December 02, 2024

Fundamentally-Driven Gold Volatility Continues

Author - Ben McGregor

Gold volatility continues to be driven by fundamentals

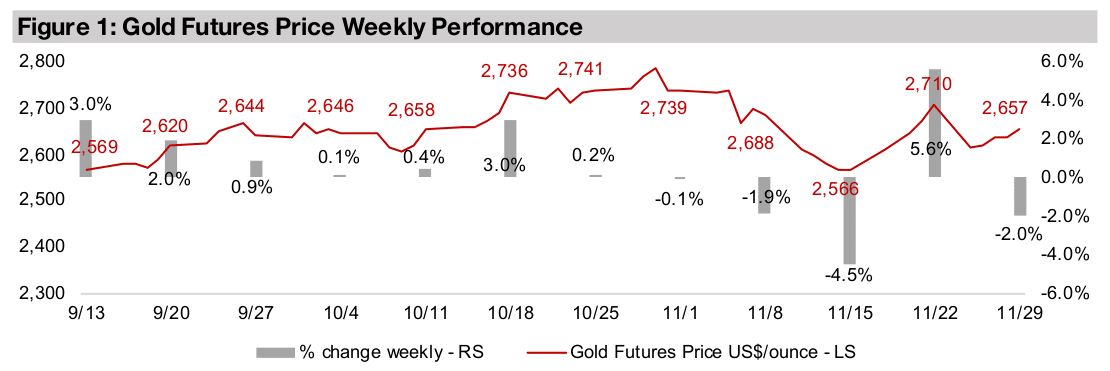

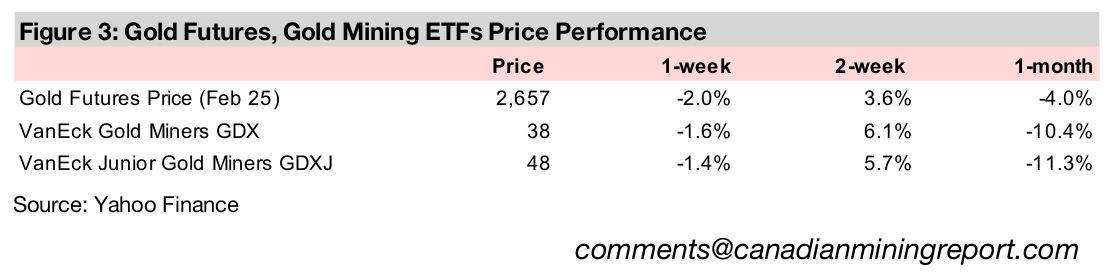

Gold declined -2.0% to US$2,657/oz, continuing the wild swings of the past month, which do not appear to have been speculative moves by markets but are rather rooted in substantial fundamental changes especially related to geopolitical risks.

Fundamentally-Driven Gold Volatility Continues

The gold price declined -2.0% to US$2,657/oz, with a fourth week of high volatility.

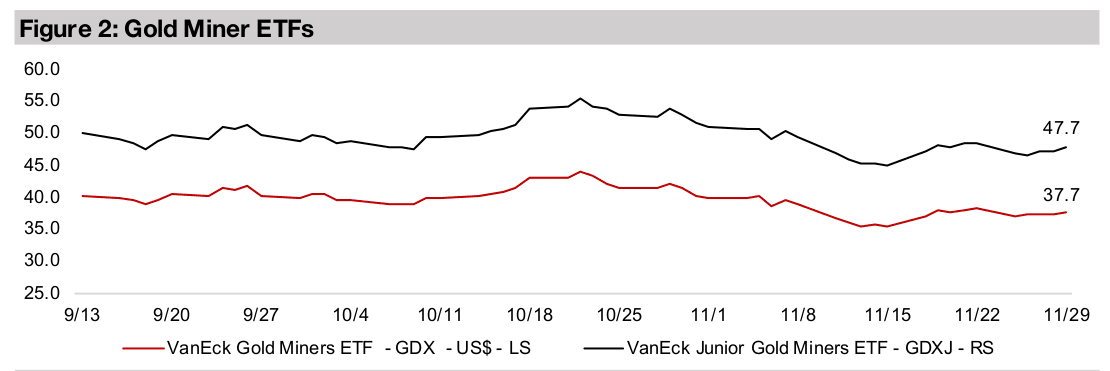

This dragged down gold stocks, with the GDX and GDXJ off -1.6% and -1.4% and

offset a continued rise in equities, with the S&P up 1.6%, Nasdaq adding 1.3% and

the Russell 2000 gaining 2.9%. Normally such aggressive moves in gold, especially

after the large overall gain in the metal over the past year, could be a sign for concern,

indicating that bouts of hope of fear have overtaken a focus on fundamentals. Bull

markets in assets are generally characterized by a steady rise, and major swings like

those of gold over the past month do not usually indicate a healthy market.

However, interestingly, gold’s recent volatility does seem to have been driven almost

entirely by large and sudden changes in the fundamentals and does not indicate wild

speculative moves by nervous markets. Over the past month, the first major move

was a drop from US$2,739/oz on November 1, 2024 to US$2,566/oz November 15,

2024 on Trump’s win. This appears to have been mainly driven by a significant

expected decline in geopolitical risk by the markets given Trump’s track record in his

previous term which was a period of very low international conflict.

However, this was mostly reversed in the next week, with the price jumping back to

US$2,710/oz as the Biden administration permitted Ukraine’s use of long-range US-

supplied missiles to strike Russia, leading the country to escalate nuclear threats in

response. In yet another major reversal, over the past week there was a cooling of

tensions in another key conflict region, with Israel declaring a ceasefire in Lebanon,

which brought the gold price down as low as US$2,617/oz mid-week.

Swings in geopolitical risk premium a major recent gold driver

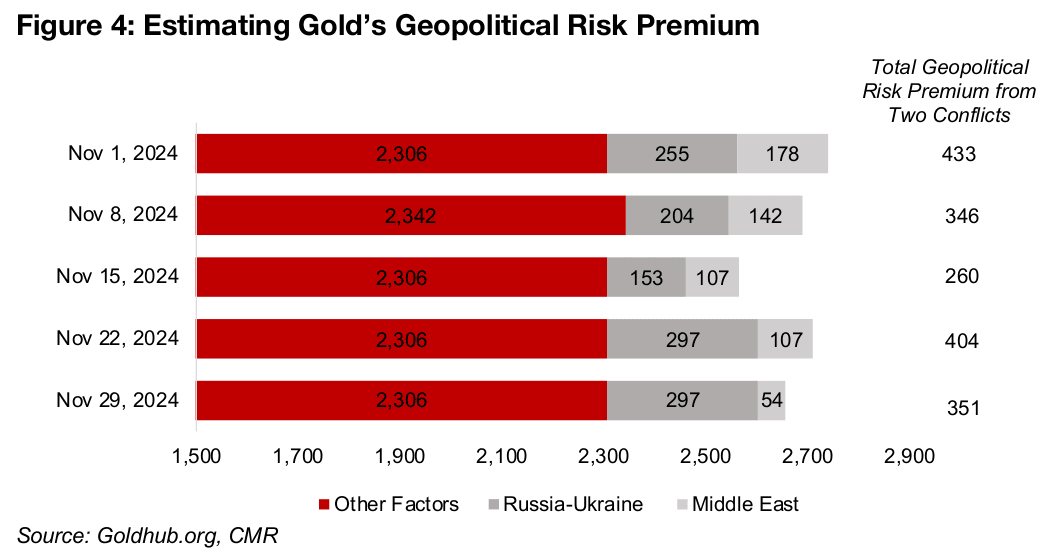

We estimate that there was about a US$433/oz premium in the gold price for these

conflicts prior to the US election, with US$255/oz for Russia-Ukraine and US$178/oz

for the Middle East, based on the price changes in the metal when these conflicts

initially erupted. Therefore signs of an escalation or cooling of these conflicts can

have a very fundamental effect on the gold price, as we have seen over the past

month. In Figure 4 we show a very rough quantification of what the shifts in gold’s

geopolitical risk premium may have looked like over the past month.

If we assume that the premium for geopolitical risk in gold dropped to about 60% of

its level of prior to the US election in the two weeks following the results through to

November 14, 2024, and that this was split roughly evenly between the two conflicts,

it would have declined to US$260/oz. We note that in this estimation we have held

the price of gold not related to these two conflicts flat for most of November. It could

be argued that this underestimates the effect of rising US$ and yields over this period,

but for the purposes of isolating just the effects of the two major geopolitical conflicts,

we have held ‘all else equal’.

Only the Russia-Ukraine conflict really escalated in week to November 22, 2024, so

holding the Middle East conflict premium and other factors the same, we estimate its

premium rose to US$297/oz. This is higher than the original US$255/oz at the start

of the November 2024, which is justifiable because of the rising nuclear threat,

bringing the total geopolitical risk premium to US$404/oz. In the week to November

29, 2024, we estimate that the Middle East ceasefire reduced the risk premium for

this conflict by half to US$54/oz, cutting the total for the two conflicts to US$351/oz.

Overall we expect to continue to see considerable risk to the gold price from the

geopolitical conflict premium heading into next year. There seems to be considerable

hope for conflict reduction under Trump, and this could be quite negative for the gold

price, if our US$350/oz premium estimate is correct. However, both of these conflicts

are extremely complex and there is also a chance that they continue to rachet up in

2025, which could drive up the gold price. Even though the Biden administration has

only a month left, its recent decisions have exacerbated one major conflict, so the

direction of political risk for the next few weeks still remains a major question mark.

While the geopolitical risk premium is important at the margin, the bulk of the gold

price value comprises monetary factors. We view the core underlying driver of the

price as being the global money supply, of which the value of the gold stock tends to

be a relatively steady proportion. As the gold stock volume grows only very slowly,

about 2.0% per year, moves in the gold price will be the main balancing factor for the

gold stock value/global money supply value ratio. With most major central banks now

in a rate cutting cycle, which correlates to a monetary expansion, we expect that this

factor will remain in gold’s favor into next year.

Some Canadian mineral exports could be immune to Trump tariffs

Another major issue related to the new US government has been the announcement

of a 25% tariff on imports from Canada and Mexico, and additional 10% tariff on

imports from China. We recently covered how Canada is a major trading partner for

the US, and vice versa, and one of the largest sources of US mineral imports. While

this news puts into doubt our initial expectation that Canada could receive favourable

trade treatment given these ties, we still view this as more of an ‘opening salvo’

indicating that trade negotiations will be tough, but that many exemptions are likely.

For several major Canadian mineral exports to the US, it may prove economically

difficult for the new government to impose major tariffs. For aluminum, with its

smelters near full capacity, the US is extremely reliant on Canadian imports, and for

uranium, US utilities are looking for more secure sources after Russia’s export

restrictions, especially with almost 20% of the country’s electricity coming from

nuclear sources. More broadly, actually implementing an increase in tariffs across all

products is actually not a simple process from an administration standpoint.

Big Base Metals down on planned rise in US tariffs

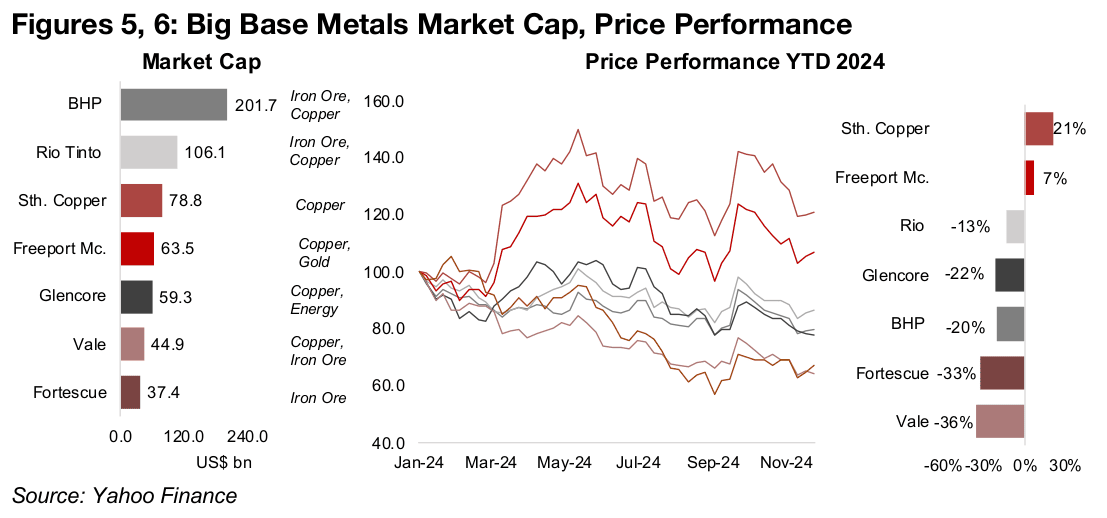

With the markets having now had nearly a month to absorb the US election results, the trend for the largest mining companies has been down, extending a move started in October 2024. For the Big Base Metals stocks, this has likely been mainly because of the probable rise in global tariffs that could hit iron ore and copper, which comprise the majority of the metal production of BHP, Rio Tinto, Southern Copper, Freeport McMoran, Glencore, Vale and Fortescue (Figures 5, 6). While the price of these two metals could be hit by an overall dampening of economic activity from the tariffs, more specifically China and South America are major exporters of both, and could face particularly high tariffs under the new US government. Most of group are down for the year given a large exposure to the major decline in iron ore.

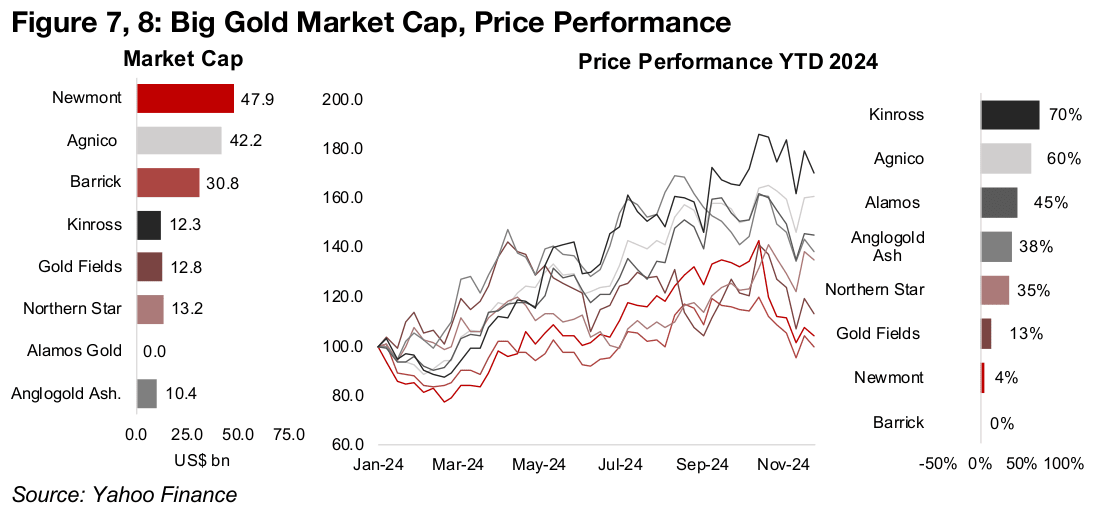

Big Gold pulls back over past two months, but sees major gains YTD

While most of the Big Gold stocks have still had a very strong year, most are down

over the past month, and the two industry giants Newmont and Barrick are near flat,

on concerns over rising costs (Figures 7, 8). We have covered how the geopolitically-

driven volatility in November 2024 has pulled down the gold price, which has weighed

on these stocks. However, the downtrend started in October 2024, with the gold price

hit by a rising US$ and yields, which tend to move inversely to the metal.

As noted above, the ongoing global monetary expansion still remains a key driver that

could continue to support the gold price heading into 2025, and even offset the

downward pressure from other key factors. For the gold stocks, even if the gold price

remains flat or even rises, cost inflation could inhibit gains, and the market seems to

be increasingly focussed on this risk. However, Big Gold valuations still remain very

low, and could provide a cushion for share prices in the sector.

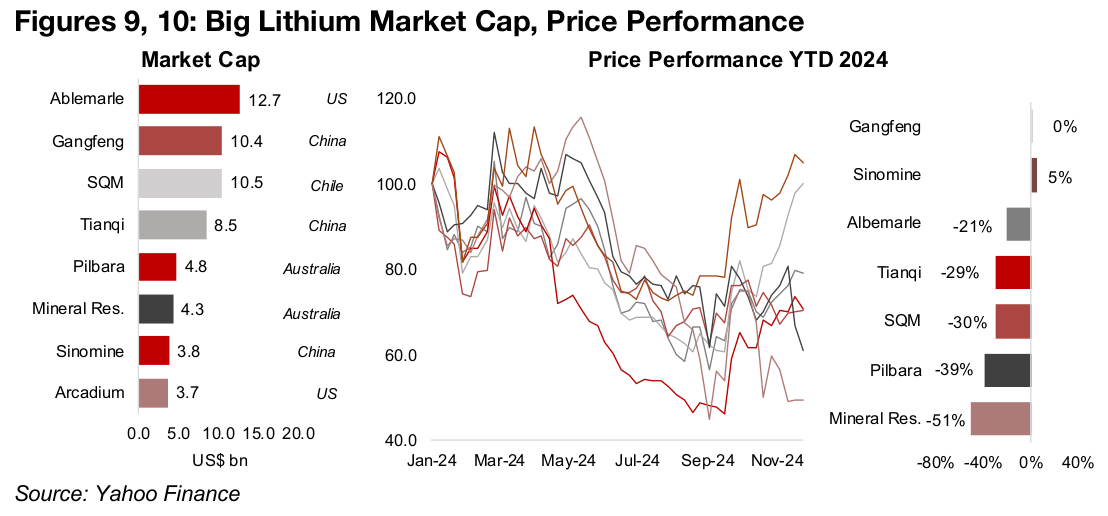

Big Lithium stocks see no consistent post-election trend

The Big Lithium stocks have actually seen no consistent trend over the past two months, with the group roughly evenly mixed between major gains, middling performances and significant declines since October 2024 (Figure 9, 10). This contrasts with the correlated decline across the sector from March 2024 through to September 2024 driven by a slide in the lithium price on a falling EV sales growth rate and rising lithium chemical supply from China, the leading global producer. However, with the lithium price having potentially reached a bottom and stagnating over the past three months, the markets have apparently been focussing more on diverging company specific drivers in the sector.

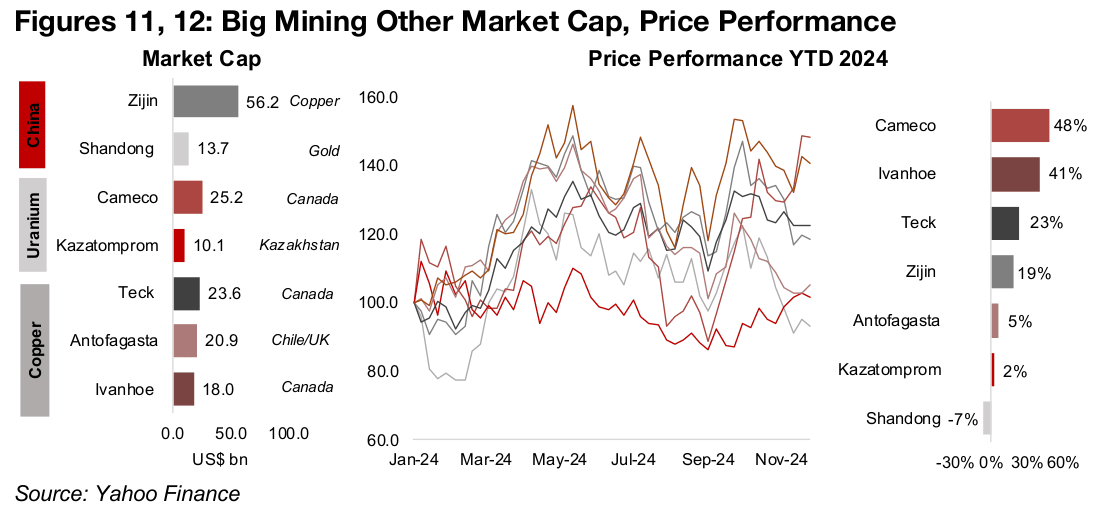

Mixed performance for Big China, Big Uranium and Mid-Tier Copper

The other largest mining stocks can be roughly split into three groups, the large China plays Zijin and Shandong gold, the uranium stocks Cameco and Kazatomprom and the mid-tier copper players Teck, Antofagasta and Ivanhoe (Figures 11, 12). While the trend for these stocks over the past two months has generally been down, most have risen year to date. However, even for the companies producing the same metals, there is a considerable divergence in their price performance for 2024, which indicates that company specific drivers have been as much in focus as broader macro trends for the underlying metals.

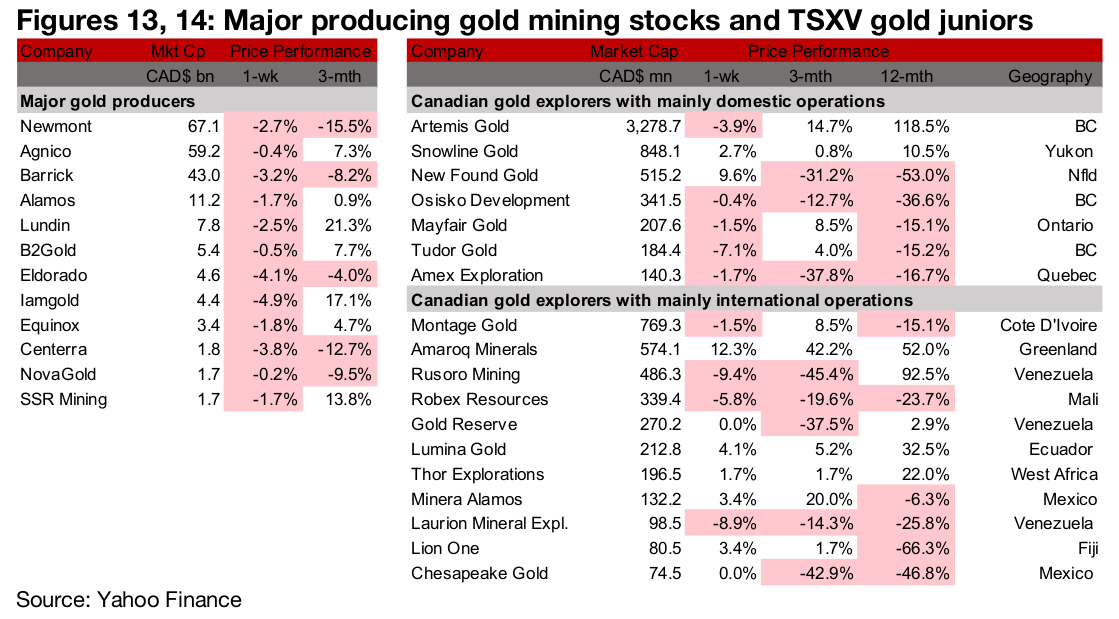

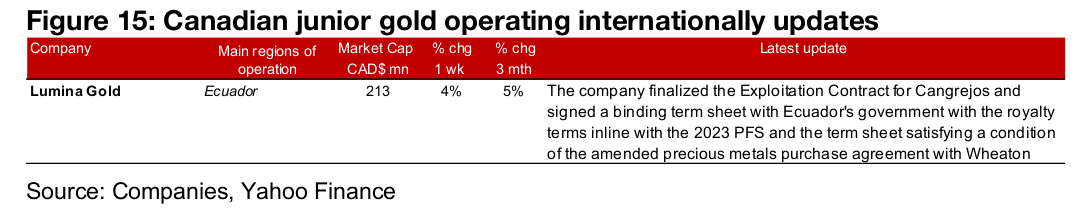

Large gold producers down, TSXV gold mixed, major new China discovery

The large gold producers were down and TSXV gold was mixed on the slide in the

metal price and rise in equities (Figures 13, 14). For the TSXV gold companies

operating domestically, there were no major announcements, and for the TSXV gold

companies operating internationally, Lumina Gold finalized the Exploitation

Agreement with Ecuador’s government and signed a binding term sheet (Figure 15).

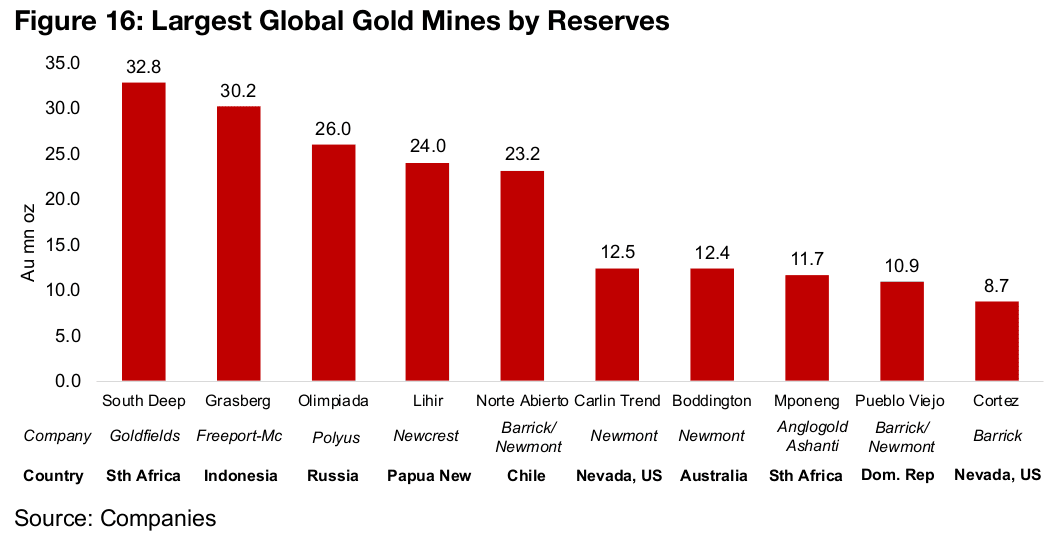

The most major news for the global gold sector this week was the announcement of

a massive new discovery in China with up to forty major veins, with the current

estimate for the deposit up to 1,000 tonnes of gold, or 35 mn oz.

If these estimates prove correct, this would make it the largest gold deposit in the

world, ahead of even Goldfield’s South Deep mine in South Africa, which currently

has largest global reserves at 32.8 mn oz (Figure 16). There is only one other currently

operating mine with over 30 mn oz in reserves, Freeport-McMoran’s Grasberg mine

in Indonesia. There are three gold mines with reserves from 23.2 mn-26.0 mn ounces,

Polyus’s Olimpiadia in Russia, Newcrest’s Lihir in Papua New Guinea, and the

Barrick/Nemont joint venture Norte Abierto in Chile. The next tier in terms of reserves

has fives mines, ranging from 8.7 mn oz to 12.5 mn oz, with Newmont’s Carlin Trend

in Nevada, US and Boddington mine in Australia, Angogold Ashanti’s Mponeng mine

in South Africa, another Barrick/Nemont joint venture, Pueblo Viego in the Dominican

Republic and Barrick’s Cortez mine in Nevada, US.

Disclaimer: This report is for informational use only and should not be used an alternative to the financial and legal advice of a qualified professional in business planning and investment. We do not represent that forecasts in this report will lead to a specific outcome or result, and are not liable in the event of any business action taken in whole or in part as a result of the contents of this report.