December 18, 2023

Fed Pivot?

Author - Ben McGregor

Gold rises on more dovish than expected Fed

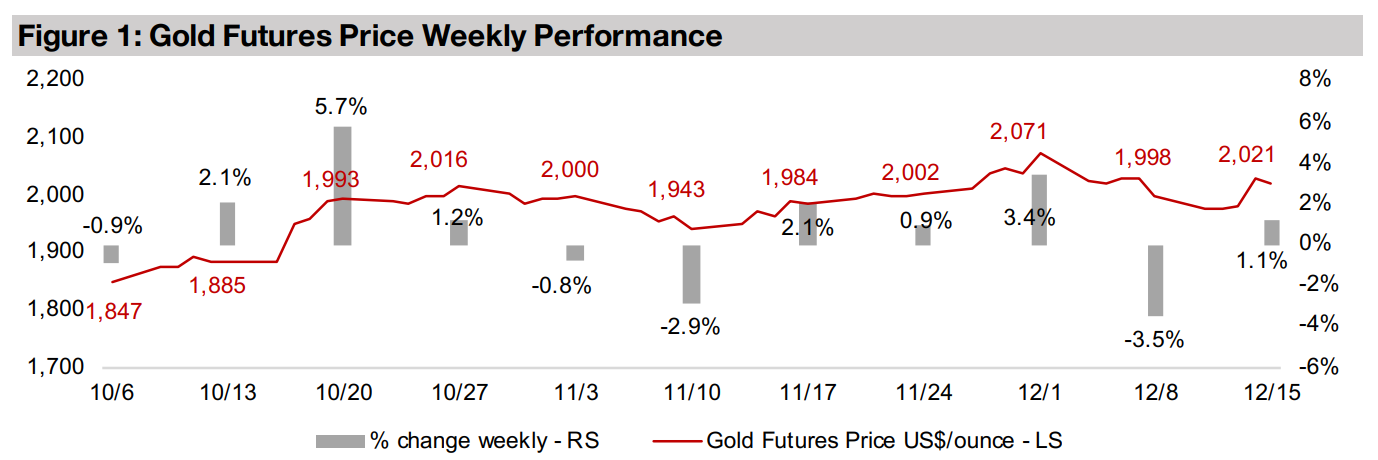

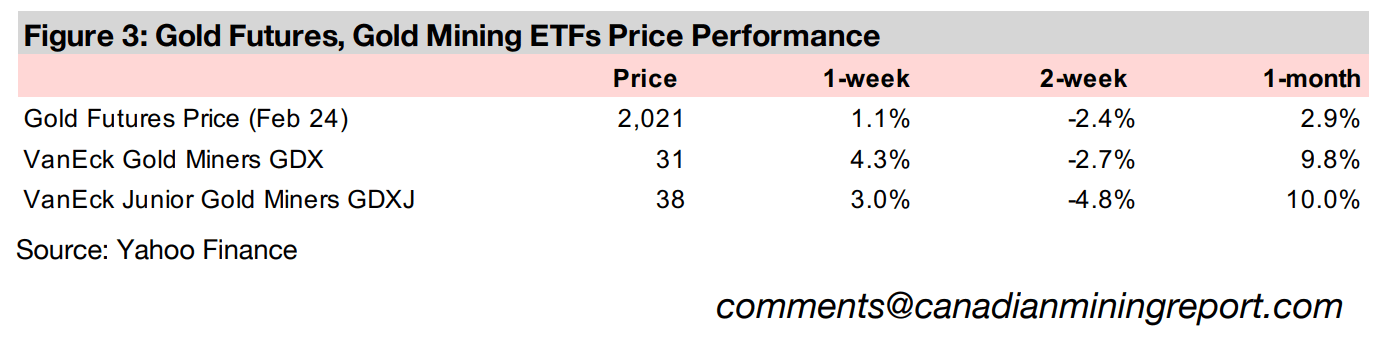

Gold rose 1.1% to US$2,021/oz as the Fed held rates steady and the central bank’s data and comments from Chairman Powell pointed to a more dovish monetary policy, indicating that not only had rate hikes peaked, but that cuts were likely into next year.

Fed Pivot?

The gold price rose 1.1% to US$2,021/oz on declining US CPI inflation and the

outcome from the US Federal Reserve meeting. The Fed held rates steady, while the

central bank’s data and comments by Chairman Powell, including indications of rate

cut talks, were taken by the market as a dovish pivot. However, Williams, another Fed

Board member, contradicted this later in the week, indicating that it was too early to

consider rate cuts and that they had not been discussed. While this paused a rally in

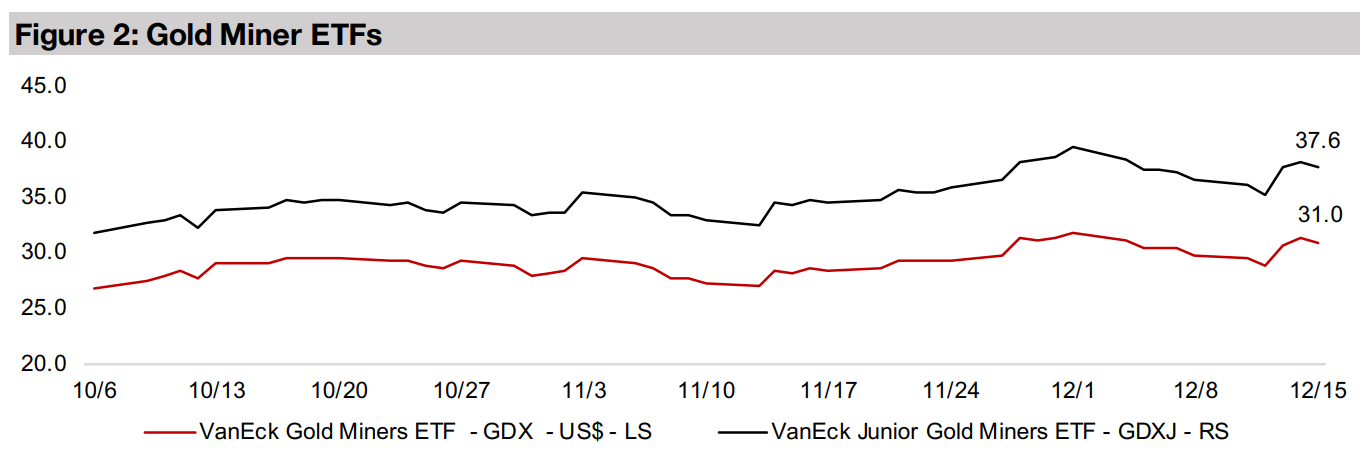

equities, the S&P, Nasdaq and Russell 2000 still ended the week up 2.7%, 3.3% and

5.6%, and gold stocks rose with the GDX and GDXJ gaining 4.3% and 3.0%.

The Fed’s move surprised the market, especially in light of the hawkish language for

most of this year, with a ‘dot plot’ that looked particularly dovish. The plot summarizes

the Fed board members rate expectations, and pointed to a 0.75% decline in the

base rate to a 4.50%-4.75% range by 2024, down from 5.25%-5.50% currently.

While the Fed remains data dependent and the market’s expectations for dovishness

have been repeatedly dashed for two years, the bank may finally be easing up. The

Fed has a mandate to both control prices and maintain strong employment, and with

inflation declining and employment to potentially come down on an expected

recession, it may have some leeway for a looser monetary policy into next year.

US inflation still declining, but at a slower rate

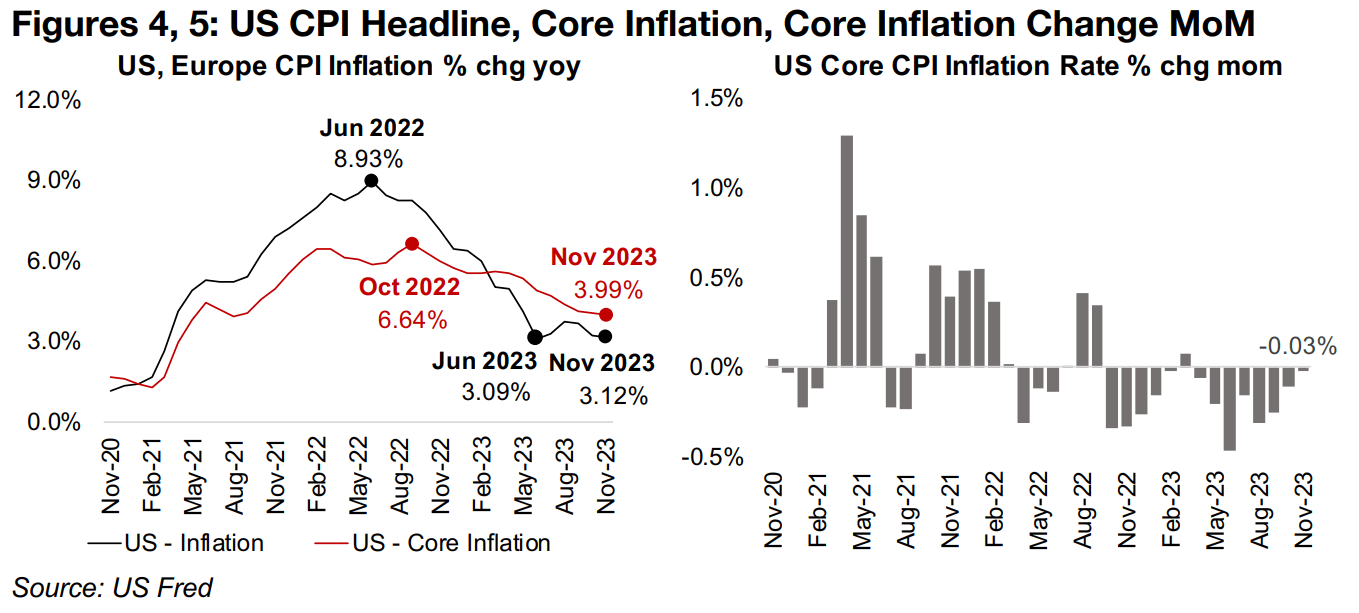

The most recent inflation data show the US CPI Index continuing to fall year on year,

supporting a more dovish Fed, although a slowdown in the rate of decline is a concern.

While there had been a precipitous 5.84% drop in headline inflation from a June 2022

peak of 8.93% to a trough of 3.09% in June 2023, it had picked back to as high as

3.71% in August 2023. Inflation has declined again since, to 3.12% in November 2023,

although this is still slightly above the mid-2023 trough.

However, the Fed tends to focus more on core inflation, which at 3.99% in November

2023, remains stubbornly above its 2.0% target. This is down 2.65% from a 6.64%

peak in October 2022, a much more gradual decline than for headline inflation. The

pace of the decline in core inflation has also slowed in recent months and was down

a minimal -0.03% in November 2023 (Figure 5). The market seems to be assuming

no resurgence in inflation that could hold the Fed held back on a potential rate cutting

path next year, thus leaving some room for a downside surprise from this measure.

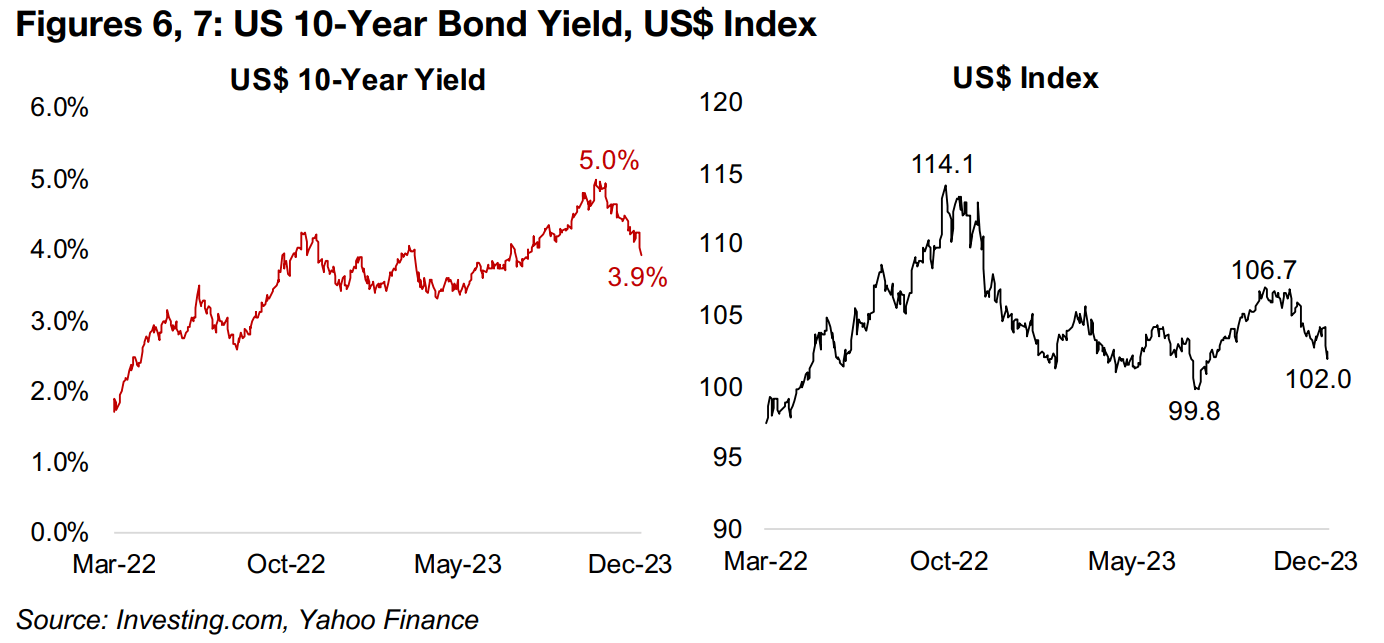

US nominal yields and dollar slide, real yield down from peak

The expectations for monetary easing from the Fed has driven a considerable decline in US nominal bond yields, with the US 10-year dropping over a percent to 3.9% from highs of 5.0% in October 2023 (Figure 6). These lower yields have been a factor in driving down the US$, as the rate differential between the US and other countries contracts, driving outflows from the dollar (Figure 7). A weaker dollar tends to be supportive of the gold price, with the two generally moving inversely.

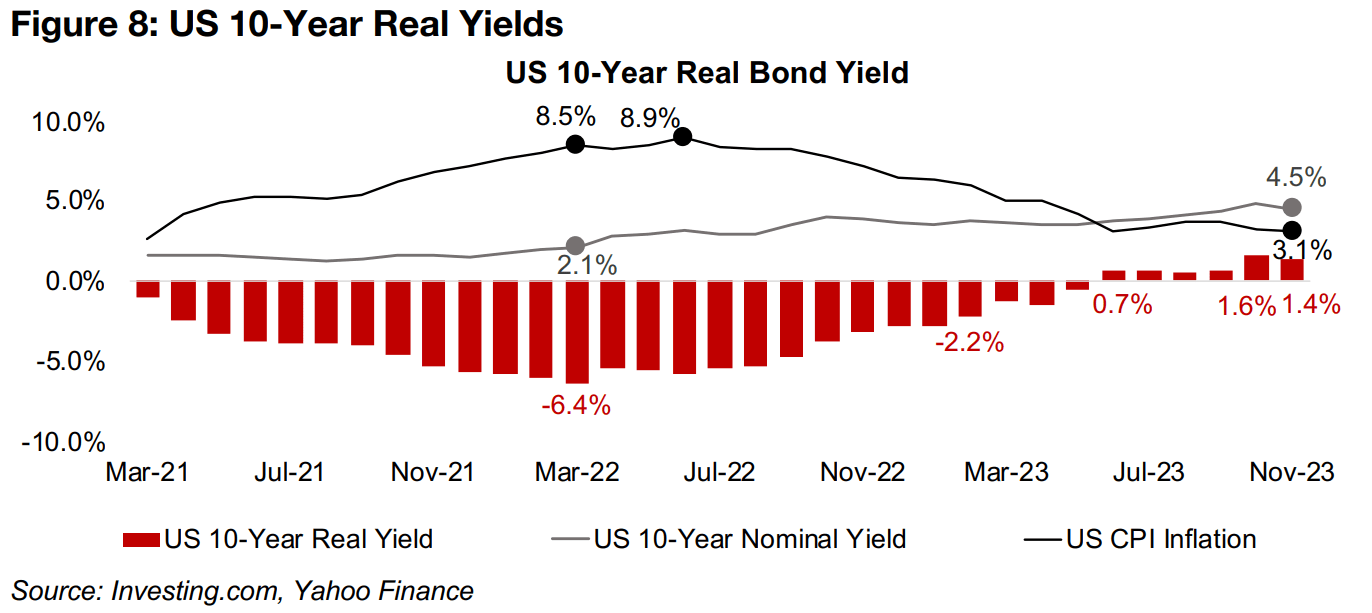

The falling nominal yields could support gold, as they can push down real yields, which also tend to move inversely to the metal, as the opportunity cost of holding gold rather than bonds declines. This occurred through 2021 and into early 2022, as nominal yields were low while inflation soared, sending real yields to a low of 6.4% in March 2022 and significantly driving up the gold price (Figure 8). Real yields became progressively less negative from mid-2022, turned positive in June 2023, and reached a peak of 1.6% in October 2023. However, real yields pulled back to 1.4% in November 2023, and may have declined further in December 2024 on the drop in nominal yields, assuming no rebound in inflation. This could have added to gold’s run in recent months, showing that while geopolitical issues where probably the greatest catalyst, fundamental economic factors have also likely been at work.

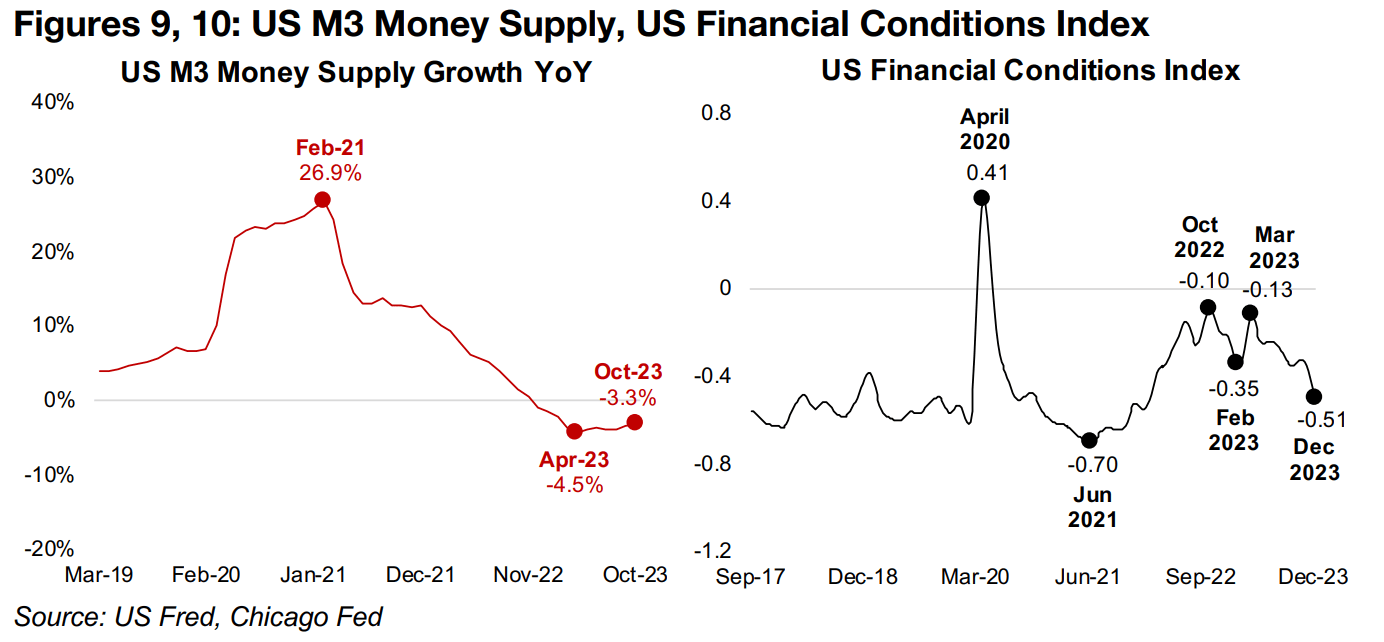

US money supply contraction less severe, financial conditions ease

Another broader macro driver is the money supply, with gold tending to rise as it increases and vice versa. This had been moving against gold from the February 2021 peak in US M3 growth of 26.9% to a low of -4.5% in April 2023 (Figure 9). Both these figures were extremes, with M3 growth usually ranging from 3.0% to 10% since 1960. While the M3 decline remains towards the bottom of this range, it has improved slightly to -3.3% as of October 2023. The National Financial Conditions index, with readings below zero indicating looser, and above zero, tighter, conditions, has tended to reflect the money supply growth. Conditions tightened from 2021-2022, with the index rising from -0.70 in June 2021 to -0.10 in October 2022, but have eased in recent months on a less severe contraction in the M3 (Figure 10). If the Fed delivers on its pivot, both these drivers could continue to move in gold’s favour into next year.

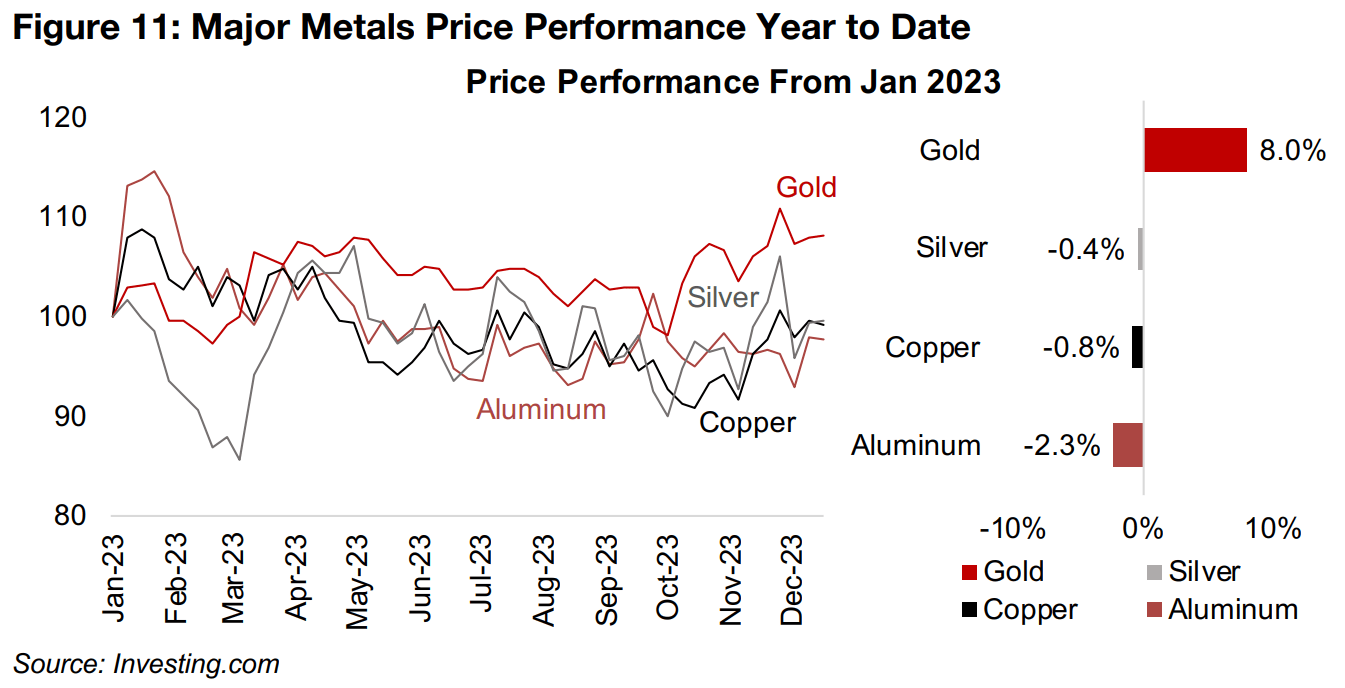

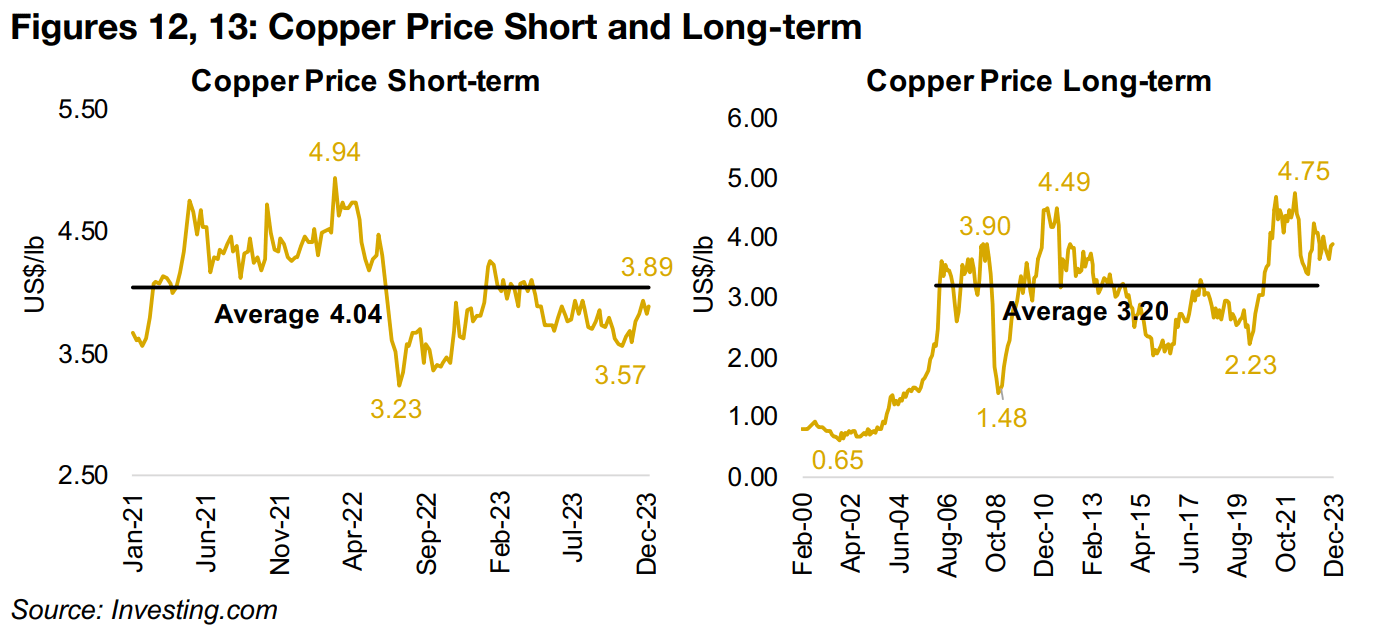

Copper forecasts to be affected by major mine shutdown

Along with the geopolitical risk premium, all these economic drivers have seen gold put in the stand-out performance this year of major metals, up 8.0%. The base metals that are more driven by the industrial cycle, in contrast, have struggled to stay even flat this year, as concerns over a global recession in 2024 continue, with silver down -0.4%, copper, -0.8% and aluminum, -2.3% (Figure 11). This is even after the copper price has picked up over the past two months to US$3.89/lb from US$3.57/lb in October 2023, reverting towards its US$4.04/lb average since 2021 (Figure 12). While the price remains about a US$1.00/lb off its US$4.75/lb highs set in March 2022, it is still considerably above its average of US$3.20/lb since 2006 (Figure 13).

Outlook for copper clouded by Panama mine shutdown

The outlook for copper heading into 2024 has become clouded by the shutdown of

a major mine in Panama, First Quantum’s Cobre, with an output substantial enough

to significantly affect the forecast supply demand balance for the metal, and therefore

its price. The mine was ordered to be shut down after a Panama court ruled in

November 2023 that the law under which the mine operated was unconstitutional,

with a decision made originally in 2017, subsequently challenged, and upheld in 2021.

This drove new negotiations by First Quantum and Panama and a new law announced

on October 20, 2023 gave the company a new twenty year contract, extendable by

an additional twenty years. However, there have been protests by Panama’s major

labour union, claiming that the contract heavily favored First Quantum and that the

mine had high environmental risk. These have been seen as related to the country’s

2024 presidential election with politicians pushing for more state control of mines.

These protests eventually culminated in both the passing of a law which bans new

mining concessions in the country and the shutdown of the Cobre mine. There will

now be a ninety-day period of talks between First Quantum and the government, and

depending on the resolution, the issue could shift to international arbitration, which

can drag on for years. This could potentially see the mine out of operation through at

least 2024, and potentially much longer, even if First Quantum gets a new contract

or the mine is eventually nationalized by the government in Panama.

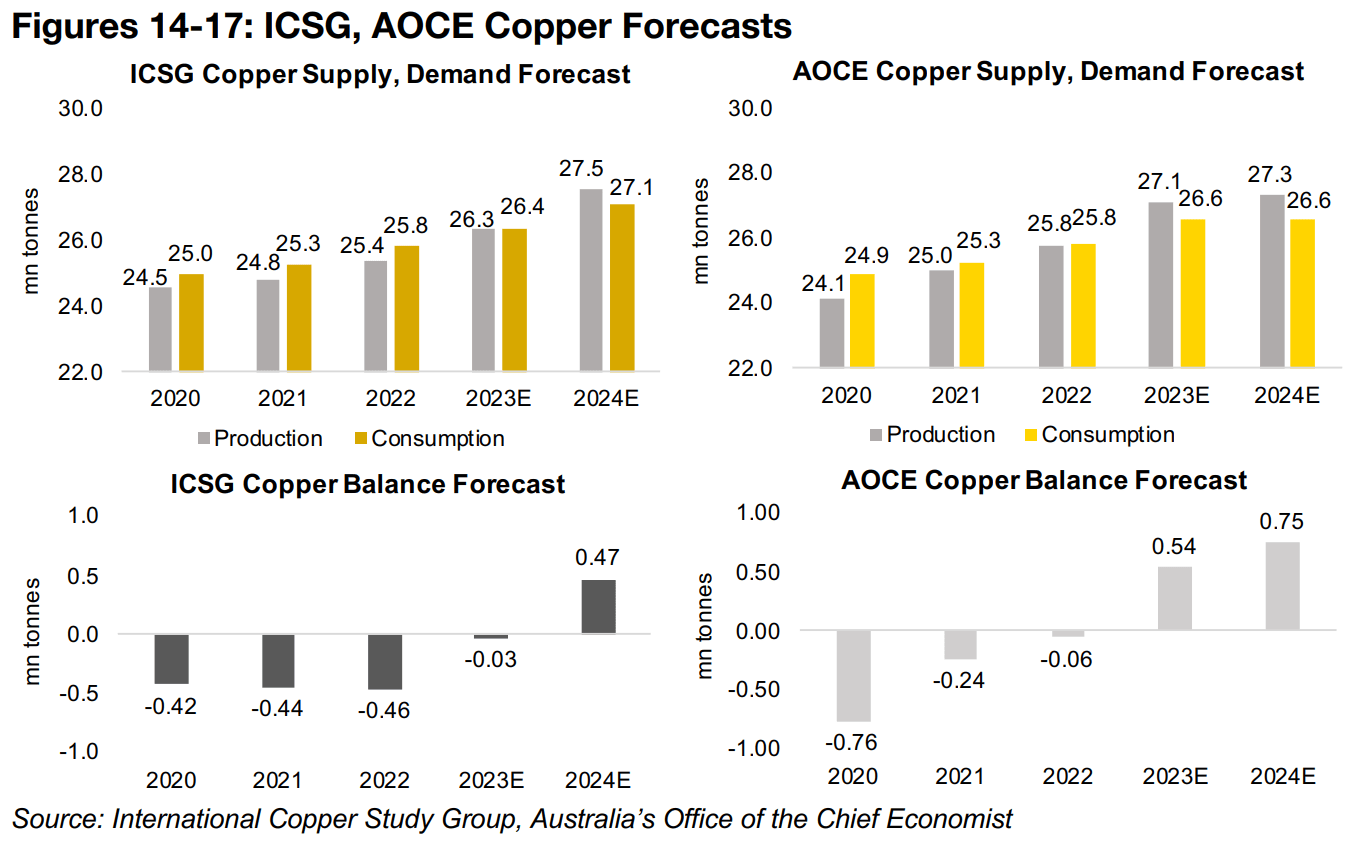

Panama shutdown could slash 2024 forecast copper surplus

The shutdown in Panama is likely to drive forecast revisions from the two major

sources of estimates for copper supply and demand, the International Copper Study

Group (ICSG) and Australia’s Office of the Chief Economist (AOCE). While the

forecasts for the supply and demand from both are similar for 2023 and 2024, at

around 26.0 to 27.0 mn tonnes, small differences in these large magnitudes can lead

to significant disparities between the market balances across these sources (Figures

14-17). As this can mean the difference between a market surplus or deficit, it can

have a significant effect at the margin on the expected copper price.

For 2022, for example, the ICSG estimate a 460k deficit and the AOCE only a 60k

deficit, and for 2023 ICSG expects a 30k tonne deficit and the AOCE a 540k tonne

surplus. For 2024, they are both are expecting a surplus, of 470k for ICSG and 750k

for AOCE. This is where we can see the large effect of the Panama mine shutdown,

which was reported after these forecasts were released. Assuming that Cobre in 2024

would have had a similar output to the 350k tonnes produced in 2022, it would reduce

the ICSG surplus by 75% and the AOCE surplus by 47% next year.

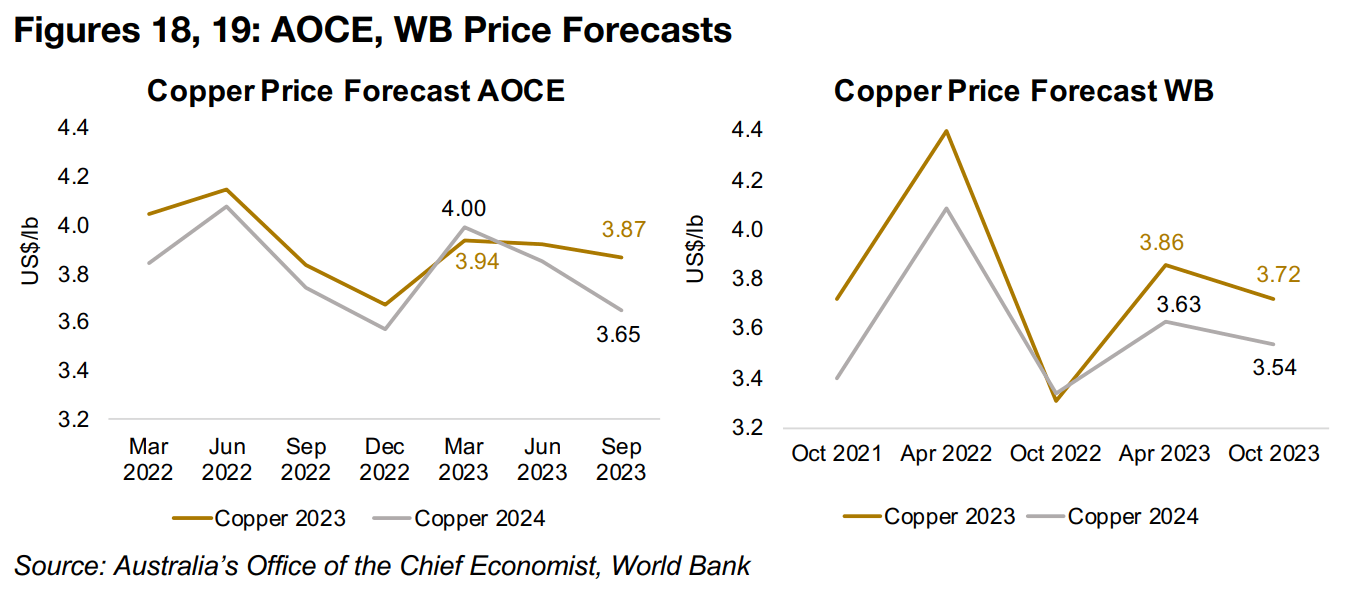

There are regularly released copper price forecasts by the AOCE and the World Bank,

with both currently expecting a considerable decline in 2024, and estimates from both

have come down over the past six months (Figures 18, 19). The AOCE is moderately

more bullish, with a US$3.87/lb forecast for 2023, near the current price, with a 5.7%

drop to US$3.65/lb in 2023, and the World Bank forecasts US$3.72/lb for 2023 and

a 4.8% drop to US$3.54/lb for 2024. It is possible that supply estimates will be cut in

the next round of forecasts, which could drive up copper price estimates. However,

demand forecasts may also be reduced as global recession concerns rise, which

could lead to relatively flat copper price estimates.

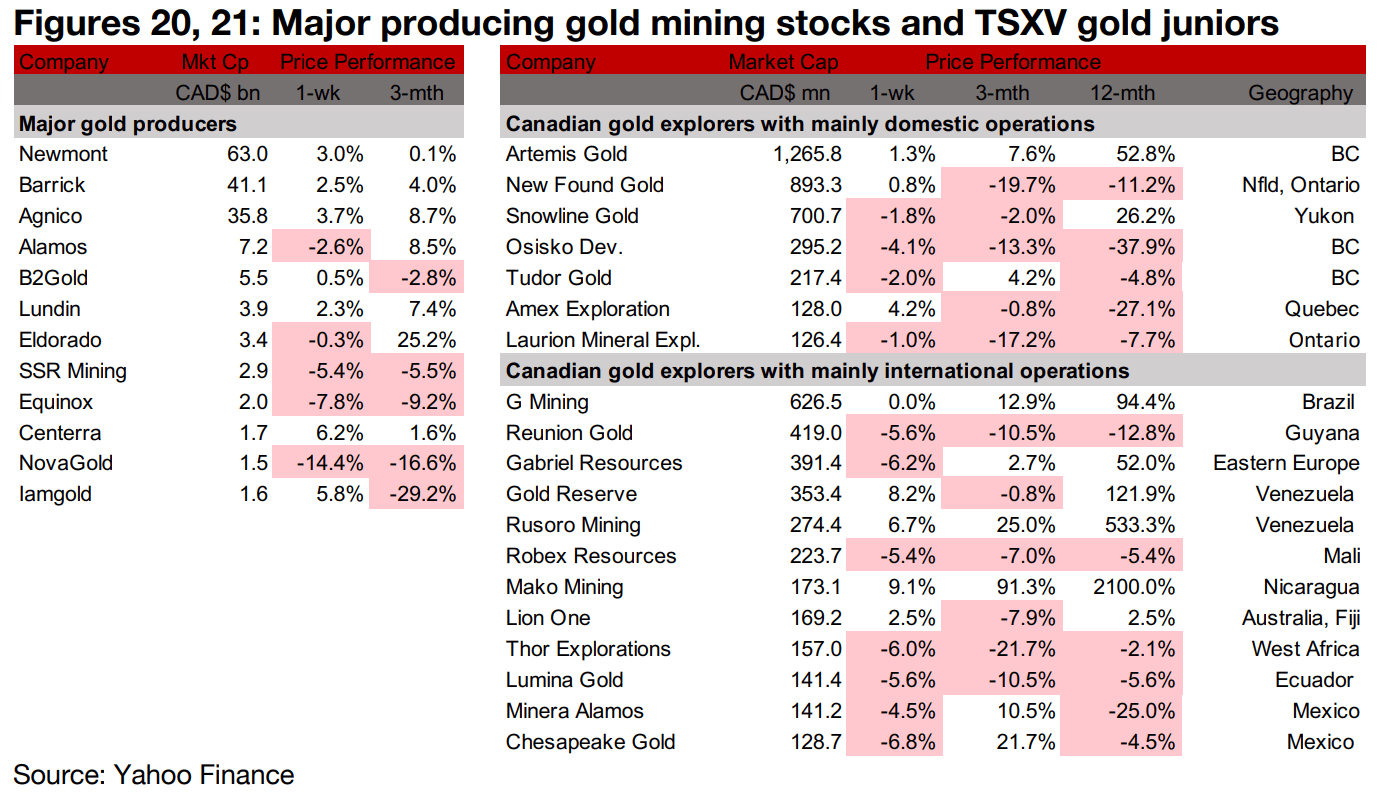

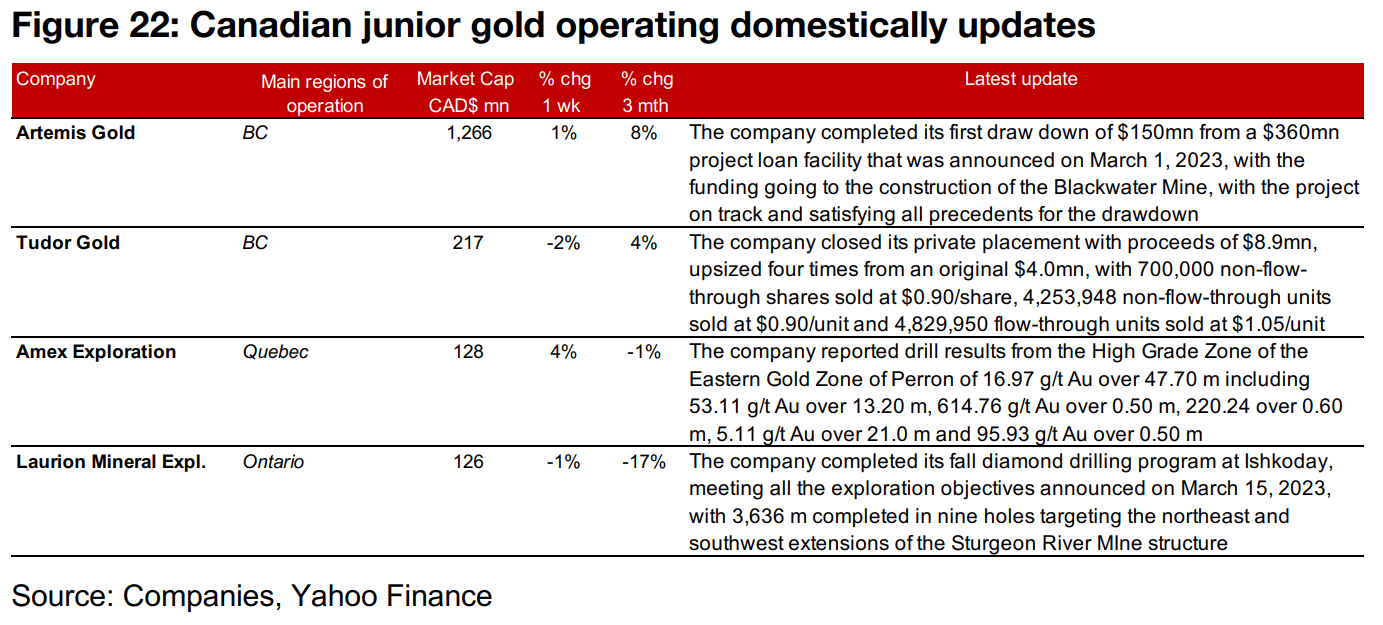

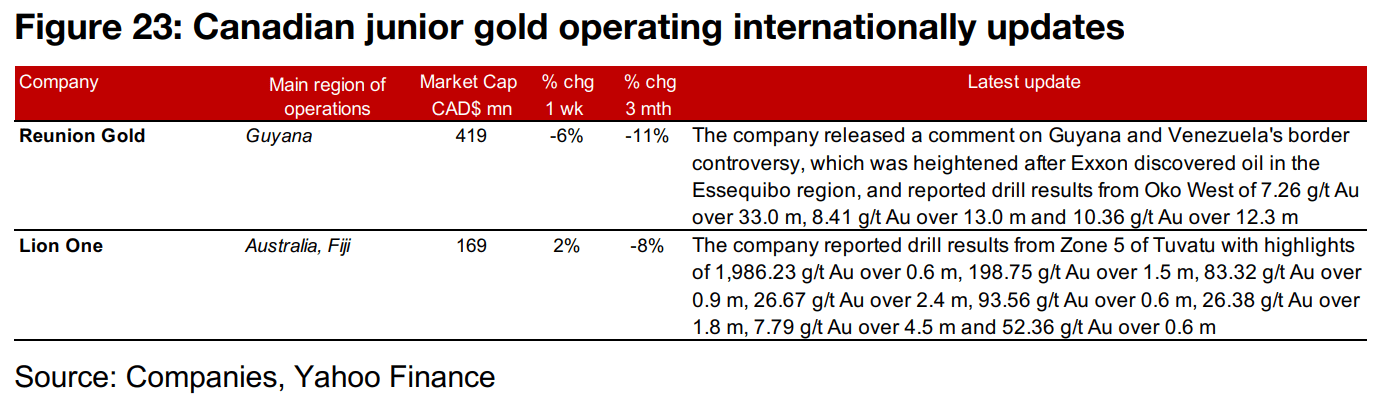

Gold producers and larger TSXV gold mixed

The major gold producers were mixed although the three largest gained, while TSXV larger gold was mixed (Figures 20, 21). For the TSXV gold companies operating domestically, Artemis Gold completed the first $150mn drawdown of its $360mn project loan facility for Blackwater, Tudor closed its four-times upsized $8.9 mn private placement, Amex Exploration reported drill results from the High Grade Zone of Perron and Laurion completed its fall diamond drilling program at Ishkoday (Figure 22). For the TSXV gold companies operating internationally, Reunion Gold commented on the Guyana and Venezuela border dispute and released drill results from Oko West and Lion One reported drill results from Zone 5 of Tuvatu (Figure 23).

Disclaimer: This report is for informational use only and should not be used an alternative to the financial and legal advice of a qualified professional in business planning and investment. We do not represent that forecasts in this report will lead to a specific outcome or result, and are not liable in the event of any business action taken in whole or in part as a result of the contents of this report.