December 25, 2020

Global risk levels remain high

Author - Ben McGregor

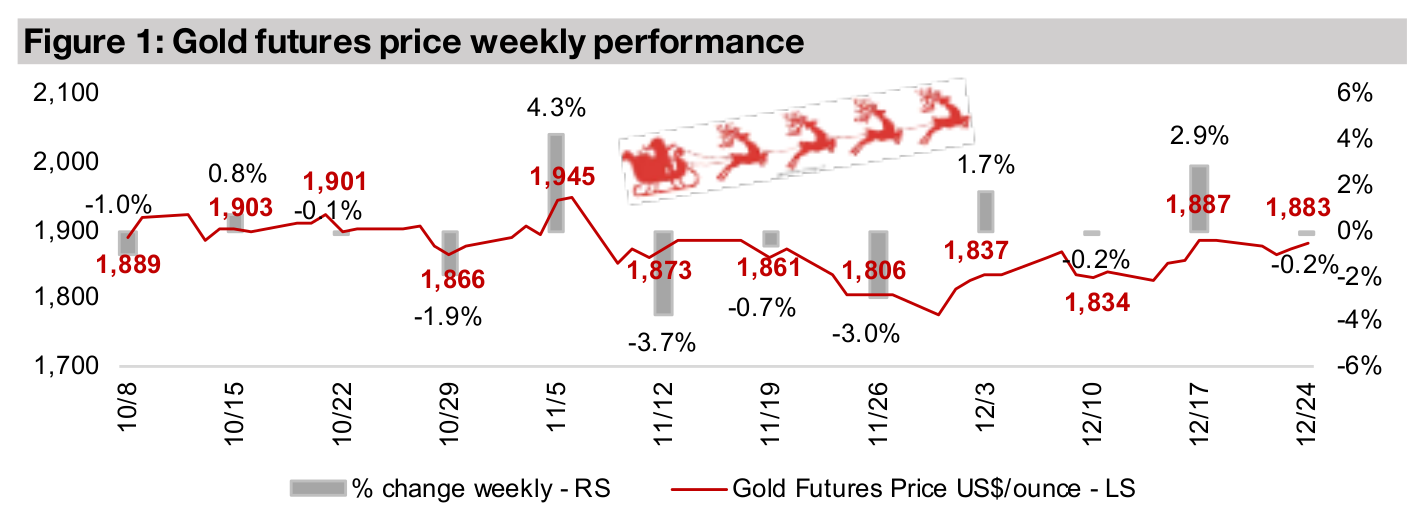

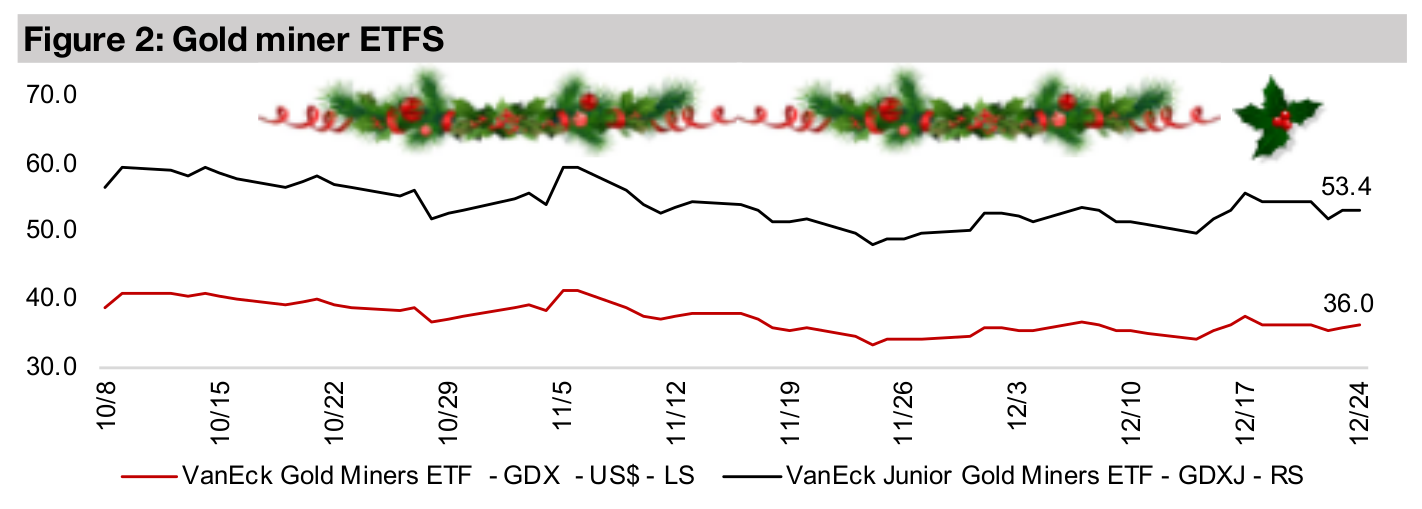

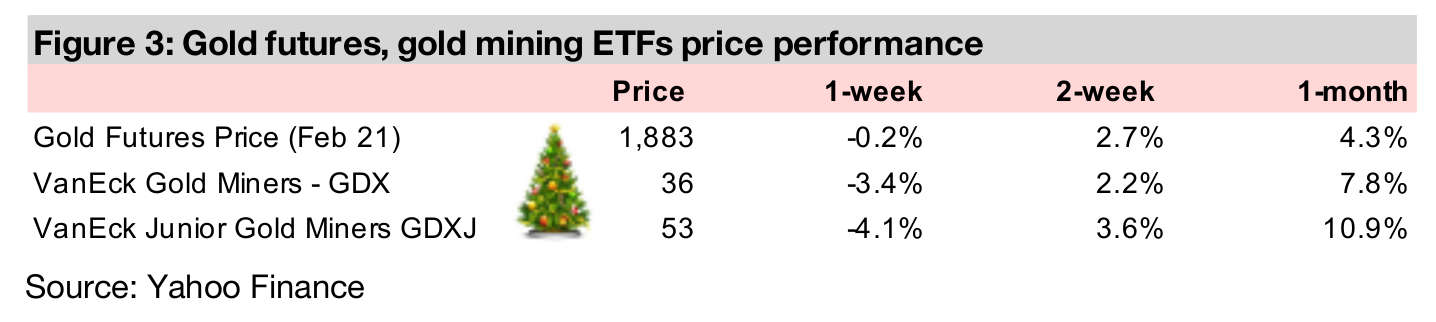

Gold relatively flat for the week

Gold was near flat for the week, edging down -0.2% to US$1,883/oz, showing that even in its new 'post-vaccines' range of the past two months, gold remains strong, suggesting the market still expects risks to remain elevated for some time.

Global risks remain elevated, which should support gold

This week we look at some data series regarding the degree of economic fallout and risk levels that remain in the aftermath of the global health crisis, even if there are signs that the virus driving the crisis is starting to come under control.

Risk in the aftermath of the global health crisis

Gold was relatively flat this week, down just -0.2% to US$1,883/oz, and has settled

into what we see as a 'post-vaccine' range averaging around the mid-US$1,800s for

the past eight weeks. Interestingly, this is still high even within the context of a very

strong year for gold, and even the promise of vaccines starting to be administered,

which will be a strong move towards containing the health crisis, has not been enough

to drive down gold much. We believe that is because there is an economic aftermath

from the global health crisis that; 1) is having immediate effects because of ongoing

lockdowns, which will certainly persist into the first half of 2021 and 2) will have much

longer lasting effects as the results of actions taken in response to the global health

crisis have a fallout that will reverberate well into 2022.

What this will mean is that risk overall will remain elevated for an extended period, in

our view, and the government's response to this is likely to be the same as it has

been through crisis periods over the past several decades – that is boosting liquidity

and fiscal stimulus. As we have shown in our weeklies over the past month, we

believe that especially the major monetary expansion will continue to support gold

for at least the next year, and likely much longer. Importantly, even a broadly and

rapidly administered vaccine will not halt this process, and the only thing that would

likely truly bring gold down materially is a dramatic increase in interest rates, or a

major pullback on stimulus. We believe that a major increase in global rates or pull

back in fiscal stimulus measures seems very unlikely any time before 2023 (at the

earliest). Therefore, even if the market is looking well ahead in its pricing of gold, we

should see strong support for gold at least through 2021, if not substantial gains, with

consensus estimates looking for an average of US$2,000/oz for 2021, up 13.2% on

the average this year of US$1,767/oz.

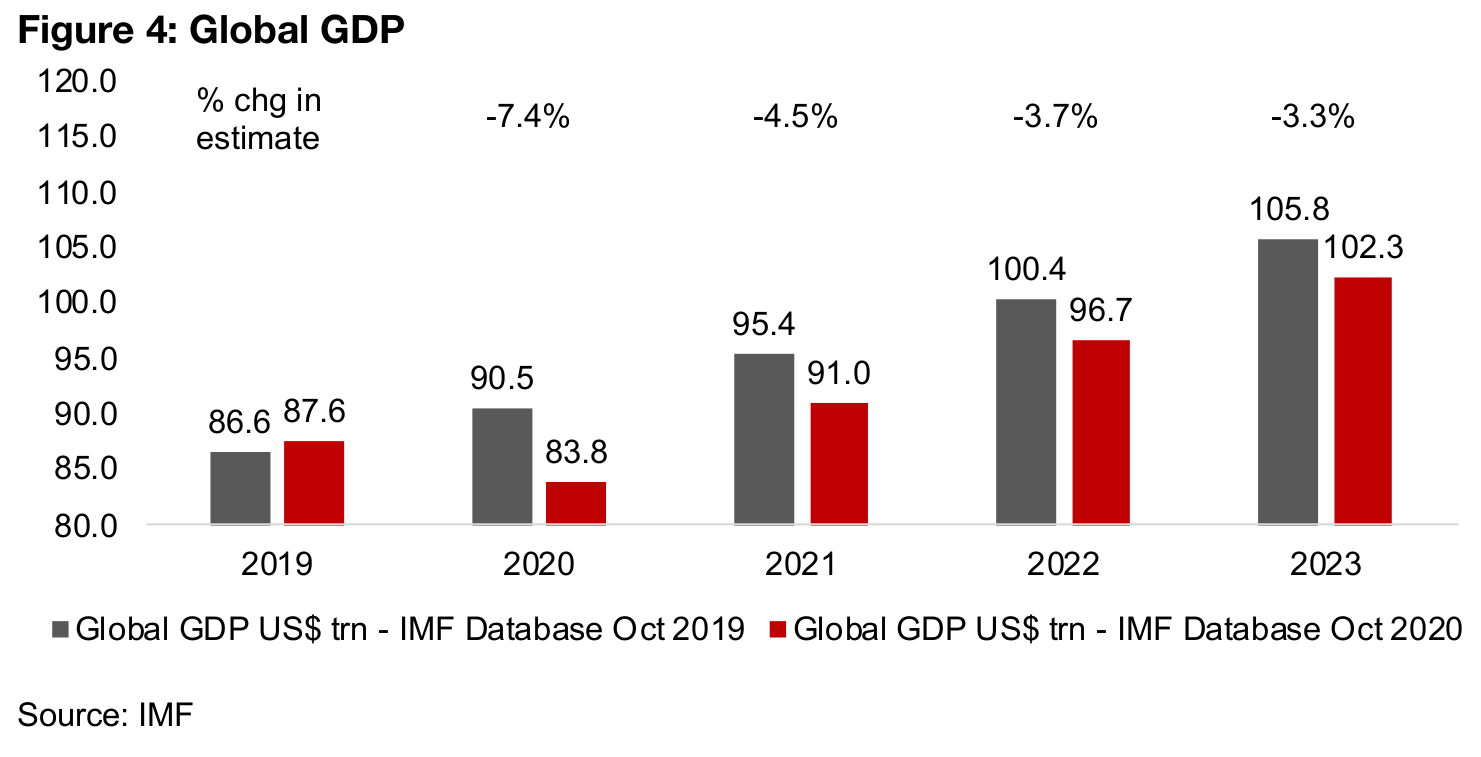

Global GDP takes a major hit

Much is being made of the global economy's growth rates over H2/20, and it is true

that compared to some Armageddon scenarios that were outlined at the peak of the

crisis in mid-2020, growth in the second half 2020 recovery is a big relief. While global

GDP is expected to drop by -4.2% from U$87.6 trn in 2019 to just US$83.8trn in 2020

by the IMF, it is expected to rebound 8.6% to US$91.0trn in 2021 (Figure 4). However,

we must also consider what has been lost in the crisis, how far off the previous growth

trajectory we have veered, and how much slack has been created in the economy,

that will very likely need to be filled by monetary boosts and fiscal spending.

Global GDP estimates from the IMF have been slashed in the most recent October

2020 estimates compared to the estimates from October 2019, by -7.4% for 2020

and by an average -3.9% for 2021-2023, with aggregate GDP from 2020-2023

declining -4.7%, or US$18.2bn, to US$373.8mn. This means that in four years, the

global economy will be nearly US$20bn behind where it could have been without the

pandemic. As there tends to be multiplier effects both to the upward and downward

in economic growth, to offset a negative spiral from the sudden reduction in global

demand, we expect that the governments will need to go both barrels to hold back

this effect, and that this is likely to be supportive of gold.

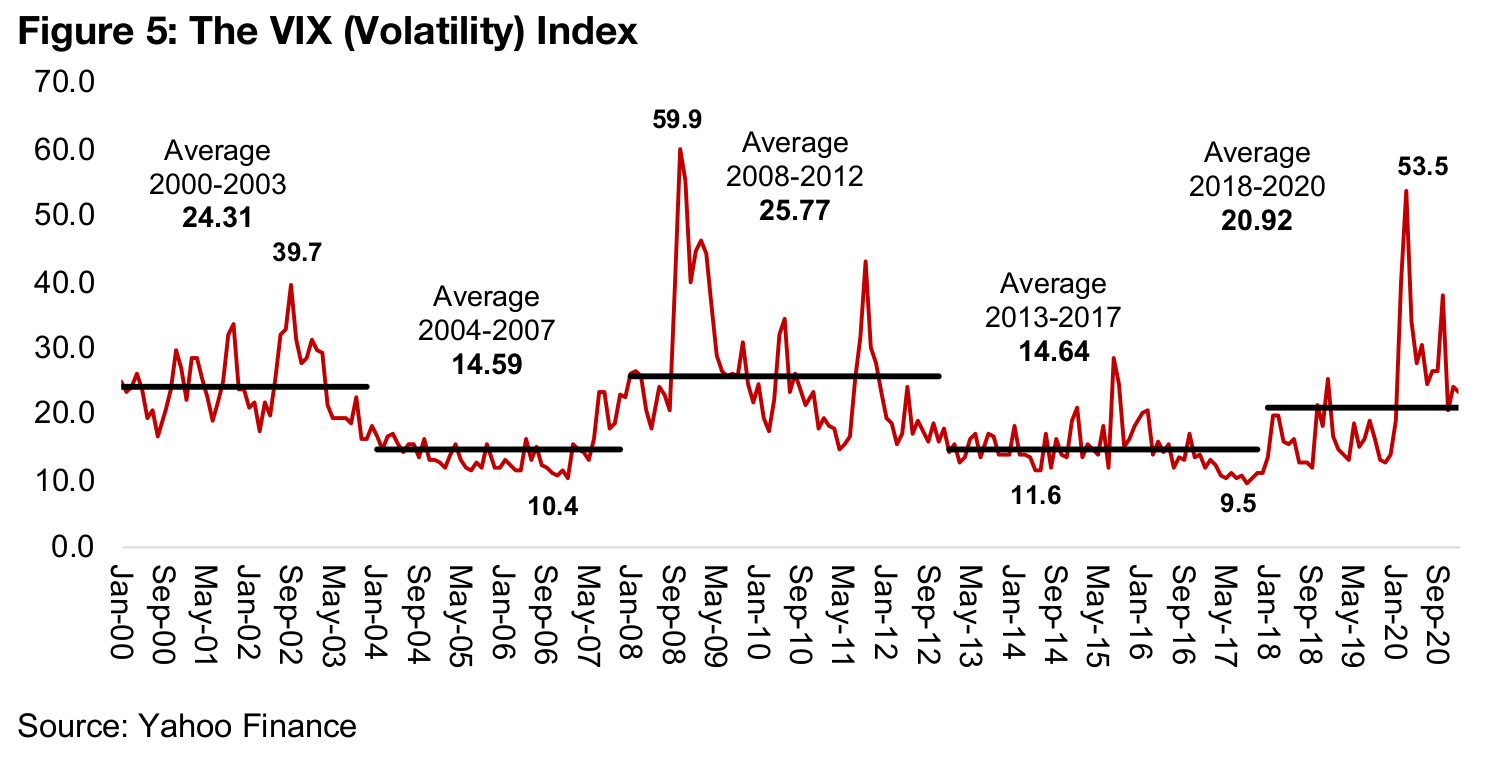

We have entered a high-risk period, as shown by rising VIX

One measure that shows that risks have been rising is the equity markets volatility

index, or the VIX, which measures the degree of movement in stocks. High volatility,

or a high VIX, is an issue because while it means that both movements up and down

are more severe, it is really the greater propensity for downside movements that is of

the greatest concern, as this increases the chances of larger losses. Periods of lower

volatility, with a low VIX, do not see major swings, reducing the possibility of major

losses, and are correlated with a bull market with consistently rising prices.

Figure 5 shows that over the past twenty years the market has made distinct shifts

from extended periods of high volatility to extended periods of low volatility. Once

volatility either really gets started, or when it cools, it tends to stay that way. Periods

of high volatility ran from 2000-2003 (with the VIX averaging 24.31), 2008-2012 (avg.

25.77) and the current period 2018-2020 (avg. 20.92). There were two periods of

extended low volatility, from 2004-2007 (avg. 14.59), and from 2013-2017 (avg. 14.64),

which saw some of the lowest levels of volatility in twenty years, below 10.0.

Volatility tends to persist long after an initial large market crash runs its course, with

a crash from 2000-2001, but volatility high for two more years, and one from 2008-

2009, but volatility high for three more years. This suggests to us that the current

period of high volatility, only two years in, could persist for some time. Also, while the

VIX has come off a spike in March 2020 to near a twenty-year peak, historically

periods of high volatility tend to have a few major spikes, and we have seen only one.

Looking at the VIX history we can see that the market virtually ignoring gold from

2013-2017 and piling into risk assets does make some sense, as risk was historically

extremely very low in the equity markets. With the spike in the VIX over the past two

years, moving into assets providing more safety, like gold, is equally starting to make

lot of sense in the current situation.

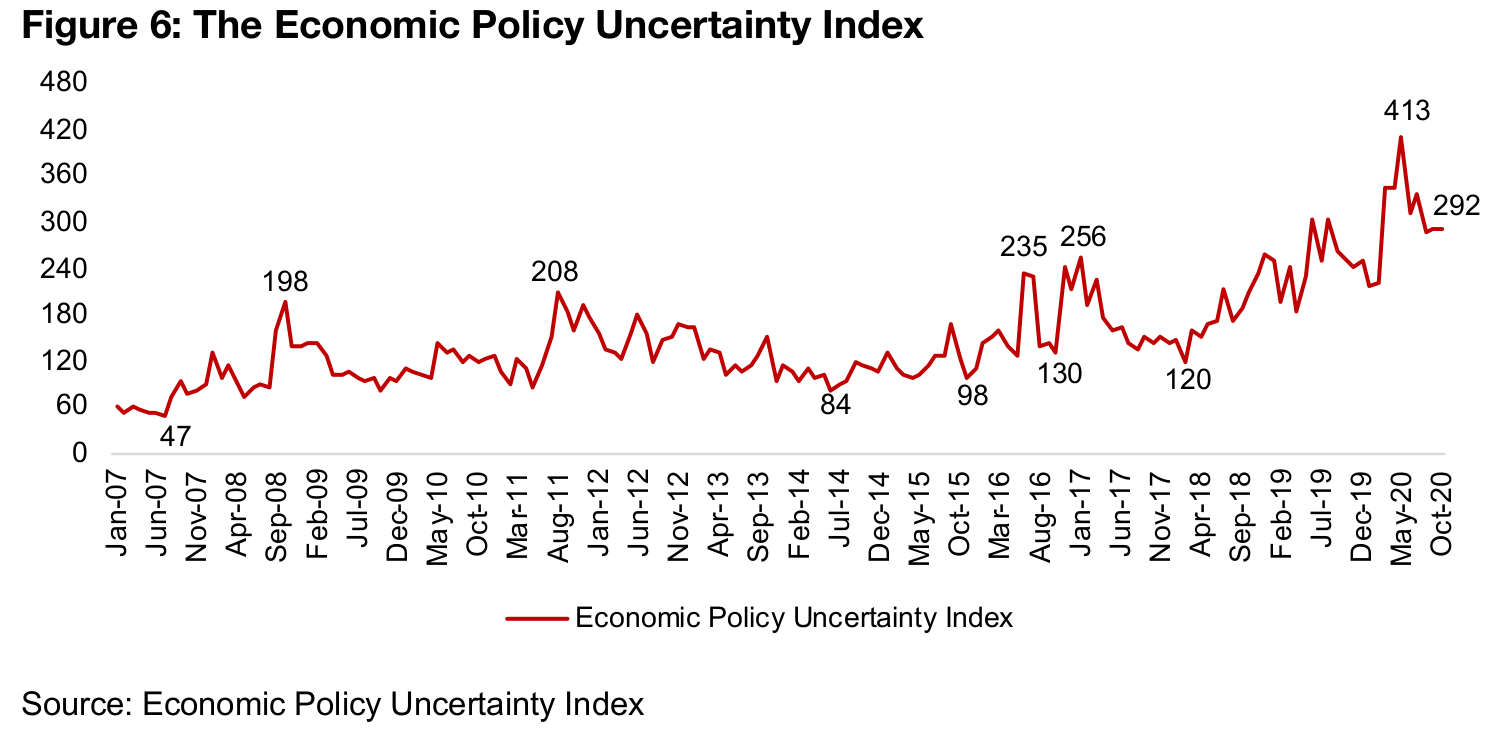

Global policy uncertainty still very elevated long-term

Another data series that we can consider is the Global Policy Uncertainty Index, which measures the level of clarity on global economic policy changes (Figure 6). In general, this index has been rising since 2018, after a relatively flat period from 2013-2017 (apart from short term jumps in 2016 and 2017), which is interestingly similar to the pattern we saw for the VIX. The index spiked to its highest level ever in May 2020 at 413, as a lack of clarity driven by the severity of the global health crisis reached a peak, and how policy makers would (or could) respond was highly uncertain. While this has fallen as peak-global-health-crisis-fears have abated, it still remains at very high levels versus its history. The outlook for policy still remains very difficult to determine, which boosts the level of perceived global risk, which should be very supportive of gold, in our view.

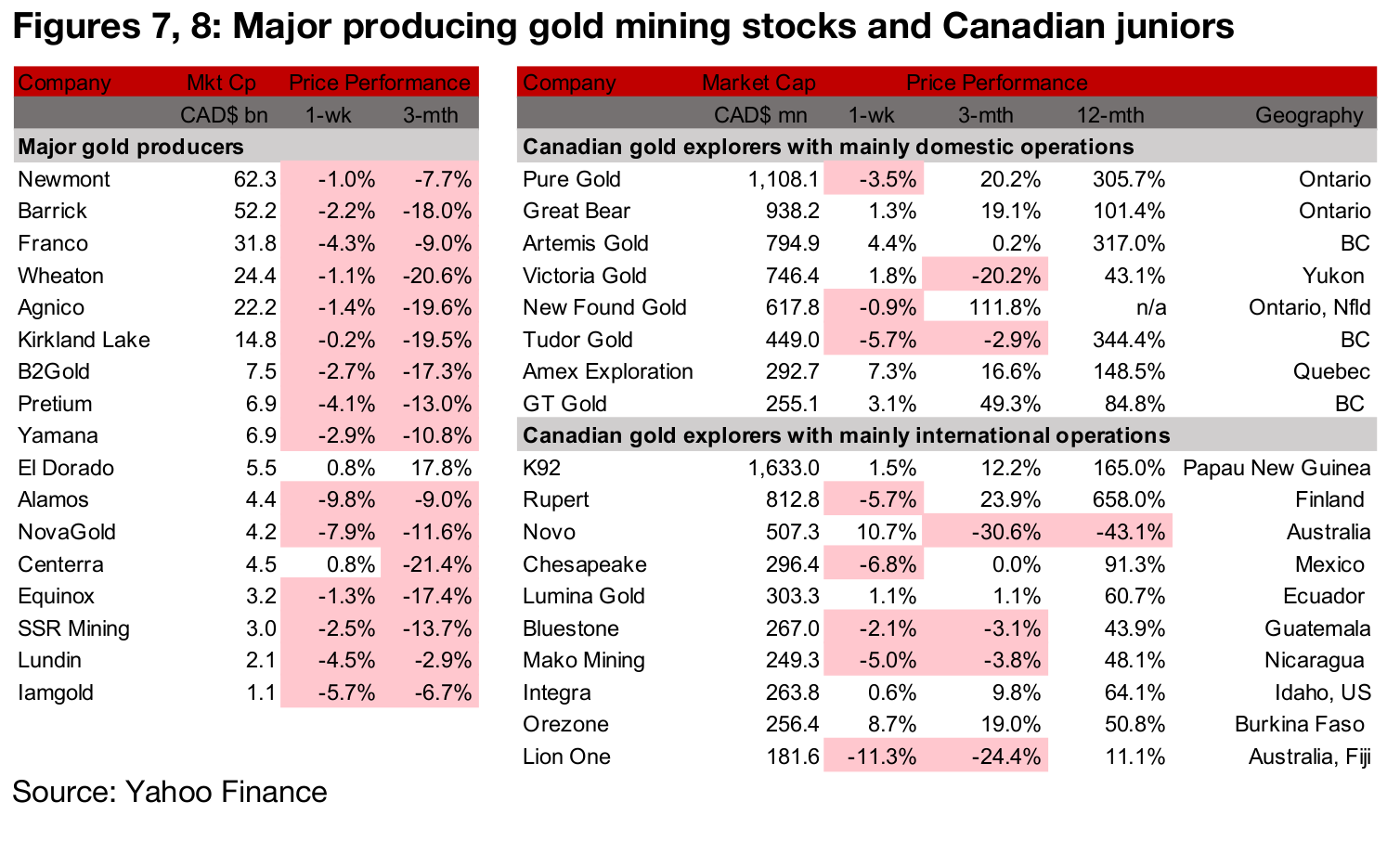

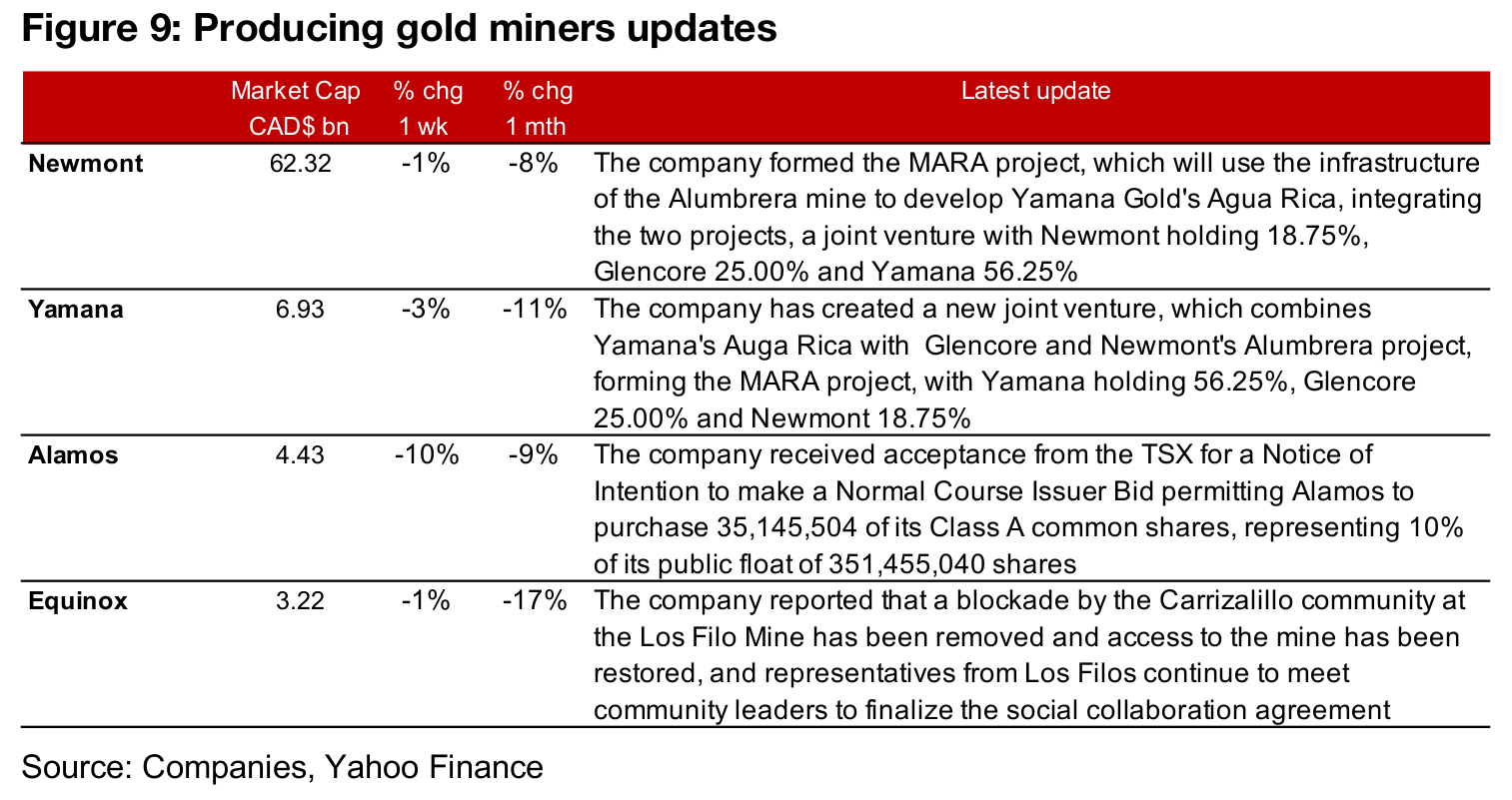

Producers mostly down on relatively flat gold

The producing miners were mostly down even as gold was relatively flat (Figure 7). There were announcements from both Newmont and Yamana on a joint venture in which both companies were involved, MARA, created using infrastructure from Newmont (which will hold 18.75% of the JV) and Glencore's (to hold 25.00%) Alumbrera project to develop Yamana's (which will hold 56.25% of the JV) Auga Rica mine (Figure 9). Other news included Alamos announcing that it intended to repurchase 35.15mn shares, or 10.0% of its public float of 351.46mn shares, and Equinox reporting that a blockade by the Carrizalillo community at its Los Filos mine had ended, and a social collaboration agreement was being finalized.

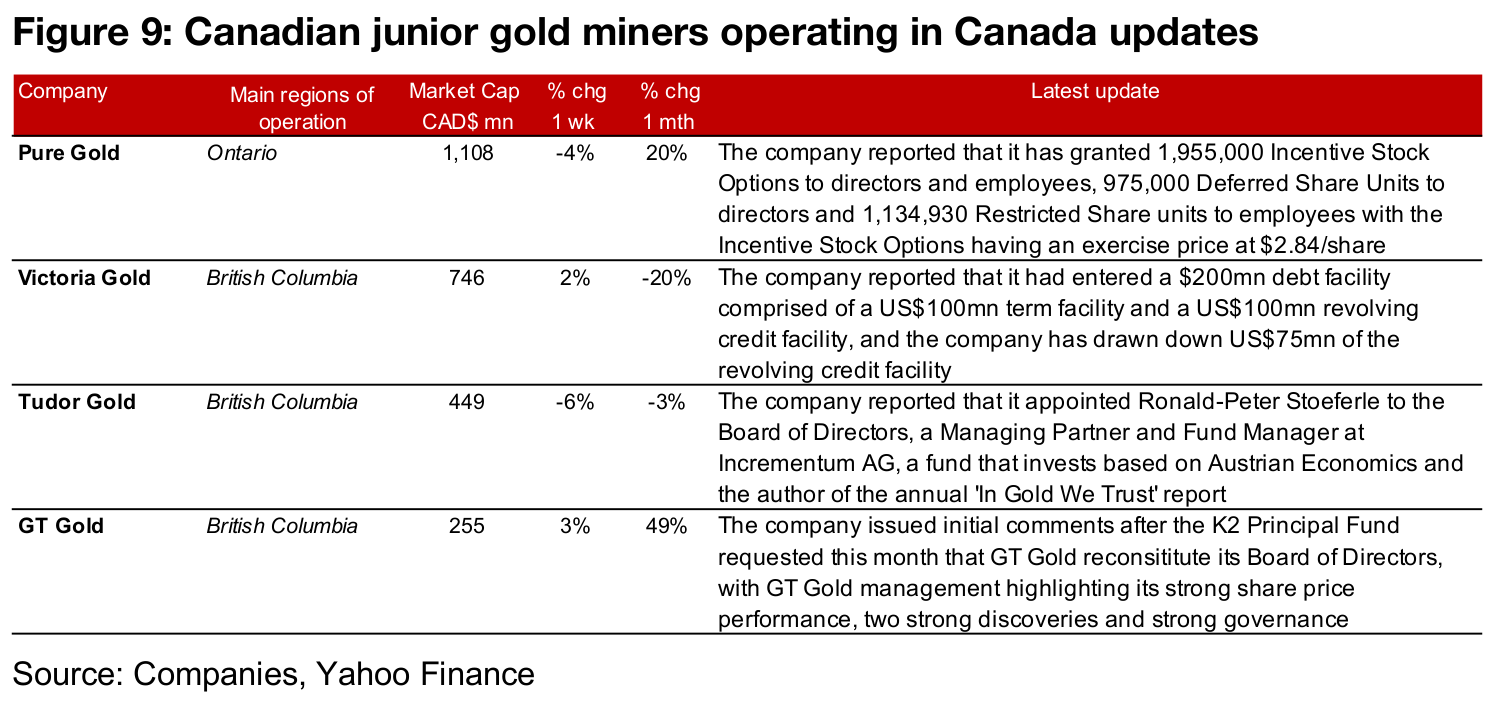

Canadian gold juniors operating domestically mixed

The Canadian juniors operating domestically were mixed this week (Figure 8). Pure Gold reported details on incentive stock options for directors and employees, and Victoria Gold announced the details of a $200mn credit facility. Tudor Gold announced the appointment of an Austrian Economics-influenced fund manager to its Board of Directors, Ronald-Peter Stoeferle, a Managing Partner at Incrementum AG, and GT Gold issued its initial comments after a major shareholder, the K2 Principal Fund, requested that the company change some members of its Board of Directors (Figure 9).

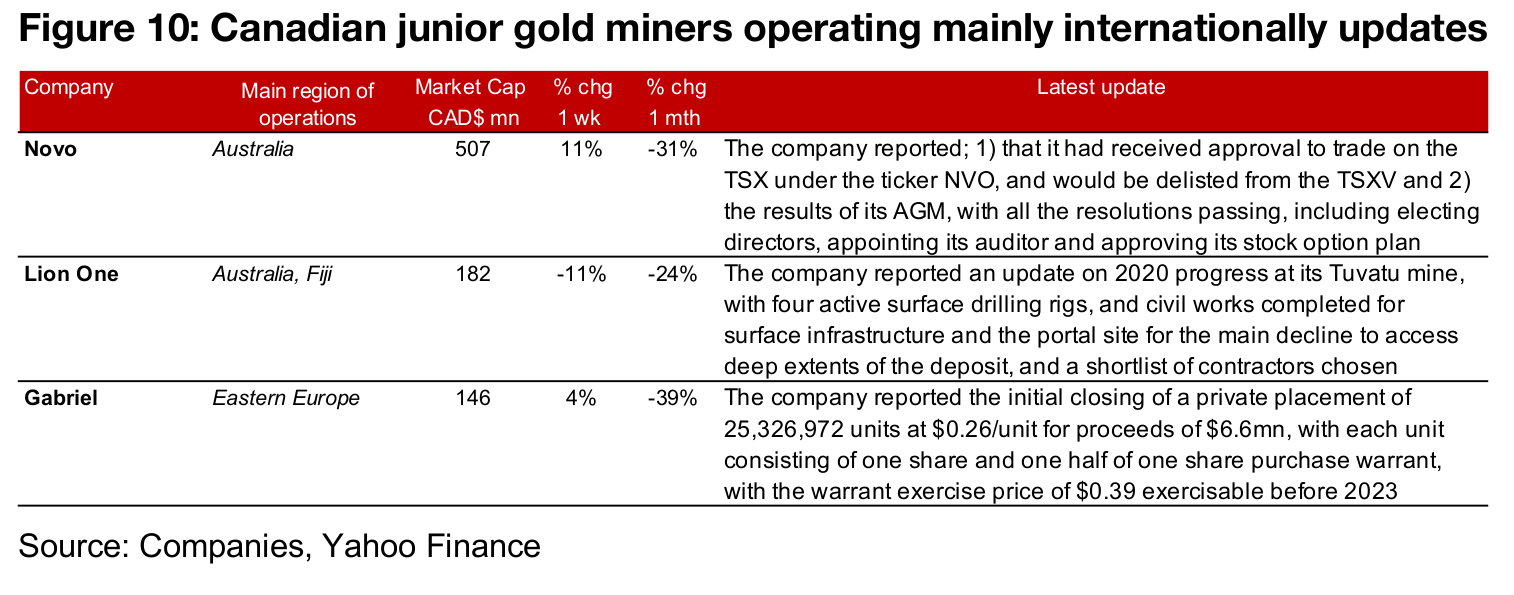

Canadian juniors operating internationally mixed

The Canadian juniors operating internationally were mixed this week (Figure 8). Novo reported that it would begin trading on the TSX, Lion One reported an updated on its Tuvatu mine, including recently choosing a shortlist of contractors to develop the surface infrastructure and portal site for the main decline to access deep extents of the deposit, and Gabriel reported the initial closing of a $6.6mn private placement (Figure 10).

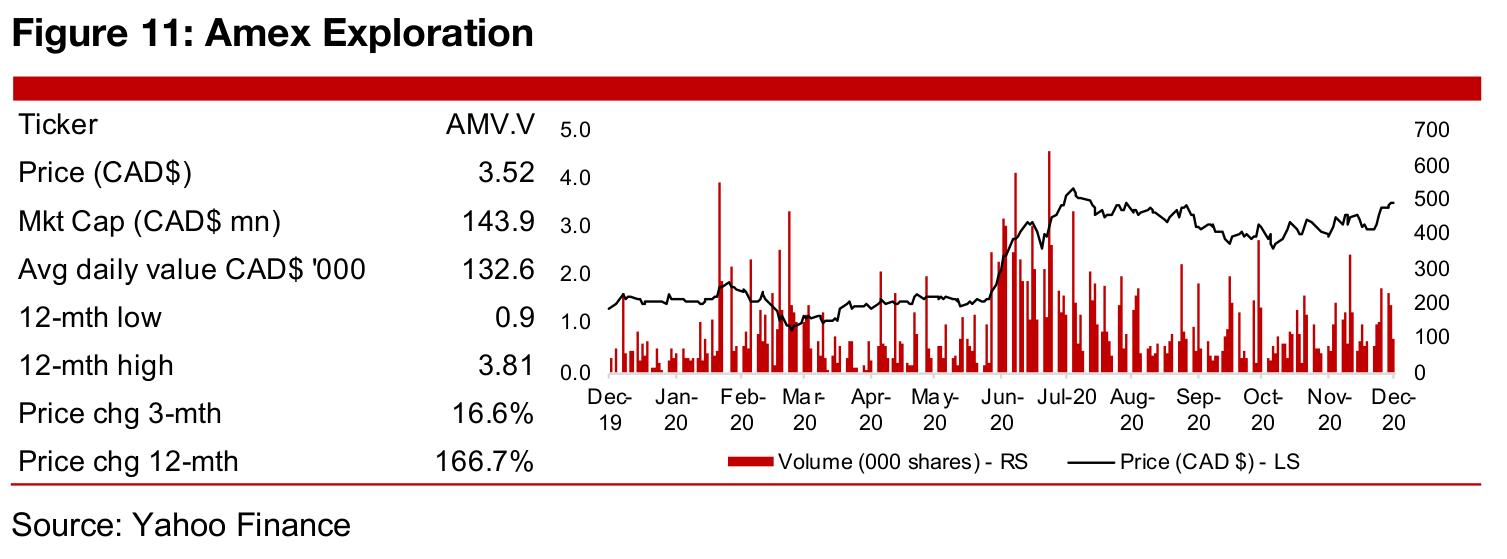

In Focus: Amex Exploration (AMX.V)

Amex operates the Perron project in the Abitibi Greenstone Belt

Amex Exploration operates the Perron project on the Quebec side of the Abitibi Greenstone Belt, which is a major mining area running across Ontario and Quebec, and home to many major currently producing gold mines and the site of widespread exploration activities. The company has been in an extensive drilling phase over the past year, and has not yet released an initial mineral resource. Amex highlights a very low all-in drilling cost of C$150/m compared to other mining exploration companies up to C$350/m, and the general access to a skilled local workforce and relatively low housing costs and well-established infrastructure, given the size and long history of Abitibi as a mining district.

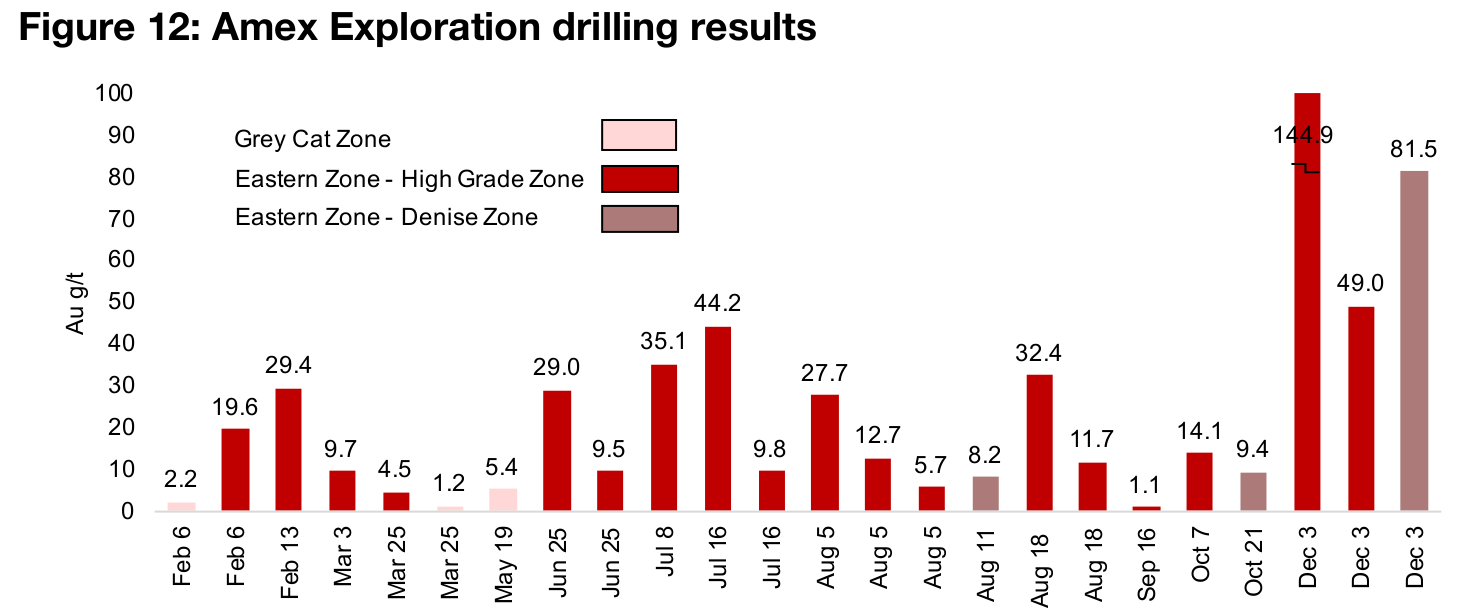

Drilling at Perron focussed on the Eastern Gold Zone

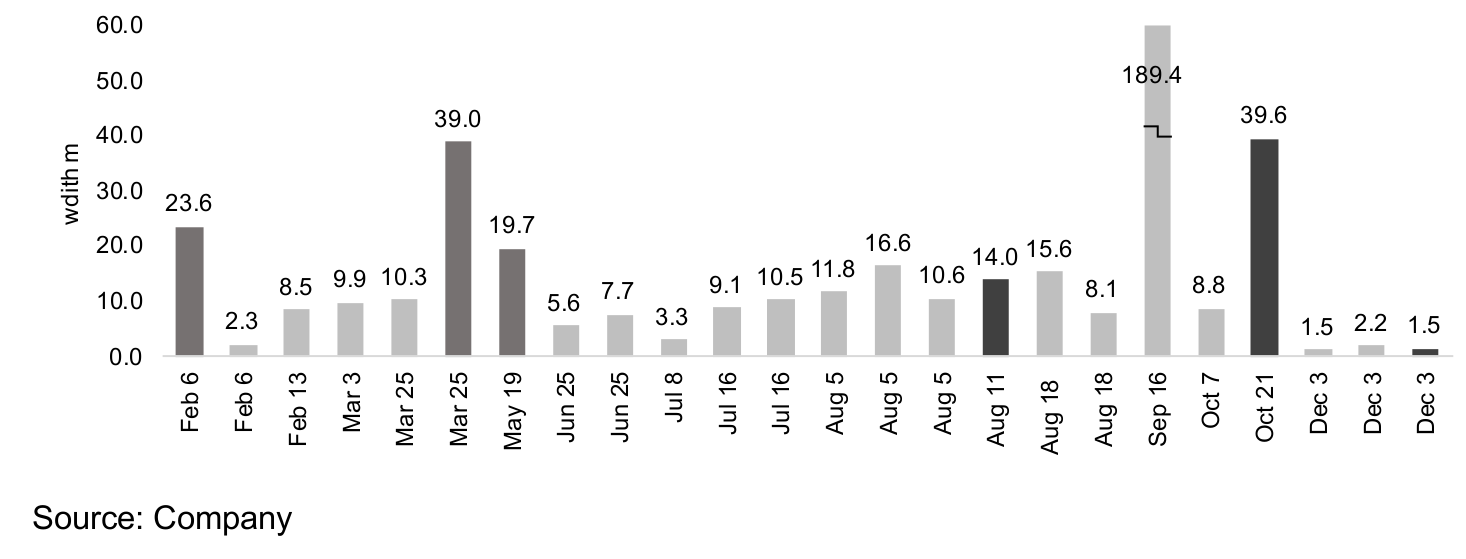

The Perron project has four zones, Grey Cat, Gratien, the Central Polymetallic Zone and the Eastern Gold Zone. The company announced that three drills were operating at the Perron project as of the beginning of January 2020, as part of a 100,000 metre drilling programming and added at fourth rig in February 2020. While exploration was paused in March 2020 it resumed in May 2020, and in June 2019 the program was upsized to a total six rigs and a planned 200,000 metres. As shown in Figure 12, drilling this year has been focussed on the Eastern Gold Zone, especially the High Grade Gold Zone, which comprised eighteen of twenty-four of the major highlighted results over the past year. Stand-out results from the High Grade Gold Zone over the year included 44.2 g/t Au over 9.1 m on July 16, 32.4 g/t Au over 15.6 m on August 18, 144.9 g/t Au over 1.5 m and 49.0 g/t Au over 2.2 m on Dec 3. Earlier in the year drilling had also focussed on the Grey Cat Zone, and later in the year, another area of the Eastern Gold Zone, the Denise Zone was also being explored, with stand-out results of 8.2 g/t Au over 14.0 m on August 11, 9.4 g/t Au over 39.6 m on Oct 21 and 81.5 g/t Au over 1.5 m on Dec 3.

Company remains well-financed for continued exploration

The company has seen strong interest from the market, with a C$9.0mn bought deal private placement announced on May 19 upgraded to $15.75mn the following day, and closed on June 17. The company announced another private placement, originally announced at C$9.36mn on August 18, which eventually closed in September at C$11.7mn, with an additional $4.3mn raised from warrants exercised. The company is very well funded to continue its exploration activities for a very extended period, and expand its exploration program, given that as of end-Q3/20 the company had $36.86 in cash, up from just $12.59mn a year earlier, compared to operating expenses in Q3/20 of just $0.6mn. Between the strong cash and the recent strong drilling results, the share price has actually picked up 16.6% over the past three months, even as many other exploration peers have seen declines.

Disclaimer: This report is for informational use only and should not be used an alternative to the financial and legal advice of a qualified professional in business planning and investment. We do not represent that forecasts in this report will lead to a specific outcome or result, and are not liable in the event of any business action taken in whole or in part as a result of the contents of this report.