December 30, 2021

A Year of Consolidation for Gold

Author - Ben McGregor

Gold moves above annual average heading into new year

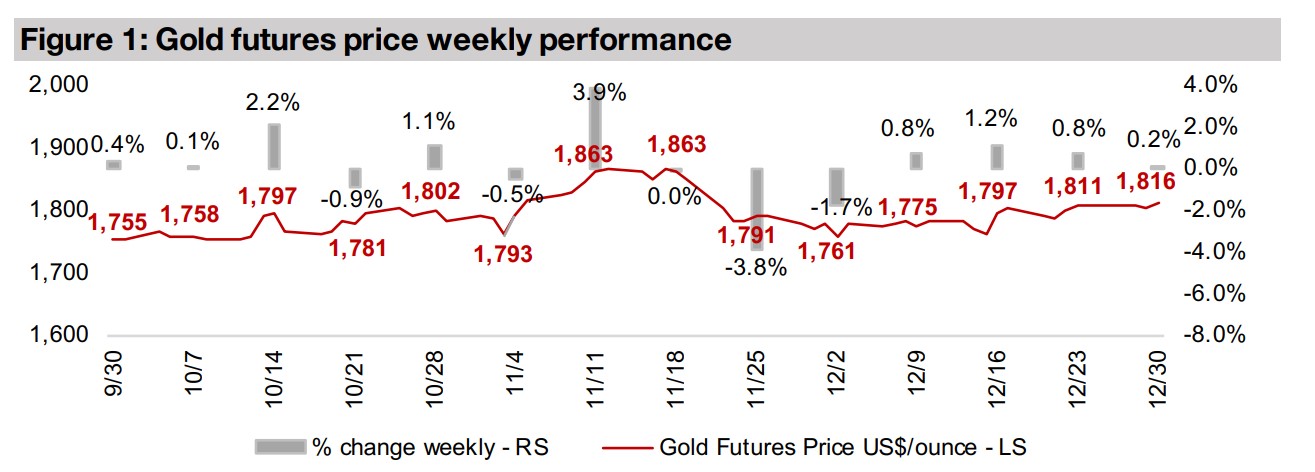

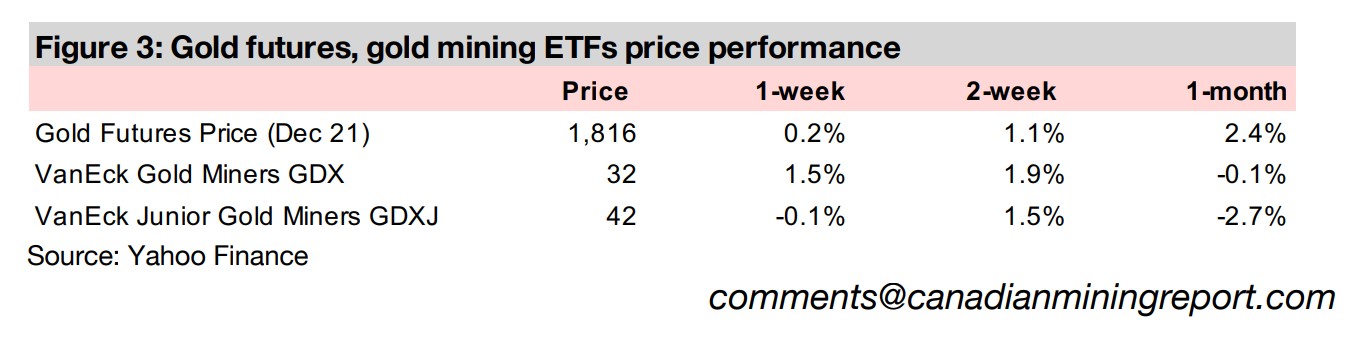

Gold rose 0.2% to US$1,816/oz, rising above the average for 2021 of US$1,798/oz as we head into the new year, and ending 2021 down -6.8% in a year that was broadly one of consolidation after the big gains of 2019 and 2020.

A review of the gold and other metals mining sectors for 2021

This week we review the 2021 performance for the gold and other metals sectors, including the price performance and valuations for the major gold producers and the larger TSXV-listed gold, silver, copper and other base metals juniors.

A Year of Consolidation for Gold

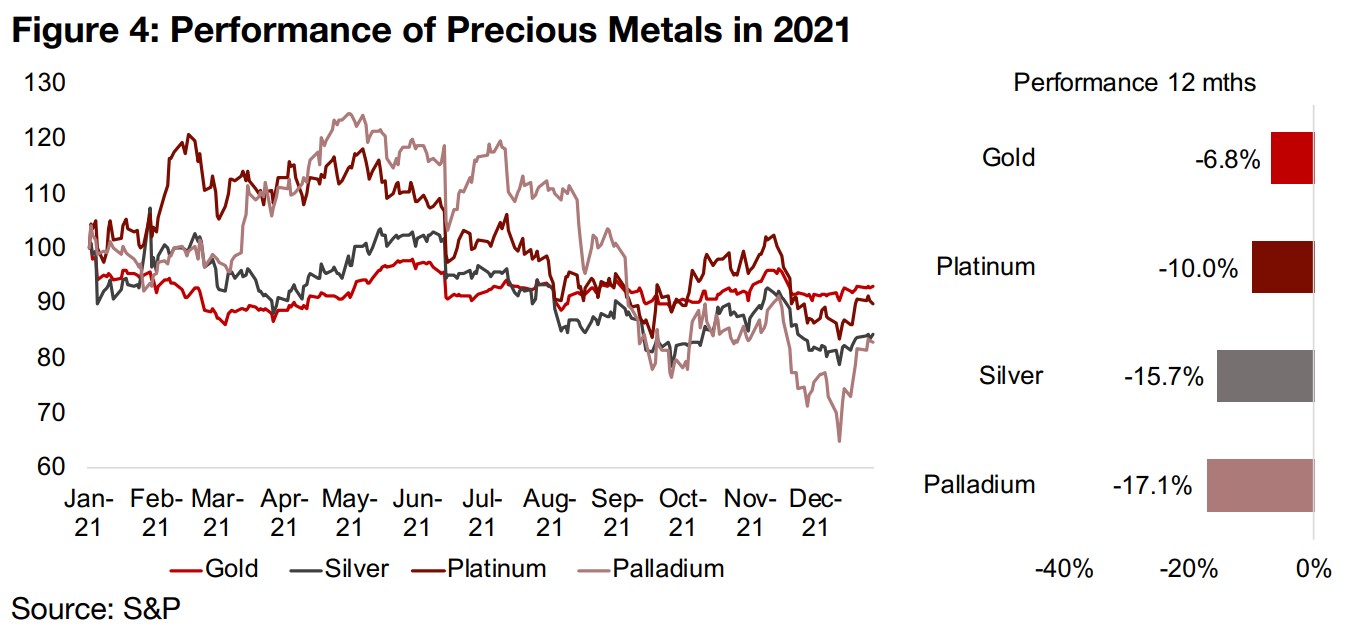

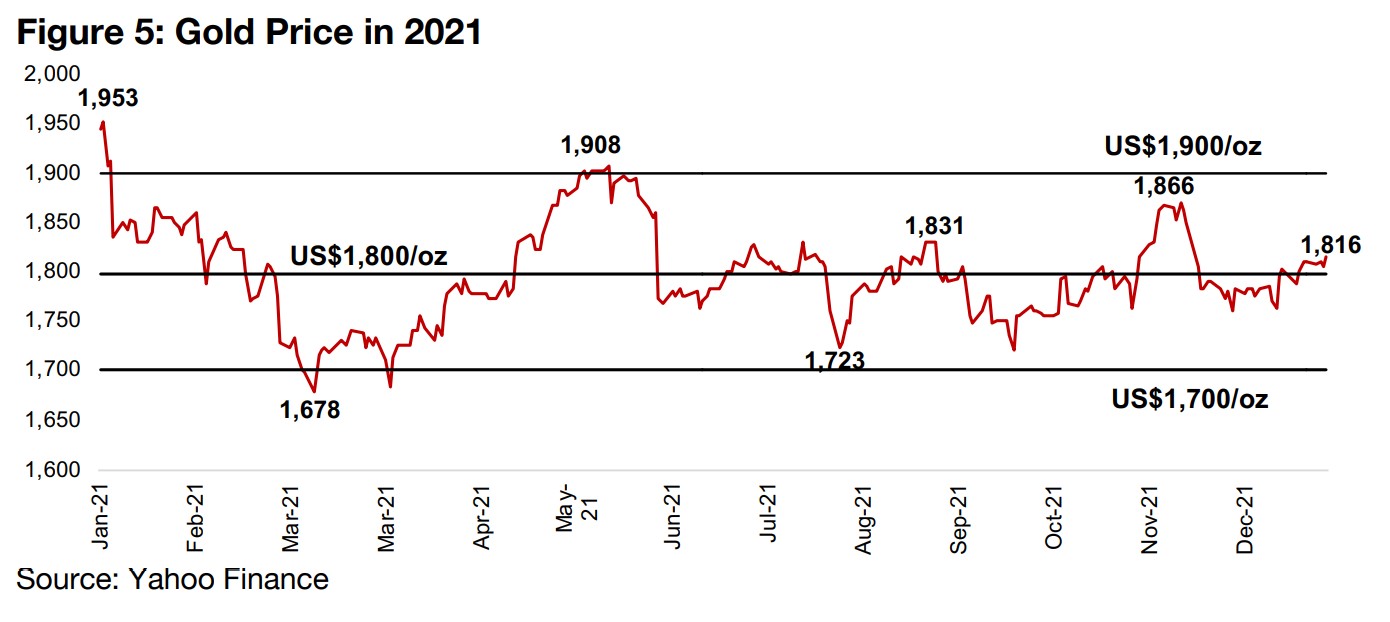

Gold rose 0.2% to US$1,816/oz for the week, bringing the decline to -6.8% for the year, which was one of broad consolidation after the big gains of 2019 and 2020 (Figure 4). The gold price also edged above the average for the year of US$1,798/oz, with most of the volatility for 2021 in the first half of the year, with gold starting off 2021 at US$1,953/oz, and getting as low as US$1,678/oz, but in the second half staying reasonably close to the year's average. Gold also outperformed all the other precious metals (Figure 5). Platinum and palladium saw a boost well into Q3/21 on automotive demand, with the metals' largest use being in catalytic convertors for vehicles. However, the jump off a low base for the car industry, and for the economic growth overall, seemed to be fading through H2/21, and platinum ended the year down -10.0% and palladium down -17.%. Silver saw pressure through most of year, with only brief periods of gains, after a large jump in H2/20, and slid especially over H2/21, as the economic growth recovery story eased, ending the year down -15.7%.

Inflation breaks out, equity market valuations remain high

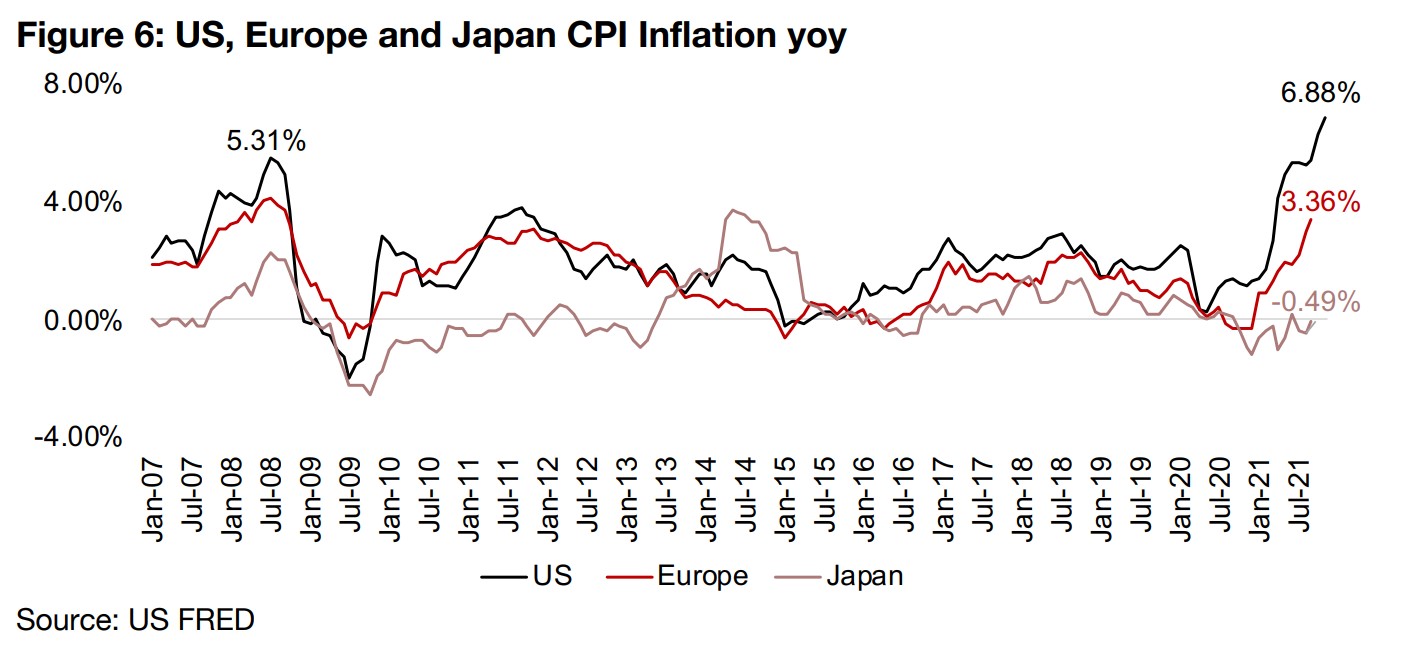

While for the first half of 2021 the economic rebound propelled investors into risk

assets, gold still held up well as concerns over the global health crisis continued to

linger and the market still kept an eye on safety. However, with CPI inflation starting

to erupt by mid-year, and reaching near a four-decade high by the end of the year,

combined with another wave of global health crisis fears, gold saw quite strong

support, and rebounded twice off dips toward the US$1,700/oz level (Figure 6).

Keeping gold from really taking off, however, was the US Federal Reserve's start of

a taper of the massive stimulus of the past year in the last months of 2021. Overall,

however, we believe that higher than expected inflation and a continued slowdown

in global economic growth from the H1/21 boom, or stagflation, is a likely outcome

for 2022. Combining this with continued concerns over the global health crisis, we

expect that gold should be supported at least near current levels through next year.

While the Fed's taper may limit gold's upside next year, we do not expect it to be

strong enough to curb inflation severely. With both the economic recovery tenuous

and global stocks markets at extremely high valuations in historical terms, we do not

expect the Fed to be aggressive with its monetary contraction lest they prompt a

simultaneous economic and stock market crash. The Fed is 'talking tough' for now,

and has removed its previous hypothesis that inflation was just 'transitory', and based

on short-term supply chain disruptions following the crisis, from their statements. It

has also suggested that it may move up its planned rate hikes to earlier periods.

However, we anticipate that actually the Fed will continue be tolerant of a bit of high

inflation, especially given the extremely difficult outcomes that are the likely

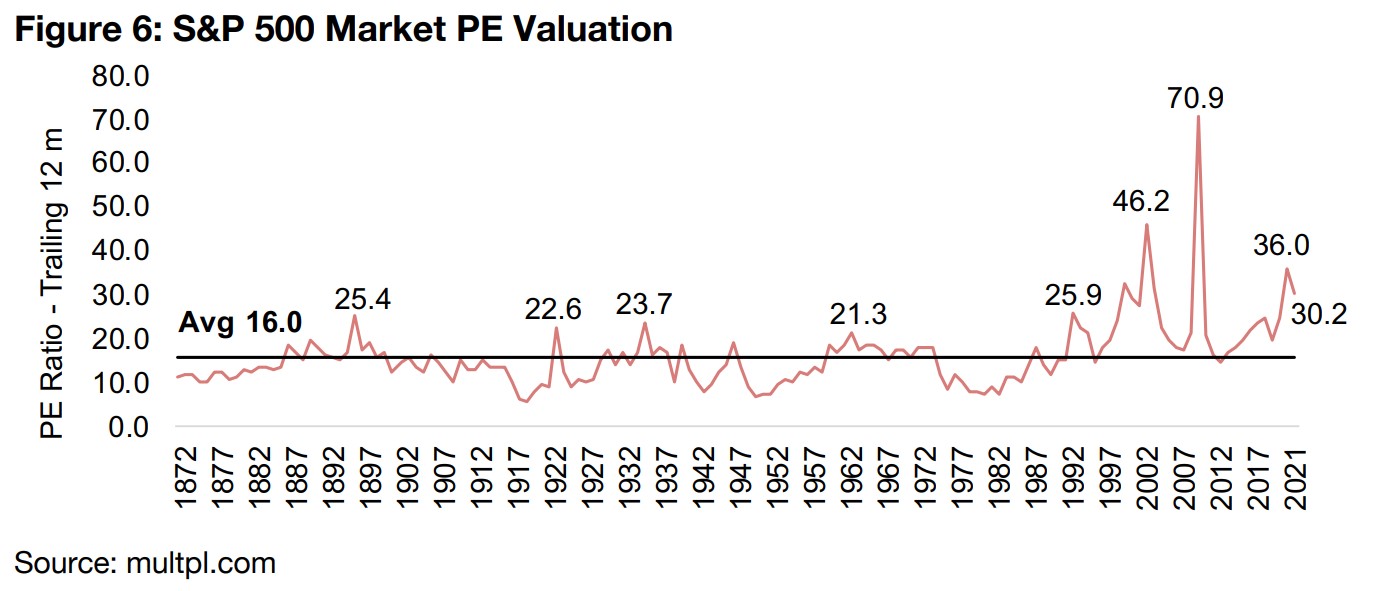

alternative. The US stock market valuations are looking particularly excessive at a PE

of 30x, nearly two times the long-term average of just 16.0x (Figure 7).

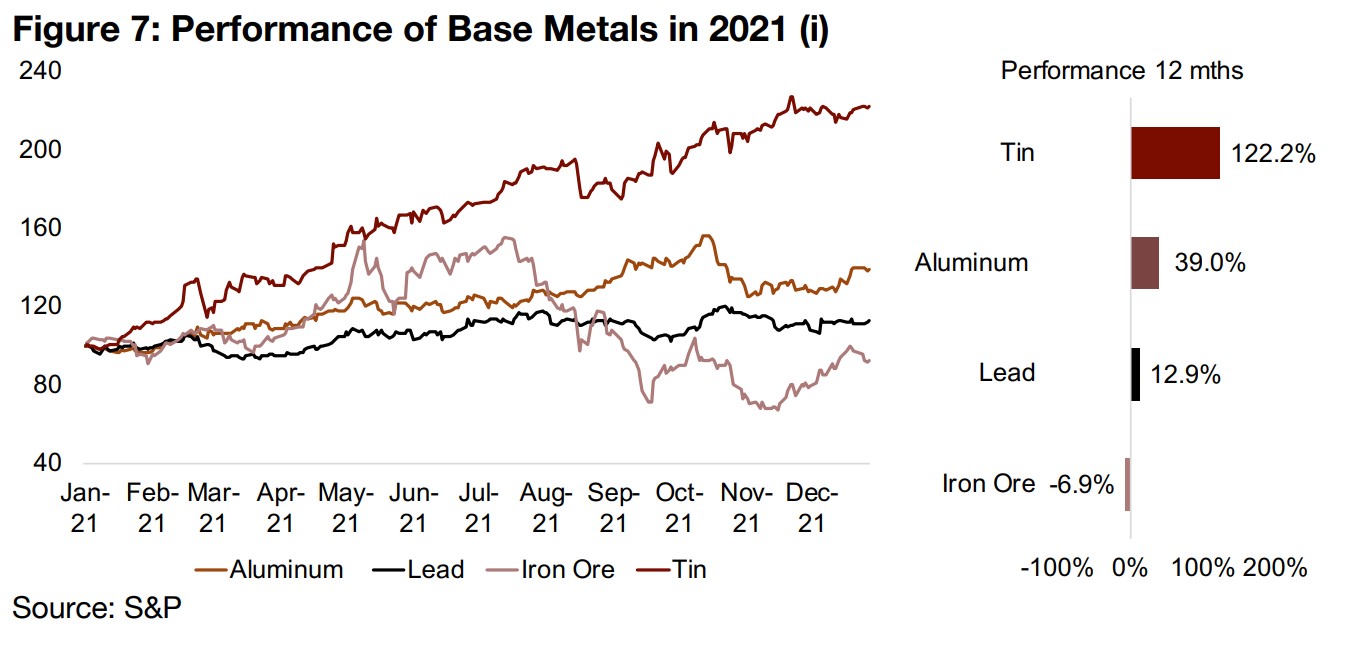

Base metals could see some pressure in 2021

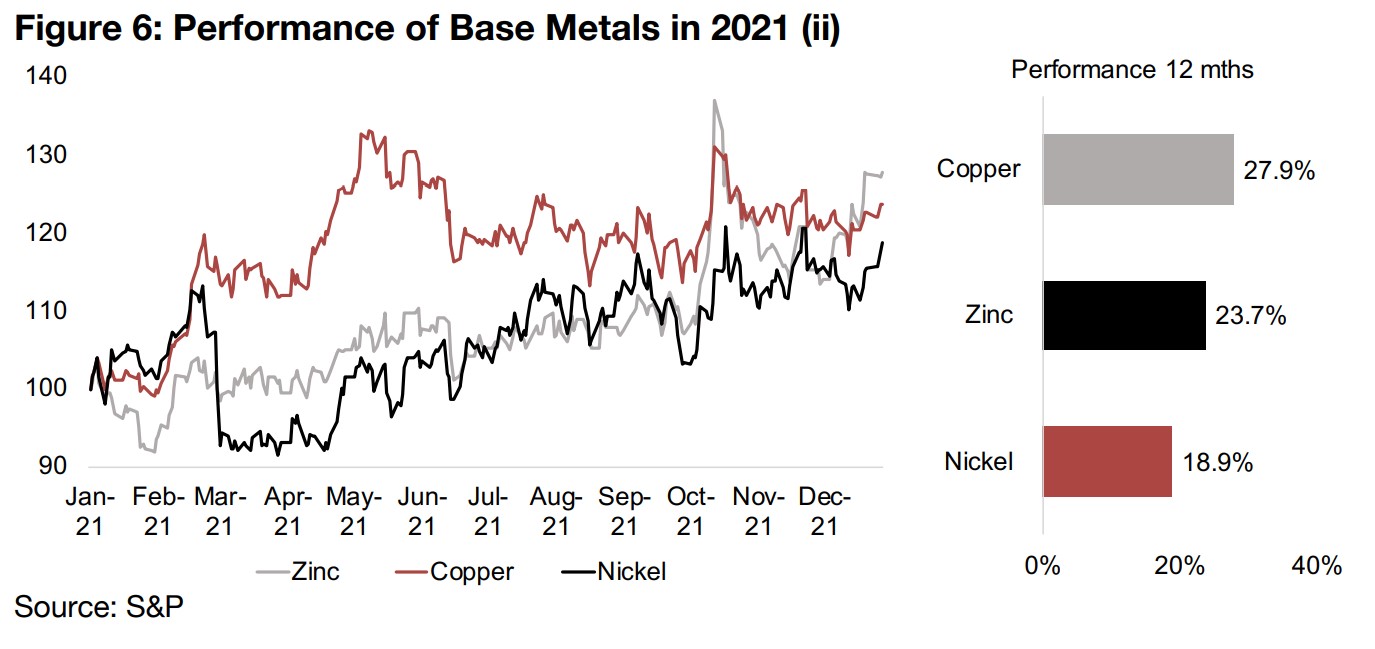

If all of this plays out as we expect, gold could hold up well next year, but the base metals could fare more poorly, if the boost from the industrial rebound in 2021 off a very low 2020 base continues to fade. Copper, zinc and nickel all saw strong gains this year, up 27.9%, 23.7% and 18.9% for 2021, but copper, commonly thought of as a very strong barometer of underlying economic demand, peaked as early as May 2021 (Figure 6). While copper held flat over H1/21, suggesting that the economy is not sliding much yet, we remain concerned that yoy growth for 2022 faces the much more difficult comps of a very strong 2021. Other base metals are showing a mixed picture, with tin still soaring, up 122.2%, by far the best performing major metal, but iron ore was down -6.9%, plummeting from major gains earlier in the year (Figure 7). However, this seems more based on sector specific issues than the general economic trend. For the other major base metals, aluminum has eased off its peak, but is still up 39.0% for 2021, while lead has been relatively flat, up 12.9%.

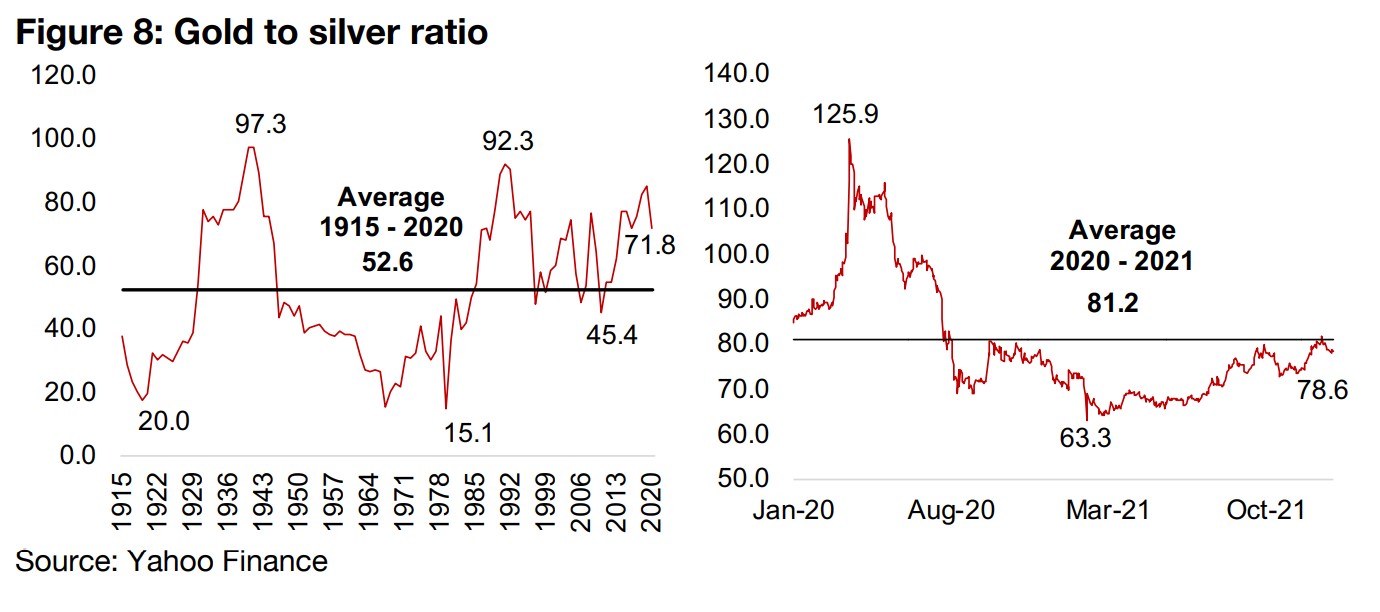

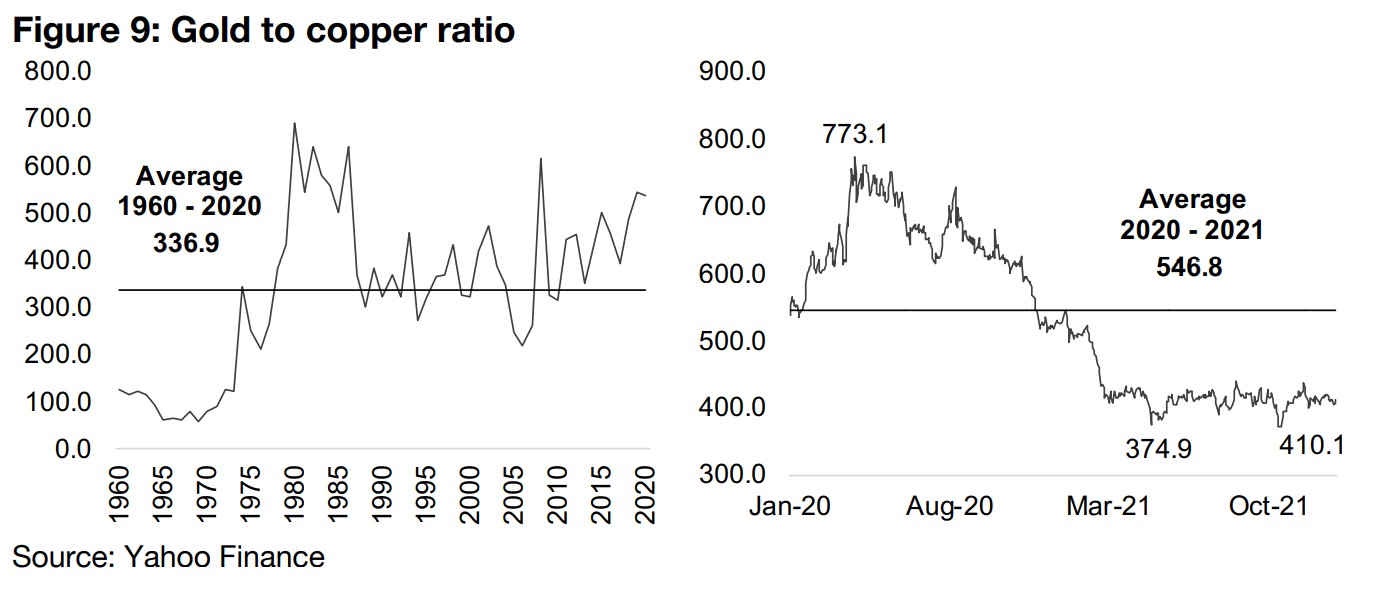

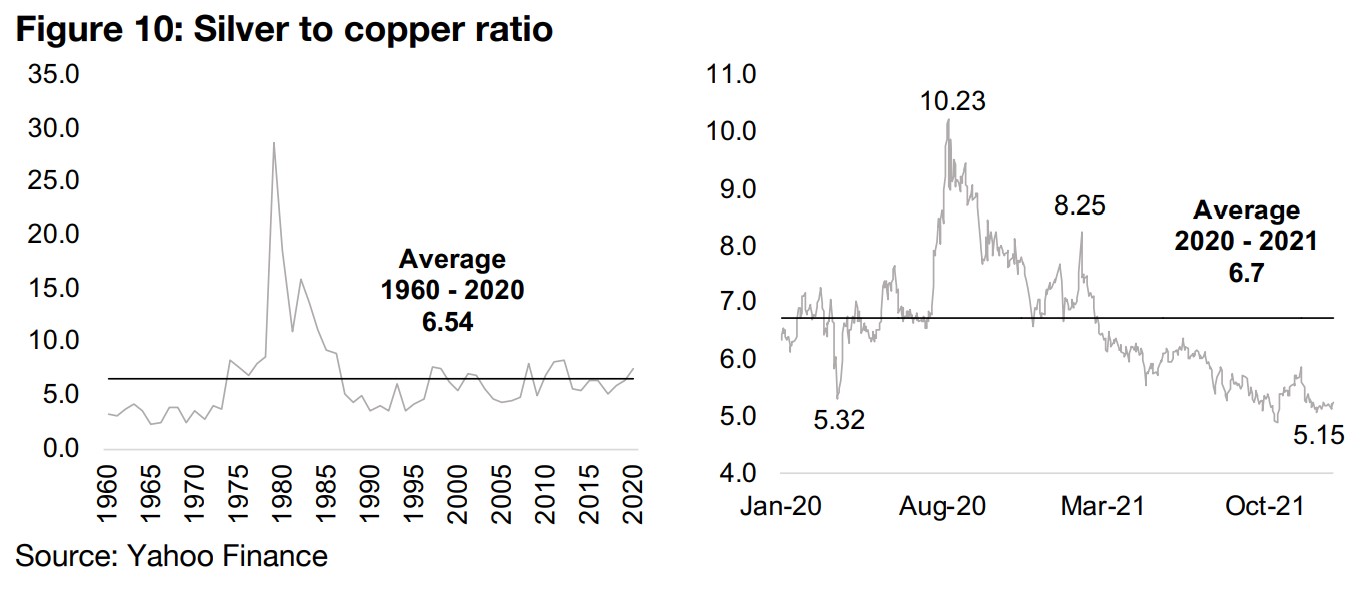

Silver may still be fundamentally undervalued

Given our assumption that gold will hold up well in 2021, we can look at its relative valuation versus other metals to ascertain the potential direction of other key metals including silver and copper. Silver certainly looks quite undervalued versus gold based on the historical gold to silver ratio. While this had come down from a clearly excessive 125.9x in early 2020, even at its low in early 2021 at 63.3x, it was still well above the long-term average of 52.6x (Figure 8). With the ratio having returned to 78.6x, it is nearing the average from 2020-2021 of 81.2x, suggesting that short-term this ratio has been returned to a balance, but long-term ratios would suggest that silver could still gain versus gold in relative terms. The gold to copper ratio has fallen below the 2020-2021 average, but is moderately above the long-term average, showing some 'balance' there (Figure 9). However, the silver to copper ratio has fallen below both the short-term and long-term average, again pointing to some degree of undervaluation for silver (Figure 10).

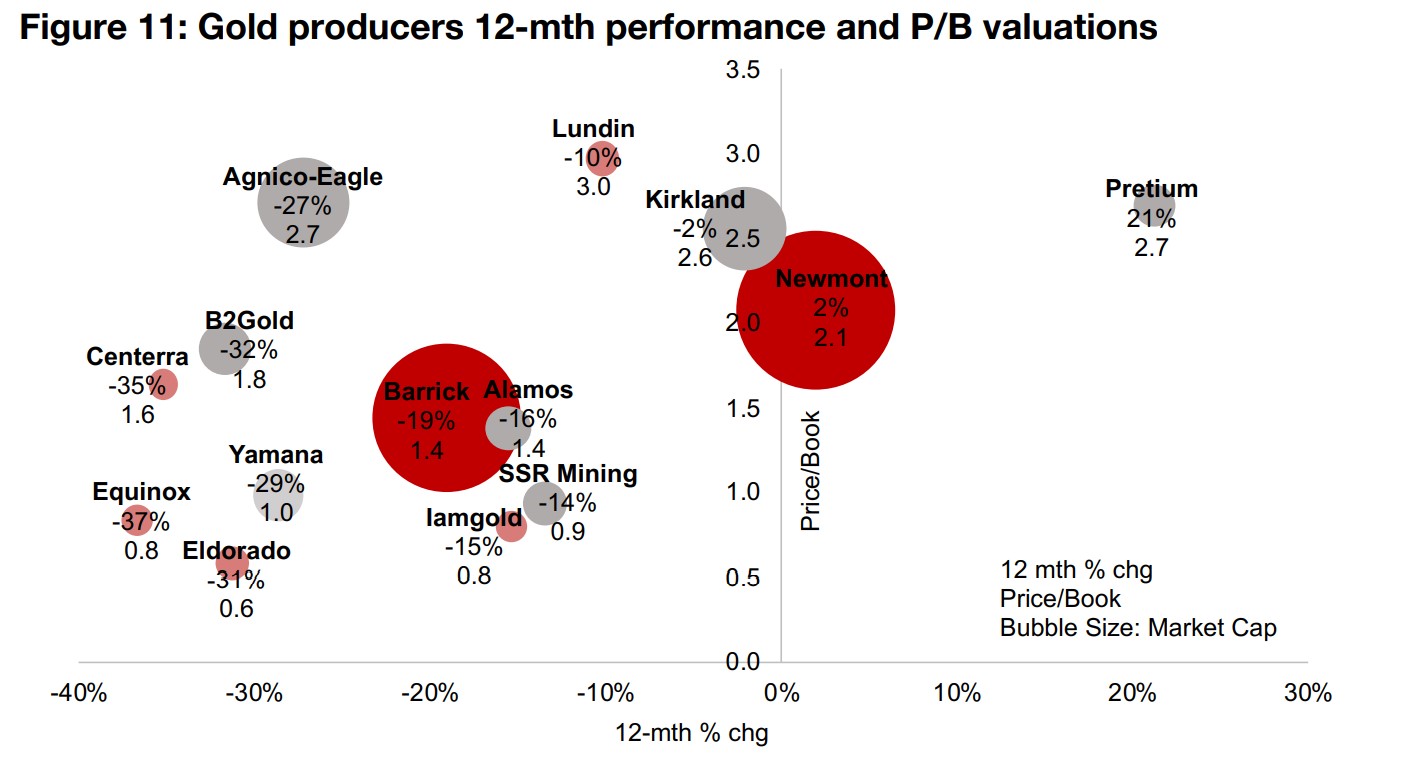

Gold producers' performance weak, but valuations cheap

The performance of the major gold producers was weak overall this year, with most seeing declines on the fall in gold. Of the two industry giants, Newmont was relatively strong versus the sector although it gained just 2%, while Barrick declined -19% (Figure 11). The only standout gain was from Pretium, up 21%, driven by its acquisition by Newcrest, with the other major M&A deal for the year, the Kirkland and Agnico-Eagle merger, seeing their share prices down -2% and -27%, respectively. To the upside, given the strong earnings performance this year for much of the sector, valuations are low, with price to book valuations for most of the group below 2.0x, suggesting that they are poised for gains if the gold price beats our expectations for a flat performance in 2021.

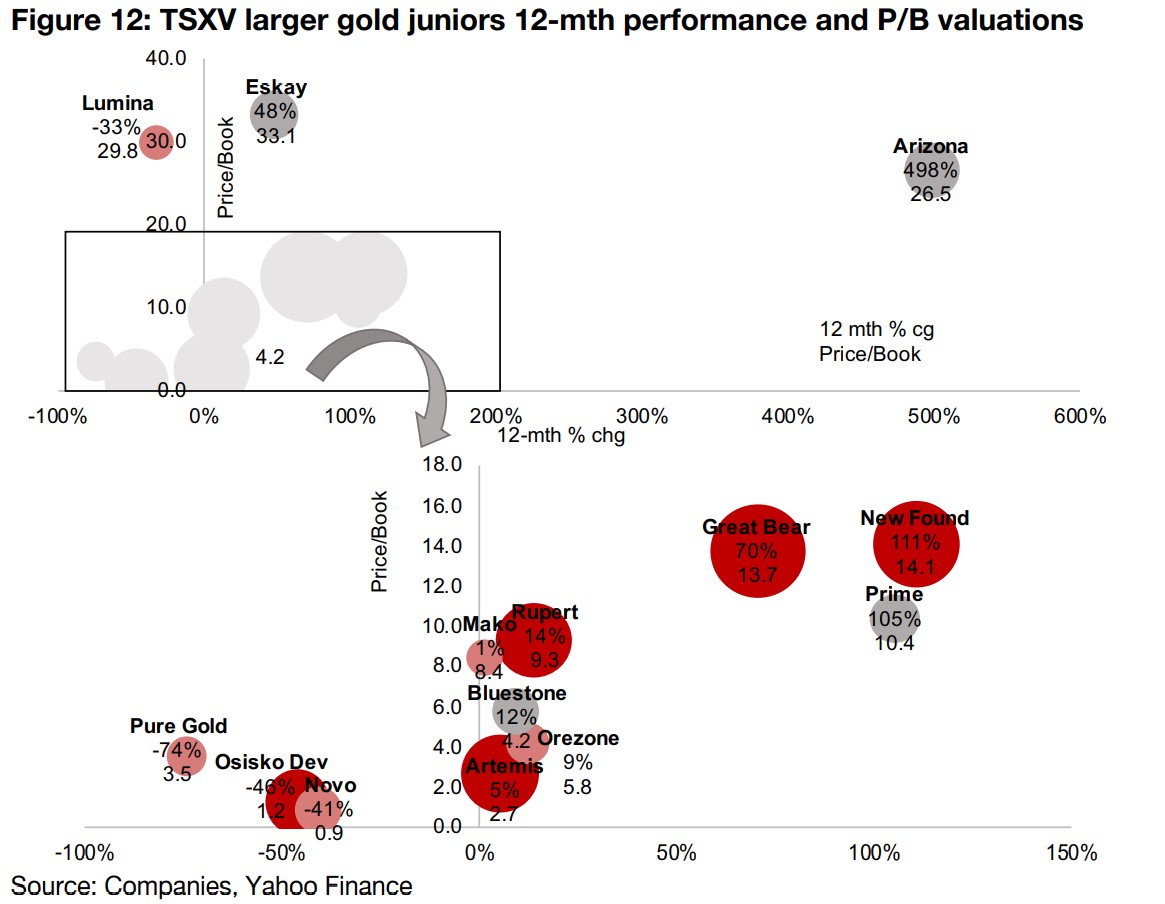

Larger TSVX-listed gold juniors see wide range of outcomes

In contrast to the consistent theme for the gold producers, the larger TSXV-listed juniors saw a wider range of outcomes. The outstanding gainers are all exploration stage companies showing strong drill results this year that have driven up their valuations. These include newcomers to the larger-cap group, Arizona Metals, Prime Mining, New Found Gold, and Eskay Mining, while Great Bear Resources, also a strong performer in 2020, was boosted by an acquisition by Kinross near the end of the year. The other companies, mainly consisting of developers and producers, formed one cluster around single to low-double digit gains and moderate P/B valuations and another with firms with substantial losses and very low P/B valuations. Lumina stands out for high losses and a very high P/B, which is distorted by its very low level of equity.

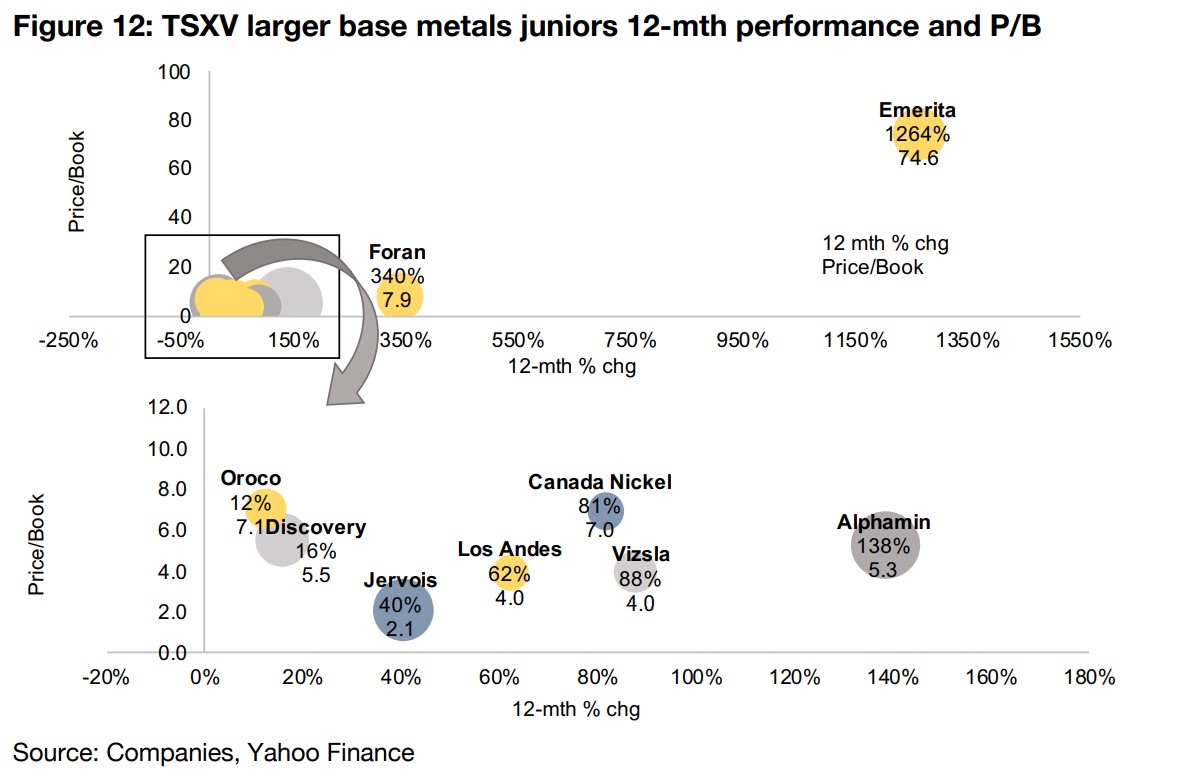

Larger TSVX-listed base metals juniors see strong year

The larger TSXV-listed base metals juniors saw a strong year overall as metals prices were driven up by the rebound in the economy. The standouts were copper plays Foran, up 340%, and Emerita, up 1264%, with the latter's P/B distorted by its low equity. The rest of the group gained by at least double digits, with Alphamin rising 138% on the surge in tin, Vizsla Silver, rising 88%, Canada Nickel, up 81%, copper company Los Andes, up 62%, cobalt producer Jervois, up 40%, and relative laggards Discovery Silver, rising only 16%, and copper company Oroco, up just 12%.

Some potential major themes for 2021: A time for caution?

While 2013-2018 was the gold and silver bear market, 2019-2020 the big recovery,

and 2021 a year of stagnation for precious metals but seeing large gains for the base

metals, we believe that 2022 could mark another new phase, with some main themes

including:

1) Gold holds up while base metals face pressure: We believe that we could see

the gold price hold up as inflation surpasses expectations, and that silver could even

gain as the ratio between the metals converges to its long-term average, while base

metals could face pressure if economic growth shows further signs of easing.

2) Miners start to face cost inflation: While the inflation could help support the gold

price, for the mining sector overall there is the downside that inflation may start coming

through in the mining sector's cost base next year, with the effect of inflation on the

miners financials through to Q3/21 still quite muted.

3) Strong M&A activity continues: While there will be some moderate cost inflation,

we expect that with many miners strongly cashed up from the rising profits of the

past two years, that the rising M&A activity that we started to see gaining pace

especially in the second half of 2021 will carry over into next year.

4) Equity markets see pressure: With the Fed starting to taper its monetary stimulus

and equity markets valuations at very high levels, we are concerned that stocks could

slide next year. Even if the gold price itself holds up, this could hit the gold mining

stocks, and especially the junior miners, as valuations may come down across

markets in general, and investors look to reduce their more risky holdings.

Overall, we believe it may be time for a bit more caution on the mining stocks than

has been warranted for the past three years. While we are most upbeat on the gold

and silver stocks, assuming there are no major gains in gold next year above our flat

expectations, there may be a chance to buy in at a lower levels later this year if the

broader equity markets undergo a correction. For the base metals stocks, overall we

remain concerned that an economic slowdown could see them under pressure.

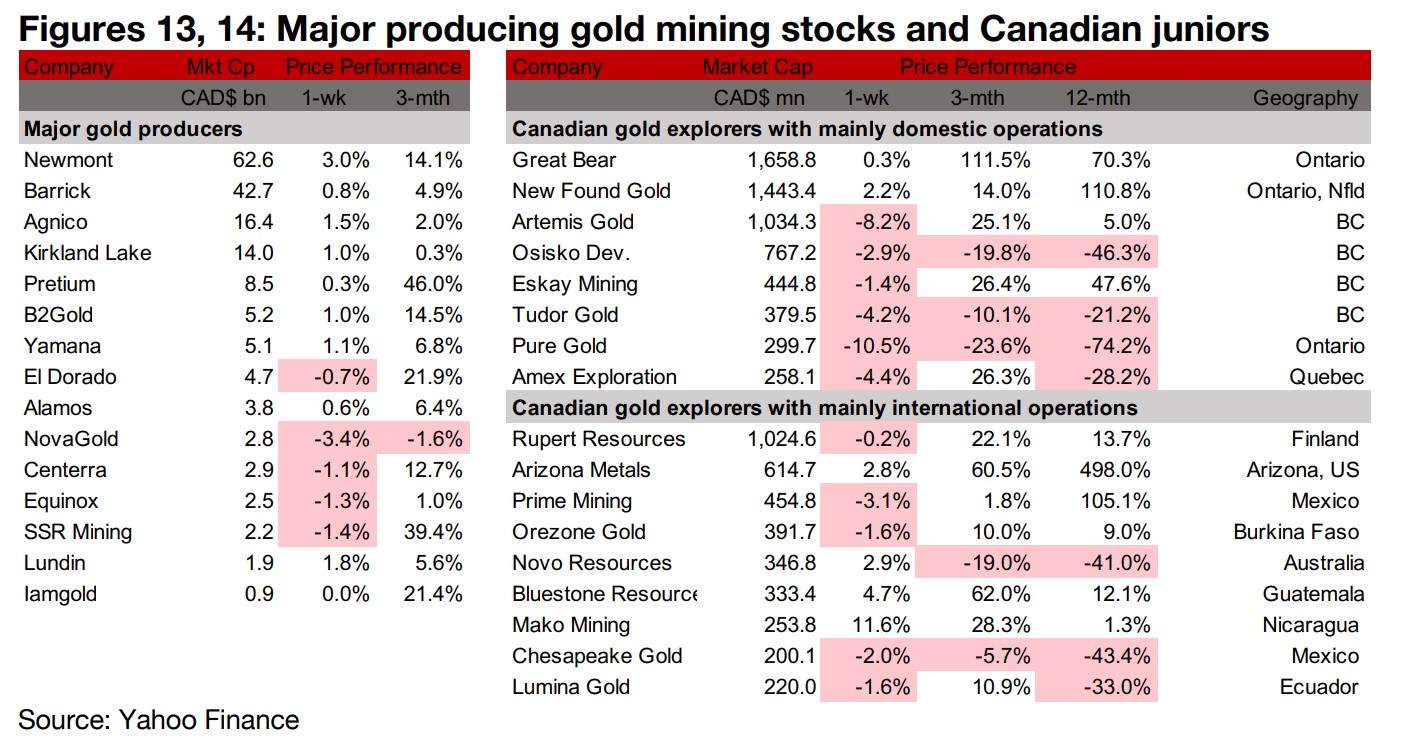

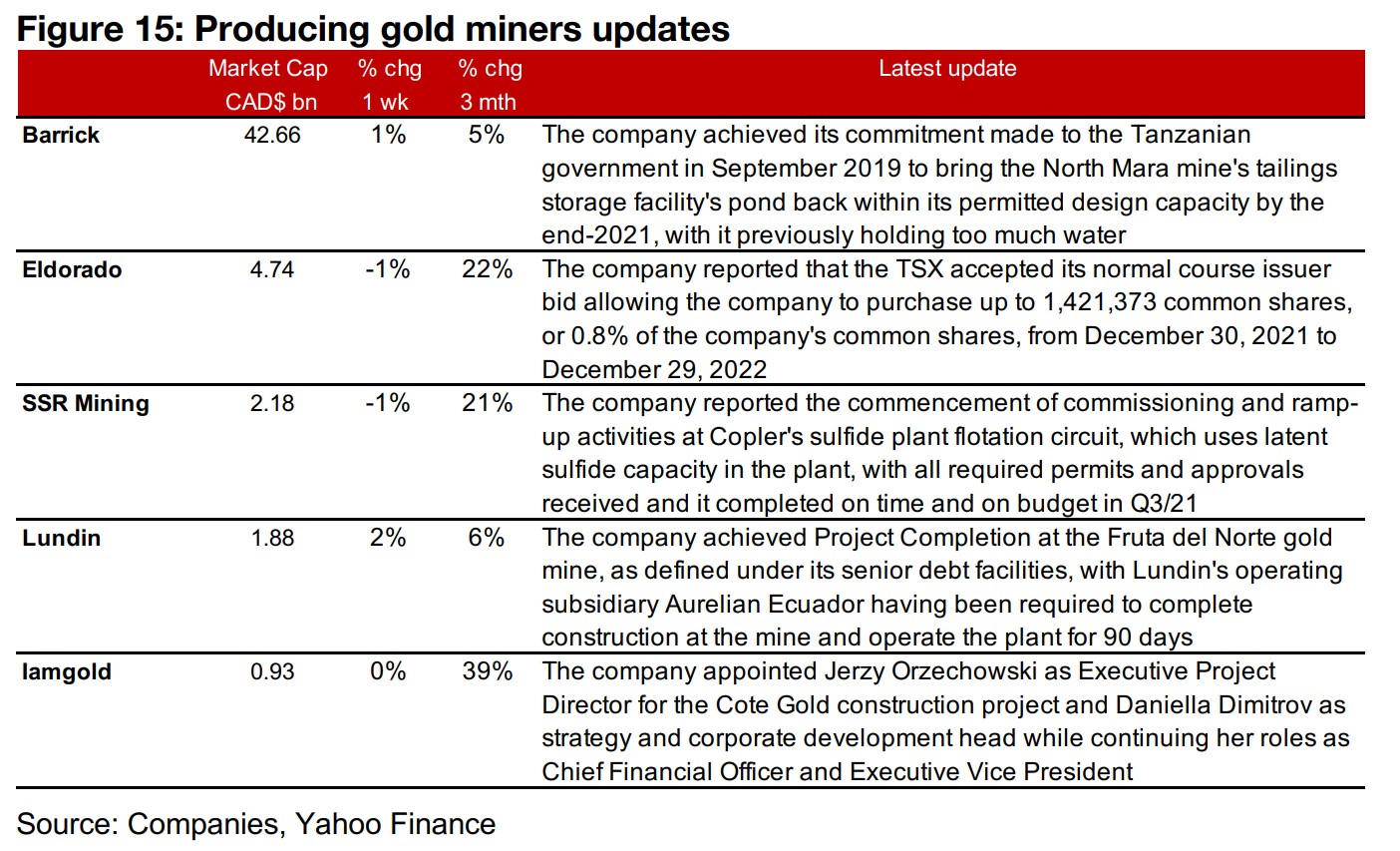

Producers mostly up as gold gains

The producing gold miners were mainly up on the gain in gold (Figure 13). Barrick announced that it had delivered on its commitment to the Tanzanian government to reduce the tailings storage facility's pond size at its North Mara mine, Eldorado reported that the TSX had accepted it normal course issuer bid to purchase 0.8% of its common shares and SSR Mining reported the commencement of commissioning and ramp-up activities at Copler's sulfide plant flotation circuit. Lundin reported Project Completion at the Fruta del Norte mine as defined under its senior debt facilities and Iamgold appointed Jerzy Orzechowski as Executive Project Director for the Cote Gold construction project and Daniella Dimitrov as strategy and corporate development head, while continuing her roles as Chief Financial Officer and Executive Vice President (Figure 15).

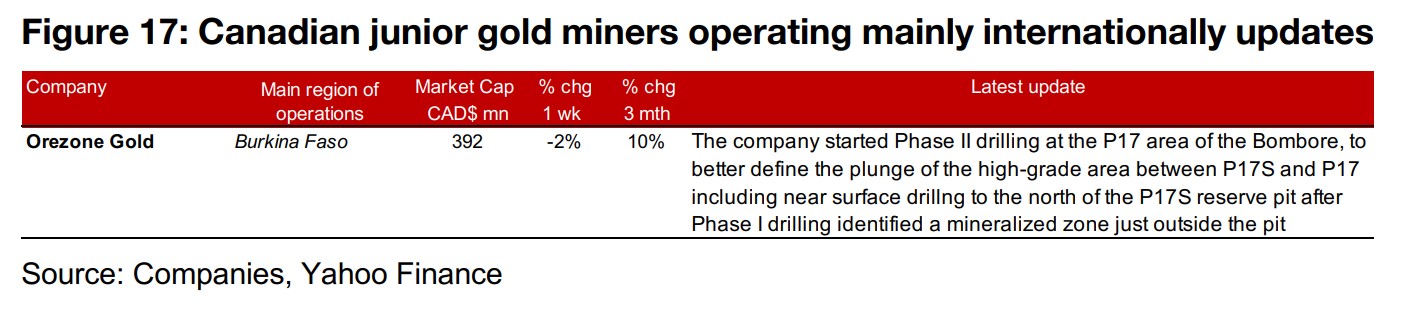

Canadian juniors mostly decline as equity markets edge down

The Canadian juniors mostly declined, even as gold rose, as equity markets edged down (Figure 14). There was only a single material update for the Canadian juniors with Orezone reporting the start of its Phase II drilling at the P17 area of the Bombore project (Figure 16).

Disclaimer: This report is for informational use only and should not be used an alternative to the financial and legal advice of a qualified professional in business planning and investment. We do not represent that forecasts in this report will lead to a specific outcome or result, and are not liable in the event of any business action taken in whole or in part as a result of the contents of this report.