October 14, 2024

Big Mining Moves Into Lithium

Author - Ben McGregor

Gold price up as US inflation above expectations

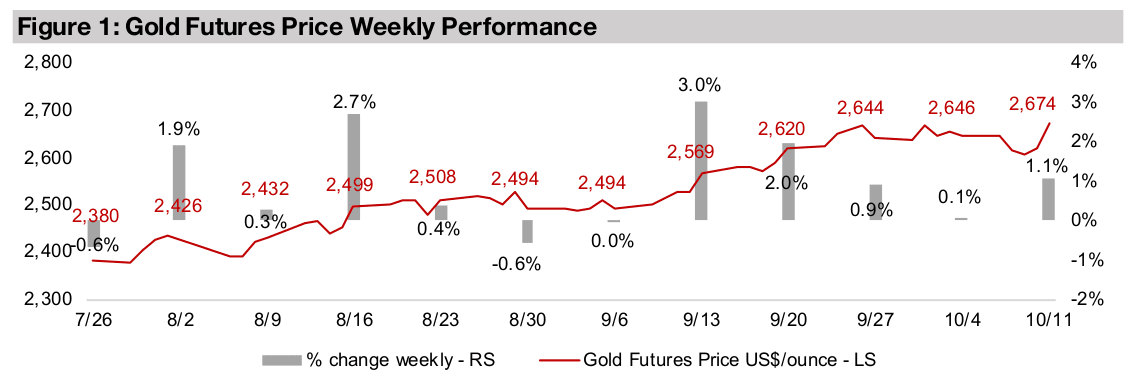

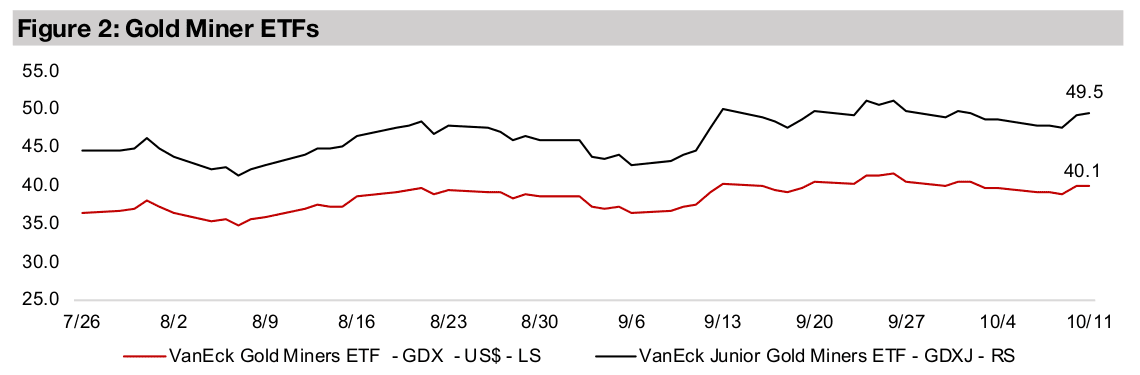

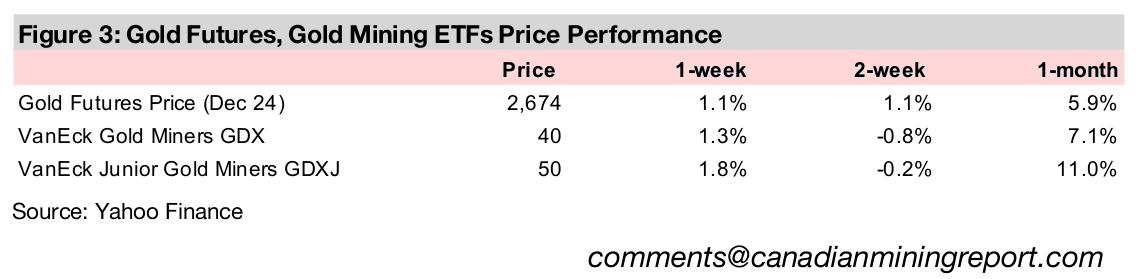

Gold rose 1.1% to US$2,674/oz, as a pause around the mid-US$2,600s/oz level continued for a third week, with overall US inflation coming in slightly above expectations, but still having declined to the lowest level since early 2021.

Rio’s Arcadium acquisition is Big Mining’s first big lithium move

Rio Tinto’s acquisition of Arcadium was Big Mining’s first major move into lithium, with other giants making only minor investments in the sector so far, or even expressing disinterest and preferring other metals to play the energy transition.

Big Mining Moves Into Lithium

The gold price rose 1.1% to US$2,674/oz, continuing a pause around the mid- US$2,600s/oz level for the third week, as US inflation for September 2024 came in ahead of expectations, but did continue to decline, to 2.3%, its lowest level since early 2021. Core inflation has remained more persistent, however, edging up slightly to 3.3% in September 2024 from lows of 3.1% in July 2024. While this is still about a percent above the Fed’s 2.0% core inflation target, the market was not overly concerned by the data, with the S&P 500 and Russell 2000 rising 1.4% and 1.3% respectively, although the Nasdaq lagged, gaining just 3.0%.

Rio Tinto’s acquisition of Arcadium is Big Mining’s first major lithium move

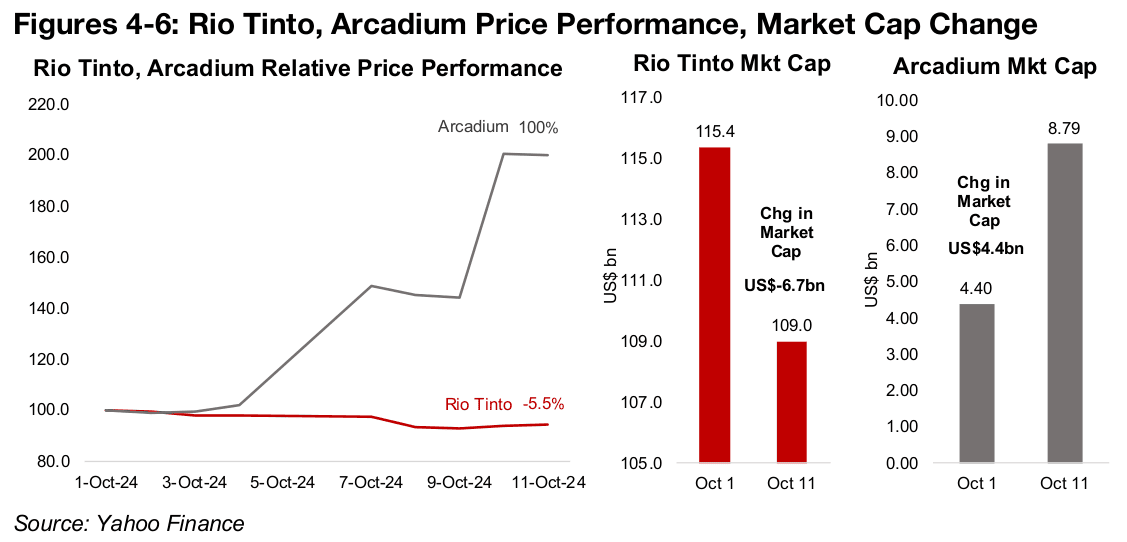

One of the biggest developments in the mining sector this week was Rio Tinto’s

proposed acquisition of lithium producer Arcadium for US$6.7mn in cash. Rio Tinto’s

market cap declined by -5.5%, or the US$-6.7bn vale of the deal, on the

announcement (Figures 4, 5). Arcadium surged 100% to US$8.8bn from US$4.4bn

as the offer was twice its valuation prior to the deal (Figure 6). This is Big Mining’s

first ever major move into the lithium and did raise the question of whether there

would be more large acquisitions in the sector by the other majors.

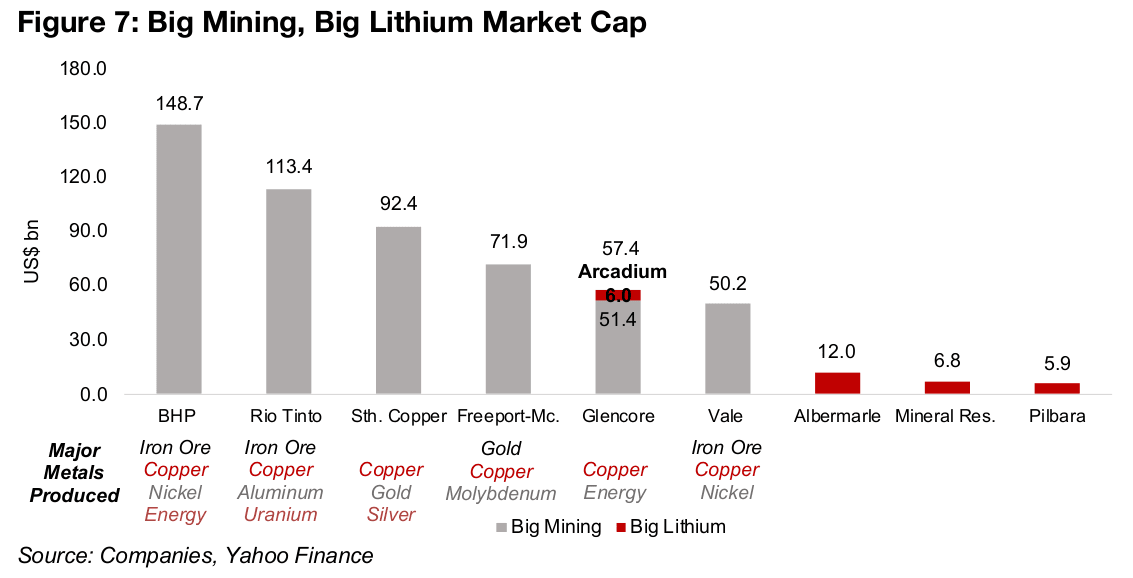

So far the investments in the lithium sector by the other majors have been limited,

and the largest player in the sector, BHP, with a US$148.7bn market cap, has

expressed clear disinterest in lithium, over concerns it would reduce their margins

(Figure 7). While Glencore has made a small investment in a battery recycling

business and Vale has a strategic partnership with Manara Minerals for energy

transition metals, including lithium, neither have announced any intentions to directly

invest in major lithium mining projects.

Several factors could limit further major lithium moves by majors

One of the reasons for the lack of interest in the lithium sector is that the majors already have high exposure to the energy transition through other metals. All of the largest players, BHP, Rio Tinto, Southern Copper, Freeport-McMoran and Vale have a large proportion of their revenue from copper, another key energy transition metal, and a much larger market. Some of these companies also have exposure to nickel and cobalt, two other key metals for the energy transition. Another issue is the small absolute size of potential lithium targets versus the majors, with Arcadium at only about 12% of Rio Tinto’s market cap, while Albermarle, Mineral Resources and Pilbara would only be 4%-8% of the market cap of BHP.

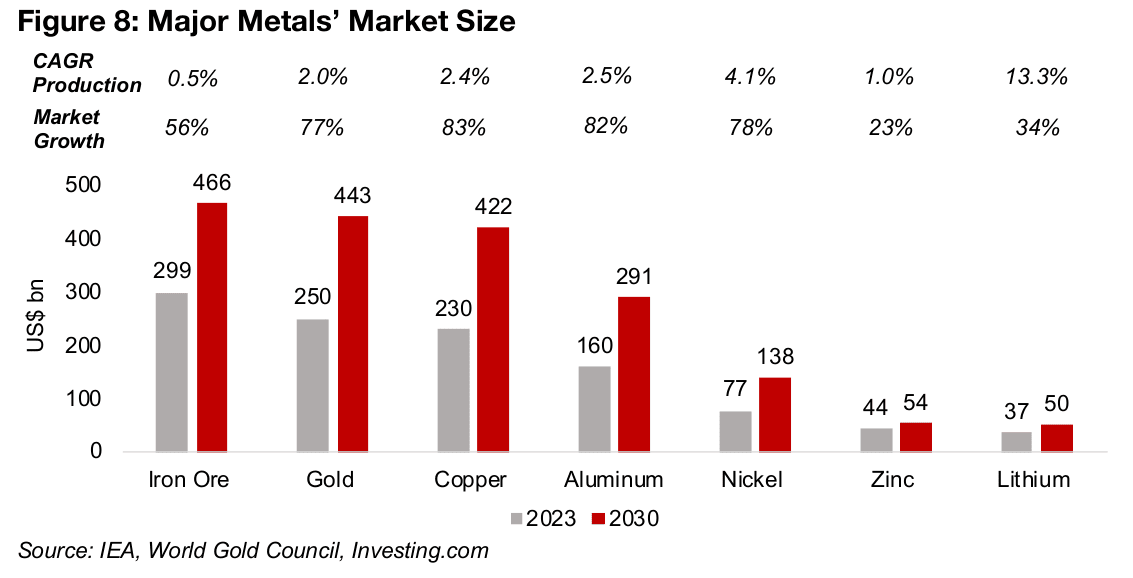

The lithium market overall is also relatively small in contrast to the huge size of the

majors’ main markets, iron ore and copper. While lithium has surged from a tiny size

just five years ago, it was still only a mid-tier market as of 2023, at US$37bn (Figure

8). Even given the strong demand for the metal expected by the International Energy

Agency and assuming the price doubles from current levels, in 2030 it will still only

be the sixth largest metal market, at US$50bn, just behind zinc, at US$54bn. With

this only be about a tenth the size of the gold, iron ore and copper markets, lithium

may not be a large enough market to justify much attention from the majors.

While in volume terms, the lithium market is expected to see the highest growth of

the major metals markets, at 13.3% from 2023 to 2030, in value terms it will only rise

35% over the period. This is because of the dramatic 85% plunge in the price from

its November 2022 highs, which has contracted the market size considerably over

the past two years. While we expect that lithium prices will recover from around

US$11,200/tonne currently to US$20,000/tonne by 2030, this would still be well off

the average around US$35,500/tonne over 2023.

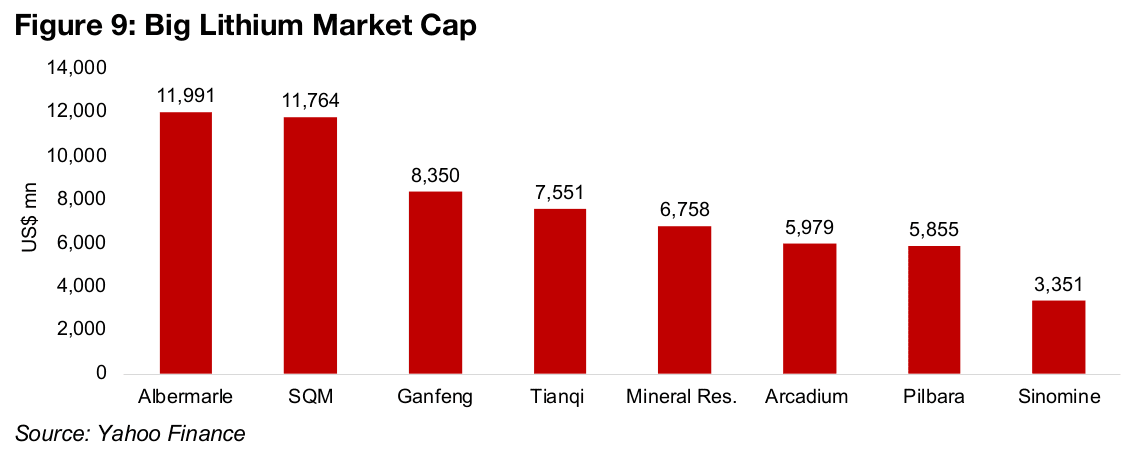

Another factor constraining big lithium acquisitions by the majors is that many of the

largest companies in the industry are from China, where there are limits on foreign

holdings. This puts three of the largest lithium companies, Ganfeng, Tianqi and

Simonine, out of the running for potential acquisition (Figure 9). The second largest

lithium company by market cap is SQM in Chile, which also has Tianqi as a major

shareholder and so limits on holding Chinese companies could also be an issue there,

and there is also a major domestic shareholder that may not be interested in divesting.

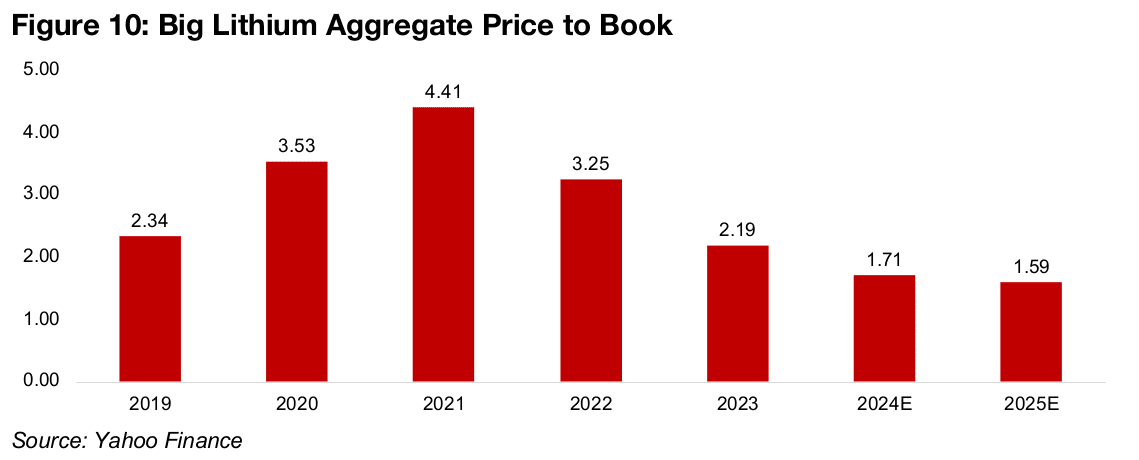

Rio Tinto highlights countercyclical acquisition with lithium sector weak

Rio Tinto highlighted that while it purchased Arcadium at a major premium to its market cap, it still viewed the acquisition as a good long-term deal, being a countercyclical move with the sector likely near a low point. It is certainly far from its peak in terms of valuations, with the sector’s price to book (P/B) weighted by market cap at just 1.71x for 2024 versus a peak at 4.41x in 2021, and expected to be 1.59x for 2025, which certainly does not indicate overexuberance (Figure 10).

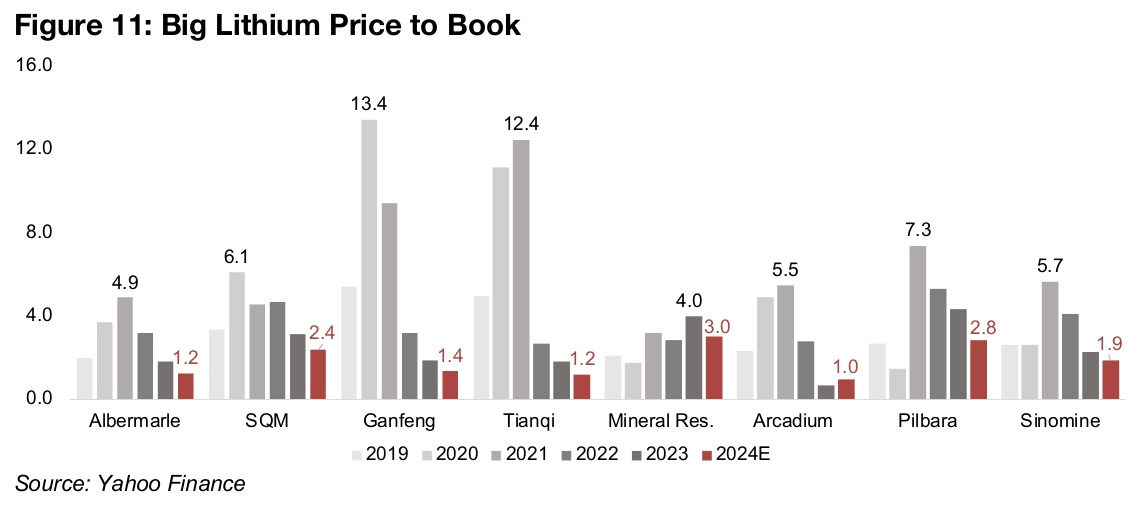

The P/Bs of most of the companies in the sector peaked in 2020 or 2021 on the surge in the lithium price, with the Chinese market leaders seeing particularly excessive multiples, with Ganfeng at 13.4x and Tianqi at 12.4x, and they have dropped to just 1.4x and 1.2x currently (Figure 11). The peak multiples for the other lithium producers were about half of this, with 4.6x for Ablemarle, 6.1x for SQM, 4.0x for Mineral Resources, 5.5x for Arcadium and 7.3x for Pilbara which have now dropped to just 1.2x, 2.4x, 3.0x, 1.0x and 2.8x, respectively.

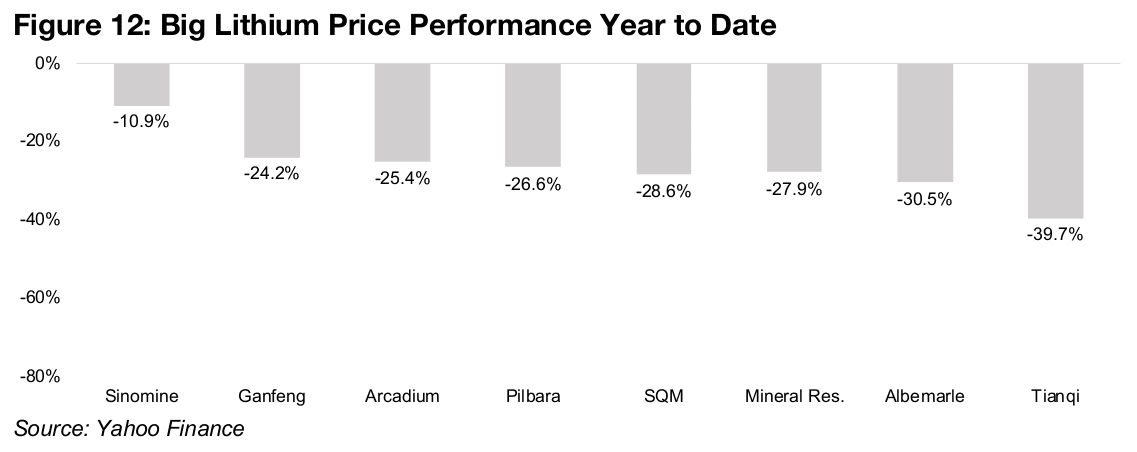

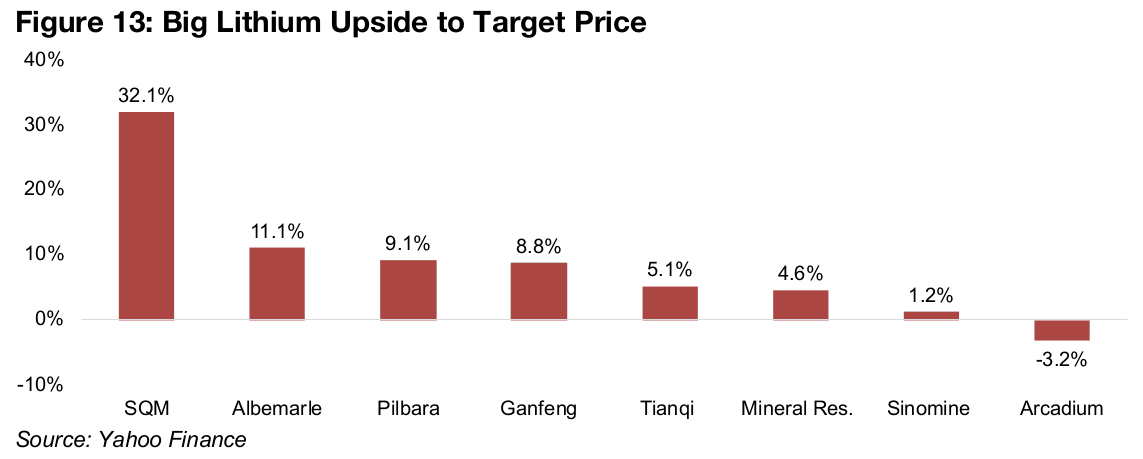

The share prices of the Big Lithium point to a market still in decline, with all of them down year to date, and most dropping about 25%-30% (Figure 12). However, the market does seem to be viewing the lithium share prices as finally having hit bottom, forecasting upside to the target prices of the entire group except Arcadium, which has a slight downside to its target after its huge 100% gain this week (Figure 13). It appears therefore that Rio Tinto could have timed its acquisition reasonably well and avoided buying at the overinflated valuations of 2020-2021.

Lithium sector bearishness driven by slowing EV demand, rising supply

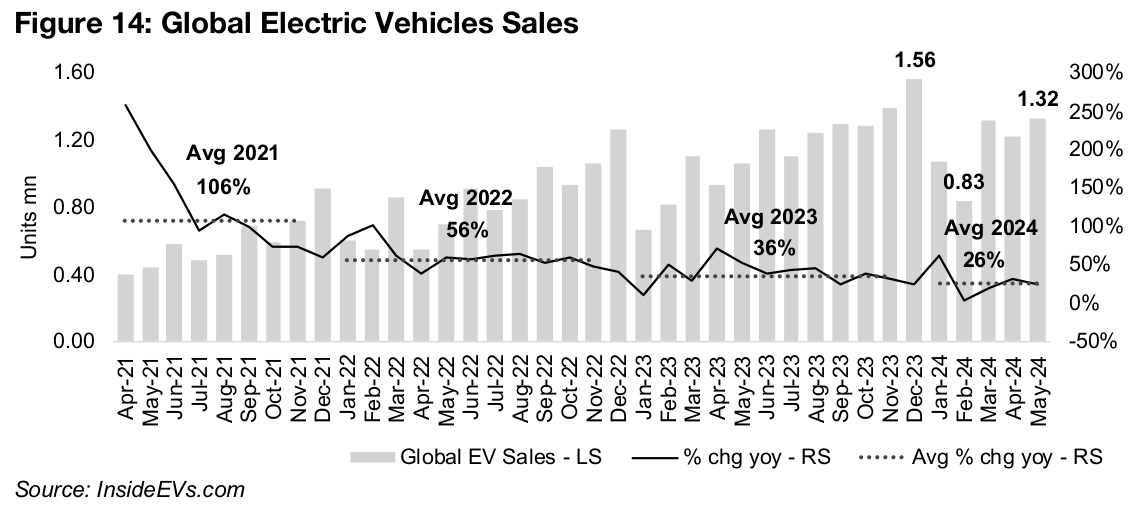

The bearishness in the sector has been driven by the fading of the two key drivers

which had been so in favor of the industry in 2020-2021, which were the surge in EV

sales and limited lithium chemical production capacity. While global electric vehicle

sales are still strong in absolute terms, with 1.32 mn units sold as of the most recently

released May 2024 numbers, the market has not surpassed the peak 1.56 mn units

reached in December 2023 (Figure 14).

The growth rate on average has also come down considerably over the past three

years, from 106% year on year on average in 2021, to 56% in 2022, 36% in 2024 and

just 26% for the first five months of 2024. If markets were pricing in continued growth

of over 100% for several years at the top of the cycle in 2021, they will have had to

bring down their growth expectations to just a quarter of that.

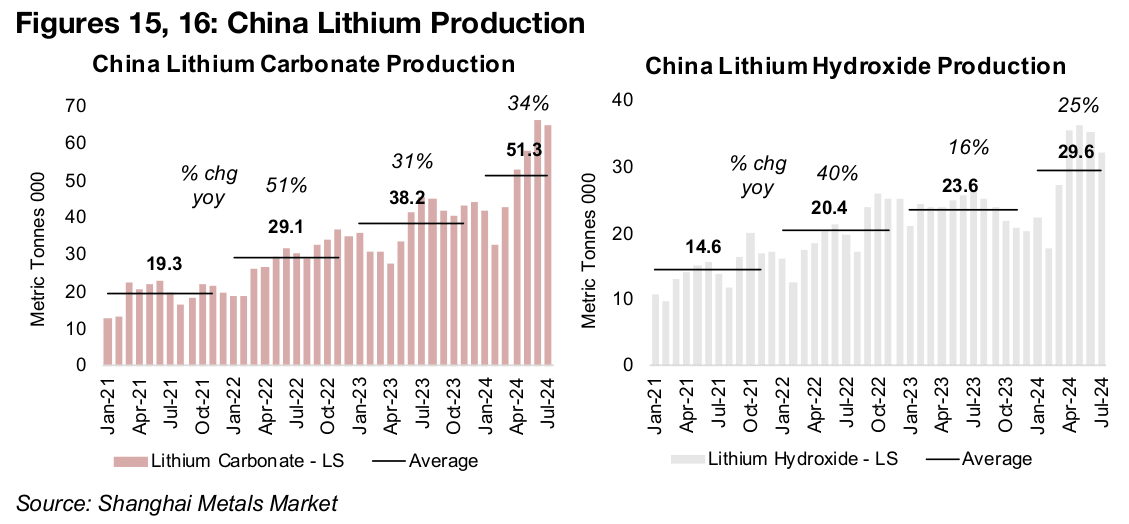

On the supply side there has been a major increase in lithium chemical output from China over the past three years, more than doubling to 51.3k tonnes on average per month in 2024 from just 19.3x in 2021 for lithium carbonate and to 29.6k tonnes in 2024 from 14.6k tonnes for lithium hydroxide (Figures 15, 16). Production for both has also ramped up further particularly from April 2024, suggesting that the average for the full year could be much higher than the year to date figure which includes the relatively low production of Q1/24.

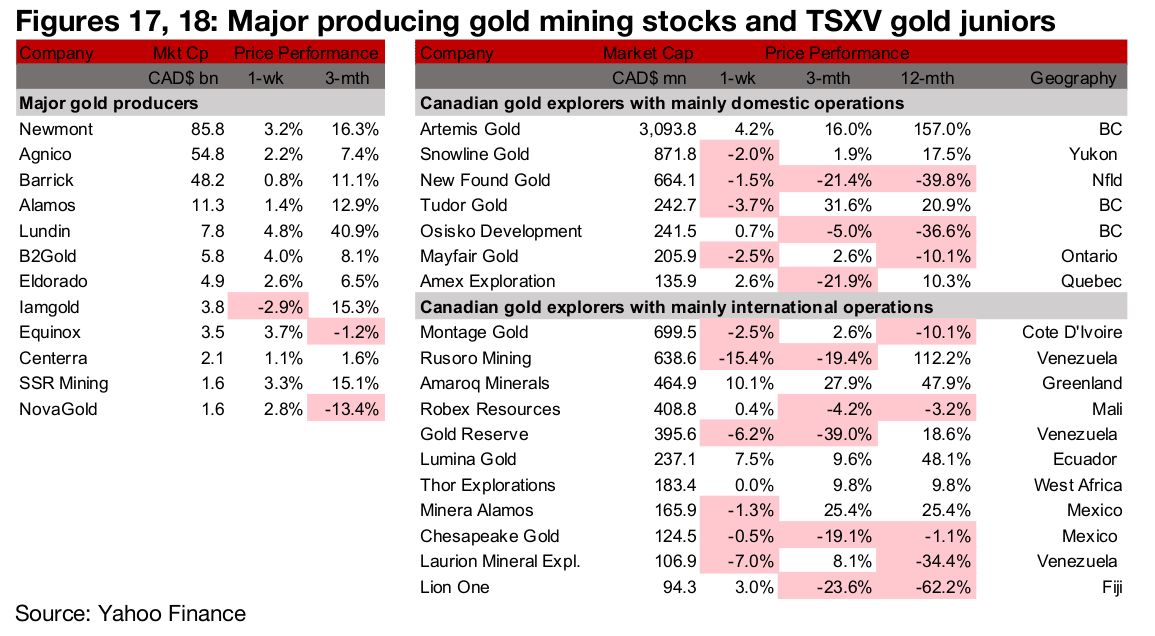

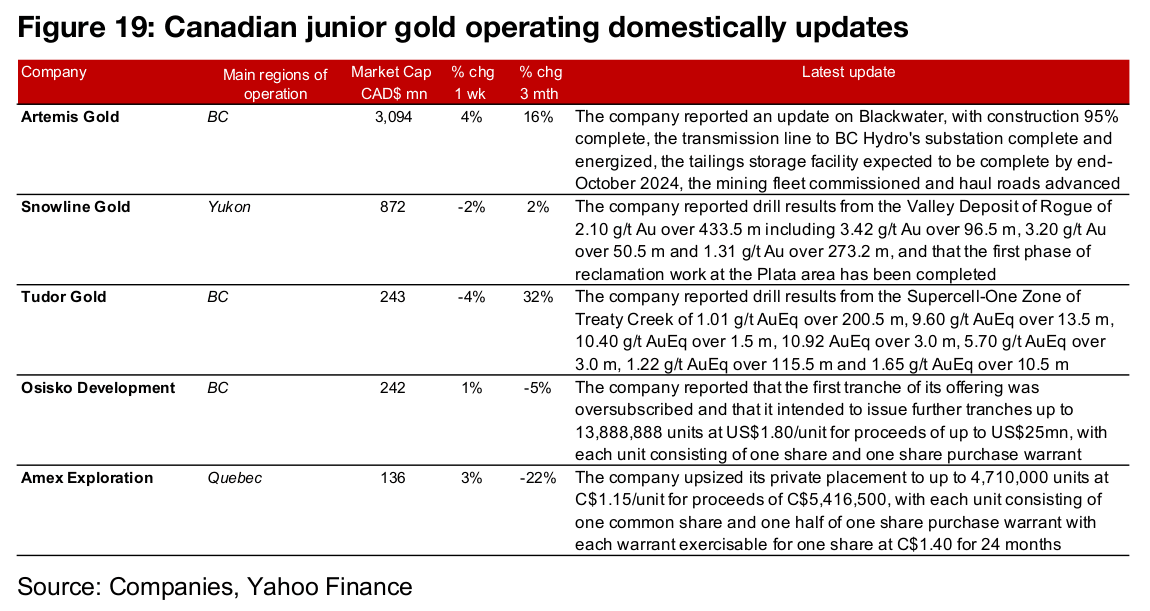

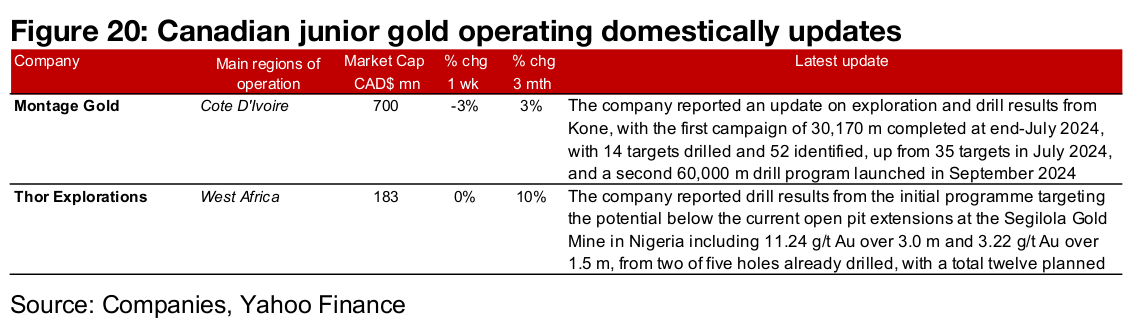

Most major gold producers rise and TSXV gold mixed

Most of the major gold producers rose while TSXV gold was mixed (Figures 17, 18). For the TSXV gold companies operating domestically, Artemis reported an operational update on Blackwater, Snowline gold released drill results from Rogue and completed the first phase of the Plata area reclamation, Tudor Gold issued drill results from the SuperCell-One Zone of Treaty Creek, and Osisko Development and Amex Exploration both upsized their private placements (Figure 19). For the TSXV gold companies operating internationally, Montage and Thor reported a drilling update from the Kone and Segilola projects, respectively (Figure 20).

Disclaimer: This report is for informational use only and should not be used an alternative to the financial and legal advice of a qualified professional in business planning and investment. We do not represent that forecasts in this report will lead to a specific outcome or result, and are not liable in the event of any business action taken in whole or in part as a result of the contents of this report.