Aug 21, 2020

Fluctuating around mid-$1900s/oz

Author - Ben McGregor

Gold price averages US$1,979/oz for three weeks

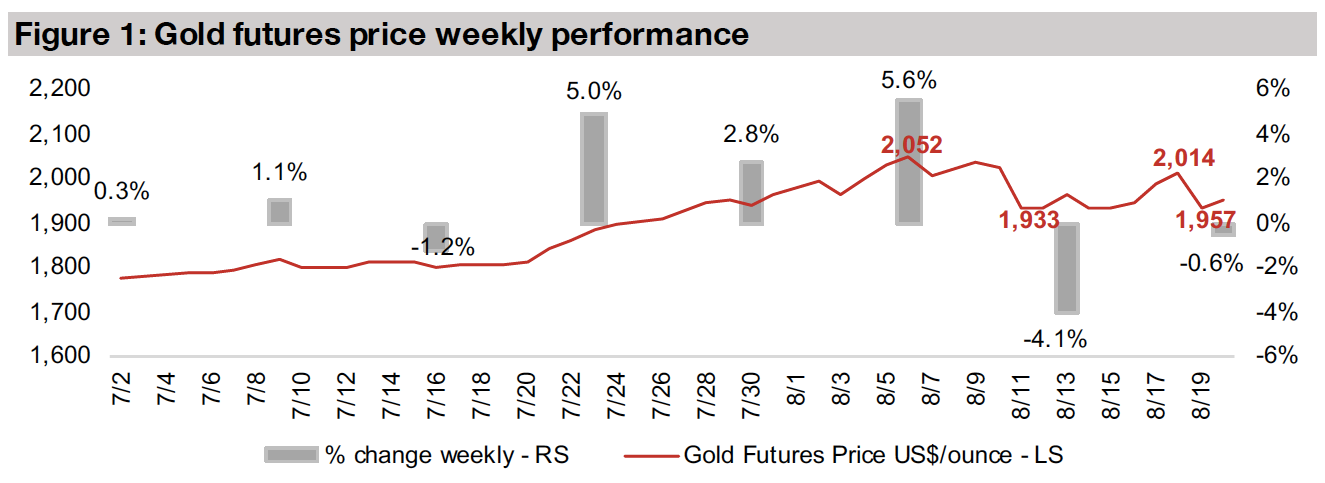

Gold futures edged down -0.6% this week to US$1,957/oz, as it traded within a new three-week range which is seeing resistance to the downside around US$1,900/oz and to the upside around US$2,000/oz, with an average of US$1,979/oz.

Producing miners mainly up

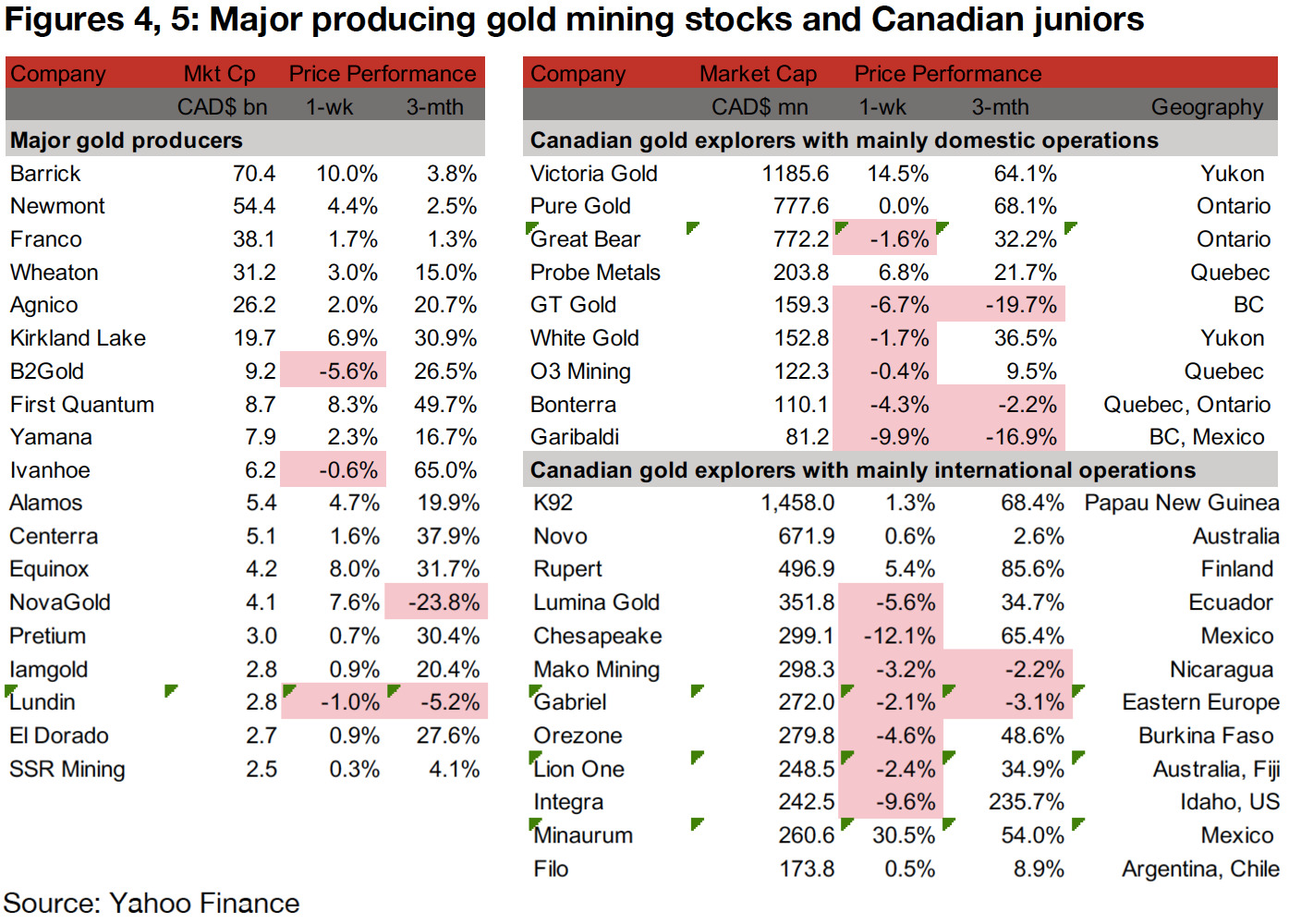

The producing miners were mainly up this week, as concerns from two weeks ago that a fall from all-time highs would continue were allayed, with gold holding up strongly above US$1,900/oz, while Q2/20 sector net income was strong.

Canadian junior miners mixed, and a look at three-month laggards

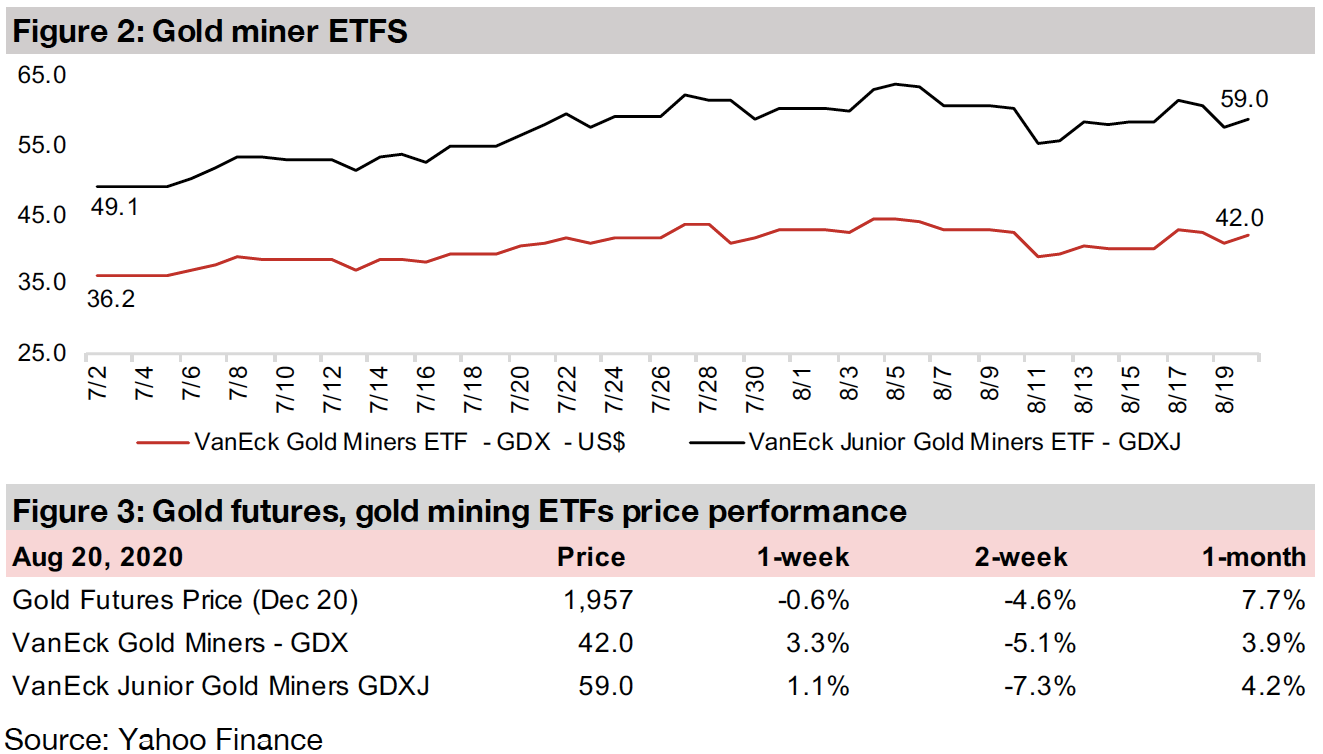

The GDXJ rose 1.1% for the week and the Canadian juniors were mixed. In Focus this week are two stocks that have been laggards and not participated in the threemonth rally of most of the Canadian juniors, Mako Mining and Gabriel Resources.

Holding a new range around US$1,900/oz to US$2,000/oz

The gold futures price declined -0.6% this week, closing at US$1,957/ounce, and for the past three weeks has seen clear resistance to the downside around US$1,900/oz and to the upside at US$2,000/oz, but averaged in the upper half this range, at US$1,979/oz. While there had been a substantial dip off all-time highs two weeks ago, with the gold price plunging -4.1%, in contrast to some more bearish views, this was not sustained, and gold seems to have found a reasonably strong floor. Barring major new macro developments, we may see trading around this level for some time, which will be more than enough to support very strong net income growth for the producing miners, as we saw in the recent results season (see our July 31, August 7 and August 14 Weekly Reports for more detail on Q2/20), and continued interest in the Canadian junior gold mining sector.

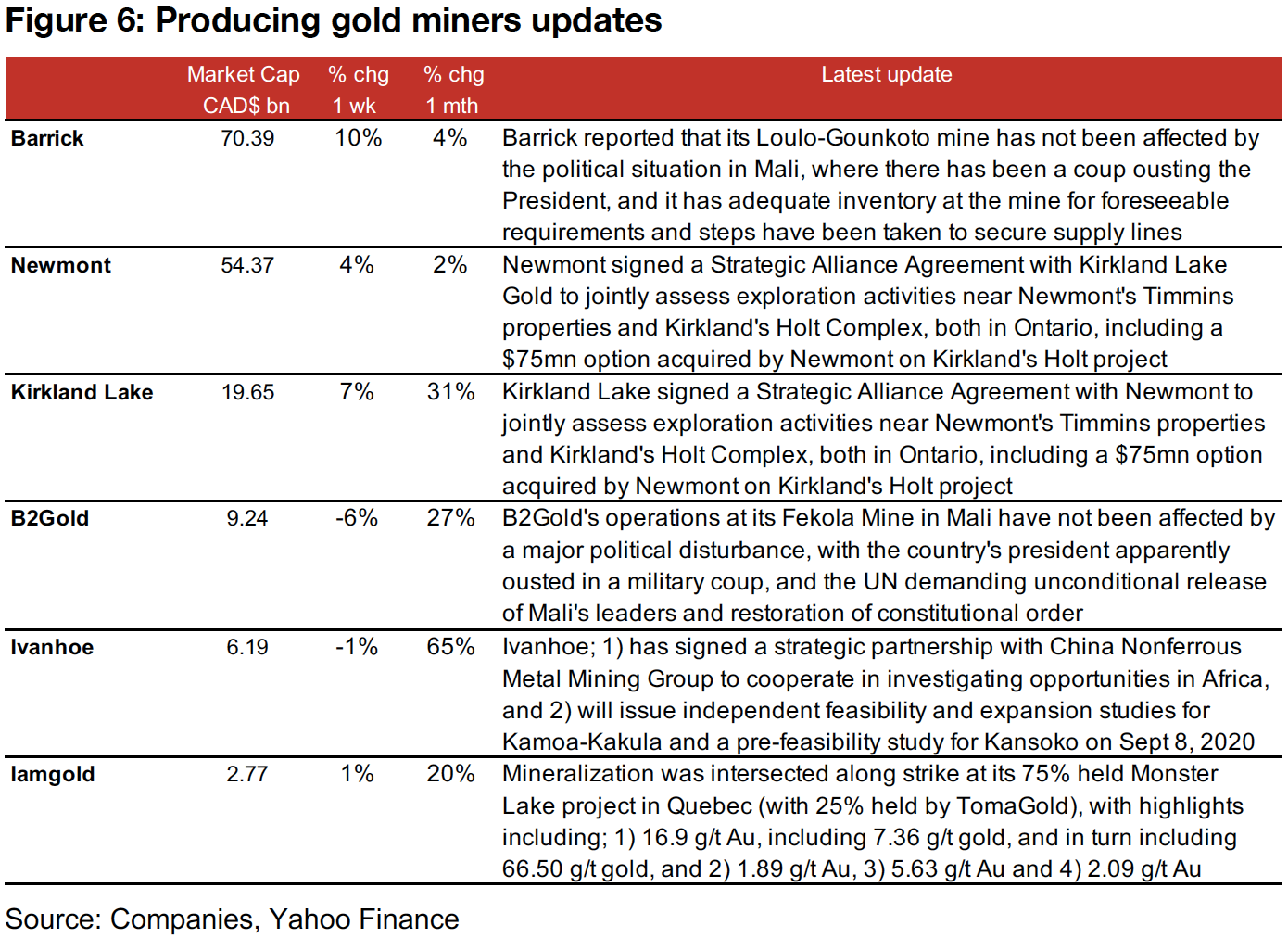

Producing miners up even as gold relatively flat

Even though the gold price was relatively flat, most of the producing miners gained this week (Figure 4). This was possibly because the fears that the gold dip of two weeks ago would be sustained were not realized, and the market may be starting to extrapolate forward on the strong Q2/20 revenue and net income growth for the sector, that was generated even under the pressure of global health crisis-related production shutdowns. News flow included a major political disturbance in Mali, where a coup ousted the President, and both Barrick and Kirkland operate, although both companies reported no issues with production at their mines (Figure 6). Newmont and Kirkland Lake announced a strategic alliance to jointly assess exploration activities in Ontario and Ivanhoe signed a strategic partnership with China Nonferrous Metal Mining Group to cooperate in investigating opportunities in Africa. Iamgold reported a new intersection of mineralization at strike at its 75%-owned Monster Lake project in Quebec.

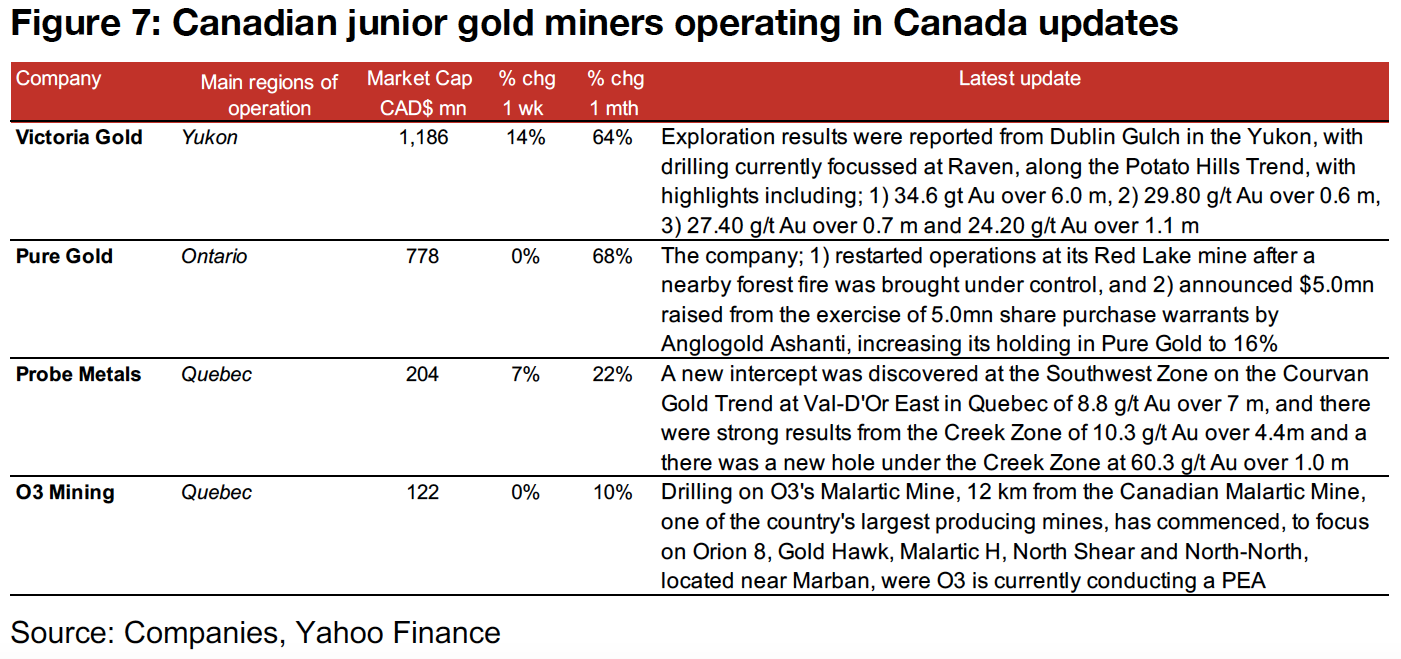

Canadian juniors operating mainly domestically mostly dip

Most of the Canadian juniors with mainly domestic operations fell this week, with the four stocks that were either flat, or up, all seeing news flow (Figure 5). Victoria rose 14% on results from exploration drilling at Raven at its Dublin Gulch property in the Yukon and Probe Metals was up 7% on a new intercept discovered at the Southwest Zone of the Courvan Gold Trend at its Val-D’Or East project in Quebec (Figure 7). Pure Gold and O3 Mining were both flat after Pure Gold announced that its operations at Red Lake had restarted after a forest fire in the area was brought under control, and O3 Mining commenced drilling on its Malartic Mine, near its Marban project.

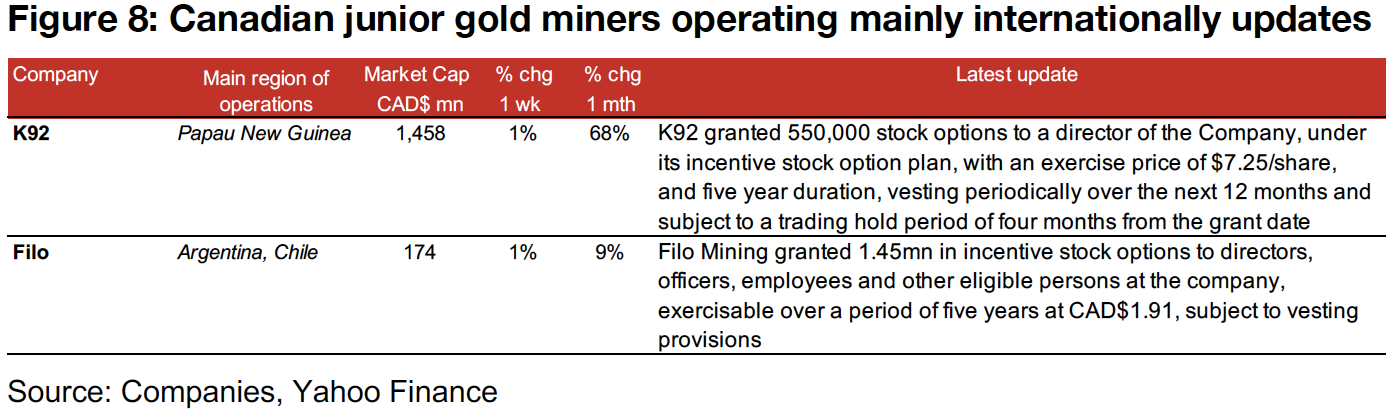

Canadian juniors operating internationally see mixed performance

The Canadian juniors operating internationally were mixed this week, with seven falling and five gaining (Figure 5). News flow was limited to detail on stock option grants to company directors and other employees from K92 Mining and Filo Mining (Figure 8).

In Focus: Mako Mining

Holds four gold projects in Nicaragua; San Albino is most advanced

Mako Mining operates in Nicaragua with four gold projects; 1) its flagship project San

Albino, with a PEA completed in 2015 and first gold expected by January 2021, 2)

Las Conchitas, currently the focus of a 10,300 m drilling program, with a maiden

resource targeted, 3) Potrerillos, which was acquired in December 2019, and 4) Le

Segoviana, which was granted in 2020.

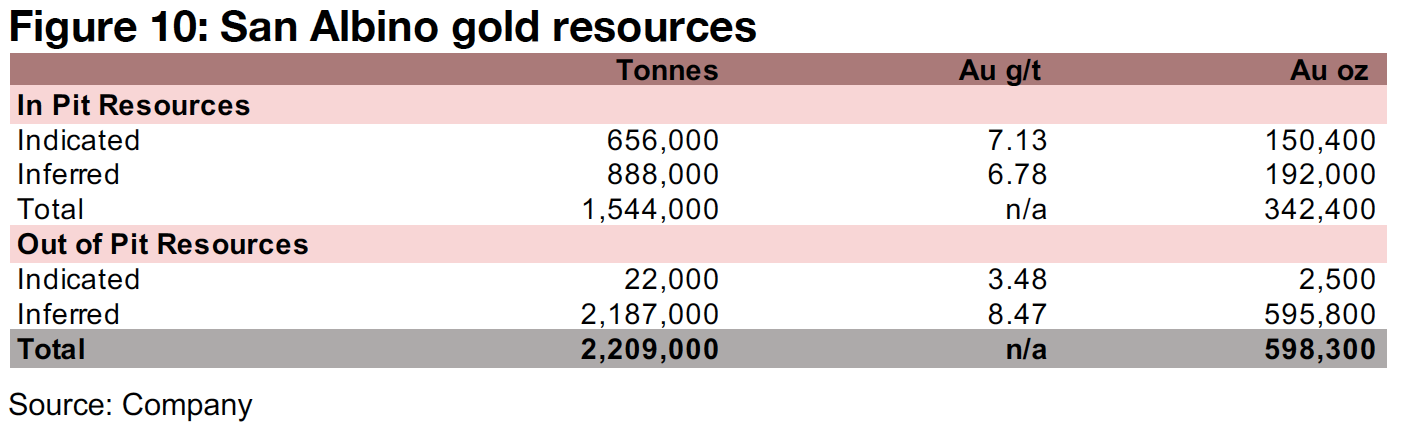

The company highlights the San Albino project for its high grade, with in pit

resources of 656k tonnes at 7.13 Au g/t for 150.4k oz in Indicated gold resources,

and 888k tonnes at 6.78 g/t for 192.0k Inferred resources, for a total 342.4k in gold

Resources, and an additional 598.3k ounces in out of pit resources (Figure 10). The

project is also expected to be low cost, with the PEA estimating an initial capex of

$21.2m, an AISC of $395/oz, a cash cost of $359/oz, a mine life of 16 years, a 41,300

oz average annual production and an after-tax net present value of $173.9mn.

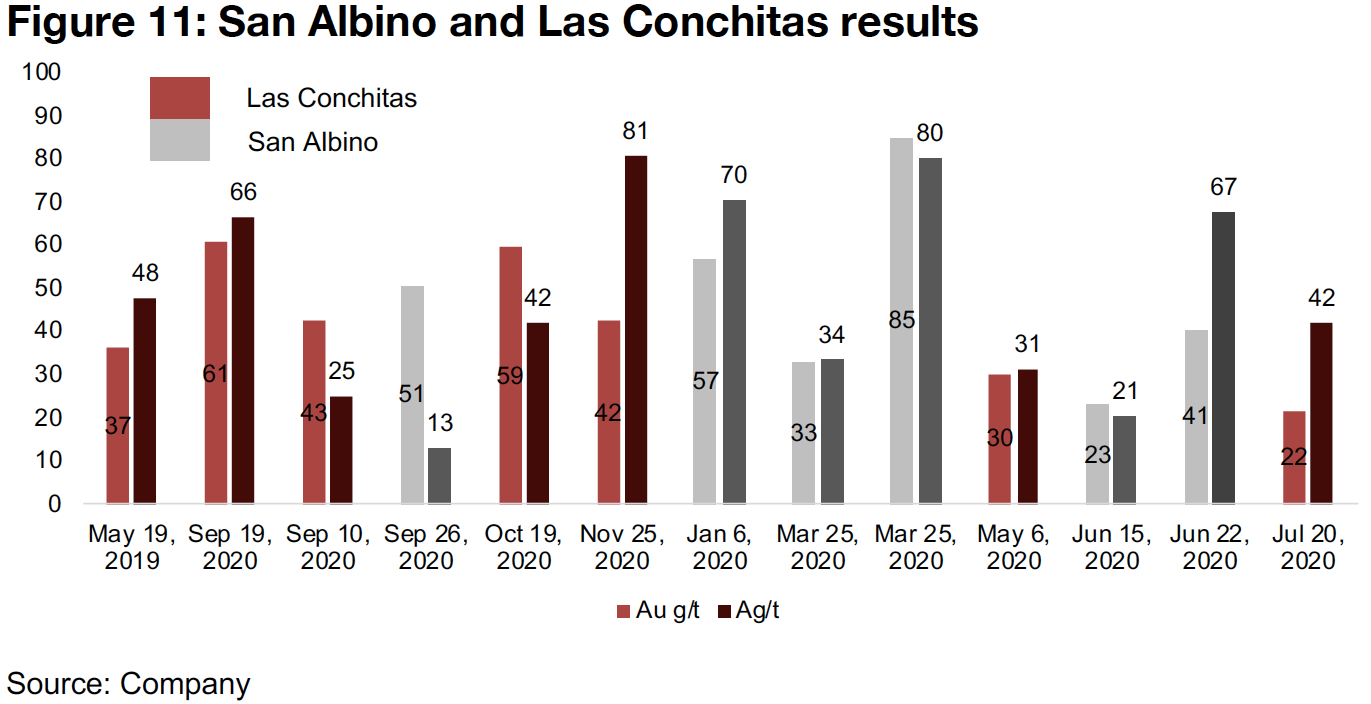

Selective infill drilling is continuing at San Albino, with 8,600m drilled in 2020 over 203

holes with highlights shown in Figure 11. The company targets using the cash flow

from San Albino, which is just 2% of its land holdings, for its other exploration projects.

The company is currently undertaking a program to delineate the maiden resource at

the Las Conchitas project, with drilling highlights shown in Figure 11. The project is

a highly mineralized area that is 3x the size of the San Albino, and the company has

identified eight mineralized zones, and highlights potential for the zones to connect.

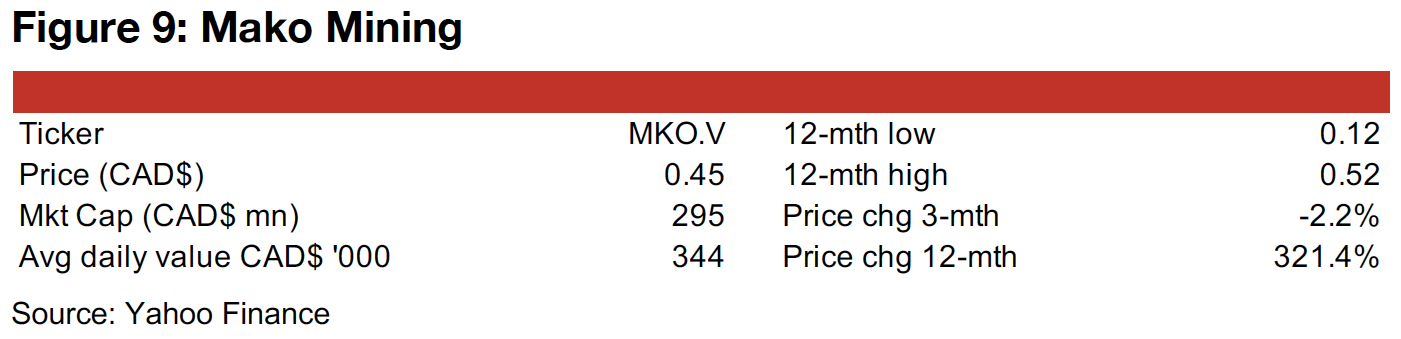

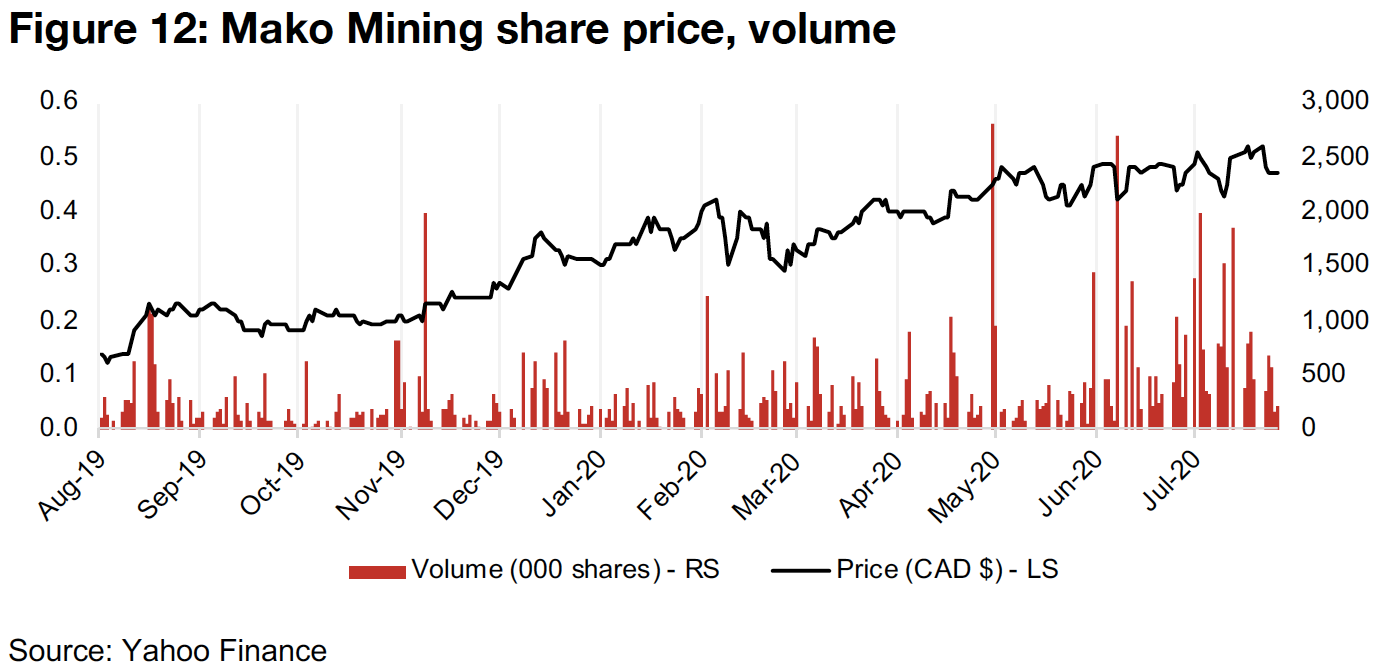

In contrast to many of the Canadian juniors, which have seen high double-digit

growth over the past three months, Mako has seen a decline of -2.2%. However,

Mako is up a huge 321.4% over the past year, and has been relatively less volatile

than many of the Canadian junior gold miners, with a generally consistent rise in the

share price (Figure 12).

In Focus: Gabriel Resources

Continued arbitration keeps Gabriel Resources out of the rally

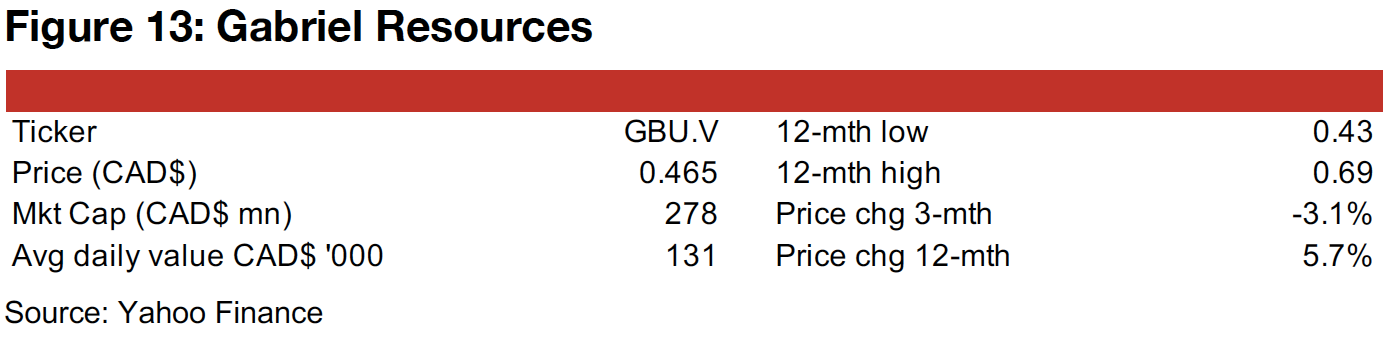

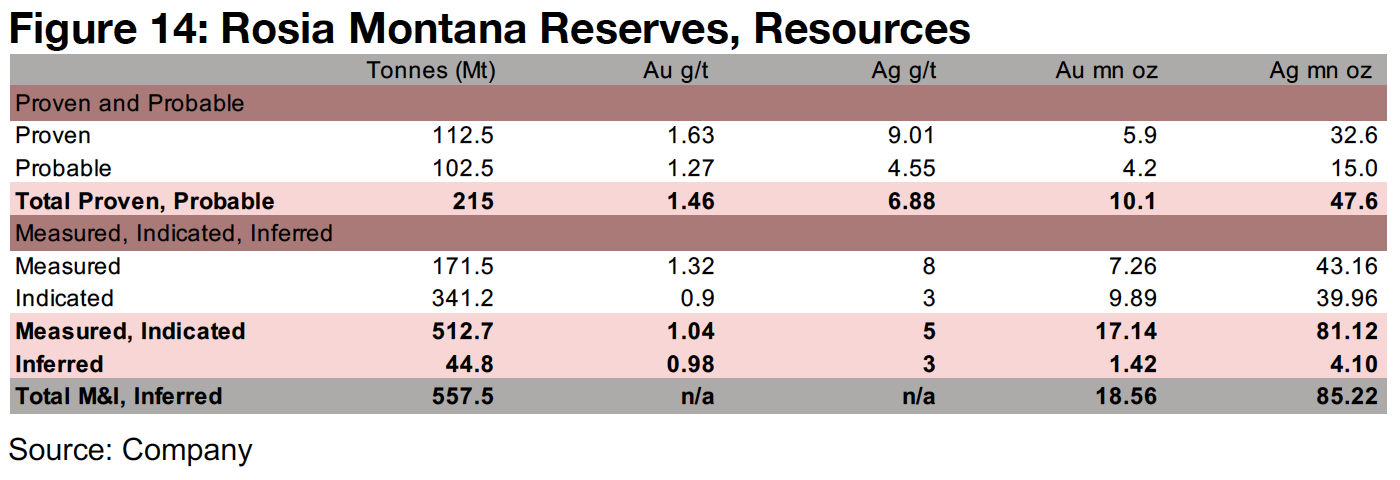

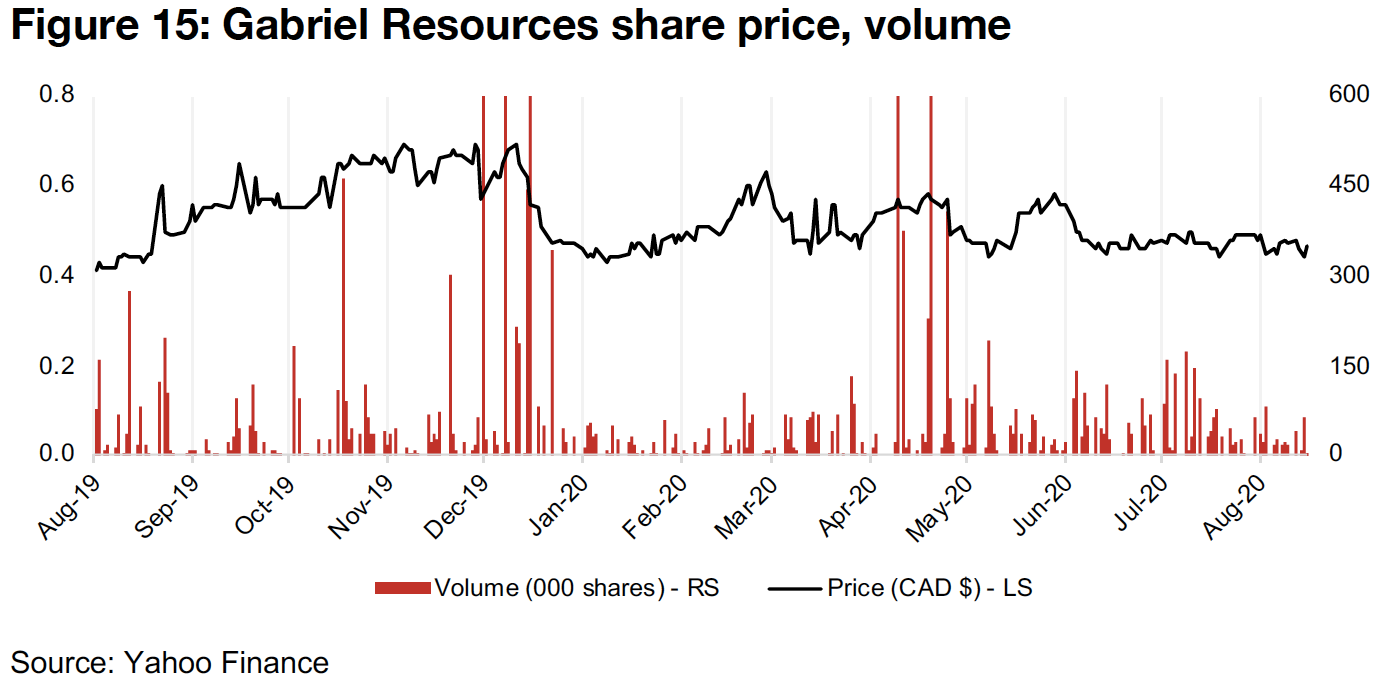

While Mako has been flat over the past three months, but seen strong gains over the past year, Gabriel Resources has been weak over both the past three months, declining -3.1%, and twelve months, rising just 5.7% (Figure 13). This is quite weak in the context of many major Canadian junior miners, which have gained 100% or more in the past year. This is because while Gabriel has a strong, advanced project, in Romania, Rosia Montana (Figure 14), it has remained stuck in a legal limbo in the country since 2016. While the company has a reasonably high market cap of $278mn, it has not seen strong moves either up or down over the past year (Figure 15), as it is not able to progress on the project, truncating the upside, and yet the market clearly attributes value to what could be a strong project if either the legal issues will be solved, or the company can sell off the concession, limiting the downside.

Ongoing arbitration involving Romania and the UN

Gabriel originally acquired the concession license for the Rosia Montana gold and

silver project in 1999, through its 80.69% held subsidiary, Rosia Montana Gold

Corporation (RMGC), of which the Romanian state-owned mining company, Minvest

Rosia Montana, holds 19.31%. Rosia Montana is considered to be one of the largest

undeveloped gold deposits in Europe, located in the Golden Quadrilateral in

Transylvania, which has been a prolific district, mined intermittently for 2,000 years.

This long history, in fact, is the crux of the issue that is holding back Gabriel

Resources’ potential development of the project. The issues began in February 2016

when the Romanian Ministry of Culture submitted an application to add the Rosia

Montana Mining Cultural Landscape to UNESCO’s Tentative List of World Heritage

Sites, followed by a full nomination in January 2017, without any consultation with

RMGC. The World Heritage Committee issued a draft decision for Rosia Montana to

be on the agenda for its June-July 2018 session.

RMGC subsequently entered arbitration over the issue, as declaring Rosia Montana

as a UNESCO World Heritage Site would not be compatible with developing the

company’s project in the area. In early July 2018, UNESCO granted a postponement

of the application to the Romanian Government given the ongoing international

arbitration taking place with Gabriel Resources’ subsidiary RMGC. Following

continued arbitration since this event, in January 31, 2020 the Ministry of Culture and

Romania’s Ambassador to UNESCO reported that they have resumed the procedure

to make Rosia Montana a UNESCO World Heritage site. The global health crisis

delayed the June-July 2020 World Heritage Committee, where a decision could have

been made, leaving the issue unresolved. The issue highlights how political and

conservation issues can hold up an otherwise very strong project, and that even in a

substantial gold bull market, not all gold companies will participate.

Disclaimer: This report is for informational use only and should not be used an alternative to the financial and legal advice of a qualified professional in business planning and investment. We do not represent that forecasts in this report will lead to a specific outcome or result, and are not liable in the event of any business action taken in whole or in part as a result of the contents of this report.