June 25, 2020

Gold at highest levels in over seven years

Gold futures breaks above U$1,770/oz

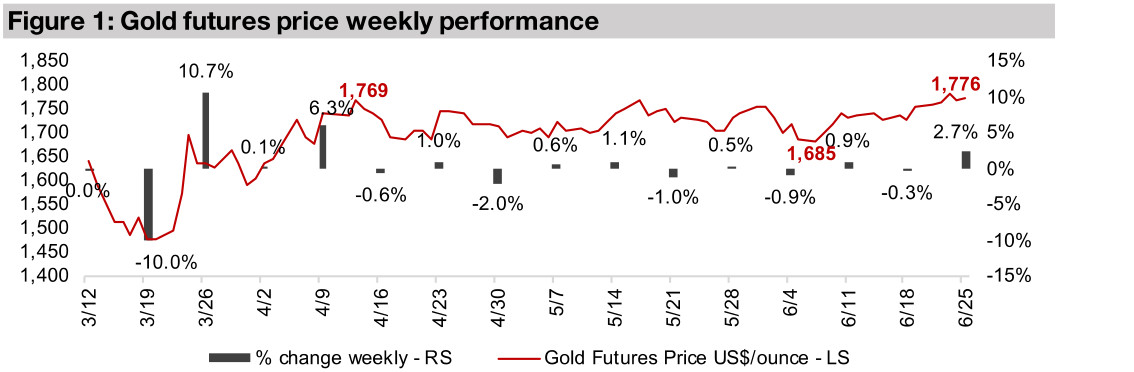

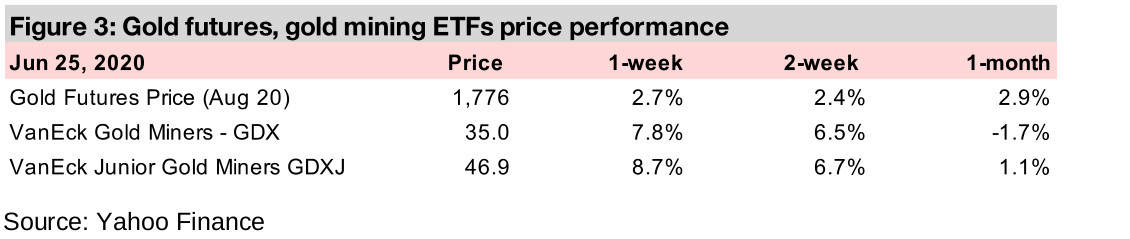

The gold futures price jumped 2.7% this week, breaking above a US$1,770/oz resistance level that had held for two months, while the spot gold price reached US$1,757/oz, near its highest level in seven and a half years.

Most producing miners up on gold bounce

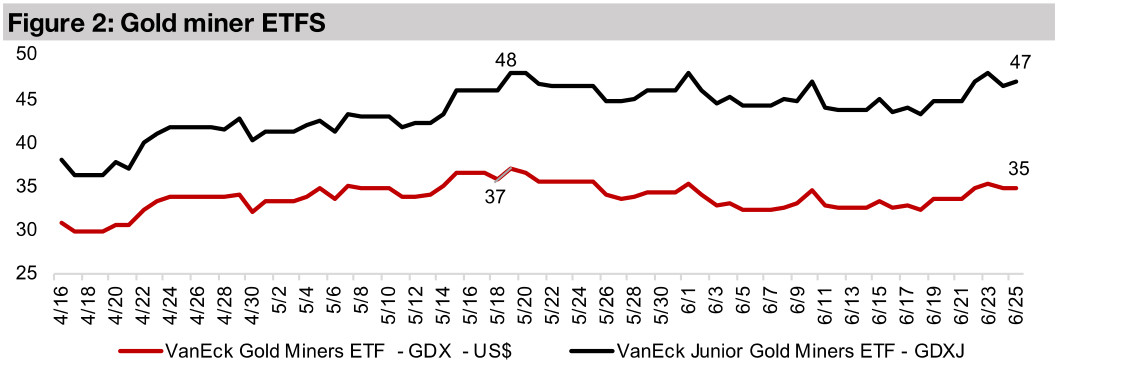

Most of the producing miners jumped this week, on average by mid-single digits, driven by the rise in the gold price, and the fact that global mining activity has begun to resume as global health crisis-related restrictions are reduced.

Gold jumps through US$1,770 resistance

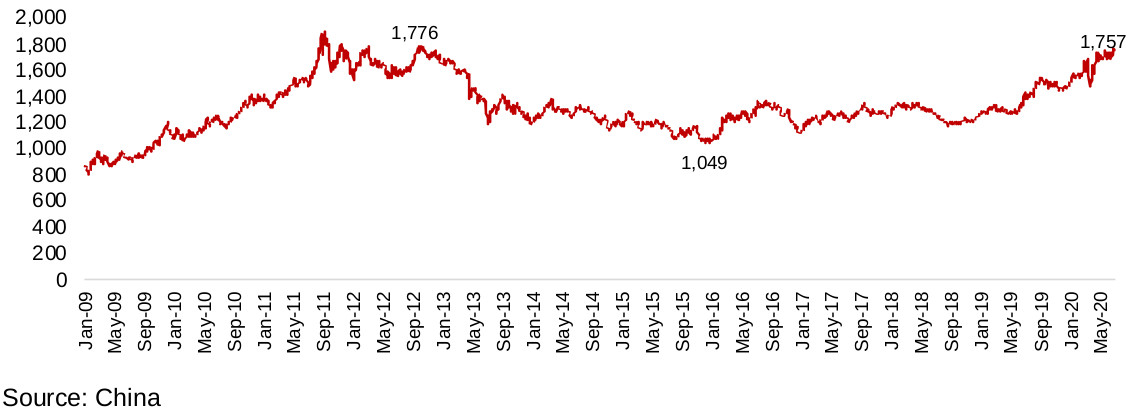

The gold futures price jumped 2.7% this week to US$1,776/oz, finally breaking through resistance at US$1,700 that had persisted for two months. The spot price reached US$1,757/oz this month, which marks the highest level since Q4/12 (Figure 4). With a combination of massive monetary expansion, continued broader global economic risk and high (although declining) global health risk, it appears that gold will be likely be maintained well above US$1,600 for an extended period. At US$1,600/oz, margins for producers are good, but if gold heads above US$1,800/oz, margins start to become quite substantial, and this in turn could drive a major surge in interest and investment in junior gold mining stocks.

Figure 4: Spot gold price

A look at recently reported data series outlining global gold demand

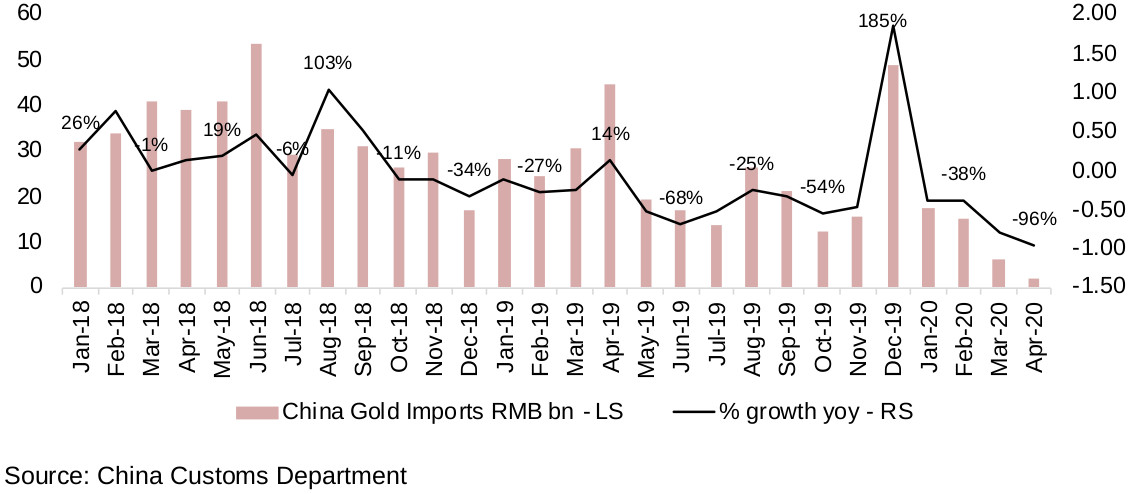

Gold continues to be strong even as some of the most timely monthly series reported for underlying fundamental gold demand have been relatively weak. These include China gold imports, a proxy for gold demand in China, and central bank purchases of gold. Clearly the weakness in these series are being offset by the monetary expansion, and economic risks and global health risks. China gold imports are a key indicator of global gold demand, as the country is the number one source of global demand for gold jewelry. While these gold imports collapsed as of the latest reported March and April 2020 figures, down -80% and -96%, respectively (Figure 4), this was likely more because of limits to global shipping and on Chinese consumers getting to retail outlets, than illustrative of a major fall in actual demand China, and we are likely to see China gold imports rebound considerably from June 2020 onwards.

Figure 5: China gold imports

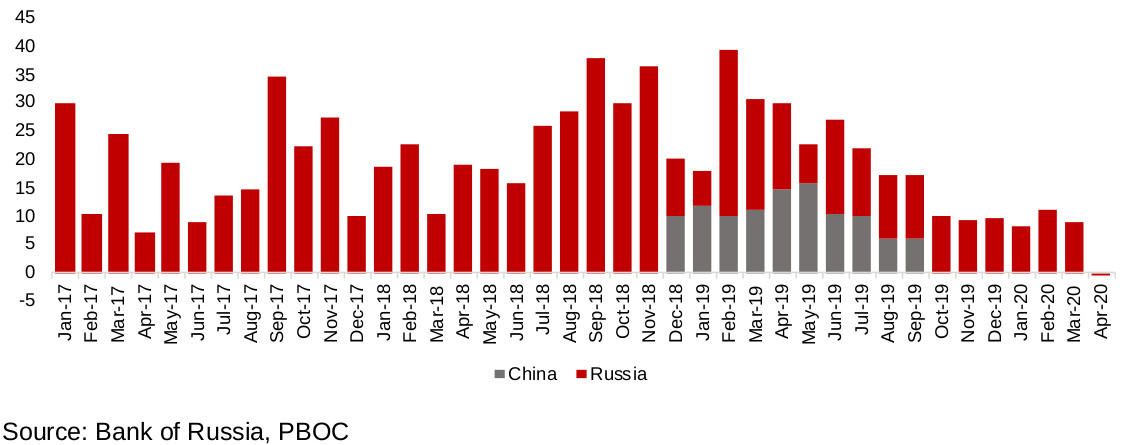

The other key series with monthly data is from Central Banks reporting the changes in their gold reserves. Over the past ten years, the largest purchases by central banks have been by the Bank of Russia, and China's central bank, with Russian purchases especially dominating (Figure 6). However, the Bank of Russia has stated that it would halt its gold purchases from April 2020, and we have seen this in the data, with a small decline in Russia's gold holding. While this does mark the absence of a major source of underlying global gold demand, with the gold price rebounding strongly in April 2020, we can conclude that the other factors we have outlined above are more than offsetting other underlying demand factors.

Figure 6: Russia and China central bank changes in gold reserves

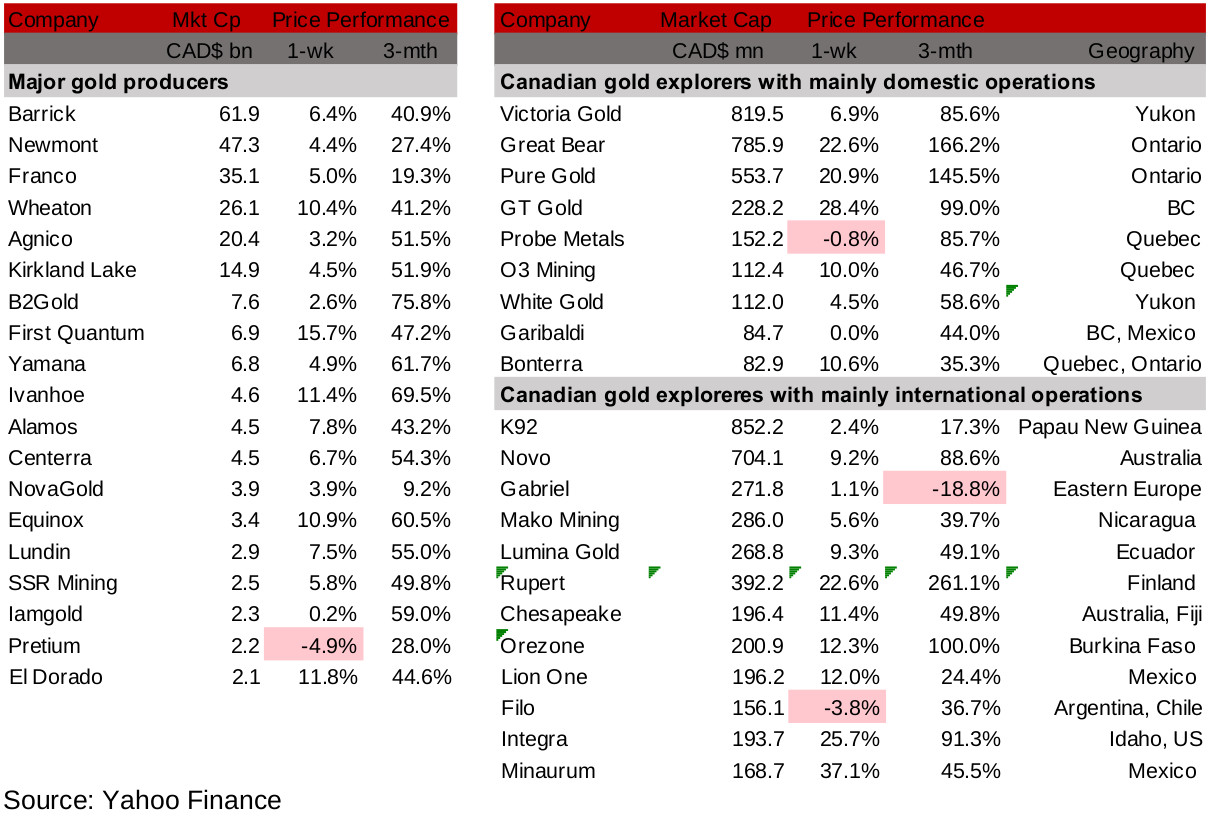

Figures 7, 8: Major producing gold mining stocks and Canadian juniors

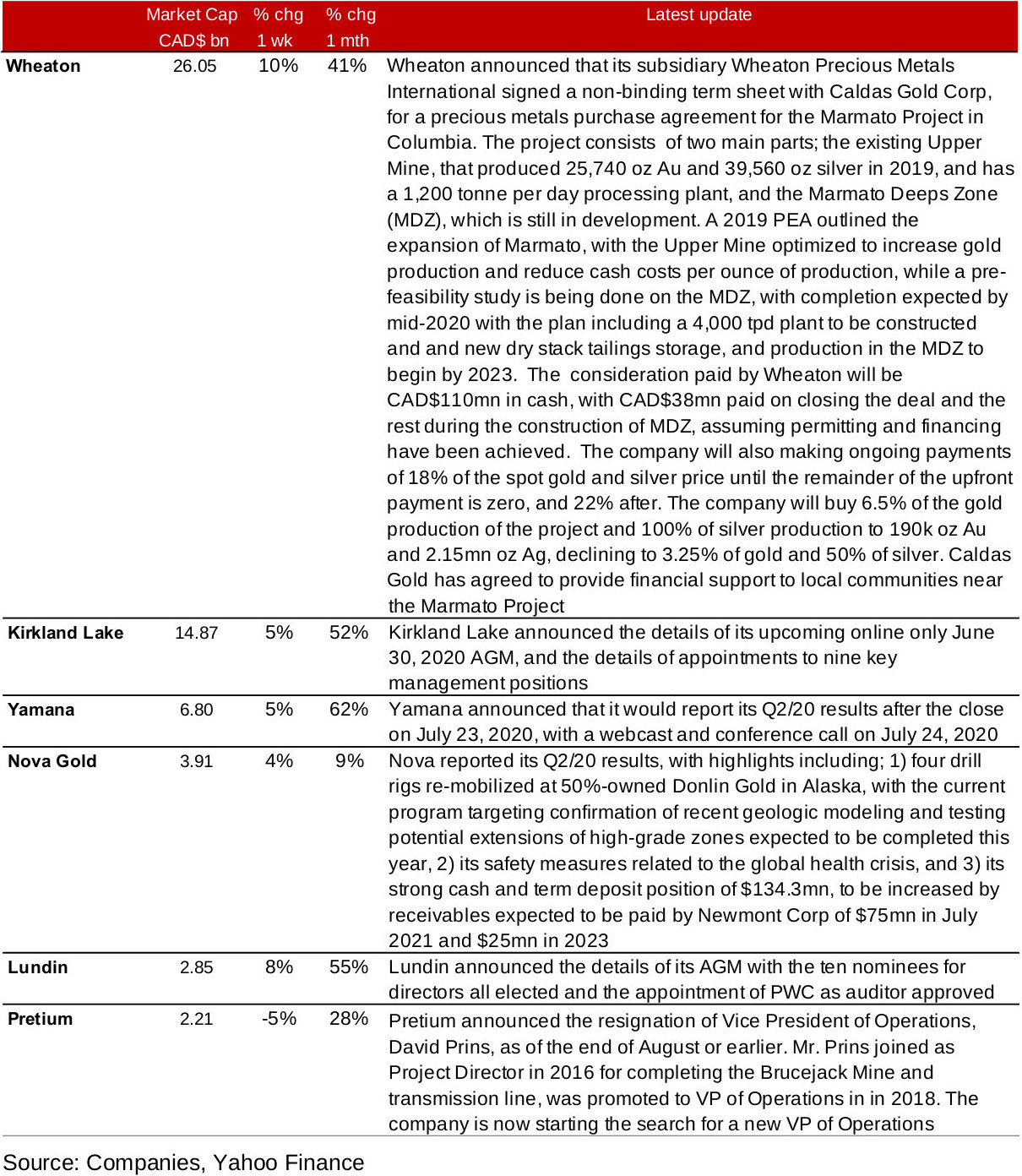

Producers miners see gains on gold price rise

Almost all of the larger producing miners were up this week, mainly on the jump in the gold price (Figure 7). Press releases included Wheaton Precious Metal's announcement that it had signed a non-binding agreement with Caldas Gold Corp for precious metals purchase from the Marmato Project in Columbia (Figure 9). Nova Gold announced its Q2/20 results, with the company highlighting the resumption of drilling at Donlin in Alaska, its strong cash position, and continued strong health measures. Other updates included details of completed or upcoming AGMs from Kirkland Lake, Yamana and Lundin, and key management changes from Pretium.

Figure 9: Producing gold miners updates

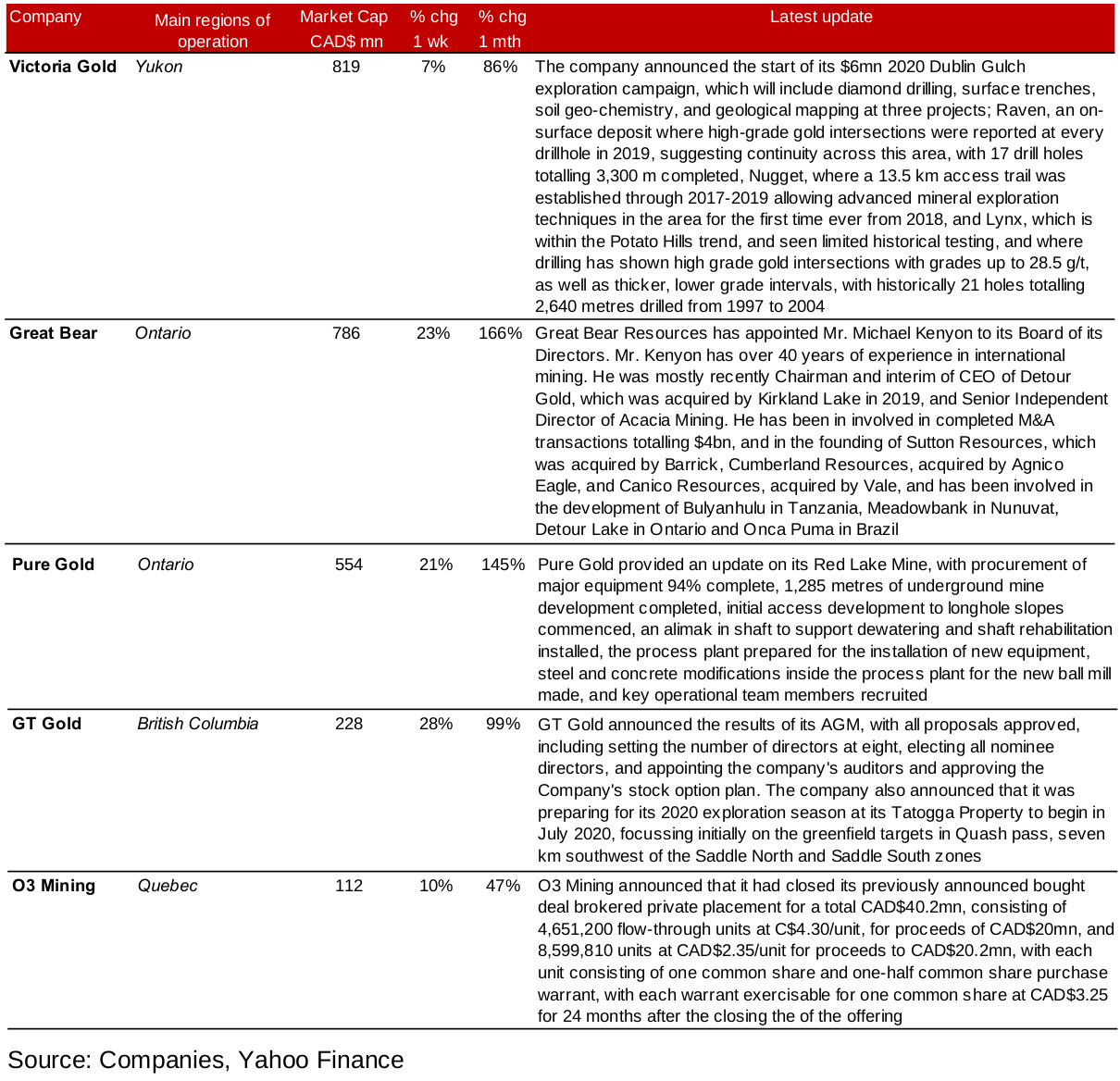

Canadian operating juniors up on gold price rise

The Canadian operating juniors were nearly all up on the rise in the gold price (Figure 8). Major press releases included Victoria Gold, which announced details of the start of its 2020 Dublin Gulch exploration campaign in the Yukon, and Pure Gold's update of progress on the construction of its Red Lake mine, with the first gold pour still targeted by Q4/20 (Figure 10). Great Bear announced an appointment to its board of directors, GT Gold the results of its AGM, and O3 Mining the closing of a previously announced bought deal brokered private placement.

Figure 10: Canadian junior gold miners operating in Canada updates

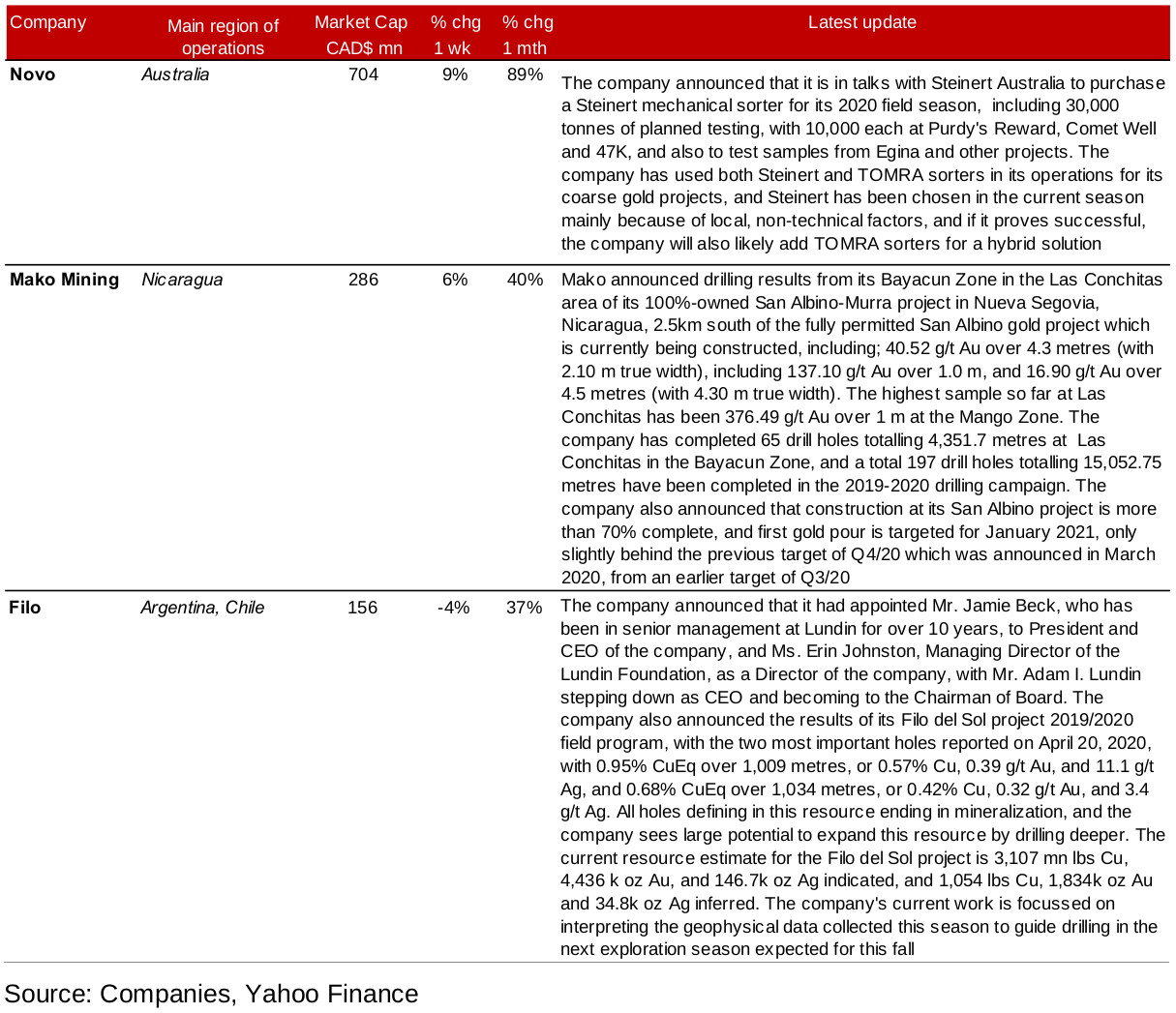

Canadian internationally operating juniors gain as gold increases

The Canadian operating junior gold mining stocks almost all rose this week, driven by the increase in the gold price (Figure 8). Press releases included Novo Gold, giving details of planned new equipment purchases, Mako Mining, with new drilling results at its San Albino-Murra project in Nicaragua, and Filo Resources, which announced management changes, including President and CEO, and the results of its 2019/2020 Filo del Sol Project field program (Figure 11).

Figure 11: Canadian junior gold miners operating mainly internationally updates

In Focus: Pure Gold and Great Bear at Red Lake

Figure 12: Great Bear Resources

Figure 13: Pure Gold Mining

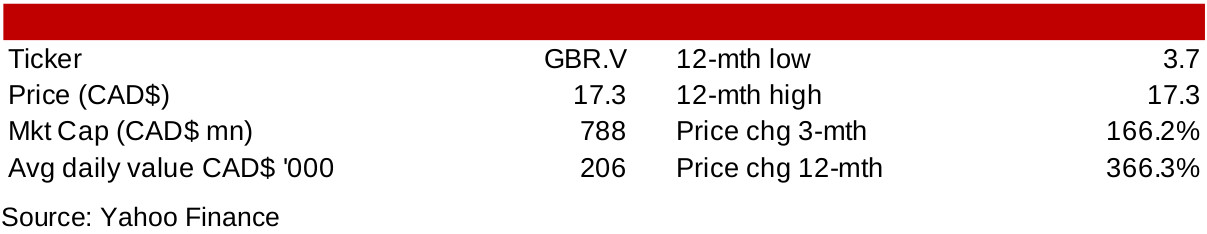

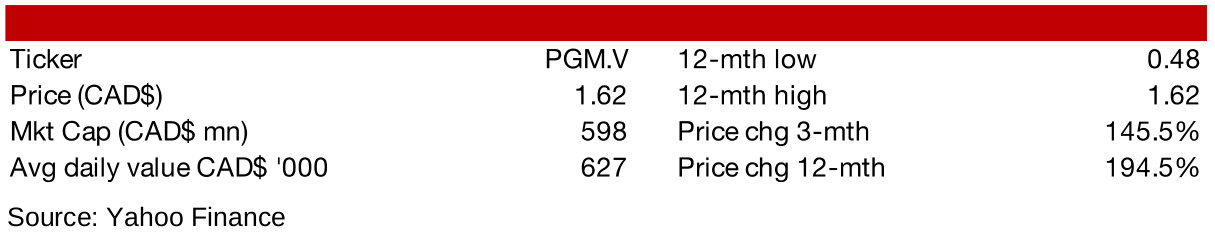

Great Bear and Pure Gold outpacing other Canadian gold juniors

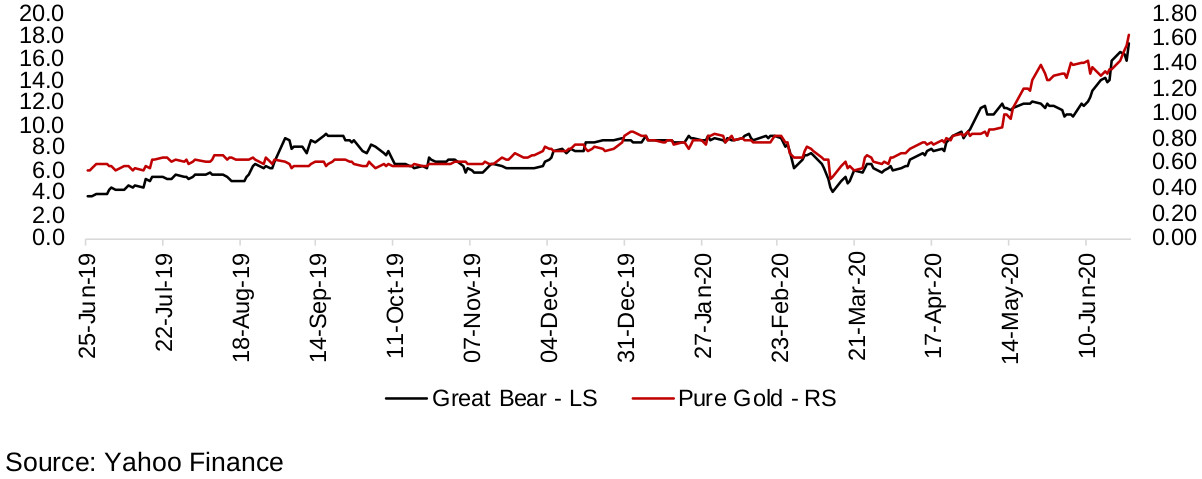

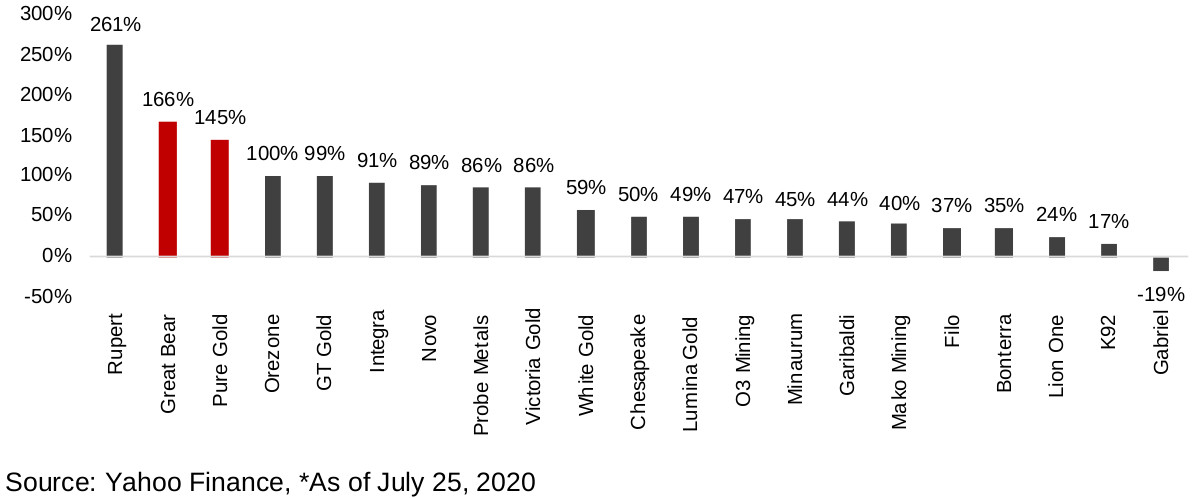

Great Bear Resources and Pure Gold Mining, both operating in Red Lake, Ontario, were up 22.6% and 20.9%, respectively, this week, and while some other larger cap Canadian junior miners are still just getting back to pre-crash levels, both these names are now well above their March lows (Figure 14). They have seen the best performance of the larger Canadian junior miners over the past three months, up 166% and 145%, respectively, other than Rupert Resources, which rose 261% (Figure 15).

Figure 14: Great Bear, Pure Gold share prices, CAD$

Figure 15: Canadian junior miner 3-mth price performance

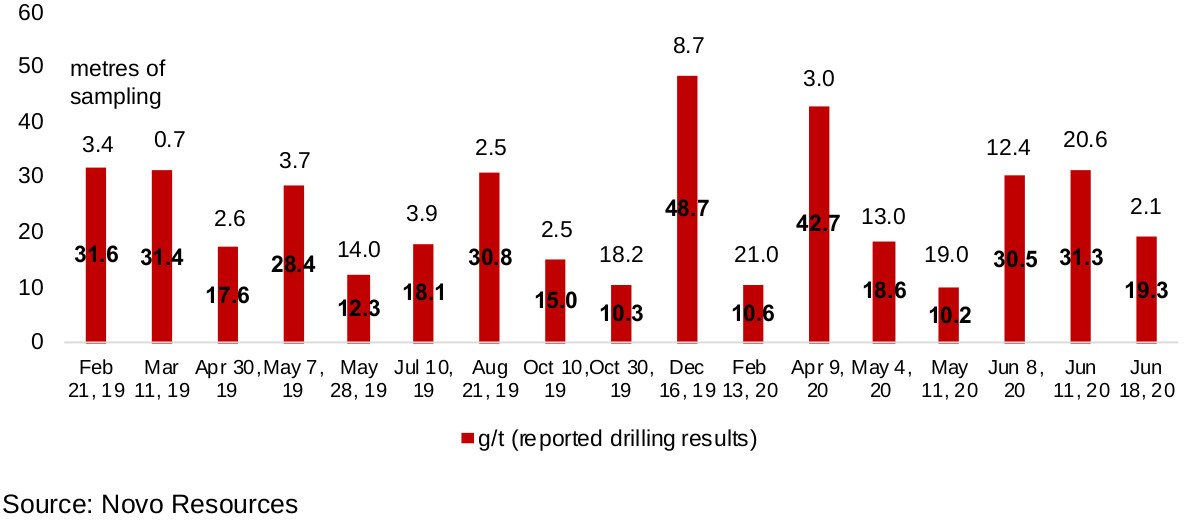

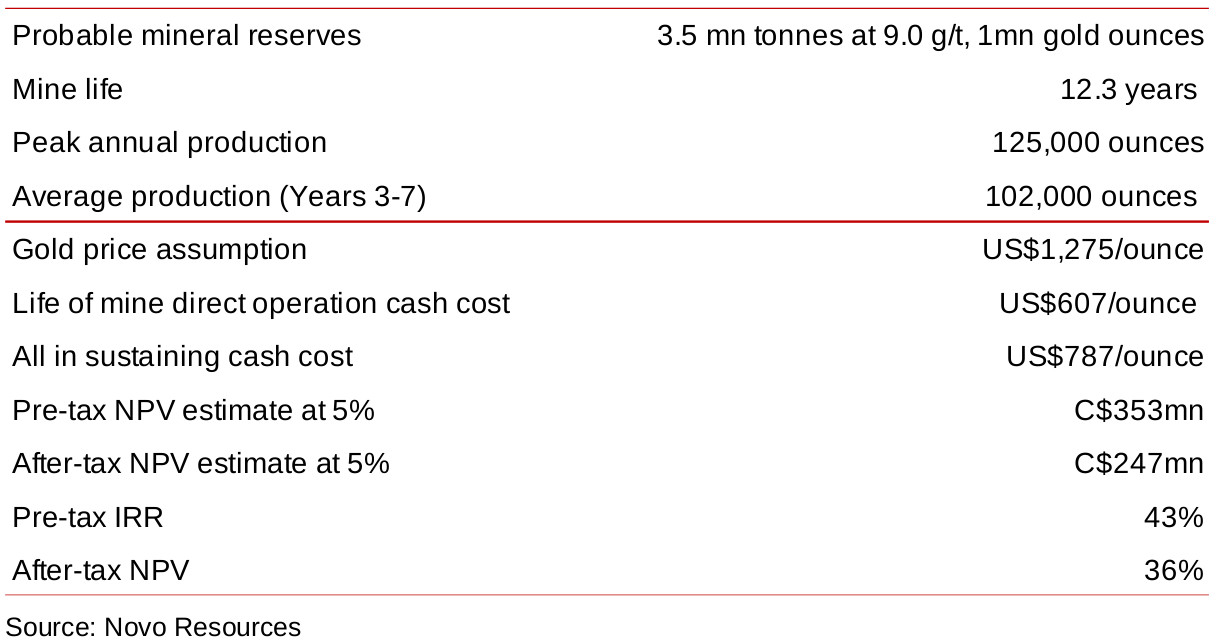

The two companies are at different phases of development, with Great Bear undertaking an extensive drilling campaign, but yet to release a resource estimate, while Pure Gold completed its PEA in February 2019. However, Great Bear's market cap of CAD$788mn is ahead of Pure Gold at CAD$598mn, following seven press releases of mainly strong drilling results at its Dixie Project so far in 2020, which importantly is showing increased continuity and therefore could potentially be a larger project than Pure Gold (Figure 15). However, with Pure Gold targeting first pour by Q4/20, it is at a considerably more advanced stage and could be more attractive to investors seeking companies with a more clearly defined potential resource, as outlined in its PEA (Figure 16).

Figure 15: Great Bear Resources' recent drilling results

Figure 16: Pure Gold's PEA, February 2019

Disclaimer: This report is for informational use only and should not be used an alternative to the financial and legal advice of a qualified professional in business planning and investment. We do not represent that forecasts in this report will lead to a specific outcome or result, and are not liable in the event of any business action taken in whole or in part as a result of the contents of this report.