January 17, 2024

Japanese EV Industry Lining Up to Support THIS

Contents

- This Elite Group of Companies Is Almost Immune to the Fed's "New Normal"

- Startup-Like Gains in the "Energy Metals" Sector

- The Most Critical Energy Metal

- The Scale Advantage

- The Next Nickel District in the Making

- A Consistent, Large Body of Unique Nickel-Iron Mineralization

- A Consistent, Invested Management Team

- Preliminary Feasibility Study: Another Major Catalyst for 2023

- A Strategic "Mystery Investor"

The age of abundant and cheap capital has ended for most companies.

Silicon Valley is no longer churning out unicorns as it did before 2022.

Banks are collapsing and blaming expensive money for their downfalls.

It may feel like there is nowhere to hide and no way to play this market.

...At least that's what the mainstream media wants you to feel.

Helpless.

But while most investors are fearful, the ones with the best foresight are looking at opportunities in one particular area.

This space offers one of the biggest investment opportunities of this decade, if not this century.

We'll show you in a moment how an elite group of companies manages to continue growing in a tough market.

We are not talking about tech... or crypto...

(Just to be clear.)

The opportunities that this hidden megatrend can present investors with are not some fly-by-night operations.

This elite group of companies will transform the way the 21st century works and lives.

And we will show you how to profit from this once-in-a-generation trend.

This Elite Group of Companies Is Almost Immune to the Fed's

The mainstream media wants us to think that capital has become more expensive across the board.

It instills panic... And we are told to prepare for a recession or another 2008-style crisis.

If you feel afraid, you're not alone. Millions of investors feel the same way.

After all, the media keeps bombarding you with doom propaganda every day.

But here is where you really need to pay attention to...

Last year, when inflation peaked, President Biden signed a massive $437-billion bill.

It is called the Inflation Reduction Act, which outlined enormous spending plans for a small, very specific group of companies. We call them the "energy metals elite."

The Biden administration plans to "upgrade" the United States economy. The administration wants to invest in power plants, electric grid installations, EV infrastructure, and others.

This green energy transition is taking place right now with billions of dollars flowing into the sector.

The country is moving away from "dirty" energy sources like coal and oil to clean and efficient solar, wind, hydro, and nuclear power generation.

Startup-Like Gains in the

This trend has already caused massive spikes in the prices of critical resources or, as we call them, "energy metals."

- Lithium price soared by 1,413%...

- Cobalt price by 219%...

- Nickel price by 649%...

What drove these gains?

Well, the White House created demand for these minerals. And the companies working with these metals found themselves in the "fast lane" of government-sponsored growth.

It is a well-orchestrated plan to support the "Energy Metals Elite" group.

But the bill doesn't apply to all companies. The funds are only for domestic companies or those working in Free Trade Agreement (FTA) countries. The list includes just 20 names...

These can get special treatment and White House funding.

The funding itself often comes without interest and sometimes no need for repayment.

This is a perfect example of the era of "cheap money" being far from over.

If you know where to look, investment capital right now is cheaper than it has ever been.

The US, Canada, Australia, and the European Union are trying to outcompete each other and create the best conditions for the "Energy Metals Elite" companies.

The countries outlined billions of dollars and euros in clean-energy funding.

And that's not only a race between governments. The major buyers of energy metals are also willing to spend billions to get access to them.

- General Motors (GM) announced a $650-million investment in a lithium company.

- Stellantis put $155 million into a copper project.

- Tesla secured a $5-billion nickel deal in Indonesia.

The list goes on... And billions of dollars keep flowing into the sector.

The era of cheap and even free money for the Energy Metals Elite Group has begun.

You can either watch this multibillion-dollar trend from the sidelines or join it.

Whichever route you decide to take may define how your portfolio performs in the decades to come.

But don't rush to buy the first "green energy" company you can find online.

Even though we're looking at a multi-generational megatrend, the Energy Metals Elite companies are the ones best positioned to benefit from Cheap Money 2.0.

The Most Critical Energy Metal

The billions of dollars available in government funding are there to support the green energy transition.

Its most critical element is a shift to electric vehicles (EVs.)

And creating the entire EV and other energy infrastructure supply chain from the bottom up is at the top of government priorities.

From mining raw materials to assembling batteries-everything needs to be done in a low-emissions way and either domestically or within the borders of "friendly nations."

It requires massive supply chain investments.

Which minerals could be at the top of the government's priority list?

You need to understand which "new energy metals" and other critical materials the US imports the most.

- Cobalt - 76% net import reliance

- Copper - 41% net import reliance

- Lithium - over 25% net import reliance

And then there's nickel...

The metal with NO refined production in the US. The entire country has only one active nickel mine. It ships its nickel concentrate to Canada and overseas...

...Leaving nothing for the domestic market.

This is not sustainable.

All of these elements are key components of the green energy transition.

The vast majority of modern cars require these.

Elon Musk has already alarmed the markets about the shortage of these metals.

He started talking about it a while ago, begging commodity producers to "mine more nickel..."

Nickel is essential for EVs. And there's not enough of it available due to the limited production and lack of mining projects coming online.

On top of this, both main sources of nickel demand-steel production and EV batteries-are growing.

For example, according to Bloomberg, nickel usage in batteries is set to grow from 388,549 tons in 2022 to 1,466,509 tons in 2030.

That's a 277% growth in demand for the key mineral of most modern EVs.

S&P Global, a research agency, estimated that EVs are responsible for around 5% of the total nickel demand today. But this share is set to grow up to 35% by 2030.

And nickel demand from the steel industry isn't going to go anywhere, either.

Construction activity (which uses a lot of steel) around the world is set to grow by 9.8% every year.

In other words, the nickel market is supply-constrained... with major drivers of demand booming...

We believe we have found one of the best ways to get direct exposure to this unique setup.

The Scale Advantage

Most final consumers of new energy metals, like Tesla or GM, won't bother investing in a nickel project that has a short mine life.

Their production scales are huge. And they need their suppliers to be large and consistent as well.

These monsters of the EV industry would love nothing more than a project that can produce the metal for decades.

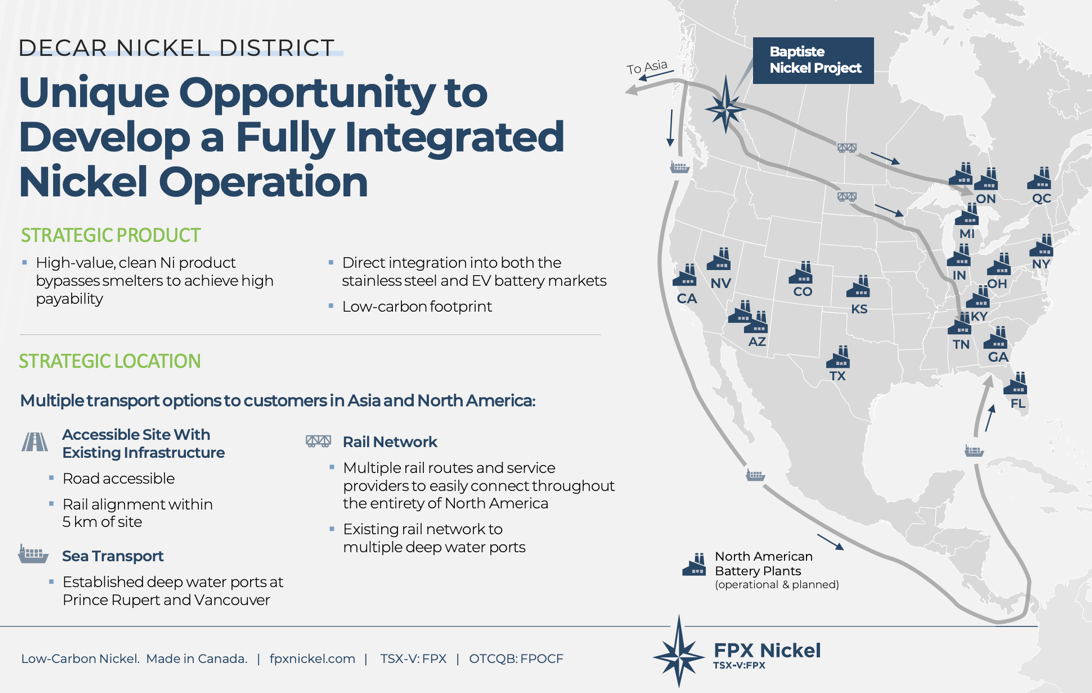

This is why we consider FPX Nickel (TSXV:FPX, OTCPK:FPOCF) a member of the New Energy Metals Elite.

Its project, Baptiste, can potentially produce the metal for over 30 years.

You should note that in the entire North America, there are only a few primary nickel projects. And only five of them can produce the metal for 20 years or more.

These are the world-class nickel projects that major nickel consumers crave access to.

One of these nickel projects stands out.

Its owner, FPX Nickel (TSXV:FPX, OTCPK:FPOCF), has just received free funding from the Canadian government.

It was the only junior nickel company to receive a grant like this.

On top of that, the company recently signed a collaboration agreement with Toyota’s battery company, and received a $14 million investment from Japan’s largest mining company, Sumitomo.

These deals are a major vote of confidence from the Japanese EV industry. Japan has clearly set its sights on FPX as a preferred North American partner for nickel.

FPX has a global reputation as the New Energy Metals Elite.

And it also recently received a multimillion-dollar investment from a corporate strategic investor that remains unknown.

Why has FPX become the target of both government funding and significant private investment?

It owns a one-of-a-kind nickel project in North America.

And here is why it's so special...

The Next Nickel District in the Making

Moreover, Canada has strong trade and political ties with the US.

The country is on the "friendly nation" FTA list. A Canada-based nickel project will pass a "preferred" source of this critical element.

As we said, FPX Nickel (TSXV:FPX, OTCPK:FPOCF) made it to the list of six companies that received the first round of funding from the government of Canada's Critical Minerals Strategy... and there may be more to come.

Both the United States and Canada desperately need to secure locally sourced battery-grade nickel.

And that's exactly what Baptiste has to offer.

The project hosts one of the largest undeveloped nickel resources in the world.

The most recent mineral resource estimate (NI 43-101 compliant), prepared in 2022, features:

- 1.8 billion tonnes of 0.211% total nickel content in the Indicated category containing 3.8 million tonnes of nickel, and

- 339 million tonnes of 0.212% total nickel content in the Inferred category containing 720 thousand tonnes of total nickel.

FPX Nickel (TSXV:FPX, OTCPK:FPOCF) has recently confirmed the project's robust economics.

In 2020, the company prepared a Preliminary Economic Assessment (PEA).

Some of the highlights included:

- a 35-year mine life,

- a 4-year payback period (on an after-tax basis),

- Net Present Value (NPV, discounted at 8%) of US$1.72 billion,

- an 18.3% after-tax Internal Rate of Return (or IRR).

In other words, not only does Baptiste feature a significant scale advantage, but also its economics are world-class.

Keep in mind that the study used a conservative nickel price of $7.75 per pound.

The metal's price has stayed over $10 per pound for a while now.

And at $9.30 per pound, Baptiste's NPV grows to about $2.7 billion.

That's a 56% increase in net present value given a 20% increase in the price of nickel.

This tells us that Baptise has leveraged exposure to nickel price. If the price goes up by 1%, the value of Baptiste increases more than that.

And that's because of the project's unique geology.

It features a disruptive new form of mineralization that can be processed using a method that's simpler and more cost efficient than other types of nickel mineralization.

A Consistent, Large Body of Unique Nickel-Iron Mineralization

Baptiste hosts a consistent body of nickel mineralization that, when the ore is processed and upgraded to the necessary nickel content percentage, will fit the requirements of EV battery makers, as well as steel producers.

The project owes it to a special mineral called awaruite, which contains nickel and iron.

Unlike other nickel-bearing rock types, it contains little in the way of "nasty minerals" like arsenic and mercury that complicate processing and production. Processing awaruite is more efficient.

FPX Nickel (TSXV:FPX, OTCPK:FPOCF) estimates that simple magnetic separation can eliminate 95% of the unnecessary material.

During this process, nickel concentration can increase from 0.22% to 2.5%. Then what's left goes through a flotation process that increases nickel content in the concentrate to over 25 times.

The final 63% nickel concentrate is a consumer-ready product.

FPX has tested its recovery process rigorously.

The company ran a pilot test on 17 tonnes of material to get these results. The next round of tests will consist of 60 to 70 tonnes of Baptiste rocks. The more material the company tests, the more reliable the results.

Confirming these excellent recoveries and nickel content upgrade processes is the key catalyst for FPX.

And as the company has already started working on the larger samples, we will not be surprised to see some massively valuable news releases soon.

In addition to its large size and consistent mineralization, Baptiste has one of the lowest carbon intensity profiles compared to its peers.

These days, it's critical. No one will permit a heavily polluting mine.

Baptiste has a massive advantage here. It is one of the lowest-carbon nickel projects out there.

As a reminder, it's located in British Columbia, a province that generates most of its power from clean hydro sources. As a result, Baptiste's nickel will have an extremely low carbon footprint.

That should make even the most ESG-sensitive investors as well as the government happy.

Nickel is a critical mineral both in the US and in Canada. The Canadian government has signalled that it wants to speed up the permitting process for critical minerals projects like Baptiste.

One of the projects located nearby, Blackwater, has recently received a final government permit. Its owner has started full-scale construction.

We expect Baptiste to receive the necessary permits without any delays.

This future success will depend on the strength of the company's team.

And, in our view, FPX has one of the strongest teams in the mining sector.

A Consistent, Invested Management Team

Martin Turenne, the President, CEO, and director of FPX, has been leading the company since 2015. He has over 10 years of experience in senior executive roles. And now, he is solely focused on developing Baptiste.

Mr. Turenne kept the company's share structure in great shape. FPX has 243.8 million shares and 13.8 million options with no warrants outstanding.

That's an impressively conservative share structure for a company that went public in 1996 without any share consolidations or rollbacks.

The management itself owns 43.9 million shares, or 18% of the total. This is a positive signal that shows that the management has "skin in the game." In other words, it is exposed to the same risks and upside potential as other investors, including the individual ones.

With C$16.5 million in cash and no debt, FPX Nickel (TSXV:FPX, OTCPK:FPOCF) is well-funded throughout mid-2024.

And what's more important, the company has already received the first tranche of funds from the Canadian government.

The state subsidy of C$725,000 came with no interest and no need for repayment.

FPX Nickel (TSXV:FPX, OTCPK:FPOCF) received the funding under Canada's Critical Minerals Strategy funding.

But Mr. Turenne is not going to stop here. He plans to complete the preliminary feasibility study (PFS) for Baptiste this year.

Preliminary Feasibility Study: Another Major Catalyst for 2023

With a PFS done, the company can apply for special "New Energy Metals" funding from the United States government.

The study is a more detailed version of the current technical report. The company plans to release it during the second half of this year.

But FPX doesn't rely solely on government funds, of course.

In fact, corporate investors have started showing massive interest in the company.

A Strategic "Mystery Investor"

In December, FPX received C$12 million from a strategic investor that preferred to stay incognito.

That deal closed at a 27% premium to the company's share price.

Now the new partner owns 9.9% of the company.

(This is the maximum share of the company's total equity that you can hold without disclosing your name.)

The market doesn't know if this investor is another mining company... one of the major EV makers... a battery producer... we don't know.

What we do know, however, is that this investor got in at the right time.

In terms of valuation, FPX Nickel (TSXV:FPX, OTCPK:FPOCF) is trading at around 0.05x Price to Net Present Value (P/NPV) of the Baptiste project.

It's one of the lowest values in the nickel universe.

Its peers trade at 0.48x Price-to-NPV. To close this gap, the company's shares would need to appreciate by 9.6 times.

(And we believe that Baptiste is much better than average.)

The area Baptiste is located in is recognized in the industry as one of North America's largest undeveloped nickel districts.

Sprott, a leading resource-focused financier, included the company in its new nickel-focused ETF. This will improve investors' awareness of the FPX story and secure strong trading volumes.

This story has started picking up traction.

And with multiple catalysts that we expect to see in 2023, this is the perfect time to put FPX Nickel (TSXV:FPX, OTCPK:FPOCF) on your watchlist.

SEE DISCLAIMER & DISCLOSURE BELOW

Sign up to receive our future articles and updates.

Disclosure

The Canadian Mining Report has been retained by FPX Nickel Corp. to provide various digital marketing and advertising services. We have been paid to provide editorial and marketing services to profile the company and its project. The preceding Article is PAID FOR CONTENT sponsored by FPX Nickel and produced in cooperation with CanadianMiningReport.com. The publisher of CanadianMiningReport.com owns securities positions in FPX Nickel and may trade on their own behalf at any time without prior notice, however, it is our general policy to not sell any shares while we are currently engaged with a client.

The Canadian Mining Report's business model includes receiving financial compensation to carry out various services for companies which may include advertising, marketing and dissemination of publicly available information. This compensation is a major conflict of interest in our ability to be unbiased.

Disclaimer

The material in this article should not under any circumstances be construed as an offering, recommendation, or a solicitation of an offer to buy or sell the securities mentioned or discussed, and is to be used for informational purposes only. Neither Canadian Mining Report (the "Publisher", "we", "us", or "our"), nor any of its principals, directors, officers, employees, or consultants ("Publisher Personnel"), are registered investment advisers or broker-dealers with any agencies in any jurisdictions. Canadian Mining Report ("Canadian Mining Report", "Us", "Our" and/or "We") is a Canadian based media company that typically works with publicly traded companies and provides digital marketing strategies and services. Read More