May 2020

AbraPlata Resource Corp

Focused on silver and gold exploration in Argentina

Flagship Diablillos project has reached PEA stage

Argentina silver and gold explorer at PEA stage

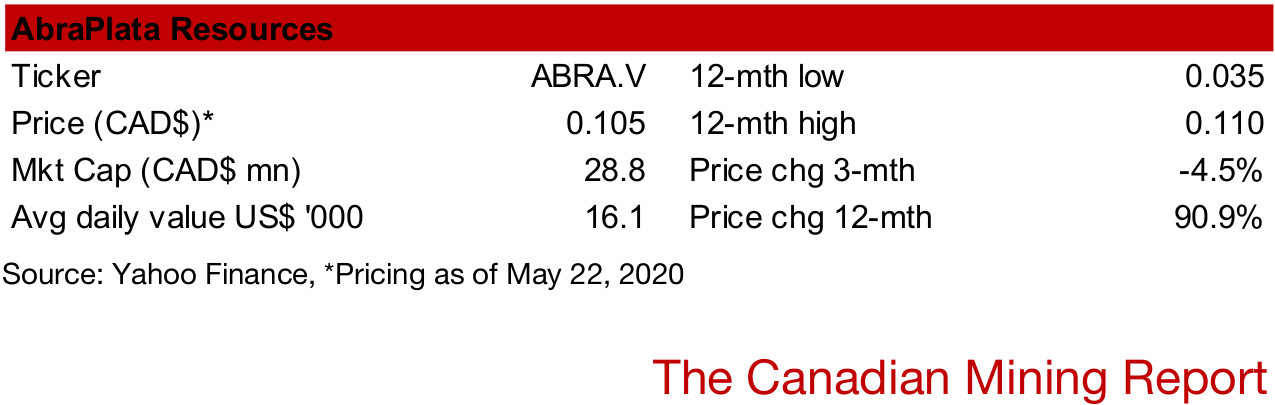

AbraPlata is a silver and gold exploration company focusing mainly on Argentina, where it has four projects, including its flagship Diablillos project, which has reached the PEA stage with an estimated pre-tax NPV of CAD$342mn compared to the company's market cap of CAD$28.8mn, and one project in Chile.

The company has raised capital of CAD$3.5mn over the past nine months

Strategic holders own over one third of the company, with SSR/Alacer holding 16% and Altius 17%

Recently funded, sizeable strategic shareholders

The company continues a 3,000 metre drilling program at Diablillos, and has closed private placements of CAD$3.5mn over the past nine months, providing it sufficient capital to proceed through 2020. The company also has the backing of two large long-term strategic shareholders, silver and gold miner SSR/Alacer, which holds 16% of AbraPlata, and the precious metals royalty and streaming company Altius Minerals, holding 17%.

High risk given early stage project in only moderately attractive global district

Low market cap/resource versus peers suggests that stock is pricing in much of the risk, but not much upside

Considerable amount of high risk priced in

AbraPlata still has considerable risk, as an early stage project in a district that is only moderately attractive in a global context. However, the company has a market cap/resource that is the lowest of a group of early stage explorer peers, indicating that a large degree of the risk has been priced in, but only a limited amount of the potential upside, even after a 90% rise in the share price over the past year.

Opportunities

Risks

1) AbraPlata background and management

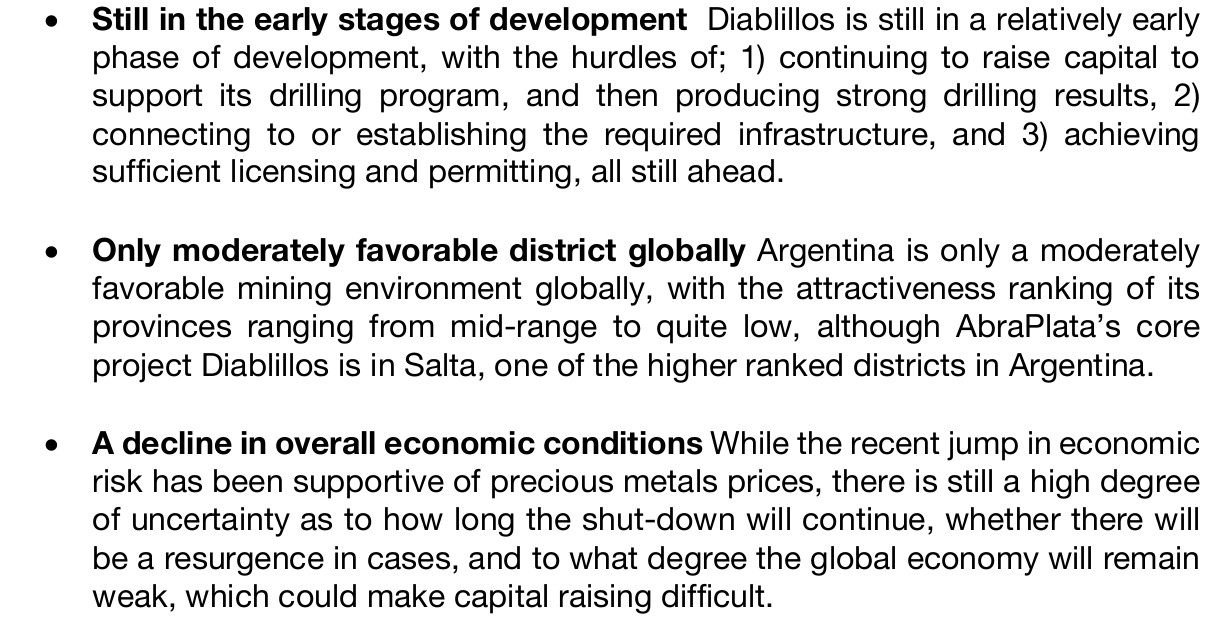

AbraPlata focusing on Diablillos in Argentina's mining-friendly Salta province

AbraPlata is an early phase exploration company with a $CAD28.8mn market cap, focused on silver and gold in South America, mainly in Argentina, where they have four projects, with one in Chile. The company's key developments since 2018 are outlined in Figure 1. Progress in 2018 included reaching the PEA phase on the company's flagship project, Diablillos, in March 2018, and two private placements, one for CAD$1.5mn completed in January 2018, and another for CAD$0.7mn completed in July 2018.

In the first half of 2019, the main development was the company beginning to partner with Aethon, which led to a full merger by July 2019. In the second half of 2019, the company raised an additional CAD$1.5mn in October 2019, and then commenced drilling on Diablillos in November 2019. In January and February 2020, the company reported encouraging drilling results at Diablillos, and by May 2020, the company had closed another CAD$2.0mn funding round to continue its drilling program. In terms of major recent developments beyond Diablillos, the company also acquired an option on the La Coipita project in San Juan in March 2020, where the company plans to bring in a joint-venture partner to conduct a drilling program.

Figure 1: AbraPlata timeline 2018-2020

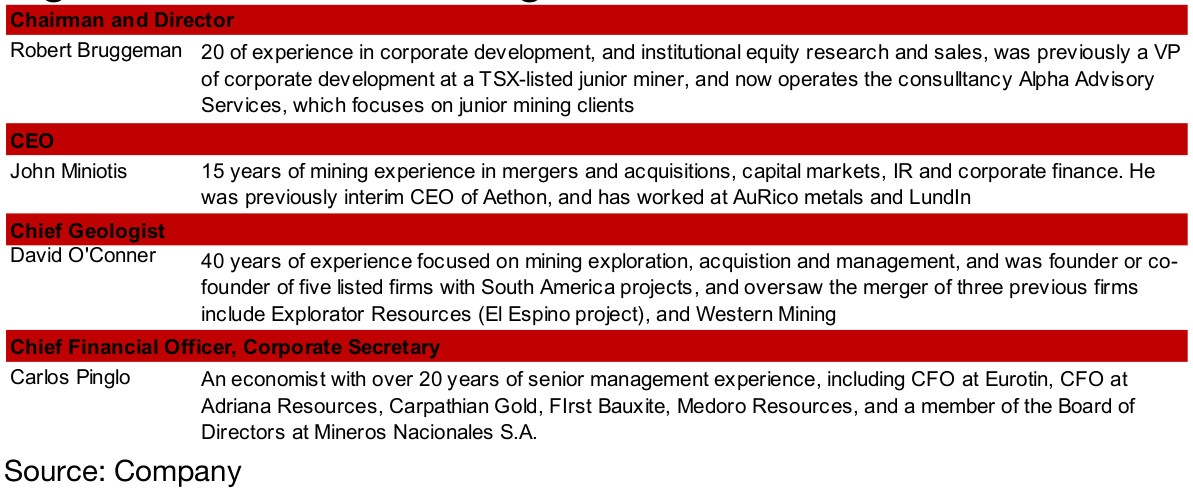

Management from AbraPlata and Aethon

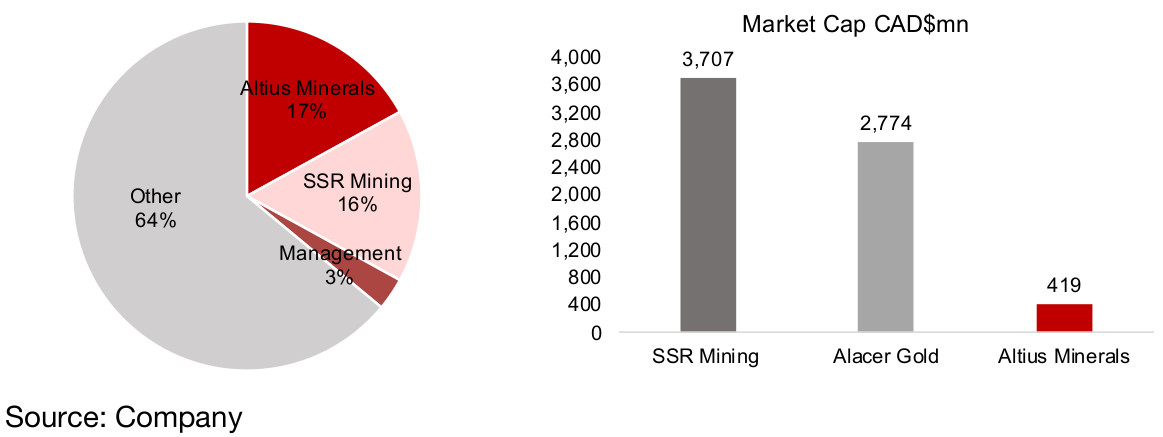

AbraPlata management has considerable combined experience in mining and South America (Figure 2). Chairman Robert Bruggeman has 20 years' experience in corporate development and institutional equity research and sales with a focus on the mining industry. AbraPlata CEO John Miniotis was previously interim CEO at Aethon and has 15 years' experience in M&A and corporate development. The Chief Geologist David O'Conner has over 40 years' experience in South America, and Chief Financial Officer and Corporate Secretary Carlos Pinglo has 20 years' experience, including as CFO of multiple mining firms. The company also has support from two large longer-term strategic shareholders, with 16% held by silver and gold miner SSR, which recently announced its intention to merge with Alacer, forming an over CAD$6.0bn firm, and the royalty and streaming company Altius Minerals, with a market cap of CAD$419mn, holding 17% (Figures 3, 4).

Figure 2: AbraPlata Management

Figure 3, 4: AbraPlata major shareholders market cap

2) AbraPlata projects

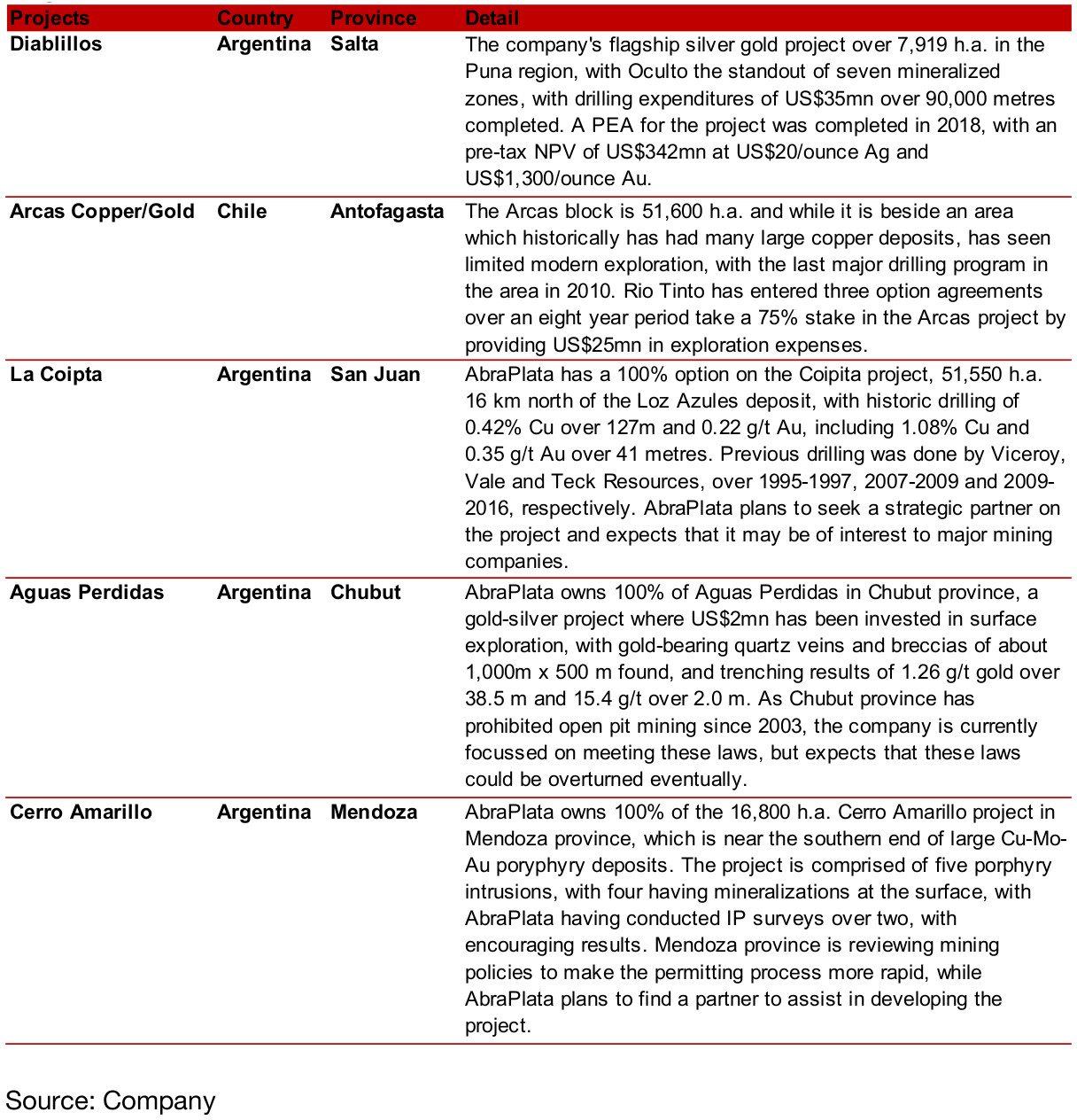

Figure 5: AbraPlata projects

Five projects, with Diablillos the core project currently

AbraPlata has five projects, four in Argentina and one in Chile, with the Diablillos project in Salta province the most advanced, having reached the PEA stage (Figures 5, 6). The company's other projects are at earlier phases, with AbraPlata generally looking for larger partners on these projects to continue development. The first is La Coipita, on which the company has a 100% option, a copper project previously explored by Viceroy, Vale and Teck Resources, on which AbraPlata is expecting to see interest from major mining companies. The second is a 100% holding of the gold-silver Aguas Perdida project, but AbraPlata is still waiting to move forward on this project as regulatory issues prevent open pit mining and some mining methods. The third is AbraPlata's 100% holding in the Cerro Amarillo project, with officials in the district currently looking to speed up the permitting process, and AbraPlata is seeking a major partner to develop this project. The company also has one project in Chile, the Arcas copper-gold project, for which Rio Tinto has taken an option to acquire up to 75%, assuming its provides up to US$25mn in exploration expenses over several years of exploration.

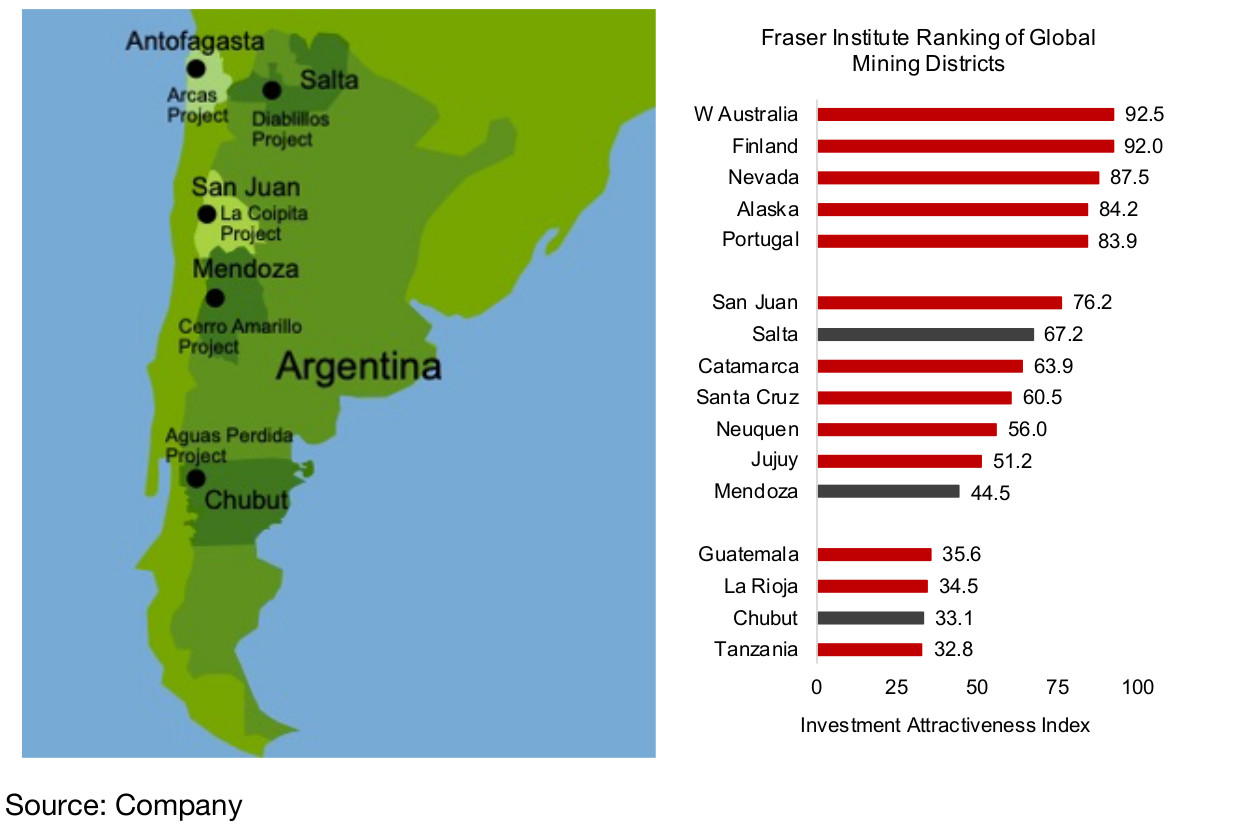

Figures 6, 7: AbraPlata project map, Fraser Institute Survey

Diablillos in one of Argentina's more attractive districts

Overall, Argentina is ranked by the Fraser Institute as only a moderately attractive district globally, with provinces ranging from around the middle of the Fraser Institute survey's investment attractiveness index in 2019, to near the bottom (Figure 7). However, AbraPlata's most advanced project, Diablillos, is in Salta province, one of Argentina's most attractive districts. However, in a global context, the ranking is only average, with a score of 77, compared to the most attractive global district, Western Australia, with a rank of 92.5, and the worst, Tanzania, at 32.8.

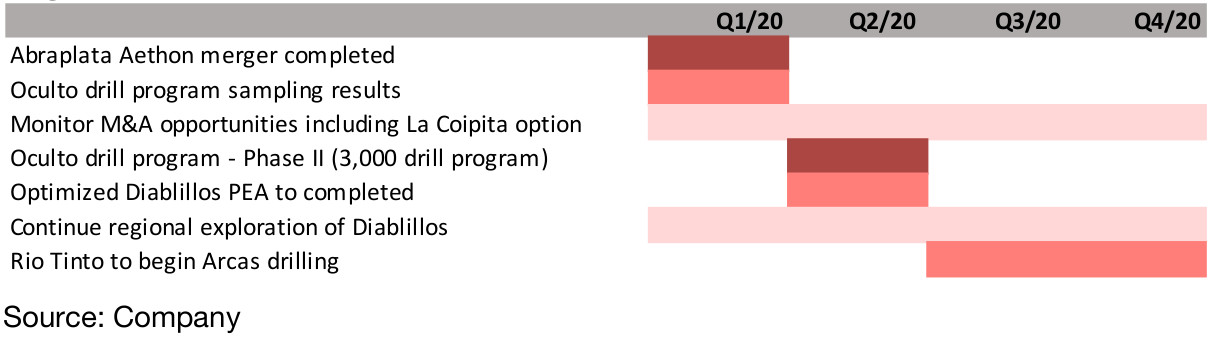

Plans for 2020 focus on Oculto at Diablillos and La Coipita

An outline of the company's planned activity for 2020 is shown in Figure 8. The AbraPlata Aethon merger was completed and the company and began to report drilling results from the Oculto site at its Diablillos project in Q1/20. Having closed its funding in May 2020, it has continued its Phase II drill program, with 3,000 metres planned, and expects to release an optimized Diablillos PEA in H2/20, and expand exploration there (Figure 8). For other projects, the company has continued to monitor M&A opportunities for the La Coipita project, and Rio Tinto is expected to begin drilling at the Arcas project in Chile in H2/20.

Figure 8: AbraPlata plans for 2020

Focussing on Oculto deposit at Diablillos

The company's most advanced project and therefore its core focus this year is Diablillos, which has two zones, Oculto and Fantasma (Figure 9). Oculto accounts for 99.5% of AbraPlata's total Measured, Indicated and Inferred resources, with 153,298k ounces of AgEq, versus just 840k ounces AgEq for Fantasma (using a gold price of US$1,550/ounce and silver price of US$16.5/ounce). The total Measured and Indicated and Inferred resources of Oculto are split roughly evenly between silver and gold on an AgEq basis, with 81,810k ounces of silver and 71,488k AgEq ounces of gold, or 761k ounces of gold.

Figure 9: Diablillos project details

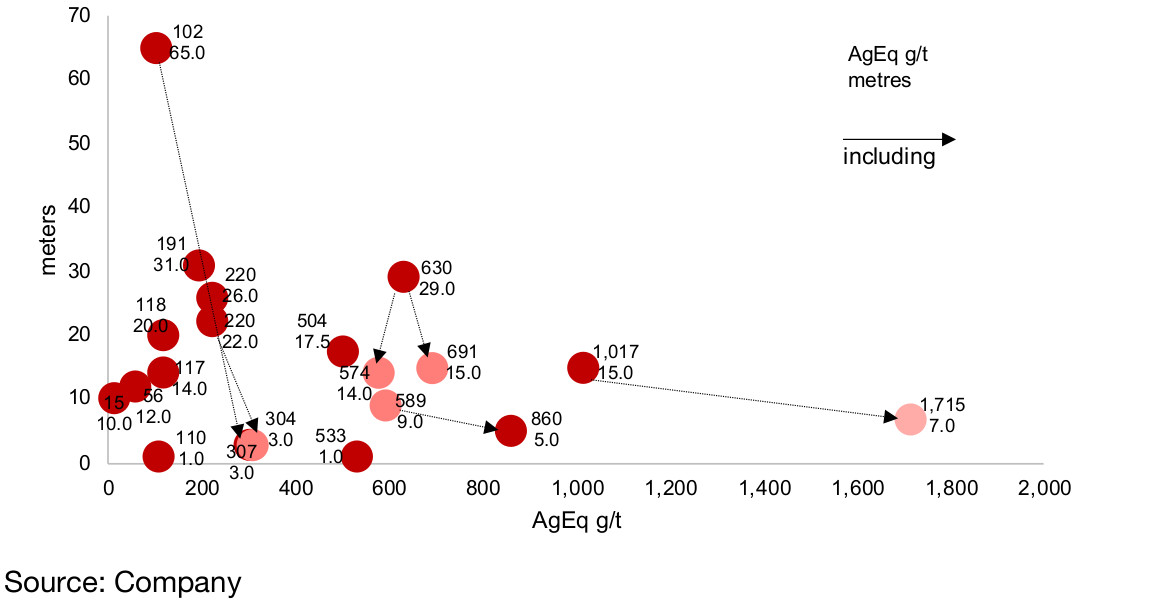

Recent drilling results reported in Jan and Feb 2020

The company's most recent drilling results, reported in January and February 2020 (with the February results particularly boosting AbraPlata's share price) are shown in Figure 10, with some of the outstanding figures including; 1) 1,017 g/t over 15.0 metres including 1,715 g/t over 7.0m, 2) 630 g/t over 29m including 691 g/t over 15m and 574 g/t over 14.0m, 3) 589 g/t over 9.0 metres, including 860 g/t over 5.0m and 4) 533 g/t over 1.0m, and 504 g/t over 17.5m.

Figure 10: Diablillos recent drilling results (AgEq)

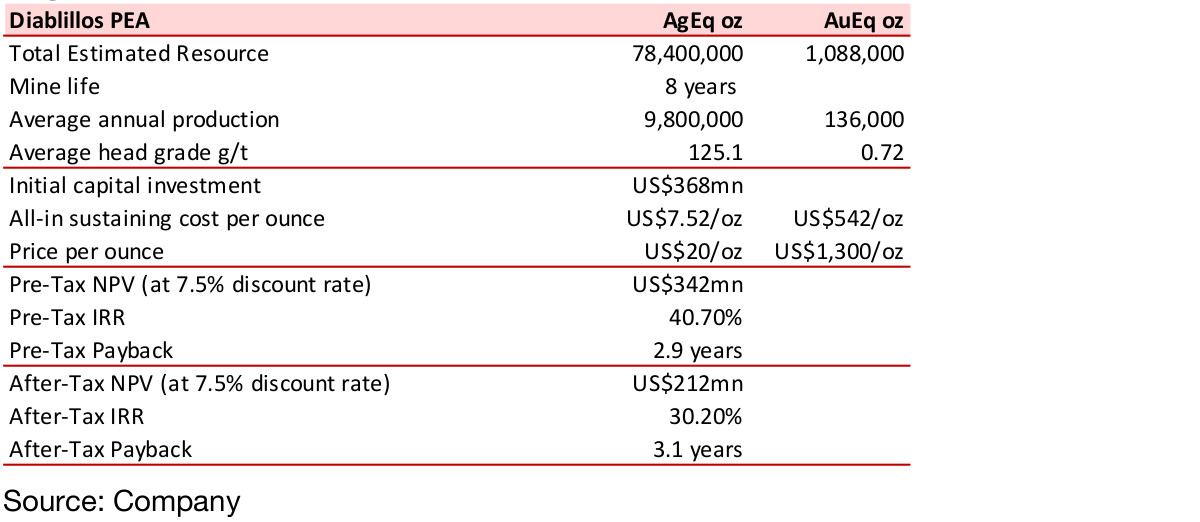

Diablillos PEA released in 2018

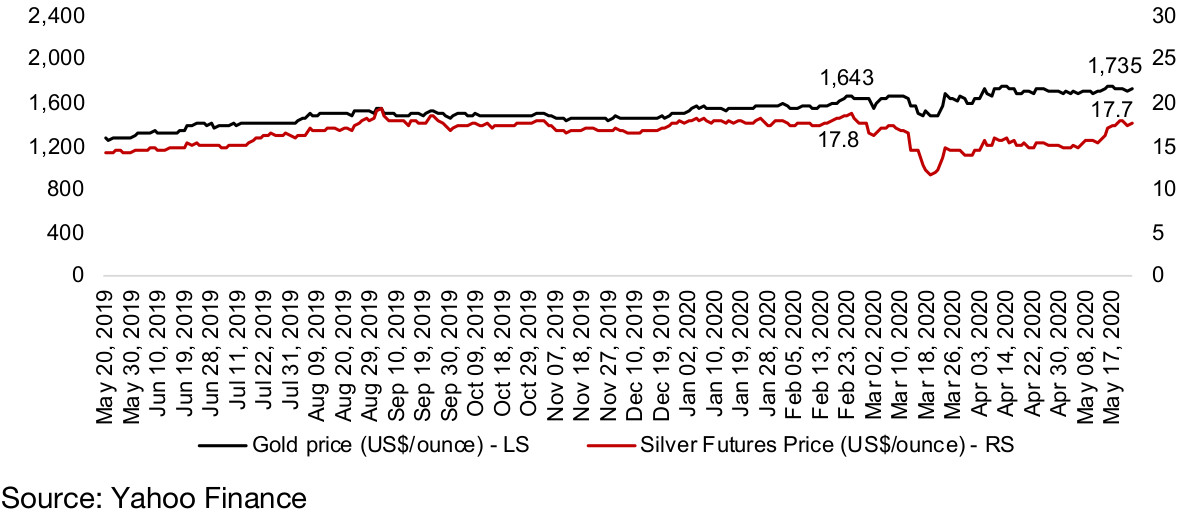

As shown in the timeline above, a Diablillos PEA was issued in 2018, and the details are shown in Figure 11. The PEA outlines a mine life of 8 years, with an annual average production of 9,800,000 AgEq oz, an initial capital investment of US$293mn, an all-in sustaining cost of US$7.52/ounce, and a silver price of US$20/ounce. Using a 7.5% discount rate, this leads to a US$342mn pre-tax NPV and an after-tax NPV of US$212mn. The company expects to release an optimized Diablillos PEA by mid-2020, which will likely use a higher gold price, given an average above US$1,600/ounce this year, but it is unclear if the silver price assumption of US$20/ounce will be maintained, with silver currently at US$17.7/ounce (Figure 12).

Figure 11: Diablillos PEA (2018)

Figure 12: Gold and silver prices

3) AbraPlata financials

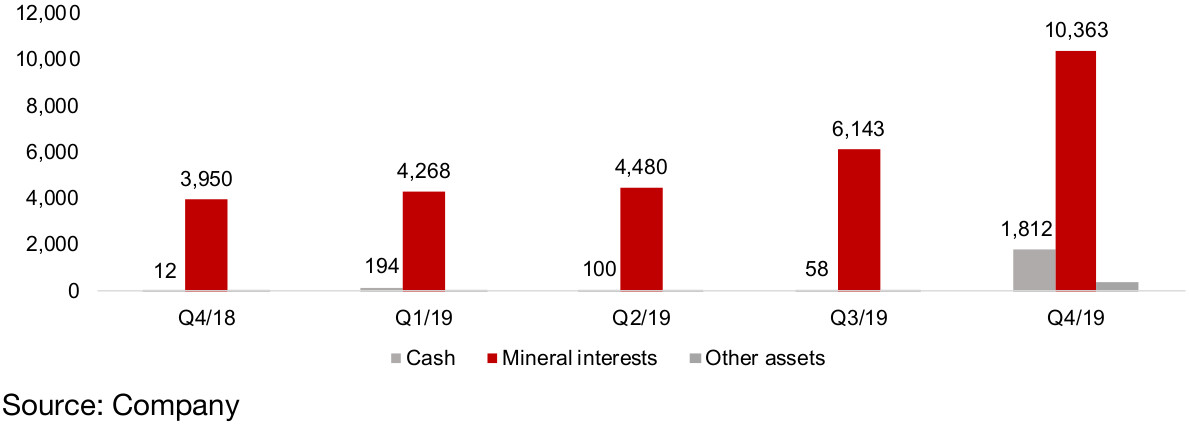

Figure 13: AbraPlata assets

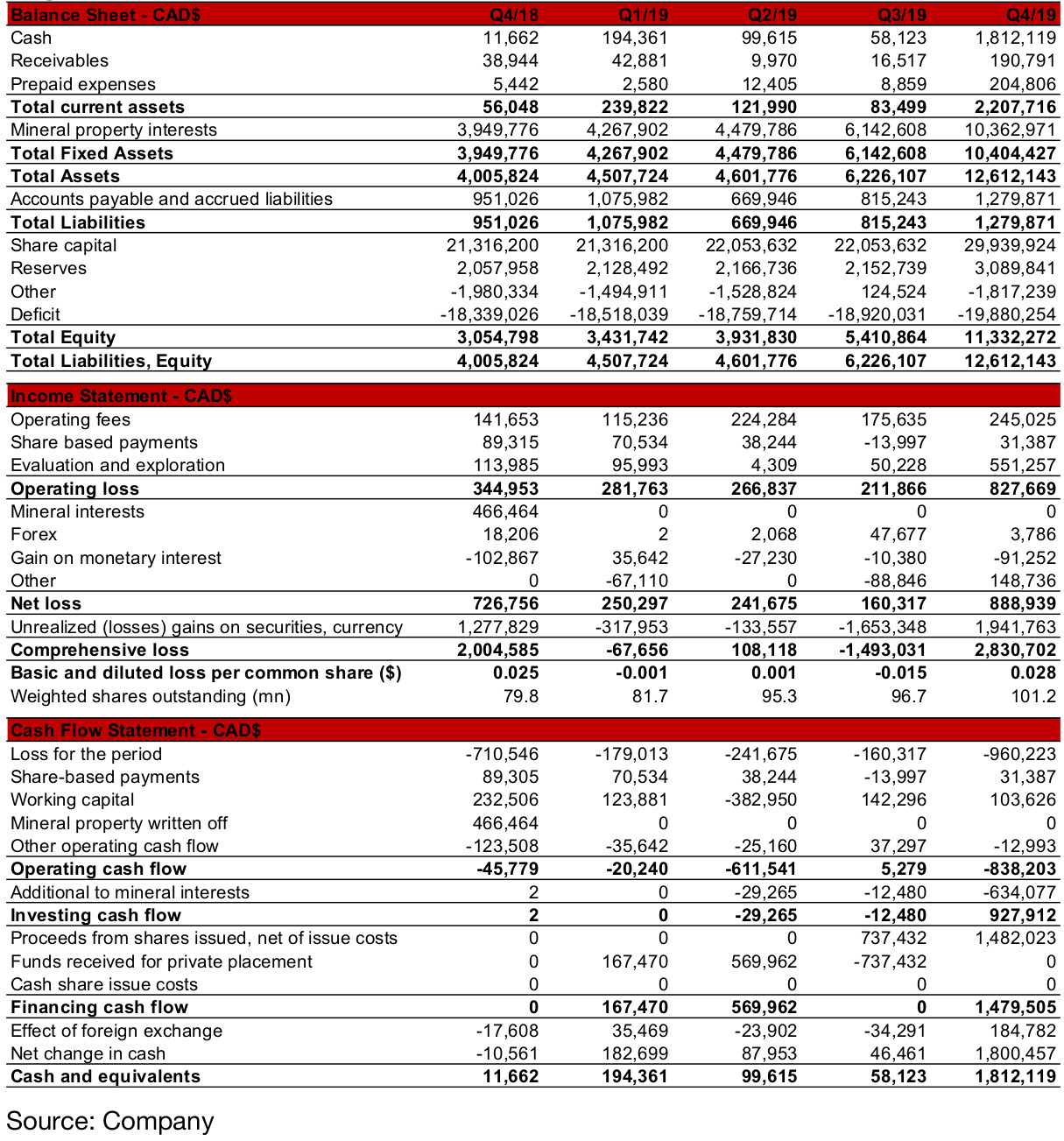

Financial position improved after private placements

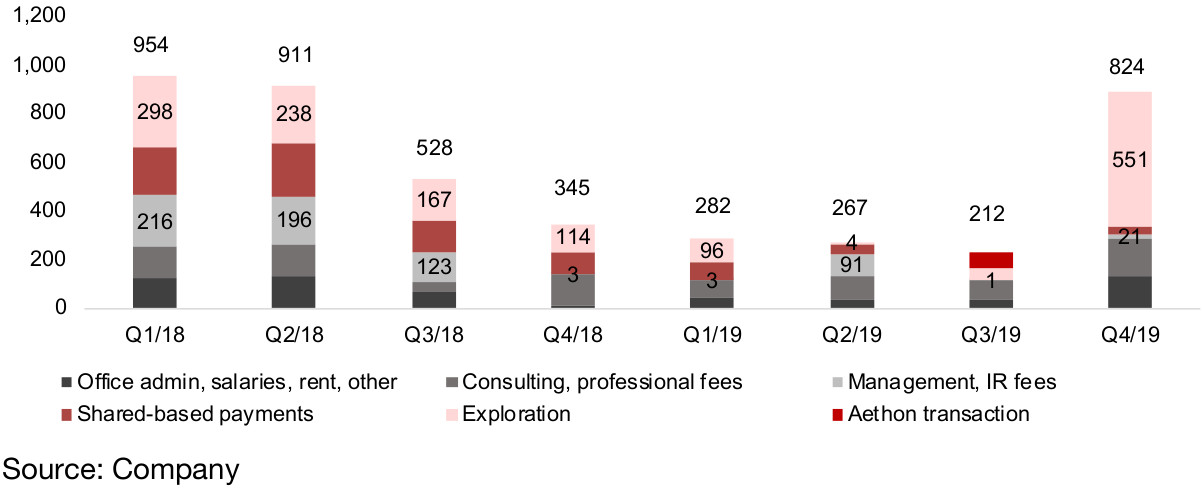

AbraPlata has reported its quarterly financial income statement from the start of 2018 and its balance sheets from end-2018. Following considerable expenditure in Q1/18 and Q2/18 of near CAD$1mn company had limited cash until a private placement in October 2019 that boosted its cash reserves to CAD$1.8mn (Figures 13, 14). The company has also recently completed a private placement in May 2020 for an additional CAD$2.0mn.

Figure 14: AbraPlata expense composition

The low cash balance from Q3/18 to Q3/19 led to falling expenses, but following the private placement, expenses returned to US$824k in Q4/19. If we assume similar expenditure for Q1/19 of around CAD$800mn/quarter, this would put the company with around CAD$1.0mn in cash as of end-Q1/20. With another quarter of around CAD$0.8mn in expenses and then factoring in the private placement of CAD$2.0mn closed in May, this would imply total cash of CAD$2.2mn by the end of Q2/20, enough to continue operations until the end of 2020, with more capital required by H1/21.

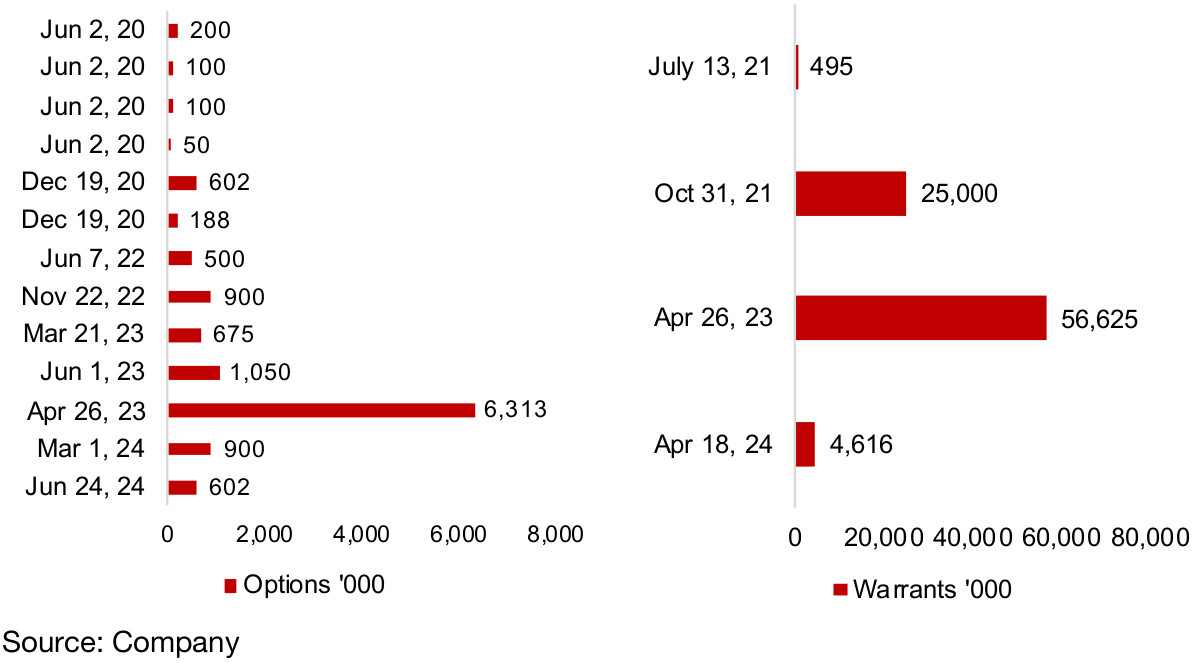

Share options and warrants schedule

The company currently has 250mn shares outstanding and the potential issuance of new shares through options and warrants is shown in Figures 15 and 16. The company could see potential dilution of less than half a percent in 2020, and no major dilution for about the next year. The potential for material dilution from currently outstanding share options and warrants would be in October 2021 through 25m warrants, or about 10% dilution, and again in April 2023 through 6,313,000 share options and 56,625,000 in warrants that could be exercised, leading to about 25% dilution.

Figures 15, 16: Share options and warrants

4) AbraPlata comparables

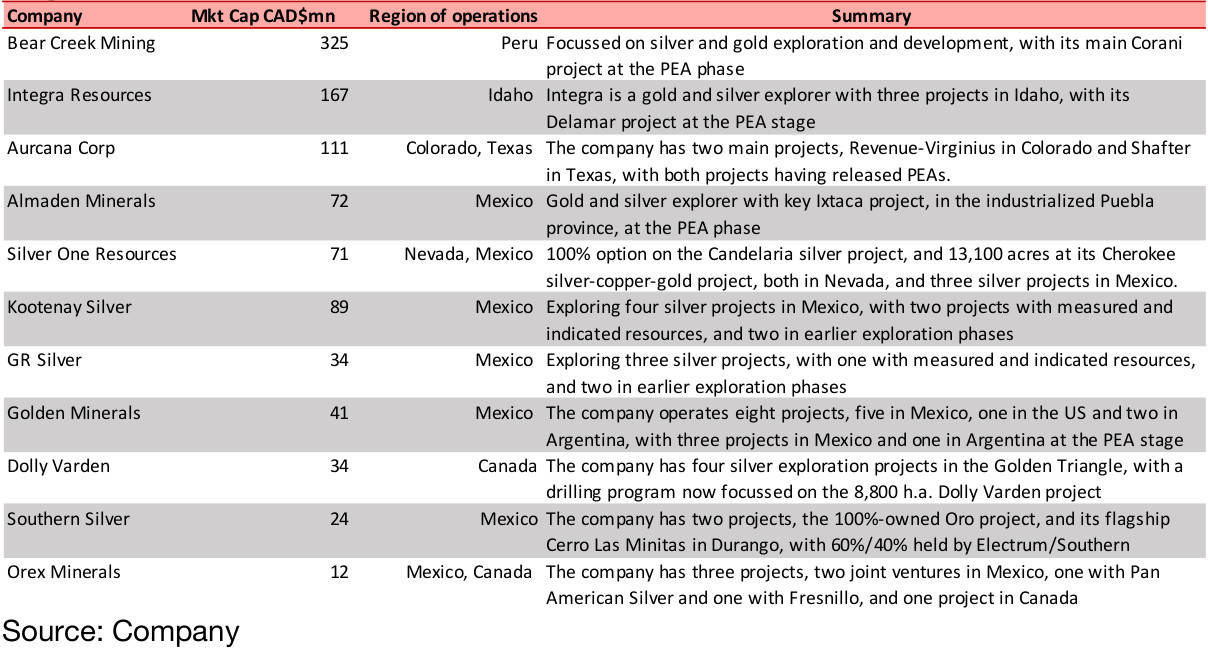

Several comparables for AbraPlata at the PEA stage

There is a reasonably large group of silver and gold exploring comparables for AbraPlata, most of which have also reached PEA stage, with several reasonably close in terms of market cap. Most of the comparables are in Mexico, one is in Peru, and two are in the US (Figure 17).

Figure 17: AbraPlata comparable companies

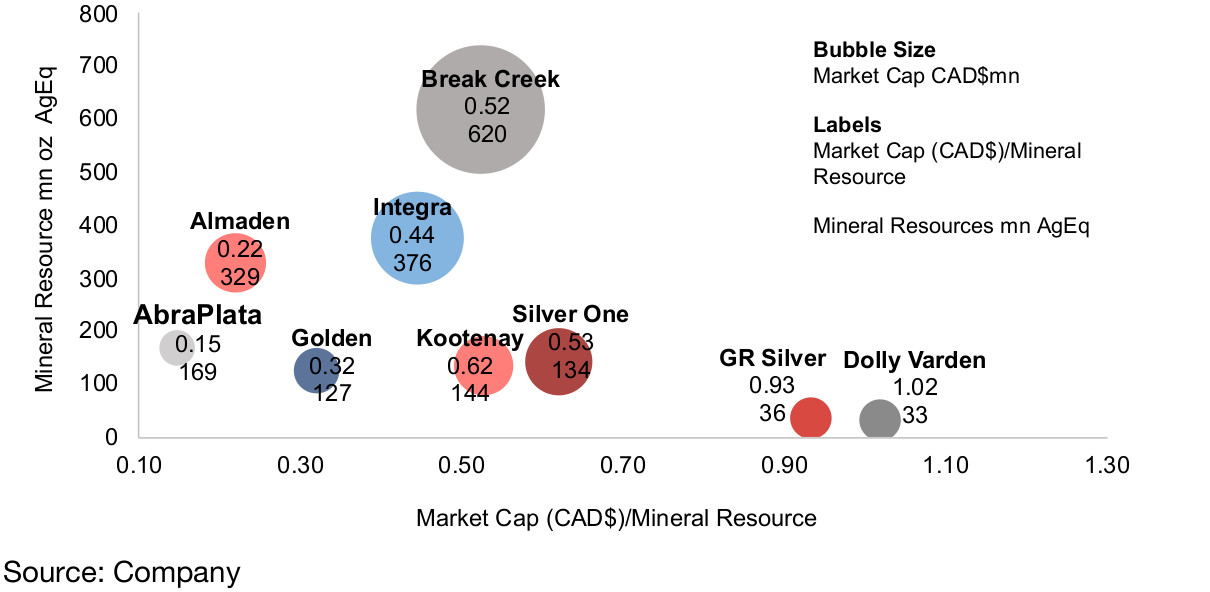

AbraPlata trading below comps on market cap/resource

Figure 18 shows the comparables with market cap/resource on the x-axis, total resources on the y-axis, and the bubble size the market cap of the company. Bear Creek stands out in terms of market cap, followed by Integra, with high absolute levels of resources, but they are around the middle of the group in terms of market cap per ounce of resource. The market is paying a comparably high level in terms of market cap/resources for Dolly Varden and GR Silver, which are similar in size to AbraPlata in terms of market cap, but have much lower levels of estimated resources. AbraPlata is the lowest of the group in terms of market cap/resource, which is likely incorporating the higher risk of operating in Argentina compared to some global jurisdictions, and that the company is still in the early stages of exploration, with substantial drilling results coming out only as recently as January and February 2020.

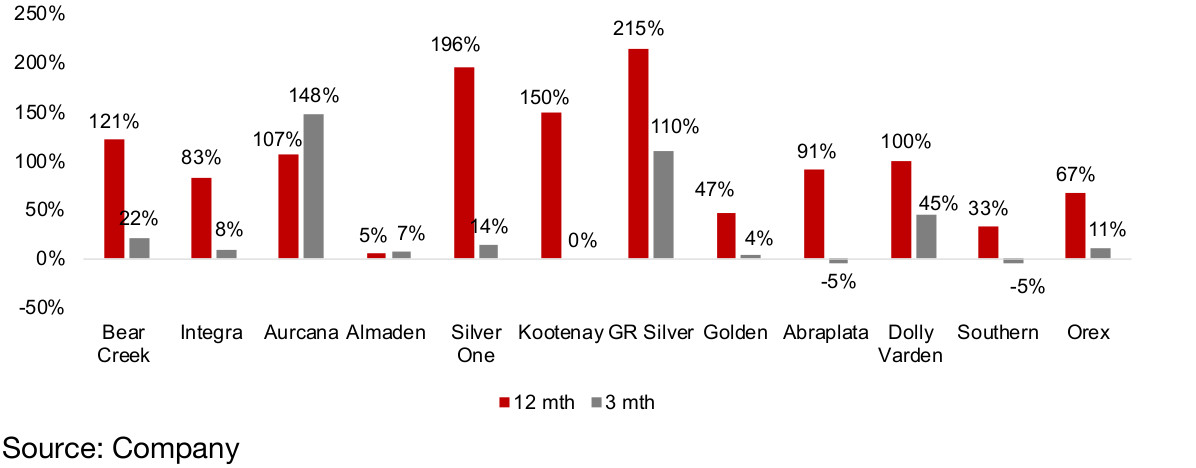

This valuation has remained low even versus the group even though AbraPlata's share price is up 91% over the past year, as much of the rest of the group has also seen major gains (Figure 19). Eight out the 12 companies have made over 80% gains in the last year, and six gained 100% or more. Overall the market seems to have priced in substantial risk for the company, which while justified to some degree, also leaves room for significant upside should the company continue to produce news flow indicating continued progress, as they have so far in 2020.

Figure 18: AbraPlata comparable companies

Figure 19: Price performance of AbraPlata, comparables

5) AlbraPlata share price

AlbraPlata nearly back to pre-crash peak

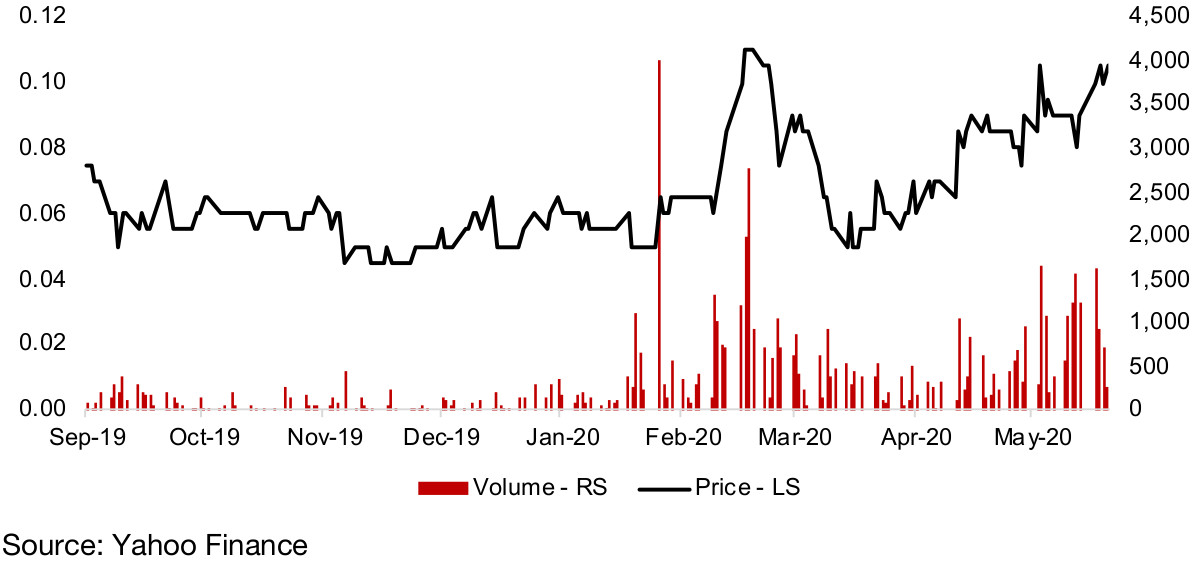

One exercise that is helpful in ascertaining how the market has recently been perceiving a given junior mining company is to look where it was trading before the market crash, as the sinking tide lowered all boats indiscriminately, with juniors nearly all heavily sold off, even as precious metals like gold and silver held up quite well. The big concern for the junior miners in the crash was whether they could still access capital to fund their operations, with many having only a cash runway of a year or less.

For AbraPlata we can see that the market had been encouraged especially by the February 2020 drilling results, with the stock price doubling from CAD$0.05/share in late January 2020 to CAD$0.11/share by February 21, 2020 just prior to the crash, after the stock had hovered around an average of just CAD$0.056/share from Sep 2019 to Feb 2020 (Figure 20). AbraPlata has jumped 100% off its lows of CAD$0.05 in March 2020, as the gold and silver junior mining sector has recovered over the past two months, and is now just 5% off its pre-crash highs.

Figure 20: AbraPlata Resource Corp

5) AbraPlata financial tables

Figure 21: AbraPlata Financials

Disclaimer: This report is for informational use only and should not be used an alternative to the financial and legal advice of a qualified professional in business planning and investment. We do not represent that forecasts in this report will lead to a specific outcome or result, and are not liable in the event of any business action taken in whole or in part as a result of the contents of this report.