March 06, 2023

Dovish Comments from Still Hawkish Fed

Author - Ben McGregor

Gold rebounds after month long drop

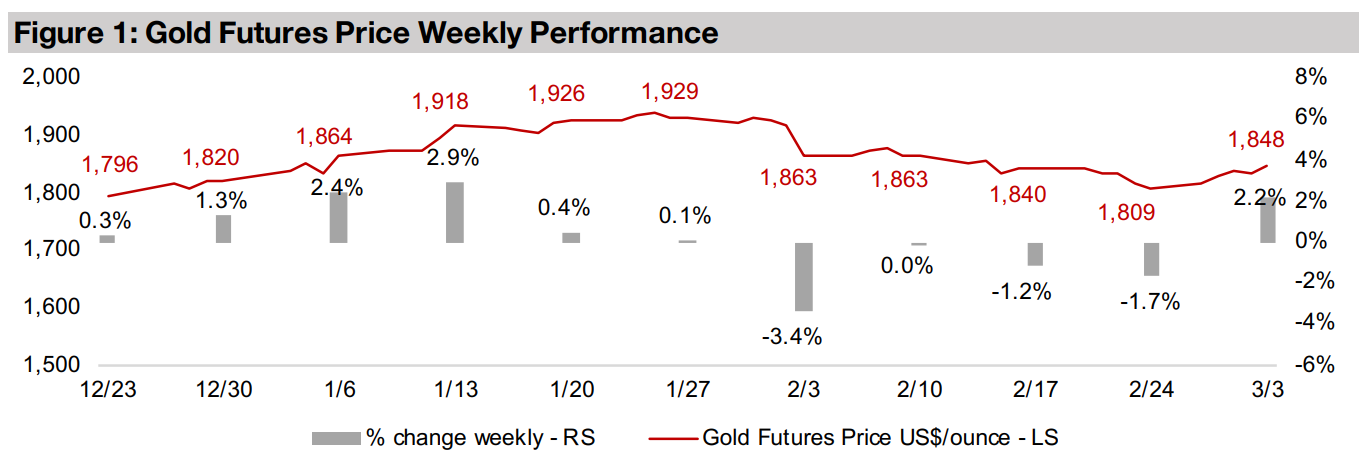

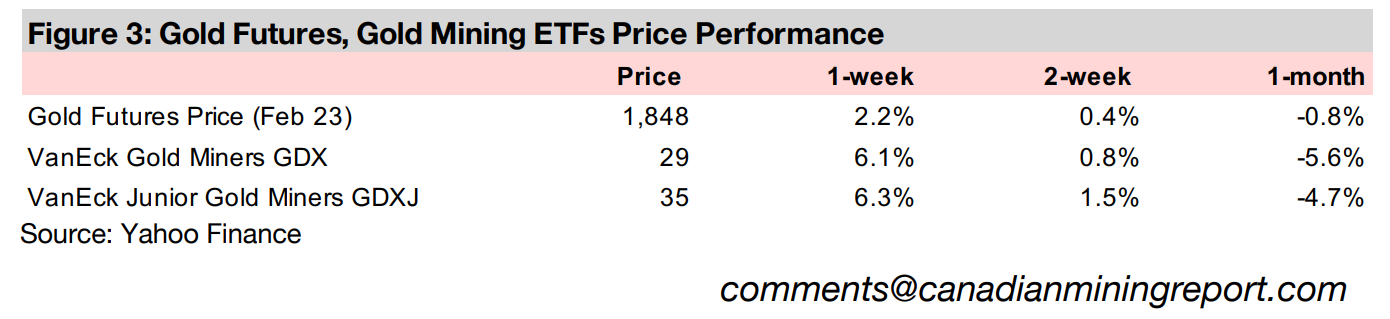

Gold rebounded 2.2% this week to US$1,848/oz, ending a month-long drop, which seems mainly to have been driven by dovish comments by one of the Federal Reserve Presidents, although talk from other Fed officials has overall remained hawkish.

Greenland-focussed gold explorer Amaroq In Focus

The Greenland-focussed gold explorer Amaroq Minerals is In Focus, with its main project the past producing Nalunaq, but it also has six other targets with gold, copper, zinc and other minerals, with exploration at two of these reported this year.

Dovish Comments from Still Hawkish Fed

Gold rose 2.2% to US$1,848/oz, ending a month-long drop, as markets reacted strongly to dovish comments from the Atlanta Federal Reserve President suggesting he believed that slower, steady 25 bps interest rate hikes were warranted by the current situation. This is in contrast to several aggressive 50 bps hikes that the Fed made several times over the past year. However, while the equity markets took these comments as very dovish and surged, the reaction seems a bit overblown, especially in light of comments from other Federal Reserve officials this week that that remained quite hawkish, indicating that more major rate hikes were still possible.

Market looking for rates to peak in June 2023, remain high for rest of year

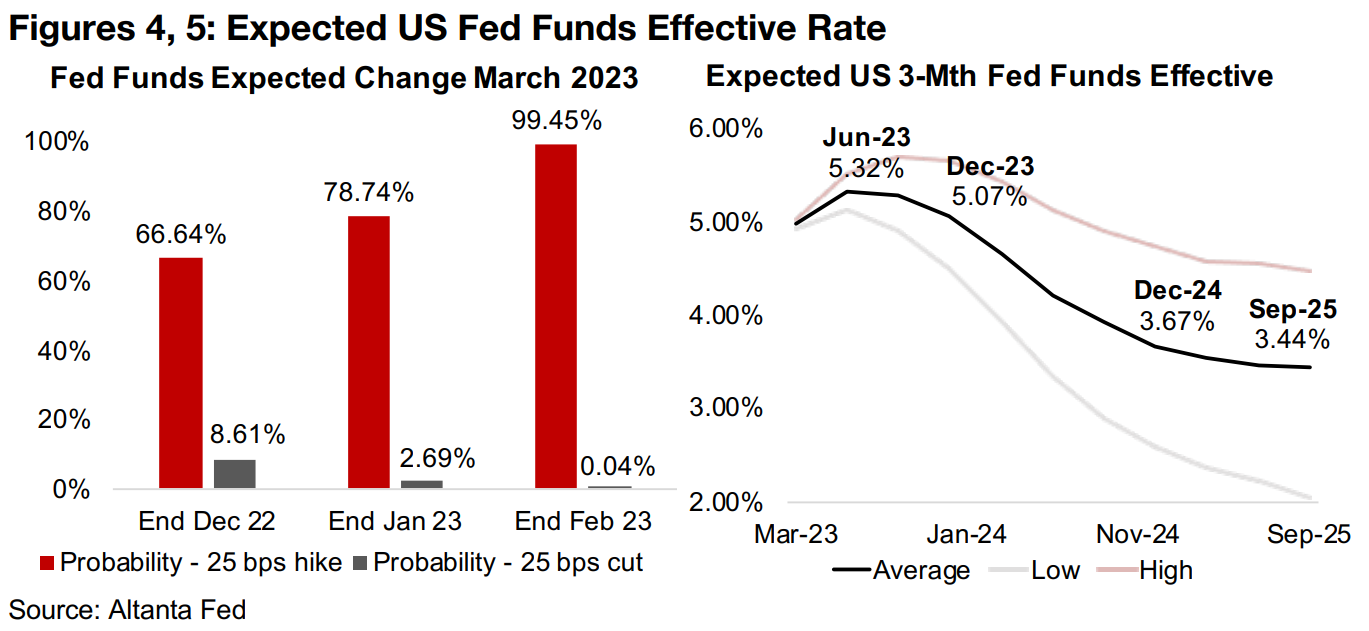

Expectations by the market for continued higher rates have risen in recent months,

with the probability of a March 2023 25 bps rate hike increasing from just 66.6% at

the end of December 2022 to 99.5% as of the end of February 2023 (Figure 4). The

market expects that rates will continue to rise through to a peak in June 2023, with

the US Fed Funds effective rate reaching 5.32%, and remain relatively high for the

rest of the year, declining to just 5.07% by December 2023 (Figure 5).

Even the large expected decline in rates by the market next year to 3.67% by

December 2024 does not leave interest rates particularly low, especially in the context

of rates that were near zero for most of the developed countries just a year ago.

Versus recent history, interest rates of 5.0%-6.0% are quite high, having been at the

top end of the range since the mid-1990s. These levels would have also been high in

the 1950s and 1960s, with the mid-1970s to early 1980s the only recent period where

rates were well above 5.0% for a sustained period, and were quite a historical

anomaly.

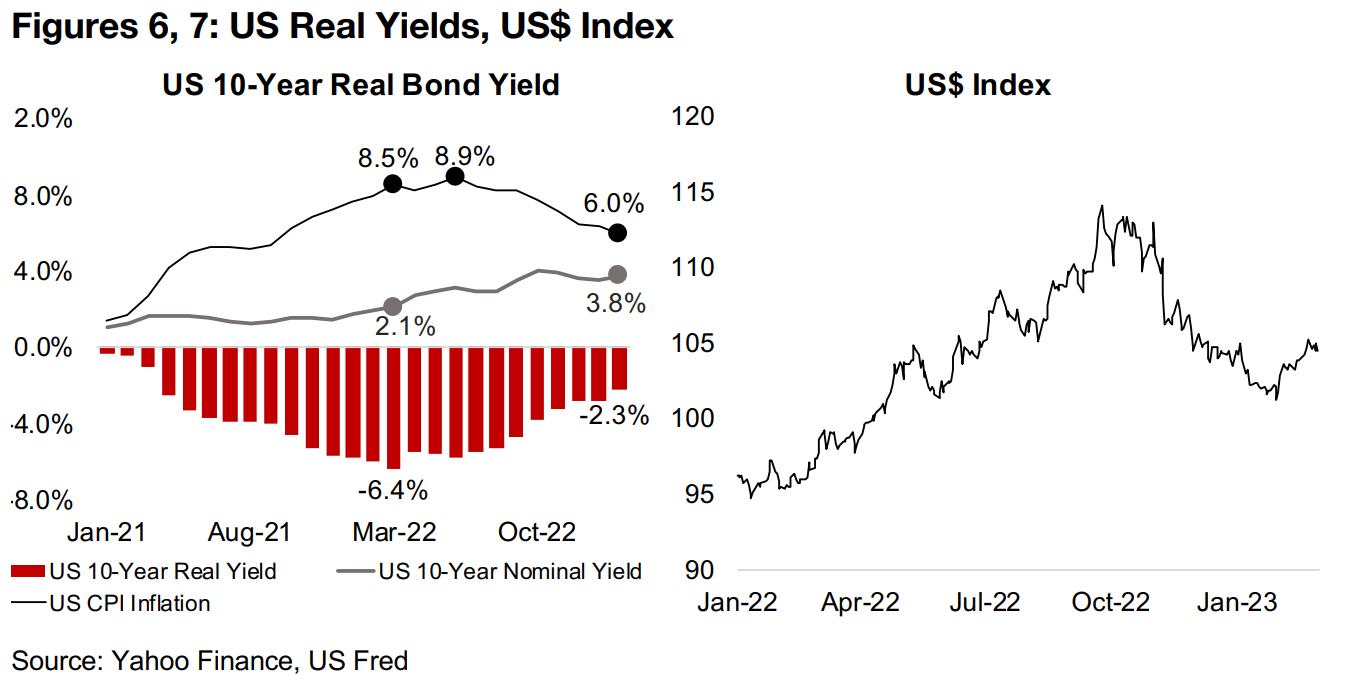

Progressively less negative US real yields likely pressuring gold

A continued rise in rates is fundamentally negative for gold overall, as it could lead to

less negative real yields and a stronger dollar, which could both pressure gold. Both

of these drivers have been moving against gold recently, with real yields becoming

less negative (Figure 6) and the US$ strengthening especially over the past month

(Figure 7). However, gold remains supported by rising geopolitical and economic risk.

With the potential for a recession rising, the market is still likely pricing into gold a

reasonable high probability of a reversal to very easy monetary policy by 2024, even

if the Fed for now looks set to be hawkish certainly through most of 2023.

While US real bonds yields are still quite negative, they are far less so than they were

early last year, when the 10-year US real yield hit -6.4% in March 2022, with a nominal

yield of 2.1% minus inflation of 8.5%. Inflation kept climbing only for three more

months to peak at 8.9% in June 2022, and then started to decline, driving a

progressively less negative real yield. The nominal yield averaged 3.8% in February

2023, and assuming inflation last month edged down to 6.0%, from 6.4% in January

2023, the real yield may have been only negative -2.3% last month.

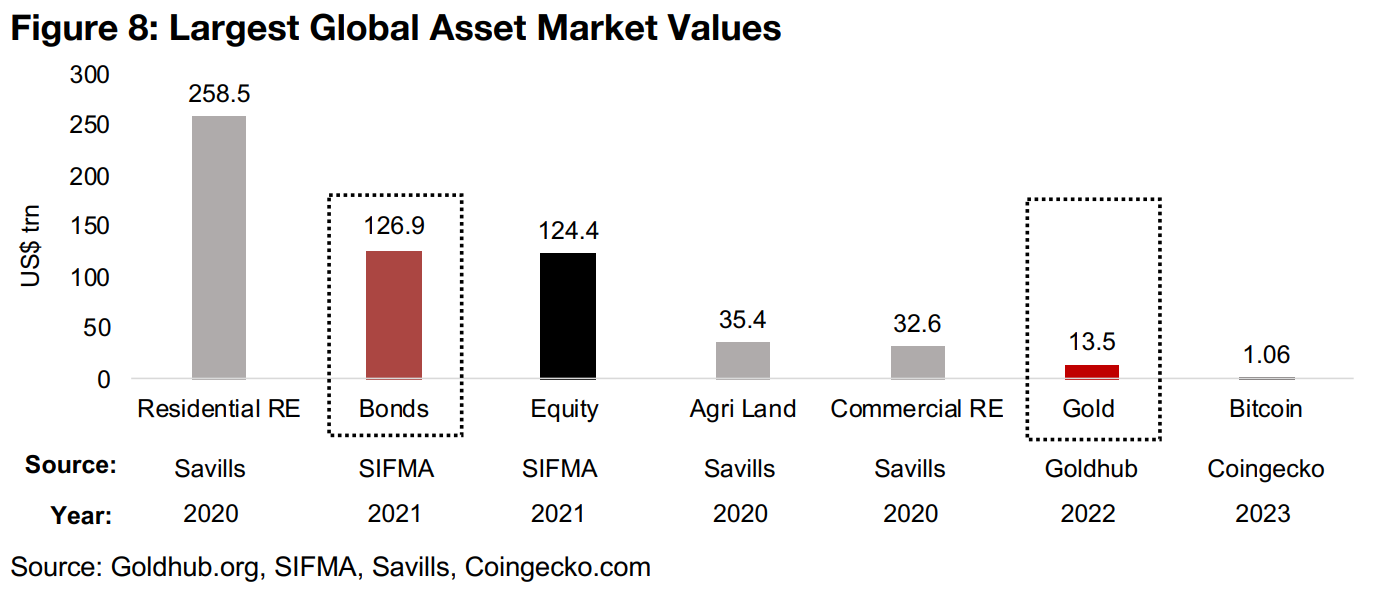

Gold market just a tenth the size of global bond market

This real yield is an important driver of gold because bonds are a key substitute for

investors looking for relatively safe liquid assets and as yields rise bonds become

more attractive versus yield-less gold. The global bond market at US$126.9trn is over

nine times the size of the US$13.5trn value of the global gold stock, and therefore

even a small shift in attractiveness of bonds can draw away a large percentage of the

potential fund flows into gold (Figure 8). While the global equity market, at

US$124.4bn, is a similar size to the bond market, it is less of a direct competitor for

gold flows as it is clearly a risky asset class and not considered a safe haven.

Even larger is the global residential market, at US$258.5trn, but this again is not a

good substitute for bonds or gold as it is very illiquid. Other real estate markets like

agricultural land or commercial real estate at US$35.3trn and US$32.6trn,

respectively, are not actually that large versus the gold market, at only about three

times its size. While cryptocurrency was considered a major competitor to gold

especially at its peak market cap of US$2.97trn in November 2021, it has declined to

just a third of this level, at 1.06 trn currently. While crypto is certainly very liquid, like

gold, the systemic breakdowns in 2022 exposed it as a very risky asset and not a

safe haven. We note the values in Figure 8 are not entirely comparable as they are for

different time periods, but are still useful in demonstrating the relative market sizes.

Rebound in the US$ in February 2023 after four-month decline

Gold has also seen pressure from a recent rebound in the US$, which tends to move

inversely with the metal, with the US$ Index rising off lows of 101.2 at the start of

February 2022 to 105.0 currently. This followed a decline through October 2022 to

January 2023 off a late September 2022 peak of 114.1, although through the first nine

months of 2022, gold battled a rising dollar, with the index starting the year at 95.7.

While this rise had been driven by US rate hikes outpacing the rest of the world, by

late 2022 other countries also fighting rising inflation started to catch up with US in

rate increases, drawing funds away from the US$.

This was combined with expectations that the Fed, having been ahead in the

tightening cycle, might also be first to shift to easing rates, with US inflation having

declined abruptly. However, in January 2023, the rapid rate of decline in inflation

eased, as economic data was released suggesting the US economy was not cooling

as much as previously expected. This led the market to reconsider the idea that the

Fed would be easing soon, and a caused a renewal of fund flows into the US$ versus

the rest of the world.

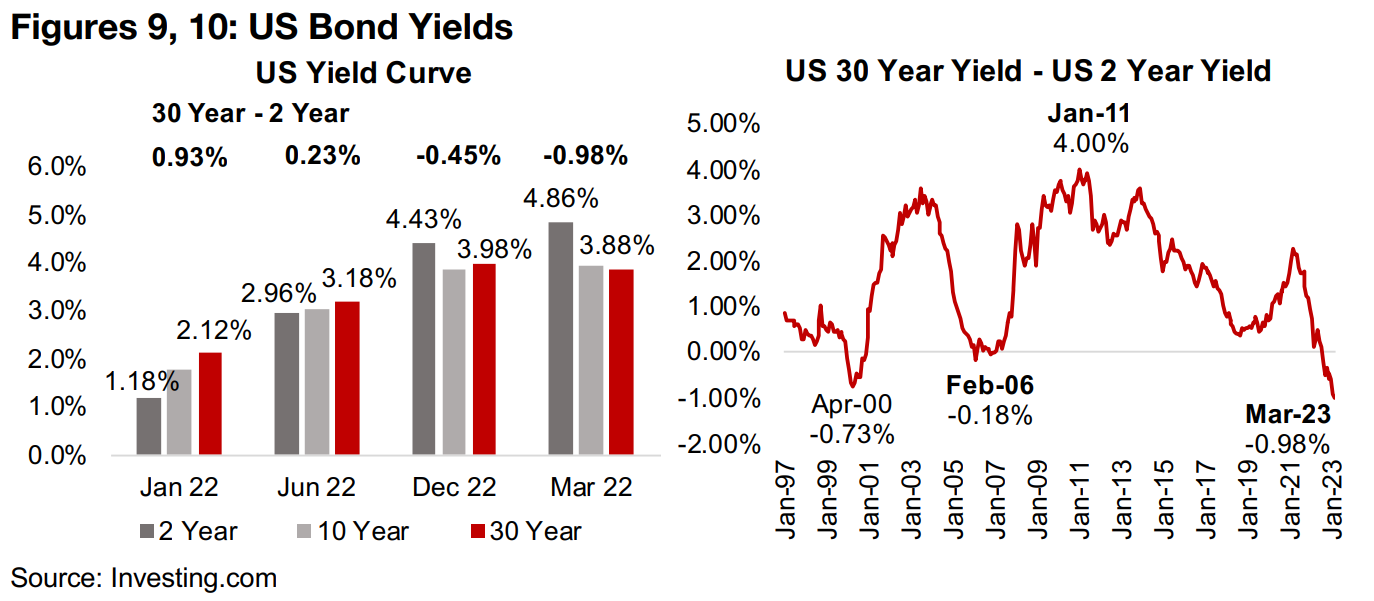

Yield curve most inverted in a quarter century

The continued aggressive Fed rate hikes have driven the market to increasing

expectations of a recession, as indicated by the US bond yield curve. This curve is

normally upward sloping, with longer maturities having higher yields to compensate

for higher risk over time. However, in certain periods the yield curve becomes

'inverted', with rates for lower maturities actually above higher maturities, and this

often historically precedes a recession. The yield curve was still upward sloping as of

the first half of 2022 (Figure 9), with the 30-year minus 2-year yield at 0.93% in

January 2022 and 0.23% in June 2022. However, it turned negative by December

2022, to -0.45%, and reached -0.98% as of March 2023.

This is the most inverted yield curve in over a quarter century, suggesting that the

odds of a recession currently are particularly high. Previous periods where the yield

curve had turned negative were just prior to the dot.com crash of 2000, and then

during the lead up to the global financial crisis in 2006-2007. That the current

inversion is worse than prior to these two cataclysmic events is concerning.

For gold, however, a recession is not necessarily a major negative. It could drive a return to very easy monetary policy, and a fall in real yields, which would be good for gold. This would also imply an expansion of the money supply, which tends to be an upward driver of the gold price. The shock of an economic downturn can also cause a flight to safety by investors, which would be supportive of gold. A global recession could also exacerbate already existing geopolitical tensions, which also tends to be a driver for gold.

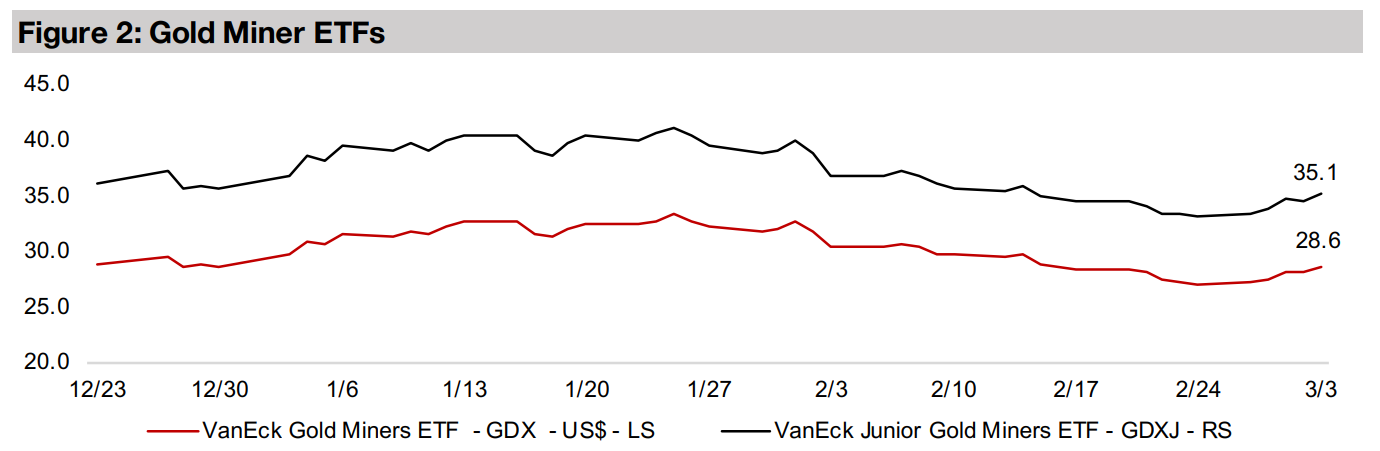

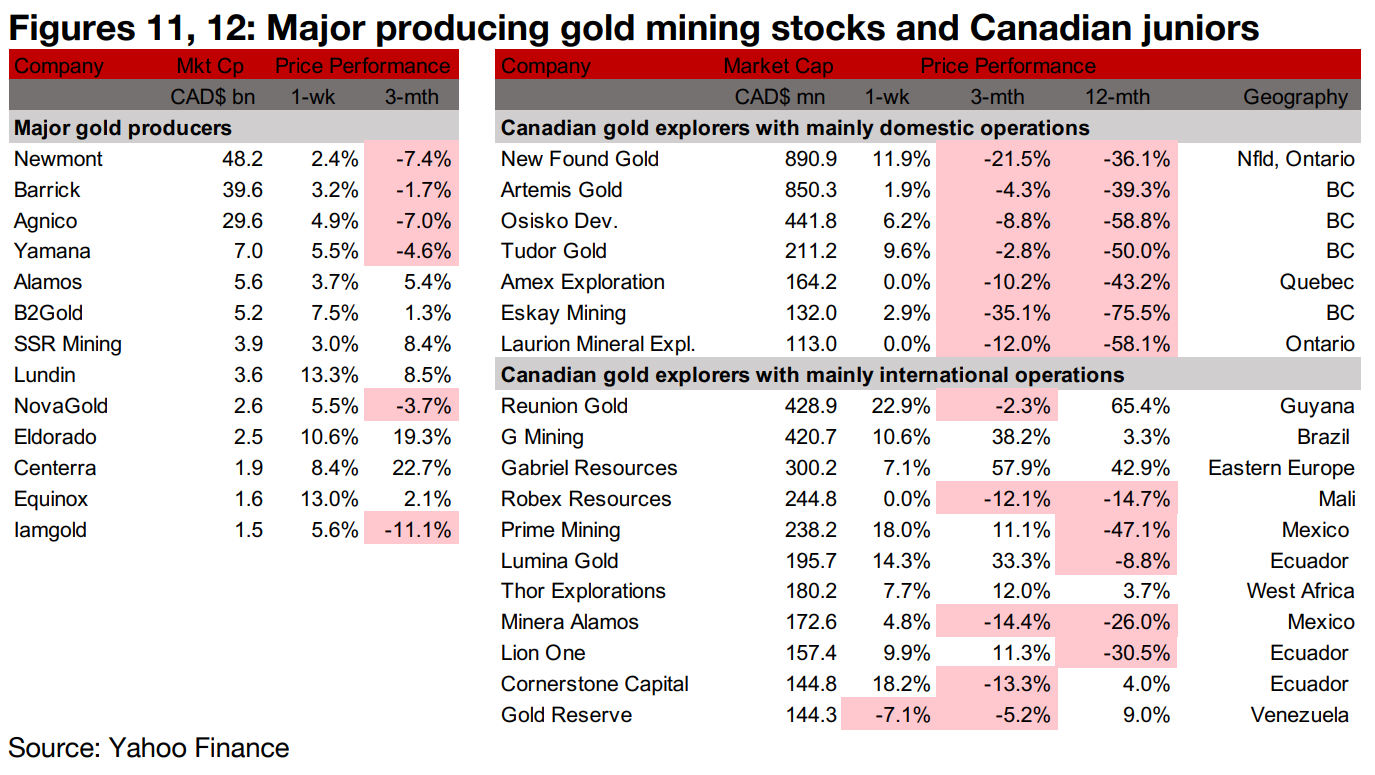

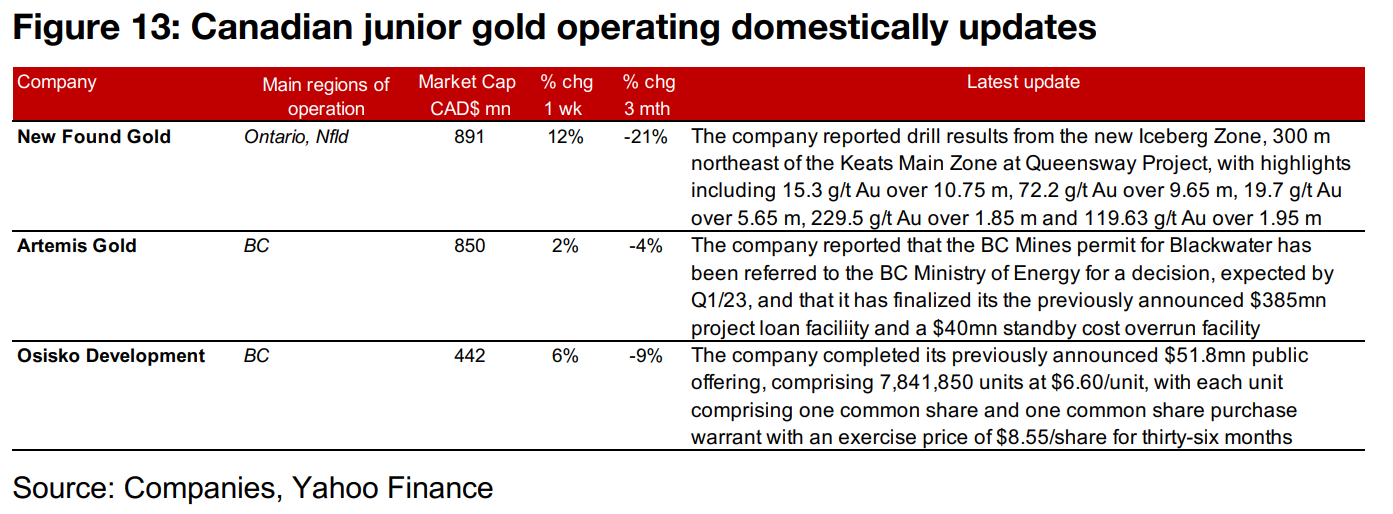

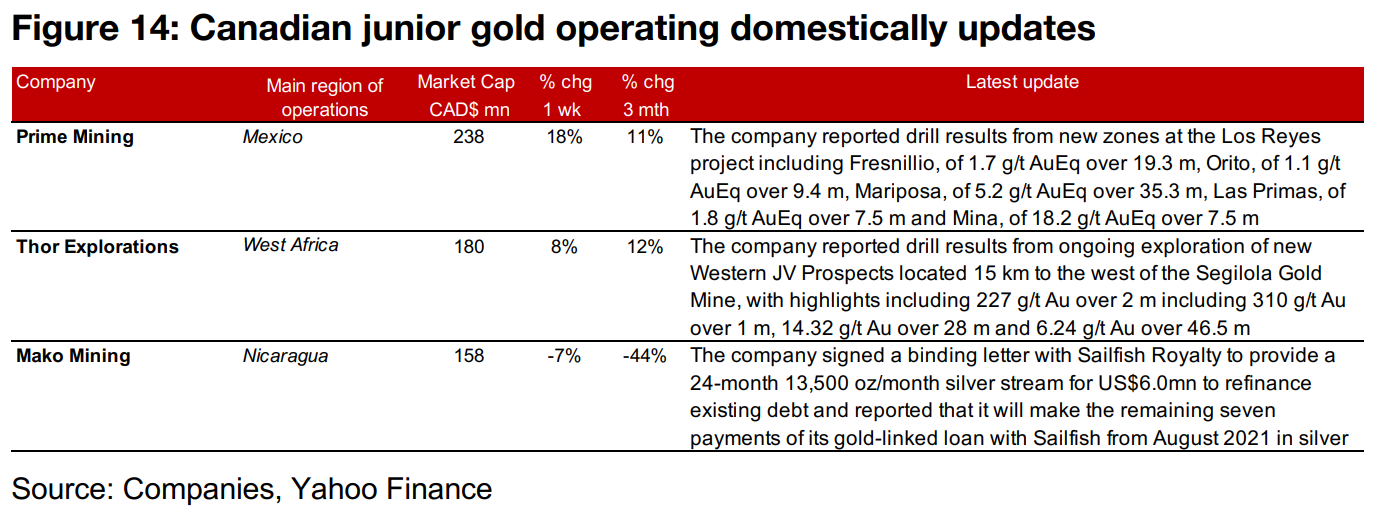

Gold producers and TSXV gold rebound

The producing gold and TSXV junior gold miners rebounded as gold and equity markets rose (Figures 11, 12). For the Canadian juniors operating mainly domestically, New Found Gold reported drill results from the new Iceberg Zone at Queensway, Artemis Gold reported that the BC Mines Permit for Blackwater has been referred to the BC Ministry of Energy for a decision, and finalized a $385mn project loan facility and a $40mn cost overrun facility and Osisko Development completed its $51.8mn public offering (Figure 13). For the Canadian juniors operating mainly internationally, Prime Mining reported drill results from new zones at Los Reyes, Thor released drill results from new Western JV Prospects west of its Segilola mine and Mako Mining signed an agreement for a silverstream with Sailfish Royalty and converted gold-linked loan payments to Sailfish to silver (Figure 14).

In Focus: Amaroq Minerals

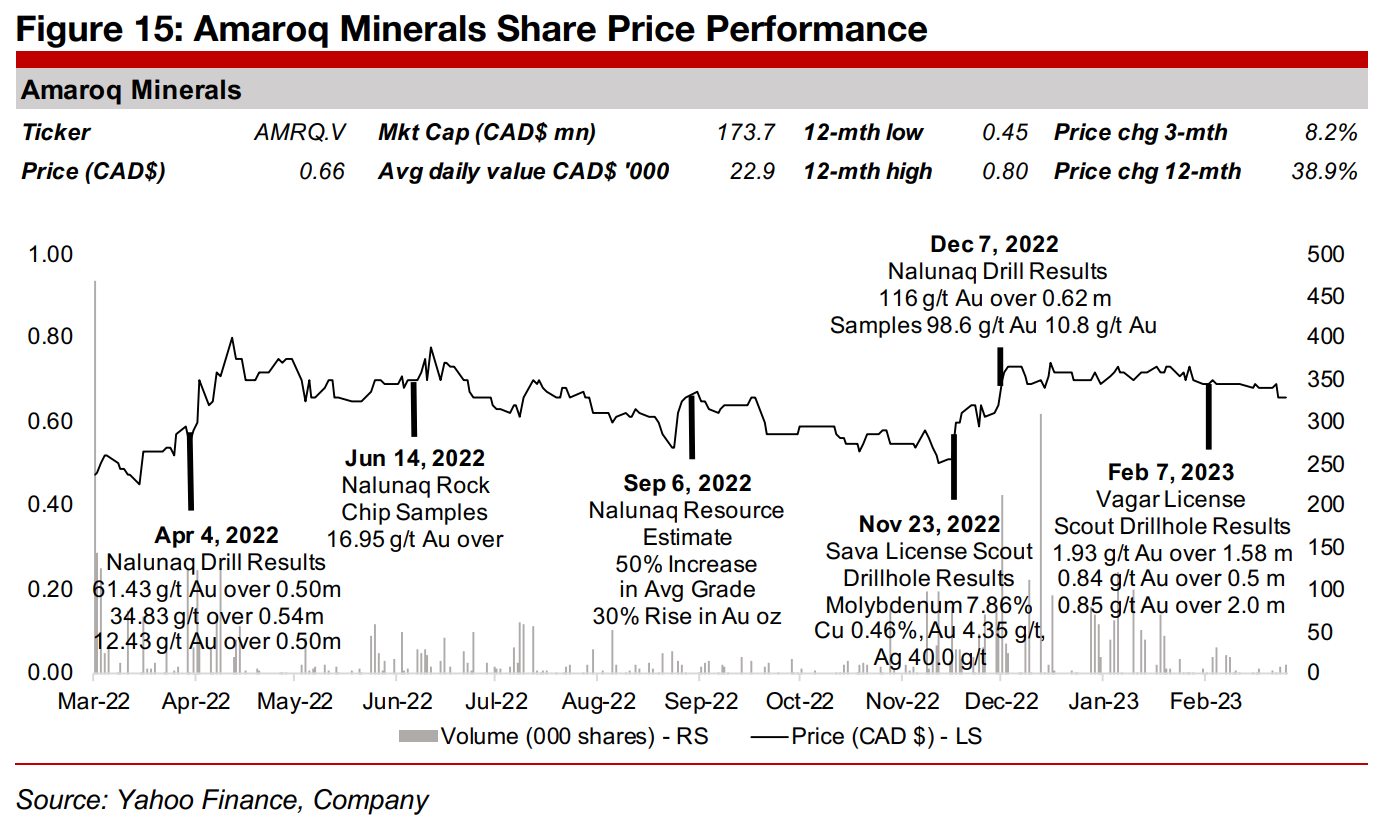

Greenland-focussed explorer Amaroq Minerals

This week Amaroq Minerals is In Focus, a Greenland explorer of gold, copper, zinc

and other minerals. The company's main project is Nalunaq, a past producing gold

mine, which has reached the mineral resource stage and is currently being advanced

towards a PEA which is targeted for 2023. While this project is expected to be the

first to produce cash flow for Amaroq, with construction targeted to start as early as

2024, it also has six other potential projects. Two are gold projects, 1) Vagar Ridge,

with highlights including a 2,533 g/t Au rock chip sample and 2) Nanoq, with an 0.8

m channel sample of 175 g/t Au and 3.83% Cu.

The remaining four project focus on other minerals; 1) grab samples at the Sava/North Sava target show 3.4% Cu and 3.7% Zn, 2) 4.8% TiO and 2,335 ppm V have been reported from the Stendalen target, 3) there were 90t Cu historically produced at the Kobberminebugt target, and 4) the company sees rare earth mineral potential at the Paatusoq target.

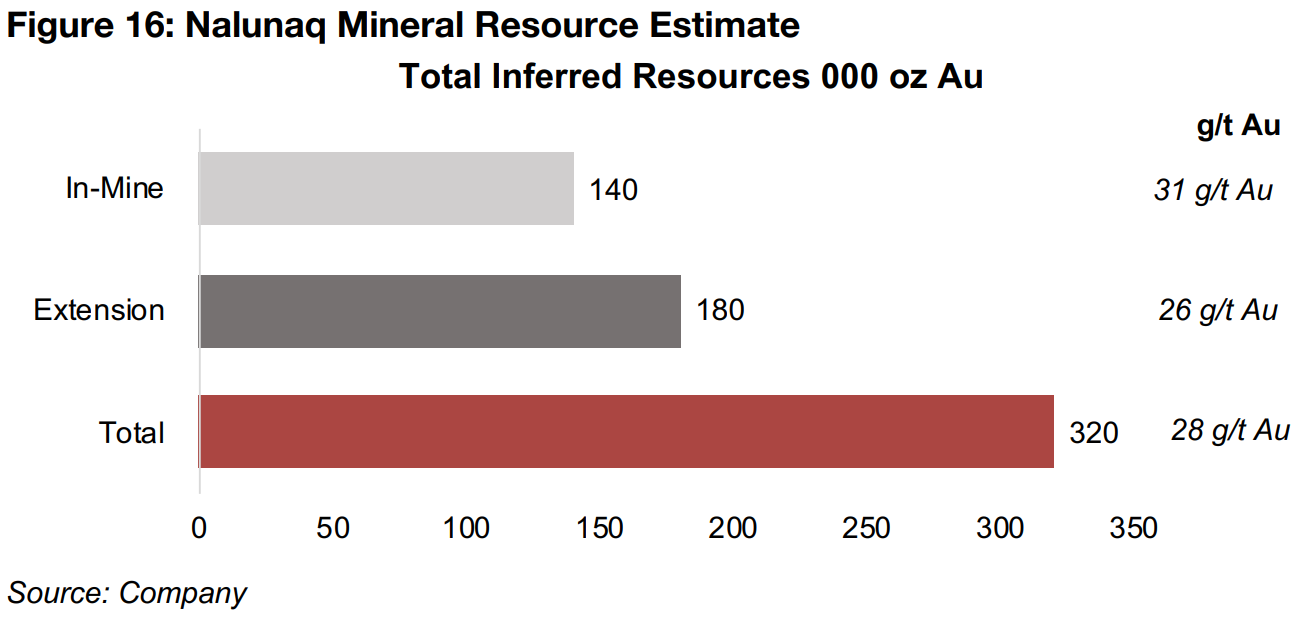

Updated Resource Estimate for Nalunaq released in September 2022

News flow through the middle of 2022 focussed on Nalunaq, including strong drill results released April 4, 2022, which boosted the share price considerably and rock chip samples released on June 14, 2022 (Figure 15). The company released an updated Resource Estimate for Nalunaq in September 2022, with Inferred In-Mine Resources of 140 k oz Au at 31 g/t Au, and Extension Resources of 180k oz Au at 26 g/t Au for a total 320k oz Au at 28 g/t Au (Figure 16). While this marked a 30% increase in the total Resources and 50% increase in the grade, the share price gains on the news were given up over the next two months.

Recent news updates on new molybdenum and gold exploration targets

Recent news has focussed on exploration at two of the new targets, with scout drillhole results released in November 2022 from the Sava Licence returning strong molybdenum and copper results driving a strong increase in the share price. High grade gold results were reported from the Vagar license in February 2022, but there was no upside to the share price on the news. Further catalysts for the share price this year would be the release of a PEA for Nalunaq, and successful further exploration at the other six targets.

Disclaimer: This report is for informational use only and should not be used an alternative to the financial and legal advice of a qualified professional in business planning and investment. We do not represent that forecasts in this report will lead to a specific outcome or result, and are not liable in the event of any business action taken in whole or in part as a result of the contents of this report.