May 02, 2022

Fed Hawks and Big Gold's Q1/22 Results

Author - Ben McGregor

Hawkish comments from the Fed drive down gold and stocks

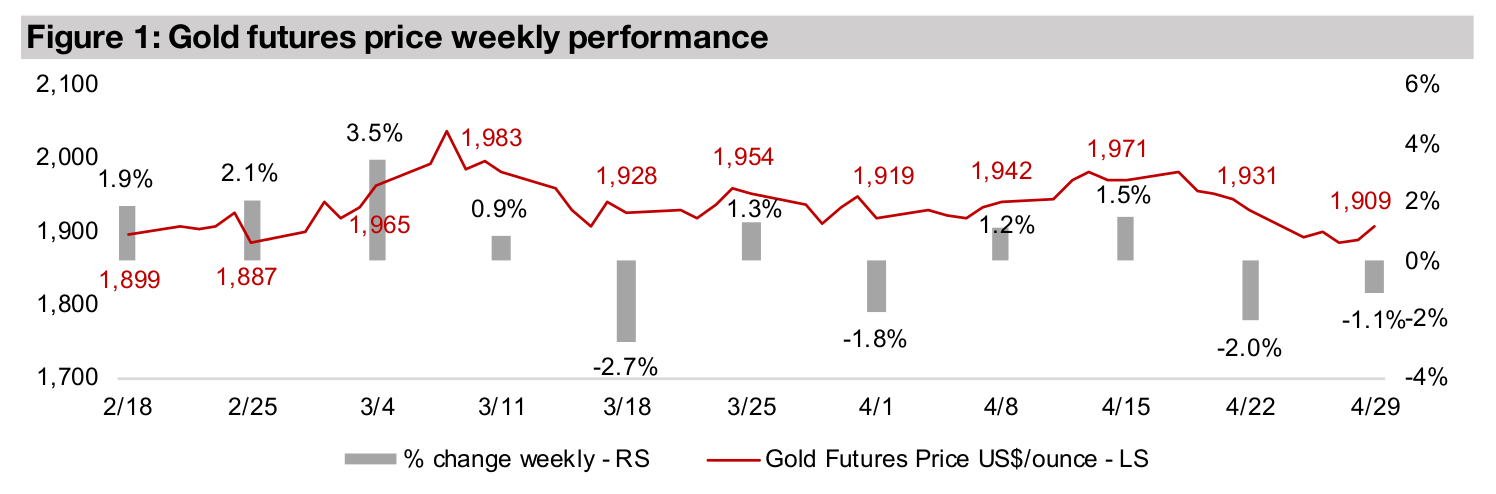

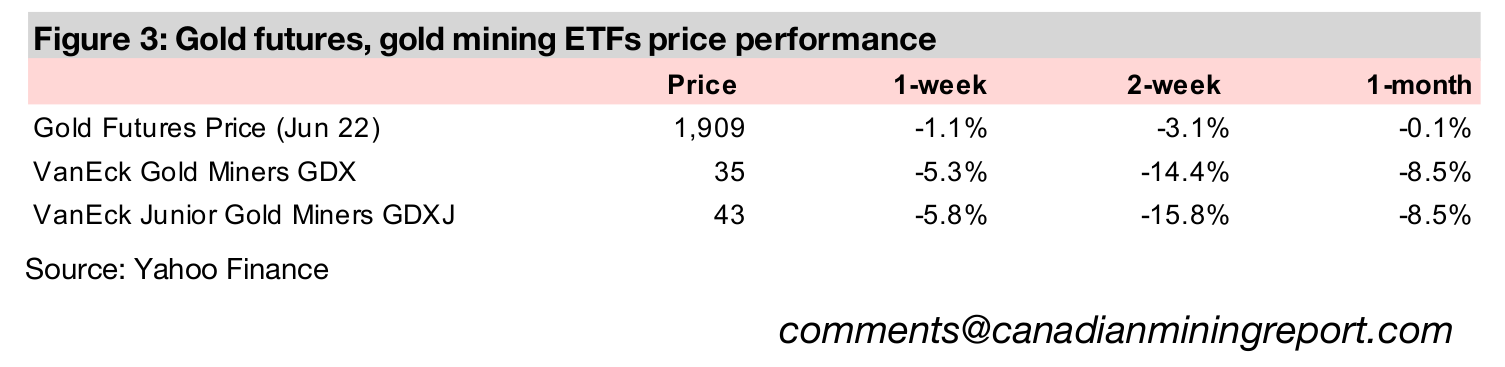

Gold dropped -1.1% to US$1,909/oz this week and equity markets saw a continued decline as Fed board members continued with hawkish comments indicating potential 50 basis point rate hikes instead of the 25 basis points previously expected.

Q1/22 results season for Big Gold continues

Q1/22 results for Big Gold continued, with Agnico-Eagle, Yamana, Eldorado and Alamos reporting, with strong production growth from Agnico following its merger with Kirkland and Eldorado's and Alamos's net incomes down on exceptional items.

Fed Hawks and Big Gold's Q1/22 Results

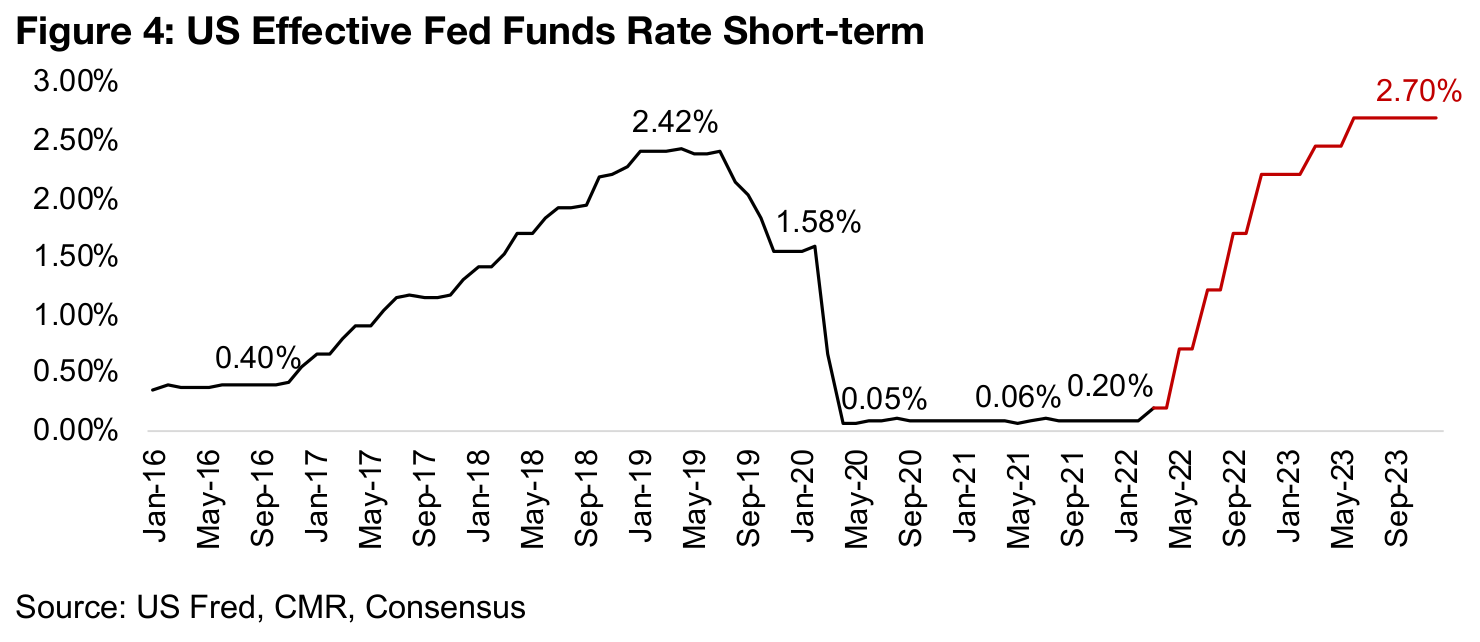

Gold was down -1.1% to US$1,909/oz and equity markets took a major hit for the second consecutive weak as another round of hawkish comments from US Fed Board members lead to concerns of rapid rate hikes. Fed Chairman Powell indicated that the next rate hike could be up to 50 bps in order to curb still surging inflation, where previously 25 bps had been generally expected. The market consensus is now for a Fed Funds rate of 2.75% by 2023, and in Figure 4 we outline a path that could get there. This would include four 50 bps interest rate hikes at the May, July, September and November 2022 Federal Open Market Committee (FOMC) meetings, and no hikes at the June and December 2022 FOMC meetings, and then two 25 bps rate hikes in March and June of 2023. However, we still believe that there will be some extreme economic and stock market fallout if they really go ahead with even a couple with these hikes, and that at some point they could be forced to back off if this policy induces a recession or a stock market crash.

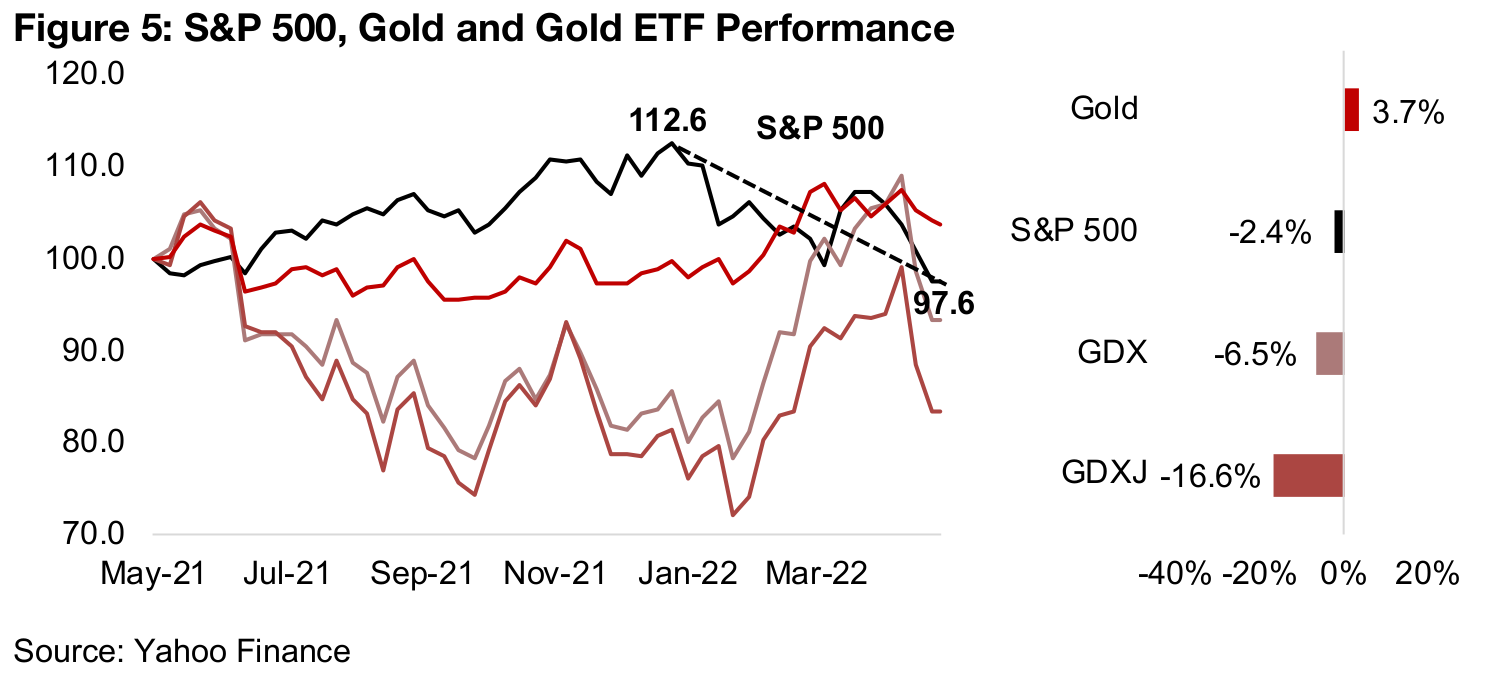

The economic rebound since the global health crisis has been heavily reliant on very low rates and high liquidity, and we are already seeing the effects on the stock market of rates just being raised by 25 bps in March 2022. While this is very small in absolute terms, in percentage terms this has driven up the Effective Fed Funds Rate over 100%, from 0.08% previous to 0.20%, and another 50% bps hike would mean that the base interest would have risen over 800% in the space of just a few months, and getting to 2.70% would mean that the Effective Fed Funds Rates will have surged by 32 times. With businesses, new home buyers, existing mortgage holders and stock investors all basing their current economic decisions on near zero rates, it seems unlikely that such a huge percentage change in interest rates would not have severe economic fallout. The S&P 500 has already declined from 15.0% off its highs on fear of rates hikes and we would expect to see more severe downside if the Fed charges ahead with the plan is currently indicating (Figure 5).

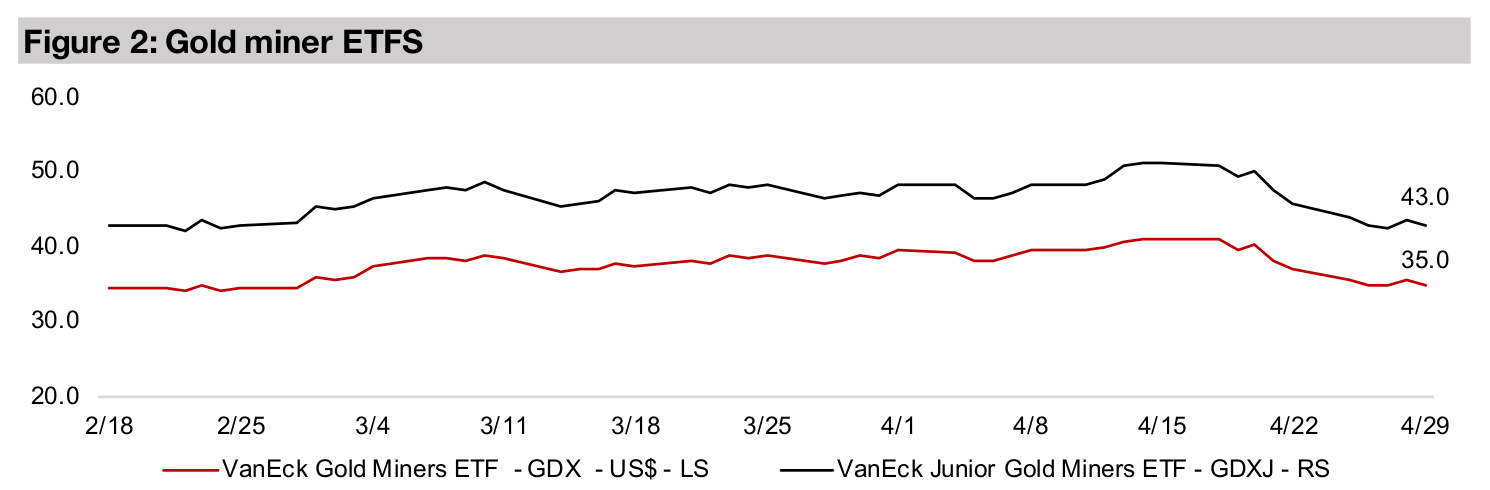

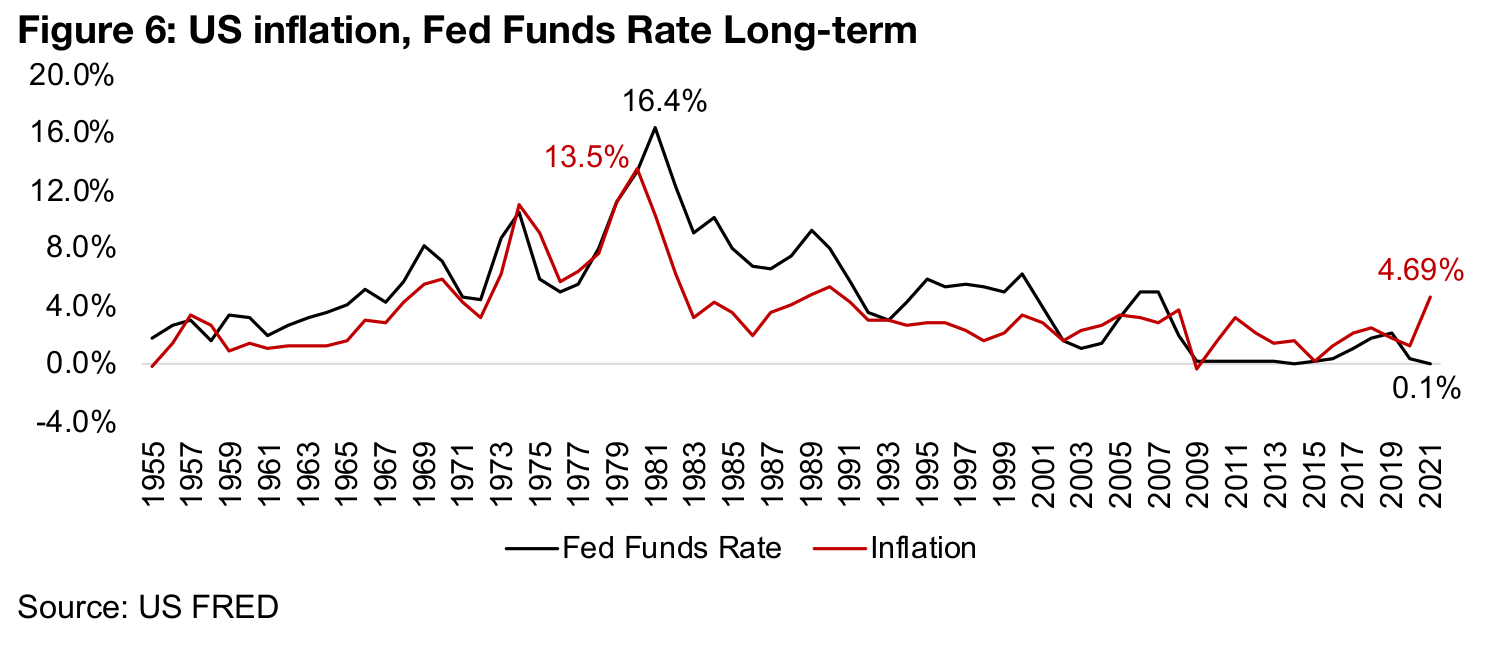

While gold has risen 3.7% over the past year, holding up well compared the S&P 500, gold stocks have been hit, especially the smaller companies, part of a broader risk- off move, with GDX ETF of gold producers down -6.5% and the GDXJ ETF of gold juniors down -16.6%. While we believe that gold could continue to hold up, if the Fed really comes through with a series of 50 bps rate hikes this year, it could see some pressure, although it will depend the level of inflation. If inflation continues to surge, it could actually outpace even the series of 50 bps rate hikes, and real yields could continue to become more heavily negative, supporting gold. However, we expect that gold stocks, and especially the juniors, could take a major hit if the Fed really comes through on its aggressive talk. To see just how far the Fed might really have to go to curb very high inflation, we have to go back to the early 1980s, when it took rate hikes peaking at 16.4% to bring down inflation peaking at 13.5%, suggesting that even a hike to 2.70% may still not be enough to curb inflation already over 8.0% (Figure 6).

Newmont sees pickup in Q1/22 income after Q4/20 exceptionals

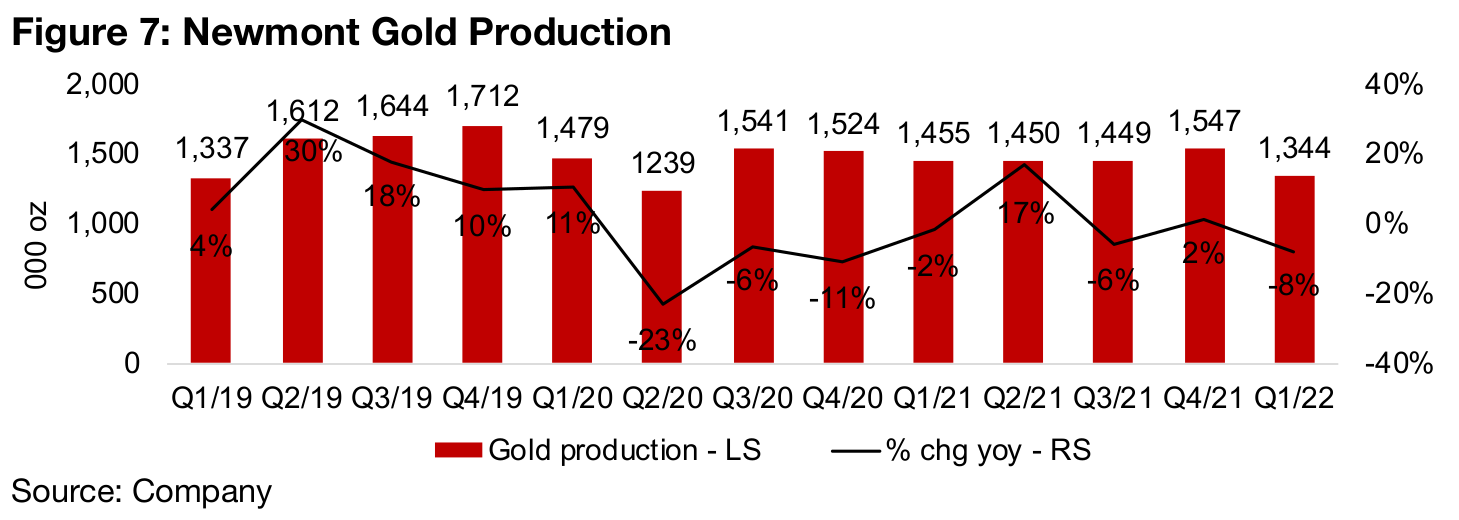

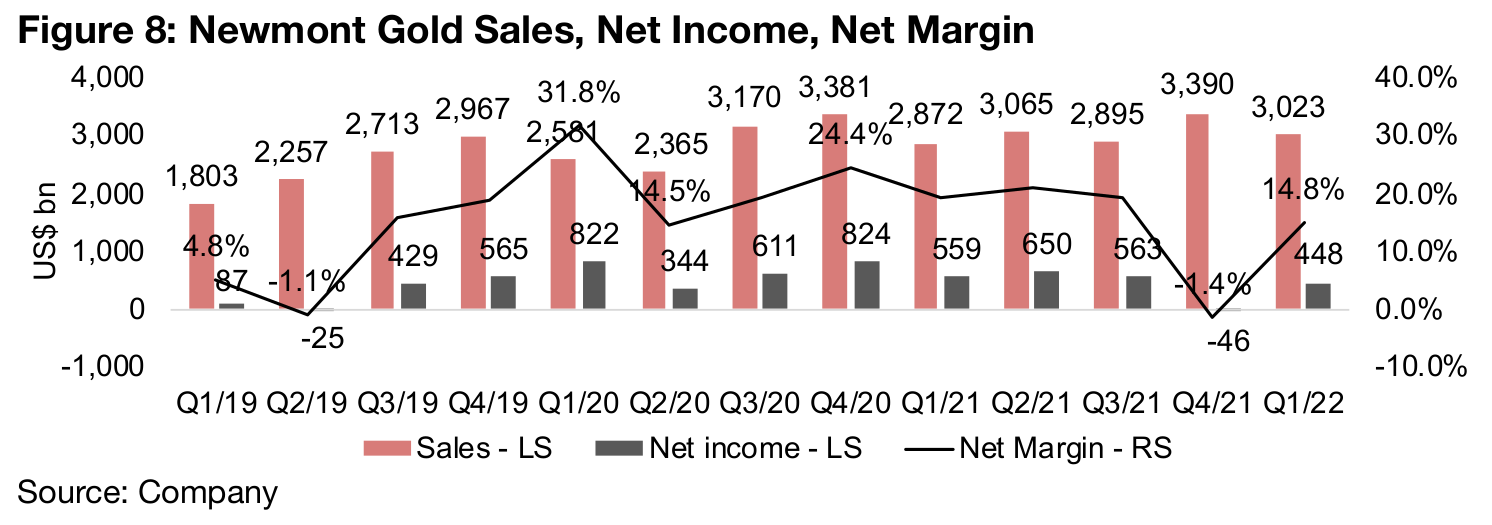

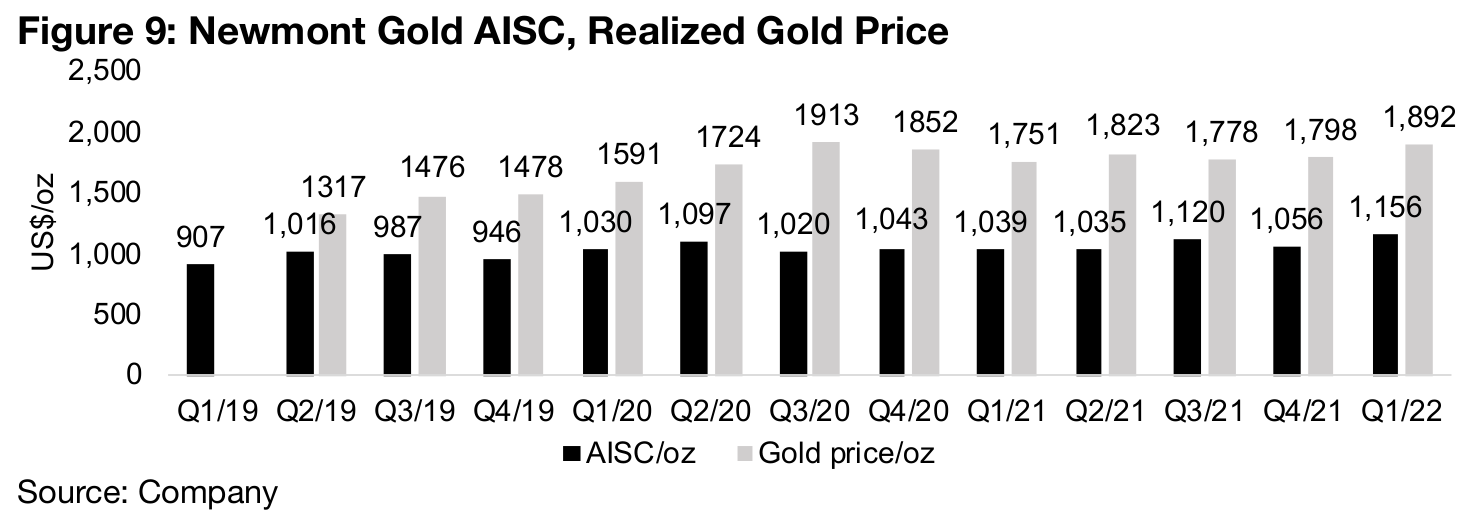

The Q1/22 results season continued this week, with several mid-tier companies reporting, including Agnico-Eagle, Yamana, Eldorado and Alamos. In Figures 7-9 we show the details for the Q1/22 of Newmont, the largest global gold companies, which were reported last week. While production contracted -8.8% yoy to 1.34mn oz, sales rose 5.2% on a higher realize gold price and its all-in-sustaining-cost (AISC) rose yoy and qoq to $1,079/oz. Net income rebounded to $448mn from just $-46mn in Q4/21, with the previous quarter's losses driven by remediation and reclamation items, which were not recurring in Q1/22.

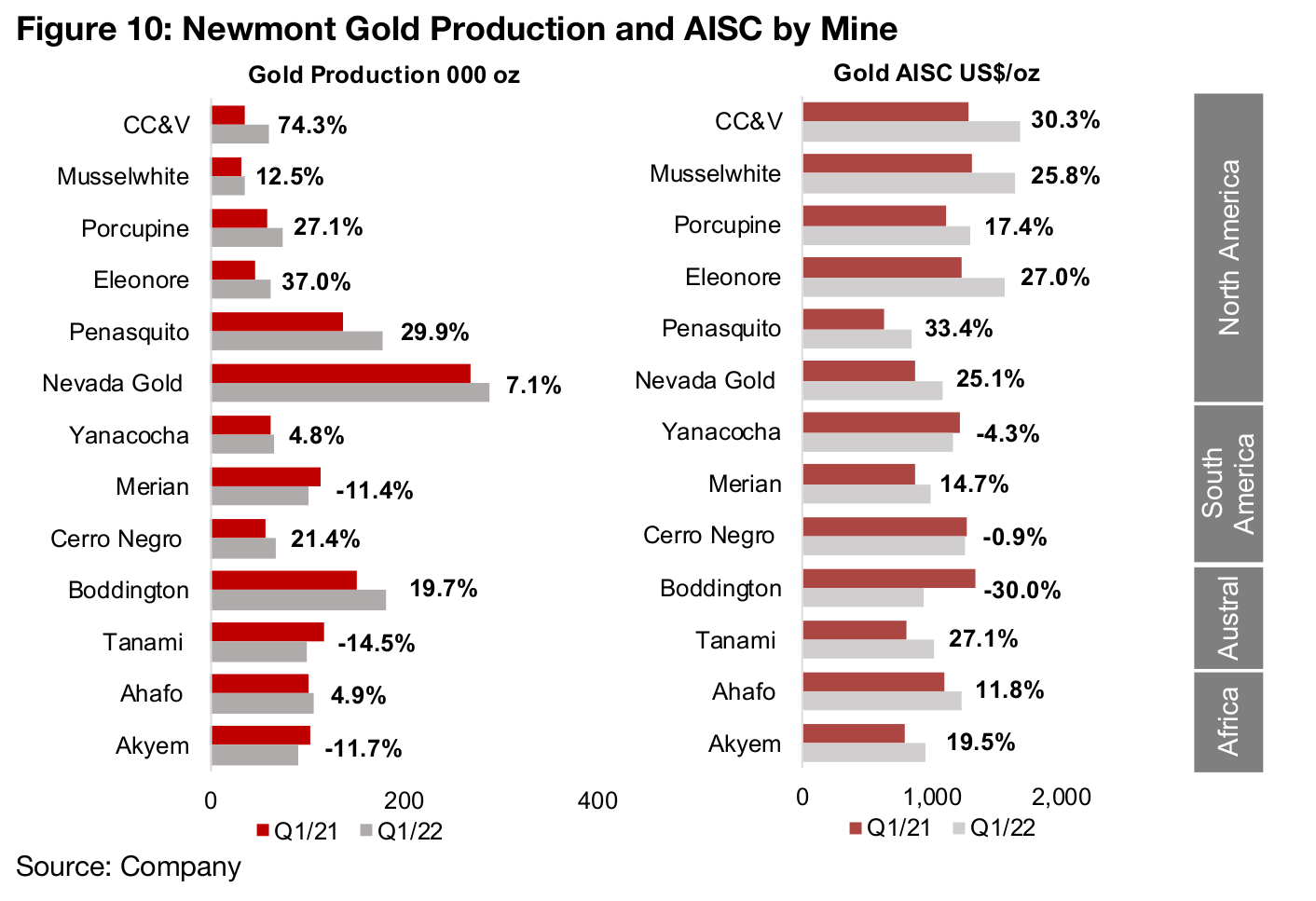

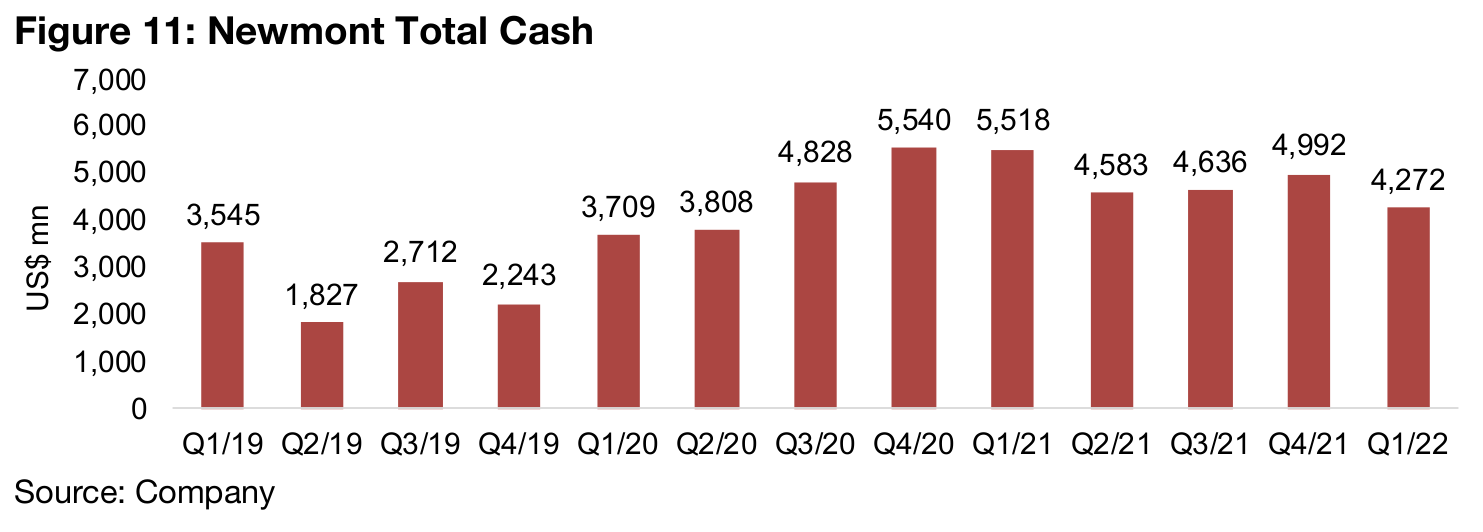

Production from Newmont's largest contributing segment, its Nevada Gold mines joint-venture with Barrick, rose 7.1%, and there was strong growth from its next two largest contributors, Penasquito, up 29.9%, and Boddington, up 19.7%. The company has seen a considerable rise in all-in sustaining costs across most of its mines, with seven of thirteen seeing 20% or more increases yoy, with only three mines seeing declines. The company continues to maintain a high cash balance of US$4.27bn, about 70% above the average level in 2019, although it was down yoy and qoq and is off its Q4/22 peak of US$5.54bn.

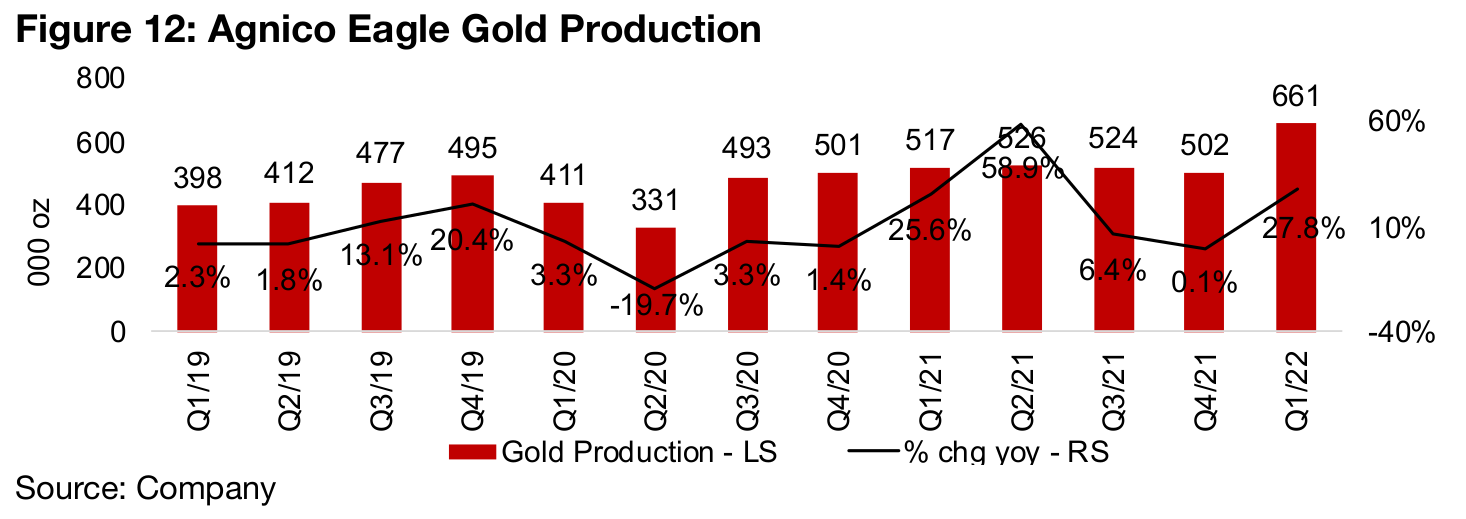

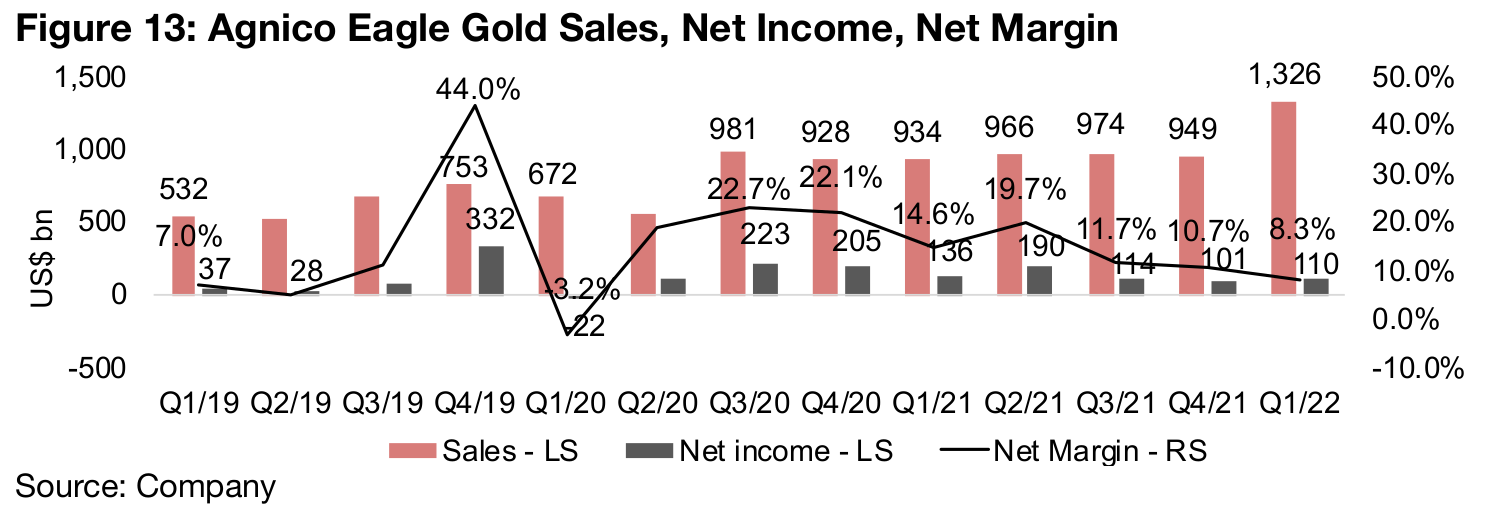

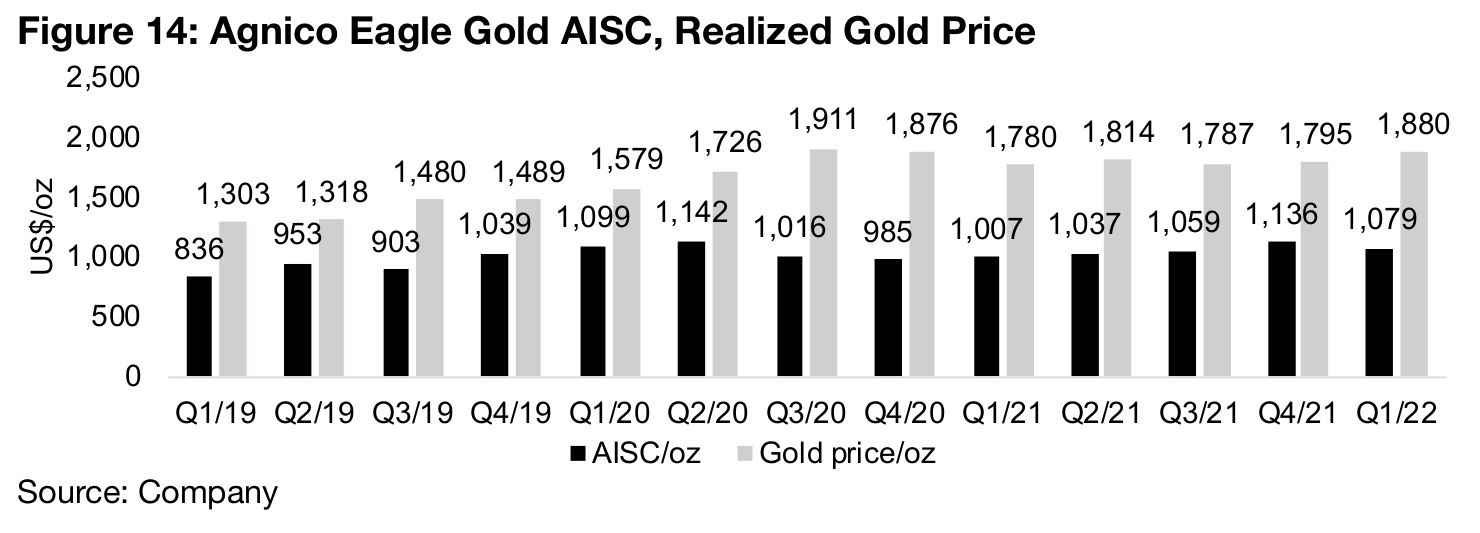

Agnico Eagle's Q1/22 up on merger with Kirkland Lake

Agnico Eagle's results were driven by its merger with Kirkland Lake which was completed in February 2022, with production rising 27.8% and revenue up 41.9% on the output contributed by Kirkland. Net income actually declined -19.4% yoy on the exceptional item of recognized costs from the merger. The company saw a major increase yoy in the realized gold price to US$1,880/oz and its AISC costs rose marginally yoy and qoq. The full effects of the merger with Kirkland Lake will be seen in Q2/22, which will be the first full quarter following the combination and will also not include the major one-time costs resulting from the transaction.

Yamana sees slight rise in revenue and net income

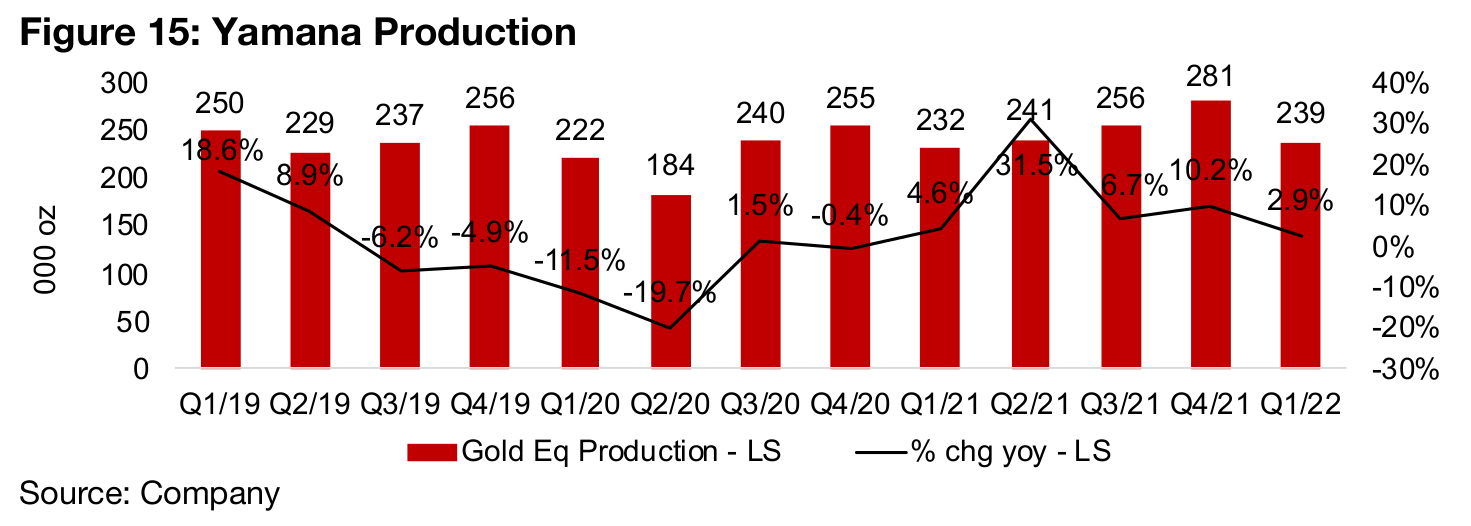

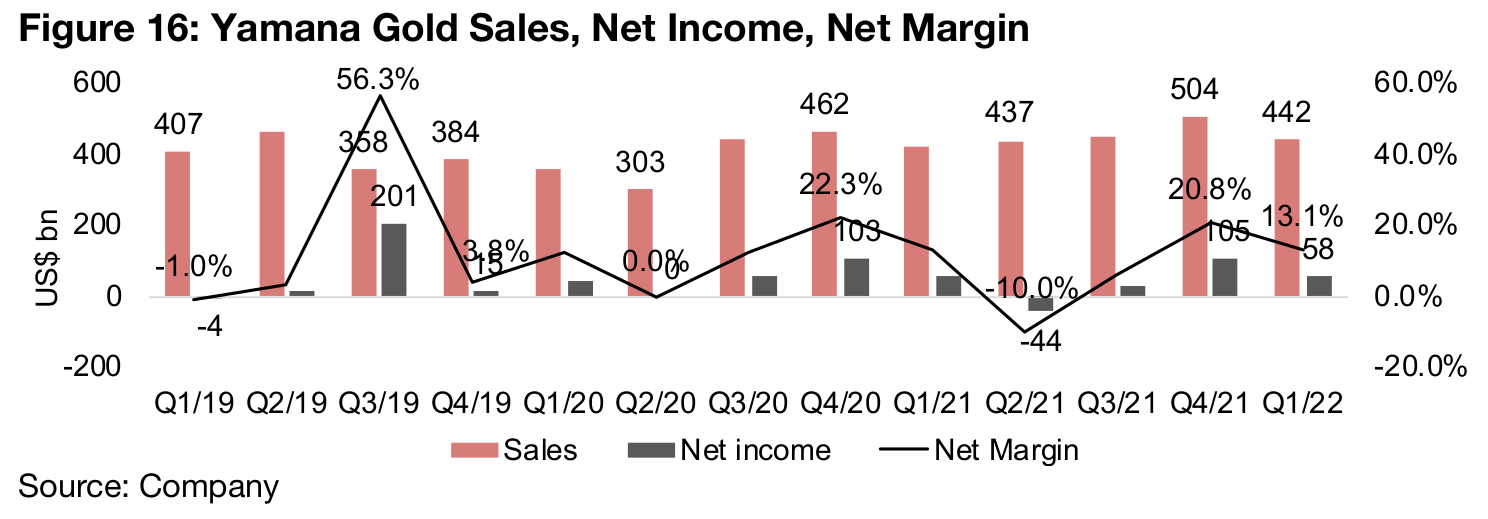

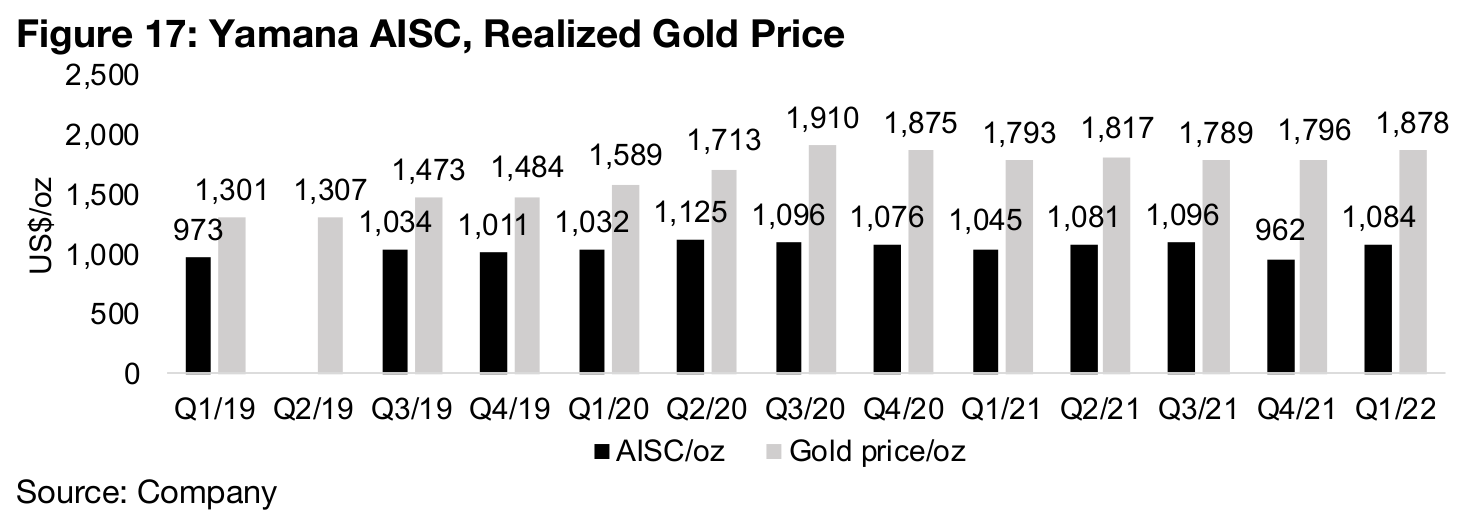

Yamana saw a slight improvement in its Q1/22 results. Production rose 2.9% yoy, with the growth rate down from 10.2% in Q4/2, while revenue rose 4.7% and net income rose 5.7%. The company's margins were at 13.1% for Q4/22, down from 20.8%, but relatively high compared to the Q2/21 and Q3/21. The company's realized gold price rose to US$1,878/oz, its highest level since a peak at US$1,910/oz in Q3/20, and its AISC rose to US$1,084/oz, up qoq from a recent low of US$962/oz.

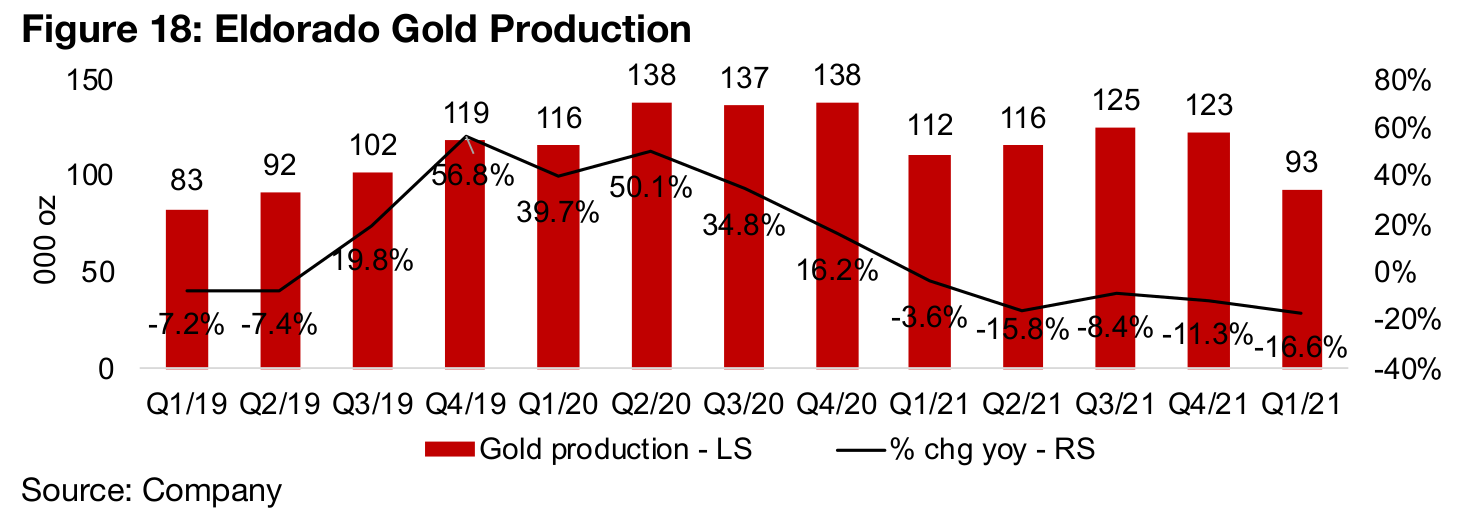

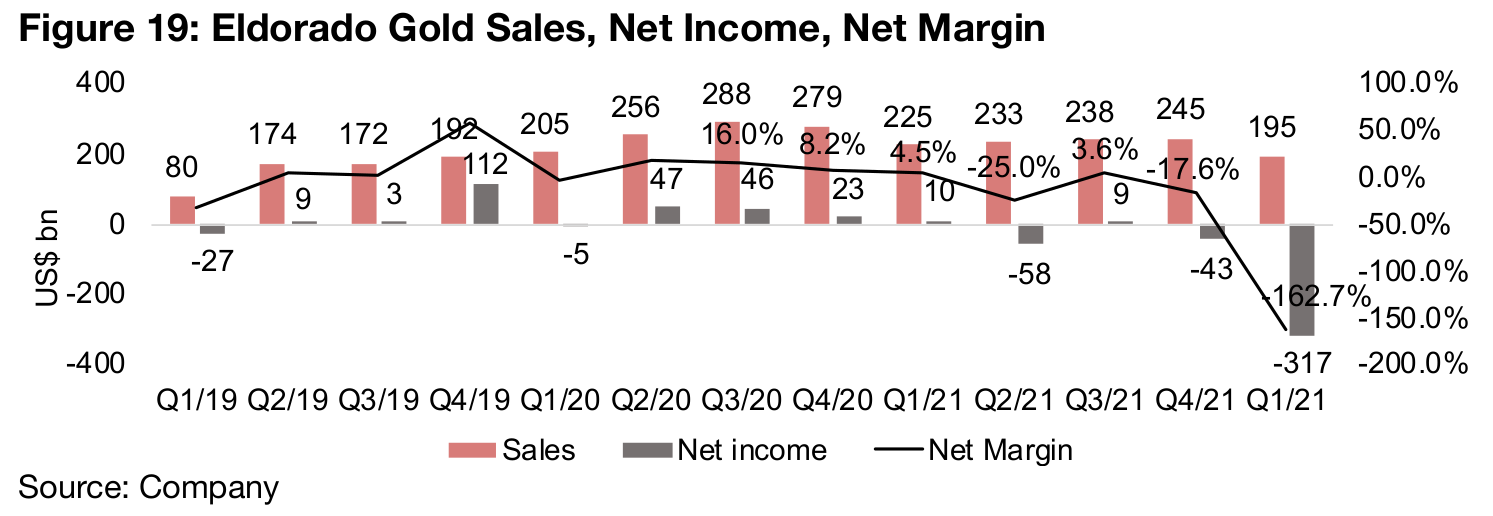

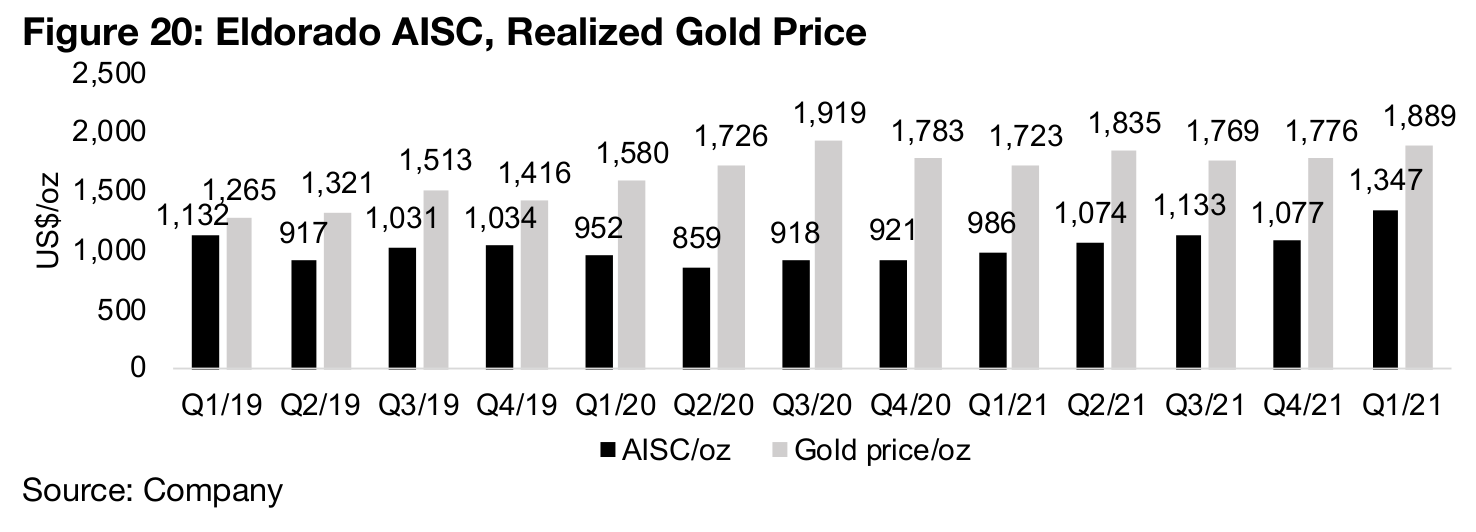

Eldorado Gold income down on declining production ad exceptionals

Eldorado saw a weak set of results for Q1/22, with production down -16.6% yoy, with production growth having generally trended down from a peak at 56.8% at Q4/19. This drove revenue growth down -13.3% yoy, which was offset by a considerable rise yoy and qoq in the realized gold price to US$1,889/oz. The company saw a major rise in its AISC yoy and qoq to US$1,347/oz, which was very high versus the other major gold producers. The company's net income dropped a substantial -162.7% yoy, driven partly by the weak core operating results, but mainly because of a large impairment on its Certej mine.

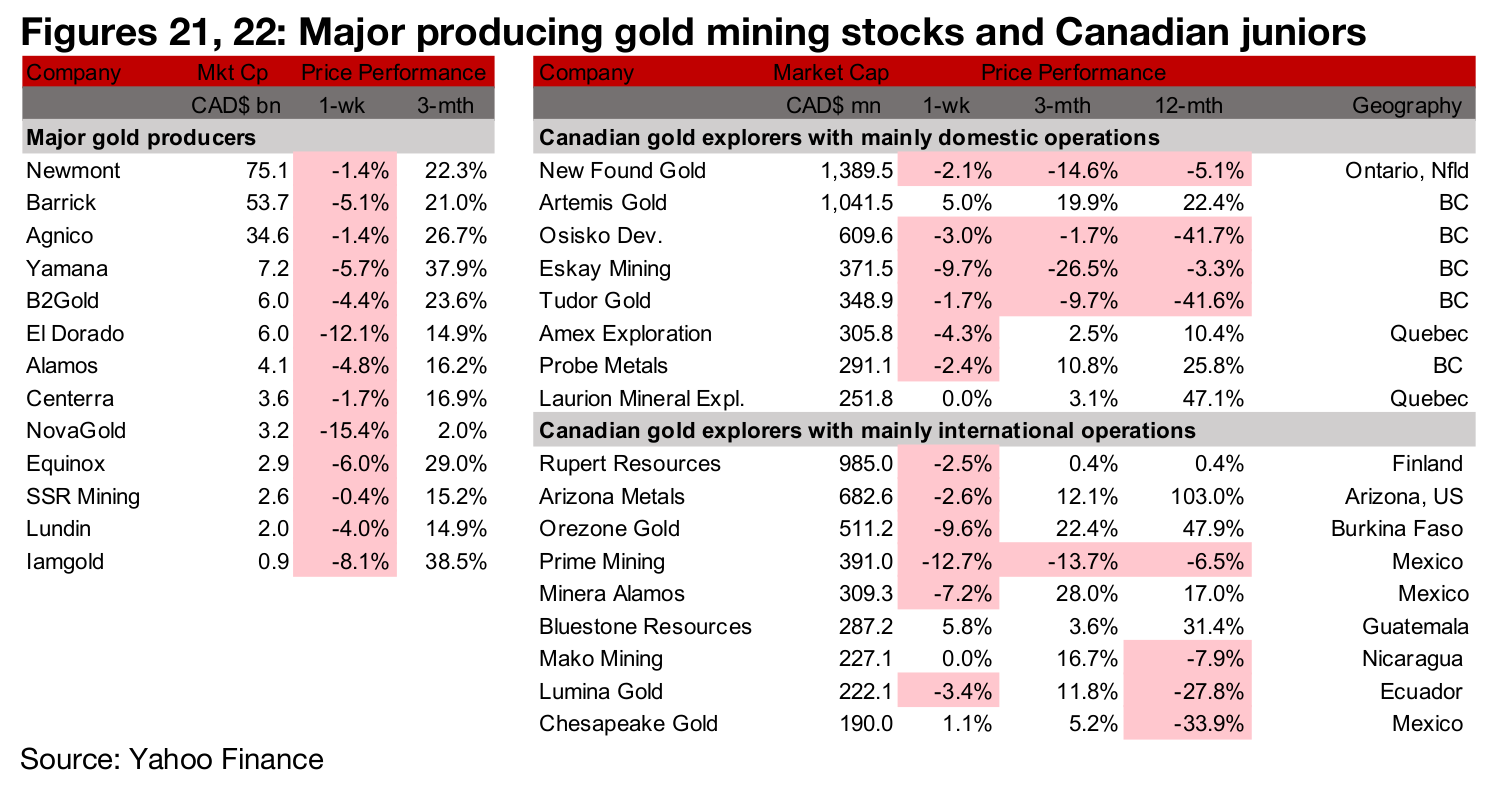

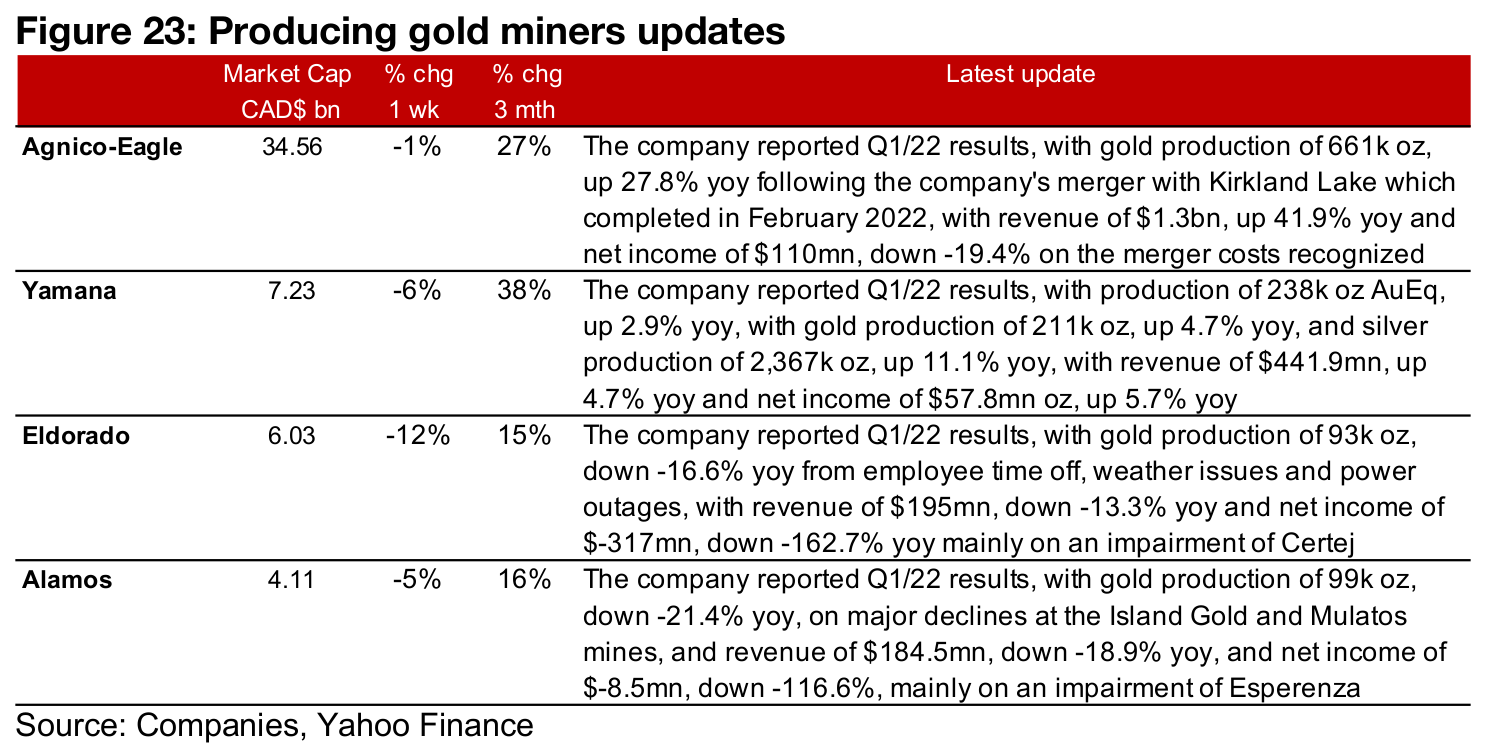

Producers decline on drop in gold and equity markets

The producing gold miners were all down as both the gold price and equity markets declined (Figure 21). The news flow was focused on the Q1/22 results season, with Agnico Eagle, Yamana, Eldorado and Alamos all reporting. Agnico Eagle saw the strongest production growth, up 27.8% yoy following the merger completed with Kirkland Lake in February 2022, with net income down -19.4% mainly because of recognized merger costs. Yamana saw moderate growth with production up 2.9% yoy and net income up 5.7%, Eldorado saw production fall -16.6% yoy on multiple operational issues and net income down -162.7% mainly on an impairment charge for Certej, and Alamos saw production down -21.4% and net income down -116.6% on an impairment charge for Esperenza (Figure 23).

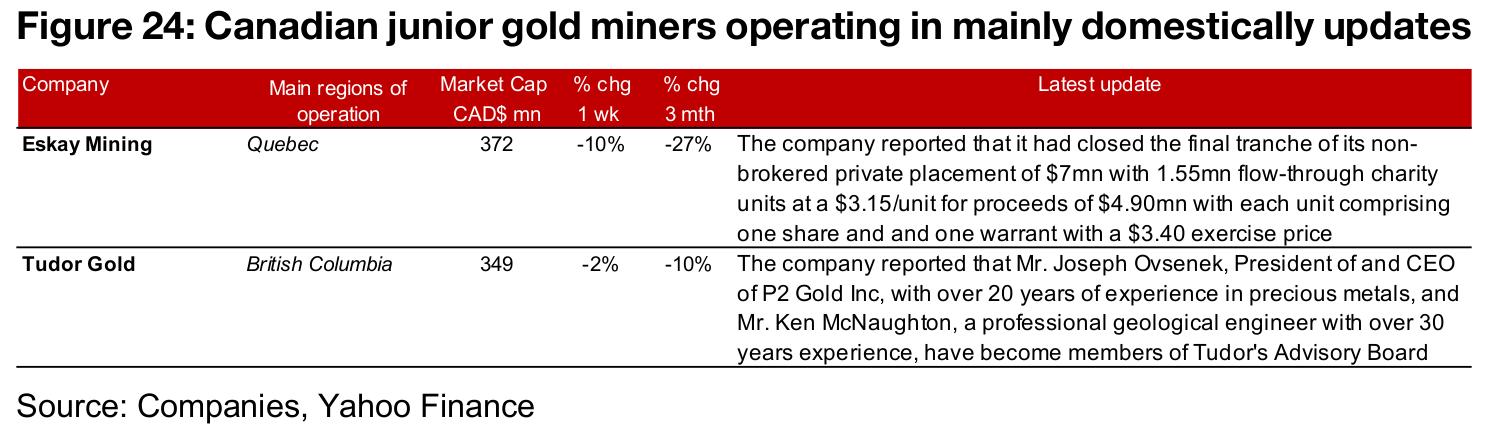

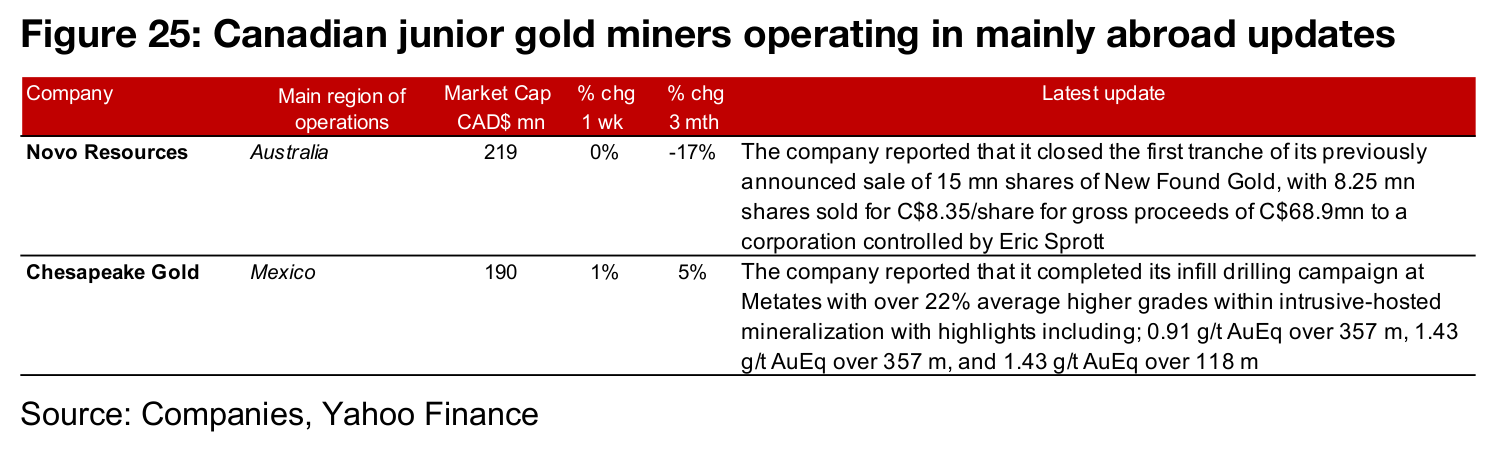

Canadian juniors mostly decline on gold and equity market pressure

The producing gold miners and the Canadian juniors were mostly down from the pressure on gold and equity markets (Figure 22). For the Canadian producers operating mainly domestically, Eskay closed the final tranche of its $7.0mn private placement with proceeds of $4.9mn and Tudor Gold reported that Mr. Joseph Ovsenek and Mr. Ken McNaughton have become members of Tudor's Advisory Board (Figure 24). For the Canadian juniors operating mainly internationally, Novo Resources reported that it had closed the first tranche of its sale of its 15mn shares of New Found Gold for gross proceeds of C$68.9mn and Chesapeake reported results from its infill drilling campaign at Metates (Figure 25).

Disclaimer: This report is for informational use only and should not be used an alternative to the financial and legal advice of a qualified professional in business planning and investment. We do not represent that forecasts in this report will lead to a specific outcome or result, and are not liable in the event of any business action taken in whole or in part as a result of the contents of this report.