End of Banks in Canada?

September 16, 2024

End of Banks in Canada?

This is incredible…

But there’s language on the official website of the Government of Canada saying that there may be no banks left in the country after June 30, 2025.

Judge for yourself:

Sunset provision

• 21 (1) Subject to subsections (2) and (4), banks shall not carry on business, and authorized foreign banks shall not carry on business in Canada, after June 30, 2025.

Extension

(2) The Governor in Council may, by order, extend by up to six months the time during which banks may continue to carry on business and authorized foreign banks may continue to carry on business in Canada. No more than one order may be made under this subsection.

What in the world does this mean?

Will banks be shut down next year? Nationalized? What about savers and investors?

Is Canada preparing to launch a Central Bank Digital Currency (or a CBDC)?

What will that mean for Canadians?

Too Much Uncertainty

We reached out to dozens of contacts in the financial industry… yet nobody could give us a definitive answer.

And that’s a problem.

When there is such clear language speaking to the end of banking in Canada, there needs to be a concrete answer.

Otherwise…

All kinds of speculation will crop up.

Conspiracy theories… market selloffs… bank runs?

And what should investors do to prepare?

Keep in mind that they have less than a year left until “Day X.”

Options for Investors

When your government says that there’s a chance the banking system may go down, you don’t have too many options.

Moving at least a portion of your capital out of this system sounds rational.

Investing in “safe haven” assets whose value tends to go up in times of market distress does, too.

And even without a massive crash, Canadian investors should consider diversifying away from the country’s currency.

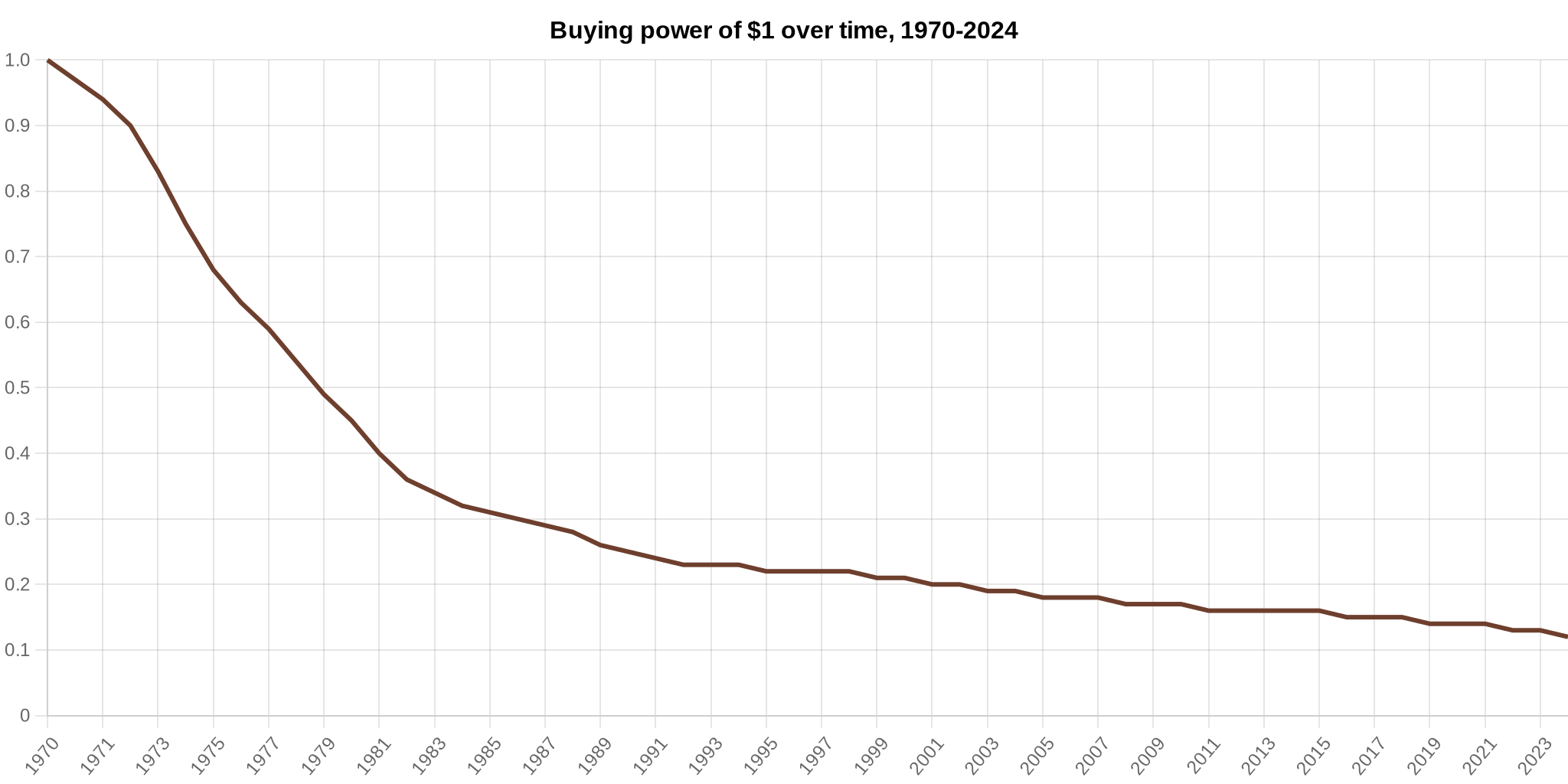

The purchasing power of one Canadian dollar has fallen by 88% since 1970. One loonie back then has shrunk to just C$0.12 this year.

Data: OfficialData.org

Between 1970 and today, prices in Canada increased by about 681%.

Ouch.

So, what to do?

Consider Gold and Silver

Gold and silver are called “monetary metals” for a reason.

They were used as currency for hundreds of years… and these days, investors choose these assets when their trust in the mainstream financial system erodes…

They have several options as far as diversifying into gold and silver goes.

One option is holding physical metals.

But what kind of coin or bar should you choose? What’s going to work best for you?

We found a provider of gold and silver investing services that automates this decision-making for you.

It’s called 7k Metals. 7k Metals is an Idaho-based company that provides an easy solution for those seeking to buy, hold, and trade gold and silver.

It also serves Canadian residents.

Its AutoSaver service allows you to subscribe to a certain collection of coins, set up a budget, and have these coins delivered to your house monthly.

Like this “Beauty of the World” silver collection…

Image: 7k Metals

These low-mintage coins are vetted and graded by 7k Metals experts, so you don’t need to do any research or appraisal.

7k also offers rare coin drops to its members.

If you’re on a limited budget, you can even buy fractions of coins and have your fiat currency converted to gold and silver instantly.

In other words, take your time to see how 7k Metals can help you diversify your portfolio.

For Extra Leverage to Gold and Silver, Consider Canadian Mining Stocks

Mining stocks tend to outperform gold and silver during bull markets.

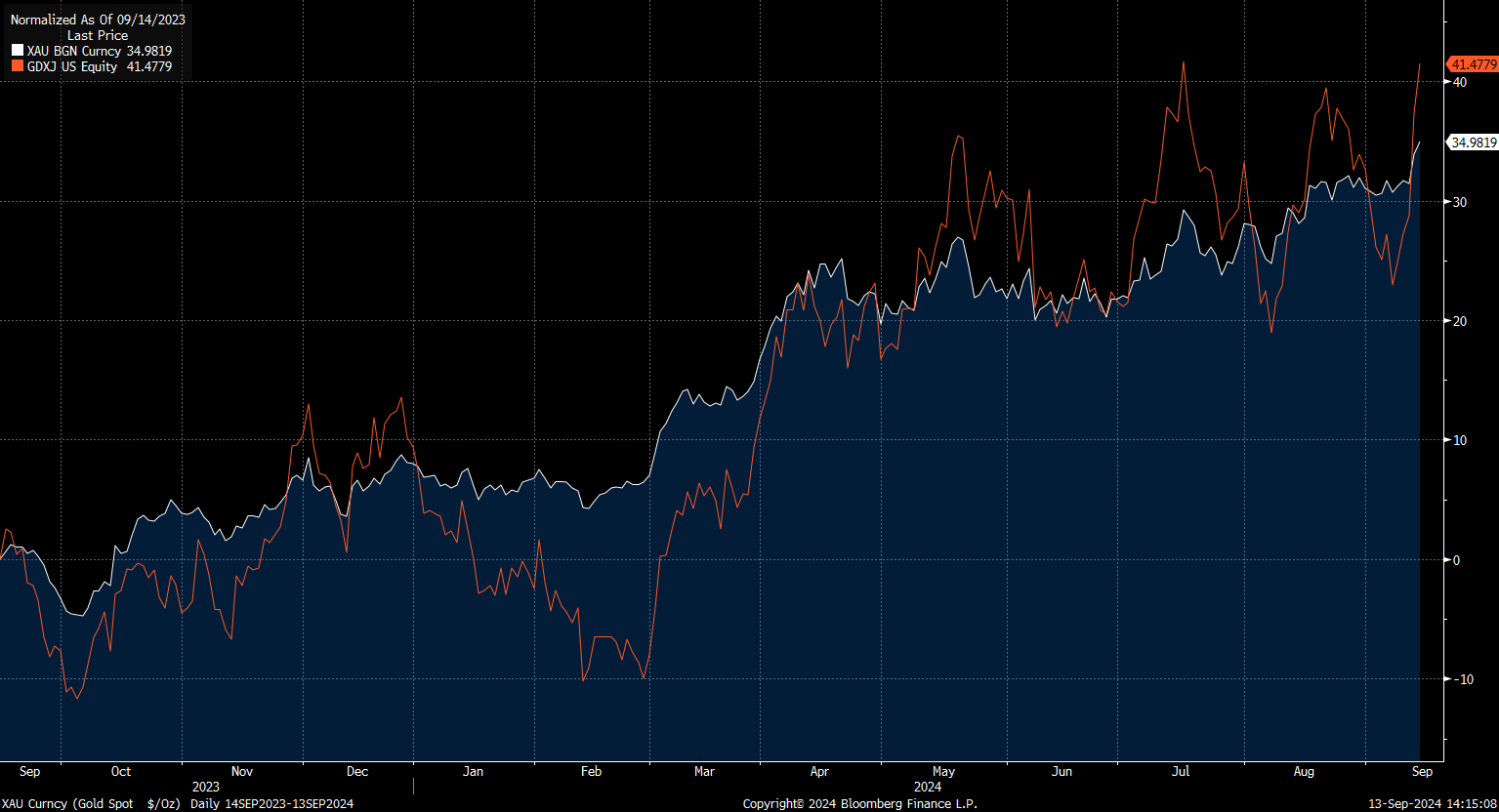

For example, since the beginning of this year, gold has delivered a 35% return (white line in the chart below). Over the same timeframe, an ETF tracking junior gold miners returned 41.5% (orange line).

Individual stocks could deliver even higher returns, of course.

They are suitable for investors with a higher risk appetite.

This sector has been our focus here at the Canadian Mining Report.

Regardless of where the Canadian banking system will find itself next year, investors should consider physical gold and silver as well as select Canadian mining companies.

The time to act is now… before this “Canadian banking collapse” story breaks all over the news…

You heard it here first.

Sign up to receive our future articles and updates.

Disclaimer

The material in this article should not under any circumstances be construed as an offering, recommendation, or a solicitation of an offer to buy or sell the securities mentioned or discussed, and is to be used for informational purposes only. Neither Canadian Mining Report (the "Publisher", "we", "us", or "our"), nor any of its principals, directors, officers, employees, or consultants ("Publisher Personnel"), are registered investment advisers or broker-dealers with any agencies in any jurisdictions. Canadian Mining Report ("Canadian Mining Report", "Us", "Our" and/or "We") is a Canadian based media company that typically works with publicly traded companies and provides digital marketing strategies and services.

At most, this communication should serve only as a starting point to do your own research and consult with a licensed professional regarding the companies profiled and discussed. Conduct your own research. We do not provide personalized or individualized investment advice or advice that is tailored to the needs of any particular recipient.