May 21, 2020

Gold breaks out briefly, junior miners see gains

Author - Ben McGregor

Second pop above 1,760/ounce in two months

The gold futures price reached US$1,767/ounce this week before retreating, which was the second time it has surpassed US$1,760 in the past two months, marking some of gold's highest levels in several years.

Producing miners see marginal gains as final results trickle in

The producing global gold mining sector overall saw slight gains this week, with the GDX up 1.4%, as declines for many of the larger producers were offset by gains from smaller producers, and the last of Q1/20 results trickled in.

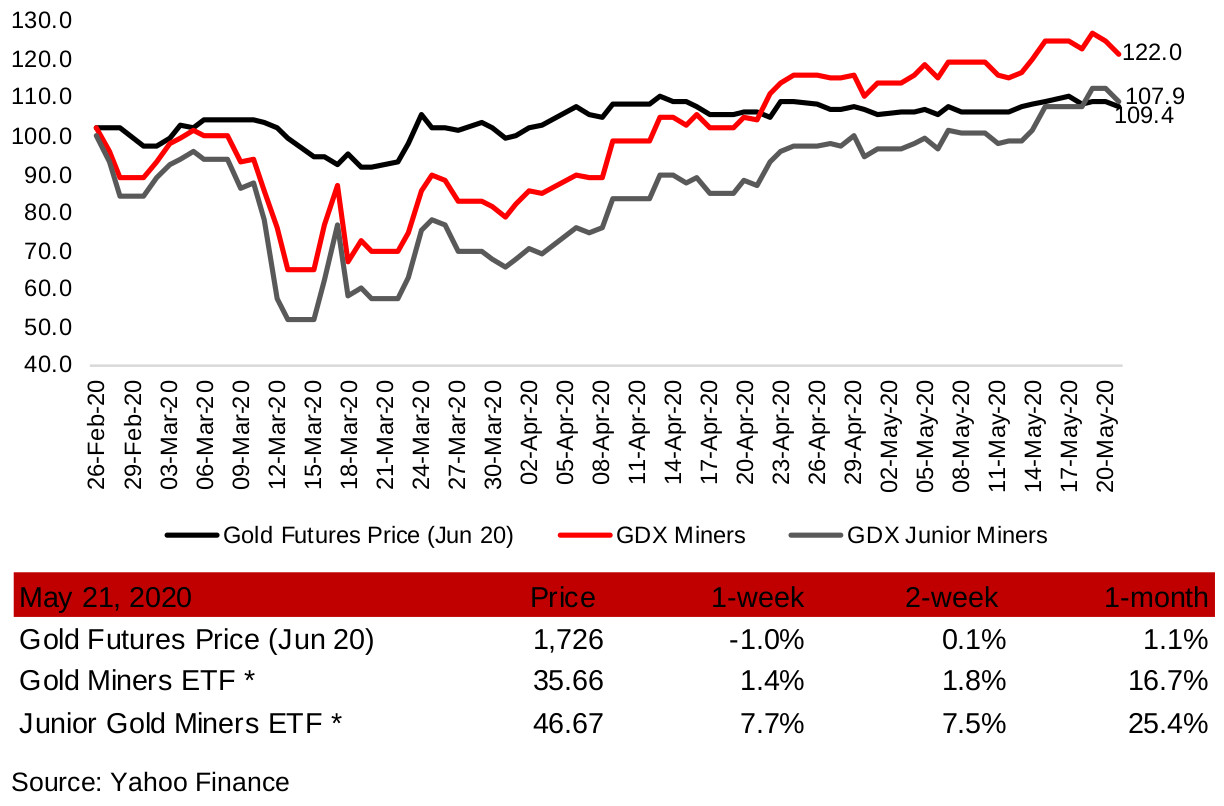

Figure 1: Gold futures price and gold mining ETFs

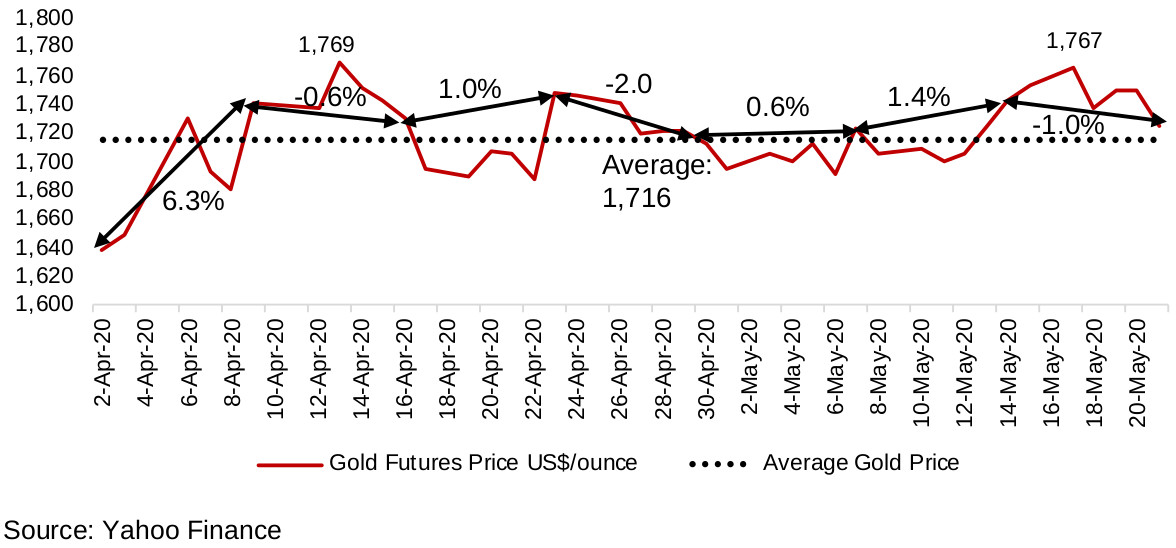

Second pop above US$1,760/ounce in two months

The gold futures price jumped US$1,767/ounce in the middle of this week, the second time it has moved above US$1,760/ounce in two months (Figure 2). While it subsequently retreated to end the week at US$1,725/ounce, down -1.0%, gold is still holding at its highest levels in many years, with an average of US$1,716 since April 2020. While most large producing miners saw declines this week as the gold price fell back, some smaller producing miners continued to make gains, mainly on company-specific drivers, and the tail-end of the Q1/20 results trickled in. Overall, the GDX was up 1.4%.

For the junior miners, however, it was a particularly strong week, with the GDXJ jumping 7.7%, as the market starts to acclimate to gold holding above US$1,700 for an extended period. At these levels, the potential return on the exploration activities of the junior gold miners is starting to significantly offset the risks. With the combined global economic and geopolitical risks at ten year highs, and with zero interest rates combined with current stimulus plans likely to drive down the value of fiat currencies versus gold, further upside for gold is possible, and an average price well above US$1,500 this year is likely.

Figure 2: Gold futures price weekly performance

Larger producing miners see declines, some smaller plays gain

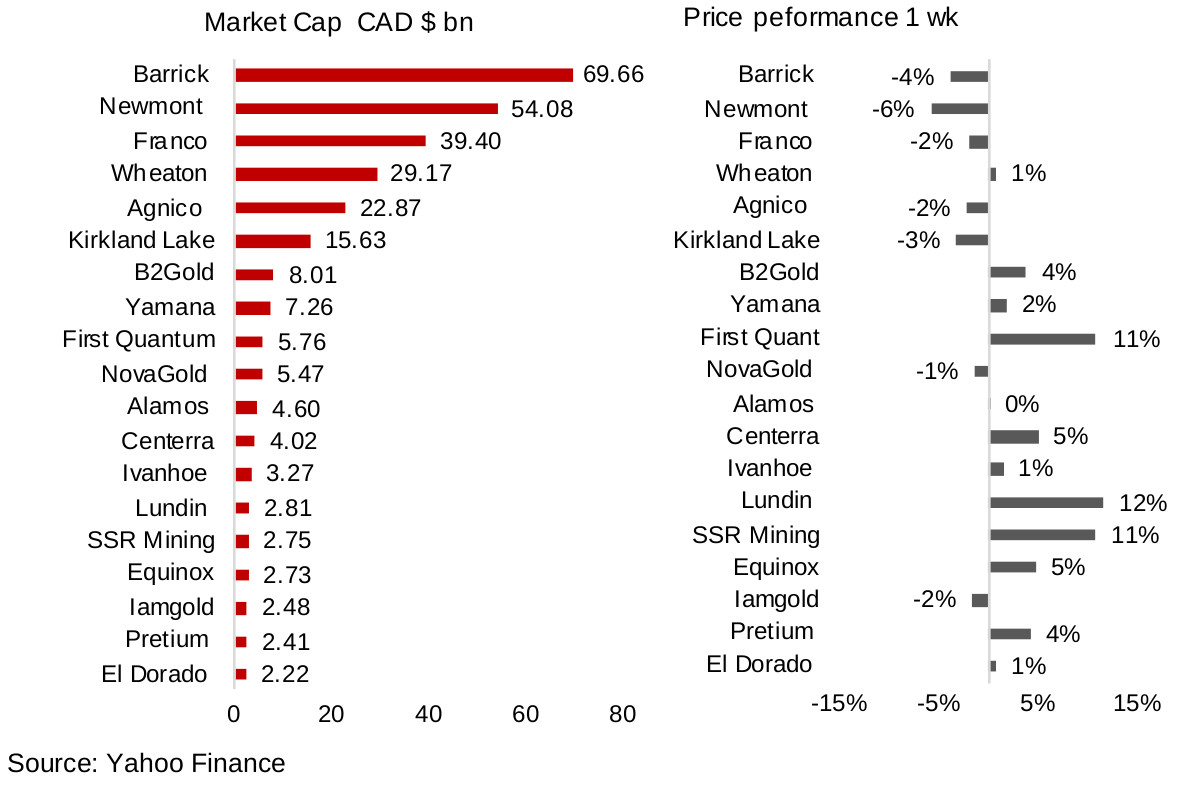

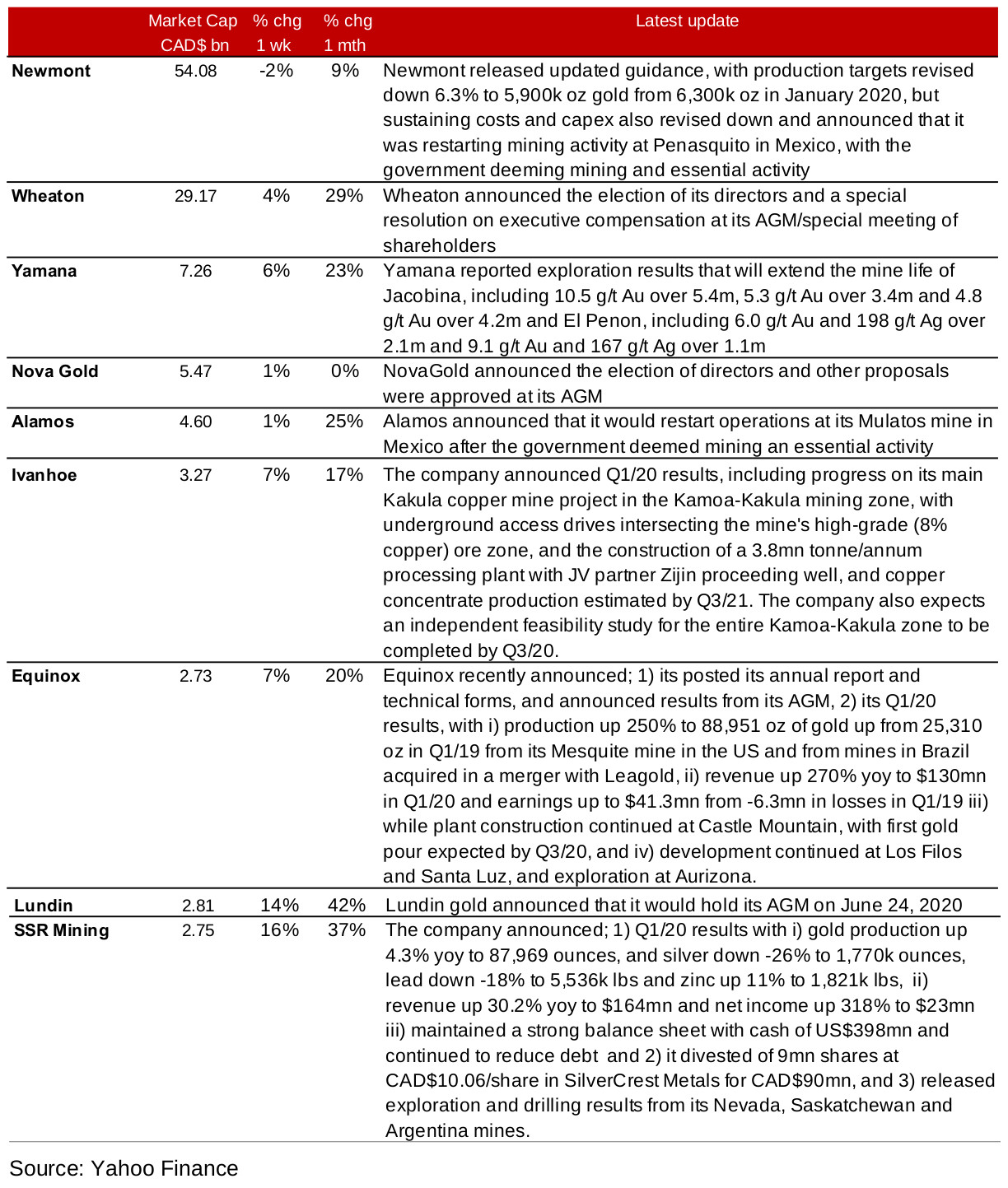

For the producing miners, it was mainly the larger cap names that saw declines this week (Figures 3, 4), as the gold price ticked down, and some post-Q1/20 news flow came through. Newmont was down -6% after it issued reduced production guidance for 2020, and Yamana was up 2% on exploration results leading to an extended mine life for two of its projects. This was offset somewhat by the smaller cap producing mines, many of which saw gains, mainly on company specific news. There were still some Q1/20 results trickling in this week, including Ivanhoe and Equinox, which saw only marginal gains, and SSR Mining, which was up 11% this week, not only from the results release, but also from the announcement of a divestiture and a report of recent exploration and drilling results (Figure 5).

Figures 3, 4: Canadian producing gold mining stocks

Figure 5: Producing gold miners updates

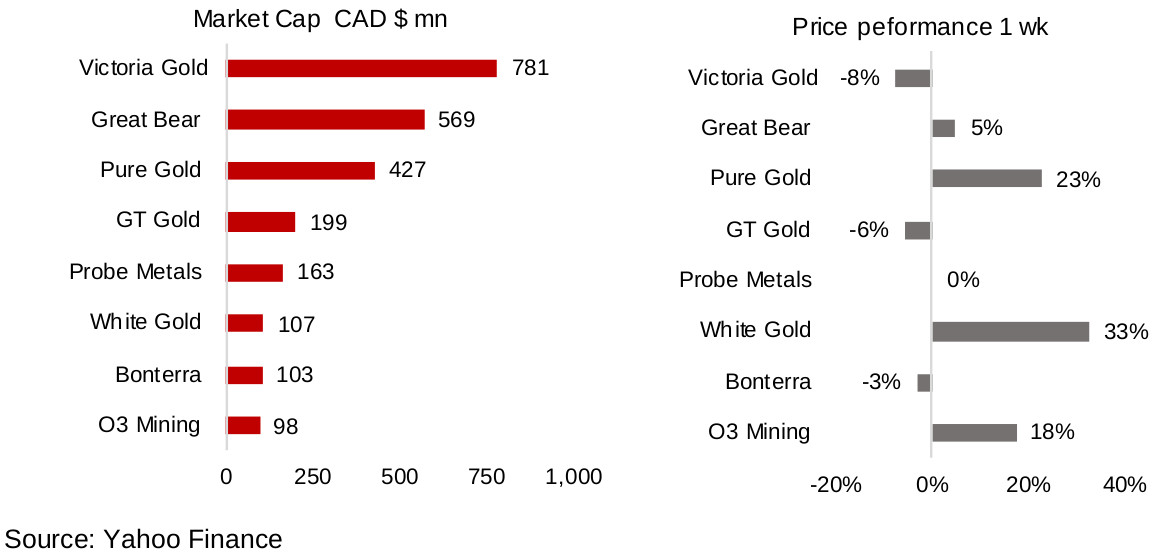

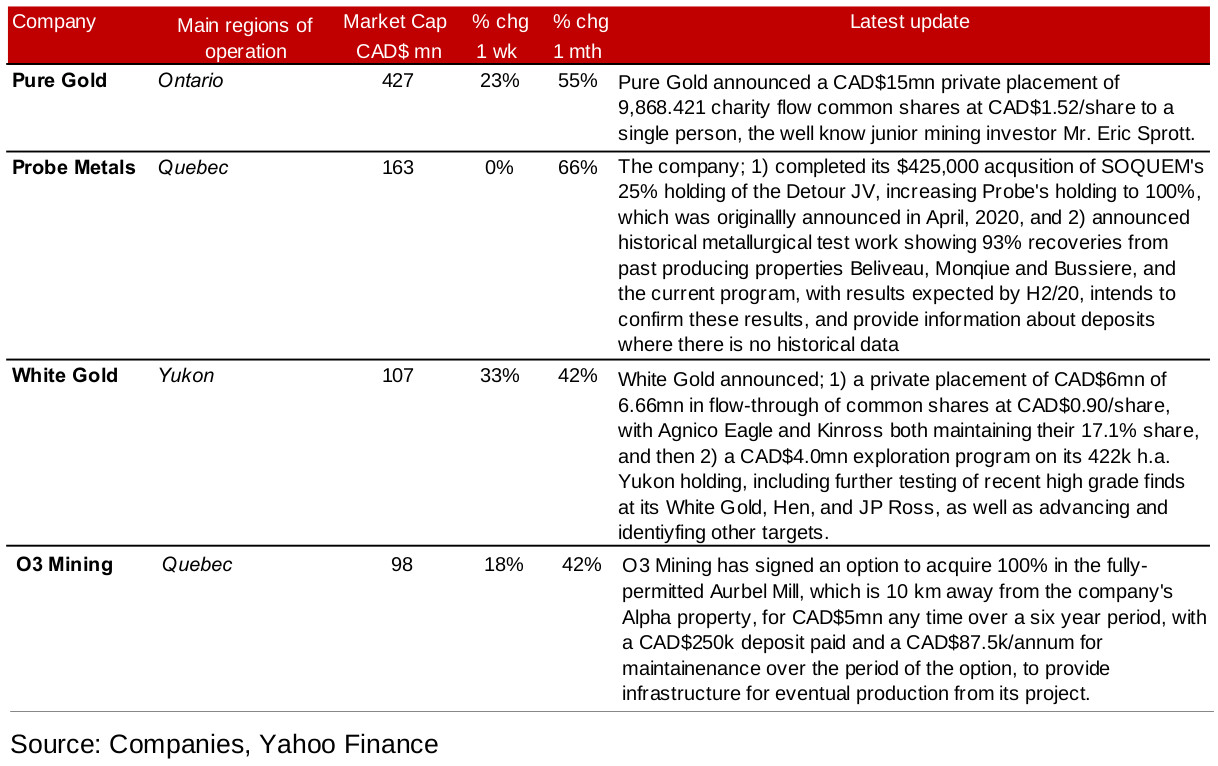

Canadian operating juniors see mixed performance this week

The Canadian operating junior gold mining stocks saw a mixed performance this week, with some names seeing large gains on company specific news flow (Figures 6, 7). Pure Gold jumped 23% on a CAD$15mn private placement made by the company to the well-known junior mining expert Eric Sprott (Figure 8). (For more on Pure Gold and the other key Red Lake junior, Great Bear Resources, see our Junior Mining Weekly reports from May 14, 2020 and May 8, 2020 and see our Overview of Red Lake Mining District report). White Gold saw the highest gains of the group, up 33% after announcing that it had completed a CAD$6.0mn private placement and that it would begin a CAD$4.0mn exploration program at its Yukon projects. O3 Mining jumped 18% after it announced a six year option on the Aurbel Mill, near its Alpha project, which would be key infrastructure for any future production from the project. Probe Metals was flat after press releases about the completion of a previously announced acquisition of the remaining 25% of its Detour project from its JV partner, and historical metallurgical test works on some past producing properties.

Figures 6, 7: Canadian junior gold miners with operations in Canada

Figure 8: Canadian junior gold miners operating in Canada updates

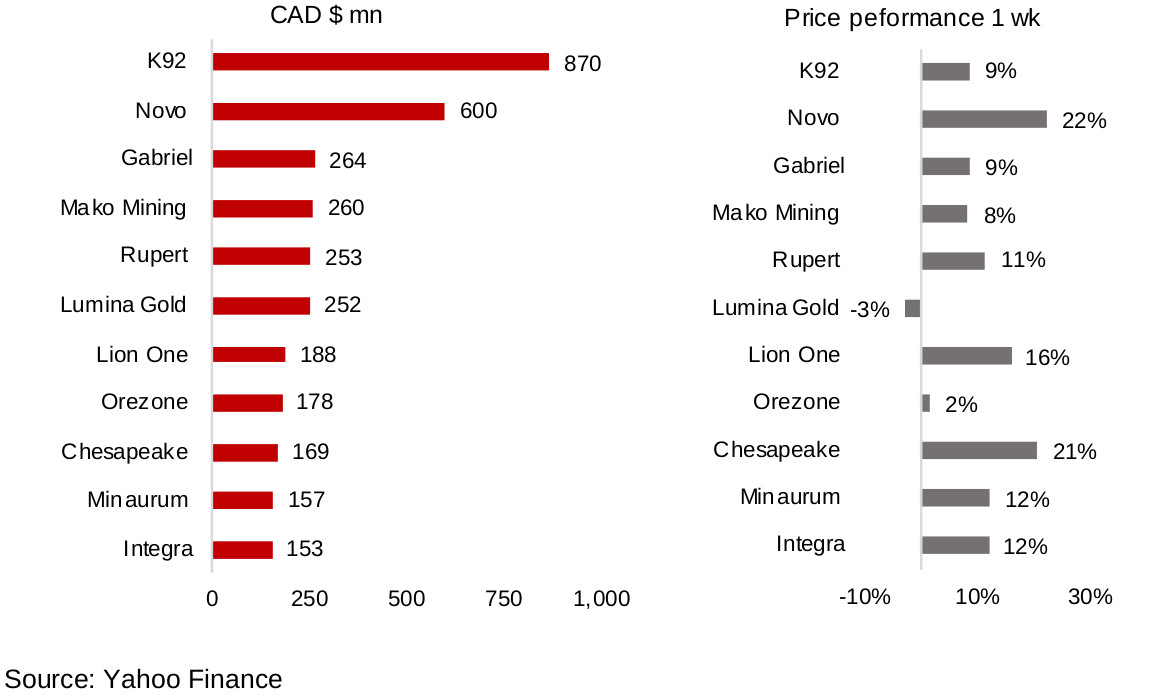

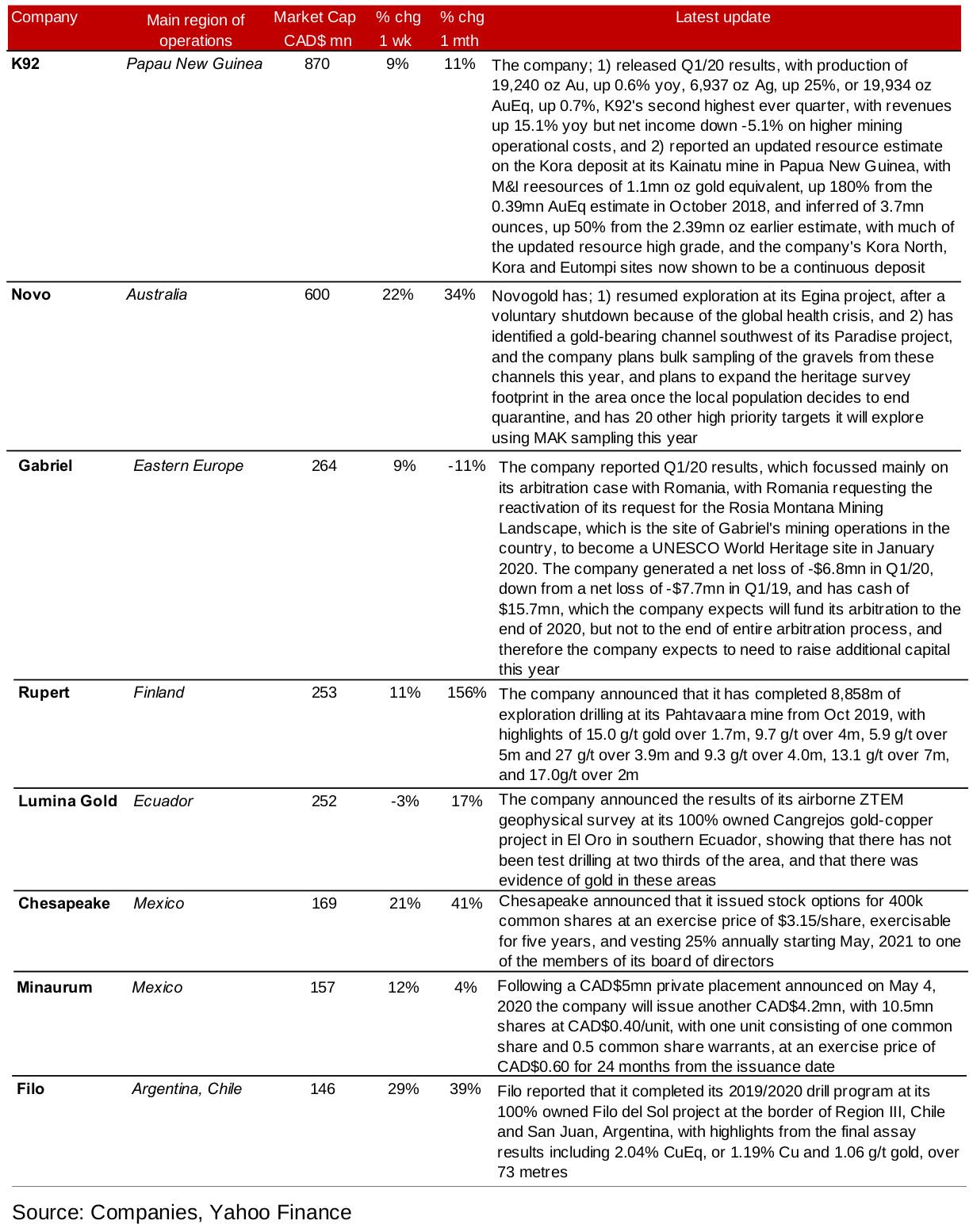

Figures 9, 10: Canadian junior gold miners operating mainly internationally

Figure 11: Canadian junior gold miners operating mainly internationally updates

Most foreign operating Canadian junior mining stocks see gains

Most of the larger cap foreign operating Canadian junior mining stocks (Figures 9, 10) this week saw considerable gains. K92 saw a 9% gain this week on its Q1/20 results and an updated resource estimate on its Kora mine in Papua New Guinea, and while Gabriel's Q1/20 results release focused mainly its difficulties with arbitration over its mining site in Romania, it also saw 9% gains (Figure 11). Filo Mining (up 29%), Novo Resources (up 22%), and Rupert Resources (up 11%) saw substantial gains on press releases reporting strong results from exploration activities, while Lumina declined marginally even after a press release of progress on its airborne geophysical survey. Minaurum was up 12% on the expansion of a private placement originally announced in early May, 2020, and Chesapeake Gold rose 21%, although the only press release this week was the granting of stock options to a newly appointed member of its Board of Directors.

Disclaimer: This report is for informational use only and should not be used an alternative to the financial and legal advice of a qualified professional in business planning and investment. We do not represent that forecasts in this report will lead to a specific outcome or result, and are not liable in the event of any business action taken in whole or in part as a result of the contents of this report.