April 07, 2025

Crash Resistant Gold

Author - Ben McGregor

Gold price holds up in market crash

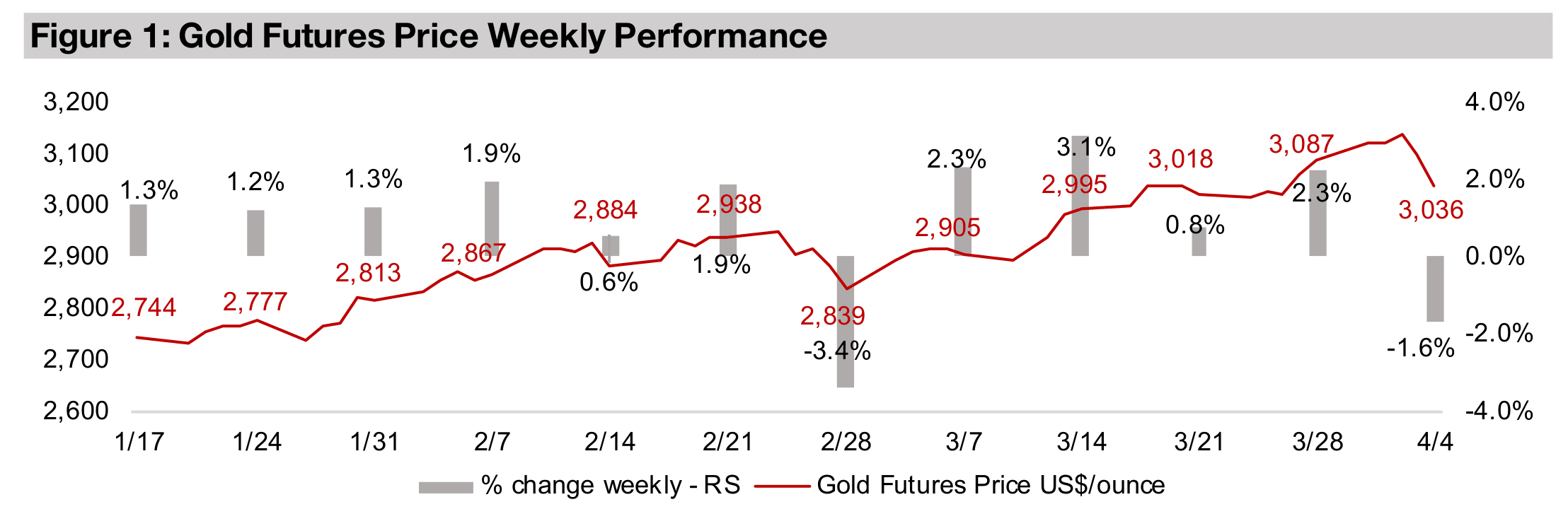

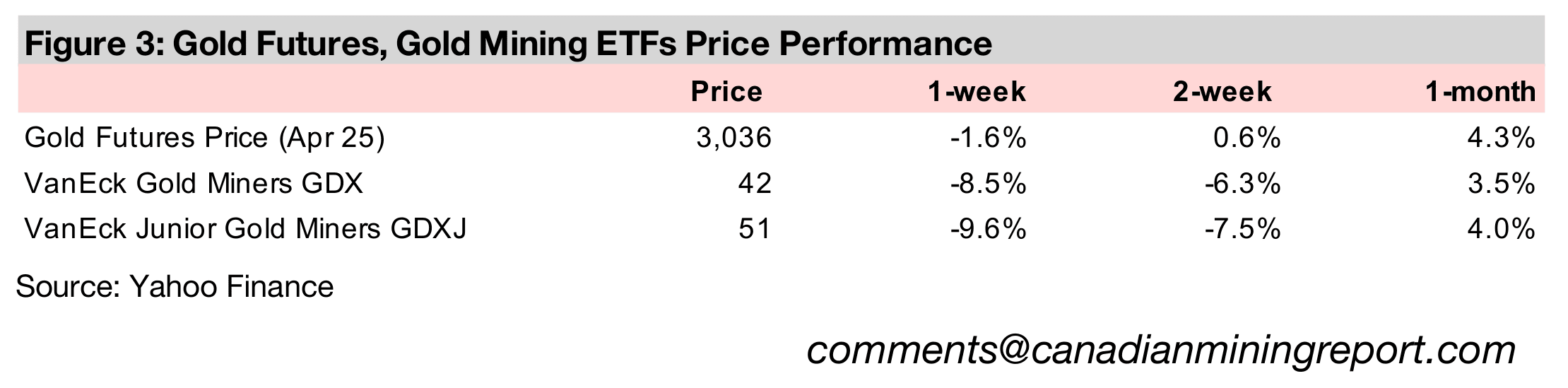

The gold price declined just -1.6% to US$3,036/oz, an outstanding performance in a week where many metals and several major equity indices crashed by over -5.0% as the latest US tariffs and the global reaction to them sent markets into a freefall.

Crash Resistant Gold

Gold declined -1.6% to US$3,036/oz, which was an exceptional outperformance

given the violent market crash which saw slumps of over -5.0% for many major metals

and most major markets. The S&P was off -8.2%, driven especially by a decline in

tech, the Nasdaq down -8.5%, and there was a similar drop in small caps, with the

Russell 2000 down -8.6%, on a severe risk off move by markets. This was driven

mainly by the unveiling of another round of major US tariffs and a strong retaliatory

response globally, including a major increase in tariffs by China.

Icon and logotype combination

While the crash seems sudden it was really just part of a broader shift towards risk

aversion ongoing for some time put into significant overdrive. Markets had paused

by March 21, 2025 and started to weaken, and there were signs of increasing hedging

as early as mid-2024 which increased towards the year’s end, indicating any bull

market was losing steam. While the peak for the S&P 500 came on February 15, 2025,

the tops for the Nasdaq and Russell 2000 were much earlier on December 16, 2024

and November 29, 2024. While the ‘Big Bang’ this week likely heralded the official

start of an extended bear market, there had been a long buildup of caution before

tech-mageddon and tariff-mageddon catalyzed the collapse.

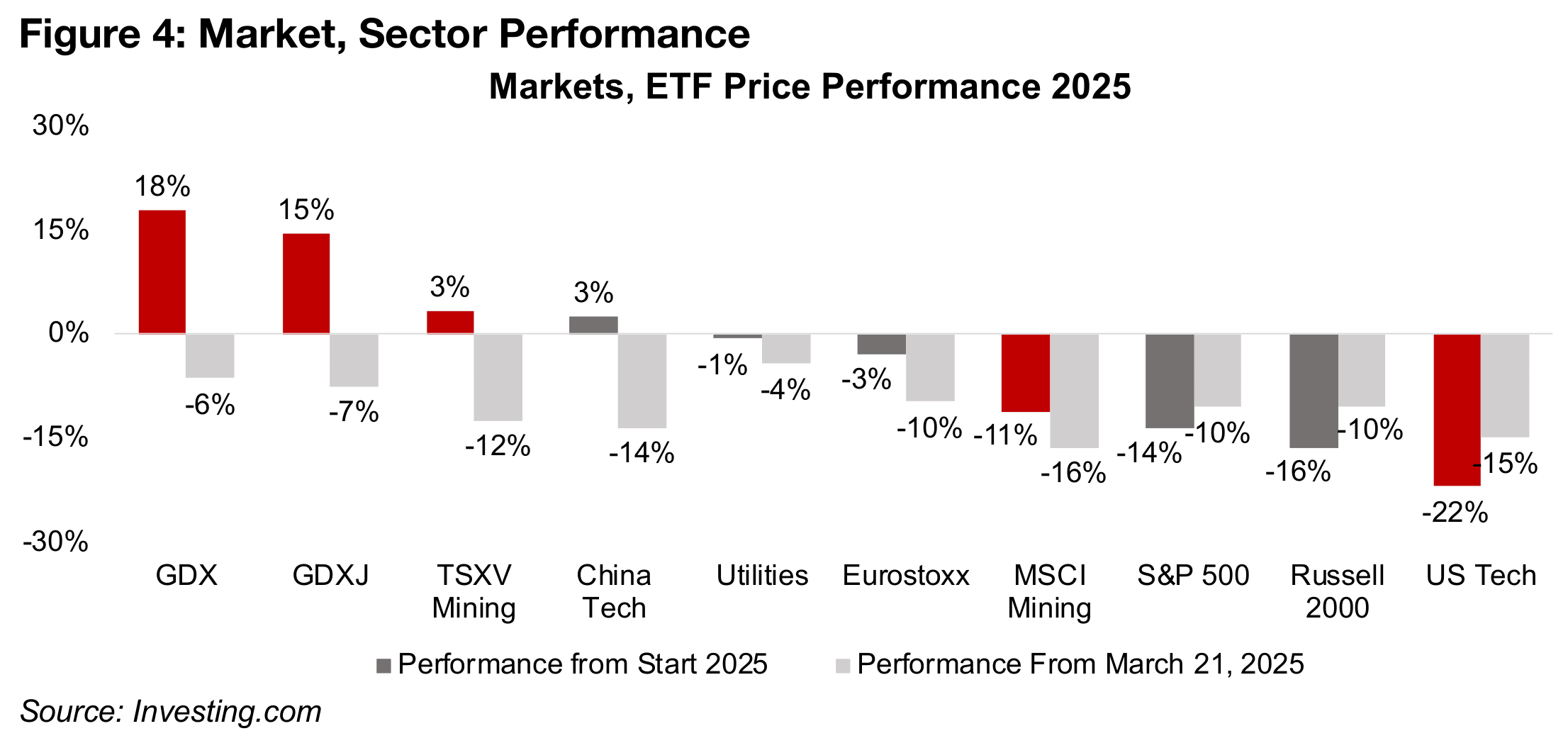

A slump in tech was a main driver of the decline, especially given what a large

proportion of global markets it had become, with the sector in the US down -22%

YTD and -15% since March 21, 2025 (Figure 4). China tech reversed most of its big

gains this year from the announcement of advances in AI, losing -14% this week, and

is up just 3% YTD. Europe has outperformed in 2025, down just -3% after the -10%

slide since March 21, 2025, versus -10% drops in the S&P 500 and the Russell 2000

over the past two weeks, and losses of -14% and -16% YTD, respectively, with the

latter lower given the higher risk of small caps.

Gold stocks hold up for first day of crash before cratering

For the broader mining indices, while TSXV Mining slumped -12% this week, it

remains up 3% for the year, beating most major global markets, supported by its

heavy weighting to gold stocks, offset somewhat by a high proportion of copper and

lithium stocks which will have been a drag on the performance. It far outperformed

the MSCI Metals and Mining, which is heavily geared to iron ore, which was already

weak YTD, and copper and aluminum, which saw major reversals this week.

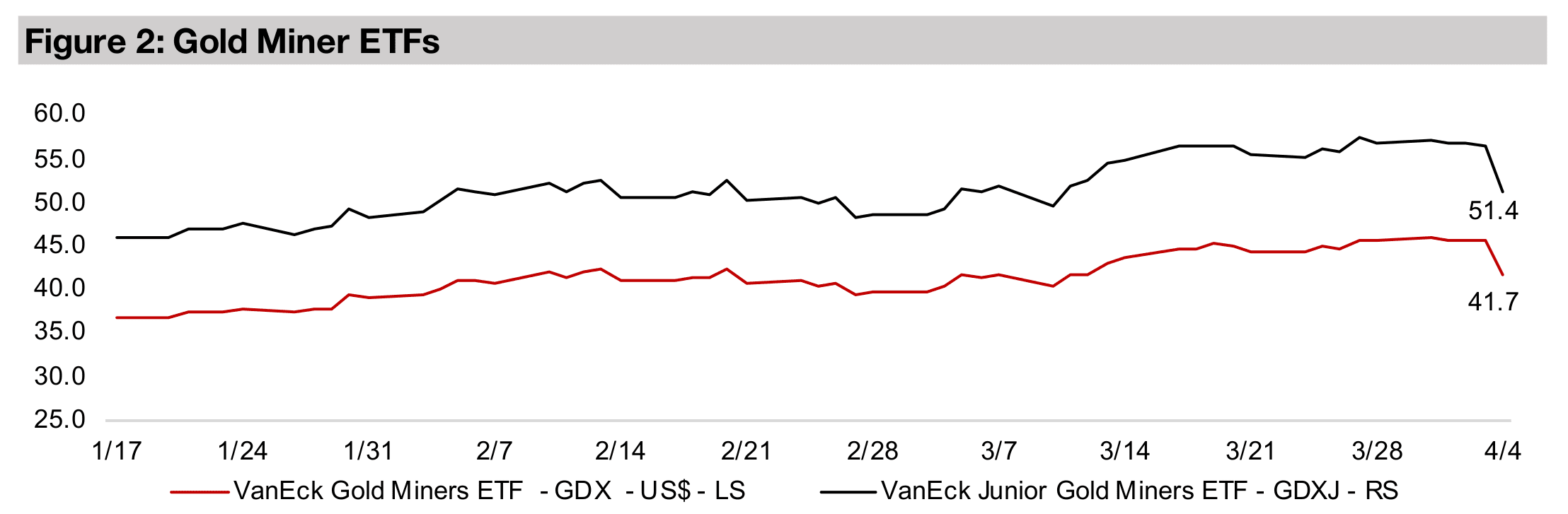

While gold stocks took a major hit, with the GDX down -8.4% and -9.6%, they

interestingly held up flat for the first day of the crash, with the GDX barely moving

even as gold edged down 1% (Figure 5). The GDX and GDXJ are also only down -6%

and -7%, respectively, since March 21, 2025, as they had continued up on the rising

gold price in the two weeks before the crash even as other assets had started to falter.

Both the GDX and GDXJ are still far outperforming major markets and sectors, up 18%

and 15% YTD. However, these robust gains may have worked against them, causing

the drop on the second day of the crash. This is when panic really took hold and may

have driven a sell off even of safe-haven assets, especially those with large gains, to

lock in profits and potentially cover leveraged losses in other assets.

Gold still far outperforming other metals this year

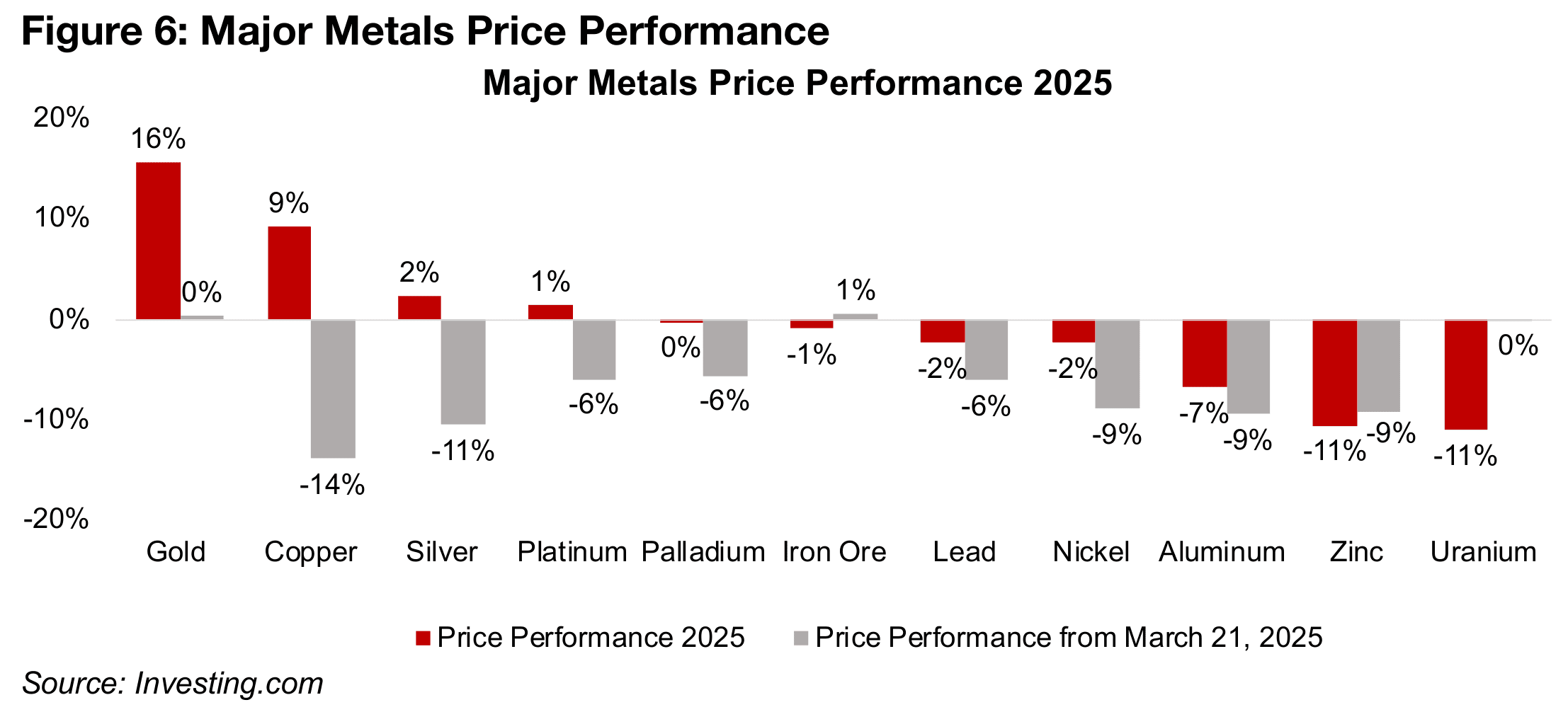

Gold has been by far the strongest performing metal this year, with its move this week not outside of typical volatility, and the metal flat since March 21, 2025 and up 16% YTD (Figure 6). The big question now is which force dominates, the pressure upward from a move into safe haven assets, or downward from forced selling of strong gainers to cover losses in other assets. While the latter is a possibility, and caused a drop at the start of the global financial crisis of 2008-2009 and health crisis in 2020, we still see the probability weighted towards gold continuing to be crash resistant.

Copper took the biggest hit of the major metals by far, down -14% since March 21,

2025. This ended a run where it had just moved ahead of its previous May 2024 highs,

before slumping back down to near the average of the past year, although it is still up

9% for the year. Silver and nickel also saw big declines, down -11% and -9%, and

platinum, palladium and lead, more moderate ones, all down -6%, although all of

these metals are still near flat year to date.

Iron ore was an interesting standout, up 1% during the crash and down just -1% YTD,

seemingly because its slump had been so extended and severe over the past year as

to have already incorporated what the market suddenly priced into other metals this

week. The metal especially reflects growth prospects in China, which the market is

apparently viewing as quite neutral given the lack of major moves this year.

Aluminum and zinc both declined -9% and have seen major falls this year of -7% and

-11%, respectively, and while uranium is also down -11% YTD, it has held flat since

in the crash. The declines in copper and aluminum, which are two of the largest

metals markets and proxies for overall economic demand, seem to indicate that the

market is pricing in a decline in global demand from the tariff war.

Current bear market more ‘standard’ than three previous major declines

The current bear market has been quite a ‘standard’ textbook crash, with a gradual

move away from risk over time, including a shift into more defensive sectors and

move out of highly cyclical ones. The riskiest group of companies, the small caps,

where the first to peak and start to decline, followed by the tech sector, which is only

moderately cyclical but also had very high valuations versus other sectors. Broad

moves towards risk aversion had been occurring as early as mid-2024, where safe

havens had temporarily overtaken tech, but it had repeatedly regained the upper hand

before its final capitulation in H2/24.

The selling over the past two weeks has now shifted to encompass most of the

market, including well established lower risk blue chips, with only a few very defensive

sectors actually seeing gains, which is typical in a major bear market. So the shock

this week has actually just been an exacerbation of an already ongoing move out of

risk which had been developing for quite some time.

This slump is very different especially from the three previous crises, which were quite

‘non-standard’, the dotcom bust in 2000, the GFC in 2008-2009 and the global health

crisis in 2020. While the current decline has quite a clear trigger in the form of new

tariffs, the previous declines were more of a shock to markets. There had also been

the negative driver of a disproportionately large tech sector with elevated valuations,

which was well known to markets, and bound to eventually reverse.

The GFC was almost entirely precipitated by a wildly overvalued and overleveraged

US housing sector, especially in the subprime segment, the fallout from which spilled

out to the global economy. Interestingly in the current crisis the valuations of the real

estate ETFs are quite muted versus other sectors. The causes of the decline during

the global health crisis was obviously completely apart from any standard economic

crisis. This allowed for a huge policy response and abrupt market rebound, driven by

a surge in tech sector given a global population largely stuck inside, and to some

degree set up the elevated valuations that are part of the current problem.

While the dotcom bust has parallels with the current crash, a major difference is that

the companies now driving tech are well established with strong earnings. In the

dotcom bust, many companies had zero value, with flimsy business models and no

revenue. This could see the current tech slump have more of a floor under it than the

dotcom bust, as megacap tech may be overvalued, but is certainly not valueless.

Crash driven by tech and highly cyclical sectors

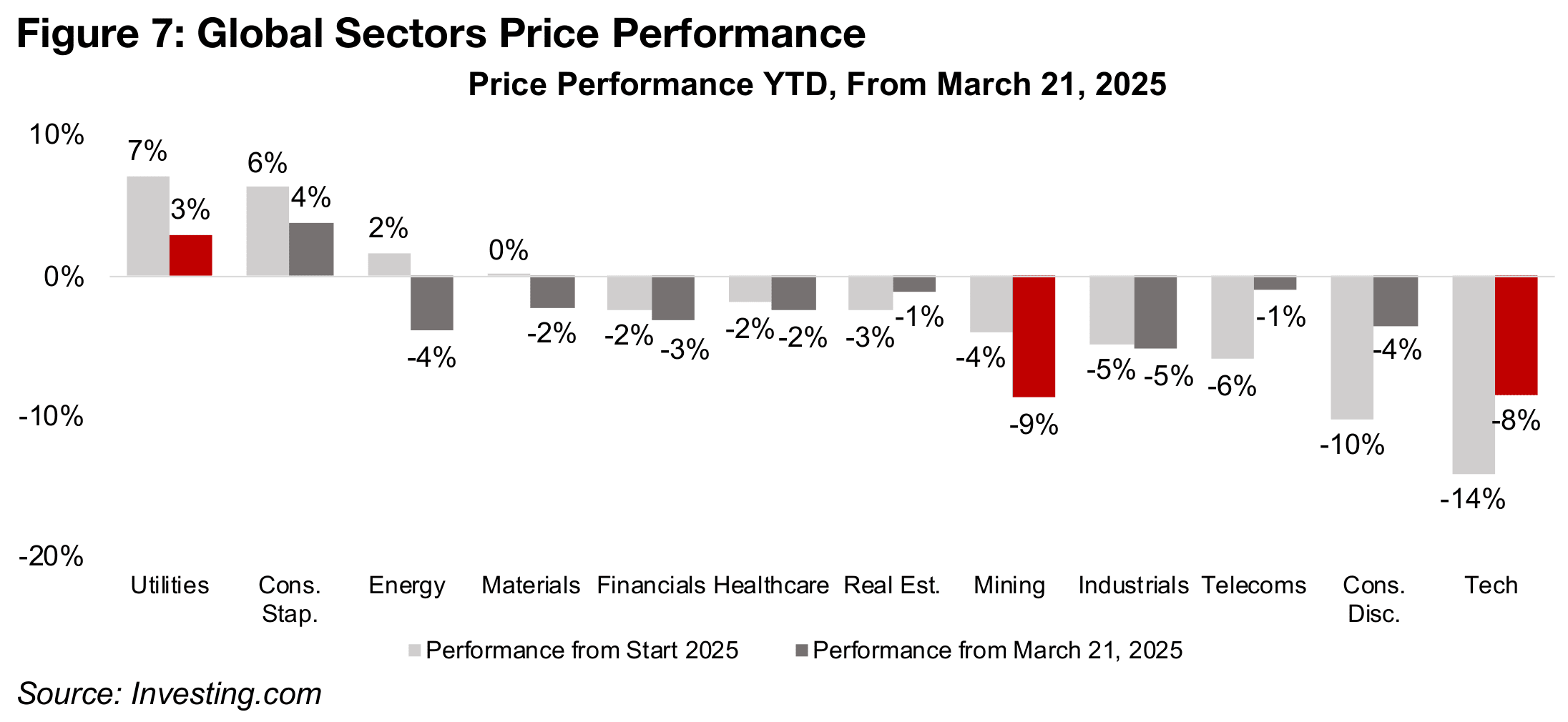

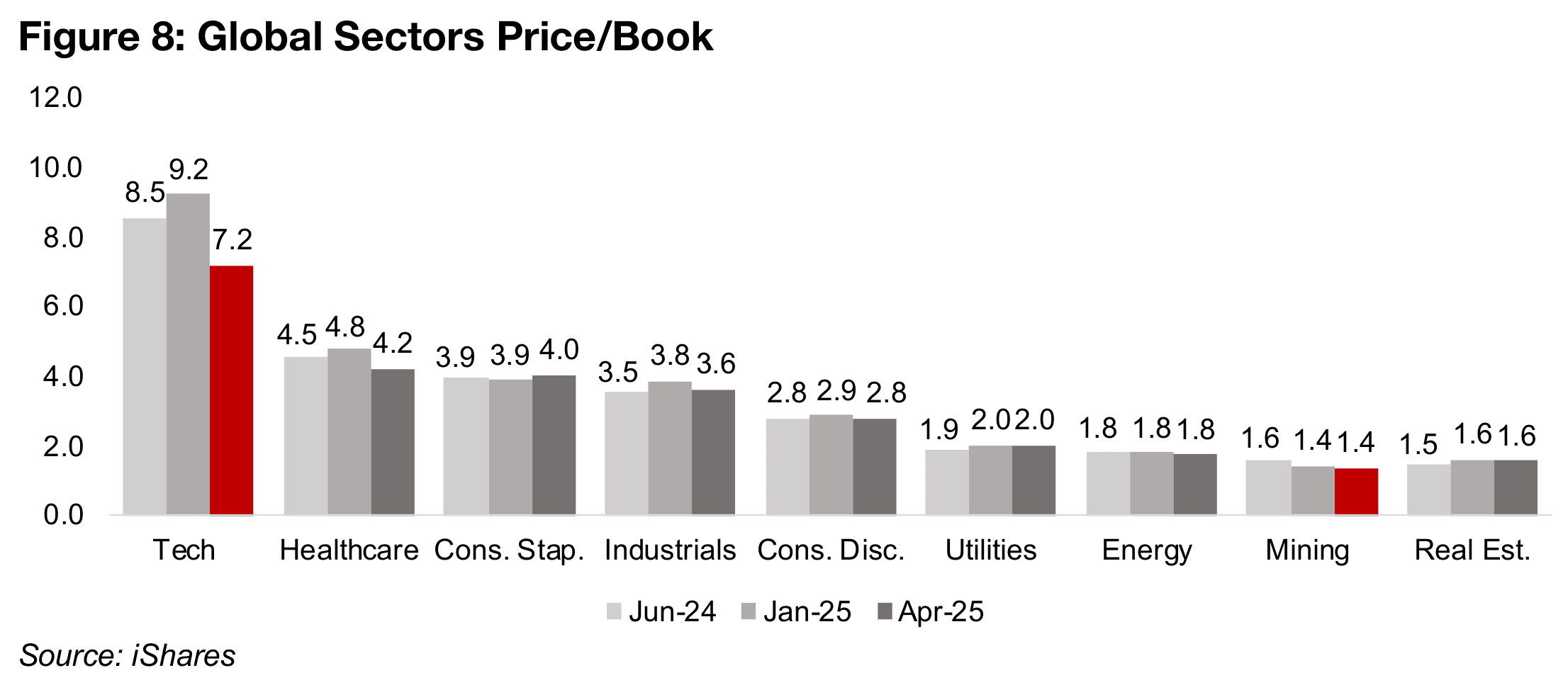

Global tech has been the major driver of the crash, collapsing -14% since March 21,

2025, and down -8% year to date (Figure 7). It is the only sector where there has been

a severe drop in valuations, to a price to book (P/B) of 7.2x, from 9.2x at the start of

2025 (Figure 8). While the sector’s elevated multiples versus other sectors are partly

supported by higher earnings growth, if a recession develops and tech earnings start

to miss still relatively high market expectations, there seems to be room for the

multiple to converge towards the rest of the market.

Two other highly cyclical sectors also saw a major pullback, consumer discretionary

and industrials, down -10% and -5%, respectively, over the past two weeks. However,

their P/B multiples are much more moderate than tech and have only ticked down in

the crash. While telecoms is usually considered a defensive sector, it fell -6% in the

crash, although it has held up YTD with only a -1% decline.

The highly defensive sectors have strongly outperformed, as would be expected in a

standard bear market, with utilities up 7% since March 21, 2025, and 3% YTD, and

consumer staples up 6% and 4% over the same two periods. Financials, healthcare

and real estate all have had only slight declines in the crash and year to date, and the

cyclical energy sector is actually up over the past two weeks, although down for 2025.

While the materials sector is cyclical, it has been flat in the crash and down just -2%

YTD, but its global mining subsector dropped 4% over the past two weeks and has

had the weakest performance of the major sectors YTD, down -9%. This is because

it has a high weighting of companies with a large proportion of earnings from copper

and aluminum, which plunged in the crash, and iron ore, which has been flat, and a

lower weighting to the gold stocks.

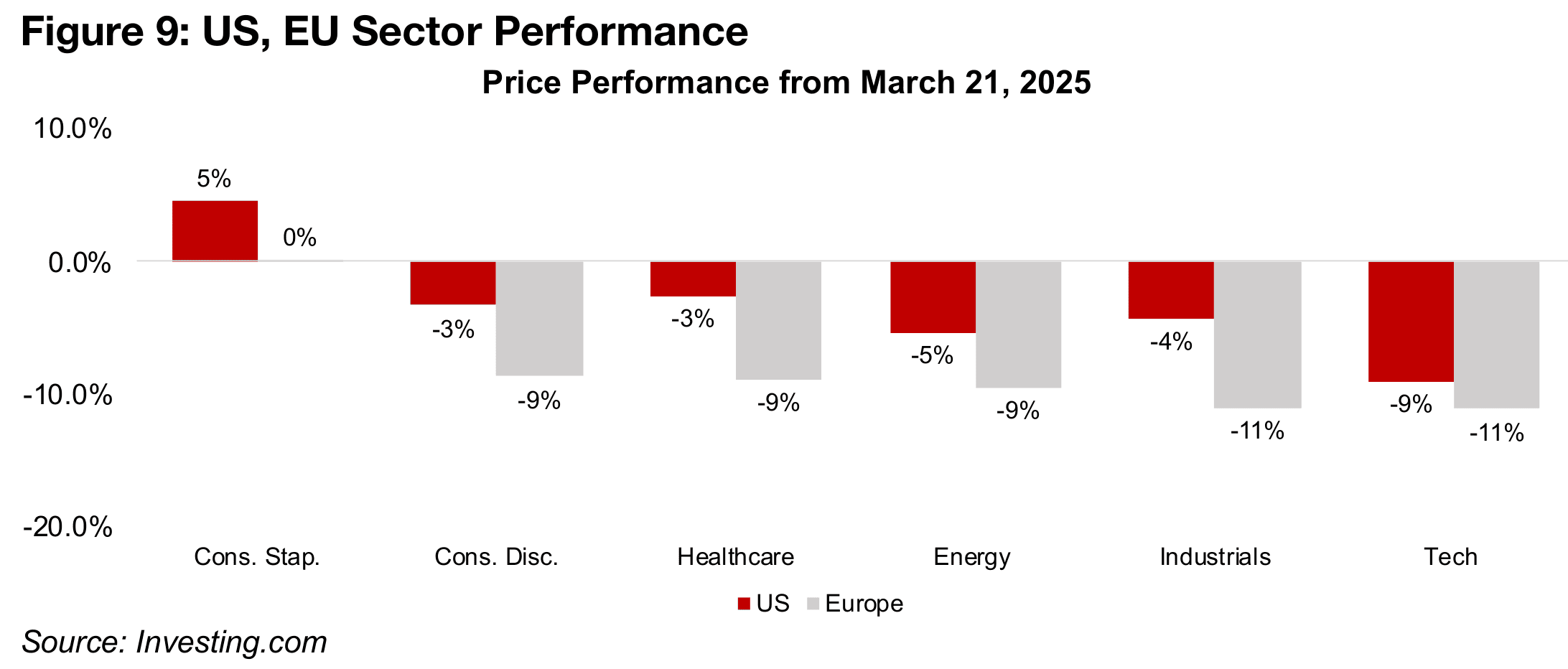

Sector ETFs in the US and EU show how the crash has been similar between the two

regions. There has been an outperformance of the defensive consumer staples sector

for both regions, up in the US 5% since March 21, 2025, and flat in the EU (Figure 9).

The tech sector has had the worst performance by far for both, down -9.0% for the

US and -11% for the EU, followed by other heavily cyclical sectors, the industrials,

down -4 and 11%, and energy, down -5% and 9%.

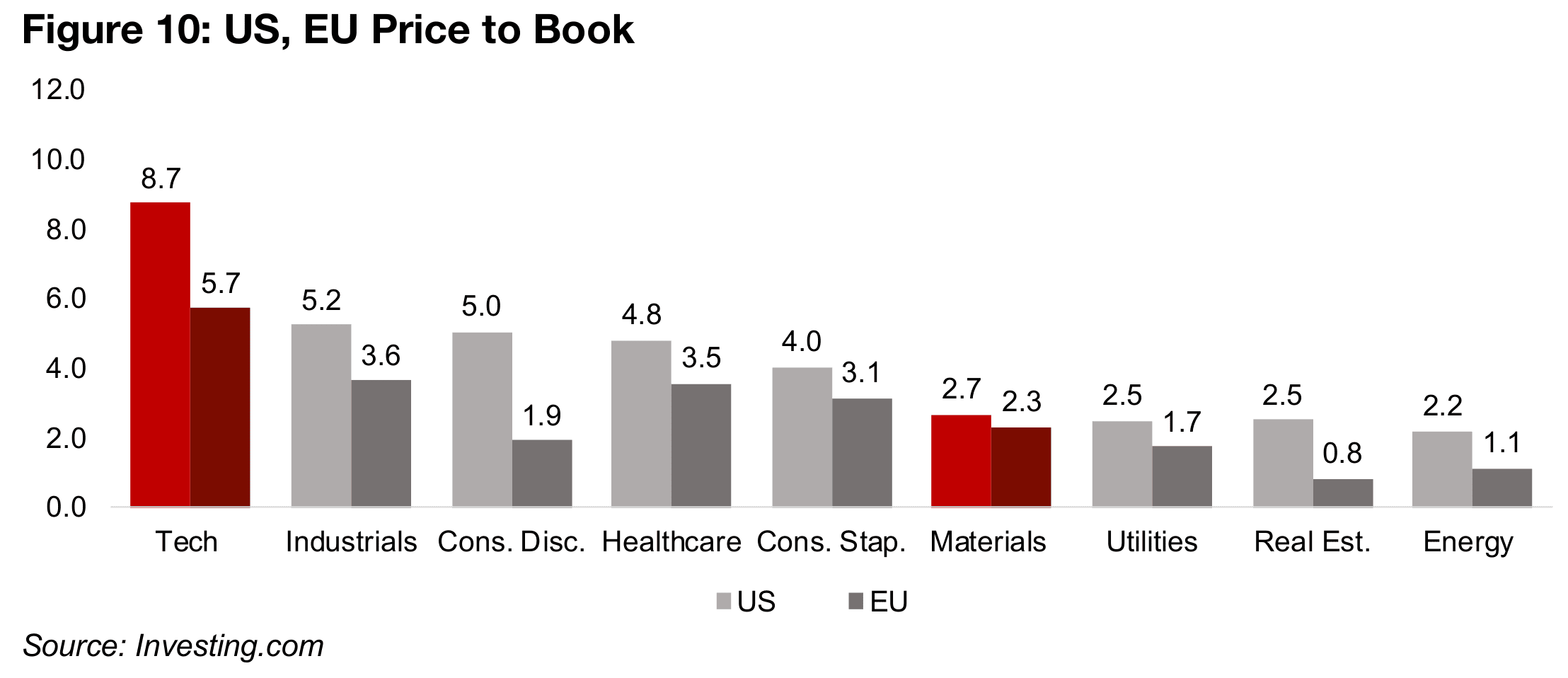

Tech valuations in both the US and the EU remain far higher than other sectors and

a continued convergence towards the rest of the market could drive further market

decline, with the gap historically not this wide, and only becoming severe in the past

five years (Figure 10). The high industrial sector multiples are also a concern as if

markets continue to shift out of more cyclical sectors, it could further pull down

markets beyond just tech. While multiples for consumer discretionary, another highly

cyclical sector, are elevated in the US, they are more muted in Europe.

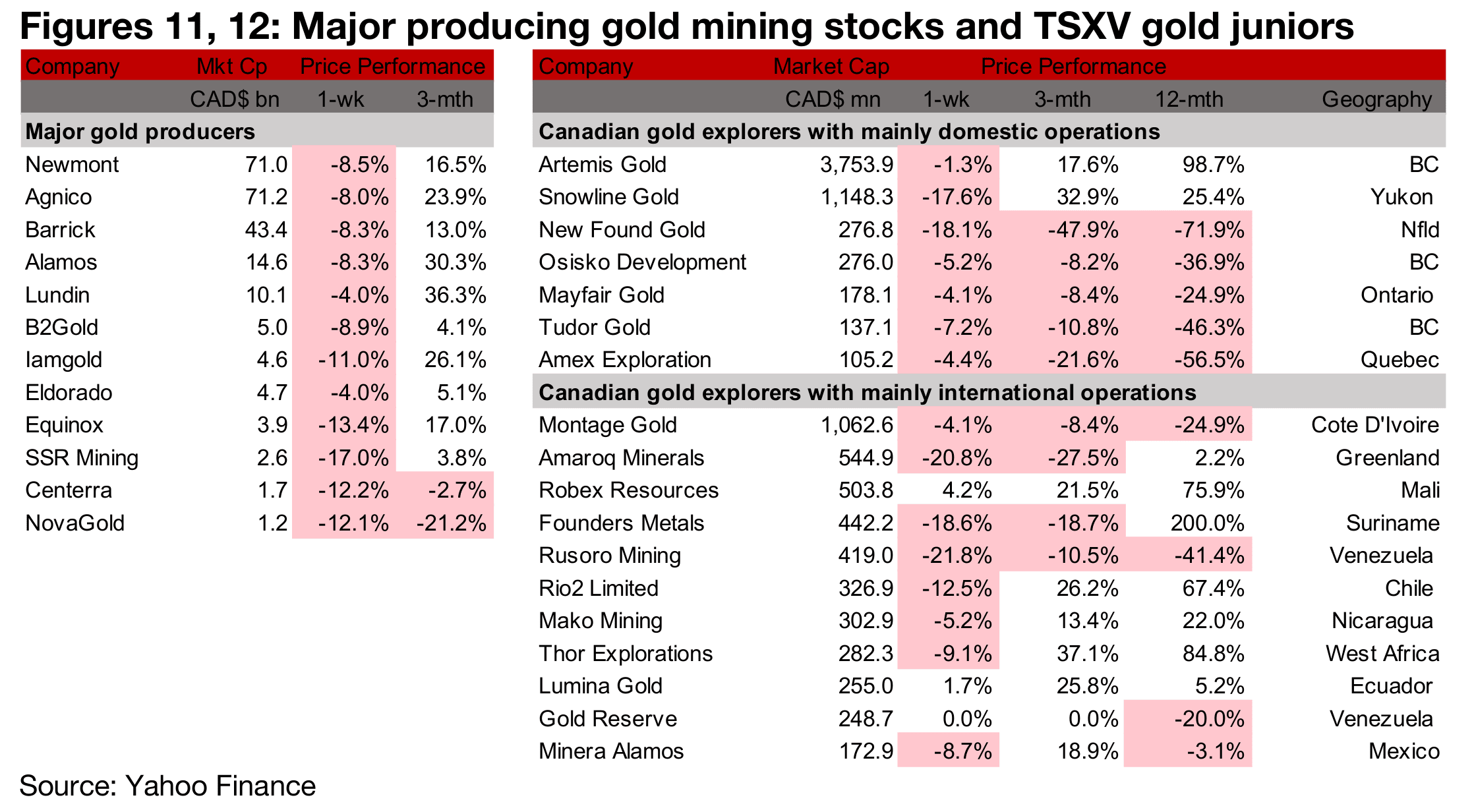

All major producers and most large TSXV gold slump

All of the major gold producers slumped by –8.0% or more with the exception of

Lundin and Eldorado, both down 4.0% (Figures 11, 12). While nearly all of TSXV large

gold declined, there were wide differences in the degrees of weakness (Figure 13).

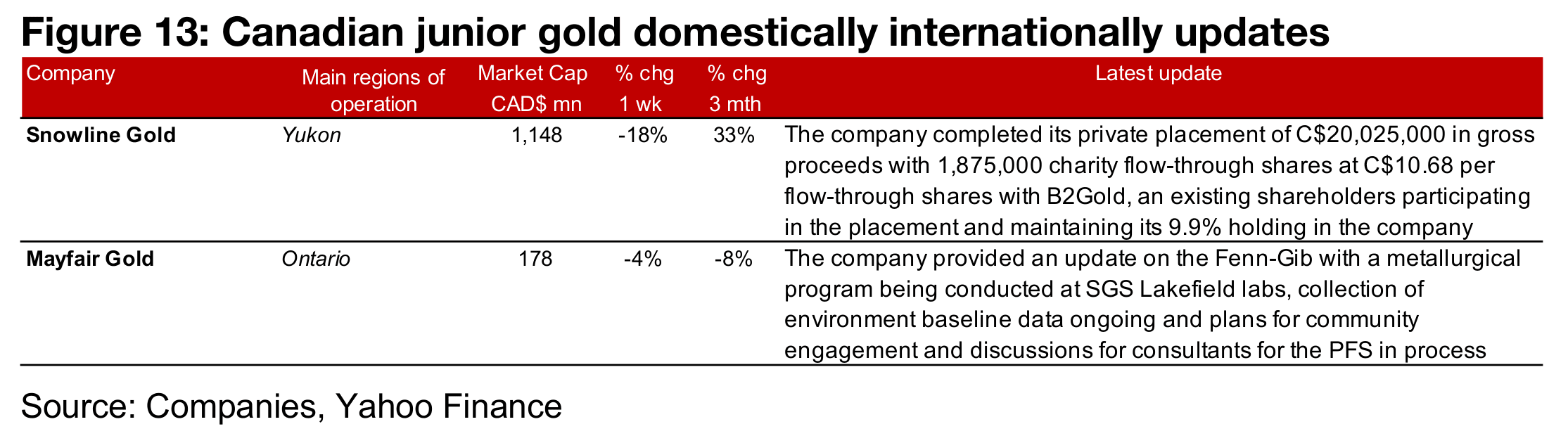

There was significant news flow only on two of the large gold stocks, with both

operating domestically, Snowline Gold, which closed a C$20.0mn private placement,

and Mayfair Gold, that provided an update on its Fenn-Gibb project.

There seems to have been some respite for the TSXV gold producers this week, which

have a much lower level of risk than the average junior on the index given that they

already generate cash flow. Artemis Gold, which recently reached first gold pour for

its huge Blackwater project, was down just -1.3%, and Robex Resources was up

4.2%, the biggest gain for the group. While producer Thor Explorations did see a

major -9.1% decline, this could have been more because of a conflict with Osun State

in Nigeria over its Segilola mine, and its shares are still up 85% over the past year.

Some of the biggest decliners were companies at the initial resource estimate stage

or earlier, that have had strong runs up in their share prices in recent years which

drove up their valuations, including Snowline Gold, New Found Gold, Founders

Metals and Amaroq Minerals. Markets are likely pulling back from these companies

on concerns that they have a long process of development ahead of them before

reaching production and cash flow and securing financing may be more difficult with

the outlook for markets deteriorating substantially over the past two weeks.

Disclaimer: This report is for informational use only and should not be used an alternative to the financial and legal advice of a qualified professional in business planning and investment. We do not represent that forecasts in this report will lead to a specific outcome or result, and are not liable in the event of any business action taken in whole or in part as a result of the contents of this report.