Aug 7, 2020

Blasting through yet another resistance level

Author - Ben McGregor

Gold price breaks US$2,000, heading for US$2,100

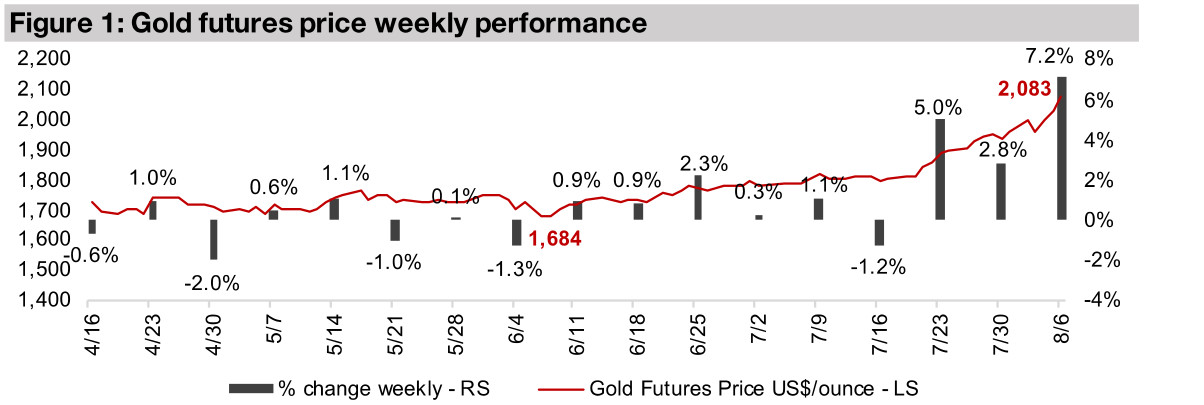

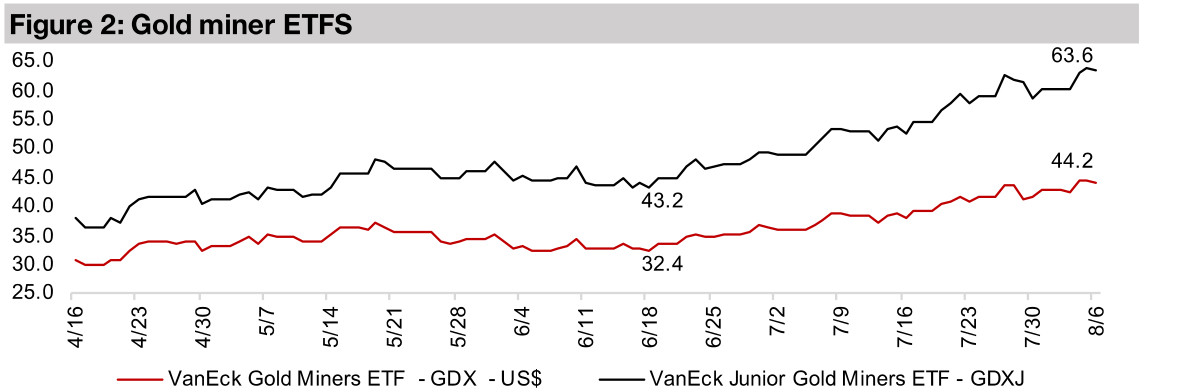

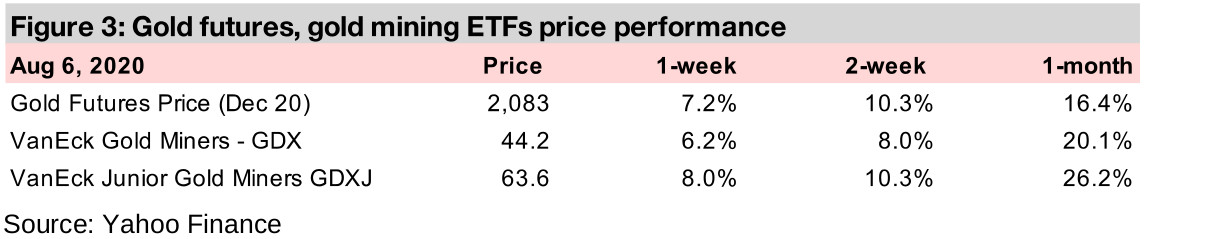

Gold ripped through yet another critical level this week, breaking above US$2,000/oz, with the futures seeing its strongest weekly bounce in months, up 7.2%, to close at U$2,083/oz, with an increasingly parabolic looking move for gold.

Producing miners gain on gold spike, most Q2/20 results now in

The producing miners mostly gained on the continued spike in gold, and with most large gold firms now having reported Q2/20, for the sector overall the rising gold price has more than offset H1/20 production shutdowns from the global health crisis.

Gold blasts through another resistance level at US$2,000/oz

Gold continued to blast through resistance, having now hurdled the US$1,700/oz, US$1,800/oz, US$1,900 and US$2,000 levels in just two months, and US$2,100/oz was in reach with this week, with the futures jumping 7.2%, its highest weekly gain in months, to US$2,083/oz. While we will continue to keep an eye on the risk of a pullback after such a rapid rise, with such retracements happening regularly even in strong gold bull markets, as we have previously shown (see our May 28, 2020 weekly), the fundamental drivers remain extremely supportive of gold. This is because of a continued perfect storm of substantial global economic, political and health risks, massive monetary expansion and government stimulus in response to these issues, implying considerable devaluation of fiat currencies, and very low current and expected alternative yields for other asset classes. While we would not be surprised by a short-term pullback in gold in short-term, the strong overall gold uptrend seems likely to continue through 2020.

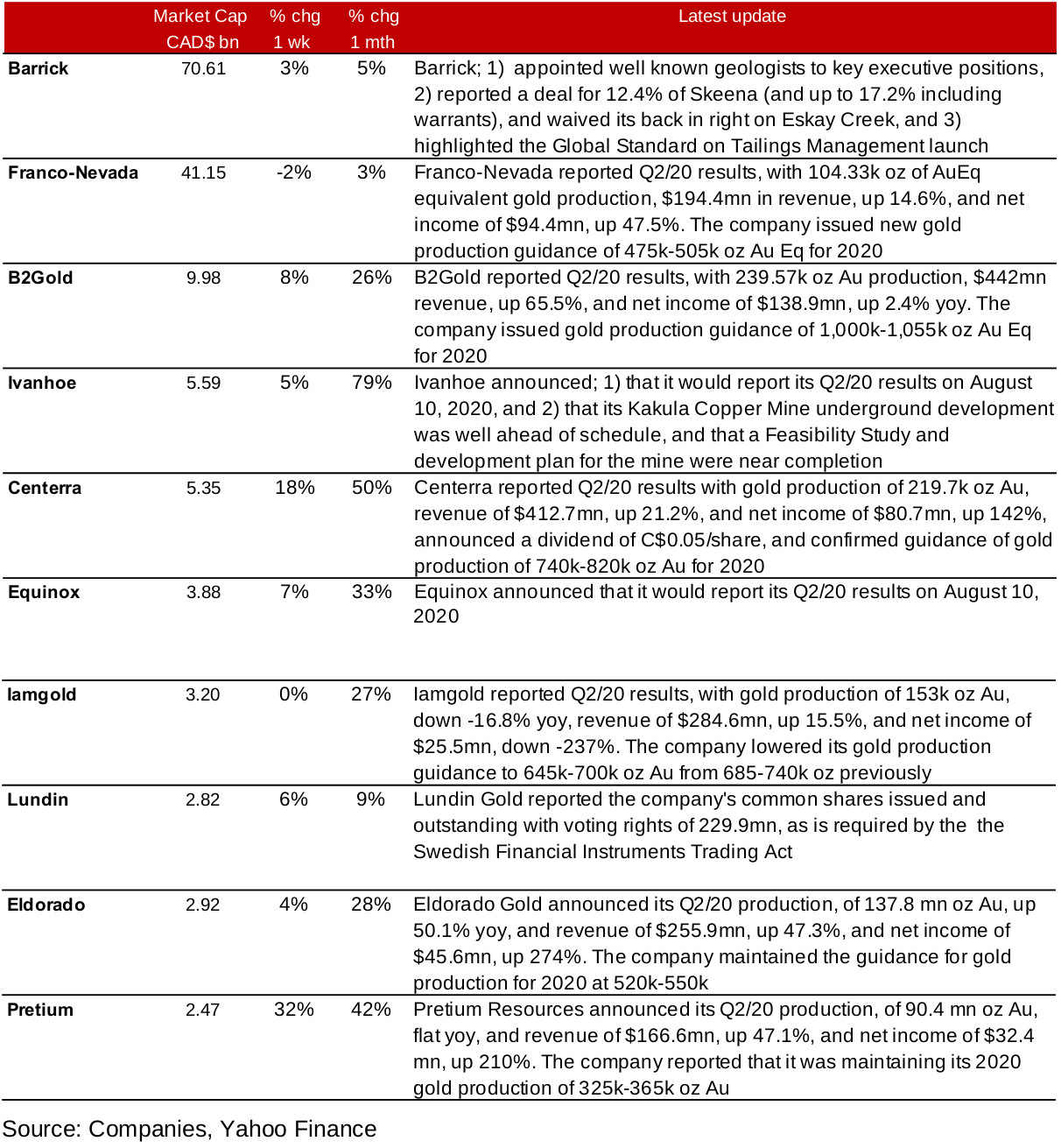

Figures 4, 5, 6: Producing miners Q2/20 results

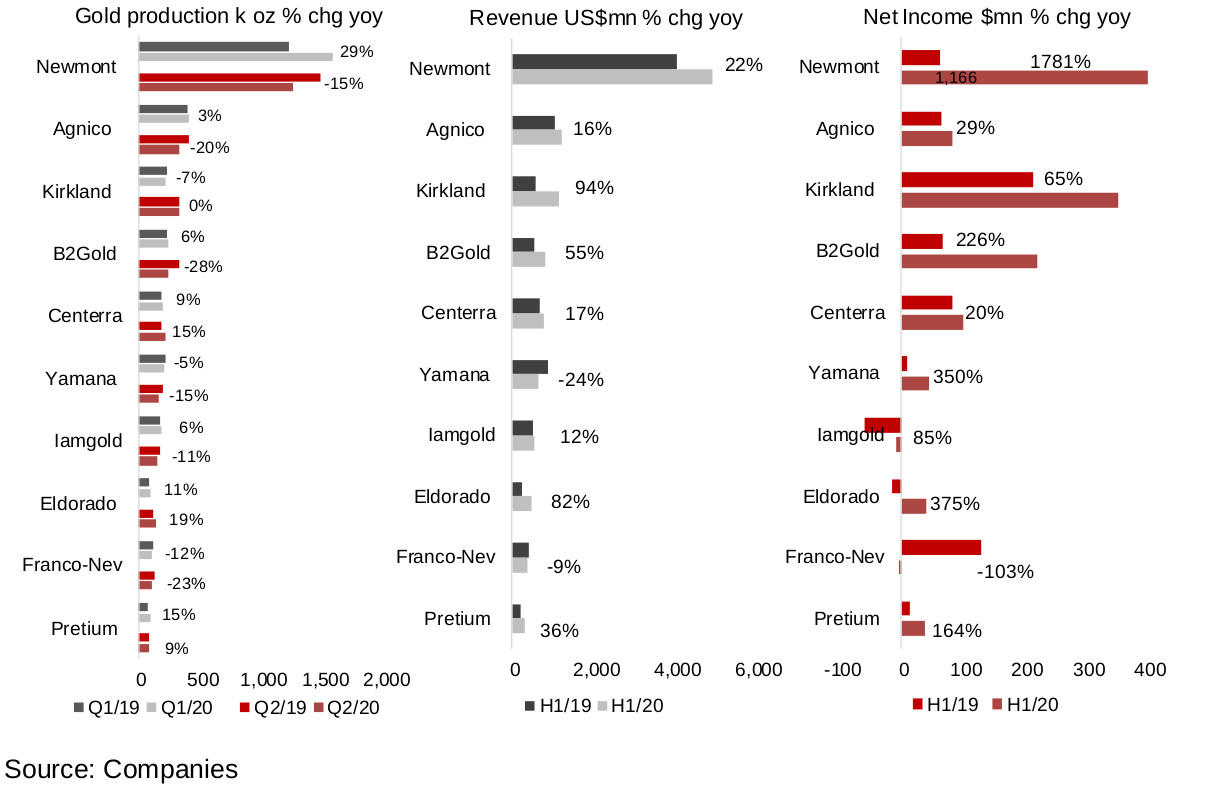

Gold price gains overall offset production declines in Q2/20 results

The Q2/20 results season for the major producing miners is nearly completed, with Barrick the only major firm still to report on Monday. The results were driven by two opposing forces; the surge in the gold price, and the global health crisis-driven production shutdowns. While Figure 4 shows many companies seeing a dip in production yoy in Q2/20 as would be expected, Figure 5 shows that this was more than offset for most firms by the raging gold price, with revenue growth overall strong for Q2/20, and this translated to strong net income gains for most of the companies, shown in Figure 6.

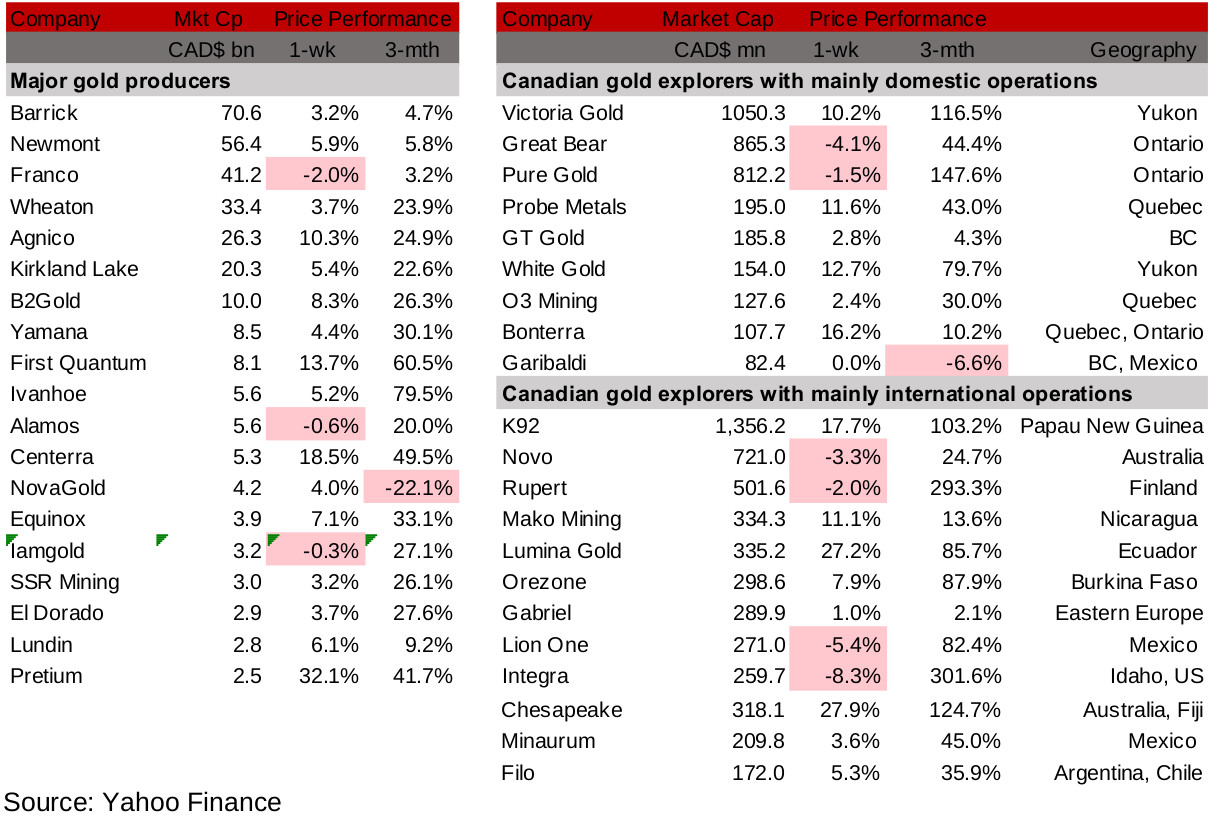

Figures 7, 8: Major producing gold mining stocks and Canadian juniors

Producing miners up on gold, Q2/20 results season nearly complete

Most of the producing miners were up on the gold price rip, and the main news was Q2/20 results, with Franco-Nevada, B2Gold, Ivanhoe, Centerra, Iamgold, Eldorado and Pretium all reporting (Figure 7). Other news flow included Barrick's appointment of key geologists to executive positions, and an announcement regarding the percentage of its holding in Skeena and that it waived its back in right on Eskay Creek (Figure 9). Ivanhoe announced its Q2/20 results and that a feasibility study for its Kakula Copper Mine is expected to be completed soon. Equinox reported its Q2/20 results date and Lundin its common shares issued with outstanding with voting rights.

Figure 9: Producing gold miners updates

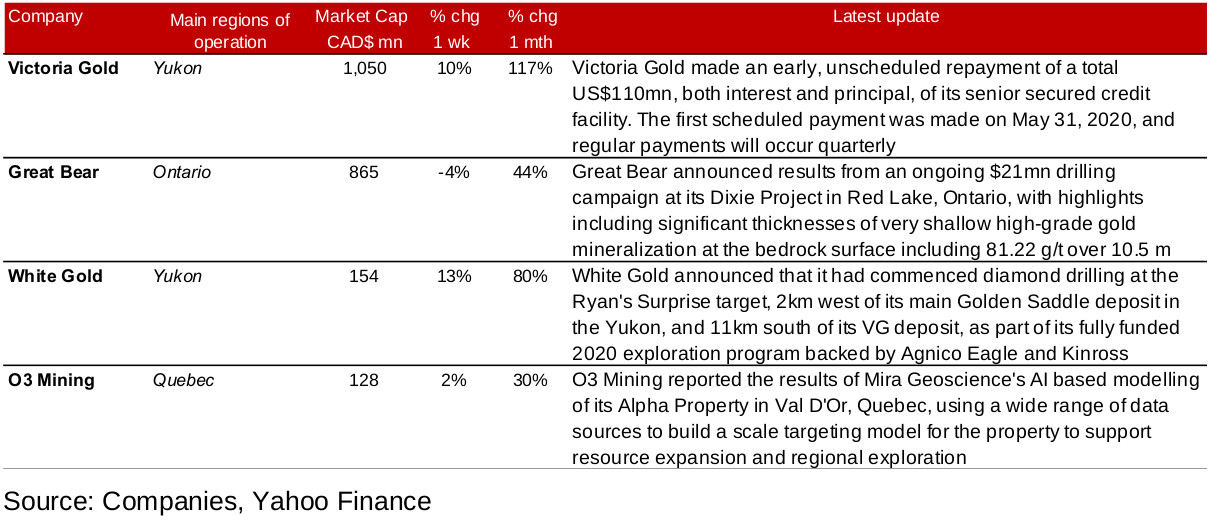

Canadian juniors operating in Canada see gains

Most of the large Canadian juniors operating saw gains, with four out of ten up over 10% (Figure 8). There was news flow from Victoria Gold, which made an unscheduled early payment on its senior secured credit facility and Great Bear, which was down -4.1% (in the context of a 44.4% gain over the last three months) after announcing recent drilling results from its Dixie Project (Figure 9). White Gold announced that it was starting drilling on a new target, Ryan's Surprise, near its Golden Saddle deposit in the Yukon, and O3 Mining announced the results of its Mira Geoscience AI based modelling of its Alpha Property in Val D'Or, Quebec.

Figure 10: Canadian junior gold miners operating in Canada updates

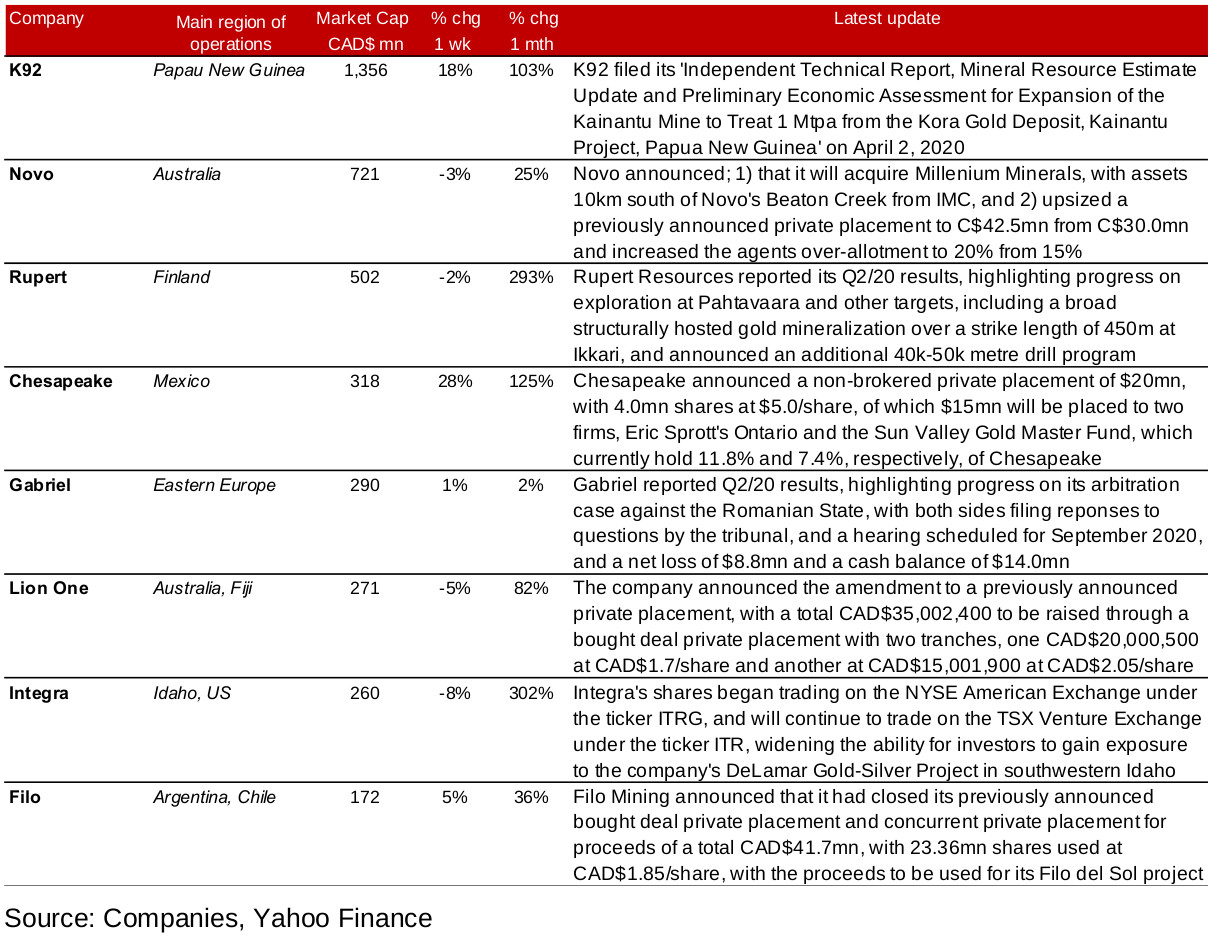

Canadian juniors operating internationally mainly gain

The Canadian juniors operating internationally mostly increased this week, with a few seeing particularly strong gains, and some seeing moderate declines (Figure 8). There was news flow from K92, which was up 17.2% for the week after filing an updated mineral resource estimate and PEA for its Kora mine. There were several press releases regarding capital raising, with Novo reporting an upsize of its previously announced private placement and the acquisition of Millenium Minerals, Chesapeake announcing the details of a non-brokered private placement, Lion One announcing changes to its previously announced private placement, and Filo Mining reporting the closing of a private placement (Figure 11). Rupert Resources and Gabriel Resources reported Q2/20 results, and Integra's shares began trading on the NYSE American Exchange.

Figure 11: Canadian junior gold miners operating mainly internationally updates

In Focus: K92 Mining

Figure 12: K92 Mining

Papua New Guinea Kora mine producing, expansion in progress

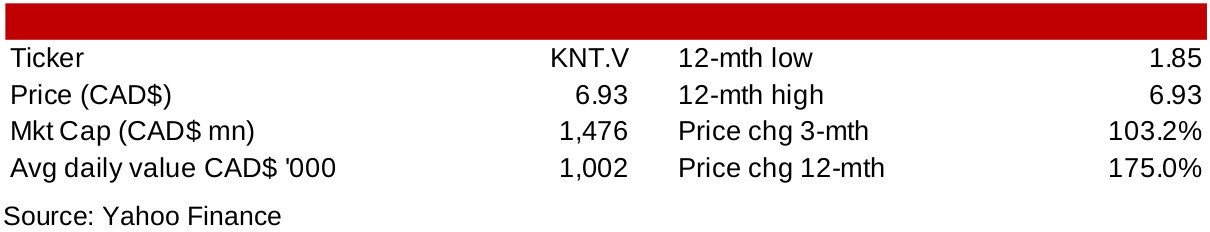

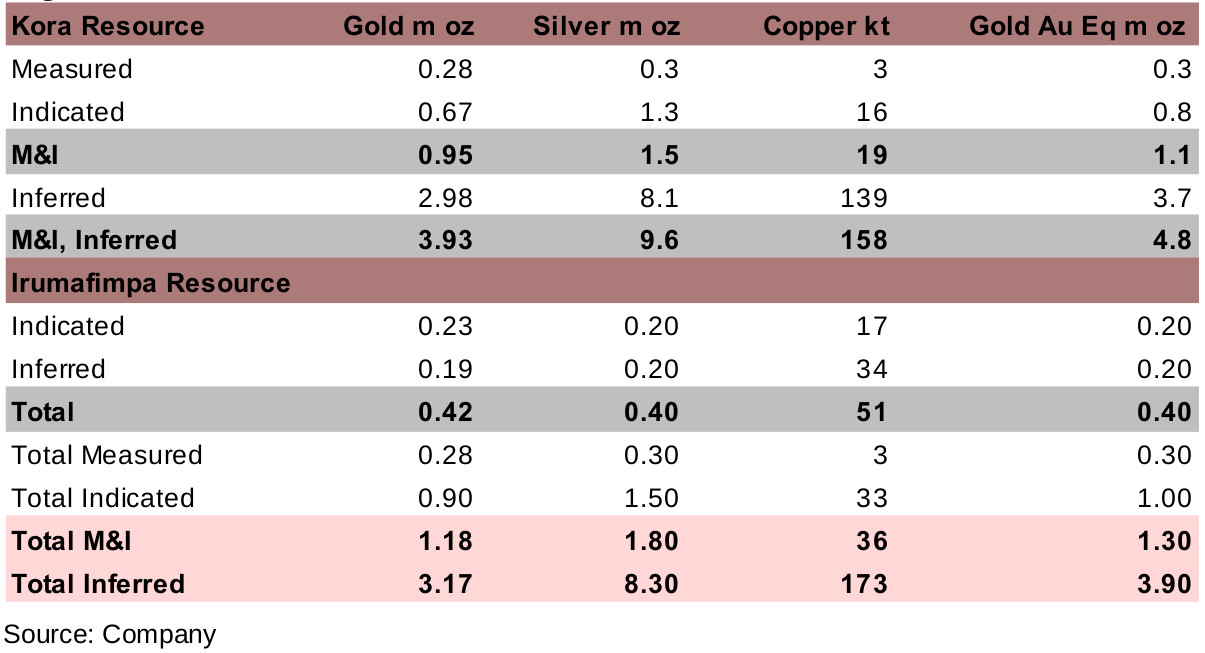

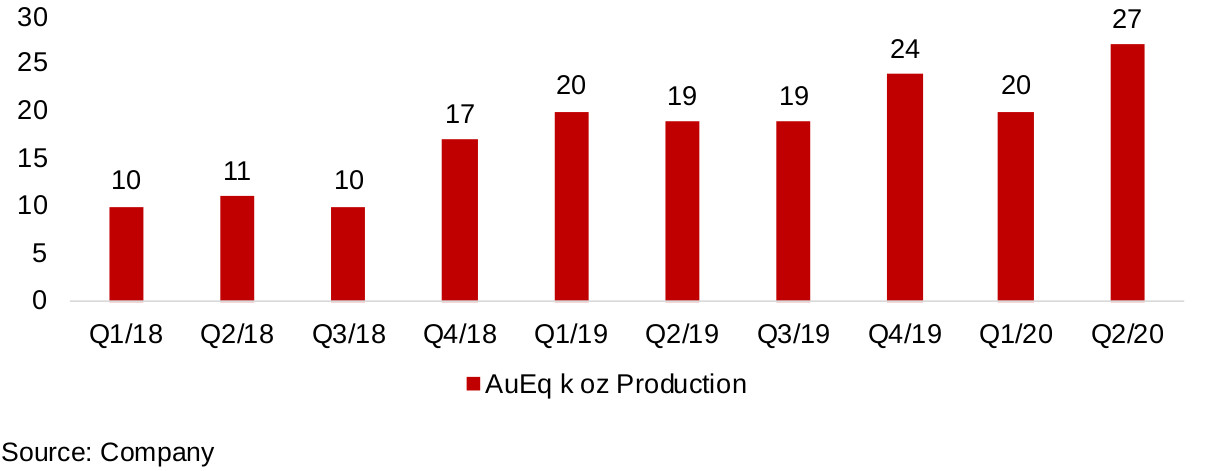

K92 Mining operates the Kora mine in Papa New Guinea, which is already producing, and is in the process of expanding this project. While Kora remains the main focus of the company currently, it also has another six zones near Kora that are also exploration targets, including Irumafimpa, which has a resource estimate, and Judd, Karempe, Maniape and Arakompa, all considered high priority targets. The Kora mine's total resource estimate is 4.8mn ounces of Au Eq, of which 3.9mn is gold, with 9.6mn oz Ag and 158 kt Cu, with 1.1mn AuEq in Measured and Indicated Resources and 3.7mn in Inferred Resources (Figure 13). The Kora mine has seen a continued ramp up in production from 2018, with Q2/20 seeing the largest output so far, with 27k oz Au Eq in production, up from 10k oz Au Eq in Q1/18 (Figure 14).

Figure 13: K92 resources

Figure 14: Kora mine production

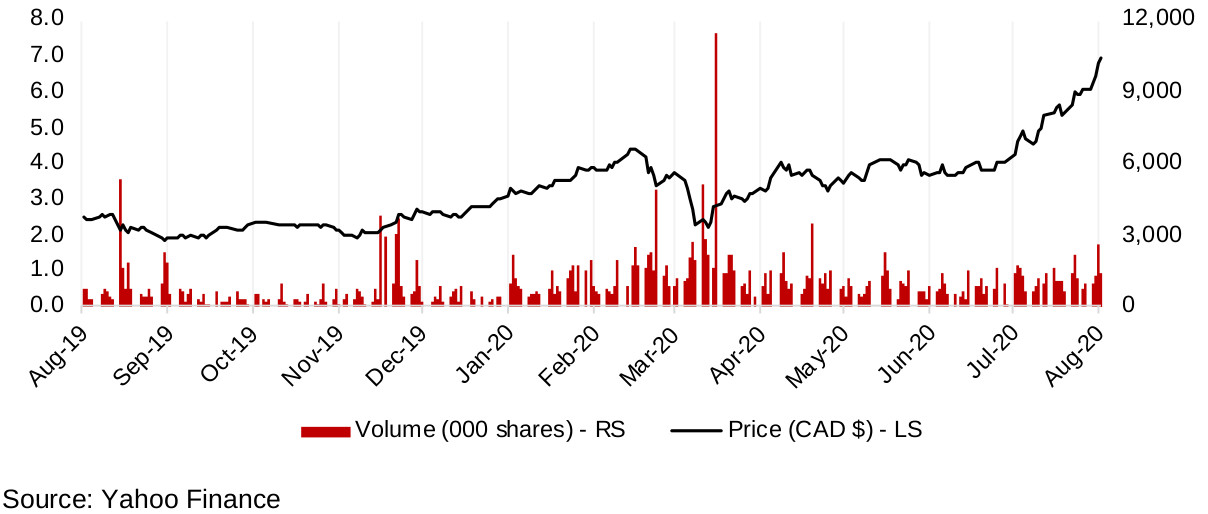

The company is already expanding into the second stage of its Kora mine, ramping up from the Phase One annual targeted production target of 47,000 oz AuEq, to the 145,000 oz AuEq production target for the first four years of Phase Two, which, based on the current output, could be achieved over the next year. The LOM target is 120,000 oz AuEq/year for thirteen years. The share price has risen 103.2% over the past three months on both the ramp up in current production, and continued progress on the planned expansion phases for Kora and exploration of adjacent zones.

Figure 14: K92 Mining share price, volume

Disclaimer: This report is for informational use only and should not be used an alternative to the financial and legal advice of a qualified professional in business planning and investment. We do not represent that forecasts in this report will lead to a specific outcome or result, and are not liable in the event of any business action taken in whole or in part as a result of the contents of this report.