July 30, 2021

Fed Eases Off Tightening Talk

Author - Ben McGregor

Gold price picks up as Fed seems more hesitant on tightening

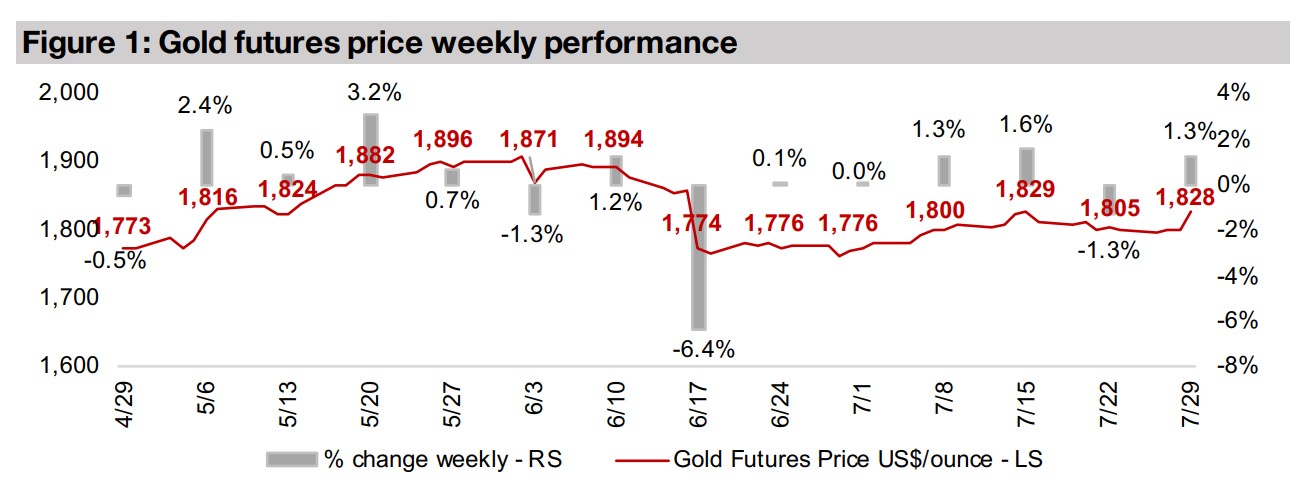

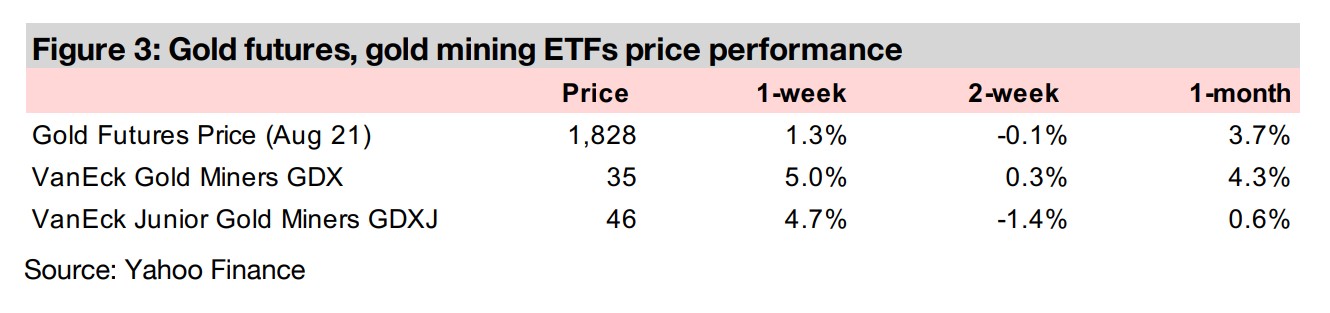

The gold price rose 1.3% this week to US$1,828/oz, as the Fed seemed more hesitant on its taper and rate hake plans in its meeting this week after rising health crisis cases, while US housing market data was sending some mixed signals on inflation.

A look at larger TSXV silver companies

This week we look at the recent developments of the major TSXV silver companies, which while they have continued to make operational progress overall, have mostly seen weak share price gains over the past year on the fall in the silver price.

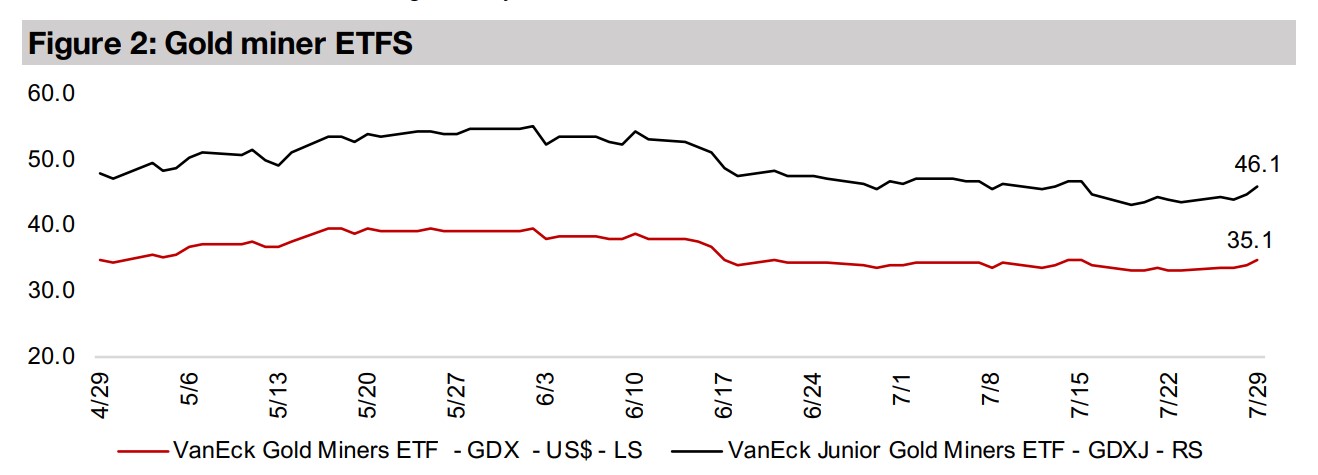

Producers and juniors up as gold rises on less aggressive Fed

The producers and juniors rose this week, with the GDX up 5.0% and the GDXJ up 4.7% and the Canadian juniors were mostly up, as gold picked as the Fed indicated a moderately less aggressive stance on tapering and rate hikes in its recent meeting.

1) Fed Tones Down Tightening Talk

Gold up for the week as Fed pulls back a bit on tightening talk

Gold rose 1.3% this week to US$1,828/oz, as the Fed at this week's meeting seemed

a bit more hesitant in its tightening talk than in recent months, as the increases in

health crisis cases had it questioning the strength of the recovery. The Fed is currently

trying to balance keeping rapidly rising inflation under control with the desire not to

choke off the surging economic recovery. It expects that inflation will subside, and

that it is mainly temporary, being driven by the reopening of global supply chains and

pent-up demand coming through. While we believe that these are certainly factors,

we also view the massive monetary expansion of the past year as a major driver, that

will continue even after supply chains are returned to normal and slack in the

economy is taken up. Interestingly, the IMF this week said that it expects that high

inflation could persist for some time.

We expect that the Fed will err on the side of letting inflation run, rather than risking

crashing the economy through early withdrawal of monetary stimulus, and that this

will be good for the gold price. It seems that any reduction of stimulus is unlikely

before 2022, and so far, the Fed is still not targeting any rate hikes until 2023. We

expect that the 'game of chicken' the Fed is playing could really see inflation take off,

at least for a while, and even any 'crack down' could be quite light at first. Harkening

back to the last major inflationary episode in the 1970s and early 1980s, it took about

six years of high prices before inflation fatigue set in enough with the public to endure

extreme measures and aggressive action was taken by the Fed to combat it, in the

form of major rates hikes and a short but sharp recession. So we could see a long

time before the Fed makes any truly substantial rate hikes, and the ones currently

planned would be quite minor, and possibly somewhat ineffective, in a case where

inflation was really surging.

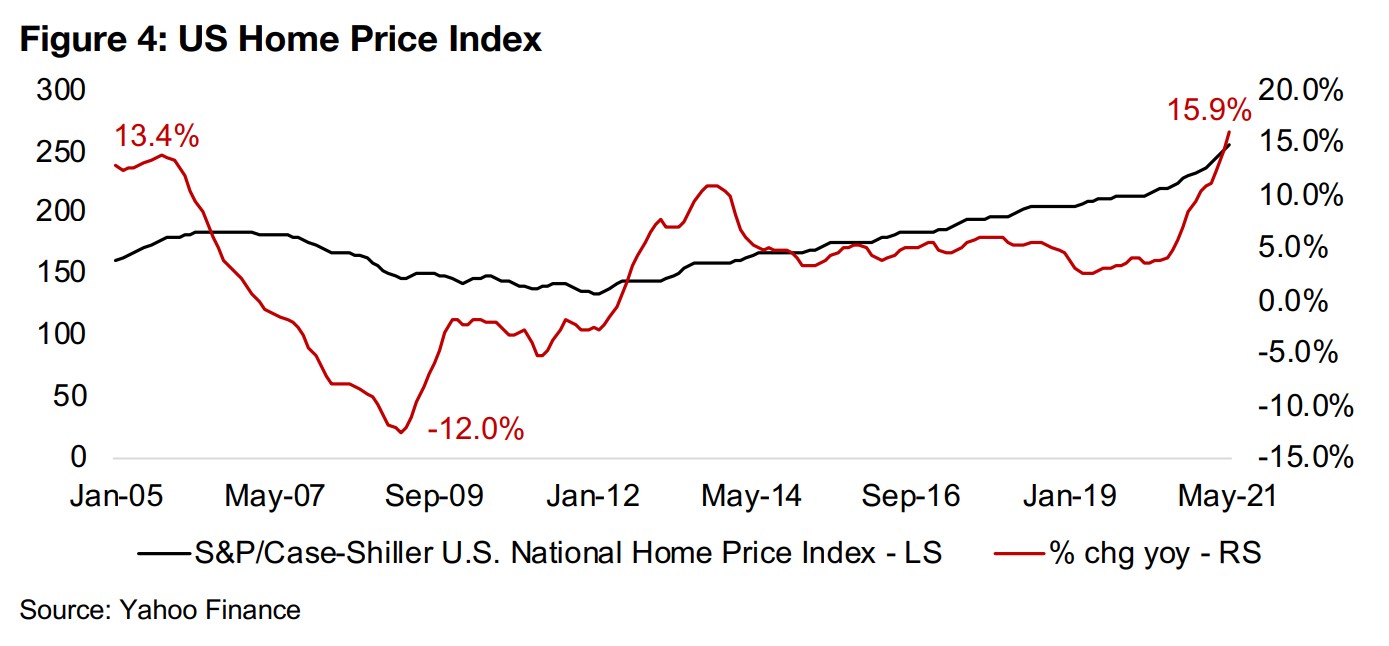

Housing market giving mixed signals on inflation

While recent data from the US housing market had been looking very inflationary so

far this year, for some of the most recent data, the picture is somewhat more mixed.

This could give some credence to the Fed's idea of temporary inflation, but we will

need to see further months of data to determine the trend. First is the Case Schiller

US Housing Price Index. There is no doubt that this indicator is still giving off clear

inflationary signals, having shot up to year-on-year growth of 15.9% in May 2021

(Figure 4), which is higher than even the 13.4% growth at the peak of the housing

boom that led to the recession in 2008-2009.

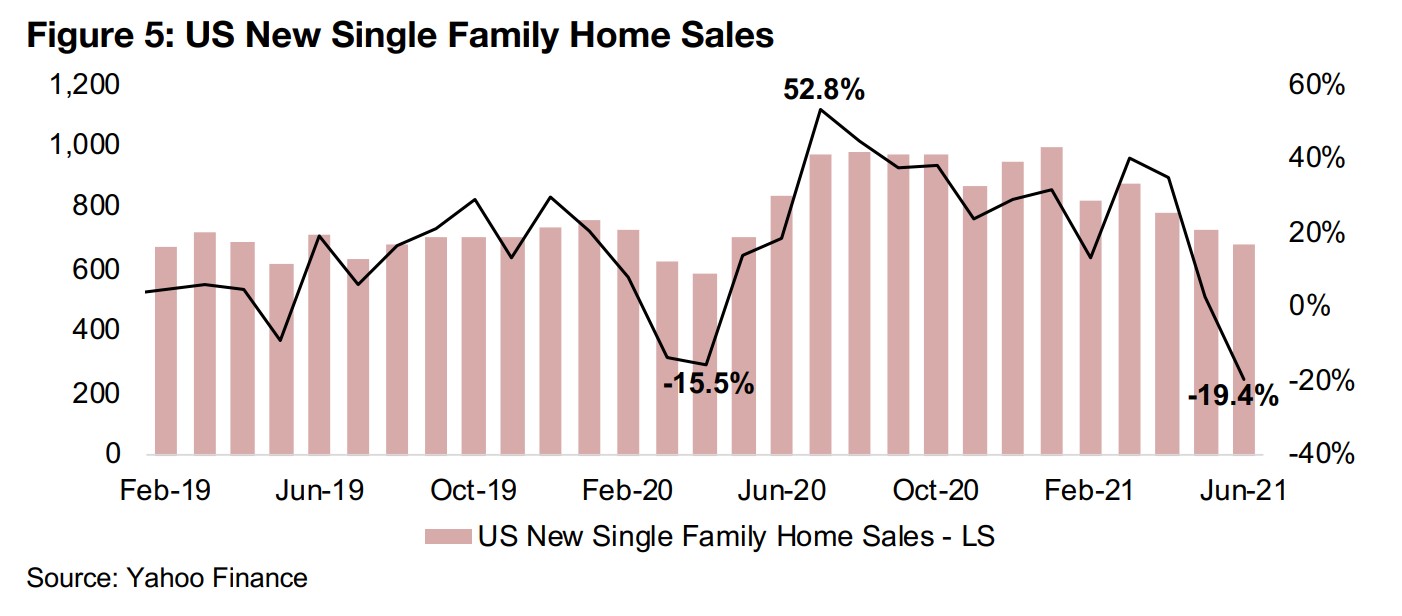

However, another housing indicator is giving off quite a different signal, US New

Single Family Home Sales, which plummeted -19.4% yoy in June 2021 (Figure 5).

Given that this series is a month ahead of the Housing Price Index figures, it may be

showing a more recent slowdown in the US housing market. US New Single Family

Home Sales are also an important indicator across the economy as they tend to

indicate new families entering a long period of high consumption. Growth in this

indicator had peaked last year at 52.8% yoy in July 2020, but remained very high until

April 2021, at 34.9%, before declining to 2.8% in May 2021 and falling well into

negative territory in June 2021.

While this may be one of the first indicators of a slowdown in economy activity, there

can be quite a lag from an initial slowdown in the new homes sales and its effect on

the broader economy. So we could still see the tsunami of money continue to flow

through to consumer prices, even as cash-strapped families start to hold off on home

purchases. If the data is pointing to a slowdown, this may also lead to the Fed sending

signals that it will maintain its aggressive stimulus for an extended period, which

could also continue to propel inflation, even as economic growth eases. This situation

has occurred before, also in the 1970s, and was called stagflation, a combination of

stagnating growth, but high inflation, during which gold saw strong gains.

2) Larger TSXV silver continue operational progress

New Pacific starts new drill program, Discovery reports results form Cordero

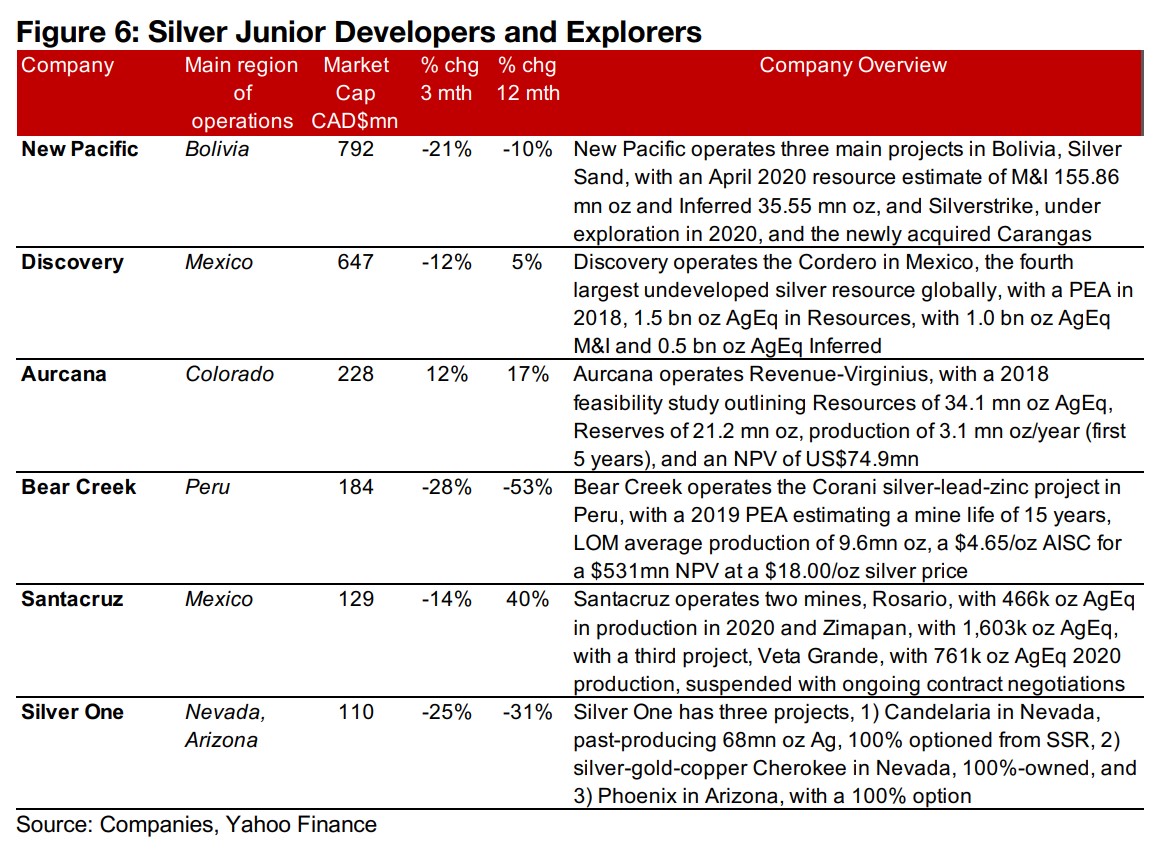

This week we review the progress of the TSXV silver companies, including New

Pacific (which is TSX-listed, but we include here as it just made the move last year),

Discovery Silver, Aurcana Silver, Bear Creek, Santacruz and Silver One (Figure 6). The

companies have faced considerable share price pressure this year, as the silver price

has lagged other metals, but most have shown continued operational progress, which

could set them up for gains if the silver price starts to rebound.

New Pacific Metals, the largest of the group by market cap, continues to focus on its

most advanced project, Silver Sand, with a 38,000 m drill program announced this

month. There have been no announcements on another project, Silver Strike, since

drill results in November 2020, the company acquired a third project in Bolivia,

Carangas, in April 2021, with exploration licenses and environmental permits received,

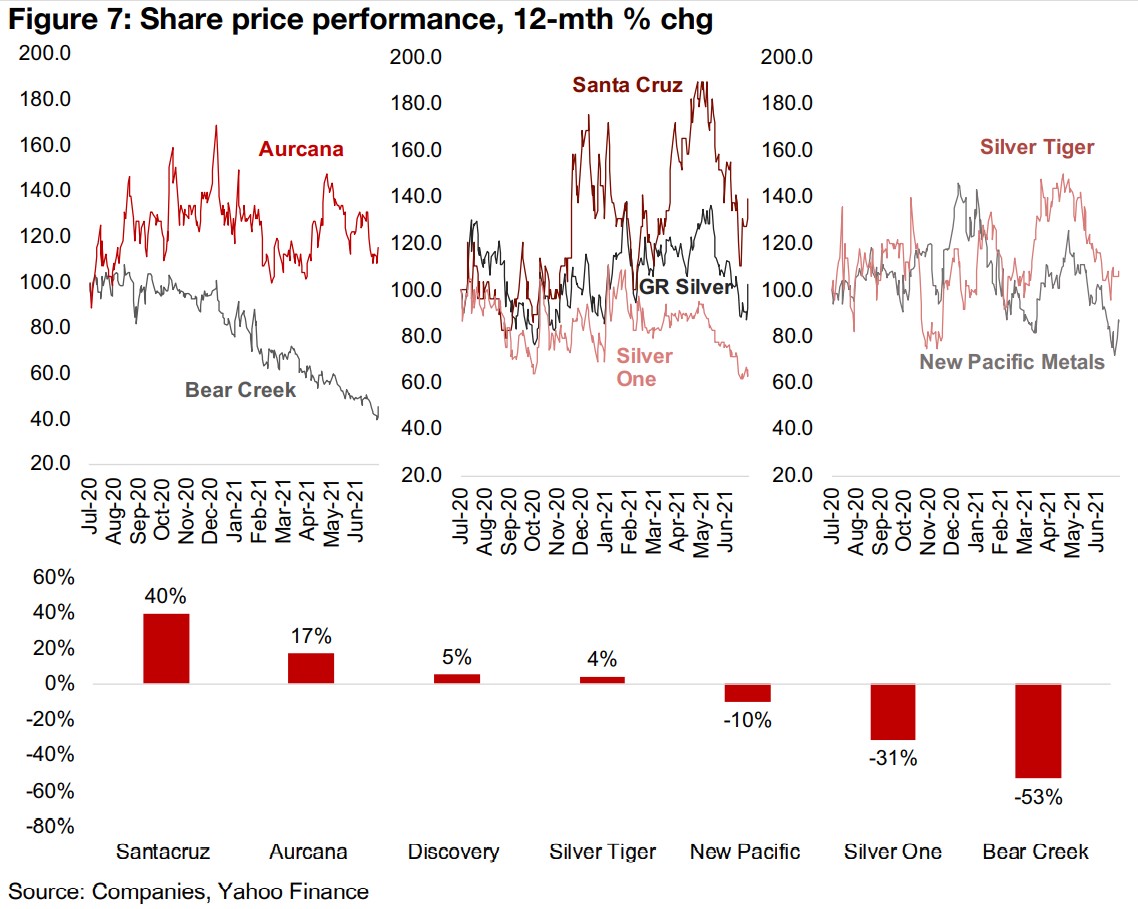

and drilling started, in June 2020. The company's share is down -10% over the past

twelve months, likely mainly reflecting the weak silver price (Figure 7), and the market

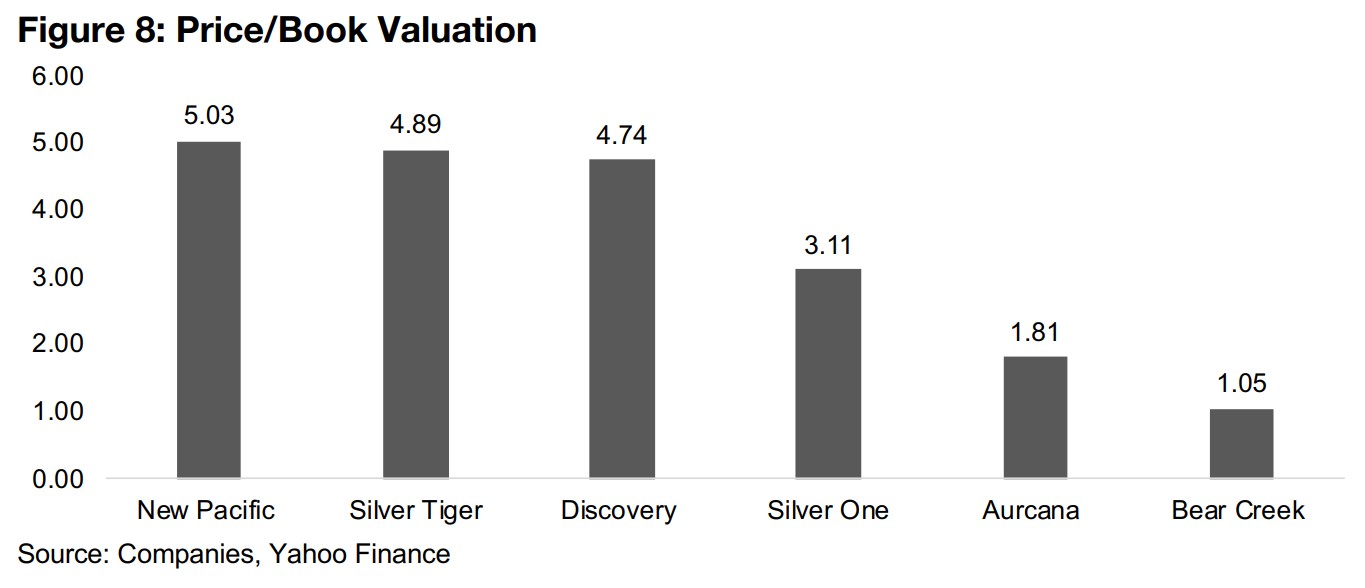

still gives it the strongest price/book multiple of the group at 5.0x (Figure 8), although

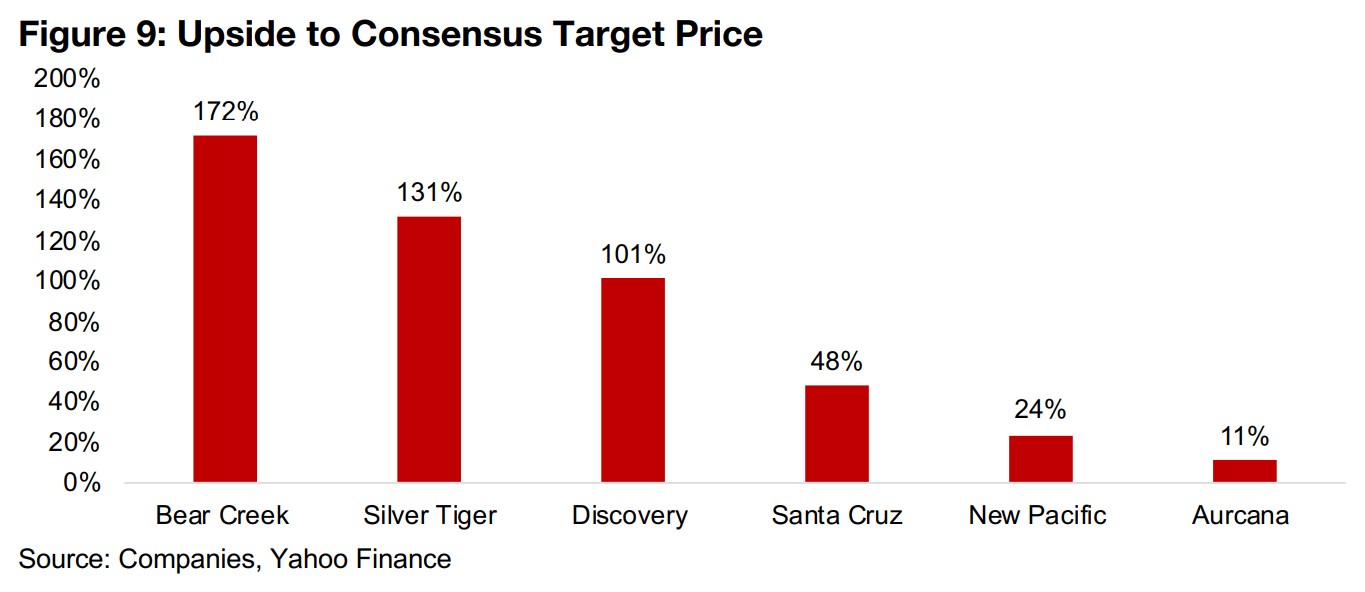

it has only a moderate 24% upside to its target price (Figure 9).

Discovery Silver has announced a series of strong drilling results this year from its Cordero project, with highlights including; 2,290 g/t AgEq over 1.3 m and 1,605 g/t AgEq over 2.9 m in March 2021, 165 g/t AgEq over 128 m and 110 g/t AgEq over 110 m in April 2021, 1,043 g/t AgEq over 4.1 m and 1,736 g/t AgEq over 1.2 m in May 2021, 258 g/t AgEq over 66 m and 120 g/t AgEq over 143 m in June 2021 and 3,934 g/t AgEq over 1.1 m 3,424 AgEq over 1.1 m. The company also announced that Ausenco Engineering will do the PEA for Cordero, which is expected to be completed by Q3/21. This has kept the share price up 5% over the past twelve months, and the market is backing a reasonably high valuation with a 4.7x Price/Book and expecting a strong 101% upside to the consensus target price.

Aurcana nearing mine restart, Bear Creek preparing for Corani construction

Aurcana is focused mainly on restarting the Revenue-Virginius Mine, a silver mine

where operations were stopped in 2015 under previous owners. The company fully

acquired the project and filed a Feasibility Study for it in 2018 and has been moving

towards bringing into back into production since. It reported in July 2021 that it was

on track for a September 2021 restart of operations and reported initial assay results.

While the stock is up 17% over the past twelve months, with the market encouraged

by the imminent restart of operations, it trades considerably below the peer group on

a Price/Book of 1.8x, and the market sees only 11% upside to its consensus target.

This may be because the market is seeing less scope for substantial upside surprises

compared to other companies exploring less historically well-defined projects.

Bear Creek Mining is also in the mine construction phase for its Corani project, with

permits and community agreements secured, and is preparing for mine development

and investigating reducing costs and construction risks. However, there has been

quite limited new flow over the past year, which has led some investors to seek

investments with more immediate drivers, and the share price has declined -53%

over the past year, with its price to book falling to just 1.0x P/B, the weakest of the

group. However, the market sees significant potential for the company once it starts

to report more clear progress on Corani, with 172% upside to the consensus target

price, the highest of the group.

Santacruz output declines over Q1/21, Silver One reports drill results

Santacruz, the only producer of the group, with two mines, Rosario and Zimpan (a

third, Veta Grande, is not operating given ongoing contract negotiations) saw total

output decline -29% in Q1/21 to 707k oz AgEq. This was partly because of unstable

power from its supplier which damaged equipment, as well as changes in silver

equivalent ounces calculation prices. However, while this did pull the share price off

highs, it is still up 40% this year, the highest of the group, and it has 48% upside to

its target price (the company has no price to book as its equity is negative).

Silver One has reported a series of drilling results from its Candelaria project this year,

with highlights including 1,032 g/t Ag over 3.05 m in February 2021, 1,776 g/t Ag and

2.55 g/t Au over 1.5 m in May 2021 and 1,070 g/t Ag and 1.48 g/t Au over 4.57 m

within 249 g/t Ag and 0.40 g/t Au over 26 m. It also has provided updates on other

projects, with early-stage exploration at Phoenix and drill targets identified at

Cherokee. The share price has dropped -31% over the past year, it trades at a 3.1x

price to book, just below the average for the group, and it has no consensus target.

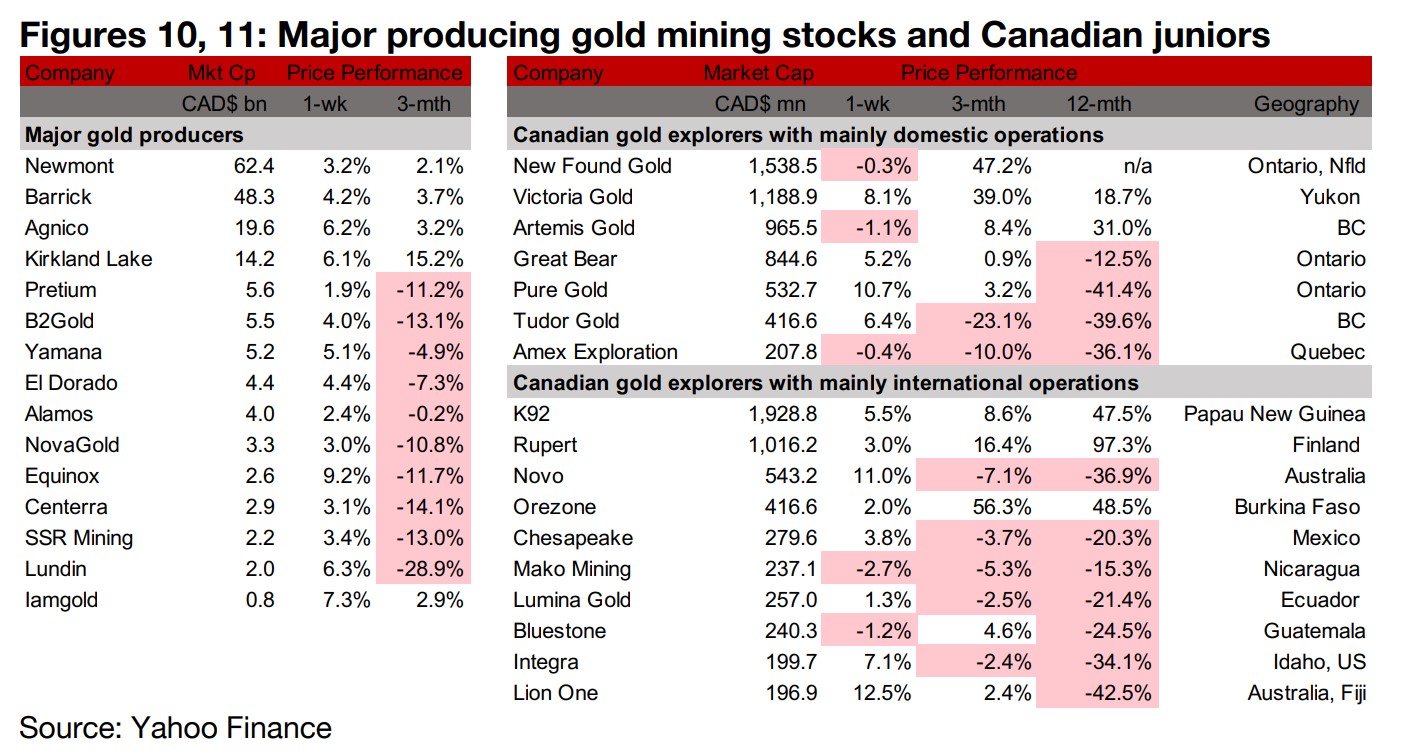

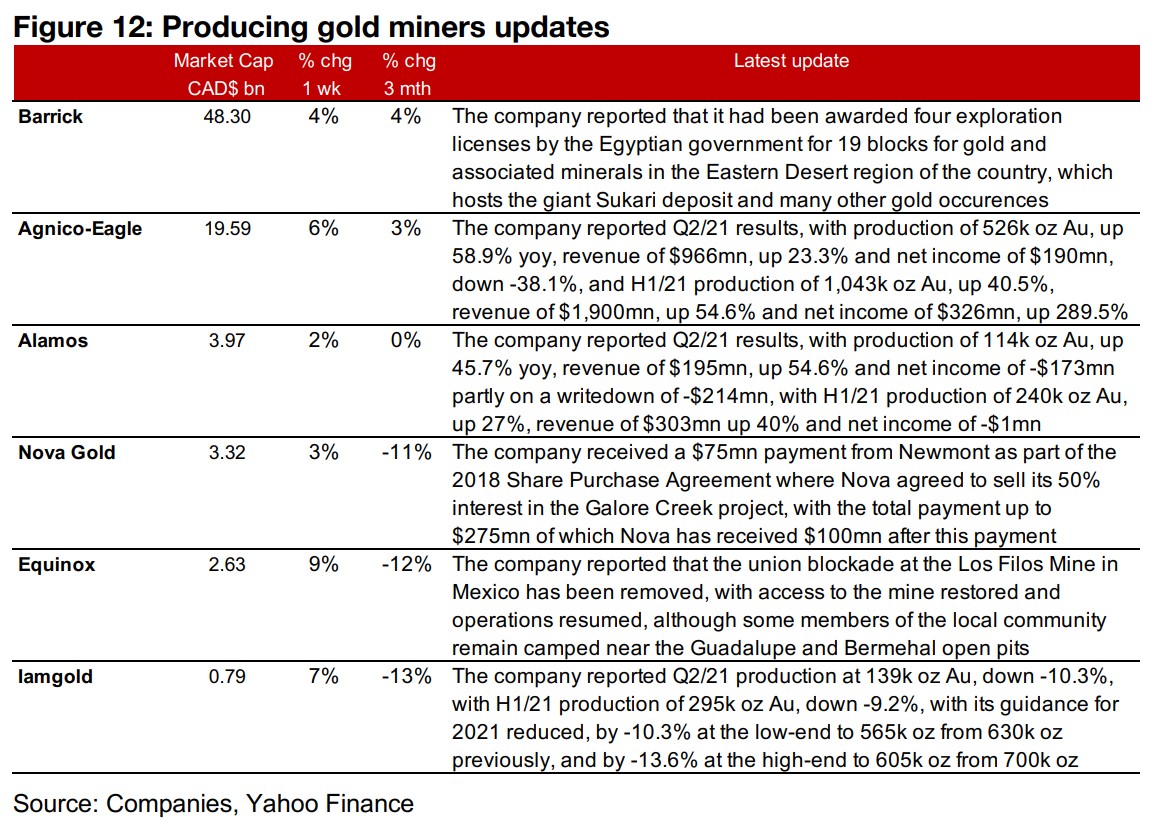

Producers all rise on pick up in gold

The major gold producers were all up this week on the rise in gold (Figure 10). Barrick announced that it had been awarded four exploration licenses in Egypt for gold and associated minerals, Agnico-Eagle and Alamos reported Q2/21 results, and Iamgold reported Q2/21 production results. Nova Gold reported a payment from Newmont as part of the Galore Creek purchase, and Equinox reported that the union blockade at Los Filos has been removed and operations resumed, but some members of local communities remain camped near open pits (Figure 12).

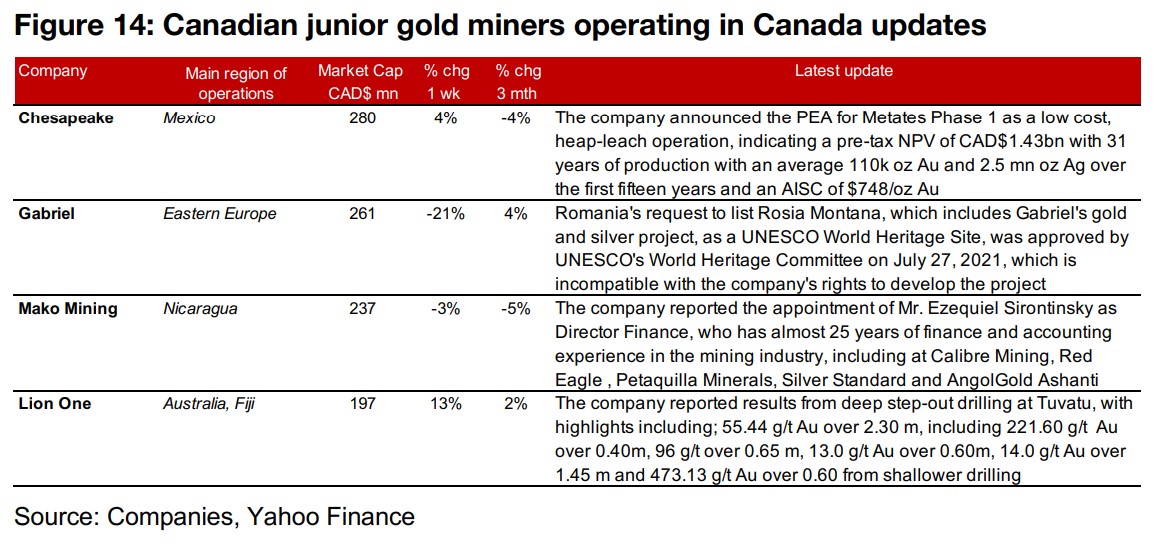

Canadian juniors mostly rise as Fed eases off tightening talk

The Canadian juniors were mostly up as the Fed eased off its tightening talk at its

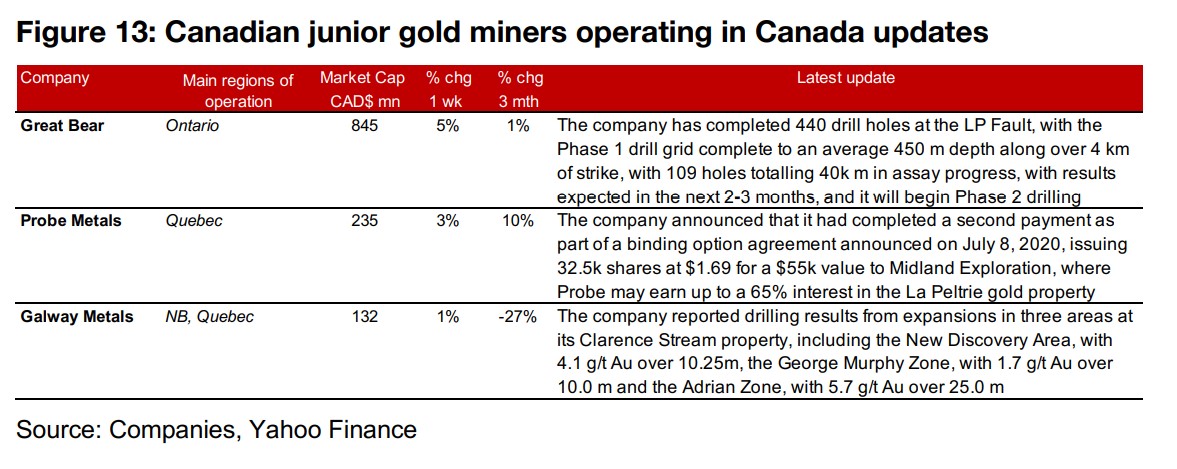

meeting this week (Figure 11). For the Canadian juniors operating domestically, Great

Bear reported the completion of Phase 1 drilling at the LP Fault, with Phase 2 to

commence in the next 2-3 months, Probe Metals completed a second payment to

Midland as part of a deal for the La Peltrie gold property and Galway Metals reported

drilling results from its Clarence Stream Property (Figure 14).

For the Canadian juniors operating mainly internationally, Chesapeake announced a

PEA for a Metates Phase 1 as a low cost, heap-leach operation and Gabriel

announced that Rosia Montana, the site of the company's gold and silver project,

was approved as a UNESCO World Heritage Site, which is incompatible with the

company's rights to develop the property. Mako Mining appointed a new Director of

Finance and Lion One reported results from deep step-out drilling at Tuvatu (Figure

14).

Disclaimer: This report is for informational use only and should not be used an alternative to the financial and legal advice of a qualified professional in business planning and investment. We do not represent that forecasts in this report will lead to a specific outcome or result, and are not liable in the event of any business action taken in whole or in part as a result of the contents of this report.