Sep 25, 2020

Gold and silver dip on rising USD

Author - Ben McGregor

Gold breaks below recent range

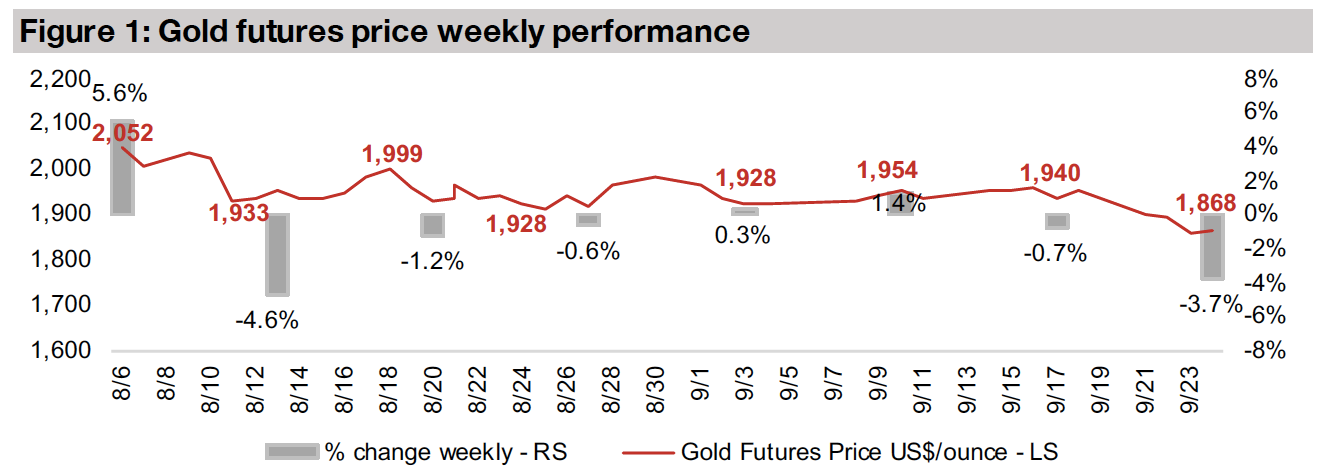

The gold price closed at US$1,868/oz this week, down -3.7%, breaking decisively below a trading range of around US$1,900/oz-US$2,00/oz that had held for eight weeks, in part driven by a rebound in the US dollar.

Producing gold miners down on gold price decline

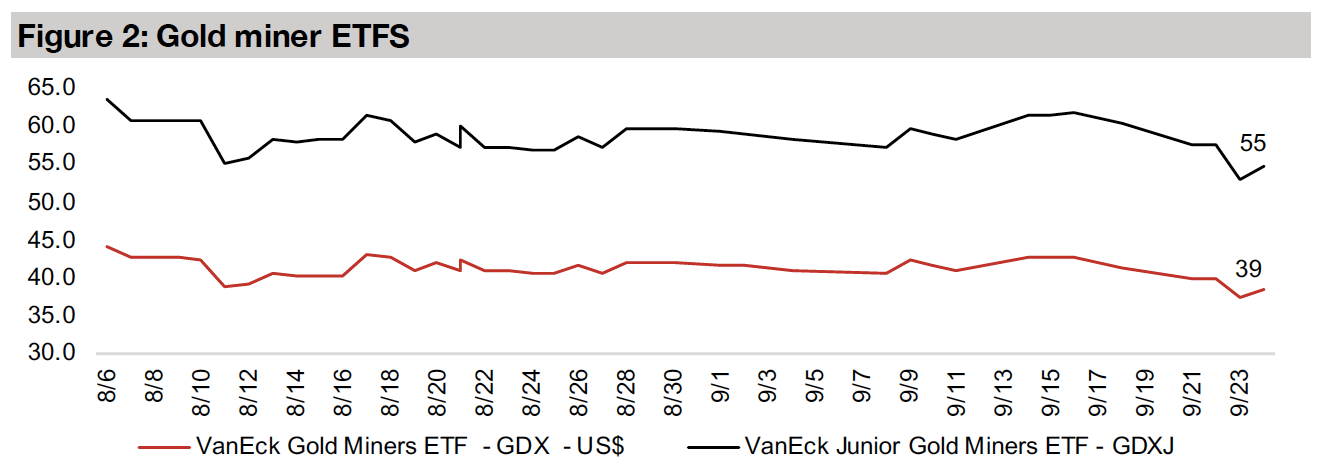

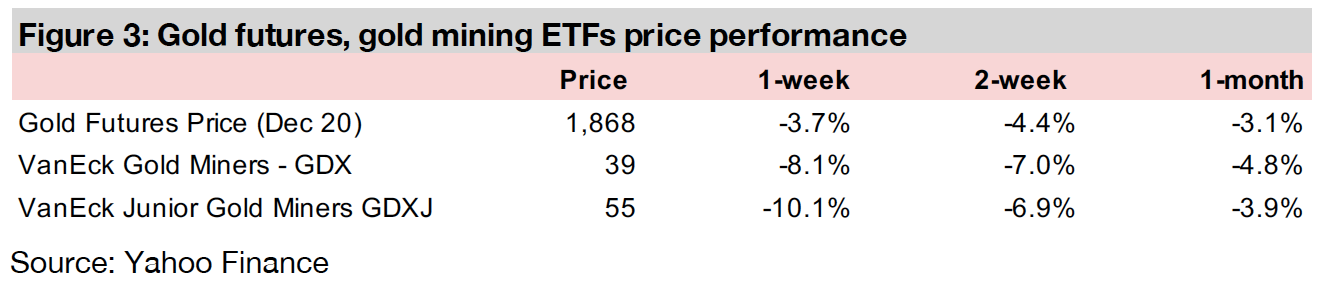

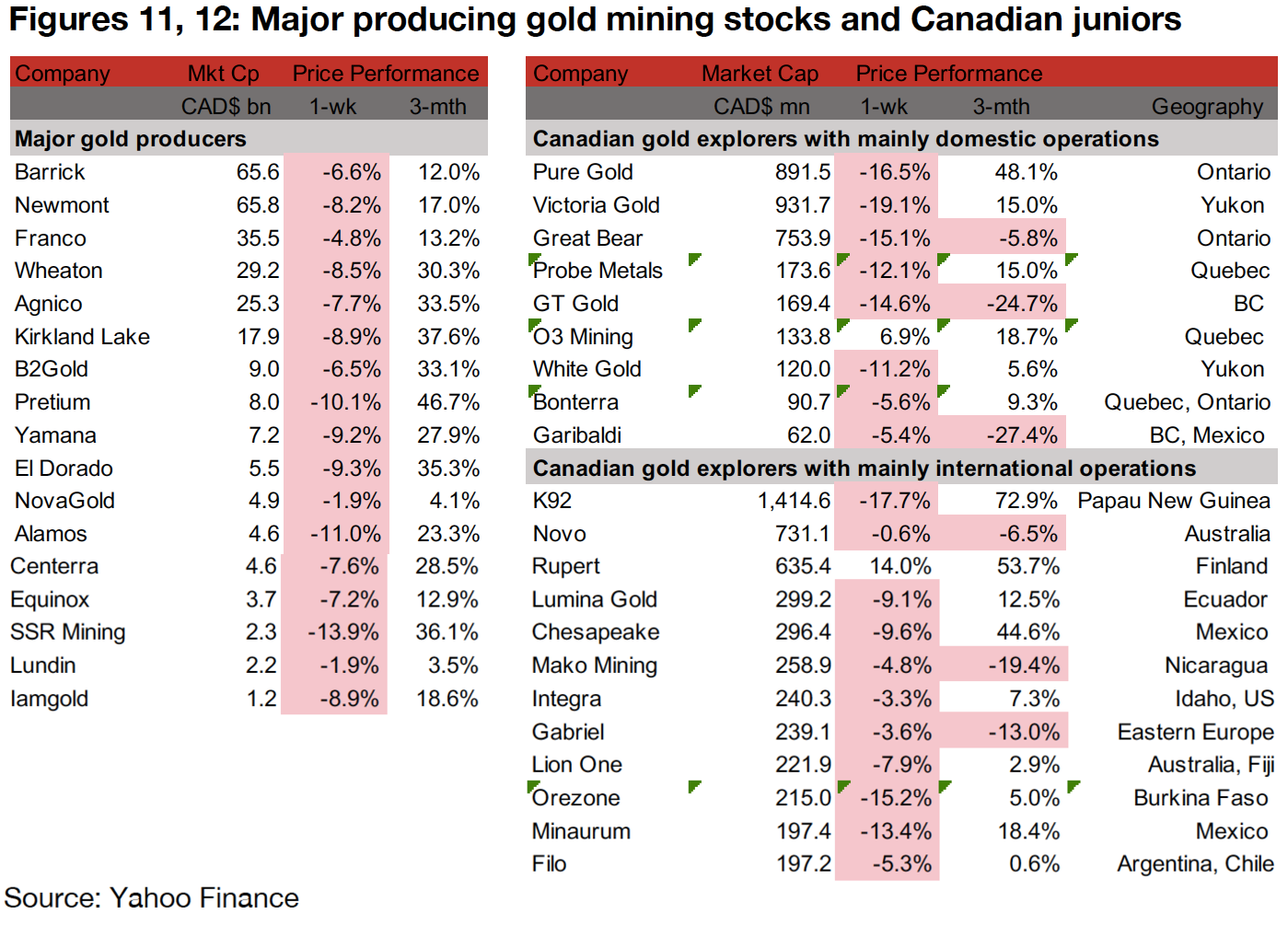

The producing miners were down considerably this week on the fall in the gold price, with the GDX sliding -8.1% for the week, and all of the producing gold miners declining, with most down by high single digits.

Canadian junior gold miners take substantial hit

The global junior gold miners were also hit, with the GDXJ down -10.1%, and nearly all major Canadian junior gold stocks down. We continue our look at silver stocks this week, with a focus on Canadian silver junior miners, with Discovery Metals In Focus.

Gold drops below recent trading range

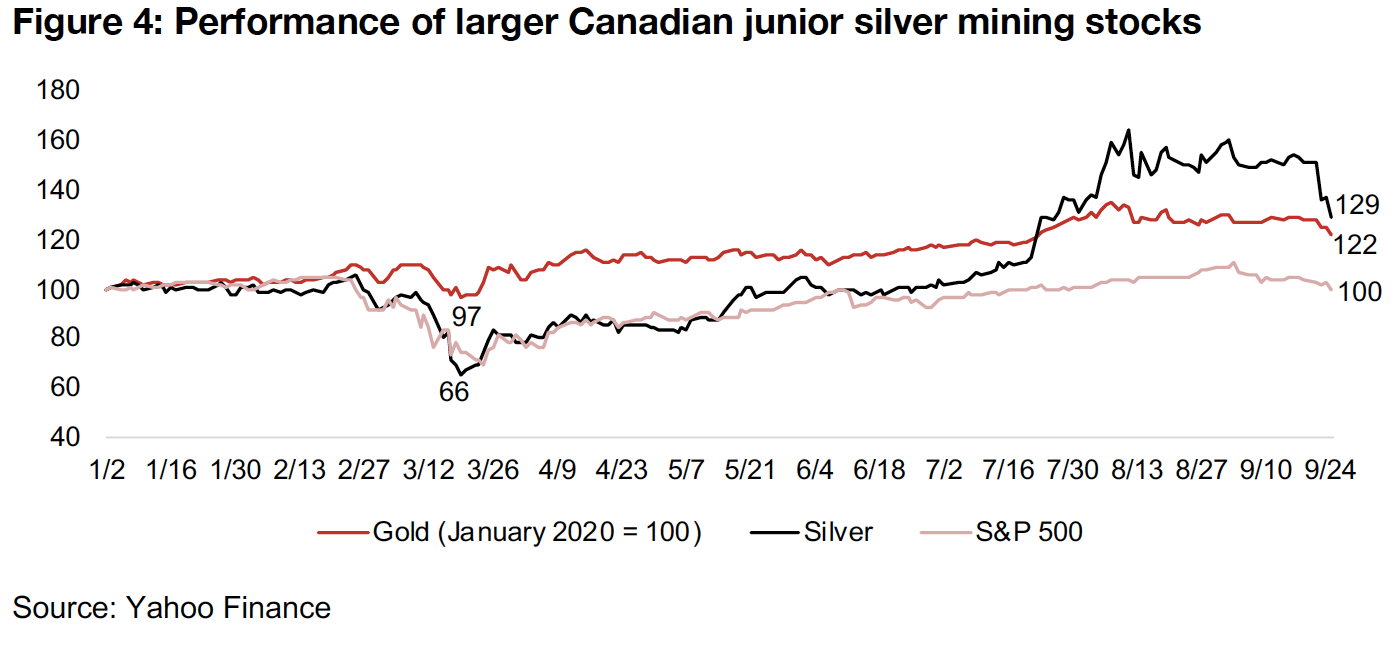

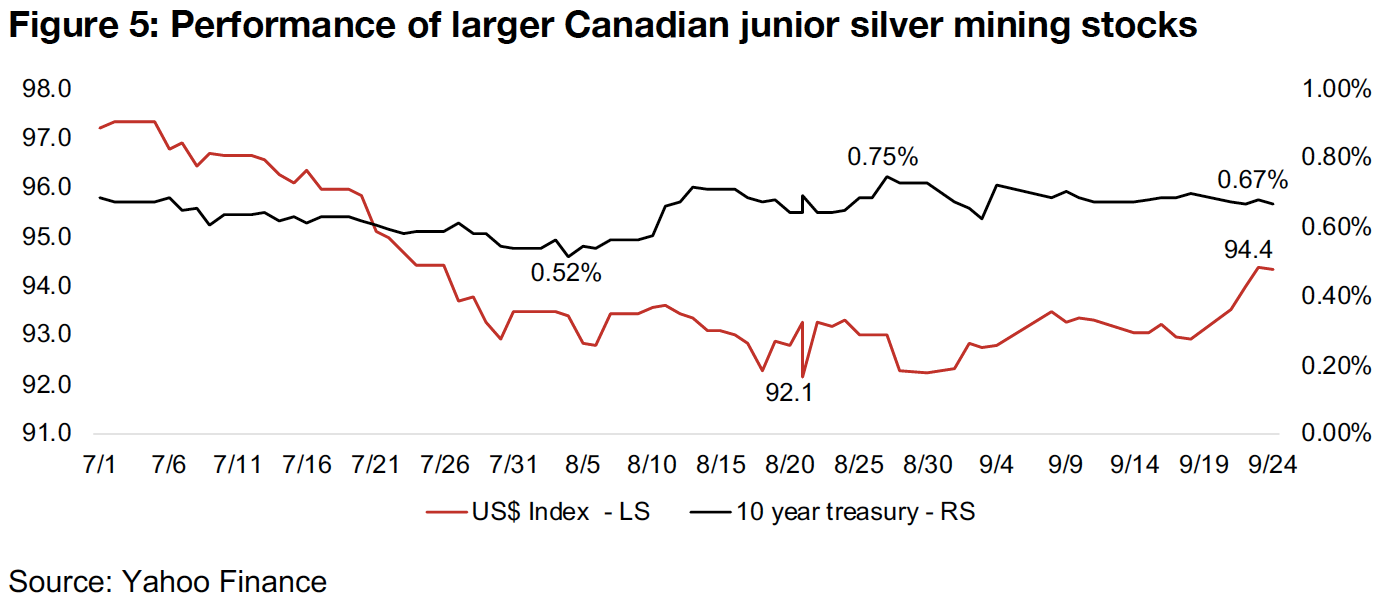

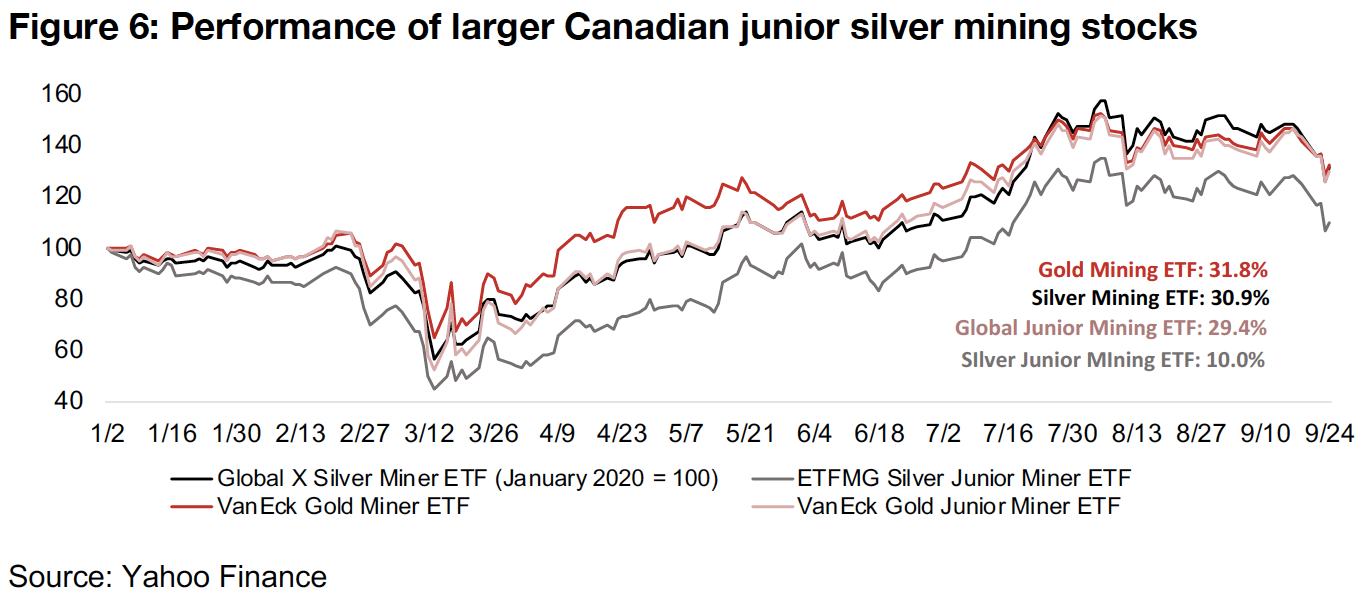

The gold futures closed at US$1,868/oz this week, down -3.7%, breaking decisively below a range of around US$1,900/oz-US$2,000/oz that had held for two months. While gold declined substantially, silver fell even more, as its YTD performance, which had shot considerably above gold over the past month, fell back to just 29%, closing the gap with gold, which is up 22% (Figure 4). We had previously expected that gold would continue to remain range bound as the market awaited the results of the November US Election, but a significant pick up in the US dollar this week, with the US dollar index jumping to 94.4, was a key factor driving a decline in both gold and silver (Figure 5). The performance of the major gold and silver stock ETFs has been roughly inline for the year, with gold ETF GDX up 31.9% YTD, and silver ETF SIL up 30.8%. The gold junior mining ETF GDXJ has also been strong, up 29.4% YTD, but the silver junior ETF, SILJ, lags the sector, up just 10.0% YTD (Figure 6).

A look at the larger Canadian silver exploration stocks

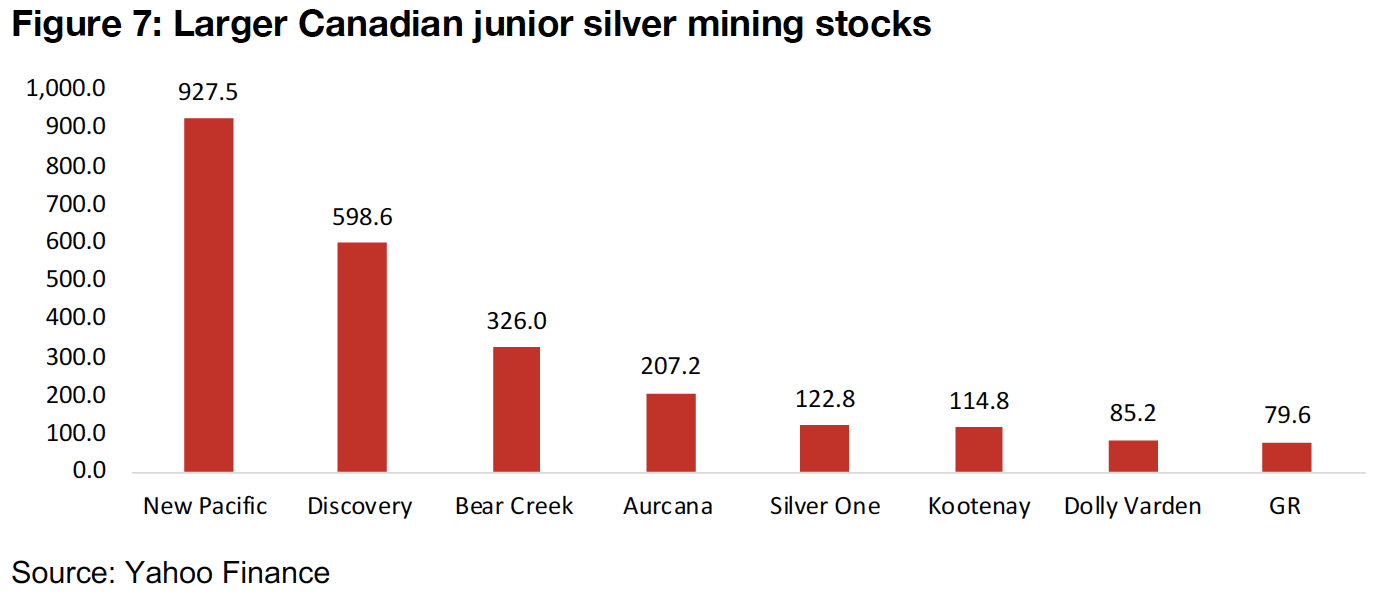

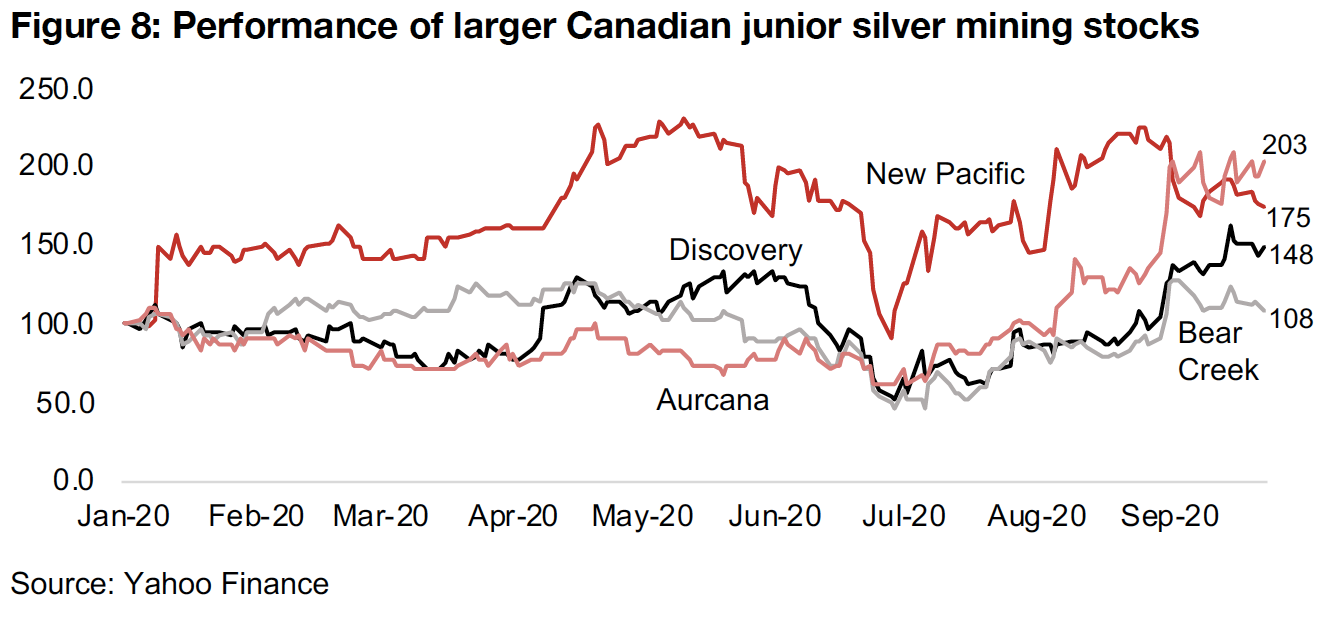

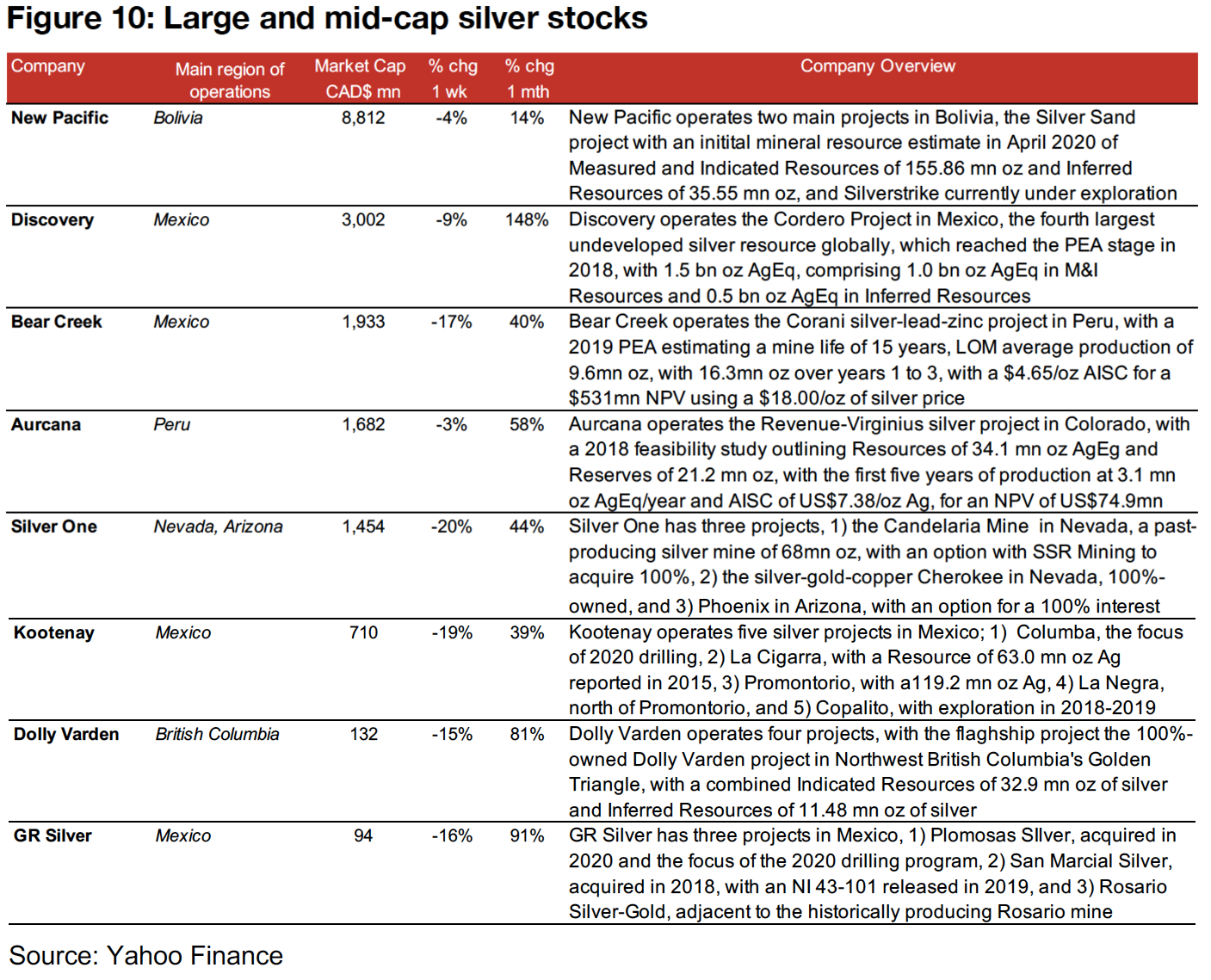

After covering the major silver producers last week, this week we look at the larger Canadian exploration stocks that are focused either purely or mainly on silver exploration. There are four large or mid-sized stocks, above a $300mn market cap, New Pacific, Discovery, Bear Creek, and Aurcana, and four smaller stocks, Silver One, Kootenay, Dolly Varden and GR Silver (Figure 7). The strongest performance this year has been from Aurcana, up 103% YTD (Figure 8), operating the Revenue-Virginius project in Peru, which reached the feasibility study stage in 2018, putting it at an advanced stage versus the rest of the group (Figure 10). The second strongest performance has come from New Pacific Metals, operating in Bolivia, with its Silver Sand project having released a mineral resource estimate in April 2020, up 75% this year (for more on New Pacific, see In Focus in the September 18, 2020 weekly).

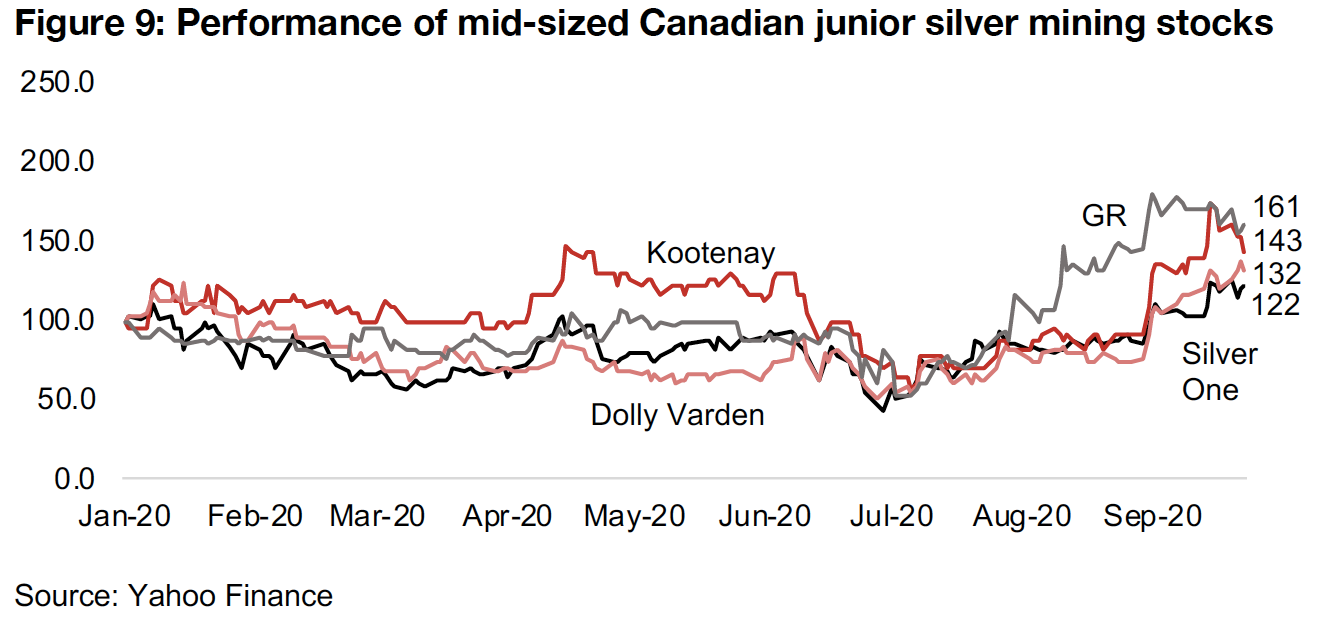

The next strongest performance has come from the smallest of the eight by market cap, GR Silver, up 61% YTD as it continues to make progress on its main silver projects in Mexico, Plomosas and San Marcial, acquired in 2018 and 2020, respectively (Figure 9). Discovery Metals has had the next strongest performance, up 48% YTD, operating Cordero, the fourth largest undeveloped silver resource in the world, for which an updated PEA was released in 2018 (for more on Discovery Metals see our In Focus section this week). Kootenay Silver, which operates five projects in Mexico, with Columba the focus of the 2020 drilling, is up 43%, and Dolly Varden, focused on the Golden Triangle in British Columbia, is up 32%. The relative laggards of the group, which have nonetheless still seen reasonable returns this year, have been Silver One, operating projects in Nevada and Arizona, up 22%, and Bear Creek, operating Corani, a silver-lead-zinc project in Peru, up 8% YTD.

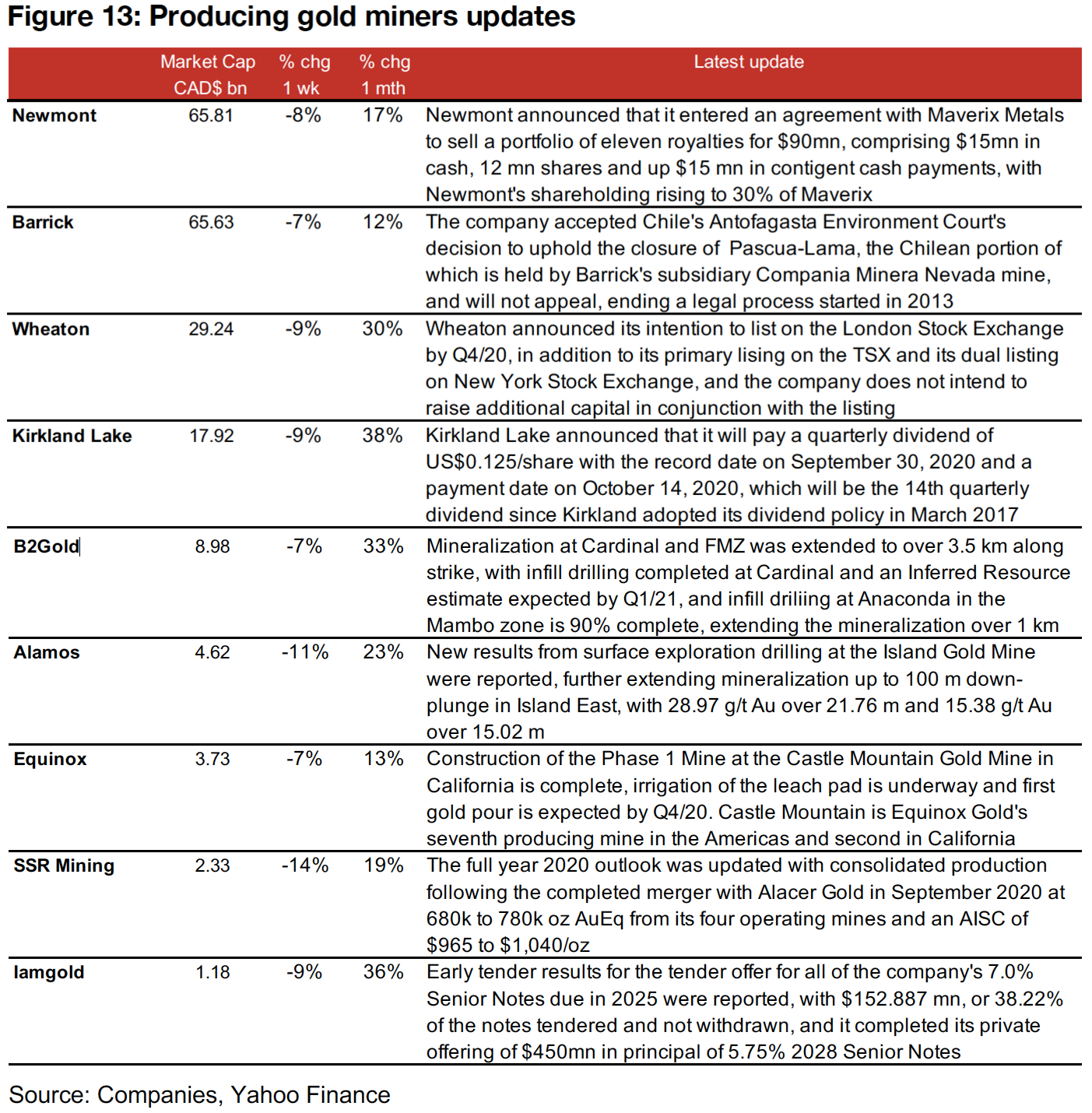

Producing gold mining stocks all down on gold retracement

The producing miners were all down this week on the retracement in gold, with most declining by high-single digits (Figure 11). News flow included Newmont's purchase of a royalties portfolio from Maverix, Barrick's acceptance of a court closing one of its subsidiary's mines in Chile, Wheaton's intention to list on the LSX and Kirkland's payment of a quarterly dividend (Figure 13). Other companies reported exploration updates, with B2Gold extending mineralization at Cardinal and Mambo, Alamos extending mineralization at its Island Gold Mine and Equinox completing the construction of Phase 1 of its Castle Mountain Gold Mine. SSR provided an updated outlook for 2020, which includes Alacer Gold output, given their recently completed merger, and Iamgold reported the results of its tender offer for existing Senior Notes and private offering of new Senior Notes.

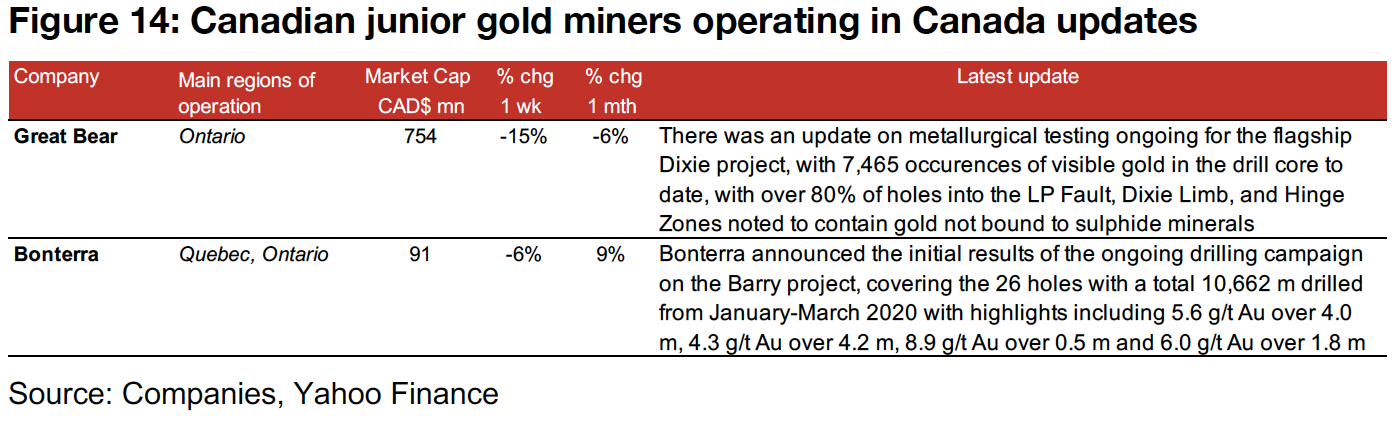

Canadian gold juniors operating domestically take hit

The Canadian juniors operating domestically took a hit, with many down over 10% on the pull back in the gold price (Figure 12). News flow included Great Bear's update on progress of its ongoing metallurgical testing at its Dixie project, and Bonterra reported the initial January 2020-March 2020 drilling results of its ongoing drilling campaign on the Barry project (Figure 14).

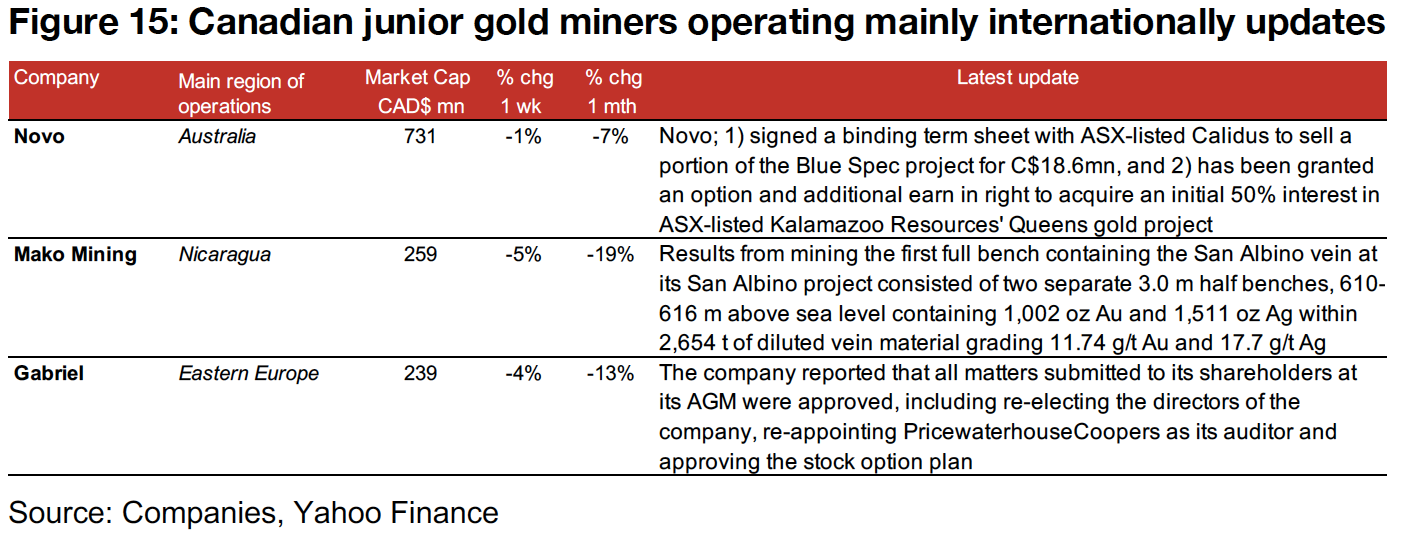

Canadian gold juniors operating internationally decline

The Canadian juniors operating internationally almost all declined this week (Figure 12). News flows included Novo signing a binding term sheet to sell Calidus part of the Blue Spec project, Mako reporting results from mining the first full bench at the San Albino vein at its San Albino project and Gabriel announcing the approval of all proposals submitted to shareholders at its annual shareholders meeting (Figure 14).

In Focus: Discovery Metals

Leading silver exploration company in Mexico

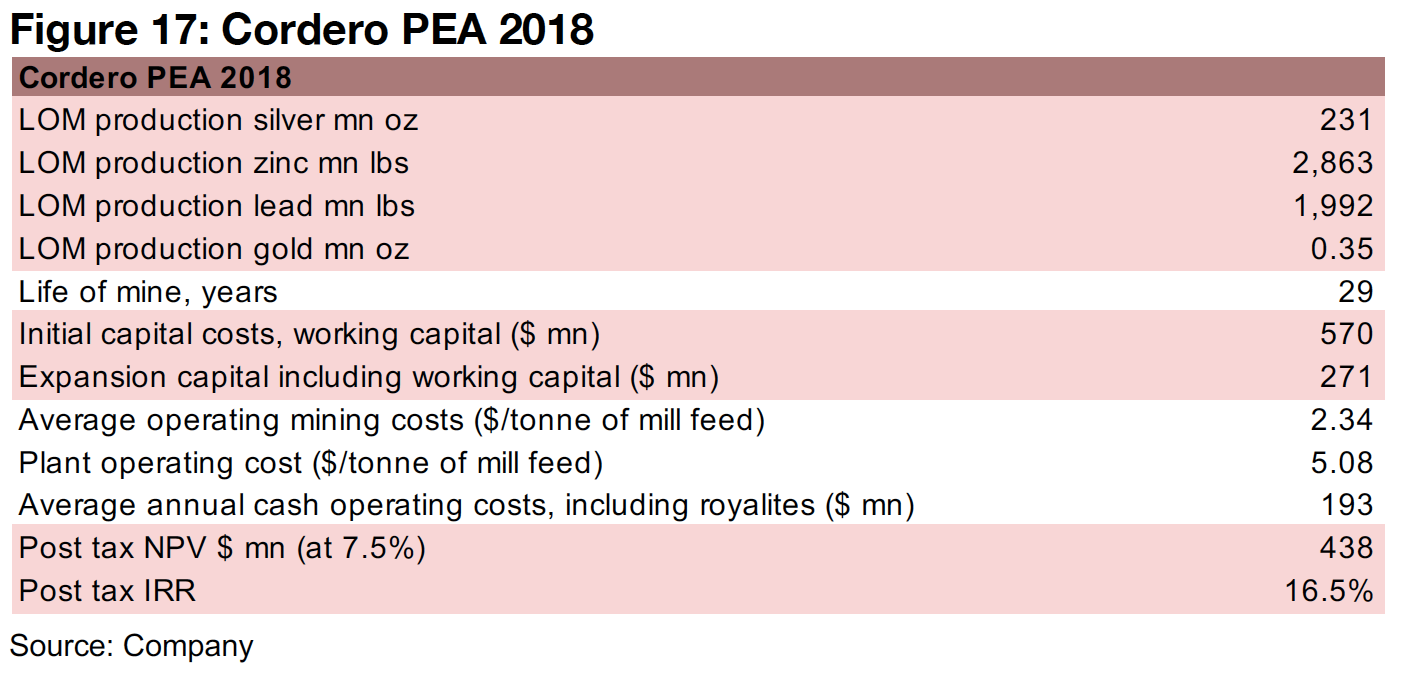

Discovery Metals is a leading silver exploration company in Mexico, with four projects; the flagship Cordero project, which has reached the PEA stage, and three drill-ready exploration projects, Puerto Rico, Minerva and Monclova. The company also has potential for new projects within 150k h.a. in the Coahuila Region and at the 35k h.a. Cordero Property. The Cordero PEA targets a 29-year mine life, with LOM production of 231mn oz of silver, 2,863 mn lbs of zinc, 1,992 mn lbs of lead and 350k oz of gold (Figure 17). On the cost side, there is an estimated $570mn initial capital costs and working capital, and $271mn in expansion capital, and average mining operating costs of $2.34/tonne of mill feed, plant operating costs of $5.08/tonne of mill feed, and average annual cash operating costs of $193mn, including royalties. This leads to an estimated NPV of $438mn for the project at 7.5%, with a post-tax of IRR at 16.5%.

Cordero drilling results the focus of exploration news flow in 2020

News flows regarding exploration in 2020 has been related to drilling results from Cordero, including; 1) January, 2020, with 617 g/t Ag over 34.7 m, including 2,524 g/t Ag over 3.7 m, 2) February 12, 2020, with 188 g/t Ag over 105.9 m, 3) April 7, 2020, with 2,153 g/t AgEq and 217 g/t Ag over 62.8 m, 4) May 7, 2020, with 207 g/t AgEq over 168.8m, including 70 g/t Ag, 0.10 g/t Au, 1.5% Pb and 1.9% Zn, 5) July 20, 2020, with 1,907 g/t AgEq over 1.4m, 6) 2,007 g/t AgEq over 1.9m and 1,073 g/t AgEq over 1.3m, and 7) 134 g/t AgEq over 402m and 247 g/t AgEq over 112m.

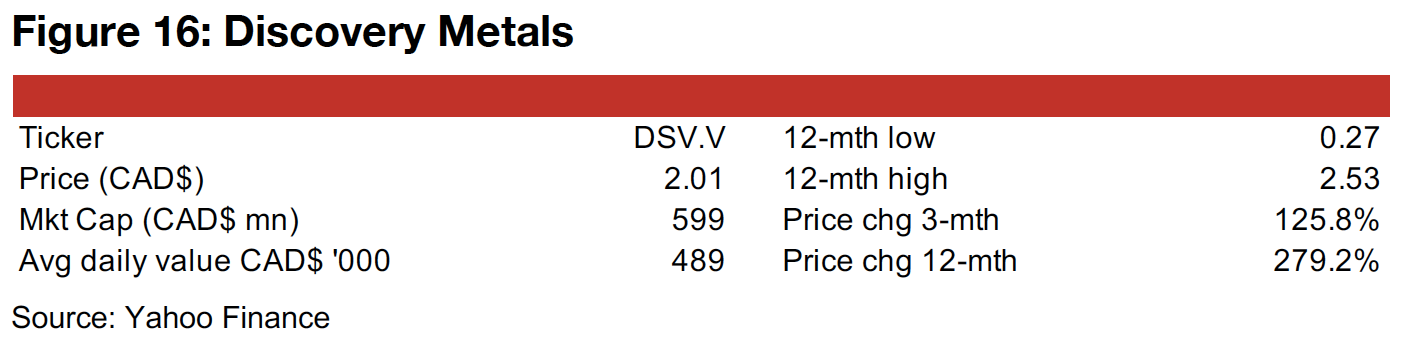

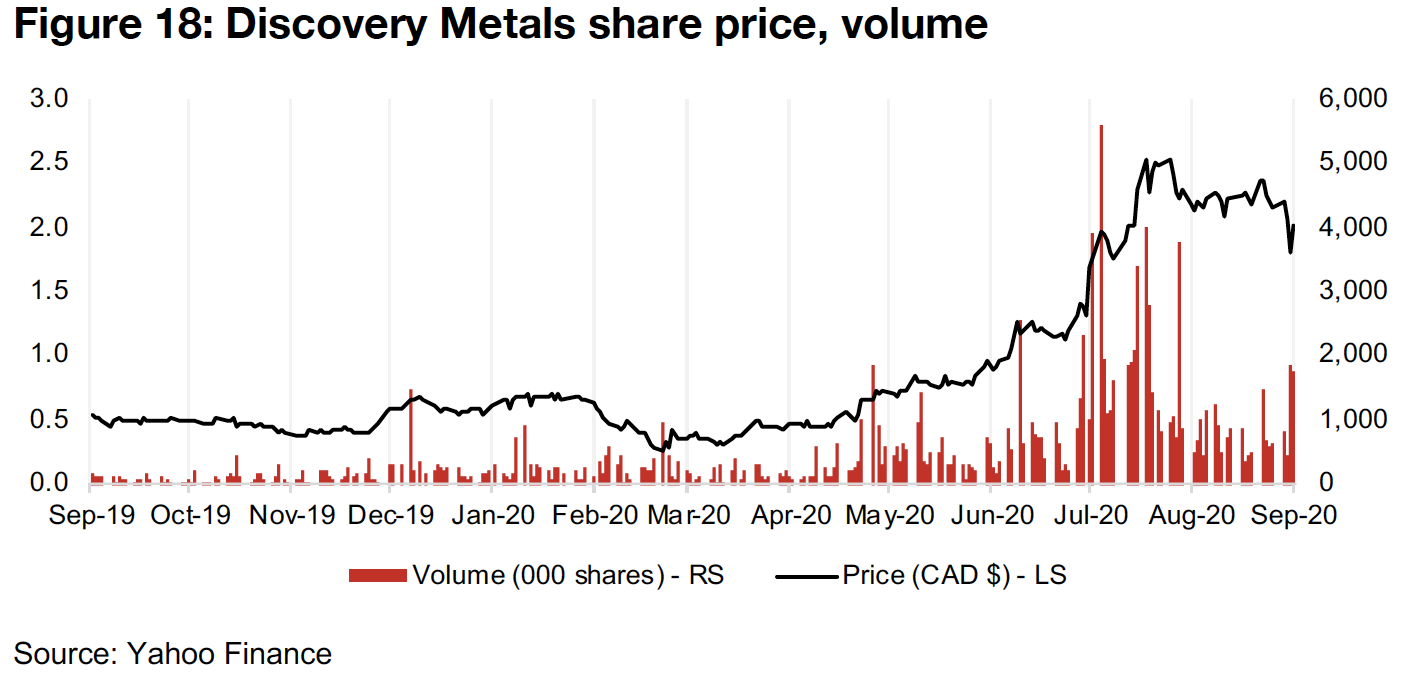

Eric Sprott makes two major investments in 2020

The company has seen two major investments from Eric Sprott in 2020, purchasing C$10.0mn of a total C$25.0mn private placement closed in June 2020, and an additional $C15.0mn of a total $C35.0mn private placement closed in August 2020. The strong drilling results and successful capital raising this year, combined with the surging silver price, had driven up the company’s 12-mth share price performance as high as 300% over the past 12 months, and even after the dip in the silver price this year, the shares are still up 279.2% (Figures 16, 18).

Disclaimer: This report is for informational use only and should not be used an alternative to the financial and legal advice of a qualified professional in business planning and investment. We do not represent that forecasts in this report will lead to a specific outcome or result, and are not liable in the event of any business action taken in whole or in part as a result of the contents of this report.