May 22, 2023

Gold Battles With Breakthrough Level

Author - Ben McGregor

Gold continues battle to hold breakthrough level

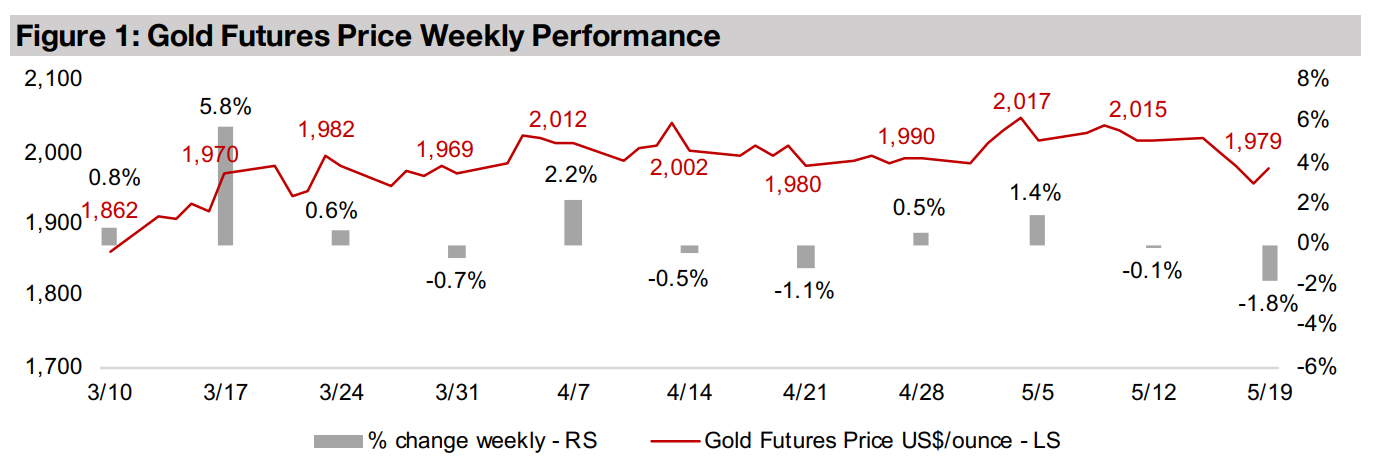

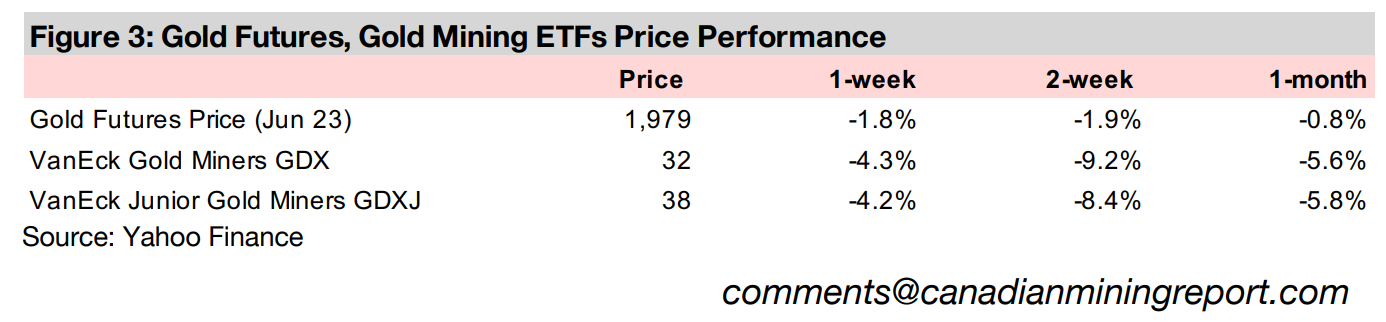

Gold dropped -1.8% this week US$1,979/oz this week, as it continued the battle to hold the key US$2,000/oz level which has now lasted six weeks, with gold above this benchmark for nearly 60% of the sessions since it was breached in early April 2023.

Precious metals continue to outperform; ATEX Resources In Focus

This week we survey the prices of all the major metals, with precious metals continuing to outperform base metals, and copper explorer ATEX Resources is In Focus, with its shares rising on strong drill results from its Valeriano project in Chile.

Gold Battles With Breakthrough Level

Gold dropped -1.8% to US$1,979/oz as it continues to battle with the breakthrough US$2,000/oz level, as the markets shifted to a more 'risk-on' stance, with the S&P 500 up 1.58% and safe havens like gold facing a pullback. Overall, however, gold is still winning its war to hold US$2,000/oz overall, closing above this benchmark for nearly 60% of the sessions since it was breached in early April 2023. As ever, overall markets will continue to have periodic bursts of hope like that seen this week that we are finally getting out of the economic woods. However, we still see more than enough risk in the pipeline this year to continue to propel gold, with a global recession widely anticipated, a continued US banking crisis, and high geopolitical risks.

Precious metals continuing to outperform

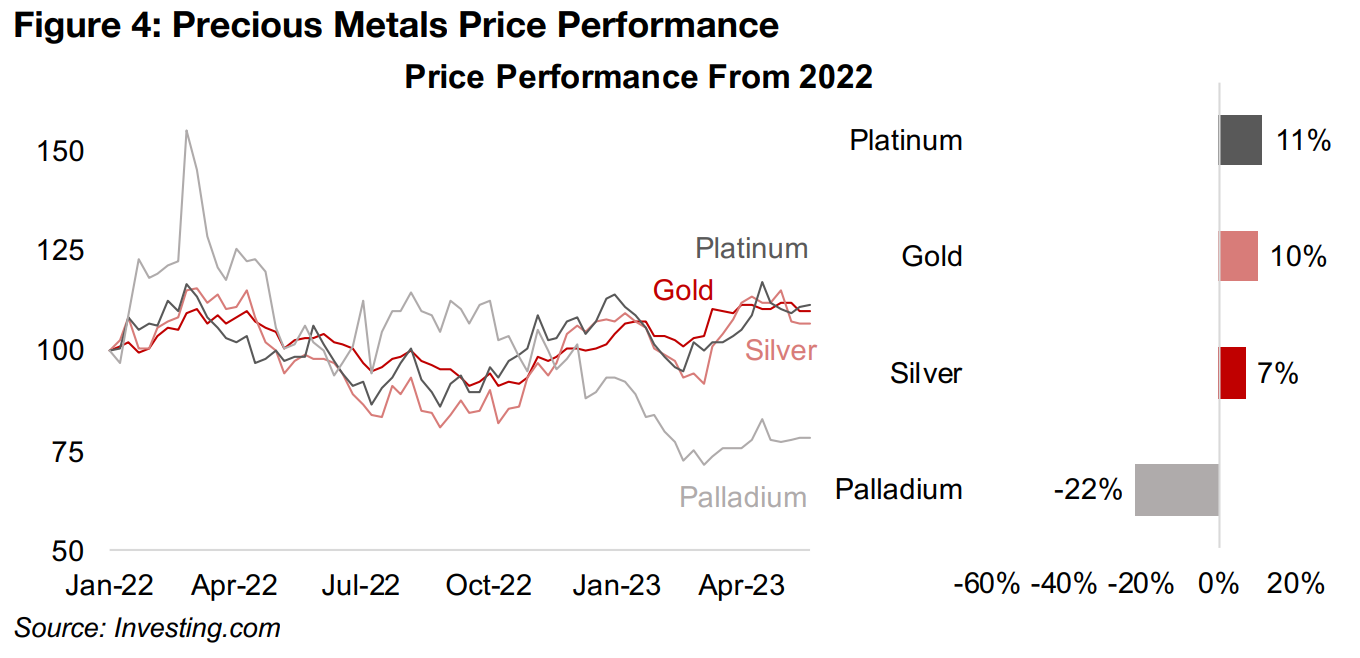

Even as gold's struggle with US$2,000/oz continues, it has outperformed most major

metals since 2022, gaining 10%, with the precious metals overall also holding up well,

with platinum gaining 11% and silver 7% (Figure 4). Gold and silver have been on a

run since around October 2022, after lows were reached in late August 2022 and their

prices stagnated through September 2022. The initial part of this run was part of an

'across the board' increase, with base metals also rising, and there seemed to be a

general perception in the market that the Fed would 'get away with' its massive and

rapid rate hikes without much economic disruption.

However, the banking crisis that started in March 2023 put an end to this period, at

which point there was a substantial divergence between safe haven assets like gold

and silver, which continued to surge, and the base metals, which started to decline.

While there has been a flattening of this uptrend for gold and silver through April and

May 2023, we still see the probabilities weighted in favour of these metals this year.

The only laggard among the precious metals has been palladium, down -22%, as the auto industry has been substituting away from it for platinum for use in autocatalysts. This is a major issue for palladium as autocatalysts make up 86% of its demand, while platinum has only 32% of its demand from autocatalysts, with jewellery, petroleum and chemicals, and investment at 23%, 14%, and 13% of demand, respectively. Meanwhile the platinum price has been supported on the supply side by major power outages in South Africa, which accounts for 65% of the metal's supply. In contrast, palladium supply from Russia, the largest producer of the metal, at 44.2% of the total, has not declined as much as had been previously feared.

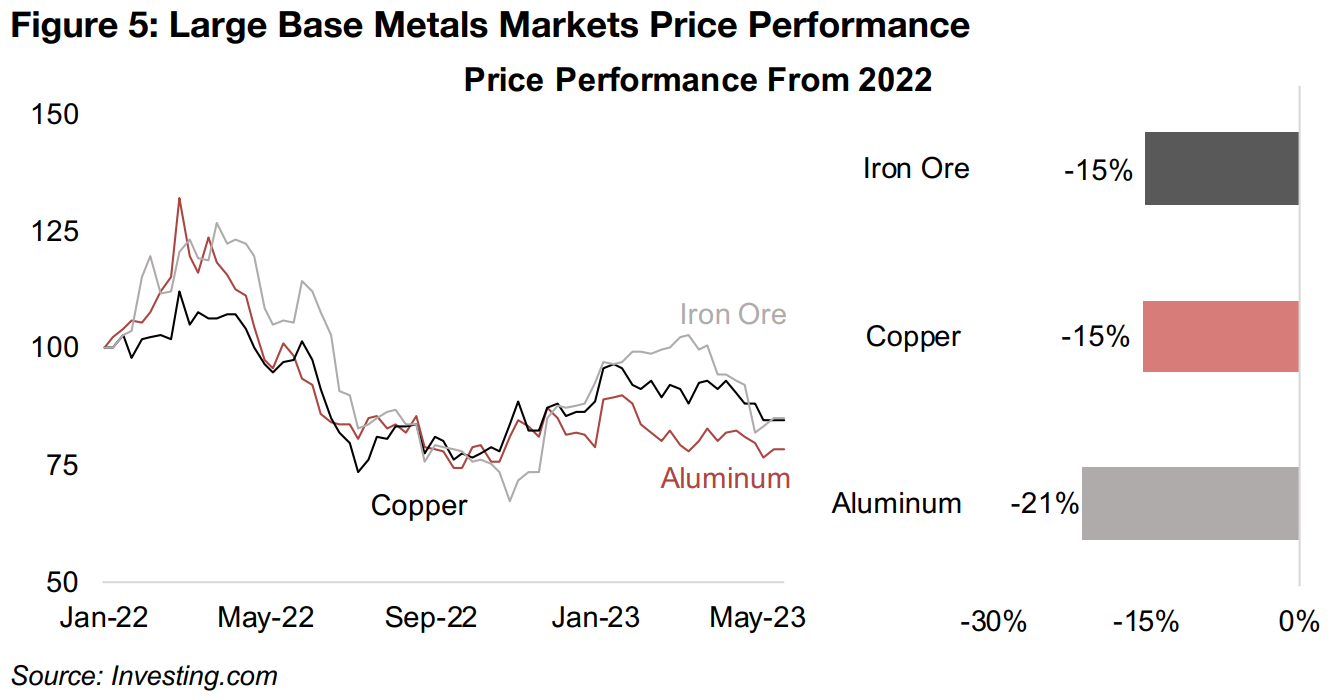

Largest base metals struggling as recession concerns continue

Of the four largest metals markets, only one is a precious metal, gold, with a value of

around US$170bn as of 2019, with the remaining three, aluminum, copper and iron

ore, all base metals, with a value of US$165bn, US$155bn and US$137bn,

respectively. With the next largest base metals markets, zinc and manganese, at just

US$49bn and US$40bn, respectively, it is aluminum, copper and iron ore that set the

tone for the base metals market overall.

That tone has been grey since these three metals peaked in February and March

2022, with a severe downtrend from April 2022 through to September 2022 (Figure

5). While these metals rebounded from October 2022 through to January 2023, most

of the gains have been reversed from March to May 2023 by rising concerns of a

global recession, catalyzed by the US and EU banking crisis. Iron ore and copper are

both down -15% since January 2022 and aluminum down -21% since 2022, and if a

major recession does erupt, we could see further downward pressure on these metals.

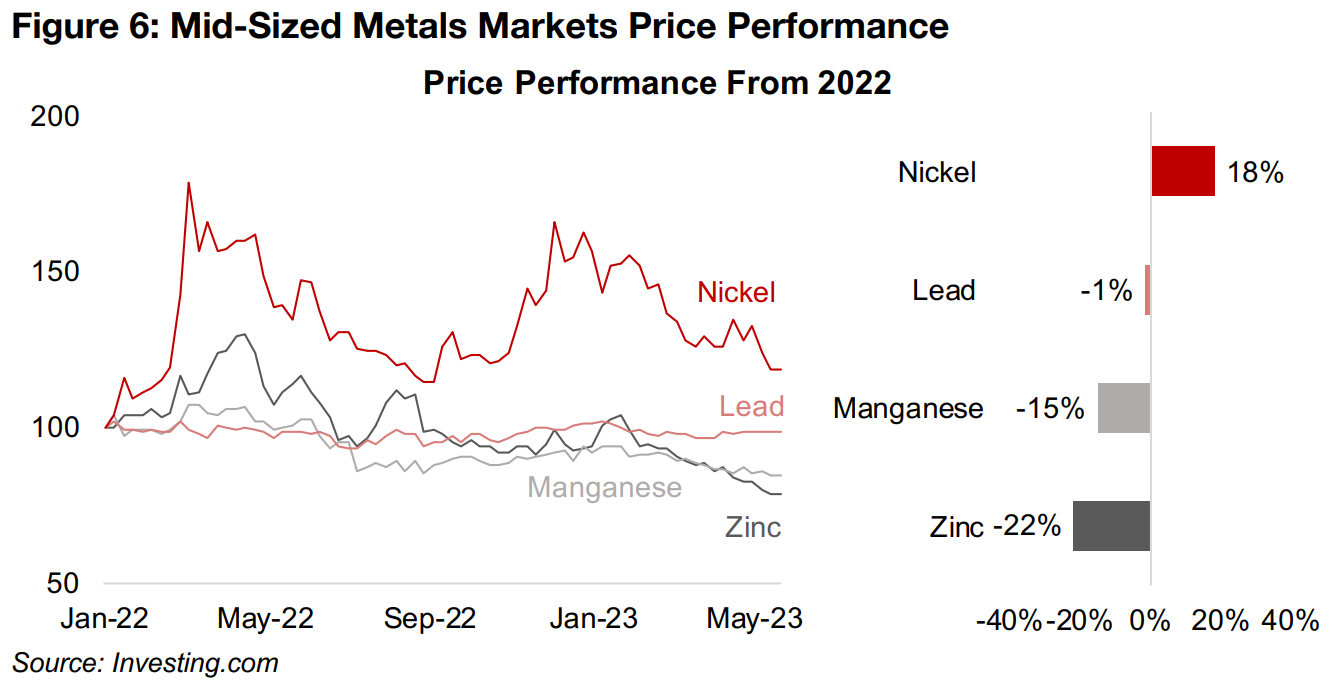

Nickel holding up best of mid-tier base metals on supply constraints

The situation with the mid-tier base metals has been more mixed. Two, manganese and zinc, down -15% and -22%, respectively, have faced pressure similar to the larger base metals (Figure 6). However, lead has been remarkably balanced since 2022, and is near flat with only a -1% decline, and was down only -7% at its lowest, and up only 2% at its highest, over the period. The nickel market is the standout of the mid-tier metals, up 18%, although it is well off of two peaks, in March 2022 and December 2022, when it was up 78% and 66%, respectively, versus the start of the 2022. The first peak was driven by fears of supply disruption from Russia, the third largest global supplier, at 9% of the total, after the Ukraine invasion and the second by concerns of supply reduction mainly from non-Russian sources.

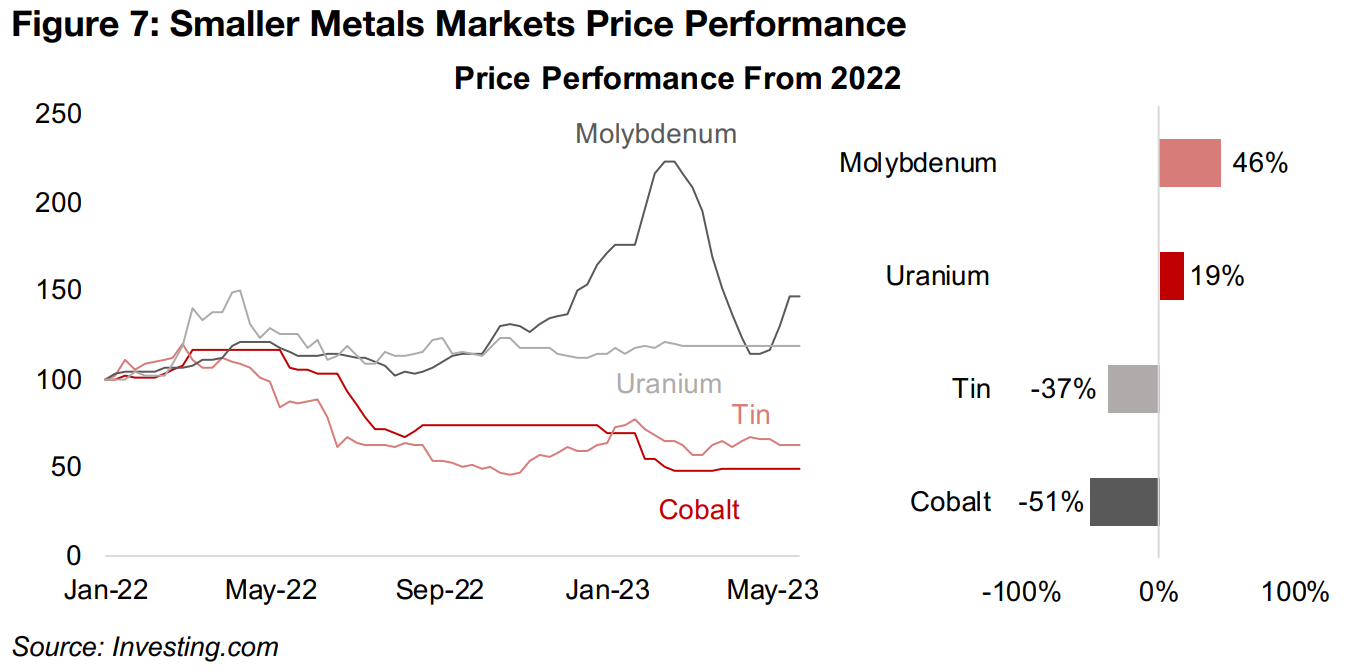

Molybdenum the best performing smaller metal on supply shortage

The smaller metals markets have also seen a mixed performance. Both tin and cobalt

have succumbed to the economic demand drop concerns facing base metals

markets overall and have had the worst performances of any of the major metals,

declining -37%, and -51%, respectively, since January 2022 (Figure 7). In contrast,

molybdenum has been the best performing major metal, up 46% since January 2022.

While this is well down off its peak 122% gain in February 2022, mainly on

expectations for weakening economic demand, the price remains elevated because

of a severe shortage of molybdenum which is expected to persist until 2025.

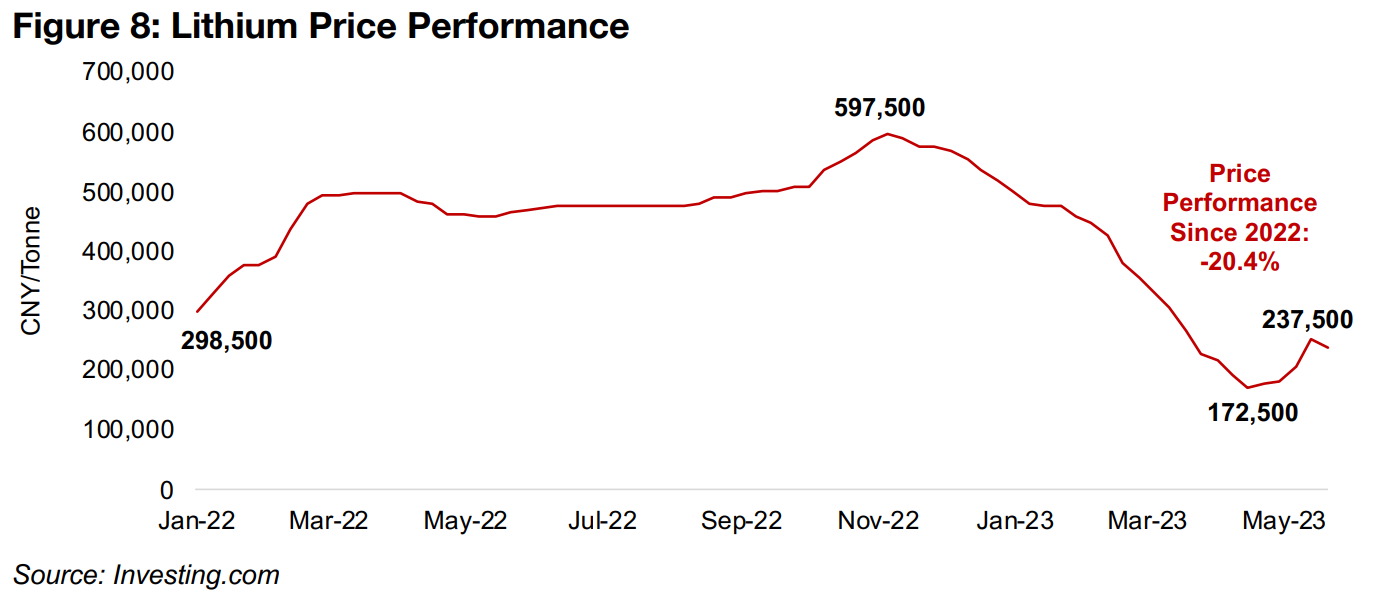

Uranium had also seen decent gains of 19% as of end-February 2023, but updated

price data has not been reported since and it may have shifted, although it is shown

as flat in the chart. For lithium, after a 100% gain from January 2022 to November

2022 as surging electric vehicle (EV) sales outpaced lithium supply, the metal

slumped 71% to its lows in April 2023 as EV demand slowed and new supply came

online. It has since recovered marginally and is now down -20% since January 2022.

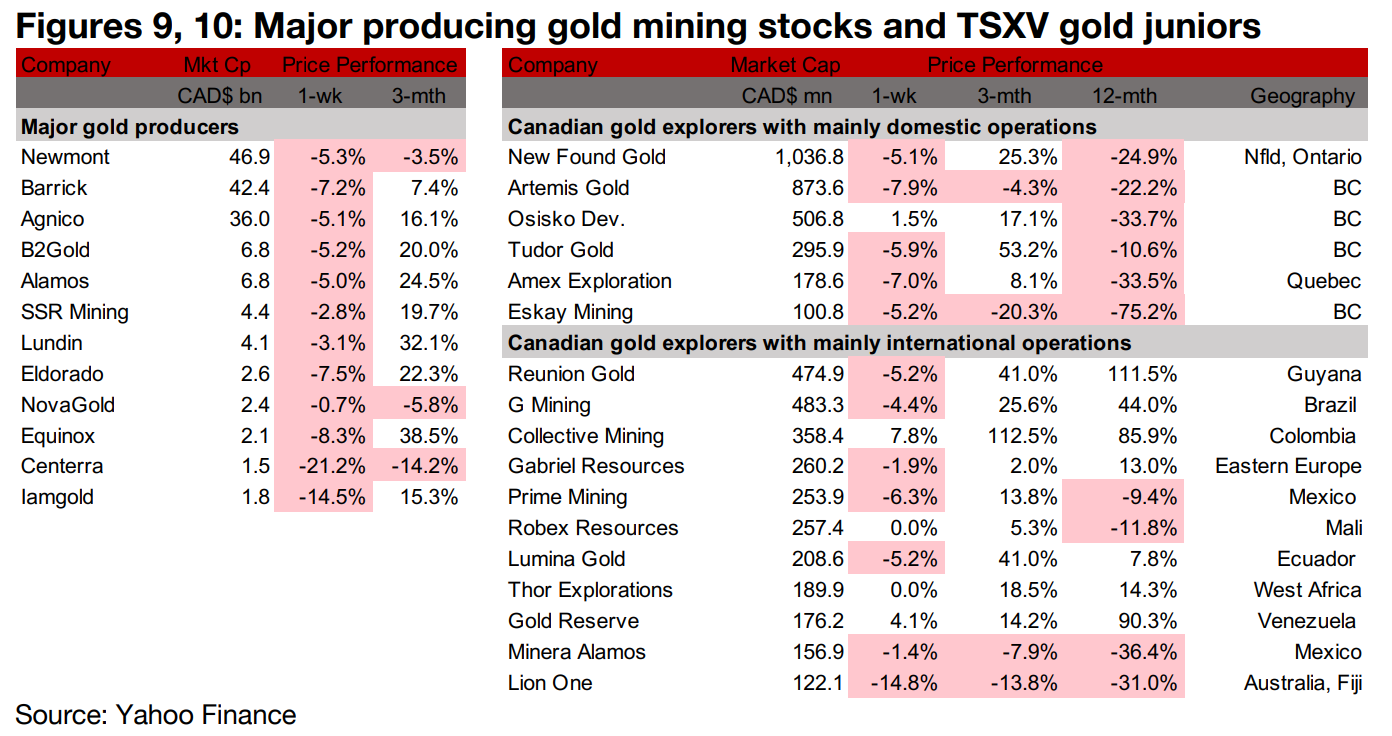

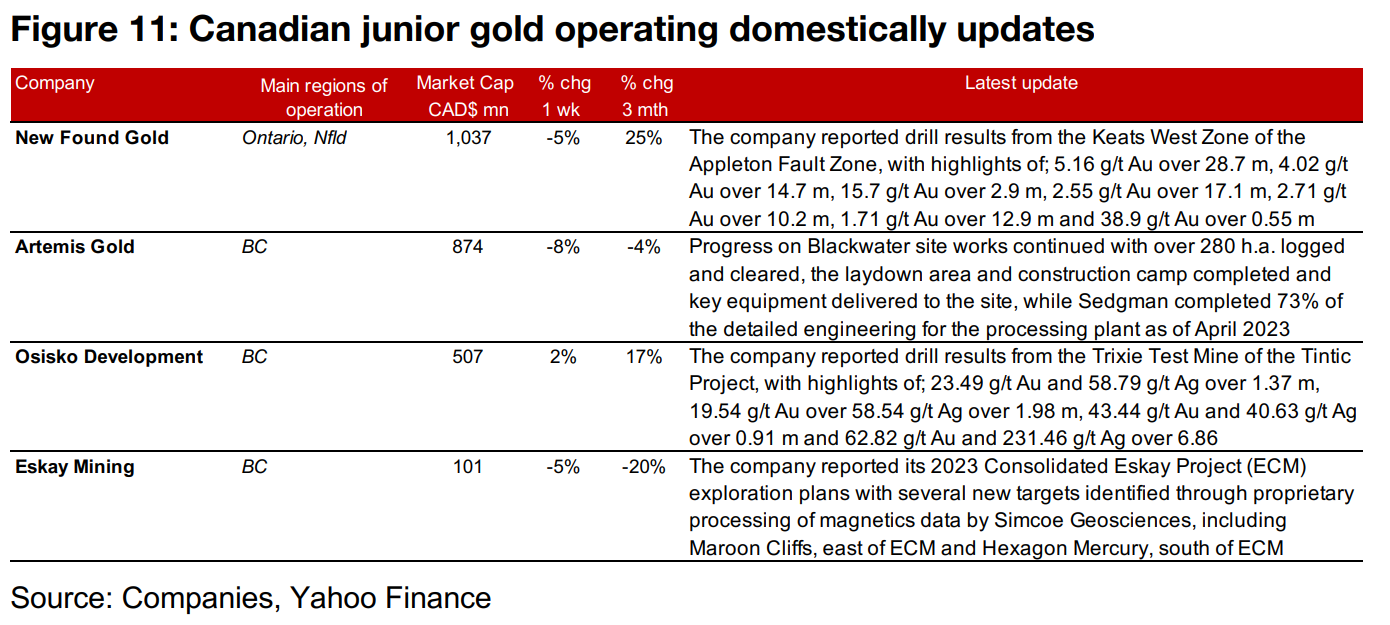

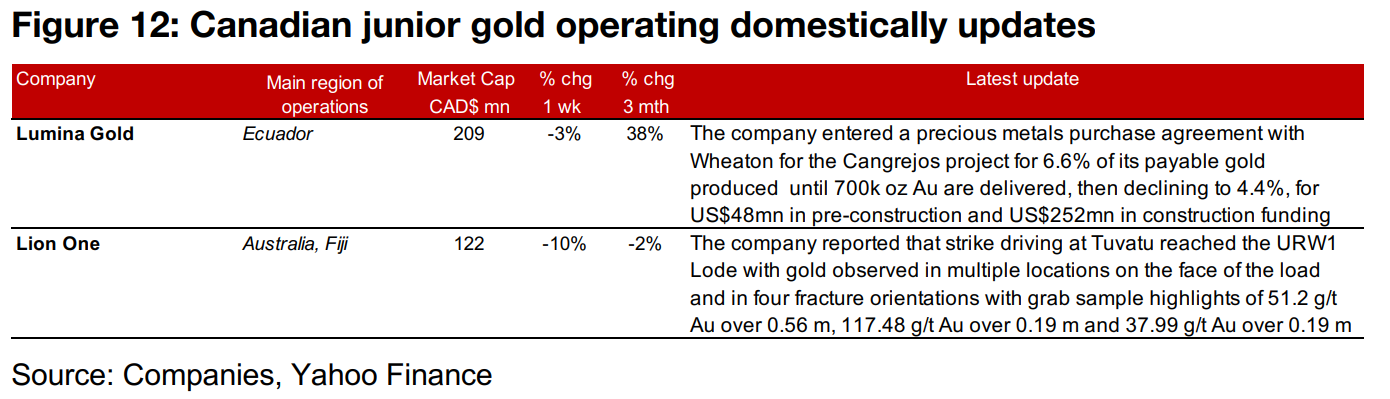

Producers all decline and TSXV large gold mainly down

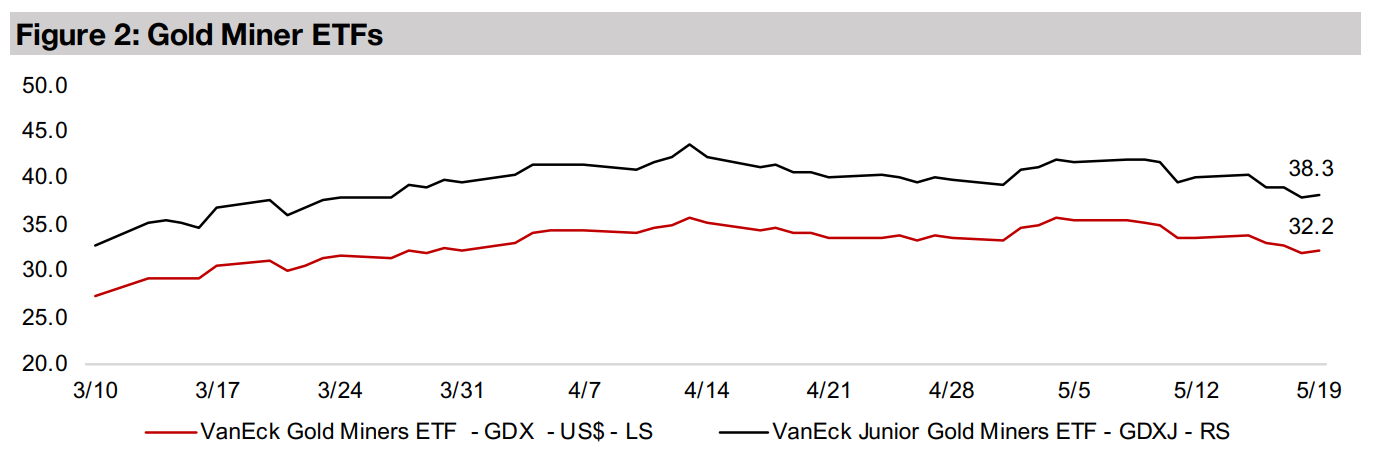

The gold producers dropped and most large TSXV gold stocks declined on the slide in the gold price, even as equity markets picked up in a shift to a 'risk-on' stance (Figures 9, 10). For the Canadian gold juniors operating mainly domestically, New Found Gold reported drill results from the Keats West Zone, Artemis announced progress on Blackwater site works, Osisko Development reported drill results from the Trixie test mine at the Tintic Project and Eskay Mining outlined its 2023 exploration plans for its Consolidated Eskay Project (Figure 11). For the Canadian gold juniors operating mainly internationally, Lumina Gold entered a precious metals purchase agreement with Wheaton Precious Metals for Cangrejos and Lion One reported that strike driving at Tuvatu reached the URW1 Lode (Figure 12).

In Focus: ATEX Resources

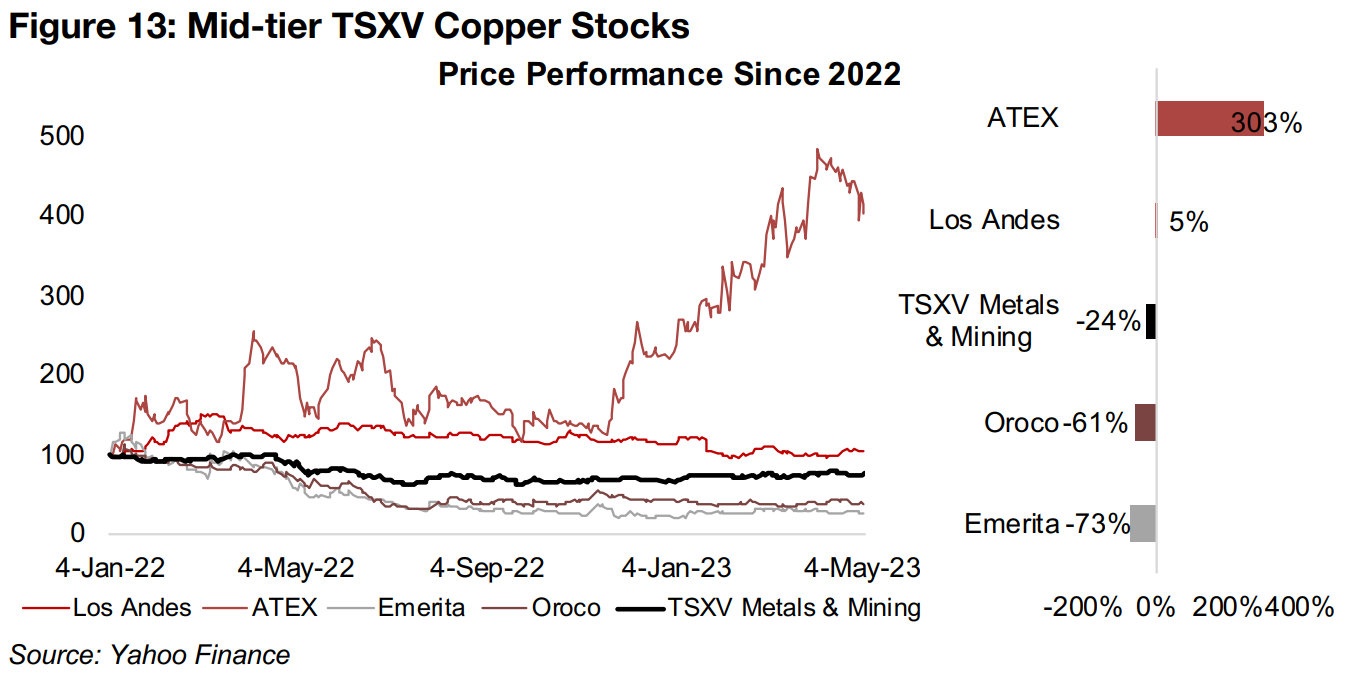

ATEX Resources advances into ranks of mid-tier TSXV copper

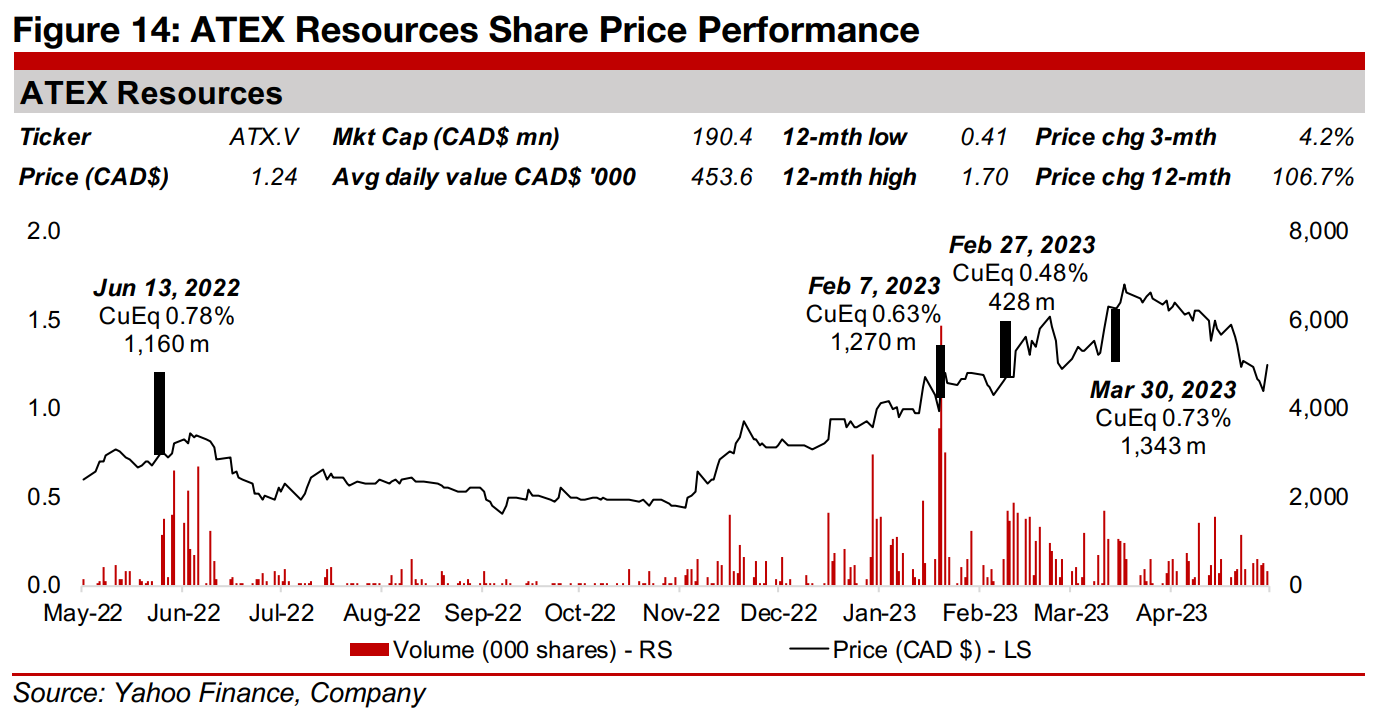

ATEX Resources has been the strongest performing mid-tier TSXV copper stock in

recent months, having gained 303% since January 2022, with most of this only since

December 2022 (Figure 13). This is as other mid-tier TSXV copper stocks have

struggled under pressure from a falling copper price. Even the best performer, Los

Andes Copper, is up just 5.0%, while Oroco Resources and Emerita Resources are

down -61% and 73%, significantly underperforming the -24% decline in the

benchmark TSXV Metals and Mining Index.

Strong drill results from Valeriano project in February and March 2023

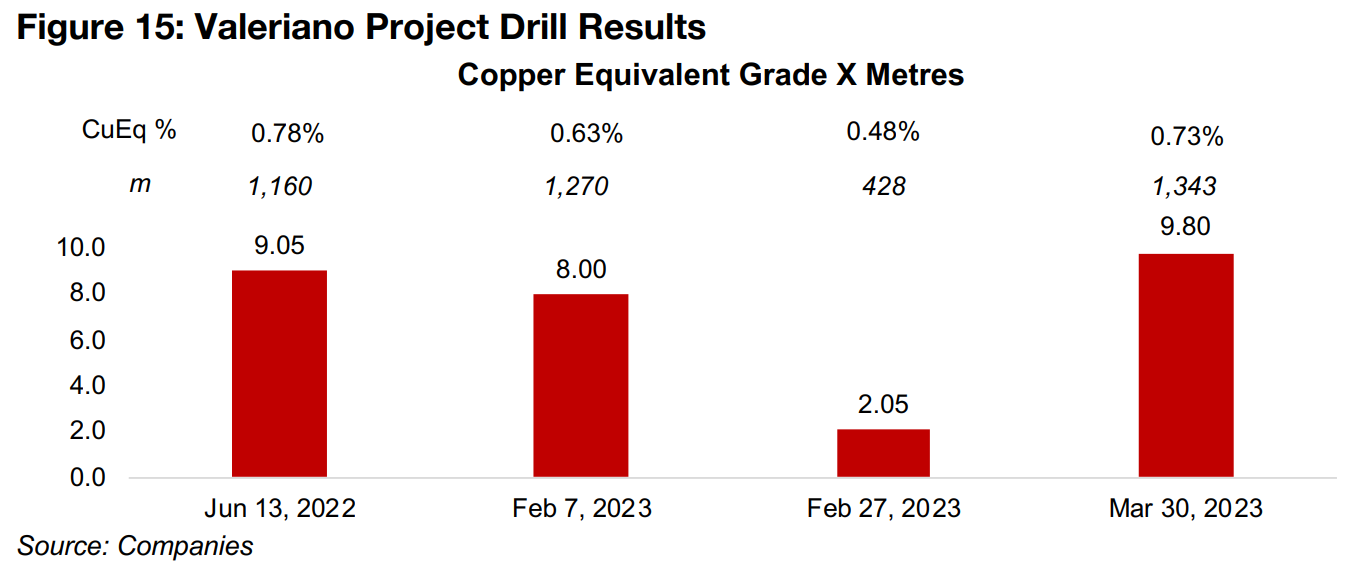

The rise has been driven by strong drill results from the company's Valeriano project

in Chile, a copper gold porphyry system in the emerging Link Belt copper district.

While the company reported strong drill results from Valeriano in June 2022, with

highlights of 0.78% CuEq over 1,160m (Figure 14) for a copper percentage-thickness

of 9.05 (Figure 15), there was limited news of drill results reported over H2/22.

Nonetheless, these earlier results were enough to support the price, which held up

well given the decline in copper and several large TSXV copper stocks over the period.

The stock began to pickup in November and December 2022 as the copper price

started to rebound, but saw significant gains through February and March 2023 as

new strong drill results from Valeriano were released. The company reported 0.63%

CuEq over 1,270 m for a copper percentage-thickness of 8.00 on February 7, 2023,

0.48% CuEq over 428 m for a copper percentage-thickness of 2.05 on February 27,

2023, and 0.73% CuEq over 1,343 m for a copper percentage-thickness of 9.80, the

strongest over the past year, on March 30, 2023.

The company continues to drill at the project with a third rig recently added and

expect to report final Phase III assay results by July and August 2023. A Phase IV

exploration program is targeted to begin by September or October 2024, a porphyry

resource update and an updated technical report expected by Q3/23 and Q4/23

respectively, and an expansion to five rigs is planned by January 2024.

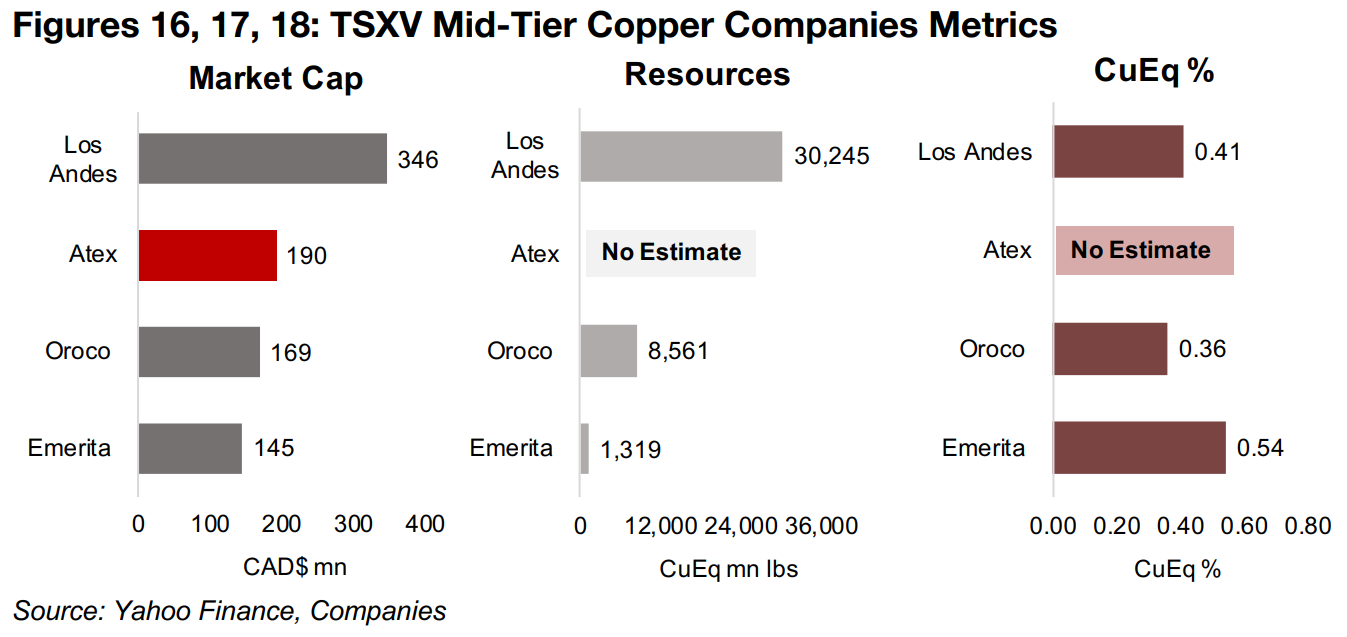

Market valuing ATEX Resources moderately above Oroco Resources

The market is currently valuing ATEX Resources at a $190mn market cap, putting it moderately ahead of Oroco Resources, at $169mn and about half the size of Los Andes Copper, at $346mn (Figure 16). With 30,245 mn lbs in CuEq, Los Andes has about three times the level of Resources of Oroco, at 8,561 mn lbs CuEq (Figure 17), and their grades are similar, at 0.41% and 0.36%, respectively (Figure 18). With ATEX Resources having not released a resource estimate yet, there are no direct indicators from the company on the size or grade of the project. However, the highlighted results with CuEq grades as high as 0.78% and 0.73% suggest that the project's overall grade could come in at least as high as Los Andes or Oroco.

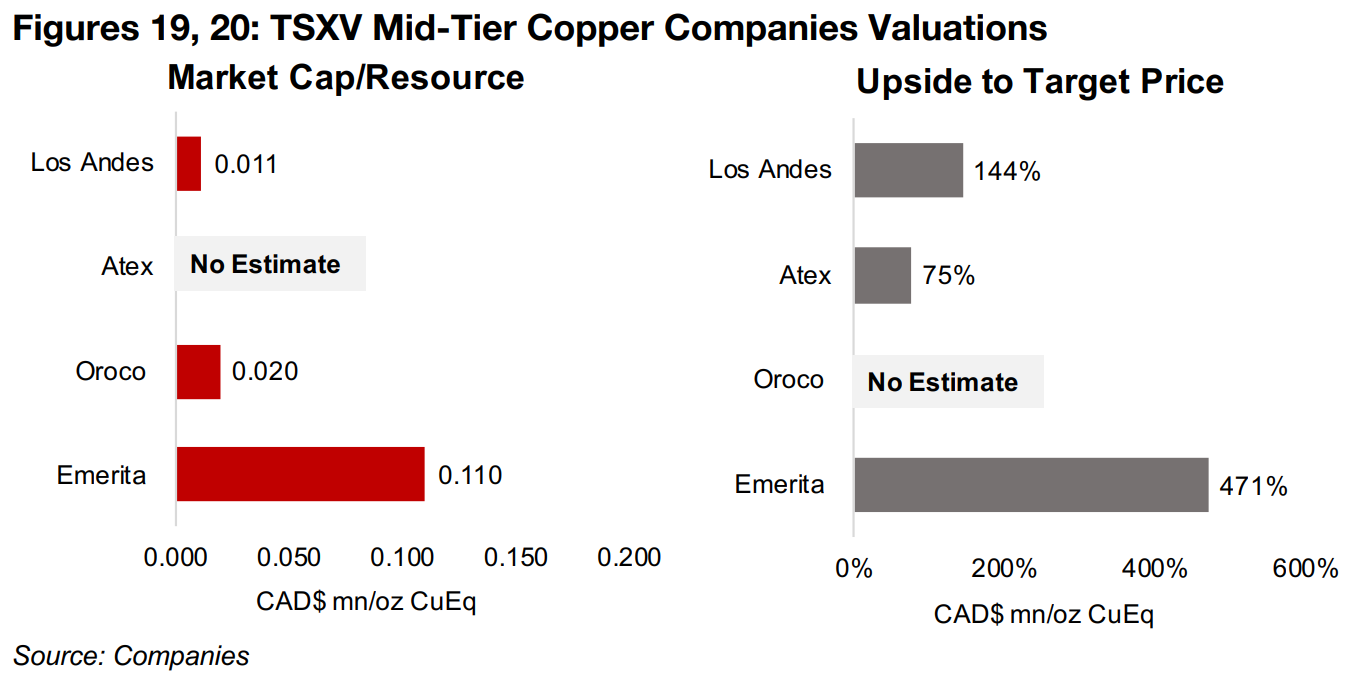

Los Andes is valued at a Market Cap/Resource of $0.011/lb CuEq, about half the

level of Oroco, at $0.20, and assuming that ATEX's Market Cap/Resource was

somewhere in between these two, this would imply total resources for the project

ranging from 9,500 mn to 17,300 mn lbs (Figure 19). The market is still targeting

strong upside for ATEX of 75% even after its major run, with 144% upside expected

for Los Andes, and a major 471% upside for Emerita, although this Emerita

'consensus' is actual a single estimate from one analyst (Figure 20)

Emerita's Market Cap/Resource of $0.11/oz CuEq is extremely high versus Los

Andes and Oroco, even though the grade for its Iberian Belt West (IBW) Project is

only moderately higher, at 0.54% CuEq. This is because these figures are only based

on a historical estimate of the IBW Project, and the company is expected to release

a new Resource Estimate soon. With recent drill results from the project strong, the

market is likely factoring in much higher resources for the project than the 1,319 mn

lbs CuEq implied by the historical estimate, which could reduce the Market

Cap/Resource considerably.

Disclaimer: This report is for informational use only and should not be used an alternative to the financial and legal advice of a qualified professional in business planning and investment. We do not represent that forecasts in this report will lead to a specific outcome or result, and are not liable in the event of any business action taken in whole or in part as a result of the contents of this report.