May 15, 2020

Global gold mining stocks take a pause

Author - Ben McGregor

Global gold mining sector broadly flat this week

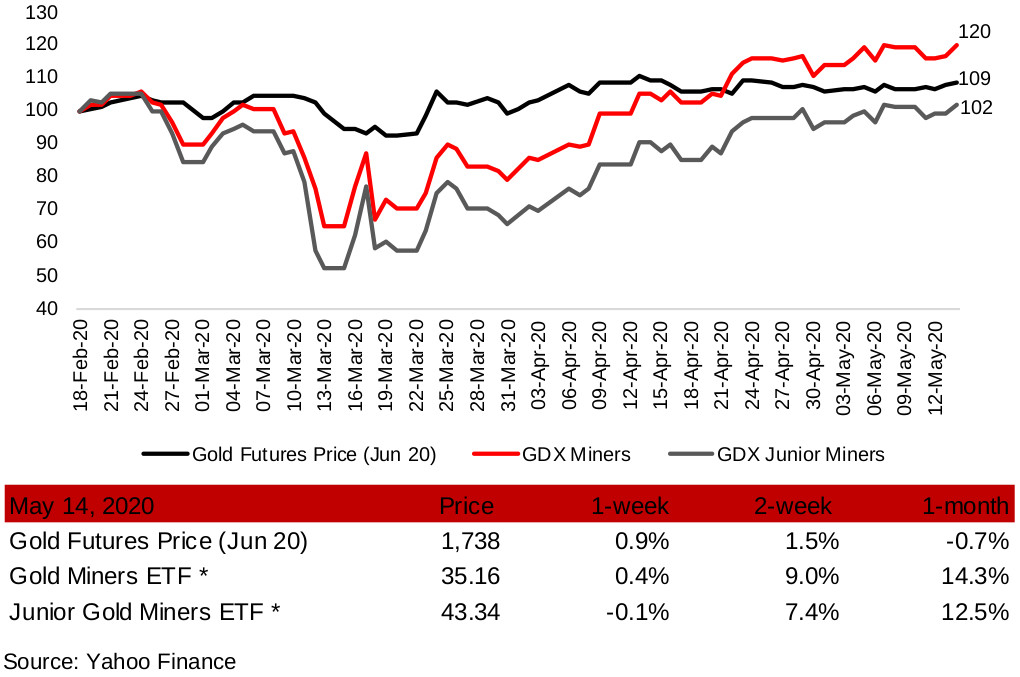

The global gold mining sector was generally flat this week, as the gold futures price edged up less than a percent, and investors likely locked in some profits after the substantial two month rebound in the sector.

Many Canadian producing gold miners edge down

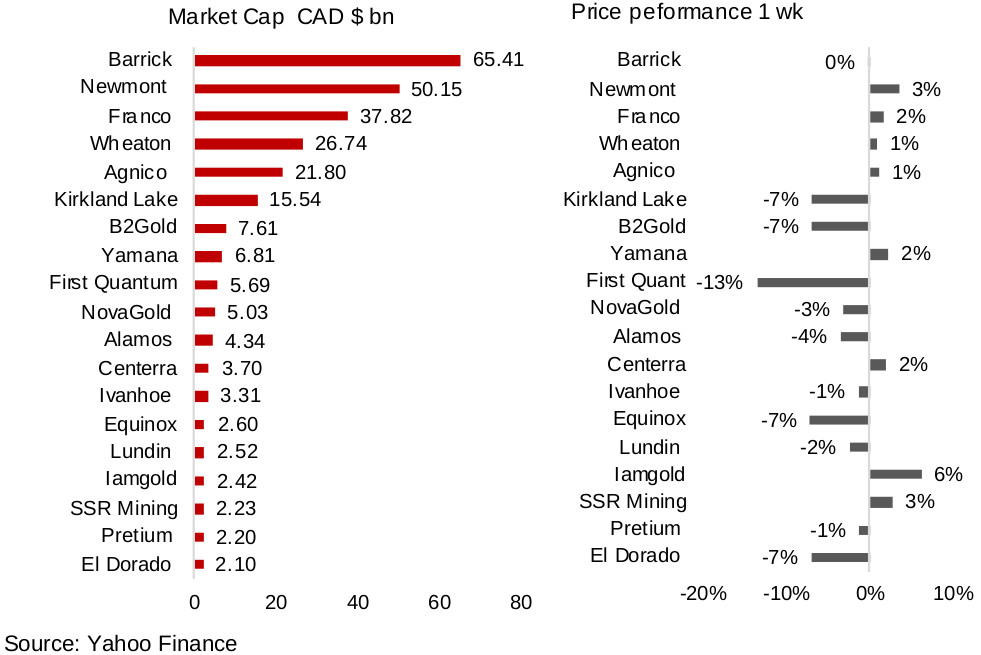

While the largest Canadian producing gold mining stocks saw low single digit gains this week, most of the group saw moderate declines with the Q1/20 results now all in and the gold price making no major breakout for about the past month.

Figure 1: Gold futures price and gold mining ETFs

Gold price taking a pause above US$1,700/ounce

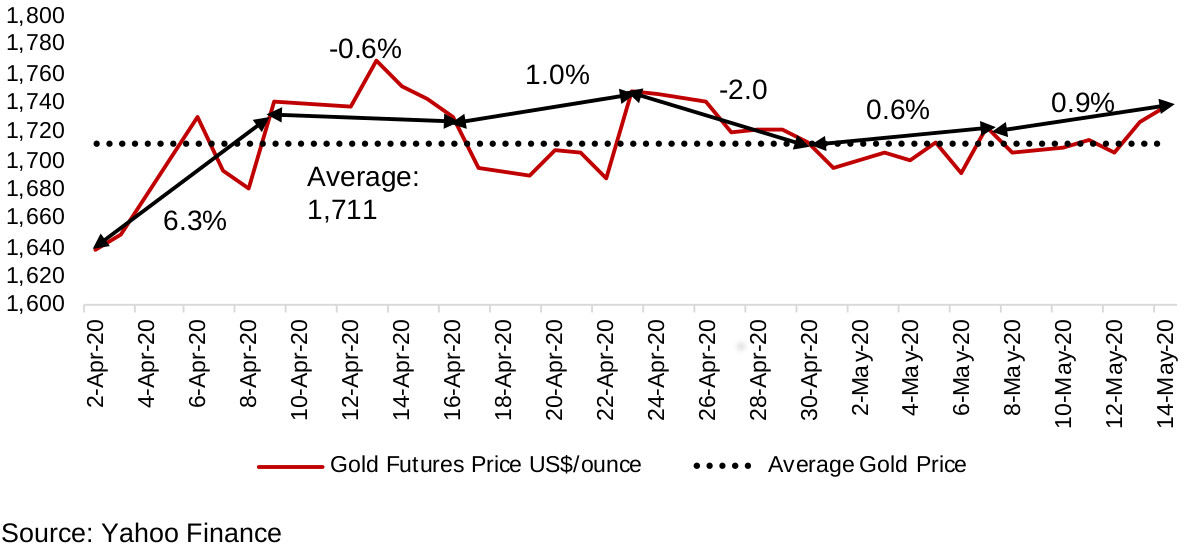

The gold price has taken a bit of a pause over the past two weeks, hovering around the average since April 2020 of US$1,711/ounce, and edging up 0.9% this week, and 0.6% last week (Figure 2). It seems that the two key drivers for gold, the massive monetary stimulus and continued economic uncertainty, are well known to the market, and baked into the price currently. It looks like the market may hold at this inflection point for some time, until there is clear sustained evidence of progress or worsening of the global health crisis coming through. The main macroeconomic driver this week was a speech by the US Fed Chairman, who suggested that negative interest rates, which would be an upside driver for gold, would not be adopted, although it was confirmed that zero interest rates would be sustained indefinitely, which was enough to hold the gold price above US$1,700. This level is more than enough to support strong profitability for the producing miners, and high enough to encourage exploration investment for the junior gold mining stocks.

Figure 2: Gold futures price weekly performance

Producing Canadian gold miners mainly decline

Nevertheless, this relatively strong gold price has likely been priced into to many gold stocks, and most of the larger Canadian producing gold miners declined this week, with only a handful of the very largest names seeing low single digit gains (Figures 3, 4). This sector has seen a very strong rebound off the crash over the past two months, and many investors may have been waiting for Q1/20 results, which are now all in, before deciding on whether to take profits, and we may just be seeing a natural pause in the sector, with limited surprising macroeconomic news coming through.

Figures 3, 4: Canadian producing gold mining stocks

Mostly muted moves on announcements from producing mines

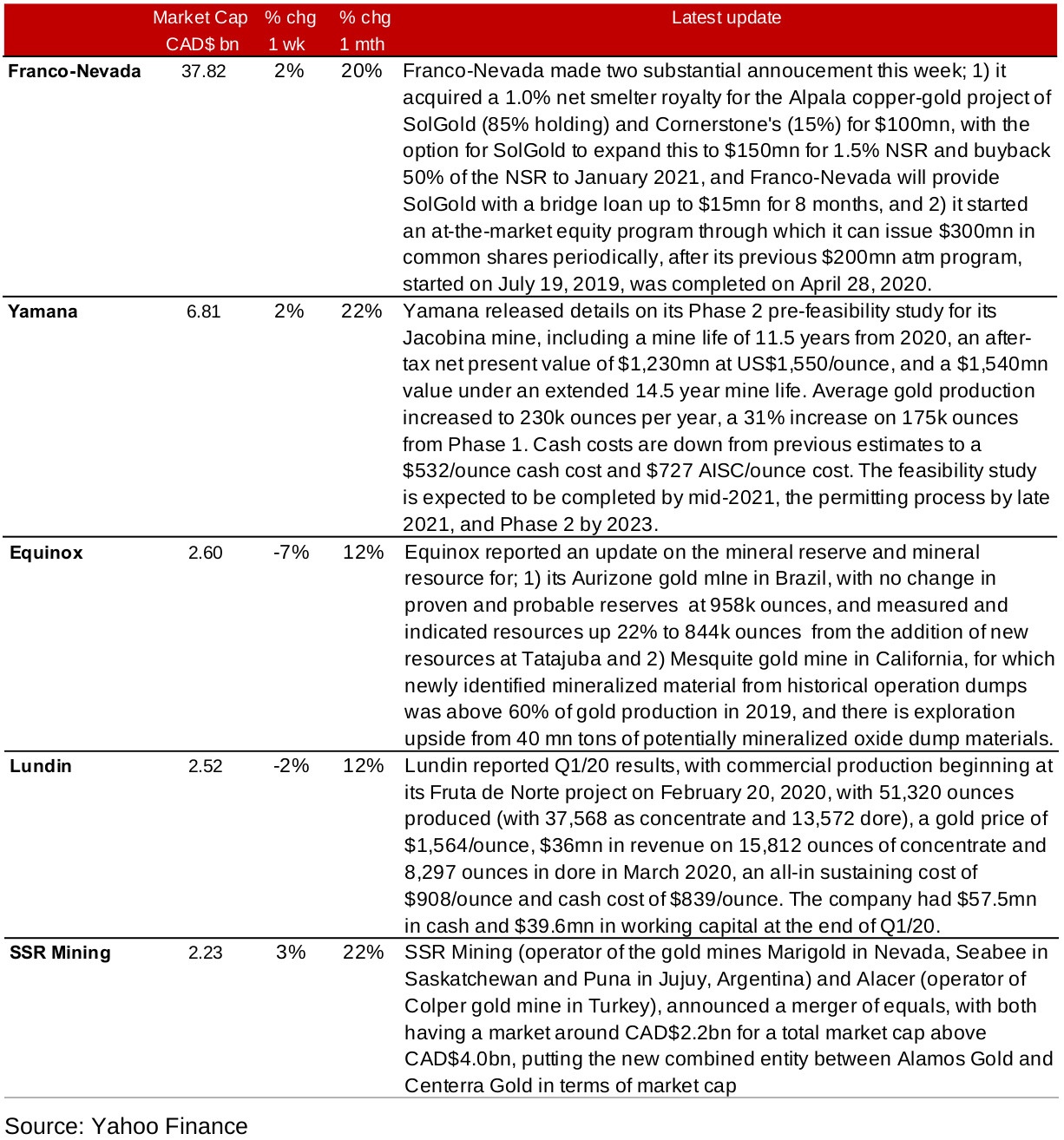

Moves this week from producing miners related to major press releases were muted. Franco-Nevada announced the acquisition of an NSR for SolGold and Cornerstone's Apala project, and Yamana released a pre-feasibility study for Phase 2 of its Jacobina mine, but both were up just 2% (Figure 5). Lundin Gold announced Q1/20 results including details of a February 2020 start of commercial production at its Fruta de Norte mine, which was already well-known to the market, and the stock price edged down 2%. Equinox's mineral reserve and resource update on its Aurizone mine in Brazil and its Mesquite mine in California did not impress the market, with the stock down -7%. There was news of a major merger of equals, with the US$2.2bn SSR Mining and Alacer Gold combining to form over a US$4.0bn player, putting it between Alamos Gold and Centerra gold in terms of market cap, but SSR Mining was up only 3% on the announcement.

Figure 5: Producing gold miners updates

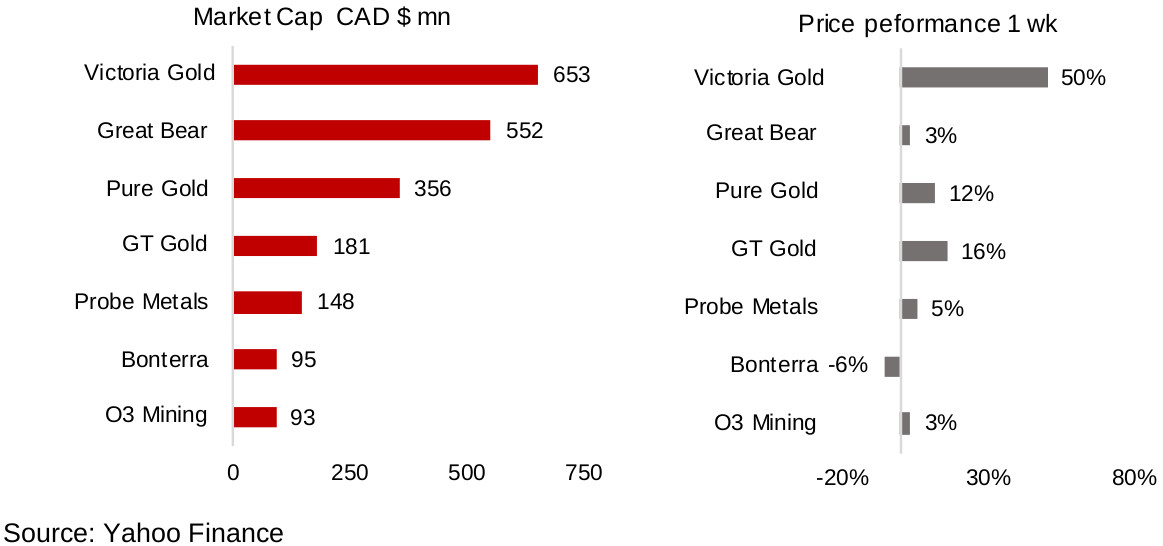

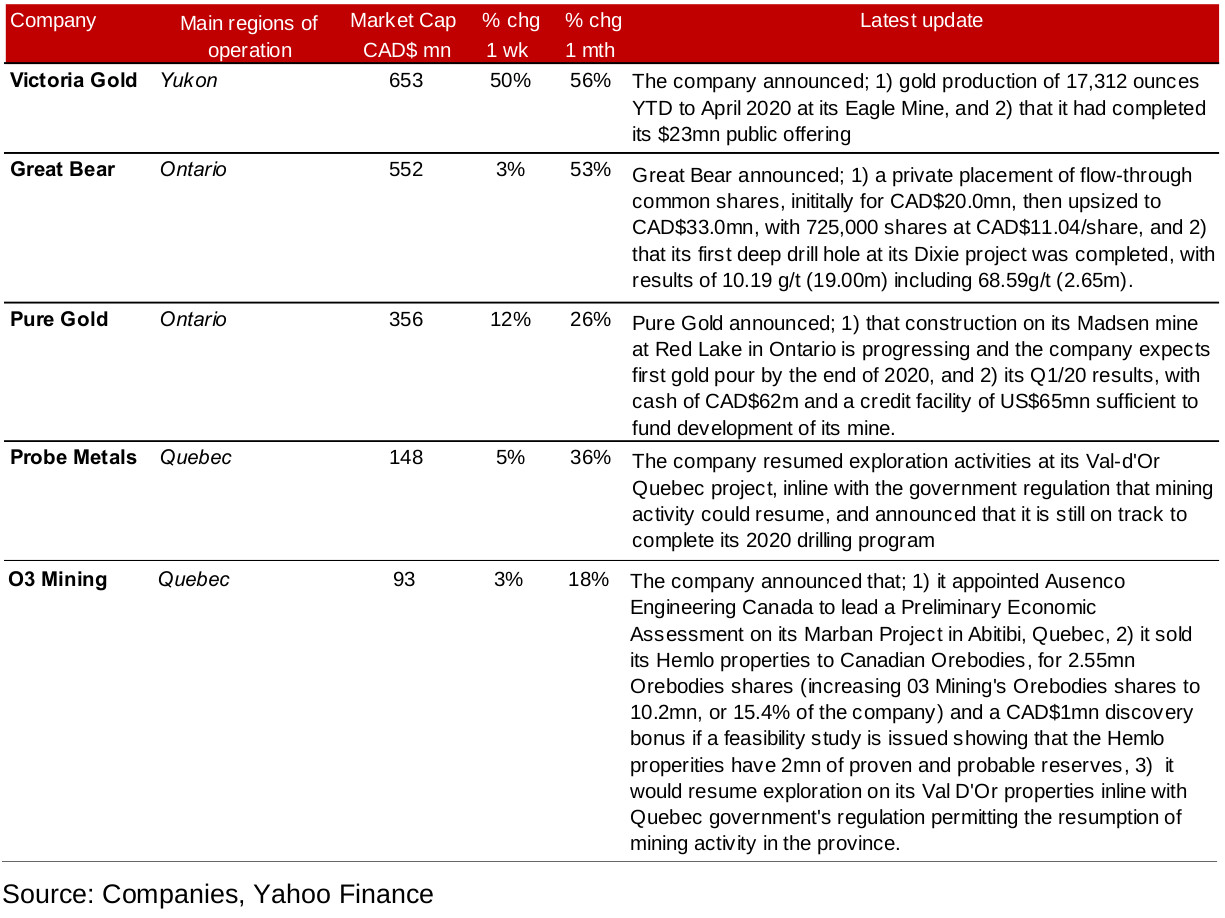

Figures 6, 7: Canadian junior gold miners with operations in Canada

Figure 8: Canadian junior gold miners operating in Canada updates

Some Canadian operating juniors see jump on news flow

Some of the group of Canadian juniors with mainly Canada based operations saw a jump this week (Figures 6, 7), with the clear stand out Victoria Gold, which made its first major announcement of production data since beginning operations at its Eagle mine, sending the stock up 50% for the week, as its successfully begins the transition from development to producer (Figure 8). Another announcement related to transitioning to a later phase in the mining cycle was Pure Gold's that it was still on track to pour first gold at its Red Lake, Ontario mine, by the end of this year, sending the stock up 12%. Other moves on press releases were comparably muted; 1) Great Bear Resources was up 3% on announcements of a private placement and sampling results from its first deep drill hole at its Dixie project, 2) Probe Metals rose 5% on resumption of exploration activities in Val D'or in Quebec, and 3) O3 Mining rose 3% on news of the assignment of a consultant for a PEA at Marban in Abitibi in Quebec, the sale of its Hemlo properties to Orebodies, and the resumption of exploration on its Val D'or properties.

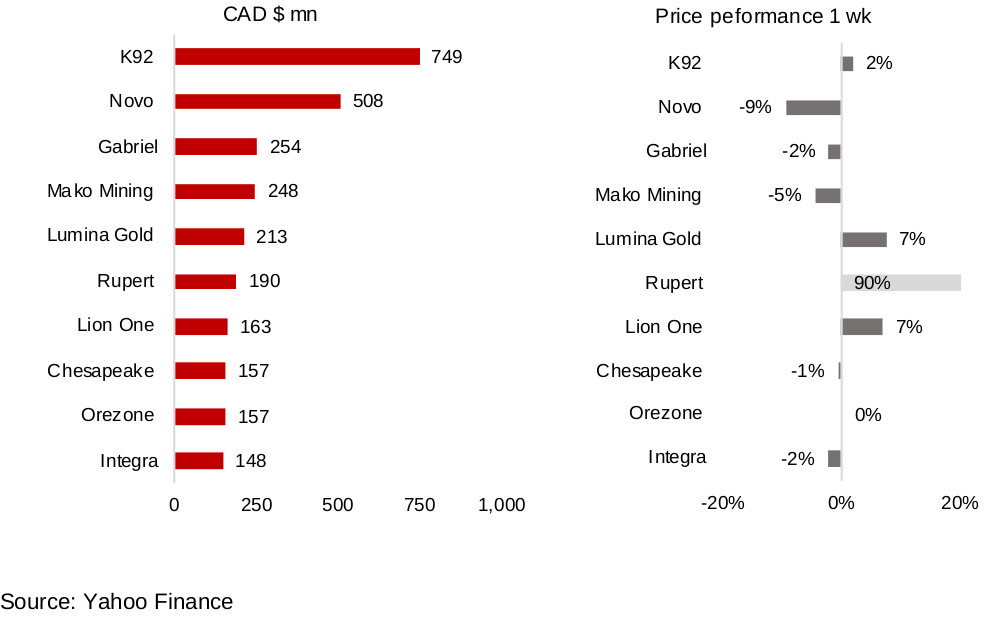

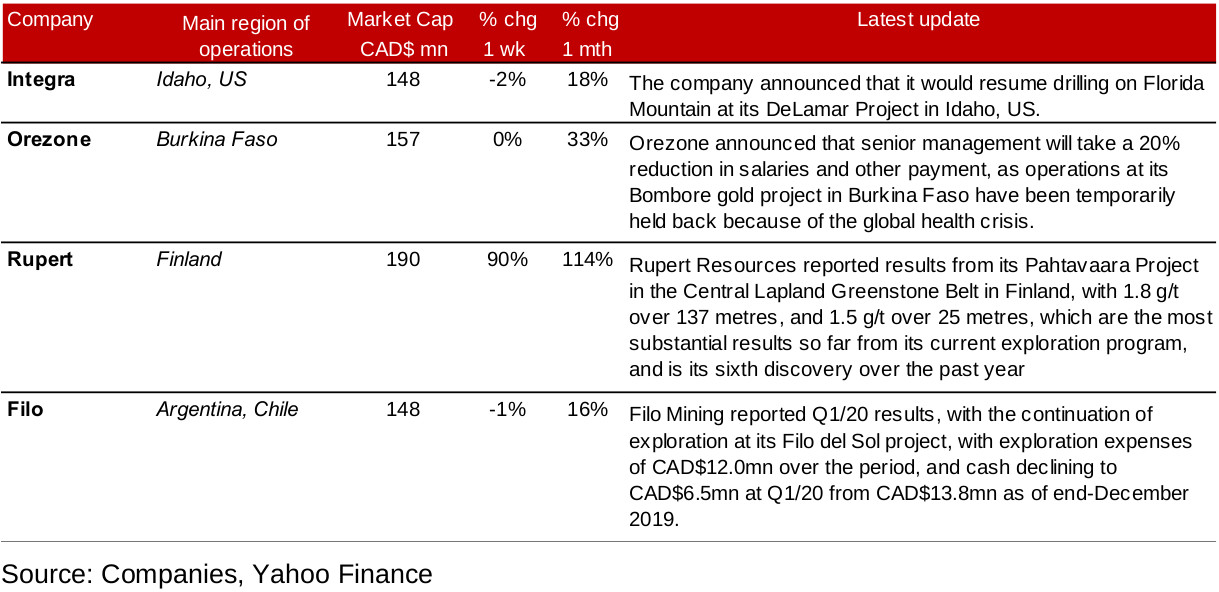

Figures 9, 10: Canadian junior gold miners operating mainly internationally

Foreign operating juniors mostly see declines

Canadian junior mining stocks with mainly foreign operations mostly declined this week (Figures 9, 10), but Rupert Resources stood out from this trend with a 90% surge on sampling results from its Pahtavaara Project in Finland (Figure 11). Other announcements from the group saw broadly flat stock price moves, with Integra resuming drilling at DeLamar in Idaho, US, Orezone announcing a 20% pay cut as Burkina Faso operations remain curtailed because of the global health crisis, and Filo Mining reported Q1/20 results.

Figure 11: Canadian junior gold miners operating mainly internationally updates

Figure 12: Pure Gold Mining

Pure Gold confirms that is still targeting 2020 first gold pour

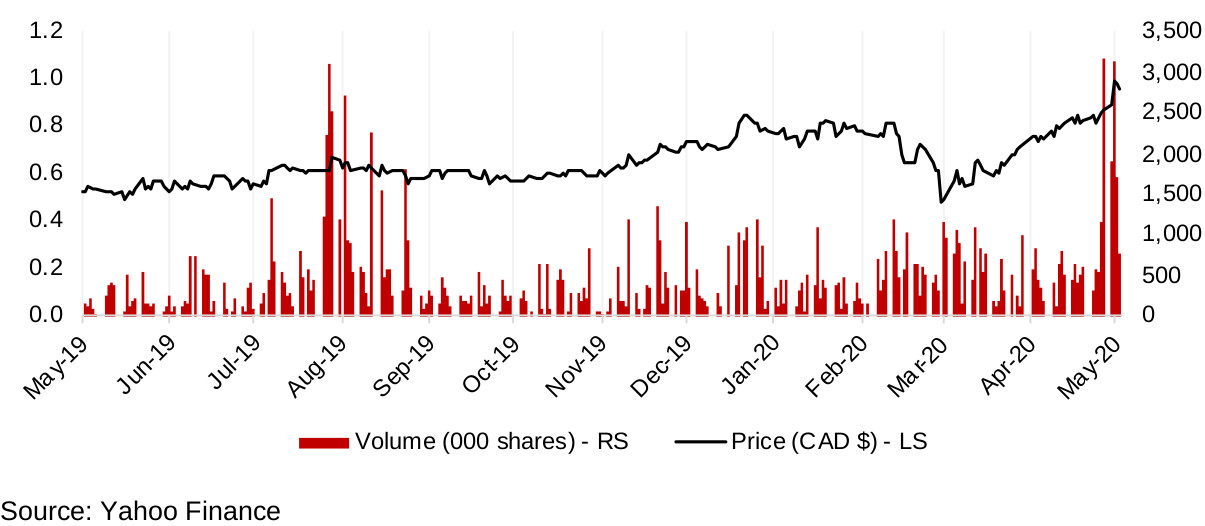

Pure Gold Mining was up 12% this week after announcing that it was still on track for its first gold pour by the end of 2020, even given the global health crisis, at its project in Ontario at Red Lake, a highly lucrative gold district historically, and in its Q1/20 results reporting substantial cash of CAD$62mn and a credit facility of CAD$65mn to fund this project (Figure 13). The company began drilling in May 2020 to convert resources to reserves, and continues to exploration drilling to expand resources from recently discovered high-grade discoveries. The company reported substantial progress on surface construction, and that underground 1,000 metres of the pre-production ramp has been completed, up from the 740 metres previously announced.

Figure 13: Pure Gold share price, volume

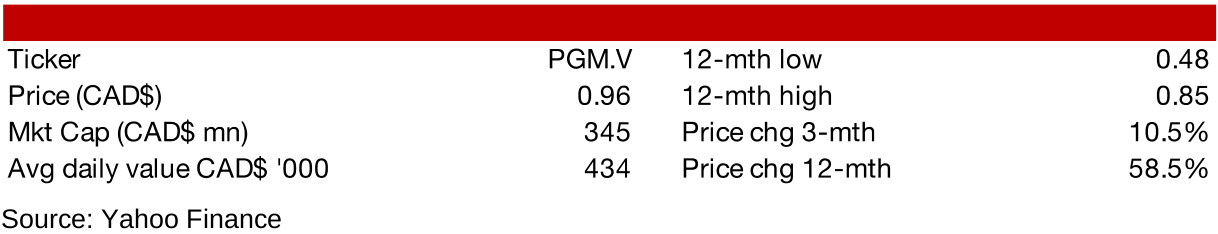

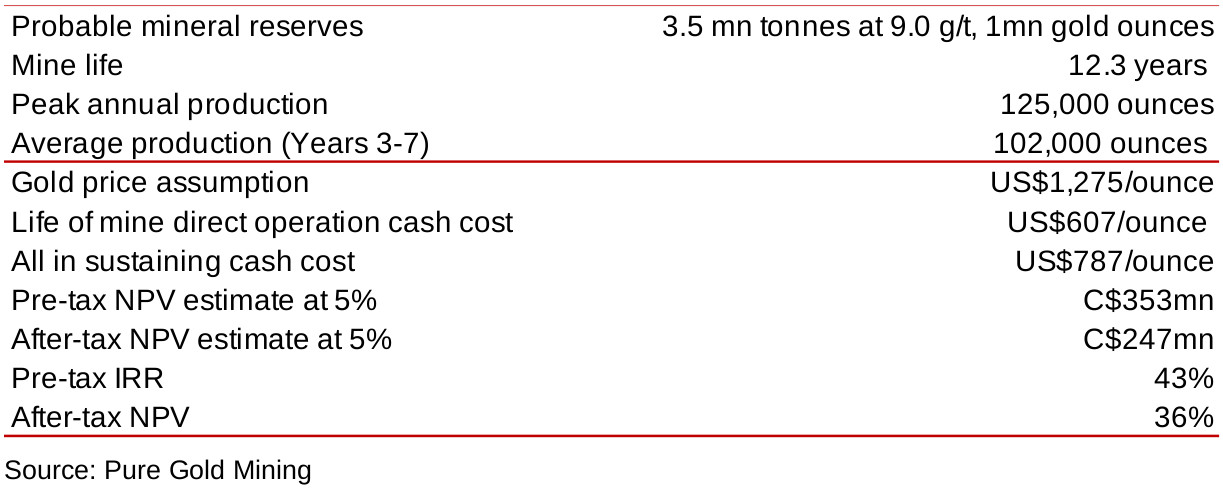

Pure Gold's PEA values project at US$247mn on low gold price

Pure Gold's preliminary economic assessment on its Red Lake mine was completed in February, and gave an NPV for the project of US$247 on an after-tax basis, but this used a gold price of just US$1,275/ounce, when the gold price has averaged over US$1,600/ounce this year and over US$1,700/ounce for over the past month (Figure 14). Pure Gold's market cap, at CAD$345mn, represents a 39.7% premium to the PEA, and therefore appears to have factored in some degree of the 33.3% gain the gold price since the PEA early last year.

Red Lake continues to gain interest, Great Bear another play

The Red Lake district continues to be a focus for junior gold mining firms, and is drawing a host of new operators. In addition to Pure Gold Mining, another key play in the area is the Canadian junior miner Great Bear Resources, which is at an earlier stage of development than Pure Gold, but actually has a considerably larger market cap of CAD$547mn, given a larger potential resource. See our weekly of May 8, 2020, for more detail on Great Bear Resources, and for more detail on many of the junior miners operating in Red Lake see our Red Lake District Overview report.

Figure 14: Pure Gold preliminary economic assessment (Feb 2019)

Figure 15: Victoria Gold

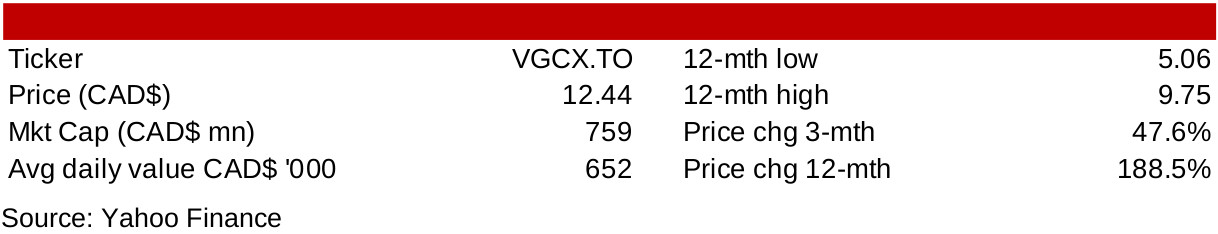

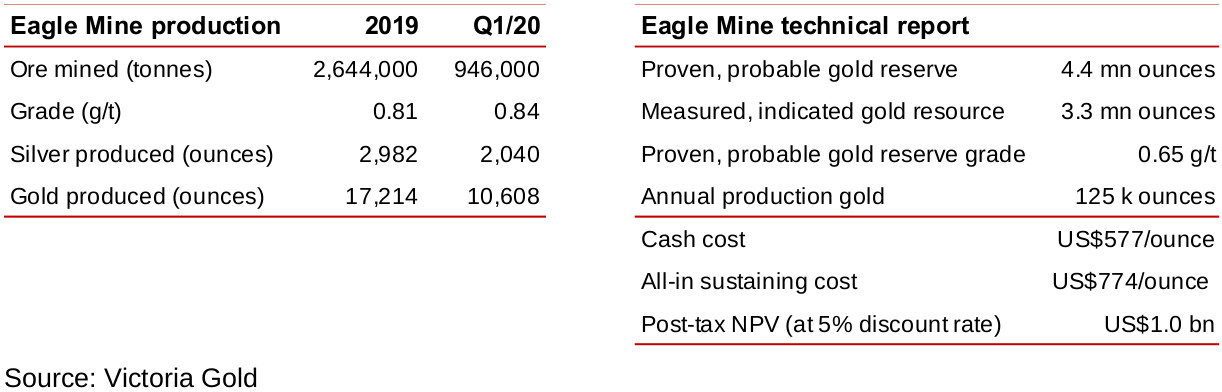

Victoria Gold enters production in Q2/20

Another company that, like Pure Gold Mining, is undergoing a transition between phases of the mining cycle, is Victoria Gold. While Pure Gold is shifting from later stage exploration into development, Victoria Gold is shifting from the later stages of development to the early stages of production. The stock jumped 27% in a single day with the release of its latest results on May 12, 2020 (Figure 16), with production at its gold and silver Eagle Mine in the Yukon convincing the market that the company was well on track in a move towards eventual large scale production.

Figure 16: Victoria Gold share price up 27% in single day

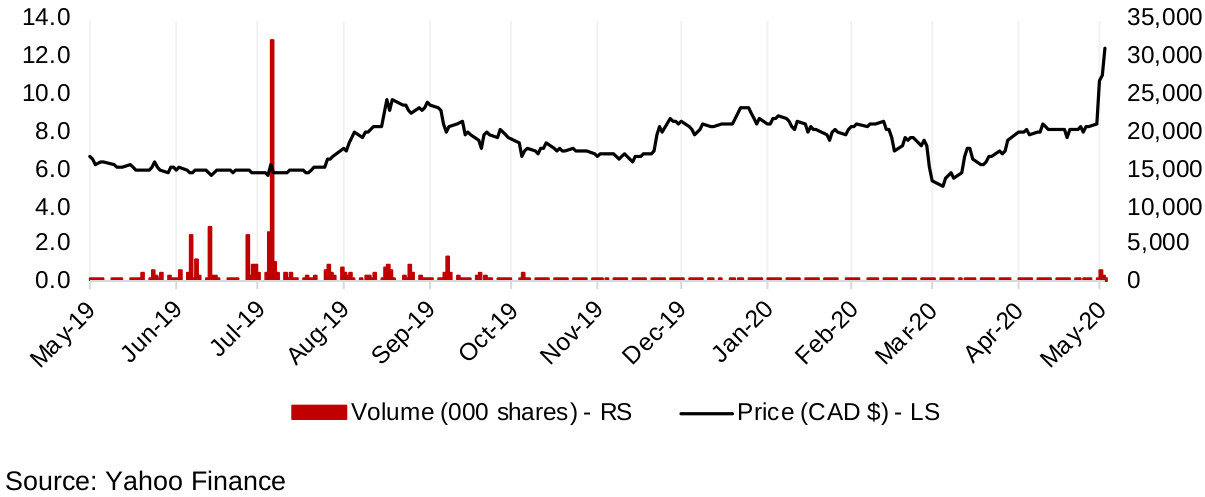

Q1/20 Eagle mine production rate jumps

While small in absolute terms, Eagle Mine's gold production of 10,608 ounces was 62% of the total production 2019, and silver production of 2,040 ounces was already at 68% of the total for 2019, showing substantial growth in the quarter (Figure 17). Victoria Gold's technical report for Eagle Mine targets an eventual average annual production of 125k ounces per year, and a total proven and probable gold reserve of 4.4mn ounces, and measured and indicated gold reserve of 3.3mn ounces (Figure 18). The technical report values Eagle Mine at US$1.0bn, which is 31.7% above the current CAD$759mn market cap of Victoria Gold, suggesting that the market is currently factoring in a discount of about 25% from the value for Eagle Mine outlined in the technical report.

Figures 17, 18: Eagle Mine production, technical report

Disclaimer: This report is for informational use only and should not be used an alternative to the financial and legal advice of a qualified professional in business planning and investment. We do not represent that forecasts in this report will lead to a specific outcome or result, and are not liable in the event of any business action taken in whole or in part as a result of the contents of this report.