May 27, 2024

Frothier Metals Pull Back

Author - Ben McGregor

Gold declines less than some 'frothier' metals

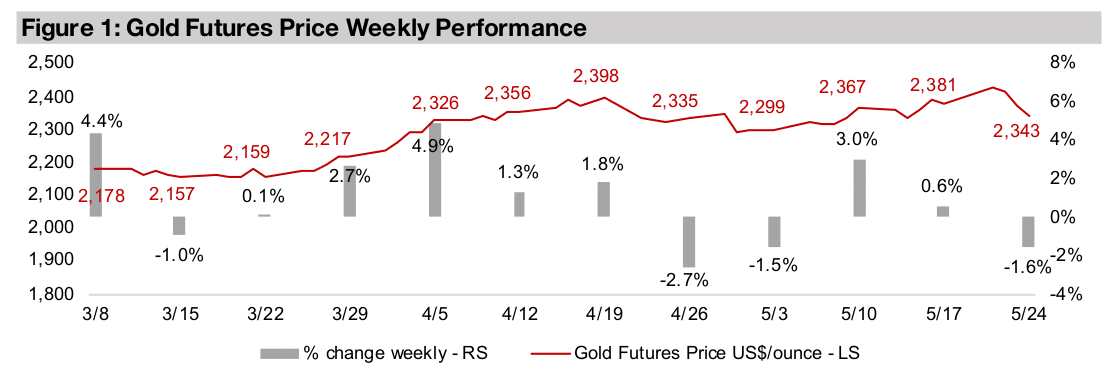

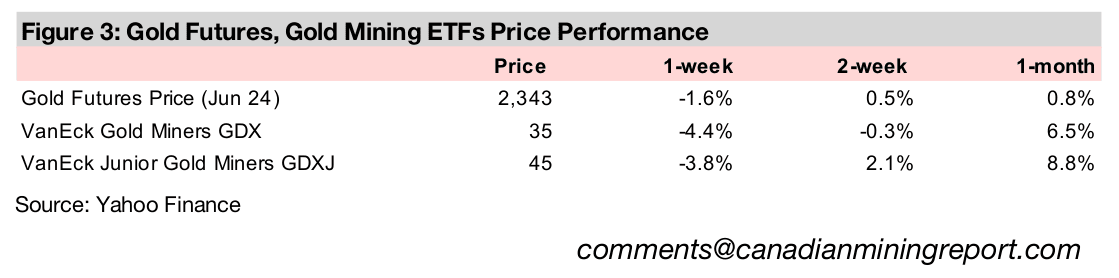

Gold fell -1.6% to US$2,343/oz, a more moderate pull back than metals with ‘frothier’ recent price action including copper and silver, down -5.7% and -2.4% respectively, after both had big, increasingly speculative looking, run ups over the past month.

Market still sees significant upside for TSXV Mining Top 20

This week we look at the performance and upside to target prices for the top twenty TSXV mining stocks, with the market still seeing substantial upside overall for most of the group including the gold, silver, base metals, lithium and uranium companies.

Frothier Metals Pull Back

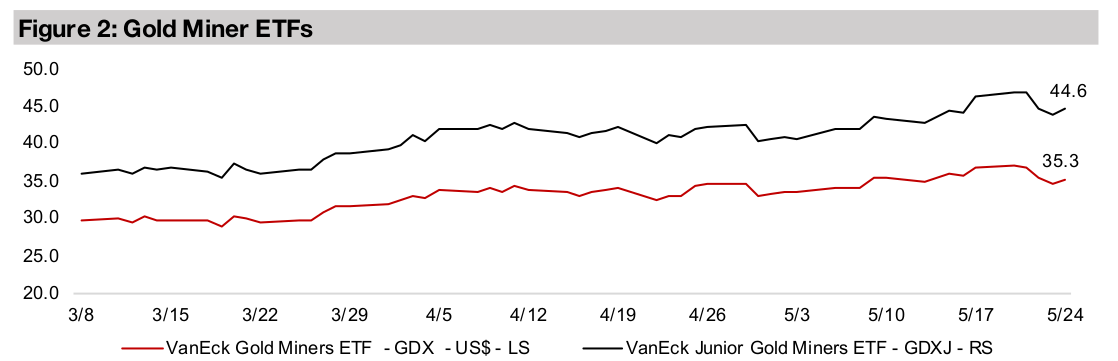

The gold futures price declined -1.6% to US$2,343/oz, as there was a pullback across the sector following some frothy price action in several major metals in recent weeks. This brought down the gold stocks, with the GDX and GDXJ declining -4.4% and -3.8%, respectively. While the market had recently been hedging the broad risk- on move in equities with gold, this did not appear to continue this week. The move into risk assets was not widespread, as equity gains were concentrated in US tech, with Nasdaq up 1.3%, driven by strong Q1/24 results from Nvidia, but the S&P and Russell 2000 were near flat, down -0.1% and up 0.1% respectively.

Market more ‘sober’ this year in sector allocation

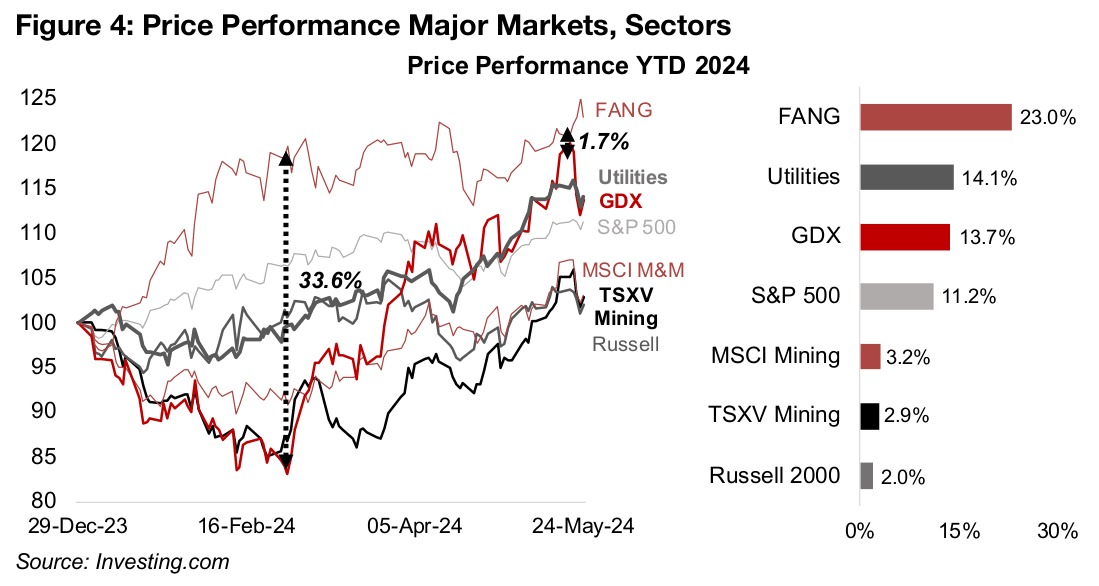

While the large US tech stocks continue to lead the market this year, with the FANG

(Facebook/Meta, Apple, Netflix, Google/Alphabet) ETF up 23.0%, ‘safer’ sectors have

dramatically caught up (Figure 4). Gold stocks were on the verge of outperforming

the big tech YTD last week, with only a 1.7% gap between the FANG ETF and GDX,

after having been as wide as 33.6% in late February 2024. While this spread widened

this week we still a strong probability that the latter can outpace the former this year.

Another defensive sector gaining ground on big tech is utilities, which reached a 5.8%

spread with FANG last week before pulling back. Utilities, up 14.1% YTD, has even

surpassed the 13.7% gain in the gold stocks for the year, and both have outpaced

the 11.2% increase in S&P 500. The Russell 2000’s rise of just 2.0% is another

indication that the move into riskier assets YTD is muted outside of big tech. Overall

this shows a sea change, with markets clearly shifting towards safer assets and a

degree of sobriety emerging on tech, certainly compared to the last several years.

The mining sector has just held onto gains YTD, with the MSCI Metals and Mining ETF up 3.2%. This ETF has large holdings in mega caps with high exposure to iron ore, the underperformance of which has weighed on its performance. Interestingly the S&P/TSXV Mining index is up almost as much, at 2.9%, outperforming the Russell 2000, even though it could be considered much riskier than this benchmark small cap index given many pre-revenue constituents. However, this small cap and no-revenue risk has likely been offset by the surge in gold and copper, with companies exposed to these metals comprising two of the larger market cap groups of TSXV mining. While lithium, the third major metal driving TSXV Mining, is up for the year, most of the gains were made in March 2024 and the metal has been relatively flat since.

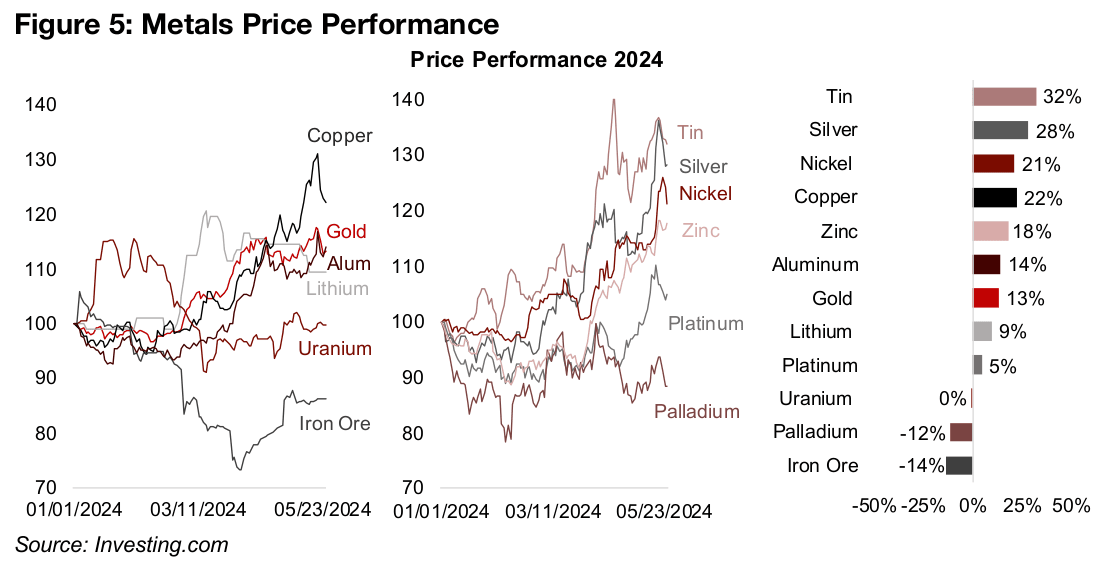

Pullback in some metals with recent ‘frothy’ price action

There were big pullbacks this week in some base metals that have seen particularly

‘frothy’ recent price action, with copper down -5.7% this week after a 22.5% gain

since the start of April 2024, and tin declining -3.0% after a 24.8% rise over the same

two periods (Figure 5). Copper’s surge has raised debate as to what degree it has

been based on short-term speculation versus longer-term fundamentals, with a peak

31.0% gain YTD reached on May 21, 2024, by far the highest of the ‘big four’ metals,

gold, copper, aluminum and iron ore.

There are clearly fundamental supply side issues for copper, including the closure of

the Cobre mine in Panama, while demand has been driven by an increasingly

electrifying global economy and a rebound in China. However, there are still wide

variations across major sources for the demand supply balance this year. Australia’s

Office of the Chief Economist is looking for a 2024 deficit of 230k tonnes and the

International Copper Study Group a surplus of 713k tonnes, which obviously would

have very different effects on the copper price.

Not every base metal with a big ascent from late-April to mid-May 2024 saw major declines this week, with nickel up 3.9% this week, after a 16.0% run up from the start of April 2023, and zinc gained 2.9% after a 22.5% rise over the same two periods. The nickel price continues to be supported by shortages from key suppliers Indonesia and the Philippines and limitations on Russian imports because of the conflict with Ukraine. For zinc there are still concerns over mine supply and even the recent restart of some European smelters this year has not curbed the price rise.

Gold participated less in recent metals ramp up

The drop in the gold spot price of -2.0% for the week was the least severe of the precious metals, with silver, platinum and palladium down -2.4%, -4.7% and -3.8%, respectively. While gold has been strong overall this year, up 13.1%, it did not participate as much in the metal ramp up since April, gaining just 6.0%, compared to a 24.6% rise for silver and 19.9% for platinum, while palladium was more subdued, up only 1.2%. This correlated big jump in these industrial-demand-driven metals hints that they are up on rising expectations for global economic demand and even rebounding inflation, in addition to just pure short-term speculation. This could explain why gold, which is almost entirely driven by monetary factors, has moved less.

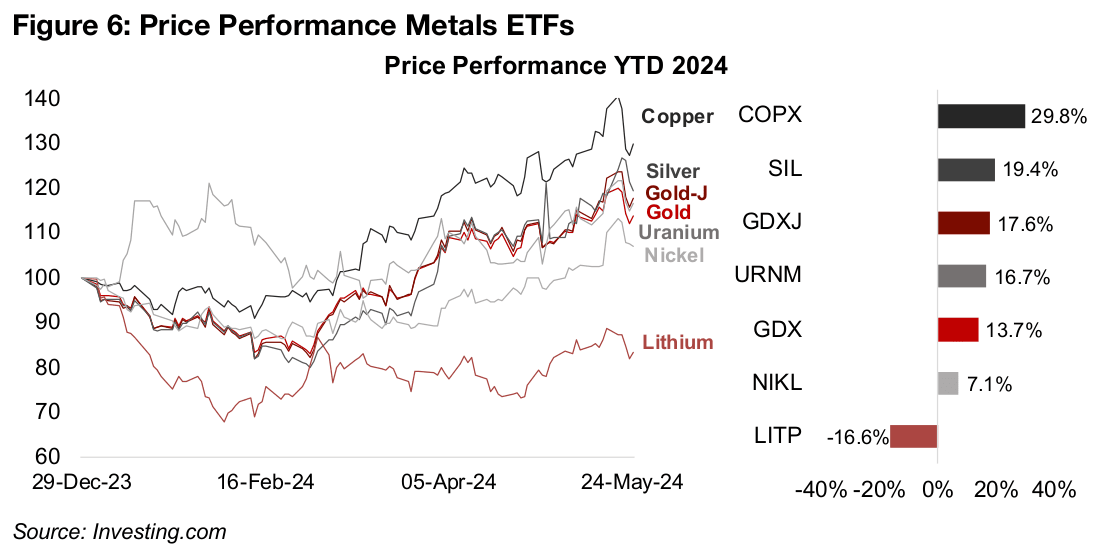

Most major metals ETFs see significant gains YTD

While the drop in the metals prices this week dragged down the major metals ETFs,

they are still up substantially this year, with the exception of lithium. The COPX ETF

of copper producers and SIL ETF of silver producers have led the market this year,

up 29.8% and 19.4%, driven by the underlying rises in their metals prices (Figure 6).

Interestingly the GDXJ ETF of riskier gold juniors, up 17.6%, has outperformed the

GDX ETF of major gold producers, up 13.7%, even though it might have been

expected to underperform the given the relative move to safety this year.

However, many of the GDXJ juniors, while smaller, are in production, unlike most of

the pre-revenue juniors in the TSXV Mining index. Investors could therefore be

seeking leveraged bets on gold given the big price action in the metal along with the

higher risk the GDXJ provides versus the GDX. The short-term performances of

smaller mining companies can also be less correlated with broader macro trends in

metals than larger producers. This can be seen in the TSXV gold stocks, which often

have only a mixed performance in the short-term even when there is a big up or down

move in the major gold producers.

While the uranium price stagnated over the past two months, the ETF price has

continued up, gaining 16.7% YTD. In contrast, the NIKL ETF of nickel producers, up

7.1% has lagged the 21.2% surge in the nickel price. The LITP ETF of lithium

producers, down -16.6%, has most severely underperformed its underlying metal,

with lithium actually rising 9.3%. This could be because of a ‘hangover’ from the -83%

plunge in lithium from its November 2022 peak to January 2024 lows. This pulled

down the LITP -45% as of January 2024 from its March 2023 listing and may have

left investors wary regarding the sector, where EV sales growth, the main demand

driver of the is sector, is slowing, while lithium capacity has expanded.

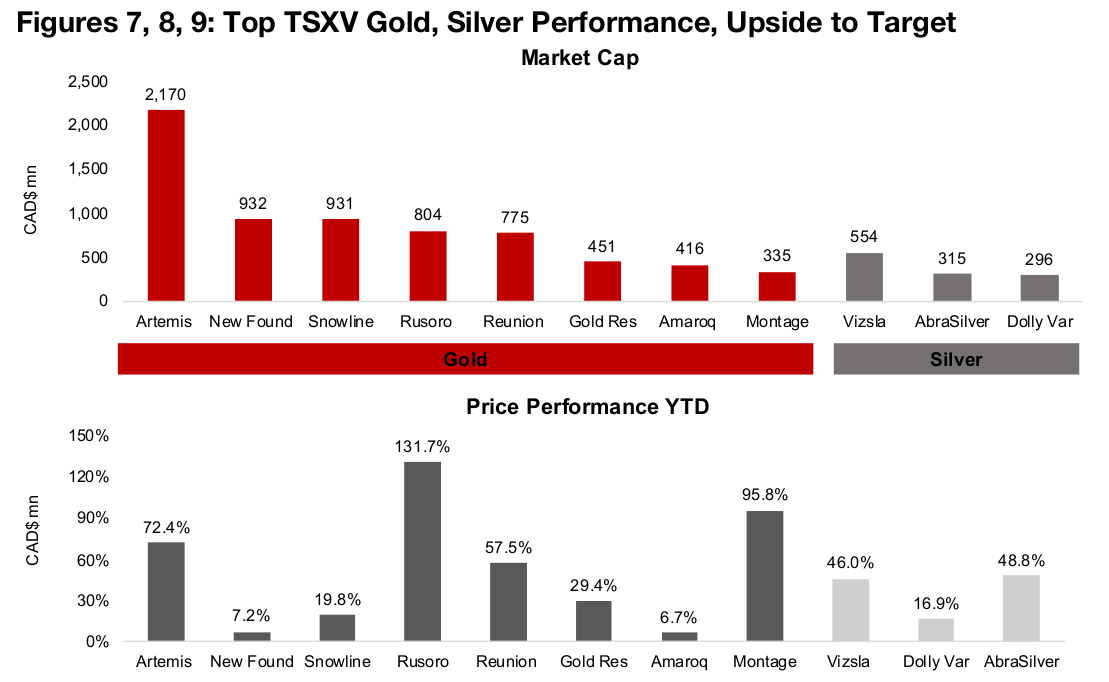

Market sees significant upside for Top TSXV Gold

Given the strong price action in metals and metals stocks this year, this week we look

at the performance of the Top 20 TSXV Mining Stocks to check whether prices are

starting to converge with consensus targets. The prices of all the gold and silver

stocks are up this year, and most substantially (Figures 7, 8). Most developers have

had major gains, with Artemis Gold, Reunion Gold and Montage Gold, up 72.4%,

57.5%, and 95.8%, respectively, although Amaroq Minerals has lagged, up just 6.7%.

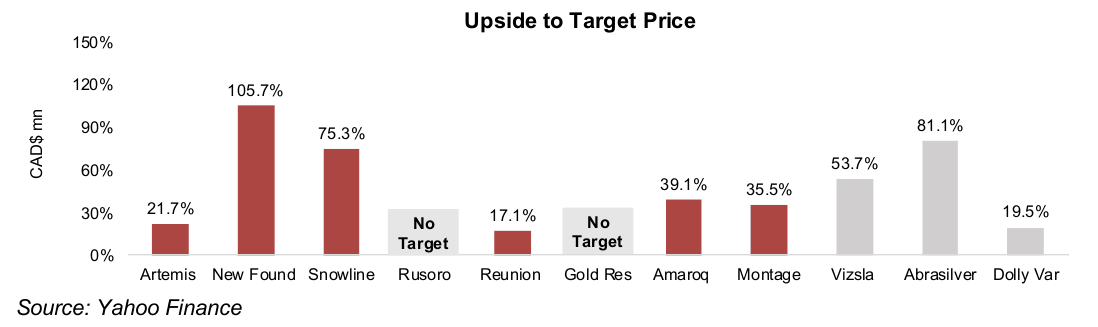

The market sees Artemis, which has risen substantially over more than a year to

CAD$2.1bn for its huge Blackwater project, as nearing full value, with 21.7% upside

(Figure 9). While Reunion and Montage are at earlier phases than Artemis, with more

derisking to still go, they have upsides of 17.1% and 35.5%, respectively. Price action

for the exploration companies has been more muted, with New Found Gold and

Snowline Gold up 7.2% and 19.8% respectively, with a more risk averse market

perhaps leaning more towards more advanced projects. However, the markets still

sees strong upside to their fair values, at 105.7% for New Found Gold and 75.3% for

Snowline Gold.

The other gold stocks, Rusoro and Gold Reserve are ‘lawsuit’ stocks with progress

in ongoing litigation related to previous projects in Venezuela driving their 131.7%

and 29.4% gains, but neither have targets. Even after the ramp up in the silver price

this year, which drove up the prices of Vizsla Silver, Dolly Varden and Abrasilver,

46.0%, 16.9% and 48.8%, respectively, the market still sees major upside for all three,

at 53.7%, 81.1% and 19.5%.

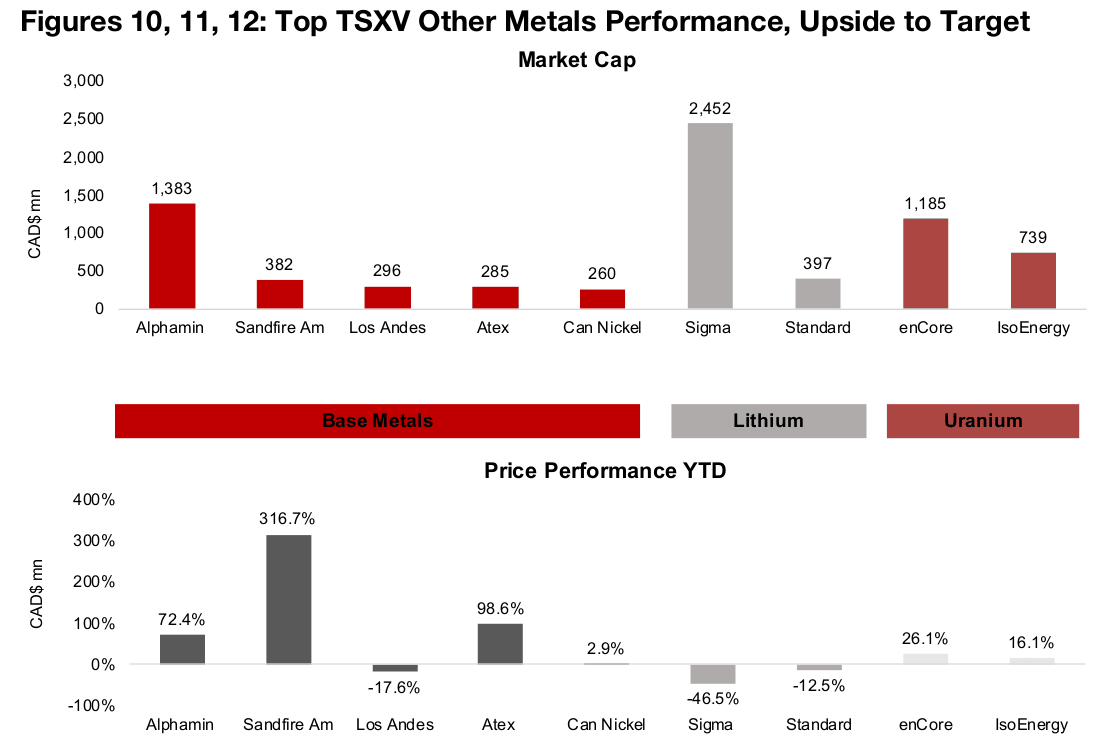

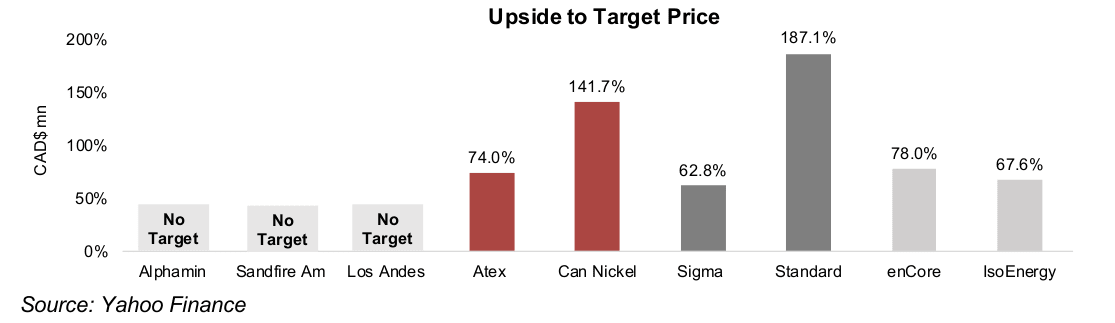

The market also seems bullish overall on the rest of the larger TSXV stocks, although

the outlook is unclear for some given no target prices (Figure 10). For the base metals,

tin producer Alphamin is up 72.4%, but has no target price, along with copper stocks

Los Andes Copper, down -17.6%, and Sandfire Resources America, up 316.7%

(Figures 11, 12). Copper stock Atex Resources has gained 98.6% and does have a

target price, indicating 74.0% upside. The performance of the remaining base metals

stock, Canada Nickel, is near flat, up 2.9% gain, although the market sees a strong

141.7% upside to its target.

While the two large lithium stocks, Sigma Lithium and Standard lithium, have

struggled this year, down -46.5% and -12.5%, respectively, the market expects

strong upside for both, at 62.8% and 187.1%. The gain in the two large uranium

stocks YTD has been moderate, up 26.1% and 16.1%, respectively, and the market

also sees strong upside for both, at 78.0% and 67.6%.

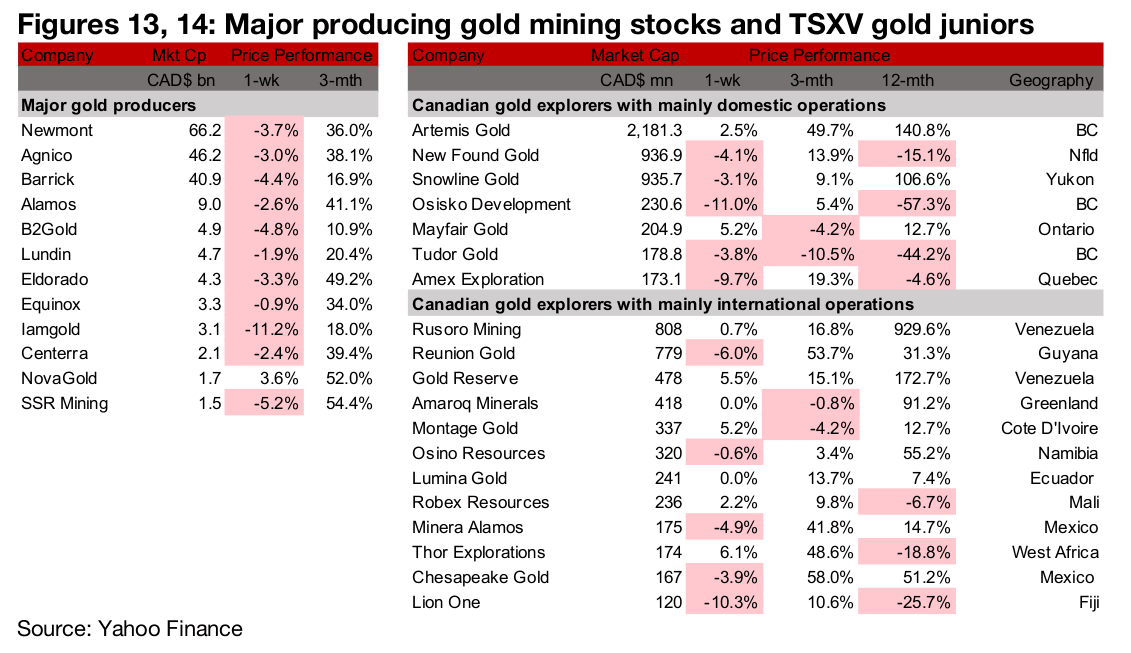

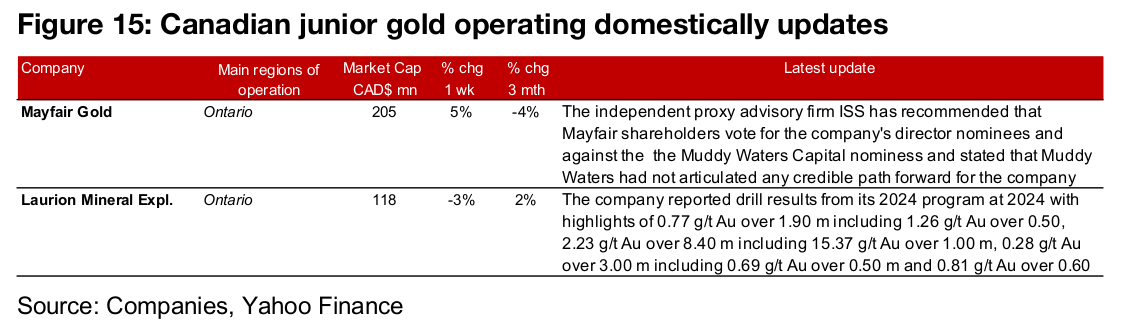

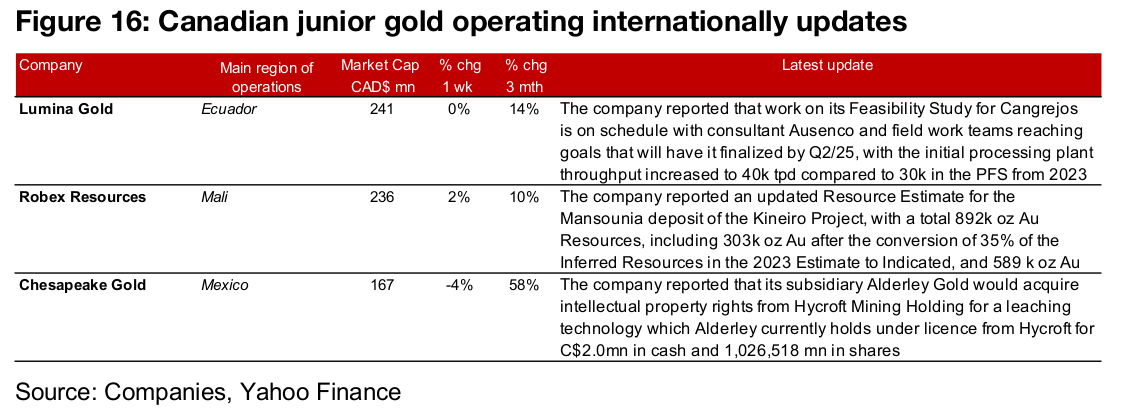

Major gold producers down and TSXV gold mixed

All of the major gold producers except NovaGold were down and TSXV gold was mixed (Figures 13, 14). For the TSXV gold companies operating domestically, Mayfair Gold reported that proxy advisory firm ISS recommended that its shareholders vote in favour of management’s nominees and against Muddy Waters Capital nominees and Laurion reported drill results from Ishkoday (Figure 15). For the TSXV gold companies operating internationally, Lumina reported that its Cangrejos Feasibility Study was on track for completion by Q2/25, Robex released an upgraded Resource Estimate for the Mansounia deposit at Kineiro and Chesapeake Gold’s subsidiary Alderly Gold will acquire the intellectual property rights for a leaching technology from Hycroft Mining which it currently holds under license (Figure 16).

Disclaimer: This report is for informational use only and should not be used an alternative to the financial and legal advice of a qualified professional in business planning and investment. We do not represent that forecasts in this report will lead to a specific outcome or result, and are not liable in the event of any business action taken in whole or in part as a result of the contents of this report.