January 23, 2024

Automaker Partnership Secured for this Lithium Leader

This article is sponsored content paid by Argentina Lithium & Energy Corp. (see disclosure and disclaimer at the bottom)

Contents

- The Looming Lithium Shortage

- Key Alliance for a Critical Mineral

- The Best Place in the World to Mine Lithium

- The Stellantis Deal

Automakers are fighting for access to “white gold”—lithium.

They can’t get enough of it to electrify their model lineups. And time is ticking.

Five U.S. states have already announced a ban on the sales of fossil-fuel-powered cars by 2035.

From Ford to GM and Stellantis, which produces the RAM truck as one of the more than 15 iconic brands they operate, these multi-billion-dollar titans of the automotive space have been rushing to increase the share of EVs in their portfolios.

But they can’t do it unless they have an ample supply of lithium.

It’s the critical element that goes into EV batteries.

And they need their lithium supply to be reliable for years to come.

Ford, for example, sold about 15,000 electric trucks in 2022. This year, sales could grow to over 25,000 units. That’s 67% year-over-year growth.

And each of them has a battery that weighs about 1,800 pounds.

That’s a lot of lithium… and we’re just talking about a single car.

So, what’s their solution to this imminent lithium shortage?

Part of their strategy appears to be investing early in promising companies in the lithium space.

That’s what Stellantis just did.

It made a pivotal investment in an Argentina-based lithium exploration company.

It passed Stellantis’s muster…

And Stellantis invested tens of millions of dollars in this company.

The Argentina peso equivalent of US$90 million, to be precise.

Argentina Lithium & Energy Corp (LIT.V, OTC:PNXLF) evolved from a promising lithium exploration venture to a partner of one of the most established auto brands in the world. For more detailed technical information on Argentina Lithium & Energy Corp.’s lithium project, visit www.sedarplus.ca and the company’s website.

This is a potential game-changer for the company.

Here’s why.

The Looming Lithium Shortage

We only have two years…

CNBC reported back in August that by 2025, the lithium market will be in a state of deficit.

It quoted research done by BMI, a unit of the prestigious Fitch Solutions analytics company.

The biggest driver of the shortage will be China, BMI says.

The country is building electric vehicles at a lightning-fast pace… yet mine supply can’t catch up.

China’s annual demand growth will run at about 20% per year… while supply is projected to grow by just 6%.

Even though China is one of the world’s largest suppliers of the metal, it also consumes massive amounts of lithium.

China will drive a lot of this shortage…

But China isn’t the only lithium-hungry nation.

Consider this… The global supply of lithium was about 540,000 tonnes in 2021.

By 2030, global demand will likely reach 3 million metric tons.

That’s a 6x increase by the end of the decade.

Electric vehicles are the primary consumers of lithium.

And every year their share of the global car fleet grows.

S&P Global projects that sales of EVs will soar from 13.8 million this year to 30 million by 2030.

And the lithium supply may be an issue by that time…

Deutsche Bank says that in 2025, lithium demand will be about 50,000 tonnes higher than supply.

By 2030, the gap will widen by fifteen times to about 768,000 tonnes.

The setup for lithium is looking increasingly bullish.

Demand for the metal is rising, while supply will likely lag.

It’s an opportunity that Argentina Lithium & Energy Corp (LIT.V, OTC:PNXLF) has seized by focusing on exploring for new sources of the metal.

But there’s more to this company.

Not every mining junior is in the same beneficial position that Argentina Lithium is, with a large partner that operates in both the US and Europe.

And in the United States, lithium is considered a critical mineral.

Here’s what it means.

Key Alliance for a Critical Mineral

Much like oil powered most of the 20th century, lithium is potentially going to play a critical role in the electrification megatrend.

As transportation goes fully electric, lithium is a primary component of battery power and storage. It will likely also play a key role in grid storage, which will help stabilize the supply of energy from renewable sources such as wind and solar.

Lithium is so important, in fact, that it has become a target of geopolitical competition.

China is one of the largest suppliers of lithium. And that’s a problem for the Western countries and the United States in particular.

The U.S. wants to “decouple” from China economically. It wants to become more independent… and build supply chains of critical minerals that it can control.

This is why it has turned to Latin America for partnerships.

Latin America has the world’s largest amounts of lithium. And in general, Latin American countries are friendly to the United States.

They also share the United States’ vision for a green future. And they want to have access to one of the largest markets in the world.

It would be a win-win. The U.S. gets its lithium supply from friendly nations, while the suppliers get access to a vast EV market.

This is why, back in May of this year, Argentina was invited to participate in the first meeting of the Mineral Security Partnership led by the United States.

The Partnership is a strategic program created by the world’s biggest economic powers to ensure an ample supply of critical minerals, including lithium.

This partnership was created in direct response to both the looming lithium shortage and the “great power” competition between the United States and China.

In other words, the U.S. is laying the foundation of an Americas-based lithium supply chain.

And it’s willing to spend billions of dollars supporting critical minerals suppliers located in friendly nations such as Argentina.

Argentina doesn’t have a free trade deal with the United States yet, but the U.S. seems to be working on an exception that will open-up U.S.-Argentina lithium trade.

This is another potential catalyst for Argentina Lithium & Energy Corp (LIT.V, OTC:PNXLF).

Even though it has already secured a deal with Stellantis, one of the world’s largest carmakers, having the full weight of the U.S. economic might supporting the Argentina lithium industry could potentially provide an even greater boost to the country’s lithium economy.

The Biden Administration has already had talks with Argentina’s Mining secretary about “potential projects” related to critical minerals, including lithium.

This is important… experts say that as a result of these talks, Argentina’s lithium exports to the United States could increase five to seven times.

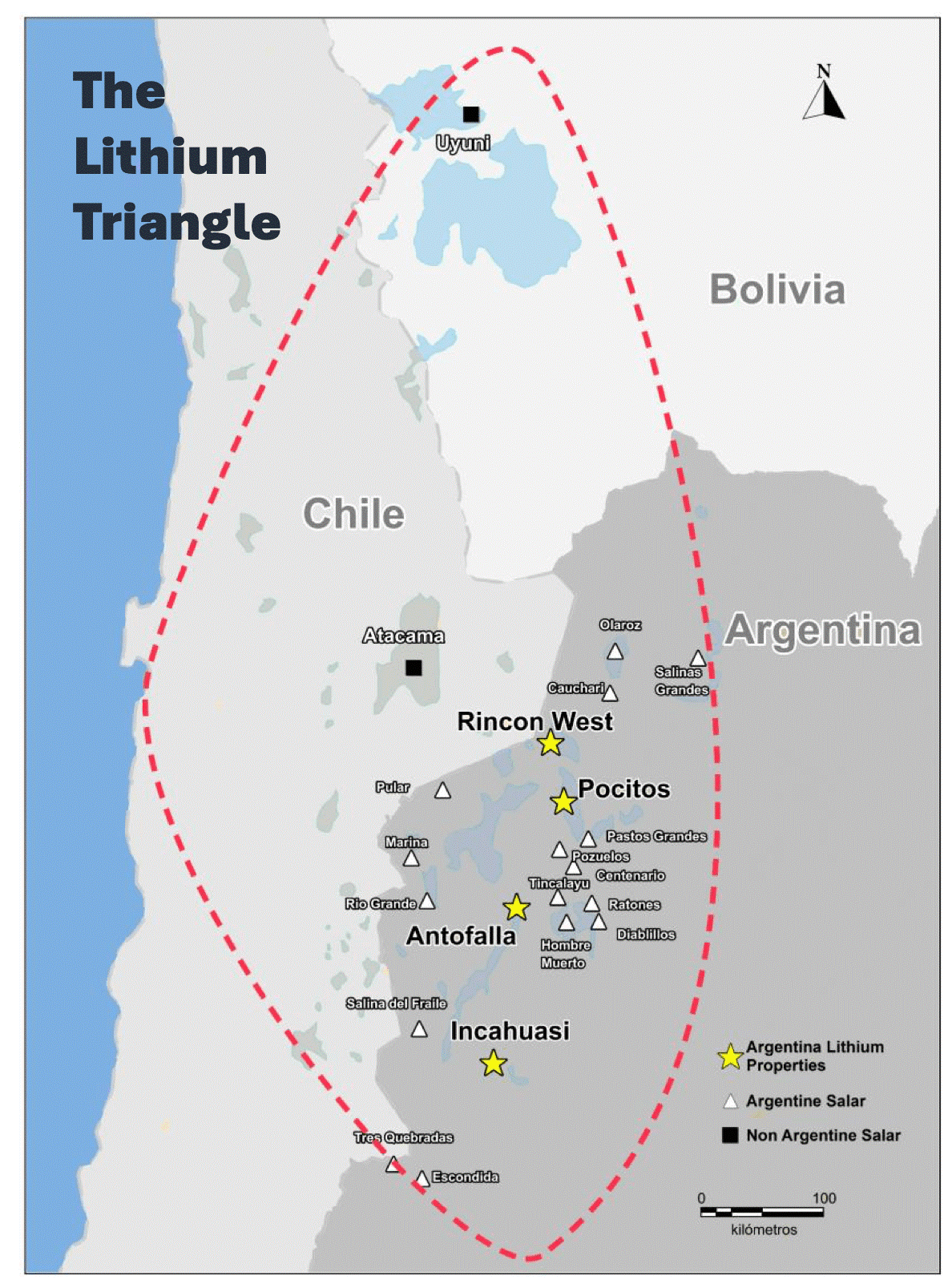

And most of it will come from a world-class area called the “Lithium Triangle.” This is exactly where Argentina Lithium & Energy Corp (LIT.V, OTC:PNXLF) is building its presence.

The Best Place in the World to Mine Lithium

It’s called the “Lithium Triangle.”

The “Lithium Triangle” is a region in the Andean corner of South America, and it’s rich in “white gold.”

The triangle covers some of the territories of Chile, Bolivia, and Argentina.

It’s massive. It hosts about 58% of the world’s lithium resources, according to the USGS Mineral Commodity Summary.

Argentina alone hosts about 19.3 million tons of lithium, about 22% of the world’s total.

And it’s available in salt lakes or salars, which are traditionally less expensive to mine than hard rock deposits. In fact, hard rock deposits could be twice as costly to mine.

So, there could be an economic advantage here. While China is focused on mining Australia’s relatively more expensive hard rock deposits, the United States has its eyes set on South America’s (and Argentina’s in particular) brines.

And experts agree that Argentina is the most promising country out of the three “Lithium Triangle” states.

Why?

First, it badly needs economic growth. The country’s economy has been in one kind of trouble or another for decades. Right now, it’s in a recession caused by a three-year drought.

To stimulate investment in the country’s lithium industry, Argentina’s former president Alberto Fernández reduced taxes on mineral export s, according to the Center for Strategic and International Studies.

Second, its mining industry is relatively less developed than its neighbors’. Argentina Lithium & Energy Corp (LIT.V, OTC:PNXLF) has built a strong presence in the country’s lithium-rich areas.

Third, Argentina has the world’s second-largest lithium reserves.

The Stellantis Deal

The auto industry is doing everything in their power to get access to future lithium supply .

That’s why they have started investing directly in exploration and mining companies… and not only the ones with active operations. They also look for juniors in the best jurisdictions in the world.

In early October, Stellantis (which makes the RAM trucks, as well as Jeep, Chrysler and Dodge cars, and others) closed a $90-million investment in equivalent ARS$ in Argentina Lithium’s Argentine subsidiary.

For this investment Stellantis got 19.9% of the company’s subsidiary, with an opportunity to convert that directly to 19.9% of Argentina Lithium itself.

(The full press release is available here.)

(For more detailed technical information on Argentina Lithium & Energy Corp.’s lithium project, visit www.sedarplus.ca and the company’s website. The company is an exploration stage company and Stellantis’ investment will help advance its projects.)

The offtake agreement that was part of the deal guarantees that Stellantis can buy up to 15,000 tonnes per year of lithium over seven years if any of Argentina Lithium’s projects advance to production.

Argentina Lithium’s properties are located in the heart of the “Lithium Triangle.”

They are close to all the critical infrastructure… including rail, water, roads, and power lines.

The company is a member of the Grosso Group that has 30 years of experience working in Argentina. The group was a pioneer of mineral exploration in Argentina back in 1993.

The group’s track record includes involvement with several important discoveries in Argentina, including Gualcamayo (gold), Chinchillas (silver-lead-zinc), Navidad (silver-lead), and Amarillo Grande (uranium-vanadium).

Right now, Argentina Lithium owns more than 67,000 hectares of mineral rights on four salars (salt lakes) in the provinces of Salta and Catamarca.

They are accessible year-round, which means that the company won’t have to wait for a certain season to do exploration and development. Many exploration and mining projects have only seasonal access, particularly at the exploration stage before infrastructure can be developed.

Argentina Lithium doesn’t have this problem.

As a result, a steady stream of press releases is expected as Argentina Lithium & Energy Corp (LIT.V, OTC:PNXLF) continues working at its properties in the best lithium region in the world.

For example, the company’s Rincon West project, which covers nearly 5,200 hectares, is on a mature salar with other third-party deposits.

It has access to an international highway to Pacific ports and an electrical power corridor just north of the salar itself.

Argentina Lithium has completed its first phase of drilling at Rincon West.

The first nine holes delivered positive results, with wide intervals and consistent grades.

The company now thinks that the aquifers it delineated could extend further and the company is in the middle of a five-hole drilling campaign to test new areas. It has also been working on obtaining permits for pump tests – a key step in delineating a resource for the project.

Another key project is Antofalla North.

It covers over 10,000 hectares of claims, some of them are wholly owned by the company, while others are optioned.

Antofalla North is located just 25 kilometers away from Argentina’s largest lithium-producing operation.

In 2024, Argentina Lithium plans to conduct electromagnetic soundings and drill up to six initial holes at the property, once its permits are in place. An expanded program in planned pending results from the initial drilling.

2024 will be a busy year for Argentina Lithium, with several catalysts anticipated on its two flagship projects as they are advanced.

The company’s management team is also top-notch.

Its CEO is Mr. Nikolaos Cacos, a mining veteran with over 30 years of experience. He holds a Master of International Management degree from Heidelberg, Germany, and a Bachelor of Science degree from the University of British Columbia.

He is a senior member of the Grosso Group, which has been present in Argentina since 1993. Mr. Cacos worked with the Grosso Group since its inception.

On the technical side, the company is led by Mr. Miles Rideout. He is Argentina Lithium’s VP Exploration.

Mr. Rideout has 34 years of experience in exploration, business management, and mining integration with local communities.

This kind of expertise is critical in establishing trust with local residents.

Mr. Rideout has experience in exploring for lithium in Argentina. He was part of the teams that discovered world-class deposits such as the Collahuasi and Ujina copper-porphyry deposits, Veladero gold deposit, and Navidad silver deposit.

In other words, he has massive experience working in Argentina with an impressive track record of world-class discoveries.

This team seems perfectly equipped to take Argentina Lithium to the next level.

Strategically Located Lithium Leader

Argentina Lithium & Energy Corp (LIT.V, OTC:PNXLF) has secured a critical investment from a massive carmaker that will help it advance its projects faster than it otherwise could.

(Visit www.sedarplus.ca and the company’s website for further information on the company, the project and the potential risks.)

Sign up to receive our future articles and updates.

Disclosure (Paid for Content)

The Canadian Mining Report has been retained by Argentina Lithium & Energy Corp to provide various digital marketing and advertising services. We have been paid to provide editorial and marketing services to profile the company and its project. The preceding Article is PAID FOR CONTENT sponsored by Argentina Lithium & Energy Corp. and produced in cooperation with CanadianMiningReport.com. The publisher of CanadianMiningReport.com owns securities positions in Argentina Lithium & Energy Corp and may trade on their own behalf at any time without prior notice, however, it is our general policy to not sell any shares while we are currently engaged with a client.

The Canadian Mining Report's business model includes receiving financial compensation to carry out various services for companies which may include advertising, marketing and dissemination of publicly available information. This compensation is a major conflict of interest in our ability to be unbiased.

Sources

Disclaimer

The material in this article should not under any circumstances be construed as an offering, recommendation, or a solicitation of an offer to buy or sell the securities mentioned or discussed, and is to be used for informational purposes only. Neither Canadian Mining Report (the "Publisher", "we", "us", or "our"), nor any of its principals, directors, officers, employees, or consultants ("Publisher Personnel"), are registered investment advisers or broker-dealers with any agencies in any jurisdictions. Canadian Mining Report ("Canadian Mining Report", "Us", "Our" and/or "We") is a Canadian based media company that typically works with publicly traded companies and provides digital marketing strategies and services.

At most, this communication should serve only as a starting point to do your own research and consult with a licensed professional regarding the companies profiled and discussed. Conduct your own research. We do not provide personalized or individualized investment advice or advice that is tailored to the needs of any particular recipient.

Read More