January 12, 2024

Defence Metals Becomes Part of North American Rare Earth Element Supply Chain

Defense Metals (TSX-V:DEFN, OTCQB:DFMTF, FSE:35D) has made a major announcement.

On January 9, 2024, it said that it had signed a Memorandum of Understanding with Ucore Rare Metals, a Canada-based company that developed a patent-pending processing technology for rare earth elements (or REEs).

SGS Canada will ship a sample sourced from its Wicheeda project in British Columbia to Ucore’s facility in Ontario for testing.

The goal is to understand how well Ucore’s RapidSX technology can process and refine the REE feedstock from Wicheeda.

What does it mean?

Establishing Itself as a Critical Player in the Rare Earth Industry

Defense’s Wicheeda project is one of the most promising REE assets in North America.

It has access to infrastructure, including roads and electricity. Located near Prince George, BC, it has access to the local port facilities as well.

This puts Wicheeda in a prime position to take advantage of the “near-shoring” trend that has been taking place in North America.

As part of this trend, both the United States and Canada aim at building and expanding the mining and processing of critical minerals domestically.

Right now, China controls the vast majority of the global REE processing capacity.

This isn’t ideal from the national security standpoint.

To address this issue, the United States Department of Defense launched a program which includes direct investment in processing located in “friendly” nations, including Canada.

Ucore’s RapidSX demonstration plant directly benefitted from the U.S. Department of Defense. The U.S. government invested $4 million in the facility, and the Canadian government awarded the company C$4.2 million to develop RapidSX.

But it needs REE feedstock, and Defense’s Wicheeda project can potentially provide it with high-quality material.

Wicheeda Has Been Advancing Toward an Economic Study

Right now, Wicheeda is a development-stage project that is fundamentally strong, according to research from Agentis Capital, and endowed with easy access to infrastructure.

Defense Metals has been advancing the project toward a pre-feasibility study stage. (As a reminder, a prefeasibility study is a detailed economic assessment of the project’s production and revenue potential.)

Just recently, Defense announced that it completed all necessary geotechnical fieldwork in support of the pre-feasibility study.

Defense says that it expects the study to become available in the second quarter of this year.

This, in our opinion, could potentially be a significant catalyst for the company.

Once the prefeasibility study is completed, the market will have a better understanding of how valuable this advanced-stage project is.

Ahead of the release of its pre-feasibility study, Defense also updated the project’s resource estimate.

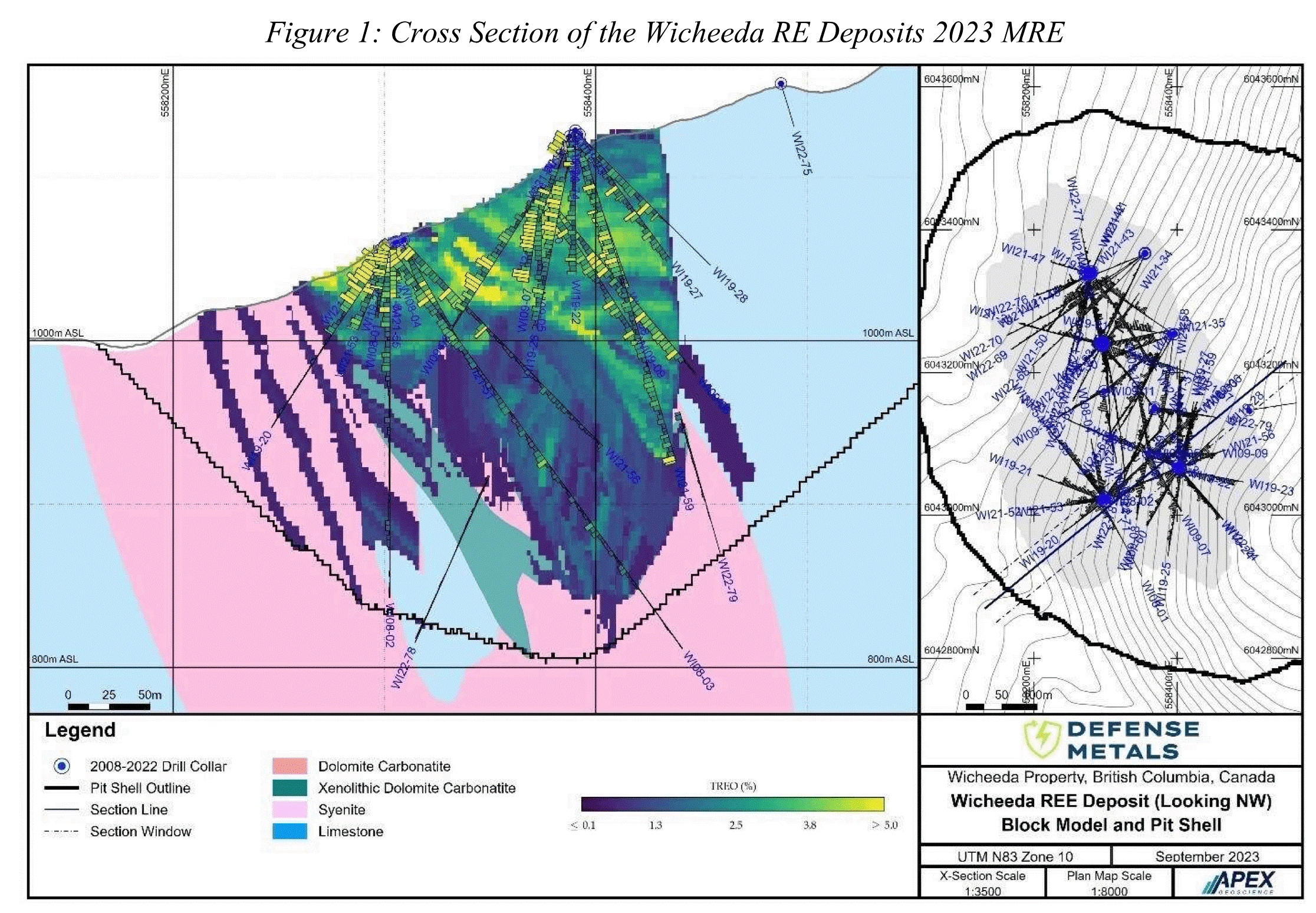

The most recent NI43-101 mineral resource estimate points at 6.4 million tonnes of Measured mineral resources at the grade of 2.86% total rare earth oxide (TREO); 27.8 million tonnes of Indicated mineral resources at an average grade of 1.84% TREO; and 11.1 million tonnes of Inferred mineral resources at an average grade of 1.02% TREO.

The model that the company released along with this estimate shows that some of the most high-grade material is found close to the surface of the potential open pit:

The green areas close to or at the surface are the highest-grade areas. This could potentially help the project’s economics because the material located closer to the surface is generally cheaper to mine.

(Please read the NI43-101 report and the accompanying press release for details and technical disclosures and stay tuned for the PFS.)

What Does All This Mean for Defense?

Defense Metals is one of the strongest players in a nascent and powerful megatrend.

The U.S. and Canada are building out a domestic REE supply chain, of which Defense could become an integral part.

Its 100%-owned project, Wicheeda, is technically strong and strategically located close to roads, electricity, and shipping infrastructure.

The company has just signed a memorandum of understanding with a partner whose demonstration plant facility was financed directly by the U.S. Department of Defense and the Canadian government.

You should take notice and read more into this company. This is a company that is plugged into both the clean energy and the critical minerals megatrend. The capital that the U.S. and Canadian governments dedicate to it is typically non-dilutive.

As a potential leader in one of the most important megatrends, Defense Metals (TSX-V:DEFN, OTCQB:DFMTF, FSE:35D) should be on your watchlist.

SEE DISCLAIMER & DISCLOSURE BELOW

Sign up to receive our future articles and updates.

Disclosure / Paid Services

The Canadian Mining Report has been retained by Defense Metals Corp. to provide various digital marketing and advertising services. We have been paid to provide editorial and marketing services to profile the company and its project. The preceding Article is PAID FOR CONTENT sponsored by Defense Metals Corp. and produced in cooperation with CanadianMiningReport.com. The publisher of CanadianMiningReport.com owns securities positions in Defense Metals and may trade on their own behalf at any time without prior notice, however, it is our general policy to not sell any shares while we are currently engaged with a client.

The Canadian Mining Report's business model includes receiving financial compensation to carry out various services for companies which may include advertising, marketing and dissemination of publicly available information. This compensation is a major conflict of interest in our ability to be unbiased.

Disclaimer

The material in this article should not under any circumstances be construed as an offering, recommendation, or a solicitation of an offer to buy or sell the securities mentioned or discussed, and is to be used for informational purposes only. Neither Canadian Mining Report (the "Publisher", "we", "us", or "our"), nor any of its principals, directors, officers, employees, or consultants ("Publisher Personnel"), are registered investment advisers or broker-dealers with any agencies in any jurisdictions. Canadian Mining Report ("Canadian Mining Report", "Us", "Our" and/or "We") is a Canadian based media company that typically works with publicly traded companies and provides digital marketing strategies and services.

At most, this communication should serve only as a starting point to do your own research and consult with a licensed professional regarding the companies profiled and discussed. Conduct your own research. We do not provide personalized or individualized investment advice or advice that is tailored to the needs of any particular recipient. Read More