Aug 28, 2020

Another week in the mid-$1900s/oz

Author - Ben McGregor

Gold price remains range bound around mid-$1,900s/oz

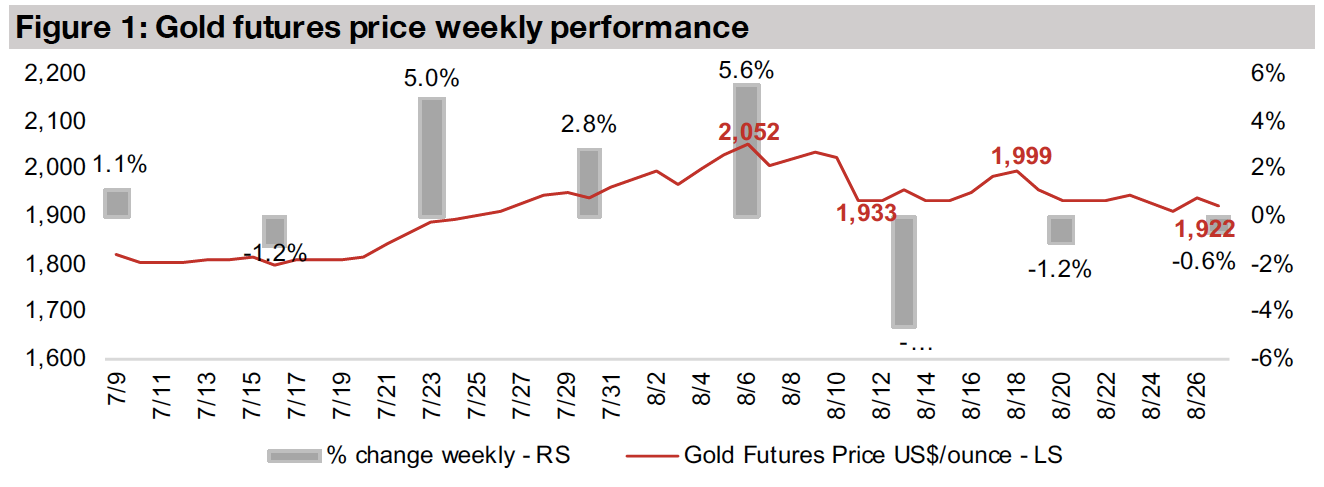

The gold price ended the week down -0.6% at US$1,922/oz, trading within a new range seeing resistance to the downside towards US$1,900/oz and to the upside towards US$2,000/oz, as there was little net change in fundamental drivers.

Producing miners dip by low single digits

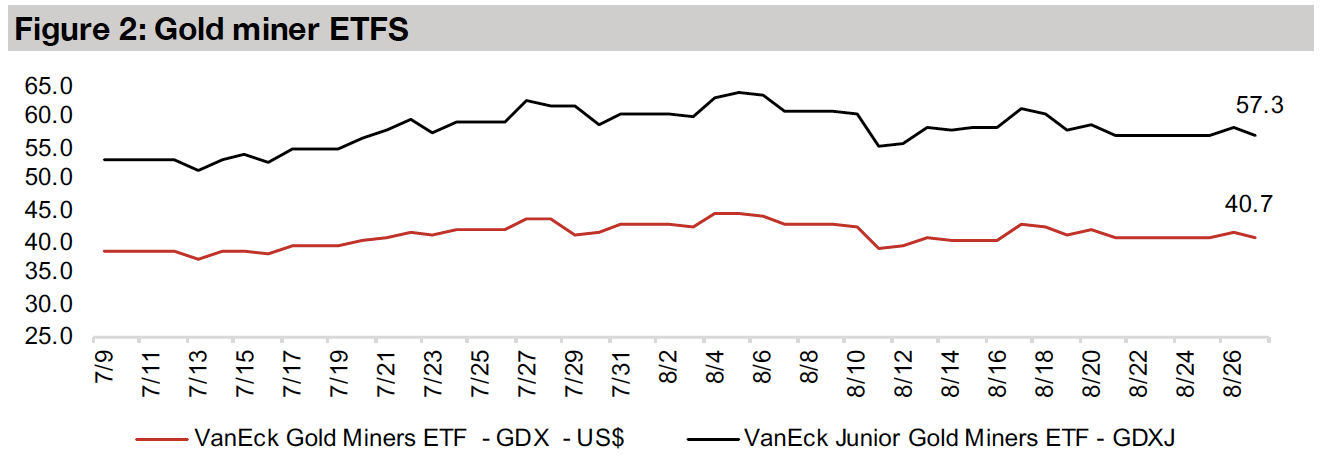

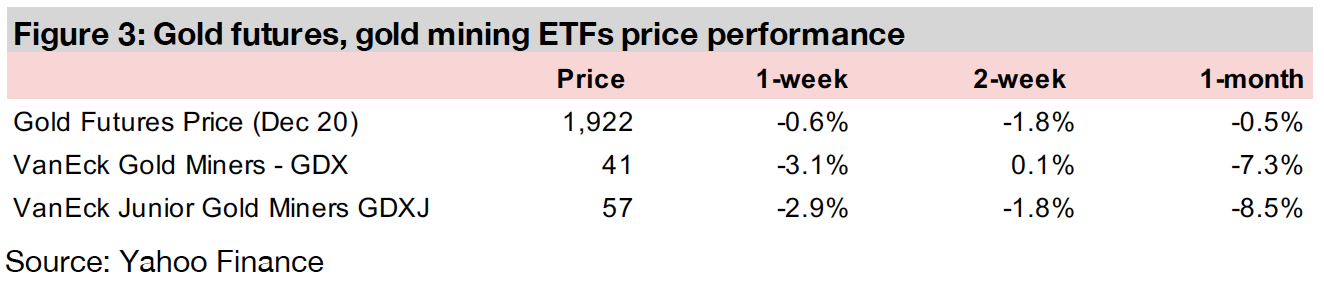

Most of the producing miners dipped by mid-single digits this week, with the GDX down -3.1%, and a period of consolidation continued as macro risks remained steady at high levels and not trending materially up or down.

Another week around the mid-US$1,900s/oz

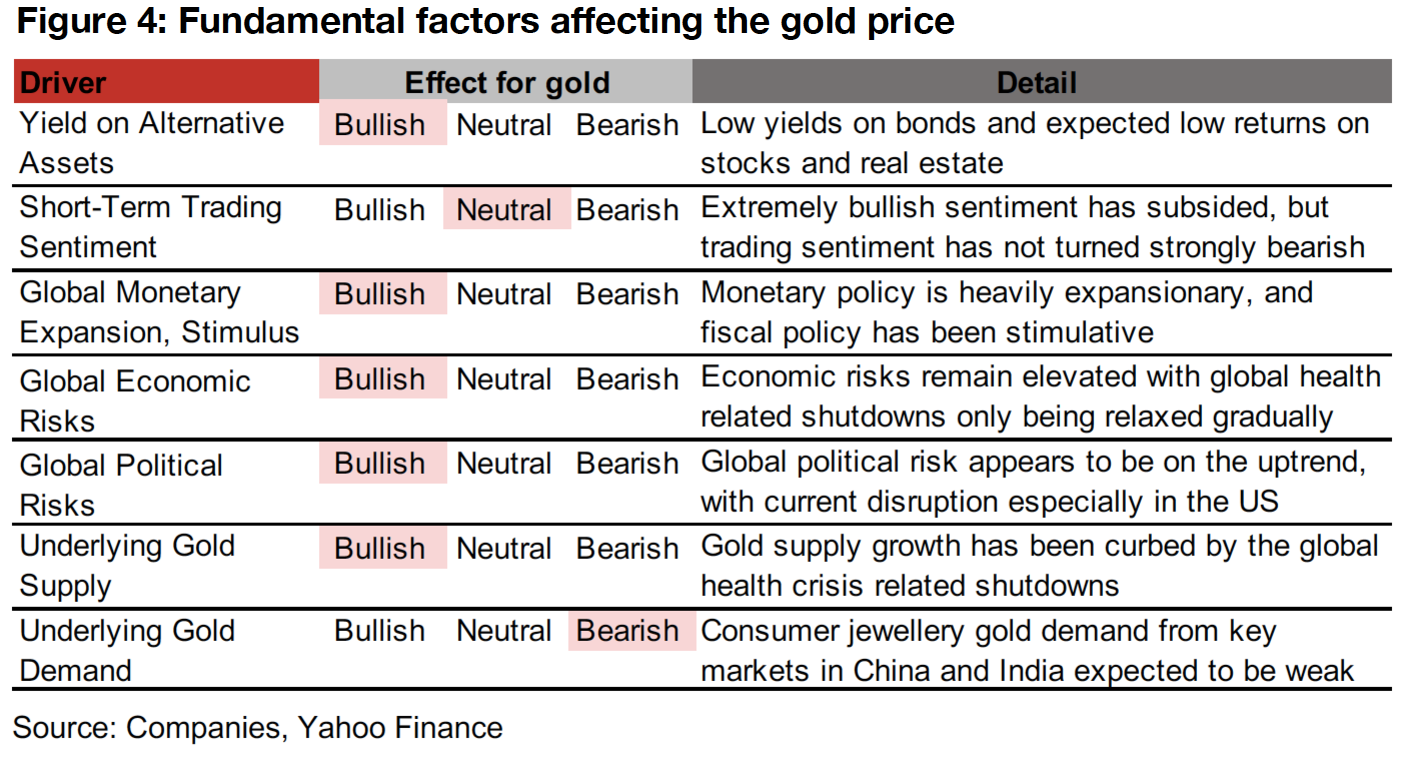

The gold futures price dipped -0.6% this week, closing at US$1,922/oz, as gold continued to average around the mid-US$1900s/oz for its fourth week, remaining range bound with resistance to the downside around US$1,900/oz and to the upside around US$2,000/oz. There has been minimal substantial change in the fundamental factors driving the gold price for the past month, with risks remaining high, but not trending substantially up or down. Thus, we are seeing range bound trading as the market considers where we are heading next. We outline the core drivers for gold in Figure 4, and overall, we believe they remain bullish over the medium-term, even if there is a continued pause short-term. A low forecast yield for substitute assets, and a continued global monetary expansion in reaction to high economic and political risks remain in support of gold, as does a reduction in mining supply because of the shutdowns this year. With short-term trading sentiment remaining relatively balanced, the only clearly bearish factor is a decline in underlying gold demand, especially for jewellery from China and India.

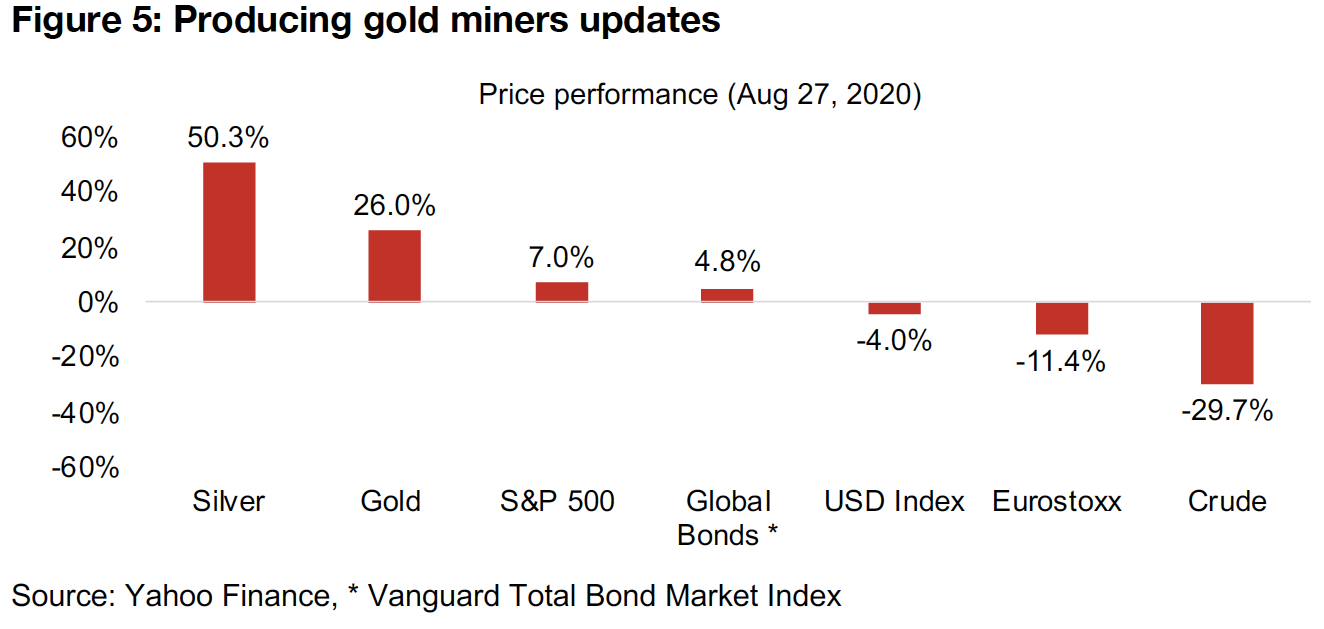

These factors combined have made gold one of the strongest performing major assets this year, up 26.0% year to date, surpassed only by silver, which had been undervalued versus gold for an extended period and has played a game of rapid catch up this year, rising 50.3% (Figure 5). Other key asset classes have been much weaker, including equity markets, with the S&P 500 gaining 7.0% and the Eurostoxx 600 declining -11.4%, while global bonds are up 4.8% this year and the USD index has declined -4.0%. While crude has recovered off a major plunge earlier in the year, it is still the worst performing of the group, down -29.7%.

Producing miners mostly down

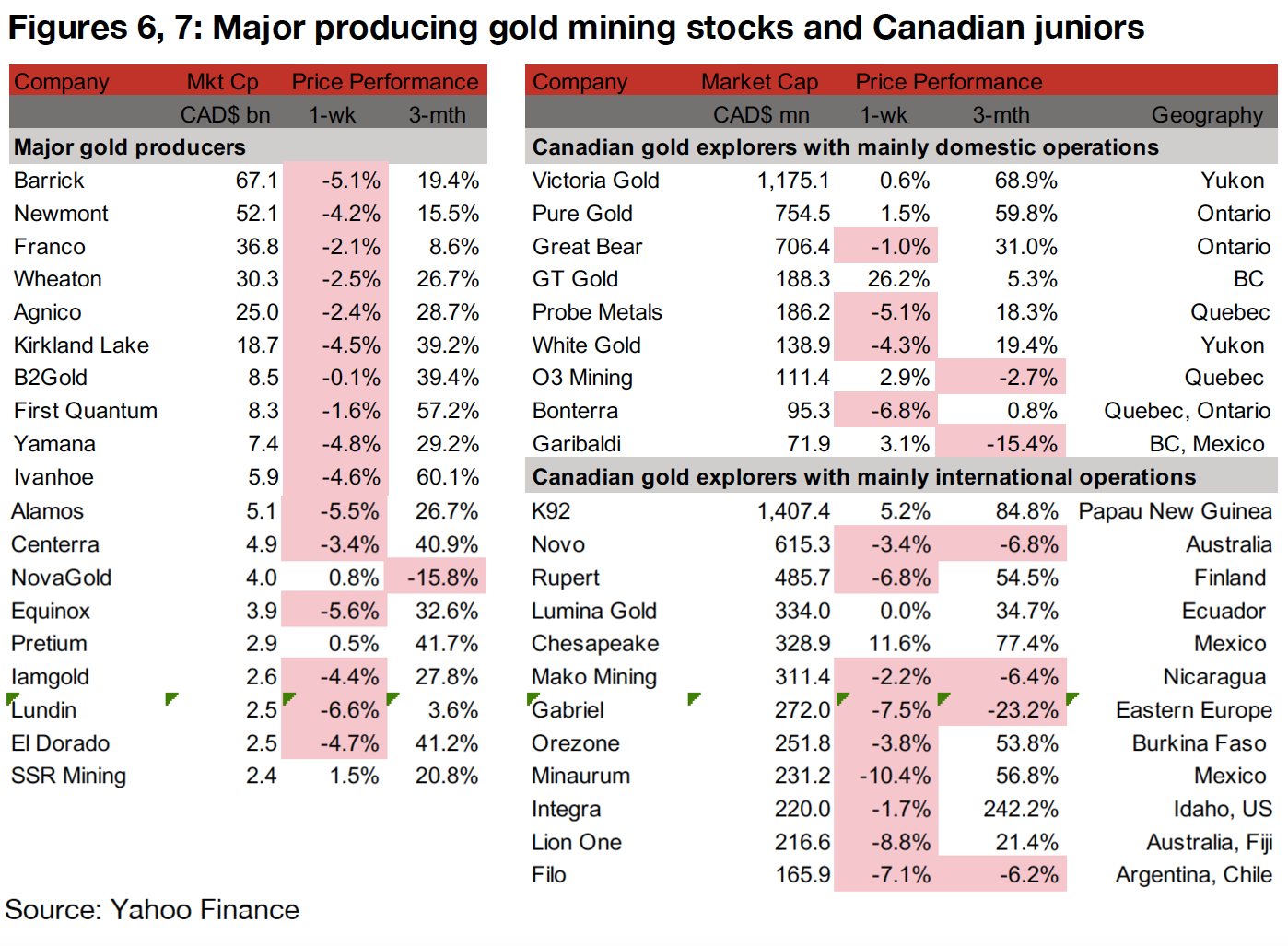

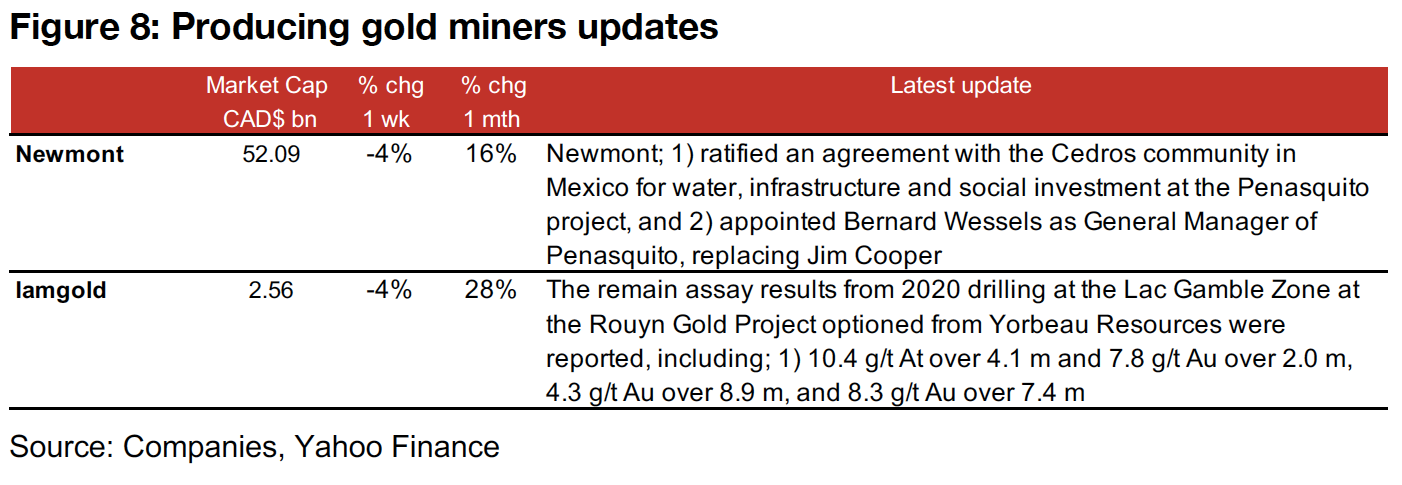

Most of the producing miners were down this week, many by mid-single digits, as a period of post-gold-surge and post-Q2-results consolidation continues (Figure 6). There was very limited news flow this week, with Newmont ratifying an agreement with the local Cedros community at its Penasquito project, which will allow for increased ease of exploration of the area, and appointing a new general manager there (Figure 8). Iamgold reported the remaining assay results from the Lac Gamble Zone at the Rouyn Gold project optioned from Yorbeau Resources.

Canadian juniors operating mainly domestically mixed

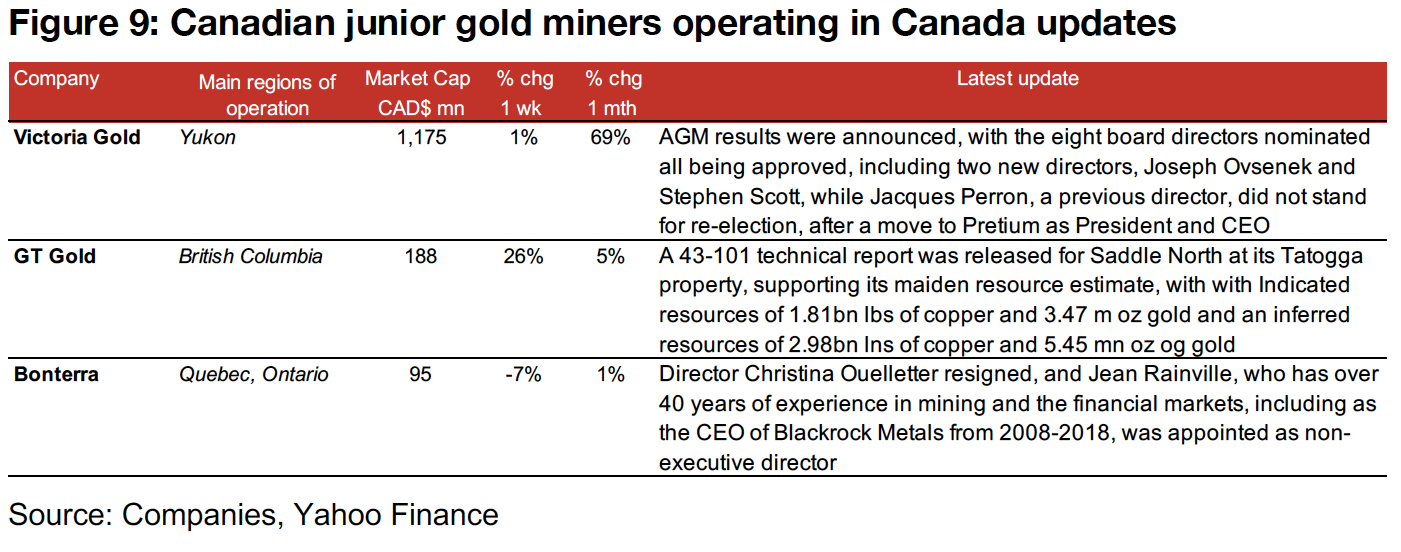

The Canadian juniors with mainly domestic operations were mixed this week (Figure 7). GT Gold had by far the strongest performance of the group, up 26%, after it released its 43-101 technical report for the Saddle North zone at its Tatogga project, and announced that its preliminary economic assessment was underway (Figure 9). Victoria Gold was relatively flat on news of its AGM, including the appointment of two new directors, and one director who did not stand for election, and Bonterra also announced an appointment of a director and a resignation of one.

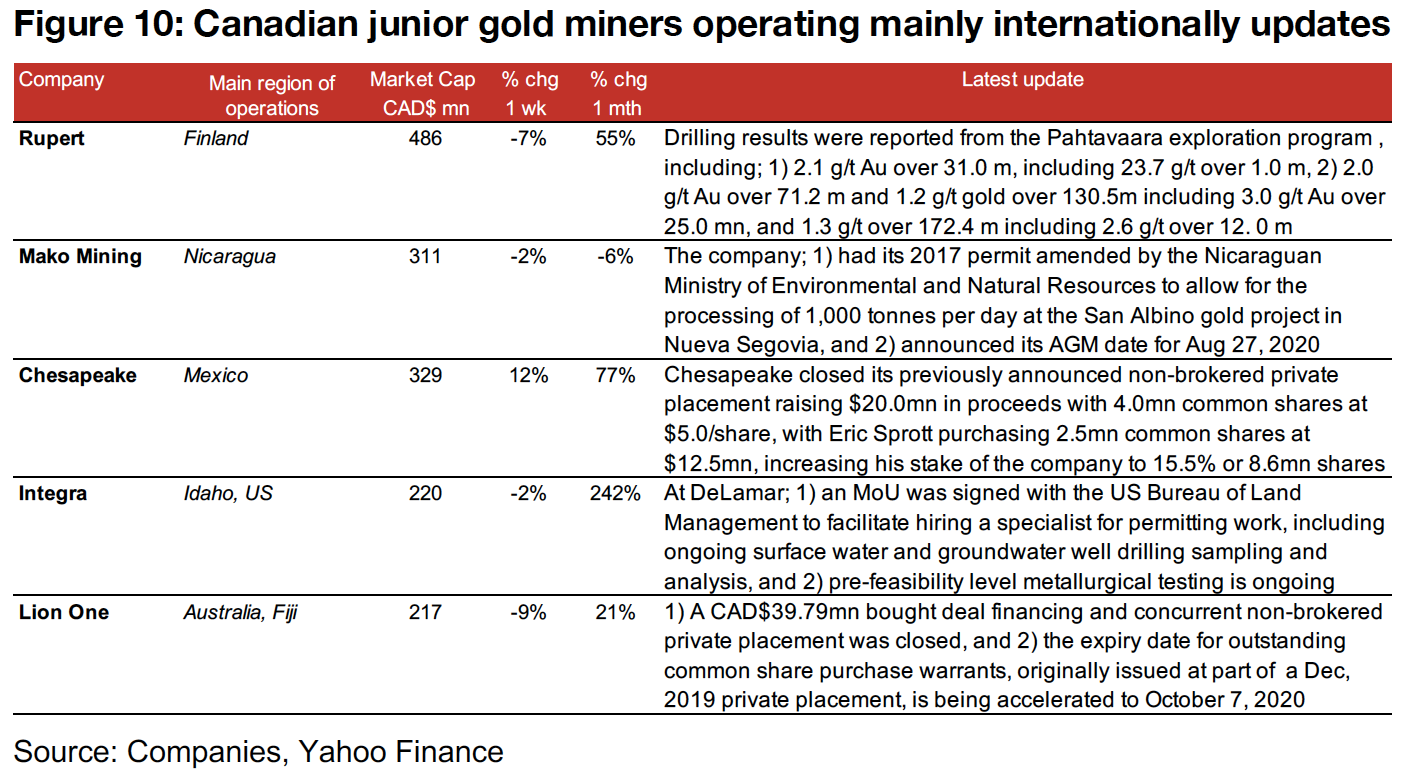

Canadian juniors operating internationally mainly down

The Canadian juniors operating internationally were mostly down this week (Figure 7). Chesapeake saw the strongest performance of the group, up 12% on the closing of its CAD$20mn non-brokered private placement of which Eric Sprott purchased 62.5% (Figure 10). Lion One declined -9%, even though it closed CAD$40mn in financing, partly because it accelerated the expiry date of some common share purchase warrants. Mako Mining ticked down -2%, after having a key environmental permit for its San Albino project in Nicaragua amended to allow for an expansion in processing volume. Rupert fell -7% after reporting drilling results from Pahtavaara, and Integra fell -2% after progress on permitting and pre-feasibility activities.

In Focus: Bonterra Resources

Bonterra has three projects in Quebec's Abitibi district

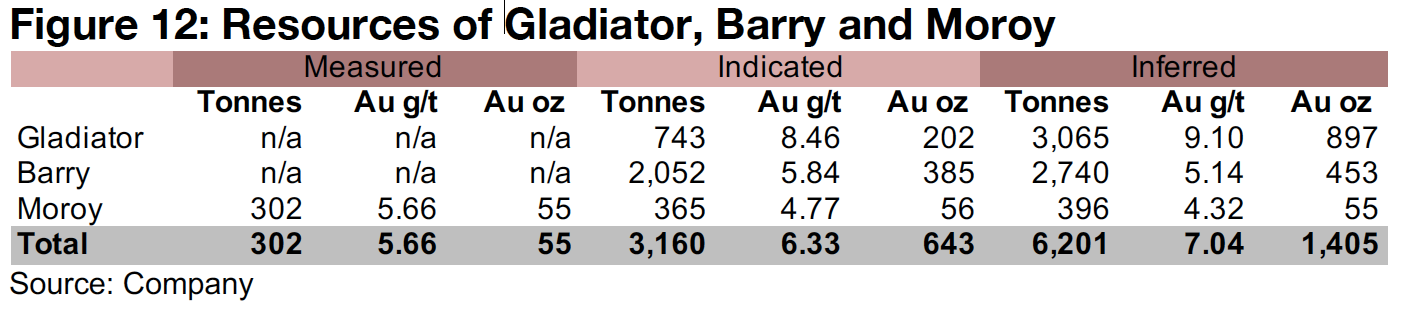

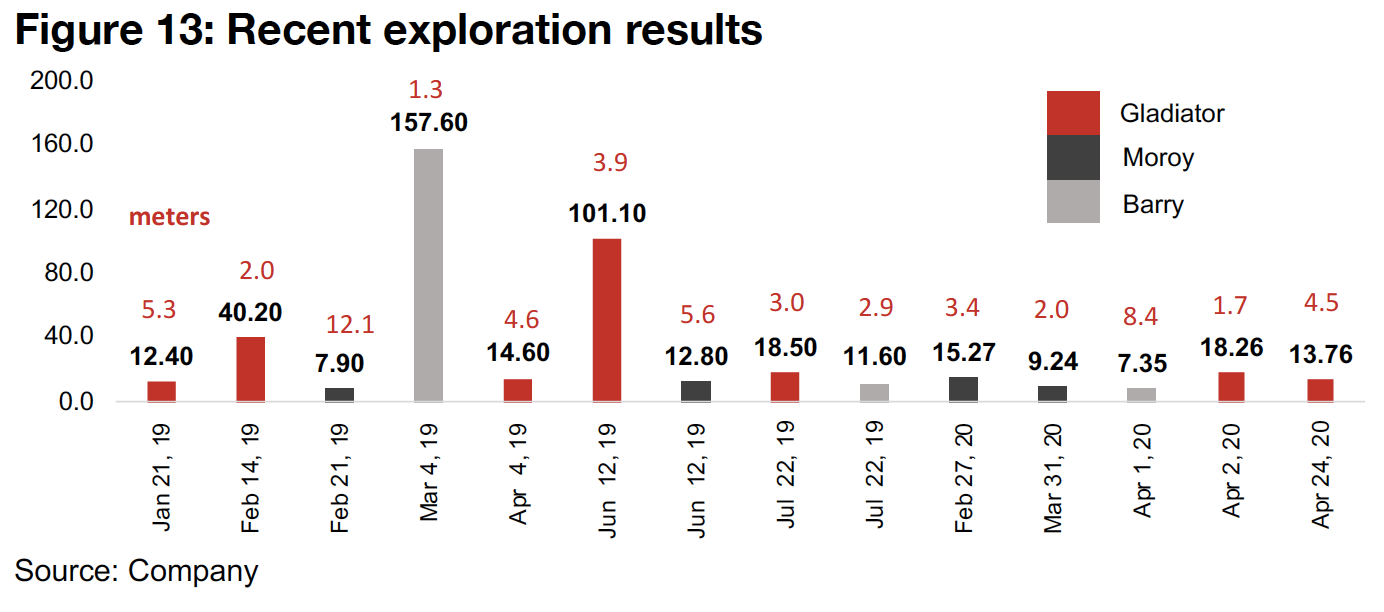

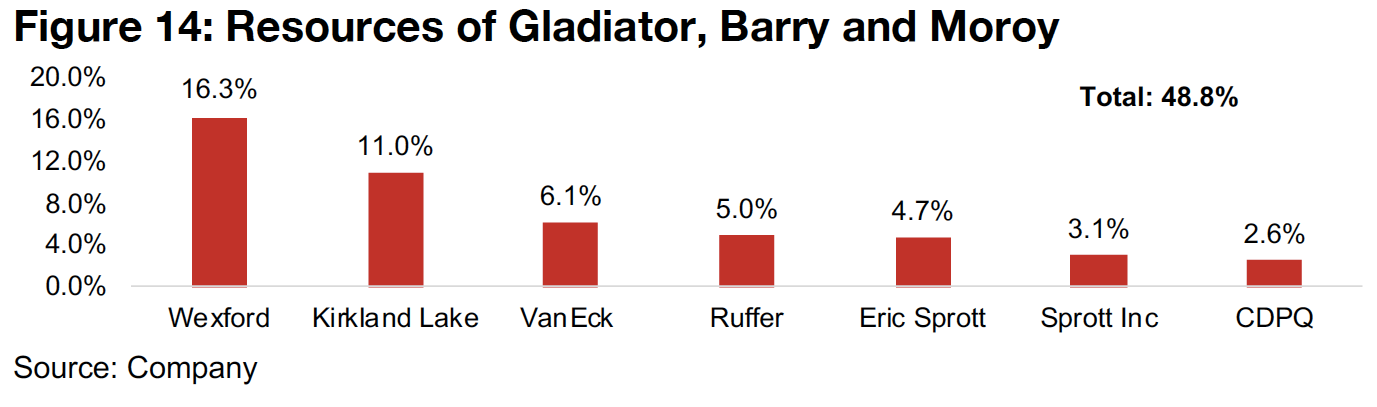

Bonterra has a 38,050 h.a. land package in Quebec's Abitibi region, with three main projects; 1) Gladiator, with 1,099k oz Au in Indicated and Inferred (I&I) Resources, 2) Barry, with 838k oz Au in I&I, and 3) Moroy, with 166k oz in Measured, Indicated and Inferred Resources (Figure 12). The company is currently undertaking a 90k meter drilling program of which 35k meters have been completed, encompassing all three of projects, with a series of reasonably strong results so far in 2020 (Figure 13). The company expects to release a resource update by Q2/21 and begin underground drilling by Q3/21. Bonterra has a potential cost advantage versus some peers in that there is a fully operational 800 tpd mill near the project with low cost expansion to 2,400 tpd. Currently the mill is only permitted for Barry, but the company is in the process of extending the permitting for the planned expansion. Bonterra also has strong institutional shareholder support, including Kirkland and Wexford (Figure 14).

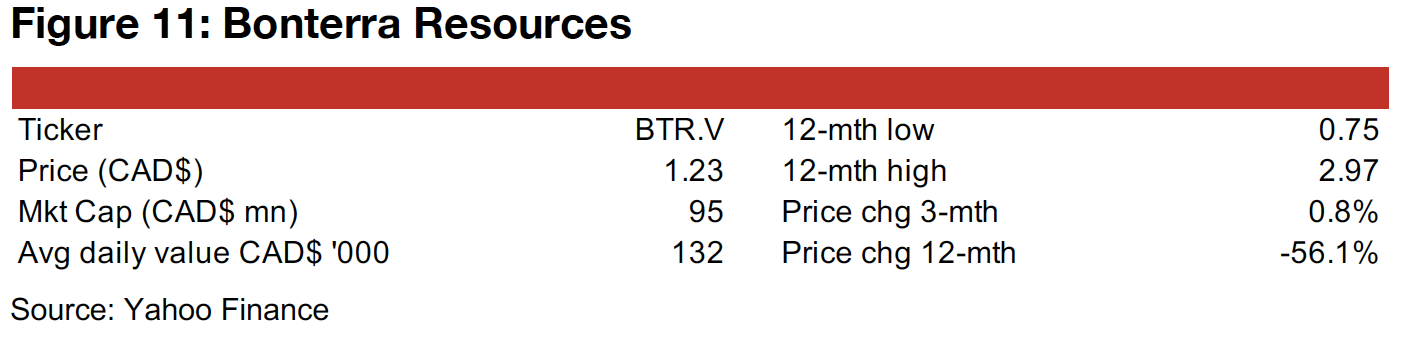

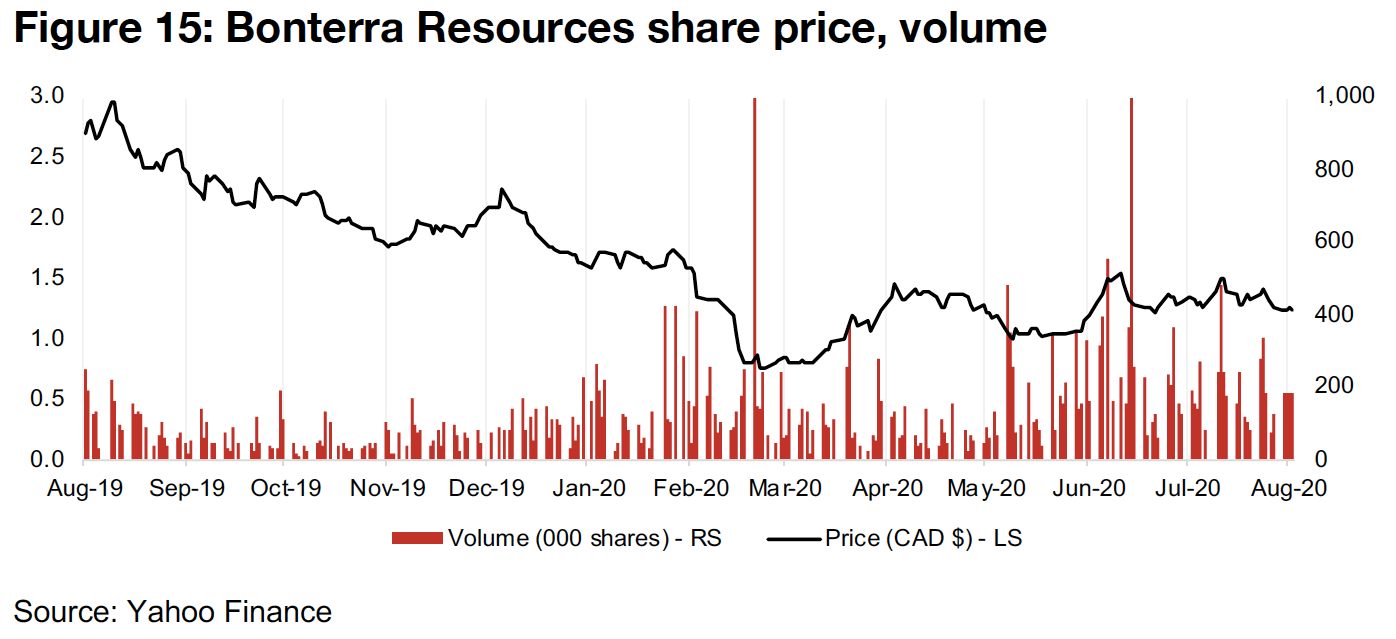

Lawsuits, delays and management changes pressuring the stock

Even though the company has a promising project in a strong district and is backed by major strategic shareholders, the share price has declined -56.1% over the past twelve months, even as most of the other comparable Canadian junior gold miners have seen major increases in their share prices. This was because of a combination of several issues; 1) in 2019 the company faced lawsuits from some ex-managers and consultants, 2) the company saw some delays in getting its 2020 drilling season started, in addition to facing temporary shutdowns related to the global health crisis, and 3) it has seen the recent departure of its CEO.

Disclaimer: This report is for informational use only and should not be used an alternative to the financial and legal advice of a qualified professional in business planning and investment. We do not represent that forecasts in this report will lead to a specific outcome or result, and are not liable in the event of any business action taken in whole or in part as a result of the contents of this report.