April 16, 2021

Gold and silver take back seat to other metals in 2021

Author - Ben McGregor

Gold price continues to trend back up

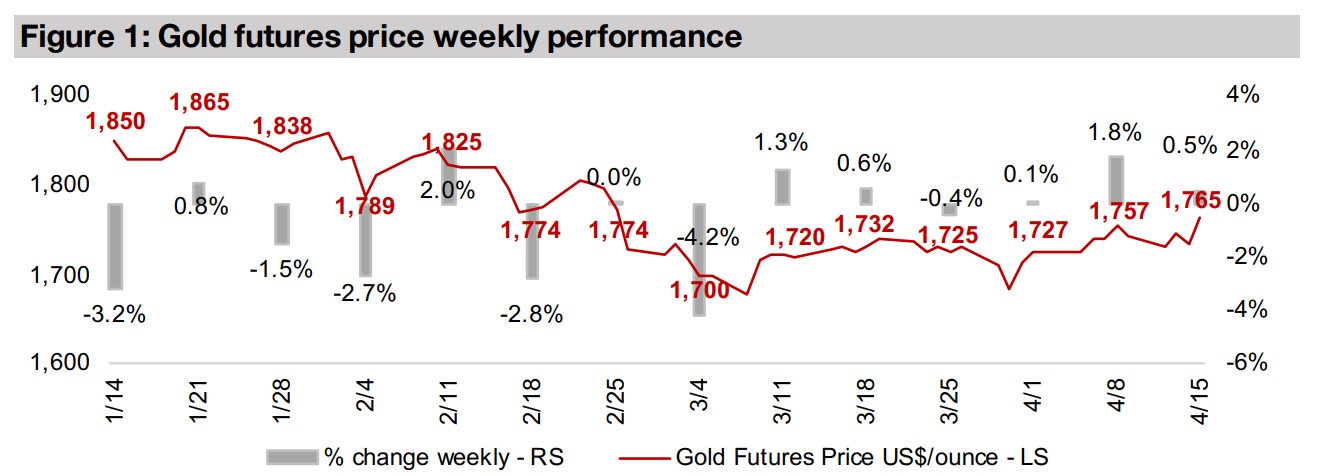

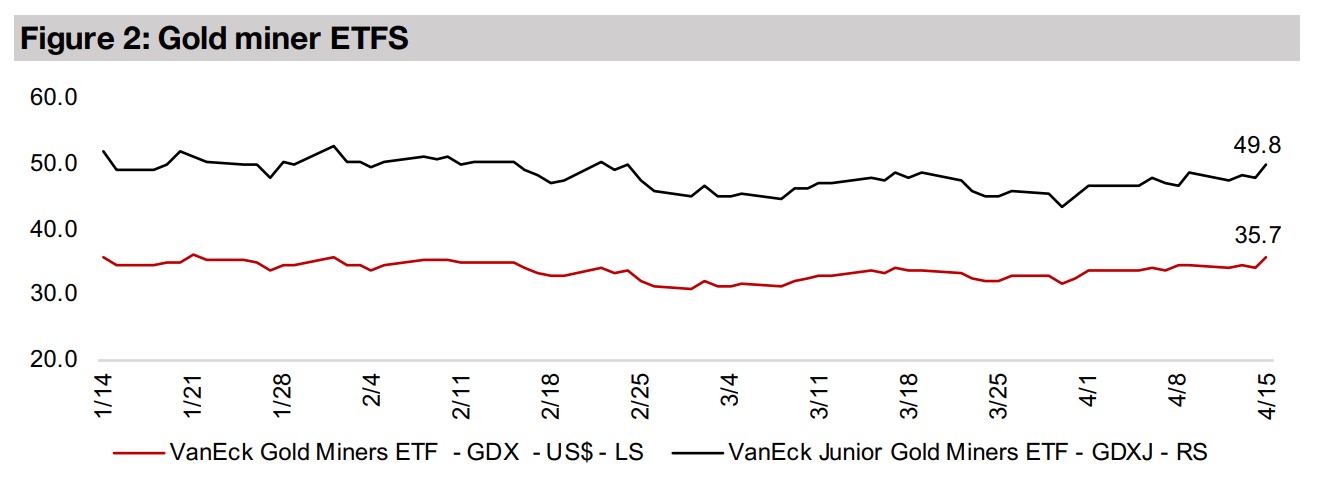

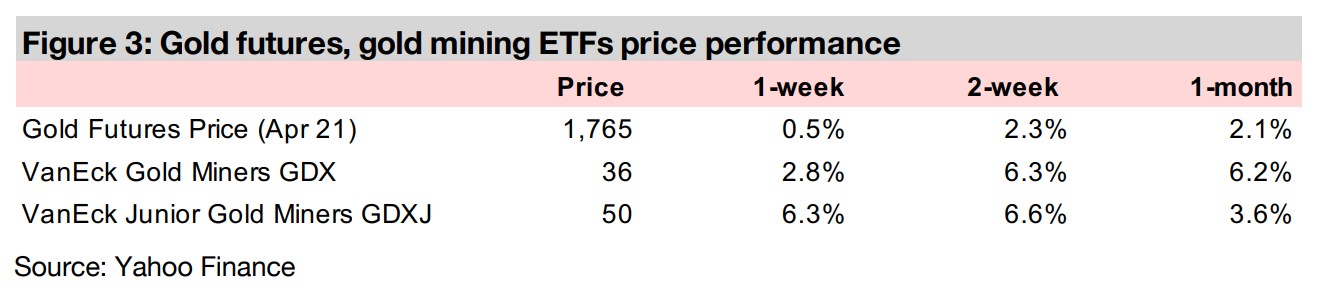

The gold price rose 0.5% this week to US$1,765/oz, and has trended up for two weeks, averaging US$1,740/oz, ostensibly because of easing yields, but in our view more because of a rampant ongoing hyperinflation-esque monetary expansion.

Gold and silver take a back seat to base metals so far in 2021

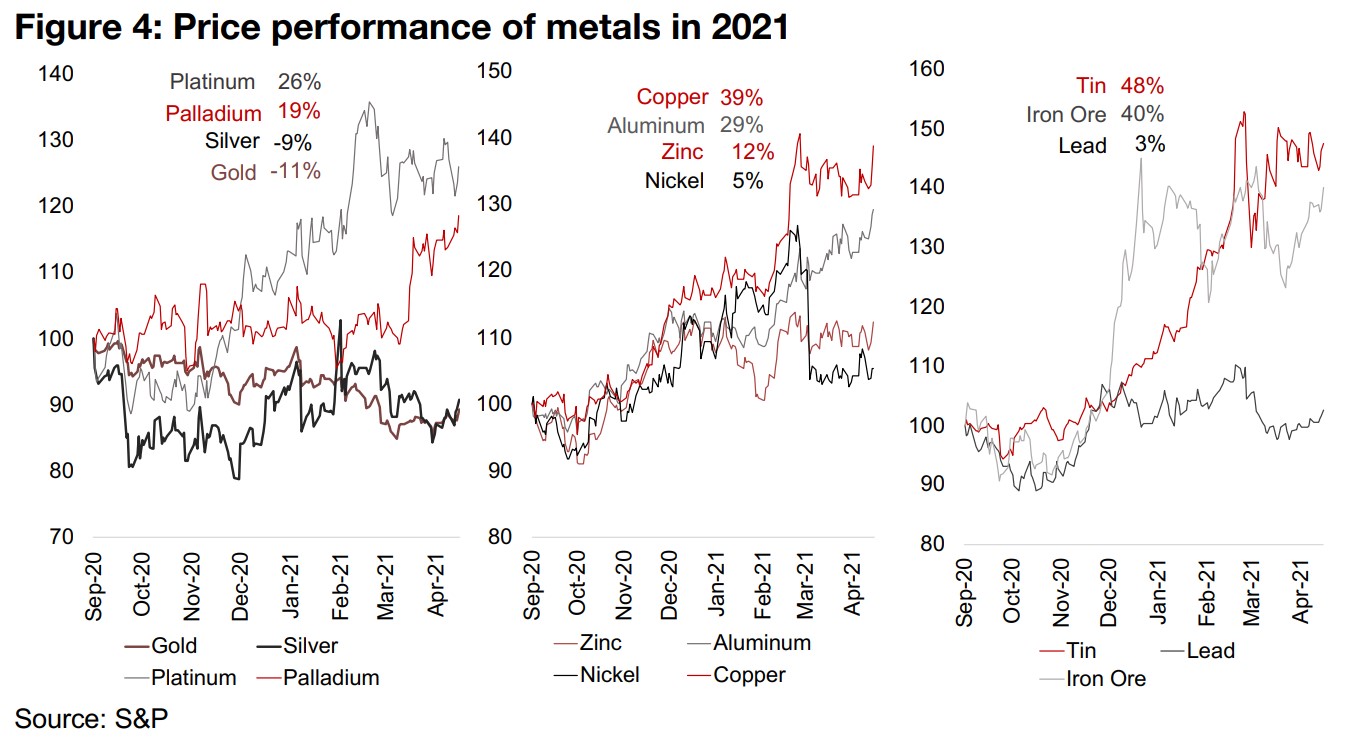

This week we again take a look at the metals space more broadly, with gold and silver taking a backseat this year to other precious metals platinum and palladium, but especially to the base metals, which have surged on the global economic recovery.

Gold moving above range of the past few weeks

The gold price rose 0.5% this week to US$1,765/oz, and has averaged US$1,740/oz for the past two weeks, after averaging US$1,725/oz in the three weeks prior to that. While this may be attributed to the market viewing a fall in bond yields as a driver of gold, we note that gold had also been picking up last week, even though bond yields were heading up. We have addressed previously the issue of whether these rising bond yields should really be a major driver for gold. If the rise in yields is in fact driven by rising inflation expectations, as has been purported, then surely an inflation hedge like gold should be purchased, not sold off. Nonetheless, the market is acting as if a rise in yields should drive a sell-off in gold, and a decline should drive up the gold price. Historically, there has been no such relationship, and we expect gold to continue rising on a massive ongoing monetary expansion, especially in the US.

Gold and silver take a back seat to other metals in 2021

Figure 4 shows performance of the major metals YTD for 2021, with gold and silver, the stand-outs for 2020, taking a back seat so far this year, down -11% and -9% respectively. For precious metals, it has been platinum and palladium that have outperformed this year, up 26% and 19%, driven by the catalytic convertor for vehicles story, and the rebound in global vehicle production. But the really outsized gains have some from the base metals, with aluminum rising 29%, copper up 39%, iron ore gaining 40%, and tin jumping 48%, as the global economy recovers, however artificial this may be, given that it is being driven by historically radical levels of monetary expansion, especially in the US, but increasingly also globally, as well as fiscal stimulus. Nonetheless, however it has been propagated, the economic recovery continues, and will likely support base metals through much of 2021.

What's weighing on gold and silver in 2021

So what has put pressure on gold and silver this year? Well, certainly part of this has

been their outstanding performance, with gold's rise starting earlier than other metals,

in H2/19, and continuing to be by far the best performing metal up to H2/20, given

that it was both a risk hedge, and was driven by a huge monetary ramp up. However,

starting in late 2020, bond yields started to rise, with the recovery propelling inflation

expectations, and a theory developed in the market that investors would drop

yieldess gold to chase yields in the bond market. While we don't have much faith in

this theory, as we discussed at length last week, nonetheless the market has bought

this idea short-term, pressuring gold.

However, medium to long-term we expect that hyperinflationary-esque money

printing in the US will eventually drive severe inflation, and drive up the gold price.

Silver is a slightly different story, as is it also a monetary metal, like gold, but is also

driven much more by industrial factors, and thus saw some gains over H1/20, but

really took off in H2/20 as the economy recovered. Silver may have been a bit weak

so far in 2021, because, like gold as of mid-2020, it had run very far, very fast by end-2020, and was perhaps due for some consolidation.

Platinum and Palladium have made the big gains in precious metals

The big gains this year in precious metals have shifted away from gold and silver and over to platinum and palladium, which like silver, are driven by the pickup in the global economy generally, but also by specific sector factors. These include especially the use of these metals in emission reducing autocatalytic convertors, with palladium for gasoline vehicles and platinum for diesel-powered vehicles. Last year, the expected move to more 'green' vehicles, had driven up palladium more than platinum, with an expected shift away from diesel vehicles. However, this year, both metals have surged on the economic recovery, with a rebound in vehicle production driving both, with the move to low-emission vehicles continuing to drive palladium, but a jump in demand for heavy-duty vehicles in China, which use diesel, supporting platinum.

Copper, aluminum, tin and iron ore jump on economic recovery

The story for most of the base metals is that they have been driven by the strong rebound in the economy and surging demand for industrial and consumer uses, while output in many cases was constrained over the past year from because of the global health crisis, with copper, aluminum, tin and iron ore especially surging. Zinc has had a comparably moderate rise, up just 12%, and nickel had been up with the rest of these base metals, hitting a peak gain for the year of 26%, but collapsed to just 5% currently because of a technological advance coming out of China, which is expected to dramatically expand supply for this metal. The weakest of the base metals has been lead, up just 3%.

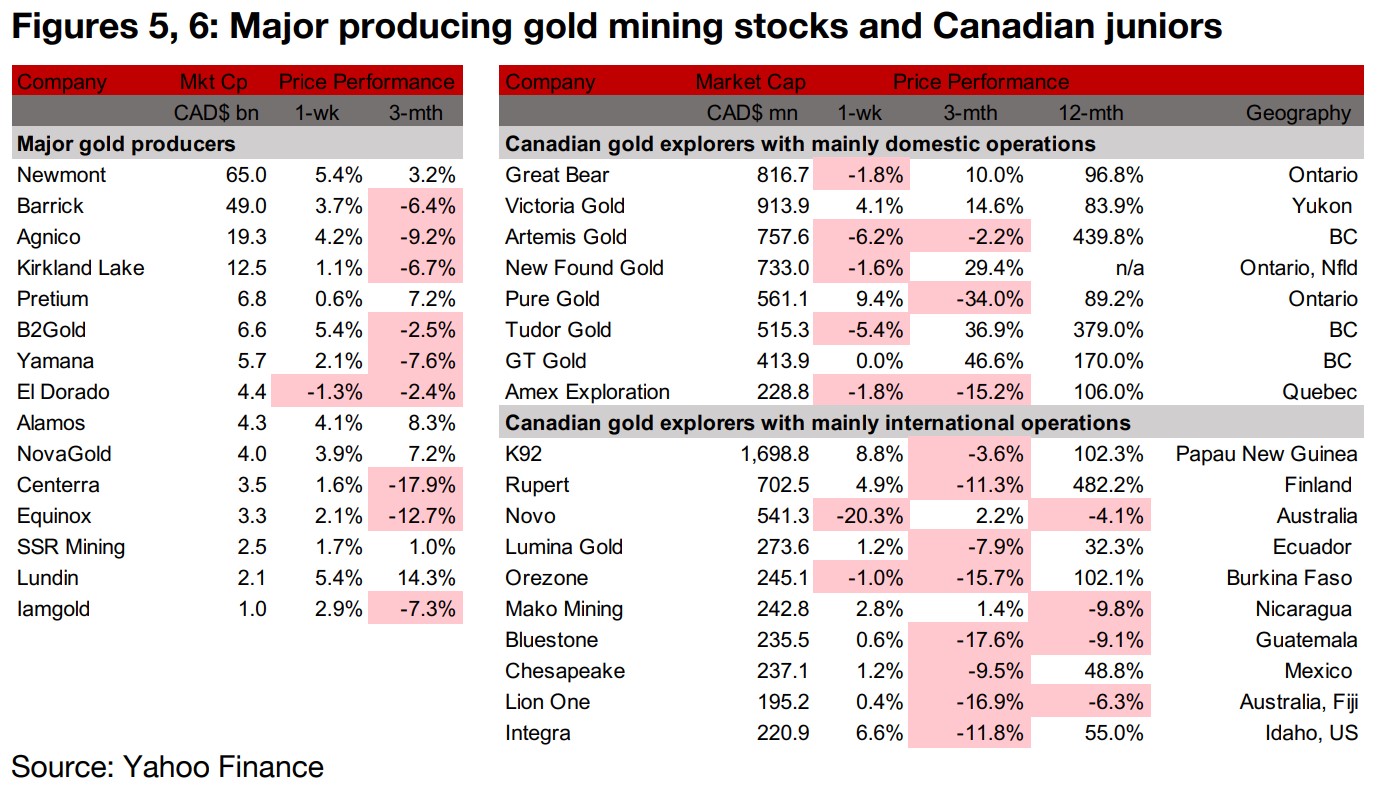

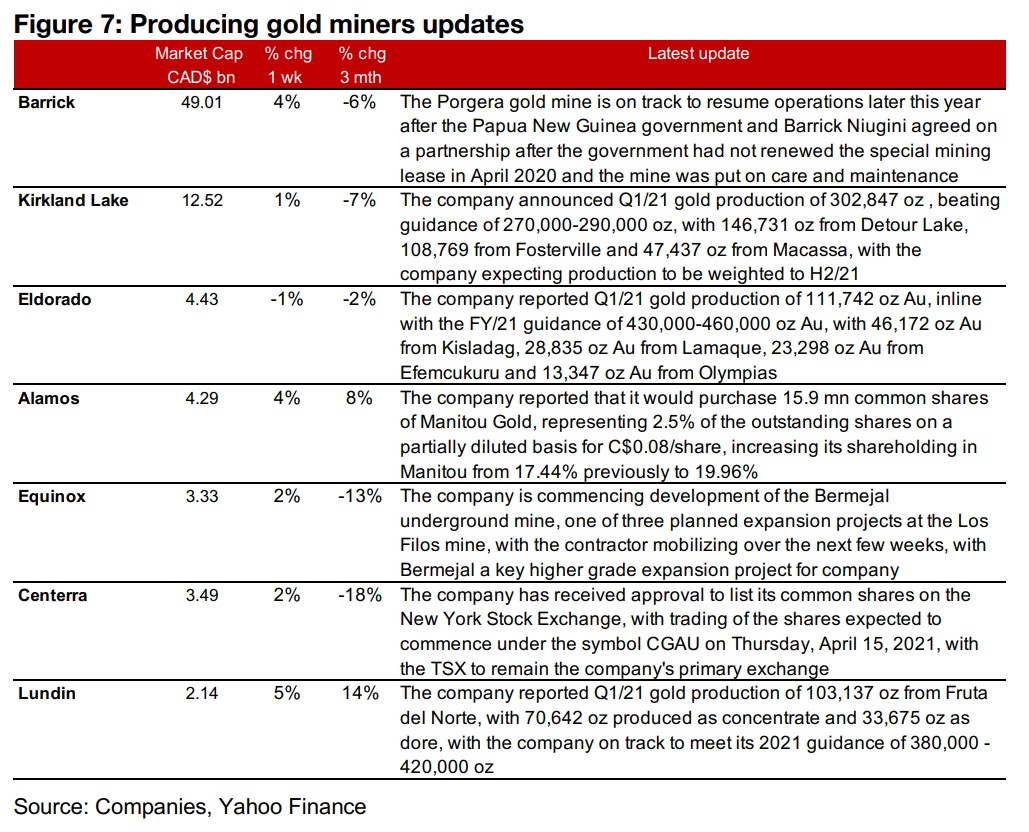

Producing miners almost all up on gold rebound

Nearly all of the large gold producers were up this week as the gold price continued to hold at higher levels of around U$1,740/oz over the past two weeks (Figure 5). Barrick announced that its was on track to resume operations at Porgera after making a partnership with the Papua New Guinea government, after its special mining lease had not been renewed in April 2020 and the mine had been on care and maintenance since. Kirkland Lake, Eldorado and Lundin reported Q1/21 production, Alamos announced an increase in its Manitou mine shareholding, Equinox commenced development of the Bermejal underground mine and Centerra announced that it will be listing on the New York Stock Exchange and maintain its primary listing on the Toronto Stock Exchange (Figure 7).

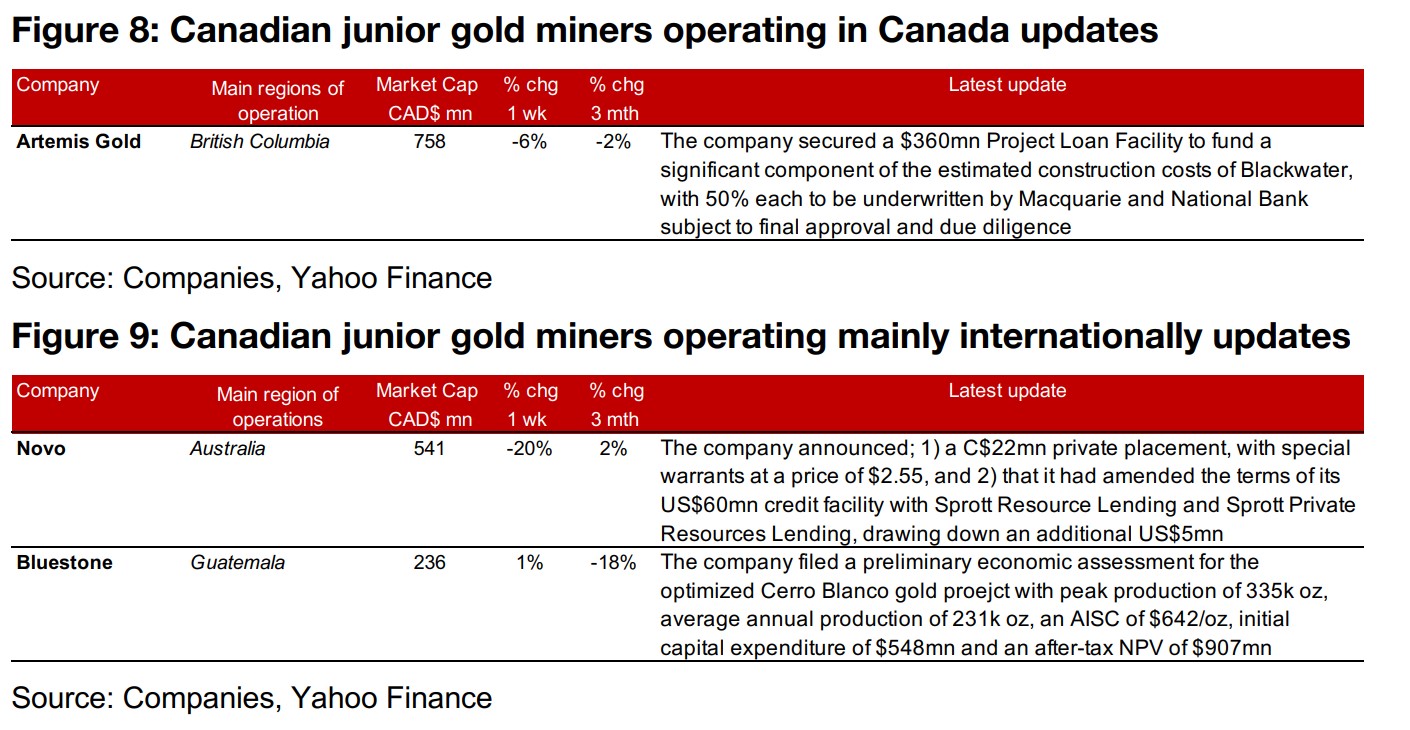

Canadian juniors mixed on individual drivers

The Canadian juniors were mixed on individual company drivers, even as the gold price trended up for the third week (Figure 5). Artemis secured a $360mn Project Loan Facility to fund a significant component of Blackwater (Figure 8), Novo announced a C$22mn private placement and amended terms for its U$60mn credit facility with Sprott Resource Lending and Sprott Private Resources, Bluestone filed a preliminary economic assessment for the optimized Cerro Blanco gold project with an after-tax NPV of $907mn (Figure 9).

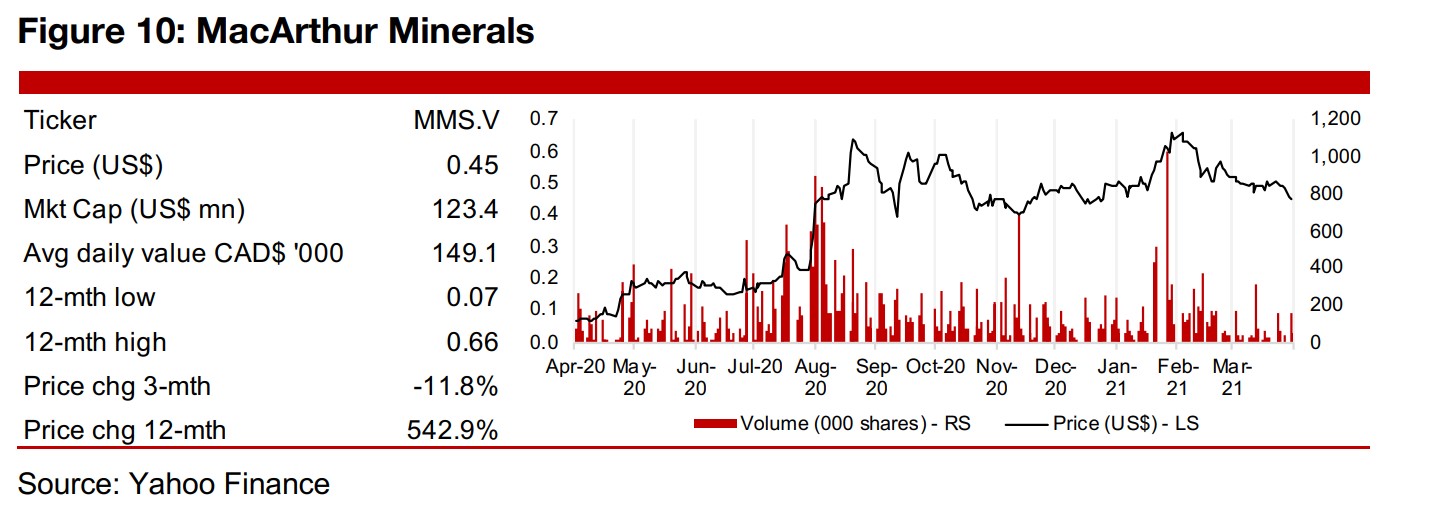

In Focus: MacArthur Minerals (MMS.V)

Lake Giles iron-ore project driving most of the value

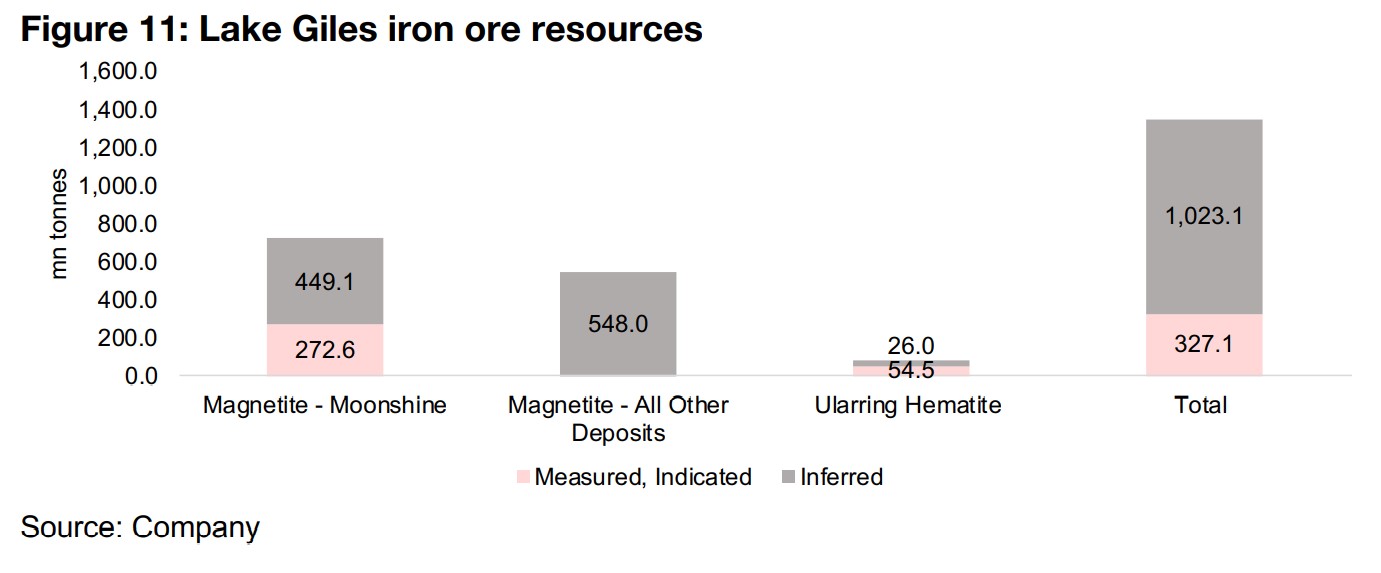

MacArthur Minerals is one of the largest juniors on the TSXV that is a major play on iron-ore; although it has many projects covering many minerals, its Lake Giles iron-ore project, comprising the Magnetite Moonshine project and the Ularring Hematite project, are what have really been driving the value for the stock. The resources for the combined project are very large for a junior miner, at a total 1.3 mn tonnes, although only 0.32 mn is measured and indicated and 1.02 mn inferred, so the deposit does remain quite speculative. Nonetheless, the market has clearly become more interested in the story, with the price surging 542.9% over the past year, although it has not tracked necessarily tracked recent gains in the iron ore price. The big lift for the stock was in mid-2020 after it released an updated resource for Magnetite project. The company has also been driven by infrastructure development drivers, as shipping iron ore is a critical driver, given its bulk and weight, compared to many other metals, and news on plans for port access gave a lift to the share price in January 2021.

Getting the ore to port is the key hurdle

The company has made considerable progress on infrastructure over the past year. The target is to ship the iron-ore from the Lake Giles project to the Perth Kalgoorlie Railway, which is only 90 km away from the project, and directly connects to the Port of Esperance in Western Australia. The company targets using this port to ship its product, although this is subject to available capacity. In June and July 2020, progress was made on developing this infrastructure, the process of developing a haul road to access the railway network was started, and a Commercial Track Access Agreement was made with Arc Infrastructure, allowing MacArthur sufficient capacity from Arc to ship its ore. In January 2021 there was further progress on securing capacity at the port, with the company signing an agreement with the Southern Ports Authority for access to ship its ore, which give a lift to the share price earlier this year.

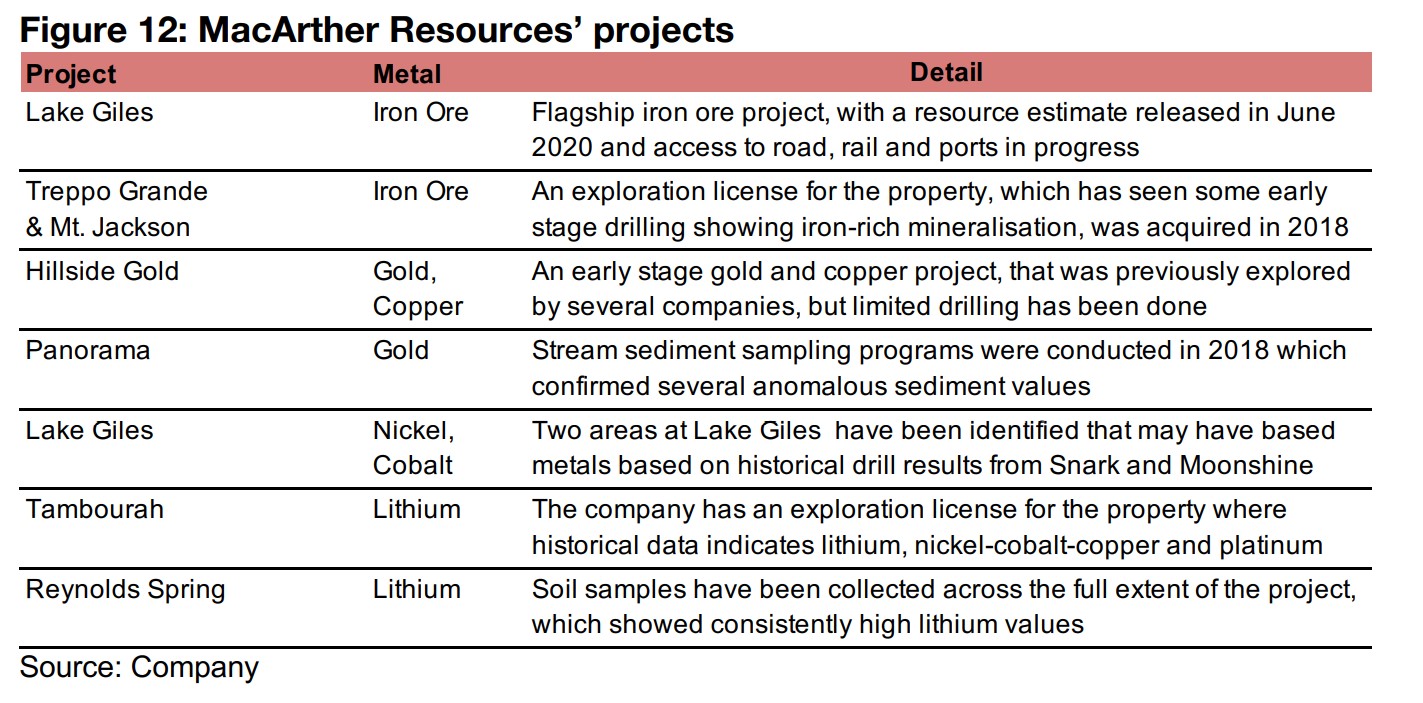

Exposure to other metals potentially through early-stage projects

While the current value in MacArthur can mainly be attributed to Lake Giles, it is not only a single project, or single metal story. It also operates two other iron ore projects, Treppo Grande and Mt. Jackson, where an exploration license was acquired in 2018. It also has exploration projects for other metals, including the gold-copper project Hillside and gold project Panorama, which has seen some limited historical exploration, and has seen some evidence for nickel-cobalt-copper and platinum at the Snark and Moonshine within the Lake Giles project, in addition to the core iron-ore resource. The company also has two lithium projects, Tambourah and Reynolds Spring. So while Lake Giles project will remain the core value driver in the short-term to medium term, and thus be driven heavily by iron-ore prices, there is potential for the company longer-term to see some upside from its exploration projects, and be driven more by a combination of different metals' prices.

In Focus: Filo Mining (FIL.V)

Operates the Fil del Sol project in Argentina and Chile

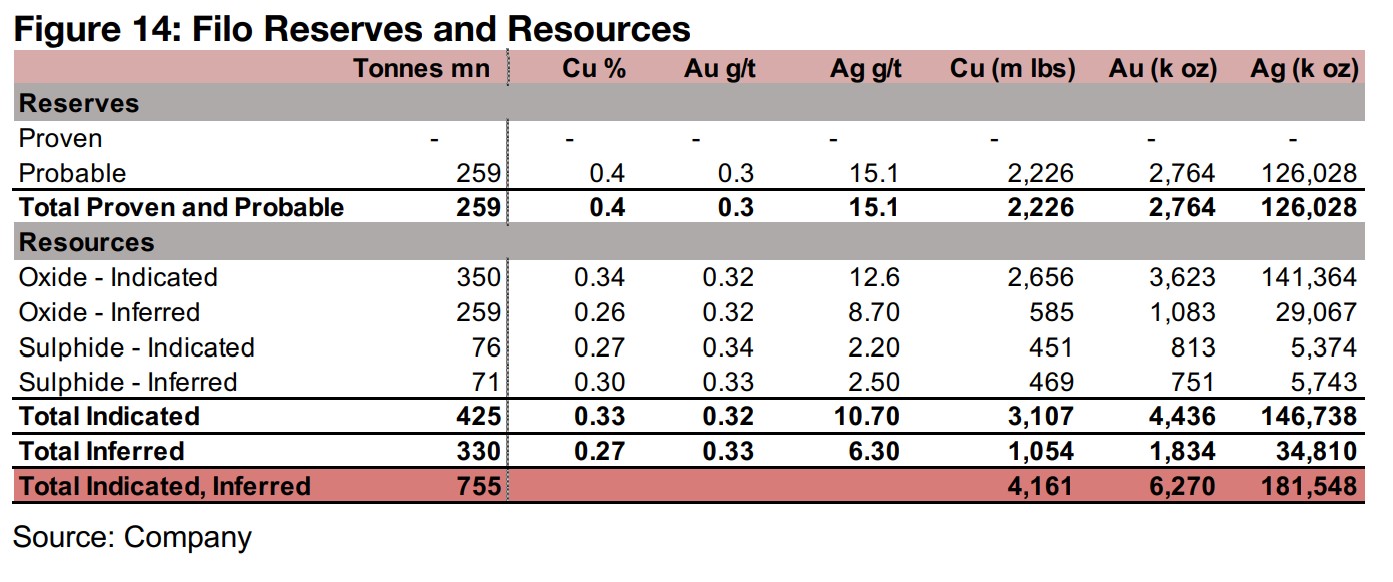

Filo Mining operates the Filo del Sol copper-gold-silver project in Argentina and Chile, which lies on a border, and is therefore in two jurisdictions, San Juan, Argentina, and Chile, for which there is an existing Mining Integration and Complementation Treaty to deal with the cross-border issues. The project has a large 2,981mn lbs of copper, 3,519 oz of Au and 127mn oz of Ag copper resources, which on a CuEq basis is around 52.7% copper, 31.8% gold and 15.5% silver. This makes it play diversified across both; 1) the economic-recovery story through copper, with economic performance and this metal historically highly correlated, and 2) the monetary metals story, with gold providing leverage to massive ongoing monetary expansion, while 3) silver is a combination of both of these stories, as it is clearly driven by economic growth, but it is also a monetary metal. The project is at an advanced stage, with a Pre-Feasibility Study for the project released in January 2019 and a 2020-2021 drilling program ongoing, targeting substantially expanding the resource.

Strong results from 2019-2020 drilling program

Filo had a strong 2019-2020 drilling season, with the three strongest holes having results of; 1) CuEq of 0.95%, including 0.57% Cu, 0.39 Au g/t and 11.1 Ag g/t over 1,009 m, 2) CuEq of 0.68%, including 042% Cu, 0.32 Au g/t and 3.4 Ag g/t over 1,034 m, and 3) CuEq of 2.04%, including 1.19% Cu, 1.05 Au g/t and 8.8 Ag g/t over 73 m. The first hole was the second-best hole with copper as the primary commodity globally over the past two years, with only Pt Sumbawa Timur Mining in Indonesia returning a higher result, with 1.893% Cu over 948m. The company also found significant intersections outside of the main resource pit shell during the 2019-2020 campaign, and developed an exploration target with scope to expand the resource.

Drill program in 2020-2021 to expand resource

The 2020-2021 drill program is targeted at continuing to expand the resource, testing gaps to the north and consider surface alteration, geochemistry, geophysics and previous drilling, with the potential to go below 1,500m, with holes open at depth, and only just hitting the top of the traditional porphyry target. The high-grade targets have geophysical anomalies similar to high-grade, breccia-hosted mineralization intersected in holes in the previous season, and the holes this season are also expected to tighten drill spacing. The three strongest holes from the 2020-2021 program so far have had results of; 1) 0.67% CuEq, including 0.42% Cu, 0.32 g/t Au and 2.2 g/t Ag, 2) 0.78% CuEq, including 0.61% Cu, 0.19 Au g/t and 3.3 g/t Ag, and 3) 1.37% CuEq, including 1.15% Cu, 0.28 g/t Au and 2.3 g/t Ag.

Pre-feasibility study released in 2019

The project advanced to the pre-feasibility study stage in 2019, indicating a large project size of $1.27bn on an after-tax basis. The expected initial capex is $1.27bn, with processing capacity of 60,000 tonnes/day, a mine life of 13 years, and 67k tonnes of copper, 159k oz of gold and 8,653k oz of silver targeted to be produced per year, and average copper, gold and silver recoveries of 80%, 70% and 82%, and prices of $3.00/lb, $1,300/oz and $20/oz, respectively.

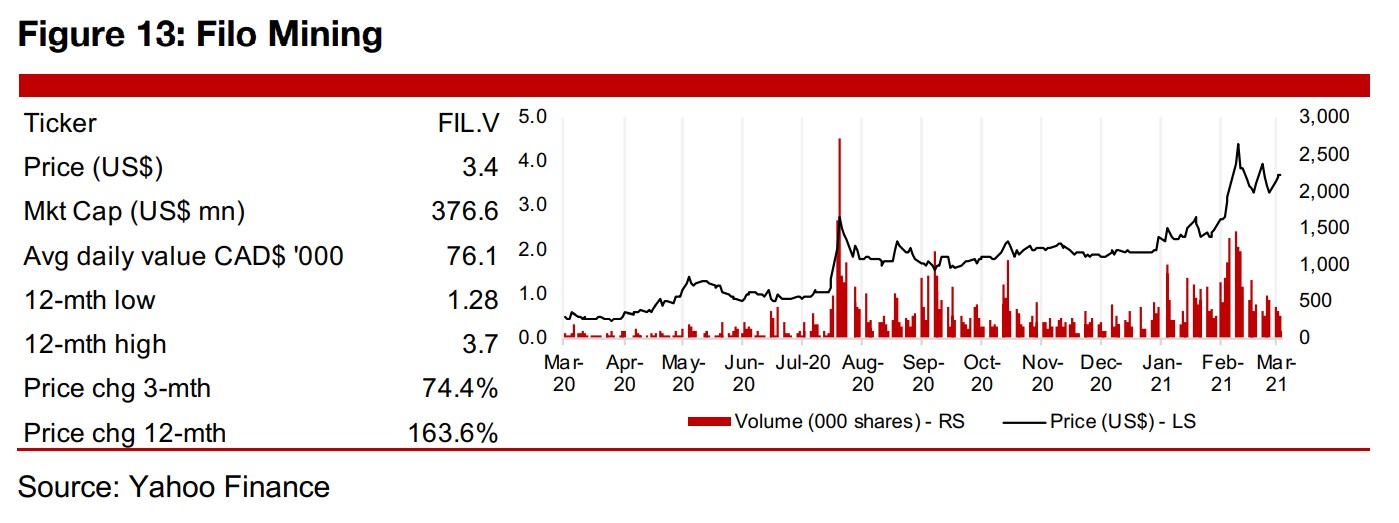

Share price saw two big lifts in July 2020 and February 2021

Filo Mining's share price saw two big increases over the past year, one in July 2020- August 2020, as it announced the completion of a $41mn private placement, with the gold price already high, silver surging, and copper starting to pick up, and another in February 2021, as the copper price really took off. The company remains an interesting mixed play between the three metals, with a sizeable resource and a project at a reasonably advanced stage.

Disclaimer: This report is for informational use only and should not be used an alternative to the financial and legal advice of a qualified professional in business planning and investment. We do not represent that forecasts in this report will lead to a specific outcome or result, and are not liable in the event of any business action taken in whole or in part as a result of the contents of this report.