold ETF.

Gold Down on Geopolitical Risk Drop

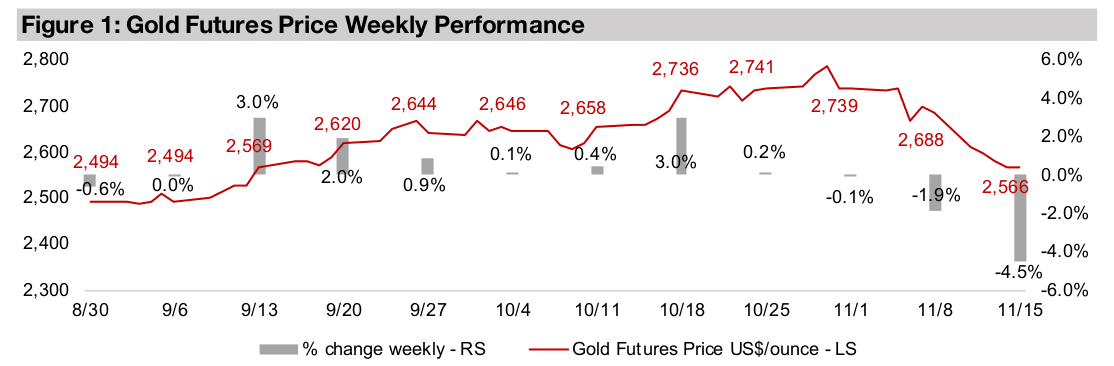

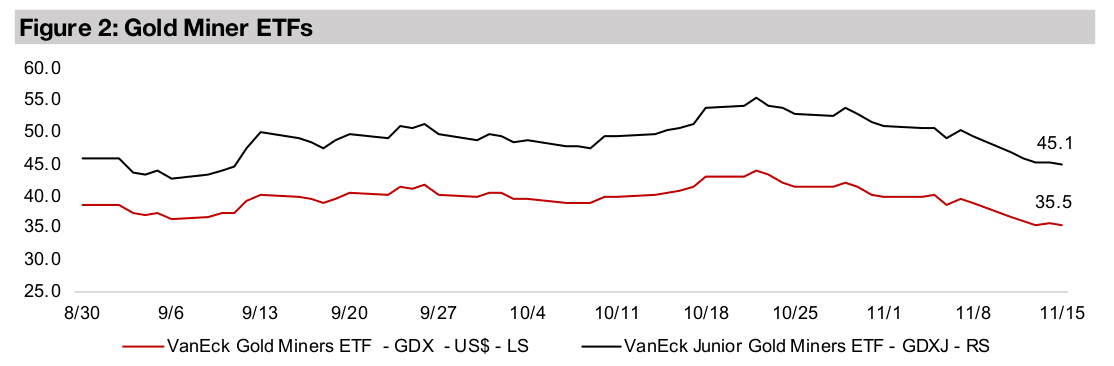

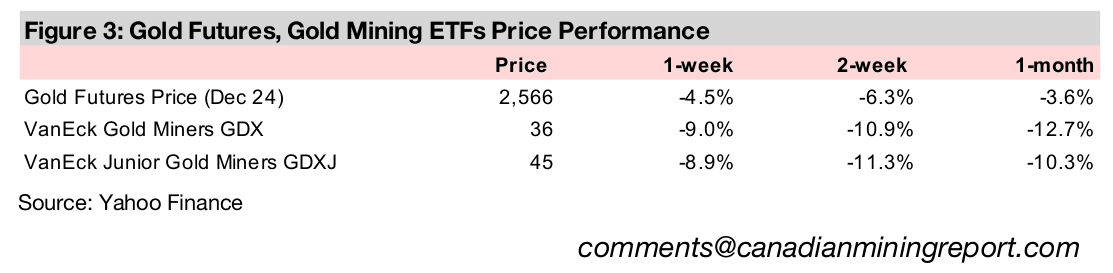

The gold price slumped -1.9% to US$2,566/oz, and is down about US$200/oz from

its peak two weeks ago. While this was partly driven by a continued rise in the

US$ and yields, it also appears to be from a perceived decline in geopolitical risk

since Trump’s win, given a track record of low international conflict in the president’s

previous term. Equities also tumbled as a post-Trump-win bounce faded, and current

realities of high valuations and persistent inflation seemed more in focus than hopes

for eventual economic improvement under the new president. The S&P fell -2.3%,

the Nasdaq -3.5% and Russell 2000 -4.7%, and the metal price and equities slump

dragged down gold stocks, with the GDX down -9.0% and GDXJ by -8.9%.

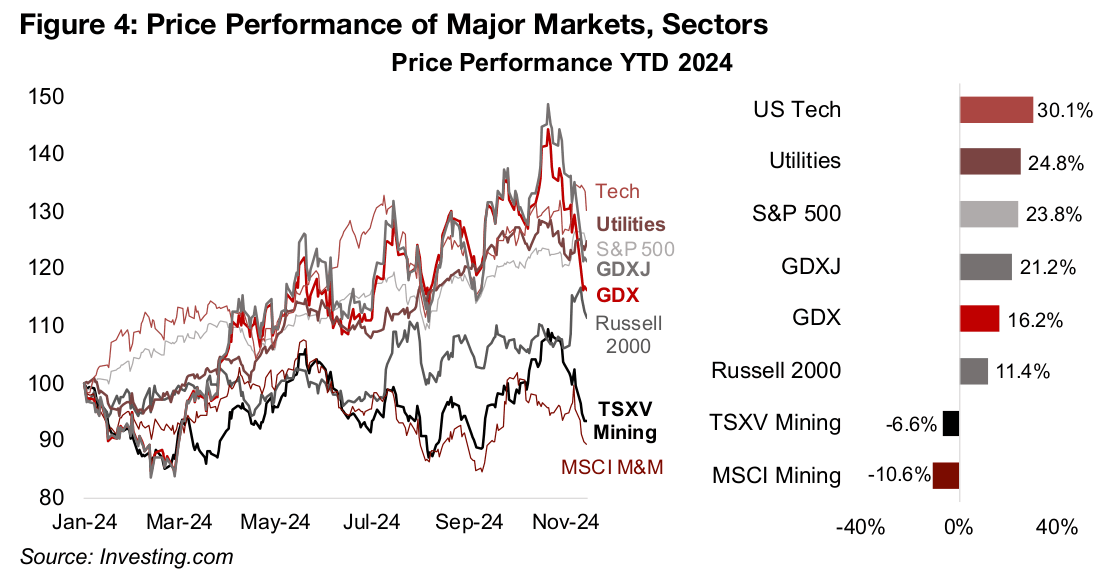

This has sent the year to date performance for gold stocks again below tech, which

is again a top performer for 2024 with a 30.1% rise, although the GDXJ and GDX are

still up a decent 21.2% and 16.2%, respectively (Figure 4). Tech has had a closer

race with utilities, which is up 24.8% this year, with the battle between these sectors

representing the split in sentiment for the market between aggressive positioning and

risk aversion, which is a shift from a 2023 that saw less concern over hedging.

The rise in safe haven gold and gold stocks is another sign of a more defensive

posture by markets this year, and we expect that the gold rally is far from over. This

week could actually be considered a healthy pullback from a particularly aggressive

ramp up in recent months, which sent gold’s ratio versus some key commodities

considerably above historical averages and indicated some frothiness. However, we

expect that the main underlying driver for gold, monetary expansion, will run into 2025,

as major central banks continue the rate cutting cycle started this year.

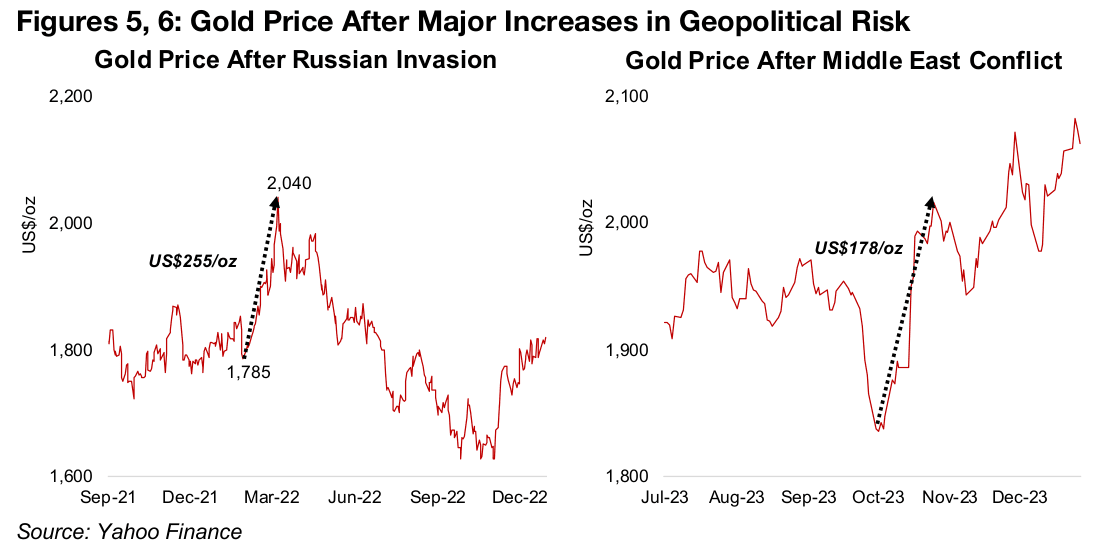

Roughly estimating the gold price’s geopolitical risk premium

We can attempt a rough quantification of just how much of a premium was in the gold

price for geopolitical risk by looking at the metal’s gains after the start of the two most

major conflicts of the past three years. The price rose US$255/oz after Russia’s

invasion of Ukraine in February 2022 and by US$178/oz after the escalation of conflict

in the Middle East in October 2023, for a combined US$433/oz (Figures 5, 6). With

neither of these conflicts easing since, we can reasonably expect that these

premiums had remained in the price until before the US election.

However, there have already been nascent signs of an improved willingness for the

parties in these conflicts to negotiate since Trump was elected. If we assume that

much of the nearly US$200/oz drop in gold was from the potential for deescalating

these tensions, we could assume roughly another US$200/oz or more is still priced

in from these conflicts. However, if we also factor in the rising US$ and yields into the

drop, the geopolitical risk premium could still be towards the US$300/oz level.

Therefore if we see further signs of the new Trump government making progress on

cooling conflict in these regions, it could drive another pullback in gold.

Crypto market size continues to catch up with gold

Another factor that could be moving against the gold price in recent weeks is a major

rise in crypto, which can be considered a substitute for the metal for investors looking

for an instrument that cannot be devalued by the creation of new supply. For crypto,

the supply of most major coins is fixed and cannot be expanded and for gold new

supply is from mine production which only grows about 2.0% per year. This contrasts

with government issued currency, which can see dramatic expansions, including

following the financial crisis of 2008-2009 and after the recent global health crisis.

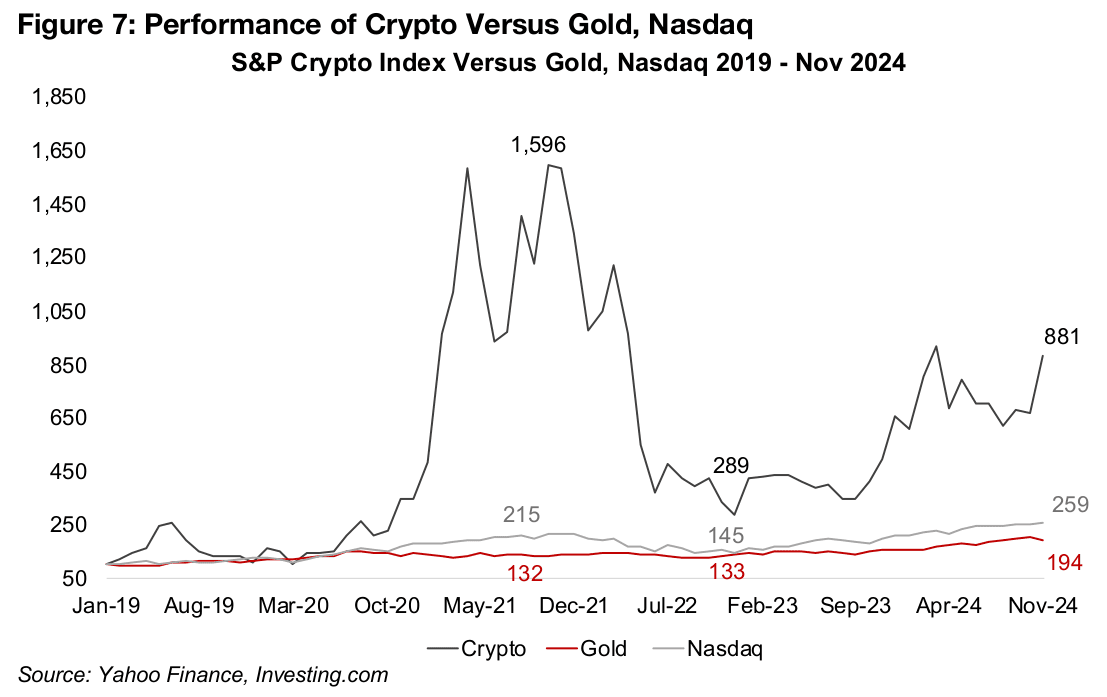

While crypto is sometimes compared to gold as a store of value, it is conversely also

often considered a risk asset, considering its correlation with the Nasdaq in some

periods. However, for the past five years, crypto has significantly outperformed both,

rising 781% versus a 159% gain in the Nasdaq and 94% rise in the gold price (Figure

7). Crypto has also proved far more volatile than either of these over the period,

reaching as high at a 1,496% gain in mid-2021 and then collapsing back to an 189%

gain as of early 2023 before once again recovering.

Overall with these wild swings, crypto cannot necessarily be considered a good store

of value over the short to medium term, although over the long-term it certainly has

had a massive increase and continues to return to new highs. While gold does have

its own issues with short-term volatility, it does not face the huge moves that crypto

does, and obviously has a far longer history as a store of value over 3,000 years.

We expect crypto and gold are likely to remain complements as much as competitors.

Crypto still has issues including lost keys to wallets and any shutdown of networks

or limited electricity availability, which will obviously not be a concern for gold. Crypto

is also not yet used by any central banks as a key reserve asset, in contrast to gold,

which comprises a substantial proportion of the monetary holdings of most major

countries. Neither is widely accepted as a form of payment, although this is more

likely to eventually change for crypto than gold. The standout common strength

between them remains that their value cannot be printed away as with fiat currency.

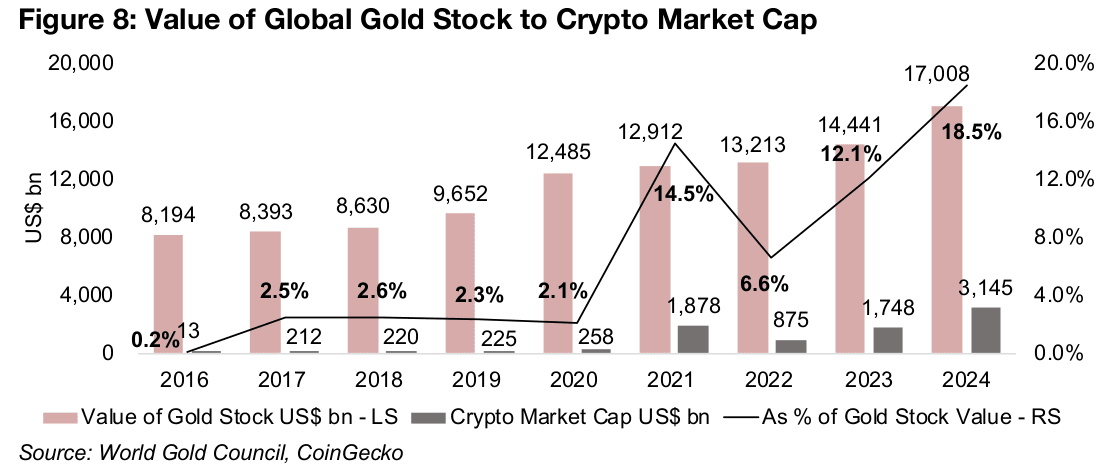

So with crypto likely to provide a different, but equally useful economic function as

gold, the size of the market has continued to catch up with the metal. One example

of this is the ratio of the crypto market cap to the value of the above ground gold

stock, which has increased to 18.5% in 2024, it highest ever (Figure 8). This ratio had

remained quite steady at just over 2.0% from 2017 to 2020, and then entered a more

volatile period, surging to 14.5% in 2021, reverting to 6.6% as crypto crashed given

major issues with some key exchanges, and then starting to recover to 12.1% in 2023.

At the current rate of expansion the crypto market cap could get to half the value of

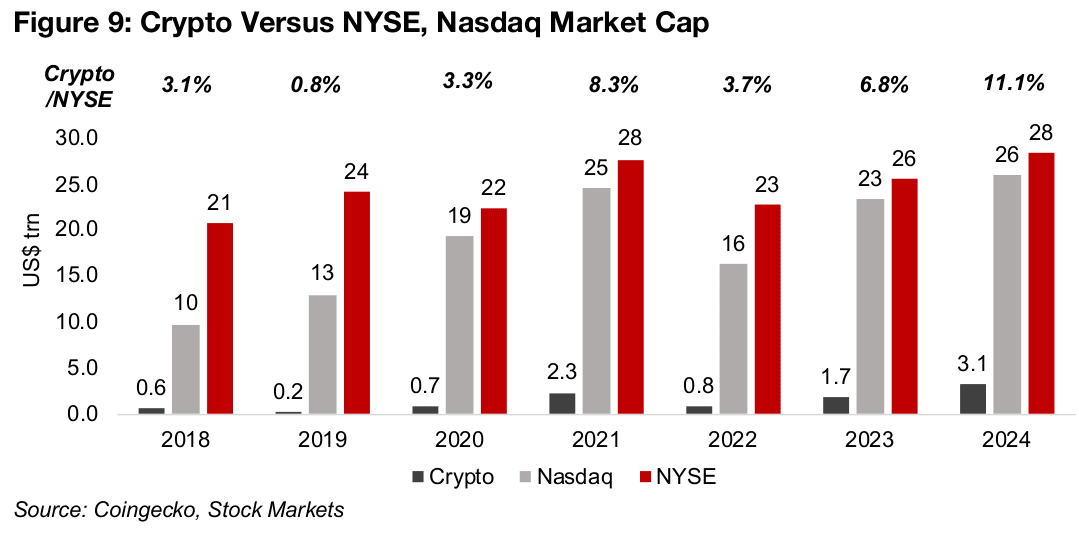

the gold stock over the next decade. The crypto market is even becoming sizeable

compared to huge equity markets, with the crypto versus NYSE market cap rising

from just 0.8% in 2019 to 11.1% in 2024 (Figure 9).

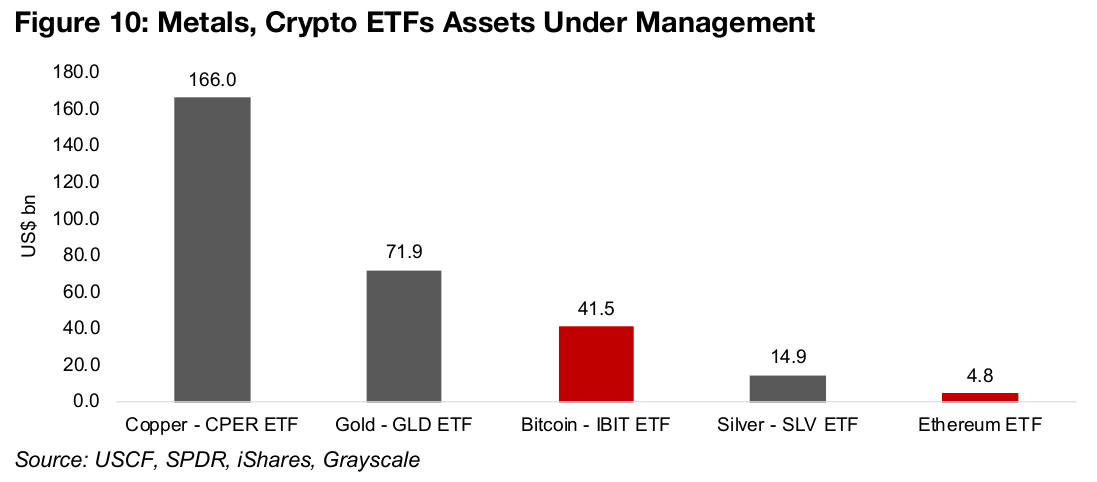

While some major crypto ETFs launched only this year, including the IBIT Bitcoin ETF, they have already reached a size within the range of many long-established metals ETFs. The IBIT ETF has assets under management (AUM) of US$41.5bn, which puts it not that far behind the largest gold ETF, GLD, with AUM of US$71.9bn, and it is now about a quarter of the value of the CPER copper ETF at US$166.0bn (Figure 10). The ETF of the second largest cryptocurrency, Ethereum, with US$4.8bn in AUM, is already about a third the size of SLV, the silver ETF.

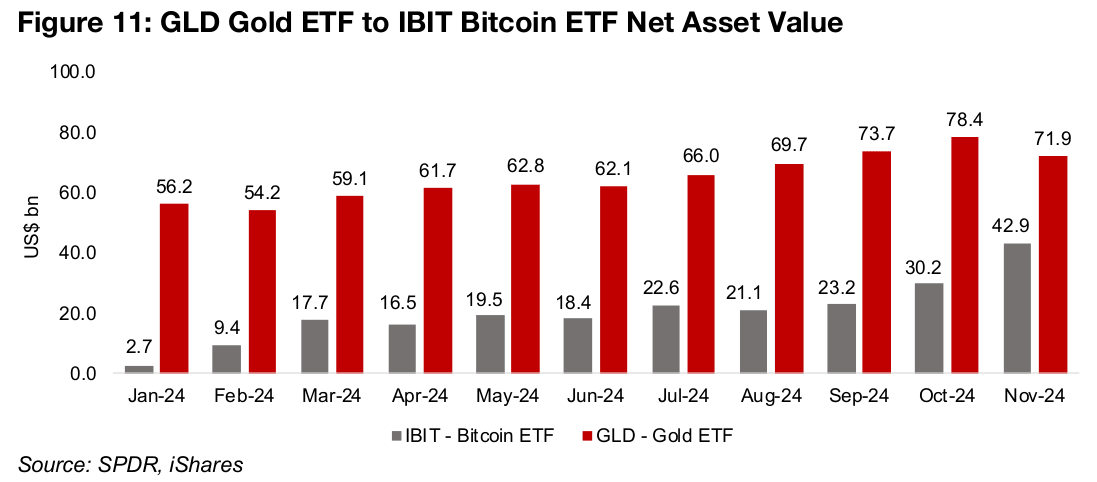

Figure 11 shows just how rapidly the growth of the IBIT ETF versus the GLD ETF has

been, starting the year with the former at just US$2.7bn in AUM, for a spread of over

US$50bn, which has declined to only about US$30bn currently. The move has been

boosted by the rarity and novelty of the cryptocurrency ETFs and the offer of a simpler

way for the wider market to invest without the more involved learning curve including

setting up wallets, which may have previously dissuaded some investors.

This could divert some of the inflows that would have otherwise gone into gold ETFs

for investors looking for protection against devalued fiat currencies long-term, that

are content to ride the short-term severe swings of crypto. With the cryptocurrency

ETFs in their relative infancy, we expect that they could continue to see strong inflows

into 2025, and at the current expansion rate the IBIT Bitcoin ETF AUM could even

surpass those of the GLD gold ETF over the next year.

However, we would hardly count out a continued popularity of gold ETFs for 2025,

and again note that crypto spikes like the one so far this year have historically been

followed by severe crashes, with often several years before new highs are reached.

If this shifts the market’s focus for cryptocurrency more towards its risk asset

characteristics than its store of value function, a long-term proven safe-haven like

gold, and its investment instruments, could still benefit.

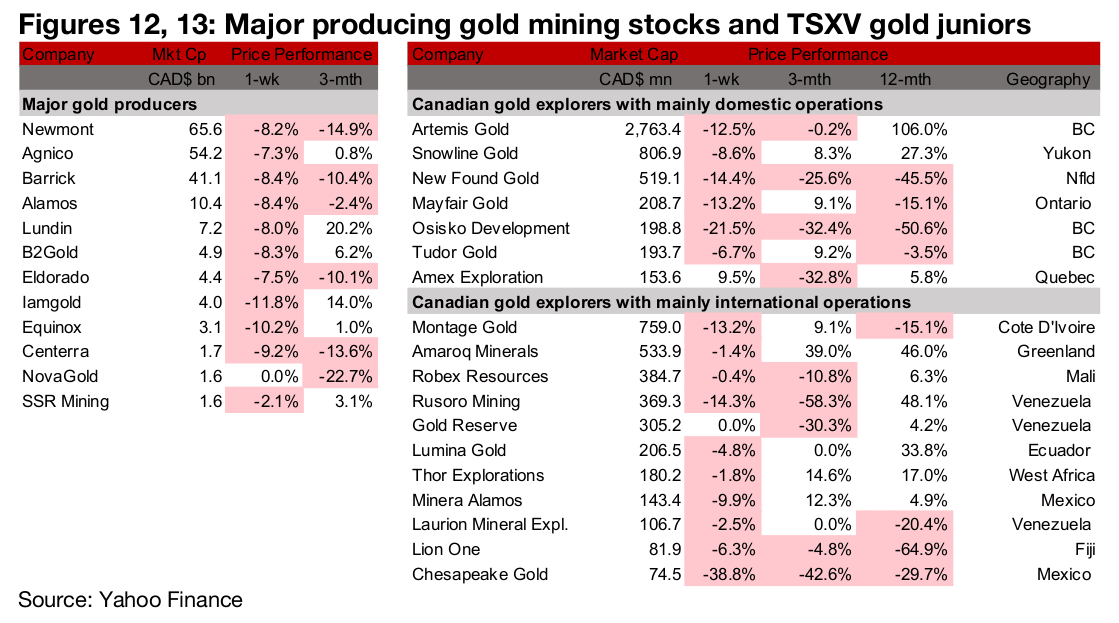

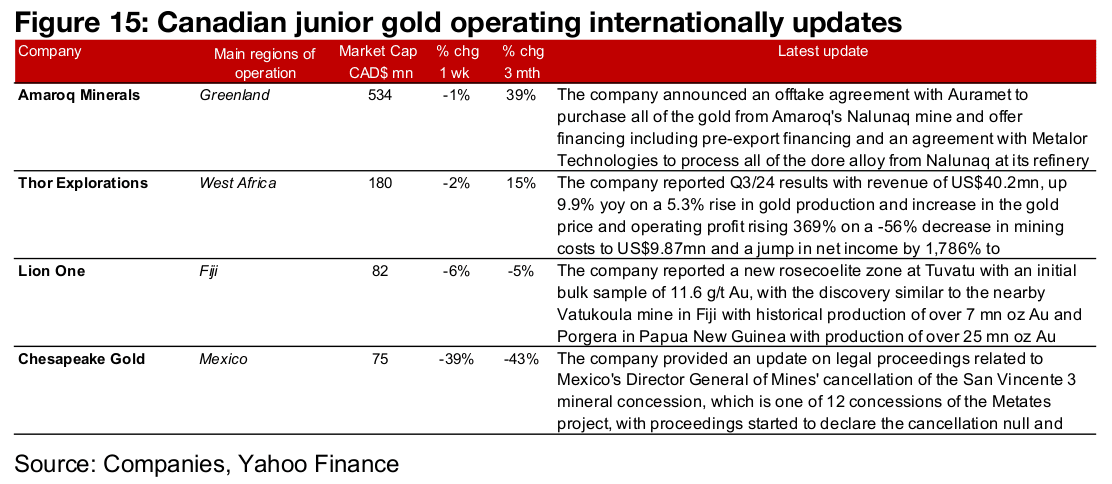

Major declines for most large producers and TSXV gold

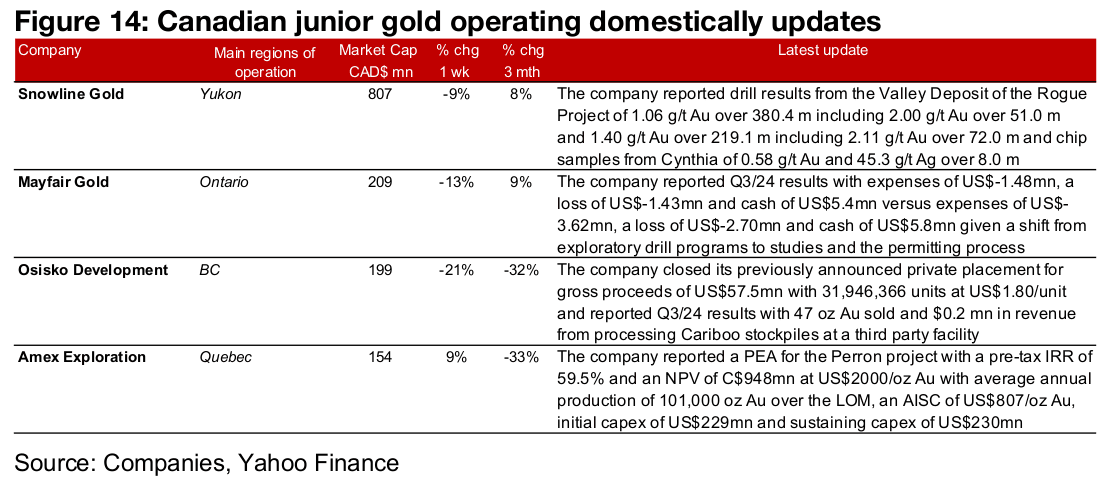

Most of the large producers and TSXV gold saw significant declines on the drop in gold and equities (Figures 12, 13). For the TSXV gold companies operating domestically, Snowline reported drill results from the Valley deposit and chip samples from Cynthia, Osisko Development closed a private placement and announced Q3/24 results, Mayfair Gold reported Q3/24 results and Amex released a PEA for Perron (Figure 14). For the TSXV gold companies operating internationally, Amaroq announced agreements with Auramet and Metalor for gold offtake and processing from Nalunaq, Thor Explorations reported Q3/24 results, Lion One announced a new zone at Tuvatu and Chesapeake provided an update on legal proceedings regarding Mexico’s cancellation of its San Vincente 3 concession, part of Metates (Figure 15).

Disclaimer: This report is for informational use only and should not be used an alternative to the financial and legal advice of a qualified professional in business planning and investment. We do not represent that forecasts in this report will lead to a specific outcome or result, and are not liable in the event of any business action taken in whole or in part as a result of the contents of this report.