October 09, 2023

Canadian Mining Investment Remains Strong

Author - Ben McGregor

Gold decline eases after last week's rout

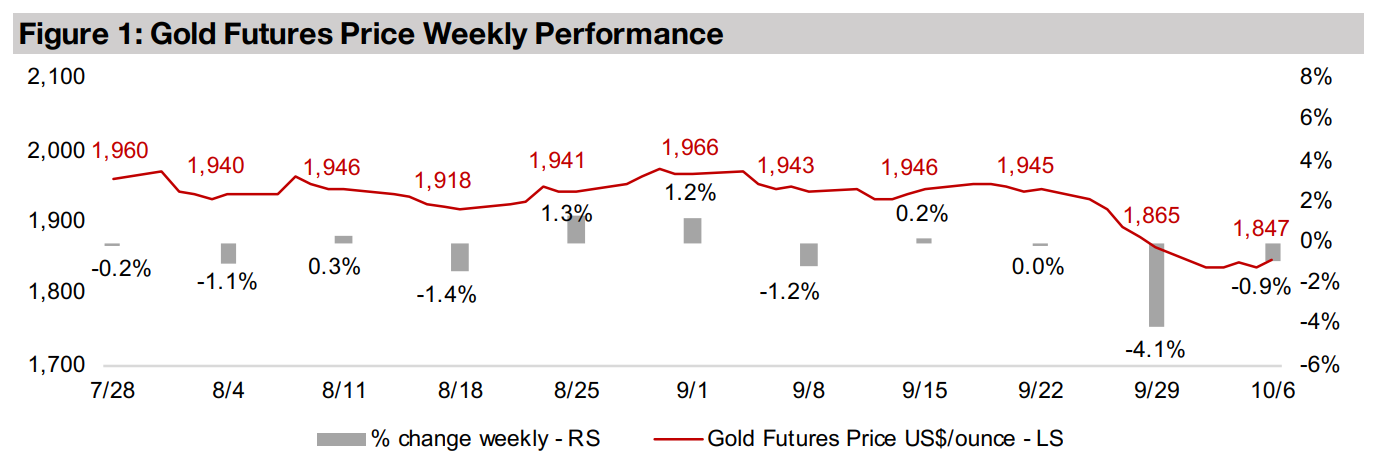

Gold slid -0.9% to US$1,847/oz, with the pace of decline easing considerably after last week’s -4.1% plunge, the metal’s worst performance since late 2021, as there was a pull back in the US$ and the high bond yields which had driven the decline.

Canadian mining investment still strong, Rusoro Mining In Focus

This week we look at trends in equity financing in the TSX and TSXV which show mining investment remaining strong so far this year, while Rusoro Mining is In Focus, with its share price surging this year on potential upside from an arbitration case.

Gold stocks edge down as metal and small cap equity drop

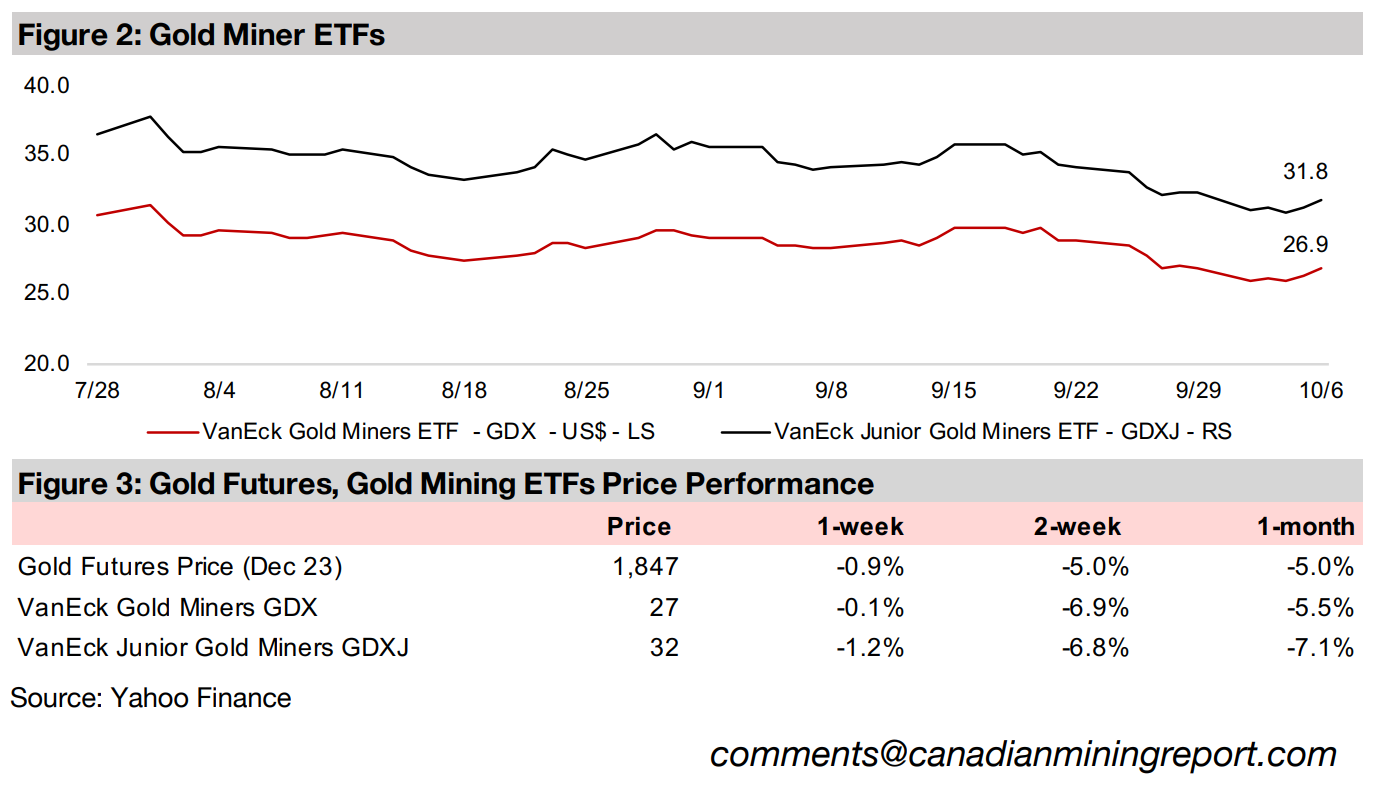

Gold stocks edged down with the GDX near flat, declining -0.1%, and the GDXJ off -1.2% as gold dropped and large cap equity rose with the S&P up 0.56% but small caps fell with the Russell 2000 down 1.98%, while TSXV larger gold mostly declined.

Canadian Investment Mining Remains Strong

The gold price fell -0.9% to US$1,847/oz, with the rate of decline easing substantially after a -4.1% plunge last week, driven by a pullback in the US$ and bond yields and fears of resurging inflation, as energy prices have been rising. The drop last week seems to have been driven by the market finally pricing in the surging US dollar and yields, which they may have been holding off on in hopes of a potentially more dovish Fed. As has been the case through 2023, these hopes were once again dashed by the Fed’s most recent comments, indicating that rates could still go higher, and would certainly be at least at current levels for an extended period.

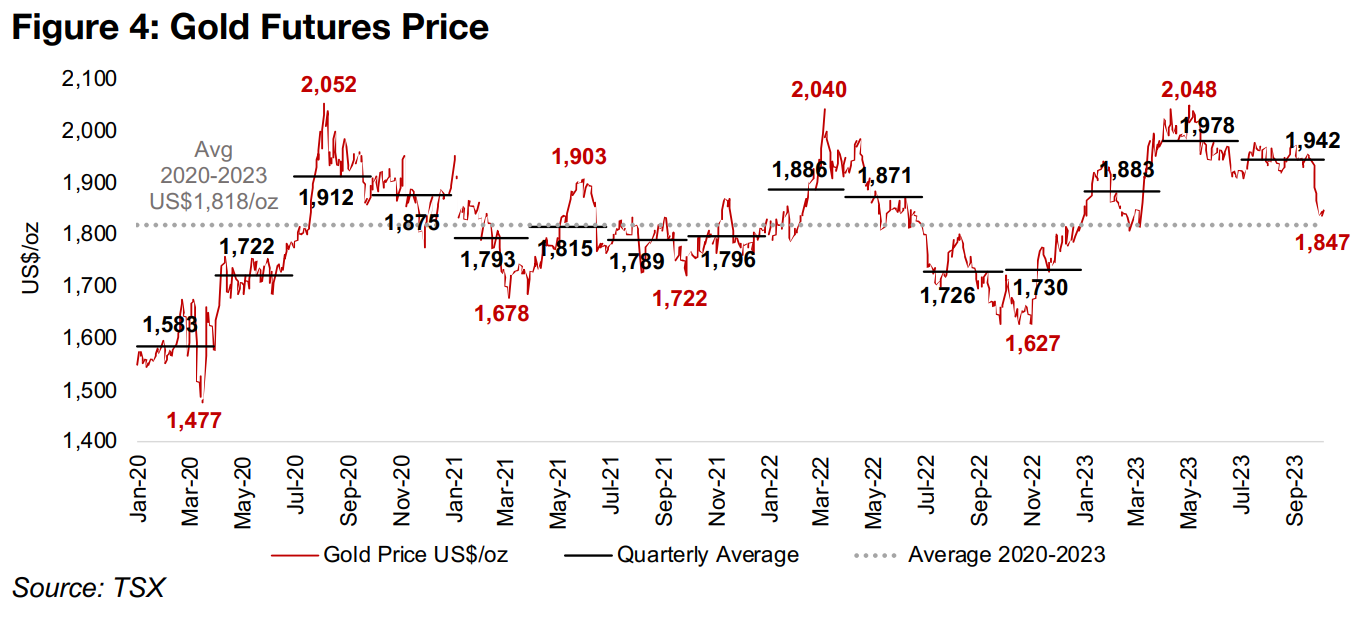

Gold again reverts towards to near four-year average

While the abrupt slump was jarring, in a medium-term context the metal was

continuing its pattern since 2020; reverting to an average around US$1,800/oz (Figure

4). The big moves above this have been driven by severe crisis, with over

US$2,000/oz reached during peak-global-health-crisis-fear in mid-2020, on the

Russian invasion of Ukraine in early 2022 and after the banking crisis in early 2023.

Meanwhile large dips below this level have occurred when the market is convinced

of the potential for ‘soft landings’ or a ‘dovish Fed’, with these hopes dashed by new

risks emerging or hawkish Fed action, sending it back up towards its average.

We believe that the disruptive effects of over a year of interest rates near their highest

levels in about three decades have yet to be realized and that the early-2023 banking

crisis could be a prelude for what is to come. So while there is scope for an inflation

rebound driving up yields and the US$ on fears of further Fed hikes, putting

downward pressure on gold, there could just as easily be economic shocks offsetting

this, driving gold up on a flight to safety. The net effect could be gold continuing to

swing around this average US$1,800/oz that has held for the past four years.

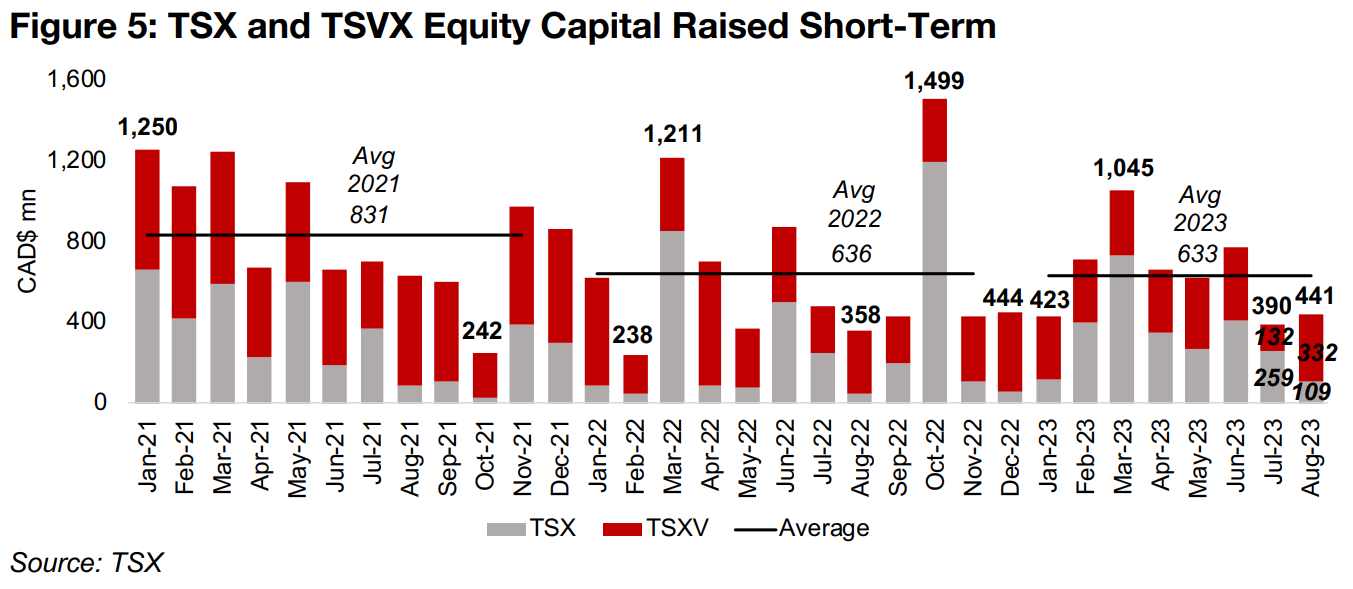

Canadian equity mining investment holding up strong

The sustained high average gold price has continued to drive strong equity

investment into the Canadian mining sector, with an average CAD$633mn per month

in combined capital raising including initial public offerings, secondary public

offerings and private placements so far in 2023, nearly the same as CAD$636mn

average in 2022 (Figure 5). While this is down from the CAD$831mn average in 2021,

that was driven by a boom period of high metals prices and a major global economic

rebound. The question remains whether the relative strength of 2023 can be extended

into next year or whether investment will be start to be curbed.

While given continued high interest rates and a broader shift to more risk aversion in

markets since late 2022, a potential downtrend in investment remains a risk, the trend

of the data up to August 2023 is not particularly concerning. Total investment in

August 2023 was CAD$441mn, down off a recent peak of CAD$1,045mn in March

2023, but well above monthly lows of CAD$242mn and CAD$238mn reached in

October 2021 and February 2022. August 2023 investment also showed a pickup

from CAD$390mn in July 2023 and is around the CAD$444mn and CAD$423mn

levels of December 2022 and January 2023.

Shift towards TSX investment versus TSXV in 2023

One slightly concerning trend is a shift in the average composition in 2023 of

investment away from the TSXV and towards the TSX, which could indicate the

market leaning away from smaller juniors and towards more established companies.

The TSXV was 48% of combined TSXV and TSX investment over 8M/23, significantly

down from 66.4% in 2022, and 60.4% in 2021. However, in August 2023 specifically,

TSXV investment dominated, at 75.4% of the total, its highest proportion since the

72.3% of January 2023. Overall, given rising risk aversion, we would expect that the

probability would be weighted towards a relative move away from the risker TSXV

juniors and towards putting more capital into the TSX this year and into 2024.

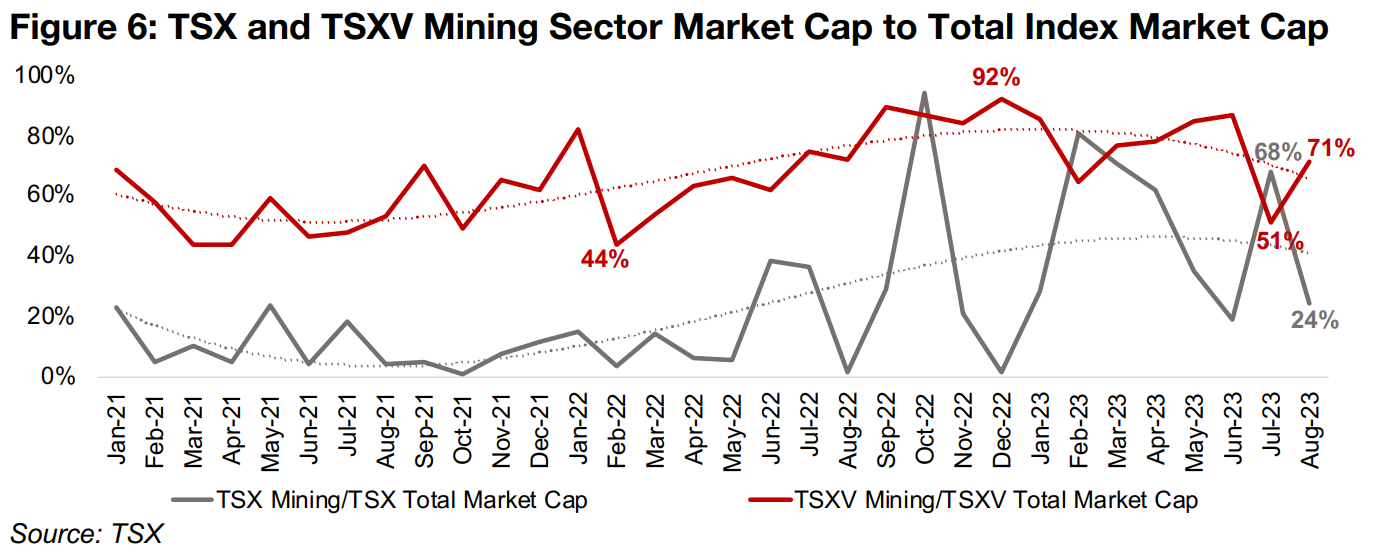

Other evidence of risk aversion has been a decline in the proportion of investment in

the riskier mining sector versus other sectors in 2023. TSXV mining investment to

total TSXV investment picked up significant through 2022 and reached a peak of 92%

in December 2022, after averaging only around 50% through 2021 (Figure 6).

However, this measure declined since, hitting a low of 51% in July 2023, and coming

in at 71% in August 2023. Mining investment is far less dominant for the TSX, which

has a much larger proportion of financials and real estate, although the sector has

had some very strong months as a proportion of total investment in 2022 and 2023.

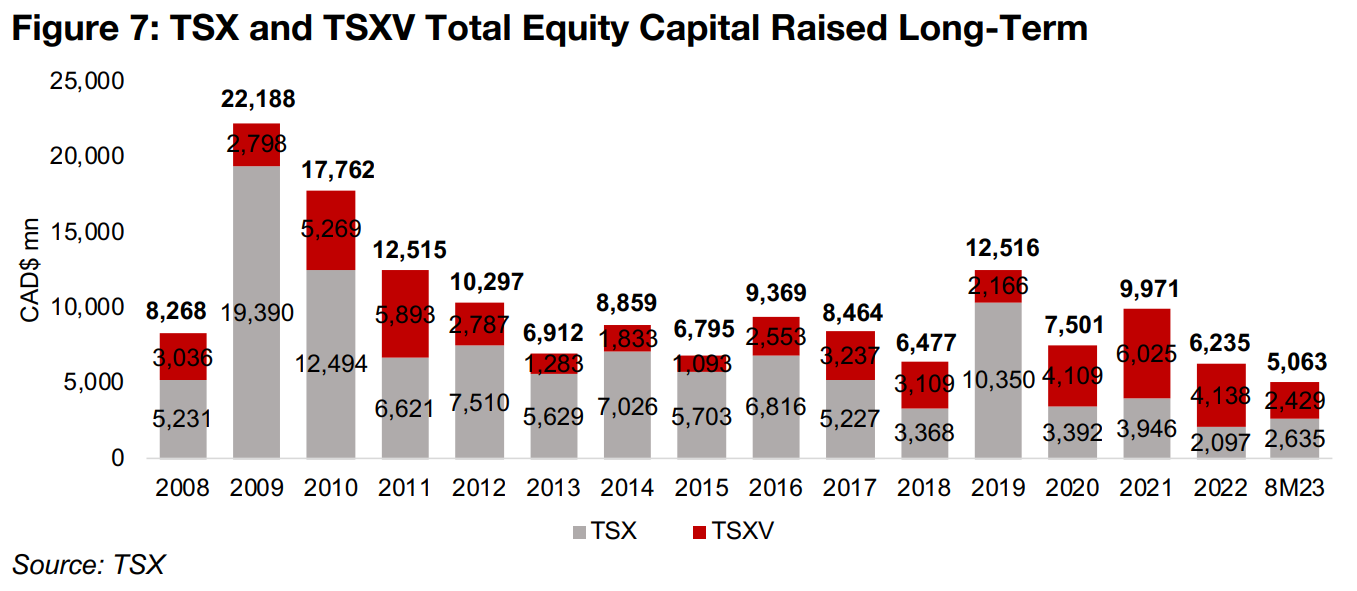

Overall Canadian mining investment still well below 2009-2010 peak

Looking at the same trends longer-term shows combined mining investment still considerably off its 2019 peak of CAD$12.5bn, although this was driven mainly by a single deal over CAD$7.0bn on the TSX (Figure 7). Excluding this, mining investment has remained in a range from around CAD$6.0bn to CAD$10.0bn since 2012. With the first eight months of 2023 already at CAD$5.1bn, assuming no major decline in the second half, this year will likely again be within this longer-term range.

However, even at its recent peaks in 2019 and 2021, sector investment was still nowhere near the surge in 2009 and 2010, to CAD$22.2bn and CAD$17.8bn, respectively, with by far the majority invested in the TSX. On average since 2008 the TSX has also attracted the majority of mining investment, at 64.4%, compared to 35.6% for the TSXV. The high proportion of relative TSXV investment in recent years has been an anomaly, averaging 60.5% from 2020 to 2022 and indicates what a boom time it has been for the juniors for the past four years. While investment in the TSX has not come anywhere close to the CAD$19.4bn peak in 2009, TSXV investment of CAD$6.2bn in 2021 surpassed the previous peak of CAD$5.9bn in 2011.

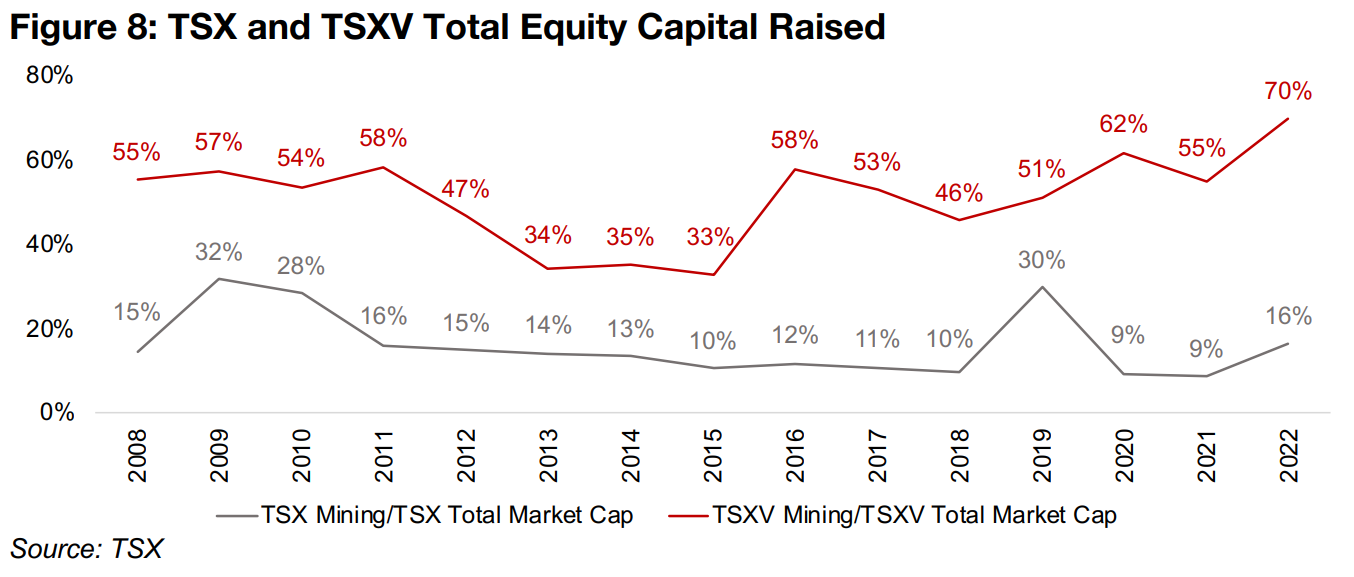

The high proportion of TSXV mining to TSXV total investment is a long-term trend, with the ratio falling significantly below 50% only from 2013 to 2015 (Figure 8). Mining investment for the TSXV has also been generally trending up as a proportion of the total since 2015 reaching its highest level of the period in 2022 at 70%. Similar to the short-term trend, mining has been a much smaller proportion of total investment for the TSX over the past fifteen years, at around 10%-15% of the total, apart from jumps in the 2009-2010 and 2019 mining sector investment booms.

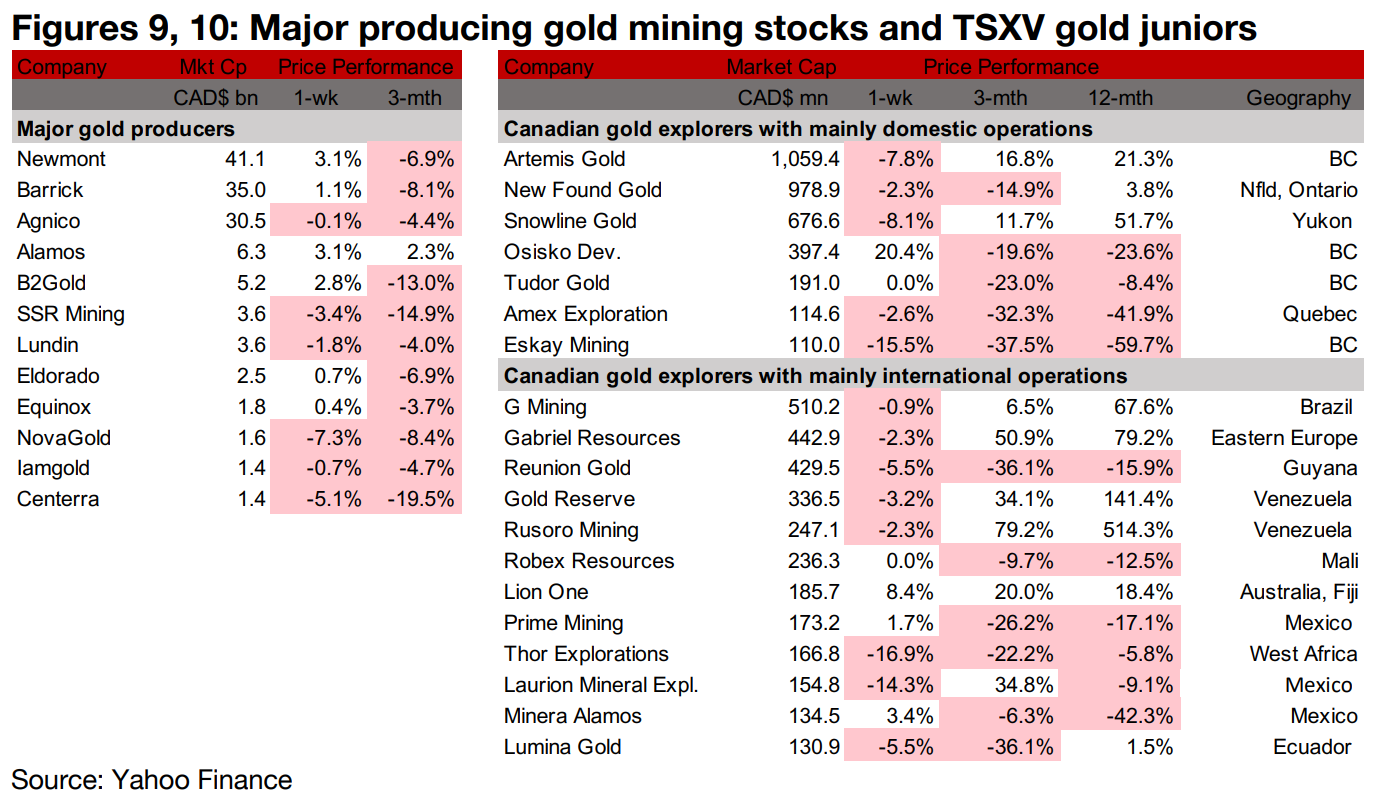

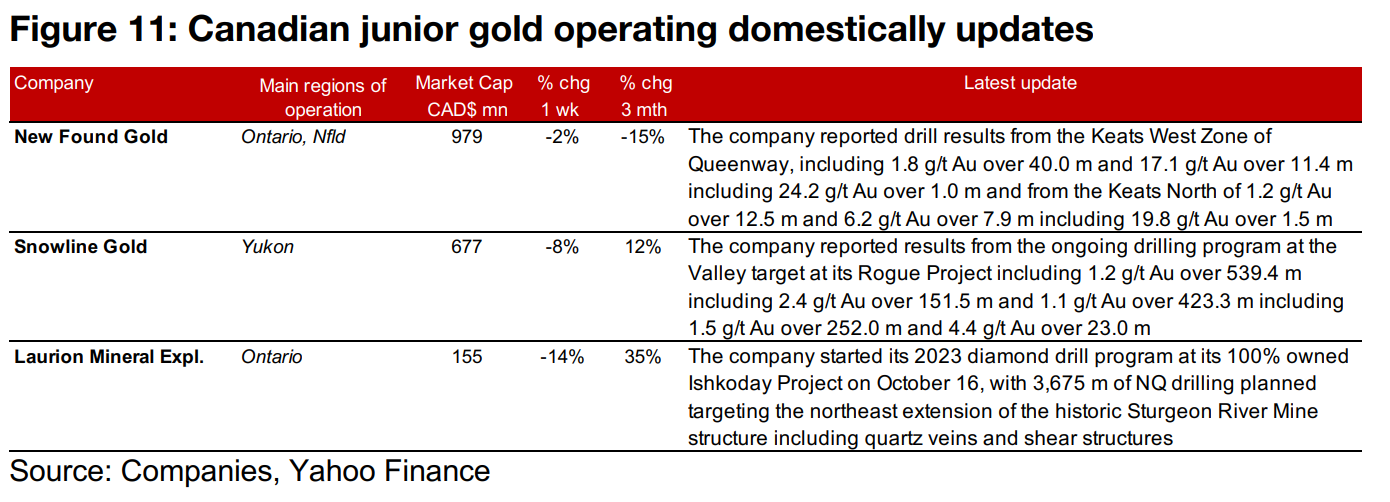

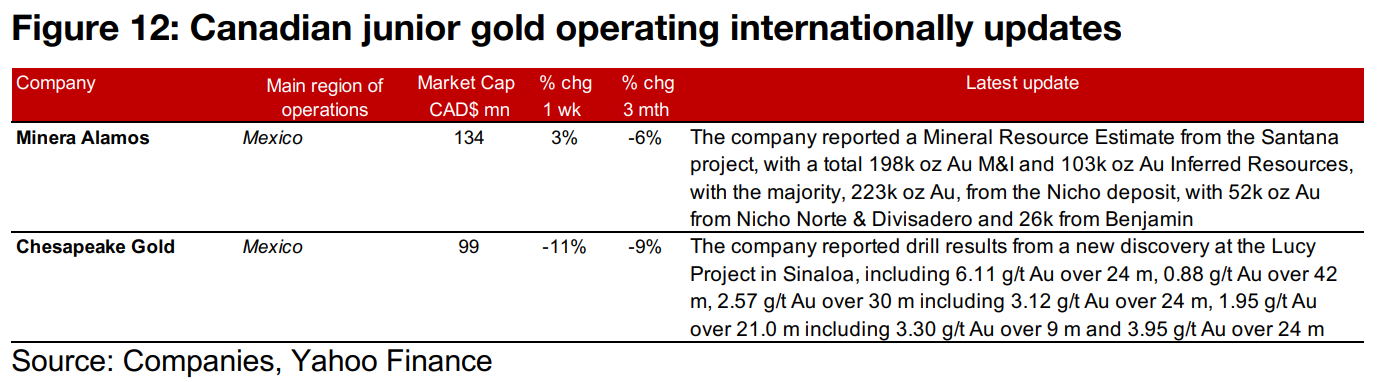

Gold producers mixed and TSXV gold mainly decline

The major gold producers were mixed and the TSXV gold stocks mostly declined. (Figures 9, 10). For the TSXV gold companies operating domestically, New Found Gold reported drill results from the Keats West and Keats North Zones of Queensway, Snowline Gold released drill results from the Valley target of the Rogue Project and Laurion Mineral Exploration started its 2023 diamond drill program at Ishkoday (Figure 11). For the TSXV gold companies operating internationally, Minera Alamos issued a Mineral Resource Estimate for the Santana Project and Chesapeake Gold reported drill results from a new discovery at the Lucy Project (Figure 12).

In Focus: Rusoro Mining

Rusoro stock shoots up on lawsuit progress related to arbitration

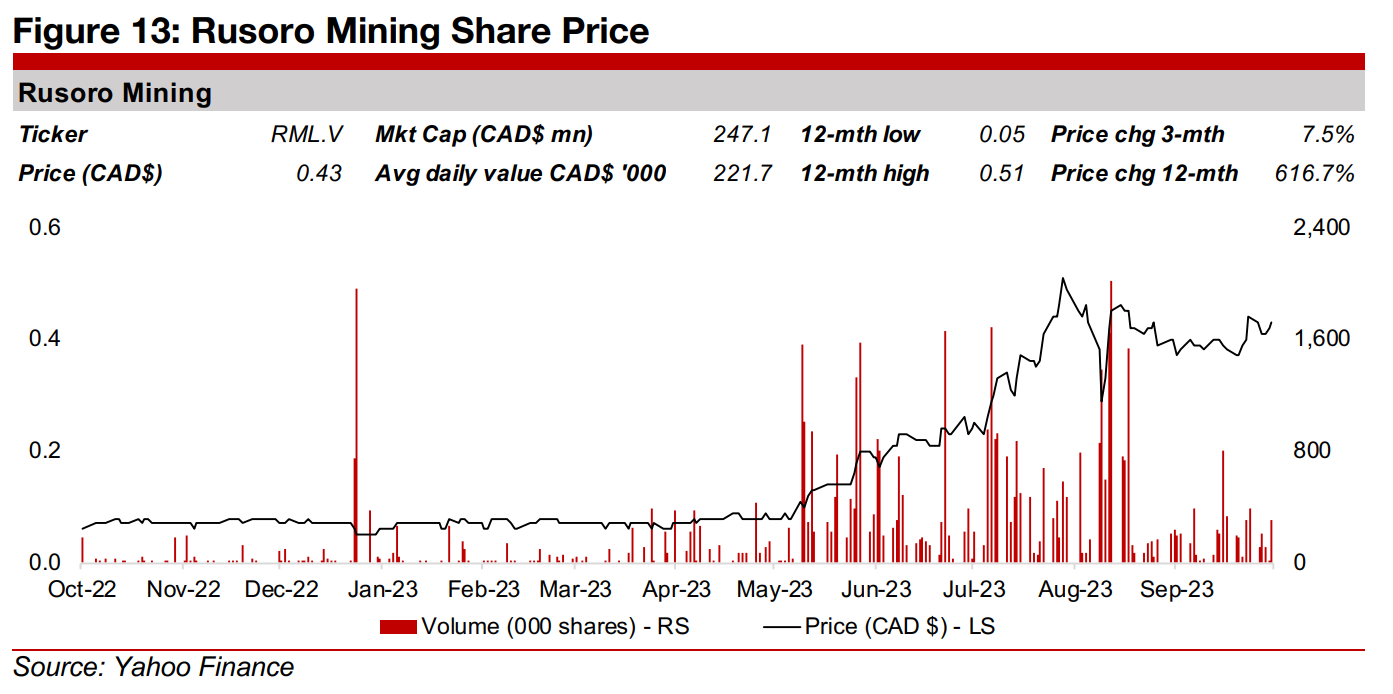

Rusoro Mining has had an extremely strong stock price performance over the past

year, shooting up 616.7%, with its market cap rising to CAD$247.1mn, putting it near

the top of the TSXV gold stocks (Figure 13). The average junior miner showing such

a gain tends to be driven by outstanding drill results that have been unexpected by

the market. However, Rusoro is quite a different case from the usual, and has not

been driven by its core operations, but rather by what is increasingly appearing to be

favourable outcome of an arbitration over legal issues going back over a decade

related to its two previous projects in Venezuela.

The company had two producing mines in 2009 in Venzuela, Choco, which produced 126k oz of gold and a 50% holding of Isidora, which produced 25k oz of gold, and had a total 12.4 mn oz of gold Resources. However, in 2011, the new Chavez regime in the country nationalized gold mining, leading to the company starting an arbitration with the International Centre for Settlement of Investment Disputes (ICSID).

Rusoro arbitral award estimated between US$1.48-US$1.82bn

While ICSID had awarded Rusoro an arbitral award of near CAD$1.0bn as early as

2016, the company has had continued difficulty in actually accessing these potential

funds. This has been because of ongoing lawsuits including most recently whether a

corporate entity, the state-owned Petroleos de Venezuela (PDVSA) should be

considered part of the Venezuelan government. This would allow Rusoro Mining to

seize assets of PDVSA to cover the arbitration payments. In July 2023 a US court

ruled that the PDVSA could be considered part of the Venezuelan government that

owes Rusoro payments, which has led to the major rise in its stock price.

The current value of the arbitral award is US$1.48bn, which includes several years of

interest, although the company notes that under another previous ruling the arbitral

award would be closer to US$1.82bn, given that is uses a different interest rate. While

the outcome remains far from certain, and the company would still have to go through

the process of seizing and selling off PDVSA assets, at a market cap of CAD$247.1mn,

the company is pricing in about 17% of the lower arbitral award.

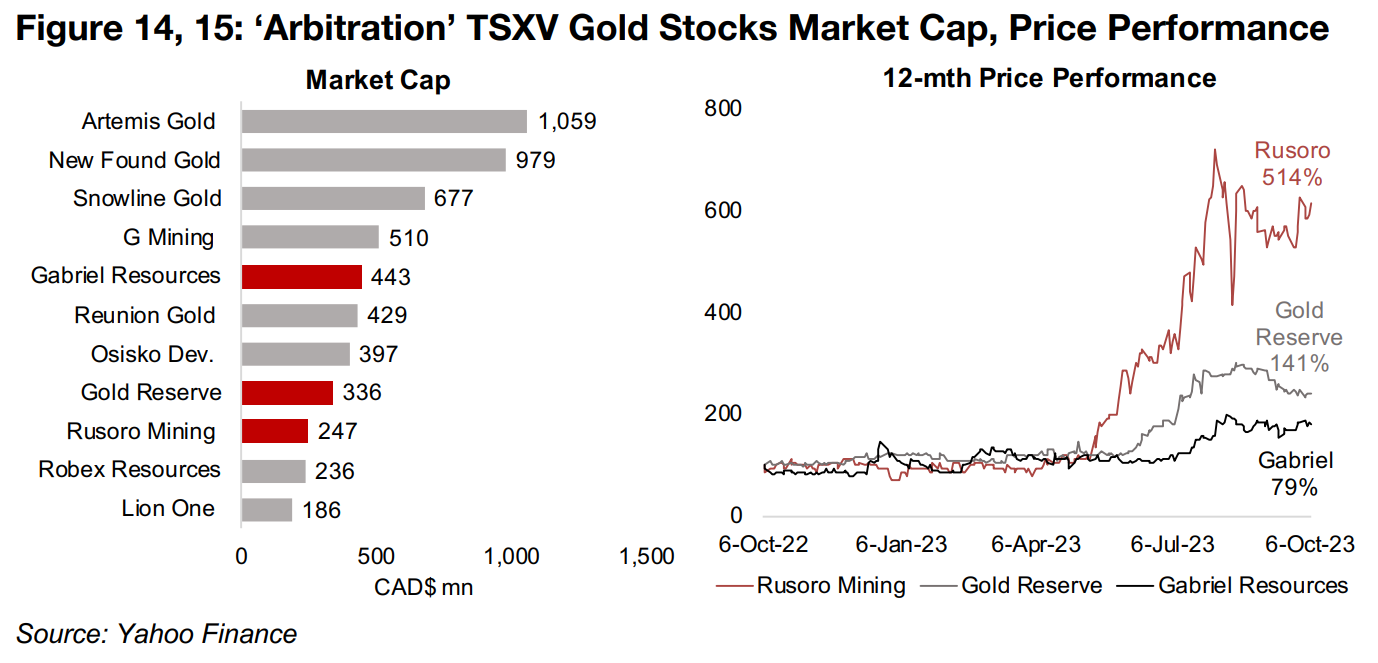

Gold Reserve and Gabriel Resources are also 'arbitration story' stocks

Interestingly, Rusoro is not the only stock to see big gains this year related to long-standing arbitration issues, sending them into the top ranks of the TSXV gold stocks by market cap. These include Gabriel Resources, with a 79% gain to a CAD$443mn market cap and Gold Reserve with a 141% rise to a $336mn market cap (Figures 14, 15). The Gold Reserve story is related to Rusoro, as it also was hit by Venezuelan gold mining nationalization in 2011. Its Brisas project was at the development stage, and the company similarly went to ICSID and received a CAD$1.03bn arbitral award in 2016. While the company did receive CAD$254mn in payments from Venezuela, there was still CAD$913mn unpaid, including interest, as of June 2021.

The company also has ongoing lawsuits in pursuit of these payments, with some rulings over the past year looking favourable, leading to gains in its share price. The company still held rights to another project in Venezuela, Siembra Minera, with the intention to eventually develop it, but these were revoked by the Venezuelan government in March 2023, which could mean additional lawsuits. With Gold Reserve’s market cap at CAD$336mn, the market has priced in over a third of the outstanding arbitral award. Gold Reserve and Rusoro are further linked by litigation between them in Venezuela which was settled in 2012.

Arbitral award imminent for Gabriel Resources

Gabriel Resources, like Rusoro and Gold Reserve, has also been in long-term

arbitration over its Rosia Montana project in Romania. The company was developing

the project when the area in which it resided was declared a World Heritage Site by

UNESCO, which prevented Gabriel from advancing the project. This led to an

arbitration led by ICSID between the company and the Romanian government.

In contrast to Rusoro and Gold Reserve, Gabriel’s arbitration process is now largely

completed with the last step to be the declaration of an arbitral award. ICSID has six

months from the September 2023 closing of the arbitration to decide on the amount

of any awards, although this can be extended, suggesting that the final amount will

be known by 2024. Gabriel’s arbitration has had no fixed value already stated as there

is for Rusoro and Gold Reserve, but the market is expecting that it will reach at least

CAD$443mn, as this is the company’s current market cap.

Disclaimer: This report is for informational use only and should not be used an alternative to the financial and legal advice of a qualified professional in business planning and investment. We do not represent that forecasts in this report will lead to a specific outcome or result, and are not liable in the event of any business action taken in whole or in part as a result of the contents of this report.