Aug 14, 2020

A pullback after major ramp up

Author - Ben McGregor

Gold price pulls back to mid-$1,900s/oz

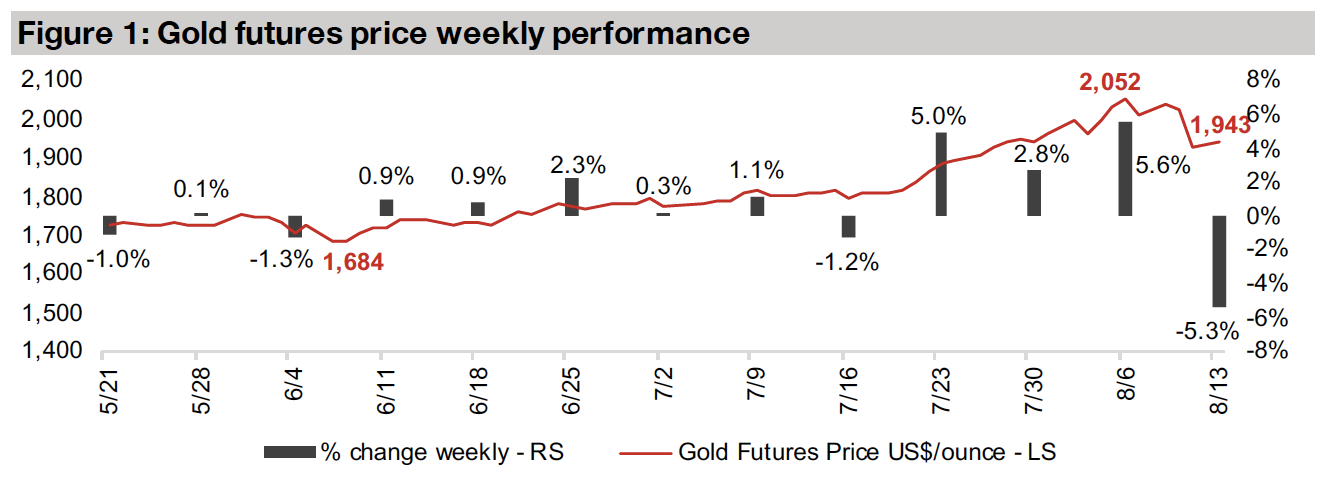

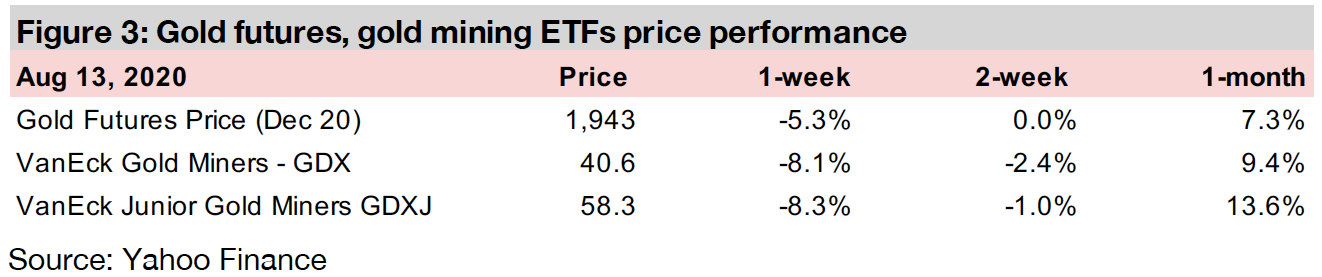

Gold declined -5.3% this week to US$1,943/oz, in reaction to a rise in US treasury yields and the dollar index, and as a natural pullback after an eight-week, 21.8% surge off US$1,684/oz lows in early June, to last week's peak close of US$2,052/oz.

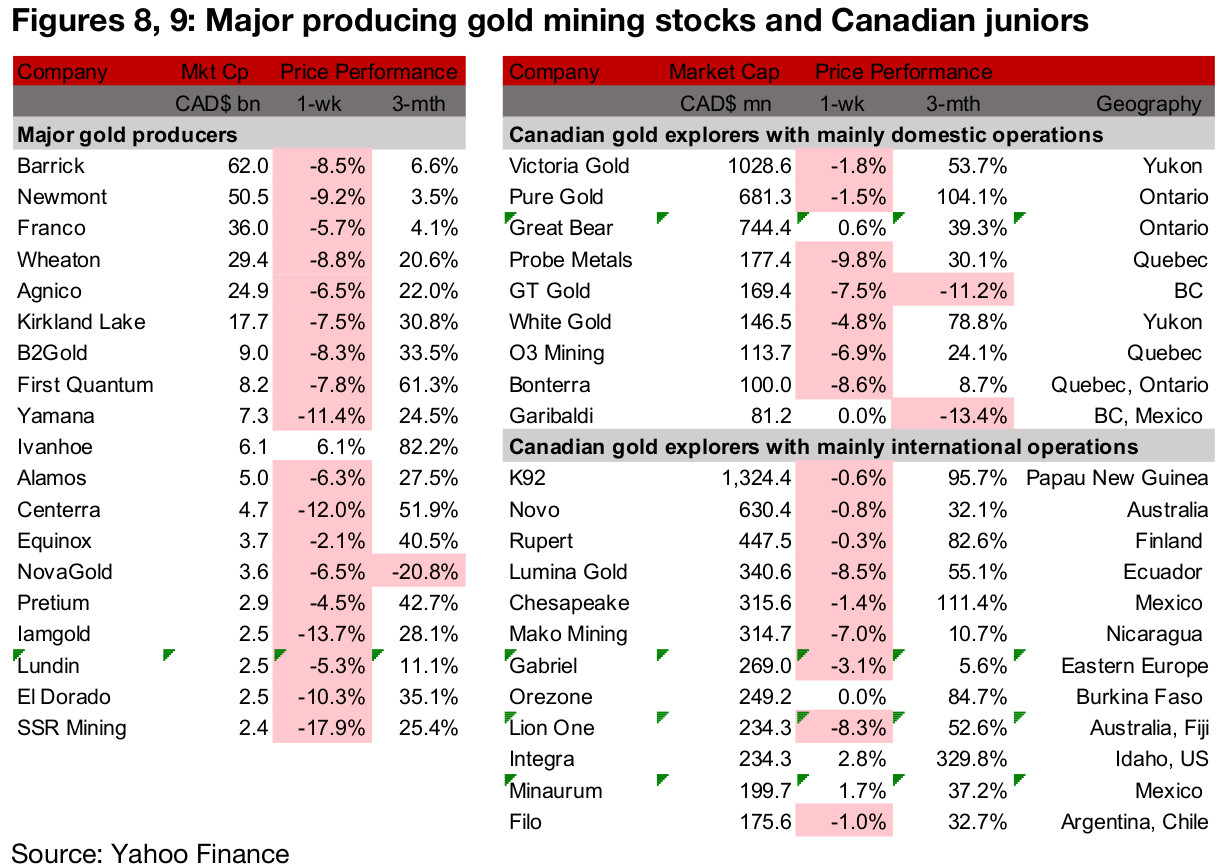

Producing miners nearly all drop on gold decline

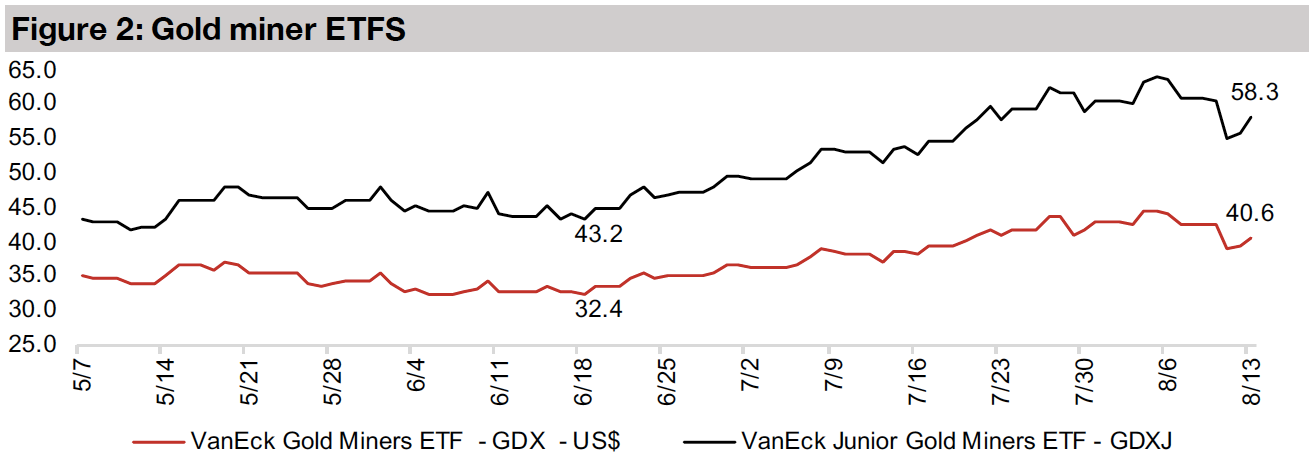

The producing miners nearly all declined on the gold dip, and a relative lull in news flow following the end of the results season, with the GDX down -8.1%, as the leverage effect of the gold price on the gold producers went into reverse.

Junior gold miners hit by the fall in gold

Global junior gold mining stocks fell on the gold reversal, with the GDXJ down -8.3% and the Canadian junior gold miners nearly all falling. Mexico-focused junior miner Chesapeake Gold is In Focus this week.

Driving out some gold speculators after huge recent ramp

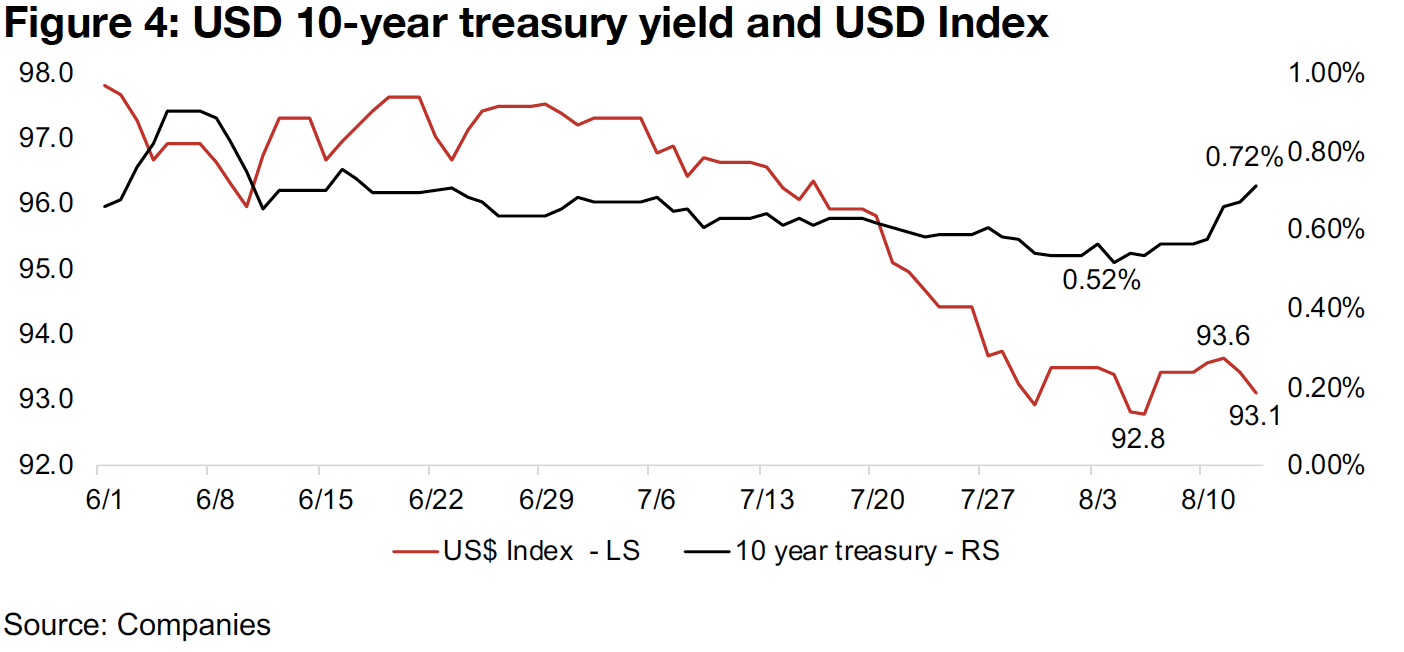

Gold futures fell considerably this, week, down -5.3% to US$1,943/oz, in reaction to; 1) a jump in US Treasury yields, with the 10-year rising to 0.72% from recent lows of 0.52% (Figure 4), 2) a rise in the US dollar index to 93.6, off lows of 92.8, although this was subsequently reversed, and 3) news of a vaccine for the global health crisis coming out of Russia, although the efficacy of it has not been substantiated. This combination of a perceived fall in health risks, however tenuous, and higher yields available in a key alternative asset, drove some recent speculators out of the market after a 21.8% rip in the gold futures price from a US$1,684/oz low in early June 2020 to a peak close of US$2,052/oz last week. With the gold futures price ranging from intraday highs of US$2,084/oz last week to lows of US$1,879/oz this week, but rapidly recovering to close in the mid-US$1900s/oz, it suggests a possible new shortterm trading range, with resistance at around US$1,900/oz to the downside, and US$2,100/oz to the upside.

Even given the substantial dip, we have still only lost about two weeks of particularly frothy price action, which to some degree is good, to clear out some very short-term speculators and check whether there are some solid foundations to the recent move, with a base that now seems to be around US$1,900/oz. And as outlined in our May 28, 2020 weekly, major pullbacks between 4%-13% occurred regularly in the gold bull market from 2009 to 2011. From an operational perspective, this dip is really not a major concern from the junior gold miners, or the producers; any level averaging above US$1,700/oz for an extended period is more than enough to drive a revival for the gold mining industry overall. With most of the Canadian junior gold miners having surged over the past three months, and with many up by well over 50%, some consolidation in share prices can be expected, and driving out some speculators helps show where these stocks should be trading based more on underlying fundamentals than on mainly momentum.

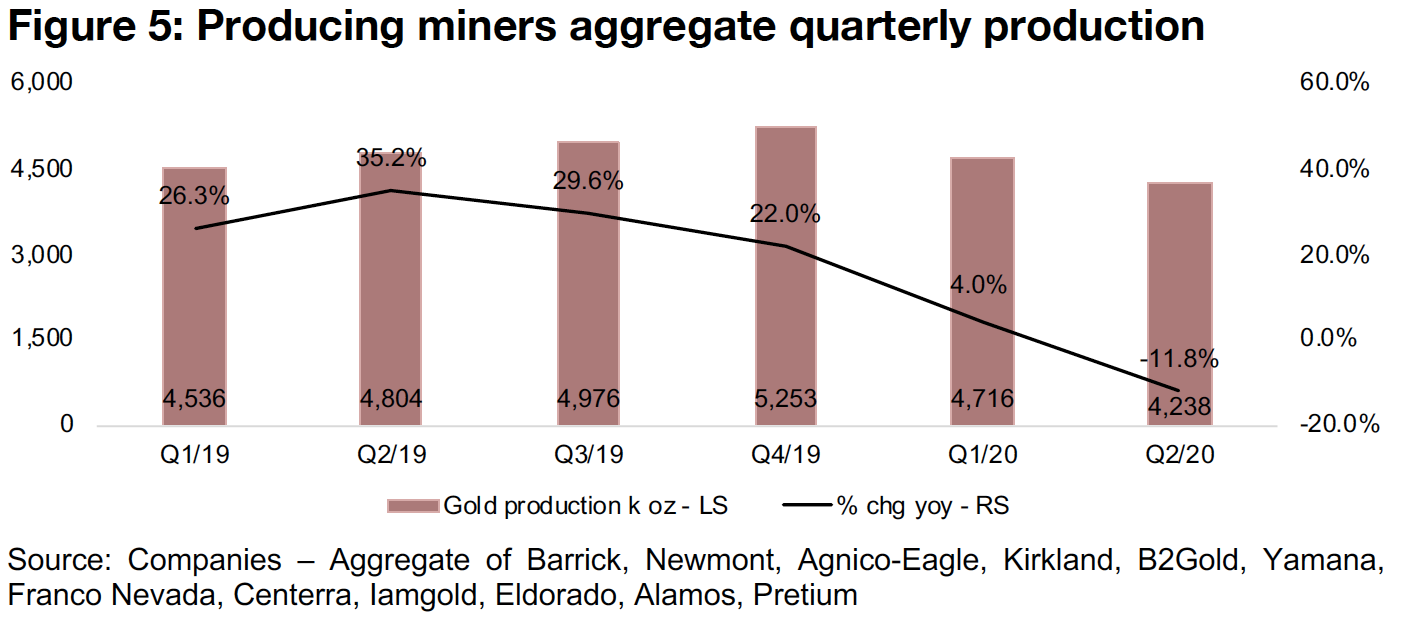

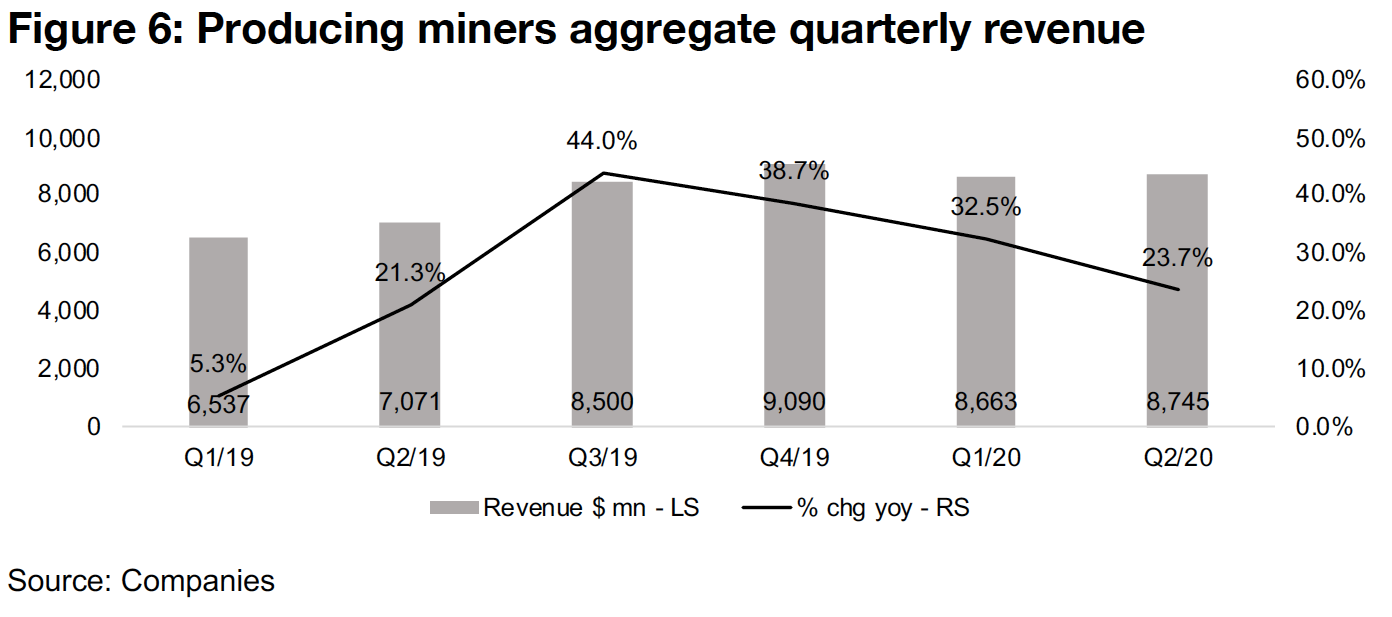

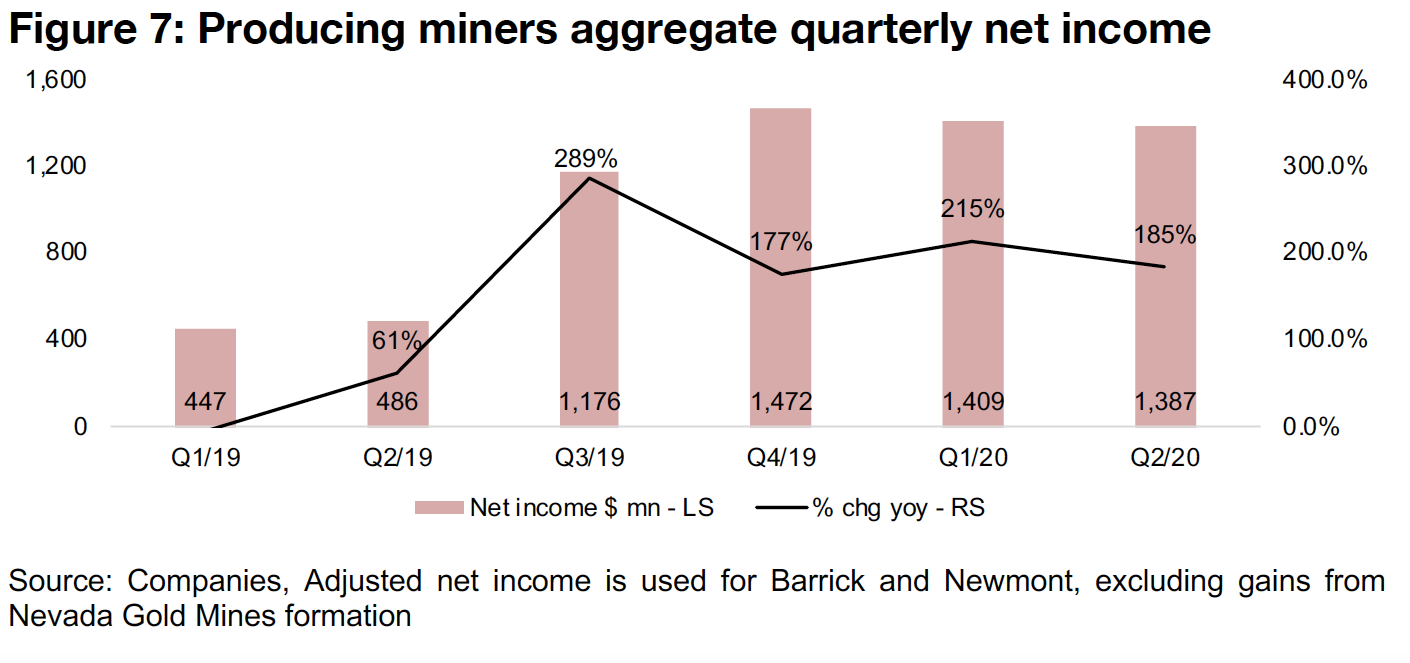

Q2/20 results; production slides, revenue rises, net income surges

The Q2/20 results season is now complete, with all of the major producing gold miners having reported. Aggregate gold production growth declined because of the global health crisis, sliding from 22.0% in Q4/19 to 4.0% in Q1/20, and then contracting -11.8% in Q2/20 (Figure 5). However, the strong gold price was more than enough to offset this, and while revenue growth declined from 38.7% in Q4/20, it was still relatively strong in Q1/20 and Q2/20, at 32.5% and 23.7%, respectively (Figure 6). Even given some top-line pressure, the bottom-line performance has been robust, with net income growth dipping only moderately to 185% in Q2/20 from 215% in Q1/20 (Figure 7). Q3/19 clearly marked the big change in profitability, with net income more than doubling from Q2/19, and for Q4/19 to Q2/20, net income has been triple the Q1/19-Q2/19 level. Given that the temporary production suspensions were mostly lifted by Q3/20, the upcoming quarter could be very impressive, with production and revenue to rebound and a lack of global health crisis related costs.

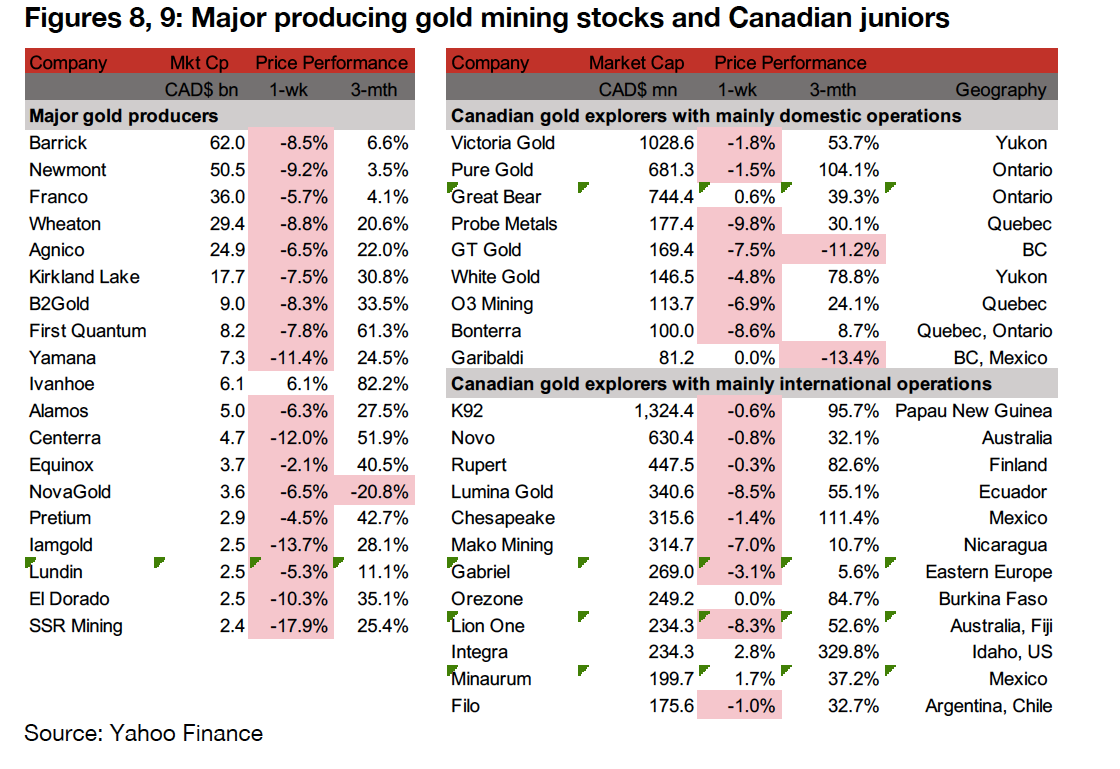

Producing miners mostly down on gold price reversal

The producing miners nearly all declined on the gold price drop, as the effect of their leverage to the gold price, which had driven substantial gains over the recent ramp, went into reverse this week (Figure 8). There was a lull in news flow for the larger cap gold producers, with most having reported Q2/20 results over the past two weeks, and Barrick the only major producer reporting their second quarter this week. Some mid and smaller sized producing miners reported Q2/20, including Nova, Equinox, SSR Mining and Lundin, and Iamgold reported the remaining assays from its 2020 drilling program from its Nelligan project (Figure 10).

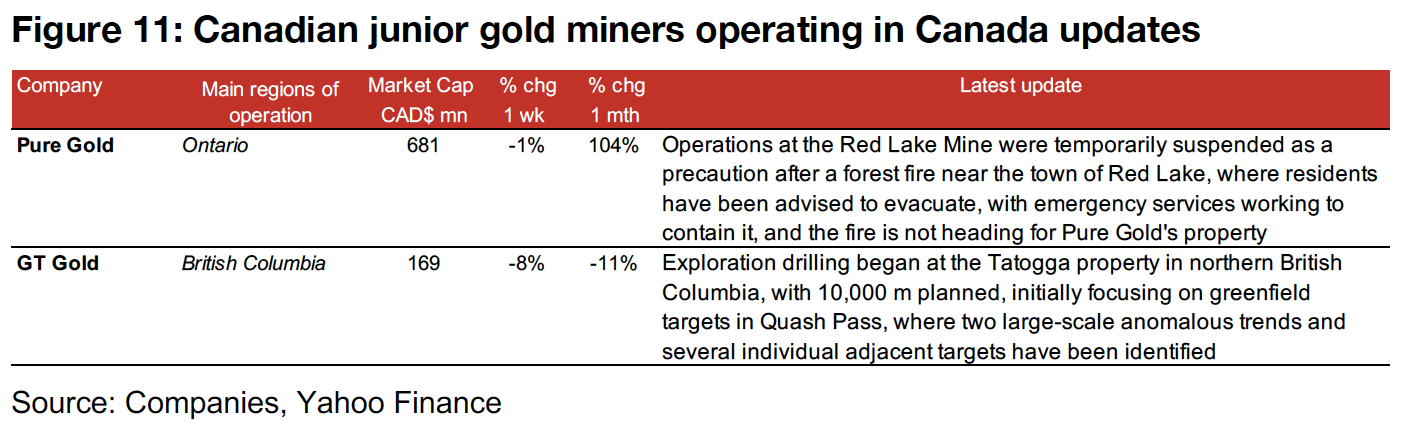

Canadian juniors operating mainly domestically mostly dip

Most of the Canadian juniors with mainly domestic operations fell this week, on the contraction in gold, although six out of nine are still up over 20% over the past three months (Figure 9). Pure Gold gave an update about a forest fire near the town of Red Lake, that is near its main Red Lake gold mine, which is currently being contained by emergency services and has been progressing in a direction away, not toward, Pure Gold's property. GT Gold reported that it had begun drilling at its Tatogga property in northern British Columbia, with 10,000 m planned with a focus on the greenfield Quash Pass area (Figure 11).

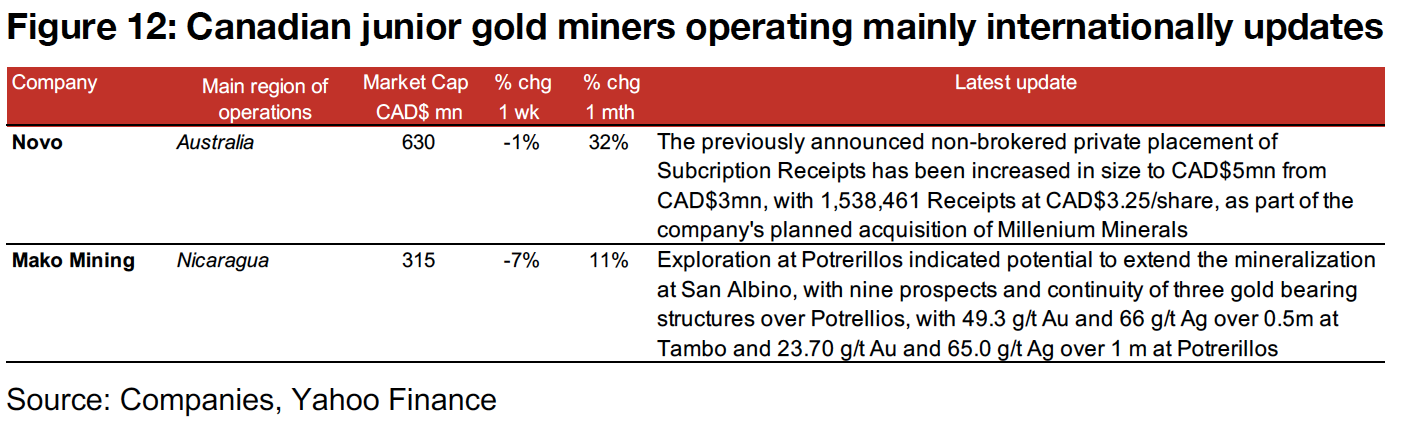

Canadian juniors operating internationally nearly all decline

The Canadian juniors operating internationally almost all declined, with only a couple of smaller caps making gains (Figure 9). There was news flow from Novo Resources, which reported an increase its previously announced non-brokered private placement of Subscription Receipts to CAD$5mn from CAD$3mn, and Mako Mining announced that exploration of the Potrerillos zone suggests that there could be continuity with the company's main, and adjacent, San Albino project (Figure 12).

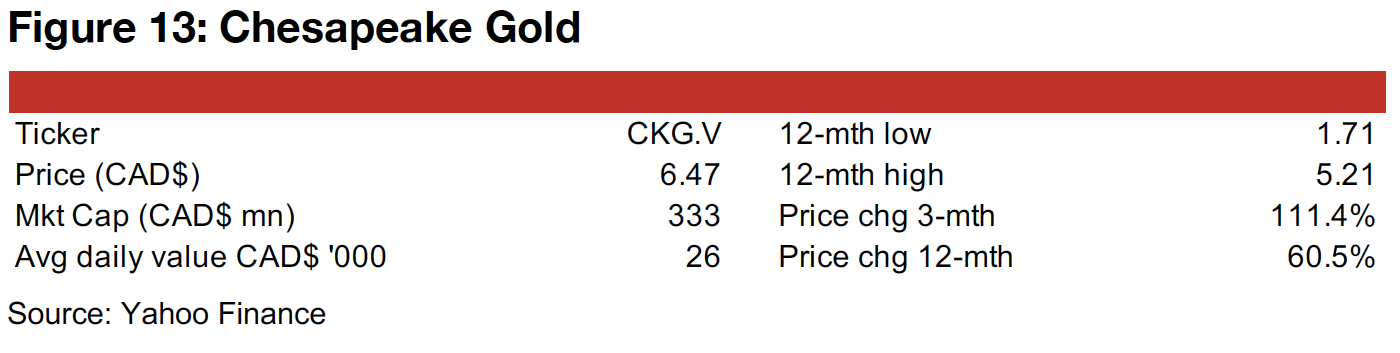

In Focus: Chesapeake Gold

Projects nearly all in Mexico with Metates the most advanced

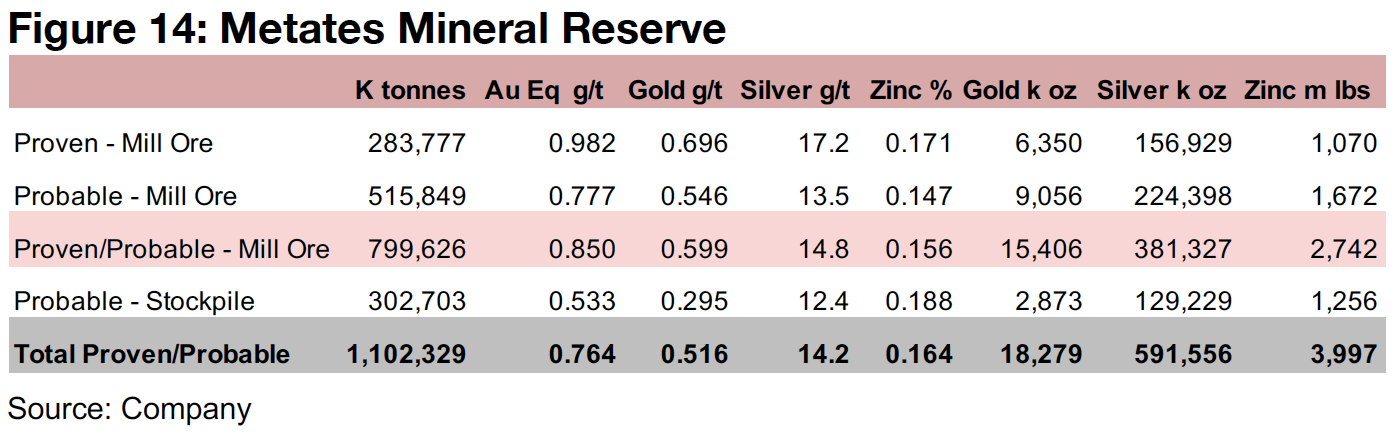

Chesapeake Gold is mainly focused in Mexico, with Metates in Durango State its

most advanced project, having reached the pre-feasibility study stage. The company

has additional properties in Durango, Sinaloa, Oaxaca and Veracruz, totaling 118,530

hectares and a 74% stake of Gunpoint Exploration, which owns the Talapoosa gold

project in Nevada and three other properties in Mexico. Metates is one of the largest

undeveloped disseminated gold, silver and zinc deposits in Mexico, with total P&P

reserves of 18,279k oz Au and 591,556k oz Ag, and 3,997 m lbs Pb (Figure 14). The

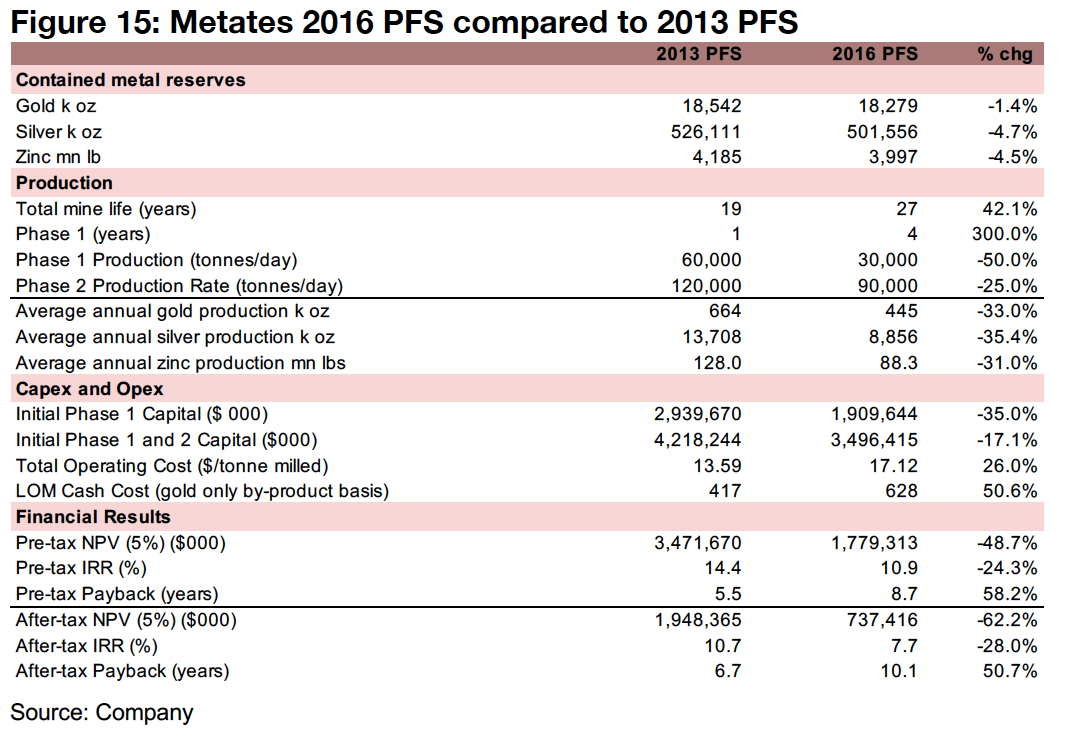

company released an update to an initial 2013 PFS in 2016 outlining a major decline

in production and an increase in costs, driving down the after-tax NPV by 62% to

$737.4mn (Figure 15). However, adjusting for recent metals prices, especially the rise

in gold and silver, would likely improve the economics of the project substantially.

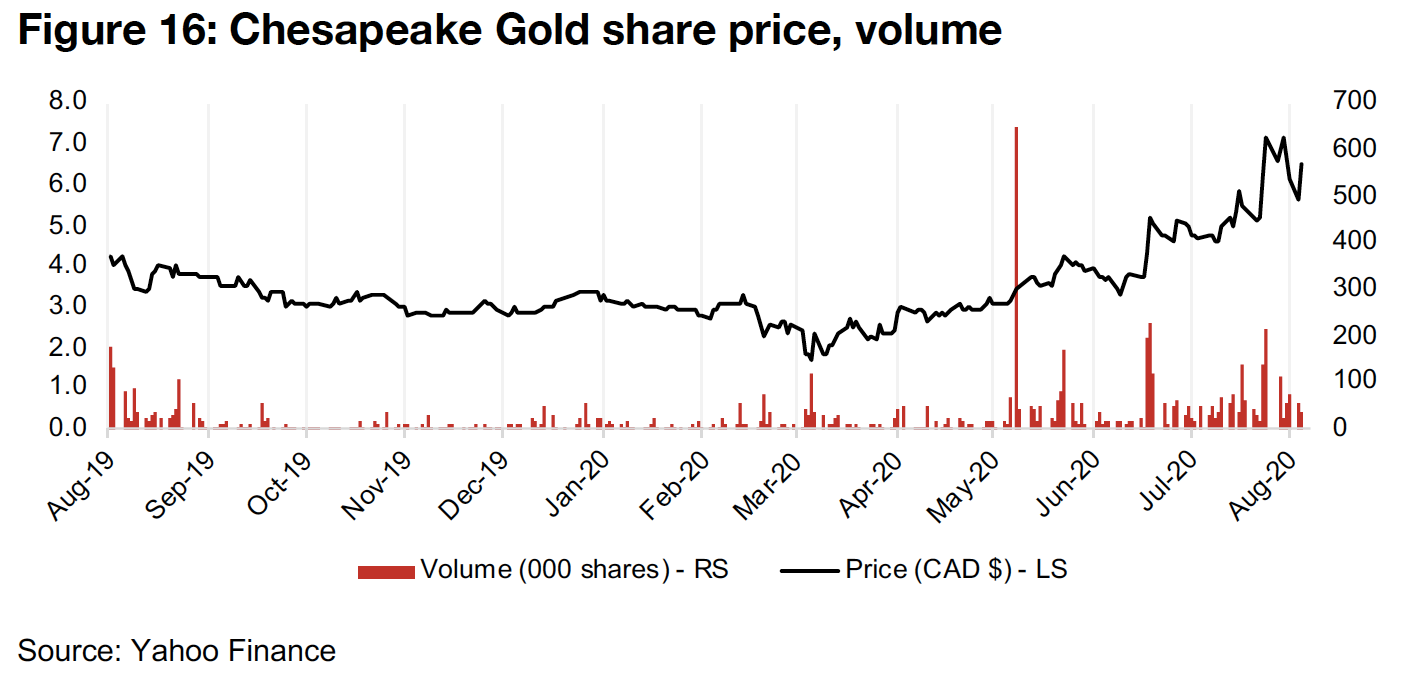

This potential is reflected in the company's share price, which has risen 111.4% over

the past three months, and 60.5% over the past twelve months (Figure 16). News

flow from the company has been sparse in 2020, with just four press releases, three

of which were relatively light, including an operational update, a newly optioned

property and a grant of stock options. However, the most recent press release in

early August was more material, with a $20mn private placement completed, with

$15mn to Eric Sprott (who will hold 16.4% of the company) and $5mn to Sun Valley

(who will hold 8.6%), showing continued financial backing for the company.

Disclaimer: This report is for informational use only and should not be used an alternative to the financial and legal advice of a qualified professional in business planning and investment. We do not represent that forecasts in this report will lead to a specific outcome or result, and are not liable in the event of any business action taken in whole or in part as a result of the contents of this report.